- Support: 855-COX-AUTO

- International

- Central Dispatch

- Dealertrack

- EV Battery Solutions

- FleetNet America

- Fleet Services

- Kelley Blue Book

- NextGear Capital

- VinSolutions

- Retail360 Deal

- Nurture Customer Relationships (CRM)

- Run Your Dealership (DMS)

- Acquire & Dispose of Cars

- Floor Plan Cars

- Plan & Optimize Inventory

- Protect Wholesale Purchases

- Recondition Cars

- Transport Cars

- Self-Inspect Cars

- Advertise Online

- Attract Trade-In Customers

- Create Your Website

- Manage Customer Price Expectations

- Manage Your Social Community

- Measure Marketing Performance

- Rank Higher in Search Results

- Access Credit App Network

- Digital Retailing

- Connect Your Sales and F&I Processes

- Digital Commerce & Transaction APIs

- Manage Rebates & Incentives

- Speed Up Registration & Titling

- Solutions for Lenders

- Attract and Retain more Fixed-Ops Business

- Servicing Fleets

- Managing Fleets

- Servicing EV Batteries

- Inventory Management Software

- Purchase Protection

- Reconditioning

- Wholesale Marketplace

- Digital Marketing Services

- Digital Media Solutions

- Pricing & Valuations

- Ownership & Retention

- Latest News

- Market Insights & Outlook

- Auto Market Snapshot

- Learning Center

- Press Releases

- Press Contacts

- Newsroom Contributors

Commentary & Voices

2022 car buyer journey study released.

Wednesday January 18, 2023

The 13 th annual Cox Automotive Car Buyer Journey Study reveals that satisfaction with the car buying process declined in 2022 for the second straight year.

The 2022 Car Buyer Journey Study shows vehicle buyers were frustrated with high prices, limited availability, and the amount of time required to complete the process. Used-vehicle buyers, who are often more price sensitive and face higher interest rates, were particularly unsatisfied with the experience in 2022, the research shows.

The 2022 Car Buyer Journey Study was created from surveying more than 10,000 consumers who were in the market for a vehicle in 2022 – 4,150 vehicle shoppers and 6,118 vehicle buyers. As part of the process, dealers were also surveyed. Most of the research was conducted during the second half of 2022. This extensive study is designed to measure vehicle buyers’ satisfaction with research and shopping as well as the dealership experience including what websites were leveraged when shopping and what digital retailing steps they completed during the transaction.

To learn more, read the press release .

Sign up here to receive bi-weekly updates on news and trends dominating the automotive industry.

@coxautomotive, related content.

Consumer key insights include:

Buyers are returning to some pre-pandemic behaviors, but it's clear the path to purchase has permanently shifted. Walk-in dealer visits are up significantly (33%, up from 28% in 2021), but online outreach as the first form of contact remains higher than pre-pandemic, and interest in digital retail products has grown.

While plenty of buyers are still interested in online buying (59% are open to the idea), more are interested in a hybrid approach that combines digital and in-store. 70% of buyers would prefer to do more from home, up from 60% in 2021. Online financing has the highest appeal: 56% of buyers would prefer to arrange to finance online.

Buyer satisfaction remains strong despite high prices. With car prices high, buyers were more likely to enter the market out of necessity (68%, up from 62% in 2021) and therefore be in a rush to buy (32%, up from 25% in 2021). Yet despite paying higher prices, 80% of buyers still felt good or great about their deal. An easy purchasing process was the number one reason buyers said they got a great deal.

Seller key insights include:

Dealerships are the most common resale channel, especially for those buying a car. 78% of people who bought from a dealership also traded in their old vehicle. 75% said that having a trade-in credit for their purchase was very important.

Instant cash offers (ICOs) are becoming more popular. 28% of sellers sold their cars with one, and even consumers who didn’t sell their cars online found ICOs valuable: 68% of people trading in their vehicles negotiated using an online offer, and 67% of them said that doing so was very effective.

80% of sellers would be open to selling their cars completely online in the future, and this may be why: Of all sellers, those who transact online are the most satisfied. These online sellers are more likely to (1) believe they got a good deal, (2) report that getting paid was easy, and (3) feel happy and excited.

The full 2022 CarGurus Insights Report is available here , including the most popular styles, new and used makes, alternative fuel considerations, and what are the top reasons people are selling.

Methodology

Data is primarily sourced from an April/May 2022 study conducted by CarGurus and GfK, a leading market research firm. The study included a survey of 3,008 recent auto consumers: n=2,511 past-four-month auto purchasers and n=1,316 past-four-month auto sellers. Respondents could qualify as both buyers and sellers, are 18+ years old, and weighted to be representative of the U.S. auto market in terms of demographics (age, gender, income, etc.) and market factors (new/used, price point, etc.). In July 2022, CarGurus conducted an additional survey of 600 past-four-month auto sellers for supplemental insights. Other data is sourced from CarGurus 2022 Electric Vehicle Sentiment Study , and CarGurus 2021 Pickup Truck Sentiment Study . Please see those reports for detailed methodology.

About CarGurus

CarGurus (Nasdaq: CARG) is a multinational, online automotive platform for buying and selling vehicles that is building upon its industry-leading listings marketplace with both digital retail solutions and the CarOffer online wholesale platform. The CarGurus marketplace gives consumers the confidence to purchase or sell a vehicle either online or in-person, and it gives dealerships the power to accurately price, effectively market, instantly acquire and quickly sell vehicles, all with a nationwide reach. The company uses proprietary technology, search algorithms and data analytics to bring trust, transparency, and competitive pricing to the automotive shopping experience. CarGurus is the most visited automotive shopping site in the U.S. (source: Comscore Media Metrix® Multi-Platform, Automotive – Information/Resources, Total Visits, Q2 2022, U.S.).

CarGurus also operates online marketplaces under the CarGurus brand in Canada and the United Kingdom. In the United States and the United Kingdom, CarGurus also operates the Autolist and PistonHeads online marketplaces, respectively, as independent brands.

To learn more about CarGurus, visit www.cargurus.com , and for more information about CarOffer, visit www.caroffer.com .

CarGurus® is a registered trademark of CarGurus, Inc., and CarOffer® is a registered trademark of CarOffer, LLC. All other product names, trademarks and registered trademarks are the property of their respective owners.

1 Comscore Media Metrix® Multi-Platform, Automotive – Information/Resources, Total Visits, Q2 2022, U.S.

Contact: Chris Kooistra at Skyya PR Media Relations E: [email protected] P: 773-972-0691

Car Buying Journey : Case Study, Factors, Stages & More

No image to upload ? Pick one

Table of Contents

Car shoppers go through various stages in the buyer cycle, called the “Car Buying Journey,” before making the final purchase. To introduce your dealership to potential buyers, you can’t wait for them to come to you. Since they interact with various touch points before visiting a dealership, you need to interact with buyers early in the process.

The automobile industry has been rapidly evolving over the past few years. Innovation and digitization are changing the industry, altering consumer behavior and perception.

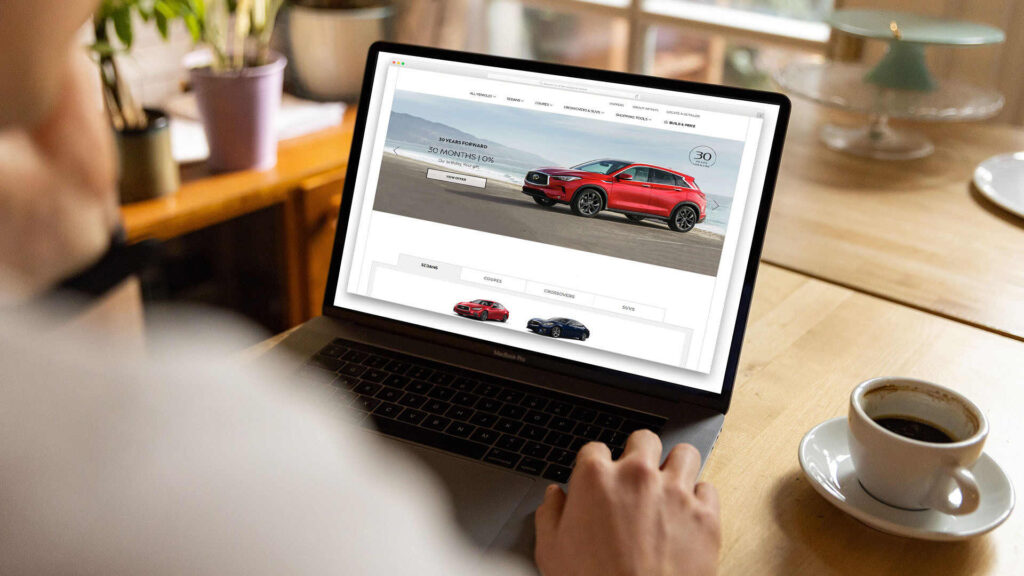

About 60% of consumers spend their time researching online before entering a dealership. Buying a car is one of the most important financial decisions in a customer’s lifetime. Therefore, buyers take quite a long time to consider their decision.

According to Google, a car shopper can have about 900+ digital interactions between the research to the final purchase. So, car dealerships must ensure they leverage every digital car buying touchpoint to influence buyers’ decisions.

What is the Car Buyer’s Journey?

The Car Buyer Journey is the name given to the process a consumer goes through to purchase a vehicle. Automotive businesses analyze the customer journey map for buying a car to determine important touchpoints and how they can be improved to increase sales and customer loyalty. This journey is not a sequence of linear actions; it includes dynamic stages that alter how a car is purchased and the post-sales customer experience.

2022 Car Buyer Journey Study

Over 10,000 vehicle consumers – consisting of 6,118 buyers and 4,150 shoppers – of 2022 were surveyed by Cox Automotive to make the automotive Car Buyer Journey 2022 Study. Let’s understand the top 10 trends uncovered by the study as well as their implications.

- The study found the satisfaction with the vehicle purchasing experience to be down to pre-pandemic levels, with the decile sharper in the case of used cars than in new cars. This presents an opportunity for dealerships to pacify shoppers with the help of online tools that manage inventory in real-time and transparency in pricing.

- Inventory shortages are forcing buyers to do more online research, a fact OEMs and franchise dealers can leverage to increase cross-shopping by targeting conquest audiences through online channels.

- Consumers’ preference for online car buying continues to increase, with 80% planning to buy entirely online. Thus, it’s a good idea to create digital showrooms and include omnichannel marketing in your Automotive Ecommerce Strategy.

- Trust plays a crucial role among consumers when selecting a lender, with 82% of the consumers using familiarity as a factor in decision-making. Lenders must build consumer loyalty by prioritizing trust and creating a consumer-centric culture.

- 49% of buyers are using lender websites as a source for their vehicle purchasing. To acquire new customers, lenders can include robust shopping tools in their online showrooms.

- The study found that if users complete all financing steps online, they save around 2 hours at the dealership.

- 67% of buyers purchase an F&I product and 53% research various F&I products before they visit a dealership. This means it is beneficial for dealers to include F&I products online in the form of product descriptions and online pricing.

- EV buyers prefer online shopping to save time, and ICE buyers purchase online to avoid feeling pressured or rushed. This means that sellers should ensure that customers experience a feeling of control and confidence during their EV online purchases.

- One out of every fifth new vehicle purchased in 2022 was pre-ordered. 74% of consumers chose this because of the ability to add or remove features as per their wishes. Pre-order target campaigns can be added to websites for better convenience in the buying process.

- 79% of buyers are more satisfied with pre-ordering a vehicle than buying the traditional way. Enhancing the pre-order process, which includes vehicle tracking and offering touchpoints during the waiting period, can increase consumers’ confidence in your brand.

Factors that Condition the Car Buying Journey

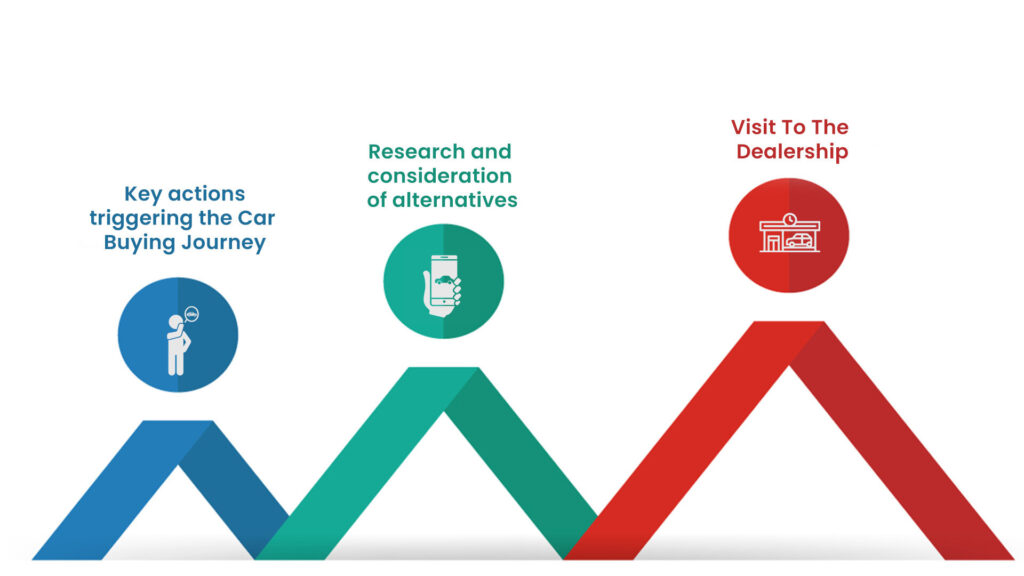

Although car buyer journeys can be highly diverse, three stages dictate the actions taken by the customers before making a purchase and their perception of your brand. These stages are discussed below.

Key actions triggering the Car Purchasing Journey

The reason behind the intent to purchase decides how long or urgently the purchase is made and with what search the car buying journey begins. The primary triggers have been identified as a change in lifestyle, if their car has broken down for good, for routine renovation, or just because they want to buy one.

The purchasing style will also vary depending on whether the person is an experienced buyer or a pioneering car customer.

An experienced customer is abreast of market trends and offerings, with a clear understanding of what they want. They begin the car purchase journey with a pre-selection of cars and require limited research of models. Dealerships must take action to improve engagement so as not to lose their business to the competition.

A pioneer client does extensive research to learn and discover all aspects of automobile purchasing. This type of customer can be attracted to a specific dealership or model. They may have a list of requirements for their upcoming car, but they may need something specific.

The company’s ability to identify a customer’s reason for purchase and type will impact their ability to manage their car purchasing journey.

Research and consideration of alternatives

The initial search in the car buying journey is full of optimism and excitement for finding the perfect car. A consumer will review sources, build option lists, and begin the search around them. They talk with friends, get their opinion of vehicles, and they may even rent the car they want to purchase before finalizing their decision.

The knowledge from these sources is a key factor in whether the car-buying customer journey with that model or brand continues or goes back to the beginning. Apart from the initial phase, research is also done during the car-buying customer journey to decide what options to add or remove.

Visit To the Dealership

When customers have gained confidence in their choice(s) and are ready for the next step, they visit the dealership. A dealership visit is a vital part of the car buying journey; their experience here can make or break their decision. On average, a customer visits two dealerships before making a purchase. Customers avoid dealership visits in the early stages as they are not confident in their knowledge and fear that the sales executives might mislead them.

A customer’s visit can be informational, but mostly they visit a dealership when they are ready to make the final purchase. Service quality and staff attention play a crucial role in this stage. The customer wants to be assured that their car choice is right and the dealer is trustworthy.

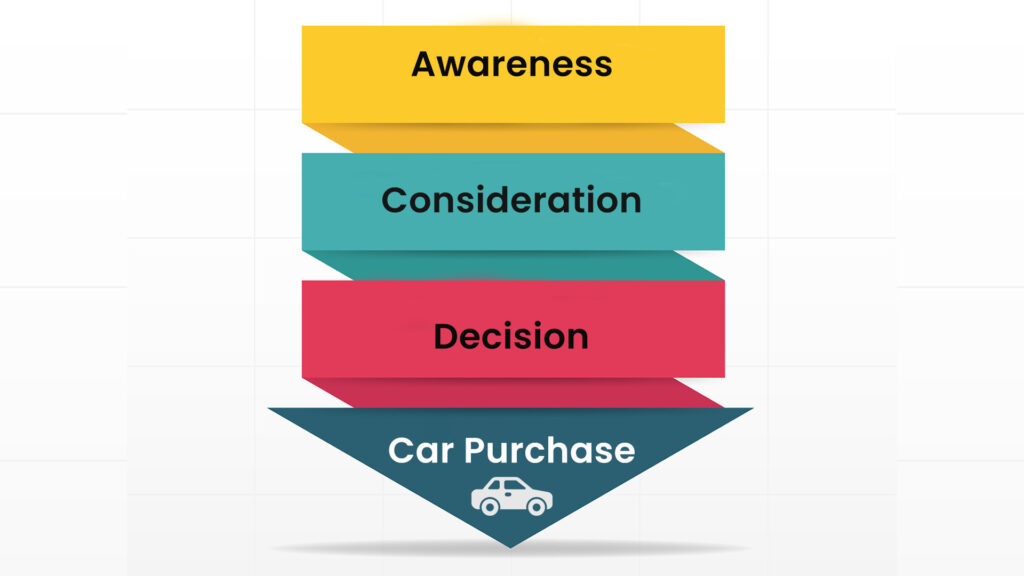

Three Stages in Car Buying Journey

Let’s understand the three main stages of a car buyer’s journey in detail.

Before the buyer’s journey begins, they are mostly unaware of the vehicle they want to purchase. So, they go online to find a suitable car that fits their budget and requirements.

About 95% of car shoppers use online as a source of information. During this time, buyers thoroughly research the various makes and models in different budget brackets.

In this stage, the buyer goes through various sources to find the perfect vehicle for them:

- Comparison sites

- Social media posts

During their online research, you (as a dealership) need to ensure that you can help them navigate through the journey.

Also, you need to provide detailed information regarding potential vehicles they might want to buy. This will enable them to make an informed decision and move to the next step.

Use high-quality images to help customers explore vehicles online. Multiple car images from different angles and 360 videos can provide immersive details of the vehicle, helping with the research. 90% of car buyers consider photos extremely important in purchasing.

Consideration

Before buyers reach the consideration stage, they are aware of the market’s solutions and know what can fix their challenges. In this stage, buyers will go further in determining the best deals and the options available.

The potential buyers will gather all kinds of information at this phase of the car-buying journey. By the end of it, they are aware of all the possible solutions that are relevant and fit their needs.

During the buyer’s consideration phase, car dealerships can tap the opportunity and reach out to them through Google Ads or Social media ads. Leveraging digital power can shape customers’ buying decisions in your favor.

This is also the stage where customers should be confident about their purchase decision. They usually prefer visiting dealerships, but 40% of buyers are likely to purchase a vehicle based on images they view online without seeing the vehicle in person.

This allows dealerships to use high-quality photos and videos to influence car buyers’ purchase decisions.

- Use high-quality, sleek, and clean car images.

- Display multiple car angles for a better perspective

- In the case of used cars (use hotspots to highlight scratches and dents)

- Use 360 interior and exterior spin videos for immersive experiences

What kind of images are essential in a car buying journey?

For new car buyers, cockpit and dashboard images are most important, while used car buyers rank images of odometer and car condition as the essential points.

Decision (or Final Purchase)

This is the last stage in the buyer’s car buying process. By this point, the buyer is ready for the purchase. However, some are still considering where and how to buy the car. More than half of the shoppers prefer buying from a dealership that offers their preferred experience (including aftermarket), even if the prices are higher.

Also, buyers don’t want any hassle or wait for hours at the dealership to complete the paperwork. Over 70% of buyers like to complete credit applications & financing paperwork online.

Use this as a guide to develop strategies for every car buying stage. These insights from top industry surveys will help you connect with your target audience at every touchpoint, digital or otherwise, of their buying journey.

At the end of this stage, the buyer eventually makes the purchase and takes the delivery of the vehicle.

Here are a few things to consider in the buyer’s decision phase:

- Make the buying process hassle-free

- Move your paperwork entirely online

- Deliver timely

“Given the short time that the buyer is willing to spend at the dealership, being efficient with the processes may endear the dealer to the potential customer.” – Deloitte.

Marketing for the Car Buyer’s Journey

After understanding the automotive customer journey, it is time to see how to design a marketing strategy around it, guiding customers to your dealership. The best method would be to appeal to all three stages, which opens up many options.

It is a good idea to include both pushes and pulls in the marketing strategy in the form of inbound and outbound marketing. You help customers understand their needs, consider your business, and make decisions.

Both new and old customers can be targeted through mailers, postcards, newsletters, relevant content, or offers. QR codes and personalized URLs can be used to direct them to your new or Used Car Website or landing page. Banner ads and social media posts should also be included in the marketing strategy.

Both digital and direct mailers should contain calls to action, so clients know what to do. Informative content like blogs and ebooks can be included to help them learn and consider your business. After contact through mail or ad, nurture the lead with targeted emails after they have engaged with your campaign. These tools serve as signposts in a customer’s car purchase journey.

Example of a Car Buyer Journey

The average time it takes a customer from looking for a car to buying one is one month. This period is made up of micro-moments of decision-making and doubt. Doubts such as whether or not the car is safe, which car has the lowest monthly payment, etc.

As stated above, the car-buying journey begins with an internet search and is divided into 3 stages – awareness, consideration, and decision. Let’s take a look at an example to understand these stages better.

James’ Car Buyer Journey

James finalized his decision to purchase in two months. He had around 600 digital interactions, ranging from Google, YouTube, car brand visits, car websites, and Used Car Dealership sites while searching for information, and deciding whether to lease a car or buy it. 70% of the search was done with a mobile device. This is a summary of his micro-moments.

- Which car is the best?: 3 out of 5 buyers begin their car purchasing journey without a particular car in mind. James’ car search focused on family safety-oriented cars, highlighting some models for him. He also looked up electric cars but removed them from consideration due to high prices. His searches included the phrases “best minivan” and “best car for family with a dog and car seats.”

- Is it the right one for me?: This is where the customer values and weighs some practical considerations, making a list of particulars he must have. James wants a car that has room for two strollers. He searched for “Brand X pictures”, “number of seats in Brand X car model”, and “Brand X models comparison.” Here, X is an example of a car brand name.

- Can I afford it?: James is at the stage of his car buying journey where he considers the price. He searches for options to pay for the car, considering the pros and cons of leasing vs. buying, etc. James’s internet searches include “brand X car price”, “get out of Current Brand lease early,” and “best car lease deals.”

- Where should I buy it?: Even though the process of buying a car has shifted online, the stage of dealership visits is still essential for many a customer. Usually, people search for dealerships near them. James also searched for special offers and availability details, with phrases such as “best dealership near Ann Harbor.”

- I’m gonna get the deal: James has researched online and offline offers and explored leading options. He compared the prices he would pay for various make and models, purchase supplies, and lease options. James’ search included “what’s a good lease money factor” and “what do you pay for Brand X make/model lease.”

From helping customers find the relevant information to assisting them in exploring vehicles online using high-quality car images until the final delivery, ensure you provide authentic details at every stage to offer an informative and engaging car buying journey. This way, you don’t just deliver vehicles but also the satisfaction that customers anticipate from the brand.

Spyne is a deep tech company that helps car dealerships with instant visual cataloging using AI-powered photography and editing technology. We enable car dealerships and marketplaces to create images and 360-degree videos using our solutions. Intrigued? Book a free demo for more information.

Q. What is the step-by-step process of buying a car?

Overall, in a car-buying journey, you will go through the following eight steps:

- Researching vehicles and their features.

- Getting approval for a loan.

- Planning your trade-in (if you want to exchange your old car).

- Locating a dealership and test-driving the car.

- Checking different prices and warranties.

- Review the deal and dealer financing.

- Closing the deal.

- Taking the car home.

Q. How long should the car buying process take?

On average, a person takes around 89 days to buy a car. Consumers shopping for a car spend around 9 hours researching vehicles and shopping online.

Q. What are five things to consider when buying a car?

Here are five things you should be aware of before going to a car dealership.

- Know what interest rate you are approved for.

- Know the factors that will affect your payment, such as the terms, the loan, and the down payment.

- Know the pros and cons of cash rebates and 0% APR.

- Know if a new or used car is right for your needs.

- Know the difference between a lease and a loan.

How long should it take to buy a car?

The car buying process can vary significantly, spanning from a day to multiple weeks or even longer depending on individual circumstances and preferences.

What are the 6 steps to buying a car?

The 6 best steps to consider for buying a car are:

1) Set a budget and adhere to it.

2) Examine your spending plan to see how much you can afford to spend each month for a car loan.

3) Look up vehicles that fit your needs.

4) Be pre-qualified for financing.

5) Check around, after a test drive, thoroughly investigate the vehicle.

6) Make the car purchase

Young, enthusiastic, and curious are the three words that describe Spyne’s content team perfectly. We take pride in our work - doing extensive research, engaging with industry experts, burning the midnight oil, etc. Every word we write is aimed at solving our readers’ problems.

Try For Free !

Related blogs.

Learn Everything About Spin 360 Car Photography Software

Innovations in car photography, particularly the advent of Spin 360

Spyne x Topster – Partnership for New-Age Automotive Solutions

“The integration [with Spyne] works very well. We are extremely

Find the Top Car 360 View App For Android and iPhone

FIn today’s competitive market, car dealerships need every edge to

Book a demo

Create high-quality catalogs at the click of a button

Spyne is a deep tech company helping businesses create studio-finish catalogs

Virtual Studio

Dealerships

Marketplace

Trusted by Enterprise Dealerships and Marketplaces Globally

Start A Free Trial Now !

Just drop in your details here and we’ll get back to you!

Get 10% off upon your website URL verification

Car BG Replacement

Car BG Removal

Car photo editing

Car Catalog Maker

Number Plate Blur

Car Merchandising

Image Enhancer

Android App

Developer Hub

Cookie Policy

Terms of service

Privacy Policy

- Link copied

How electric vehicles are reshaping the car buying journey

EY Global Advanced Manufacturing & Mobility Leader

Passionate about manufacturing, mobility and disruption. Champion for women and diversity & inclusiveness in the Advanced Manufacturing & Mobility industries.

EY Global Mobility Solutions Leader

Focused on business transformation. Passionate about cars and exploring the world.

EY Global Advanced Manufacturing & Mobility Analyst Leader, EY Knowledge

Passionate about mobility disruption. Helping share the auto industry narrative in this disruptive landscape.

EY Global Advanced Manufacturing & Mobility Analyst

Mobility thought leader. Passionate about knowledge and teaming. Avid reader.

Menaka Samant

Show resources, the latest ey mobility consumer index shows that digital auto retail is being driven by the rise of the electric vehicle..

- Car buyers want a digital-first experience but one that offers online convenience with the reassurance of personal interaction with dealer staff.

- Several automakers are using the metaverse to enhance the customer experience, and a few are leveraging it for product launches.

- Electric vehicles have caused an industry-wide shift in the relationship between consumers, dealers and OEMs toward an agency model.

M uch of the narrative around consumer attitudes to the electric vehicle (EV) transition tends to center on the product — a wider variety of more appealing models, with greater ranges — and infrastructure — the availability (or otherwise), usability and cost at charging points.

But what of the change in customer expectations that is accompanying this shift in drivetrain technology? The lesson from other sectors is that consumers increasingly expect a seamless digital customer journey, whether they are buying a new laptop, smartphone or even a carryout meal.

On the face of it, auto consumers are no exception to this trend — car buyers too are going digital, and not just EV buyers. The latest EY Mobility Consumer Index (MCI) indicates that up to two-thirds of all car buyers now use digital channels (apps, websites and social media) to gather information about their prospective purchases. A figure that rises to 71% of EV buyers, reflecting both the greater digital fluency of EV customers and their desire to thoroughly research the purchase of what is still a relatively novel technology in advance.

Omnichannel comes to car buying

Immersive experiences are on the rise.

The MCI 2022 also highlights the evolution of digital auto retail that is being specifically driven by the rise of the EV, both through physical experience centers (often a type of tech-enabled virtual dealership providing an enhanced product experience) and advanced experiential technologies, These include augmented reality (AR), virtual reality (VR), and the latest and most immersive tech of all, the metaverse. Most legacy manufacturers provide experience centers for their EV models, and gradually pure play EV manufacturers are also catching up, with a select few establishing new benchmarks with exceptional experiences. In some instances, these EV startups have inspired the legacy manufacturers to pull through to provide experience centers. To this end, EV original equipment manufacturers (OEMs) are also responding to the same cues, partnering with specialist tech firms to develop metaverse applications covering the consumer experience.

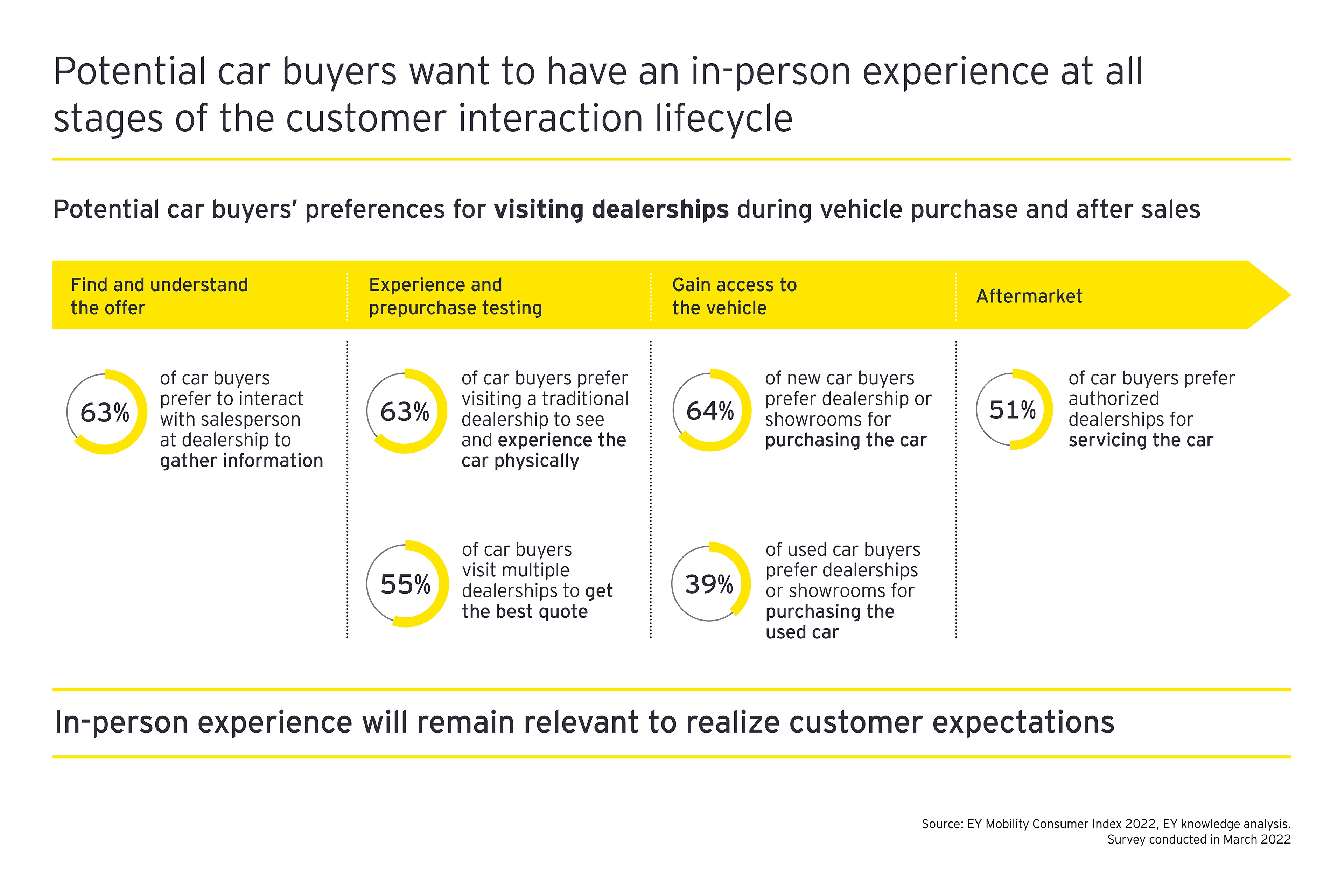

… but physical interactions remain key

But appearances can be deceptive, and despite overall similarities with other retail products, cars remain distinctive in the minds of consumers in several significant ways. A car represents a major financial commitment, and the in-person experience is important: the majority of consumers still prefer physical interactions when it comes to both trying before they buy and, ultimately, parting with their hard-earned money. While online modes are picking up, physical ones continue to dominate with only 38% of buyers preferring mobile or digitally advanced showrooms over the traditional dealership for prepurchase viewing and testing, while even fewer — 23% — prefer online channels for final purchase.

Who owns the customer?

Digital is also fueling a battle for the customer between dealers — who have traditionally owned the relationship with their customers — and OEMs, who have not. Direct-to-consumer models have been pioneered by pure play EV manufacturers and are now being adopted by some legacy brands. Other OEMs are pursuing an agency role for their dealers, whereby vehicles are owned by the OEM or its national sales company, and agents are paid on a fee basis for delivering cars to customers.

Meanwhile, sales of new internal combustion engine (ICE) cars may be in secular decline, but they remain significant. As does the market for aftercare and maintenance of the huge numbers of older ICE cars that will still be in use for another couple of decades at least. Dealers in particular may want to ask themselves about digital opportunities in these historically analogue revenue streams.

So the car-buying journey is a more complex and nuanced picture than what might first meet the eye. Success for both OEMs and dealers alike will depend on an appreciation of how those nuances apply to them, and on a willingness to continuously evolve new business models and revenue streams that facilitate a seamless, integrated customer journey.

How EY can help

Mobility lens suite: explore the future of mobility.

Find out where mobility is headed across the world with the help of EY propriety toolsets offered by the Mobility Lens Suite.

Melding of the digital and physical

The personal touch remains powerful.

While the use of online channels as an adjunct to offline is now the norm, the in-person experience remains important throughout the customer journey. Buyers are looking for a digital-first experience, but one that offers the convenience of online with the reassurance of personal interaction with expert dealer staff. Over 60% of all car buyers, regardless of drive chain choice, prefer to visit a dealer for prepurchase and purchase stages: 63% prefer a dealer interaction for information gathering, and the same proportion prefer a dealer to experience the car physically. 64% of new car buyers prefer to purchase from a dealer rather than online.

Fifty-seven percent of all car buyers and 60% of EV buyers said they intend to buy their next car from a dealer. Dealers have already evolved from offering physical-only to physical-plus-online customer experiences. They must continue that process to provide an even more digitally enabled experience while retaining the personal elements that customers value highly. This includes integrating both virtual and face-to-face elements into a joined-up journey that takes the customer from prepurchase digital brochures and virtual product tours through developing specs, ordering and the sale itself to after-sales support — all in a completely seamless way.

But buyers expect digital too

At the same time, consumers are increasingly open to using quick and convenient digital tools for at least some parts of the process. Well over 60% of buyers said that they would be interested in booking a test drive and working out the price of a new car online, for example, while around 50% would use an online configurator to spec a car.

EV buyers are consistently more likely to use digital tools than ICE buyers. This may reflect a more “digital” mindset among EV buyers, but it is also likely to be a result of the fact that EVs are a relatively novel purchase in comparison to ICE vehicles. Consumers thus seek out more information and reassurance when buying an EV than they do a more familiar ICE vehicle.

Use of online tools to substitute some parts of the buying process has resulted in fewer or shorter dealer visits, with a corresponding decrease in costs for dealers. As technology improves and its use encompasses more of the customer journey, costs for dealers are likely to be further reduced.

Demographic divide?

While there are differences between Gen Z, millennials, Gen X and boomers, they do not entirely conform to generic “the younger you are, the more digital you are” consumer stereotypes. Buyers in all four of the demographic groups considered in MCI 2022 expressed strong preference for either visiting dealerships, an in-person experience or both. At one end of the age spectrum, over 50% of Gen Z buyers prefer to visit dealers and interact with a salesperson for information gathering, to experience the car physically and to purchase a vehicle. At the other end, that rises to over 70% of boomers for the same three stages of the customer journey. But while the in-person experience will persist for some buyers and some steps on the journey, its importance is waning especially with new generations of younger consumers.

Even though a large portion of these customers want some physical touchpoints today, will they require it tomorrow? The need of physical channels is estimated to reduce over the years. New automotive players are thinking of reducing investments in large physical networks and increasing investments online sales technology. The physical store is often seen as a model of inefficiency, with huge capital investments. Automakers are either moving away from the large physical stores or transforming them into experience centers to enhance the customer purchase experience. For example, a leading EV manufacturer is moving away from offline stores and focusing on cheaper locations, remote management of test drive fleet and delivery and service matters. 1

Digital is an increasingly valued part of the experience, especially among those younger consumers. Sixty-five percent of Gen Z, 69% of millennials, 66% of Gen X and 60% of boomers prefer to use apps and online tools to gather prepurchase information. Only 13% of boomers buying new cars prefer to actually purchase a vehicle online, rising to 20% of Gen X, 28 % of millennials and 37% of Gen Z.

So even where so-called “digital natives” are concerned, it’s not a case of either physical or digital but both. Younger buyers are more inclined to prefer a digitally enhanced experience but still seek the reassurance of physical and in-person interactions. Perhaps reflecting that they are less-experienced buyers, and that a car represents an even more significant investment of capital to those in Gen Z than it does to older buyers who are likely to have more savings and higher incomes.

Looking to the future

Dealership experience centers are expanding.

If consumers expect to be able to perform more buying tasks online than they could in the past, the quality and nature of the experiences they seek is also changing. Dealers and OEMs alike are offering AR and VR enhanced brand experiences — several EV makers use AR/VR technology to enhance the purchasing experience, often via tech-enabled experience centers. These centers can showcase in car tech and new models via AR ad VR technology, offer virtual test drives and even virtual factory tours — all without the need for holding physical stock on site, reducing costs and the amount of space required.

Making waves in the metaverse

The latest and perhaps the ultimate immersive experience of 2022 is the metaverse, a high-tech alternative universe, which by 2024 is touted to create US$800b of business opportunity — across sectors as diverse as the arts and media to manufacturing and real estate — according to industry estimates. 2

On one level, the metaverse is just the latest upgrade to the AR/VR brand experience that many are already providing. But its real commercial potential lies in the opportunities for creating a huge range of margin-enhancing revenue streams at practically zero marginal cost, and also in its appeal to future cohorts of Gen Z car buyers, who will likely expect OEMs to be in the metaverse in the same way that their parents expected them to have a website.

Our analysis also suggests that EV manufacturers are taking a “build it, and they will come” approach to this novel technology, busily embracing the metaverse even if those revenue promises have largely yet to materialize. Several automakers are using the metaverse to enhance the customer experience, while some prioritize overall brand promotion, and a select few are leveraging it for product launches.

The distribution dilemma

EVs are intrinsically lower maintenance than ICE cars, a factor that has catalyzed a shift toward direct-to-consumer EV sales (even from some legacy OEMs), and an industry-wide shift in the relationship between consumers, dealers and OEMs toward an agency model.

The agency model — which sees ownership of vehicle inventory to be sold remain with the OEM or its sales company, rather than with the dealership as has historically been the case — offers OEMs several advantages. For one thing, it makes the provision of that integrated seamless customer journey easier, as there is much less back-and-forth between dealer and OEM systems to cause friction. It also provides better control of pricing and multiple opportunities to upsell and cross-sell along the way. And it gives them a more direct connection with the customer.

Agents of change

For dealers, the agency model is something of a mixed blessing. In return for fixed fee per vehicle (and likely reduced costs from simpler operations and a smaller real estate footprint) the dealer’s role becomes that of “last mile” distribution and delivery of vehicles already ordered and paid for via the OEM.

In the light of the reduced servicing requirements of EVs, how dealers can use their existing relationships with long-term customers to generate new and alternative sources of revenue may prove to be an important consideration as this shift continues.

There is as yet no “one size fits all” solution to the distribution dilemma, and OEMs are still experimenting to find the right balance between direct sales, dealer sales and the agency model. Some pure play EV makers who started out with direct-only sales models are looking to develop their own dealer networks, while others are dialing back on their level of physical presence in favor of direct sales. By contrast, some legacy OEMs have adopted direct-only sales for their EV models, while others are rightsizing and reconfiguring their dealership footprints to deliver a more integrated experience and maximize revenue opportunities. Given this trend, the future of the physical retail network is expected to be less dense, with OEMs and dealers leveraging an omnichannel model as the customer journey becomes increasingly digital.

Toward a seamless tomorrow

Dealers and OEMs have already become used to a world where getting a sale is no longer just about having the best product, the smartest salespeople and the most competitive deal. Now they will also have to evolve beyond competing for the wow factor of who has best online or virtual experience, to who can offer the best customer lifetime experience.

The goal of a customer experience is a seamless digital marriage of online, offline and virtual elements. OEMs and dealers have tested and developed many of the individual elements of that experience; the challenge now is how to best integrate them into a unified whole. The leaders of tomorrow, whether OEM or dealership, will be those that offer consumers the seamless buyer experience they expect, with the physical touchpoints they still need, via whatever medium they choose.

To conclude, here are three important considerations for OEMs and other stakeholders as they transition away from the old product-centric worldview and distribution model toward this seamless integrated future:

- Keep delivering for dealers: The transition to alternate distribution models would require changing roles, revenue opportunities and expectations from dealers. Keeping dealers onside will be crucial for OEMs as they seek to get closer to the end customer.

- Boost digital skills: A new era requires an enhanced skillset — working in an experience center is not the same as in a traditional showroom. OEMs will have to provide ongoing digital and technical training if they are to successfully integrate both online and offline.

- Assess required investments: New digital infrastructure and experience centers (and skills, as above) will require greater levels of investment from OEMs.

Show article references#Hide article references

- “ Tesla weighs bringing “Tesla Center” strategy to China and closing retail stores ,” Electrek website, 15 September 2022.

- “ Metaverse may be $800 billion market, next tech platform ,” Bloomberg website, 1 December 2021.

Related content

The future car-buying experience will involve a mix of online, offline and virtual elements with the personal component that consumers still desire.

About this article

Connect with us

Our locations

Do Not Sell or Share My Personal Information

Legal and privacy

Accessibility

EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

EY | Assurance | Consulting | Strategy and Transactions | Tax

EY is a global leader in assurance, consulting, strategy and transactions, and tax services. The insights and quality services we deliver help build trust and confidence in the capital markets and in economies the world over. We develop outstanding leaders who team to deliver on our promises to all of our stakeholders. In so doing, we play a critical role in building a better working world for our people, for our clients and for our communities.

EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients. For more information about our organization, please visit ey.com.

© EYGM Limited. All Rights Reserved.

EYG/OC/FEA no.

This material has been prepared for general informational purposes only and is not intended to be relied upon as accounting, tax, or other professional advice. Please refer to your advisors for specific advice.

Get our latest newsletter direct to your inbox

Ey supply chain digest, welcome to ey.com.

In addition to cookies that are strictly necessary to operate this website, we use the following types of cookies to improve your experience and our services: Functional cookies to enhance your experience (e.g. remember settings), and Performance cookies to measure the website's performance and improve your experience . , and Marketing/Targeting cookies , which are set by third parties, allow us to execute marketing campaigns, manage our relationship with you, build a profile of your interests and provide you with content or service offerings in accordance with your preferences.

We have detected that Do Not Track/Global Privacy Control is enabled in your browser; as a result, Marketing/Targeting cookies , which are set by third parties that allow us to execute marketing campaigns, manage our relationship with you, build a profile of your interests and provide you with the content or service offerings in accordance with your preferences are automatically disabled.

You may withdraw your consent to cookies at any time once you have entered the website through a link in the privacy policy, which you can find at the bottom of each page on the website.

Review our cookie policy for more information.

Customize cookies

I decline optional cookies

Watch CBS News

Planning on buying a new car? Here are some tips

By Alexus Davila

March 13, 2024 / 8:24 AM EDT / CBS Baltimore

BALTIMORE -- You may be planning to cash your tax return to get a new set of wheels. But is it worth buying a used or a new car in this current market?

According to Bankrate , Baltimore is one of the top 10 most affordable cities for buying used cars.

But an expert with Kelley Blue Book said there are some other factors to remember before you drive away in your new ride.

Bankrate ranked Baltimore in ninth place for used car affordability with the average cost being $23,386 for a used car.

That's $3,905 less than the nationwide average, Bankrate said.

The monthly average is about $445 but Executive Editor of Kelley Blue Book Brian Moody said this is not the number to focus on.

"You can buy a Ferrari for $400 a month but then how many months are you paying for that car?" Moody said.

The good news is the current price of a brand new car is down by 5.5% since December of 2022, according to Moody.

But interest rates are high.

Moody said if you turn to a used car to save some extra money, do some research and determine what incentives you can get.

"There may be one car that has zero percent or 1.9 percent financing, or there may be other cars that are similar to it that are at just the going rate, which can [range up to] 10 percent," he said.

For months, WJZ told you about the uptick in Kia and Hyundai thefts because of a social media trend. The car manufacturers then had to offer a software upgrade for these cars.

Moody said there is a big takeaway from this that car buyers can use.

Before buying a used car, Moody said to pay attention to the standard equipment it had when the car was new.

"What if the LX of whatever brand we are talking about, doesn't have head airbags," he said. "Doesn't have a standard backup camera. Doesn't have the theft immobilizer. Those are all things you have to look into. It's great to get an inexpensive car but make sure you are not doing it at the cost of inconvenience to you."

Moody advises you to avoid purchasing minivans, luxury SUVs and pickup trucks as they are always in high demand.

Rather, look into purchasing a sedan or a hatchback from your local car dealership to save some extra dollars.

Before buying a car, also ask your insurance ahead of time how it would be impacted if you get the car you are eyeballing. If you are worried about gas prices, consider a hybrid car. Moody said many affordable hybrids can travel nearly 60 miles a gallon.

Featured Local Savings

More from cbs news.

Woman, daughter carjacked near Arundel Mills as car thefts involving minors increase

Dozens of National Guard soldiers return to Maryland after Middle East deployment

The Baltimore Station is turning lives around, one veteran at a time

UMBC sexual misconduct investigation could cost the state $4.1 million

Resurrecting Moskvitch Won’t Be Easy for Russia

Renault's relinquished Moscow plant could relaunch a dormant brand, along with promised EVs, but development will be a challenge in uncertain times.

- Renault has transferred its plant in Moscow and its stake to the government of the city, while also giving up its stake in AvtoVAZ to the NAMI institute.

- The Moscow city government has revealed a plan to relaunch the Moskvitch brand at the Renault plant in Moscow, located on the former site of the AZLK plant that produced Moskvitch vehicles for decades.

- The plan faces serious challenges as the country's auto industry has been largely cut off from western European investment and technology.

"The first stage will be the production of internal combustion engined cars, and then potentially electric cars," Moscow mayor Sergei Sobyanin said in a statement.

Sobyanin did not indicate whether the gas-engined models or EVs would be developed within the country or produced under license, raising quite a few questions about the feasibility of the project. The mayor did indicate that the KamAZ truck plant, which produces trucks and buses in Naberezhnye Chelny, several hundred miles east of Moscow, would serve as the main engineering partner for the Moskvitch plant. In addition to heavy trucks, KamAZ produces electric city buses.

The Moscow-based AZLK plant—for decades one of the main passenger car production factories in the USSR—was known for its Moskvitch sedans and station wagons at home and in many export markets. The plant, located on Volgogradsky Prospekt in Moscow's southeast, had seen some tough times in the 1990s when a five-door hatchback named the Moskvitch 2141 that was launched in the mid 1980s effectively became the last available platform, spawning a number of sedans and coupes built in small numbers. The factory had effectively come to a standstill in early 2000s as the country struggled to recover from the financial crisis of 1998, and was eventually absorbed into Renault's operations years later, producing the inexpensive Logan range of small cars.

"This has been a very unexpected development, first of all, but with the city administration having gotten the plant once again for the first time since the 1990s, something has to be produced there," Yaroslav V., an eastern European auto historian told Autoweek . "The big question is where they're going to get the tooling for gas and electric cars at this point, and almost everything really points to China. The Moskvitch factory would have difficulties getting a whole assembly line from some western automaker, while China has plenty of automakers and EVs in production. So they can sell designs and assembly lines."

"The other option is more AvtoVAZ models under the Moskvitch brand with some exterior differences, but that would probably cause oversupply of current models. That would be a simple solution, and perhaps something that will also end up happening."

Industry observers in Russia have speculated that the plant won't be able to keep Renault production going even if it wanted to, due to the need to source components from Renault, effectively closing the door to existing platforms produced at the plant. Auto industry watchers have also noted that funding for a plant retrofit to restart car production would be difficult in the near term, given that car sales in Russia have fallen over 70% since the start of the war in Ukraine.

"I don't see them doing something quickly with the Moskvitch project, given where car sales and priorities are right now," Yaroslav adds. "But with the upcoming end of imports of some western brands, demand for domestic models will have to return to levels unseen for decades because Russia will now have to build a lot of its own cars instead of importing them. With the current political situation and the pullout of several automakers, the domestic car industry is going to have to grow really fast in the coming years to keep up with demand. But mostly, I believe this will be a boon for Chinese brands that will want to take advantage of export opportunities."

European auto industry observers are also noting that amid the confident announcements from the city government, if bringing back Moskvitch was so easy, why wasn't it done years ago when economic conditions were much more favorable? Now the new owners of the plant face a much bleaker supply chain environment and perhaps tighter budgets, even when it comes to putting internal combustion models into production. The only upside the project faces is the fact that competition from imported models is likely to be much weaker in the coming years, as there won't be as many foreign brands left on the market.

Share your thoughts in the comments below.

Jay Ramey grew up around very strange European cars, and instead of seeking out something reliable and comfortable for his own personal use he has been drawn to the more adventurous side of the dependability spectrum. Despite being followed around by French cars for the past decade, he has somehow been able to avoid Citroën ownership, judging them too commonplace, and is currently looking at cars from the former Czechoslovakia. Jay has been with Autoweek since 2013.

.css-1u92ux6:before{background-color:#ffffff;border:0 solid transparent;bottom:38%;color:#000;content:'';display:none;height:0.3125rem;position:absolute;right:0;width:100%;z-index:under;}@media(min-width: 40.625rem){.css-1u92ux6:before{height:0.625rem;}}@media(min-width: 64rem){.css-1u92ux6:before{bottom:25%;}} Renault

Italian Design Great Marcello Gandini Dead at 85

Renault R5 Returns as EV, and the Price Is Right

Renault Super 5 Is Down on the Parisian Street

Zagato Pays Tribute to Stylish Le Mans Competitor

1961 Renault Dauphine Gordini Is Junkyard Treasure

The Best of the Best of France and Italy

2023 Orphan Car Show Photos from Ypsilanti, Mich.

Chrysler’s Francois Castaing Has Died, 1945-2023

Alpine A110 Climbs Pikes Peak in 9:17

2017 Renault Duster Is Junkyard Treasure

Mitsubishi Wants to Be All-Electric(ish) by 2035

- Bahasa Indonesia

- Slovenščina

- Science & Tech

- Russian Kitchen

10 most popular cars in Russia (PHOTOS)

In Russia, every third resident has their own vehicle. At the beginning of 2021, 45 million passenger cars were registered in the country. Almost a third of these are made by the Russian car company LADA. Toyota is currently the second most popular brand, with over four million cars in the country— the RAV4 and Camry are the most popular models. Next come Hyundai and Kia with over two million cars each in the country.

Compared with the United States and most of Europe, where around two out of three residents have their own vehicle, the car market in Russia is still relatively open and continues to develop. Russia imposes rather large customs duties on imported cars in order to force international car companies to produce their vehicles inside the country. As a result, many foreign car manufactures have localized their production in Russia and in some cases even modified their car models to accommodate Russian road conditions and people's tastes.

Russians prefer low-budget crossovers and sedans. Hatchbacks and station wagons are less common, and small electric cars are generally an unusual sight (there are just 11,000 electric cars in the country, and 9,000 of them are the Nissan Leaf).

"Russians are not interested in hatchbacks because of the lack of association with a high position in society," says Alexey Kozhukhov, an automotive marketing expert. He notes that in the Soviet period, a long Volga sedan was considered a high-class car and a symbol of power, and that these associations have been passed on to subsequent generations.

Manufacturers have created economy-class sedans and SUVs that are specifically catered to the Russian market. According to the Association of European Businesses , in the first half of 2021 around 45% of new cars sold were crossovers.

Best selling cars in Russia in 2021

1. lada granta.

The simplest and cheapest car on the Russian market, the Granta is assembled at the AvtoVAZ plant in Togliatti. Some typical customer reviews state that the car is “reliable and without problems” or that “I didn’t have big illusions and got what I expected.” A sedan without air conditioning costs 560,000 rubles ($7,800), and the LUXE version with a heated windshield, cruise control and an automatic transmission costs 780,000 rubles ($11,000).

2. Lada Vesta

Lada’s latest model, the Vesta, is designed to be a sedan and crossover, although there is also a sports version. The car meets most consumers’ needs but is cheaper than foreign brands. “When I bought it, I understood that it was AvtoVAZ and there might be problems ahead, but the desire to buy this beauty simply prevailed, and I only wanted a new car in this budget,” one Russian driver writes , adding that he didn’t want to buy a used car.

The simplest model with a manual transmission, air conditioning and airbags sells for 795,000 rubles ($11,200), while the most expensive “Sport” version costs 1.2 million rubles ($17,000).

3. Hyundai Creta

This crossover is one of the most inexpensive cars in its class in Russia. Its price ranges from 1.2 million rubles ($17,000) to about 2 million rubles for the top version ($28,000). “Many Creta owners with a 1.6-liter engine complain about the sluggish dynamics. I wasn't looking for a racing car, so the car is fine for me. My priority was AWD, which fully justified itself. Now I can go to nature any time and not worry about getting stuck on a dirt road,” writes one driver from the Urals.

Hyundai also was also the first car manufacturer in Russia to offer online sales directly from the factory without the dealer.

4. Hyundai Solaris

The Solaris is a version of the Accent that was localized specifically for Russia in 2010 and is produced in St. Petersburg. Russian drivers seem quite satisfied with the model, which is a budget sedan that is resistant to temperature changes and harsh weather conditions and is generally reliable. “I wanted to use it for at least five years without looking under the hood,” wrote one driver about why he chose this model.

The Solaris ranges in price from 890,000 rubles ($12,500) to 1.3 million rubles ($18,300) for the top configuration.

5. KIA Rio

The KIA Rio has also been produced in St. Petersburg since 2011, and, like the Solaris, only comes in a sedan model, which is more popular among local customers. The design and technical characteristics of the Russian Rio are slightly different from versions sold in other countries. Many drivers note that it has good heating and the ability to start at minus 30 Celsius. As a result, the car has become one of the best-selling models in the country. It ranges in cost from 950,000 ($13,400) to 1.3 million rubles ($18,300)

6. Volkswagen Polo

All Polo models sold in Europe are hatchbacks, but in Russia Volkswagen opted to modify this legendary model to produce what has become one of the most popular sedans in Russia. “The car is a car. The trunk is huge and comfortable. There is quite a lot of space in the cabin, both in front and behind. The driving is not bad, better than other cars of this class,” writes one owner.

The Polo Sedan is assembled at a factory in Kaluga (about 200 km from Moscow). The cheapest model costs 1 million ($14,100), while the most expensive version goes for 1.9 mln rubles ($26,800).

7. Lada Niva

The first Soviet SUV is still in production and has a loyal customer base for its combination of being extremely cheap and strong for off-road driving. Many Russians use it to get to their remote dachas.

The simplest version costs 660,000 rubles ($9,300). The most expensive version is called the Niva Travel (formerly the Chevrolet Niva), costs 993,000 rubles ($14,000) and is equipped with a snorkel in case the car is overtaken by water in severe road conditions. And there is no automatic transmission! “Its passion is dirt roads, super suspension, it ‘swallows’ holes in the roads, you don't notice irregularities,” wrote a driver from the Amur Region in the Far East. However, customers note that the interior is not particularly comfortable and that the car consumes a lot of fuel.

8. Škoda Rapid PA II

This is another economy class sedan that has won the hearts of many Russian drivers. “The new Rapid is comfortable to drive, there is a lot of automation,” says one owner from St. Petersburg. They go on to write : “Turn the steering wheel and hit the gas, and switch on cruise control on a high-way, and the car will do everything else by itself.”

The Škoda Rapid is assembled at a plant in Kaluga. The simplest version costs 990,000 rubles ($14,000) and already includes a media system with a touch screen and Bluetooth. The most expensive version costs 1.4 million rubles ($19,700).

9. Renault Duster

Renault cars are assembled in Moscow. For a long time, the most popular Renault model was the Logan sedan, but this year the Duster SUV took that title. "Who can imagine a life that is no longer just being in a hurry," one driver jokes about driving the car. "The Duster is a family car. The car is enough to cheerfully stay in traffic" writes another.

The price of the simplest model with a manual transmission starts at 1 million rubles ($14,300), while the most expensive 4x4 version is twice as much.

10. Lada Largus VP

The only wagon model in this list is also produced by the Russian company AvtoVAZ. Largus is a fairly budget car that is popular not only among dacha enthusiasts, but also for commercial purposes. “The main plus is the suspension and stability on the road,” writes a driver from Tyumen (Siberia), “No need to worry about driving the highway on Largus in winter.” All versions are equipped with a manual transmission and cost from 780,000 ($11,000) to 978,000 rubles ($13,700).

If using any of Russia Beyond's content, partly or in full, always provide an active hyperlink to the original material.

to our newsletter!

Get the week's best stories straight to your inbox

- Russian driverless cars are ready to replace taxis. Watch out, hooman!

- Could a Soviet citizen buy a car?

- 5 facts about this amphibious 8-wheel Soviet monster car

This website uses cookies. Click here to find out more.

Car Buyer Journey Study Shows Growing Frustration with Car Buying Process

- Jan 19, 2023

- Read Time: 7 Mins

New research released Jan. 18 by Cox Automotive showed satisfaction with the car buying process declined in 2022 for the second straight year.

The 2022 Car Buyer Journey Study revealed vehicle buyers were frustrated with high prices, limited availability and the amount of time required to complete the process. Used-vehicle buyers, who are often more price sensitive and face higher interest rates, were particularly unsatisfied with the experience in 2022, the research indicated.

Since 2009, Cox Automotive's annual Car Buyer Journey Study has offered a comprehensive look at the overall vehicle buying process in the U.S., with an eye toward consumer satisfaction. The study provides a holistic view---the journey through researching, shopping and the many purchase steps required to complete the deal---for both new- and used-vehicle buyers, and also includes research among dealership staff and management.

"With the annual NADA convention opening in Dallas later this month and bringing together auto dealers from across the country, we think it is more important than ever to showcase the current state of vehicle buying in America," said Isabelle Helms , vice president of research and market intelligence at Cox Automotive. "While buying a vehicle is a complicated transaction, with financing required, trade-in valuations to consider and plenty of research required, it does not have to be frustrating for the consumer. With the right digital tools and systems in place, car buying can be a highly satisfying activity, and as efficient and streamlined as consumers want it to be."

The 2022 Car Buyer Journey Study was created from surveying more than 10,000 consumers who were in the market for a vehicle in 2022---4,150 vehicle shoppers and 6,118 vehicle buyers. As part of the process, dealers were also surveyed. Most of the research was conducted during the second half of 2022.

Key Takeaways from the 2022 Cox Automotive Car Buyer Journey Study

Overall satisfaction with the car buying journey declined in 2022..

According to Cox Automotive research, 61% of vehicle buyers in 2022 were highly satisfied with the process, down from 66% the year earlier and well below the peak of 72% in 2020. Results in 2022 were generally in line with pre-pandemic levels.

Satisfaction for new-vehicle buyers declined only modestly to 70%, down from 71% in 2021, while satisfaction among used-vehicle buyers fell significantly. In 2021, 65% of used-vehicle buyers noted they were highly satisfied with the process. In 2022, the percentage dropped to 58%.

Three elements impacted overall car buying satisfaction: time spent, limited inventory and high prices.

The time spent in the vehicle buying process jumped significantly in 2022, with the typical vehicle buyer reporting the process took 14 hours and 39 minutes, up from 12 hours and 27 minutes in 2021, an increase of 18%. Time spent online shopping and researching vehicles increased by more than an hour compared to 2021, while time at the dealership increased by approximately 20 minutes.

Vehicle shoppers visited more websites during the process, an average of 4.9 sites, up from 4.0 in 2021. All four website categories---automaker, dealer, third-party and used vehicle online retailers---saw an increase in shoppers using their sites. Third-party sites played the largest role, with 79% of buyers visiting sites such as Kelley Blue Book or Autotrader , both Cox Automotive sites, during the process, followed by dealership sites (59%), used vehicle online retailers such as Carvana and Vroom (34%), and automaker websites (33%).

Interestingly, 13% of buyers used a lender website when shopping for their most recent vehicle purchase, an 86% increase from 2021.

In 2022, the shopping experience became less about finding the perfect vehicle and more about finding any vehicle. More than half of the vehicle buyers in 2022 who reported limited inventory said that was a key driver of the increased time spent researching and shopping online.

Also, buyers showed less loyalty to dealerships and vehicle brands last year, especially new-vehicle buyers. In 2022, 37% of new-vehicle buyers purchased a brand they had never owned before, up from 31% in 2021. A record share of shoppers also considered both new and used vehicles last year: 64%, which is up significantly from 55% in 2021.

Record high prices were commonplace in 2022, and buyers were negatively impacted. In 2022, 54% of buyers found prices to be higher than expected, compared to only 31% in 2021. And 63% of these buyers paid more than they intended for a vehicle, compared to 48% the previous year. For all buyers, satisfaction with the price paid declined as well, to 48%, down from 63% in 2021.

Vehicle ordering increased significantly in 2022, and buyers who pre-ordered were generally more satisfied with the overall experience.

Due mostly to new-vehicle inventory shortages, vehicle buyers were far more likely to have pre-ordered last year. Nearly one in five new vehicle sales last year was a pre-ordered vehicle, an 89% increase year over year. More dealers offered this solution, and 74% of consumers who pre-ordered indicated they chose that route to get the key features they wanted and exclude those they didn't.

Further, most consumers (79%) who ordered vehicles were generally more satisfied with the experience, compared to a previous experience of buying off the lot. They also indicated they would likely pre-order again when returning to the market.

Among buyers who pre-ordered vehicles, overall satisfaction was higher among those who ordered directly from the automaker, as opposed to ordering through a dealership. The research indicated those who ordered from the automaker had shorter waiting periods, with better vehicle tracking and overall engagement through the process.

More buyers selected F&I products with their purchases in 2022 and leaned into lenders they trust.

Last year, 67% of vehicle buyers indicated they purchased an F&I product, up from 59% in 2021. More products were purchased as well, an average of 1.6, an increase from 1.3 products the year earlier. Shoppers continue to choose products such as extended warranties, GAP insurance to help protect auto loans, and wheel and tire protection plans.

With auto loan rates rising in 2022, the top reason for selecting a lender was predictably tied to the loan rate offered. Notably, though, was a growing importance of "trust in the lender" and general familiarity with the lender. This was particularly true among Gen Z buyers and "Mostly Digital" buyers. In fact, in 2022, trust in the lender was more important than an easy loan application process.

When it comes to securing financing, many buyers indicate they desire more online activity. However, while 55% of buyers checked their credit scores online, only 36% calculated monthly payments online; 30% applied for credit online, and fewer still, only 12%, signed paperwork online last year. This is seen by the Cox Automotive analysts as an opportunity for dealers and consumers, as more online F&I activity improves satisfaction and streamlines the experience.

EV buyers see digital retailing and eCommerce as a way to save time, while buyers choosing traditional powertrains feel it is the avenue to achieve the best deal and reduce buying pressure.

For EV buyers, online is the preferred route. The latest research indicates that 87% of EV buyers are open to the idea of buying fully online---a true eCommerce solution---while only 73% of buyers of new, traditional, internal combustion engine (ICE) vehicles are open to fully eCommerce solutions.

Looking forward, 80% of EV buyers indicate their next purchase will be a mostly online process, compared to 61% of new ICE buyers. New ICE buyers see eCommerce solutions as an avenue to reduce buying pressure and achieve the best deal while spending less time at the dealership. EV buyers, who on average are younger and more tech-savvy, feel digital solutions can save time and make the process easier and more convenient.

Shoppers, buyers and dealers agree: Digital solutions make the car buying journey better.

Nearly all auto dealers---87%---indicate that digital retailing solutions have positively impacted at least one area of their business, reducing time spent, improving efficiency and also benefitting sales, profits and relationships with customers.

Importantly, 81% of shoppers in 2022 noted online activities improve the overall buying experience. Transacting online saves time, according to buyers, and 78% of buyers believe an eCommerce approach provides greater transparency around pricing, and 86% say it allows them to interact with fewer dealership sales personnel.

"Mostly Digital" buyers---those who complete more than 50% of the purchase process steps online---were the most satisfied among all buyers. The research indicated 67% of Mostly Digital buyers were satisfied with the buying experience compared to 49% of Light Digital buyers, who perform less than 20% of the steps online. Mostly Digital buyers are also more likely than Light Digital buyers to feel the dealership gave them a good deal. They were also more satisfied with the amount of time spent during the buying process and at the dealership.

In the year ahead, Cox Automotive forecasts half of all vehicle buyers will engage with at least one digital tool during the purchase process.

Source: Cox Automotive

Stay Up to Date on Popular Collision Repair News Topics

- Electric Vehicles

- Industry Lawsuits

- Legislation

- Technician Shortage

- Mergers and Acquisitions

- Vehicle Recalls

- On the Lighter Side

- Who Pays for What?

Join the Autobody News Community!

Subscribe now and receive our weekly e-newsletters, delivered directly to your inbox.

Please complete all required fields!

Sponsored Content

Top Stories

Featured Video Equalizer Products - The Cutting Edge of Auto Glass Removal & Replacement Technology

Shop & product showcase.

Current Digital Issue: April 2024

Autobody News is a free monthly publication for the owners and managers of 36,000+ collision repair shops across the country. Click on the regional area of your choice or subscribe here .

ABOUT CAR BUYING: Car Buyer Journey Study Shows Growing Frustration with Car Buying Process

Watch Out For The Dealer's Jerk-Around

- After peaking in 2020, satisfaction with vehicle buying drops for the second straight year in 2022.

- High prices, tight inventory take a toll on the car-buying journey.

- Shoppers, buyers, and dealers agree that smart digital solutions make the process more efficient and improve overall satisfaction.

ATLANTA , Jan. 18, 2023 -- New research released today by Cox Automotive shows that satisfaction with the car buying process declined in 2022 for the second straight year. The 2022 Car Buyer Journey Study reveals vehicle buyers were frustrated with high prices, limited availability, and the amount of time required to complete the process. Used-vehicle buyers, who are often more price sensitive and face higher interest rates, were particularly unsatisfied with the experience in 2022, the research indicates.

Since 2009, Cox Automotive's annual Car Buyer Journey Study has offered a comprehensive look at the overall vehicle buying process in the United States , with an eye toward consumer satisfaction. The study provides a holistic view – the journey through researching, shopping and the many purchase steps required to complete the deal – for both new- and used-vehicle buyers, and also includes research among dealership staff and management.

Research released today by Cox Automotive shows that satisfaction with the car buying process declined again in 2022.

"With the annual NADA convention opening in Dallas later this month and bringing together auto dealers from across the country, we think it is more important than ever to showcase the current state of vehicle buying in America," said Isabelle Helms , vice president of Research and Market Intelligence at Cox Automotive. "While buying a vehicle is a complicated transaction, with financing required, trade-in valuations to consider and plenty of research required, it does not have to be frustrating for the consumer. With the right digital tools and systems in place, car buying can be a highly satisfying activity, and as efficient and streamlined as consumers want it to be."

The 2022 Car Buyer Journey Study was created from surveying more than 10,000 consumers who were in the market for a vehicle in 2022 – 4,150 vehicle shoppers and 6,118 vehicle buyers. As part of the process, dealers were also surveyed. Most of the research was conducted during the second half of 2022.

1. Overall satisfaction with the car buying journey declined in 2022.

According to Cox Automotive research, 61% of vehicle buyers in 2022 were highly satisfied with the process, down from 66% the year earlier and well below the peak of 72% in 2020. Results in 2022 were generally in line with pre-pandemic levels. Satisfaction for new-vehicle buyers declined only modestly to 70%, down from 71% in 2021, while satisfaction among used-vehicle buyers fell significantly. In 2021, 65% of used-vehicle buyers noted they were highly satisfied with the process. In 2022, the percentage dropped to 58%.

Three elements impacted overall car buying satisfaction: time spent, limited inventory and high prices.

- Time spent: The time spent in the vehicle buying process jumped significantly in 2022, with the typical vehicle buyer reporting the process took 14 hours and 39 minutes, up from 12 hours and 27 minutes in 2021, an increase of 18%. Time spent online shopping and researching vehicles increased by more than 1 hour compared to 2021, while time at the dealership increased by approximately 20 minutes. Vehicle shoppers visited more websites during the process, an average of 4.9 sites, up from 4.0 in 2021. All four website categories – automaker, dealer, third-party, and used vehicle online retailers – saw an increase in shoppers using their sites. Third-party sites played the largest role, with 79% of buyers visiting sites such as Kelley Blue Book or Autotrader, both Cox Automotive sites, during the process, followed by dealership sites (59%), used vehicle online retailers such as Carvana and Vroom (34%), and automaker websites (33%). Interestingly, 13% of buyers used a lender website when shopping for their most recent vehicle purchase, an 86% increase from 2021.