Pay for your flight with Uplift

Feel good about where you fly and how you pay for it. With Uplift, you can book your trip now and pay for it over time with budget-friendly monthly payments.

Low monthly payments

Budget-friendly loan options.

Easy application

Receive a quick decision.

No surprises

That means no late fees, no prepayment penalties.

Automatic payments

So you don't have to remember due dates either.

How Uplift works

Step 1: Select Uplift at checkout

Shop for your trip on our website or app like you normally do and select Uplift as your payment method at checkout.

Step 2: Complete a quick application

Provide a few pieces of information and receive a quick decision without ever leaving the payment page.

Step 3: Enjoy your trip

Relax knowing you can travel now and pay for it over time with low monthly payments.

Frequently asked questions

What is uplift.

Uplift gives you the freedom to purchase travel now and pay over time with simple monthly payments. Some plans include interest while some are interest-free.

How do I apply?

Shop for your flights like you normally would. Then, select Uplift as your payment method at checkout. You’ll complete a short application and receive a quick decision letting you know if you’ve been approved. You can choose the terms of your plan before you complete checkout and enjoy your trip.

How is my loan term offer determined?

Uplift looks at a number of factors, including your credit information, purchase details and more.

How do I make installment payments?

You can make a payment anytime by visiting pay.uplift.com and selecting the “Loans” tab. From there, select the "Make a Payment" button.

Uplift recommends you enable AutoPay at the time of purchase so your payments are automatically deducted from your bank account each month. You can enable AutoPay on the "Accounts" page on pay.uplift.com. You can also update your payment method here at any time.

Can I travel before paying off my trip with Uplift?

Yes! You do need to allow a few days between booking your trip and departure for things to process. Other than that, you are free to travel whenever—even before you’re all paid off.

Where can I find Uplift’s Privacy Policy and Terms of Use?

Here is the Privacy Policy and Terms of Use for Uplift.

Down payment may be required. Actual terms are based on your credit score and other factors and may vary. APRs range from 0% to 36%. Not everyone is eligible. Loans made through Uplift are offered by their lending partners . Privacy Policy and Terms of Use . Uplift’s address: 440 N Wolfe Road, Sunnyvale, CA 94085

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How Uplift Buy Now, Pay Later Works for Travel

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

What is Uplift buy now, pay later?

Which airlines offer financing through uplift, how uplift works for travel, should you use buy now, pay later for travel, alternatives to uplift, if you’re interested in using uplift to pay for travel.

Many travelers want to book vacations, but with inflation and surging demand affecting the price of airline tickets, rental cars and other household expenses, sometimes they simply don't have the money. Instead of carrying a balance on high-interest rate credit cards, some are turning to buy now, pay later options like Uplift to finance their travel.

Here's a look at how Uplift buy now, pay later works, when you should or shouldn’t use it and what other alternatives exist for financing a trip.

Uplift is one of the buy now, pay later options available to finance purchases of clothes, household goods, travel and more. BNPL allows you to spread the cost of purchases across multiple payments.

These financial technology — or fintech — companies generally offer easier credit than traditional credit cards or personal loans. Some don't pull a hard inquiry from your credit report, which means that signing up won't affect your credit score.

Uplift doesn't charge any fees to customers, including late fees or prepayment penalties. However, depending on your purchase and credit history, you may pay interest between 0% and 36%. Uplift charges simple interest on its loans, which means it doesn't charge interest on top of interest.

» Learn more: Factors that affect your credit score and how to improve them

When booking your flight, you’ll notice that many airlines offer BNPL financing through Uplift or one of its competitors. Uplift is currently available for use on many U.S. and international airlines.

Here are a few of the major airlines that offer financing through Uplift:

Air Canada.

Alaska Airlines.

Allegiant Airlines.

Frontier Airlines.

Hawaiian Airlines.

Southwest Airlines.

Spirit Airlines.

United Airlines.

Delta Air Lines and American Airlines use a different BNPL service called Affirm.

Here's how to book your flight using Uplift:

Find a participating airline .

Choose your travel dates, departure city and destination as usual.

Select the flight that meets your needs.

Enter traveler(s) details.

At the payment screen, select Uplift as your payment method.

Enter your personal details and click "check my rate."

You’ll be presented with several payment options, including higher and lower monthly payments. Choose the payment plan that works best for you.

Complete your purchase.

How to apply for Uplift financing

The application process is quick and easy. After selecting Uplift as your payment method during checkout, you’ll provide basic personal information like your name, mobile number and date of birth. If you are a U.S. citizen, you must also provide your Social Security number. Then, you'll receive an instant credit decision.

Depending on your credit history, purchase details, repayment term and other factors, you may or may not pay interest on your purchase. Uplift interest rates vary between 0% and 36%.

Uplift will send email and text reminders when a payment is due. You'll make payments at Uplift.com according to the plan that you selected — loan proceeds go to the airline from Uplift.

Automatic payments are available to ensure that all of your payments are made on time. If you don't authorize this, you'll need to make each monthly payment manually. You can also pay off your balance early without incurring prepayment penalties.

Even if you don't have a flight to purchase, some of Uplift's partners allow customers to pre-qualify ahead of time. This will give you a good idea of how much you can afford through its buy now, pay later financing.

» Learn more: Tips for traveling without a credit card

While many people view BNPL loans as a good way to finance purchases, they may not be a wise choice. The loans can make it easy to get into debt, and the recurring payments can quickly overwhelm your budget.

Here are some reasons you may want to skip financing with a BNPL loan:

Cannot travel immediately. Because the payment process between Uplift and the airline isn't immediate, you must wait a few days between booking your flight and when you travel. For travelers who are in a hurry, BNPL financing may not work.

Fees add up. Though Uplift advertises itself as a fee-free service, other BNPL apps may charge fees. Depending on the size of your purchase, BNPL fees may be more than the interest charges from other options, like a credit card or personal loan.

No flexibility with payments. When you make a BNPL purchase, there’s a predefined repayment schedule that you must adhere to. You cannot extend your repayment schedule or refinance your payments through Uplift. Payments are usually more than the minimum payment due on a credit card. If you can’t make the BNPL payment, some lenders charge a late fee. In most cases, you can’t make any additional purchases until your account is brought current.

Credit limits can be much lower. Many BNPL apps offer financing without the traditional hard credit check and underwriting that credit cards require. Because of that, credit limits tend to be lower than many credit cards.

Doesn't earn rewards. Most BNPL loans don't earn rewards like a credit card when paying for your flights. This makes it harder to earn miles, points or cash back toward your next vacation.

No travel benefits. Travel credit cards also include other benefits that BNPL apps don't include, such as trip interruption or cancellation insurance, delayed/lost baggage protection and trip delay reimbursement.

Not all airlines accept BNPL apps. The roster of airlines that accept BNPL financing is growing, but not all airlines currently participate. Among the major U.S. airlines, only American Airlines doesn't offer BNPL financing. Alaska, Delta, Frontier, JetBlue, Southwest and United all offer some form of buy now, pay later payment options.

» Learn more: How travel credit cards work

While buy now, pay later loans are growing in popularity, they aren't always the best option when booking a flight. These payment alternatives to Uplift may be a better option for your situation:

Pay with your existing credit card. While you may pay a higher interest rate, credit card minimum payments are fairly low. Because of this, you'll have more flexibility with your monthly minimum payments over a loan through Uplift.

New credit card 0% APR offer. If you need extra time to pay off your purchase without incurring interest, a 0% APR credit card is an excellent option.

Get a personal loan. A personal loan offers a fixed payment schedule. Lenders who do traditional underwriting may offer a lower interest rate than a company like Uplift that does a quick credit check.

Apply for peer-to-peer lending. Peer-to-peer lending platforms are a good option for consumers with fair credit.

» Learn more: Best 0% APR and low interest credit cards

BNPL lenders like Uplift enable customers to pay for their flights over time without using their credit cards. Depending on your credit and purchase details, you may qualify for 0% financing on your purchase.

While BNPL financing can be attractive, remember that you won't earn additional rewards like you would when using a credit card. Additionally, these purchases don't have the same benefits and protections as a credit card, and won’t offer insurance for trip cancellation, lost bags or a trip delay. Consider all of the factors before deciding if using Uplift or BNPL loans are right for you when booking your next flight.

Yes, you can pay for someone else's flight using Uplift. You don't have to be on the trip to use this payment method.

No, you may travel even if your balance isn't paid off. This flexibility is actually one of the main benefits of using Uplift buy now, pay later financing. The main caveat, however, is that you should allow a few days between your purchase and travel dates so that the application and payment process can be completed.

If your plans change and you need to cancel the flight, the first step is to contact the airline. The airline will process the cancellation and, if you are eligible for a refund, the airline will notify Uplift. Your account will be updated when the cancellation is fully processed. Travelers who aren't eligible for a refund are still responsible for paying the outstanding balance on their Uplift account.

Yes, you can use Uplift to finance multiple purchases at a time. Uplift looks at several factors, including your credit information and existing BNPL loans, before approving each request. Note that approval by Uplift in the past doesn't guarantee your next application will be approved.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1.5%-6.5% Enjoy 6.5% cash back on travel purchased through Chase Travel; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year). After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

$300 Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

on Capital One's website

2x-5x Earn unlimited 2X miles on every purchase, every day. Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options.

75,000 Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel.

- Search Search Please fill out this field.

What You Need to Know About Uplift

A buy-now-pay-later service for travel

How Does Uplift Work?

Is there a credit limit.

- Does Uplift Affect Credit Score?

Does Uplift Charge Interest?

Is uplift safe, who accepts uplift.

- How Do Returns Work With Uplift?

How Do I Pay Uplift?

DaniloAndjus / Getty Images

You might not have heard of Uplift yet. But if you like to travel and you're a fan of increasingly popular buy-now-pay-later (BNPL) lenders , you probably will soon.

Uplift has been combining both of these things—travel and BNPL loans—since 2014, but it's rapidly poised to grow as travel picks back up again after pandemic restrictions. According to a January 2021 company press release, it plans to handle more than $1 billion in transactions over the next 18 months.

Learn how Uplift’s installment plans work, which fees it charges, its interest rates, and what the purchase process is like.

Uplift offers one product: installment loans with term lengths from three months to two years for purchases made with its travel partners. Uplift teams up with some of its partners to provide special travel offers, such as 0% APR loans.

To use Uplift, you'll add your travel purchases to your cart and then apply for a loan through Uplift at checkout.

You can use Uplift to purchase only travel you participate in, either alone or with other people. You can't use Uplift to pay for a trip someone else is taking without you.

Is There a Minimum Purchase Size When Using Uplift?

Yes. The minimum you can borrow is $100.

Is There a Maximum Purchase Size When Using Uplift?

Yes. The maximum you can borrow is $25,000.

Do Products Bought With Uplift Ship After First Payment?

You're only able to make travel-related purchases with Uplift, so you won't really receive any products in the mail, per se.

You can complete your travel before you finish paying off the loan, but you'll need to apply for the loan at least a few days before you plan to travel in order for the charge to be processed. Don't rely on Uplift if you need to travel today.

Can I Use Uplift to Pay Bills?

No. Uplift works for travel purchases only.

Uplift loans don't have a set credit limit since each loan is a separate product. You can have more than one loan, but each one is considered on a case-by-case basis.

Uplift does not offer prequalifications or rate checks. Instead, the only way to know whether you're approved for a loan is to apply for it during the checkout process. You don't have to accept the loan terms if you don't want to, and Uplift only does a hard credit check if you accept the loan.

Does Uplift Affect Your Credit Score?

Not all BNPL lenders will check your credit, but some do. Here's where Uplift stands on the issue.

Does Uplift Check Credit?

Yes. When you apply for a travel loan during checkout, Uplift will do a soft credit check to see if you're eligible for financing and check your identity.

If you're approved and you click "proceed" with the loan, then Uplift will do a hard credit check . This one can ding your score by a few points but remains on your credit report for 12 months, in some cases.

Does Uplift Report Your Activity to Credit Bureaus?

Yes. Unlike some other BNPL lenders, Uplift reports your payments to the credit bureaus . This means you can use Uplift loans to help build credit as long as you make on-time payments.

What Credit Score Do You Need to Use Uplift?

Uplift declined to say what credit score is required for approval. But in general, the better your credit score, the better your chances of approval.

In addition to your credit score, Uplift considers other factors when you apply for a loan, such as the timeline of your travel.

If Uplift denies your application, it will send you a letter explaining why.

Yes, Uplift charges 0% to 36% APR and uses simple interest rather than compound interest . The average rate for loans is 15% APR, though travel partners such as Allegiant and Carnival offer 0% promotions, according to a company representative.

Generally, the more creditworthy you are, the better the rates you may qualify for. If you have good credit, Uplift may be a cost-effective way to get a loan. But if your credit score isn't the greatest, an Uplift loan with a 36% APR can be quite expensive.

For example, the average credit card interest rate for people with bad or fair credit was around 24% in 2021, according to The Balance’s research. If you opt for a personal loan instead, it'll be cheaper still—the average interest rate on a 24-month personal loan was between 9% and 10% during the same period, according to the Federal Reserve.

Does Uplift Charge Fees?

Yes, a small number of loans may have a 2% origination fee that’s rolled into the loan. However, Uplift doesn't charge prepayment penalties or late fees.

Yes. Uplift is trusted by some of the largest companies in the travel industry, so you should feel confident that your purchase is as safe as anywhere else.

However, using services like Uplift may cause you to overspend, especially if you have good credit and can qualify with ease. Also, Uplift’s BNPL program may tempt you to make purchases that throw you off track for your long-term goals, like saving up for a house or an emergency fund.

That said, Uplift can be a good choice if you absolutely need to travel and you're confident you can pay back what you borrow. If you need to travel for your last chance to see a family member, for example, Uplift absolutely can be a good option because of how it splits up payments over time. It can also be a good choice if you can qualify for 0% APR financing and you're looking to build credit, too.

As of 2020, Uplift partnered with more than 100 travel brands, including:

- Royal Caribbean

- Southwest Airlines

- Universal Orlando

- United Airlines

- CheapCaribbean.com

- Secrets Resorts & Spas

Because its travel partners are pretty diverse, Uplift can offer financing for hotel stays, cruises, airline tickets, rental cars, and attractions.

How to Use Uplift Online

There's only one way to use Uplift:

- Visit a travel partner, which you can find listed on Uplift's directory .

- Choose which purchases you want to make and add them to your cart.

- When checking out, select "Uplift" from the payment options.

- Enter in your information, such as your name and the last four digits of your Social Security number.

- If you're approved, Uplift will show you a range of payment plans to choose from.

- Pick which plan you like, and then complete your purchase.

Unlike some BNPL lenders, Uplift does not offer an app or a way to make purchases at non-partner stores with a digital card number.

How to Use Uplift in Stores

Since Uplift is focused on one area—travel purchases—you can generally only use it online. You may be able to use it in certain offline cases, too, such as through Uplift's travel advisor partners or call centers.

How Do Returns Work When Using Uplift?

If you request a refund from the merchant or if your trip is canceled, a few things can happen.

Your ability to get your money back is always subject to the merchant's own refund policies. A merchant can choose to deny your refund if it's outside of the scope of the merchant’s cancellation policies, so you should read these carefully before you make a purchase. If the merchant allows refunds, you'll either get a credit or voucher you can use for future travel, or the merchant sends a cash refund to Uplift.

If the merchant opts for a cash refund, Uplift will credit your loan with the amount of the refund. It can take up to 90 days for this to happen, so you may still be paying on your loan for quite some time after it's canceled. If that refund wipes out your balance and there's still money left, Uplift will refund you the remaining money.

But—and this is important—if the merchant gives you a voucher for future travel, you still must pay back your Uplift loan. You can use this voucher to book travel later and it'll likely be paid off by then, but it can be a bummer to be paying for travel that you can't use yet.

Uplift recommends sending to support@uplift.com a copy of the email that confirms your refund.

If you're in the United States, you have two options for how to pay:

- ACH transfer from your bank

If you're in Canada, you can pay using these two methods:

- Direct debit from a bank account

- Visa or Mastercard virtual debit card

When you sign up for your loan, Uplift will ask you to link your payment method and sign up for autopay. You don't have to agree to autopay, but it's always a good idea to do this for any debt so that you don't miss any payments. Otherwise, you'll need to remember to log in each month and make your payment.

Uplift is also unique in that it requires monthly payments. In comparison, many other BNPL lenders require biweekly payments.

What Happens If I Don’t Pay Uplift?

Uplift doesn't charge late fees, but there are plenty of other reasons why you'll want to make your payments on time.

If more than 30 days pass since your last payment, your Uplift loan will continue to accrue interest, making it more expensive to pay off. Uplift may blacklist you from getting another loan through them again and may also report your late payments to the credit bureaus, which can damage your credit score .

Uplift. " Buy Now, Pay Later Travel Leader Uplift Raises $68M in Credit Financing to Support Rapid Growth in Anticipation of 2021 Travel Industry Rebound ."

myFICO. " Credit Checks: What Are Credit Inquiries and How Do They Affect Your FICO Score ?"

Board of Governors of the Federal Reserve System. " Consumer Credit - G.19 ."

Uplift. " Buy Now, Pay Later Travel Leader Uplift Raises $68M in Credit Financing to Support Rapid Growth ."

Uplift. " Payments and Refunds ."

Uplift - Buy Now, Pay Later 17+

Shop interest free. zero fees., uplift inc..

- #87 in Shopping

- 4.7 • 2.6K Ratings

iPhone Screenshots

Description.

Buy Now, Pay Later with the world's most popular travel brands and shop hundreds of your favorite stores and pay over time with low, monthly installments. Uplift gives you a better way to pay for the things that matter most and even features interest-free terms*! Here’s how it works: Already an Uplift customer? Great! Download and easily start managing all your thoughtful purchases and account information directly within the app today. Not an Uplift customer? No problem! Simply download and explore plenty of travel inspiration for your next adventure with tons of the worlds favorite travel brands. When you’re ready to book with one of our travel partners, simply select “Pay with Uplift” at checkout. We’ll help you split the total amount into bite-sized monthly payments. You can choose the plan that works best for your budget. Unlock Purchase Power so you can shop at hundreds of great stores, too! Qualifying customers in good standing will be able to unlock their Purchase Power over time and start shopping at their favorite stores. Uplift’s Purchase Power tells you just how much we can offer you through the Uplift app to spend and pay back over time with an installment plan. Shoppers can select “Pay with Uplift” at purchase and split the total amount into bite-sized monthly payments. Once you pick your plan, we’ll issue you a virtual card. Copy the card information and use it at checkout—just like you would use a regular credit card - and complete your purchase! You’re probably thinking that there must be a catch. Well, there isn’t! There are no fees or mystery charges. Simply follow your surprise-free monthly payment plan to pay off your purchases and unlock Purchase Power over time. What makes Uplift great? Let us count the ways: EASY UPLIFT ACCOUNT MANAGEMENT You can easily manage your Uplift purchases, monthly payments, and account information directly in the My Uplift tab within the Uplift App. Update your payment information, AutoPay status, and more right from your mobile device. SIMPLE, SURPRISE-FREE PAYMENTS No fees. Ever. No prepayment penalties. No confusing math. Best of all, you don’t have to mastermind a pay-off strategy. Upfront, you’ll know exactly how much to pay and when, so you can pay off your tab easily. INTEREST-FREE OPTIONS AVAILABLE* The Uplift app gives you interest-free payment options. That gives you more time to make your money work for you and more freedom to enjoy your purchase—without undue strain to your finances. Know that not all plans are interest-free and some plans include interest. Take the stress out of traveling and shopping, all in one place! Make doing the things you love a reality while using a smarter way to shop and pay. Problems with downloading or installing the app? See www.uplift.com/app-faq Still need help? Reach out! [email protected] Terms of Service: https://www.uplift.com/terms/ *3 month Interest-free terms are only available when checking out for certain merchants and well qualified applicants. 0% APR offers available for qualified applicants. Based on a purchase price of $200 you could pay a down payment of $50 today, followed by 3 monthly payments of $50 at $0% APR. Minimum purchase may be required. Down payment may be required. Actual terms are based on your credit score and other factors and may vary. APRs range from 0% to 36%. Not everyone is eligible. Loans made through Uplift are offered by these lending partners: uplift.com/lenders. Terms of Use: www.uplift.com/terms Privacy Policy: www.uplift.com/privacy

Version 2.2.0

Minor bug fixes and improvements.

Ratings and Reviews

2.6K Ratings

Ease of use

I’ve used 3 different buy now-pay later apps, Klarna, Affirm & Afterpay. This one is a keeper! They all have different repayment plans but I really like paying in 3 months, zero down & no interest. Other than Affirm the shortest time are 4 payments every 2 weeks with an amount due now. Affirm is worse actually unless you finance a big purchase. I’ve used them for 2 yrs. I have good credit score (700’s), never missed a payment or been late but they advertise if you do exactly those requirements you can pay at a lower interest rate. That is a lie period. I still get charged 29%-36%. So I’m going to be using Uplift.

Developer Response ,

Thank you so much for your kind review! We wish you happy shopping in the future!

Unprofessional

I have used Uplift in the past and I was extremely impressed with the app in the beginning. Then my purchase power went up and I was able to make purchases on my budget. One day I logged in and everything disappeared! I still have a small balance to pay off (less than $30) but no one at the company has given me a real answer. Customer service says they are not sure what is going on with the app. The email support advised me to go use other apps platforms because they are unable to define a specific time frame for operations. I was also told by their customer service representative that they were “surprised that I had a loan because everyone else is using the travel app”! I’m so disappointed in this app because I thought they were going to be honest but I’m going to pay them that little bit and delete the app. It’s been going on for over a year now and nothing has changed. I was paying the balance slowly hoping it would be up and running by now but I was wrong. Please Uplift don’t respond to my review with that bot reply because emailing support team is a waste of time.

I got approved with uplift for a purchase . I even already made the virtual card . But the app kept freezing so i close the app and opened it back up when i went back to the purchase area and click for the virtual card the card disappeared and thinking it like other apps i went to virtual card area to see if i can see the card info but it wouldn’t show up . I then cancel the card because it said that once it cancel that i will see my power purchase go back instantly. I waited an 1 hour and nothing . Not only isthe purchase power did not Reverse but the app also keeps freezing and getting error . I logged in logged out . I even deleted the app and still the app is not Longing . This is simply the worst app i y see. I never had such issue’s with any app before and it frustrating anf confusing since i was literally so close to checking out before it failed.

Hi mAkieya18 - we're sorry to hear this. We'd like to understand more about the issues you're experiencing and work together on any possible fixes. If you wouldn't mind sending an email to [email protected] with the email address you are using in the app, we will assist. Thank you!

App Privacy

The developer, Uplift Inc. , indicated that the app’s privacy practices may include handling of data as described below. For more information, see the developer’s privacy policy .

Data Linked to You

The following data may be collected and linked to your identity:

- Financial Info

- Contact Info

- Identifiers

Data Not Linked to You

The following data may be collected but it is not linked to your identity:

- Diagnostics

Privacy practices may vary, for example, based on the features you use or your age. Learn More

Information

- App Support

- Privacy Policy

You Might Also Like

Four | Buy Now, Pay Later

Postpay | Shop Now. Pay Later.

Sezzle - Buy Now, Pay Later

Zip - Buy Now, Pay Later

Progressive Leasing

- Book a Flight

- Manage Reservations

- Explore Destinations

- Flight Schedules

- Track Checked Bags

- International Travel

- Flight Offers

- Low Fare Calendar

- Upgrade My Flight

- Add EarlyBird Check-In

- Check Travel Funds

- Buy Carbon Offsets

- Flying with Southwest

- Book a Hotel

- Redeem Points for Hotels

- More Than Hotels

- Hotel Offers

- Best Rate Guarantee

- Rapid Rewards Partners

- Book a Vacation Package

- Manage My Vacation

- Vacation Package Offers

- Vacation Destinations

- Why Book With Us?

- FLIGHT STATUS

- CHANGE FLIGHT

How do I apply?

Shop for your items and add them to your cart like you normally would. When you are ready to check out, simply select Uplift as your payment method. To apply, you'll need to provide some basic information like your mobile number, date of birth, and if you are a US resident, your Social Security number. If you're approved, finish checking out and you're done.

How are my loan offers determined?

We look at a number of factors, including your credit information, purchase details, and more.

How do I make installment payments?

You can make a payment anytime by visiting pay.uplift.com and clicking on the Loans tab. From there, click the Make a Payment button. We recommend that you enable AutoPay at time of purchase so that your payments are automatically deducted each month. If you don't have AutoPay enabled, visit pay.uplift.com , click on the Accounts page, and set the AutoPay toggle to ON. You can also change the form of payment on file with Uplift anytime by visiting pay.uplift.com .

I purchased a trip using Uplift, can I travel before it’s paid off?

Yes! You do need to allow a few days between booking and your departure date for things to process. Other than that, you are free to travel whenever - even before you're all paid off.

What is your Privacy Policy and Terms of Use?

Here is a link to our Privacy Policy and Terms of Use .

Down payment may be required. Actual terms are based on your credit score and other factors and may vary. APRs range from 0% to 36%. Minimum $49 purchase required. Not everyone is eligible. Loans made through Uplift are offered by these lending partners: uplift.com/lenders. Privacy Policy and Terms of Use .

*0% APR offer available on 3 month terms between 4/1/2024-4/30/2024 for approved applicants purchasing Wanna Get Away Plus®, Anytime, and Business Select® tickets. Based on a purchase price of $200, you could pay a down payment of just $50 today, followed by 3 monthly payments of $50 at 0% APR. APRs range from 0%-36%, not everyone is eligible to receive a 0% APR offer. Minimum $49 purchase required. Actual terms are based on your credit score and other factors and may vary. Not everyone is eligible. Loans made through Uplift are offered by these lending partners: uplift.com/lenders . Privacy Policy . Terms of Use .

Help Center

- Terms & Conditions

- Privacy Policy

- Do Not Sell/Share My Info

© 2024 Southwest Airlines Co. All Rights Reserved.

- Destinations

- AAdvantage®

AAdvantage login

Exclusive AAdvantage® experiences Verify AAdvantage® Number(s)

Enjoy now. Pay over time.

Spread the cost of your trip over low monthly payments.

Experience Buyer's Joy Feel good about what you book and how you pay for it. With Uplift, you can make thoughtful purchases and pay for them in bite-sized installments while keeping yourself on a budget.

Low monthly payments Budget-friendly loan options

Easy application Quick decision

Surprise-free No late fees or prepayment penalties

Easy AutoPay No payment dates to remember

- Select Uplift at checkout Add purchases to your cart just like you normally would. When you are ready to check out, choose Uplift as your form of payment.

- Quick & easy Provide a few pieces of information and receive a quick decision.

- Enjoy now Enjoy your trip now and pay for it over time with low monthly installments.

Find vacations

Frequently Asked Questions

- What is Uplift?

Uplift gives you the freedom to book travel now and pay over time with simple fixed installments. Some plans include interest while some are interest-free. When you're ready to check out, just select "Uplift" as your payment method, complete a short application and receive quick decision. Choose the terms of your payment plan, finish checking out and enjoy your purchase. Then, pay over time with simple, no-surprise monthly payments.

- How do I apply for installment payments through Uplift?

Shop for your items and add them to your cart just like you normally would. When you are ready to check out, simply select Uplift as your payment method. To apply, you'll need to provide some basic information like your mobile number, date of birth, and if you are a U.S. resident, your Social Security Number. If you're approved, finish checking out and you're done.

- How are my loan term offers determined?

We look at a number of factors, including your credit information, purchase details and more.

- How do I make installment payments?

You can make a payment anytime at pay.uplift.com and clicking on the Loans tab. From there, click the Make a Payment button.

We recommend that you enable AutoPay at time of purchase so that your payments are automatically deducted each month. If you don't have AutoPay enabled, visit pay.uplift.com, click on the Accounts page and set the AutoPay toggle to ON. You can also change the form of payment on file with Uplift anytime at pay.uplift.com.

Make installment payments Opens in a new window

- I purchased a trip using Uplift, can I travel before it’s paid off?

Yes! You do need to allow a few days between booking and your departure date for things to process. Other than that, you are free to travel whenever - even before you're all paid off.

- What is your Privacy Policy and Terms of Use?

Privacy Policy Opens in a new window

Terms of Use Opens in a new window

Down payment may be required. Actual terms are based on your credit score and other factors and may vary. APRs range from 0% to 36%. Minimum $300 purchase required. Not everyone is eligible. Loans made through Uplift are offered by these lending partners: uplift.com/lenders.

Uplift lenders Opens in a new window

Uplift’s Address: 440 N. Wolfe Road Sunnyvale, CA 94085

Airport lookup

Our system is having trouble.

Please try again or come back later.

Please tell us where the airport is located.

Your session expired

Any confirmed reservations have been saved, but you'll need to restart any searches in progress

We'll Be Right Back!

Suggested companies

Uplift financial, inspire uplift.

Uplift Reviews

In the Travel & Vacation category

Visit this website

Company activity See all

Write a review

Reviews 4.8.

4,246 total

Most relevant

It is very early in my experience with…

It is very early in my experience with Uplift but I will say very easy application and approval process Interest rates are pretty high but it leaves my credit cards open to use while traveling. Planning on paying off early to keep interest costs to a minimum. I will definitely look at them as an option when booking my next cruise!

Date of experience : April 16, 2024

Uplift was a God send

I needed to go see my youngest daughter in Texas. It was very important. I am on disability and I am on a tight budget. The plane tickets were high. I didn't know how I was going to afford the flight. I was booking on Southwest airlines and Uplift showed up. I tapped on it and now I can make payment for the flight. I don't know what I would have done without Uplift. Thank you Uplift.

Date of experience : April 06, 2024

Big purchases no problem

I really like the fact I can take a trip using my uplift credit. Paying it off easy to budget. I recommend Uplift to those who like to spread spending their money over time making big purchases.

do not bother using uplift for car rentals

If I could give zero I would. I used to rent a car from budget and eventually missed my late son's funeral because neither budget or uplift knew what the heck they were doing and kept tossing me around on the phone for two hours. Disgusted customer service. If you know that budget cannot service customers through uplift then I do not know what the heck you approve people for

Date of experience : April 09, 2024

Family Cruise in 2025!

Joining Uplift allowed me the opportunity to vacation with my family. My family and I vacation together every year. This trip was booked during tax season and I wasn’t attending. Couldn’t afford it…Uncle Sam hit me hard this year. Uplift changed my decision and the planning was simple, affordable and convenient.

Date of experience : April 11, 2024

I recently purchase a flight ticket and…

I recently purchase a flight ticket and Uplift gave me the option to make monthly payments it was actually very convenient for me ! Thanks uplift

Date of experience : April 17, 2024

THE EMERGENCY TRAVEL APP.

I've used your service last vacation and it was so convenient for me to pay overtime and have my cash to spend in jamaica. Thanks for allowing me to do the same again this year. Recommend to all.

Date of experience : April 15, 2024

I have used your service before and was…

I have used your service before and was very satisfied. I will be telling people about your company. I will continue using your services in the future as well.

Easy process

I have purchased plane tickets several times. The process is easy and pay back is flexible. Uplift makes travel possible when you may not have all you need for a good price ticket.

Uplift is a awesome

Uplift is a blessing for those of us who love to travel but don't have thousands of dollars just laying around. Uplift offers easy payment plans along with flexible changes. I have taken many trips using this wonderful payment plan!!!

We love to travel

I love the freedom of using uplift, my husband and I have used uplift for years and have enjoyed several trips that we would never have been able to afford to pay all at once. I love that there is no penalty for early payoff and if I need to more time to pay my monthly payment, they are more than accommodating, all done in the app❤️

Date of experience : April 13, 2024

Easy and Great APR

This payment method is new to me, and it's more like a credit for tickets. I like it because it's easy to use, and they give me the option to upgrade from economy to business class.

Date of experience : April 14, 2024

Great option

Easy option to take advantage of pre-season sales!!!! Fast customer service. I have used this company several times and will continue to do so!!!

My my experience w/ Uplift was great it…

My my experience w/ Uplift was great it allowed me to take a much needed vacation that i would have not been able to afford. Thanks Uplift!!

Uplift is amazing

Uplift is amazing! We were able to enjoy a dream vacation because of uplift. It allowed us to book our vacation with ease and pay later! Thank you Uplift we are now a month away from our dream vacation!

Date of experience : March 24, 2024

I work with single hard working parents in a educational setting. I was very pleased to be rewarded with the opportunity to travel and pay in installments for people that need the option to pay later. Thanks. B . D.

Date of experience : April 12, 2024

My boyfriend and I planned a trip and…

My boyfriend and I planned a trip and we were wondering how we were going to pay for our trip. Uplift made it possible at the last minute. Thanks Uplift

A good option splitting your payments…

A good option splitting your payments into a more comfortable budget and they have great rates too.

Great option to pay in full.

It was very nice to have my travel paid for and for me to make payments. It was easy and I did not have to worry about being late on a payment since it is automatically done. I love the option of using Uplift.

Easy and convenient

This is such a an easy and convenient way to pay. Even though there is interest attached to the amount it makes making payments easy.

- Go to navigation

- Go to main content

- Go to search

- Go to footer

Main content

Uplift - book now. pay over time..

Feel good about what you book and how you pay for it. With Uplift, you can make thoughtful purchases and pay for them in bite-sized pieces while keeping yourself on budget.

Flight search

Why uplift.

Now you can spread your adventure into easy payments with Uplift's Pay Monthly option. Uplift, a third party provider, offers access to affordable payment options that fits nicely within your monthly budget. It's a fast and easy way to turn your ideal vacation into a reality.

Low Monthly Payments

Budget-friendly loan options

Easy Application

Quick decision

Surprise-Free

No late fees or prepayment penalties

Easy AutoPay

No payment dates to remember

How Uplift Works

Select Uplift at Checkout

Add your trip to the cart just like you normally would. When you are ready to book, choose Uplift as your form of payment.

Quick & Easy

Provide a few pieces of information and receive a quick decision.

Enjoy your trip now and pay for it over time with low monthly installments.

Frequently Asked Questions

What is uplift.

Uplift gives you the freedom to book travel now and pay over time with simple fixed installments. Some plans include interest while some are interest-free. When you’re ready to checkout, just select “Uplift” as your payment method, complete a short application, and receive a quick decision. Choose the terms of your payment plan, finish checking out, and enjoy your purchase. Then, pay over time with simple, no-surprise monthly payments.

How do I apply?

Shop for your items and add them to your cart just like you normally would. When you are ready to checkout, simply select Uplift as your payment method. To apply, you’ll need to provide some basic information like your mobile number, date of birth, and if you are a US resident, your Social Security Number. If you’re approved, finish checking out and you’re done.

How are my loan term offers determined?

We look at a number of factors, including your credit information, purchase details, and more.

How do I make installment payments?

You can make a payment anytime by visiting pay.uplift.com and clicking on the Loans tab. From there, click the Make a Payment button. We recommend that you enable AutoPay at time of purchase so that your payments are automatically deducted each month. If you don’t have AutoPay enabled, visit pay.uplift.com , click on the Accounts page, and set the AutoPay toggle to ON. You can also change the form of payment on file with Uplift anytime by visiting pay.uplift.com .

I purchased a trip using Uplift, can I travel before it's paid off?

Yes! You do need to allow a few days between booking and your departure date for things to process. Other than that, you are free to travel whenever - even before you're all paid off.

What is Uplift's Privacy Policy and Terms of Use?

You can read Uplift's at Privacy Policy and Terms of Use .

Down payment may be required. Actual terms are based on your credit score and other factors and may vary. APRs range from 0% to 36%. Not everyone is eligible. Loans made through Uplift are offered by these lending partners . Privacy Policy and Terms of Use . Uplift’s Address: 440 N. Wolfe Road Sunnyvale, CA 94085

Upgrade acquires travel-focused BNPL startup Uplift for a song

Upgrade, a provider of personal credit lines and other consumer financial products, today announced that it’s agreed to acquire Uplift, the buy now, pay later (BNPL) vendor, for $100 million in cash and stock.

It’s likely not the exit Uplift was hoping for — and a sign of serious consolidation in the BNPL space, which just a few years ago was booming, buoyed by pandemic-era spending habits. Uplift had raised nearly $700 million in equity and debt, securing $123 million at a reported $195 million valuation in its Series C round alone.

In a conversation with TechCrunch, Renaud Laplanche, Upgrade’s CEO and a co-founder, said that Uplift initially reached out in May to inquire whether Upgrade would be interested in participating in Uplift’s Series D financing as a strategic investor. Upgrade, however, thought a purchase made more sense — and it’s tough to argue with that logic. Upgrade arguably got Uplift for a song.

“There’s a lot of areas of potential synergy,” Laplanche said. “We’re already providing BNPL and financing at the point of sale for home improvements and auto purchases, so this is really an expansion of our strategy into travel as another vertical and another significant need of consumers.”

Laplanche is referring to the BNPL-style product that Upgrade launched in October 2021, which lets users pay down their debt over six to 36 months with a fixed interest rate. Like many BNPL products on the market, Upgrade’s features a checkout option on merchants’ websites that allows Upgrade to group a user’s card purchases into one lump some and invoice them what they owe over four months.

In Uplift, Upgrade saw a gateway to a previously untapped portion of the BNPL segment: travel. Uplift, Laplanche noted, has a distribution network that includes 300 of the top airlines, cruise lines and hotel chains — a network that’d be tough to build from scratch.

“Travel is a big market, obviously — over $450 billion in annual consumer spending — and a significant area of financing and payments needs for our customers, so we believe there is a great opportunity to keep growing the distribution and user base,” Laplanche said.

Uplift was founded in 2014 by Brian Barth, who previously sold his travel startup SideStep to Kayak for $200 million. From the start, the focus was travel, with an emphasis on partnerships with the vacation package sites of United Airlines, Southwest and American Airlines as well as Allegiant Travel Company and Kayak.

Uplift’s core offering was installment plans for trips. For example, if a family was considering a trip to Disneyland for a price of $2,000, Uplift might’ve offered a one-year financing plan with monthly payments of $189 a month.

At one point, Uplift was on track to drive nearly $1 billion in loans — or so the company’s president, Robert Soderbery, claimed . And those rosy prospects attracted major backers like Madrone Capital Partners, DNX Ventures and Ridge Ventures. But evidently, business sagged somewhere down the line.

To blame could be general malaise in the BNPL sector post-pandemic, particularly among consumer-focused BNPL vendors.

Klarna , once Europe’s most valuable VC-backed company, suffered an 85% valuation cut, from $45.6 billion to just $6.7 billion in July 2022 following an $800 million round. Meanwhile, publicly traded BNPL companies like Affirm and Australia’s Zip have seen their share prices plummet; Affirm was recently forced to shut down its crypto unit and lay off 19% of its staff.

Changing consumer spending habits likely played a role in scaring investors away. But the threat of stricter oversight — and rising delinquency rates — undoubtedly had something to do with it, too.

The purchase of Uplift effectively doubles Upgrade’s customer base, adding 3.3 million users to the platform, and comes as Upgrade weighs an IPO. Laplanche previously said that Upgrade would aim for a public offering sometime in 2023, but it’s unclear whether the company’s still committed to that timeline.

Over the past several years — perhaps in anticipation of an IPO, whenever it ends up arriving — Upgrade has sought to diversify its offerings, launching a rewards checking account, a Bitcoin rewards card, a credit card with BNPL-like options and a debit rewards card for everyday purchases. Laplanche says that Upgrade’s looking to provide close to $10 billion in credit by year-end 2023.

“Travel has become more expensive in the last couple of years, and we’re glad we can provide financing for yet another large expense category, and make that financing more affordable through Upgrade’s access to low-cost capital,” he added. “This ‘merchant network’ strategy is a great complement to the direct-to-consumer strategy we’ve implemented with mobile banking, cards and loans.”

Uplift’s team will join Upgrade in “various capacities,” Laplanche says, moving from their current teams to corresponding teams at Upgrade (e.g. finance to finance). That includes Uplift execs, who’ll be joining Upgrade in their respective field, including CEO Brian Barth as head of strategy.

- Articles >

The Moscow Metro Museum of Art: 10 Must-See Stations

There are few times one can claim having been on the subway all afternoon and loving it, but the Moscow Metro provides just that opportunity. While many cities boast famous public transport systems—New York’s subway, London’s underground, San Salvador’s chicken buses—few warrant hours of exploration. Moscow is different: Take one ride on the Metro, and you’ll find out that this network of railways can be so much more than point A to B drudgery.

The Metro began operating in 1935 with just thirteen stations, covering less than seven miles, but it has since grown into the world’s third busiest transit system ( Tokyo is first ), spanning about 200 miles and offering over 180 stops along the way. The construction of the Metro began under Joseph Stalin’s command, and being one of the USSR’s most ambitious building projects, the iron-fisted leader instructed designers to create a place full of svet (radiance) and svetloe budushchee (a radiant future), a palace for the people and a tribute to the Mother nation.

Consequently, the Metro is among the most memorable attractions in Moscow. The stations provide a unique collection of public art, comparable to anything the city’s galleries have to offer and providing a sense of the Soviet era, which is absent from the State National History Museum. Even better, touring the Metro delivers palpable, experiential moments, which many of us don’t get standing in front of painting or a case of coins.

Though tours are available , discovering the Moscow Metro on your own provides a much more comprehensive, truer experience, something much less sterile than following a guide. What better place is there to see the “real” Moscow than on mass transit: A few hours will expose you to characters and caricatures you’ll be hard-pressed to find dining near the Bolshoi Theater. You become part of the attraction, hear it in the screech of the train, feel it as hurried commuters brush by: The Metro sucks you beneath the city and churns you into the mix.

With the recommendations of our born-and-bred Muscovite students, my wife Emma and I have just taken a self-guided tour of what some locals consider the top ten stations of the Moscow Metro. What most satisfied me about our Metro tour was the sense of adventure . I loved following our route on the maps of the wagon walls as we circled the city, plotting out the course to the subsequent stops; having the weird sensation of being underground for nearly four hours; and discovering the next cavern of treasures, playing Indiana Jones for the afternoon, piecing together fragments of Russia’s mysterious history. It’s the ultimate interactive museum.

Top Ten Stations (In order of appearance)

Kievskaya station.

Kievskaya Station went public in March of 1937, the rails between it and Park Kultury Station being the first to cross the Moscow River. Kievskaya is full of mosaics depicting aristocratic scenes of Russian life, with great cameo appearances by Lenin, Trotsky, and Stalin. Each work has a Cyrillic title/explanation etched in the marble beneath it; however, if your Russian is rusty, you can just appreciate seeing familiar revolutionary dates like 1905 ( the Russian Revolution ) and 1917 ( the October Revolution ).

Mayakovskaya Station

Mayakovskaya Station ranks in my top three most notable Metro stations. Mayakovskaya just feels right, done Art Deco but no sense of gaudiness or pretention. The arches are adorned with rounded chrome piping and create feeling of being in a jukebox, but the roof’s expansive mosaics of the sky are the real showstopper. Subjects cleverly range from looking up at a high jumper, workers atop a building, spires of Orthodox cathedrals, to nimble aircraft humming by, a fleet of prop planes spelling out CCCP in the bluest of skies.

Novoslobodskaya Station

Novoslobodskaya is the Metro’s unique stained glass station. Each column has its own distinctive panels of colorful glass, most of them with a floral theme, some of them capturing the odd sailor, musician, artist, gardener, or stenographer in action. The glass is framed in Art Deco metalwork, and there is the lovely aspect of discovering panels in the less frequented haunches of the hall (on the trackside, between the incoming staircases). Novosblod is, I’ve been told, the favorite amongst out-of-town visitors.

Komsomolskaya Station

Komsomolskaya Station is one of palatial grandeur. It seems both magnificent and obligatory, like the presidential palace of a colonial city. The yellow ceiling has leafy, white concrete garland and a series of golden military mosaics accenting the tile mosaics of glorified Russian life. Switching lines here, the hallway has an Alice-in-Wonderland feel, impossibly long with decorative tile walls, culminating in a very old station left in a remarkable state of disrepair, offering a really tangible glimpse behind the palace walls.

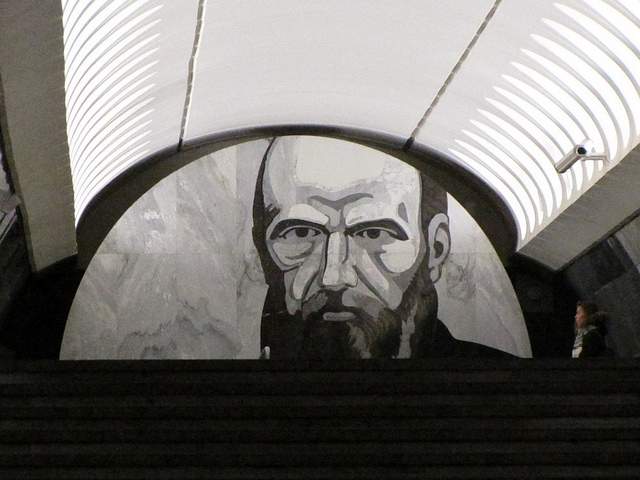

Dostoevskaya Station

Dostoevskaya is a tribute to the late, great hero of Russian literature . The station at first glance seems bare and unimpressive, a stark marble platform without a whiff of reassembled chips of tile. However, two columns have eerie stone inlay collages of scenes from Dostoevsky’s work, including The Idiot , The Brothers Karamazov , and Crime and Punishment. Then, standing at the center of the platform, the marble creates a kaleidoscope of reflections. At the entrance, there is a large, inlay portrait of the author.

Chkalovskaya Station

Chkalovskaya does space Art Deco style (yet again). Chrome borders all. Passageways with curvy overhangs create the illusion of walking through the belly of a chic, new-age spacecraft. There are two (kos)mosaics, one at each end, with planetary subjects. Transferring here brings you above ground, where some rather elaborate metalwork is on display. By name similarity only, I’d expected Komsolskaya Station to deliver some kosmonaut décor; instead, it was Chkalovskaya that took us up to the space station.

Elektrozavodskaya Station

Elektrozavodskaya is full of marble reliefs of workers, men and women, laboring through the different stages of industry. The superhuman figures are round with muscles, Hollywood fit, and seemingly undeterred by each Herculean task they respectively perform. The station is chocked with brass, from hammer and sickle light fixtures to beautiful, angular framework up the innards of the columns. The station’s art pieces are less clever or extravagant than others, but identifying the different stages of industry is entertaining.

Baumanskaya Statio

Baumanskaya Station is the only stop that wasn’t suggested by the students. Pulling in, the network of statues was just too enticing: Out of half-circle depressions in the platform’s columns, the USSR’s proud and powerful labor force again flaunts its success. Pilots, blacksmiths, politicians, and artists have all congregated, posing amongst more Art Deco framing. At the far end, a massive Soviet flag dons the face of Lenin and banners for ’05, ’17, and ‘45. Standing in front of the flag, you can play with the echoing roof.

Ploshchad Revolutsii Station

Novokuznetskaya Station

Novokuznetskaya Station finishes off this tour, more or less, where it started: beautiful mosaics. This station recalls the skyward-facing pieces from Mayakovskaya (Station #2), only with a little larger pictures in a more cramped, very trafficked area. Due to a line of street lamps in the center of the platform, it has the atmosphere of a bustling market. The more inventive sky scenes include a man on a ladder, women picking fruit, and a tank-dozer being craned in. The station’s also has a handsome black-and-white stone mural.

Here is a map and a brief description of our route:

Start at (1)Kievskaya on the “ring line” (look for the squares at the bottom of the platform signs to help you navigate—the ring line is #5, brown line) and go north to Belorusskaya, make a quick switch to the Dark Green/#2 line, and go south one stop to (2)Mayakovskaya. Backtrack to the ring line—Brown/#5—and continue north, getting off at (3)Novosblodskaya and (4)Komsolskaya. At Komsolskaya Station, transfer to the Red/#1 line, go south for two stops to Chistye Prudy, and get on the Light Green/#10 line going north. Take a look at (5)Dostoevskaya Station on the northern segment of Light Green/#10 line then change directions and head south to (6)Chkalovskaya, which offers a transfer to the Dark Blue/#3 line, going west, away from the city center. Have a look (7)Elektroskaya Station before backtracking into the center of Moscow, stopping off at (8)Baumskaya, getting off the Dark Blue/#3 line at (9)Ploschad Revolyutsii. Change to the Dark Green/#2 line and go south one stop to see (10)Novokuznetskaya Station.

Check out our new Moscow Indie Travel Guide , book a flight to Moscow and read 10 Bars with Views Worth Blowing the Budget For

Jonathon Engels, formerly a patron saint of misadventure, has been stumbling his way across cultural borders since 2005 and is currently volunteering in the mountains outside of Antigua, Guatemala. For more of his work, visit his website and blog .

Photo credits: SergeyRod , all others courtesy of the author and may not be used without permission

Claudia Looi

Touring the Top 10 Moscow Metro Stations

By Claudia Looi 2 Comments

Komsomolskaya metro station looks like a museum. It has vaulted ceilings and baroque decor.

Hidden underground, in the heart of Moscow, are historical and architectural treasures of Russia. These are Soviet-era creations – the metro stations of Moscow.

Our guide Maria introduced these elaborate metro stations as “the palaces for the people.” Built between 1937 and 1955, each station holds its own history and stories. Stalin had the idea of building beautiful underground spaces that the masses could enjoy. They would look like museums, art centers, concert halls, palaces and churches. Each would have a different theme. None would be alike.

The two-hour private tour was with a former Intourist tour guide named Maria. Maria lived in Moscow all her life and through the communist era of 60s to 90s. She has been a tour guide for more than 30 years. Being in her 60s, she moved rather quickly for her age. We traveled and crammed with Maria and other Muscovites on the metro to visit 10 different metro stations.

Arrow showing the direction of metro line 1 and 2

Moscow subways are very clean

To Maria, every street, metro and building told a story. I couldn’t keep up with her stories. I don’t remember most of what she said because I was just thrilled being in Moscow. Added to that, she spilled out so many Russian words and names, which to one who can’t read Cyrillic, sounded so foreign and could be easily forgotten.

The metro tour was the first part of our all day tour of Moscow with Maria. Here are the stations we visited:

1. Komsomolskaya Metro Station is the most beautiful of them all. Painted yellow and decorated with chandeliers, gold leaves and semi precious stones, the station looks like a stately museum. And possibly decorated like a palace. I saw Komsomolskaya first, before the rest of the stations upon arrival in Moscow by train from St. Petersburg.

2. Revolution Square Metro Station (Ploshchad Revolyutsii) has marble arches and 72 bronze sculptures designed by Alexey Dushkin. The marble arches are flanked by the bronze sculptures. If you look closely you will see passersby touching the bronze dog's nose. Legend has it that good luck comes to those who touch the dog's nose.

Touch the dog's nose for good luck. At the Revolution Square station

Revolution Square Metro Station

3. Arbatskaya Metro Station served as a shelter during the Soviet-era. It is one of the largest and the deepest metro stations in Moscow.

Arbatskaya Metro Station

4. Biblioteka Imeni Lenina Metro Station was built in 1935 and named after the Russian State Library. It is located near the library and has a big mosaic portrait of Lenin and yellow ceramic tiles on the track walls.

Lenin's portrait at the Biblioteka Imeni Lenina Metro Station

5. Kievskaya Metro Station was one of the first to be completed in Moscow. Named after the capital city of Ukraine by Kiev-born, Nikita Khruschev, Stalin's successor.

Kievskaya Metro Station

6. Novoslobodskaya Metro Station was built in 1952. It has 32 stained glass murals with brass borders.

Novoslobodskaya metro station

7. Kurskaya Metro Station was one of the first few to be built in Moscow in 1938. It has ceiling panels and artwork showing Soviet leadership, Soviet lifestyle and political power. It has a dome with patriotic slogans decorated with red stars representing the Soviet's World War II Hall of Fame. Kurskaya Metro Station is a must-visit station in Moscow.

Ceiling panel and artworks at Kurskaya Metro Station

8. Mayakovskaya Metro Station built in 1938. It was named after Russian poet Vladmir Mayakovsky. This is one of the most beautiful metro stations in the world with 34 mosaics painted by Alexander Deyneka.

Mayakovskaya station

One of the over 30 ceiling mosaics in Mayakovskaya metro station

9. Belorusskaya Metro Station is named after the people of Belarus. In the picture below, there are statues of 3 members of the Partisan Resistance in Belarus during World War II. The statues were sculpted by Sergei Orlov, S. Rabinovich and I. Slonim.

10. Teatralnaya Metro Station (Theatre Metro Station) is located near the Bolshoi Theatre.

Teatralnaya Metro Station decorated with porcelain figures .

Taking the metro's escalator at the end of the tour with Maria the tour guide.

Have you visited the Moscow Metro? Leave your comment below.

January 15, 2017 at 8:17 am

An excellent read! Thanks for much for sharing the Russian metro system with us. We're heading to Moscow in April and exploring the metro stations were on our list and after reading your post, I'm even more excited to go visit them. Thanks again 🙂

December 6, 2017 at 10:45 pm

Hi, do you remember which tour company you contacted for this tour?

Leave a Reply Cancel reply

You must be logged in to post a comment.

Please go to the Instagram Feed settings page to create a feed.

Uplift Offers Travel Advisors New Opportunities to Upsell

This article originally appears at https://www.mtravel.com/blog/uplift-offers-travel-advisors-new-opportunities-to-upsell/

Have your clients ever asked, “Do you offer a payment plan?” or hesitated to book now due to upfront costs?

Enter Uplift, our exciting new preferred supplier, which gives your clients the option to secure a short-term loan to pay for their vacation or cruise in full at the time of booking. Uplift was designed to make it easy for clients to commit to their dream vacation now with a flexible and convenient monthly payment solution.

Uplift Offers Book Now, Pay Over Time Solution

Uplift is available to Travel Advisors through an easy-to-use agent tool and is integrated into the MTravel booking process for an effortless customer experience. The entire process is quick and easy. The portal allows you to estimate monthly payment costs for clients during the sales process. Should they wish to finance, you can simply send an application link to your client. They can fill out the application on their smartphone or desktop and the entire process only takes a few minutes.

After a soft check on their credit score, the client will be given a variety of payment plan options based on what works best for them. Once the client selects the plan that meets their needs, they will be given their total trip cost along with a monthly payment amount, allowing them immediate booking satisfaction while taking control of their budget. The best part is that this allows your client to travel before their trip is even paid off, and the reservations are paid in full at the time of booking, so you will only invoice a full payment through ClientBase online. There is no charge to the Travel Advisor to offer Uplift. The only cost to travel clients is an annual percentage rate that can be as little as half the traditional credit card rate. And there is no need to worry about chasing down payments, as all plans are done directly with Uplift.

Clients 18 years old and up are eligible to apply if they possess a Debit Card. They can apply for as little as $150 to as much as $25,000 with terms ranging from 3 months up to 24 months. They can even use the Uplift payment plan to pay for third parties in cases where a friend or relative wants to cover the costs of a group or loved one.

A Winning Partner for Travel Advisors

“We are pleased to partner with Uplift so that our network of Travel Advisors can offer their clients a reputable and trusted solution that allows them to experience vacations that may have been otherwise delayed or hesitated planning until they had the savings,” says Christy Schafer , SVP MTravel. “Uplift is an excellent resource to our affiliate Travel Advisors to encourage their clients to enjoy enhancements to their experience, higher category accommodations, or even extended lengths of stay that they otherwise felt they could not splurge on.” Additionally, with the ease of a flexible payment plan through Uplift, a client can take advantage of special offers or pay in full deals before they are no longer available. Uplift makes these scenarios possible, which may translate to improved sales, easier accessibility to meeting goals, and more significant commissions for our affiliates.

If you missed our March Uplift online seminar there is a training video on Agent Connex > Travel Industry Webinars > Uplift – Payment Plans for Vacation Dreams.

To register and become certified with Uplift, please visit learning-uplift.com/us-partner/ . There is a 30-minute certification training and sixteen questions. Within 72 hours of completion, you will receive an email from Uplift with your username and temporary password. If you do not receive an email within 72 hours, please check your spam/junk email folders.

This site uses cookies. By continuing to browse the site, you are agreeing to our use of cookies. Ce site utilise des témoins de connexion. En continuant à naviguer sur le site, vous acceptez que nous utilisions des témoins.

Cookie and Privacy Settings

We may request cookies to be set on your device. We use cookies to let us know when you visit our websites, how you interact with us, to enrich your user experience, and to customize your relationship with our website.

Click on the different category headings to find out more. You can also change some of your preferences. Note that blocking some types of cookies may impact your experience on our websites and the services we are able to offer.

These cookies are strictly necessary to provide you with services available through our website and to use some of its features.

Because these cookies are strictly necessary to deliver the website, refuseing them will have impact how our site functions. You always can block or delete cookies by changing your browser settings and force blocking all cookies on this website. But this will always prompt you to accept/refuse cookies when revisiting our site.

We fully respect if you want to refuse cookies but to avoid asking you again and again kindly allow us to store a cookie for that. You are free to opt out any time or opt in for other cookies to get a better experience. If you refuse cookies we will remove all set cookies in our domain.

We provide you with a list of stored cookies on your computer in our domain so you can check what we stored. Due to security reasons we are not able to show or modify cookies from other domains. You can check these in your browser security settings.

We also use different external services like Google Webfonts, Google Maps, and external Video providers. Since these providers may collect personal data like your IP address we allow you to block them here. Please be aware that this might heavily reduce the functionality and appearance of our site. Changes will take effect once you reload the page.

Google Webfont Settings:

Google Map Settings:

Google reCaptcha Settings:

Vimeo and Youtube video embeds:

You can read about our cookies and privacy settings in detail on our Privacy Policy Page.

Money latest: Tourist tax warning - here are 10 cities in Europe where you'll need to pay

The latest official data on inflation has been released - read all the reaction and analysis on what the numbers could mean for interest rates in the Money blog. Listen to the latest Sky News Daily podcast about inflation as you scroll.

Wednesday 17 April 2024 21:14, UK

- Inflation falls to lowest level since 2021 - but less than predicted

- Ian King analysis: Why an interest rate cut may not come as soon as you think

- Basically... What is inflation - and how can it affect interest rates?

- Spending calculator: Use our tool to see which prices have gone up or down

- Tourist tax warning - here are 10 cities where you'll need to pay

Essential reads

- Spotlight on unpaid carers: 'I feel isolated, lonely and guilty': Daughter caring for mother with motor neurone disease alone

- How to improve your credit score

- Most expensive street in London revealed

- Money Problem: My boss ruined end of maternity leave with ultimatum - what are my rights?

The day began with the release of the latest inflation figures by the Office for National Statistics at 7am.

Inflation fell to 3.2%, though economists had predicted it would ease further, to 3.1%.

We've dug into the ONS data, which shows that food prices were among the biggest drivers of the inflation drop in March.

This chart, updated with figures released today, shows food and non-alcoholic drinks fell by 0.11 percentage points last month.

"Once again, food prices were the main reason for the fall, with prices rising by less than we saw a year ago," Grant Fitzner, chief economist at the ONS, said.

This helped bring inflation to its lowest rate for two-and-a-half years.

Other big downwards drivers included furniture and household goods, and clothing and footwear.

At the other end of the scale, the largest upward contributions came from communication and transport.

By Mickey Carroll , science and technology reporter

"I had just woken up and I got an email that said, 'We're going to have a company-wide meeting'. I knew right away."

James (not his real name) was visiting his family earlier this year when he saw the message.

"I started thinking about everything I was set to lose."

He had worked as a game designer at one of the UK's biggest video game studios for nearly a decade. It was a job he loved and had dreamt of since he was nine years old. But recently he had been worried.

All around him, friends in the gaming industry were being let go.

"My mind was racing, what could I do? I wasn't going to be the only one job-seeking at the moment because there were so many layoffs. They all happened at the same time."

He went to the meeting, where his worst fears were confirmed. The company's chief executive said around 25% of people at the studio would be cut. James was one of them.

Gaming is an anxious world right now. There's been more than 8,000 jobs cut globally since the start of this year and in March, the number of available jobs in the UK hit a record low, according to the report Games Jobs Live.

But in London, as the BAFTA Games Awards 2024 rolled around last week, gamers could just enjoy themselves.

Read the full story here ...

B&M has said it will open at least 45 stores across the UK in the next year.

It comes after the discount chain recorded a 10.1% revenue increase in its 2023/24 financial year, with its UK arm seeing sales rise by 8.5% to £4.4bn.

The company currently trades from 741 stores in the UK under the B&M brand, 335 stores under the Heron Foods and B&M Express brands, and from 124 stores in France.

Chief executive Alex Russo said the group's "relentless focus on everyday low prices, great product ranges and excellence in operational standards" had chimed with customers.

Miss getting a Tango Ice Blast at the cinema? Well, its creator has announced it's releasing limited edition drinks in their iconic flavours.

The fizzy frozen treat has slowly been disappearing from cinemas since 2019 when Cineworld stopped selling it, and opted to replace it with the Icee product created by Vimto.

Fans have been disappointed by the decision since then and it seems its owner Britvic has finally produced a drink to satiate their taste buds.