Why Gofreight

Learn How GoFreight Compares to Other Freight Management Software

- By Shipment Type

Switch to GoFreight

Transform Into a Digital Freight Forwarder in 7 Days

Resource Center

- Product Updates

- Refer a Friend

- Data Sheets

- Whitepapers

- Referral Program

If you’ve ever been involved in international shipping, you’ve likely come across a labyrinth of terms that seem confusing at first glance. From “Incoterms” to abbreviations like DDU and DDP, it’s crucial to understand what these mean for your bottom line and shipping process. In particular, let’s delve into DDU—Delivered Duty Unpaid—an Incoterm that signifies the seller’s and buyer’s obligations concerning costs, risks, and responsibilities.

What is DDU and Why is it Crucial in International Shipping?

DDU, short for Delivered Duty Unpaid , indicates that the seller has fulfilled their obligation once the goods are made available at an agreed-upon location in the destination country. However, the buyer pays for the import clearance and all other costs incurred to bring the shipment from the final destination to their own facilities. Understanding DDU is crucial for any international customer because it impacts not just the shipping procedures but also the import duties, shipping charges, and risks involved.

Brief Overview of Incoterms and Their Significance

Incoterms, or International Commercial Terms , are a series of pre-defined terms published by the International Chamber of Commerce (ICC). They provide a common ground for sellers and buyers, essentially acting as the language of international trade. By understanding Incoterms like DDU, you can better navigate customs procedures, duties and taxes, and additional costs, thereby saving money and ensuring a smoother delivery process to the destination port.

By the end of this comprehensive guide, you’ll understand the intricacies of DDU, from import clearance procedures to the responsibilities of the parties involved, ensuring you make informed decisions in your international shipping endeavors.

A Deep Dive into DDU: Delivered Duty Unpaid

Navigating the landscape of international shipping can be like walking through a maze. But when you understand terms like DDU , or “Delivered Duty Unpaid,” the path becomes a lot clearer.

What Does “Delivered Duty Unpaid” Mean?

In the context of international shipping, DDU stands for Delivered Duty Unpaid , a term that specifically outlines the obligations of the buyer and seller. When a shipment is sent DDU, the seller is responsible for all the risks and transportation costs up until the goods reach an agreed-upon location in the destination country. However, unlike Delivered Duty Paid (DDP), under DDU terms, the buyer takes on the responsibility of handling import clearance, customs duties, and any additional costs from that point forward. Essentially, DDU signifies that the goods are delivered with duty unpaid, meaning that the buyer pays all import duties and handles all customs formalities once the shipment arrives at the specified location.

Responsibilities and Costs Covered Under DDU

Let’s break down the specific responsibilities and costs under DDU:

Seller’s Responsibility :

Handling and packing the goods

Managing export formalities

Bearing all risks and transportation costs until the goods reach the agreed-upon destination

Providing the necessary export documentation

Buyer’s Responsibility :

Taking legal possession of the goods at the agreed-upon location

Import clearance procedures

Payment of customs duties, import tariffs, and other charges

Coordinating further transportation to own facilities or a storage facility

Understanding these responsibilities is crucial because they directly impact the shipping charges, customs charges, and delivery costs that are incurred. DDU, therefore, offers a way for both parties to understand their obligations clearly, making it easier to avoid surprise duties and additional costs.

By getting familiar with DDU, you are better prepared to manage the costs and responsibilities tied to international shipping, whether you’re the seller shipping internationally or an international customer. This understanding, in turn, allows for better planning and potentially fewer risks involved in the import process.

Incoterms: DDU vs DDP (Delivered Duty Paid)

When it comes to international shipping, two terms that often cause confusion are DDU (Delivered Duty Unpaid) and DDP (Delivered Duty Paid). Although they may seem similar, the differences are significant and can have a considerable impact on your shipping process, customs fees, and overall costs incurred.

Explanation of DDP and Its Contrast with DDU

DDP , or Delivered Duty Paid , is almost the opposite of DDU in terms of responsibilities and costs. Under DDP terms, the seller bears all the risks, transportation costs, and customs duties until the goods are received by the buyer at the main delivery location. The seller handles all export and import formalities, effectively making the process seamless for the buyer. Unlike DDU, where the buyer takes possession at an agreed-upon destination and handles the import clearance and duties, in DDP, the seller manages these aspects.

The Pros and Cons of DDU and DDP

Here’s a rundown of the advantages and disadvantages of both terms:

Pros of DDU:

Flexibility for the Buyer : Buyers have more control over import clearance procedures and payment of import duties.

Less Complexity for the Seller : The seller is not involved in the complex process of customs clearance in a foreign country.

Cons of DDU:

Higher Risks for the Buyer : Since the buyer is responsible for import duties and customs formalities, there’s a risk of unexpected costs like surprise duties.

Requires In-Depth Knowledge : Both parties need to understand international commerce terms to avoid misunderstandings.

Pros of DDP:

Convenience for the Buyer : The buyer essentially receives a door-to-door service with minimal involvement in shipping procedures and customs.

Fixed Costs : Since the seller pays all costs, the buyer knows upfront the total cost of receiving the goods.

Cons of DDP:

Costly for the Seller : The seller needs to calculate all potential costs, which can be challenging and often leads to higher pricing.

Limited Control for the Buyer : Since the seller manages all aspects, the buyer has less influence over the shipping methods and timing.

Understanding the contrast between DDU and DDP is crucial for making informed decisions that align with your business model and shipping needs.

The Costs and Fees: Delivery Duty Unpaid vs Delivery Duty Paid

When shipping goods internationally, it’s vital to have a clear understanding of the associated costs, especially when dealing with terms like DDU (Delivery Duty Unpaid) and DDP (Delivered Duty Paid). These costs can greatly influence your choice between DDU and DDP.

Breakdown of Costs Under Both Terms

Under DDU , or Delivery Duty Unpaid , the following costs are typically involved:

Transportation Costs : Paid by the seller up to the agreed-upon destination in the foreign country.

Customs Duties : Buyer handles all customs duties, taxes, and additional fees.

Import Clearance : The buyer pays for import clearance procedures.

Conversely, DDP , or Delivery Duty Paid , involves:

Transportation Costs : Covered entirely by the seller, including shipping to the main delivery location.

Duties and Taxes : All customs duties and import tariffs are paid by the seller.

Customs Clearance : Managed and financed by the seller, thereby reducing the buyer’s obligations.

How to Decide Which Term is Most Economical for You

When choosing between DDU and DDP, consider your familiarity with the import process in the destination country, as well as your capacity to handle customs formalities.

If you’re an experienced international customer and have a deep understanding of the customs procedures and import tariffs in the destination country, DDU may be more economical for you. This approach offers more control and potentially lower costs, although it does expose you to risks such as surprise duties.

On the other hand, if you prefer a more hands-off approach, DDP allows for more predictable costs but often comes at a premium, as the seller bears more responsibilities and risks.

Your choice ultimately depends on your business model, the resources you have for managing shipping procedures, and your appetite for risk in international shipping.

Handling Customs: From Import Clearance Procedures to Duties and Taxes

When it comes to international shipping, one of the most daunting aspects for businesses is the realm of customs. From official authorization requirements to unexpected fees, navigating this landscape is not for the faint of heart. Let’s explore how customs handling varies between DDU (Delivery Duty Unpaid) and DDP (Delivered Duty Paid) .

How Customs Procedures Vary Under DDU and DDP

Under DDU , the onus of navigating through import clearance procedures lies with the buyer. After the shipment arrives at the destination port or an agreed-upon location, the buyer must handle the customs clearance, which includes paperwork, import duties, and any additional costs.

Conversely, under DDP , the seller takes on the burden of managing all customs formalities. This includes securing official authorization, paying import duties, and ensuring all customs charges are covered. The buyer’s role is comparatively minimal, often limited to taking legal possession of the goods at the final destination.

Surprise Duties and Risks Involved in the Shipping Process

Whether you choose DDU or DDP, it’s crucial to be aware of the potential for surprise duties or additional costs. Under DDU, the buyer is more susceptible to these risks since they are responsible for customs duties and import tariffs. Failure to accurately estimate these can result in unexpected expenses that affect the overall business model.

On the DDP end, sellers may pass on the costs incurred in customs clearance to the buyer, albeit wrapped into the overall price. However, because the seller manages customs procedures, the risk of encountering surprise duties is lower.

Understanding the landscape of customs is essential for making informed choices in your international shipping activities, ensuring that both parties fulfill their respective obligations without the burden of unforeseen costs.

Navigating DDU Logistics: From Seller’s Obligations to Destination Country

Shipping internationally under DDU (Delivered Duty Unpaid) terms involves a variety of logistics and planning considerations. The seller’s obligations, shipping methods, and even the destination country’s regulations play critical roles in this context. Understanding these aspects can not only save money but also eliminate potential roadblocks in your shipping process.

Shipping Methods, Seller Obligations, and the Logistics of DDU

Under DDU, the seller is tasked with making the goods available at an agreed-upon destination in the foreign country. This involves:

Shipping Methods : Whether it’s by sea, air, or land, the seller selects the shipping methods and bears all associated transportation costs until the shipment reaches the agreed-upon location.

Seller’s Obligations : These include handling export formalities, obtaining the necessary official authorization, and providing all export documentation. Essentially, the seller must coordinate arrangements to deliver the goods safely and efficiently.

Logistics : Managing storage facilities, tracking shipments, and ensuring the goods are delivered alongside any necessary certifications fall under the seller’s purview.

Important Considerations When Shipping to the Destination Country

When shipping to the destination country under DDU terms, consider:

Customs Regulations : The buyer must be aware of the destination country’s customs regulations, as they’ll be responsible for import clearance and customs fees.

Risks Involved : DDU opens up potential risks like import tariffs, additional costs, or delays in customs clearance. Both parties need to understand these risks and should be prepared for any contingencies.

Payment : Typically, the buyer pays for all costs from the point the goods are made available. Ensure you understand your obligations as a buyer to avoid complications.

By closely examining these considerations, you can navigate the complex landscape of DDU logistics, thereby making informed decisions that align with your international shipping needs.

Case Study: DDU Shipping from China

Navigating international shipping can be intricate, but it becomes even more so when the goods are coming from a manufacturing powerhouse like China. Due to its significant role in global trade, understanding the specifics of DDU shipping from China is crucial for any international customer or business.

Typical Practices, Import Duties, and Potential Complications

In a DDU shipping scenario from China , several practices are standardized:

Import Clearance : As the buyer, you’ll be responsible for all import clearance procedures. Import duties and taxes customs formalities are often more complex, given China’s extensive list of export formalities and regulations.

Customs Duty : Depending on the destination country, you might find that customs duties from China can be quite substantial, which could impact the overall costs incurred.

Additional Costs : Complications can arise in the form of unexpected customs charges or surprise duties, especially if there’s a misunderstanding of the regulations in the destination country.

Shipping Procedures : DDU shipments from China often involve multiple shipping methods. Whether it’s air freight or sea cargo, understanding the shipping process is critical to avoiding delays and additional costs.

This case study highlights the need for buyers to be well-informed about their responsibilities, especially when dealing with DDU shipments from China. Familiarity with import tariffs, customs procedures, and the specific import process of the destination country can save money and mitigate risks involved.

The Future of DDU and International Shipping

As we wrap up this comprehensive guide on DDU (Delivered Duty Unpaid) and international shipping, it’s essential to recap the key points. DDU is a significant incoterm in international commerce, specifying that the seller delivers goods to an agreed-upon location, but the buyer is responsible for import duties and customs procedures. This contrasts sharply with DDP (Delivered Duty Paid), where the seller bears most of the responsibilities and costs, including customs fees.

In terms of costs and logistics, understanding the intricacies of DDU can offer more control and potentially lower costs for experienced buyers. However, it comes with its set of challenges, such as navigating complex customs regulations and potential surprise duties.

As the world of international shipping evolves, so too will these commercial terms. The globalization of markets and advances in shipping technology could make DDU and other Incoterms more flexible and user-friendly, further democratizing international commerce for businesses of all sizes.

Latest Blog

Democratizing access to software for forwarders: a conversation with gofreight ceo trenton chen and eric johnson, logistics demand forecasting: unlocking the future of supply chain management, us customs clearance process: fees, processing time & payments, sustainable logistics: benefits & best practices, supply chain forecasting: how to weather disruptions, top 10 freight forwarding training courses in 2024, bill of lading vs. packing slip: understanding the differences, get the latest from gofreight, keep reading.

+1(888)331-4686

GoFreight Solutions

- Freight Forwarding Software

- Container Tracking

- Security Filing

- Customer Portal

- Integration

- Accounting Solutions

- About Gofreight

Shipment Type

Sign up for our newsletter.

- Copyright © 2024 GoFreight Inc. All rights reserved.

- Privacy & Terms

- Designed & Developed by CzarGroup Technologies

- OTR Flatbed Company

- OTR Van Company

- Regional/Dedicated Van Company

- OTR Heavy Haul Company

- OTR Flatbed Lease

- OTR Van Lease

- Regional/Dedicated Van Lease

- OTR Heavy Haul Lease

- Owner-Operator

- Career Path

- Available Positions

- Hiring Areas

- Job Matcher

- Learning Center

« View All Posts

Types of Certifications and Security Clearances for Truck Drivers

June 16th, 2023

Jeron Rennie

Having grown up around the trucking industry — with his dad and several uncles serving as truck drivers — it’s only natural Jeron found his way into the industry as well. Jeron joined ATS in 2018 as a member of the marketing team, where he grew his knowledge of the trucking industry substantially. Now as the driver recruiting manager, he is responsible for ensuring a smooth recruiting process in order to create a quality driver experience.

Drivers are always looking for a way to make more money. One of the best ways to do that? Diversify your skillset!

Wondering how to diversify your skillset? Get clearance to haul freight in areas you’ve never been able to access before!

The more you open up your opportunities for the types of freight you can haul and the places you can go, the more money you can make.

Typically, truck drivers don’t require security clearances unless they’re involved in specialized or sensitive transportation operations. For instance, if a truck driver is engaged in a job that involves transporting goods or materials related to national security, classified information or sensitive installations, they may be required to obtain certain security clearances.

However, the more clearances, certifications and endorsements you get, the more opportunities you have. With a Transportation Worker Identification Credential (TWIC card), passport, Transport Security Administration (TSA) certification, government security clearance and Hazmat endorsement, you open yourself up to haul freight in Canada and Mexico, at ports and at airports and on military bases. A lot of this freight is lucrative and can make a huge difference in your wallet.

In this article, you’ll learn about the different clearances, certifications and endorsements you can get to diversify your freight options to haul more and earn more money.

A TWIC card is an identification card issued by the Transportation Security Administration (TSA) in the U.S. It’s designed to enhance security at maritime facilities and regulate access to certain sensitive areas within the transportation industry.

The TWIC card is required for individuals who need unescorted access to secure areas of maritime facilities or vessels regulated by the Maritime Transportation Security Act (MTSA) of 2002. This includes workers who are involved in maritime transportation, such as longshoremen, port workers, truck drivers, mariners and others who require access to restricted areas.

The TWIC card requires fingerprints and a background check to ensure individuals who hold the card have been vetted for security purposes. It serves as a form of identification and allows authorized personnel to gain access to restricted areas, such as ports, terminals and other maritime facilities.

Without a TWIC card, you can’t access these authorized locations without an escort. You may have to pay a fee for an escort and you’ll be at the mercy of their schedule. Keep in mind, some ports don’t allow escorts and you must have a TWIC card to enter.

To obtain a TWIC card, which is a fairly easy process, applicants must submit personal information, undergo a security threat assessment, provide fingerprints and pay a fee of $125.25. The card is valid for five years, after which it must be renewed for $60.

It's important to note that the TWIC card is specific to the transportation industry and is different from other security clearances, such as those issued by the Department of Defense (DOD) or other government agencies. It’s also not the same as a TSA certification.

Related: What paperwork do you need to get a TWIC card?

Passport

A passport is a great investment for truck drivers, as it’ll allow you to cross the border into Canada and Mexico to haul lucrative freight. It isn’t the same thing as a TWIC card, as a TWIC card cannot be used to travel internationally — it’s only used to access ports.

If you need to get a passport , you’ll need to complete the following steps:

- Prepare the required documents for a passport application. These typically include proof of U.S. citizenship (such as a birth certificate or previous passport), a valid form of identification (such as a driver's license) and any additional supporting documentation requested by the passport agency.

- Fill out the DS-11 Application. You can complete this form online or print it out and fill it in manually. Be sure to provide accurate and up-to-date information.

- Get passport photos taken that meet the specifications outlined by the U.S. Department of State. Many drugstores, photo studios or post offices offer passport photo services.

- Locate a passport acceptance facility near you. These can include post offices, government offices and some public libraries. Bring your completed application form, necessary documents, photos and any applicable fees. The acceptance facility will review your documents, administer an oath and accept your application.

- Pay the passport application fees, which consist of an application fee and an execution fee. The fees vary depending on factors such as the type of passport, whether it's a new application or renewal and processing options. Check out the current fee schedule .

- If you need your passport expedited due to imminent travel plans, you may be required to provide proof of your travel itinerary or an expedited service fee.

After submitting your application, it typically takes several weeks for the passport to be processed. You can track the status of your application online using the application's reference number. Once your application is processed, your passport will be mailed to you at the address you provided on the application form.

After receiving your passport, some drivers elect to enroll in the Free and Secure Trade (FAST) program for commercial vehicles. The clearance program allows low-risk drivers with low-risk shipments to go through customs much faster and use special lanes at busy border crossings.

TSA-certified drivers can access TSA-controlled airports and facilities. The certification allows drivers to enter TSA areas and move freight from their trucks to an aircraft. This certification isn’t needed for drivers picking up already-cleared freight from an airport.

Air travel is heavily regulated, as is the freight that can travel by air. The TSA certification adds another level of safety.

It can be a bit confusing to understand how to get this certification, but there are only two steps.

First, you must work for a trucking company that has completed the steps to become a certified Indirect Air Carrier (IAC). This certification is earned annually and is done so by submitting an application through the TSA’s Indirect Air Carrier Management System . Carriers also have to work with a TSA Principle Security Inspector.

If the trucking company you drive for is a certified IAC, you’ll need to go through the Security Threat Assessment (STA) to receive unescorted access to cargo shipped by air. Drivers also need training on handling sensitive information and cargo.

The TSA ensures you’re not a threat to national security or transportation security and you’re not a suspected terrorist.

Once you submit the STA application, the TSA needs to confirm your identity and information. Once confirmed, you’ll receive the TSA certification.

Related: Learn more about why the TSA certification benefits you

Government Security Clearance

To haul transport protective service (TPS) freight and arms, ammunition and explosives (AA&E), drivers need to fill out the Standard Form 86 (SF-86). This is a comprehensive questionnaire used to conduct a background investigation for individuals seeking a security clearance in the U.S.

The SF-86 collects detailed information about an individual’s personal, educational, employment and financial history. It includes sections that ask for information on residences, employment history, education, references, foreign contacts, military service, criminal record, drug usage, financial history and more.

While the SF-86 is not directly related to truck driving, certain truck drivers may need to complete the form if their job involves handling sensitive or classified materials, transporting goods related to national security or working in positions that require a security clearance.

The requirement for a truck driver to complete the SF-86 form would depend on the specific job responsibilities and the security protocols set by the employer or the government agency they work for. Truck drivers in such roles may be required to undergo a background investigation as part of the security clearance process, and the SF-86 would be one of the forms they need to complete to initiate that investigation.

For instance, if a driver wanted to haul freight for the Department of Defense (DOD) with their trucking company, filling out the SF-86 and receiving security clearance would grant them access to that (very lucrative) freight.

Related: What does it take to haul military freight for the DOD?

Hazardous Materials Endorsement

While a hazardous materials endorsement (H endorsement) doesn’t allow you access to special locations, it’s required to move a lot of the freight mentioned above — specifically DOD freight for the military.

To obtain a Hazmat endorsement on a commercial driver’s license (CDL) in the U.S., drivers must follow a specific process mandated by the TSA and the Federal Motor Carrier Safety Administration (FMCSA). After ensuring you’re eligible to apply, here are the general steps involved in obtaining a Hazmat endorsement:

- Visit your local Department of Motor Vehicles (DMV) or licensing agency and request a Hazmat endorsement application. Fill out the application form accurately and completely.

- Schedule an appointment with a TSA-approved fingerprinting location to complete the required background check. The TSA will conduct a security threat assessment to determine your eligibility for the Hazmat endorsement. The fingerprinting fee is typically separate from the application fee.

- Prepare the necessary documents for your application, which may include your CDL, proof of citizenship or immigration status, Social Security number, and any other documents required by your state's licensing agency. Check with your local DMV for specific document requirements.

- Study the Hazardous Materials section of the CDL manual and prepare for the Hazmat knowledge test.

- Pay the required application and endorsement fees at the DMV or licensing agency. The fees may vary depending on your state.

The TSA will review your background check results and application. If you pass the security threat assessment and meet all the requirements (including passing the knowledge test), the TSA will notify your state’s licensing agency of your eligibility for the Hazmat endorsement.

Once the TSA approves your application, visit the DMV or licensing agency again to receive your new CDL with the Hazmat endorsement. You may need to have a new photo taken and surrender your old CDL.

It's important to note that the process and requirements for obtaining a Hazmat endorsement can vary slightly between states. Check with your local DMV or licensing agency for specific guidelines and procedures in your state.

Related: CDL endorsements

Haul More Freight

Diversifying your skillset as a truck driver can greatly enhance your earning potential. Obtaining various certifications and security clearances can open up new opportunities for hauling freight and accessing restricted areas. There are five important credentials: the TWIC card, passport, TSA certification, and government security clearance, as well as the Hazmat endorsement. Each of these certifications grants drivers like you access to specific areas, such as ports, airports, military bases and international borders, enabling you to transport a wider range of freight and earn higher incomes.

By obtaining these certifications and clearances, you can significantly increase your earning potential and access more diverse and profitable freight options. However, it’s important to note that the specific requirements and processes for obtaining these credentials may vary. It’s advisable to consult local authorities and agencies for accurate and up-to-date information.

Overall, investing in expanding your skillset is a valuable strategy for truck drivers — especially when the market takes a turn.

For more tips to enhance your career opportunities and financial success, check out these tips for hauling freight in a soft market .

An official website of the United States government Here's how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( Lock A locked padlock ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

Freight Facts and Figures

Freight Facts and Figures , developed by the Bureau of Transportation Statistics, is a collection of charts and statistical tables about freight transportation in the United States. These interactive visualizations and tables provide a snapshot of freight movement; the extent, condition, and performance of the freight transportation system; the economic implications of freight movement; and the safety, energy, and environmental impacts of freight transportation.

We introduce this new digital version of Freight Facts and Figures . In these stories, we continue to release the statistics contained in the annual publication that has been produced since 2004. The new format features interactive charts and tables, open and accessible data, and regular updates to the content.

BTS strives to continually improve Freight Facts and Figures. If you have a suggestion on how to make this product better, find an issue, or have a question, please contact us at Ask A Librarian . We welcome your feedback.

View Freight Facts and Figures

Related Datasets:

To choose multiple values, please hold the Ctrl key as you make your selection.

- Activity Summary of Roadside Safety Inspections by Motor Carrier Inspection Type

- Automated Track Inspection Program (ATIP) Exceptions per 100 Miles

- Average Daily Long-Haul Truck Traffic on the National Highway System: 2015

- Average Hourly Wages in Select Freight Transportation-Related Occupations

- Average Time for Commercial Vehicles to Travel One Mile At Select U.S.-Canada Border Crossings

- Average Truck Speeds on Select Interstate Highways: 2017

- Average Truck Speeds on Select Metropolitan Area Interstates

- Average Truck Transit Time at Select U.S.-Mexico Border Crossings

- Average Vessel Capacity per Call at U.S. Ports

- Class I Railroad Locomotive Fleet by Year Built

- Combination Truck Fuel Consumption and Travel

- Commercial Motor Carrier Compliance Reviews by Safety Rating

Baltimore bridge collapse: Everything we know about the disaster

Rescue teams are searching for survivors after the 1.6-mile long Francis Scott Key Bridge crashed into the Patapsco River at around 1.30am local time (5.30am UK time) on Tuesday.

Wednesday 27 March 2024 04:54, UK

A major bridge collapsed in the US city of Baltimore after it was hit by a 289m-long cargo ship.

Six people remain missing after two others were rescued from the water following the disaster in the early hours of Tuesday morning.

Here's everything we know about the incident so far.

What happened?

A large section of the 1.6 mile-long Francis Scott Key Bridge fell into the water after it was struck by a container ship, known as the Dali, at around 1.30am local time (5.30am UK time).

The vessel struck one of the bridge's supports, causing the whole structure to collapse, sending the road surface and steel beams crashing into the water.

Baltimore bridge latest: Follow live updates

The National Transportation Safety Board is leading the investigation into what happened, with its chair Jennifer Homendy saying at least six people are still missing.

Eight people were initially unaccounted for - with one described as being in a "very serious condition" in hospital. The other was not injured.

The six missing are believed to be part of a construction crew that was repairing potholes on the bridge, the Maryland Department of Transportation has said.

All 22 crew members on board the ship, including the two pilots, have been accounted for and there were no reports of injuries.

Read more: Biden promises to visit Baltimore 'as soon as possible' 'Huge implications' as collapse forces busy port to close Two possible causes for the catastrophe

What does the footage show?

Dramatic video shows the cargo vessel approaching the bridge before the structure collapses into the water.

Vehicles can be seen falling from the bridge.

An exact number has not been given, but Baltimore fire department's communications chief Kevin Cartwright said multiple vehicles were on the bridge when it was struck by the ship, one of which was the size of an HGV.

US president Joe Biden said in a news conference hours after the collapse that personnel on the ship were able to alert the Maryland Department of Transportation that they had lost control of their vessel.

Mr Biden added this "undoubtedly saved lives" at it meant local authorities were able to close the bridge before it was struck.

Please use Chrome browser for a more accessible video player

What happened in the moments before the crash?

CCTV and marine tracking data shows the container ship lost power for about 60 seconds about four minutes before it hit the bridge. It appeared to adjust its course and start smoking before impact.

According to the timings on the CCTV, the vessel hit the structure at 1.28:44am - with the bridge collapsing four seconds later.

The operators of the Dali cargo ship issued a mayday call that the vessel had lost power moments before the crash, but the ship still headed toward the bridge at "a very, very rapid speed", Maryland Governor Wes Moore said.

The ship was moving at eight knots, which is roughly 9mph, when it hit the structure, the governor said.

What do we know about the ship?

The Singapore-flagged container ship, known as Dali, was headed to Colombo in Sri Lanka at the time of the collision.

Synergy Marine Group, the company which manages the ship, said it hit the bridge while under the control of two pilots.

The firm said the exact cause of the incident was yet to be determined.

The Dali was previously involved in a minor incident when it hit a quay at the Port of Antwerp in Belgium in 2016, according to Vessel Finder and maritime accident site Shipwrecklog.

An inspection of the Dali last June at a port in Chile identified a problem with the ship's "propulsion and auxiliary machinery", according to Equasis, a shipping information system.

The deficiency involved gauges and thermometers, but the website's online records did not elaborate.

The most recent inspection listed for the Dali was conducted by the US Coast Guard in New York on 13 September 2023. The "standard examination" did not identify any deficiencies, according to the Equasis data.

What do we know about the bridge itself?

Last June, federal inspectors rated the 47-year-old bridge to be in fair condition. But the structure did not appear to have pier protection to withstand the crash, experts said.

"If a bridge pier without adequate protection is hit by a ship of this size, there is very little that the bridge could do," according to Virginia Tech engineering professor Roberto Leon.

Built in 1977 and referred to locally as the Key Bridge, it was named after the author of the American national anthem.

Keep up with all the latest news from the UK and around the world by following Sky News

What impact could this collision have?

All ship traffic into and out of the Port of Baltimore has been suspended until further notice, though the port remains open to trucks, Maryland Transportation Secretary Paul Wiedefeld said.

Last year, the port handled a record 52.3m tons of foreign cargo worth $80bn (£63bn), according to the state. In addition to cargo, more than 444,000 passengers cruised out of the port in 2023.

The port is a major east coast hub for shipping. The bridge spans the Patapsco River, which massive cargo ships use to reach the Chesapeake Bay and then the Atlantic Ocean.

The Dali was headed from Baltimore to Colombo, Sri Lanka, and flying under a Singapore flag, according to data from Marine Traffic.

President Biden said that he plans to travel to Baltimore "as quickly as I can" and that he expects the federal government to pick up the entire cost of rebuilding the bridge.

Has this ever happened before?

From 1960 to 2015, there were 35 major bridge collapses worldwide due to ship or barge collisions, with a total of 342 people killed, according to a 2018 report from the World Association for Waterborne Transport Infrastructure.

Eighteen of those collapses happened in the United States.

Among them were a 2002 incident in which a barge struck the Interstate 40 bridge over the Arkansas River at Webbers Falls, Oklahoma, sending vehicles plunging into the water. Fourteen people died and 11 were injured.

In 2001, a tugboat and barge struck the Queen Isabella Causeway in Port Isabel, Texas, causing a section of the bridge to tumble 80 feet into the bay below. Eight people were killed.

In 1993, barges being pushed by a towboat in dense fog hit and displaced the Big Bayou Canot railroad bridge near Mobile, Alabama.

Minutes later, an Amtrak train with 220 people onboard reached the displaced bridge and derailed, killing 47 people and injuring 103 others.

Related Topics

- Baltimore bridge collapse

- United States

Baltimore Port: What impact will bridge collapse have on shipping?

PORT FEATURES

Current status of cargo ships inside port, cruise ships, london metal exchange warehouses, bunker fuel.

Get weekly news and analysis on the U.S. elections and how it matters to the world with the newsletter On the Campaign Trail. Sign up here.

Reporting by Josephine Mason, Nick Carey, Helen Reid, Jonathan Saul, Nigel Hunt, Marwa Rashad, Scott DiSavino, Shariq Khan and Eric Onstad; Compiled by Josephine Mason and Nina Chestney; Editing by Nick Macfie and Nick Zieminski

Our Standards: The Thomson Reuters Trust Principles. , opens new tab

Kuwait has handed its annual $2 million contribution to the U.N. Relief and Works Agency for Palestinian refugees (UNRWA), the Kuwaiti state news agency KUNA reported on Thursday.

Russia vetoed on Thursday the annual renewal of a panel of experts monitoring enforcement of longstanding United Nations sanctions against North Korea over its nuclear weapons and ballistic missile programs.

- International

Baltimore Key Bridge collapse

Trump's Georgia hearing

Bankman-Fried sentencing

March 26, 2024 - Baltimore Key Bridge collapses after ship collision

By Helen Regan , Kathleen Magramo , Antoinette Radford, Alisha Ebrahimji , Maureen Chowdhury , Rachel Ramirez , Elise Hammond , Aditi Sangal , Tori B. Powell , Piper Hudspeth Blackburn and Kathleen Magramo , CNN

Ship lights flickered and veered off course shortly before Baltimore bridge hit, CNN analysis shows

From CNN’s Allegra Goodwin in London

The Singaporean-flagged cargo ship that struck the Francis Scott Key Bridge in Baltimore Tuesday altered course and veered toward a pillar shortly before impact, a CNN analysis of MarineTraffic ship-tracking data confirms.

It’s unclear what caused the ship to crash into the bridge or why its lights were flickering. CNN has reached out to the National Transportation Safety Board to inquire about a possible power failure.

The container ship DALI, which was en route to Colombo, Sri Lanka, begins to change course toward the bridge’s pillar at 1:26 a.m. local time, striking the bridge at 1:28 a.m. ET, according to MarineTraffic data and video from the scene. Video from 1:25 a.m. ET shows a plume of dark smoke billowing from the ship. DALI's lights flicker at least twice before the incident.

In video, as it navigates down the Patapsco River, the ship’s lights can be seen going out at 1:24 a.m. ET, before turning back on, and then flickering off and on again between 1:26 a.m. ET and 1.27 a.m. ET, just before it hits the bridge.

Maryland transportation secretary says contractors were working on bridge at time of collapse

From CNN's Antoinette Radford

Maryland State Transportation Secretary Paul Wiedefeld told reporters there were workers on the Francis Scott Key Bridge at the time of its collapse.

"We know there were individuals on the bridge at the time of the collapse, working on the bridge, contractors for us," he said at a news conference Tuesday morning.

Wiedefeld said the workers were "basically doing some concrete deck repair," but said they did not know how many vehicles were involved.

He added that the transport authority has set up a facility for family members of those who were believed to be on the bridge at the time of its collapse.

Baltimore fire chief: Sonar has detected the presence of vehicles submerged in the water

Baltimore Fire Chief James Wallace says authorities have detected vehicles submerged in the water.

“Our sonar has detected the presence of vehicles submerged in the water,” said Wallace at a news conference on the collapse of Francis Scott Key Bridge. “I don't have a count of that yet.”

He said emergency services are using sonar, drones and infrared technology as a part of their search for people and vehicles who may have fallen from the Key Bridge into the Patapsco River.

No indication of "terrorism" or intent in Baltimore bridge collapse, police chief says

From CNN’s Andy Rose

Baltimore Police said there was no evidence that the ship collision that caused the collapse of the Francis Scott Key Bridge was intentional.

“There is absolutely no indication that there's any terrorism, that this was done on purpose,” Chief Richard Worley said at a news conference.

The FBI said that it was joining the investigation into the cause of the collision.

Rescue crews have determined there are vehicles in the Patapsco River following the bridge collapse.

“Our sonar has detected the presence of vehicles submerged in the water,” said Fire Chief James Wallace. “I don't have a count of that yet.”

Wallace said they are waiting to make sure that the ship is secure and stable before investigators board it.

“Never would you think that you would see, physically see, the Key Bridge tumble down like that,” Mayor Brandon M. Scott said.

Cruises, cars and commodities: What to know about the Port of Baltimore

From CNN's Mark Thompson and Hanna Ziady

The collapse of the Francis Scott Key Bridge over the Patapsco River outside the Port of Baltimore threatens to disrupt shipping operations at a major US trade hub for autos, container traffic and commodities. Baltimore also has a cruise terminal.

Closer to the Midwest than any other port on the East Coast, Baltimore ranks first in the United States for autos and light trucks, handling a record 850,000 vehicles last year. It was also the leading port for farming and construction machinery, as well as imported sugar and gypsum. It was second in the country for exporting coal.

Overall, Baltimore ranks as the 9th biggest US port for international cargo, handling a record 52.3 million tons, valued at $80.8 billion in 2023.

“The immediate focus is the rescue operation, but there will clearly be a highly-complex recovery phase and investigation to follow and we don't know what impact this will have on operations at the Port of Baltimore," said Emily Stausbøll, market analyst at Norway-based shipping analytics company Xeneta.

“While Baltimore is not one of the largest US East Coast ports, it still imports and exports more than one million containers each year so there is the potential for this to cause significant disruption to supply chains," she added.

Baltimore's cruise terminal serves ships operated by Royal Caribbean, Carnival and Norwegian. Cruises carrying more than 444,000 passengers departed from the port last year.

According to the Maryland state government, the port supports 15,330 direct jobs and 139,180 jobs in related services.

Rescue crews looking for at least seven people in Baltimore bridge collapse

Rescue operations are underway near the wreckage of the Francis Scott Key Bridge in Baltimore, as crews look for people who fell into the Patapsco River.

“We are still very much in an active search and rescue posture at this point, and we will continue to be for some time,” Wallace added.

Baltimore Fire says two people have been rescued from the river – one who was uninjured, and another in hospitalized “very serious condition.”

“This is an unthinkable tragedy,” Mayor Brandon Scott said. “We have to first and foremost pray for all of those impacted.”

Ship that collided with Baltimore bridge was chartered by Danish shipping company Maersk

From CNN's Alex Stambaugh in Hong Kong

The container ship that collided with the Francis Scott Key Bridge in Baltimore on Tuesday was chartered by Maersk and carrying their customers' cargo, the Danish shipping company told CNN.

"We are horrified by what has happened in Baltimore, and our thoughts are with all of those affected," The company said in its statement.

The company, which has a full name of A.P. Moller - Maersk, said no company crew and personnel were onboard the vessel. It said the ship, DALI, is operated by charter vessel company Synergy Group.

"We are closely following the investigations conducted by authorities and Synergy, and we will do our utmost to keep our customers informed," the statement said.

CNN is attempting to contact the owner and managers of the ship, including Synergy.

FBI Baltimore on the scene at the Key Bridge

FBI Baltimore personnel are on the scene at the Francis Scott Key Bridge, they have said in a post on X.

The agency said it was working "side by side with our local, state and federal partners."

Baltimore fire emergency chief says 2 people saved from water after Key Bridge collapse

The Baltimore Fire Department Chief James Wallace says authorities rescued two people from the water this morning, one without injury and the other who has been transferred to hospital in a serious condition.

Authorities are continuing their search for upwards of seven people, Wallace says. But, he says that number could change as it is a "very large incident." Earlier on Tuesday, an official said as many as 20 people could be in the water.

Wallace added that the crew remains on board the ship, and are communicating with the US Coast Guard. He added that emergency services are looking into reports that there were workers on the bridge at the time of the incident.

Speaking at the press conference, Baltimore Mayor Brandon Scott also described the incident as an “unthinkable tragedy,” and offered his prayers for all those affected, as well as his thanks to first responders.

Please enable JavaScript for a better experience.

What we know about Baltimore’s Francis Scott Key Bridge collapse

The Francis Scott Key Bridge in Baltimore collapsed early Tuesday after being hit by a cargo ship, with large parts of the bridge falling into the Patapsco River.

At least eight people fell into the water, members of a construction crew working on the bridge at the time, officials said. Two were rescued, one uninjured and one in serious condition, and two bodies were recovered on Wednesday. The remaining four are presumed dead. The workers are believed to be the only victims in the disaster.

Here’s what we know so far.

Baltimore bridge collapse

Baltimore’s Francis Scott Key Bridge collapsed after being hit by a cargo ship , sending at least eight people from a construction crew into the water. Two people were rescued and the remaining six are presumed dead, officials said. Follow live updates and see photos from the scene .

How it happened: The container ship lost power shortly before hitting the bridge, Maryland Gov. Wes Moore (D) said. Video shows the bridge collapse in under 40 seconds.

Victims: Divers recovered the bodies of two construction workers who died , while finding other vehicles trapped and probably containing the other victims, officials said. They were fathers, husbands and hard workers . The entire crew aboard the container ship Dali survived . First responders shut down most traffic on the four-lane bridge after the crew issued an urgent mayday call. It saved lives, Moore said.

Economic impact: The collapse of the bridge, which severed ocean links to the Port of Baltimore, adds a fresh headache to already struggling global supply chains . See how the collapse will disrupt the supply of cars, coal and other goods .

History: The Key Bridge was built in the 1970s and spanned the Patapsco River. Rebuilding the bridge will probably take years and cost hundreds of millions of dollars, experts said.

- Remains of two people recovered as details emerge about Baltimore bridge collapse Earlier today Remains of two people recovered as details emerge about Baltimore bridge collapse Earlier today

- Six presumed dead in bridge collapse were immigrants, soccer fans, family men March 27, 2024 Six presumed dead in bridge collapse were immigrants, soccer fans, family men March 27, 2024

- Why investigators are looking into ‘dirty fuel’ in Baltimore bridge collapse March 27, 2024 Why investigators are looking into ‘dirty fuel’ in Baltimore bridge collapse March 27, 2024

An official website of the United States government

Here’s how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( Lock A locked padlock ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

TSA PreCheck®

Enjoy the same great tsa precheck benefits you know and love, now with new enrollment options..

Enjoy a smoother security screening process with no need to remove shoes, laptops, 3-1-1 liquids, belts or light jackets.

*TSA uses unpredictable security measures, both seen and unseen, throughout the airport. All travelers will be screened, and no individual is guaranteed expedited screening.

TSA PreCheck Benefits

Wait 10 Minutes or Less

About 99% of TSA PreCheck® passengers wait less than 10 minutes.

Families Welcome

Children 17 and under can join an adult with TSA PreCheck® when TSA PreCheck appears on the child’s boarding pass. Learn more .

Nationwide Access

More than 200 airports and 90+ airlines provide TSA PreCheck®

How it works

To enroll in TSA PreCheck just follow these three steps or walk into any enrollment location. Be sure the enrollment provider selected has enrollment locations near you. To renew simply click here and complete your renewal online in as little as 5 minutes.

1. Apply Online

Select an enrollment provider with enrollment locations near you. Submit your TSA PreCheck application online in as little as 5 minutes.

2. Visit an Enrollment Location

Complete enrollment in 10 minutes at your chosen provider which includes fingerprinting, document and photo capture, and payment.

3. Get Your TSA PreCheck Number

Once approved, get your Known Traveler Number (KTN), add it to your airline reservations and start saving time in screening.

New TSA PreCheck Enrollment Options

TSA has selected the following partners to help enroll travelers in TSA PreCheck. Applicants can pick any enrollment provider based on cost, locations , and additional benefits. Get started below.

Costs for enrollment vary by provider which results in pricing variation.

tsaenrollmentbyidemia.tsa.dhs.gov

Convenient access to 610+ enrollment centers and local enrollment events daily.

610+ Active Locations

IDEMIA provides fast and easy online renewal

- Renew online for $70

- Renew in-person for $78

tsaprecheckbytelos.tsa.dhs.gov

Enroll in TSA PreCheck® with Telos and look for upcoming travel deals.

26 Active Locations

Renew through Telos for a convenient renewal experience

- Renew in-person for $70

Additional TSA Resources

Tsa precheck customer service.

Learn who to contact based on your question or concern, plus ways to contact us.

Find your TSA PreCheck Number

Need your Known Traveler Number (KTN) to complete a renewal or update an existing airline reservation? TSA PreCheck members only, excludes Global Entry.

Search Here

TSA PreCheck Enrollment Locations

Find open enrollment locations for IDEMIA or Telos. Check back for updates.

TSA PreCheck Enrollment Offers and Specials. Find ways to save here.

Advertisement

The Dali was just starting a 27-day voyage.

The ship had spent two days in Baltimore’s port before setting off.

- Share full article

By Claire Moses and Jenny Gross

- Published March 26, 2024 Updated March 27, 2024

The Dali was less than 30 minutes into its planned 27-day journey when the ship ran into the Francis Scott Key Bridge on Tuesday.

The ship, which was sailing under the Singaporean flag, was on its way to Sri Lanka and was supposed to arrive there on April 22, according to VesselFinder, a ship tracking website.

The Dali, which is nearly 1,000 feet long, left the Baltimore port around 1 a.m. Eastern on Tuesday. The ship had two pilots onboard, according to a statement by its owners, Grace Ocean Investment. There were 22 crew members on board, the Maritime & Port Authority of Singapore said in a statement. There were no reports of any injuries, Grace Ocean said.

Before heading off on its voyage, the Dali had returned to the United States from Panama on March 19, harboring in New York. It then arrived on Saturday in Baltimore, where it spent two days in the port.

Maersk, the shipping giant, said in a statement on Tuesday that it had chartered the vessel, which was carrying Maersk cargo. No Maersk crew and personnel were onboard, the statement said, adding that the company was monitoring the investigations being carried out by the authorities and by Synergy Group, the company that was operating the vessel.

“We are horrified by what has happened in Baltimore, and our thoughts are with all of those affected,” the Maersk statement said.

The Dali was built in 2015 by the South Korea-based Hyundai Heavy Industries. The following year, the ship was involved in a minor incident when it hit a stone wall at the port of Antwerp . The Dali sustained damage at the time, but no one was injured.

Claire Moses is a reporter for the Express desk in London. More about Claire Moses

Jenny Gross is a reporter for The Times in London covering breaking news and other topics. More about Jenny Gross

Table of Content

- Responsibility of the Seller

- Responsibility of the Buyer

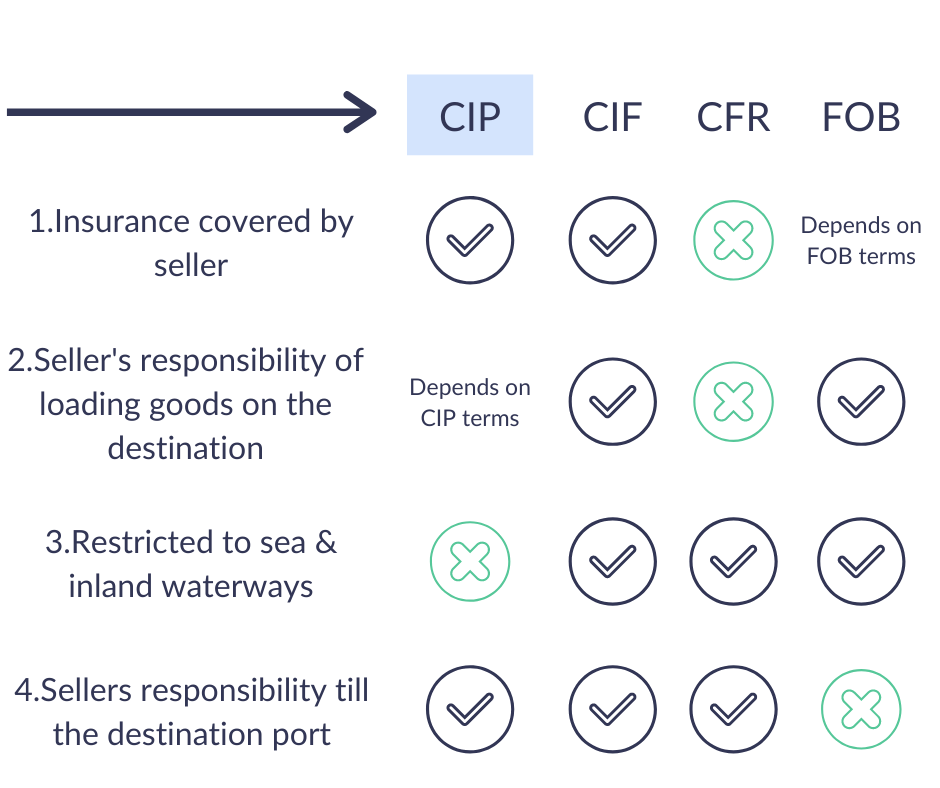

Difference Between CIP, CIF, CFR, FOB

Faqs on cip incoterms.

Explore Drip Capital’s Innovative Trade Financing Solutions

15 June 2020

CIP Incoterms [Carriage Insurance Paid] - Meaning & Process

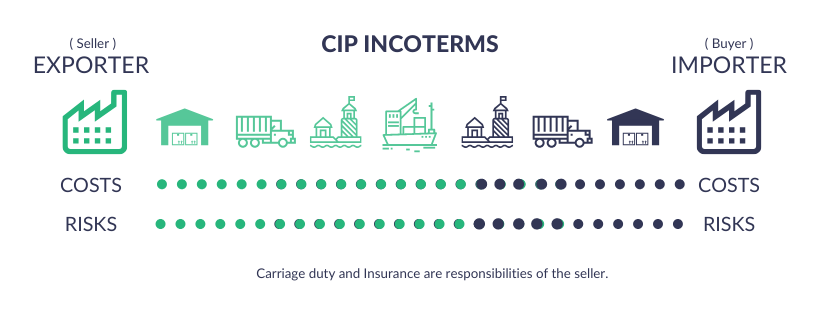

The CIP incoterm stands for ‘Carriage and Insurance Paid to’, wherein the seller is responsible for goods only till the first port, which is the exporter's country's port and not the terminal. It is one the 11 incoterms published by the International Chamber of Commerce, with a scrutinized edition released in January 2020. The term receives universal acceptance in international trade with consent from governments and authorities all over the world.

The rule is somewhat similar to CPT with only one difference in particular -- that the seller is accountable for carriage and insurance coverage till the named port. CIP can be used for multi-modal shipments, or for more than one mode of transit. In CIP, the title transfers when the goods are received by the buyer on the first port.

CIP Shipping terms in 2020

- The seller is responsible for the goods till the designated port (in this case the second port, or the importing country’s port).

- Insurance is the responsibility of the seller; the buyer may pay for additional insurance incurred for carriage of goods from the port till his place.

- The risk of goods is transferred at the designated port.

- The target port is something that the two parties have to discuss and finalise.

Seller’s Responsibilities

The seller has responsibilities till the named place of destination, and will bear costs such as:

- Charges for maintaining goods in the warehouse

- Inland transit of goods -- from the warehouse to the first port

- Pay for depot charges

- Freight forwarder’s charges

- Air freight charges -- if the goods are to be transported by air

- Marine insurance charges -- for moving goods through sea/ocean

- Ocean freight charges and overall insurance coverage charges

Freight terms

As we considered our CIP place of destination to be the second port in the example above, the seller has his share of responsibilities till the target port which are to be completed within an agreed time and period.

He will have tasks such as:

- Inland transit (from rail/road) - from warehouse to the first port

- Carriage from the first port to the second port

Duty and custom clearance

CIP does include customs clearance , where the seller is liable for export customs and involved duty charges. He’ll be paying for settlement charges and look after freight forwarding proceedings. He has to prepare all the mandatory documents required for customs clearance and file them as required.

In a CIP transaction, the seller pays for insurance of goods . The seller, at his own cost, has to carry out the shipping terms and bear all the charges for licensing and security permits. He has to take coverage of goods as the liability of goods stays with him till the nominated port. The seller is not responsible for insuring goods after the goods have reached the nominated port. He can seize his duty and hand over all the necessary documents so that the buyer can comply with the importing formalities.

Buyer’s Responsibilities

In CIP trade terms, the buyer’s responsibilities are limited to the charges and conditions mentioned in the terms of contract. As the place of delivery plays a major role in a CIP transaction, the buyer will be entitled to carry out proceedings right after the port of delivery. It can be the first port -- where the charges are incurred right from the carriage for shipping to the importer country’s port -- or the second port -- where he will incur charges related to import proceedings and inland transit.

When the agreed place of delivery is the second port, the buyer has to take care of unloading of goods on the designated port and take care of freight for inland transit of goods from the port to his warehouse. If the nominated place is the first port, the freight duty for bringing the goods to the importer country’s port lies with the buyer.

Duty and customs clearance

Under CIP incoterm, the buyer has to ensure that he receives all the necessary documents from the seller required for import proceedings. As the buyer takes over authority right after the destination port, he’ll be the one paying for charges such as import taxes and duties.

The buyer has no obligation in CIP with respect to insurance (referring to risk and damage of goods). The insurance coverage charges are to be borne by the seller. But as discussed earlier, the buyer could pay for additional coverage borne by the seller, i.e., insurance from the named port till the buyer’s warehouse, as per the agreed terms between both the parties.

Also read: CIF , CFR and FOB

What is the process in CIP?

A CIP process starts with the seller -- responsible for the the freight, shipping and insurance till the destination port after which the risk is transferred to the buyer who is liable for transit and costs incurred thereafter.

What does CIP price mean?

The CIP price is the price or cost which is chargeable or quoted to the buyer by the seller during the trade process. Under CIP the seller has to pay for freight, carriage and all other charges till the destination port out of his own pocket and cannot recover it as shipping cost from the buyer, however he may consider these costs and accordingly arrive at the price which he wants to quote to the buyer.

Does CIP include customs clearance?

Under CIP terms, both parties have an equal contribution. where the exporter settles for export proceedings and arranges all essential documents, the buyer gives his consent for all the evidence provided by the seller and looks after the import customs.

What is the difference between CIP and CIF?

In CIP, the risk of goods passes from the seller to the buyer at the destination port, whereas in CIF the risk is transferred to the buyer -- once the goods are loaded by the seller on the vessel port.

We use cookies to give you the best possible experience on our website. By continuing to browse this site, you give consent for cookies to be used in accordance with and for the purposes set out in our Privacy Policy and acknowledge that your have read, understood and consented to all terms and conditions therein.

Connect with us!

Baltimore bridge collapse: What we know, who are the victims and will it affect US supply chain?

A container ship lost power and rammed into the major bridge causing the span to buckle into the river below, by ap and staff • published march 27, 2024 • updated on march 27, 2024 at 8:42 pm.

Authorities are piecing together what led to the bridge collapse in Baltimore . But so far, we know that Maryland Gov. Wes Moore said a large cargo ship lost power and issued a mayday call moments before it struck the Francis Scott Key Bridge.

The span broke apart and tumbled into the Patapsco River almost instantly. Two people were rescued, but officials say six others are presumed dead. They were in a construction crew filling potholes on the bridge at the time. Ship traffic has been suspended at the Port of Baltimore, which handles tens of billions of dollars in cargo each year.

Here's what we know so far about the collapse, the victims and how the incident will impact the U.S. supply chain:

In Photos: Francis Scott Key Bridge collapses after being struck by container ship

6 workers presumed dead after Baltimore bridge collapse; recovery mission begins

We're making it easier for you to find stories that matter with our new newsletter — The 4Front. Sign up here and get news that is important for you to your inbox.

What exactly happened?

The operators of the Dali cargo ship issued a mayday call that the vessel had lost power moments before the crash, but the ship still headed toward the span at “a very, very rapid speed," Maryland Gov. Wes Moore said.

The 985-foot-long (300-meter-long) vessel struck one of the 1.6-mile (2.6-kilometer) bridge’s supports, causing the span to break and fall into the water within seconds.

Six construction workers who were filling potholes on the bridge are presumed dead. Jeffrey Pritzker, executive vice president of Brawner Builders, said they were working in the middle of the span when it came apart.

An inspection of the Dali last June at a port in Chile identified a problem with the ship’s “propulsion and auxiliary machinery,” according to Equasis, a shipping information system. The deficiency involved gauges and thermometers, but the website’s online records didn’t elaborate.

The most recent inspection listed for the Dali was conducted by the U.S. Coast Guard in New York in September. The “standard examination” didn’t identify any deficiencies, according to the Equasis data.

The ship was moving at 8 knots, which is roughly 9 mph (15 kph).

Given the vessel’s massive weight, it struck the bridge support with significant force, said Roberto Leon, a Virginia Tech engineering professor.

“The only way the post can resist it is by bending,” Leon said. “But it cannot absorb anywhere near the energy that this humongous ship is bringing. So it’s going to break.”

Last June, federal inspectors rated the 47-year-old bridge in fair condition. But the structure did not appear to have pier protection to withstand the crash, experts said.

“If a bridge pier without adequate protection is hit by a ship of this size, there is very little that the bridge could do,” Leon said.

Who are the missing people?

Two people were rescued, and six others are missing and presumed dead. They all were part of a construction crew that was repairing potholes on the bridge.

The ship's operator issued a mayday call moments before the crash, enabling authorities to limit vehicle traffic entering the span. The fast action by authorities likely saved lives , Moore said.

Some vehicles on the span seemed to escape with seconds to spare, and police believe the construction workers are the only people who went into the water.

Among the victims are people from Guatemala, Honduras and Mexico, according to diplomats from those countries.

Guatemala’s consulate in Maryland confirmed that two of the missing were Guatemalan citizens working on the bridge. Mexico’s Washington consulate also confirmed in a statement posted on X that Mexican citizens were among the missing but did not say how many.

The Honduran man was identified as Maynor Yassir Suazo Sandova by that country's deputy foreign affairs minister. He was a father of teenage boy and a 6-year-old girl.

"The hope we have is to be able to see the body," Suazo’s brother told NBC News. "We want to see him, find him, know whether he is dead, because we don’t know anything."

Father Ako Walker, a Catholic priest at Sacred Heart of Jesus, said outside a vigil that he spent time with the families of the workers as they waited for news of their loved ones.

“You can see the pain etched on their faces,” Walker said.

María del Carmen Castellón told our sister station Telemundo 44 that her husband Miguel Luna, 49, was one of the missing employees working on the bridge. Castellón said Luna is a father of six from El Salvador.

“They only tell us that we have to wait, that for now, they can’t give us information,” she said Tuesday. “[We feel] devastated, devastated because our heart is broken, because we don’t know if they’ve rescued them yet. We’re just waiting to hear any news.“

Jesús Campos said he's worked construction for Brawner Builders, alongside some of the missing, for years and that last night his coworkers were replacing concrete on the bridge.

“Watching what’s happening makes my heart hurt. We’re human beings and they’re my coworkers,” he said. “God willing, they’re alive. It’s what we’re hoping for most.”

The ship is owned by Singapore-based Grace Ocean Private Ltd., which said all crew members, including the two pilots, were accounted for and there were no reports of injuries.

How will this impact the supply chain and travel?

The collapse will almost surely create a logistical nightmare for months, if not years, in the region and beyond, shutting down ship traffic at the Port of Baltimore, a major shipping hub. The accident will also snarl cargo and commuter traffic.

The bridge was “a normal commuting route for 30,000 Marylanders every day,” Gov. Moore said. It had 185 feet (56 meters) of clearance above the water and was a key cog in the region's transportation infrastructure.

The American Trucking Association estimated some 4,900 trucks per day carrying an annual average of $28 billion worth of goods would have to be re-rerouted — at a cost to shippers and ultimately consumers

The port is a major East Coast hub for shipping. The bridge spans the Patapsco River, which massive cargo ships use to reach the Chesapeake Bay and then the Atlantic Ocean.

Baltimore is the largest entry point in the U.S. for large agriculture and construction equipment like tractors, farming combines, forklifts, bulldozers and heavy-duty trucks that are bound for the Midwest, according to DAT Freight and Analytics, a freight-exchange service, NBC News reports.

Companies may have to reroute their shipments to nearby ports, like those in Georgia or Florida, he said. That will mean higher freight shipping costs as trucks have to travel further and may have to wait longer to pick up their loads if those ports become congested, said Dean Croke, principal analyst with DAT.

"It's very difficult to estimate the [shipping] cost impact, but it’s fair to say it's going to be costlier to transport autos and trucks to and from the U.S. in the short term because of the oversize impact on the port of Baltimore," said Tinglong Dai, a professor at the Johns Hopkins Carey Business School.

Baltimore is also the No. 1 automobile port in the U.S. Other Eastern Seaboard ports are expected to be able to shoulder some Baltimore-bound auto shipments, said Emily Stausbøll, market analyst with the shipping group Xeneta, which could limit the impact on global shipping rates.

“However, there is only so much port capacity available and this will leave supply chains vulnerable to any further pressure,” Stausbøll wrote in a note to clients, according to NBC News.

The Dali was headed from Baltimore to Colombo, Sri Lanka, and flying under a Singapore flag, according to data from Marine Traffic.

President Joe Biden said he plans to travel to Baltimore “as quickly as I can” and that he expects the federal government to pick up the entire cost of rebuilding the bridge.

What other bridges have collapsed in the US?

From 1960 to 2015, there were 35 major bridge collapses worldwide due to ship or barge collisions, with a total of 342 people killed, according to a 2018 report from the World Association for Waterborne Transport Infrastructure.

Eighteen of those collapses happened in the United States.

Among them were a 2002 incident in which a barge struck the Interstate 40 bridge over the Arkansas River at Webbers Falls, Oklahoma, sending vehicles plunging into the water. Fourteen people died and 11 were injured.

And in 2001, a tugboat and barge struck the Queen Isabella Causeway in Port Isabel, Texas, causing a section of the bridge to tumble 80 feet (24 meters) into the bay below. Eight people were killed.

This article tagged under:

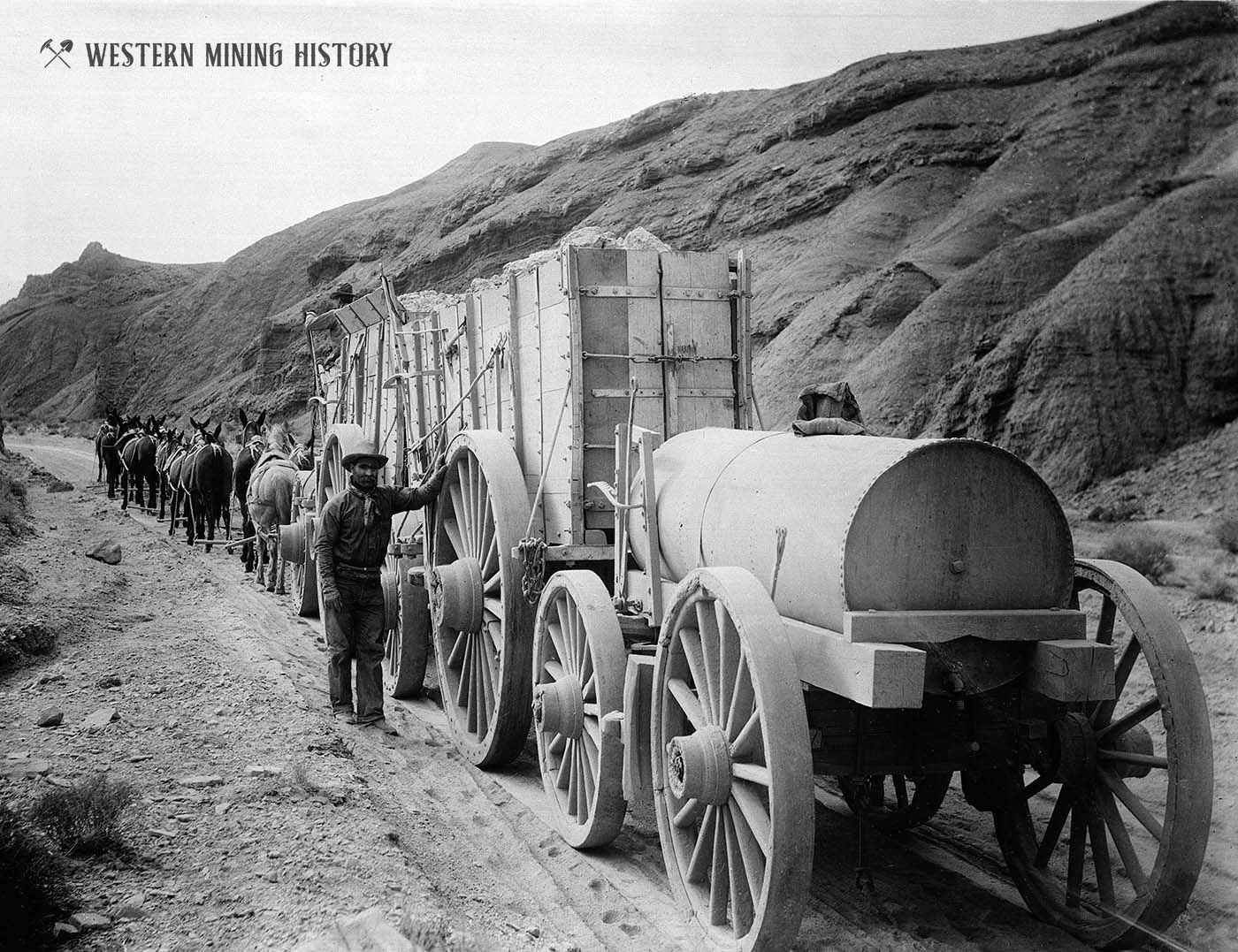

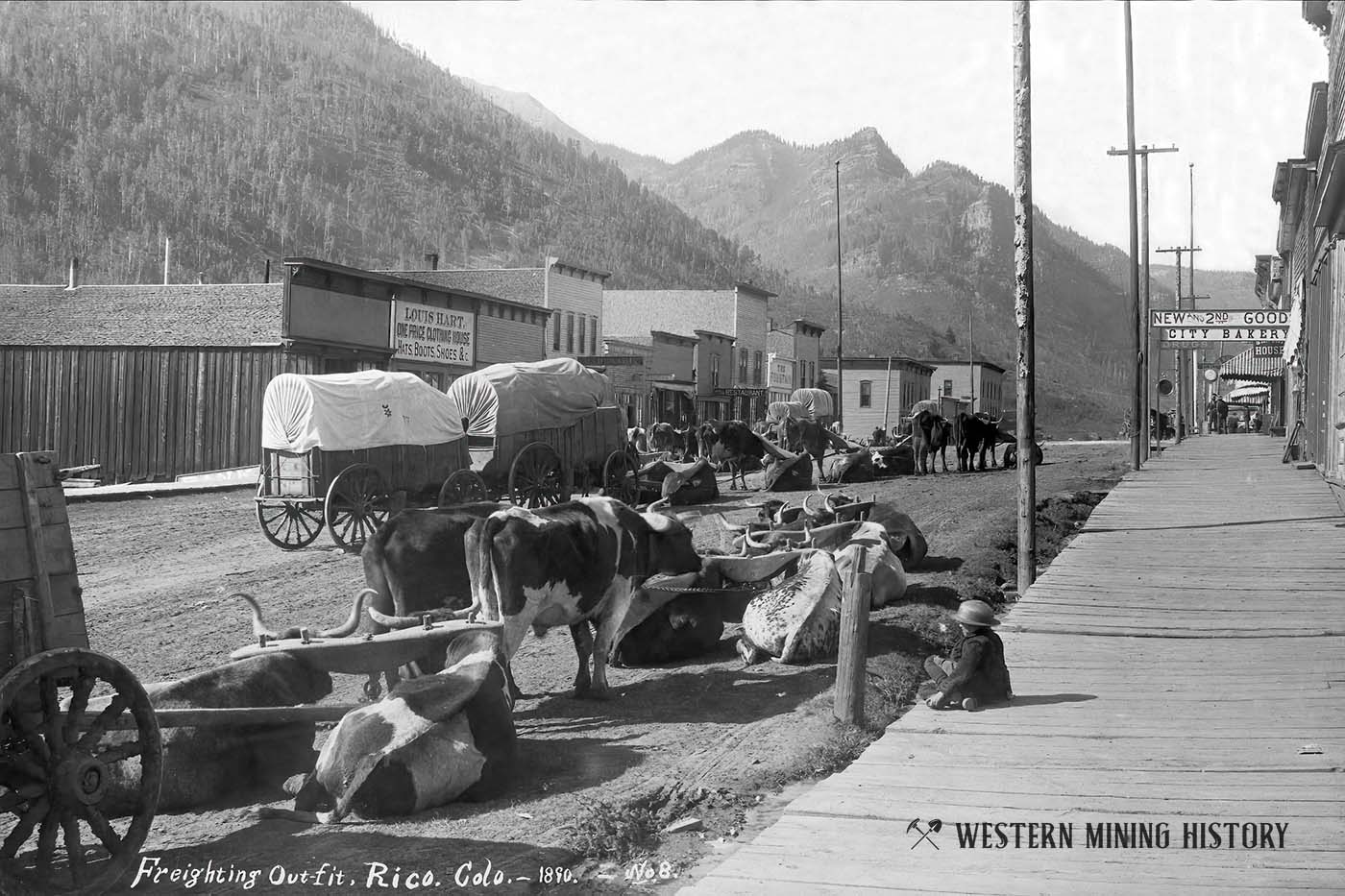

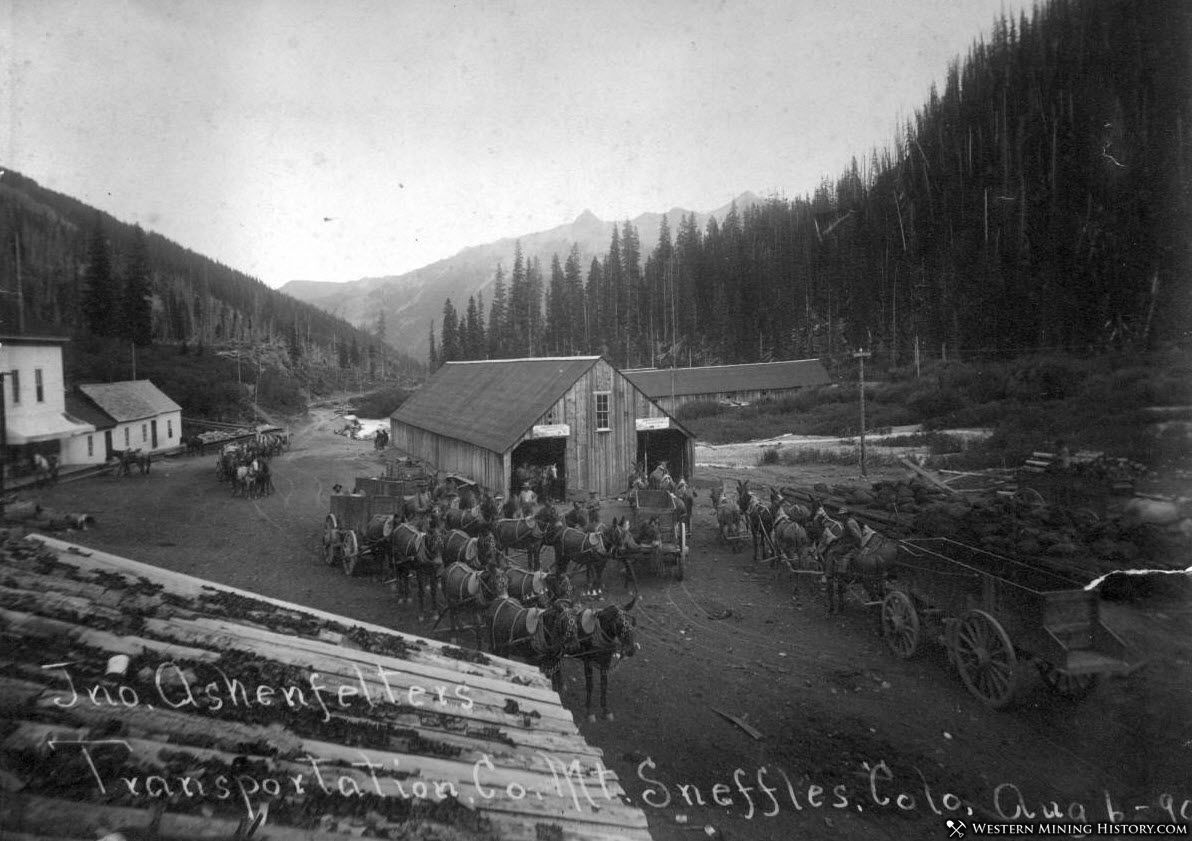

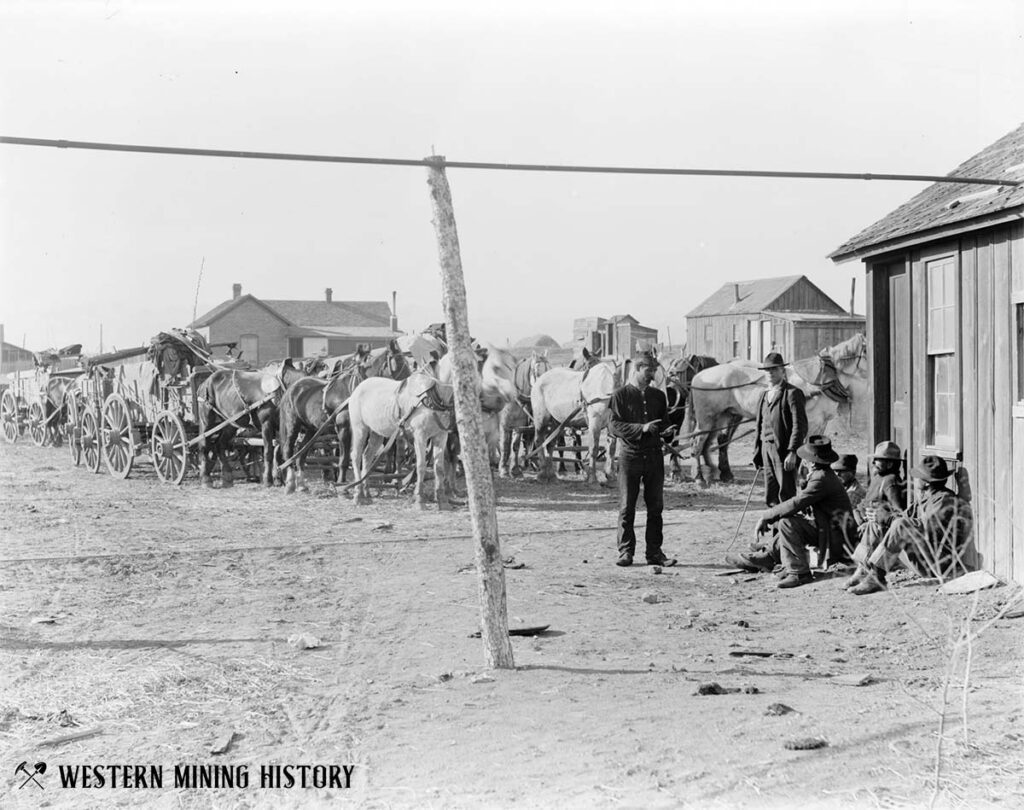

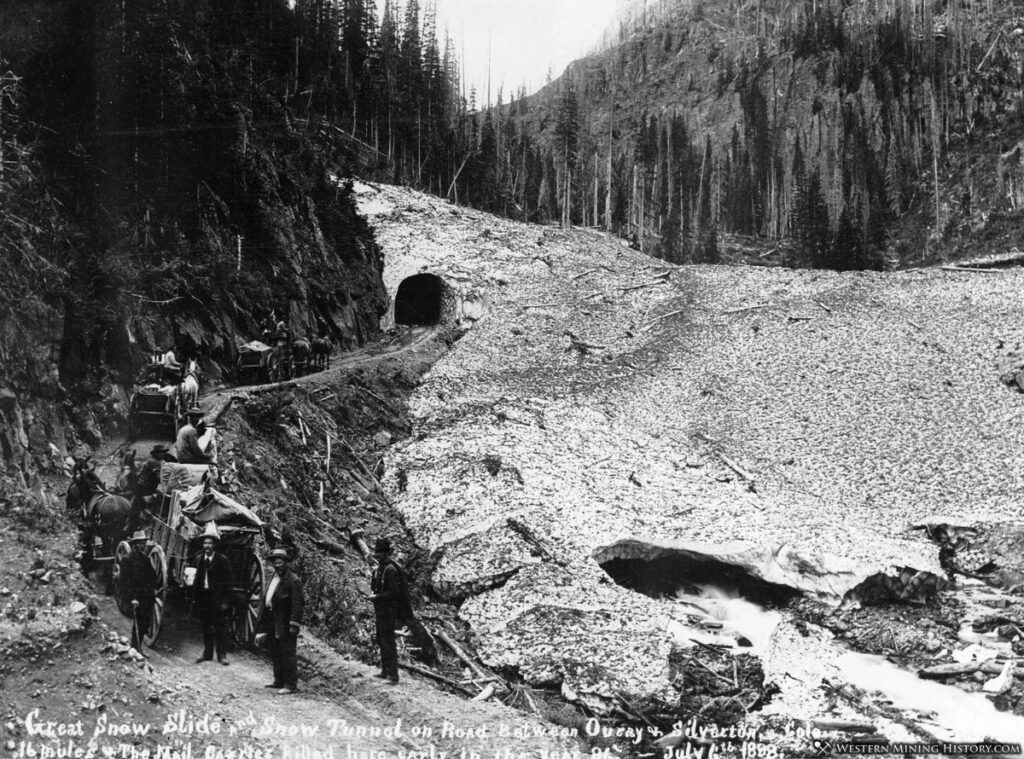

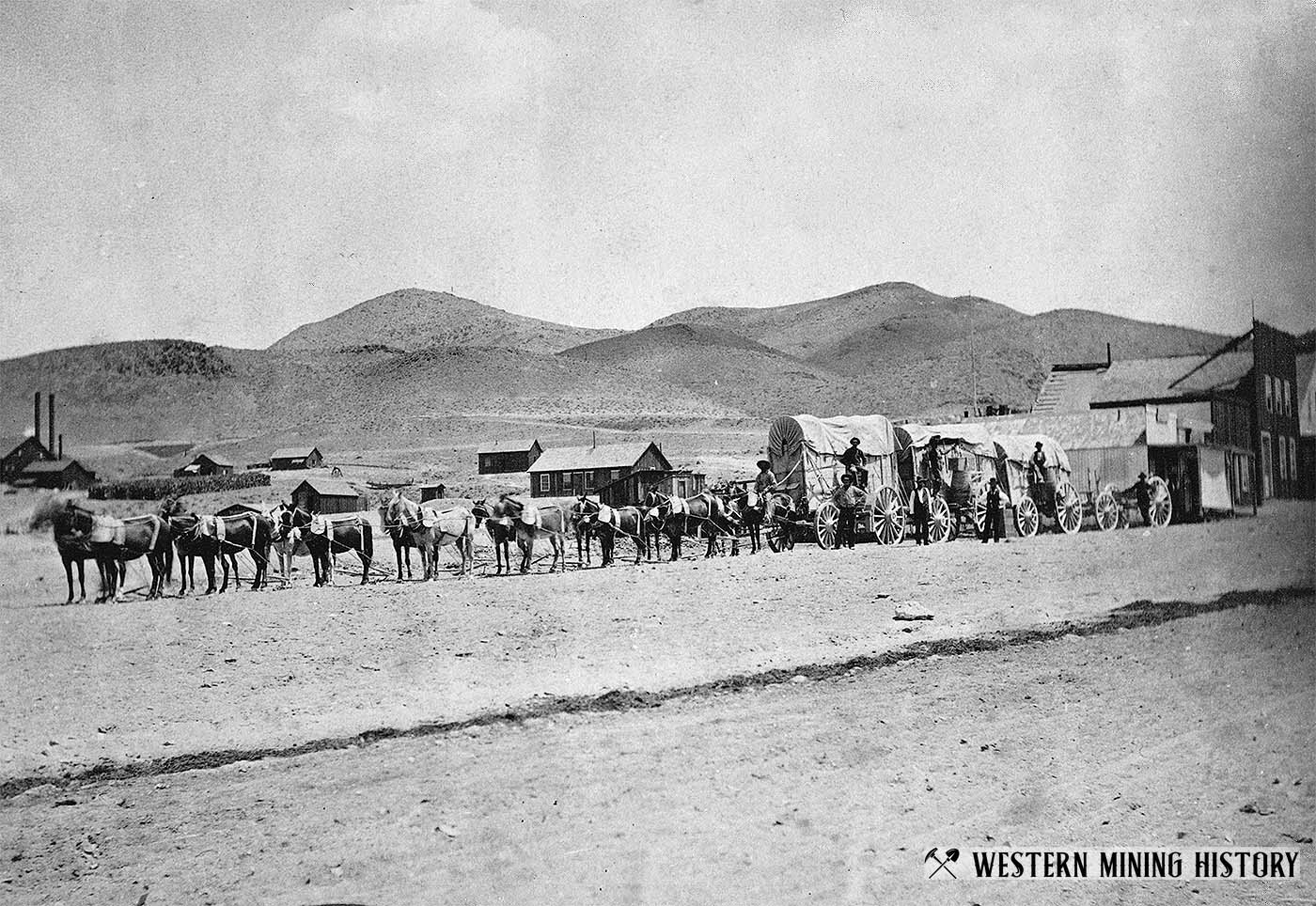

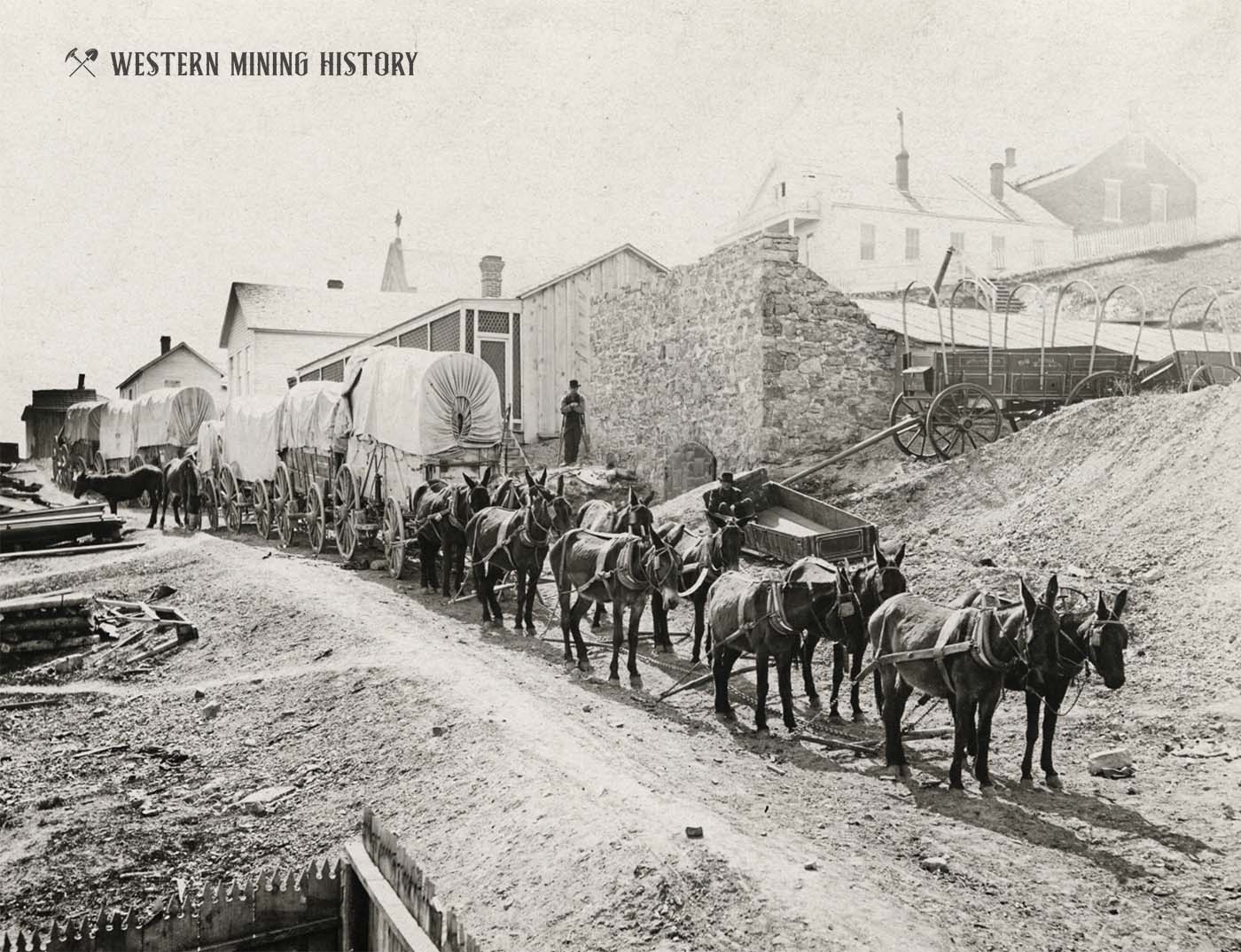

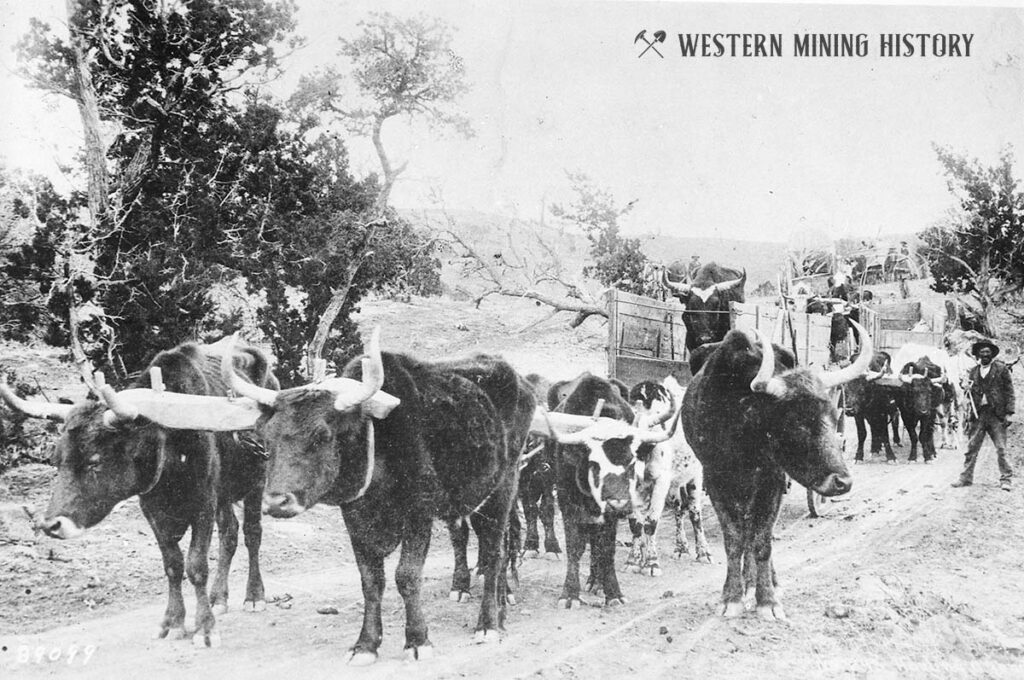

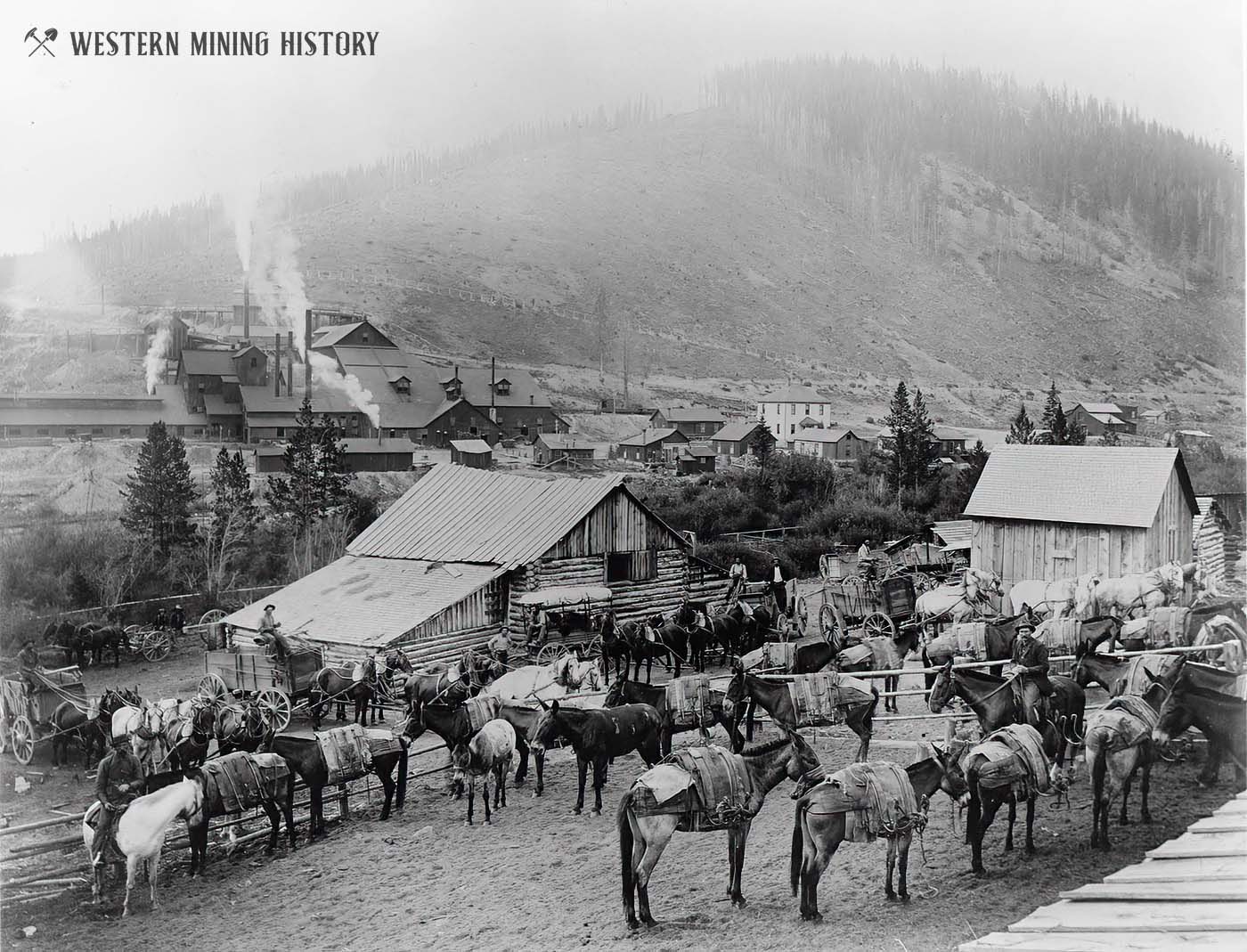

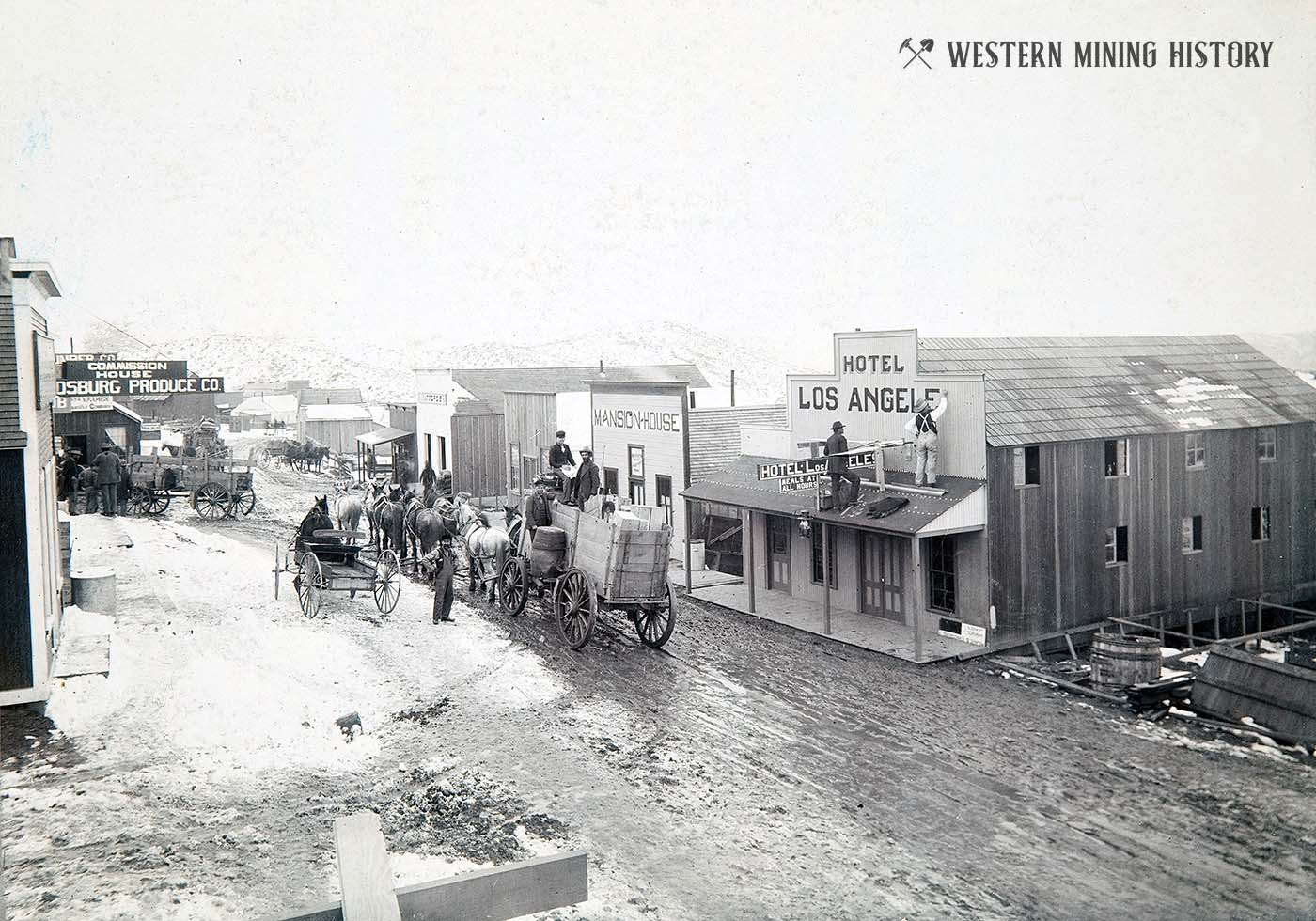

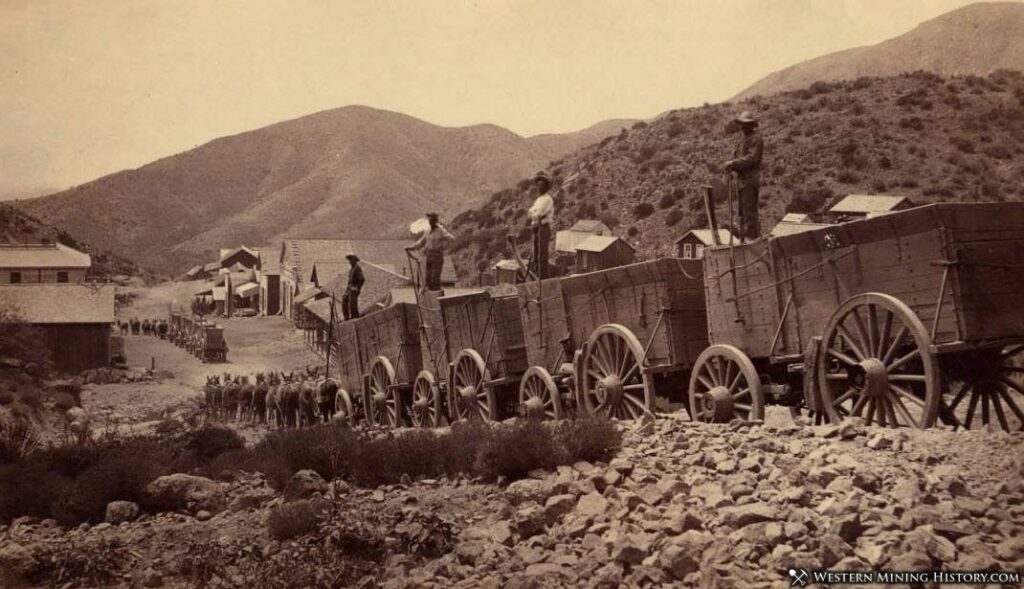

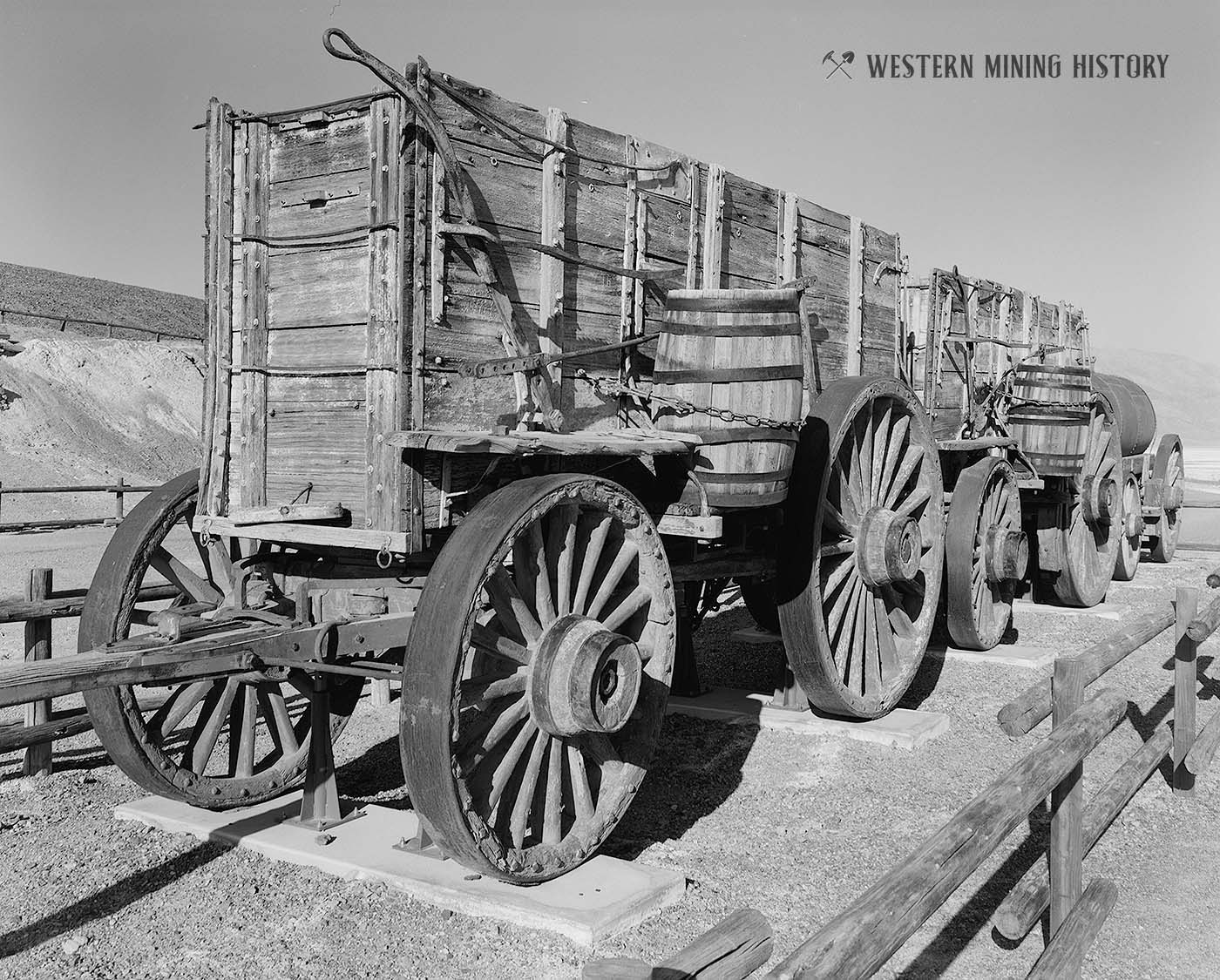

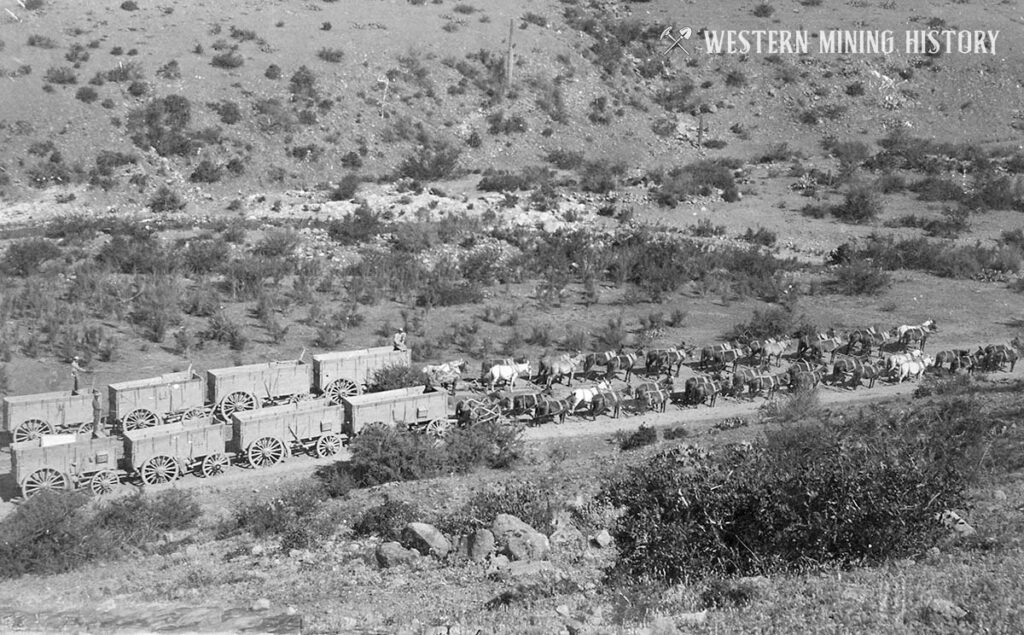

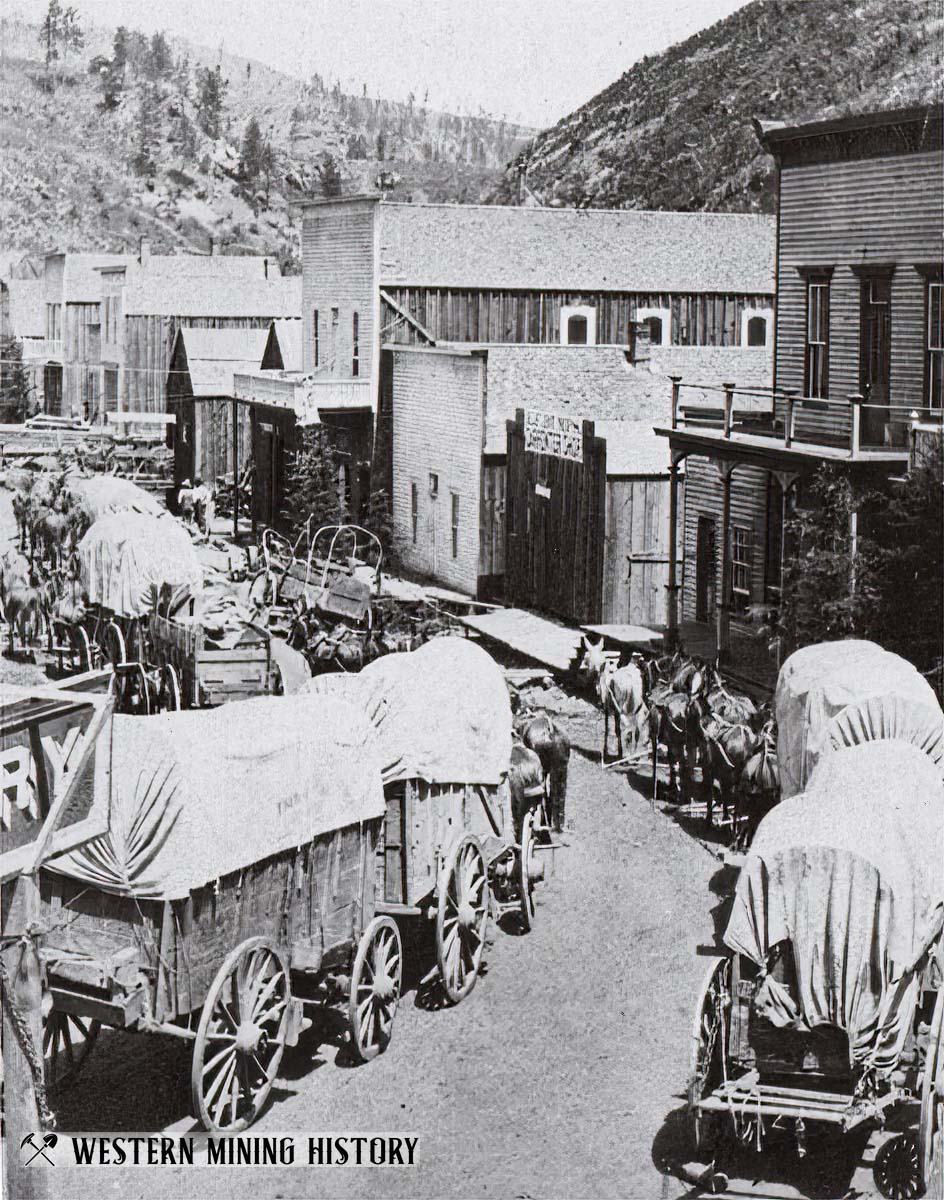

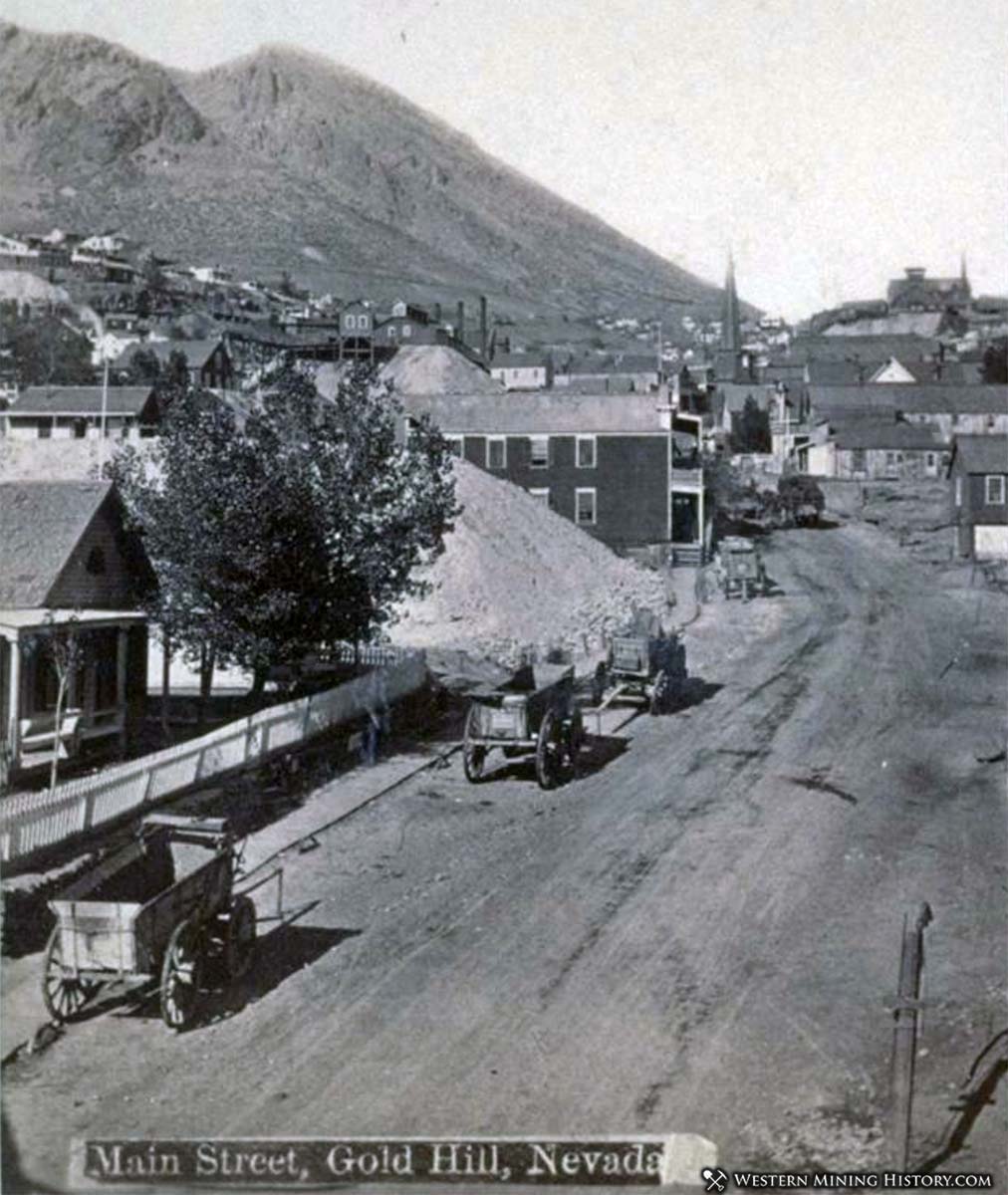

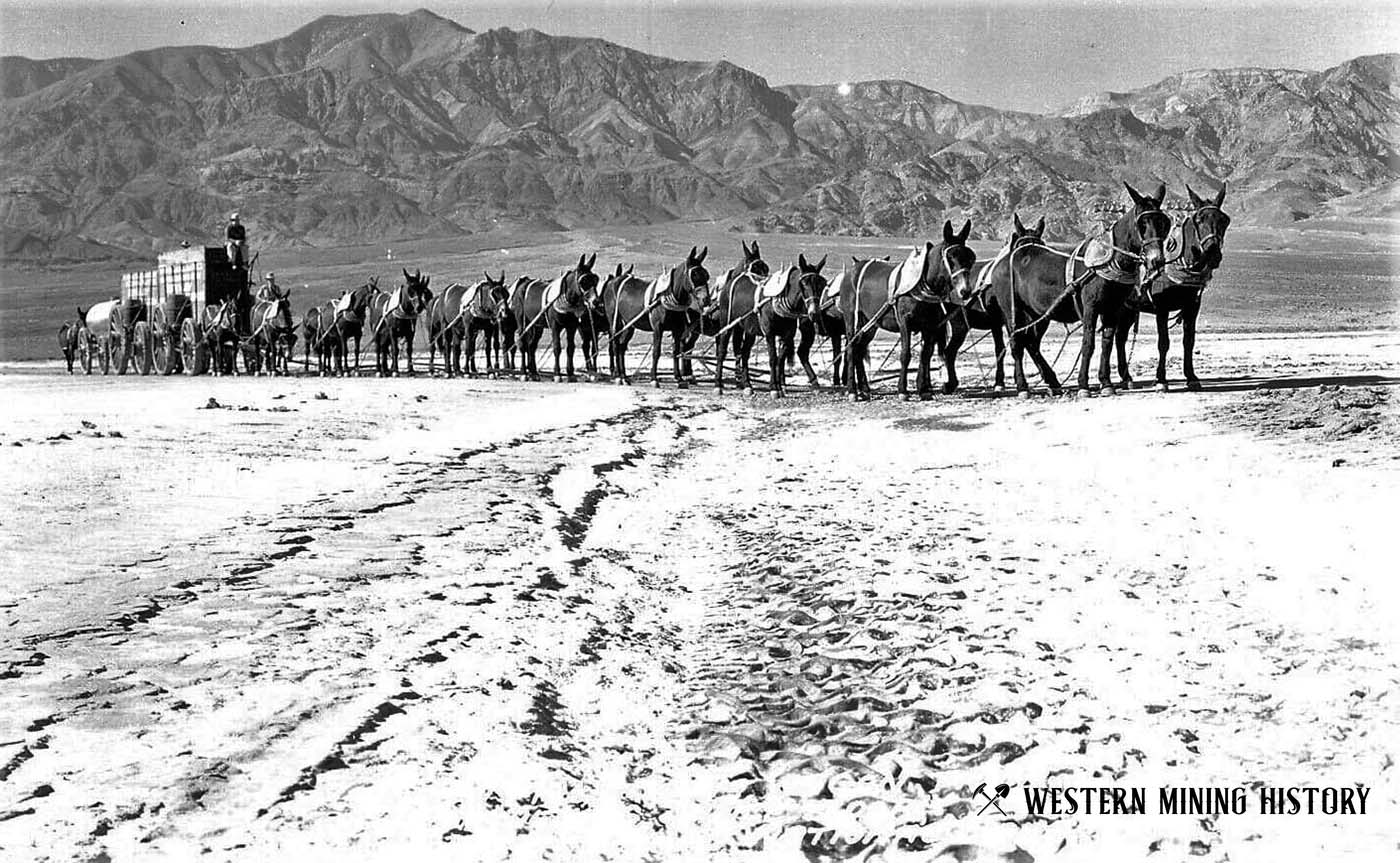

Heavy Freight Wagons of the American West

Text By Gary Carter

Photos sourced by Western Mining History from various archives.

Author`s Note

Twelve billion tons of freight were transported by truck in the United States last year. The skilled drivers have CB contact, radio, headphones, paved roads, power steering, sleeper cabs, and comfortable seats. Truck stops provide food, showers, and fuel.

One of the least appreciated but important jobs during the era of the western expansion was moving freight to provide everything from food to machinery, household goods, ore, and needed equipment for the rancher, miner, farmer, households, and storekeeper. Yet the “mule skinner” or “bull whacker” ranked near, if not at the bottom, on the scale of importance in stories about the old West, and even during their time they were looked down upon.

This article will provide a snapshot of the operation and men (mostly) of early freighting in the period before wheeled vehicles. The use of steamboats on navigable waters in the west, and the steady growth of railroads from the 1840’s well into the latter part of the century provided a huge slice of the freight transporting business, but those modes generally reached cities and large towns, off loaded and needed to be transported.

The focus of this article is on heavy duty freight wagons. Light weight express wagons, farm wagons, “Prairie Schooners“ and Conestoga wagons typically used along the trails heading West, military supply/escort wagons, and stage coaches will not be addressed. I hope readers will be as surprised, interested and entertained as I was doing the research.

The Freight Companies

Sometimes the scope of things really doesn’t change that much. Just as today, in the early days (up to 1900), there were large freight companies and plenty of independent operators who saw a need to earn a living transporting goods.

Some of the larger companies in the Western States were: The Miller Brothers Freight Company in Arizona, Charles T. Hayden’s Freight company, which had a wide range of coverage. Russell, Majors, and Waddell, while starting in the Great Plains eventually grew to ship goods throughout the west via Santa Fe. Ketchum’s Fast Freight Line served most places in Idaho.

Frank Shaw had a large freight operation that supplied many towns and mines in eastern California and western Nevada and hauled out the first Twenty Mule Team borax wagon load from Death Valley.

Remi Nadeau was known as the king of the Desert Freighters and his company regularly moved goods from Los Angeles to Salt Lake City and Virginia City, Montana. In the late 1860’s Remi Nadeau and Mortimer Belshaw, part owner of the famous Cerro Gordo silver mine, combined to operate the famed Cerro Gordo Freight Company which served most of California and clear into New Mexico.

During the California Gold Rush, mining camps were often so remote and difficult to reach that pack trains of mules carried supplies and much of this was done by individuals. By the mid 1850’s some trails were sufficient to be attempted by wagons, and Phineas Banning and David Alexander formed a freight company which supplied many camps. Their livestock included over 500 mules and horses capable of hitching to forty or more wagons.

In Colorado, especially in the rich San Juan Mining District, John Ashenfelter ran a large pack train and freighting company that supplied the towns and mining camps, and along with Dave Wood were the largest freighters into Southwestern Colorado towns and mining districts.

These are just a few of the larger freight companies. On a smaller scale were the independent and often lone teamsters who took on the contracts too small, dangerous, or remote for the larger outfits to bother with.

Mule Skinners and Bull Whackers

Depending on your team of animals those who drove the freight wagons were called mule skinners or bull whackers. The mules, of course were not skinned, but the “bull whackers” did have long whips with which to “urge the oxen along”.

Typically drivers were loners, and might go days without seeing another human, a bath, decent food, or necessities. They slept in the open or under the wagons and most often the larger wagons, especially the ore wagons, had no place to sit, so the freighter rode on the last animal that was in harness or yoke. Some of the wagons had wooden bench seats but men often walked since it was easier on the body than the bouncing of the wagon.

There were often no way stations, no pull offs, no places to safely seek shelter. Up until around the mid 1880, Indians were a menace and quite eager to attack a lone freight wagon and take the animals and goods.

The teamsters usually traveled light carrying a hat, knife, rifle, and the clothes they wore including heavy boots. A rough and ready group, full of profanities and lack of social etiquette, their work day began early and ended late – taking care of the animals and feeding themselves. John Bratt, a bull whacker, said he only ever knew one who did not chew tobacco, swear or drink.

Their life on the trail and vices generally meant most were single and when they did have free time it was often spent on booze, gambling, and soiled doves. The pay of around $70-$80 a month for an experience hand was above that of common laborers or miners who generally got from $2.00-$3.50 a day. To put that in perspective, before the Civil War soldiers (privates) stationed in the West received no more than $15 a month.

A typical charge to haul freight might be $8 to $10 per one hundred pounds but also depended on distance, dangers and difficulty. Large companies with many outfits on the road could do quite well. Russell, Majors and Waddell wagons once made $300,000 on one trip carrying supplies for the army.

The Earp brothers were often engaged in the freight trade, taking turns as “swampers” (helpers who generally assisted in loading and unloading) and drivers.

In deliveries to towns of any size there often was an area of town where the needs of the freighters, such as reshoeing and repairs, could be obtained. More often, especially on lonely, isolated stretches, the swamper and driver performed the chores. Fortunately the wagons were so carefully and sturdily built that despite the difficult conditions serious breakdowns were infrequent.

The Animals

As you might imagine the most important aspect of the trade were the animals. Oxen, mules, and horse were all put in harness and each contributed their own advantages and disadvantages.