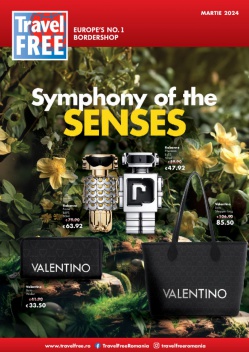

Welcome to Travel FREE

Select a country.

- Czech Republic

Europe’s Bordershop Number 1

Our passion for the border business goes back to 1991 – Travel FREE however, was founded in 2004. In that year, many new countries joined the EU and duty free business wasn’t allowed anymore within its borders. If you, like many people, didn’t notice that, it’s probably because of Travel FREE. We took over many former duty free shops, offer the same assortment and keep prices as low as possible.

Your shopping advantages

One of a kind: our range of goods..

You can spend a long time searching for these in your supermarket: Most of our range are produced exclusively for the travel market. So, go to the border and shop like you've never shopped before!

Open almost every day.

Have you run out of coffee for Sunday breakfast? Nothing to toast with on New Year's Eve? Here you can save money almost every single day: Whether on weekdays, Sundays or holidays. (in shops until 200 m2)

100% quality brands.

Our products come directly from the manufacturer. All are original goods and the highest possible standards of quality are naturally guaranteed - after all, we know what our customers want.

Up to 50% cheaper.

We don’t do things by halves – unless it’s the prices: Save up to 50% compared to neighbouring domestic market prices.

43% more content.

Many of our products are not only cheaper than elsewhere, but larger as well. With our 1 litre spirits for example, you simply save twice.

A whole lot of choice.

Find anything you’re looking for in our huge selection of coffee, tea, alcoholic and nonalcoholic beverages, sweets, tobacco, perfumes, cosmetics, fashion and accessories.

Maximum quantities per person

Spirits (Over 22%)

Spirituosen (Up to 22%)

- f Přihlášení

- Česká koruna

Registrujte se zde:

AKTIVUJTE SI SVŮJ ZÁKAZNICKÝ PORTÁL

V zákaznickém portále Travel FREE máte přehled o získaných bodech a můžete zde pohodlně upravovat své údaje.

Zadejte jednoduše Váš email, nebo číslo své CLUB CARD.

Číslo své CLUB CARD naleznete v emailu s Vaší nově vygenerovanou digitální kartou. Máte-li fyzickou kartu, naleznete číslo na zadní straně pod čárovým kódem.

- Go to navigation

- Go to main content

- Go to search

- Go to footer

Main content

Travel id—one login, lots of options.

Traveling can be really easy: with your single Travel ID . Now you can log into all Lufthansa Group channels and into Miles & More using just one email address .

The only ID you need now

From booking to check-in and beyond—make the most of the many benefits and an all-round convenient travel experience. Register now for the first time, or complete your existing Miles & More profile with your single Travel ID. These benefits await you:

Free messaging above the clouds

Travel ID and Miles & More customers can benefit from free, unlimited messaging in the FlyNet® portal on selected Lufthansa family flights with connectivity (Internet on board). Stay in touch with your loved ones above the clouds and relax during the flight.

Set up Travel ID

Register now for the first time, or complete your existing Miles & More account with your single Travel ID.

Launch FlyNet® portal

On your next flight, visit our FlyNet® portal and register using your Travel ID. Miles & More members can register using their Travel ID or service card number.

Select Free Messaging & get chatting

Select "Free messaging" from the price list and you can get started.

New registration without Miles & More profile

Your new travel id.

With Travel ID, you can make the most of lots of benefits and useful services. For example, you’ll receive personalized offers on all Lufthansa Group Airlines booking platforms, or you can keep an eye on your personal details and current updates to your bookings at all times. What’s more, if you’d like to take advantage of additional, exclusive offers then sign up for Miles & More while you’re registering for Travel ID. This will not only make your trips smoother and more convenient but at the same time with Miles & More you can also earn valuable air miles and Points.

Travel ID benefits at a glance

One single login.

Your personal Travel ID offers you the option of logging into all Lufthansa Group Airlines and your Miles & More profile.

Personal details

Store your personal details in your Travel ID—that way you won’t have to enter them again when you make bookings in future.

Individual offers

Tell us about your flight preferences, receive personalized offers and information, and always have an overview of all the self-services available on your flights.

Saved means of payment

Save your preferred payment methods for all Lufthansa Group Airlines and save valuable time when booking your trips.

All flights at a glance

Always have an overview of your upcoming flights. In addition you can view your complete flight history over the last 10 years.

Important travel documents

Simply upload the relevant travel documents and save them for your next trips.

Additional benefits with Miles & More

✓ Earn miles and Points (Points, Qualifying Points, und HON Circle Points) with 40 airline partners

✓ Become a frequent flyer and enjoy privileges

✓ Earn miles for hotel and rental car bookings with lots of service providers

✓ Redeem miles for flight awards or other travel awards

Switch with existing Miles & More profile

Your travel id as a miles & more member.

With your Travel ID you can now log in to Miles & More simply using an email address of your choice and a password, as well as with your usual login of service card number and user name. This is both your single login to Lufthansa and to all the other airlines in the Lufthansa Group. With Travel ID you can also make the most of all Miles & More benefits for a smoother and more convenient travel experience.

It’s easy to switch to Travel ID:

- Log in to your Miles & More account as usual.

- You will automatically be asked to add Travel ID to your Miles & More account.

- Set up your preferred email address and password.

Once you’ve switched, you can conveniently use all the benefits of Travel ID in the Lufthansa Group channels and Miles & More.

If you can log in already using your email address and password, this means you already have a Travel ID—and you don’t need to switch your profile.

Do you have more questions about Travel ID?

How can I change the email address I use to log in? How do I add a flight to “My bookings” in my Travel ID account? And why doesn’t the flight I have already booked appear in “My bookings”? We’re happy to help—we’ve listed these and lots of other common questions for you in our FAQs.

To the FAQs

- To Frequently Asked Questions and Answers

- To the terms and conditions

- To the data protection information

Good to know

Lufthansa group.

Lufthansa Group Airlines and Miles & More GmbH belong to the Lufthansa Group.

Lufthansa Group Airlines

If you have given your consent to receive digital communications, you will also receive promotional content from the following Lufthansa Group companies:

Austrian Airlines AG, Brussels Airlines SA/NV, Deutsche Lufthansa AG, Eurowings GmbH, Eurowings Discover GmbH, and Swiss International Air Lines AG.

Partner companies

If you have given your consent to receive digital communications, you will also receive promotional content from the following Lufthansa partner companies:

AIG Versicherung, Booking.com, Deutsche Bahn, Europcar, GetYourGuide, Hertz, Worldshop, Park.Aero, Porsche Deutschland GmbH, ShareNow, and Sixt.

- Skip to content

- Skip to primary sidebar

World Wonder Travelers

Capture the Wonders

Beginners Guide To Getting FREE Travel Using Travel Rewards Credit Cards

Travel Rewards Credit Cards / April 6, 2022 by Daniel

Are you ready to learn a system that will allow you to start getting FREE Travel Using Travel Rewards Credit Cards?

Using travel rewards credit cards is the process of collecting points and miles in numerous ways to either travel for free or for a fraction of the regular price. To me, this means getting the most travel experience(s) for the least amount of money. To accomplish this, you must know the rules of the game. I will teach you those rules in this article. First, I’ll cover the types of travel rewards credit cards you will likely be working with. Then give you a blueprint for you to use to plan and execute your travel rewards credit card redemption. With a bit of research and planning, you will be on your way to free travel in no time. I enjoy my trips regardless of the price, but it does feel a little bit better when they are incredibly cheap or FREE.

What does this involve?

Utilizing credit card travel rewards programs involves various strategies to earn points/miles used as currency towards travel. The following three things will be required.

- Signing up for frequent flyer and hotel programs.

- Applying for travel rewards credit cards. (it’s a game-changer)

- Learning, researching, planning, traveling, repeat.

Note : Some airline travel redemptions have taxes and fees that are very minimal but are still there. The standard government security fee charge is $5.60 per one-way award ticket for domestic flights. For international flights, taxes and fees can range but usually are around $50-$100 round trip. Here are some things you can look forward to if you choose to use the credit card travel reward techniques outlined in this guide.

- Free or cheap flights to anywhere in the world

- Free accommodations at the best hotels

- Free access to airport lounges

- Free Airbnb stays

- Free car rentals

- Free Cruises

- Free Uber rides

Sound too good to be true? I promise it’s not! You’ll be on your way to visiting the Great Pyramid of Giza in no time!

Warning : If you are currently carrying a credit card balance month-to-month, this probably isn’t for you. I’m telling you, if you have credit card debt, don’t open a new card! Applying for credit cards can impact your credit score and financial life. The examples I’ll provide are just that, examples of what is possible. I will share real-life credit card hacks I’ve done, but always do your own research and assess your own financial situation. Possible seek a professional to decide if opening a new line of credit is a wise choice. Also, be aware that any credit card offers in this article can change.

The art of using travel rewards credit cards

Utilizing credit card rewards cards is essentially using points and miles to book free or significantly reduced travel. Banks, airlines, and hotel chains offer these reward credit cards. The easiest and fastest way to do this is to apply for a credit card and get their one-time high bonus offer. Most offers will want you to spend a certain amount on the credit card in order to receive the bonus offer. You can also earn points by making ongoing purchases using that particular credit card. I will show several examples of these types of offers in the next section, but this is what the process looks like.

- Research and find out which credit card offer is best for your travel goal.

- Apply for a credit card.

- Receive the credit card and spend the amount required to receive the bonus miles or points.

- Receive the bonus miles or points in your account, and use these to book the trip.

Besides the initial one-time bonus offer, you can earn miles/miles with every dollar you spend on the credit card. Some cards offer 1 mile/point for 1 dollar spent on regular purchases and usually 2-5 miles/points per dollar spent on travel purchases depending on the credit card. For example, let’s say you have an American Airlines credit card from Citi Bank. Spending money on the credit card will equate to miles in your American Airlines frequent miles account because your card from Citibank is attached to your American Airlines frequent flyer account. So if you fly on American Airlines and have an American Airlines credit card, you will earn miles for flying with them and earn miles for making everyday purchases with that credit card. These two actions can add up to a nice sum.

Here are the five main types of points and miles credit cards

The terms “miles” and “points” are essentially the same thing. They are a value or currency in whatever program you are working with. But here is the difference. When discussing an airline currency, use the term “miles” when talking about a value you have in a frequent miles account. The term “points” refers to all other programs such as transferable points accounts and hotel points programs. Here are the five main types of credit cards that you can use to earn free flights, hotel stays, rental cars, etc.

- Transferable Credit Cards

- Co-Branded Airline Credit Cards

- Co-Branded Hotel Credit Cards

- Cash-Back Credit Cards

- No-Annual Fee Credit Cards

Don’t feel overwhelmed with so many programs and credit card options. I will go through each of these five types of credit cards, provide a current credit card offer, and explain it in detail.

1) Transferable Credit Cards

Most people find these types of credit cards to have the highest value because of the tremendous flexibility that they offer. Some people call them transferable or flexible credit cards. This group of cards earns membership points. You apply and get one of these credit cards that are a part of the members listed below. You earn points (signup bonus and ongoing spending), which accrue in your membership account total. In the main membership programs below, I’ve included a few of the credit cards that can earn points for that membership program.

- Chase Ultimate Rewards – Chase Sapphire Preferred credit card, Chase Sapphire Reserve credit card

- Amex Membership Rewards – American Express Gold credit card, American Express Platinum credit card

- Citi ThankYou Points – Citi Thankyou Premier credit card, Citi Thankyou Prestige credit card

- Capital One Miles – Capital One Venture credit card, Capital One VentureOne credit card

- Marriott Bonvoy – American Express Marriott Bonvoy Boundless card, Marriott Bonvoy Bold card

These membership points are flexible in a few ways. First off, the points that you earn can be used to book a flight, hotel, cars, and other things within the membership program’s online booking portal. Each one of these five programs has its own booking portal. You simply log in to one, search for flights or hotels, and it will show you how many membership points it will cost you to make the booking. Another option is to take membership points and transfer these to an airline or hotel partner. Each membership group has a list of transferable partners.

Let’s take a look at probably the most popular program, the Chase Ultimate Rewards program. I want to show you what a credit card offer looks like and how to make a redemption booking once you accrue the points needed to do so. Arguably the most popular travel rewards credit card out there right now that earns points for the Chase Ultimate rewards programs is the Chase Sapphire Preferred card. So let’s have a look at the offer that is currently available.

- Card: Chase Sapphire Preferred Credit Card

- Earn a 100,000 point bonus after spending $4,000 in 3 months

- Annual Fee is $95

- $50 Annual Ultimate Rewards hotel credit

- 3 points per dollar spent on a restaurant, grocery store,

- 2 points per dollar on travel such as airline and hotel purchases

Let’s break this down. You will receive a one-time bonus of 100,000 points once you spend the minimum spending amount of $4,000 in three months of being approved for this credit card. The clock starts once you submit the credit card application. This card does charge you an annual fee of $95 upfront but is halfway offset by the $50 statement credit each account anniversary year for hotel stays purchased through Ultimate Rewards.

Note that not all cards have this high of a minimum spending amount ($4,000) to receive the bonus, so don’t be turned off as many card offers don’t require anything close to this amount. Also, some do not have an annual at all or waive it for the first year. Later in this article, I will also provide ways to meet the minimum spending amounts required by these higher minimum spending requirements.

Lastly, you will earn three points per dollar with this card when using your credit card at restaurants. Two points per dollar spent on travel such as booking hotels and flights. Once you meet the spending standard to qualify for the bonus, it will appear in your Chase Ultimate Rewards account. You will usually get the bonus points in your account by the end of your next credit card billing cycle.

Now that you have a nice signup bonus, you have many redemption options to consider. One way to redeem your points is to transfer your points to one of the many airline and hotel partners. Partners you can transfer to inside the Chase ultimate reward portal include British Airways, Flying Blue, JetBlue, Emirates, Singapore Airlines, Southwest Airlines, United Airlines, Virgin Atlantic, Aer Lingus, and Iberia. Also, there are three hotel programs: Hyatt, IHG, and Marriott programs.Transferring points is very simple. You need the account number of the airline or hotel you want to transfer points to. You simply go to that partner’s website and create an account. If you already have an account and have a miles balance, you can add to this balance by transferring miles to that specific airline frequent flyer account or hotel program.

For example, let’s say you have 10,000 miles already in your Southwest frequent flyer account, and you need 20,000 in order to book a flight you want to take. You can simply log into the Chase portal and transfer the additional 10,000 miles to your Southwest Airlines account that is required to complete the booking. Transferring points to airline partners probably provides the best value with your points, but this does depend on the actual transfer and booking at hand.

Another way to redeem points could be to book a flight, hotel, cruises, rental cars, and experiences using the Chase portal. Click “Redeem for travel,” It’ll take you to the travel homepage, which has everything you need to begin your search. It works just like Expedia or any other travel booking platform regarding how to search. Chase Sapphire Preferred points are worth 1.25 cents apiece when redeemed for Ultimate Rewards travel. Usually, one point is worth one cent. So, for example, 10,000 points would typically be worth $100, but because you have Chase Sapphire points and are booking through the Chase portal, your 10,000 points are now worth $125 worth of travel. Chase gives you this 25% bonus as an incentive to book through their portal.

The last option is to buy gift cards (restaurant, airline, hotel, amazon, etc.) or receive cashback on any purchase. This redemption is the lowest redemption value compared to transferring miles to an airline partner or booking travel through the Chase portal. I don’t recommend this type of redemption for a more significant amount of points because you’ll only receive one cent per point. This option is great for when your balance is low and you’re trying to use the rest of your points. For example, you could buy a $50 Amazon gift card if you only had 5,000 points left in your account. You could also simply make any $50 purchase and use the cashback option to erase the purchase essentially. Furthermore, you could take the current bonus points of 60,000 and transfer them as a $6000 deposit into your checking account.

So what can the 60,000 point bonus get you? If you book travel within the Chase booking portal, you can book $750 worth of flights, hotels, car rentals, etc. The 60,000 points is worth $600 plus the 25% bonus that the Chase portal gives you an incentive to book through their booking platform. You will realize a 1.25 cents per point value (750/60,000), which is decent redemption. Not bad, not great.

As mentioned, the real value comes by transferring the points to partners. I recently transferred Chase Ultimate Rewards points inside my Chase account to my United Airlines account. I transferred 33,000 points to book a one-way flight to Santorini, Greece. If I were to pay cash, the cost would have been $1,000. The fee for booking with miles was $44 on this flight. So the redemption value on this transfer of points and booking was 2.89 cents per point. ($1,000 cash value -$44 booking fee = $956), then( $956/ 33,000 pts = .0289)

See how much more valuable transferring to partners is!? Any redemption value over 2 cents per point is considered a great redemption rate.

Related : Chase Sapphire Preferred Guide

My favorite flexible credit cards:

- Chase Sapphire Preferred – a remarkable booking portal and many transfer partners

- Capital One Venture Card – great flexibility and easy, straightforward redemption process

- American Express Gold Card – fantastic signup bonus in a tremendous flexible points program, high points per dollar earned when you spend on groceries, travel, and restaurants

2) Co-Branded Airline Credit Cards

These credit cards involve banks or credit card companies partnered up with Airlines. With these types of cards, you will use the bank or credit card company’s card. The bank or credit card company records your spending and adds this to the partner’s airline to add miles to your loyalty account. Here are some examples of these card types.

- Delta Airlines with American Express

- United Airlines with Chase Bank

- Alaska Airlines with Bank of America

- American Airlines with Citibank

I work these cards in the same manner as the transferable credit cards. Apply for the card, and meet the minimum spending required to receive the bonus. These miles will show up in your frequent flyer account and are ready for use to book a flight.

Let’s take a look at an example offer.

- Card: United Explorer Card by Chase

- 60,000 bonus miles after spending $3,000 in 3 months

- An additional 10,000, if you spend $6,000 in the first 6 months

- $0 annual fee for the first year; after that, $95 annually

- 2 United airport lounge passes

- $100 Global Entry or TSA fee credit

- 2 miles per $1 spent on United flights, restaurants, hotels

- 1 mile per $1 spent on all other purchases

Airline credit cards are a lot more straightforward than the transferable card type. Once you spend the minimum spending amount of $3,000 in the first three months of opening this card, the bonus of 60,000 miles will automatically be transferred by the bank (Chase) into your United airlines frequent flyer account. Then, an additional 10,000 miles will be added if you spend $6,000 in the first 6 months. This transfer will usually be within your next billing cycle.

Frequent flyer miles will also be accrued by spending money on your card. You’ll receive two miles per dollar spent on United flights, restaurants, and hotel bookings. In addition, you’ll receive one mile per dollar spent on all other purchases. The card has a $95 annual fee, but it is not charged during the first year. A fantastic added bonus is the two free lounge passes that can be used at any United lounge on the flight day ($118 value). Yet another perk when getting this card is you will be credited up to $100 once you apply for either global entry or TSA precheck and use this credit card to pay for that service. Be sure not to overlook the other perks like these offered in addition to the big one-time bonus.

Making a booking with airline credit cards is super easy! The first thing to do is go over to United.com and log into your United Airlines frequent flyer account. Enter your flight search criteria and select the “book with miles” box. Then, click the purple “Find flights” button to run your search. You will see a flight display box at the center of the page alongside its miles cost and taxes and fees for that given flight. One nice thing about the United search engine is that it shows a week’s worth of award pricing at the top of the screen if you are flexible on dates. Click on a date to see all the available flight options for that given day. You can sort by seat type by clicking on the label for the cabin you’d like to fly in. You can search by economy tickets, premium economy, business, and first-class tickets. To complete the booking, choose the cabin class and seat, pay the small tax and fee charge, and you’re all set!

Each airline has its own booking award charts or flexible, dynamic pricing. They are similar in some ways with pros and cons to booking with each of them. When booking with partner airlines, you must book through the airline with which you have the miles. You can do this by using the airline’s online booking system, but sometimes you have to call the reservations line. For example, say you want to take Air Canada to Europe with your United miles. You can do this by booking at United.com or calling the United reservations number.

Why use a partner airline? There are a couple of reasons. The partner airline you are considering might have a cheaper option in terms of miles you will have to use. You will have to gauge the value of each mile’s program and make the decision from there. Compare the value of the miles by looking a the cost of miles vs. the cash price of the ticket from each airline. Another reason is an airline might not service a particular destination, so you might have to use a partner that does. Co-branded airline credit cards can take you to fantastic places. Maybe even places you never thought you could visit before. If you are loyal to a particular airline, grab their airline’s credit card by all means. If you do not have a favorite airline that you value more than the rest, find an airline with a significant presence at your local airport and a great signup bonus offer.

My favorite airline credit cards:

- Alaska Airlines Visa Signature Card by Bank of America – Great airline, nice bonus, a low annual fee

- United Explorer Card by Chase – Easy minimum spending for the bonus, extra perks

- American Airlines Aviator by Barclaycard – Bonus points after first purchase, great airline partners

- Southwest Airlines by Chase – Fantastic redemption value, perfect for those who want a solid card to travel domestically

3) Co-branded hotel credit cards

These credit cards are a bank or credit card company partnered up with a hotel chain or program. With these types of cards, you will use the bank or credit card company’s card. The bank or credit card company records your spending and adds this to the hotel brand it is partnered with, so hotel points can be added to your loyalty account. Here are some examples of these credit cards.

- IHG Rewards Club Premier Card With Chase

- Hilton Honors Surpass with American Express

- Marriott Bonvoy Boundless with Chase

- World of Hyatt with Chase

Hotel co-branded credit cards work very similarly to how airline co-branded credit cards work. The bank or credit card company records your spending and allocates points into your loyalty account based on the amount and category of spending. From your loyalty account, you can make bookings using your points. Let’s have a look at an example.

- Card: Hilton Honors Surpass with American Express

- Earn 130,000 Hilton Honors bonus points after spending $2,000 in 3 months

- Plus, you can earn 50,000 more points after you spend an additional $8,000 on the Card (for a total of $10,000 in combined purchases) in the first 6 months of Card Membership

- The annual fee is $95

- 12 points per dollar spent at Hilton hotels or partner hotels, 6 points per dollar spent at restaurants, supermarkets, and gas stations, 3 points per dollar spent on all other purchases

- Complimentary Hilton Honors Gold status (which gives you perks like the 5th night free when you use points to book the first four nights)

This hotel card packs a solid punch. With a low minimum spending requirement of $2,000, obtaining the 130,000 point bonus shouldn’t be much of a struggle. Also, you can earn an additional 50,000 points after you spend $8,000 more on the Card (for a total of $10,000 in combined purchases) in the first 6 months of Card Membership. You’ll pay an annual fee of $95. What can 150,000 points get you? That amount of points will score you 5-8 free stays at most Hiltons hotels and their partners. Or 2-3 nights at some of the resort hotels and partners. Some of their partners include Hampton Inn, Homewood Suites, DoubleTree, and Embassy Suites, to name a few.Aside from the generous signup bonus, this card offers some nice points that you can earn when you spend money. You’ll earn 12 points per dollar when you book a Hilton hotel or partner room. When you spend money at a restaurant, supermarket, or gas station, you’ll earn 6 points per dollar. Also, earn 3 points per dollar on other purchases.

These types of cards are for people who have a hotel brand they are loyal to and enjoy staying with or just looking for some free hotel stays. It is a fantastic way to cut down on lodging expenses.

My favorite hotel credit cards

- Marriott Bonvoy Boundless from Chase – Flexibility, able to redeem points for things other than hotel stays

- IHG Rewards Club Premier Credit Card – Sweet bonus, Annual free night

- Hilton Honors American Express Surpass Card – Awesome signup bonus, a manageable annual fee

4) Cashback credit cards

Cash-back cards are the easiest to learn and use. Cashback is essentially a rebate of a percentage of your purchases on the card. With flat-rate cash back credit cards, every purchase earns the same percentage of cashback (usually 1 cent per dollar spent). Some cards will give you more cashback if you use your card to purchase restaurant food, airline tickets, hotel bookings, etc. Let’s take a look at some sample cards that offer cashback.

- Chase Freedom Unlimited Credit Card

- Capital One Quicksilver Rewards Credit Card

- Discover It Cash Back

Cashback credit cards have the most straightforward redemption process. Redeeming your rewards is as simple as logging into your account, specifying the amount you want to redeem in cashback, and hitting the submit button. There are several ways to redeem your cashback rewards, including a statement credit, cash deposit to a bank account, and purchase of gift cards or merchandise. How many options you have to redeem will vary from card to card and issuer to issuer. Here is a sample cashback credit card offer.

- Card: Chase Cash Freedom Unlimited

- Earn $200 cashback when you spend $500 in 3 months

- 5% cashback when purchasing travel through the Chase portal

- 3% cashback on restaurants and food delivery services

- 1.5% on all other purchases.

Once you spend $500 within 3 months, around the time your next billing cycle is up, you’ll receive the $200 cashback in your account that can be used at your discretion. You’ll also earn a different cashback percentage based on the categories you made purchases in. For example, if you spent $100 going out to dinner at a restaurant (3% cashback on these types of purchases) and spent another $500 on miscellaneous purchases (1.5% cashback), your cashback amount will be $10.50.

As you can see, the rewards in terms of cash value aren’t exceptional with cashback credit cards. But, with the signup bonus of $200 and decent category cash back percentages, your cashback amount will add up over time. The main benefit here is simplicity! Redeeming is super easy. Cashback cards are great for beginners just getting started and who want to get their toes wet. It’s also great for those who want to keep a card for the long haul and want to save up cashback over time for the future.

My favorite cashback credit cards

- Chase Freedom Flex – Rotating bonus categories ( drugstores, dining, and grocery, for example)

- SavorOne Rewards from Capital One – Nice Bonus, 3% on Dining and Entertainment

- Capital One VentureOne – Solid Bonus, has airline transfer partners, low minimum spending requirement for the bonus

5) No- Annual Fee Credit Cards

There is no better way to minimize costs than using a credit card with no annual fee. Indeed, cards with no annual fee usually have fewer benefits and lower reward rates when compared to most other rewards credit cards out there. Despite this, there are still some no-annual-fee cards out there that are valuable. Let’s take a look at a few no-annual-fee credit cards.

- American Airlines Advantage Mileup – Airline Card

- American Express Hilton Honors Card – Hotel Card

- Chase Freedom Flex- Cash Back Card

- Capital One Ventureone Credit Card – Flexible Card

Notice that no annual fee cards exist in all of the previous card types that I have gone through (flexible, airline, hotel, cashback). All of the cards I listed above are essentially downgraded versions of cards with a higher signup bonus. Do you see the trade-off here? With the no annual fee versions of the card, you will not have to pay an annual fee, but you will also get less of a signup bonus and ongoing perks.

Let’s look at upgraded versions of the cards for each of these. The Capital One Venture Card is the upgraded version of the Capital One Ventureone Credit Card. There are many upgraded versions of the American Airlines AAdvantage Mile up, including the American Airlines platinum select from Citibank and American Airlines Aviator card from Barclay. The American Express Hilton Honors Card’s upgraded version is the American Express Hilton Honors Surpass card. The Chase Freedom Flex card is a cashback card with no annual fee and is the little brother of the Chase Sapphire Preferred card.

Let’s pull down the Chase Freedom Flex Card, which has a bonus of $200 cashback once you make purchases of $500 within three months. You will enjoy an annual fee of $0. The upgraded version is the Chase Sapphire preferred card that you can earn 60,000 Chase ultimate rewards points after spending $4,000 in three months. The annual fee for this card is $95. You can see the relationship and trade-off as far as initial signup bonus points vs. minimum spending amounts vs. annual fees associated with each card.

The beauty about these two cards is you can get them both. You could get your feet wet with the Chase Freedom Flex card, and in the future, go ahead and get the Chase Sapphire Preferred. These two card points can be combined into the same account. So if you did get both cards at some point, your total would be 80,000 Chase Ultimate Rewards points(60,000 + 20,000). The points from both cards would actually sit in different accounts. Still, you could transfer your freedom flex points into your Sapphire account to enjoy the 25% bonus when travel is booked inside the chase portal (the chase points program was discussed earlier).

Let’s take it even a step further. The Chase Sapphire Preferred card’s upgraded version is the Chase Sapphire Reserve card. This card comes with more perks than the Chase Sapphire Preferred card. Such as a $300 annual travel credit, door dash pass, higher points earned per dollar spent in specific categories, and a 50% bonus when bookings are made in the Chase portal instead of the 25% with the Chase Sapphire Preferred. The bonus offer is 50,000 for $4,000 spent. The annual fee is much higher at $550. You have to be a frequent traveler and use most of this card’s perks to justify the hefty annual fee.

My favorite no-annual-fee credit cards:

- Chase Freedom Unlimited – Easy redemption and can be turned into Chase ultimate rewards points

- American Express Hilton Honors Card – Great bonus, great hotel, and partners

Seven steps to your next travel reward redemption!

When some people get started with credit card hacking, sometimes they take the shotgun approach to collecting points. What I mean is that they start applying for cards and collecting points randomly just because they see great offers. The good news for these people is they are successfully earning points that can be redeemed for travel. But this might not be the most systematic way to gather points to achieve your travel goals. The cards that you want to apply for and earn points from should be cards that are well researched that align with where you want to go and stay. The following seven steps should be taken to efficiently execute your credit card travel rewards plan.

1) Setting your travel goals.

The most important thing you can do when starting is to come up with a plan. As I mentioned, you don’t want just to start applying for random cards. Beginners should start with a few key travel goals. Things to think about are:

- Where do you want to go?

- When do you want to go?

- Do you want free flights?

- Do you want free hotel stays?

- How many people are traveling?

- Are you going to be loyal to a particular brand?

Aside from these, are you after a card that offers flexibility like Chase Ultimate Rewards Points, Citi Thankyou Rewards, or Amex Membership Rewards Points? With these programs, you can transfer points to hotels and airlines and book reservations after the points have been transferred to your frequent flyer program or hotel loyalty account.

If you don’t know your travel goal yet, that’s okay. With some research and planning, you will figure out which cards and programs will suit your travel goals accordingly. Once you see how a single card can get you to Cancun or Paris for free, this initial learning stage will be well worth the time invested. Research and being intentional in this stage will ensure the cheapest possible travel costs!

2) Sign up for frequent flyer programs.

If you have not already signed up for a few frequent flyer programs, go ahead and do so now. It just takes a few minutes and is completely free. I would choose a few of the larger airline and hotel loyalty programs that you could see yourself using in the future. If you are loyal to specific brands, then sign up for those. You can always sign up for a program later if you decide to use one that you do not sign up for now. The point here is to get yourself familiar with how these programs operate. Here are the major airline frequent flyer programs to join. Google each airline’s name followed by “loyalty program sign up.”

- American Airlines

- Delta Airlines

- United Airlines

Here are some major hotel loyalty programs to join. Google each hotel’s name followed by “loyalty program sign up.”

- Marriott Bonvoy

- Hilton Honors

- IHG Rewards

You might do this step simultaneously as the next step, which is choosing the credit card to get. Your credit card and frequent miles account have to be connected. When you apply for a co-branded airline or hotel card, they will ask you for your frequent flyer number or hotel loyalty number on the application. That is why signing up for a loyalty program before applying for a credit card is practical.

3) Choose your credit card(s).

If you are loyal to a specific airline or hotel, I would go ahead and look into that brand’s credit card to see if they offer a nice signup bonus. Another option if you are loyal to a brand is to find a transferable credit card that transfer points to that particular airline or hotel. Just Google “points credit cards that transfer to” and then enter your preferred airline or hotel brand. If you don’t have a preference just want to get to a card that will either let you stay or fly to a particular location for free, then a little research needs to be done by looking at the destination and figuring out which hotels are there as well as which airlines fly there. For hotels, look at your destination and see if they have some of the hotel brands I have mentioned. Then look to see how many points it will cost per night to stay there. The next step would be to apply for that credit card with a signup bonus big enough to cover the number of nights you will stay. For example, let’s say you see that Cancun has a Hilton Hotel for 25,000 points per night that you found out from visiting the Hilton Hotel website, and you plan to stay six nights. You could get the Hiltons Honors Surpass card that offers a 150,000 signup bonus. This bonus will cover the six nights stay (6 x 25,000 = 150,000).

Airline cards will work the same way. Find out who flies there and how many miles it will cost to book the trip by looking at the airline reward chart or dynamic pricing. Do this by going to airline websites and doing mock searches from airport A to B to see the miles cost from different airlines. Naturally, if you don’t care which airlines you fly with, you will select the co-branded airline card with a generous offer that will allow you to make the booking with miles. You can also choose to pick up a flexible card type that you can transfer miles to that particular airline that flies to your destination.

One of my favorite online tools is awardhacker.com . It allows you to enter departure and arrival destinations and see how many miles it will cost you to travel within various airline loyalty programs. Key features of this online tool include;

- It shows how many points it will cost for different airlines to get to your chosen destination.

- Identifies which transferable loyalty programs points can be transferred to the airline flying to a chosen destination. (Chase Ultimate Rewards, Amex Membership Rewards, Citi Thankyou Rewards Points, Marriott Bonvoy, Capital One Miles)

- Provides you with the booking website or airline phone number to book the flight. It also shows you the airline’s routes to its destination. This is helpful when you have to call and make the booking, as you can see the most direct route options and check if they are available.

- You can choose a particular frequent flyer program that you have points in to see how many points it will cost to book within that program. For example, if you have American Airlines miles to use, you can check a box saying that you only want to search for a flight using American Airlines miles.

- You can search flights based on “on-peak season” (Holidays and Summer usually) or “off-peak Season” (Fall, Winter, Spring).

The screenshot above shows a flight from Seattle, WA, to Munich, Germany. The cheapest miles cost is 40,000 Alaska Airlines miles. If you click on the upward arrow on the right, you can see more details. The details include searching for available tickets, transfer miles if you need to, booking your ticket, and also flight routes. The flight will be operated by either Alaska (AS) or American Airlines (AA). The screenshot below shows some of the possible routes on your way to Munich.

Awardhacker.com also gives you information on how to search for flight availability. You can search online at the Alaskan Airlines website or by calling the reservations number listed with this particular flight. Also, note that because Alaska Airlines is in the OneWorld alliance, you can use those to book a flight on Alaskan Airlines if you have miles within American Airlines, British Airways, Japan Airlines, or Qantas programs. These details can be found below.

Also provided are the available transfer partners. Marriott Bonvoy points can be transferred to your Alaskan Airlines account at the rate of 3 MB points for 1.25 Alaska miles. So you could choose to transfer these points and then book the flight with Alaska Airlines. The “redeem for ticket” gives you both the online and phone information.

Limitations of this site include:

- It will not show you award space availability. Meaning it will show you the miles it will cost you to travel from point A to point B, but it’s not real-time, so it won’t show if the airline has a seat for you for sure. You will have to check that airline’s award website or call to check if a seat is open.

- The miles that they show are the cheapest possible. Sometimes you can’t get that rock bottom cost of miles that the site shows. Again the tracking isn’t real-time, so the miles cost they quote might be slightly off. Use this site for ballpark numbers to estimate the miles cost of your trip.

Point.me This website does everything awardhacker.com does but is better with real-time award availability. The catch here is they do cost money to use their system. They have a yearly service charge of $99 or a monthly plan for $12. I think the monthly plan is a great way to plan and figure out how many miles are needed within each program. It could help you see how many miles you need in each program to make your desired redemption. After gathering this information, you can cancel the monthly subscription. With that information, you could see which credit card offers are available that cover the miles needed to make the booking. I like that they tell you exactly what you need to do to book. You will also find paid premium mileage redemption service with experts to help you plan your travel rewards credit card strategy.

Free Hotel Stays As mentioned before, if you are looking for free accommodations, look into hotel co-branded cards. They can offer some great value if you do a little research. Here is a list of the top loyalty programs available to look at.

- Wyndham Rewards

- World of Hyatt

- Marriott Rewards

- Best Western Rewards

- Radisson Rewards

An excellent resource to find out if hotels are located in your travel destination is at awardmapper.com.

Hotels can be searched by brand and by points per night cost. This website is an excellent research tool you should be using to help plan your free hotel strategy. My favorite hotel programs are the Hilton Honors Rewards, World of Hyatt, and IHG Rewards. I think these programs and co-branded cards offer the best value, but I would recommend using any of the ones listed above if you find value in them.

4) Credit card redemption timeline.

As a beginner, you will want to start your credit card travel rewards plan about 9-12 months before your travel dates. This will give you time to do the following steps.

A) Research and obtain the right credit card for your travel goals. (2 weeks)

B) Get the credit card and meet the minimum spending requirement to get the bonus points. (3 months or less)

C) After you complete the spending requirement, it will take 2-4 weeks for your bonus point to appear in your account in most cases.

D) At this point, you should be 5-8 months out from your projected travel date. You don’t always have to have points ready to book this far in advance, but as a beginner, I want you to have plenty of time to book while figuring out how all this works. You are now ready to make a booking. I recommend starting 9-12 months out because award availability sometimes can be pretty limited when booking with airlines miles. These seats sometimes fill up quickly, but I am confident that you can book seats with no problem if you are flexible on dates.As mentioned earlier, transferable cards have an option to book through the program’s portal, such as Chase Ultimate Rewards. With these types of cards, you will not be booking scarce award availability as you do with airline miles. It will just be like booking through Expedia as far as if a seat is physically available on the plane, you can book it with points from the flexible cards programs. This is another advantage of the transferable card types.

5) Meet the Minimum Spending Requirement.

After applying for the card and receiving it in the mail, it is time to spend the minimum amount to obtain the one-time bonus. Most minimum spending amounts will range from $500 to $5,000 and give you 3-4 months to spend that amount. I usually go for the cards that require $3,000 spent in 3 months. I think this amount is the most doable and, at the same time usually offers a generous signup bonus. The time clock starts the day you apply for the card, not the day you actually receive it in the mail and activate it. Once you meet the required amount spent, the bonus points will be deposited in your account within a month in most cases.

You may be thinking that the minimum spending requirement is too high for you to meet. Putting all of your bills on the cards for three months should make a significant dent in the required amount. Many creative ways exist to help meet this spending requirement. I will list several ways below but do your own research for additional ideas. It is good to brainstorm a solid list of purchases you can make on the card without spending extra money you wouldn’t have spent normally. Here are some spending ideas.

- Put all of your monthly bills on the card.

- Pay for gifts in advance for holidays and birthdays.

- Pay tuition costs, taxes, property taxes, and business travel.

- Pay for costs ahead of time (tires, insurance). Also, you could go by gift cards for known future purchases. For example, if you shop on Amazon.com often, you could buy Amazon gift cards (which count towards the spending requirement) and load your account.

- HSA Reimbursement (use a credit card to pay for medical expenses, submit the bill, get reimbursed, and pay off the credit card)

- Pay for a friend or family’s purchase on the credit card, then have them pay you back.

- Mortgage. Some third-party sites such as plastic , allow you to pay them using a credit card. Then they will send a check to your mortgage company. They require a 2-3 percent fee, but it is something to consider if you need a huge amount toward your minimum spending amount.

- Venmo . Send someone money through this pay app using your credit card and have them transfer the funds to your bank account, then pay off the amount you sent. It does cost 3%, but consider it if you need a huge chunk toward your spending minimum. This has worked for me, but do some research to see if this will work for your credit card. Make sure it will register as an amount spent, not a cash advance. Cash advances do not count towards the minimum spending amount. The best way to find this out is to call the credit card company and verify.

These are just a few of the many ways to meet the spending requirement. Again, do some research and find ways to meet the spending amount that is comfortable for you. I like to line credit cards up with known higher fixed costs due to come my way. For example, paying for two (you and your spouse) six-month car insurance policies would be an excellent jump towards the spending requirement. Another great option is to get a card that lines up with Christmas shopping.Also, around tax time, you might do some splurge spending with your tax return money. Around these times, it might be a good time to ask friends and family if they have any more significant purchases you can pay for and be reimbursed. You just need to be creative, and these higher minimum spending amounts don’t seem that daunting to achieve.

6) Use your Points.

Now is the time to cash in your “hard-earned” points and get out of town. You should have a good idea of the airline you will use from research on awardhacker.com or point.me and individual airline websites. Keep in mind that if you have to call to make a booking, you make sure to have a calendar to check multiple days with the airline representative for available space on an award ticket. The exact day you have in mind to travel may be expensive or unavailable, so keep a range of days to go over with the representative.

Don’t feel pressured to book just then. Get a good idea of what days are open for booking and call back later if you need to. Don’t wait too long, as the vacant award seats can fill up fast sometimes. This only happens if you are looking for a flight departing in the near future. If you plan ahead and check online or call to book well before your departure date, I am confident that you will find a date and time that works just fine. If you book at least 8-12 weeks out, you should not have any problem booking your desired dates. With that said, holidays should be booked further in advance.

If you are transferring points from a transferable credit card to a frequent flyer account, make sure to call the airline and hold a seat. Explain to them that you’re transferring points and cannot yet complete the booking process until the points are in your airline’s frequent flyer account. They will be glad to hold some seats for you. The points usually take just a few minutes to transfer, but sometimes it takes up to a week. This is also a tactic to use when you’re waiting for a chunk of bonus miles/points to hit your account, and you don’t quite have them yet. You’ll be able to hold a seat before you get your credit card bonus miles. Score!

7) Keeping track of credit cards and points.

Keeping track of one or two cards is easy, but things need to be organized when you have 15-20 cards. If you think I’m joking, I’m not. Some people have 30-40 cards! You can join a free service over at awardwallet.com . This site keeps track of all of your cards, miles accrued, annual fees, annual fee dates, and much more. You have to input your frequent miles number and credit card info, and it will keep everything organized for you. If you feel a little uneasy about handing over all of your credit card information, head over to google sheets and make yourself a simple spreadsheet. I prefer this route.

Here is a simple spreadsheet to keep your cards organized.

This is a basic version of the one that I use. You can add whenever you think is necessary to keep track of every detail. You can add total points accrued, initial signup bonuses, and key perks of the card. I also always note what accounts my cards are attached to. For example, my cell phone bill is automatically taken out each month from a credit card. So when I get a new credit card, it is easy to take my old card off autopay and add my new one.

Overall, keeping track of credit cards and points is relatively easy but should be taken seriously. You don’t want to pay an annual fee on a card you don’t plan on using. You also don’t want your hard-earned miles to expire! Yes, miles do expire, usually in 18-24 months of a non-active account. Meaning you haven’t earned any miles in that timeframe with that particular airline. With some airlines, miles don’t ever expire. With airline co-branded and hotel co-branded credit cards, canceling the card does not result in a loss of points/miles. This is because the bank doesn’t own those points or miles, the airline or hotel does. They were added to your frequent flyer or hotel account. Once added, miles/points in inactive frequent flyer accounts or hotel loyalty programs will expire in the 18-24 month range.If you cancel the card, you lose all points with a transferable credit card account. So make sure to use or transfer them before canceling with transferable cards. Nonetheless, call your credit card issuer for confirmation of cancel details and rules.

Example travel rewards redemptions.

I wanted to show you exactly which cards I picked up and how I executed the redemption process. These examples should clarify the massive amount of info you just took on and further help you form your own plan for your unique travel goals.

- 10 free nights at IHG Hotel Partners.

I signed up for the IHG Rewards Club card. The initial signup bonus was 80,000 points for 2,000 spent in three months. The 80,000 points got me five free hotel stays. I pay the ongoing annual fee of $49 because one of the perks of this card is a free annual stay at any hotel under 40,000 points (which is 99 percent of their hotels). So I have used the annual free stay for five more stays.

Yes, those annual free stays are not actually free because I am paying the $49 annual fee to keep this card active. I once redeemed my “free” annual stay in Key West, Florida, at a super nice Crowne Plaza. If I paid cash, the cost for that weekend night would have been $639!! So I’d call that close enough to free. I have also stayed two nights at the InterContinental Mark Hopkins in downtown San Francisco using the free annual nights. That was perhaps the nicest hotel I’ve ever stayed at.

- Free Roundtrip Flight to Europe.

I used the points from the Capital One Venture Card. To earn the bonus of 40,000 on this card, I had to spend $3,000 in three months. Since this card earns two points per dollar spent, once I spent the $3,000 minimum, my total points with the bonus was 46,000 points ( 3,000 x 2 = 6,000 + 40,000 bonus). This 46,000 points is worth $460 of cashback on any travel purchase. I found a flight on google flights for $450 to Brussels, Belgium. I booked it with Air Canada on their website using my Capital One card to pay for the flight. Then I logged into my Capital One account after a few days, found the $450, and applied a cashback credit to this charge. On a side note, I really enjoyed the little waffle stands that seem to be everywhere in Belgium.

- Free flight to Brazil to Peru and back to the USA.

This was my biggest travel reward redemption. Over the course of a year, I was able to get the signup bonuses from two Citi AAdvantage Platinum Select cards (me and my spouse). The spending minimum to get the bonus was $2,500 for each card. The signup bonus was 60,000, so with two bonuses and the minimum spending amount to get the bonus, we totaled 125,000 American airlines miles (60,000 x 2, + 2,500 x 2).So we worked on that spending minimum for the first card before we applied and got the second card. After completing the second American Airlines card spending, we moved on to the United Explorer card, which offered 40,000 miles after spending $3,000 in 3 months. We now have a total of 125,000 American Airlines miles and 40,000 United miles. Just to be clear, the American airline miles cannot be combined into one account. So they sit with a total of 62,500 each in two separate accounts (one in mine, one in my spouse’s).

After looking at award flights to Rio De Janeiro, Brazil, we booked two tickets with American Airlines for 30,000 one way each, totaling 60,000 miles. We then booked our flight from Rio De Janeiro to Lima, Peru, using our United Miles. Each flight costs 20,000 miles one way each, totaling the full 40,000 from my account. We flew with one of United’s partners for that flight that we found on the United website. The last flight was booked with American Airlines from Lima, Peru, back to the US. The cost was 30,000 each, totaling 60,000 miles from the second American Airlines account.

Also, note that we did not book one flight before having the miles to book the rest. We looked at both American Airlines award flights and United airlines award flights and lined up each flight in terms of dates and miles to ensure we had enough miles to make it to these two destinations and back before we made any bookings. If we paid cash, the cost would have been OVER $7,000!! The total cost of fees we paid for the flights was ONLY $203 total for the two of us! We got to see two of the world’s wonders ( Christ the Redeemer and Machu Picchu ) with airline miles essentially.

- Free Round Trip to the Dominican Republic.

I got the Delta SkyMiles Gold American Express Card which offered 40,000 miles, after spending only $1,000 in three months. I used these miles to see the incredible beaches of Punta Cana, Dominican Republic. I used 20,000 delta miles to fly one way to Punta Cana, took a bus to the bustling Capital City of Santo Domingo, and used another 20,000 to take a flight home. I also called the airline and extended my layover in NYC to 20 hours, so I could spend the night and see the city. How did I book the hotel? You guessed it. I used my annual free night with my IHG card to snag a pretty nice hotel downtown NYC. That is why I keep the IHG rewards club premier credit card. Even though it does have that $49 annual fee, it comes in handy for random hotel stays.

- First-class flight from London to Paris

Here is another thing you can do, upgrade tickets with miles. We had two economy tickets booked, and I noticed I had 10,000 British Airlines miles I probably wouldn’t use for anything because of the low balance. I upgraded our two tickets to first-class for 5,000 miles each.

- 30 free Domestic Flight and counting.

Besides the bigger trips, I have taken at least 30 domestic flights (on the low end) using several points and miles programs.

How do I remember all those redemptions? I’m very systematic and keep a tight spreadsheet. You should be too!

Here are some simple strategies and examples to help you plan your next trip.

-This is a super basic redemption plan. Get the Chase Sapphire Card and use this for an airline ticket or hotel stay. If you get the bonus of 60,000 points and book on the Chase Ultimate Rewards portal, the value should be around $750. The 60,000 bonus is equal to $600. Plus, for booking in the portal, they will give you a 25% bonus equal to $150, totaling $750. Where can you travel and stay for $750? Furthermore, you can most likely get more value out of these points by using one of the several airline and hotel transfer partners.

-You get the bonus points from the American Express Gold Card, and your wife gets the IHG rewards club premier credit card. You find a flight with Delta to a vacation spot you’ve wanted to go to and transfer points from your flexible American Express rewards account to your Delta account, and book the flight. The signup bonus points from your wife’s IHG Hotel card will cover the accommodations netting you a free trip. It really is that easy.

-To add to the last example, you could get the bonus offer from the Capital One Venture Card. This card can be used for any travel expense. Let’s say you’re heading to Hawaii, and the wife wants to take an excursion to swim with the Manta Rays. No problem! You would purchase the excursion with your Capital One card to see the Manta Rays, log into your Capital One account and apply a credit with your points towards this purchase. But wait, how will you get to the excursion meeting point? Use the Capital One Venture card to book a rental car and apply a credit to your account. You can apply credits towards Uber charges as well!

-One revolving strategy could be to open up one or two cards a year. It is a non-aggressive way to earn bonus miles and do some minimal traveling. Nothing wrong with that if that’s all you want to do. Getting the bonuses for two airline cards a year should enable you to take 2-4 round-trip flights, depending on the card and where you are going.

-Couples can stagger the same card. So player one gets a particular card, both work on that minimum spending requirement. Then player B gets the same card, and you both work on that minimum spending. This makes the redemption easier as you will be working with common points or miles and only have to use one booking site.

-If you are interested in domestic travel primarily, either get a credit card with your favorite airline(s) or do some research and see which airline has a significant presence at your local airport with many routes to different locations daily. For reference, check out these airlines’ co-branded cards. Delta SkyMiles® Gold American Express Card, United Explorer cards, Southwest Rapid Rewards Priority Credit Card, Alaska Airlines credit card, Citi / AAdvantage Platinum Select World Elite Mastercard®. I have personally had all of these cards, and each pack great value!

I wanted to throw out some more examples besides the ones I executed. My goal here is to open up your mind and help you better understand what combinations these cards can provide to help with your personal travel goals.

Recommended credit cards for beginners, intermediate, and advanced reward users.

Here are my recommendations for getting started with travel rewards credit cards. I think first-timers should feel comfortable after reading this article alone to begin with the intermediate options below. If you really just want to get your toes wet, by all means, choose a beginner card. The advanced cards are for people who want to get points rolling in and can use all of the other perks these cards tend to offer. Note that all of these credit cards can change or disappear at any time and their offers.

Beginner reward users

- Chase Freedom or Flex Card – Flexible

- Capital One VentureOne – Flexible

- Citi American Airlines Advantage Mileup – Airline

- American Express Hilton Honors Card – Hotel

- American Express Blue Cash Everyday – Cash Back

Intermediate reward users

- Chase Sapphire Preferred Card – Flexible

- Capital One Venture card – Flexible

- Citi Premier Card – Flexible

- American Express Gold Card – Flexible

- Any higher-end miles offered with your preferred airline

Advanced reward users

- Chase Sapphire Reserves – Flexible

- Citi Prestige Card – Flexible

- American Express Platinum Card – Flexible

- American Express Aspire Card – Hotel

- American Express Delta SkyMiles Reserve – Airline

Here are five simple things to remember when using travel reward credit cards.

1) I might sound repetitive on this, but if you currently carry a balance on other credit cards, this game is not for you.

2) Pay on time by setting up automatic payments immediately when you get a new credit card.

3) Negotiate annual fees when they are due.

4) Decide to cancel a credit card only while keeping your credit score/profile in mind.

5) Even after reading about the perks of your new card, call your credit card company and ask about or have them send you a complete list of their rewards and perks to get the most out of your card.

Frequently Asked Questions

I’ve added a Q & A section to tie up loose ends and answer questions that are commonly asked when getting involved in credit card travel rewards.

- What credit score do I need to be able to qualify for a travel credit card?

Most travel credit cards require good-to-excellent credit, meaning you’ll want a score close to or over 700. A 700-770+ score is ideal. That’s not to say that you won’t be approved if your score isn’t that high, but it is a good rule of thumb when you consider applying for a credit card.

- Will applying and opening credit cards hurt my credit?

Even if you’ve done your homework and decided which card you want to apply for, you should not apply for it until you understand how your credit score is calculated. Here’s a breakdown of the factors involved. With 35% pertaining to payment history, it’s no surprise that the category that carries the most weight is your on-time payment history. The utilization rate counts for 20% of your credit score. This is the total balance on all your credit cards divided by your total credit limit. 15% is scored by the length of your credit history, also known as the average age of accounts. 10% is allocated to the credit mix. This refers to the various lines of credit you may have, including credit cards, student loans, car loans, a mortgage, etc. New inquiries on your credit report account for 10% of your score.

While the exact impact might vary from case to case, generally speaking, you can expect your score to drop by about five points each time you apply for a new credit card. But it depends on your credit profile. For me, these have bounced back within 30 days of applying for a new card. Although I can’t give you an exact answer because I don’t know what the picture of your credit profile looks like, I’ve had about 25 cards in the last five years, and my score hovers in the high 700s. I’ve paid all of my cards off in full, each and every month. So consider the factors above and decide for yourself how getting credit cards will affect your credit score and if getting one is the right decision for you. This is not financial advice and you may want to speak with a financial professional to determine what may be best for your individual needs.

- Should I pay or not pay the credit card annual fee?

First off, you must decide if the initial annual fee is worth the card. For most cards with an annual fee under $100, the card is generally worth the upfront annual fee if you can meet the minimum spending amount and get the bonus. Let’s say a year rolls around, and now you have to decide to keep the card and pay the annual fee again. Or, in some cases, for the first time if the annual fee was waived the first year. For most transferable card programs like the Chase Ultimate Rewards, American Express Rewards, Capital One Miles, Citi Thankyou Points, and Marriott Bonvoy points, once you cancel the card attached to this account, you will lose the points. If you have a lot of points, it’s best not to cancel and pay the annual fee because the points in your account are probably worth much more than the annual fee.

With co-branded cards such as the Citi American Airline AAdvantage card, your miles are safe when you cancel because the bank does not hold your miles as they will be in your American Airlines account. With the high annual fee cards, you really need to think about all of the credit card’s perks and if you use them before justifying paying the hefty annual fee.

- How many credit cards can I have?

Generally, you can have as many as the banks are willing to allow you to have. Some travel rewards users out there get a dozen a year. Each bank has its own rules and limitations. For example, Chase has a rule known as the 5/24 rule. You cannot apply and get a new Chase card if you have gotten five new cards in the past 24 months. This includes cards from any issuer, not just Chase cards. With this in mind, consider getting the most valued Chase cards first if you plan on getting several cards. Because once you have over five cards within two years, you won’t be able to get any more Chase cards until you clear the 5/24 rule.

Action Steps!

1) I don’t expect you to grasp all of these concepts right away! Reread the article as a lot of material was covered. At the very least, go back and read the example travel rewards redemptions that I have done and the additional strategies and point stacking techniques.

2) Get an official free credit report or create a credit Karma account to identify any outstanding credit card debt so you can find out your credit score.

3) Study some of the credit card offers to understand better the terms you must complete to get the bonus.

4) Follow the seven steps to plan your next credit card rewards redemption.

5) After choosing a credit card that will help you with your next travel goal, brainstorm some ways to meet the minimum spending amount required by that card. Be sure to use some of the ways I’ve suggested.

Learn how to travel for FREE!

Ready to travel more?

Planning your own adventure?

Check out these resources!

Best travel rewards credit cards!

Earn free travel!

Have questions?

Ask Us Anything!

Disclosure: Please note that some of the links above may be affiliate links, and at no additional cost to you, I earn a commission if you make a purchase or signup for a credit card. Nothing written on this site is intended to be financial advice, and you may want to seek a financial professional. I recommend only products and companies I use or have done ample research on, and the income goes to keeping the site community-supported and ad-free. Read full Copy Rights and Privacy Policy.

Privacy Overview

Please Like & Share!

What’s up with travel clubs promising free travel?

I’ve been getting a steady drumbeat of calls about something I thought died six years ago: Travel clubs promising free or discounted travel.

Vacation club sales being pushed by postcard, e-mail and telephone

This is a pitch that can come to you in a variety of ways, either by phone call, e-mail or even postcard. In each case, you are told you’ve won a prize, usually a vacation like a cruise, an air flight or perhaps a resort stay. Sometimes you may be told you’ve won $5,000 or a car or some other expensive prize.

You’re also told you have to call in to ‘claim’ your ‘prize.’ That’s when the person on the other end of the line requires you to make an appointment to hear a sales pitch for a vacation club or travel club before you get your ‘prize.’

Once you hear the pitch, they’ll typically try to get $5,000 or $6,000 from you, stringing you along all the while with the promise of free travel, cruises and more.

But let me stop and ask you something: If you’re told you won something, you should just say ‘thank you’ and that’s it, right? You should not have to pay upfront for anything.

Anytime you’re told you will have to go in to hear a presentation, you should know that it’s suspect. The high pressure will start and they’ll try to get you into a high-priced contract for a timeshare or the like.

Read more: The #1 mistake people make at hotel checkout

The attorney general of Massachusetts is now suing a discount travel company and its affiliate for allegedly scamming more than two dozen people out of thousands of dollars this way.

The Boston Globe takes this story a step further. They’re reporting a new twist I’ve never heard before, where one of these vacation club outfits is sending people colorful postcards that show a Carnival cruise ship on the card. You’re told you’ve won a free cruise, but in the mice type it says ‘sample itinerary.’

So there is no Carnival cruise and you’re not getting that free trip. Who knows what prize you’ll ultimately get? I can tell you it probably won’t be much. But it will cost a lot in heartache, lost time, and lost funds.

For more money-saving travel advice, see our Travel section .

- 9-night Greece & Turkey escape with air from $1,680

- 7-night Italy escape with air & train from $1,479

- 14-night Norway & Scotland cruise from $1,149

- 7-night Pacific coastal wine country cruise from $349

- Show Comments Hide Comments

- The best deals of The Home Depot’s Spring Kickoff sale

- f Autentificare

Sunteți aici pentru prima dată?

- data-pos="1"

- data-pos="2"

- data-pos="3"

- data-pos="4"

- data-pos="5"

- data-pos="6"

- data-pos="7"

- data-pos="8"

- data-pos="9"

Selectarea magazinului

- AGIGEA AGIGEA

- CALAFAT CALAFAT

- CENAD CENAD

- CONSTANȚA CONSTANȚA

- GALAȚI GALAȚI

- GIURGIU VAMĂ GIURGIU Border

- GIURGIU ZONA LIBERĂ GIURGIU FREE ZONE

- MORAVIȚA MORAVIȚA

- PETEA PETEA

- PORT TURNU - SEVERIN TURNU - SEVERIN HARBOUR

- TULCEA TULCEA

- URZICENI URZICENI

- VALEA LUI MIHAI VALEA LUI MIHAI

- VAMA VECHE VAMA VECHE

OFERTE ACTUALE

Servicii fără limite

- Vă împachetăm cumpărăturile pentru a fi dăruite cadou

- Vă ajutam să transportați cumpărăturile la mașină

- Suntem fericiți să vă oferim sfaturi competente

- Carduri cadou disponibile la casa de marcat (100 LEI, 200 LEI, 300 LEI, 500 LEI).

Rămâneți informați cu newsletterul nostru: oferte, promoții, concursuri, și multe alte noutăți.

Prin apăsarea butonului „Înregistrează-te”, îți exprimi acordul pentru prelucrarea datelor cu caracter personal .

Economisiți profitând de avantajul cantităților mari

Cantitățile maxime premise în magazinele Travel Free

Granițele cu state membre UE

- cafea: 10 kg

- bere: 110 litri

- vin: 90 litri

- vin spumant: 60 litri

- băuturi < 22% alcool: 20 litri

- băuturi > 22% alcool: 10 litri

Un card cadou este un gest foarte apreciat! Perfect în cazul în care doriți să surprindeți persoana dragă. Clienții nostri pot alege dintr-o gamă variată de categorii și găsesc cu siguranță ceva potrivit pentru fiecare gust.

Prețurile produselor prezentate pe website au caracter strict informativ și pot suferi modificări în funcție de fluctuațiile cursului valutar, precum și magazinul din care se face achiziția. Pentru informații exacte privind prețurile produselor, vă rugăm să luați legatura cu magazinul de unde doriți achiziția.

Pushkino in Moscow Oblast Destination Guide Russia

- You are here:

Pushkino in Moscow Oblast, Russia

Safety Score: 4,4 of 5.0 based on data from 9 authorites. Meaning please reconsider your need to travel to Russia.

Travel warnings are updated daily. Source: Travel Warning Russia . Last Update: 2024-03-24 08:30:44

Delve into Pushkino

Pushkino in Moscow Oblast with it's 102,816 habitants is a city located in Russia about 21 mi (or 33 km) north-east of Moscow, the country's capital town.

Current time in Pushkino is now 07:03 PM (Sunday). The local timezone is named Europe / Moscow with an UTC offset of 3 hours. We know of 7 airports closer to Pushkino, of which two are larger airports. The closest airport in Russia is Sheremetyevo International Airport in a distance of 18 mi (or 29 km), West. Besides the airports, there are other travel options available (check left side).

There are several Unesco world heritage sites nearby. The closest heritage site in Russia is Kremlin and Red Square, Moscow in a distance of 21 mi (or 34 km), South-West. In need of a room? We compiled a list of available hotels close to the map centre further down the page.

Since you are here already, you might want to pay a visit to some of the following locations: Vostochnoe Degunino, Moscow, Orekhovo-Borisovo Yuzhnoye, Cheremushki and Ramenskoye. To further explore this place, just scroll down and browse the available info.

Local weather forecast

Todays local weather conditions & forecast: 2°c / 36 °f.

Monday, 25th of March 2024

3°C (38 °F) -1°C (30 °F) Sky is clear, moderate breeze, clear sky.

Tuesday, 26th of March 2024

4°C (38 °F) 1°C (34 °F) Overcast clouds, light breeze.

Wednesday, 27th of March 2024

4°C (40 °F) -1°C (30 °F) Light snow, light breeze, broken clouds.

Videos from this area

These are videos related to the place based on their proximity to this place.

Paintball tank under infantry attack

Published: July 22, 2007 Length: 32:17 min Rating: 4 of 5 Author: Denis Malyukov