Quick Quote

- Airline Travel Insurance Review

- Country Travel Health Insurance

- Country Traveler Information

- Cruise Company Insurance Review

- Insurance Carrier Review

- Travel Company Insurance Review

- City Guides

Azamara Cruise Insurance - 2024 Review

Azamara cruise insurance.

- Strong Insurance Partner

- Easy to add insurance at checkout

- No Medical Waiver

- Weak Medical Insurance

- Weak Medical Evacuation

Sharing is caring!

Azamara cruises for 2022.

Azamara prides itself on its ability to set itself apart from many of the other cruise lines by offering unique, intimate experiences at each destination. Touting hidden gems and immersive locally inspired experiences, this cruise line is considered ideal for travelers who are seeking a more culturally transformative adventure. If the idea of a “boutique hotel at sea” is appealing to you for your next vacation, then you’ll want to reserve a room on board one of Azamara Cruise ships four ships.

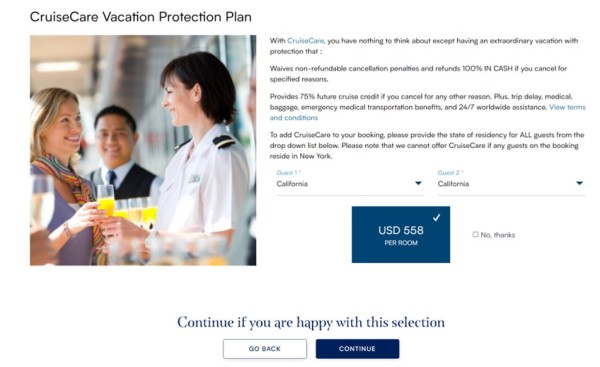

Of course, no adventure is complete without proper travel protection. Azamara’s travel insurance program, Azamara CruiseCare is underwritten by Arch Insurance Company. The Azamara CruiseCare plan provides what can only be described as basic coverages. As you make your way through the selections on the Azamara website, you are asked whether you would like to add this plan to your reservation.

Sample Cruise Itinerary

To be able to demonstrate the quality of coverage, price and benefit levels of the Azamara CruiseCare plan versus other plans available in the wider travel insurance marketplace, we need to take a vacation. So let's hoist the main-sail, order our sail-away cocktails and take a trip with Azamara.

To get an idea of Azamara’s travel insurance plan and cost we attempted to book our cruise. We chose the 10-day Greece Intensive Voyage, from August 10 - 19, 2022. For our quote our travelers are both aged 65. They reside in California and the total cost of the cruise for both travelers is $6,559.

Once we’ve selected our room through the Azamara site, we arrive at the travel insurance option page. The cost for this plan seems to be based on varying factors. If one were to select a different room or a different package, the price of the Azamara CruiseCare changes. It is not clear how pricing is structured. In our case, the cost of the Azamara CruiseCare insurance for our trip is $558 for both travelers.

When traveling outside the United States, our team at Cruise Insurance 101 recommend a minimum coverage of $100,000 in Medical Insurance, $250,000 in Medical Evacuation, and if at all possible we strongly advocate you select a plan that gives you a Pre-existing Medical Condition Waiver.

Turning to the Azamara CruiseCare , we can see that the policy provides the following basic travel insurance coverages:

- Trip Interruption: up to 150% of total trip cost

- Trip Delay: up to $500 for catch-up expenses

- Accident Medical: up to $25,000 if you get hurt on your vacation

- Sickness Medical: up to $25,000 if you get sick on your vacation

- Emergency Medical Evacuation: up to $50,000 if you need emergency medical transportation

- Baggage Protection: up to $1,500 if your bags are lost, stolen or damaged

- Baggage Delay: up to $500 to purchase necessary personal items if your bags are delayed

- Missed Connection: up to $300 for transportation expenses

Further on in this review we explain why we recommend much higher limits to those offered by the Azamara CruiseCare plan, and we provide an objective review of Azamara’s insurance cost for coverage by comparing it to some of the other independent travel insurance providers available to you.

Comparison Quotes

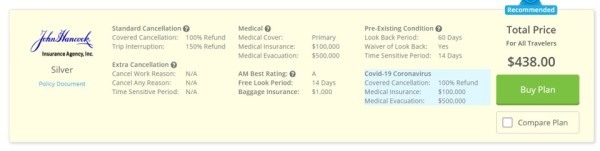

Based on our sample couple, both aged 65 years, we created comparison quotes using Cruise Insurance 101’s travel insurance marketplace engine. The trip cost used for the comparison is the cruise cost for both travelers, $3,279.50 per person, for a total of $6,559.

We used Cruise Insurance 101 ’s recommendation of a minimum coverage of $100,000 in Medical Insurance, $250,000 in Medical Evacuation, and a Pre-existing Medical Condition Waiver to choose the selected quotes. We beleive this is the minimum acceptable coverage for excursions outside the United States.

The least expensive plan with adequate coverage on our quote from Cruise Insurance 101 is the John Hancock Silver .

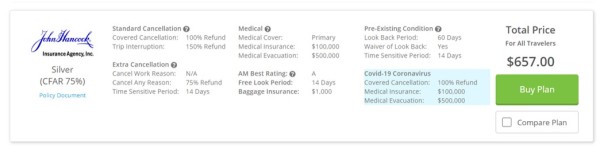

For a Cancel For Any Reason policy to provide greater cancellation flexibility, we chose the John Hancock Silver (CFAR 75%) , because it is the least expensive plan which includes Cancel For Any Reason (CFAR) benefits, and would be comparable to the Azamara CruiseCare plan.

Next, we break down the benefits of each policy in a side-by-side comparison so you can see what coverage levels and price the three options give you.

Cost Comparison

Overall, it is clear to see that the Azamara CruiseCare has minimal coverage. Their Protection Plan Plus (CFAR) policy does not increase coverage from their standard policy and only provides a cruise credit valid for one year if using the CFAR option. Both Cruise Insurance 101 policies provide 4x the medical coverage and 10x the medical evacuation coverage over the Azamara CruiseCare policy.

By shopping for cruise insurance through Cruise Insurance 101 , our two travelers can save over $100 for a standard cancellation plan, which can be applied to airfare, additional tours, or shopping. Or, for only about $50 more per person, they can secure this same great coverage plus a cancel for any reason benefit which would give them a 75% cash refund if canceling for a reason not listed in the policy.

In the following sections, we explain why we make certain recommendations and what we suggest you look for when shopping for travel insurance for your Azamara cruise.

Trip Cancellation

A significant concern for travelers is Trip Cancellation . If you became ill or had an accidental injury prior to your departure date, you may have to cancel your travel arrangements, resulting in financial losses. While this would of course be disappointing, Trip Cancellation is doubly painful without cancellation insurance.

Azamara’s CruiseCare Plan permits cancellation for the following reasons:

- Sickness, injury, or death of yourself, a traveling companion, or members of either of your immediate families, which is diagnosed and treated by a physician at the time your cruise vacation is terminated

- Involvement in a traffic accident, en route to departure, that causes you to miss your cruise

- Your home is made uninhabitable by a natural disaster such as fire, flood, earthquake, hurricane, or volcano

- You are called into active duty by the military to provide aid or relief as a result of a natural disaster

- Subpoena or being called to serve for Jury duty

The above list is indeed valuable coverage; however, at Cruise Insurance 101 , recommend policies that also include:

- Inclement weather

- Involuntary Termination (layoff)

- Default or bankruptcy of the common carrier or travel supplier

- Employer-initiated transfer of 250 miles or more

- Destination uninhabitable or unreachable by fire, flood or natural disaster

- Mechanical breakdown of a common carrier

- Documented theft of passports or visas.

The John Hancock Silver plan offers a far broader list of covered reasons, including cancelling due to contracting COVID.

Trip Interruption

A Trip Interruption is a situation during your trip that causes you to miss some or the rest of your vacation. It’s like Trip Cancellation but happens during your travels.

The most common trip interruption is the injury or illness of a traveler. If you had an injury or illness on your vacation but can continue traveling after treatment, trip interruption reimburses the unused portion of the trip, and the cost to rejoin the trip in progress.

Trip interruption also includes a family member who had a sudden grave illness or passed away. If your covered situation requires curtailing the trip and going home early, Trip Interruption also reimburses for the unused portion of the trip, plus the added cost of going home early.

In the Azamara CruiseCare insurance policy, Trip Interruption benefits share the same list of covered reasons as Trip Cancellation. Same goes for the John Hancock plan—the broad list of covered reasons for Trip Cancellation also applies to Trip Interruption. Both the Azamara CruiseCare plan and the John Hancock plan offer 150% of trip costs for interruption. Therefore, they cover up to 100% of the unused costs, plus up to an additional 50% to cover transportation costs to return home. This is a useful coverage as return flights on the day you need them are likely to be far more expensive than booking onths in advance.

Cancel For Any Reason

Cancel For Any Reason cruise insurance provides the highest level of flexibility and reimbursement if you must cancel your trip for any reason not covered by the policy.

If you cancel your Azamara cruise for a reason not listed in the CruiseCare policy, they grant future credits for 90% of the prepaid, non-refundable cancellation fees paid to them. Credits expire after one year, are non-transferrable and not redeemable for cash. Azamara, not their insurance policy, provides this Cancellation Penalty Waiver. When it comes to refunds, we always prefer cash since future credits may not be used.

Alternatively, travel insurance policies like John Hancock Silver with Cancel For Any Reason included pay a 75% cash refund of all prepaid, non-refundable trip costs including arrangements made outside of Azamara. This could include flights, hotels, rental cars, excursions, and transfers.

Cancel For Any Reason policies have several stipulations:

- Purchase the policy within 10 - 21 days (depending on policy), of your initial payment or deposit date and

- Insure 100% of the prepaid trip costs subject to cancellation penalties or restrictions. For additional prepaid non-refundable payments made after the purchase of the policy, insure within 10-21 days (depending on policy), of each subsequent payment added to your trip, and

- Cancel your trip 2 days or more before your scheduled departure date.

Medical Insurance for Emergency Treatment

One of the biggest concerns that most people have when travelling abroad is Medical Insurance . Anything can happen, including accidental injuries or sudden illness. Many Americans mistakenly believe countries with universal health care will treat them for free. Unfortunately, this is not the case.

Instead, Americans receive treatment at private hospitals, not public, and must pay like anyone else. Admission for inpatient care can cost $3,000-$4,000 per day, plus the cost of treatment, x-rays, surgeries, and specialists.

A common question we’re asked is, “Would my primary medical plan in the USA cover me internationally?” Most of the time, it would not. Even when there is international coverage, we find there are large deductibles to be met first. For example, while Medicare does not cover you overseas, some Medicare supplements do, but have lifetime limits or reduced benefits, and pay for emergencies only. They can still require you to pay a 20% coinsurance.

If you have a medical emergency when traveling and don’t have proper medical insurance coverage, you could find yourself with devastatingly large hospital bills.

Cruise Insurance 101 urges overseas travelers to take travel medical insurance of at least $100,000 per person . In a medical emergency, $100,000 provides ample health care and helps protect your retirement savings from unexpected financial burdens.

Azamara CruiseCare only provides a $25,000 benefit for Medical Insurance. John Hancock’s Silver policy includes $100,000 per person of Medical Insurance, so you can receive proper care and treatment without finding yourself in debt.

Emergency Medical Evacuation

Unfortunately, injuries and illnesses don’t always occur while you are near a hospital. An accident can happen on a ship, during a culturally immersive tour or in some other remote location. This is where Emergency Medical Evacuation becomes crucial. This coverage pays to transport you from the place of injury or illness to the closest hospital able to adequately treat your condition. Once you’re stable enough for transport, Medical Evacuation brings you home via commercial flight or, if necessary, private medical jet.

Medical flights can cost up to $25,000 per hour, and regular health insurance typically would not cover this cost. In addition, the US State Department does not offer any medical treatment or evacuation assistance for US citizens. Cruise Insurance 101 recommends that travelers hold at least $250,000 in Medical Evacuation to assure there’s enough coverage to bring you safely home from almost anywhere in the world. Note: When travelling to Asia, Africa or beyond, the team at Cruise Insurance 101 recommend you carry at least $500,000 of Medical Evacuation coverage.

Azamara’s CruiseCare plan includes Medical Evacuation, but only up to $50,000 per person. By contrast, the John Hancock Silver provides $500,000 per person for Medical Evacuation. That’s an extra zero on the end ($450,000 more coverage) for more than $100 less in premium! It certainly pays to shop around! Consider this extra money in your wallet to go out to dinner, buy souveniers, or see a show at one of the ports-of-call.

Pre-existing Medical Conditions

A significant concern, especially for senior travelers , can be pre-existing medical conditions. A Pre-Existing Medical Condition is one in which you’ve received medical treatment, testing, medication changes, added new medications, or received a recommendation for a treatment or test that hasn’t happened yet. Most travel insurance policies exclude pre-existing conditions unless you purchase the policy within the required time period from your initial trip deposit date (called the Time Sensitive Period). Otherwise, the insurer will look backward 60, 90, or 180 days (depending on the policy) from the date you purchased the insurance to see if there are any pre-existing medical conditions they won’t cover. This is called the Look Back Period. Any medical conditions older than this Look Back Period, unchanged or stabilized with no medication dosage changes are covered, as are any new conditions that arise after you purchase the policy.

If you must cancel, interrupt, or seek medical treatment for a medical condition while traveling, travel insurance policies typically exclude claims related to Pre-existing Medical Conditions. However, if you purchase the policy within a few days of your Initial Trip Payment or Deposit date, many policies add a Waiver to the policy that covers Pre-existing Conditions. As a result, there is no Look Back Period, and Pre-existing Conditions are covered.

Sadly, the Azamara CruiseCare policy does not cover any Pre-existing conditions. The John Hancock Silver policy, with and without CFAR, does cover Pre-existing Medical Conditions if the policy is purchased during the 14-day Time Sensitive Period.

Price and Value

In comparison to the John Hancock Silver and John Hancock Silver (CFAR 75%) policies we found on Cruise Insurance 101 , the Azamara CruiseCare plan falls short in several areas. The CruiseCare plan provides minimal coverage and is more expensive than other available options. The medical insurance coverage is only $25,000, and medical evacuation is only $50,000, which may not be adequate for a serious illness or injury. Cancellation reasons are limited and adding the Cancel For Any Reason option only grants future cruise credits that expire after a year. Overall, the CruiseCare plan offers limited value for the price.

In contrast, by comparison shopping, we found the John Hancock policy comes in at $438 ($120 LESS than Azamara!) It includes superior medical and evacuation benefits, 100% refund for trip costs for covered cancellation, 150% refund for covered trip interruption, and a robust list of cancellation reasons. The John Hancock Silver also comes with the option to add a true, cash back CFAR option for a total policy premium of only about $100 more than the Azamara plan.

After extensive review of both policies, we’ve determined the Azamara CruiseCare plan, while featuring some important coverages, lacks many of the essential benefits we feel a travel policy should include at the limits we recommend. Unfortunately, medical coverage and medical evacuation limits are low, and there are a limited number of covered cancellation and interruption reasons. Overall, we rate it a 6 out of 10.

Travelers planning a culturally immersive Azamara Cruise will find the best value for their money and peace of mind when they shop around for travel insurance at Cruise Insurance 101 – the Travel Insurance Marketplace. There, you can review dozens of options, easily compare prices, and select the best policy to fit your needs.

Remember, Cruise Insurance 101 recommends having at least $100,000 in travel medical coverage and $250,000 emergency medical evacuation when traveling outside the US ($500,000 if travelling to Asia or Africa). And, if you purchase the policy within the 14-21 days of initial trip payment, please consider a travel insurance policy with the Pre-existing Condition Waiver included to ensure the most coverage for your money.

If you are planning an Azamara cruise in 2022, be sure to pack insurance before you travel. You never know when you may need it.

Have questions? Chat with us online, send us an email at [email protected] or alternatively call us at +1(786) 751-2984 . We would love to hear from you.

Safe Travels!

This article has been written for review purposes only and does not suggest sponsorship or endorsement of AARDY by the trademark owner.

Recent AARDY Travel Insurance Customer Reviews

Lady Coinbits

My agent, Shanna was awesome. Helped me find the best policy or my needs and explained everything to me.

monica munoz

Excellent customer service.

Spoke to Melanie. Excellent customer service, she was very thorough, answered all my questions, and was very nice.

A number of policies to choose from

A number of policies to choose from. Fast response. Reasonable price.

Azamara Travel Insurance

Highlights of the Allianz Expedition insurance plan are outlined below. Price varies by state and is 10% to 12.25% of the trip cost.

* “Trip cost” is equal to the price for travel expenses you are booking on our partner’s website at the time you purchase insurance. It does not include any trip expenses booked separately, gift cards, or merchandise, so the trip cost insured may not include the full cost of your planned travel. After you purchase, you may insure additional trip costs by modifying your plan at agentmaxonline.com or calling us at 800-284-8300. Insuring additional trip costs requires additional premium. Minimum amount of Trip Cancellation and Trip Interruption coverage purchasable under this plan is $300 per person. Maximum amount of Trip Cancellation coverage purchasable under this plan is $100,000 per person. Maximum amount of Trip Interruption coverage purchasable under this plan is $100,000 per person. *Benefit limits shown apply in most states. Azamara will offer a Cancel for Any Reason (CFAR) waiver option, which will provide 80% of the non-refundable cruise fare (as a future cruise credit with Azamara) for cancellation reasons not covered by the Expedition Plan. Disclosures Plans are subject to terms, conditions and exclusions. Plan charge includes the price for insurance benefits and assistance services. See Pricing Details for more information, or call us at 800-284-8300. AGA Service Company dba Allianz Global Assistance (AGA) compensates its travel (including event) suppliers or agencies for allowing AGA to market or offer products to customers of the supplier or agency. By purchasing, you agree to Allianz Global Assistance's Purchase Terms and Disclosures and Privacy Policy , including receiving notices and communications electronically. Your plan includes a waiver of the exclusion for pre-existing medical conditions if you meet the requirements listed in your plan; otherwise, the exclusion for pre-existing medical conditions will apply. All other terms, conditions, and exclusions apply. See Plan Details for more information. This plan includes insurance benefits and assistance services. This plan is offered and sold only as a single pay, single term, indivisible package of benefits and services. OUR PROMISE TO YOU Since your satisfaction is our priority, we are pleased to provide you 15 days (or more, depending on your state of residence) to review your plan. If, during this period, you are not completely satisfied for any reason, you may cancel your plan and receive a full refund of the plan price. After this period, the plan price is nonrefundable. Please note, no refund is available if the trip has started, a claim has been filed, or the policy has ended. PLEASE BE ADVISED: This plan contains insurance benefits (which may include disability and/or health insurance benefits) that only apply during the covered trip. This optional coverage may duplicate coverage or refunds already available or provided by your personal auto, home, renter’s, health, life, personal liability, or other insurance policy or source of coverage or refund, but may be subject to different restrictions. You should review the terms of this policy with your existing coverage. If you have any questions about your current coverage, call your insurer/health plan or insurance agent/broker. This insurance is not required to purchase any other products/services. Unless licensed, travel retailers and their employees may provide general information about the insurance, including a description of coverage and price, but are not qualified/authorized to answer technical questions about terms, benefits, exclusions, and conditions of the insurance or evaluate the adequacy of existing coverage. Plans are intended for U.S. residents only and may not be available in all jurisdictions. Insurance benefits underwritten by Jefferson Insurance Company (NY, Administrative Office: 9950 Mayland Drive, Richmond, VA 23233), rated “A+” (Superior) by A.M. Best Co., under Jefferson Form No. 101 series. A+ (Superior) is the 2nd highest of A.M. Best’s 13 Financial Strength Ratings. Plans only available to U.S. residents and may not be available in all jurisdictions. Allianz Global Assistance and Allianz Travel Insurance are marks of AGA Service Company dba Allianz Global Assistance or its affiliates. Allianz Travel Insurance products are distributed by Allianz Global Assistance, the licensed producer and administrator of these plans and an affiliate of Jefferson Insurance Company. The insured shall not receive any special benefit or advantage due to the affiliation between AGA Service Company and Jefferson Insurance Company. Any Non-Insurance Assistance services purchased are provided through AGA Service Company. Except as expressly provided under your plan, you are responsible for charges you incur from third parties. Contact AGA Service Company at 800-284-8300 or 9950 Mayland Drive, Richmond, VA 23233 or [email protected] . This is not a complete description of all benefits and limitations. For full terms and conditions of coverage, ask your Vacations To Go cruise counselor. Prices, terms and conditions listed in this summary are subject to change without notice and need to be reconfirmed with your Vacations To Go cruise counselor at the time of booking. If you book an Azamara cruise, you can purchase insurance from Azamara or from the independent insurance provider, Generali Global Assistance (formerly CSA Travel Protection). Click here to see details of the Go Plan from Generali Global Assistance.

Travel Insurance

An illness, an accident or an unexpected situation can arise before or during any type of vacation. Such an event might cause you to cut short your cruise or cause your trip to be canceled altogether. Unfortunately, most cruise lines impose penalties for canceling a cruise, up to and including loss of the entire cruise price.

Because a cruise is a significant investment, most cruise lines offer some form of insurance to protect their passengers from financial loss in the event of an emergency. Details and prices vary from cruise line to cruise line, as do coverage limits and exclusions.

If you decide to purchase insurance, you will have two options, to go with the cruise line's plan or to use our independent insurance provider, Generali Global Assistance. Use the summaries below to compare policies and prices.

Generali can provide insurance coverage to all customers, regardless of their country of citizenship, except residents of the province of Quebec, Canada.

For more information or a complete copy of a policy, ask your Vacations To Go cruise counselor.

Independent Insurance Coverage

Generali Global Assistance

Cruise Line Coverage

- Cruise and Hotels

- Azamara Club Cruises

- Protect Your Azamara Club Cruises Experience with the Best Travel Insurance

Traveling on an Azamara Club Cruise is an extraordinary experience, filled with luxury, relaxation, and exploration. However, unexpected events can occur, and it’s essential to protect your investment and ensure a worry-free journey. This is where the best travel insurance comes into play, safeguarding your Azamara Club Cruises experience and granting you peace of mind.

Whether you’re embarking on a Mediterranean adventure, exploring the breathtaking beauty of Alaska, or indulging in the vibrant cultures of Asia, having the right travel insurance can make all the difference. With comprehensive coverage, you can protect yourself against unforeseen circumstances such as trip cancellation or interruption, medical emergencies, lost or delayed baggage, and more. By choosing the best travel insurance for your Azamara Club Cruises experience, you can fully immerse yourself in the journey, knowing that you’re well-prepared for any eventuality.

To help you understand the importance of protecting your Azamara Club Cruises experience with the best travel insurance, here are some key points to consider:

By carefully selecting the best travel insurance for your Azamara Club Cruises experience, you can protect yourself against potential financial losses and enjoy your journey to the fullest. Remember to review the policy terms and conditions thoroughly, including exclusions and limitations, to ensure it aligns with your specific needs.

Trusted sources: – [Azamara Club Cruises](https://www.azamara.com/) – [Travel Insurance Review](https://www.travelinsurancereview.net/) – [InsureMyTrip](https://www.insuremytrip.com/)

Now that you’re aware of the importance of travel insurance, embark on your Azamara Club Cruises adventure with confidence, knowing that you’ve taken the necessary steps to protect your experience. Bon voyage!

Can you add travel protection after booking a cruise?

Adding travel protection after booking a cruise with Azamara Club Cruises is a smart decision to safeguard your experience. Travel insurance provides crucial coverage for unexpected events such as trip cancellations, medical emergencies, lost luggage, and more. It is important to note that travel protection must typically be purchased within a certain time frame after booking the cruise, so it is advisable to act promptly. By investing in the best travel insurance for your Azamara Club Cruises experience, you can have peace of mind knowing that you are protected against unforeseen circumstances that may disrupt your trip.

Are cruises covered under travel insurance?

Cruises are indeed covered under travel insurance, providing peace of mind and protection for your Azamara Club Cruises experience. Whether you’re embarking on a luxurious voyage or exploring exotic destinations, having the right travel insurance ensures that you are safeguarded against unforeseen circumstances. From trip cancellation and interruption to medical emergencies and lost luggage, comprehensive travel insurance offers a safety net for your cruise adventure. It is essential to choose the best travel insurance policy that suits your needs and covers all aspects of your Azamara Club Cruises journey. By selecting the right insurance, you can relax and fully enjoy your cruise, knowing that you are protected every step of the way.

Does cruise insurance cover cancellations?

Cruise insurance can provide coverage for cancellations, offering peace of mind and financial protection for travelers. When you book an Azamara Club Cruise, it is essential to consider the best travel insurance options to safeguard your experience. In the event of unforeseen circumstances such as illness, injury, or a family emergency, cruise insurance can reimburse you for non-refundable expenses, including the cost of your cruise, flights, and accommodations. It is important to review the policy details, as coverage may differ depending on the insurance provider and the specific plan chosen. By securing the right travel insurance, you can protect your investment and enjoy your Azamara Club Cruises with confidence.

What is the Azamara price guarantee?

The Azamara price guarantee is a valuable feature provided by Azamara Club Cruises, ensuring that customers receive the best price for their cruise experience. With this guarantee, if the price of a cruise drops after booking, Azamara will adjust the fare to the lower rate, allowing travelers to save money. This guarantee provides peace of mind and helps protect your investment in an Azamara Club Cruise. To make the most of this benefit, it is important to have the best travel insurance in place. By obtaining comprehensive travel insurance, you can safeguard your Azamara Club Cruises experience and ensure that you are protected against any unforeseen circumstances that may arise during your trip. It is always wise to compare different travel insurance policies to find the one that offers the most suitable coverage for your needs. With the right travel insurance, you can fully enjoy your Azamara Club Cruises experience, knowing that you are protected financially and have the best price guarantee on your side.

When it comes to planning a luxurious cruise experience with Azamara Club Cruises, it is essential to consider protecting your investment with the best travel insurance. While cruising can be a delightful and relaxing way to explore the world, unexpected events can sometimes disrupt your plans. Whether it’s a medical emergency, trip cancellation, or lost luggage, having the right insurance coverage can provide peace of mind and financial protection.

One of the key aspects to consider when choosing travel insurance for your Azamara Club Cruises experience is medical coverage. While most cruise ships have onboard medical facilities, the cost of medical treatment can be exorbitant, especially if you require evacuation to a shoreside hospital. Therefore, it is crucial to opt for a travel insurance plan that offers comprehensive medical coverage, including emergency medical evacuation. This coverage ensures that you will receive the necessary medical care, even in remote locations, without worrying about the financial burden.

Another essential aspect to consider is trip cancellation and interruption coverage. Azamara Club Cruises offers a wide range of itineraries, from short getaways to extended voyages. However, unforeseen circumstances such as illness, family emergencies, or natural disasters can force you to cancel or cut short your trip. With the right travel insurance, you can be reimbursed for non-refundable expenses, such as cruise fares, airfare, and pre-paid shore excursions. This coverage provides financial protection and allows you to reschedule or plan a new trip without incurring significant losses.

Additionally, travel insurance can protect you against baggage loss, delays, and theft. While Azamara Club Cruises takes great care of its passengers’ belongings, incidents can still occur during the journey. Having insurance coverage for lost or stolen luggage ensures that you can replace essential items and continue enjoying your cruise experience without disruption. Moreover, if your baggage is delayed, travel insurance can provide compensation for the necessary purchases of clothing and toiletries until your belongings are returned to you.

To ensure that you are adequately protected during your Azamara Club Cruises experience, it is important to choose a reputable travel insurance provider. One trusted option is Allianz Global Assistance, which offers a range of comprehensive travel insurance plans. Their plans are designed to meet the specific needs of cruisers, providing coverage for medical emergencies, trip cancellation, baggage loss, and more. With over 25 years of experience in the travel insurance industry, Allianz Global Assistance has established itself as a reliable and customer-focused provider.

In conclusion, protecting your Azamara Club Cruises experience with the best travel insurance is a wise decision. By choosing a comprehensive plan that includes medical coverage, trip cancellation protection, and baggage protection, you can enjoy your cruise with peace of mind. Remember to select a reputable travel insurance provider, such as Allianz Global Assistance, to ensure that you receive the necessary support and assistance in case of unexpected events. So, before embarking on your next Azamara Club Cruises adventure, take the time to research and invest in the right travel insurance to safeguard your journey.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Any Experience with Azamara Travel Insurance? CruiseCare

By JM0115 , November 6, 2022 in Azamara

Recommended Posts

What has been your experience with CruiseCare? Or should I buy travel insurance on my own?

Link to comment

Share on other sites.

takemewithyou

Definitely your own. Always better. There is a good forum on Cruise Citric for this:

https://boards.cruisecritic.com/forum/499-cruisetravel-insurance/

Please sign in to comment

You will be able to leave a comment after signing in

- Welcome to Cruise Critic

- ANNOUNCEMENT: Set Sail Beyond the Ordinary with Oceania Cruises

- ANNOUNCEMENT: The Widest View in the Whole Wide World

- New Cruisers

- Cruise Lines “A – O”

- Cruise Lines “P – Z”

- River Cruising

- Cruise Critic News & Features

- Digital Photography & Cruise Technology

- Special Interest Cruising

- Cruise Discussion Topics

- UK Cruising

- Australia & New Zealand Cruisers

- Canadian Cruisers

- North American Homeports

- Ports of Call

- Cruise Conversations

Announcements

- New to Cruise Critic? Join our Community!

Write Your Own Amazing Review !

Click this gorgeous photo by member SUPERstar777 to share your review!

Features & News

LauraS · Started 5 hours ago

LauraS · Started Monday at 09:50 PM

LauraS · Started Monday at 05:37 PM

LauraS · Started Monday at 04:09 PM

LauraS · Started Monday at 06:02 AM

- Existing user? Sign in OR Create an Account

- Find Your Roll Call

- Meet & Mingle

- Community Help Center

- All Activity

- Member Photo Albums

- Meet & Mingle Photos

- Favorite Cruise Memories

- Cruise Food Photos

- Cruise Ship Photos

- Ports of Call Photos

- Towel Animal Photos

- Amazing, Funny & Totally Awesome Cruise Photos

- Write a Review

- Live Cruise Reports

- Member Cruise Reviews

- Create New...

- Need help? 1-888-751-7804 1-888-751-7804

- Let Us Call You CALL ME

- Drink Packages

- Flights by Celebrity℠

- Hotels by Celebrity

- Manage Reservation

- Shore Excursions

- Upgrade with MoveUp

- My Tier and Points

- Join Captain's Club

Already booked? Sign in or create an account

- South Korea

- New Zealand

- Grand Cayman

- St. Maarten

- U.S Virgin Islands

- New England & Canada

- Pacific Coast

- Antarctic Ocean

- Panama Canal

- Transatlantic

- Transpacific

- Cruise Ports (+300)

- Mediterranean

- Perfect Day at CocoCay

- All Inclusive

- Bucket List Cruises

- Cruise & Land Package

- Groups & Events

- New Cruises

- Popular Cruises

- Specialty Cruises

- Destination Highlights

- Group Excursions

- Private Journeys

- Shore Excursions Overview

- Small Group Discoveries

- 360° Virtual Tours

- Celebrity Apex®

- Celebrity Ascent℠ NEW

- Celebrity Beyond℠

- Celebrity Constellation®

- Celebrity Edge®

- Celebrity Eclipse®

- Celebrity Equinox®

- Celebrity Infinity®

- Celebrity Millennium®

- Celebrity Reflection®

- Celebrity Silhouette®

- Celebrity Solstice®

- Celebrity Summit®

- Celebrity Xcel℠ COMING SOON

- Explore Edge Series

Galapagos Expedition Series

- Celebrity Flora®

- Celebrity Xpedition®

- Celebrity Xploration®

- The Retreat

- All Suites. All Included

- Iconic Suite

- Penthouse Suite

- Reflection Suite

- Royal Suite

- Signature Suite

- Celebrity Suite

- Aqua Sky Suite

- Horizon Suite

- Sunset Suite

- Concierge Class

- Galapagos Accommodations

- Eat & Drink

- Entertainment

- Spa & Wellness

- Cruising 101

- Cruise Fare Options

- Cruise Tips

- First Time on a Cruise

- What is Included on a Cruise

- Future Cruise Vacations

- Accessible Cruising

- Captain's Club Rewards

- Cruise Insurance

- Flights by Celebrity

- Healthy at Sea

- Manage Cruise

- The Celebrity Store

- Travel Documents

- Royal Caribbean International

- Celebrity Cruises

- 75% Off 2nd Guest + Bonus Savings

- 3rd and 4th Guests Sail Free

- Galapagos 20% Savings + Free Flights

- Resident Rates

- Exciting Deals

- View All Offers

- All Included

- Cruise & Land Packages

- Dining Packages

- Photo Packages

- Wi-Fi Packages

- View All Packages

- Captain's Club Overview

- Join the Club

- Loyalty Exclusive Offers

- Tiers & Benefits

- Celebrity Cruises Visa Signature® Card

Enjoy 75% off your second guest’s cruise fare and get bonus savings of up to $150. Plus, additional guests in your stateroom sail free on select sailings.

CruiseCare Travel Protection

We want this to be the best vacation of your life. And, to make sure you have the most carefree vacation possible, we offer CruiseCare®. CruiseCare® is an optional travel protection add-on to your cruise booking that’s available through Celebrity for US residents in all states except New York 1 . For New York residents who wish to purchase the product, please visit https://travelcruisecare.com.

Call to add

1-888-751-7804

New York residents may call Aon Affinity Services

1-800-797-4516

Why Travel Protection?

Cancellation penalty waiver program – non-insurance features provided by celebrity cruises.

Allows you to cancel and waives the normally non-refundable cancellation charges if you need to cancel for specified reasons. In addition, CruiseCare® Cancel For Any Reason Cruise Vacation Enhancement makes sure that in the event you choose to cancel for a reason not eligible under the plan, at any time up until departure, Celebrity will provide you with a cruise credit equal to 90% of the non-refundable value of your cruise vacation prepaid to Celebrity, for your use towards a future cruise (excluding Flights by Celebrity).

Trip Interruption & Trip Delay 2

Provides coverage if you can’t start or finish your cruise vacation because you’re sick or hurt, there’s a death in the family, or for another covered reason. For Trip Delays, the plan reimburses up to $2,000 for covered out-of-pocket expenses to catch up to your cruise. For trip interruption the plan covers up to 150% of your total trip cost.

Baggage and Bag Delay Protection 2

If your baggage or personal property is lost, stolen, or damaged, the plan covers up to $1,500. If your bags are delayed or misdirected for more than 24 hours, the plan reimburses up to $2,000 for the purchase of necessary personal items due to a covered delay.

Medical Expense, Evacuation & Repatriation Benefits 2

Should you become injured or sick during your vacation, the plan reimburses for covered medical expenses for up to one year from the date of your accident or illness. It is important to evaluate your current insurance to ensure that you have adequate medical coverage while you are traveling. Depending on your plan, Medicare and other health insurance providers may not cover expenses incurred outside of the US. Coverage is up to $25,000 for Accident or Sickness Medical Expenses, up to $50,000 for Emergency Evacuation and up to $25,000 for Repatriation.

24/7 Emergency Assistance 3 – emergency travel assistance provided by CareFree Travel Assistance TM

Provides 24-hour travel assistance, medical assistance and emergency services, such as: pre-trip health, safety, and weather information, assistance with travel changes, lost luggage assistance, emergency cash transfer assistance, medical consultation, emergency legal, medical and dental assistance and more.

Need to file a claim?

Claims may be filed through Aon Affinity for guests who purchased Celebrity’s CruiseCare® plan. 1 A claim may be filed online at www.aontravelclaim.com . To view terms, conditions and exclusions, visit: https://www.archinsurancesolutions.com/coverage/Celebrity .

1 This Celebrity CruiseCare® plan is an optional travel protection add-on to your cruise booking and is available through Celebrity for residents in all states except New York. New York state residents who are interested in travel protection may contact Aon Affinity by visiting https://travelcruisecare.com or calling Aon Affinity at 1-800 797-4516. If added, CruiseCare® is not effective until the plan cost has been paid. Plan cost is not automatically included as part of your initial cruise deposit.

2 Travel Insurance benefits are administered by Aon Affinity and underwritten by Arch Insurance Company, with administrative offices in Jersey City, NJ (NAIC #11150) under Policy Form series LPT 2013 and applicable amendatory endorsements. This is a brief overview of the coverages. Subject to terms, conditions, and exclusions. This is a general overview of travel insurance benefits available. Coverages may vary in certain states and not all benefits are available in all jurisdictions. Please refer to your certificate of benefits or policy of insurance for detailed terms, conditions and exclusions that apply.

This program was designed and is administered by Aon Affinity. Aon Affinity is the brand name for the brokerage and program administration operations of Affinity Insurance Services, Inc. (TX 13695); (AR 100106022); In CA & MN, AIS Affinity Insurance Agency Inc. (CA 0795465); in OK, AIS Affinity Insurance Services Inc.; in CA, Aon Affinity Insurance Services Inc. (CA 0G94493), Aon Direct Insurance Administrations and Berkely Insurance Agency and in NY, AIS Affinity Insurance Agency.

3 Worldwide Emergency Assistance are emergency travel assistance provided by CareFree Travel Assistance TM . CEL_12162022

View Terms, Conditions and exclusions here.

Consumer Notices | Privacy Policy

www.archinsurancesolutions.com/consumer-notices-aon &

www.archinsurancesolutions.com/documents/archprivacynotice.pdf

Previewing: Promo Dashboard Campaigns

- Favorites & Watchlist Find a Cruise Cruise Deals Cruise Ships Destinations Manage My Cruise FAQ Perfect Day at CocoCay Weekend Cruises Crown & Anchor Society Cruising Guides Gift Cards Contact Us Royal Caribbean Group

- Back to Main Menu

- Search Cruises " id="rciHeaderSideNavSubmenu-2-1" class="headerSidenav__link" href="/cruises" target="_self"> Search Cruises

- Cruise Deals

- Weekend Cruises

- Last Minute Cruises

- Family Cruises

- 2024-2025 Cruises

- All Cruise Ships " id="rciHeaderSideNavSubmenu-4-1" class="headerSidenav__link" href="/cruise-ships" target="_self"> All Cruise Ships

- Cruise Dining

- Onboard Activities

- Cruise Rooms

- The Cruise Experience

- All Cruise Destinations " id="rciHeaderSideNavSubmenu-5-1" class="headerSidenav__link" href="/cruise-destinations" target="_self"> All Cruise Destinations

- Cruise Ports

- Shore Excursions

- Perfect Day at CocoCay

- Caribbean Cruises

- Bahamas Cruises

- Alaska Cruises

- European Cruises

- Mediterranean Cruises

- Cruise Planner

- Make a Payment

- Beverage Packages

- Shore Excursions

- Dining Packages

- Royal Gifts

- Check-In for My Cruise

- Update Guest Information

- Book a Flight

- Transportation

- Book a Hotel

- Required Travel Documents

- Redeem Cruise Credit

- All FAQs " id="rciHeaderSideNavSubmenu-7-1" class="headerSidenav__link" href="/faq" target="_self"> All FAQs

- Boarding Requirements

- Future Cruise Credit

- Travel Documents

- Check-in & Boarding Pass

- Transportation

- Perfect Day at CocoCay

- Post-Cruise Inquiries

- Royal Caribbean

- Celebrity Cruises

What Travel Protection Program does Royal Caribbean offer?

Make sure nothing gets in the way of your adventure with Royal Caribbean Travel Protection program benefits, including medical, baggage and Evacuation coverages to protect you during your trip. With the Royal Caribbean Travel Protection Program Cancellation Penalty Waiver (a non-insurance feature offered by Royal Caribbean), if your plans go awry and you cancel your cruise vacation (for specified reasons), Royal Caribbean will waive the non-refundable cancellation provision of your cruise ticket contract and pay you IN CASH the value of the unused portion of your prepaid cruise vacation. In addition, should you need to cancel for "any other reason" you may be eligible for credit toward a future cruise - up to 90% of the non-refundable, prepaid cruise vacation cost.

Because our liability for loss or damage is limited by the Cruise Ticket Contract, we recommend that all guests check their own insurance coverage or consider purchasing the Royal Caribbean Travel Protection Program.

RCC_10282020B

Still need help? Contact Us

Get support by phone or email.

Email Your Questions

Locate a Travel Agent

Previewing: Promo Dashboard Campaigns

My Personas

Code: ∅.

IMAGES

VIDEO

COMMENTS

But the unexpected CAN happen, so we encourage every Azamara guest to purchase travel protection. Azamara Trip Protection by Allianz can help protect your vacation investment and give you some peace of mind by providing the following benefits: Allianz (For all states except as noted below) Trip Cancellation. 100% of trip cost. Trip Interruption.

Miami, FL and Richmond, VA, March 29, 2023 — Azamara, the upmarket cruise line and leader in Destination Immersion® experiences, has partnered with Allianz Global Assistance to offer trip protection products to reassure valued guests who are booking with the line. Allianz trip protection includes benefits for covered unexpected cancellations, interruptions, and travel delays, as […]

Embark on your Azamara cruise worry-free. See our latest health and safety protocols that make up our Explore Well at Sea program. Request a Quote Talk to an expert 1-855-292-6272

Insurance benefits underwritten by BCS Insurance Company (OH, Administrative Office: 2 Mid America Plaza, Suite 200, Oakbrook Terrace, IL 60181), rated "A" (Excellent) by A.M. Best Co., under BCS Form No. 52.201 series or 52.401 series, or Jefferson Insurance Company (NY, Administrative Office: 9950 Mayland Drive, Richmond, VA 23233), rated ...

2.6k. April 1, 2012. Canada. #3. Posted March 23, 2019. When I go through an American TA they tell me their insurance products are generally not available to non-Americans. Cruise insurance is usually a rip-off anyway (the insurance firms wouldn't be in business if it wasn't) so I'm not generally fussed. As Whitby says, check out what your ...

Onboard Physicians. Every Azamara vessel is equipped with a medical facility. At least one licensed physician and one nurse are generally in attendance on all Azamara ® voyages. Select medical services and medications are available for a fee, though medication types are limited. While we're here to help with any medical issues that arise ...

This new enhancement to the CruiseCare program guarantees a 100% Future Cruise Credit to U.S. guests sailing before December 31, 2021. Guests who purchase the enhanced CruiseCare protection ...

With Azamara Club Cruises, passengers can sail with confidence, knowing that their health insurance needs are taken care of. For more information on Azamara's health insurance options, please visit their official website at [insert link]. ... Whether it be reviewing the benefits of Azamara's own travel insurance plans or understanding the ...

Across the fleet, you will find we go beyond the expectations of even the most well-traveled cruisers, with our top-tier crew, premiere service and world class amenities. Our ships, Azamara Journey®, Azamara Quest®, Azamara Pursuit®, and Azamara Onward℠, are perfectly sized to cross oceans, sail into intimate rivers, cruise along scenic ...

Azamara has implemented a revised travel insurance program to cover all booking cancellations, regardless of the specified reason, in an effort to give travelers added confidence and flexibility during the coronavirus (COVID-19) outbreak. The updated "CruiseCare" travel protection program guarantees a 100 percent future cruise credit to U.S ...

To get an idea of Azamara's travel insurance plan and cost we attempted to book our cruise. We chose the 10-day Greece Intensive Voyage, from August 10 - 19, 2022. For our quote our travelers are both aged 65. ... John Hancock's Silver policy includes $100,000 per person of Medical Insurance, so you can receive proper care and treatment ...

We need to purchase either Azamara Cruise Care insurance or 3rd party like Travel Guard. Not worried about hotel or flight cancellations so mainly just the cruise portion of our trip. Leaning towards Cruise Care because Too late to get pre existing health condition covered and Azamara offers cred...

All Activity; Home ; Categories ; Cruise Lines "A - O" Azamara ; Any Experience with Azamara Travel Insurance? CruiseCare

20.9k. August 24, 2011. Member Title: Cruise Critic Host & 20,000+ Club. New York. #3. Posted October 28, 2022. In general, it is never good advice to buy insurance from the trip provider. Such insurance does not include Vendor Default coverage, to protect you if the vendor goes bankrupt. You would need to compare the fine print for other ...

Destination Immersion® leader Azamara implements enhanced travel policies and travel insurance program to protect guests booking close-in or in the future

Allianz Travel Insurance products are distributed by Allianz Global Assistance, the licensed producer and administrator of these plans and an affiliate of Jefferson Insurance Company. ... If you book an Azamara cruise, you can purchase insurance from Azamara or from the independent insurance provider, Generali Global Assistance (formerly CSA ...

Because a cruise is a significant investment, most cruise lines offer some form of insurance to protect their passengers from financial loss in the event of an emergency. Details and prices vary from cruise line to cruise line, as do coverage limits and exclusions. ... Cruise Line Coverage Azamara. Find a Bargain Please choose a vacation type ...

Whether you're ready to book, or have a question about your upcoming Azamara cruise, our team is standing by to help. Request a Quote Talk to an expert 1-855-292-6272 Menu Azamara

Your clients can earn 5% in onboard credit when they pay for their cruise in full, 180 days before departure. Learn more. Sign In Help Training Hub Talk to an expert 1-855-292-6272

By investing in the best travel insurance for your Azamara Club Cruises experience, you can have peace of mind knowing that you are protected against unforeseen circumstances that may disrupt your trip. ... Additionally, travel insurance can protect you against baggage loss, delays, and theft. While Azamara Club Cruises takes great care of its ...

Any Experience with Azamara Travel Insurance? CruiseCare Any Experience with Azamara Travel Insurance? CruiseCare. By JM0115, November 6, 2022 in Azamara. Share More sharing options... Followers 1. Recommended Posts. JM0115. Posted November 6, 2022. JM0115. Members; 1.2k October 2, 2018; Colorado USA

Trip Interruption & Trip Delay 2. Provides coverage if you can't start or finish your cruise vacation because you're sick or hurt, there's a death in the family, or for another covered reason. For Trip Delays, the plan reimburses up to $2,000 for covered out-of-pocket expenses to catch up to your cruise. For trip interruption the plan ...

With the Royal Caribbean Travel Protection Program Cancellation Penalty Waiver (a non-insurance feature offered by Royal Caribbean), if your plans go awry and you cancel your cruise vacation (for specified reasons), Royal Caribbean will waive the non-refundable cancellation provision of your cruise ticket contract and pay you IN CASH the value ...