- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

WorldTrips Travel Insurance Review: Is it Worth The Cost?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Since 1998, WorldTrips has provided medical insurance and trip protection to travelers from the U.S. and around the world in addition to coverage for international students. The company also provides coverage for various tour groups, missionary work and student exchange programs. The insurance policies are underwritten by Tokio Marine HCC, a Houston-based insurance company.

Whether you’re a U.S. resident looking for comprehensive travel insurance plans or a student looking for a medical-only policy, WorldTrips insurance has coverage options.

What kind of plans does WorldTrips provide?

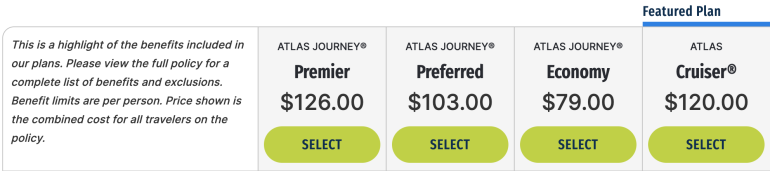

If you’re a U.S. resident, WorldTrips offers four single-trip comprehensive travel insurance plans: Atlas Cruiser, Atlas Journey Economy, Atlas Journey Preferred and Atlas Journey Premier. Here's a quick overview of the coverage offered by each plan.

Atlas Cruiser: This plan comes with 100% trip cancellation , 100% trip interruption , $25,000 medical expenses, $100,000 medical evacuation and $1,500 baggage loss coverage (up to $500 per item). This plan also offers optional Cancel For Any Reason coverage for up to 75% of the total trip cost (as long as you purchase it within 21 days of your initial trip payment and more than 48 hours before your trip begins).

Atlas Journey Economy: This budget plan covers 100% trip cancellation, 100% trip interruption, $10,000 medical expenses , $250,000 medical evacuation and $1,000 baggage loss (up to $250 per item).

Atlas Journey Preferred: This mid-range plan offers coverage for 100% trip cancellation, 150% trip interruption, $100,000 medical expenses, $1 million medical evacuation and $1,500 baggage loss (up to $500 per item). You can add Cancel For Any Reason coverage for 50% or 75% of the total trip cost.

Atlas Journey Premier: The priciest plan also provides the most coverage, including 100% trip cancellation, 150% trip interruption, $150,000 medical expenses (primary coverage), $1 million medical evacuation and $2,000 baggage loss (up to $500 per item). You have the option to add Cancel For Any Reason coverage for 50% or 75% of the total trip cost.

Non-U.S. residents and international students have access to medical-only policies. Annual plans aren’t available for U.S. residents.

» Learn more: The best travel insurance companies

WorldTrips travel insurance cost and coverage

WorldTrips offers several comprehensive single-trip plans that include basic trip protections and medical coverage. The cost varies based on coverage limits.

WorldTrips single-trip plan cost

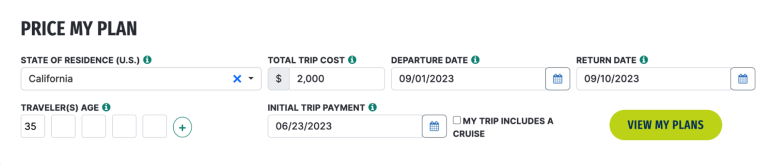

Here's a comparison of the cost of WorldTrips insurance plans for a 10-day trip that costs $2,000 for a 35-year-old traveler from California. In our example, the destination isn’t specified, and the trip doesn’t include a cruise.

The Atlas Journey Premier plan comes in at $126, the most expensive option. The Atlas Cruiser plan has a similar cost of $120. The Preferred and Economy plans, which cost $103 and $79, respectively, are a bit cheaper, but come with lower coverage limits.

» Learn more: What to know before buying travel insurance

Which WorldTrips travel insurance plan is for me?

The kind of coverage you’re seeking for your upcoming travels is going to affect your plan selection. Here are a few situations which might influence your decision:

If you’ve made nonrefundable deposits for your trip: If you’re going on a safari to Kenya or on a cruise to Antarctica and you’ve prepaid nonrefundable expenses, you probably want to go with plans that offer more coverage, such as Atlas Journey Preferred or Atlas Journey Premier.

If you need to add on Cancel for Any Reason coverage: For single-trip insurance plans, go with either Atlas Cruiser, Atlas Journey Preferred or Atlas Journey Premier because they offer this optional upgrade.

If travel insurance is mandatory and you hold a premium travel rewards credit card : If a tour operator requires you purchase travel insurance but you hold a credit card that already provides some trip protections, you can probably get away with the least expensive Atlas Journey Economy policy.

» Learn more: What does travel insurance cover?

How to get a quote from WorldTrips

To get an online quote, go to the WorldTrips home page and select whether you’re a U.S. resident, a non-U.S. resident or an international student. If you’re a U.S. resident, click on that box, then fill out the form to price your plan.

Make sure to provide your state of residence, total trip cost, departure and return dates, traveler’s age and initial trip payment date. If you’re going on a cruise, be sure to check the box. Once the form is complete, select “View my plans” and compare the plan types.

What isn’t covered by WorldTrips insurance?

As with any travel insurance policy, there are some exclusions to coverage. Here’s a sampling of things WorldTrips doesn’t cover:

Intentional self-inflicted injuries, including suicide.

War, invasion or acts of foreign enemies.

Speed or endurance competitions as well as athletic stunts.

Piloting or learning how to pilot an aircraft.

Being engaged in illegal activities.

Medical tourism.

Traveling against a physician’s advice.

Operating a motor vehicle without a license.

» Learn more: How much is travel insurance in 2023?

Is WorldTrips travel insurance worth it?

WorldTrips insurance offers multiple plans for U.S. travelers looking for trip insurance and medical coverage abroad as well as non-U.S. travelers and students looking for medical coverage in case of an unexpected injury or illness.

If you travel once or twice per year, WorldTrips offers several comprehensive single-trip policy options that are worth checking out. However, if you need an annual plan, you'll want to look elsewhere.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Ultimate Rewards®, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 toward travel when you redeem through Chase Ultimate Rewards®.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

Atlas Travel Insurance Review: Is it Worth it For You?

This article may contain references to some of our advertising partners. Should you click on these links, we may be compensated. For more about our advertising policies, read our full disclosure statement here.

In this Atlas Travel Insurance review, we’ll explore what plans they offer, what they cover, and whether the plans are worth it for you. Enjoy!

If you’re getting ready for a trip, you know it can involve a fair bit of planning. From finding affordable vacation ideas to choosing the ideal flights, there are a lot of decisions to make.

One decision you’d probably rather not deal with is choosing a travel insurance plan. Unlike scouting for the best flight and hotel deals, there’s nothing fun about thinking about the worst-case scenario. It’s tempting to skip it altogether – but don’t.

Anything could happen, and it’s better to be safe than sorry. The best travel insurance companies offer comprehensive coverage that protect your financial investment and your health.

Today I’ll review two types of insurance offered by Tokio Marine HCC-MIS Group, otherwise known as Atlas.

Atlas at a Glance

- Started in 1998 in Indianapolis, IN

- One of the first to make insurance products and services available on the internet

- Sells three comprehensive trip cancellation insurance plans

- Offers a multi-trip travel medical plan

- Offers two customizable single-trip travel medical plans

Atlas Travel Insurance Products

Atlas provides a suite of travel insurance options to meet the diverse needs of today’s traveler. Let’s take a look.

Trip Cancellation Insurance

Atlas trip cancellation insurance plans protect the non-refundable deposits you make when you book your trip. They’re considered comprehensive plans because they also offer emergency medical coverage. There are three tiers available:

- Atlas Excursion

- Atlas Expedition

- Atlas Enterprise

Atlas MultiTrip

The Atlas MultiTrip plan covers frequent travelers for all trips up to 30 or 45 days in a 364-day period. It’s primarily a travel medical plan, although it also includes trip interruption, trip delay, and baggage loss coverage. It does not include trip cancellation, so you’ll either have to use a travel rewards credit card that includes it, or purchase that separately for each trip.

Travel Medical Insurance

Atlas offers two customizable travel medical insurance plans that provide single-trip coverage for trips lasting 5 to 364 days. These plans also include trip interruption, travel delay, and lost baggage:

- Atlas Travel

- Atlas Premium

In this review, I’ll focus on the trip cancellation insurance and MultiTrip plans. If you want to learn more, you can compare Atlas travel medical insurance plans here .

Atlas Travel Insurance: What’s Included?

Atlas trip cancellation insurance plans protect you from financial loss if you cancel your trip or return home suddenly (for a covered reason). There are 3 plans to choose from – Excursion, Expedition, and Enterprise.

As an example, the basic Atlas Excursion plan includes:

- Trip Cancellation

- Trip Interruption

- Baggage Delay

- Emergency Medical and Dental Expense

- Emergency Medical Evacuation and Repatriation of Remains

- Common Carrier AD&D

Of course, the higher-tiered Expedition and Enterprise plans offer more coverage per category and offer extras like Cancel for Any Reason coverage and a Pre-existing Medical Conditions Waiver.

One note about these plans – they are not easy to find on their website. In fact, you have to get a quote (and therefore, already know your plans or have made reservations) to even get access to coverage amounts. We’d love to see coverage amounts front-and-center like they do for their MultiTrip and travel medical plans – without having to put in specific information first. Anyone should be able to see up-front how much insurance is provided.

Atlas’ MultiTrip plan is a travel medical plan that covers all trips lasting up to 30 or 45 days in a 364-day period. It’s an attractive solution for frequent travelers . Their MultiTrip plans include:

- Emergency Medical Evacuation: $1,000,000 lifetime maximum

- Repatriation of Remains: Up to the overall maximum limit

- Emergency Dental: $300

- Accidental Death and Dismemberment: Lifetime max up to $25,000 depending on age

- Common Carrier Accidental Death: up to $50,000 depending on age

- Personal Liability: $25,000 lifetime max

- Trip Interruption: $10,000

- Lost Luggage: $1,000

- Travel Delay (12 hours): $100/day for maximum 2 days

- Lost or Stolen Passport/Travel Visa: $100

- Deductible: $250 per covered trip

- For a full list of what’s covered, click here .

Remember that while it includes trip interruption, trip delay, and baggage loss coverage, it does not include trip cancellation insurance. If you want that, you can purchase it separately.

Great Coverage for Your Epic Trip – Protect yourself and your trip from catastrophe. Get started with comprehensive medical and trip insurance from Atlas. Get your free quote here .

Atlas Travel Insurance: How Much?

The cost of a travel insurance policy depends on several factors, including your age, the length and cost of your trip, whether you’re traveling solo or with family, and your state of residence. To weigh your options, get an online quote directly from Atlas. That said, these examples help illustrate how the plans compare in terms of price.

Let’s consider a 33-year-old solo traveler heading to Belgium for two weeks in June. He’s from the U.S. state of Georgia, and his trip costs $3,000. Here is what he would pay for each of the Atlas trip cancellation insurance plans:

- Atlas Excursion: $91

- Atlas Expedition: $107

- Atlas Enterprise: $126

Now, let’s shake things up and see what the prices would look like if it were a family vacation. Let’s add his 35-year-old wife and their two kids, ages 7 and 10. With the additional airfare, let’s say the trip costs $5,500:

- Atlas Excursion: $204

- Atlas Expedition: $240

- Atlas Enterprise: $280

In both examples, the jump from Atlas Excursion to Atlas Expedition is pretty small. Considering Atlas Expedition gets you an extra $100,000 in emergency medical coverage and the pre-existing medical conditions waiver, I think it’s worth it.

Note that adding Cancel for Any Reason coverage to the Atlas Enterprise plan would cost an extra $182. The standard trip cancellation coverage includes the most common reasons for canceling a trip, so most people probably wouldn’t add it on.

Atlas MultiTrip: How Much?

When buying the MultiTrip Plan, you can insure trips lasting up to 30 or 45 days. Let’s look at how much it would cost to insure the travelers from the previous example for all trips taken for 364 days.

Our 33-year-old solo traveler would pay:

- $188 for all trips lasting up to 30 days

- $230 for all trips lasting up to 45 days

The family of 4, ages 35, 33, 10, and 7 would pay:

- $282 for all trips lasting up to 30 days

- $345 for all trips lasting up to 45 days

Atlas Travel Insurance: What Isn’t Covered?

The nitty-gritty exclusion details vary by plan and can be found in your plan certificate. Here are a few things worth noting.

Pre-existing Medical Conditions (Certain Circumstances)

The Atlas trip insurance plans define a pre-existing medical condition as one you had in the 60 days preceding your scheduled departure. That 60 days is called the look-back period. Pre-existing conditions are handled differently based on the type of travel insurance you purchase.

The Atlas Excursion plan does not cover pre-existing medical conditions in any circumstance. For some, this is a good reason to buy the Atlas Expedition or Enterprise plans instead.

The Atlas Expedition and Enterprise plans have a pre-existing conditions waiver. That means that if you meet certain criteria, your trip cancellation, interruption, and medical benefits will cover your pre-existing medical conditions. These are the criteria:

- You purchase your travel insurance plan within 21 days of making your initial trip deposit

- You purchase insurance for the full cost of your trip

- You’re medically able to travel on the effective date of your policy

The Atlas MultiTrip plan has a look back period of two years. That means a condition is considered pre-existing if you had it in the two years prior to the beginning of your coverage.

The MultiTrip plan does not cover pre-existing medical conditions except in cases of acute onset. Acute onset means a sudden, unexpected, brief flare-up that requires urgent care (excluding chronic or congenital conditions).

Adventure Sports

There’s a whole list of adventure sports that aren’t covered. That means if you sustain an injury while taking part in one, Atlas won’t pay your claim. Here are a few notable exclusions:

- Parachuting

- Any kind of race

- Base jumping

- Independent scuba diving

- Spelunking or cave diving

- Whitewater rafting

- Big game hunting

If any of these are an important part of your travel plans, you should look elsewhere for your insurance needs. We recommend checking out World Nomads , which is known for its adventure sports coverage.

Lost or Damaged Medical Items

It’s important to note that baggage/personal effects and baggage delay coverage do not cover loss or damage to medical items you may travel with. This includes:

- Eyeglasses, sunglasses, and contacts

- Artificial teeth and dental bridges

- Hearing aids

- Prosthetic devices

- Prescribed medications

- Retainers and orthodontic devices

The best course of action is to keep these items in your carry-on luggage to reduce the chance of loss or damage.

Standard Exclusions

As is the case with most travel insurance providers, Atlas does not cover losses related to:

- Anything self-inflicted

- War, invasion, acts of foreign enemies, civil war, hostilities between nations

- Any non-emergency medical treatment

- Injury or sickness when traveling against the advice of a physician

- Participation in professional sports, piloting, or military training exercises

Again, consult your plan certificate for the full list of exclusions.

Need an all-in-one travel insurance plan? Atlas has your back with several single trip and multi-trip options. Get started today with a free quote.

Atlas Travel Insurance: Who Can be Covered?

Two of the Atlas trip cancellation plans, Atlas Expedition and Atlas Enterprise, cover travelers up to age 99. This is something to consider if you or someone you are traveling with is a senior. Atlas Excursion provides coverage to age 75. Atlas MultiTrip provides coverage to travelers aged 14 days to 75 years.

Atlas Travel Insurance Pros and Cons

Who should buy atlas travel insurance.

Frequent Travelers – If you travel several times a year, Atlas MultiTrip can save you money.

Travelers Who Need an All-In-One Insurance Product – If you need to insure your non-refundable trip deposits but you also want high levels of medical coverage, the Atlas Expedition or Enterprise plans will be a good fit for you. They come with a generous $150,000 or $200,000 in medical coverage.

Travelers Who Need Cancel For Any Reason Coverage – The Atlas Enterprise plan comes with optional Cancel for Any Reason coverage. Although it’s expensive, it will be worth it for some travelers.

Who Should Skip Atlas Travel Insurance?

Seniors Aged 75 and Over – Seniors over age 75 are not eligible for the Atlas Excursion plan or the MultiTrip plan. They can get the Atlas Expedition and Enterprise plan, but they can likely find more options elsewhere.

Adventurous Travelers – Atlas doesn’t offer adventure sports coverage, so if bungee jumping or mountain climbing are in the cards, look elsewhere. I recommend checking out World Nomads .

Frequent Travelers Who Need Trip Cancellation – The Atlas MultiTrip plan is a great option for frequent travelers, except for one thing: it doesn’t include trip cancellation insurance. If you’ll be making expensive deposits several times per year, the MultiTrip plan won’t check all your boxes.

How to Buy Atlas Travel Insurance

The simplest way to buy any of the Atlas plans is online. Start by grabbing a quote and reviewing the coverage. If you like what you see, enter your details and your payment information, and you’re good to go.

The Atlas trip cancellation insurance plans come with a 10-day review period. This means you can request a refund within 10 days of purchasing your plan if you change your mind (as long as your coverage hasn’t started).

With the Atlas MultiTrip plan, you can request a refund any time before coverage begins.

How to Make a Claim

You have 20 days for trip cancellation insurance or 60 days for MultiTrip insurance from the day coverage ends (the last day of the certificate period) to file a claim.

To start a claim, you must contact Tokio Marine HCC-MIS to give notice of your claim. You can do this online or by mail, and you can call to get help. They will advise what forms and information you need to provide.

Atlas Travel Insurance: Should You Buy It?

If you’re looking for a solid, comprehensive travel insurance plan that protects your non-refundable deposits and offers emergency medical coverage, Atlas has you covered.

Their Expedition and Enterprise plans offer robust coverage at a reasonable price. They are the trip insurance plans that will meet most travelers’ needs. In my opinion, the Excursion plan just doesn’t offer enough medical coverage for most situations.

The MultiTrip plan is a good fit for travelers looking to insure multiple trips a year but don’t need trip cancellation coverage.

Whether you chose Atlas or another provider, make sure you protect yourself and your trip by purchasing a travel insurance policy before you go. Thanks for reading and safe travels!

Get International Medical Insurance with Atlas – Are you ready to protect your trip and your health? Hop over to Atlas to get your free quote for your next trip. Grab a free quote here.

Atlas Travel Insurance Review

- Amount of Coverage

- Medical Coverage

- Travel Coverage and Protections

- Affordability

- Covered Activities & Sports

- Availability

Their Expedition and Enterprise plans offer robust coverage at a reasonable price. They are the trip insurance plans that will meet most travelers’ needs. In my opinion, the Excursion plan just doesn’t offer enough medical coverage for most situations. The MultiTrip plan is a good fit for travelers looking to insure multiple trips a year but don’t need trip cancellation coverage.

There is little adventure sports coverage and no annual plans that include trip cancellation insurance.

Sandra Parsons is a professional freelance writer and personal finance expert who writes about all things money. Her work has been featured on sites like MoneyTips, Credit Knocks, Women Who Money, and CreditCards.org. She also adores travel (preferably paid for with credit card rewards) and routinely reviews sightseeing passes and travel insurance solutions. Prior to focusing on her writing career, Sandra spent five years working in banking. She also holds master’s degrees in employment relations and psychology. Learn more about Sandra here.

Similar Posts

Survey Club Review: An Easy Way to Make Some Fun Money

Survey Club is a legitimate way to make money, but is it worth it? We’ll go over how the site works and if it’s the right fit for you.

Atlanta CityPASS Review 2024: Is It a Good Deal for You?

The Atlanta CityPASS helps save time and money on Atlanta’s top tourist attractions. In this review, we’ll determine if it’s a good fit for your plans.

Wealthfront Review: Put Your Investments on Autopilot

Wealthfront helps put your savings and investment goals on auto-pilot. In this review, learn about its features, fees, and whether it’s right for you!

Amsterdam All-Inclusive Pass Review 2024: Good Deal or Waste of Money?

If you’re going to the Netherlands, the Amsterdam Pass can save you tons of money on more than 50 sightseeing attractions. Find out if it’s right for you.

Go City Barcelona All-Inclusive Pass Review 2024: Is It Worth It?

The Go City Barcelona Pass helps tourists save time and money at over 40 top attractions. Read our review to learn if it’s worth it for you!

TaxAct Online Review: A Solid Choice for DIY Tax Preparation

TaxAct offers online tax preparation software for both Federal and State income taxes. This review explores the pros and cons, including features and costs.

Pin It on Pinterest

- Auto Insurance Best Car Insurance Cheapest Car Insurance Compare Car Insurance Quotes Best Car Insurance For Young Drivers Best Auto & Home Bundles Cheapest Cars To Insure

- Home Insurance Best Home Insurance Best Renters Insurance Cheapest Homeowners Insurance Types Of Homeowners Insurance

- Life Insurance Best Life Insurance Best Term Life Insurance Best Senior Life Insurance Best Whole Life Insurance Best No Exam Life Insurance

- Pet Insurance Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes

- Travel Insurance Best Travel Insurance Cancel For Any Reason Travel Insurance Best Cruise Travel Insurance Best Senior Travel Insurance

- Health Insurance Best Health Insurance Plans Best Affordable Health Insurance Best Dental Insurance Best Vision Insurance Best Disability Insurance

- Credit Cards Best Credit Cards 2024 Best Balance Transfer Credit Cards Best Rewards Credit Cards Best Cash Back Credit Cards Best Travel Rewards Credit Cards Best 0% APR Credit Cards Best Business Credit Cards Best Credit Cards for Startups Best Credit Cards For Bad Credit Best Cards for Students without Credit

- Credit Card Reviews Chase Sapphire Preferred Wells Fargo Active Cash® Chase Sapphire Reserve Citi Double Cash Citi Diamond Preferred Chase Ink Business Unlimited American Express Blue Business Plus

- Credit Card by Issuer Best Chase Credit Cards Best American Express Credit Cards Best Bank of America Credit Cards Best Visa Credit Cards

- Credit Score Best Credit Monitoring Services Best Identity Theft Protection

- CDs Best CD Rates Best No Penalty CDs Best Jumbo CD Rates Best 3 Month CD Rates Best 6 Month CD Rates Best 9 Month CD Rates Best 1 Year CD Rates Best 2 Year CD Rates Best 5 Year CD Rates

- Checking Best High-Yield Checking Accounts Best Checking Accounts Best No Fee Checking Accounts Best Teen Checking Accounts Best Student Checking Accounts Best Joint Checking Accounts Best Business Checking Accounts Best Free Checking Accounts

- Savings Best High-Yield Savings Accounts Best Free No-Fee Savings Accounts Simple Savings Calculator Monthly Budget Calculator: 50/30/20

- Mortgages Best Mortgage Lenders Best Online Mortgage Lenders Current Mortgage Rates Best HELOC Rates Best Mortgage Refinance Lenders Best Home Equity Loan Lenders Best VA Mortgage Lenders Mortgage Refinance Rates Mortgage Interest Rate Forecast

- Personal Loans Best Personal Loans Best Debt Consolidation Loans Best Emergency Loans Best Home Improvement Loans Best Bad Credit Loans Best Installment Loans For Bad Credit Best Personal Loans For Fair Credit Best Low Interest Personal Loans

- Student Loans Best Student Loans Best Student Loan Refinance Best Student Loans for Bad or No Credit Best Low-Interest Student Loans

- Business Loans Best Business Loans Best Business Lines of Credit Apply For A Business Loan Business Loan vs. Business Line Of Credit What Is An SBA Loan?

- Investing Best Online Brokers Top 10 Cryptocurrencies Best Low-Risk Investments Best Cheap Stocks To Buy Now Best S&P 500 Index Funds Best Stocks For Beginners How To Make Money From Investing In Stocks

- Retirement Best Gold IRAs Best Investments for a Roth IRA Best Bitcoin IRAs Protecting Your 401(k) In a Recession Types of IRAs Roth vs Traditional IRA How To Open A Roth IRA

- Business Formation Best LLC Services Best Registered Agent Services How To Start An LLC How To Start A Business

- Web Design & Hosting Best Website Builders Best E-commerce Platforms Best Domain Registrar

- HR & Payroll Best Payroll Software Best HR Software Best HRIS Systems Best Recruiting Software Best Applicant Tracking Systems

- Payment Processing Best Credit Card Processing Companies Best POS Systems Best Merchant Services Best Credit Card Readers How To Accept Credit Cards

- More Business Solutions Best VPNs Best VoIP Services Best Project Management Software Best CRM Software Best Accounting Software

- Manage Topics

- Investigations

- Visual Explainers

- Newsletters

- Abortion news

- Coronavirus

- Climate Change

- Vertical Storytelling

- Corrections Policy

- College Football

- High School Sports

- H.S. Sports Awards

- Sports Betting

- College Basketball (M)

- College Basketball (W)

- For The Win

- Sports Pulse

- Weekly Pulse

- Buy Tickets

- Sports Seriously

- Sports+ States

- Celebrities

- Entertainment This!

- Celebrity Deaths

- American Influencer Awards

- Women of the Century

- Problem Solved

- Personal Finance

- Small Business

- Consumer Recalls

- Video Games

- Product Reviews

- Destinations

- Airline News

- Experience America

- Today's Debate

- Suzette Hackney

- Policing the USA

- Meet the Editorial Board

- How to Submit Content

- Hidden Common Ground

- Race in America

Personal Loans

Best Personal Loans

Auto Insurance

Best Auto Insurance

Best High-Yields Savings Accounts

CREDIT CARDS

Best Credit Cards

Advertiser Disclosure

Blueprint is an independent, advertising-supported comparison service focused on helping readers make smarter decisions. We receive compensation from the companies that advertise on Blueprint which may impact how and where products appear on this site. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Blueprint. Blueprint does not include all companies, products or offers that may be available to you within the market. A list of selected affiliate partners is available here .

Travel Insurance

WorldTrips travel insurance review 2024

Jennifer Simonson

Mandy Sleight

“Verified by an expert” means that this article has been thoroughly reviewed and evaluated for accuracy.

Heidi Gollub

Updated 9:06 a.m. UTC Nov. 13, 2023

- path]:fill-[#49619B]" alt="Facebook" width="18" height="18" viewBox="0 0 18 18" fill="none" xmlns="http://www.w3.org/2000/svg">

- path]:fill-[#202020]" alt="Email" width="19" height="14" viewBox="0 0 19 14" fill="none" xmlns="http://www.w3.org/2000/svg">

Editorial Note: Blueprint may earn a commission from affiliate partner links featured here on our site. This commission does not influence our editors' opinions or evaluations. Please view our full advertiser disclosure policy .

Best for extension of travel insurance coverage

Top-scoring plan

Covers covid, medical & evacuation limits per person, what you should know.

WorldTrips’ Atlas Journey Preferred policy offers an extension of coverage benefit that’s almost three weeks longer than that of any other company we evaluated, and this extension includes medical quarantine coverage.

- Cheapest of the 5-star plans in our rating.

- Top-notch $1 million per person in medical evacuation coverage.

- Very good travel delay and missed connection coverage.

- Optional “cancel for any reason” coverage of 50% or 75%.

- Emergency medical coverage is secondary, with optional upgrade to primary.

- No “interruption for any reason” coverage.

About WorldTrips travel insurance

WorldTrips Atlas Journey travel insurance plans provide customizable travel insurance coverage at a competitive price. Depending on the type of trip you are planning, you can customize your travel insurance coverage by adding upgrades such as pet care coverage, hunting and fishing equipment coverage and even destination wedding coverage.

In this WorldTrips insurance review, we break down WorldTrips’ three main insurance plans, share sample pricing for its top-rated travel insurance plan and explain some common policy exclusions.

WorldTrips travel insurance plans

WorldTrip’s Atlas Journey travel insurance plans include medical coverage and trip interruption coverage for both domestic and international trips. The three travel insurance plans — Premier, Preferred and Economy — allow you to select the plan with the appropriate amount of coverage to meet your travel needs.

Atlas Journey Economy

The WorldTrips Atlas Journey Economy plan was designed for travelers who are looking for basic coverage on their next vacation or business trip.

The plan includes all the basic travel insurance coverages such as trip cancellation, trip interruption, trip delay, medical coverage, medical evacuation and baggage coverage.

Of the three plans, the economy plan offers the lowest payout benefits. The travel medical insurance limit is only $10,000 per person. This coverage limit might be fine when traveling through the United States where your primary medical insurance would cover any emergency medical situations. However, if you are traveling internationally through countries that do not accept your domestic health insurance , you might want to upgrade your plan to include more medical coverage.

Atlas Journey Preferred

The WorldTrips Atlas Journey Preferred plan includes everything the economy plan does, but increases the coverage amount for every benefit. This plan gets 5 stars in our rating of the best travel insurance .

Atlas Journey Preferred provides the same trip cancellation , interruption and emergency evacuation benefits as the top-tier Premier plan, but offers slightly lower limits for delay, missed connection and baggage insurance.

The biggest difference between the Preferred and the more expensive Premier plan is that the Preferred plan offers up to $100,000 in secondary emergency medical coverage while the Premier plan offers up to $150,000 in primary emergency medical coverage. You can opt to upgrade the Preferred plan to primary coverage for an additional fee, however.

Know more: Flight cancellations

Atlas Journey Premier

The WorldTrips Atlas Journey Premier plan is the crème de la crème of the WorldTrips trio of plans. It offers travelers the highest payout benefits of all the plans, which is especially important for those traveling overseas.

Compare WorldTrips travel insurance plans

What worldtrips travel insurance covers.

The core types of travel insurance packaged together in WorldTrips Atlas Journey policies include:

- Sickness or injury that renders you or your traveling companion unable to travel.

- Death of a family member, traveling companion or business partner.

- Severe weather that causes your common carrier to shut down for more than 12 hours.

- Terrorist incident or civil unrest in your destination.

- Emergency medical expenses: Travel medical insurance helps pay doctor and hospital bills and emergency evacuations if you get sick or injured on your trip.

- Travel delay: If your trip is delayed for five hours or more due to a reason listed in the policy, travel delay insurance can help cover the cost of accommodations, meals and local transportation while you are delayed.

- Baggage: Baggage insurance includes lost or stolen baggage, excessive baggage damage and baggage that is delayed more than 12 hours.

- Travel Assistance Services: Multilingual travel agents can provide worldwide travel, medical, emergency, and security assistance 24 hours a day, seven days a week.

What WorldTrips travel insurance doesn't cover

Like all travel insurance plans, WorldTrips plans will not cover everything. While it is always a good idea to read the fine print before buying a policy, here are some exclusions to WorldTrips travel insurance plans.

- Traveling against the advice of a physician.

- Medical tourism.

- Intoxication.

- Pre-existing conditions, unless you qualify for a waiver of the pre-existing condition exclusion.

- Participation in an organized sports competition or as a sporting professional.

- Participation in bodily contact sports, extreme sports, and certain adventure sports.

WorldTrips travel insurance rates

Worldtrips additional coverage options and benefits.

You can customize and enhance WorldTrips travel insurance plans with the following add-ons, provided they are available with the plan you choose and in your state.

“Cancel-for-any-reason” (CFAR) coverage

A “cancel for any reason” upgrade allows you to cancel your trip for any reason not already covered by your trip cancellation benefit, as long as you do so at least 48 hours before your scheduled departure.

Premier and Preferred plan policyholders can choose to be reimbursed for 50% or 75% of their costs with CFAR. This optional coverage is not available with the Atlas Journey Economy plan.

“Interruption-for-any-reason” coverage

The trip “interruption for any reason” (IFAR) upgrade reimburses 50% of your trip cost as long as you are at least 48 hours into your trip when you decide to end your travels early. This optional coverage is only available on the WorldTrips Atlas Journey Premier plan.

Destination weddings

This upgrade allows you to get trip cancellation benefits if the destination wedding you are attending is canceled after you buy your travel insurance policy. The destination wedding coverage is only available on the WorldTrips Atlas Journey Preferred and Premier plans.

Adventure sports

This optional coverage extends your travel insurance to include safari activities, bungee jumping, hang gliding and other extreme activities. This add-on is available for all WorldTrips Atlas Journey plans.

Emergency medical expense primary coverage

WorldTrips Atlas Journey Preferred policyholders have the option to upgrade their emergency accident and sickness coverage from secondary to primary coverage.

Rental car damage and theft

This upgrade adds collision damage and theft coverage for rental vehicles. The rental car coverage is an available add-on for all plans.

This upgrade adds trip cancellation or trip interruption coverage in the event of the death or critical illness of your dog or cat. It also adds vet care compensation if your dog or cat becomes ill when traveling with you. The pet care coverage is an add-on option for all plans.

Baggage damage or loss primary coverage

This add-on doubles your baggage coverage limits. It also increases the baggage insurance to primary coverage up from the secondary coverage available on the WorldTrips Atlas Journey plans. This upgrade is available on all plans.

Vacation rental accommodations

The vacation rental coverage offers interruption coverage if your vacation rental is unclean, overbooked or the keys are lost. The optional coverage upgrade is available on all plans.

Additional covered school activities

This optional upgrade adds cancellation coverage if a student is required to take a test, the school year is extended or if a sporting event is scheduled. The coverage upgrade is available on all plans.

Hunting and fishing activities

The hunting and fishing upgrade covers cancellation due to government restrictions. It also covers equipment if it is lost, damaged or stolen and reimburses travelers for rental gear. The optional coverage upgrade is available on all plans.

Methodology

Our insurance experts reviewed 42 aspects of 53 policies to find the best travel insurance plans. We used data provided by Squaremouth, a travel insurance comparison provider. For companies offering more than one travel insurance plan, we shared information about the highest-scoring plan (or two, in case of a tie).

Some companies may offer plans with additional benefits or lower prices than the plans which scored the highest, so make sure to get travel insurance quotes to see your full range of options.

The factors we scored out of a possible 100 points include the following.

Cost: 30 points. We scored the average cost for each travel insurance policy for a variety of trips and traveler profiles:

- Couple, age 30 for an 8-day trip to Mexico costing $3,000.

- Couple, age 30 for an 8-day trip to Mexico costing $3,000, with CFAR coverage upgrade.

- Couple, age 40, for a 17-day trip to Italy costing $6,000.

- Couple, age 40, for a 17-day trip to Italy costing $6,000, with CFAR coverage upgrade.

- Family of four, for a 17-day trip to Italy costing $15,000.

- Family of four, for a 17-day trip to Italy costing $15,000, with CFAR coverage upgrade.

- Couple, age 65, for a 17-day trip to Italy costing $6,000.

- Couple, age 65, for a 17-day trip to Italy costing $6,000, with CFAR coverage upgrade.

- Couple, age 70, for an 8-day trip to Mexico trip costing $3,000.

- Couple, age 70, for an 8-day trip to Mexico trip costing $3,000, with CFAR coverage upgrade.

Medical expenses: 15 points. We scored travel medical insurance by the coverage amount available. Travel insurance policies with travel medical expense benefits of $250,000 or more per person were given the highest score of 15 points.

Medical evacuation: 15 points. We scored each plan’s emergency medical evacuation coverage by coverage amount. Travel insurance policies with medical evacuation expense benefits of $500,000 or more per person were given the highest score of 15 points.

“Cancel for any reason” upgrade: 5 points. We gave travel insurance plans with the option of a “cancel for any reason” upgrade 5 points.

Trip interruption travel insurance: 5 points. We gave 5 points to travel insurance plans that offer trip interruption reimbursement of 150% or more.

Travel delay required waiting time: 5 points. We gave 5 points to travel insurance policies with travel delay benefits that kick in at 6 hours or less.

Baggage delay required waiting time: 5 points. We gave 5 points to travel insurance policies with baggage delay benefits that kick in at 12 hours or less.

Pre-existing medical condition exclusion waiver: 5 points. We gave policies that cover pre-existing medical conditions if purchased within a required timeline 5 points.

Non-medical evacuation: 5 points. If a policy provides coverage for non-medical evacuation, such as for political or security reasons, we gave it 5 points.

Cancel for work reasons: 5 points. If a plan allows you to cancel your trip for work reasons, such as your boss requiring you to stay and work, we gave it 5 points.

Employment layoff: 5 points. Travel insurance policies that allow you to cancel your trip because of layoff at a company where you have worked for one continuous year were scored 5 points. If a plan requires that you had the job for more than a year to qualify, no points were given.

WorldTrips insurance review FAQs

Yes, WorldTrips offers both annual and group medical insurance plans.

- Atlas Group medical insurance plans offer a 10% reduced rate for families and groups of five or more when traveling abroad.

- Atlas MultiTrip insurance is annual travel medical coverage for multiple trips abroad in a period of 364 days.

Yes, WorldTrips offers travel health insurance for international students. WorldTrips’s Atlas America travel health insurance is for non-U.S residents and citizens who travel internationally to the United States. Atlas America insurance reviews online are overwhelmingly positive, with 96% of reviewers recommending the policy.

WorldTrips considers a pre-existing condition to be an illness, disease or other condition during the lookback period (90 days in most states) immediately prior to your effective date of coverage for which you received or were recommended to receive a test, examination or medical treatment or received a medical prescription.

WorldTrips will waive the pre-existing conditions exclusion if you purchase your plan within 21 days of the date you made your first payment toward your trip and you are medically able to travel on the date of purchase.

Blueprint is an independent publisher and comparison service, not an investment advisor. The information provided is for educational purposes only and we encourage you to seek personalized advice from qualified professionals regarding specific financial decisions. Past performance is not indicative of future results.

Blueprint has an advertiser disclosure policy . The opinions, analyses, reviews or recommendations expressed in this article are those of the Blueprint editorial staff alone. Blueprint adheres to strict editorial integrity standards. The information is accurate as of the publish date, but always check the provider’s website for the most current information.

Jennifer Simonson covers everything from business to the wine industry to international travel. Outdoor adventure, water parks and all things Texas are by far her favorite beats. Her work has appeared in Forbes, Travel + Leisure, Texas Monthly, Smithsonian Magazine, Fodor's, Lonely Planet, Slate and more. You can follow her on Instagram at @storiestoldwell.

Mandy is an insurance writer who has been creating online content since 2018. Before becoming a full-time freelance writer, Mandy spent 15 years working as an insurance agent. Her work has been published in Bankrate, MoneyGeek, The Insurance Bulletin, U.S. News and more.

Heidi Gollub is the USA TODAY Blueprint managing editor of insurance. She was previously lead editor of insurance at Forbes Advisor and led the insurance team at U.S. News & World Report as assistant managing editor of 360 Reviews. Heidi has an MBA from Emporia State University and is a licensed property and casualty insurance expert.

10 worst US airports for flight cancellations this week

Travel Insurance Heidi Gollub

10 worst US airports for flight cancellations last week

Average flight costs: Travel, airfare and flight statistics 2024

Travel Insurance Timothy Moore

John Hancock travel insurance review 2024

Travel Insurance Jennifer Simonson

HTH Worldwide travel insurance review 2024

Airfare at major airports is up 29% since 2021

USI Affinity travel insurance review 2024

Trawick International travel insurance review 2024

Travel insurance for Canada

Travel Insurance Mandy Sleight

Travelex travel insurance review 2024

Best travel insurance companies of March 2024

Travel Insurance Amy Fontinelle

Best travel insurance for a Disney World vacation in 2024

World Nomads travel insurance review 2024

Outlook for travel insurance in 2024

Survey: Nearly 85% of Americans avoid family over the holidays

Travel Insurance Kara McGinley

You are using an outdated browser. Please upgrade your browser to improve your experience.

At ConsumersAdvocate.org, we take transparency seriously.

To that end, you should know that many advertisers pay us a fee if you purchase products after clicking links or calling phone numbers on our website.

The following companies are our partners in Travel Insurance: Travel Guard Insurance , Allianz Global Assistance , Travelex , TravelInsurance.com , Seven Corners , Generali Global Assistance , Trawick International , Squaremouth , John Hancock , and Faye .

We sometimes offer premium or additional placements on our website and in our marketing materials to our advertising partners. Partners may influence their position on our website, including the order in which they appear on the page.

For example, when company ranking is subjective (meaning two companies are very close) our advertising partners may be ranked higher. If you have any specific questions while considering which product or service you may buy, feel free to reach out to us anytime.

If you choose to click on the links on our site, we may receive compensation. If you don't click the links on our site or use the phone numbers listed on our site we will not be compensated. Ultimately the choice is yours.

The analyses and opinions on our site are our own and our editors and staff writers are instructed to maintain editorial integrity.

Our brand, ConsumersAdvocate.org, stands for accuracy and helpful information. We know we can only be successful if we take your trust in us seriously!

To find out more about how we make money and our editorial process, click here.

Product name, logo, brands, and other trademarks featured or referred to within our site are the property of their respective trademark holders. Any reference in this website to third party trademarks is to identify the corresponding third party goods and/or services.

Best to compare and buy from big-name insurers in minutes

- Lowest prices guaranteed on any plan

- 24/7 emergency assistance worldwide

- Over 100,000 verified customer reviews with a 97/100 rating

- Safe & secure checkout with instant confirmation of coverage

- Access to cruise, domestic & international policies from only top rated insurers in the market

- Travel Insurance

- Tokio Marine Review

Tokio Marine Atlas Travel Medical Insurance Review

The following companies are our partners in Travel Insurance: Travel Guard Insurance , Allianz Global Assistance , Travelex , TravelInsurance.com , Seven Corners , Generali Global Assistance , Trawick International , Squaremouth , John Hancock , and Faye .

We sometimes offer premium or additional placements on our website and in our marketing materials to our advertising partners. Partners may influence their position on our website, including the order in which they appear on a Top 10 list.

The analyses and opinions on our site are our own and our editors and staff writers are instructed to maintain editorial integrity. Our brand, ConsumersAdvocate.org, stands for accuracy and helpful information. We know we can only be successful if we take your trust in us seriously!

To find out more about how we make money and our editorial process, click here.

How is Tokio Marine rated?

Overall rating: 4.4 / 5 (excellent), tokio marine plans & coverage, coverage - 4.5 / 5, emergency medical coverage details, baggage coverage details, tokio marine financial strength, financial strength - 4.6 / 5, tokio marine price & reputation, price & reputation - 4.6 / 5, tokio marine customer assistance services, extra benefits - 4.1 / 5.

Our Comments Policy | How to Write an Effective Comment

6 Customer Comments & Reviews

Related to travel insurance, top articles.

- Trip Cancellation Insurance – What is Covered?

- Do I Really Need Travel Insurance?

- Emergency Travel Insurance Coverage

- Common Parasites and Travel-Related Infectious Diseases

Suggested Comparisons

- Travel Guard Insurance vs. Travelex

- Allianz Global Assistance vs. Travel Guard Insurance

- Allianz Global Assistance vs. Berkshire Hathaway

- Allianz Global Assistance vs. Travelex

- Or via Email -

Already a member? Login

- Travel insurance plans

- WorldTrips cost

Compare WorldTrips Travel Insurance

- Why You Should Trust Us

WorldTrips Travel Insurance Review 2024

Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate insurance products to write unbiased product reviews.

WorldTrips has been a reputable travel insurance provider for more than 20 years. Unsurprisingly, it boasts an A+ rating from the Better Business Bureau and positive reviews from thousands of customers.

Trip cancellation coverage for up to 100% of the trip cost and trip interruption coverage for up to 150% of the trip cost

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Affordable base plans that can be customized with add-ons including rental car, pet care, hunting and fishing, and vacation rental coverage

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Insurance plans available for international student travelers

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Trip delay coverage benefit that kicks in after just five hours

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Pre-existing conditions waiver can be purchased within 21 days of initial trip payment

- con icon Two crossed lines that form an 'X'. Lower medical, evacuation and accidental death limits

- con icon Two crossed lines that form an 'X'. Limited, secondary baggage loss coverage although baggage protection can be upgraded at a low cost

- con icon Two crossed lines that form an 'X'. No special coverages for pets, sports equipment, etc.

- Travel medical insurance (Premium, Group, Annual, and International Student options)

- Trip cancellation insurance

- Trip protection insurance

WorldTrips Travel Insurance Review: Types of Policies Offered

WorldTrips offers several unique products for travelers, including a dedicated plan for students pursuing study abroad programs. This section will help you understand the different plans available through WorldTrips in either category.

Most plans include COVID-19 coverage by default. Many also allow you to customize the plan to include optional upgrades for additional protection.

Travel medical insurance plans

Atlas Travel

Flagship product Atlas Travel provides travel medical insurance for travelers of various nationalities - a valuable product for anyone seeking financial support while exploring the world. The maximum coverage available through an Atlas Travel plan goes up to $2 million.

It's worth noting Atlas Travel does not cover US citizens and residents. However, US citizens and residents can purchase travel insurance coverage for countries outside the United States under an Atlas International plan. In addition, non-US citizens outside of the United States are also eligible for coverage within the US under the Atlas America plan. The site automatically selects it for the traveler at the time of purchase.

Atlas Premium

Atlas Premium is an upgraded version of Atlas Travel offering more flexibility on deductibles, coverage duration, and coverage maximums. This plan is ideal for several types of travelers, including parents covering an entire family, travelers planning adventurous activities carrying some risk, and people planning luxury or expensive travel.

Atlas Group

Atlas Group offers Atlas Travel benefits at a 10% discount for people traveling in groups of five or more. This policy is ideal for traveler profiles such as youth groups, missionaries, students studying abroad, larger families, and organizations planning international travel.

Atlas MultiTrip

Digital nomads and frequent international travelers can benefit from an Atlas MultiTrip plan. It provides global health coverage for any number of pre-planned or last-minute trips within 364 days, as long as each trip lasts fewer than 30 or 45 days. The duration guidelines vary depending on the coverage selected.

StudentSecure

Students studying abroad can purchase StudentSecure, an international health insurance policy for full-time students and scholars pursuing academic studies outside their home country. StudentSecure comes in four levels of coverage to meet each student's specific needs and meets or exceeds most country or school insurance requirements.

Trip protection insurance plans

Atlas On-The-Go

Atlas On-The-Go covers you if you only need financial reassurance for your travel plans. This trip protection insurance is for US residents traveling worldwide. In addition, it provides medical coverage for unexpected sickness, injury, lost or stolen bags, or travel cancellations.

Atlas Journey

Atlas Journey offers trip protection coverage for US citizens and residents on domestic and international travel. You can choose from three tiers of coverage: Premier, Preferred, or Economy, with up to 150% of trip costs covered in the case of travel interruptions, as well as up to $1 million in medical evacuation expenses.

Additional Coverage Options (Riders)

Buyers can customize many WorldTrips policies to enhance the overall benefits of the insurance plan. Here are some of the available riders and purposes.

Cancel-for-any-reason (CFAR) coverage

Cancel-for-any-reason insurance coverage, often abbreviated as CFAR, is an optional upgrade. It allows you to claim a percentage of your nonrefundable travel costs if you cancel your trip for any reason.

CFAR is available as an add-on on specific WorldTrips policies and can cover either 50% or 75% of your total nonrefundable travel forfeited when you cancel. However, you'll have to purchase CFAR coverage within a specific time limit after your first payment for travel expenses. You must cancel your trip more than 48 hours before the scheduled departure to make an eligible CFAR claim.

Adventure activities coverage

WorldTrips offers additional coverage options for adventurous travelers pursuing risky or challenging activities. This add-on increases your medical and evacuation benefits in the event of an incident.

Pet care coverage

If you're traveling with a pet, this coverage will help cover some of the costs associated with pet travel, including medical expenses if needed.

Rental accommodations coverage

This add-on covers expenses you may incur if your accommodations are double-booked or untenantable.

Rental car coverage

If you rent a car during your travels, you can purchase this add-on to forego the coverage offered at the rental car desk. Note, if you hold a premium credit card with travel benefits, you may already have access to free rental car insurance meeting or exceeding any ceilings offered through WorldTrips, even with this upgrade.

School activities interruption/cancellation coverage

If a school schedule change impacts your travel plans, this add-on will reimburse you for nonrefundable travel expenses associated with the travel cancellation or interruption.

Hunting and fishing cancellation/interruption

This add-on will help defray your cost if changes to your local government restrictions or equipment delays impact your travel plans. Unfortunately, this policy does not cover big game hunting.

Destination wedding cancellation or interruption coverage

This policy add-on protects guests attending a destination wedding. If the couple cancels the wedding or the event is delayed or canceled due to other circumstances, this policy will help cover expenses incurred by the change in plans.

WorldTrips Travel Insurance FAQs

WorldTrips offers excellent travel insurance plans for any traveler but is particularly beneficial for students studying abroad, travelers planning a group trip, or digital nomads looking for continuous medical coverage while abroad.

WorldTrips offers different options to file claims, including mail, online, etc. However, it requires extra paperwork compared to many other travel insurance providers. As a result, the process may be more complicated compared to competitors.

WorldTrips offers a study abroad travel insurance policy called StudentSecure, which covers medical expenses and emergencies while students are abroad.

WorldTrip Travel Insurance Cost

Travel insurance coverage varies greatly, and the amount you pay reflects the range of protection . However, since travel insurance protects your financial investment, it's typically worth spending a few extra dollars for higher coverage maximums, especially for medical insurance and evacuation expenses.

Let's say you're planning a 10-day solo trip in Mexico over the winter holidays with a total cost of $6,000, including a cruise and some potential adventure excursions. Here's what a WorldTrips Atlas Journey insurance plan would cost and include. We have included three different tiers of coverage:

Many WorldTrips policies can be customized with optional add-ons enhancing the overall benefits of the insurance plan. We priced out a number of the available riders based on the hypothetical trip to Mexico and represented the cost of the add-on as a percentage of the estimated trip cost of $6,000.

How to File A Claim with WorldTrips

Unfortunately, the WorldTrips claim filing process leaves much to be desired. WorldTrips customers need to keep their travel insurance policy handy to know which claims process to follow.

You'll also need to have some other information on hand, such as whether or not a medical provider would bill WorldTrips directly on your behalf or if you have to pay out of pocket at the time of your service.

Atlas Travel, Atlas Premium, Atlas Group, Atlas MultiTrip, and StudentSecure travel medical insurance

If you hold a policy under one of the travel medical insurance products above, here's the step-by-step guide you'll reference when submitting a claim. You can submit your claim via email or regular mail using the following contact information:

Email: [email protected]

Mail: WorldTrips

Claims Department

Farmington Hills, MI 48333-2005

You can also submit your claim electronically through your customer portal: Client Zone for most policyholders and Student Zone for students.

Atlas Journey and Atlas On-The-Go trip protection insurance

If you have an Atlas Journey or Atlas On-The-Go plan, you'll reference the "submit a claim" section of this FAQ for the relevant forms you'll need to complete and the supporting documentation for your claim.

You can submit your claimant's statement and authorization form via your customer portal ( Client Zone for most policyholders or Student Zone for students). Buyers can also use the WorldTrips Online service page and select "submitting a claim or an appeal" from the dropdown menu under the "contact us" header at the top of the page.

If you prefer to submit your claim through email or regular mail, the contact information is as follows:

If you can't access the required forms online, contact WorldTrips to have the documents faxed, emailed, or mailed.

If you're a student, you must submit additional documents for your claim proving you are a full-time student. Having the proper records can make your claim much less frustrating.

Deborah from California posted on Squaremouth , "When we returned home I called WORLD TRIPS and they said that I must file a claim with the airline first and then once that claim was adjudicated to file a claim with WORLD TRIP. I haven't gone back to read the policy terms but didn't think that this WORLD TRIP was secondary to other sources of recovery."

See how WorldTrips Travel Insurance stacks up against the competition.

WorldTrips Travel Insurance vs. Nationwide Travel Insurance

WorldTrips compares favorably to Nationwide . While Nationwide is also a reputable insurance provider with great reviews, the company offers just two standard plans customizable with unique add-ons. Nationwide does offer some of the most affordable travel insurance rates with a large and recognizable company name behind it. However, unique add-ons like sports equipment and pet coverage are not available.

Thus, travelers seeking more customized travel protection may prefer the unique plans offered through WorldTrips, especially those looking for specialized coverage for destination weddings, group travel, study abroad programs, and more. On the other hand, travelers without special coverage needs looking for cheap travel insurance may want to stick with Nationwide.

Karen S posted about her trip to Turks & Caicos on insuremytrip.com, saying, "It was easy to find a plan with the coverage that I needed. My travel companion is my 92-year-old mother so it was imperative that I have the best coverage at a reasonable cost."

Nationwide Travel Insurance Review

WorldTrips Travel Insurance vs. Berkshire Hathaway Travel Insurance

WorldTrips and Berkshire Hathaway are well-known insurance companies in the travel protection industry, offering various plans to meet the needs of any traveler. If you're planning a particular trip with multiple variables, WorldTrips has more customizable options with different types of add-ons and upgrades. However, Berkshire Hathaway offers a significantly easier claim filing process through its proprietary app, which can help you submit photos and other evidence for your claim in just a few seconds.

Both companies have customer reviews suggesting coverage provides peace of mind. But claims filing gets mixed reviews.

Berkshire Hathaway Travel Insurance Review

Why You Should Trust Us: What Went into Our WorldTrips Travel Insurance Review

We evaluated WorldTrips against the best travel insurance companies by comparing the options offered, customizations available, coverage ceilings, and ease of filing a claim. A licensed insurance agent reviews our articles. Our rating system is available to read in-depth here .

Editorial Note: Any opinions, analyses, reviews, or recommendations expressed in this article are the author’s alone, and have not been reviewed, approved, or otherwise endorsed by any card issuer. Read our editorial standards .

Please note: While the offers mentioned above are accurate at the time of publication, they're subject to change at any time and may have changed, or may no longer be available.

**Enrollment required.

- Main content

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

WorldTrips Travel Insurance Review — Is It Worth It?

Content Contributor

56 Published Articles

Countries Visited: 197 U.S. States Visited: 50

Jessica Merritt

Editor & Content Contributor

78 Published Articles 449 Edited Articles

Countries Visited: 4 U.S. States Visited: 23

Stella Shon

News Managing Editor

78 Published Articles 559 Edited Articles

Countries Visited: 25 U.S. States Visited: 22

Who Can Get WorldTrips Travel Insurance?

Worldtrips atlas journey travel insurance coverage types and benefits, pre-existing conditions, covid-19 coverage, worldtrips travel insurance economy plan, worldtrips travel insurance preferred plan, worldtrips travel insurance premier plan, atlas on-the-go insurance, atlas journey plans, atlas travel plans, worldtrips travel insurance vs. competitors, worldtrips travel insurance vs. credit card insurance, tips for ensuring a smooth claim process, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

Planning trips is fun. Reading about travel insurance for them isn’t. But a little effort to plan for problems during your upcoming vacation can make a big difference.

WorldTrips provides multiple types of travel insurance, ranging from minimalist policies with just medical insurance to full-scale policies that cover anything that might go wrong during your next family vacation. The insurer also offers add-ons that most competitors lack, such as policies for students studying abroad, special provisions for hunting and fishing trips, veterinary emergencies, school activities that force you to delay your vacation, and even coverage for destination weddings when the bride or groom calls it off.

However, you may be surprised that rental car protections are only available as an add-on to WorldTrips plans, and you’ll need the most expensive plan if you want to add coverage for pre-existing medical conditions.

Here’s a look at the various travel insurance plans from WorldTrips and whether the costs are worth it.

Before understanding who can get a plan, it’s essential to understand the different types of travel insurance plans available from WorldTrips.

Atlas Travel plans are available for citizens and residents of numerous countries when traveling internationally. Conversely, Atlas Journey plans are available only to U.S. citizens and residents, covering domestic and international travel. Atlas Journey plans are geared primarily toward trip delay and cancellation benefits, while Atlas Travel plans are focused primarily on medical coverage. However, they share some crossover benefits.

WorldTrips also has travel insurance policies that aren’t focused on typical tourists. StudentSecure plans provide injury and illness coverage for those studying abroad. Atlas MultiTrip plans provide coverage for 364 days, covering trips up to 30 or 45 days each (depending on the plan you choose), and Atlas Group plans can provide up to a 10% discount if you’re traveling in a group of 5 or more people.

Additionally, WorldTrips Atlas Travel plans can provide medical coverage for those doing overseas volunteer or missionary work.

What Does WorldTrips Travel Insurance Include?

WorldTrips offers multiple types of travel insurance policies. Atlas Travel plans are available only for international trips (open to residents of many countries) and primarily focus on medical coverage. With these plans, you’ll choose your preferred deductible and maximum coverage limit, then provide your age and destination.

U.S.-based travelers have access to Atlas Journey plans. These cover domestic and international trips and are what you likely think of when considering travel insurance. We’ll analyze these in depth in the article and then cover the medical-focused Atlas Travel plans near the end.

To know what you’re looking for in a travel insurance policy, you should first understand what the types of coverage are:

- Trip Cancellation Insurance: Covers prepaid, non-refundable expenses when you cancel a trip for covered reasons like sickness, injury, or death of a family member.

- Trip Interruption: Reimburses prepaid, non-refundable expenses if you miss part of a trip or have to end a trip early due to covered reasons like weather, jury duty, or injury.

- Travel Delay: Applies to additional expenses incurred for delays of 5+ hours, covering accommodation, meals, and local transport costs.

- Travel Inconvenience: Applies when one of the following occurs: your return home is delayed and causes you to miss 2 or more days of work, your flight must land 50+ miles from the original destination, there’s a documented security breach causing delays at your departure terminal, you’re a victim of a verified physical assault, your credit/debit card is canceled for reasons beyond your control, or your travel documents are stolen and can’t be replaced locally.

- Emergency Accident and Sickness Medical Expense: Covers losses due to medical and dental emergencies. This is secondary coverage except on the Premier plan.

- Medical Evacuation and Repatriation of Remains: Covers medically necessary transportation and care en route when you’re ill or injured and don’t have access to appropriate care in the immediate area. You also can be covered for repatriation to your home or other U.S. city with appropriate care, requiring prior approval.

- Baggage Damage or Loss: Provides reimbursement for loss, damage, or theft of personal effects in excess of other insurance, such as homeowners’ or airline baggage policies.

- Baggage Delay: Provides reimbursement for covered expenses after 12+ hours of baggage delay at your destination. Covered expenses include necessary clothing, laundry, toiletries, and costs for retrieving your baggage. Coverage ends when your luggage is retrieved or you return home — whichever is first.

- Missed Connection: Can reimburse expenses related to missed cruises, tours, flights, or trip departures due to 3+ hours of delays. Covered delays include weather, carrier problems, strikes, quarantines, and more. Expenses cover costs to catch up with your trip or money lost from missing the trip.

- Airline Cancellation or Reissue Fees: Reimburses costs for changing or canceling tickets after interruptions or canceled flights. This coverage applies to costs after any refunds or vouchers you receive.

- Travel Assistance Services: Provides 24/7 assistance services like security advice, coordination of medical benefits, interpreters, legal referrals, and referrals for needs during emergencies. Note that you may have costs for services you use from these referrals.

It’s also important to note that each section has rules and restrictions about which costs are covered, when coverage applies, and other terms you must follow.

Optional Add-ons to Atlas Journey Plans

You’ll see options for additional coverage depending on the base plan you select:

- Cancel for Any Reason Coverage (CFAR): This add-on policy covers up to 75% of your losses if you cancel for reasons not covered in other sections of your policy, so long as you purchase within 21 days of your first deposit and cancel 48+ hours before the trip. This add-on isn’t available for Economy plans.

- Interruption for Any Reason: Provides reimbursement for 50% of non-refundable trip costs after a trip is interrupted for non-covered reasons. WorldTrips says, “No questions asked” on this coverage. This add-on is available for Premier plans only.

- Pre-existing Conditions: Requires purchasing a policy within 21 days of the initial deposit and covers pre-existing conditions that have a change in treatment or that make you unable to travel.

- Adventure Sports: Provides coverage for leisure, non-professional sports like bungee jumping, scuba diving, and mountain climbing up to 7,000 meters, as well as safari activities. This add-on is available for all plan levels.

- Rental Car Damage and Theft: Requires a $250 deductible; afterward, provides rental car coverage for collision, theft, and damage beyond your control. You must be authorized to drive at the destination and listed on the rental policy. This add-on is available for all plan levels.

- Pet Care: Provides reimbursement for a trip canceled due to the death or critical illness of your dog or cat within 7 days of trip departure. Provides up to $250 in coverage for boarding fees if your return home is delayed for a covered reason and up to $500 for emergency veterinary care for a pet traveling with you. This add-on is available with all plan types.

- Rental Accommodations Protection: Covers trip interruptions if you can’t access your vacation rental property for 12+ hours or if your property is unsuitable or not as described on arrival. It’s available on all plan levels.

- School Activities: Provides cancellation coverage for trips you must cancel due to school activities like exams or sporting events beyond standard season dates. This coverage also applies to study abroad, volunteer, or philanthropic programs. This add-on is available for all plan levels.

- Hunting and Fishing: Covers canceled and interrupted trips related to changes in government regulations or delays of 24+ hours in receiving your necessary equipment. This coverage also applies to theft, damage, and destruction of your essential equipment and trips where your guide or traveling companion becomes medically unfit to participate. This add-on is available for all plan levels.

- Destination Wedding: Provides reimbursement for lost funds when you plan to attend a wedding and then it’s canceled. Coverage also applies to canceled flights, flights forced to land 50+ miles from the intended airport, and flight delays of 12+ hours. This add-on isn’t available for Economy plans.