- Auto Insurance Best Car Insurance Cheapest Car Insurance Compare Car Insurance Quotes Best Car Insurance For Young Drivers Best Auto & Home Bundles Cheapest Cars To Insure

- Home Insurance Best Home Insurance Best Renters Insurance Cheapest Homeowners Insurance Types Of Homeowners Insurance

- Life Insurance Best Life Insurance Best Term Life Insurance Best Senior Life Insurance Best Whole Life Insurance Best No Exam Life Insurance

- Pet Insurance Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes

- Travel Insurance Best Travel Insurance Cancel For Any Reason Travel Insurance Best Cruise Travel Insurance Best Senior Travel Insurance

- Health Insurance Best Health Insurance Plans Best Affordable Health Insurance Best Dental Insurance Best Vision Insurance Best Disability Insurance

- Credit Cards Best Credit Cards 2024 Best Balance Transfer Credit Cards Best Rewards Credit Cards Best Cash Back Credit Cards Best Travel Rewards Credit Cards Best 0% APR Credit Cards Best Business Credit Cards Best Credit Cards for Startups Best Credit Cards For Bad Credit Best Cards for Students without Credit

- Credit Card Reviews Chase Sapphire Preferred Wells Fargo Active Cash® Chase Sapphire Reserve Citi Double Cash Citi Diamond Preferred Chase Ink Business Unlimited American Express Blue Business Plus

- Credit Card by Issuer Best Chase Credit Cards Best American Express Credit Cards Best Bank of America Credit Cards Best Visa Credit Cards

- Credit Score Best Credit Monitoring Services Best Identity Theft Protection

- CDs Best CD Rates Best No Penalty CDs Best Jumbo CD Rates Best 3 Month CD Rates Best 6 Month CD Rates Best 9 Month CD Rates Best 1 Year CD Rates Best 2 Year CD Rates Best 5 Year CD Rates

- Checking Best High-Yield Checking Accounts Best Checking Accounts Best No Fee Checking Accounts Best Teen Checking Accounts Best Student Checking Accounts Best Joint Checking Accounts Best Business Checking Accounts Best Free Checking Accounts

- Savings Best High-Yield Savings Accounts Best Free No-Fee Savings Accounts Simple Savings Calculator Monthly Budget Calculator: 50/30/20

- Mortgages Best Mortgage Lenders Best Online Mortgage Lenders Current Mortgage Rates Best HELOC Rates Best Mortgage Refinance Lenders Best Home Equity Loan Lenders Best VA Mortgage Lenders Mortgage Refinance Rates Mortgage Interest Rate Forecast

- Personal Loans Best Personal Loans Best Debt Consolidation Loans Best Emergency Loans Best Home Improvement Loans Best Bad Credit Loans Best Installment Loans For Bad Credit Best Personal Loans For Fair Credit Best Low Interest Personal Loans

- Student Loans Best Student Loans Best Student Loan Refinance Best Student Loans for Bad or No Credit Best Low-Interest Student Loans

- Business Loans Best Business Loans Best Business Lines of Credit Apply For A Business Loan Business Loan vs. Business Line Of Credit What Is An SBA Loan?

- Investing Best Online Brokers Top 10 Cryptocurrencies Best Low-Risk Investments Best Cheap Stocks To Buy Now Best S&P 500 Index Funds Best Stocks For Beginners How To Make Money From Investing In Stocks

- Retirement Best Gold IRAs Best Investments for a Roth IRA Best Bitcoin IRAs Protecting Your 401(k) In a Recession Types of IRAs Roth vs Traditional IRA How To Open A Roth IRA

- Business Formation Best LLC Services Best Registered Agent Services How To Start An LLC How To Start A Business

- Web Design & Hosting Best Website Builders Best E-commerce Platforms Best Domain Registrar

- HR & Payroll Best Payroll Software Best HR Software Best HRIS Systems Best Recruiting Software Best Applicant Tracking Systems

- Payment Processing Best Credit Card Processing Companies Best POS Systems Best Merchant Services Best Credit Card Readers How To Accept Credit Cards

- More Business Solutions Best VPNs Best VoIP Services Best Project Management Software Best CRM Software Best Accounting Software

- Manage Topics

- Investigations

- Visual Explainers

- Newsletters

- Abortion news

- Coronavirus

- Climate Change

- Vertical Storytelling

- Corrections Policy

- College Football

- High School Sports

- H.S. Sports Awards

- Sports Betting

- College Basketball (M)

- College Basketball (W)

- For The Win

- Sports Pulse

- Weekly Pulse

- Buy Tickets

- Sports Seriously

- Sports+ States

- Celebrities

- Entertainment This!

- Celebrity Deaths

- American Influencer Awards

- Women of the Century

- Problem Solved

- Personal Finance

- Small Business

- Consumer Recalls

- Video Games

- Product Reviews

- Destinations

- Airline News

- Experience America

- Today's Debate

- Suzette Hackney

- Policing the USA

- Meet the Editorial Board

- How to Submit Content

- Hidden Common Ground

- Race in America

Personal Loans

Best Personal Loans

Auto Insurance

Best Auto Insurance

Best High-Yields Savings Accounts

CREDIT CARDS

Best Credit Cards

Advertiser Disclosure

Blueprint is an independent, advertising-supported comparison service focused on helping readers make smarter decisions. We receive compensation from the companies that advertise on Blueprint which may impact how and where products appear on this site. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Blueprint. Blueprint does not include all companies, products or offers that may be available to you within the market. A list of selected affiliate partners is available here .

Credit Cards

The complete guide to the Amex Travel portal

Carissa Rawson

Allie Johnson

“Verified by an expert” means that this article has been thoroughly reviewed and evaluated for accuracy.

Robin Saks Frankel

Published 7:39 a.m. UTC Feb. 28, 2024

- path]:fill-[#49619B]" alt="Facebook" width="18" height="18" viewBox="0 0 18 18" fill="none" xmlns="http://www.w3.org/2000/svg">

- path]:fill-[#202020]" alt="Email" width="19" height="14" viewBox="0 0 19 14" fill="none" xmlns="http://www.w3.org/2000/svg">

Editorial Note: Blueprint may earn a commission from affiliate partner links featured here on our site. This commission does not influence our editors' opinions or evaluations. Please view our full advertiser disclosure policy .

onurdongel, Getty Images

The American Express Travel portal offers valuable benefits to American Express cardholders, including special prices. Depending on which card you hold, you may also be able to pay for travel with Membership Rewards® points and get access to perks such as discounted airfare and specialty benefits at luxury hotels. Let’s take a look at how the Amex Travel portal works, whether the benefits are worthwhile and who can access Amex Travel’s website.

- American Express Travel offers hotels, vacation rentals, flights, rental cars and cruises.

- Luxury hotel benefits and discounted airfare are two benefits of booking through Amex’s travel portal.

- American Express cardholders can access Amex Travel.

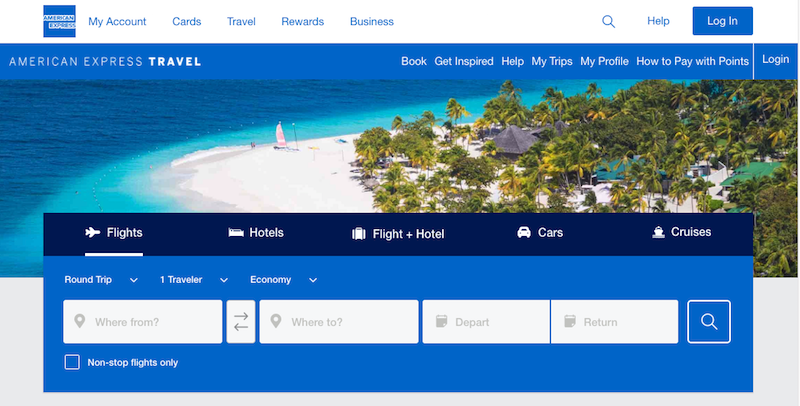

How to book travel through the Amex Travel portal

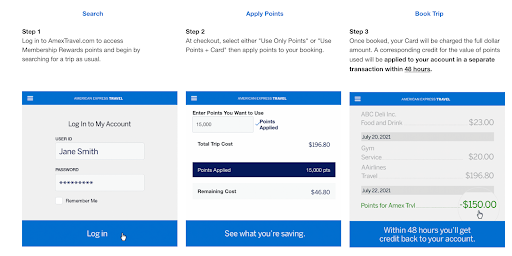

Booking travel through the Amex Travel portal requires you to have an online account associated with an Amex card. While you can complete a search on the Amex Travel website without logging in, you will need to do so in order to make a booking.

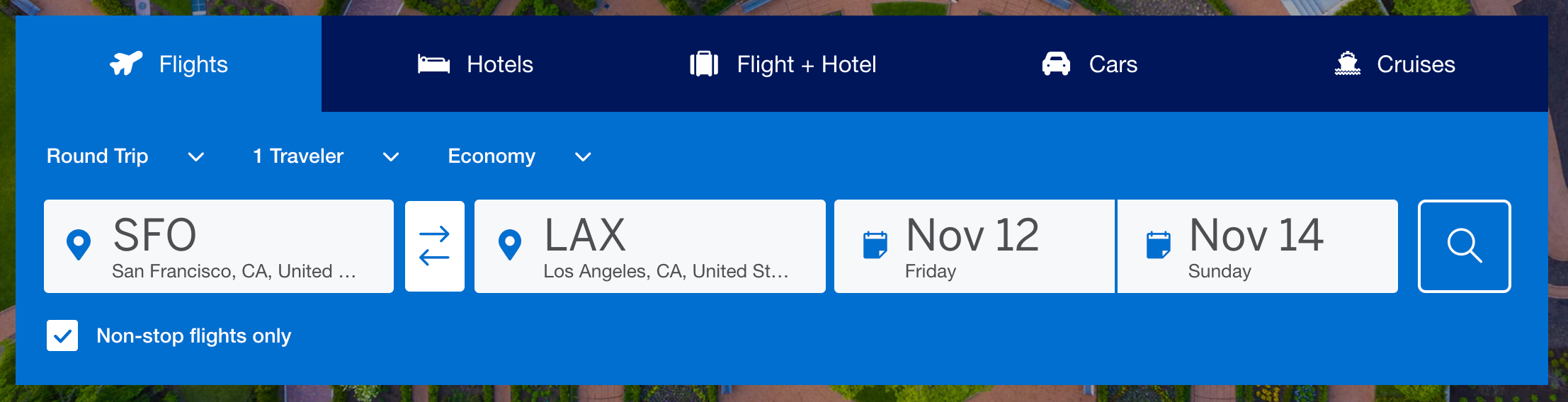

After you choose whether to book a flight, hotel, vacation rental, vacation package, rental car or cruise, you’ll need to enter your travel details.

For example, if you want to book a flight through Amex Travel, you’ll need to put in your departure airport and destination as well as your dates of travel. The site will then bring up a list of matching results.

You can filter based on when the flights take off as well as how many stops you’re willing to tolerate, among other options.

The Amex Travel site offers a wide variety of hotel stays and flights, but you’ll always want to double check elsewhere before booking since it doesn’t always feature every option.

Once you’ve selected a booking, you’ll be taken through the checkout process. This includes providing your personal information and can also include seat requests and adding in loyalty program numbers.

To pay for your booking, you can use your American Express Membership Rewards, if you have a card that earns them, or your American Express card or a combination of both.

After you’ve booked, you’ll receive a confirmation email containing your reservation information. You can also find your bookings under the My Trips section of Amex Travel.

Who can use the portal?

Any American Express cardholder can use the Amex Travel portal to book travel. But those whose cards don’t earn Amex Membership Rewards points will need to pay with their Amex card.

However, many American Express cards earn Membership Rewards points that can be redeemed for travel through the Amex Travel portal. These cards include (terms apply):

The Platinum Card® from American Express

- American Express® Gold Card

- American Express® Green Card * The information for the American Express® Green Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

- Amex EveryDay® Credit Card * The information for the Amex EveryDay® Credit Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

- The Business Platinum Card® from American Express * The information for the The Business Platinum Card® from American Express has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

- American Express® Business Gold Card * The information for the American Express® Business Gold Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

All information about American Express® Green Card, Amex EveryDay® Credit Card, The Business Platinum Card® from American Express and American Express® Business Gold Card has been collected independently by Blueprint.

our partner

Blueprint receives compensation from our partners for featured offers, which impacts how and where the placement is displayed.

Welcome Bonus

Earn 80,000 Membership Rewards® Points after you spend $8,000 on purchases on the Card in your first 6 months of Card Membership.

Regular APR

Credit score.

Credit Score ranges are based on FICO® credit scoring. This is just one scoring method and a credit card issuer may use another method when considering your application. These are provided as guidelines only and approval is not guaranteed.

Editor’s Take

- Over $1,500 in travel and entertainment credits can offset the annual fee.

- Comprehensive lounge access benefit.

- Generous travel and purchase protections.

- High annual fee and spending requirements.

- Amex’s once-per-lifetime rule limits welcome bonus eligibility.

- Annual statement credits have limited use.

Card Details

- Earn 80,000 Membership Rewards® Points after you spend $8,000 on purchases on your new Card in your first 6 months of Card Membership. Apply and select your preferred metal Card design: classic Platinum Card®, Platinum x Kehinde Wiley, or Platinum x Julie Mehretu.

- Earn 5X Membership Rewards® Points for flights booked directly with airlines or with American Express Travel up to $500,000 on these purchases per calendar year and earn 5X Membership Rewards® Points on prepaid hotels booked with American Express Travel.

- $200 Hotel Credit: Get up to $200 back in statement credits each year on prepaid Fine Hotels + Resorts® or The Hotel Collection bookings with American Express Travel when you pay with your Platinum Card®. The Hotel Collection requires a minimum two-night stay.

- $240 Digital Entertainment Credit: Get up to $20 back in statement credits each month on eligible purchases made with your Platinum Card® on one or more of the following: Disney+, a Disney Bundle, ESPN+, Hulu, The New York Times, Peacock, and The Wall Street Journal. Enrollment required.

- $155 Walmart+ Credit: Cover the cost of a $12.95 monthly Walmart+ membership (subject to auto-renewal) with a statement credit after you pay for Walmart+ each month with your Platinum Card®. Cost includes $12.95 plus applicable local sales tax. Plus Up Benefits are excluded.

- $200 Airline Fee Credit: Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees are charged by the airline to your Platinum Card®.

- $200 Uber Cash: Enjoy Uber VIP status and up to $200 in Uber savings on rides or eats orders in the US annually. Uber Cash and Uber VIP status is available to Basic Card Member only. Terms Apply.

- $300 Equinox Credit: Get up to $300 back in statement credits per calendar year on an Equinox membership, or an Equinox club membership (subject to auto-renewal) when you pay with your Platinum Card®. Enrollment required. Visit https://platinum.equinox.com/ to enroll.

- $189 CLEAR® Plus Credit: Breeze through security with CLEAR Plus at 100+ airports, stadiums, and entertainment venues nationwide and get up to $189 back per calendar year on your Membership (subject to auto-renewal) when you use your Platinum Card®. Learn more.

- $100 Global Entry Credit: Receive either a $100 statement credit every 4 years for a Global Entry application fee or a statement credit up to $85 every 4.5 years for a TSA PreCheck® (through a TSA official enrollment provider) application fee, when charged to your Platinum Card®. Card Members approved for Global Entry will also receive access to TSA PreCheck at no additional cost.

- Shop Saks with Platinum: Get up to $100 in statement credits annually for purchases in Saks Fifth Avenue stores or at saks.com on your Platinum Card®. That’s up to $50 in statement credits semi-annually. Enrollment required.

- $300 SoulCycle At-Home Bike Credit: Get a $300 statement credit for the purchase of a SoulCycle at-home bike with your Platinum Card®. An Equinox+ subscription is required to purchase a SoulCycle at-home bike and access SoulCycle content. Must charge full price of bike in one transaction. Shipping available in the contiguous U.S. only. Enrollment Required.

- Unlock access to exclusive reservations and special dining experiences with Global Dining Access by Resy when you add your Platinum Card® to your Resy profile.

- $695 annual fee.

- Terms Apply.

Is the portal worth using?

The Amex Travel portal can be worth using in certain cases, though it won’t always make sense. For example, some flights aren’t bookable via Amex Travel, so if what you need isn’t available you’ll want to look elsewhere.

That being said, those with certain cards are entitled to exclusive benefits that can lower prices or allow them to redeem points for travel. There are also perks for booking luxury hotels within the portal. In these cases, Amex Travel is definitely worth investigating.

How to maximize your Amex Travel benefits through the portal

International airline program.

Available to those who hold a high-end American Express card, including The Platinum Card from American Express, The Business Platinum Card from American Express and the American Express Centurion Black Card * The information for the American Express Centurion Black Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. , the International Airline Program (IAP) can save you money on certain international flights booked via the Amex Travel portal.

All information about American Express Centurion Black Card has been collected independently by Blueprint.

This benefit is only available on tickets booked in premium economy, business or first class, but the savings can be significant.

For example, we looked at a round-trip flight in premium economy from San Francisco (SFO) to Tokyo (NRT). Booking with Japan Airlines (JAL) directly resulted in a cost of $4,431.40, while the Amex Travel portal and the IAP charged just $3,797.40 for a savings of over $600.

Fine Hotels + Resorts ® and The Hotel Collection

American Express also offers the Fine Hotels and Resorts and The Hotel Collection to eligible cardholders.

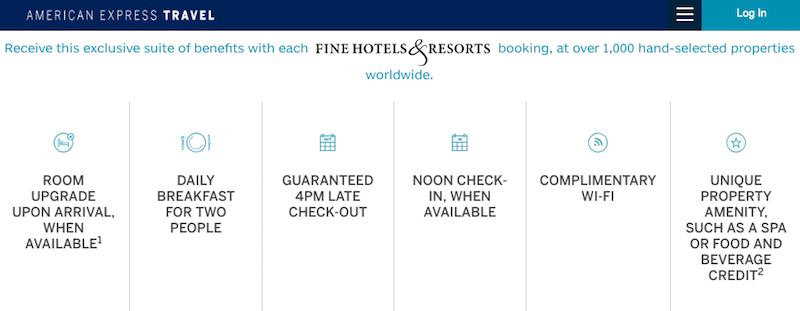

Fine Hotels and Resorts allows guests to book luxury hotels with special benefits. These include room upgrades, complimentary breakfast, an experience credit, late check-out, early check-in and more.

The Hotel Collection offers similar but less exorbitant benefits. It’s directed toward more midscale properties and includes an experience credit as well as a room upgrade.

35% rebate on redeemed points

Those who hold The Business Platinum Card from American Express are able to get a 35% rebate on points redeemed for eligible flights booked through the Amex Travel portal (up to 1,000,000 points per calendar year).

Eligible flights include all fare classes on an airline that you select each year. It also includes first and business class tickets on any airline.

Quick guide to Amex Membership Rewards

American Express Membership Rewards are the points you earn with eligible Amex cards. These highly flexible and valuable points can be redeemed in a number of ways, though they tend to be most valuable when transferred to Amex airline partners.

Other ways of redeeming Amex points include:

- Gift cards.

- Travel booked via Amex Travel.

- Online shopping.

- Statement credits.

While these are nice options to have, you’ll generally get much less value from your Membership Rewards points by redeeming them in these ways. Finally, although you can redeem your points in the Amex Travel portal, this isn’t necessarily a good idea if you aim to reap maximum value. Even if you’re taking advantage of the 35% rebate on redeemed points for flights, you’ll only ever receive a value of 1.54 cents per point. This is lower than you’d expect when transferring your Amex points to many airline and hotel partners.

Frequently asked questions (FAQs)

No, travel insurance is not automatically included when booking through the Amex portal. But many of the best credit cards feature complimentary travel insurance when using your card to pay, including those from American Express. Otherwise, you may be able to opt in to travel insurance during the booking process or via a third party provider.

Those with the The Platinum Card from American Express can earn 5 Membership Rewards® points per $1 for flights booked directly with airlines or with American Express Travel on up to $500,000 per calendar year, 5 points per $1 on prepaid hotels booked with American Express Travel and 1 point per $1 on other purchases. The card has an annual fee of $695 ( rates & fees ).

Those with the The Business Platinum Card® from American Express * The information for the The Business Platinum Card® from American Express has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. , meanwhile, earn 5 Membership Rewards points per $1 on flights and prepaid hotels through American Express Travel, 1.5 points per $1 at U.S. construction material & hardware suppliers, electronic goods retailers and software and cloud system providers, shipping providers, and purchases of $5,000 or more on up to $2 million per calendar year and 1 point per $1 on other eligible purchases. The card has a $695 annual fee.

All information about The Business Platinum Card® from American Express has been collected independently by Blueprint.

The phone number for American Express Travel is: 1-800-297-2977.

The number of Amex points that you’ll need to redeem for a flight will depend on the cash cost of your flight and whether you’re booking through Amex Travel or transferring your Membership Rewards points to an Amex airline partner. Amex Points are worth about one cent when booking flights through the portal, so a flight that costs $500 in cash would require about 50,000 Amex points. You’ll typically get a better deal with transfer partners than booking through the portal.

For rates and fees for The Platinum Card® from American Express please visit this page .

*The information for the American Express Centurion Black Card, American Express® Business Gold Card, American Express® Green Card, Amex EveryDay® Credit Card and The Business Platinum Card® from American Express has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

Blueprint is an independent publisher and comparison service, not an investment advisor. The information provided is for educational purposes only and we encourage you to seek personalized advice from qualified professionals regarding specific financial decisions. Past performance is not indicative of future results.

Blueprint has an advertiser disclosure policy . The opinions, analyses, reviews or recommendations expressed in this article are those of the Blueprint editorial staff alone. Blueprint adheres to strict editorial integrity standards. The information is accurate as of the publish date, but always check the provider’s website for the most current information.

Carissa Rawson is a credit cards and award travel expert with nearly a decade of experience. You can find her work in a variety of publications, including Forbes Advisor, Business Insider, The Points Guy, Investopedia, and more. When she's not writing or editing, you can find her in your nearest airport lounge sipping a coffee before her next flight.

Allie is a journalist with a passion for money tips and advice. She's been writing about personal finance since the Great Recession for online publications such as Bankrate, CreditCards.com, MyWalletJoy and ValuePenguin. She's also written personal finance content for Discover, First Horizon Bank, The Hartford, Travelers and Synovus.

Robin Saks Frankel is a credit cards lead editor at USA TODAY Blueprint. Previously, she was a credit cards and personal finance deputy editor for Forbes Advisor. She has also covered credit cards and related content for other national web publications including NerdWallet, Bankrate and HerMoney. She's been featured as a personal finance expert in outlets including CNBC, Business Insider, CBS Marketplace, NASDAQ's Trade Talks and has appeared on or contributed to The New York Times, Fox News, CBS Radio, ABC Radio, NPR, International Business Times and NBC, ABC and CBS TV affiliates nationwide. She holds an M.S. in Business and Economics Journalism from Boston University. Follow her on Twitter at @robinsaks.

Can you pay off one credit card with another?

Credit Cards Louis DeNicola

Amex Gold vs. Platinum

Credit Cards Harrison Pierce

Why I chose the Chase Sapphire Preferred as my first ever rewards card

Credit Cards Sarah Li Cain

How to use Alaska Airlines Companion Fare

Credit Cards Ariana Arghandewal

How I maximize my Chase Ink Business Unlimited Card

Credit Cards Lee Huffman

How to do a balance transfer with Discover

9 ways to maximize the Citi Custom Cash card’s 5% cash-back categories

American Express Business Platinum benefits guide 2024

Credit Cards Chris Dong

Why I applied for the new Wells Fargo Autograph Journey℠ Visa® Card

Credit Cards Jason Steele

Which Citi balance transfer card should I get?

Credit Cards Julie Sherrier

5 reasons why the Citi Diamond Preferred is great for paying down debt

Credit Cards Michelle Lambright Black

Welcome offer on Chase’s IHG One Rewards Premier Business card soars to 175K points

Credit Cards Carissa Rawson

You might be a small business owner and not even know it

Chase Freedom Flex benefits guide 2024

6 ways to maximize the Citi Double Cash Card

Credit Cards Ben Luthi

American Express Travel Review [2024]: Worth the hype?

![amex travel insiders reddit American Express Travel Review [2024]: Worth the hype?](https://assets-global.website-files.com/63d1baf79ce0eb802868785b/63d1baf89ce0eb5404689322_american%20express%20travel.jpg)

Heard about the amazing perks and benefits that Amex cardholders have through Amex Travel? Whether you're already a cardholder or if you're looking to sign up, definitely check out all of the perks of Amex Travel before you choose to book with them!

Editor's Note: This is a review of American Express' Travel Platforms, not specifically the credit cards. This review is independently written and was not sponsored by American Express.

Are you an American Express cardholder planning to book a trip soon? You might want to take a look at the Amex Travel portal in preparation for your vacation.

American Express cardholders and non-cardholders alike have access to this booking portal, but American Express cardholders can receive travel benefits like room upgrades, resort credit, and more by booking through Amex Travel.

Plus, cardholders can use Membership Rewards Points to cover all or part of their booking on Amex Travel!

However, it's important to note that the Amex Travel portal might not be the best option for every traveler. Some drawbacks include the barrier to entry and the low points-to-dollar conversion for travel services booked on the site.

Keep reading to learn more about the Amex Travel portal and whether we think it's worth using to book your next trip!

What is Amex Travel?

AMex Travel , also known as American Express Travel, is a travel booking portal that allows users to book travel, including flights, cruises, and hotel stays. It's an additional service portal that American Express Credit Card Holders get to use as part of their membership.

Cardholders can redeem American Express Membership Rewards Points directly to use on travel bookings. It is a convenient way to redeem points for travel directly in the portal rather than having to transfer points to a partner airline or hotel group.

How does Amex Travel work?

First things first, only American Express cardholders can use the Amex Travel portal to redeem points to book travel.

If you have an American Express branded credit card and Membership Rewards points ready to use, you're good to go. Otherwise, you'll still be able to use the site, but you won't be able to apply points to your booking or reap the benefits of certain cardholder-only programs.

Amex Travel is simple and easy to use and has a clean interface that allows users to quickly find what they're looking for on the platform. Users can book travel directly in the Amex Travel portal by using American Express Membership Rewards Points, a credit card, or both.

Travel services available on the Amex Travel portal include flights, hotels, car rentals, cruises, and vacation packages.

How can I book a trip through Amex Travel?

The ease of use and simple user interface make booking travel on Amex Travel an enjoyable, stress-free experience.

All you need to do to book a trip through Amex Travel is:

- Log into your American Express account.

- Search for the trip type you want to book, like flights, hotels, cruises, etc.

- Apply points to your booking at check-out.

- Book the trip!

American Express Credit Cards

Depending on which American Express card or cards you have, you get access to certain perks when booking travel through the Amex Travel portal.

These are the two most popular travel-related American Express Credit Cards, which besides the Centurion no-limit invite-only card, contains the best Amex point rewards and benefits system!

American Express Gold Cardholders

The American Express Gold Card is the affordable credit card options if you're looking for great reward points for a cheaper annual fee. The Amex Gold Card's annual fee comes to $250, which includes

- Up to $120 Uber Cash (U.S.)

- Up to $120 dining credits

- Access to the Hotels Collection

- Other Insurance & general perks!

With the 3x amount of points earned on travel and 4x amount of points earned on groceries, this card is a great place to start if you're looking to build up travel reward points for your next travel getaway!

American Express Platinum Cardholders

The American Express Platinum card, Amex's flagship credit card, receives tons of travel-related credits that can then be used when booking through the Amex Travel Portal. Coming in at a $695 annual fee, it's easily to be discouraged for signing up for such an expensive credit card.

However, the travel benefits that comes with the Amex Platinum card are incredible, which includes but are not limited to:

- Up to $200 annual airline credits

- Up to $200 Uber Cash (U.S.)

- Up to $200 hotel statement credits on Fine Hotel + Resorts or The Hotel Collection bookings

- Up to $189 Clear statement credits

- Global Lounge Collection

- Complimentary Hilton Honors + Marriott Bo

- Bonvoy Gold Elite

- and more non-travel credits!

If you travel frequently, we recommend you take advantage of the huge benefits that comes with the Amex Platinum credit card!

American Express Travel Benefit Programs

The hotel collection.

The Hotel Collection is a select American Express membership perk that allows specific cardholders to book participating hotels through Amex Travel portal to receive exclusive benefits, using cash or points.

In order to gain access to The Hotel Collection, you'll need to have access to the following Amex credit cards:

- American Express Gold Card + Business Gold

- American Express Platinum + Business Platinum

- American Express Centurion Card

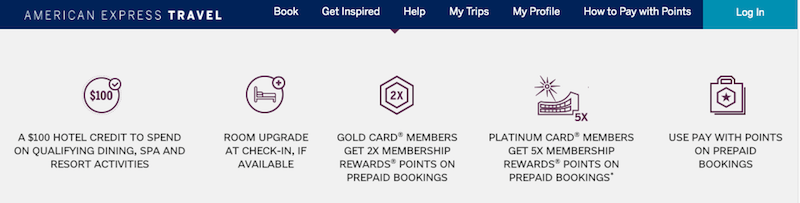

Here are all of the benefits Amex card holders can receive with access to the hotels Collection Program:

- Pay-With-Points

- Exclusive deals on lower rates for hotel bookings or reservations

- Room Upgrade upon check-in when staying 2 nights or longer

- up to $100 in hotel credits, which can be used to spend on dining, spa and other eligible activities when staying 2 nights or longer

- 5x Membership reward points for Platinum cardholders, 2x membership reward points for Gold cardholders on prepaid reservations or bookings.

The Fine Hotels & Resorts Program

The Fine Hotels & Resorts program, also known as "Amex FHR" or "FHR," has a suite of benefits such as daily breakfast for two, guaranteed 4pm check-out, complimentary WiFi, and room upgrades when available.

The Fine hotel & Resorts program is only available for American Express Platinum cardholders and above.

When booking through the Fine Hotels & Resorts program, you'll also receive a $100 experience credit for services at the spa or food and beverages at the hotel–note that this benefit varies based on the property.

The FHR program is entirely different from the Amex Travel Portal, so points and credits aren't guaranteed in this program. Be sure to check up on whether your points count towards the FHR program with Amex Travel's representative before booking!

Cruise Privileges Program

American Express Platinum cardholders also have access to the Cruise Privileges Program in the Amex Travel portal.

Platinum Card and Centurion Card Members can receive amenities like $100-$300 in onboard credit, as well as 2x points per dollar spent per booking when using the Amex Travel portal. These benefits are available on sailings of five nights or more and may include additional perks specific to each cruise line.

Platinum Destinations Vacations

Platinum Destinations Vacations is another perk of using the Amex Travel portal as an American Express Platinum cardholder. Cardholders can receive up to 2x points per dollar spent on a qualifying independent or escorted vacation package through Amex Travel.

Additional Amex Travel Benefits

Another key benefit of booking travel through the Amex Travel portal is that users can receive additional points on bookings when using their American Express credit card.

American Express Platinum cardholders can earn 5x points on flights and prepaid hotels, and American Express® Gold cardholders can earn 3x points on flights. American Express® Green cardholders can earn 3x points on all travel. If you're looking to rack up more American Express Member Rewards points, this is a quick way to do so.

For a comprehensive list of all available benefits associated with the Amex Travel portal, visit the Amex Travel website .

Is Amex Travel worth it?

Amex Travel is an easy-to-use, convenient travel booking portal, but it might not be a good option for travelers looking to get the best value for their American Express Membership Rewards points.

While always changing, the points-to-dollar conversion rate has historically yielded less value than transferring points to partner programs like Delta or Marriott. This is worth noting because better value often means you'll get more out of the points you accrue.

Further, you aren't guaranteed to earn loyalty points with outside partners since Amex Travel is a third-party booking service.

For travelers looking to enhance their loyalty status, booking directly with the hotel group might make more sense. For airline miles, you might still be able to earn loyalty points or miles with the airline when booking through Amex Travel.

Be sure to check with the airline before booking if you aim to receive miles for your flight. Note that basic economy fares, whether found on Amex Travel or another website, are sometimes not eligible for earning miles or enhancing your loyalty status.

Something important to note is that a fee is added using the service, which is built into the cost of a ticket. This fee is unavoidable and can be higher if you call to book as opposed to using the online booking platform. The fees are waived if you have the Platinum Card, Business Platinum Card, or the Centurion Card.

For travelers considering convenience as their main priority in the booking process, Amex Travel makes it easier than ever to book a trip.

Overall, Amex Travel is worth checking during the booking process to compare prices and points conversions on flights or hotels you might be interested in.

However, for the budget traveler or the points-and-miles traveler, Amex Travel might not be worth it to use while booking your next vacation because of the low redemption value of American Express Membership Rewards points in the portal.

If you're an American Express cardholder and want to earn more Membership Rewards points when booking travel, Amex Travel is a great option. If you do not have any American Express credit cards, there is no real advantage to using Amex Travel compared to any other third-party booking service.

Our Rating: 4.1/5

- Easy to use

- Pay with Points

- Hotel benefits for Gold & Platinum Members

- Additional points per dollar spent on travel

- A pricer option for higher-end hotels and resorts

- Must be a Amex cardholder member to access

- Not guaranteed to earn loyalty points with travel providers

- Additional Amex Travel fees

Book travel and plan with Pilot!

Now that you're considering redeeming some of those travel points or even alternative platforms for your travels, it's time to start planning your trip!

If you're looking to relax before your flights, we've previously reviewed Priority Pass and LoungeBuddy as potential options. Whatever you choose, be sure to use Pilot for all of your travel plans.

Disclosure : Pilot is supported by our community. We may earn a small commission fee with affiliate links on our website. All reviews and recommendations are independent and do not reflect the official view of Pilot.

Satisfy your wanderlust

Get Pilot. The travel planner that takes fun and convenience to a whole other level. Try it out yourself.

Trending Travel Stories

Discover new places and be inspired by stories from our traveller community.

Related Travel Guides

![amex travel insiders reddit Priority Pass Review [2024]: Lounges worth it for the price?](https://assets-global.website-files.com/63d1baf79ce0eb802868785b/63d1baf89ce0ebf1516886b9_Priority_pass_logo.png)

Priority Pass Review [2024]: Lounges worth it for the price?

![amex travel insiders reddit Loungebuddy Review [2024]: Does it beat Priority Pass?](https://assets-global.website-files.com/63d1baf79ce0eb802868785b/63d1baf89ce0eb29c6688624_loungebuddy%20logo%20thumbnail.jpeg)

Loungebuddy Review [2024]: Does it beat Priority Pass?

![amex travel insiders reddit Expedia Review [2023]: A Booking Site for All Travelers?](https://assets-global.website-files.com/63d1baf79ce0eb802868785b/63d1baf89ce0ebb1996892dc_expedia%20logo.jpg)

Expedia Review [2024]: A Booking Site for All Travelers?

Aeroplan Review: Canada Top Travel Loyalty Program?

![amex travel insiders reddit Expedia Review [2024]: A Booking Site for All Travelers?](https://assets-global.website-files.com/63d1baf79ce0eb802868785b/63d1baf89ce0ebb1996892dc_expedia%20logo.jpg)

Make the most of every trip

You won’t want to plan trips any other way!

The trip planner that puts everything in one place, making planning your trip easier, quicker, and more fun.

/static-assets/statics-12318/images/financebuzz.png)

Trending Stories

/images/2018/01/23/navina-side-hustle-mid_MPfEDfV.jpg)

15 Legit Ways to Make Extra Cash

/images/2019/12/06/smart_strategies_to_save_money_on_car_insurance.jpg)

6 Smart Strategies to Save Money on Car Insurance

Amex travel: when it makes sense & how to find the best deals.

/authors/jason-lawenda-headshot1.jpg)

This article was subjected to a comprehensive fact-checking process. Our professional fact-checkers verify article information against primary sources, reputable publishers, and experts in the field.

/images/2019/05/24/amex-travel-uses.jpeg)

We receive compensation from the products and services mentioned in this story, but the opinions are the author's own. Compensation may impact where offers appear. We have not included all available products or offers. Learn more about how we make money and our editorial policies .

When you think of American Express, charge cards and credit cards probably come to mind. Many people don’t realize that 50+ years before they got into the consumer credit card game, American Express was in the travel agency business dating back to 1915. Today, that service still exists, and it’s called American Express Travel, or Amex Travel for short.

Amex Travel is available to anyone who wants to use it for a nominal fee. But if you have one of the American Express credit cards , the fees are waived, and you get to enjoy a few additional travel perks.

Keep reading to learn the basics of Amex Travel, the costs associated with it, the services it offers, and — most importantly — when using it makes sense.

What is Amex Travel?

Using amex travel for flights, using amex travel for flight and hotel packages, using amex travel for hotels, using amex travel for rental cars, using amex travel for cruises, 5 times it makes sense to use amex travel, commonly asked questions about amex travel, is amex travel worth it.

Amex Travel is an OTA, or Online Travel Agency, and you can think of it like the original Expedia or Orbitz. It’s a service that can help you plan and book all sorts of travel, such as flights, hotels and resorts, rental cars, cruises, flight and hotel packages, or even an entire trip package. As mentioned, it’s available for anyone to use, although Amex cardholders can get significantly more value from it.

How to book with Amex Travel

Services can be booked online or by phone. To book online, simply visit the American Express Travel website . Or you can call Amex Travel's customer service toll-free at 800-297-2977.

Amex Travel fees

There’s a nominal fee to use the service, which is built into the cost of the ticket, whether you book online or call. Just note: If you call to speak with a representative to book your travel, there’s an additional $39 fee.

These fees are waived if you have The Platinum Card ® from American Express , The Business Platinum Card ® from American Express , or The Centurion ® Card from American Express .

To me, the fees are usually worth it for many people, since you’ll have a knowledgeable American Express representative available 24/7 should something go wrong and you need help to resolve the issue in real time.

Searching for flights with Amex Travel is like using any other online travel site. You can search one-way, round-trip, or multi-city flights. Personally, if I need to connect, I try to find a connection that has an Amex Centurion Lounge. These lounges are among the best, and Platinum and Centurion cardholders get in for free.

You can also do specific city or airport searches (don’t rule out a city search, as a regional airport might offer a better value ), select your departure and return dates, and opt for a three-day search to find the lowest fare.

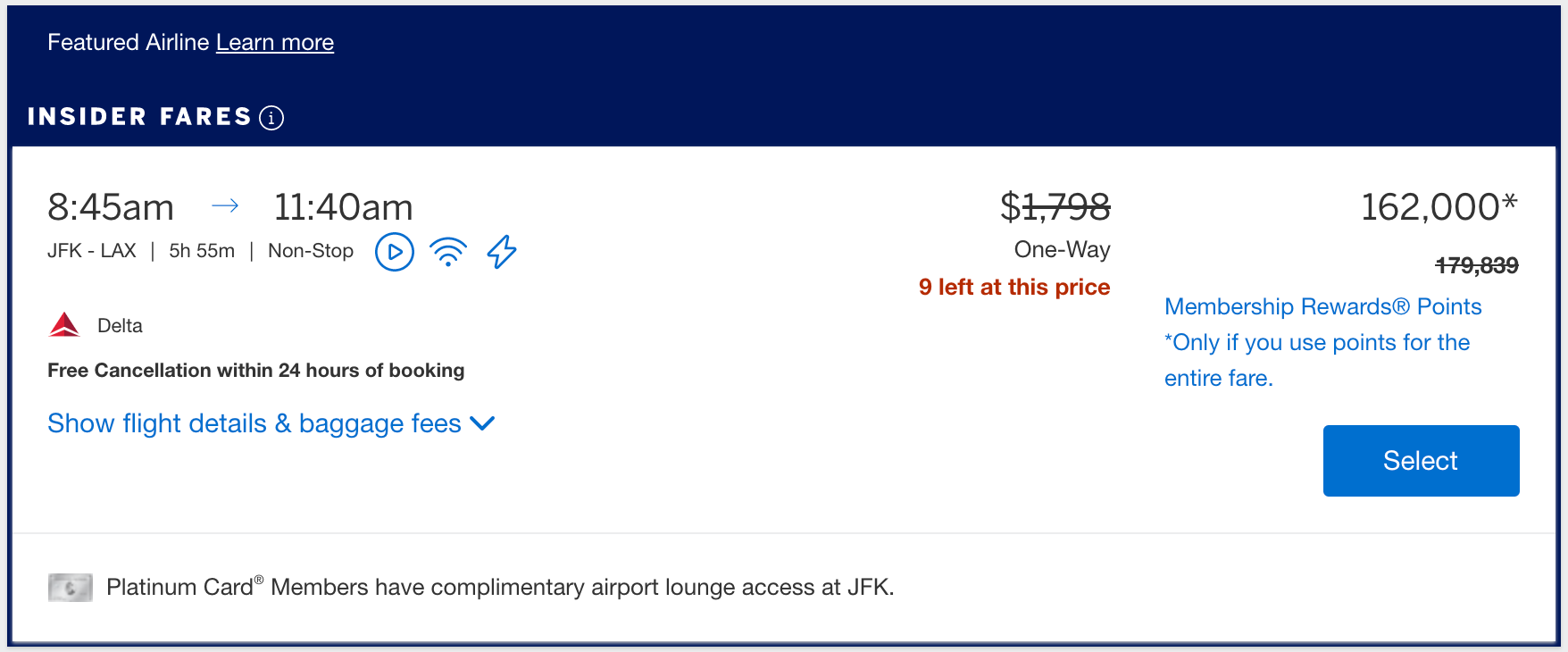

Once the results populate, you’ll notice Delta flights appear at the top as a “featured airline.” This is because of the partnership between Delta and American Express (which has recently been extended through 2029). Under the featured airline, you’ll see more results, starting with the lowest fares. You can also filter the results by the number of stops, departure/arrival times, specific flight number, and airline.

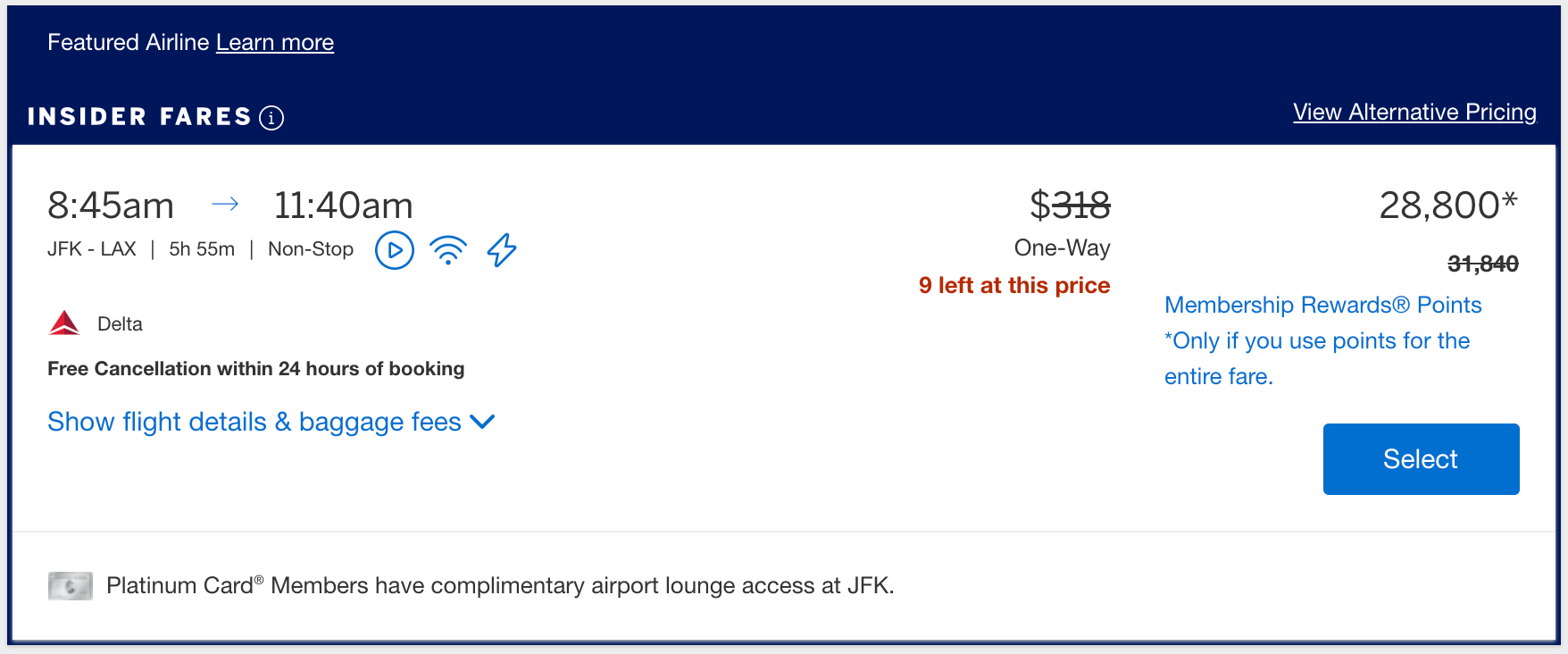

If you’re logged in, you may see discounted fares if you have enough Membership Rewards to cover the cost of the flight, or you may see an insider fare offering a deeper discount. If you decide to use your Membership Rewards to book a flight, you can expect a value of one cent to 1.05 cents per point. Not necessarily the best value or use of points, but it might make sense, depending on your travel plans. I tend to find the best value when transferring Membership Rewards to one of the many airline partners of American Express .

Amex Travel fees to book flights

American Express charges a flat fee of $6.99 per domestic ticket and $10.99 per international ticket, which are bundled into the price of the flight. These fees are waived for Platinum and Centurion cardholders.

Next up, let’s take a look at flight and hotel packages. Just like other online travel sites, you can book flight and hotel packages through Amex Travel. Besides the incredible service, you can often receive exclusive perks, discounts, and special promotions as well.

The rates you’ll see in the results field will show a total per person, which is inclusive of all taxes and fees with the cheapest flight option appearing first. Once you select a hotel, you can choose a specific flight, and the price will adjust accordingly.

I’ve found that sometimes you can save a few hundred dollars by booking flights and hotels separately, but it takes a little patience and time to compare pricing and options. You also tend to have a bit less flexibility if you book a package deal instead of booking separately, so be sure to read the fine print and consider the limitations before booking a package deal.

Amex Travel fees to book flight and hotel packages

The fee structure is the same as booking a flight reservation, which means $6.99 per domestic ticket or $10.99 per international ticket (bundled into the cost of the flight). Fees for Platinum and Centurion cardholders are waived.

Now let’s get into what I tend to use Amex Travel for the most — hotel searches.

Option #1: Standard booking

To start your search, input the city, dates, number of rooms, and number of guests. The search results will be based on price, reviews, and location and will populate a list of “recommended” at the top of the results.

Amex Travel fees to book hotels

Rates can get a little confusing, as Amex Travel doesn’t include all fees and taxes on the results page (you have to select and click through to see them). I’ve found the pricing to be similar to other online travel sites and almost always a little higher than booking directly with the hotel.

This might make sense for you depending on your needs, such as wanting to book an independent hotel or if you aren’t in the loyalty program. Personally, I prefer taking advantage of a different program offered through Amex Travel called Fine Hotels & Resorts, which I’ll get to in a bit.

Option #2: The Hotel Collection

Using Amex Travel to access The Hotel Collection guarantees the lowest rates when you book a prepaid rate, plus a few premium perks.

The benefits include:

- Room upgrades at check-in (based on availability)

- $100 hotel credit (good for things like dining or the spa)

- Amex Gold Card members earn 2X Membership Rewards points on prepaid bookings

- Amex Platinum Card members earn 5X Membership Rewards points on prepaid bookings

- Easily redeem your points to reserve prepaid bookings

While standard Amex Travel hotel bookings are available to anyone, The Hotel Collection is only available to cardholders with one of the following cards:

- American Express ® Gold Card

- American Express ® Business Gold Card

The Platinum Card ® from American Express

- The Business Platinum Card ® from American Express

- The Centurion ® Card from American Express

Some potential downsides of The Hotel Collection are that you’ll need to book prepaid rates to get the benefits, you won’t earn hotel loyalty benefits, and there’s a two-night minimum stay policy. On the plus side, you can receive benefits for up to three rooms, which is excellent if you’re traveling with a family or as part of a group.

Option #3: Fine Hotels & Resorts program

By far my favorite part of Amex Travel is the Fine Hotels & Resorts program. While there’s some overlap between this program and The Hotel Collection, the Fine Hotels & Resorts program is designed more for the leisure travel crowd who want higher-end properties and other luxury benefits.

Here are the standout perks:

- Noon check-in (based on availability)

- Room upgrades (based on availability)

- Daily breakfast for two

- Guaranteed 4 pm late check-out

- Complimentary WiFi

- Unique amenity (usually $100 spa or dining credit)

- You can enjoy these perks and earn points/stay credits from hotel loyalty programs (just be sure to add your loyalty number to the reservation)

The Fine Hotels & Resorts program is limited to cardholders who have one of the following cards:

With Fine Hotels & Resorts, you don’t have to prepay to receive the benefits, and I've found the pricing is almost always identical to the rates when booking directly with the hotel (so why not take advantage of all the extra perks?). Cardholders can now also book stays through Fine Hotels & Resorts using Membership Rewards. It may not be the best value (one cent per point redemption) or use of points, but it’s an option to keep in mind.

Searching for a rental car via Amex Travel is as simple as entering an airport, city, or nearby address and then seeing a handful of options instantly come up in the search results.

This can be especially helpful when trying to find the closest car rental in a remote location. I’ve found these rates to be similar and sometimes even a buck or two lower than booking directly with the car rental company.

When you search for a cruise on Amex Travel, the results will be based on the lowest available rate, and if you hover your mouse over the rate, it will show all available cabin types with prices (cruises can be complex with so many cabin options). I’ve found the rates to be nearly identical when booking with Amex Travel as they are when booking directly.

By booking a cruise through Amex Travel, you’ll also receive a special onboard amenity, higher onboard credits, or premium champagne. It’s worth nothing this program is more restricted than Fine Hotels & Resorts and is only available on specific cruises.

1. You value customer service above price

Amex Travel has a track record of providing exemplary customer service. This is especially true if problems arise when you’re traveling. Having 24/7 access to a knowledgeable representative for assistance can give you peace of mind. As the saying goes, “You get what you pay for,” and in my experience, that’s been true with American Express.

2. You’ll earn bonus rewards as an American Express cardholder

American Express cardholders can enjoy all that Amex Travel has to offer without paying any of the fees for using its services. Not only can you snag some serious deals this way, but you can also earn rewards on every dollar spent. It’s a great way to pad your rewards account for your next trip.

3. You’re booking a cruise and want extra onboard perks

If you’re looking into a cruise, doing so through Amex Travel can secure extra perks for when you’re ready to set sail. Be sure to check on the cruise special offers page during your search.

4. You’re looking for luxury hotel perks and service

If your travel style appreciates the finer things, such as complimentary made-fresh breakfast and room upgrades with a view, the Fine Hotels & Resorts program can help you book hotel stays that are sure to please without paying extra for additional perks and service.

5. Price match

Despite its limitations, one great thing when booking a prepaid hotel room is the price-match guarantee. If your reservation details are found at a lower price, Amex Travel will match the price as long as the details line up.

Do I need an American Express card to use Amex Travel services?

You don’t have to have an American Express card to use Amex Travel services. But you will need an American Express card and a bank of Membership Rewards points if you want to pay for your travel using points. If you have an American Express card, you may also be able to take advantage of additional deals and earn more points when making a reservation through the site.

For example, American Express ® Gold Card members would earn 3X Membership Rewards points on flights booked directly with airlines or on Amextravel.com and have access to all the benefits and perks of the Hotel Collection.

Does American Express Travel have offices?

American Express Travel used to have physical locations where you could visit and make your travel arrangements. The last of these offices closed in 2013, but since then Amex has built partnerships with travel agencies and agents to create a Travel Insiders program. Now, if you’re looking for an office to visit, you can use the Travel Services Locator tool on their website and find a partner agency to help with your trip planning.

What is the phone number for American Express Travel?

To book or change a reservation with American Express Travel, call 1-800-297-2977.

Does Amex travel charge a fee to book a flight?

American Express Travel does add fees if you book a flight using its services. If you book through the website, you can expect an additional $6.99 for each domestic ticket and $10.99 for each international ticket.

If you make a flight or complete a trip reservation by phone, you may be charged a $39 fee per ticket or transaction. Also, if you need to change your flight, Amex may also add a $39 fee to re-issue each ticket. This is in addition to any change fees the airline might charge.

Is Amex travel more expensive?

It’s hard to give a yes or no answer to this question, as rates and deals vary from day-to-day and from one travel booking website to the next. It’s always smart to first shop around to find the range of prices for your travel plans, and then make decisions about what to book.

For American Express cardholders, the company offers a guarantee for the lowest price on prepaid hotel reservations. To get this, you have to file a claim with information showing a lower price for the exact dates and other specifications. If approved, you’ll get a credit for the difference between what you paid and the lower price.

As someone who has searched high and low on every online booking site for many trips, I can confidently say Amex Travel is worth it in many instances — especially if you’re an Amex cardholder.

If you don’t currently have an Amex card, I’d encourage you to compare rates on other booking sites before settling on booking through Amex Travel. While the perks and service are incredible, there are instances where it may not provide the best value or rate options, meaning you could pay less by booking your travels through a different site. Still, if you’re looking to book a trip with a premium support helpline, this service could be a good choice for you.

If you travel often, it may be worth applying for an American Express card so that you can book through Amex Travel. Further, these are some of the best travel credit cards for earning rewards. There are several options, including some with no foreign transaction fees and no annual fees. That way, you can get the Membership Rewards points from your regular spending and use them to save on your travel purchases.

Luxury Travel Benefits

/images/2022/06/29/amex_platinum.jpg)

FinanceBuzz writers and editors score cards based on a number of objective features as well as our expert editorial assessment. Our partners do not influence how we rate products.

Current Offer

- Earn 80,000 Membership Rewards points after spending $8,000 on purchases on your new card in the first 6 months

Rewards Rate

- 5X points per dollar spent on eligible airfare (on up to $500,000 per calendar year, after that 1X) and eligible hotel purchases, and 1X points per dollar on all other eligible purchases

- Select your metal card design: classic Platinum Card, Platinum x Kehinde Wiley, or Platinum x Julie Mehretu

- 5X points on flights booked directly with airlines or on Amextravel.com (on up to $500,000 per calendar year, after that 1X) and prepaid hotels booked on Amextravel.com

- Access to Centurion and Priority Pass airport lounges

- Select benefits require enrollment.

- $ 695 annual fee

- High annual fee

- Terms apply

Author Details

/authors/jason-lawenda-headshot1.jpg)

- Credit Cards

- Best Credit Cards

- Side Hustles

- Savings Accounts

- Pay Off Debt

- Travel Credit Cards

Want to learn how to make an extra $200?

Get proven ways to earn extra cash from your phone, computer, & more with Extra.

You will receive emails from FinanceBuzz.com. Unsubscribe at any time. Privacy Policy

- Vetted side hustles

- Exclusive offers to save money daily

- Expert tips to help manage and escape debt

Hurry, check your email!

The Extra newsletter by FinanceBuzz helps you build your net worth.

Don't see the email? Let us know.

How American Express Travel can elevate your next trip

Update: Some offers mentioned below are no longer available. View the current offers here .

There are a ton of perks that come with having a card from American Express — many of which can make your travel experience more rewarding and luxurious. From airport lounge access to airline fee credits and benefits at top-notch resorts around the world , holding the right Amex card can transform your time on the road.

However, there's also a way for Amex cardholders to do this when making flight reservations — by booking online with American Express Travel . For select cards, American Express Travel can save you money and provide additional flexibility when it's time to use your Membership Rewards® points , a valuable combination as travel continues to rebound.

Here are some of the ways Amex Travel can elevate your next trip.

Related: Everything you need to know about Amex Travel

Unlock special prices

Thanks to Insider Fares and the International Airline Program through American Express Travel, eligible cardholders can save on domestic and international airfare across cabins. And because airfare purchased through Amex Travel comes in coded as a revenue ticket, you also earn airline miles and credit toward elite status (more on that below).

Searching for airfare on American Express Travel is easy: Simply navigate to this page , then click Log In and enter your account credentials. From there, begin searching for the type of travel you want.

However, this isn't just a place to search for flights. There are many ways you can use American Express Travel to unlock special pricing for your next trip — and here are two programs exclusively for eligible card members.

Insider Fares

Insider Fares give you access to flight deals on select domestic and international itineraries, and they're offered on all eligible American Express cards that earn Membership Rewards points, including:

- The Platinum Card® from American Express

- The Business Platinum Card® from American Express

- American Express® Gold Card

- American Express® Business Gold Card

- The Blue Business® Plus Credit Card from American Express

When searching for airfare at AmexTravel.com , Insider Fares will appear only if you have enough Membership Rewards points to cover the entire cost of the ticket — but they won't be available on every flight. In addition, Insider Fares must be booked entirely with points.

In the above example, the Insider Fare would save you over 3,000 Membership Rewards points on this one-way flight from New York-JFK to Los Angeles (LAX).

And you could save even more when booking a Delta One ticket on the same flight.

Travelers could save nearly 18,000 Membership Rewards points to fly in the first-class cabin on this example.

And while Insider Fares are limited to flights booked at AmexTravel.com entirely using points, there's another way to save when paying with your card at AmexTravel.com .

International Airline Program

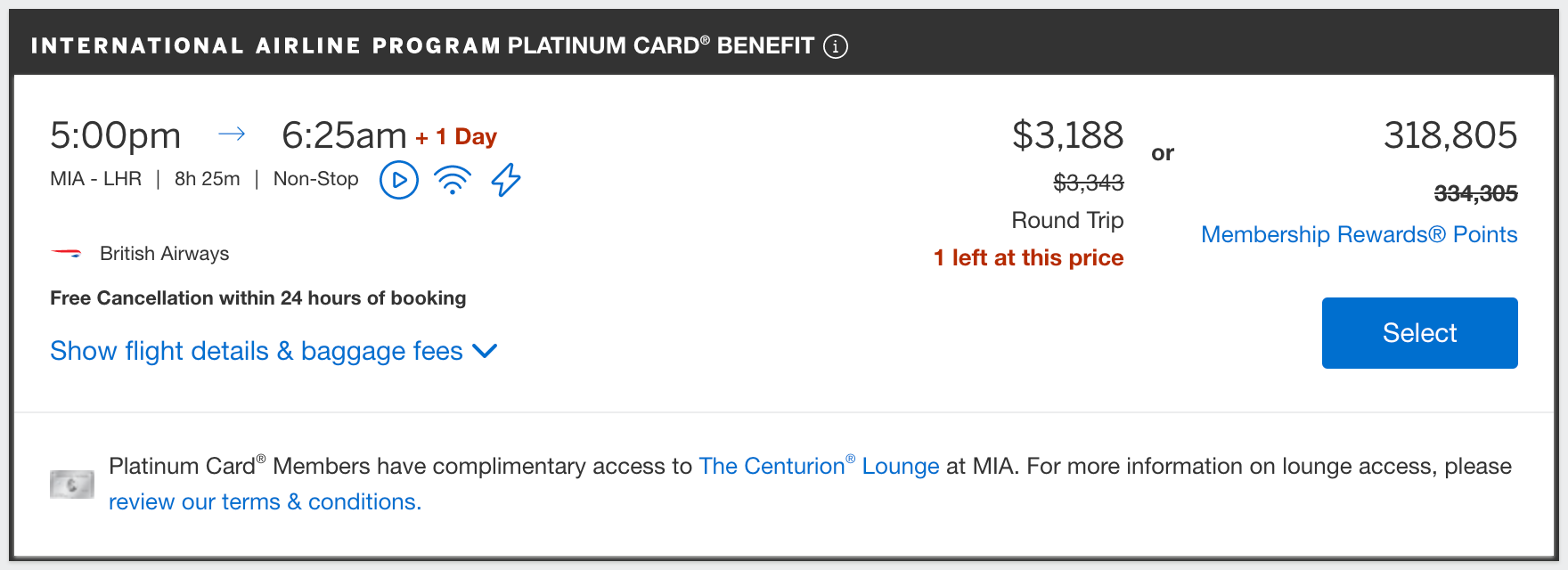

Cardholders of the Amex Platinum and the Amex Business Platinum cards can save when booking premium-cabin seats on international flights with the International Airline Program through American Express Travel.

You can find these fares on more than 25 airlines, and the program includes both refundable and nonrefundable tickets. It also extends to a total of eight travelers — you (as the cardholder) and up to seven companions.

Best of all, you can pay for your ticket with your card, points or a combination of both — and don't forget that you also still earn airline miles as you normally would, which you can then redeem for future travel.

Unlike Insider Fares, the International Airline Program is available to eligible cardholders no matter your current amount of Membership Rewards points. You also have the option to pay with your card or with your Membership Rewards points. And the higher the class of service, the greater the potential for savings.

In the above example, holders of either the Platinum or Business Platinum card would save $155 or 15,500 points on this round-trip, business-class ticket from Miami (MIA) to London-Heathrow (LHR).

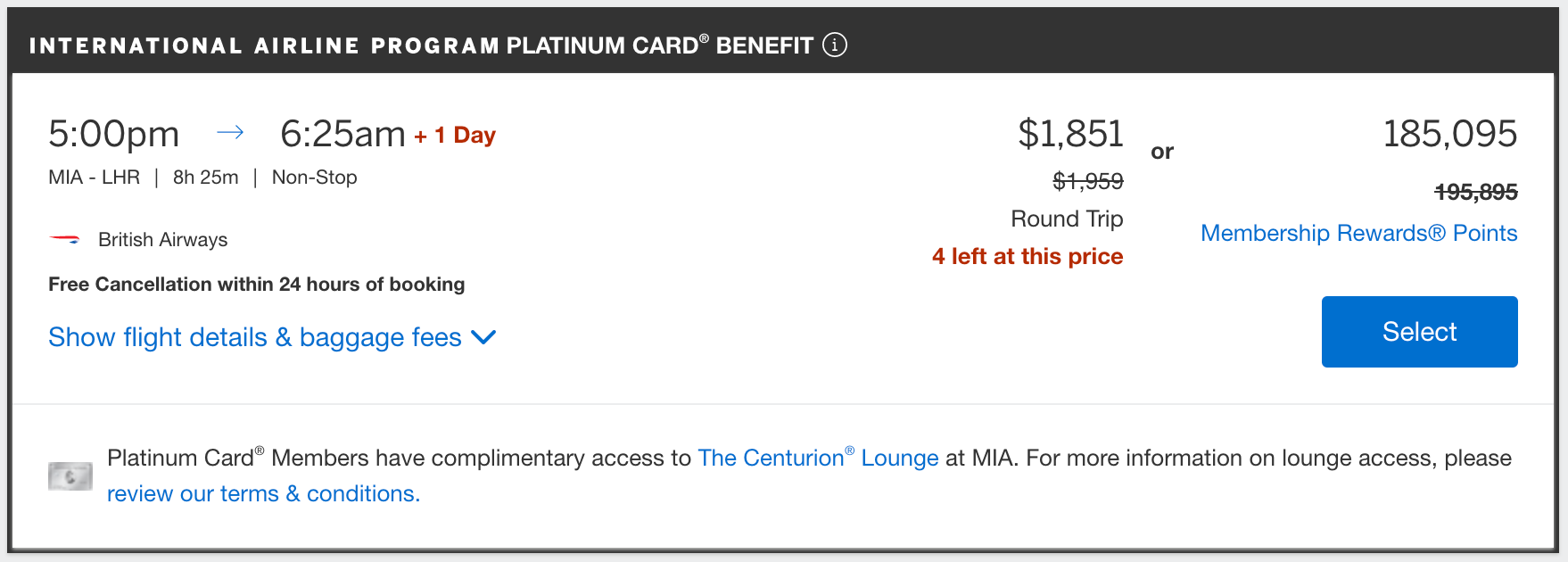

There's even savings to be had when booking many premium-economy tickets through American Express Travel. In this example, you would save about $108 or 10,800 points on a round-trip ticket on the same flight from Miami to London.

These savings appear automatically for participating airlines when searching for flights at AmexTravel.com — giving you another reason to start your flight searches there.

Related: The ultimate guide to American Express Membership Rewards

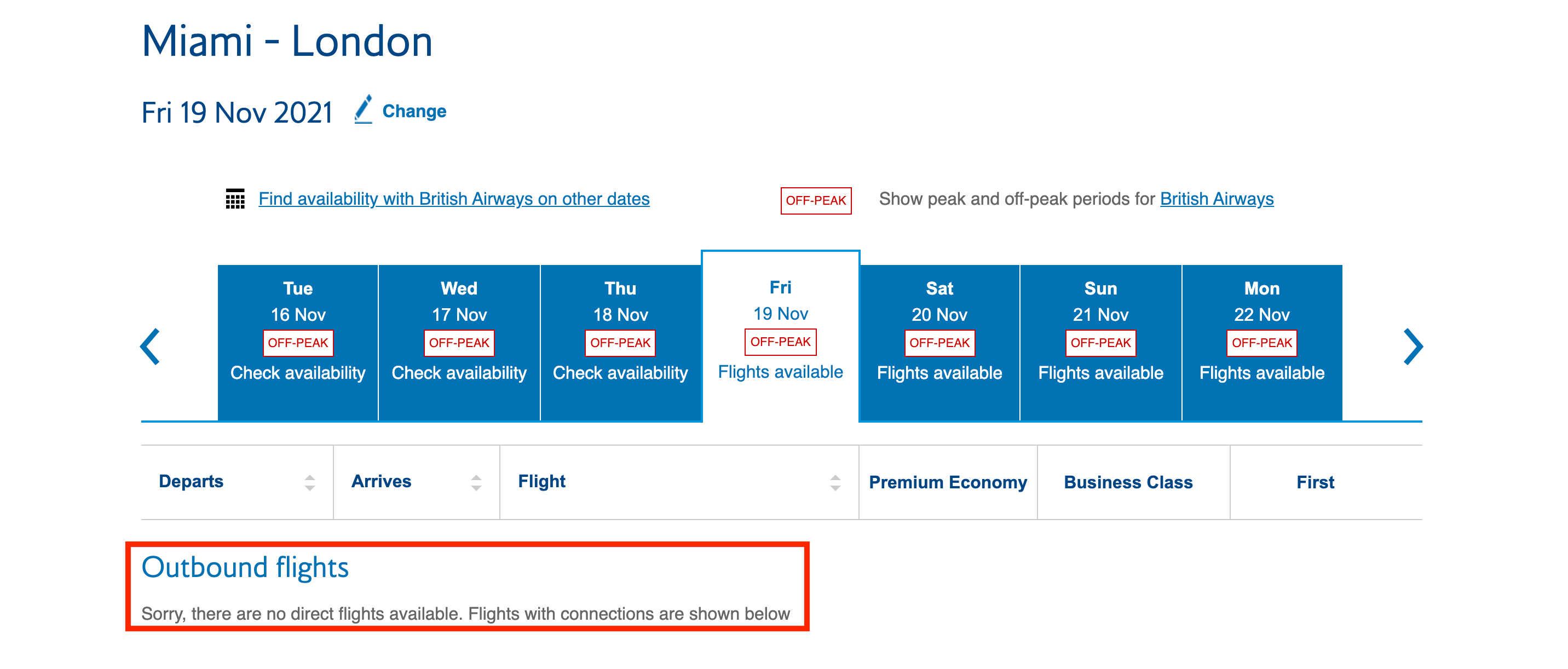

Don't worry about award availability

While it's true that you can transfer Membership Rewards points to travel partners, it may be worthwhile to book through American Express Travel thanks to the additional flexibility you can get. For starters, award availability through airline programs is limited — especially in premium cabins. And transfers to airline partners can't be reversed, so a canceled flight could leave you with miles that are much less flexible than Membership Rewards points.

The last thing you want is for those points to be stuck somewhere you can't use them .

Luckily, you can always use points to pay for flights booked through American Express Travel, because there are no blackout dates.

The same British Airways flight above doesn't have any award availability in any class of service at the time of writing. But you wouldn't have to worry about that when you book with Amex Travel — and you'd still be saving whether you chose to pay with points or with your card.

Earn rewards for your next trip

The Platinum and Business Platinum cards are great for earning Membership Rewards points on flights booked through American Express Travel as well.

Those who have the Platinum card earn 5x Membership Rewards points on flights booked directly with airlines and at AmexTravel.com (up to $500,000 per calendar year), while Business Platinum cardholders can earn 5x on airfare booked at AmexTravel.com . (Both can also earn 5x points on prepaid hotels booked at AmexTravel.com .)

But other cards offer bonuses on airfare purchases too. For example, the Amex Gold card awards 3x points for flights booked directly with the airline and at AmexTravel.com — so you don't need to have a Platinum card to earn bonus Membership Rewards points.

And remember — you also earn airline miles and credit toward any applicable airline elite status requirements on the flights as you normally would, because airfare booked through American Express Travel comes in coded as a revenue ticket. This is true whether you pay for your flight with your card or with Membership Rewards points, allowing you to earn rewards across two programs — and potentially putting you closer to a given airline's elite status.

Enjoy benefits while traveling

In addition to the above benefits from booking through American Express Travel and at AmexTravel.com, it's also worth noting that Platinum cardholders have access to many additional perks that can enhance their experience on the road. This includes:

- Annual Uber Cash of up to $200 (for U.S. services)*

- Comprehensive airport lounge access , including Centurion Lounges*

- Gold elite status with Hilton Honors and Marriott Bonvoy *

*Enrollment required for select benefits. Terms and conditions also apply. Please see each benefit's page for details.

For more details, check out our complete guide on maximizing benefits with the Amex Platinum card .

Bottom line

American Express Travel can elevate your flight booking experience by allowing you to save on airfare with two programs: Insider Fares and the International Airline Program.

Insider Fares are available to eligible American Express card members that are enrolled in the Membership Rewards program, while the International Airline Program is limited to holders of the Platinum and Business Platinum cards . And using your Membership Rewards points for flights in either program means you don't have to worry about scant award availability through frequent flyer programs.

Perhaps most importantly, all flights purchased through American Express Travel and at AmexTravel.com — whether with points or using your card — will count as revenue tickets and thus be eligible to earn miles as you normally would and count toward applicable airline elite status requirements.

For these reasons, consider starting your flight searches for your next trip with American Express Travel .

For full Platinum card benefits and their terms and conditions, click here. For full Gold card benefits and their terms and conditions, click here.

Featured photo by Zach Honig/The Points Guy

- My Account My Account

- Cards Cards

- Banking Banking

- Travel Travel

- Rewards & Benefits Rewards & Benefits

- Business Business

- Today's news

- Reviews and deals

- Climate change

- 2024 election

- Fall allergies

- Health news

- Mental health

- Sexual health

- Family health

- So mini ways

- Unapologetically

- Buying guides

Entertainment

- How to Watch

- My watchlist

- Stock market

- Biden economy

- Personal finance

- Stocks: most active

- Stocks: gainers

- Stocks: losers

- Trending tickers

- World indices

- US Treasury bonds

- Top mutual funds

- Highest open interest

- Highest implied volatility

- Currency converter

- Basic materials

- Communication services

- Consumer cyclical

- Consumer defensive

- Financial services

- Industrials

- Real estate

- Mutual funds

- Credit cards

- Credit card rates

- Balance transfer credit cards

- Business credit cards

- Cash back credit cards

- Rewards credit cards

- Travel credit cards

- Checking accounts

- Online checking accounts

- High-yield savings accounts

- Money market accounts

- Personal loans

- Student loans

- Car insurance

- Home buying

- Options pit

- Investment ideas

- Research reports

- Fantasy football

- Pro Pick 'Em

- College Pick 'Em

- Fantasy baseball

- Fantasy hockey

- Fantasy basketball

- Download the app

- Daily fantasy

- Scores and schedules

- GameChannel

- World Baseball Classic

- Premier League

- CONCACAF League

- Champions League

- Motorsports

- Horse racing

- Newsletters

New on Yahoo

- Privacy Dashboard

Insider Today: Bad times for big cities

This post originally appeared in the Insider Today newsletter.

You can sign up for Business Insider's daily newsletter here .

Welcome back to our Sunday edition , a roundup of some of our top stories. Fed up with the cost of life in the US ? An increasing number of Americans are turning to " geoarbitrage ."

On the agenda:

It's not just you — Reddit is taking over Google's search results .

America's big cities are about to run out of money .

A McKinsey associate left a $200,000 salary to salvage their mental health .

Microsoft's astounding plan for the AI boom: Triple data-center capacity .

But first: Netflix added millions of subscribers . Wall Street balked .

If this was forwarded to you, sign up here . Download Insider's app here.

This week's dispatch

Netflix's Wall Street worry

Netflix announced last week that it had added 9.33 million subscribers in the first three months of the year, far surpassing Wall Street expectations.

It now has almost 270 million subscribers, which is comparable to the populations of Russia and Mexico combined.

However, those kinds of comparisons will be harder to make in the future, as Netflix also announced that starting next year, it will stop releasing subscriber numbers and will instead announce milestones as it passes them.

Wall Street did not react well to the news, sending the stock lower .

Netflix's password-sharing crackdown has been a great success. That's good news for other streaming platforms like Disney that are looking to launch their own crackdown. But the boost will likely fade over time, and some on Wall Street worry the new level of secrecy on subscriber numbers is a sign that growth is decelerating.

Plus, Netflix's stock had increased 50% in the six months before earnings. It's possible some investors saw an opportunity to book some of their profits.

What's not in question? Netflix's supremacy in streaming .

Reddit overruns Google Search

If you've noticed more Reddit posts popping up in your Google Search results, you're not alone. Posts from sites like Reddit and Quora are overrunning the search engine.

In part, Google's shift to promoting more human, helpful sites has helped bring on a surge in Reddit traffic. And already, spammers are using the new trend to their benefit.

How Reddit took over Google .

Read Google's memo warning employees to 'think again'

Google just made a huge company shakeup. Here's who's gaining power .

Bad times for big cities

Across the country, the rise of remote work has led to a decline in commercial real-estate prices and falling property-tax revenue. Cities from San Francisco to Boston are weighing whether to slash budgets.

At the root of these cities' woes is the struggle to figure out what the new normal budget is and how to deliver the services and investments citizens depend on without breaking the bank.

Things could soon get even worse .

Leaving McKinsey

When this employee started at McKinsey in 2021, they knew they were there "for a bad time, not a long time."

The employee said they worked from 7:30 a.m. to 11:30 p.m., and received no mentorship or guidance. They ultimately took a mental health break after a year, and left soon thereafter.

What they learned from their time at McKinsey .

Microsoft's big plans for the AI boom

A leaked presentation revealed that Microsoft significantly expanded its data-center capacity recently, and plans to ramp up growth to astounding levels going forward.

In the first half of Microsoft's 2025 fiscal year, the company aims to "achieve 3x growth" in new data-center capacity.

Read more from the leaked presentation .

Microsoft has a target to amass 1.8 million AI chips by the end of the year, internal document shows

Electric grids need upgrades thanks to data centers. Guess who helps pay for that.

This week's quote:

"Only the very wealthy are going to have any dignity in their old age."

— Pam, a 57-year-old worker, on the looming retirement crisis .

More of this week's top reads:

It's easy to bash tech, but I've started taking robotaxis — and they're awesome .

More and more Americans are becoming "ALICEs."

Remote workers are about to get a rude awakening .

Harry and Meghan are terrible at business. So why do companies keep offering them millions ?

America's young men are blowing their money like never before .

More and more Americans are deciding that the only way to get ahead is to leave .

Goldman Sachs wants its coders to have studied philosophy .

The Insider Today team: Matt Turner , deputy editor-in-chief, in New York. Jordan Parker Erb , editor, in New York. Dan DeFrancesco , deputy editor and anchor, in New York. Lisa Ryan , executive editor, in New York.

Read the original article on Business Insider

Recommended Stories

Hidden ai stock plays: here are the companies powering the next revolution.

AI is changing the data center landscape and unearthing an entirely new avenue of infrastructure demands— an investment opportunity that’s currently ‘underappreciated’ by the market, according to Morgan Stanley.

Women in AI: Anna Korhonen studies the intersection between linguistics and AI

To give AI-focused women academics and others their well-deserved — and overdue — time in the spotlight, TechCrunch is launching a series of interviews focusing on remarkable women who’ve contributed to the AI revolution. Anna Korhonen is a professor of natural language processing (NLP) at the University of Cambridge. Korhonen previously served as a fellow at the Alan Turing Institute and she has a PhD in computer science and master's degrees in both computer science and linguistics.

Manchester United collapses, but Coventry's stunning FA Cup comeback spoiled by inch-tight call, penalties

Coventry City, a second-division English club, nearly came back from 3-0 down to beat Manchester United in the FA Cup semifinals.

Clippers star Kawhi Leonard out for Game 1 vs. Mavericks

Leonard has been dealing with knee inflammation and was questionable prior to being ruled out.

Zelensky says new U.S. aid will give Ukraine ‘a chance for victory’ against Russia

"We want to get things as fast as possible," Zelensky said of the urgency to receive U.S. aid.

MotoGP races to capture a new U.S. audience the way F1 did

MotoGP, global motorcycle racing’s version of Formula 1, looks primed for a bid to copy F1’s explosive growth and bring a new group of fans — notably from the U.S.

The world isn’t as messed up as you might think

Americans are in a gloomy mood, but new research points out that a lot of imortant things are going right.

Michael Porter Jr. praises Nuggets teammates for support during emotional week

Porter spoke to reporters about the support he's received from teammates amid the public struggles of two of his brothers.

EV vs. hybrid: Which one is best for you?

It’s a tough market for automakers selling EVs, but on the flip side, it’s never a better time for those making hybrids.

Will airline ticket prices go back up this summer? What experts say.

Travelers have been feeling the brunt of increased travel expenses, but the extra costs may not be coming from where they think.

Fintech startup Ramp sees 32% bump in valuation, Mercury expands into consumer banking

Ramp, a spend management startup rivaling the likes of Brex, Navan and Airbase, told TechCrunch exclusively last week that it had raised $150 million at a post-money $7.65 billion valuation. Khosla Ventures and Founders Fund co-led the round, which represented a 31.9% bump in valuation from its August 2023 raise.

Kelly Ripa uses a dry brush on her skin every day: This one from Amazon is a steal for just $9

This beauty tool used to exfoliate skin and stimulate blood flow has nearly 13,000 fans.

These 10 gadgets with 10,000+ five-star ratings make spring gardening so much easier, starting at $14

You never knew you needed these garden essentials — but you absolutely do.

This CEO has battled billionaire activist Carl Icahn twice — here's his advice to Disney CEO Bob Iger

Illumina chairman and Hologic CEO Stephen MacMillan is no stranger to dealing with well-known activist investors.

'It's the best': Olivia Wilde loves CeraVe — and the brand's eye repair cream is down to $14

Improve the look of puffiness, dryness and more with this cult-fave moisturizer.

Guardians' Josh Naylor punishes baseball, then his own helmet on go-ahead HR

Josh Naylor knows how to celebrate a home run. We think.

Women in AI: Ewa Luger explores how AI affects culture — and vice versa

To give AI-focused women academics and others their well-deserved — and overdue — time in the spotlight, TechCrunch is launching a series of interviews focusing on remarkable women who’ve contributed to the AI revolution. Ewa Luger is co-director at the Institute of Design Informatics, and co-director of the Bridging Responsible AI Divides (BRAID) program, backed by the Arts and Humanities Research Council (AHRC). Previously, she was a fellow at the Alan Turing Institute, served as a researcher at Microsoft, and was a fellow at Corpus Christi College at the University of Cambridge.

NBA playoffs: Nuggets work over Lakers to pick up where they left off from last year

The Lakers have now lost nine straight games to the Nuggets.

Dave McCarty, player on 2004 Red Sox championship team, dies 1 week after team's reunion

The Red Sox were already mourning the loss of Tim Wakefield from that 2004 team.

Arch Manning puts on a show in Texas' spring game, throwing for 3 touchdowns

Arch Manning gave Texas football fans an enticing look at the future, throwing for 355 yards and three touchdowns in the Longhorns' Orange-White spring game.

- Sustainability

- Small Business

- The Xbox Mastercard, issued by Barclays, now available in the U.S. with more value

No annual fee card converges virtual experiences and everyday purchases, allowing cardmembers to earn points on purchases in the Microsoft Store, dining delivery, streaming services, and more

In September 2023 , Xbox Insiders received early access to the Xbox Mastercard, Xbox’s first-ever co-branded credit card in the United States, issued by Barclays US Consumer Bank. Today, the card is available in all 50 states to qualified US residents 18 years of age and older.

With no annual fee and a bonus of 5,000 card points after the first purchase (a $50 value), the card, with the flexibility of use across contactless payments and digital wallets, is designed to seamlessly integrate into players’ lifestyles, providing card points and benefits for their purchases in the Microsoft Store and everyday purchases. The Xbox Mastercard is equipped with five iconic designs and the option to customize with players’ Xbox gamertag to add a personalized touch.

The Xbox Mastercard offers benefits for new and existing cardmembers, including three months of Xbox Game Pass Ultimate for new Game Pass members after their first purchase, 5X points on eligible products at the Microsoft Store , 3X points on select streaming and dining delivery services, 1X card points for all other everyday purchases, and more. Cardmembers also receive access to their FICO® Credit Score for free, and the benefits of the Mastercard network including ID Theft Protection™, Zero Liability Protection and Global Services for emergency assistance for added peace of mind. For those interested in building financial knowledge on credit scores, fraud prevention, budgeting and more, visit Barclays Money Basics.

To provide even more meaningful value for players, additional benefits are available today for new and existing cardmembers:

- Two three-month codes to gift to friends or family to try Game Pass Ultimate for the first time, with $7,000 or more spent within the first 12 months of opening the card account.

- Upgrade to Level 2 of Microsoft Rewards to earn faster rewards.