- Trading Strategies

What’s the Pattern Day Trading Rule? And How to Avoid Breaking It

All traders and investors should be aware of the pattern day trading rules. Learn more about the required minimum equity and the number of trades you can make.

Key Takeaways

- You can violate the pattern day trader (PDT) rules without realizing it

The consequences for violating PDT vary but can be inconvenient for investors who are not actively trading

For active investors who want to place an occasional day trade, learn how margin and open positions can affect total trade equity to help avoid PDT violations

You’re not normally a rule-breaker. But violating the pattern day trader rule is easier to do than you might suppose, especially during a time of high market volatility. Don’t let this happen to you. Here’s what you need to know.

First, a hypothetical. Suppose you bought several stocks in your margin account. Minutes or hours later, you change your mind, so you sell them. Your “round trip” (buy and sell) trades all took place on the same trading day.

If you execute four or more round trips within five business days, you will be flagged as a pattern day trader.

Here’s where you might be dinged: If you’re flagged as a pattern day trader and you have less than $25,000 in your account, you could be restricted from opening new positions.

So, what now? You’re in trouble, but what are the consequences? What if you do it again? More importantly, what should you know to avoid crossing this red line in the future? Keep in mind that you don’t have to borrow on margin to violate the pattern day trader rule. It’s a good idea to be aware of the basics of margin trading and its rules and risks .

There are a few simple but strict rules that define pattern day trading. Let’s go over them.

Round Trip: There and Back Again

What exactly is a day trade.

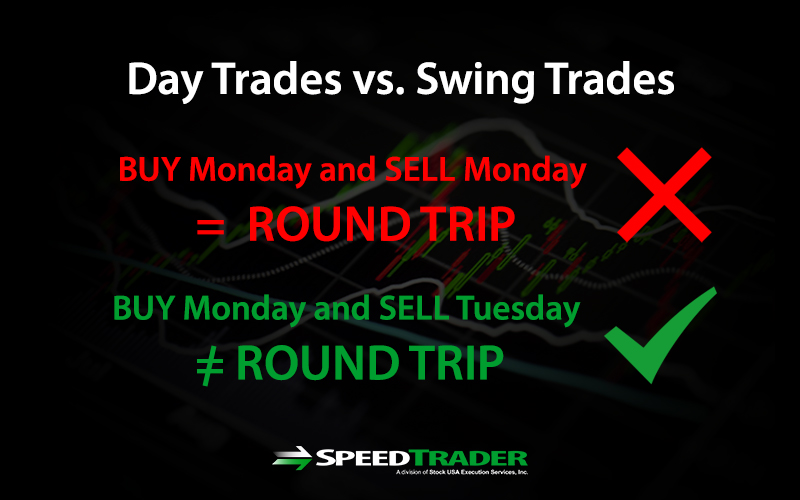

A day trade happens when you open and close a security position on the same day.

Let’s break that down:

- Open and close (round trip): When we say “open and close,” it means buying and selling, or for short sellers, selling (short) and then buying. This is also called a “round trip.”

- Security position: Day trading applies to virtually all securities—stocks, bonds, ETFs, and even options (calls and puts).

- Same day: If you do a round trip on the same day, it’s a day trade. If you hold your security position beyond the close of the trading day, it’s not a day trade.

What is a pattern day trader?

You’re a pattern day trader if you make four or more day trades (as described above) in a rolling five-business-day period, and those trades make up more than 6% of your account activity within those five days.

There are different types of day traders, but we’ll focus on two:

- Self-identified day traders: This includes folks who are actually day traders, meaning their brokerage is aware that they intend to day trade and that they meet the $25,000 minimum account value requirement.

- Pattern day trading violators: These are people who day traded in violation of the rules without meeting the sufficient capital requirement.

Well, I violated the pattern day trader rules. What are the consequences?

Now what? It depends on your brokerage. For first-time offenders, the consequences might not be so bad, assuming your brokerage has a more forgiving policy. However, you’ll likely be flagged as a pattern day trader (in the violator sense) just so your broker can watch your activities for any consistent or repeat offenses. So, tread carefully.

If you make four day trades in a rolling five days, some brokerages may subject you to a minimum equity call, meaning you have to deposit enough funds to have the $25,000 minimum account value (even if you don’t intend to day trade on a regular basis). If you make an additional day trade while flagged, you could be restricted from opening new positions.

This is a big hassle, especially if you had no real intention to day trade. If you violated the pattern day trading rules by accident, or if you were tempted to take some profits (or close out losses) within the same day—enough to get flagged in violation—the hassle just isn’t worth the momentary lapse in caution. But if you inadvertently end up flagged as a day trader and don’t intend to day trade going forward, you can contact your broker who may be able to give you some alternatives to avoid trading restrictions. Regulatory guidance on flag removals is fairly strict and limited. With proper agreements in place, you may have the flag removed from your account one time. As you continue to trade, if your future trading activity constitutes pattern day trading, the pattern day trading flag will be placed back on your account, and it cannot be removed.

If you do want to officially day trade and apply for a margin account, your buying power could be up to four times your actual account balance. You could inform your broker (saying “yes, I’m a day trader”) or day trade more than three times in five days and get flagged as a pattern day trader. This allows you to day trade as long as you hold a minimum account value of $25,000 — just keep your balance above that minimum at all times.

Knowledge: One of your most valuable assets

Check out our wide range of educational resources including articles, videos, an immersive curriculum, webcasts, and in-person events.

I have a little over $25k. Can I place occasional day trades?

Before you do that, be sure you really understand your account balance, as there are many things that can affect your trade equity, such as:

- If you have no open positions, meaning no unrealized gains or losses, then your start-of-day equity is likely to be the same as your previous day’s end-of-day equity.

- If you have open positions, either unrealized gains or losses, then your opening equity will depend on how your positions are marked-to-market at the beginning of the trading day. (Marked-to-market is the value of your positions if they were to be immediately sold or bought at current market prices.)

- If you hold positions with unrealized losses, then your losses may reduce your trade equity (think of them as being marked-to-market at any given time).

- If you’re holding stocks that were bought on margin, then you may need to subtract the amount of maintenance margin from your trade equity, both cash and unrealized returns, to determine how much you actually have. If your account value falls below $25,000, then any pattern day trader activities may constitute a violation.

- If you trade futures, keep in mind that futures cash or positions do not count toward the $25,000 minimum account value.

Bottom line

Getting dinged for breaking the pattern day trader rule is no fun. Of course, if you want to be a more active trader, possibly even do a little day trading on occasion, then you might go ahead and brush up on the rules concerning margin. Otherwise, if you can steer clear of violating the rules, or simply keep your account value well over $25,000, you’ll have less to worry about should you need to execute a short-term trade.

To learn more about day trading, watch the video below.

Start your email subscription

Recommended for you, related videos, more like this, related topics.

Call Us 800-454-9272

Quick Links

- About Ticker Tape

- About TD Ameritrade

- Tools & Platforms

- For Active Traders

- Retirement Planning

- Rollover IRA

- IRA Selection Tool

- Income Solutions

- Goal Planning

- Find a Branch

- Funding & Transfers

- Form Library

Do Not Sell or Share My Personal Information

Content intended for educational/informational purposes only. Not investment advice, or a recommendation of any security, strategy, or account type.

Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Clients must consider all relevant risk factors, including their own personal financial situations, before trading.

Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. Margin is not available in all account types. Margin trading privileges subject to TD Ameritrade review and approval. Carefully review the Margin Handbook and Margin Disclosure Document for more details.

The risk of loss on a short sale is potentially unlimited since there is no limit to the price increase of a security. There is no guarantee the brokerage firm can continue to maintain a short position for an unlimited time period. Your position may be closed out by the firm without regard to your profit or loss.

Market volatility, volume, and system availability may delay account access and trade executions.

Past performance of a security or strategy does not guarantee future results or success.

Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Options trading subject to TD Ameritrade review and approval. Please read Characteristics and Risks of Standardized Options before investing in options.

Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request.

This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union.

FINRA / SIPC , and a subsidiary of TD Ameritrade Holding Corporation. TD Ameritrade Holding Corporation is a wholly owned subsidiary of the Charles Schwab Corporation. TD Ameritrade is a trademark jointly owned by TD Ameritrade IP Company, Inc. and The Toronto-Dominion Bank. © 2024 Charles Schwab & Co., Inc. Member SIPC . --> TD Ameritrade, Inc., member FINRA / SIPC , a subsidiary of The Charles Schwab Corporation. © 2024 Charles Schwab & Co. Inc. All rights reserved.

This link takes you outside the TD Ameritrade Web site.

- Find a Branch

- Schwab Brokerage 800-435-4000

- Schwab Password Reset 800-780-2755

- Schwab Bank 888-403-9000

- Schwab Intelligent Portfolios® 855-694-5208

- Schwab Trading Services 888-245-6864

- Workplace Retirement Plans 800-724-7526

... More ways to contact Schwab

Chat

- Schwab International

- Schwab Advisor Services™

- Schwab Intelligent Portfolios®

- Schwab Alliance

- Schwab Charitable™

- Retirement Plan Center

- Equity Awards Center®

- Learning Quest® 529

- Mortgage & HELOC

- Charles Schwab Investment Management (CSIM)

- Portfolio Management Services

- Open an Account

Active Traders: Beware the Pattern Day Trader Rule

Actively trading securities can be exciting, especially when markets are volatile. But be aware that if you execute too many day trades for the same security in your margin account across too many consecutive sessions, you could be branded a "pattern day trader" and have permanent limits placed on your account.

Here's how it works.

Day trading

Day trading is the purchasing and selling, or selling short and purchasing, of the same security on the same day within a margin account. 1

Pattern Day Trader

If you make four or more day trades over the course of any five business days, and those trades account for more than 6% of your account activity over the period, your margin account will be flagged as a pattern day trader account. (Note that you can day trade in a cash account.)

If this happens, even inadvertently, you'll be required to maintain a minimum balance of $25,000 in the flagged account—on a permanent basis. If you're short of the minimum at the close of any business day, you’ll be limited on the following day to making liquidating trades only.

The Financial Industry Regulatory Authority (FINRA) created the pattern day trader designation after the tech bubble popped back in the early 2000's, with the goal of holding active traders to higher standards than those who trade less frequently.

If you don't want to hold $25,000 in your account at all times, pay close attention to your trades to make sure you don't end up with a flagged account. That said, Schwab does allow a one-time exception to clients who may have been flagged as day traders, so long as they commit to not doing so again.

Day trading at Schwab

If you want to be a day trader, then the $25,000 minimum balance requirement will apply to your account at all times. To help traders keep track of their balances, Schwab displays a feature called Day Trade Buying Power (DTBP), which represents the amount of marginable stock that you can day trade in a margin account without incurring a day trade margin call.

DTBP is displayed under the Margin Buying Power in the Balances section of our platforms.

On Schwab.com:

On StreetSmartEdge:

On StreetSmartCentral:

Each day’s maximum DTBP is determined by the prior night's market close. If you exceed your DTBP, a day trade margin call will be issued for the deficiency.

- The call is due in five business days and can be met by making a deposit, journal or transfer of funds, journal or transfer of marginable stock, or sale of long options or non-margined securities.

- Funds deposited to meet a day trade margin or minimum equity call must remain in the account for a minimum of deposit day plus two business days.

If you don't have an outstanding day trade margin call, your DTBP will update throughout the day as you execute trades—falling with opening trades and rising with closed day trades.

If you do have an outstanding day trade margin call, your DTBP will fall with each opening transaction during the day, but you won’t be credited when transactions close.

A few other things to note:

- Orders for leveraged ETFs reduce DTBP by an amount equal to the cost of the order multiplied by the leverage factor of that particular ETF. For example, if you place a $10,000 order for a 3x leveraged ETF, your DTBP will shrink by $30,000.

- Trades with non-marginable securities are subject to cash account rules, not margin account rules, meaning you can day trade in your margin account without fear of being flagged as a pattern day trader.

- Short Sales of non-marginable securities will reduce the DTBP by an amount equal to the cost of the order multiplied by four.

The bottom line

Having restrictions placed on your account because of pattern day trader rules isn't ideal. If you want to be a more active trader, or occasionally do a little day trading, be sure to keep tabs on all the applicable limits. Otherwise, if you can steer clear of violating the rules, and keep your account value well over $25,000, there will be no restrictions should you need to execute a short-term trade.

1 Exceptions include a long security position (holder owns the security) held overnight and then sold the next day prior to any new purchase of the same security, or a short security position (sale of security borrowed from Schwab) held overnight and then repurchased the next day prior to any new sale of the same security.

What is it like to trade with Schwab?

More from charles schwab.

Today's Options Market Update

Looking to the Futures

Weekly Trader's Outlook

Related topics.

Day trading generally is not appropriate for those with limited resources, limited investment or trading experience, and low risk tolerance.

When considering a margin loan, you should determine how the use of margin fits your own investment philosophy. Because of the risks involved, it is important that you fully understand the rules and requirements involved in trading securities on margin.

For more information please refer to your account agreement and the Margin Risk Disclosure Statement .

- Margin trading increases your level of market risk.

- Your downside is not limited to the collateral value in your margin account.

- Schwab may initiate the sale of any securities in your account, without contacting you, to meet a margin call.

- Schwab may increase its "house" maintenance margin requirements at any time and is not required to provide you with advance written notice.

- You are not entitled to an extension of time on a margin call.

The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third-party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

- ActiveWeb Axos

- ActiveWeb Curvature

- AXOS Clearing

- Curvature Clearing

- Axos Cashiering

Understanding the Pattern Day Trader Rule

Oct 11, 2016 | Day Trading

What Is The Pattern Day Trade Rule?

The Pattern Day Trader (PDT) Rule requires any margin account identified as a “Pattern Day Trader” to maintain a minimum of $25,000 in account equity, in order to day trade. The Financial Industry Regulatory Authority (FINRA) defines a “Pattern Day Trader” as a brokerage customer that executes more than three round trip trades during a rolling five-business day period. Different brokerages may also implement additional requirements for customers.

Customers that are classified as a pattern day trader are required to maintain minimum of $25,000 in account equity in a margin account. PDT restrictions come into effect when the net liquidation value falls under the $25,000 requirement.

What Is the Rationale For PDT Rule?

Day trading became “mainstream” in the late 1990s and reached a fever pitch in 1999-2000. The technology heavy Nasdaq Index skyrocketed through 5,000 by March 2000 fueled by day traders, overvalued initial public offerings (IPOs) and short squeezes. The NASDAQ price/earnings (P/E) ratio grew to 200. Ultimately, the bubble burst in mid-2000, as the Nasdaq collapsed 78% from its highs. Retail traders with dreams of quitting their day jobs to become full-time traders for crushed in the bubble.

The extreme losses suffered by retail day traders prompted the Securities and Exchange Commission (SEC) to implement new rules in an attempt to “protect” unsophisticated retail traders from repeating the same mistakes. The SEC collaborated with the NYSE and NASD to determine a “Pattern Day Trader”, as one who executes four or more round trips in a rolling 5-business day period in a margin account.

The SEC implemented the mandatory $25,000 minimum account equity requirement for accounts that qualified as “Pattern Day Trader” under NASD Rule 2520 and NYSE Rule 431. The PDT Rule attempts to protect small account retail traders. capital (under $25,000) by limiting the trading activity. The assumption is that retail customers with over $25,000 in account equity are assumed to be familiar with the accepted the risks entailed with day trading.

While establishing a minimum watermark, they also increased the buying power for margin accounts above the $25,000 watermark from 2 to 1 up to 4-to-1 margin or 25% margin requirement. Therefore, a margin account with $25,000 cash allowed for up to $100,000 for intra-day buying power and 2 to 1 on overnight positions, or $50,000 in this example.

Monitor Margin Requirements For Volatile Stocks

Individual brokerages may adjust the day trading margin at their discretion, based on their risk assessment for specific stocks based on volatility and liquidity. Therefore, not every stock may be granted a 4 to 1 intra-day margin. It is imperative to check with your brokerage daily on thinly traded and or highly volatile stocks with limited short-able shares.

For example, stocks that are gapping over 20% on news with high short interest are susceptible to limited margin abilities. If a trader assumes 4 to 1 margin on a stock that has been adjusted to 2 to 1 margin by his broker, he may get a margin call or even a forced liquidation without even being aware of it. Stocks with low floats and/or hard to locate short-able shares are especially dangerous. This is how short squeezes are often triggered.

What Defines a Round Trip?

A round trip is defined as buying and selling the same stock or options position during the same day, which includes pre-market, regular market and post-market trading sessions. This means buying to open and selling to close the same stock or options contracts in a single day.

For example, if you buy 500 shares of AAPL and then sell the 500 shares the same day, that is considered a round trip. However, if you buy 500 shares of AAPL today and then sell 500 shares tomorrow, that does not qualify as a day trading round trip. Therefore, the 3 round trips per rolling 5 business days’ period remain in tact.

What Happens If You Break the PDT Rule?

If a margin account’s net liquidation value falls under $25,000 by the close, then the PDT restriction of maximum 3 round trips per 5 business days kicks in starting the next day. If the value rises back above $25,000, then the restrictions may be lifted. The account net liquidation value can be raised either by depositing more funds or the underlying securities rise in value. If the account holder trades more than the maximum 3 round trips within 5 business days, he is flagged for breaking the PDT Rule.

At the discretion of the brokerage, a first-time PDT Rule violation may only receive a warning. However, a second violation will result in the “freezing” of trading activity in the account for 90 days, as mandated by the NYSE regulation. Positions can only be closed during this time and no new open positions can be established. This can be remedied if more funds are deposited into the account to get it above the $25,000 minimum.

Tips for Traders Under the PDT Rule

The following are tips to help prevent violating the PDT Rule:

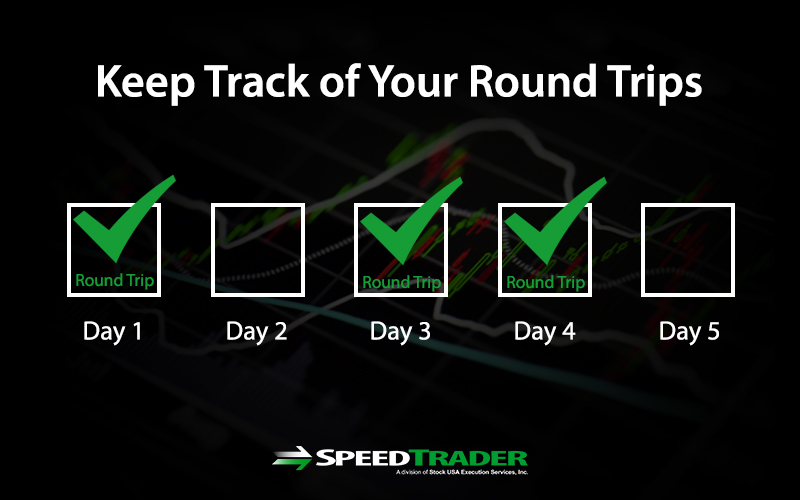

Keep Track of Your Round Trip Trades

This is pretty straightforward. Use a day timer or calendar to track the five-day period after a round trip trade is made. This will be when that specific round trip will reset. Be aware that you are only allowed a maximum of three round trip day trades within a rolling five-business day period.

Spare Your Remaining Round Trips

Consider each round trip as a bullet in an ammunition clip that only holds three bullets. The longer you go without making a round trip, the easier it is to avoid the PDT Rule violation. Each round trip resets after five business days. Be conscious of when a round trip was executed and mark the days on the calendar.

Avoid the Fourth Opening Trade Unless It is an Overnight Trade

Avoid the fourth opening trade within the 5-business day period, unless it is an overnight/swing trade. Some platforms will restrict the fourth opening trade as part of the safety mechanism in the platform algorithm.

Filter Tightly For The Best High-Probability Set-Ups

To avoid triggering the PDT Rule, be a sniper and meticulously plan your round trip trades carefully. In addition to monitoring support/resistance price levels with targets and triggers, you should also manage the allocation carefully in case some or part of the position might require an overnight hold. Prioritize which chart time frame is best suitable for the trade.

Scaling Into and or Out of Positions Separately

Rather than opening a position with one order, it may be more advantageous to consider scaling into the position with multiple orders on pullbacks. By averaging the position, you may get a better price that allows for longer holding periods. The PDT Rule applies only to round trips. Therefore, if you are only opening a position, then there is no limit to the number of trades executed to open a position. The same applies to closing a position. You can use multiple closing trades to average out the position closing price, as long as no shares were opened on the same day.

If you scale into a 900 share long position by executing three separate 300 share buy trade orders, this doesn’t qualify as a round trip. However, if you can close out the trade by selling 300 shares a piece with three separate sell orders, it would qualify as three round trip trades. In this situation, it would be best to close out all 900 shares in a single closing trade if executed on the same day. This would qualify as a single round trip, instead of three. As a rule of thumb, keep the scaling into a position separated by at least an overnight from scaling out of the position.

- Swing Trading

Swing trading usually involves at least an overnight hold. Swing trade positions have smaller allocations than day trade positions due to the inherent risk associated with longer holding periods. Make sure you comfortable with this style, which requires more patience and temperament for larger trading price ranges.

Ready to open an Account?

Check our daily updated short list, new account promo, recent posts.

- A History of Stock Market Crashes – What You Need To Know

- How Do the Stock and Bond Markets Affect Each Other?

- Types of ETFs and How to Trade Them

- How A Company Share Structure Impacts Stock Price

- Understanding Secondary Offerings

- Pair Trading – What You Should Know About This Strategy For Hedging Risk

- Understanding Time Decay – What You Should Know

- Why Serious Day Traders Need A Specialized Broker

- How Dividends Affect Stock Prices – A Deeper Look

- Economic Factors That Can Impact the Stock Market

- Chart Patterns

- Day Trading

- Day Trading Starter Guide

- Fundamental Analysis

- Level 2 Strategies

- Market Recaps

- Options Trading

- Short Selling

- SpeedTrader Updates

- Stock Brokers

- Stock Market

- Technical Analysis

- Technical Indicators

- Trading Platforms

- Trading Psychology

- Trading Strategy

- Trading Tips

Understanding the Pattern Day Trading Rule

Please make sure you fully understand how the PDT rule works before trading.

You’re generally limited to no more than three day trades in a five-trading-day period, unless you have at least $25,000 of equity in your account at the end of the previous day. This sounds tricky, but it just means that if you want to day trade today, you had to have an account value of more than $25,000 at the end of yesterday.

Your portfolio value may fluctuate above $25,000 at some point during the trading day, but we only take into account the closing balance of the previous trading day. To verify whether you are restricted from day trading or not on any given day, click the Day Trade Counter button in your Account Report under the TRADE tab section of your trading platform. If the popup reads “No round trip limitation” and your balance is above $25,000 you are free to day trade.

The five-trading-day window doesn’t necessarily align with the calendar week. For example, Wednesday through Tuesday could be a five-trading-day period. If you place your fourth day trade in the five-day window, your account will be marked for pattern day trading for ninety calendar days. This means you won’t be able to place any day trades for ninety days unless you bring your account equity above $25,000.

Day Trade Counter

- Tap the TRADE tab in the top left corner of your trading software

- Tap Account Report

- Tap Day Trade Counter

One Buy, One Sell

This is one day trade because you bought and sold ABC in the same trading day.

Non-Leading Sell

- Sell 10 ABC

This is one day trade.

Though you already own 10 shares of ABC, you opened a new position in ABC with the initial purchase.

Leading Sell

Since your first transaction for ABC was selling ABC that you already owned from a previous day, it doesn’t count toward your day trades .

Multiple Buys and Sells

This is one day trade because there is only one change in direction between buys and sells.

Examples of Two Day Trades

2x buy and sell.

- Sell 15 ABC

- Sell 35 ABC

This is two day trades because there are two changes in directions from buys to sells.

Order Versus Execution

When you place an order, it won’t actually count as a day trade unless it executes. However, you’ll notice that an open order that you’ve placed but hasn’t been executed will appear as a day trade in your Day Trade Counter. We designed this feature to let you know that if your order executes, you’ll have made another day trade.

Multiple Executions

An order to buy 10,000 shares of XYZ may be split into separate orders.

- Buy 1,000 shares

- Buy 2,000 shares

- Buy 3,000 shares

- Buy 1,500 shares

- Buy 2,500 shares

Placing a sell order before your buy order has been completely filled puts you at risk of executing multiple trades that would pair with each sell order, resulting in multiple day trades.

If you place a sell order before all 10,000 shares are purchased, every sell order (up to five) that you place on this stock on this day would count as a separate day trade.

- Search Search Please fill out this field.

- Definitions O - Z

Round Trip Transaction Costs: Meaning, Profitability, Example

Julia Kagan is a financial/consumer journalist and former senior editor, personal finance, of Investopedia.

:max_bytes(150000):strip_icc():format(webp)/Julia_Kagan_BW_web_ready-4-4e918378cc90496d84ee23642957234b.jpg)

What Are Round Trip Transaction Costs?

Round trip transaction costs refer to all the costs incurred in a securities or other financial transaction. Round trip transaction costs include commissions , exchange fees, bid/ask spreads, market impact costs, and occasionally taxes. Since such transaction costs can erode a substantial portion of trading profits, traders and investors strive to keep them as low as possible. Round trip transaction costs are also known as round turn transaction costs.

Key Takeaways

- Round trip transaction costs refer to all the costs incurred in a financial transaction, such as commissions and exchange fees.

- Over the past two decades, round trip transaction costs have declined significantly due to the termination of fixed brokerage commissions, but still remain a factor to consider in purchasing a security.

- The concept of 'round trip transaction costs' is similar to that of the 'all-in cost,' which is every cost involved in a financial transaction.

How Round Trip Transaction Costs Work

The impact of round trip transaction costs depends on the asset involved in the transaction. Transaction costs in real estate investment, for instance, can be significantly higher as a percentage of the asset compared to securities transactions. This is because real estate transaction costs include registration fees, legal expenses, and transfer taxes, in addition to listing fees and agent's commission.

Round trip transaction costs have declined significantly over the past two decades due to the abolition of fixed brokerage commissions and the proliferation of discount brokerages . As a result, transaction costs are no longer the deterrent to active investing that they were in the past.

The concept of 'round trip transaction costs' is similar to that of the ' all-in cost ,' which is every cost involved in a financial transaction. The term 'all-in costs' is used to explain the total fees and interest included in a financial transaction, such as a loan or CD purchase, or in a securities trade.

Round Trip Transaction Costs and Profitability

When an investor buys or sells a security, they may enlist a financial advisor or broker to help them do so. That advisor or broker most likely will charge a fee for their services. In some cases, an advisor will enlist a broker to execute the transaction, which means the advisor, as well as the broker, will be able to charge a fee for their services in the purchase. Investors will have to factor in the cumulative costs to determine whether an investment was profitable or caused a loss.

Round Trip Transaction Costs Example

Shares of Main Street Public House Corp. have a bid price of $20 and an ask price of $20.10. There is a $10 brokerage commission . If you bought 100 shares, then quickly sell all of them at the bid and ask prices above, what would the round-trip transaction costs be?

Purchase: ($20.10 per share x 100 shares) + $10 brokerage commission = $2,020

Sale: ($20 per share x 100 shares) - $10 brokerage commission = $1,990

The round-trip transaction cost is: $2,020 - $1,990 = $30

Morningstar. " Morningstar's Annual Fund Fee Study Finds Investors Saved Nearly $6 Billion in Fund Fees in 2019 ."

:max_bytes(150000):strip_icc():format(webp)/Regularlyscheduledinvestments-ac483b861b3f4f8f83dfc56d70e80d14.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

At SmartCapitalMind, we're committed to delivering accurate, trustworthy information. Our expert-authored content is rigorously fact-checked and sourced from credible authorities. Discover how we uphold the highest standards in providing you with reliable knowledge.

Learn more...

What Is round-Trip Trading?

Round-trip trading, in terms of individual investors, refers to the practice of buying and selling the same security in the same trading day. Since this is a risky practice, many markets have regulations in place that prevent this from taking place unless the investor has a significant amount of money in his or her trading account. In terms of companies, round-trip trading takes place when a company sells an asset to another company and then buys the same asset back from the second company for the same price. This practice inflates trading volume, which can boost stock prices in the process, and also can be used to artificially raise revenue totals for the companies involved.

Unfortunately, there are unscrupulous individuals and institutions that attempt to manipulate markets and investors in their favor. As a result, market regulatory bodies, like the Securities and Exchange Commission (SEC) in the United States, have instituted rules to try to dissuade these practices. One particular practice that has drawn the scrutiny of market regulators is the technique known as round-trip trading, which can deceive investors if left unchecked.

Day-traders, who are investors who make a significant number of market transactions in a single day in an attempt to time price movements, are the people most likely to use round-trip trading. Making a round-trip trade requires buying a security and then selling it in the same day. Since there are severe risks involved in making these kinds of trades on a constant basis, the SEC requires traders to have a significant minimum amount in their accounts to round-trip trade without limits.

Perhaps even more damaging to the overall economic picture is when companies indulge in round-trip trading. When it takes place on a corporate level, a round-trip trade involves two companies clandestinely agreeing to the sale of an asset. After a short time, the company that bought the asset simply resells it to the company that owned it originally.

There are two ways in which corporate round-trip trading is deceptive. First, the trades, if they are performed often enough and involve stocks or bonds, can boost trading volume. Investors often track volume as a way to measure interest in a company, so improved volume often leads to improved stock prices. The other way that a corporate round-trip trade is misleading is that it increases revenue totals for the companies involved. Even though there is no actual loss or gain involved, the higher revenue totals also can entice unsuspecting investors.

You might also Like

Recommended, as featured on:.

Related Articles

- What is a Trading Unit?

- How do I Choose the Best Commodity Trading Software?

- What is Commodity Trading?

Discuss this Article

Post your comments.

- By: cheekywemonkey Round-trip trading, in terms of individual investors, refers to the practice of buying and selling the same security in the same trading day.

- Election 2024

- Entertainment

- Newsletters

- Photography

- Personal Finance

- AP Buyline Personal Finance

- Press Releases

- Israel-Hamas War

- Russia-Ukraine War

- Global elections

- Asia Pacific

- Latin America

- Middle East

- March Madness

- AP Top 25 Poll

- Movie reviews

- Book reviews

- Personal finance

- Financial Markets

- Business Highlights

- Financial wellness

- Artificial Intelligence

- Social Media

Stock market today: Wall Street hits record high following a 2-year round trip scarred by inflation

The Fearless Girl statue stands outside of the New York Stock Exchange is shown on Friday, Jan. 19, 2024, in New York. Wall Street is rising Friday and may break past its all-time high set two years ago, before the highest inflation and interest rates in decades sent financial markets tanking worldwide. (AP Photo/Peter K. Afriyie)

A street sign at the intersection of Wall Street and Broadway is shown on Friday, Jan. 19, 2024, in New York. Wall Street is rising Friday and may break past its all-time high set two years ago, before the highest inflation and interest rates in decades sent financial markets tanking worldwide. (AP Photo/Peter K. Afriyie)

The exterior of the New York Stock Exchange is shown on Friday, Jan. 19, 2024, in New York. Wall Street is rising Friday and may break past its all-time high set two years ago, before the highest inflation and interest rates in decades sent financial markets tanking worldwide. (AP Photo/Peter K. Afriyie)

A person departs the Wall Street subway station on Friday, Jan. 19, 2024, in New York. Wall Street is rising Friday and may break past its all-time high set two years ago, before the highest inflation and interest rates in decades sent financial markets tanking worldwide. (AP Photo/Peter K. Afriyie)

The exterior of the New York Stock Exchange is shown on Friday, Jan. 19, 2024, in New York. (AP Photo/Peter K. Afriyie)

A security officer stands outside an entrance to the New York Stock Exchange on Friday, Jan. 19, 2024, in New York. Wall Street is rising Friday and may break past its all-time high set two years ago, before the highest inflation and interest rates in decades sent financial markets tanking worldwide. (AP Photo/Peter K. Afriyie)

- Copy Link copied

NEW YORK (AP) — Wall Street returned to record heights Friday to cap a punishing, two-year round trip dogged by high inflation and worries about a recession that seemed inevitable but hasn’t arrived.

The S&P 500, which is the centerpiece of many 401(k) accounts and the main measure that professional investors use to gauge Wall Street’s health, rallied 1.2% to 4,839.81. It erased the last of its losses since setting its prior record of 4,796.56 at the start of 2022. During that time, it dropped as much as 25% as inflation soared to levels unseen since Thelonious Monk and Ingrid Bergman were still alive in 1981.

Even more than high inflation itself, Wall Street’s fear was focused on the medicine the Federal Reserve traditionally uses to treat it. That’s high interest rates, which press the brakes on the economy by making borrowing more expensive and hurting prices for stocks and other investments. And the Fed rapidly hiked its main interest rate from virtually zero to its highest level since 2001, in a range between 5.25% and 5.50%.

Historically, the Fed has helped induce recessions through such increases to interest rates. Coming into last year, the widespread expectation on Wall Street was that it would happen again.

But this time was different, or at least it has been so far. The economy is still growing, the unemployment rate remains remarkably low and optimism is on the upswing among U.S. households.

“I don’t think this cycle is normal at all,” said Niladri “Neel” Mukherjee, chief investment officer of TIAA’s Wealth Management team. “It’s unique, and the pandemic introduced that element of uniqueness.”

After shooting higher as snarled supply chains caused shortages because of COVID-19 shutdowns, inflation has been cooling since its peak two summers ago. It’s eased so much that Wall Street’s biggest question now is when the Federal Reserve will begin moving interest rates lower.

Such cuts to rates can act like steroids for financial markets, while releasing pressure that’s built up on the economy and the financial system.

Treasury yields have already relaxed significantly on expectations for rate cuts, and that helped the stock market’s rally accelerate sharply in November. The yield on the 10-year Treasury slipped Friday to 4.13%, and it’s down sharply from the 5% that it reached in October, which was its highest level since 2007.

Of course, some critics say Wall Street has gotten ahead of itself, again, in predicting how soon the Federal Reserve may begin cutting interest rates.

“The market is addicted to rate cuts,” said Rich Weiss, chief investment officer of multi-asset strategies at American Century Investments. “They just can’t get enough of it and are myopically focused on it.”

Repeatedly since the Fed began this rate-hiking campaign early in 2022, traders have been quick to forecast an approaching easing of rates, only to be disappointed as high inflation proved to be more stubborn than expected. If that happens again, the big moves higher for stocks and lower for bond yields may need to revert.

This time around, though, the Fed itself has hinted that rate cuts are coming, though some officials have indicated they may begin later than the market is hoping for. Traders are betting on a nearly coin flip’s chance that the Fed will start cutting in March, according to data from CME Group.

“The truth is likely somewhere between what the Fed is saying and what the market is expecting,” said Brian Jacobsen, chief economist at Annex Wealth Management. “That will continue to cause dips and rips” for financial markets “until the two reconcile with each other.”

Some encouraging data came Friday after a preliminary report from the University of Michigan suggested the mood among U.S. consumers is roaring higher. It said sentiment jumped to its highest level since July 2021. That’s important because spending by consumers is the main driver of the economy.

Perhaps more importantly for the Fed, expectations for upcoming inflation among households also seem to be anchored. A big worry has been that such expectations could take off and trigger a vicious cycle that keeps inflation high.

Friday’s lift for Wall Street came with a big boost from technology stocks, something that’s become typical in its run higher.

Several chip companies rose for a second straight day after heavyweight chipmaker Taiwan Semiconductor Manufacturing Co. delivered a better forecast for revenue this year than analysts expected. Broadcom rose 5.9%, and Texas Instruments climbed 4%.

All told, the S&P 500 rose 58.87 points to its record. The Dow Jones Industrial Average set its own record a month earlier, and it gained 395.19, or 1.1%, Friday to 37,863.80. The Nasdaq composite jumped 255.32, or 1.7%, to 15,310.97.

Last year, a select few Big Tech companies were responsible for the wide majority of the S&P 500’s gains. Seven of them accounted for 62% of the index’s total return, according to S&P Dow Jones Indices.

Many of those stocks — Microsoft, Apple, Alphabet, Nvidia, Amazon, Meta Platforms and Tesla — rode a furor in the market around technology related to artificial intelligence. The hope is AI will lead to a boom in profits, both for companies using it and for companies providing the hardware for it.

Investors may have wished they had stayed in just those stocks, which got the nickname of “the Magnificent 7.” But some of them remain below their record highs, such as Tesla. It’s still down 48% from its all-time high set in November 2021.

Friday’s return of the S&P 500 to a record serves as another example that investors who stay patient and spread their investments across the U.S. stock market end up making back all their losses. Sometimes it can take a long time, like the lost decade of 2000 through 2009 when the S&P 500 tumbled through the dot-com bubble bust and the global financial crisis. But the market has historically made investors whole again, given enough time.

Including dividends, investors with S&P 500 index funds already returned to break-even a month ago.

Of course, risks still remain for investors. Besides uncertainty about when the Fed will begin cutting interest rates, it’s also still not a sure thing that the economy will avoid a recession.

Hikes to interest rates take a notoriously long time to make their way fully through the system, and they can cause things to break in unexpected places within the financial system.

AP Writers Matt Ott and Zimo Zhong contributed.

Wall Street hits record high following a 2-year round trip scarred by inflation

Wall Street returned to record heights and capped a punishing, two-year round trip dogged by high inflation and worries about a possible recession that seemed inevitable but hasn’t arrived.

The S&P 500 , which is the main measure that professional investors use to gauge Wall Street’s health, rallied 1.2% to 4,839.81. It erased the last of its losses since setting its prior record of 4,796.56 at the start of 2022. During that time, it dropped as much as 25% as inflation soared to levels unseen since Thelonious Monk and Ingrid Bergman were still alive in 1981.

Even more than high inflation itself, Wall Street’s fear was focused on the medicine the Federal Reserve traditionally uses to treat it. That’s high interest rates , which press the brakes on the economy by making borrowing more expensive and hurting prices for stocks and other investments. And the Fed rapidly hiked its main interest rate from virtually zero to its highest level since 2001, in a range between 5.25% and 5.50%.

Through many cycles in history, the Federal Reserve has helped induce recessions through such increases to interest rates. Coming into last year, the widespread expectation on Wall Street was that it would happen again.

But this time was different, or at least it has been so far. The economy is still growing , the unemployment rate remains remarkably low and optimism is on the upswing among U.S. households.

“I don’t think this cycle is normal at all,” said Niladri “Neel” Mukherjee, chief investment officer of TIAA’s Wealth Management team. “It’s unique, and the pandemic introduced that element of uniqueness.”

Reversing pandemic pressures

After shooting higher as snarled supply chains caused shortages because of COVID-19 shutdowns, inflation has been cooling since its peak two summers ago. It’s eased so much that Wall Street’s biggest question now is when the Federal Reserve will begin moving interest rates lower .

Such cuts to rates can act like steroids for financial markets, while releasing pressure that’s built up on the economy and the financial system.

The market is ahead of the Fed?

Treasury yields have already relaxed significantly on expectations for rate cuts, and that helped the stock market’s rally accelerate sharply in November. The yield on the 10-year Treasury slipped Friday to 4.13%, down sharply from the 5% that it reached in October, which was its highest level since 2007.

Of course, some critics say Wall Street has gotten ahead of itself, again, in predicting how soon the Federal Reserve may begin cutting interest rates.

“The market is addicted to rate cuts,” said Rich Weiss, chief investment officer of multi-asset strategies at American Century Investments. “They just can’t get enough of it and are myopically focused on it.”

Repeatedly since the Fed began this rate-hiking campaign early in 2022, traders have been quick to forecast an approaching easing of rates, only to be disappointed as high inflation proved to be more stubborn than expected. If that happens again, the big moves higher for stocks and lower for bond yields may need to revert.

This time around, though, the Fed itself has hinted that rate cuts are coming , though some officials have indicated they may begin later than the market is hoping for. Traders are betting on a nearly coin flip’s chance that the Fed will start cutting in March, according to data from CME Group.

“The truth is likely somewhere between what the Fed is saying and what the market is expecting,” said Brian Jacobsen, chief economist at Annex Wealth Management. “That will continue to cause dips and rips” for financial markets “until the two reconcile with each other.”

Sentiment improves

Some encouraging data came Friday after a preliminary report from the University of Michigan suggested the mood among U.S. consumers is roaring higher. It said sentiment jumped to its highest level since July 2021. That’s important because spending by consumers is the main driver of the economy.

Perhaps more importantly for the Fed, expectations for upcoming inflation among households also seem to be anchored. A big worry has been that such expectations could take off and trigger a vicious cycle that keeps inflation high.

The link between stocks and 401(K)s: Stocks and your 401(k) may surge now that Fed rate hikes seem to be over, history shows

Tech stocks lead

Friday’s lift for Wall Street came with a big boost from technology stocks , something that’s become typical in its run higher.

Several chip companies rose for a second straight day after heavyweight chipmaker Taiwan Semiconductor Manufacturing Co. delivered a better forecast for revenue this year than analysts expected. Broadcom rose 5.9%, and Texas Instruments climbed 4% after announcing its dividend.

All told, the S&P 500 rose 58.87 points to its record. The Dow Jones Industrial Average set its own record a month earlier, and it gained 395.19, or 1.1%, Friday to 37,863.80. The Nasdaq composite jumped 255.32, or 1.7%, to 15,310.97.

Last year, a select few Big Tech companies were responsible for the wide majority of the S&P 500’s gains. Seven of them accounted for 62% of the index’s total return, according to S&P Dow Jones Indices.

Many of those stocks — Microsoft, Apple, Alphabet, Nvidia, Amazon, Meta Platforms and Tesla — rode a furor in the market around technology related to artificial intelligence. The hope is AI will lead to a boom in profits, both for companies using it and for companies providing the hardware for it.

Investors may have wished they had stayed in just those stocks, which got the nickname of “the Magnificent 7.” But some of them remain below their record highs, such as Tesla. It’s still down 48% from its all-time high set in November 2021.

Friday’s return of the S&P 500 to a record serves as another example that investors who stay patient and spread their investments across the U.S. stock market end up making back all their losses. Sometimes it can take a long time, like the lost decade of 2000 through 2009 when the S&P 500 tumbled through the dot-com bubble bust and the global financial crisis. But the market has historically made investors whole again, given enough time.

Including dividends, investors with S&P 500 index funds already returned to break-even a month ago.

Of course, risks still remain for investors. Besides uncertainty about when the Fed will begin cutting interest rates, it’s also still not a slam dunk that the economy will avoid a recession. Hikes to interest rates take a notoriously long time to make their way fully through the system, and they can cause things to break in unexpected places within the financial system.

What are Round-Trip Transactions?

Complete Explanation of Round Tripping including Purpose, Example, & Risks

Home › Finance › Corporate Finance › What are Round-Trip Transactions?

In the complex world of financial markets and corporate accounting, the term “round-trip transactions” often surfaces amidst discussions of financial ethics, regulatory compliance, and corporate governance.

These transactions, while not inherently illicit, tread a fine line between strategic financial management and the murky waters of manipulative practices.

This comprehensive guide aims to unravel the intricacies of round-trip transactions, shedding light on their purposes, risks, and the legal and ethical considerations they entail.

- Round-Trip Transactions Meaning

Key Takeaways

The purpose of round-trip transactions, how is round tripping used, round tripping example, the risks and implications of round-trip transactions, legal and regulatory framework, ethical considerations of round trip transactions, detecting and preventing round-trip transactions, what exactly defines a round-trip transaction in financial terms, why might a company engage in round-trip transactions, what are the potential risks of engaging in round-trip transactions, how can round-trip transactions be identified or prevented.

Round-trip transactions refer to a series of transactions in which a company sells an asset to another party with the agreement that the asset will be bought back at a later date, usually at a similar or predetermined price.

This cycle creates the appearance of genuine business activity without any substantive change in the company’s financial position or the asset’s ownership. While round-trip transactions span various industries, they are notably prevalent in the energy sector and financial markets, where companies might engage in these deals to inflate revenue figures or to create a facade of heightened market activity.

The distinction between legitimate and manipulative uses of round-trip transactions hinges on intent and disclosure. Legitimate uses are typically transparent and aim to achieve lawful financial or operational objectives, such as hedging against price fluctuations. Conversely, manipulative practices are designed to deceive stakeholders or regulatory bodies about a company’s true financial health or market activity.

Manipulative Impact on Financial Statements : Round-tripping is primarily used to artificially inflate a company’s revenue and trading volume, misleading stakeholders about the company’s true financial performance and market activity.

Legal and Ethical Risks : Engaging in round-trip transactions carries significant legal and ethical risks, including regulatory penalties and reputational damage, as these practices can be considered deceptive and manipulative.

Importance of Transparency and Regulation : The detection and prevention of round-trip transactions highlight the importance of transparent accounting practices and stringent regulatory oversight to ensure the integrity of financial markets and protect investor interests.

Round tripping is often used to artificially inflate a company’s revenue and trading volume, creating the appearance of a higher level of business activity than actually exists.

This practice can be employed to meet financial targets, influence stock prices, or enhance the attractiveness of the company to investors by manipulating financial statements. By artificially inflating revenue, a company can appear more financially robust and liquid than it truly is, potentially influencing stock prices and investor perception.

The allure of round-trip transactions lies in their ability to temporarily enhance a company’s financial standing without necessitating actual business growth or operational improvements. This can make a company more attractive to investors, lenders, and analysts in the short term, albeit at significant risk.

Companies might engage in round-trip transactions in several different ways. Here are the most common round-trip transactions:

Inflating Revenue : A company may engage in round-tripping by selling an asset to another entity and buying it back at a similar price. These transactions can be recorded as legitimate sales and purchases, artificially inflating the company’s revenue and sales volume without any real change in its economic situation, misleading stakeholders about the company’s financial performance.

Boosting Asset Turnover : By repeatedly selling and repurchasing assets in round-trip transactions, a company can give the impression of higher asset turnover than is actually the case. This can make the company appear more efficient in its use of assets, potentially misleading investors about its operational effectiveness.

Manipulating Market Activity: In the case of publicly traded companies, round-trip transactions can be used to create an illusion of heightened trading activity for the company’s shares. This can influence stock prices by suggesting a higher demand for the shares than actually exists, potentially attracting more investors based on misleading information.

An example of round-tripping involves a company, Company A, selling an asset to Company B for $1 million. Shortly thereafter, Company B sells the same asset back to Company A for approximately the same price, say $1.01 million.

This sequence of transactions makes it appear as though Company A has engaged in $1 million worth of sales, thereby inflating its revenue figures, even though there has been no real change in the economic position of either company.

This practice can be used to manipulate financial statements and give an inflated impression of the company’s financial health and trading volume, potentially misleading investors and regulators.

The primary risk associated with round-trip transactions is the potential for legal repercussions and loss of investor trust. Regulatory bodies in many jurisdictions scrutinize such practices closely, and companies found guilty of using round-trip transactions to manipulate financial outcomes can face hefty fines, legal sanctions, and reputational damage.

Notable incidents, such as the Enron scandal, highlight the catastrophic impact that deceptive financial practices can have on stock prices, market stability, and investor confidence.

Moreover, round-trip transactions can distort market perceptions, leading to inefficient capital allocation and undermining the integrity of financial markets. The artificial inflation of activity or liquidity can mislead stakeholders about market demand, price stability, and the true value of assets involved.

The legal status of round-trip transactions varies by jurisdiction, but there is a growing trend towards stricter regulation and oversight. Financial regulatory bodies worldwide have implemented guidelines and reporting requirements to curb the abuse of such transactions.

The role of auditors and financial regulators is pivotal in detecting manipulative practices, necessitating rigorous examination of financial records, transaction trails, and disclosure statements.

Beyond legal implications, round-trip transactions pose significant ethical dilemmas. The fine line between creative accounting and outright fraud is often blurred, challenging companies to maintain integrity and transparency in their financial reporting.

Ethical business practices and robust corporate governance structures are crucial in mitigating the temptation to engage in deceptive financial maneuvers.

Companies must foster a culture of honesty and accountability, ensuring that all stakeholders can rely on the veracity of financial statements and market activities.

For investors and regulators, identifying potential round-trip transactions involves scrutinizing sudden spikes in revenue or trading volume without corresponding changes in market conditions or company operations. Vigilance and due diligence are essential in assessing the authenticity of reported financial health and operational activity.

Companies, on their part, can prevent misuse by adopting transparent accounting practices, regularly auditing financial records, and ensuring that all transactions are conducted at arm’s length and properly disclosed. As the financial landscape evolves, so too must the strategies for maintaining fairness and integrity in corporate reporting and market transactions.

Round-trip transactions, while a legitimate tool in certain contexts, present a complex challenge in the realm of financial ethics and regulation. As companies navigate the pressures of financial performance and market competitiveness, the temptation to engage in such practices underscores the importance of robust regulatory frameworks, corporate governance, and ethical leadership.

The future of round-trip transactions will undoubtedly be shaped by ongoing efforts to balance financial innovation with transparency and integrity, ensuring the stability and trustworthiness of markets and corporate institutions. In this ever-changing environment, the collective responsibility of companies, regulators, and investors to foster transparency and integrity has never been more critical.

Frequently Asked Questions

A round-trip transaction refers to a set of transactions where an asset is sold and subsequently repurchased by the original seller, often at a similar price, to artificially inflate volume or revenue without any real change in asset ownership.

Companies may use round-trip transactions to meet financial targets or create the illusion of increased business activity, thereby enhancing their financial statements or market valuation temporarily.

Round-trip transactions can lead to legal penalties, reputational damage, and a loss of investor trust if used to manipulate financial statements or deceive stakeholders.

Identifying round-trip transactions involves scrutinizing financial records for transactions that inflate company activity without real economic substance, while prevention requires transparent accounting practices and rigorous financial oversight.

Accounting & CPA Exam Expert

Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career.

Find anything you save across the site in your account

The Stock Market’s Round Trip

By James Surowiecki

The precipitous rise of the stock market over the past five weeks—at the moment, it’s up about twenty-eight per cent since its March 6th bottom—has plenty of people talking about “sucker rallies,” bear-market head fakes, and an impending crash. The general take seems to be that investors have gotten ahead of themselves, succumbing to “unjustified euphoria” about the prospects for a near-term recovery.

What’s perplexing about this argument is that it seems to assume that investors are averting their eyes from all that’s wrong with the current economy, and have driven stock prices up to unusually high levels. But they haven’t. The S. & P. 500 is now about ten points lower than it was in early February, and it’s about five per cent below where it was when the year started. That doesn’t mean current prices are justified. But it does mean that stock prices are not, as one recent analyst suggested, “in the stratosphere.”

Of course, if you believe that stocks were significantly overvalued back in February (or back in December), then you probably believe that they’re still overvalued today. I would argue that there are good reasons to believe that the economy, while still very weak, is much closer to a bottom than it was two months ago, and that the Obama Administration’s management of the crisis—which we could only guess at in January—has been a net plus for the economy (and therefore for the stock market). Yet despite all this, the simple fact is that the stock market has not gone up since February. In fact, for all its ups and downs, after four months of action it’s ended up pretty much where it started. It’s a strange world, indeed, in which that counts as euphoria.

By signing up, you agree to our User Agreement and Privacy Policy & Cookie Statement . This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

By John Cassidy

By Joshua Yaffa

By Elizabeth Kolbert

trading higher

- Positive IXIC 16,399.52

trading lower

Tripadvisor Inc

All listings.

Source: LSEG , opens new tab - data delayed by at least 15 minutes

Markets Performance

Commodities, rates & bonds.

IMAGES

VIDEO

COMMENTS

This is also called a "round trip." Security position: Day trading applies to virtually all securities—stocks, bonds, ETFs, and even options (calls and puts). Same day: If you do a round trip on the same day, it's a day trade. If you hold your security position beyond the close of the trading day, it's not a day trade.

Open and close (round trip). When we say "open and close," it means buying and selling, or, for short sellers, selling (short) and then buying. This is also called a "round trip."

Round-trip trading attempts to inflate transaction volumes through the continuous and frequent purchase and sale of a particular security . The term can also be used to refer to the practice of a ...

Under the PDT rule, a day trade is the purchase and sale, or sale and purchase, of the same security in a margin account within a single trading day, sometimes called a "round trip". It applies to both long and short trades and includes pre- and post-market trading. The key to determining what counts as a day trade is matching buy and sell orders.

Your "round trip" (buy and sell) trades all took place on the same trading day.Here's where you might get dinged: If you execute four or more intraday round trips within five rolling business days ...

A "round trip" simply means opening and closing a security position. Whether you buy or sell to open, when you close the position, you've completed a round trip. If you did it within a ...

Each day's maximum DTBP is determined by the prior night's market close. If you exceed your DTBP, a day trade margin call will be issued for the deficiency.. The call is due in five business days and can be met by making a deposit, journal or transfer of funds, journal or transfer of marginable stock, or sale of long options or non-margined securities.

A round trip is defined as buying and selling the same stock or options position during the same day, which includes pre-market, regular market and post-market trading sessions. This means buying to open and selling to close the same stock or options contracts in a single day.

If the popup reads "No round trip limitation" and your balance is above $25,000 you are free to day trade. ... If you place a sell order before all 10,000 shares are purchased, every sell order (up to five) that you place on this stock on this day would count as a separate day trade. Support; Disclosures; Terms;

A round trip is where you buy and sell in the same day. Under this rule, you can still have multiple entries with one exit or multiple exits from one entry. For example, you could buy three lots of 200 shares, and sell 600 shares to exit the trade or vice versa. ... The stock market is constantly changing. If you are fortunate enough to find ...

To discourage excessive trading and protect the interests of long-term investors, mutual funds keep a close eye on shareholders who sell shares within 30 days of purchase - called round-trip ...

Finally, there's the round-trip sell rule. According to this rule, investors should sell the growth stock if it falls back near the buy point after it has made a gain of more than 10%. Try to sell ...

Stocks have finished a round trip, as that hypothetical $10,000 investment finished last week worth $10,068. ... From that date, the stock market required a 33% gain to reach its nominal breakeven ...

Wash trading - also referred to as round trip trading - is an illegal practice where investors buy and sell the same financial instruments at the same time in order to manipulate the market. The practice can unnaturally increase the trading volume in order to make the security appear as though it is more desirable than it actually is.

Round trip transaction costs refer to all the costs incurred in a securities or other financial transaction. Round trip transaction costs include commissions , exchange and other fees, bid/ask ...

First, avoid round trips (when a stock erases all gains from a buy point) as much as possible. When you've bought a stock correctly at the breakout, and the stock has stretched 20% to 25%, sell at ...

What Is a Round Trip Stock Trade?. Part of the series: Stock Market Tips & Facts. Round trip stock trading, which is illegal in the United States, is when an...

Round-trip trading, in terms of individual investors, refers to the practice of buying and selling the same security in the same trading day. Day-traders, who are investors who make a significant number of market transactions in a single day in an attempt to time price movements, are the people most likely to use round-trip trading. Making a round-trip trade requires buying a security and then ...

Wall Street returned to record heights and capped a punishing, two-year round trip dogged by high inflation and worries about a possible recession. ... Treasury yields have already relaxed significantly on expectations for rate cuts, and that helped the stock market's rally accelerate sharply in November. The yield on the 10-year Treasury ...

All told, the S&P 500 rose 58.87 points to its record. The Dow Jones Industrial Average set its own record a month earlier, and it gained 395.19, or 1.1%, Friday to 37,863.80. The Nasdaq composite ...

Manipulating Market Activity: In the case of publicly traded companies, round-trip transactions can be used to create an illusion of heightened trading activity for the company's shares. This can influence stock prices by suggesting a higher demand for the shares than actually exists, potentially attracting more investors based on misleading ...

The precipitous rise of the stock market over the past five weeks—at the moment, it's up about twenty-eight per cent since its March 6th bottom—has plenty of people talking about "sucker ...

Round trip stock trading, which is illegal in the United States, is when an investor buys and sells a stock in the same day. Learn how round trip stock trade...

Get Tripadvisor Inc (TRIP.DF) real-time stock quotes, news, price and financial information from Reuters to inform your trading and investments

Tripadvisor last released its quarterly earnings results on February 14th, 2024. The travel company reported $0.21 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.07 by $0.14. The company earned $390 million during the quarter, compared to analysts' expectations of $372.93 million.

Catch the top stories of the day on ANC's 'Top Story' (27 March 2024)