- Search Parks

You are using an out of date browser. It may not display this or other websites correctly. You should upgrade or use an alternative browser .

Travel Date Internet?

Discussion in ' Tech Talk ' started by MojitoLady , Apr 23, 2022 .

MojitoLady Expand Collapse Member

Hello All RV Life Friends! My first time posting and asking a question. I need a good reliable wifi/internet while traveling. The free wifi at campgrounds is not secure and just too weak (although, I very much appreciate it's even provided and free at that) and I need my phone too much to use a hotspot. There are so many options out there but to narrow it down I've been reading the reviews on a service called Travel Data. Similar to Nomad, however, TD's customer service seems much better and their plans are much more affordable. But before I jump in, I wanted to reach out to my RV Life Friends for any feedback or suggestions. I am not looking to buy multiple sim cards, that is not feasible for me. I need reliable wifi for downloading files and streaming and doesn't manage or throttle. Thanks in advance for your help!

Rollin Ollens Expand Collapse Member

I have been using a mobile wifi device for a number of years now. I began with AT&T but we discovered that their service was very poor in many areas even though their map appeared to cover more area that others. We traveled mostly in the west and many places we visited had no or very poor reception. We switched to Verizon and, although not as good as we expected, it was still far better than AT&T. We paid a few dollars per month more but at least we had a service that was more reliable. We are retired so "great" service is not critical. We have friends that operate a business while on the move and they have a satellite service. They are very pleased but I'm, sure that type of service will be pricey. If you are primarily going to be east of the Mississippi I think any of the big four will be able to cover your needs. FYI, Our experience does not cover east of the Big Muddy but I am sure others will be chipping in with their experience. I'm including a link that discusses coverage for the big four if it will help you. https://www.letstalk.com/cellphones/guides/best-coverage-map/#att Good luck. Let us know which way you go. Darrell

Rollin Ollens said: ↑ I have been using a mobile wifi device for a number of years now. I began with AT&T but we discovered that their service was very poor in many areas even though their map appeared to cover more area that others. We traveled mostly in the west and many places we visited had no or very poor reception. We switched to Verizon and, although not as good as we expected, it was still far better than AT&T. We paid a few dollars per month more but at least we had a service that was more reliable. We are retired so "great" service is not critical. We have friends that operate a business while on the move and they have a satellite service. They are very pleased but I'm, sure that type of service will be pricey. If you are primarily going to be east of the Mississippi I think any of the big four will be able to cover your needs. FYI, Our experience does not cover east of the Big Muddy but I am sure others will be chipping in with their experience. I'm including a link that discusses coverage for the big four if it will help you. https://www.letstalk.com/cellphones/guides/best-coverage-map/#att Good luck. Let us know which way you go. Darrell Click to expand...

Fitzjohnfan Expand Collapse Member

If you are a member of FMCA, you might want to look into their Sprint/Verizon MiFi. I'm not saying its good or bad, but lots of the members there have gotten it and received various results

NYDutch Expand Collapse Member

We travel mostly in the east now, and we've found having cell service with both AT&T and Verizon has worked well for us everywhere we've been. One or the other service has always been good, and many times both are acceptable. We use separate hotspots rather than our phones. Our AT&T unlimited data only service plan is no longer available, although we're grandfathered in at $23.50/mo. Our Verizon service is through their Visible division's unlimited talk, text, and data service at $25/mo with "Party Pay". We use it only for data, and the maximum speed is throttled to 5 Mbps which we find works reasonably well for moderate resolution streaming.

Share This Page

- Duty of Care

- Program Compliance

- Traxo for TMCs

- Spend Visibility

- Program Savings

- Folio Parsing

- Data Distribution

The latest news, events, and industry trends from Traxo.

- There are no suggestions because the search field is empty.

LATEST INSIGHTS

Amex GBT’s CWT Acquisition Underscores Why Complete Travel Data is Essential

Aash Shravah

In the ever-evolving corporate travel landscape, change is not just inevitable—it's an opportunity for growth and innovation. The recent announcement of Amex GBT's plans to acquire CWT for approximately $570 million represents a significant milestone in the industry's journey. This acquisition will bring together two of the largest corporate

Travel Management Fundamentals: What is Travel Data?

Unstructured data, structured data, complete data—these terms can intimidate those who are not accustomed to or well-versed in managing data. While most travel managers wouldn’t consider themselves data experts, they actually acquire and use a massive amount of travel data to do their jobs.

According to a 2021 study by Expedia , 68% of all business travelers book more than half of their travel outside of approved channels. This high level of travel leakage means that travel managers actually need a lot more booking data than they typically have to run efficient programs.

Data for Travel Management: What is travel data?

In the context of travel management, travel data is the information that pertains to your travelers and their itineraries. This data includes the following:

- Travelers' personal details, including their basics (name, date of birth, emergency contacts, contact details, and home address)

- Travelers' loyalty numbers for travel business programs whereby they are collecting points and maintaining status

- Purchase details, including booking costs, upgrades, taxes and fees (like resort and sustainability fees)

- Travel itinerary details and specifics such as dates and locations of travel plans, booking confirmation numbers, etc.

Gathering and Accessing Travel Data

Travel data can come from many sources, including supplier sites, online travel agencies, travel management companies (TMCs), and aggregation services like Traxo. Oftentimes, data is sent across in reports and spreadsheets or accessed via a direct integration. In the case of Traxo, data is securely consumed in real-time, standardized and stored for easy analysis and portability—which means bookings can be captured quickly and then sent along to travel management partners, like duty of care and price assurance providers.

Data Security: Why It Matters

With personal and travel-specific data, companies need to be mindful of data security —how the data is being collected, maintained, secured, and used in accordance with privacy acts.

More commonly than not, mid-large-scale organizations work with a dedicated travel management company (TMC). The TMC has a secure traveler profile that is used as a depository of traveler-specific details pertinent to booking travel plans on behalf of the respective traveler. Travelers are responsible for setting up and keeping their personal travel profiles to ensure the accuracy of the information being collected and stored.

For start-ups or small-scale companies who may not yet need the services of a TMC, travel managers or administrators really need to consider how their travelers' data is being gathered, stored, and maintained, all the while keeping data security top-of-mind. Utilizing a Google Sheets or Excel Spreadsheet won’t cut it.

If companies are using a travel data aggregation service to capture both TMC and non-TMC itinerary data in one place, they need to ensure that data partner employs high data-security standards. For instance, Traxo employs some of the highest data security standards so clients can rest assured that their employees’ information remains safe.

Travel Data is Essential for Travel Management

Effective travel management has always been contingent on knowing when and where employees are traveling. With modern tools and travel management partners, it’s easier than ever to gain the booking details you need to create travel management programs that optimize costs, keep travelers safer, and make business travel an awesome experience.

To learn more about accessing complete booking details no matter where travel is booked, fill out the form to schedule a quick call with the Traxo team.

Connect with Traxo

Leveraging Complete Corporate Travel Data to Reach Business Objectives

Brian Butler

In the dynamic landscape of corporate travel, staying ahead requires more than just managing logistics; it involves understanding and leveraging the wealth of data generated by every trip. At Traxo, we specialize in capturing and analyzing comprehensive travel data, enabling businesses to fine-tune their travel programs for maximum efficiency and

Business Continuity in Corporate Travel: How Traxo Keeps You in the Game

In the ever-complex and unpredictable world of corporate operations, business continuity management (BCM) stands as a cornerstone for ensuring an organization's ongoing stability. Business continuity refers to the planning and preparation undertaken to ensure that an organization can continue to operate in case of serious incidents, disasters, or

Unleashing the Power of ChatGPT for Smarter, Safer Corporate Travel

Lacey Williams

In corporate travel's complex, fast-paced realm, staying ahead of the curve is necessary. Today, the technological revolution spearheaded by artificial intelligence (AI) has reshaped the landscape, with tools like ChatGPT becoming game-changers. Designed by OpenAI, ChatGPT leverages advanced language understanding capabilities that could assist

Overcoming Weather Delays and Mass Cancellations with Traxo

In corporate travel, weather delays and mass cancellations are significant roadblocks . These unexpected situations can lead to missed meetings, lower productivity, and heightened employee stress; taking a toll on overall business performance. The need for efficient management and control of these unpredictable events has never been more critical.

What Travel Management Teams Need to Know About NDC

The world of corporate travel management is constantly evolving, and one of the most significant developments in recent years is the introduction of New Distribution Capability (NDC). NDC is a new standard for airline distribution that aims to modernize and simplify the booking process for travel agencies, travel management companies, and

How Corporate Travel Data Enables Greater Booking Flexibility

Justin Morris

In today's fast-paced business environment, corporate travel management teams face many challenges, such as ensuring the safety and comfort of their business travelers while keeping costs under control. One of the main challenges is to provide flexible booking options that meet the specific needs of their travelers while retaining full visibility.

How Enterprise-Level Companies Address Personal Trips

With the rise of work-from-home and work-from-anywhere trends, as well as the blending of business and leisure travel (also known as "bleisure" trips ), many corporations have shifted their focus from being responsible for the safety and security of the traveler to being accountable for the safety and security of the employee, regardless of their

Using Data for Better Travel Management: What Does Traxo Do?

You may be wondering, "What does Traxo Do?" Traxo helps organizations audit their corporate travel programs by providing full visibility into travel bookings, regardless of the booking source, well before trips actually happen. By parsing booking details from 100,000+ air, car and hotel suppliers, Traxo provides travel managers with comprehensive

2022 Work Trends: Changes in Business Travel and Daily Operations

While the world faces emerging viral outbreaks, inflation and air travel disruptions, business travel continues to rebound from its mid-pandemic low—though its full recovery timeline has been pushed to 2026.

Until recently, businesses went into fight-or-flight mode each time a new COVID variant surfaced, which caused the height of cancellations,

How Complete Travel Data Supports Corporate Sustainability

Matt Griffin, Traxo

As our environment shifts, the importance of corporate sustainability grows stronger. As individual contributors and corporations, the actions and impact that we make together could not be more important than acting to offset our carbon footprint now.

The lasting impact of our actions plays an integral part in the Earth future generations

Traxo Product Update: Automatic Currency Conversion

Traxo has been providing travel managers and organizations across the globe with complete trip visibility, providing consolidated reporting and ease of locating travelers before, during, and after trips. We’ve recently taken Traxo’s reporting to the next level by launching computed prices , a new feature to automatically convert all travel data

6 Tips for Managing Bleisure Travel

Franz Loriega

A bleisure trip is what you get when you blend a business and a leisure trip together — a concept that is no stranger to modern business travelers or travel managers. An example of a bleisure trip would be an employee traveling to San Francisco for a business conference at their company’s expense and then tacking on a couple days for a quick jaunt

Why You Should Use a Travel Aggregator for Business Travel Data

Imagine waking up to news headlines that war has erupted , a political crisis has ensued, or a newly identified virus has begun to rapidly spread. As your organization's appointed travel manager, would you be scratching your head, wondering if you have employees in the affected region, or would a quick check of your travel aggregator let you know

4 Ways to Ensure Business Travel Safety During International Conflict

Many organizations had offices, work-from-home employees, and travelers visiting Ukraine when Russia invaded on February 24th, 2022. Regardless of why employees were in the country, organizations had a legally binding duty of care to their team members. Before they could ensure employees were out of harm's way, they needed to locate them. Today,

3 Aspects of an Effective Price Assurance Strategy

What is price assurance.

Price assurance is a corporate travel savings strategy made of three components — supplier negotiations, rate auditing and re-shopping. Technologies that continually audit rates and re-shop for discounts are crucial to ensuring your suppliers adhere to your contracted discounts and non-negotiated bookings are optimized.

4 Reasons Why Travel Managers Need Access to Detailed Business Travel Analytics

The role of a travel manager often varies with the size and scale of organizations. Global organizations may have large, complex travel programs, typically managed by a team of corporate travel professionals . Whereas small to medium-sized businesses may only have a single point of contact managing the travel program. Regardless of the size of your

The Benefits of Using Traxo to Manage Multiple TMCs

Having multiple travel management companies (TMCs) supporting an organization is common in today’s business sector, especially for those with a global presence. This fragmentation makes leveraging a travel program data aggregation and auditing solution mission-critical.

What Are TMCs (Travel Management Companies)?

TMCs, travel management companies

Corporate Travel Technology: 3 Travel Management Technologies Every Business Should Implement

New, industry-leading corporate travel t technologies are emerging all the time. We’ve also witnessed businesses reinventing themselves to stay relevant as the world changes around us. To continue future-proofing corporate travel programs, there are three key areas where travel managers should focus:

- Ensuring access to complete pre-trip travel

Corporate Travel Program Policy Types

A well-written corporate travel policy provides guidance for business travelers while helping organizations influence behavior, manage spend, utilize preferred suppliers , and keep travelers safe. Despite the numerous benefits a travel policy provides, travel managers still face policy compliance challenges.

How do you move the needle on

Updating Your Travel Program: 5 Corporate Travel Policy Best Practices

Once you’re familiar with the three corporate travel program policy types – mandated, flexible, and hybrid – it’s time to decide what comes next. Do you need to make changes, and if so, what are the corporate travel policy best practices you should follow?

Before diving headfirst into policy changes, let’s take a step back to evaluate the entire

Full Data Visibility: The New Table Stakes For Corporate Travel

Andres Fabris

As the global economy begins to reopen, corporate travel teams worldwide are planning for how best to restart their company’s business travel activity. Most firms have made it through the initial “triage” stage of the pandemic. Now, teams are taking stock of how their travel programs performed in the midst of the crisis, in order to assess how

Traxo and Your TMC, Ensuring Your Travel Program is Prepared

Uncertain times – I have lost count of how many times I heard the phrase “uncertain times” over the last two months. Since the spread of COVID-19 began, the world has certainly been faced with innumerable challenges on every imaginable level - physically, mentally, spiritually, and more, especially in the realm of business travel. There are many

COVID-19 and Corporate Travel: Steps to Take Now for What Comes Next

Cara Whitehill

Travel managers have been on the front line of corporate travel’s response to the COVID-19 outbreak. Companies are in varying stages of dealing with the outbreak, but we’ve heard three common themes in how travel teams are approaching this unprecedented new reality.

Three Ways Travel Managers Are Approaching COVID-19

- Employees first – Ensuring

China, Coronavirus, Corporate Travel and Duty of Care

If your CEO or head of risk management walked into your office today and asked you how many employees recently traveled to China, and hence could be at risk for exposure to coronavirus, how confident are you of your answer?

Importance of Data Visibility During the COVID-19 Outbreak

The swift outbreak of the coronavirus (now known as COVID-19)

Traxo and Data Privacy: FAQs

We frequently get questions from prospective clients regarding data privacy and security, and how Traxo's services meet legal requirements for both areas. For corporate travel managers seeking to understand their booking blindspots, we've compiled some of the most common questions and our responses, which can be shared with internal legal and IT

Traxo at ACTE 2018: Off-Channel Spend Takes Center Stage

The Traxo team was in New York City last week for the annual ACTE Global Summit and enjoyed the opportunity to connect with hundreds of corporate travel managers and buyers. Our booth at InterACTE was busy nonstop! Thanks to all who stopped by to say hello -- we hope we helped shed some light on the challenges of managing your off-channel

Traxo Update: SOC 2 Type II Achieved

In an era where data security and privacy are paramount concerns, Traxo has announced its successful completion of the Systems and Organizational Control (SOC) 2 Type II examination. This achievement reinforces Traxo's commitment to maintaining the highest level of security. The in-depth audit, conducted by Dansa D'Arata Soucia LLP , provided an

Mandatory Emissions Reporting: Implications for Global Corporate Travel

Post-pandemic recovery has ushered in an era where the environment and sustainability are paramount. For the travel industry, the spotlight is on new mandatory emissions reporting standards. As the The World Travel & Tourism Council (WTTC) points out , navigating this evolving landscape requires commitment and innovation. Let's delve into how

Travel Data Security: What is Pen Testing?

You’ve likely experienced a cyber attack at some point during your career or personal life. For example, you may have had an account hacked into or received an alarming message from a service provider that there has been a systems data breach and your personal details were compromised. With larger-scale cyberattacks, these often go unnoticed or

There’s always more to know.

Subscribe to our mailing list for the latest product news, events, webinars, and industry insights.

Get the latest from Traxo

Corporate travel management is a dynamic field. Join our mailing list to keep abreast of the latest news on Traxo products and key industry insights.

- Platform for managers of modern travel programs

- Travel Program Savings

- NDC Visibility

- Partners spanning all functions for a smarter travel program

- Resources for smarter travel program management

- Blog on the latest travel management trends

- Traxo Traveler for personal itineraries

- NDC Tracker for the latest NDC updates

- Developer Center

- Service Status

- Talk to an Expert

- About Traxo

- Affiliate Program

- Privacy Policy

- User Agreement

- EU Data Protection

Travel Analytics: Data Sources, Use Cases, and Real-Life Examples

- 11 min read

- Data Science , Travel

- 19 Sep, 2023

- No comments Share

In the continuously changing travel industry, data-driven insights are revolutionizing decision-making processes. Beyond its fundamental role in elevating customer experience, travel analytics has a valuable impact on revenue growth and cultivating a competitive edge. This article explores the influence of analytics on marketing strategies, revenue management, guest personalization, and other aspects of the travel industry. We will examine key data sources, real-world use cases, and how to approach analytics in travel.

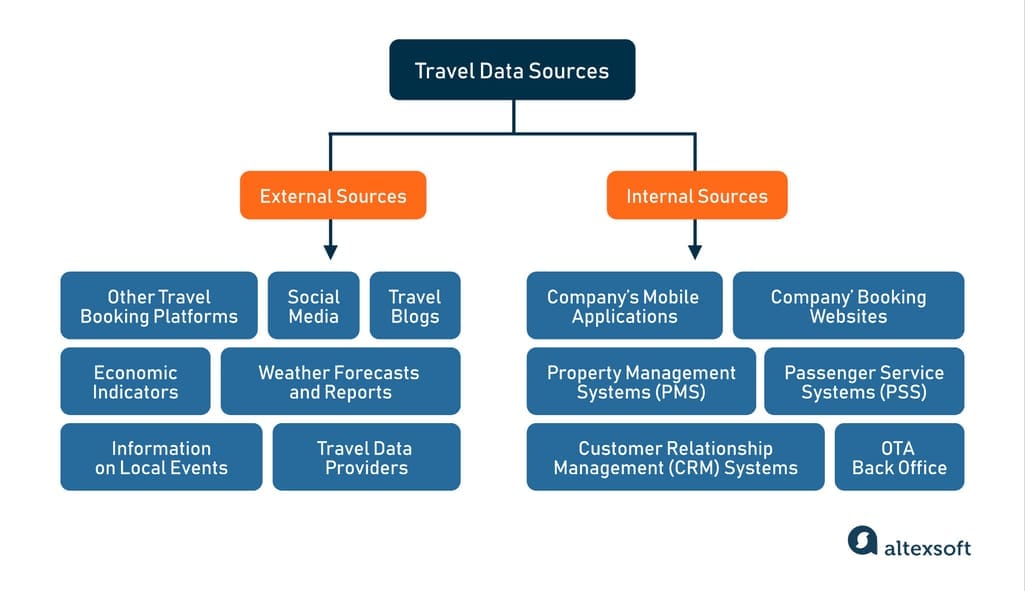

Internal vs. external travel data sources

At the core of effective travel analytics lies the fundamental requirement for diverse and robust data from internal and external sources.

Internal travel data sources

Internal data refers to the proprietary information generated and collected by an organization as a result of its day-to-day operations and interactions with clients. It provides a comprehensive overview of a company's performance, highlighting both successes and areas needing improvement. By harnessing internal data sources, travel businesses can develop personalized services that cater to their customers' ever-evolving needs, as well as optimize their operations, enhance marketing strategies, and improve resource allocation, ultimately driving growth and profitability. Company’s booking website and mobile app allow you to track and collect a wealth of data, from web traffic information to user behavioral metrics (session duration, navigation paths, etc.), geolocation, profiles, and feedback. Internal systems — like a property management system (PMS) in hospitality, a passenger service system (PSS) used by airlines, or an OTA back office — are the backbone and the most relevant source of transaction details, booking histories, and inventory data for a travel business. Learn more about the functions of internal systems with our dedicated articles about hotel property management systems and passenger service systems . Customer relationship management (CRM) systems contain customer profiles with demographic information like age, gender, location, travel preferences, contact information, and communication history. They record and track customer and company interactions, spanning various communication channels like emails, chats, and phone calls. Loyalty program data can also be part of CRM records with information on membership tiers or rewards earned.

External travel data sources and providers

External data encompasses all types of information and datasets created outside a company and existing beyond its direct control, ownership, or management. Analyzing external data helps travel businesses stay competitive, adapt to shifting market conditions, and make well-informed choices regarding pricing, promotion, and overall strategies. Other travel booking platforms are the main source of information on competitors' offerings. By monitoring and comparing them, you can identify popular services, destinations, and accommodations. This approach culminates in inventory optimization and competitive pricing strategies. Social media and travel blogs contain valuable information about travelers' experiences, recommendations, preferences, and popular upcoming events. These online platforms include customer reviews and user comments, covering everything from current trends to destination-specific information. Economic indicators cover a wide range of statistics that reflect the economic state of a region, country, or industry. They can be indicators of inflation, exchange rates, unemployment, and consumer spending. For the travel industry, this data is essential for understanding economic conditions that can impact travel patterns and consumer behavior. Travel data providers offer a diverse range of ready-to-use data for hotels, travel agencies, and other stakeholders . For instance, a notable expert in this domain, OAG , has a suite of air-related datasets, including historical flight data spanning 20 years. Businesses selling vacation rentals can take advantage of data collection from AirDNA , Mashvisor , and others. Read our article to find a more detailed exploration of short-term and vacation rental data . Other external data sources that can be helpful when building travel analytics solutions are weather forecasts and reports, and information on events that take place in a particular location.

The importance of the events economy in the travel industry.

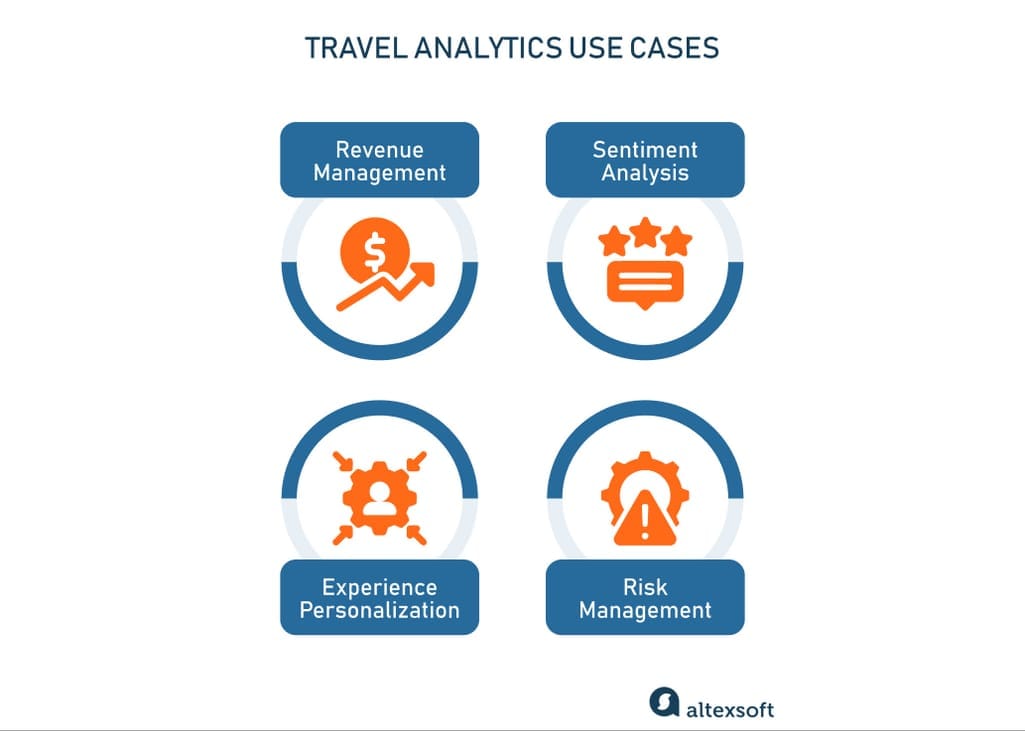

4 travel analytics use cases

4 travel analytics use cases.

1. Revenue management

Revenue management is a set of practices for maximizing revenue by setting optimal prices based on demand. Many factors should be considered to find the right balance between rates and current seat availability, room occupancy levels, etc. That’s where modern analytical methods can help you out. Demand forecasting with machine learning allows companies to spot the slightest shifts in consumer behavior and predict a probable future demand for a product or service. For instance, businesses can prepare for more customers when flight bookings intensify for a specific destination. They can adjust prices and create appealing travel packages. Read our dedicated article to learn more about demand forecasting methods . Price prediction empowers companies to maintain a competitive edge in the market by establishing optimal rates. Learn about our experience in building machine learning models for flight price prediction and hotel price prediction . Occupancy rate prediction is crucial for making data-based decisions on pricing strategy, planned maintenance, and staff scheduling. Accurate forecasts allow revenue managers to quickly identify periods of increased or decreased interest, for example, months in which rooms will be sold at a higher or lower price. To gain further insights on this topic, take a look at our article that discusses occupancy rate prediction using machine learning . Dynamic pricing is the process of setting the price of a product or service in response to current demand, market trends, and other factors. Demand forecasting, price prediction, and occupancy rate prediction can be part of a dynamic pricing approach, helping revenue managers maximize profits in ever-changing conditions.

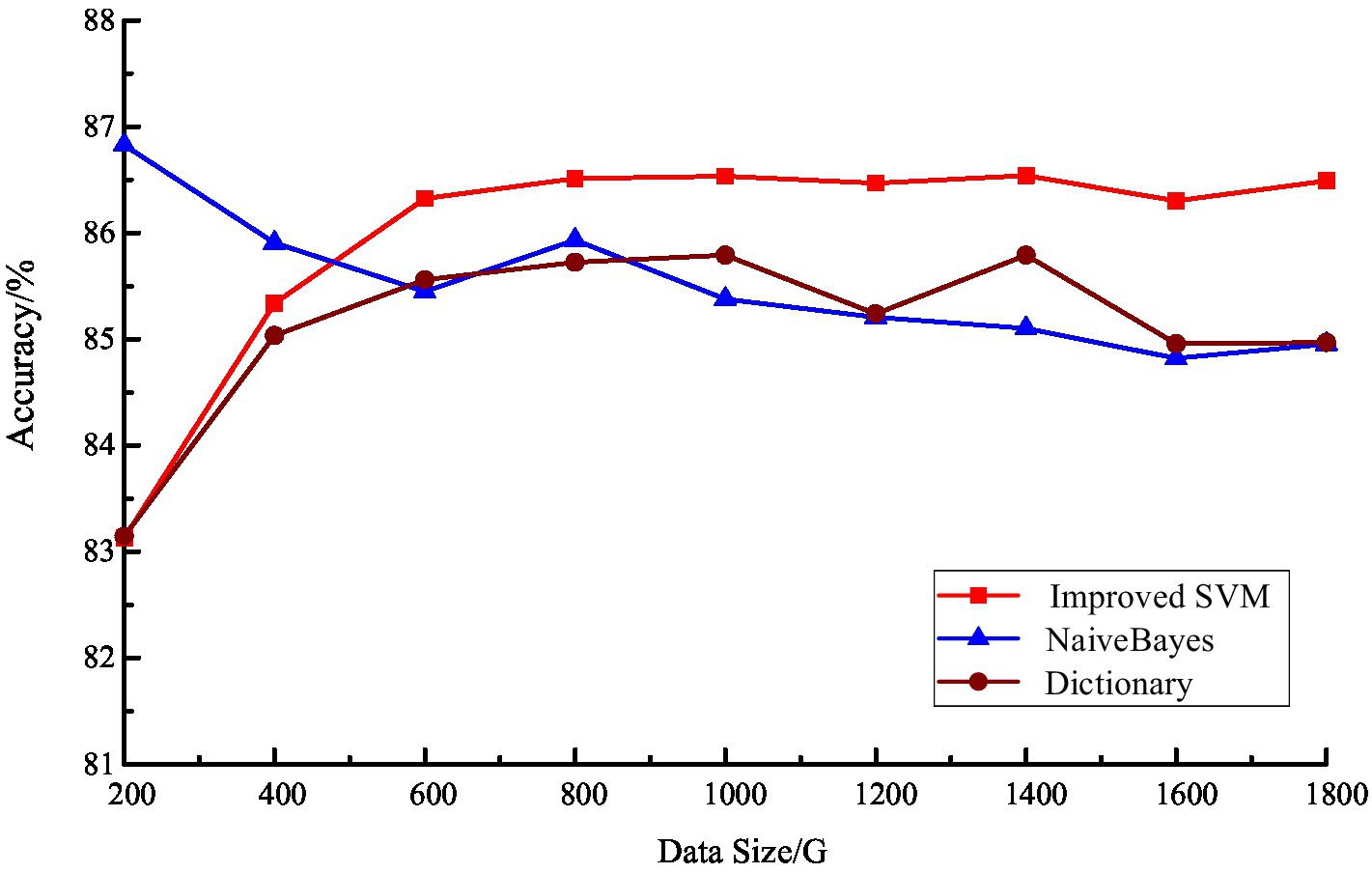

2. Sentiment analysis

With the widespread adoption of social media, travelers often share their experiences and recommendations, providing businesses with information about customers’ perceptions and preferences. This data can be used to run sentiment analysis. Sentiment analysis employs natural language processing (NLP) , statistics, and machine learning to decipher emotions, opinions, and judgments in text by extracting subjective information. Also known as opinion mining, it categorizes sentiments as positive, negative, or neutral. This type of text analysis can pinpoint areas for adjustment and assist in making improvements in service quality and customer experience, ultimately enhancing the brand's reputation. Read our article about sentiment analysis in hotel reviews to learn how we generate instant feedback snapshots, enabling travelers to swiftly compare various options and make the optimal choice.

3. Personalizing customer experience

Over 70 percent of customers expect the companies they engage with to consider their unique needs and desires. By analyzing factors like age, goals, status, region, values, and interests, businesses can facilitate effective personalization strategies for the various consumer types. Recommender systems and trip planning tools are two popular examples of how analytics enable this process in travel. Recommender systems use machine learning algorithms to make real-time personalized offers that meet the needs of a particular traveler. They can also aid in sustainable travel by suggesting ways to reduce carbon emissions and mitigate over-tourism, offering places with fewer visitors. For a deeper understanding, read our article that covers recommender systems or watch our video about the main types of recommender systems.

Main types of recommender systems.

Trip planning is another example of how analytics drive personalization in travel. It can be viewed as an advanced recommender system that generates an itinerary and recommends the best order of places to visit based on a traveler’s preferences, behavior, and other data. While some platforms go no further than proposing accommodations or ticket booking, more advanced services offer comprehensive trip arrangements, saving both time and money.

4. Risk management

In the travel industry, challenges can arise from various unexpected events. It’s important to surveil such situations and spot potential disruptions. Fraud detection driven by analytics helps pinpoint subtle and hidden events in user behavior that can signal possible risks, such as fake bookings and chargebacks. To counter these risks, besides analytical tools, implement travel fraud prevention measures, including additional verification steps and raising the company staff's awareness of the fraud risk. Read our article on ML-assisted fraud detection or watch this video:

Fraud detection: Fighting financial crime with machine learning.

Guest screening is another application of travel analytics, involving the processing of guest information, booking details, and historical behavior patterns. In this examination, each reservation is assigned a risk score — a quantitative representation of the potential risk associated with that particular reservation. It takes into account factors such as the likelihood of property damage, the risk of non-payment, and the potential for illegal activities. Guest screening equips hoteliers with the insights needed to make informed decisions regarding reservation acceptance. Identifying potential issues before guests arrive enables you to create a secure environment and mitigate risks that can impact the property's safety, reputation, and financial stability. Flight arrival and departure time prediction is a powerful method for mitigating delay scenarios. Machine learning algorithms consider various factors like weather, arrival gates, aircraft type, and more, enabling airlines and ground handlers to better allocate gates, swap aircraft or crews on particular flights as needed, and thus minimize tarmac wait times. Predictive maintenance utilizes machine learning to process data from IoT sensors and detect early signs of equipment failures. Due to this analytical method, airlines, car rental companies, and other businesses can address small problems before they develop into costly damages. For example, in aviation, predictive maintenance reduces the need to pull the aircraft out of service, helps optimize repair schedules, prevents unexpected faults, and insures against flight delays.

Real-life examples of successful travel analytics implementation

Here, we're sharing real-life examples of notable brands leveraging analytics to achieve impressive results in customer engagement, cost reduction, and operational efficiency.

Marriott: Bringing more personalization to the loyalty program

Marriott International, headquartered in Bethesda, Maryland, is a renowned American multinational company that operates, franchises, and licenses a diverse portfolio of lodging options, including hotels, residential properties, and timeshares. Marriott began as an A&W Root Beer franchise in Washington, DC, in 1927. Thirty years later, the company expanded into the lodging industry, marking a significant milestone. To drive analytics, Mariotte partnered with IBM. After migrating to a modern data stack , Marriott deployed Db2 Warehouse on Cloud , which allowed IBM data scientists to map comprehensive customer data across all Marriott brands and build a travel experience platform that now powers Marriott Bonvoy, the industry's largest loyalty program with over 140 million members. Each time customers redeem their loyalty points, the platform gains more data to better understand those travelers and market to them in a more personalized way.

American Airlines: Optimizing operations and reducing fuel consumption

American Airlines, founded almost 100 years ago, has a deep-rooted legacy of pioneering achievements, launching the first major carrier loyalty program , and introducing airport lounges. Headquartered in Fort Worth, Texas, it is the largest airline globally in terms of scheduled passengers carried and revenue passenger miles, a metric used to measure the total miles traveled by paying passengers. After transitioning its data platform to Microsoft Azure, American Airlines got a specific focus on optimizing operational efficiency. At the heart of its analytical efforts is an intelligent gating program that leverages real-time data on routes and runways and automatically assigns the nearest available gate to arriving aircraft. This enabled significant reductions in taxi time and fuel consumption, saving up to 10 hours of taxi time per day and thousands of gallons of jet fuel per year. American Airlines also developed the Hub Efficiency Analytics Tool (HEAT), an ML-driven program implemented to minimize the impact of weather-related flight delays. It analyzes various data points, including weather conditions, customer connections, air traffic, and gate availability. HEAT's proficiency in dynamically adjusting departure and arrival times has decreased flight cancellations during adverse weather conditions. All told, American Airlines' strategic embrace of AI, machine learning, and data analytics has led to notable improvements in operational efficiency, customer experience, and cost reductions.

Hilton: Personalization with data-driven smart suggestions

Hilton Worldwide Holdings Inc. is a renowned American multinational hospitality company headquartered in McLean, Virginia. From its inception in 1919, Hilton's goal was to operate the finest hotel in Texas. Commitment to excellence and innovation has positioned it as one of the world's most respected brands that has grown to operate in over 100 countries. Recognizing the growing importance of data in hospitality, the company is constantly investing in analytics to stay ahead in an ever-evolving market. For example, Hilton implemented in-page data capture technology by Celebrus , to accurately capture the smallest details of customer behavior on hotel sites. It allows for a better understanding of visitors and enhances their experience. Hilton also benefits from OnQ CRM, a proprietary system developed to handle large amounts of diverse customer data collected through various communication channels. With predictive analytics, the company can use these large volumes of data to forecast customer retention and better meet guest demands. Incorporating advanced data analytics and innovative technologies, Hilton has not only solidified its position as one of the global hospitality leaders but has also demonstrated its commitment to an exceptional guest experience.

Agoda: Enhancing user journey with OpenText Analytics

Agoda, founded in 2005, has revolutionized travel by simplifying the search and booking process. This Singapore-based OTA operates globally and is considered one of Asia's leading travel-tech companies. With millions of registered customers and over 6,000 employees across 31 markets, Agoda offers access to over 2 million properties worldwide and a range of travel-related services. Every day, the company's website serves millions of customers, which makes a frictionless booking journey and overall usability a major competitive factor. “Customers will stick with us if we provide high-quality products and a streamlined experience, and accommodation owners will offer optimized pricing if we give them the best marketplace," Idan Zalzberg, VP Data at Agoda, explains . To stay ahead of rivals, Agoda employed Vertica Analytics Platform (now owned by OpenText.) It enabled the OTA to analyze complex user behavior patterns in seconds and constantly improve the website based on insights from large volumes of data.

How to approach travel data analytics

The process of unlocking valuable insights from data involves the following key steps. Assemble a data science team. Building or hiring a skilled data science team with expertise in the travel domain is a fundamental step to take before the process even begins. Pay attention to the collaboration and communication skills of the team members since they must interact a lot with other stakeholders and be on the same page with them. Formulate key questions. Clearly define the problem your organization is going to solve with the help of analytics. Establish measurable goals and KPIs to gauge the success of your efforts. Articulating the anticipated results is critical for ensuring that all stakeholders have a shared understanding of the project's purpose and direction. Define data sources and collection methods. The next crucial phase is to gather the necessary data for analysis. The choice of data sources and collection methods should align with business objectives to ensure that the analysis is based on accurate and relevant information. Define the timeframe for data collection and create a clear plan with information on team assignments, relevant data sources, and key requirements. Choose analytical tools. Depending on the nature of the data and your business objectives, a variety of techniques may be employed, including machine learning, deep learning , natural language processing (NLP), and computer vision . Discuss the most appropriate methods with your data science team. Communicate and visualize the results. This step ensures that stakeholders understand and can use the analytics results to make informed decisions. Engage with stakeholders in a way that resonates with their level of expertise and interest, maintaining clarity and transparency. To enhance effective storytelling, utilize BI tools like Power BI or Tableau, or Python libraries like Matplotlib and Seaborn. Read our article on data visualization libraries and tools to learn more. Consider implementing data governance. An effective data governance strategy ensures the accuracy, availability, and security of data, making it compliant with data regulations, such as the GDPR in the EU and CCPA in California. Data governance policies safeguard the company’s reputation and enhance both partner and customer trust. These steps are crucial to fully leverage the power of data in your travel operations and ensure that your business initiatives are geared towards making informed, customer-centric decisions.

Comparing online travel review platforms as destination image information agents

- Original Research

- Open access

- Published: 22 April 2021

- Volume 23 , pages 159–187, ( 2021 )

Cite this article

You have full access to this open access article

- Xinxin Guo ORCID: orcid.org/0000-0002-7904-3040 1 ,

- Juho Pesonen 1 &

- Raija Komppula 1

5673 Accesses

11 Citations

Explore all metrics

Online travel reviews have been extensively used as an important data source in tourism research. Typically, data for online travel review research is collected only from one platform. However, drawing definite conclusions based on single platform analyses may thus produce biases and lead to erroneous conclusions and decisions. Therefore, this research verifies whether or not there are discrepancies and commonalities between different travel review platforms. In this study, five native Chinese travel review platforms were selected: Ctrip; Qyer; Mafengwo; Tuniu; and Qunar. Using a mixed content analysis method, the destination image of Finland was extracted from 10,197 travel reviews in Simplified Chinese as the destination image is a popular topic in online review research. Results show Finland’s destination image representation varies between Chinese travel review platforms. This discrepancy is especially prominent in the dimension of functional and mixed functional-psychological destination attributes. Significant theoretical contributions and managerial implications for the analysis of online travel reviews and destination image research are discussed.

Similar content being viewed by others

Social media influencer marketing: foundations, trends, and ways forward

Yatish Joshi, Weng Marc Lim, … Satish Kumar

Customer engagement in social media: a framework and meta-analysis

Fernando de Oliveira Santini, Wagner Junior Ladeira, … Barry J. Babin

The influence of social media eWOM information on purchase intention

Choi-Meng Leong, Alexa Min-Wei Loi & Steve Woon

Avoid common mistakes on your manuscript.

1 Introduction

Today, online travel reviews (OTRs) have a huge influence on the tourist decision-making process, because they are often used when tourists compare various options and make travel-related decisions. OTRs are also an indicator of a destination’s post-visit destination image (DI) because tourists write reviews of their experiences based on the image they have after the trip (González-Rodríguez et al. 2016 ; Park et al. 2007 ). OTRs are therefore gaining increasing attention in tourism research and destination marketing. Meanwhile, DI is increasingly analyzed using online textual data instead of other data collection methods such as interviews (Lu and Stepchenkova 2015 ). New analysis methods based on big data allow us to gain in-depth knowledge from this vast social media data ocean (Fazzolari and Petrocchi 2018 ).

Earlier studies involving OTRs have relied on a single data source (Xiang et al. 2017 ). In using a single data source for OTR research, researchers ignore platform-specific biases such as differences in platform design, user base, platform-specific behavior, and storage strategy (Pfeffer 2014 ). Using a single platform is also a potential source of sampling bias that potentially complicates the interpretation of the research findings (Tufekci 2014 ). This study aims to explore whether or not platform-specific biases in OTRs should be accounted for in tourism research and practice, and if so how. Moreover, earlier studies have mainly used statistical analyses, natural language processing techniques, or algorithms to explore the length of the review, frequently words, topics, and review sentiment (Xiang et al. 2017 ; Zhang and Cole 2016 ), or have analyzed the functional features of different websites (Pai et al. 2014 ).

Additionally, research on OTR platforms in tourism studies is still based largely on the Western context (Xiang et al. 2017 ). With the rapid growth of Chinese outbound tourists in recent years, scholars are increasingly focusing on China and other Asian countries. The exploration of Chinese social media platforms has become an important research venue (Sotiriadis and Sotiriadis 2017 ). However, cultural and language barriers mean research on Chinese OTR platforms is rarely published in English. Data from OTR platforms may, therefore, provide a new approach to destination image research among Chinese tourists.

To address these gaps in the previous research, this study makes an in-depth comparison of various native Chinese OTR platforms to identify their potential differences and universal attributes. The differences are analyzed by comparing the DI between platforms as the DI concept is an important topic in OTR analysis (Marine-Roig and Ferrer-Rosell 2018 ). Additionally, the aim was to explore the reasons for discrepancies and commonalities in the representation of the DI. An instrumental case study approach (Mills et al. 2013 ) was used in this study as we are interested in the differences of online platforms in representing DI instead of the case itself. Since the research team is familiar with Finland and tourism in the country, it was chosen as the case destination. Finland is also a relatively new destination for Chinese tourists, but growing fast before COVID-19 pandemic. This development aspect makes Finland an interesting case to study the phenomenon. However, we acknowledge that the context is secondary for this research compared to the phenomenon itself and the destination could have been virtually any another destination. The data was collected from five Chinese OTR platforms and analyzed using a mixed content analysis approach focusing on data referring to Finland as a tourist destination. A qualitative content analysis was used to formulate a DI coding manual (for use in the analysis) from part of the samples. A quantitative content analysis was then conducted to objectively extract Finland’s DI from the other OTRs’ data, based on the coding manual.

The structure of the paper is as follows: Chapter 2 presents previous social media studies of OTR platforms. Chapter 3 introduces the theoretical background of the DI framework. The methodology and results are presented in Chapters 4 and 5. A theoretical discussion and practical implications based on the results are presented in Chapter 6. The final chapter includes a conclusion, a discussion of the study’s limitations, and suggestions for future study.

2 Social media analytics on online travel review platforms

In 2018, the number of Chinese outbound tourists exceeded 149 million (iResearch 2019 ). The increasing outbound travel has also led to the increasing use of online travel review platforms in China. With the development of information technologies, China’s tourism information services now cover the pre-travel, on-travel, and post-travel processes (Pan et al. 2019 ). OTR platforms are especially prominent: 51.4% of outbound tourists obtain travel recommendations and information from Chinese OTR platforms (iResearch 2019 ). Besides, 71.6% of Chinese outbound tourists share travel experiences on Chinese social media, and 39.9% of tourists share travel experiences on OTR platforms (iResearch 2019 ). All the evidence indicates that OTR platforms are very important in any attempt to understand outbound Chinese tourists.

There is a vast amount of online information on OTR platforms, commonly known as “big data”. When researchers conduct DI studies based on shared online travel experiences, OTRs are regarded as a form of electronic word-of-mouth communication (eWOM) (Marine-Roig 2017 ). Although online reviews may be seen as unsolicited and unbiased online information that reflects the realistic tourist perception of the destination (Marine-Roig 2017 ), the OTR content given by different tourist segments has different focuses (Van der Zee and Bertocchi 2018 ). Nowadays, the application of OTRs in tourism research has received increasing attention, and researchers usually collect data from a single Western OTR platform, especially TripAdvisor, Yelp, or Expedia (Xiang et al. 2017 ).

Many researchers have adopted a single OTR platform approach in tourism studies (Xiang et al. 2017 ). The platform-specific biases of different OTR platforms mean that multi-platform data sources may be more valid in researching tourism phenomena. These biases are not only reflected in the platform design itself (Pai et al. 2014 ), but in the posting behavior of tourists and managers (Pfeffer 2014 ). The research already demonstrates that the major Western OTR platforms differ regarding the cost of reviewing (Chevalier et al. 2018 ; Zhuang et al. 2018 ), the review content posting behavior in terms of the number of reviews, the review length, customer preference, and sentiment, for example (Proserpio and Zervas 2017 ; Wang and Chaudhry 2018 ; Xiang et al. 2017 ).

Researchers are thus well aware of the differences between major Western OTR platforms. However, although we often use OTR platforms for destination image analytics (Marine-Roig and Ferrer-Rosell 2018 ), how the OTR platform itself affects DI analytics remains unknown. It is imperative to understand how the DI differs between different platforms or whether there is a difference at all. We, therefore, compare Chinese OTR platforms and analyze the results of online DI analytics from major Chinese OTR platforms.

3 The framework of the destination image

The usual definition of DI is the sum of a person’s beliefs, ideas and impressions of a destination (Crompton 1979 ). It is formed in a process in which personal, sociocultural, and information technology factors (Beerli and Martin 2004 ; Josiassen et al. 2015 ; Kislali et al. 2016 ; San Martín and Del Bosque 2008 ), as well as stimulus factors (e.g., information sources, previous experience of the destination) affect the formation of the image (Gartner 1993 ). According to Gartner ( 1993 ), destination information can be regarded as a continuum of various image formation agents, ranging from traditional forms of the induced agent to autonomous and organic image agents. “Induced agents” refers to the information provided by commercial destination actors representing the supply-side view of DI as the projected image (Mak 2017 ). “Autonomous image agents” refers to information sources which are not under the control of the destination organizations, referring to news, movies, and documentaries, for example (Gartner 1993 ). “Organic image agents” refers to information sources based on a visit to the area (Gartner 1993 ).

With the development of information technology, induced and organic image formation agents are not necessarily mutually exclusive but may complement each other (Selby and Morgan 1996 ). One view is that the Internet can be seen as an induced information agent in the image formation process (Beerli and Martin 2004 ). The opposing view is that the previous point is outdated in the modern online environment, and the different online travel platforms (such as official tourism websites, travel blog platforms, or travel review platforms) on the Internet can be classified as induced, autonomous, or organic information agents (Llodrà-Riera et al. 2015 ). Online destination information can, therefore, be regarded as an agent of induced or organic image formation, both of which play a significant role in the image formation process (Llodrà-Riera et al. 2015 ). Besides, when tourists obtain destination information from different online travel platforms, there may be a discrepancy between the destination images based on official tourism website content (induced), travel blog platform content (autonomous), and travel review platform content (organic) (Mak 2017 ; Marine-Roig and Ferrer-Rosell 2018 ). Perceptions of official tourism website content (induced) and travel blog platform content (autonomous) differ less from each other (Marine-Roig and Ferrer-Rosell 2018 ).

Due to the OTRs’ source credibility and information quality, travel review platforms as organic information agents are more unbiased and trustworthy than the induced information agents of official tourism websites (Filieri et al. 2015 ). The assessment of DI formation based on OTR data is, therefore, becoming increasingly popular. In particular, understanding DI based on different OTR platform content may assist in exploring whether there is a DI discrepancy between different organic information agents. Mak ( 2017 ) used the term online destination image to depict “the online representation of the collective beliefs, knowledge, ideas, feelings and overall impressions of a destination.”

There are two main approaches to defining DI construction. One considers DI as a multidimensional construct with two main components: the cognitive image and the affective image of destinations (Baloglu and McCleary 1999 ). These two images respectively represent a tourist’s knowledge of the destination and their emotions based on their destination knowledge (Baloglu and McCleary 1999 ; Gartner 1993 ). The other most-cited construction is considering DI as a person’s overall evaluation of the destination, which includes attribute-based and holistic components (Echtner and Ritchie 1991 , 1993 ). Each component can be further subdivided into functional-psychological; or common-unique characteristics (Echtner and Ritchie 1991 , 1993 ). The attribute-holistic continuum illustrates whether the representation of DI is from the perspective of an individual attribute or a holistic aggregate. The functional-psychological continuum refers to functional (directly observable or measurable) or psychological (less tangible, difficult to measure) attributes. The common-unique continuum also refers to common characteristics, attributes, and impressions according to which destinations are commonly compared, or it refers to unique or destination-specific features (Echtner and Ritchie 1991 , 1993 ). By introducing a three-dimensional DI framework, Echtner and Ritchie ( 1993 ) developed a 35-item destination attribute scale, ranging from more functional attributes (including tourist sites/activities, national parks, and historic sites) and mixed destination attributes (including crowdedness, cleanliness, and political stability) to more psychological destination attributes (including hospitality, place atmosphere, and reputation).

Subsequently, some studies have proposed various scales to determine the destination attributes and measure the DI (Beerli and Martin 2004 ; Choi et al. 2007 ; Enright and Newton 2005 ; Gallarza et al. 2002 ; Marine-Roig 2017 ; Rodrigues et al. 2015 ; Vinyals-Mirabent 2019 ). In this study, we have combined Echtner and Ritchie’s ( 1993 ) functional-psychological attribute scales and Beerli and Martín’s ( 2004 ) attribute classification as an adapted framework (see Appendix 1 ) for data analysis. Echtner and Ritchie’s ( 1993 ) study placed 35-item destination attributes into a functional-psychological scale, which does not cover all the universal attributes in the destination. Therefore, another often cited destination attribute study by Beerli and Martín ( 2004 ) was applied for the adapted framework. Beerli and Martín’s ( 2004 ) study classified destination attributes into nine dimensions, but they did not distinguish the functional or psychological features of these attributes. For this reason we developed an adapted attribute framework which combines the advantages of Echtner and Ritchie’s ( 1993 ) and Beerli and Martín’s ( 2004 ) studies.

In order to build the adapted attribute framework, the first step was to place Echtner and Ritchie’s ( 1993 ) 35 identified destination attributes into Beerli and Martín’s ( 2004 ) destination attribute classifications. Then, according to the functional-psychological definition of the attribute given in Echtner and Ritchie’s ( 1993 ) study, the functional and psychological feature of the attribute classification were determined. For example, tourist sites, tourist activities, sports activities, national parks, and tourist entertainment were regarded as functional destination attributes in Echtner and Ritchie’s study ( 1993 ). In Beerli and Martín’s ( 2004 ) study, these attributes were classified as a tourism leisure dimension. Therefore, the tourism leisure dimension was considered a functional attribute after some research group discussion. Moreover, in the tourism leisure dimension, architecture and buildings, which were not covered in Echtner and Ritchie’s ( 1993 ) study but were identified in Beerli and Martín’s ( 2004 ) study, were also considered as a functional destination attribute. The adapted DI framework comprehensively illustrates the destination attributes from continuous functional to psychological characteristics in nine dimensions. The tourism leisure and recreation, natural resources, and tourism infrastructure dimensions are more related to the functional level. On the other hand, the dimensions of culture, history, art, general infrastructure, and natural environment belong to the mixed functional-psychological level. The abstract psychological attributes include politics and economics, the social environment, and the atmosphere of the place in question.

As socio-demographic and sociocultural factors (Beerli and Martin 2004 ; Josiassen et al. 2015 ; Kislali et al. 2016 ; San Martín and Del Bosque 2008 ) play an important role in the image formation process. It can be assumed that tourists with different cultural backgrounds may perceive the same destination attribute differently (Nakayama and Wan 2019 ). As most of the academic research on destination image analytics has been conducted Using western platforms, a short review of the literature focusing on Chinese tourists’ perceived images of Western destinations may highlight the dimensions of the image the Chinese tourists’ highlight. Chinese tourists retain different preferences for domestic and Western destinations (Li and Stepchenkova 2012 ; Wang and Hsu 2010 ). In domestic travel, the service quality attribute is the most important factor in shaping the DI (Wang and Hsu 2010 ). However, most Chinese tourists visiting Western countries share travel experiences concerning natural resources and local cultures (Huang and Gross 2010 ; Li and Stepchenkova 2012 ; Sun et al., 2015 ). Chinese tourists are also willing to discuss political and economic issues affecting Western destinations (Li and Stepchenkova 2012 ). To confirm judgements about Western destinations, Chinese outbound tourists tend to compare differences between a Western destination’s social systems and China’s (Huang and Gross 2010 ). Additionally, Chinese cultural norms play an important role in the process of perception formation and the interpretation of Western destinations (Sun et al. 2015 ). These cultural norms include the desire for harmony and respect for the authorities. The different cultural backgrounds of Chinese and Western tourists mean there may be significant differences in perceptions of the same destination (Tang et al. 2009 ). According to Kim and Morrison ( 2005 ), Chinese outbound tourists are more likely to change their perception of destinations in a short period than Western tourists.

4 Methodology

Adopting the mixed qualitative and quantitative content analysis approach, this study compared the representation of the image of Finland in different Chinese OTRs, to interpret the commonalities and discrepancies between various platforms. China has become one of the largest source markets in international tourism (UNWTO 2018 ), and this growth has also been witnessed in Finland. Between 2011 and 2018, the number of Chinese tourists visiting Finland increased by 323% (Statistics Finland 2019 ). In 2012, the Finnish national tourism office (VisitFinland) and the Finnish airline company Finnair established digital marketing strategies on Weibo, in China. Although the data reveals that the Nordic countries have great potential in the Chinese market, gaps and deficiencies remain in DI research in the Nordic countries (Andersen et al. 2018 ). Today, China has the largest market of Internet users, accounting for 21% of the worldwide total (Meeker 2019 ). With an increasing number of Chinese tourists sharing travel experiences online, the massive amount of information they generate provides researchers with a way of studying the DI of a European destination from the perspective of Chinese tourists. Even though the study uses Finland and China as examples, the results can be generalized to other market combinations.

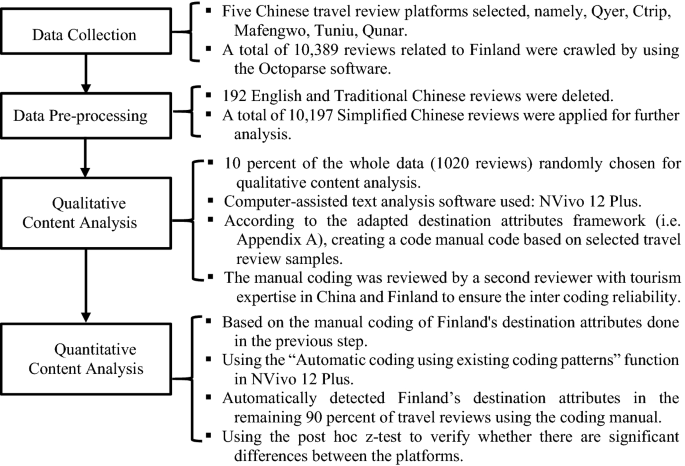

In China, travel websites with review functions can be classified in two main categories: travel vertical platforms, such as Mafengwo, Qyer; and online tour agents (OTA), such as Ctrip, Tuniu, and Qunar (Graff and Parulis-Cook 2019 , p. 53). Vertical travel websites rely heavily on user-created content, and provide tourists with generated travel information and related travel-specific services (Graff and Parulis-Cook 2019 ; Kizmaz 2018 ). Chinese OTA websites provide many travel-related services including visa arrangements, tax refunds, and financial services, as well as travel information. Many Chinese OTA websites now also have a review function for users to share their comments about destinations. Before entering the detailed introduction of the research method, a flowchart (Fig. 1 ) summarizing the key information of the research process is shown below.

The flowchart of the research process

The flowchart shows the four main parts of the research process, namely data collection, data pre-processing, qualitative content analysis, and quantitative content analysis. The following chapters will introduce each of these steps in detail.

4.1 Data collection and pre-processing

Baidu is the largest online search engine in China. Its information center ( http://site.baidu.com/ ) displays 23 popular Chinese tourism websites. Manually typing “芬兰” (Finland) into the search engine of each tourism information website resulted in six websites with Chinese OTRs for Finland. These OTRs were on Qyer, Ctrip, Mafengwo, Tuniu, Qunar, and Maotuying (the Chinese version of TripAdvisor). On Maotuying, the OTRs in Chinese are translated from other languages. This platform was therefore excluded from the study. Table 1 displays background information about these five platforms. Figure 2 shows the format of the OTRs on different platforms. OTRs are basically comprised of four components: linguistic features; semantic features; sentiment; and reviewer information (Xiang et al. 2017 ). The differences in travel platform design mean that not all these features can be found on each platform (Xiang et al. 2017 ). For example, except for Tuniu, tourists can attach photos to OTRs on the other four platforms. On Qyer, Mafengwo, Tuniu, and Qunar tourists can comment on others’ OTRs. However, all the platforms contain basic review features (textual review content, ratings, and the release time) and reviewer’s information (nickname, profile photo).

The format of the OTRs on Qyer, Ctrip, Mafengwo, Tuniu, and Qunar

In Fig. 2 , the red box indicates the content of the OTRs. The black circle indicates the reply function.

Data collection was conducted using a web crawler, Octoparse, which was used to extract the required data information from the hypertext markup language on the travel review webpages. In this study, we collected only the textual review content, release date, and reviewer’s nickname. The collection process took place between early October and the end of December 2018. A total of 10,389 OTRs related to Finland were crawled by the setting crawling process. The textual OTR content includes descriptions of attractions, hotels, restaurants, entertainment activities, and others. Furthermore, only Simplified Chinese OTRs were considered in this study. After deleting 192 English and Traditional Chinese OTRs, a total of 10,197 Simplified Chinese OTRs were applied for further analysis. As Table 2 shows, Qyer had the largest number (3570) of OTRs, followed by Ctrip and Qunar. Mafengwo and Tuniu had a nearly equal number of OTRs and are the smallest platforms.

4.2 Data analysis

The content analysis approach is commonly adopted to analyze textual messages (Stepchenkova and Mills 2010 ). It can be used to compress many words into categories based on explicit coding rules (Harwood and Garry 2004 ). Most of the existing literature used either the qualitative or quantitative content analyses to study the perceived destination from OTRs, and the quantitative approach seems to be the mainstream choice (Marine-Roig and Ferrer-Rosell 2018 ; Qi et al. 2018 ; Zhang and Cole 2016 ). Applying the computerized quantitative content analysis approach to OTR-based image studies includes two basic steps, data pre-processing and attribute identification (Marine-Roig and Clavé 2016 ; Xiang et al. 2017 ). Data pre-processing generally involves some operations, including tokenization (means breaking the review text into words, phrases, or other meaningful elements), and removing stop words (e.g. a, the, so, or other words do not contribute to the meanings of the text) (Xiang et al. 2017 ). Attribute identification in a quantitative content analysis aims to detect the frequency, density and weight of keywords or key phrases in the content by computer program, and then aggregate keywords or key phrases into destination attribute categories (Marine-Roig and Clavé 2016 ). Because a quantitative content analysis often focuses on searching for keywords, adopting a quantitative computerized approach alone often results in ignoring valuable contextual information embedded in the OTR data (Stepchenkova et al. 2009 ; Zhang and Cole 2016 ).

In contrast to the quantitative content analysis approach, the qualitative content analysis approach is the subjective interpretation of textual content, and used to manually extract the DI from a small number of tourists’ narrative descriptions (Sun et al. 2015 ; Tegegne et al. 2018 ). Using the qualitative content analysis approach could extract the valuable contextual information embedded in the textual content. The systematic classification process of encoding the destination attributes and identifying attribute categories is the core of the qualitative content analysis approach in DI studies (Lian and Yu 2017 ). In addition, inter-coder reliability must be carefully considered, which means that different coders need to produce the same encoding results in the same way (Lian and Yu 2017 ). Although a qualitative content analysis focuses on valuable contextual information embedded in the text content, manual coding is quite time-consuming to apply for large-scale text analysis. In order to solve the two problems of extracting valuable information embedded in review content, and processing large amounts of OTR data, thus, a novel approach combining both qualitative and quantitative methods was applied in this study.

The qualitative content analysis in this study was conducted first to identify Finland’s destination attributes and build up a coding manual. In this process, the coding of the destination attributes and categorization followed the adapted attribute framework from previous studies (see Appendix 1 ). Basically, the adapted attribute framework ensured the validity of encoding destination attributes and identifying attribute categories. Therefore, two coders randomly chose 10% of the travel reviews to formulate a coding manual of Finland’s destination attributes. All data coding was conducted on Chinese-language texts using the computer-assisted text analysis software NVivo 12 Plus. The data reached a saturation point when adding additional OTRs failed to reveal novel aspects or issues (Papathanassis and Knolle 2011 ). The coding manual was built by using the following steps: (a) an OTR was read carefully and destination attribute were identified based on the context of review content, (b) the identified attribute was verified in the adapted attribute framework, (c) the code was confirmed if the identified attribute existed in the framework, (d) if the identified attribute did not exist in the framework, the coders discussed and decided on the attribute code and its classification. Furthermore, in order to ensure the reliability of the coding manual, a second reviewer with tourism expertise in China and Finland was asked to review the codes.

In the process of formulating the coding manual, several operations were performed on the selected reviews. First, the coders made efforts to unify the spelling of the names of attractions on different review platforms. For example, the description of Kamppi Chapel and the Silent Church pointed to the same attraction, which was coded as “Kamppi Chapel” under the destination attribute code “churches”. Second, universal terms of destination attributes were applied in the cases that Chinese tourists mentioned general infrastructure without giving a specific name. For instance, Chinese tourists gave descriptions of Finland’s libraries without referring to a certain place, thus the general terms “libraries” were applied to these descriptions.

Based on the coding manual from the qualitative content analysis, a computerized quantitative content analysis was applied to the remaining data by using the “automatic coding using existing coding patterns” function in NVivo 12 Plus. The premise of using pattern-based auto-coding is that the coder needs to manually code part of the material. When using the identified codes for automatic coding, NVivo compares each text part (e.g., a sentence or paragraph) with the review content already coded into the destination attribute. If the content of the text paragraph is similar in wording to the content already coded for the destination attribute, the text paragraph will be coded for that identified attribute. In doing so, the quantitative content analysis results can then reveal Finland’s image on the various Chinese OTR platforms. This study further used the post hoc z test to verify whether the differences between Finland’s image on different platforms are significant. The chi-square post hoc z-test using adjusted residuals is applied to detect differences between groups data (Zhang et al. 2017 ). The premises of using the z-test are that the variance is known and the sample size is large enough (sample size ≥), as is in this case (Table 4 ). The test shows the cells in the chi-square table that have significantly lower or higher adjusted residuals on the 95% confidence interval.

5 Results of the destination image analysis

5.1 qualitative analysis results for finland’s destination image categories.

Compared with the adapted DI framework (see Table 3 ), the qualitative content analysis results proved that Finland’s Chinese OTR data-based DI covered all nine destination attribute dimensions, from the functional to the psychological levels. However, within every attribute dimension, while some universal destination attributes did not appear, other new destination attributes were identified in the data.

The following paragraphs demonstrate some of the aspects identified with some quotations from the source data to illustrate the points.

At the functional level, attributes identified in the adapted frameworks such as beaches and the richness of the countryside did not appear in the Chinese OTRs. However, other attributes were identified in the selected OTR samples, for example, the new attributes of city parks (Quotation 1) and payment methods (Quotation 2) were identified at the functional level. This can be seen in the following quotations:

Quotation 1 “ Sibelius Park is located about 1.5 km northwest of Temppeliaukio Church. It was built to commemorate the great Finnish musician Sibelius. The park is full of flowers and green grass, …”—Reviewer (Case number: 5143) from Ctrip.

Quotation 2 “… At the terminal, we bought a round-trip ticket for 5 euros at the self-service ticket vending machine. It seems that only cash is accepted, and no credit card was accepted. ….”—Reviewer (Case number: 3474) from Qyer.

At the mixed functional-psychological level, attributes concerning the development of health services and telecommunications and traffic congestion which were in the adapted framework were missing. However, a few new attributes, such as educational facilities (Quotation 3), and national industry (Quotation 4) were identified at the mixed functional-psychological level. The following quotations illustrate these aspects.

Quotation 3: “The informatization of Finnish libraries is very good. Finns can borrow materials from the public libraries… and return books to another library which is near their home, …”—Reviewer (Case number: 9583) from Mafengwo.

Quotation 4: “… Known for its technology-intensive industries, it has become a leading technology center in the Nordic region, where Nokia's headquarters is located.”—Reviewer (Case number: 5700) from Qyer.

At the psychological level, aspects from the adapted framework including the degree of urbanization, economic development, the opportunity for adventure, the mystic vs prosaic aspect, the luxurious vs impoverished nature of the destination, or fashionable vs outdated elements could not be discerned. This did not mean that Chinese tourists were not aware of Finnish destination attributes at the psychological level. On the contrary, Chinese outbound tourists seem to have an abundant and unique psychological perception of Finland, especially concerning the atmospheric dimensions. The following quotations (Quotation 5, 6) emphasize the “harmonious” atmosphere.

Quotation 5 “…there are a lot of people of different skin color sitting on the steps, sunbathing and chatting, and the whole atmosphere is very harmonious and enjoyable.”—Reviewer (Case number: 9172) from Qyer

Quotation 6 “There are also food stalls in the market, there are fruit sellers and handicraft sellers. This free market is across the road from the presidential palace and other government buildings—what a great harmonious society scene!”—Reviewer (Case number: 10030) from Tuniu.

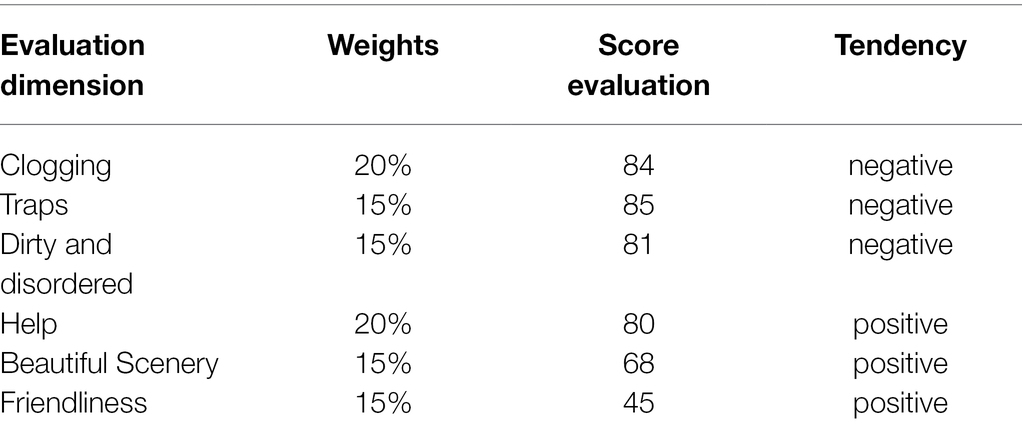

Table 3 shows Finland’s destination attributes identified in Chinese OTRs. As can be seen most of the attributes appeared at the psychological level including attributes concerning ethnic origins, an ancient and historic atmosphere, an artistic atmosphere, as well as desolate, depressing, harmonious, majestic, fairytale, magical and solemn attributes.

5.2 Quantitative analysis results of Finland’s image on five review platforms

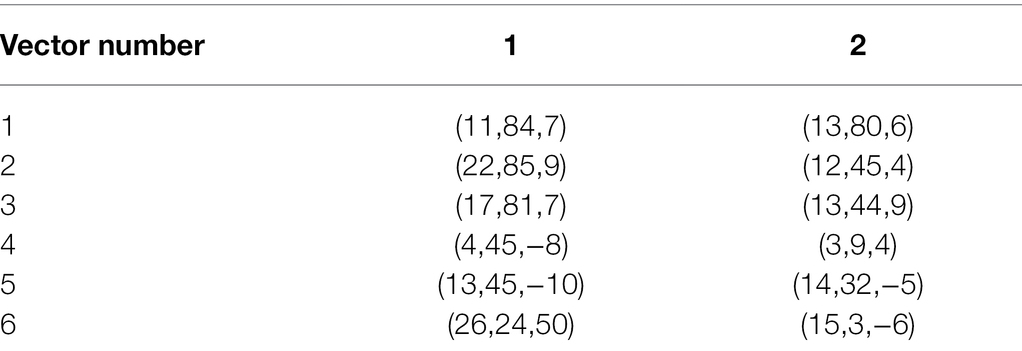

Based on the coding manual created in the qualitative analysis phase, a quantitative content analysis for the remaining 90% of OTR data was conducted. The results presented in Table 4 show that Chinese tourists visiting Finland generally perceived Finland as a leisure destination with various cultural, historic, and artistic elements. The culture, history, and art dimensions had the largest amount of coding references, accounting for 20.32% of the total, followed by the tourism leisure and recreation dimensions, accounting for 19.51%. These two attribute dimensions accounted for a large share of the Finland’s DI at the functional level. The largest dimension at the psychological level was the place atmosphere, with a 19.25% share of mentions. Furthermore, the shares of the dimensions encompassing Finnish natural resources, natural environment, political and economic, and social environment were 5.52, 5.69, 3.53, and 2.35%. The proportions of the latter three dimensions were much lower than the proportions of the first three dimensions.

As can be seen from Table 4 , the results therefore also reveal a discrepancy in Finland’s DI based on different platform OTRs. From the number of destination attribute references, the total number of destination attribute references came to 4961 on Qyer, the largest of the other four platforms, followed by Ctrip, with 3579, Mafengwo, with 2493, Qunar, with 2019, and Tuniu, with 1437 references. Qyer had a greater number of attribute references than the other four platforms concerning the natural resources dimension (320), tourism infrastructure dimension (651), general infrastructure dimension (977), natural environment dimension (257), political and economic dimension (234), social environment dimension (120), and the place atmosphere dimension (889). Ctrip had a greater number of destination attributes references concerning the tourism leisure and recreation dimension (827), and the culture, history, art dimension (823). The remaining three platforms Qunar, Mafengwo and Tuniu did not have the largest number of references for any destination attribute dimension.

The z test showed that the differences between the five travel review platforms were significant. Reviews on Qyer discuss natural resources, tourism infrastructure, general infrastructure, and political and economic situation significantly more than what could be expected. However, there is significantly less information about tourism leisure and recreation, and culture, history and art compared to other platforms. These two destination image dimensions are more prominent on Ctrip, as well as tourism infrastructure. However, Ctrip lacks reviews on general infrastructure, as does Qunar and Mafengwo. Tuniu seems to focus the most on culture, history, and art as well as the atmosphere of the place. The results are interesting also in the destination image dimensions. It seems that the most significant differences are in functional dimensions whereas psychological dimensions are relatively similar between different platforms.

6 Discussion