Card Accounts

Business Accounts

Other Accounts and Payments

Tools and Support

Personal Cards

Business Credit Cards

Corporate Programs

Prepaid Cards

Personal Savings

Personal Checking and Loans

Business Banking

Book And Manage Travel

Travel Inspiration

Business Travel

Services and Support

Benefits and Offers

Manage Membership

Business Services

Checking & Payment Products

Funding Products

Merchant Services

Introduction to American Express Travel Protection

Types of travel protection offered, american express travel protection: a guide to your benefits.

Affiliate links for the products on this page are from partners that compensate us and terms apply to offers listed (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate credit cards to write unbiased product reviews .

The information for the following product(s) has been collected independently by Business Insider: Hilton Honors American Express Aspire Card, Amex EveryDay® Preferred Credit Card, American Express® Green Card, The Plum Card® from American Express. The details for these products have not been reviewed or provided by the issuer.

- Some American Express cards offer trip cancellation and interruption benefits .

- You'll find these perks on cards like The Platinum Card® from American Express.

- If you're eager to sign up for a travel credit card with perks, compare each card's offerings.

Overview of Travel Protection Benefits

While credit card insurance and travel protection coverage are usually considered secondary to rewards programs and other cardholder perks, these benefits can be equally important if you travel.

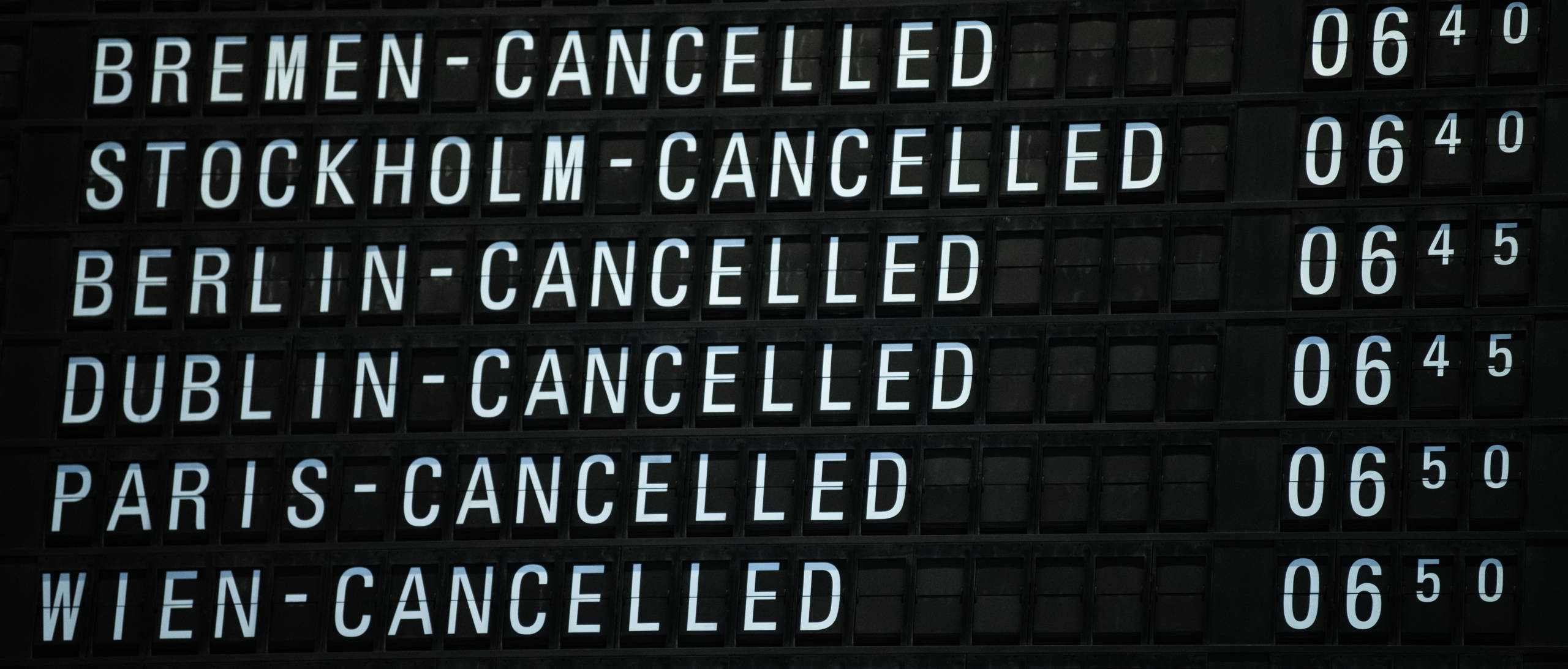

When you pay for a trip with a credit card that offers trip cancellation and interruption insurance, for example, you can get reimbursed for some of your travel expenses in the event your vacation is halted for reasons beyond your control. Meanwhile, trip delay insurance lets you apply for some reimbursement when a delay of your trip results in surprise expenses, such as an unplanned hotel stay near the airport when your flight is on hold.

Importance of Travel Insurance

Chase credit cards like the Chase Sapphire Reserve® and Chase Sapphire Preferred® Card have really stood out for years in terms of the protections they offer, and with some of the highest limits out there. Still, American Express is still coming around — it recently added trip cancellation and interruption insurance, along with trip delay coverage, to many of its top rewards credit cards.

If you're in the market for an American Express card and you're hoping to take advantage of important travel benefits, consider the cards below and their expanded travel protections.

Trip Cancellation and Interruption Insurance

New trip cancellation and interruption insurance from American Express credit cards will provide you with up to $10,000 in coverage (and up to $20,000 per account per year) you can use for reimbursement of prepaid travel expenses like airfare and hotels. This coverage can come in handy if your trip is canceled for a covered reason beyond your control, or you're stuck in your destination and require an extended stay and additional costs before you can return home.

Note that this coverage is good for round-trip travel booked with your credit card, meaning you have to pay for travel expenses with a common carrier with your American Express credit card in order to be eligible.

American Express cards that qualify for this coverage include:

- The Platinum Card® from American Express

- Delta SkyMiles® Reserve American Express Card

- Hilton Honors American Express Aspire Card

- Marriott Bonvoy Brilliant® American Express® Card

- The Business Platinum Card® from American Express

- Delta SkyMiles® Reserve Business American Express Card

Other versions of the Amex Platinum card — including the Goldman Sachs, Morgan Stanley, and corporate flavors — also offer this coverage, as do all versions of the Amex Centurion (black) card , which is invite-only.

Baggage Insurance Plan

Quite a few American Express credit cards also offer a baggage insurance plan, although this isn't a new or upgraded benefit from the card issuer. This coverage can come in handy if your luggage is lost or stolen during a covered trip. To be eligible for this coverage, you have to pay for travel with a common carrier (airfare, cruise fare, etc.) with your American Express credit card.

The amount of coverage you'll receive depends on the card you have. For example, baggage insurance from the The Platinum Card® from American Express offers up to $3,000 in coverage per person for carry-on luggage and up to $2,000 per person in coverage for some types of checked baggage.

With baggage insurance from the Amex EveryDay® Preferred Credit Card , on the other hand, you'll only qualify for up to $1,250 in coverage per person for carry-on luggage and up to $500 for covered checked baggage, although an extra benefit of $250 is offered for qualified "high risk items" like jewelry or sporting equipment.

American Express cards that come with baggage insurance include:

- The Platinum Card® from American Express (including various versions)

- American Express® Gold Card (including various versions)

- American Express® Green Card (including various versions)

- Delta SkyMiles® Gold American Express Card

- Delta SkyMiles® Platinum American Express Card

- Hilton Honors American Express Surpass® Card

- Amex EveryDay® Preferred Credit Card

- The Plum Card® from American Express

American Express business cards with baggage insurance include:

- American Express® Business Gold Card

- The Blue Business® Plus Credit Card from American Express

- Delta SkyMiles® Gold Business American Express Card

- Delta SkyMiles® Platinum Business American Express Card

- Marriott Bonvoy Business® American Express® Card

- The Hilton Honors American Express Business Card

- Lowe's Business Rewards Card from American Express

- Amazon Business Prime American Express Card

- Amazon Business American Express Card

Various versions of the Amex Centurion card and several Amex corporate cards also offer baggage insurance.

Travel Accident Insurance

Some American Express cards also offer secondary auto rental coverage, which means this coverage kicks in after other policies you have are exhausted, as opposed to primary car rental coverage.

While this benefit applies to many Amex cards, note that coverage limits can vary. With the Amex Gold card, for example, coverage is limited to $50,000 per rental agreement for damage or theft, yet the Amex Platinum card offers up to $75,000 in coverage. The insurance doesn't cover personal liability, either.

Also note that this coverage comes with a certain amount of Accidental Death or Dismemberment Coverage that varies by card. With , for example, you'll receive up to $200,000 in coverage per person and up to $300,000 in coverage per car accident for accidental death and dismemberment. Make sure to read your credit card's terms and conditions so you know exactly how much coverage you have.

American Express cards that come with secondary auto rental coverage include:

- The Platinum Card® from American Express (including various versions)

- Delta SkyMiles® Blue American Express Card

- Hilton Honors American Express Card

- Marriott Bonvoy American Express® Card (no longer available to new applicants)

- Blue Cash Everyday® Card from American Express

- Blue Cash Preferred® Card from American Express

- Amex Everyday® Credit Card from American Express

And business cards from Amex that offer secondary car rental insurance include:

While American Express did offer travel accident insurance on some of its cards, this coverage was effectively dropped as of January 1, 2020. The same is true for the American Express Roadside Assistance Hotline, which is no longer available.

Trip Delay Insurance

In January of 2020, American Express also rolled out an upgraded trip delay insurance benefit for many of its top rewards credit cards. While this perk may seem like an unusual one, there are so many scenarios where trip delay coverage could help you save money and avoid surprise expenses when travel is delayed beyond your control.

With trip delay coverage from Amex, you can be reimbursed for up to $500 per trip for hotel stays, meals, and other miscellaneous required expenses when your flight or other trip plans are delayed by more than six hours. If you're sitting at the airport and your flight is suddenly delayed until the next morning, for example, you could use this coverage to get reimbursed for a nearby airport hotel and your dinner, then for an Uber or Lyft ride back to the airport.

To qualify for American Express trip delay coverage, you need to pay for your round-trip travel expenses with a common carrier with your credit card.

Amex cards that come with trip delay coverage include:

- American Express® Gold Card

- American Express® Green Card

Again, the various versions of the Amex Platinum and Amex Centurion cards also offer trip delay insurance.

Most travel protections are automatically activated when you use your American Express card to book your travel. However, specific activation steps, if any, depend on the benefit.

Covered reasons for trip cancellation or interruption typically include illness, severe weather, and other unforeseen events, reimbursing you for non-refundable travel expenses.

Yes, baggage insurance plans come with coverage limits, which vary depending on the card and the type of loss (e.g., lost, damaged, or stolen baggage).

The Global Assist Hotline offers medical, legal, and other emergency coordination and assistance services, but financial costs for services rendered are typically the cardholder's responsibility.

Eligibility for specific travel protections varies by card. Premium cards often offer more comprehensive protections compared to basic cards.

For rates and fees of The Platinum Card® from American Express, please click here.

Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. Trip Delay Insurance, Trip Cancellation and Interruption Insurance, and Cell Phone Protection Underwritten by New Hampshire Insurance Company, an AIG Company. Global Assist Hotline Card Members are responsible for the costs charged by third-party service providers. If approved and coordinated by Premium Global Assist Hotline, emergency medical transportation assistance may be provided at no cost. In any other circumstance, Card Members may be responsible for the costs charged by third-party service providers. Extended Warranty, Purchase Protection, and Baggage Insurance Plan Underwritten by AMEX Assurance Company. Car Rental Loss & Damage Insurance Underwritten by AMEX Assurance Company. Car Rental Loss or Damage Coverage is offered through American Express Travel Related Services Company, Inc.

- Main content

Your guide to Amex's travel insurance coverage

Update : Some offers mentioned below are no longer available. View the current offers here .

American Express premium credit cards offer some of the best perks in the credit card space. While lounge access and travel credits are typically the highlights of these cards, some of the lesser-known benefits, such as trip delay reimbursement and trip cancellation and interruption insurance, are becoming hot topics as the coronavirus pandemic continues to impact the travel industry.

Want more credit card news and advice from TPG? Sign up for our daily newsletter!

As a result, many TPG readers have sent in questions about Amex's travel insurance protections. As travel restrictions change, policies and best practices will likely change as well. But this guide will walk you through which Amex credit cards have these benefits, what's currently covered and how you can file a successful claim.

Related: Best credit cards for trip cancellation and interruption insurance

Amex cards offering trip delay, cancellation or interruption insurance

Here is an overview of the Amex cards that offer trip delay reimbursement, trip cancellation/interruption insurance or both:

The information for the Hilton Aspire Amex card and American Express Corporate Platinum Card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Related: The best credit cards with travel insurance

What is covered by trip cancellation and interruption insurance?

You can find the full terms and conditions of what is generally covered on your respective card in your Guide to Benefits, which can be found through your online account. I'll use the Delta SkyMiles® Reserve as an example.

Here is a rundown of the "covered losses" provided by Amex's trip cancellation and interruption insurance:

- Accidental bodily injury or loss of life or sickness of either the eligible traveler, traveling companion or a family member of the eligible traveler or traveling companion

- Inclement weather, which prevents a reasonable and prudent person from traveling or continuing on a covered trip

- The eligible traveler or his or her spouse's change in military orders

- Terrorist action or hijacking

- Call to jury duty or subpoena by the courts, either of which cannot be postponed or waived

- The eligible traveler or traveling companion's dwelling made uninhabitable

- Quarantine imposed by a physician for health reasons

Related: Book carefully if you have multiple Amex cards that offer travel protections

Amex also provides an extensive list of things that are not covered by trip cancellation/interruption insurance:

- Pre-existing conditions

- The eligible traveler's suicide, attempted suicide or intentionally self-inflicted injury

- A declared or undeclared war

- Mental or emotional disorders, unless hospitalized

- The eligible traveler's participation in a sporting activity for which he or she receives a salary or prize money

- The eligible traveler's being intoxicated at the time of an accident. Intoxication is defined by the laws of the jurisdiction where such accident occurs

- The eligible traveler being under the influence of any narcotic or other controlled substance at the time of an accident, unless the narcotic or other controlled substance is taken and used as prescribed by a Physician

- The eligible traveler's commission or attempted commission of any illegal or criminal act, including but not limited to any felony

- The eligible traveler parachuting from an aircraft

- The eligible traveler engaging or participating in a motorized vehicular race or speed contest

- Dental treatment except as a result of accidental bodily injury to sound, natural teeth

- Any non-emergency treatment or surgery, routine physical examinations

- Hearing aids, eyeglasses or contact lenses

- One-way travel that does not have a return destination

- A counterfeit scheduled airline or train ticket; or a scheduled airline or train ticket which is charged to a fraudulently issued or fraudulently used eligible card.

- Any occurrence while the eligible traveler is incarcerated

- Loss due to intentional acts by the eligible traveler

- Financial insolvency of a travel agency, tour operator or travel supplier

- Any expenses that are not authorized and reimbursable by the eligible traveler's employer if the eligible traveler makes the purchases with a commercial card

If you do find yourself canceling or cutting a covered trip short, here are the basic guidelines provided by Amex on what types of expenses are covered for trip cancellation/interruption:

"If a Covered Loss causes an Eligible Traveler's Trip Interruption, we will reimburse you for the nonrefundable amount paid to a Travel Supplier with your Eligible Card for the following: 1. The forfeited, non-refundable, pre-paid land, air and sea transportation arrangements that were missed; and 2. Additional transportation expenses that the Eligible Traveler incurs less any available refunds, not to exceed the cost of an economy-class air ticket by the most direct route for the Eligible Traveler to rejoin his or her places of origin.

If a Covered Loss causes an Eligible Traveler to temporarily postpone transportation by Common Carrier for a Covered Trip and a new departure date is set, we will reimburse you for the following: 1. The additional expenses incurred to purchase tickets for the new departure (not to exceed the difference between the original fare and the economy fare for the rescheduled Covered Trip by the most direct route); and 2. The unused, non-refundable land, air, and sea arrangements paid to a Travel Supplier with your Eligible Card."

What is covered by trip delay insurance?

Trip delay coverage provides reimbursement for reasonable additional expenses incurred when your trip is delayed due to a covered hazard for more than six hours.

Coverage is limited to $500 per trip and cardmembers are only eligible for two claims each 12 consecutive month period.

Amex outlines what is not covered, which includes the following:

- Covered losses that are made public or known to the eligible traveler prior to the departure for the covered trip

- An eligible traveler's expenses paid prior to the covered trip

Filing a claim

When you have a delay or trip cancellation/interruption that you think qualifies for coverage, you can file a claim by calling Amex at 1-844-933-0648 within 60 days of the covered loss.

Trip delay reimbursement requires the following documentation:

- Proof of loss – You must furnish written proof of loss to Amex within 180 days after the date of your loss

- Receipts - Acceptable documentation includes the following:

- A statement from the common carrier that the covered trip was delayed

- Charge receipt

- Copies of common carrier ticket(s)

- Receipts for travel expenses

Trip cancellation/interruption insurance requires slightly different documentation.

- Proof of loss – You must furnish written proof of loss to Amex within 180 days after the date of your loss. Acceptable documentation includes:

- Court subpoenas, orders to report for active duty, physician orders, etc.

- Copies of your common carrier tickets and travel supplier receipt

- Your eligible card billing statement showing the charges for the covered trip

- Copy of travel supplier's cancelation policy

After Amex receives notice of your claim, instructions will be sent on how to send the proof. Typically, you have up to 180 days to file a claim after a delay or cancellation.

Proof of flight delay or cancellation

One of the documents required to file for trip delay reimbursement is a verification form that outlines the reason for the delay or cancellation by the carrier. You can typically get this at the airport when the delay or cancellation is announced, but keep in mind that it may require a supervisor. Each U.S. major airline also has a process for requesting this information after the fact.

Here is an overview of the process that major U.S. airlines require for you to receive a delay or cancellation verification form:

Amex cards that offer car rental insurance

Unfortunately, no American Express credit cards offer primary car rental coverage, although most offer secondary coverage. You can see the entire list of cards that offer secondary car rental protection on the American Express website . However, all American Express credit cards offer an optional "Premium Car Rental Protection policy" that can be added to rentals made using the card for a small fee.

Read our guide on when to use American Express' Premium Car Rental Protection for more details on this coverage option.

You can add Premium Car Rental Protection to any American Express card . TPG has a guide of the best American Express cards , but here are some of the best cards in terms of the return you could receive when renting a car. Note, the estimated return rate for these cards is based on TPG's latest valuations:

- Hilton Honors American Express Aspire Card: $450 annual fee (see rates and fees); 4.2% return on car rentals booked directly from car rental companies; no foreign transaction fees (see rates and fees)

- The Blue Business® Plus Credit Card from American Express: $0 annual fee (see rates and fees); 4% return on general spending on the first $50,000 in purchases per calendar year and 1x thereafter; 2.7% foreign transaction fee (see rates and fees)

- The Amex EveryDay® Preferred Credit Card from American Express: $95 annual fee; 3% return on general spending in billing cycles where you make 30+ purchases; 2.7% foreign transaction fee

The information for the Amex EveryDay Preferred card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Amex cards that offer baggage insurance

If you're a frequent traveler, you've likely run into this situation at some point (it's the worst). Over the years, airlines have been working on improving the baggage system by introducing live bag tracking. Regardless, it's still a smart idea to have some protections in place, like baggage insurance.

Related: Everything you need to know about Amex's baggage insurance plan

This is why you need to pay attention to the benefits each of your travel rewards cards offers. Nearly all of Amex's premium rewards cards offer baggage insurance. You can check out the full list of cards and details on American Express's website.

The types of losses it covers: You're covered for losses resulting from damaged, stolen or lost baggage, including both carry-on and checked bags.

When you're covered: To be eligible for coverage, you have to travel on a common carrier, which Amex defines as any air, land or water vehicle (other than a personal or rental vehicle) that is licensed to carry passengers for hire and available to the public. Your rental car, as well as taxis and ride-share services such as Uber and Lyft, would be excluded from this protection.

To receive coverage, you also need to pay for the entire fare with an eligible American Express card or by using Membership Rewards points to book tickets through Amex Travel . Trips booked with miles from other sources — even the cobranded Delta SkyMiles cards from Amex — are excluded. Your trip also isn't covered if you used a combination of miles and dollars unless the miles came from a Membership Rewards transfer. This is a welcome change. A few years ago, a TPG staffer found out the hard way that Amex's policy didn't cover frequent flyer mile awards.

Who's covered: This policy covers both primary and additional cardholders, as well as cardmembers' spouses or domestic partners and any dependent children under 23 years old. In addition, travelers must be permanent residents of one of the 50 states, Washington, D.C., Puerto Rico and the U.S. Virgin Islands.

How much it covers: Most American Express credit cards will cover replacement costs for checked bags and their contents up to $500 per person, although so-called "high-risk items" are only covered for a maximum of $250. These items include jewelry, sporting equipment, photographic or electronic equipment, computers and audio/visual equipment. Carry-on bags are covered for up to $1,250, which is good to know since your belongings could be stolen from the overhead bins.

You'll enjoy additional coverage if you use The Platinum Card from American Express, The Business Platinum Card from American Express, the Platinum Card from American Express Exclusively for Mercedes-Benz and Morgan Stanley-branded Platinum Card (but not the Delta SkyMiles® Platinum American Express Card).

The information for the Amex Platinum Mercedes-Benz and Morgan Stanley Platinum card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Amex cards that offer medical assistance

One of the lesser known benefits of some of Amex's most premium cards is its Premium Global Assistance. This benefit can quite literally be a lifesaver if you or an immediate family member run into any unexpected issues or accident on your trip. For example, this service can help you arrange emergency medical referrals.

All Amex cards have access to Amex's Global Assist Hotline, but the Premium Global Assist Hotline and higher level of coverage are reserved exclusively for the Amex's premium cards:

- The Platinum Card from American Express

- The Business Platinum Card from American Express

- American Express Corporate Platinum Card

- Hilton Honors Aspire Card from American Express

- Delta SkyMiles® Reserve American Express Card

- Delta SkyMiles® Reserve Business American Express Card

- Marriott Bonvoy Brilliant® American Express® Card

- American Express Centurion Card

- American Express Business Centurion Card

The information for the Amex Centurion and Amex Business Centurion cards has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Bottom line

Having a card with trip insurance can save you hundreds of dollars when unexpected hiccups happen in your travel plans. Still, it can be confusing to know what is covered and the right documentation you need to file a claim.

Nothing is worse than getting through an entire claims process only to be denied or have to start over because you don't have the required documentation for the insurance provider. Before you start filing a claim, make sure you have the documents listed above. Keep in mind that a provider may ask for additional documentation related to the incident, so you may have to collect receipts and other forms to help your case.

If you're starting to travel again, it's also a good idea to consider booking refundable travel . Some airlines and hotels even waive cancelation fees and/or change fees for certain fares, which can make last-minute adjustments in the case of emergencies.

Additional reporting by Stella Shon and Madison Blancaflor.

For rates and fees of the Amex Platinum card, please click here. For rates and fees of the Amex Gold card, please click here. For rates and fees of the Amex Business Gold card, please click here. For rates and fees of the Amex Green card, please click here. For rates and fees of the Hilton Aspire card, please click here. For rates and fees of the Amex Blue Business Plus card, click here. For rates and fees of the Marriott Bonvoy Brilliant card, click here. For rates and fees of the Delta SkyMiles Reserve card, please click here. For rates and fees of the Delta SkyMiles Reserve Business card, please click here. For rates and fees of the Delta SkyMiles Platinum card, please click here. For rates and fees of the Amex Business Platinum card, click here.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Benefits of the American Express Platinum Card

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

The Platinum Card® from American Express is like a flashy suitcase overflowing with premium benefits for your travel experience.

It has a $695 annual fee, yes, but it also comes with a slew of valuable benefits that can easily make up for that cost, assuming you'll use them. From travel credits and airport lounge access to purchase protections and exclusive services, this card is all about luxury.

Here are the benefits of The Platinum Card® from American Express :

» MORE: Complete card details for the American Express Platinum

Points: Rewards on spending

The Platinum Card® from American Express earns Membership Rewards points , which offer flexible redemption options that vary in value.

1. A jet-setting welcome offer

The introductory offer can take your travel further: Earn 80,000 Membership Rewards® Points after you spend $8,000 on purchases on your new Card in your first 6 months of Card Membership. Terms Apply.

» MORE: American Express card benefits you may not know you have

2. Big travel rewards

You earn ongoing Membership Rewards at the following rates:

5 Membership Rewards points per dollar on up to $500,000 spent per calendar year on flights booked directly with airlines or with American Express Travel.

5 points per dollar on prepaid hotels booked through American Express Travel.

2 points per dollar on other eligible travel expenses booked through American Express Travel.

1 point per dollar on all other purchases.

Terms apply ( see rates and fees ).

» MORE: NerdWallet review of the American Express Platinum

3. AmEx Offers

As a cardholder, you’re eligible to earn additional rewards or rebates in the form of a statement credit when you activate AmEx Offers and use your card to shop with specific merchants. Terms may apply, so read the fine print carefully to ensure you can collect an offer. Enrollment is required.

Perks: Goodies that come with the card

The Platinum Card® from American Express offers a long list of perks, most of which require you to use the card to qualify for them.

4. Up to $200 in annual credit for airline incidental fees

You can choose one qualifying airline to receive up to $200 per calendar year in statement credit when you enroll and charge incidental fees such as checked bags or in-flight refreshments to your card. Learn more about travel credits .

5. Up to $200 in Uber cash for rides

You’re automatically enrolled in Uber VIP status, which connects you with top-rated drivers. And you’ll get up to $15 monthly in Uber Cash for rides in the U.S. on your Uber account, plus a bonus of up to $35 in December. You must add your card as a payment method in the Uber app.

6. Up to $200 in annual hotel credit

You'll get a credit on prepaid bookings with American Express Travel at The Hotel Collection (two-night minimum required) or Fine Hotels + Resorts properties (more than 2,200 worldwide) when you pay with the card, up to $200 each calendar year.

7. Up to $300 Equinox credit

You'll get up to a $300 statement credit when you use the card to pay for an Equinox fitness club membership. Or it can be applied to Equinox+, an on-demand fitness app.

8. $300 SoulCycle credit

When you purchase a SoulCycle at-home bike, you'll receive a $300 statement credit. Enrollment is required, and you need to have an Equinox+ subscription to qualify.

9. Up to $240 in digital entertainment credit

This credit can be applied at $20 per month when using the card to pay for one of the following services: Peacock, Disney+, The Disney Bundle, ESPN+, Hulu, The New York Times and The Wall Street Journal, up to $240 per calendar year. Enrollment is required.

10. $189 Clear credit

This annual credit covers the cost of Clear , which uses biometrics to let members bypass part of the security line at airports and stadiums in some cities.

11. Reimbursement of application fees for TSA Precheck or Global Entry

You get a statement credit either once every four years for Global Entry or once every 4.5 years for TSA Precheck. Learn more about TSA Precheck and Global Entry . TSA Precheck costs $85, while Global Entry costs $100.

12. Up to $100 in statement credits annually at Saks Fifth Avenue

Receive this amount annually for purchases made in-store or online with your card. Credits are divvied up in $50 increments; one from January through June, and the other from July through December. Enrollment is required.

13. Walmart+ Monthly Membership Credit

Use the card to pay for a monthly Walmart+ membership and get reimbursed with statement credits for the full amount (up to $12.95 plus applicable taxes). Terms apply. A Walmart+ membership offers perks like free delivery on groceries, free shipping, savings on gas, returns from home and video streaming with Paramount+, among others.

Terms apply.

Lounge benefits

14. access to the american express global lounge collection at airports.

This portfolio includes Centurion Lounges , Delta Sky Clubs (when flying Delta only), Priority Pass Select , International American Express lounges, Airspace and Escape lounges. Enrollment required. Terms apply.

15. Centurion Lounge Complimentary Guest Access

Get complimentary guest access to a Centurion Lounge after spending $75,000 in eligible purchases in a calendar year. You can bring two guests per visit into locations of The Centurion Lounge in the U.S., Hong Kong International Airport and London Heathrow Airport. Terms apply.

Hotel-friendly benefits

16. upgrade to marriott bonvoy gold elite status.

You don’t have to do much work to earn this status. Simply enroll and you’ll be eligible for a 25% Marriott Bonvoy points bonus, an enhanced room at check-in (when available), 2 p.m. late checkout, free in-room Wi-Fi and more. Terms apply.

17. Upgrade to Hilton Honors Gold status

When you enroll in this status, you get room upgrades at select properties (when available), a complimentary fifth reward night on standard room reward stays of five nights or more, and 80% bonus points on all Hilton Honors base points. Terms apply.

18. Money-saving perks for stays booked through The Hotel Collection

If you book a stay of at least two consecutive nights with The Hotel Collection at over 600 properties, you can get a $100 hotel credit to spend on dining, spa and resort activities. You can also qualify for a room upgrade upon arrival depending on availability.

19. Complimentary benefits through Fine Hotels & Resorts

At over 1,300 properties, you can get a room upgrade (when available), daily breakfast for two, guaranteed 4 p.m. late checkout, noon check-in (when available), complimentary Wi-Fi and an amenity credit valued at $100.

20. Free shipping with ShopRunner

Get unlimited free two-day shipping and free return shipping on qualifying items when you sign up for a ShopRunner membership using your card. Enrollment required.

21. Concierge service

You have 24-hour access to assistants for personal, travel or card-related needs. The service is free, but fees may apply for costs incurred to fulfill your requests.

22. Low fares through the International Airline Program

You and your travel companions could earn savings on International First, Business and Premium Economy Class tickets on over 20 participating airlines when you book through American Express Travel.

23. Savings with the Cruise Privileges Program

Use your card to book cruises of five nights or longer through American Express Travel and get up to $300 in shipboard credit per stateroom. Additional perks include exclusive amenities that vary per cruise line and one extra Membership Rewards points per dollar spent.

24. Car Rental Privileges

Get complimentary premium status for car rental programs like Avis Preferred, National Car Rental Emerald Club and Hertz Gold Plus Rewards when you enroll in Car Rental Privileges. You’ll be eligible to receive upgrades, discounts and priority service for your next car rental at participating locations, depending on availability, when you pay with the card. Terms apply.

25. Deals through the Amex Auto Purchasing Program

You’re connected with eligible dealers that accept American Express. Dealers on the auto purchasing program's website accept your card for at least $2,000 and up to the full purchase price of the car. These same dealers also offer a Guaranteed Savings Certificate on your configured car and in-stock cars that align with your preferences. Terms apply.

26. An extra point when booking Platinum Destinations Vacations

Get one extra Membership Rewards point per dollar spent with your card on an eligible vacation package booked through the Platinum Travel Service.

27. Additional value through the InCircle rewards program

Enroll your card into InCircle, a Neiman Marcus and Bergdorf Goodman rewards program, and you can earn a $100 point card every time you earn 10,000 InCircle points. Points cards can be used to shop at Neiman Marcus, Bergdorf Goodman, Last Call, Horchow and CUSP. Terms apply.

28. AmEx Carbon Emissions Tracker

Receive an estimate of your carbon emissions based on purchases made with the card, contribute monthly to carbon removal projects and get carbon reduction tips and information.

Access to unique experiences

29. the global dining access by resy.

Get access to exclusive reservations at popular restaurants, Priority Notify and a badge on your Resy profile that confirms membership to the Global Dining Access program.

30. Exclusive events

The “By Invitation Only” platform offers an open invitation to purchase tickets to exclusive events from sporting and fashion to dining, art and performances.

31. An open invitation to events with Membership Experiences

Get access to presale tickets, offers, special events and experiences in music, theater and sports, to name a few.

32. A better view with American Express Preferred Access

Get dibs on coveted seats and advance ticket sales for concerts, sports and entertainment events.

Benefits of the Alaska Airlines credit card

Benefits of the American Express Gold Card

Benefits of the American Express Green Card

Benefits of the Bank of America Travel Rewards card

Benefits of the Capital One Savor cards

Benefits of the Capital One Venture card

Benefits of the Capital One Quicksilver card

Benefits of the Capital One Platinum card

Benefits of the Chase Freedom Flex and Freedom Unlimited cards

Benefits of the Chase Sapphire Preferred Card

Benefits of the Chase Sapphire Reserve card

Benefits of the Citi Costco credit card

Benefits of the Citi Custom Cash Card

Benefits of Citi Double Cash Card

Benefits of Delta Air Lines credit cards

Benefits of the Discover it Cash Back

Benefits of Marriott Bonvoy credit cards

Benefits of Southwest Airlines credit cards

Benefits of United Airlines credit cards

Benefits of the Wells Fargo Active Cash Card

Benefits of the Wells Fargo Autograph

Benefits of the Wells Fargo Autograph Journey

Convenient features

33. no foreign transaction fees.

The Platinum Card® from American Express doesn’t charge foreign transaction fees, but you may experience limited merchant acceptance abroad. American Express cards aren’t as widely accepted internationally as Visa and Mastercard products. See NerdWallet’s best no foreign transaction fee cards.

34. Upgrade with points

Redeem Membership Rewards points for an airline ticket upgrade. The dollar amount of the upgrade will be charged to the card and points will be subtracted from your Membership Rewards to cover the expense as a credit. Terms apply.

35. No preset spending limit

The Platinum Card® from American Express doesn’t have a preset spending limit. You’ll still have a general limit, though, that fluctuates with changing factors such as your purchases and credit history. Regardless of how much you spend, you’ll have to pay it off in full every month.

36. A lower annual fee on additional cards

Add authorized users to your account and earn Membership Rewards points for all qualifying purchases made by additional card members. The annual fee is $195 for every additional card. Terms apply.

37. CreditSecure

Enroll in CreditSecure with the card to receive fraud assistance services and monitoring for your credit and identity. You’ll pay $1 for the first 30 days and $16.99 per month thereafter.

Protections

Retail and travel, 38. cell phone protection.

Get reimbursed after paying to fix or replace a lost or damaged cell phone , up to $800 per claim, with a limit of two approved claims per 12-month period. To qualify, you must pay for the cell phone bill with the card and pay a $50 deductible for each approved claim. Terms apply.

39. Purchase protection

This benefit protects qualifying purchases made with your card if they’re accidentally damaged, stolen or lost for up to 90 days from the purchase date. Coverage includes up to $10,000 per incident for up to a maximum of $50,000 per year. Learn more about purchase protection.

40. Return protection

If a merchant won’t take an item back within 90 days, American Express may refund you the value up to $300 item purchased with your card (for a maximum of $1,000) per year. The benefit doesn’t cover costs for shipping and handling. Learn more about return protection.

41. Extended warranty

Get up to an extra year added to an original manufacturer’s warranty of five years or less when you use the card to pay for qualifying purchases. Terms apply. Learn more about extended warranty protections.

42. Baggage insurance plan

If your luggage is lost, damaged or stolen, this plan covers you up to $2,000 for checked bags and up to a combined maximum of $3,000 for checked and carry-on baggage. You have to pay for the entire fare with your card to be covered. Terms apply.

43. Car rental loss and damage insurance

This benefit offers secondary coverage for a rental car that is damaged or stolen. To qualify, you must pay for the rental car with your card and decline the collision damage waiver. Exclusions and terms apply. Learn more about rental car coverage provided via cards.

44. Premium Car Rental Protection

When you enroll and purchase Premium Car Rental Protection with the card and pay for rental charges with the card, you’ll be charged a flat rate per rental for up to 42 consecutive days and receive primary rental coverage. The flat rate also applies to rentals of eligible luxury cars, SUVs and pickup trucks. Terms apply.

45. Trip delay insurance

Pay for a round trip with the card and get covered if your trip is delayed by more than six hours for a qualifying reason. Trip delay insurance will reimburse certain expenses made with the card (up to $500 per trip) that result from the delay. Examples of expenses include meals, lodging, toiletries, medication and personal use items, to name a few. You’ll get a maximum of two claims per eligible card for every 12-month period.

46. Trip cancellation and interruption insurance

When you purchase a round trip with the card and the trip is interrupted or canceled for a qualifying reason, the insurance will reimburse non-refundable expenses made with the card. Coverage applies on up to $10,000 per trip and up to $20,000 per eligible card per consecutive 12-month period. Terms apply.

Emergency services: Assistance 24 hours a day

47. premium global assist hotline.

If you’re traveling farther than 100 miles from home, American Express offers around-the-clock medical, legal, financial or other select emergency and assistance services. This benefit may also provide emergency medical transportation assistance. You may be responsible for any costs charged by third-party service providers.

More about the card

Complete card details for The Platinum Card® from American Express

NerdWallet review of The Platinum Card® from American Express

Cell phone protection

Coverage for a stolen or damaged eligible cellular wireless telephone is subject to the terms, conditions, exclusions and limits of liability of this benefit. The maximum liability is $800, per claim, per eligible card account. Each claim is subject to a $50 deductible. Coverage is limited to two claims per eligible card account per 12 month period.

Eligibility and benefit level varies by card. Terms, conditions and limitations apply.

Please visit Travel and Retail American Express Card Benefits | AmEx for more details.

Underwritten by New Hampshire Insurance Company, an AIG Company.

Purchase protection

Purchase protection is an embedded benefit of your card membership and requires no enrollment. It can help protect covered purchases made on your eligible card when they’re accidentally damaged, stolen, or lost, for up to 90 days from the covered purchase date. The coverage is limited up to $10,000 per occurrence, up to $50,000 per card member account per calendar year. Coverage limits apply.

Underwritten by AMEX Assurance Company.

Return protection

With return protection, you may return eligible purchases to American Express if the seller won't take them back up to 90 days from the date of purchase. American Express may refund the full purchase price excluding shipping and handling, up to $300 per item, up to a maximum of $1,000 per calendar year per card account, if you purchased it entirely with your eligible American Express® Card. Purchases must be made in the U.S. or its territories.

Extended warranty

When an American Express® card member charges a covered purchase to an eligible card, extended warranty can provide up to one extra year added to the original manufacturer’s warranty. Applies to warranties of five years or less. Coverage is up to the actual amount charged to your card for the item, up to a maximum of $10,000; not to exceed $50,000 per card member account per calendar year.

Baggage insurance plan

Baggage insurance plan coverage can be in effect for covered persons for eligible lost, damaged, or stolen baggage during their travel on a common carrier vehicle (e.g. plane, train, ship, or bus) when the entire fare for a ticket for the trip (one-way or round-trip) is charged to an eligible card. Coverage can be provided for up to $2,000 for checked baggage and up to a combined maximum of $3,000 for checked and carry-on baggage, in excess of coverage provided by the common carrier. The coverage is also subject to a $3,000 aggregate limit per covered trip. For New York State residents, there is a $2,000 per bag/suitcase limit for each covered person with a $10,000 aggregate maximum for all covered persons per covered trip.

Car rental loss and damage insurance

Car rental loss and damage insurance can provide coverage up to $75,000 for theft of or damage to most rental vehicles when you use your eligible card to reserve and pay for the entire eligible vehicle rental and decline the collision damage waiver or similar option offered by the commercial car rental company. This product provides secondary coverage and does not include liability coverage. Not all vehicle types or rentals are covered. Geographic restrictions apply.

Underwritten by AMEX Assurance Company. Car rental loss or damage coverage is offered through American Express Travel Related Services Company, Inc.

Trip delay insurance

Up to $500 per covered trip that is delayed for more than 6 hours; and two claims per eligible card per 12 consecutive month period.

Trip cancellation and interruption insurance

The maximum benefit amount for trip cancellation and interruption insurance is $10,000 per covered trip and $20,000 per eligible card per 12 consecutive month period.

Eligibility and benefit level varies by card.

Terms, conditions and limitations apply. Please visit Travel and Retail American Express Card Benefits | AmEx for more details.

On a similar note...

Find the right credit card for you.

Whether you want to pay less interest or earn more rewards, the right card's out there. Just answer a few questions and we'll narrow the search for you.

- Auto Insurance Best Car Insurance Cheapest Car Insurance Compare Car Insurance Quotes Best Car Insurance For Young Drivers Best Auto & Home Bundles Cheapest Cars To Insure

- Home Insurance Best Home Insurance Best Renters Insurance Cheapest Homeowners Insurance Types Of Homeowners Insurance

- Life Insurance Best Life Insurance Best Term Life Insurance Best Senior Life Insurance Best Whole Life Insurance Best No Exam Life Insurance

- Pet Insurance Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes

- Travel Insurance Best Travel Insurance Cancel For Any Reason Travel Insurance Best Cruise Travel Insurance Best Senior Travel Insurance

- Health Insurance Best Health Insurance Plans Best Affordable Health Insurance Best Dental Insurance Best Vision Insurance Best Disability Insurance

- Credit Cards Best Credit Cards 2024 Best Balance Transfer Credit Cards Best Rewards Credit Cards Best Cash Back Credit Cards Best Travel Rewards Credit Cards Best 0% APR Credit Cards Best Business Credit Cards Best Credit Cards for Startups Best Credit Cards For Bad Credit Best Cards for Students without Credit

- Credit Card Reviews Chase Sapphire Preferred Wells Fargo Active Cash® Chase Sapphire Reserve Citi Double Cash Citi Diamond Preferred Chase Ink Business Unlimited American Express Blue Business Plus

- Credit Card by Issuer Best Chase Credit Cards Best American Express Credit Cards Best Bank of America Credit Cards Best Visa Credit Cards

- Credit Score Best Credit Monitoring Services Best Identity Theft Protection

- CDs Best CD Rates Best No Penalty CDs Best Jumbo CD Rates Best 3 Month CD Rates Best 6 Month CD Rates Best 9 Month CD Rates Best 1 Year CD Rates Best 2 Year CD Rates Best 5 Year CD Rates

- Checking Best High-Yield Checking Accounts Best Checking Accounts Best No Fee Checking Accounts Best Teen Checking Accounts Best Student Checking Accounts Best Joint Checking Accounts Best Business Checking Accounts Best Free Checking Accounts

- Savings Best High-Yield Savings Accounts Best Free No-Fee Savings Accounts Simple Savings Calculator Monthly Budget Calculator: 50/30/20

- Mortgages Best Mortgage Lenders Best Online Mortgage Lenders Current Mortgage Rates Best HELOC Rates Best Mortgage Refinance Lenders Best Home Equity Loan Lenders Best VA Mortgage Lenders Mortgage Refinance Rates Mortgage Interest Rate Forecast

- Personal Loans Best Personal Loans Best Debt Consolidation Loans Best Emergency Loans Best Home Improvement Loans Best Bad Credit Loans Best Installment Loans For Bad Credit Best Personal Loans For Fair Credit Best Low Interest Personal Loans

- Student Loans Best Student Loans Best Student Loan Refinance Best Student Loans for Bad or No Credit Best Low-Interest Student Loans

- Business Loans Best Business Loans Best Business Lines of Credit Apply For A Business Loan Business Loan vs. Business Line Of Credit What Is An SBA Loan?

- Investing Best Online Brokers Top 10 Cryptocurrencies Best Low-Risk Investments Best Cheap Stocks To Buy Now Best S&P 500 Index Funds Best Stocks For Beginners How To Make Money From Investing In Stocks

- Retirement Best Gold IRAs Best Investments for a Roth IRA Best Bitcoin IRAs Protecting Your 401(k) In a Recession Types of IRAs Roth vs Traditional IRA How To Open A Roth IRA

- Business Formation Best LLC Services Best Registered Agent Services How To Start An LLC How To Start A Business

- Web Design & Hosting Best Website Builders Best E-commerce Platforms Best Domain Registrar

- HR & Payroll Best Payroll Software Best HR Software Best HRIS Systems Best Recruiting Software Best Applicant Tracking Systems

- Payment Processing Best Credit Card Processing Companies Best POS Systems Best Merchant Services Best Credit Card Readers How To Accept Credit Cards

- More Business Solutions Best VPNs Best VoIP Services Best Project Management Software Best CRM Software Best Accounting Software

- Manage Topics

- Investigations

- Visual Explainers

- Newsletters

- Abortion news

- Coronavirus

- Climate Change

- Vertical Storytelling

- Corrections Policy

- College Football

- High School Sports

- H.S. Sports Awards

- Sports Betting

- College Basketball (M)

- College Basketball (W)

- For The Win

- Sports Pulse

- Weekly Pulse

- Buy Tickets

- Sports Seriously

- Sports+ States

- Celebrities

- Entertainment This!

- Celebrity Deaths

- American Influencer Awards

- Women of the Century

- Problem Solved

- Personal Finance

- Small Business

- Consumer Recalls

- Video Games

- Product Reviews

- Destinations

- Airline News

- Experience America

- Today's Debate

- Suzette Hackney

- Policing the USA

- Meet the Editorial Board

- How to Submit Content

- Hidden Common Ground

- Race in America

Personal Loans

Best Personal Loans

Auto Insurance

Best Auto Insurance

Best High-Yields Savings Accounts

CREDIT CARDS

Best Credit Cards

Advertiser Disclosure

Blueprint is an independent, advertising-supported comparison service focused on helping readers make smarter decisions. We receive compensation from the companies that advertise on Blueprint which may impact how and where products appear on this site. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Blueprint. Blueprint does not include all companies, products or offers that may be available to you within the market. A list of selected affiliate partners is available here .

Credit Cards

American Express Business Platinum benefits guide 2024

Ashley Barnett

“Verified by an expert” means that this article has been thoroughly reviewed and evaluated for accuracy.

Robin Saks Frankel

Published 6:04 a.m. UTC April 9, 2024

- path]:fill-[#49619B]" alt="Facebook" width="18" height="18" viewBox="0 0 18 18" fill="none" xmlns="http://www.w3.org/2000/svg">

- path]:fill-[#202020]" alt="Email" width="19" height="14" viewBox="0 0 19 14" fill="none" xmlns="http://www.w3.org/2000/svg">

Editorial Note: Blueprint may earn a commission from affiliate partner links featured here on our site. This commission does not influence our editors' opinions or evaluations. Please view our full advertiser disclosure policy .

mastezphotois , Getty Images

With an eye-watering $695 annual fee (terms apply), there’s no denying that The Business Platinum Card® from American Express * The information for the The Business Platinum Card® from American Express has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. is an expensive card. But without a doubt, it’s also one of the best business travel cards , thanks to its extensive array of perks and ability to earn flexible, valuable Membership Rewards® points . Although the annual fee is high, it’s offset by valuable perks like statement credits, airport lounge access and top-notch travel and purchase protection¹.

All information about The Business Platinum Card® from American Express has been collected independently by Blueprint.

Amex Business Platinum Card overview

The Business Platinum Card® from American Express * The information for the The Business Platinum Card® from American Express has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. is one of the best cards for high-end travel benefits, lifestyle perks and ways to make your business run more smoothly. Of course, it all comes at a significant cost (a $695 annual fee). Therefore, it’s important to assess the card’s features to see if it’s worth it for you and your business.

Those features include access to over 1,400 airport lounges worldwide, elite status with select hotel and rental car partners, airline fee statement credit and CLEAR ® Plus reimbursement, business-focused statement credits like Dell, Adobe, Indeed and much more. Enrollment is required for select benefits.

Looking for an Amex Business card with a less-lofty annual fee? Our list of the best American Express business cards will help you choose the right one for you.

Major Amex Business Platinum Card benefits

Travel benefits .

The Business Platinum Card® from American Express * The information for the The Business Platinum Card® from American Express has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. , like the consumer version, The Platinum Card® from American Express , is a powerhouse for premium travel benefits. Let’s break it down:

- Airport lounge access: You will have access to a wide range of airport lounges. They include The Centurion® Lounge ; Delta Sky Club® lounges (when flying on a same-day Delta flight; limited to 10 annual visits starting Feb. 1, 2025); Priority Pass Select lounges upon enrollment (but not Priority Pass restaurants); Escape Lounges — The Centurion Studio Partner; Plaza Premium lounges and Lufthansa lounges when flying Lufthansa Group (access varies depending on what airline and cabin you’re flying).

- Hotel elite status: You’ll receive complimentary Hilton Honors Gold and Marriott Bonvoy Gold Elite status with enrollment. This offers benefits such as 25% bonus points on eligible hotel purchases, complimentary in-room Wi-Fi access and room upgrades at select properties (when available).

- Rental car elite status: You’ll get complimentary elite status with Avis Preferred Plus, Hertz Gold Plus Rewards President’s Circle and National Emerald Club Executive. One of the best parts of elite status, at select locations, is the ability to skip the line and go straight to your car at the start of your rental. In addition, you may receive car upgrades and waived second driver fees. Enrollment is required.

- Other hotel benefits: You will also get access to Amex’s Fine Hotels + Resorts® and The Hotel Collection programs through Amex Travel. Perks include complimentary breakfast for two (varies by property), early check-in when available, late checkout, complimentary Wi-Fi and room upgrades when available (certain rooms may not be eligible for upgrade). At select properties, you’ll also receive an experience credit of at least $100. The credit can be used towards purchases of on-site services, such as dining or spa treatments. Experience credits vary by property and will be applied to eligible charges up to the amount of the credit.

- Airline fee credit: You’ll receive up to $200 in statement credits per calendar year for incidental airline fees charged to your card. One qualifying airline must first be selected in advance before receiving this benefit, which can cover fees such as changes and cancellations, seat selection, upgrades, checked bags, lounge access and more.

- CLEAR Plus reimbursement: You can get a credit for up to $189 per calendar year for Clear Plus membership fees. No advance enrollment is required for this benefit; pay with your Business Platinum card to automatically receive a statement credit.

- TSA PreCheck/Global Entry reimbursement : You’ll also receive statement credits to reimburse your application fees for Global Entry ($100) or TSA PreCheck ($85). This benefit is available every 4 years for Global Entry or every 4.5 years for TSA PreCheck.

- Pay with Points airline bonus: With The Business Platinum Card® from American Express * The information for the The Business Platinum Card® from American Express has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. , you’ll get 35% of your points back (3.5 extra points for every 10 points redeemed – up to 1,000,000 bonus points per calendar year) when booking a flight with points through Amex Travel. This applies to flights in any cabin on your selected qualifying airline, or for first or business class flights on any airline.

Small business benefits

As a small business card, The Business Platinum Card® from American Express * The information for the The Business Platinum Card® from American Express has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. offers tailored statement credits and perks to help companies run more smoothly (enrollment is required for select benefits):

- Adobe statement credit: You’ll get up to $150 back in Adobe statement credits for eligible annual prepaid business plans for Creative Cloud for teams or Acrobat Pro DC with e-sign for teams through Dec. 31, 2024.

- Dell statement credit: You can get up to $200 back semi-annually ($400 per year) on U.S. purchases with Dell technologies through Dec. 31, 2024.

- Indeed statement credit: Through Dec. 31, 2024, you can also get up to $90 back quarterly ($360 per year) via statement credits for purchases with Indeed.

- Wireless credit: You’ll receive up to $10 back per month ($120 per year) in statement credits for wireless telephone service purchases made directly through a wireless provider in the U.S. on your Business Platinum card.

Insurance and protection benefits

The Business Platinum Card® from American Express * The information for the The Business Platinum Card® from American Express has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. has a robust array of travel and purchase protections¹. These include:

- Trip delay insurance: Trip delay insurance applies to eligible round-trip travel expenses paid for with the Business Platinum. Coverage is good for up to $500 per trip, and for incidental expenses that apply (including meals, lodging, toiletries, medication and more) when a trip is delayed by six hours or longer. You are eligible to file two claims per 12-month period.²

- Trip cancellation and interruption insurance: Trip cancellation and interruption insurance will apply to eligible round-trip travel purchases charged to the Business Platinum card. This coverage is good for up to $10,000 per covered trip with a maximum benefit of $20,000 per eligible card every 12 months.³

- Baggage insurance: You’ll get automatic baggage insurance when paying with the card on a common carrier (like an airline or cruise line). This coverage is good for up to $2,000 per person for checked baggage and up to a combined $3,000 per person for checked and carry-on baggage.⁴

- Cellphone protection: Paying your cellphone bill with your card provides cellphone protection. There is a maximum of $800 liability per claim, and each claim is subject to a $50 deductible. There’s also a limit of two claims per eligible account in a 12-month period. You can maximize this perk by combining it with the wireless credit benefit above.⁵

Bonus points for spending

While The Business Platinum Card® from American Express * The information for the The Business Platinum Card® from American Express has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. isn’t the best card to use for all spending categories, there are certain instances where it does make sense to use it — like on flights and prepaid hotels through Amex Travel, as well as on large purchases — cardholders earn:

- 5 Membership Rewards points per $1 on flights and prepaid hotels through American Express Travel.

- 1.5 points per $1 at U.S. construction material & hardware suppliers, electronic goods retailers and software and cloud system providers, shipping providers, and purchases of $5,000 or more on up to $2 million per calendar year.

- 1 point per $1 on other eligible purchases.

Additional benefits worth noting

- Global Dining Access with Resy: Global Dining Access perks include Priority Notify at all of Resy’s thousands of restaurants worldwide. This gives you special access to primetime tables at many of the most in-demand restaurants across the U.S. and internationally.

- Secondary Auto Insurance Coverage: Rental cars booked with The Business Platinum Card® from American Express * The information for the The Business Platinum Card® from American Express has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. receive secondary car rental loss and damage insurance⁶. Consider getting a credit card with primary rental car insurance if you want primary, as compared to secondary, coverage.

Frequently asked questions (FAQs)

Yes, The Business Platinum Card® from American Express * The information for the The Business Platinum Card® from American Express has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. has access to over 1,400 airport lounge locations worldwide with the Amex Global Lounge Collection.

First, to make the most of the Amex Business Platinum, be sure to maximize your points potential by meeting the minimum spending requirements to earn a welcome bonus.

Then, enroll your card in the statement credit offers such as those with Adobe, Indeed, Dell, select U.S. wireless telephone service providers, CLEAR and more. Also, sign up for hotel and rental car elite status programs that are included with the Business Platinum. Travelers will want to utilize lounge access, Resy benefits and more.

Maximize the points you earn by putting larger purchases on The Business Platinum Card® from American Express * The information for the The Business Platinum Card® from American Express has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. . Beyond earning as many points as possible, you’ll also want to maximize the value upon redemption .

Both cards serve different purposes. While The Business Platinum Card® from American Express * The information for the The Business Platinum Card® from American Express has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. is geared more towards frequent travelers with more premium perks like lounge access, the American Express® Business Gold Card * The information for the American Express® Business Gold Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. (terms apply) is tailored to those with high spending who may not travel as frequently.

Overall, it’s better to spend on the Amex Business Gold card, with bonus-earning spending categories that include purchases at U.S. media providers for advertising in select media, U.S. restaurants, U.S. gas stations, transit purchases such as taxis or rideshare, and more.

All information about American Express® Business Gold Card and The Business Platinum Card® from American Express has been collected independently by Blueprint.

The Business Platinum Card® from American Express * The information for the The Business Platinum Card® from American Express has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. does not come with a traditional preset spending limit. The amount you can spend adapts based on factors such as your purchase, payment, and credit history.

Yes, The Business Platinum Card® from American Express * The information for the The Business Platinum Card® from American Express has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. comes with travel insurance, including trip delay insurance², trip cancellation and interruption insurance³ and baggage insurance⁴.

The publicly available offer for The Business Platinum Card® from American Express * The information for the The Business Platinum Card® from American Express has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. waxes and wanes. The current offer is for 120,000 Membership Rewards points after spending $15,000 on eligible purchases in the first three months of card membership. However, you may be targeted for even higher offers through your Amex account or via a tool like Cardmatch or even mailers.

¹Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by AMEX Assurance Company.

²Up to $500 per Covered Trip that is delayed for more than 6 hours; and 2 claims per Eligible Card per 12 consecutive month period. Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by New Hampshire Insurance Company, an AIG Company.

³The maximum benefit amount for Trip Cancellation and Interruption Insurance is $10,000 per Covered Trip and $20,000 per Eligible Card per 12 consecutive month period. Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by New Hampshire Insurance Company, an AIG Company.

⁴Baggage Insurance Plan coverage can be in effect for Covered Persons for eligible lost, damaged, or stolen Baggage during their travel on a Common Carrier Vehicle (e.g. plane, train, ship, or bus) when the Entire Fare for a ticket for the trip (one-way or round-trip) is charged to an Eligible Card. Coverage can be provided for up to $2,000 for checked Baggage and up to a combined maximum of $3,000 for checked and carry-on Baggage, in excess of coverage provided by the Common Carrier. The coverage is also subject to a $3,000 aggregate limit per Covered Trip. For New York State residents, there is a $2,000 per bag/suitcase limit for each Covered Person with a $10,000 aggregate maximum for all Covered Persons per Covered Trip.Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by AMEX Assurance Company.

⁵Coverage for a Stolen or damaged Eligible Cellular Wireless Telephone is subject to the terms, conditions, exclusions and limits of liability of this benefit. The maximum liability is $800, per claim, per Eligible Card Account. Each claim is subject to a $50 deductible. Coverage is limited to two (2) claims per Eligible Card Account per 12 month period. Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by New Hampshire Insurance Company, an AIG Company.

⁶Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by AMEX Assurance Company. Car Rental Loss or Damage Coverage is offered through American Express Travel Related Services Company, Inc.

*The information for the American Express® Business Gold Card and The Business Platinum Card® from American Express has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

Blueprint is an independent publisher and comparison service, not an investment advisor. The information provided is for educational purposes only and we encourage you to seek personalized advice from qualified professionals regarding specific financial decisions. Past performance is not indicative of future results.

Blueprint has an advertiser disclosure policy . The opinions, analyses, reviews or recommendations expressed in this article are those of the Blueprint editorial staff alone. Blueprint adheres to strict editorial integrity standards. The information is accurate as of the publish date, but always check the provider’s website for the most current information.

Chris Dong is a travel, loyalty, and credit cards reporter. He has covered travel and personal finance content for national print and digital publications including The Washington Post, Business Insider, The Points Guy, Travel + Leisure, AFAR, Condé Nast Traveler, Lonely Planet, and more. When he’s not on the road, Chris calls Los Angeles home after nearly 10 years in New York City.

Ashley Barnett has been writing and editing personal finance articles for the internet since 2008. Before editing for USA TODAY Blueprint, she was the Content Director for an international media company leading the content on their suite of personal finance sites. She lives in Phoenix, AZ where you can find her rereading Harry Potter for the 100th time.

Robin Saks Frankel is a credit cards lead editor at USA TODAY Blueprint. Previously, she was a credit cards and personal finance deputy editor for Forbes Advisor. She has also covered credit cards and related content for other national web publications including NerdWallet, Bankrate and HerMoney. She's been featured as a personal finance expert in outlets including CNBC, Business Insider, CBS Marketplace, NASDAQ's Trade Talks and has appeared on or contributed to The New York Times, Fox News, CBS Radio, ABC Radio, NPR, International Business Times and NBC, ABC and CBS TV affiliates nationwide. She holds an M.S. in Business and Economics Journalism from Boston University. Follow her on Twitter at @robinsaks.

Can you pay off one credit card with another?

Credit Cards Louis DeNicola

Amex Gold vs. Platinum

Credit Cards Harrison Pierce

Why I chose the Chase Sapphire Preferred as my first ever rewards card

Credit Cards Sarah Li Cain

How to use Alaska Airlines Companion Fare

Credit Cards Ariana Arghandewal

How I maximize my Chase Ink Business Unlimited Card

Credit Cards Lee Huffman

How to do a balance transfer with Discover

9 ways to maximize the Citi Custom Cash card’s 5% cash-back categories

Why I applied for the new Wells Fargo Autograph Journey℠ Visa® Card

Credit Cards Jason Steele

Which Citi balance transfer card should I get?

Credit Cards Julie Sherrier

5 reasons why the Citi Diamond Preferred is great for paying down debt

Credit Cards Michelle Lambright Black

Welcome offer on Chase’s IHG One Rewards Premier Business card soars to 175K points

Credit Cards Carissa Rawson

You might be a small business owner and not even know it

Chase Freedom Flex benefits guide 2024

6 ways to maximize the Citi Double Cash Card

Credit Cards Ben Luthi

How to use the Citi trifecta to maximize your rewards

Credit Cards Ryan Smith

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

Why the Amex Platinum Is the Only Card I’ll Use To Book Flights

Carissa Rawson

Senior Content Contributor

250 Published Articles

Countries Visited: 51 U.S. States Visited: 36

Stella Shon

News Managing Editor

85 Published Articles 618 Edited Articles

Countries Visited: 25 U.S. States Visited: 22

The Amex Platinum Card Earns Me the Most Points

The amex platinum card has excellent travel insurance, amex’s global lounge collection is industry-leading, amex points are my favorite flexible currency, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

Although I’m not technically a digital nomad, I fly enough to qualify as one.

With trips taking me on roughly 100 flights per year, I’ve done a lot of research when it comes to booking airfare.

Though I have plenty of credit cards to spare, The Platinum Card ® from American Express always finds its way to the front when it comes time to pay — here’s why.

There are plenty of credit cards that earn bonus points on travel , and especially airfare. However, the Amex Platinum card personally beats out others, despite its $695 annual fee ( rates & fees ).