TD First Class Travel® Visa Infinite* Card Review

Last Updated on March 5, 2024

Rewards Canada's review of TD's flagship travel rewards credit card!

The TD First Class Travel® Visa Infinite* Card is a veteran in the Canadian credit card scene and is TD's flagship proprietary travel rewards credit card. The card, which has been in the market for quite a long time has actually never had a complete review here on Rewards Canada, just a lot of separate articles about it! So here it is, our review of the mainstay card from TD.

The review of the TD First Class Travel Visa Infinite Card is broken down into the following sections:

- Costs & Sign Up Features

- Features & Benefits

What is good about this card

What is not so good about this card, who should get this card.

The TD First Class Travel® Visa Infinite* Card was revamped in 2022 and with those changes it regained a spot in our Top Travel Rewards Credit Card rankings. Here at Rewards Canada we rank it as the fifth best Travel Points Card with an annual fee and consider it the 14th best card overall in Canada.

It is a relatively strong travel rewards card thanks to its accelerated earn rate categories and good to really good redemption value in those points that are earned. It also features a very valuable welcome bonus with no annual fee in the first year so you can test drive it for the first 12 months to see if the card meets your needs.

Costs & Sign up Features

The TD First Class Travel Visa Infinite Card has an annual fee of $139 which is now considered the standard for premium cards like this one. Many competing cards also charge $139 annually however others in this same category range from $120 to $150. Additional or supplementary cards are $50 annually per card. You can have the annual fee waived every year if you have a TD All Inclusive Account or Unlimited Chequing Account.

The standard welcome bonus on the card offers 40,000 TD Rewards Points however the card frequently has limited time increased welcome bonus offers.

Right now the TD First Class Travel Visa Infinite Card has an increased limited time welcome bonus offer of up to 100,000 TD Rewards points! The bonus is awarded as 20,000 points when you make your first purchase with the card and then you can earn 80,000 TD Rewards Points when you spend $5,000 or more dollars in the first 180 days of account opening. You can also earn up to a 10,000 points more as a birthday bonus. On top of the bonus points their is a first year annual fee rebate for the primary cardholder and the first authorized users. The 100,000 points is worth $500 when you redeem them for travel via Expedia for TD. This offer is available until June 3, 24 (This offer is not available for residents of Quebec. For Quebec residents, please click here .)

The interest rate on the card is 20.99% and annual income requirements are $60,000 Personal or $100,000 Household .

The card earns TD Rewards Points as follows:

- 8 Points per dollar spent when you book travel through Expedia® For TD.

- 6 Points per dollar spent on Groceries and Restaurants

- 4 Points per dollar spent on regularly recurring bill payments set up on your Account

- 2 Points per dollar spent on all other eligible purchases

Plus earn an annual Birthday Bonus of up to 10,000 TD Rewards Points. This bonus is equal to 10% of the total number of TD Rewards Points earned over the 12 months preceding the Primary Cardholder’s birthday, to a maximum Birthday Bonus of 10,000 TD Rewards Points.

Point Valuation Chart

With the birthday bonus:

The TD First Class Travel Visa Infinite Card participates in the TD Rewards program which provides numerous rewards options for your points. The primary and most valuable is redeeming your points for travel that is booked via Expedia for TD. You can also redeem points for any travel you book on your own or for that matter, any purchase you make on the card. Other redemption options include educational payments, merchandise and gift cards.

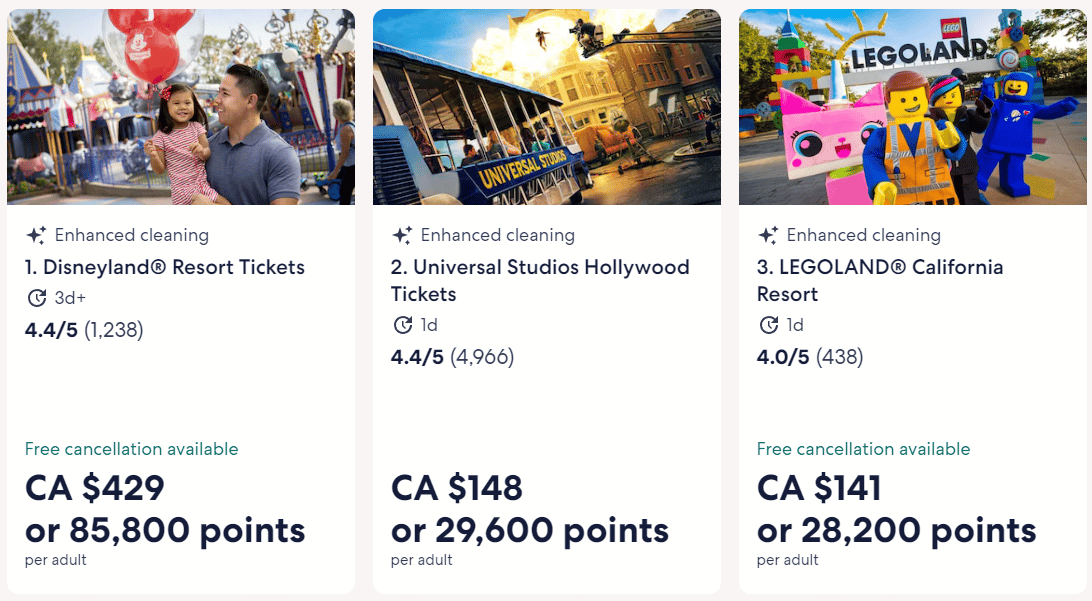

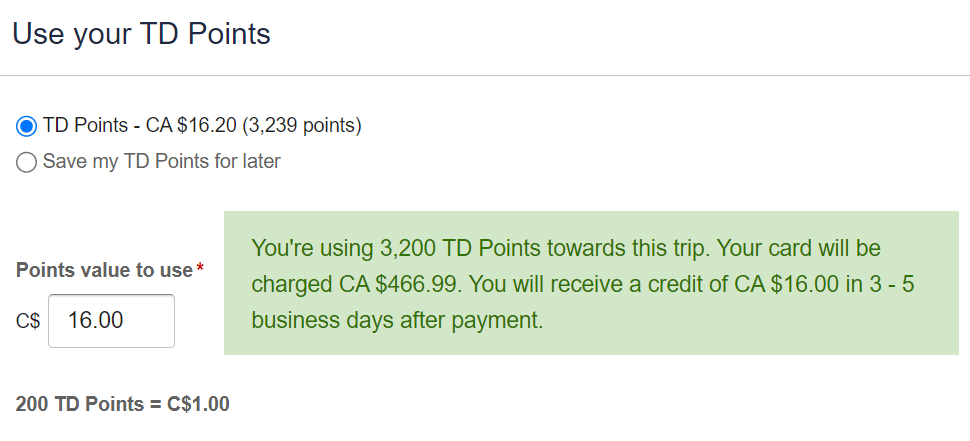

We'll start off by looking at the Expedia for TD redemption option. This redemption option is pretty simple. Simply login to Expedia for TD and search for the travel you would like to book or call in to Expedia for TD to book your travel. After you are done searching for Flights, hotels, vacation packages and so on and have selected what you would like to book you'll be given the option to redeem points against that booking. You can redeem points for a partial payment or cover the whole amount - it is up to you and how many points you have in your account. The redemption is 200 points for $1 so if you have 2,000 points you can use them to get $10 of your booking or if you have 200,000 points you can use them to take $1,000 off the cost of your booking.

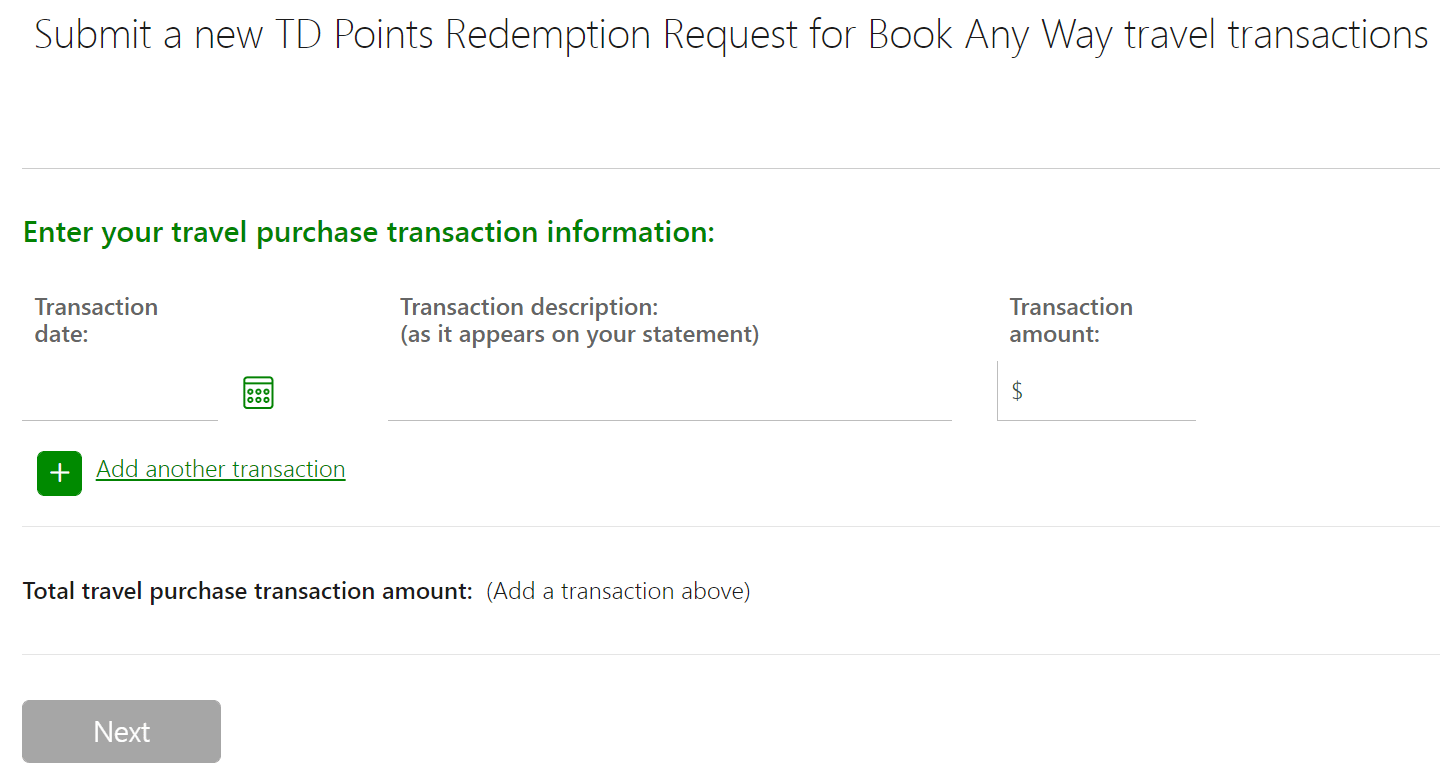

The next travel redemption option is being able to redeem points for any travel you book on your own. What this means is that you can book a flight directly with Air Canada, WestJet or any other airline, book any hotel, car rental etc. and when that charge shows up on your account you can redeem your points against that charge. This redemption option starts is 250 points for a $1 credit for the first $1,200 of a travel booking and 200 points for $1 for any portion above $1,200. So if you purchase $1,500 of flights and you have enough points to cover it all, the first $1,200 will be covered as 250 to $1 (300,000 points) and the remaining $300 would be 60,000 points. Just like the Expedia option you can choose to do a partial or complete redemption for these purchases. With this option you have up to 90 days after the charge posts to your account to redeem against it. This is a perfect option for those booking travel on the fly (ie buying a train ticket right at the train station)

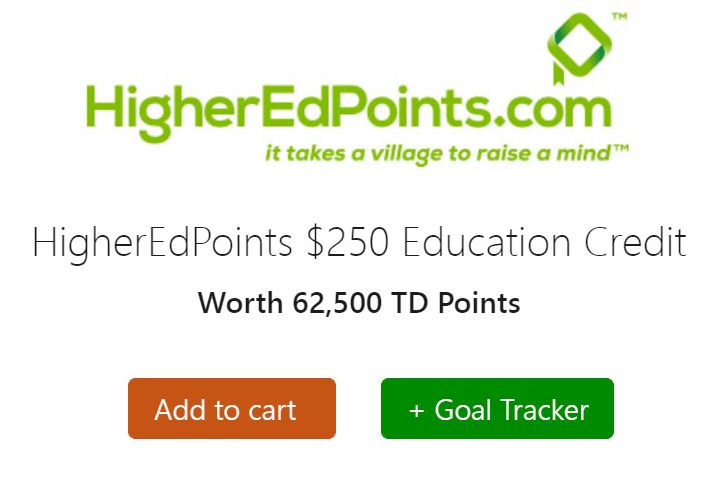

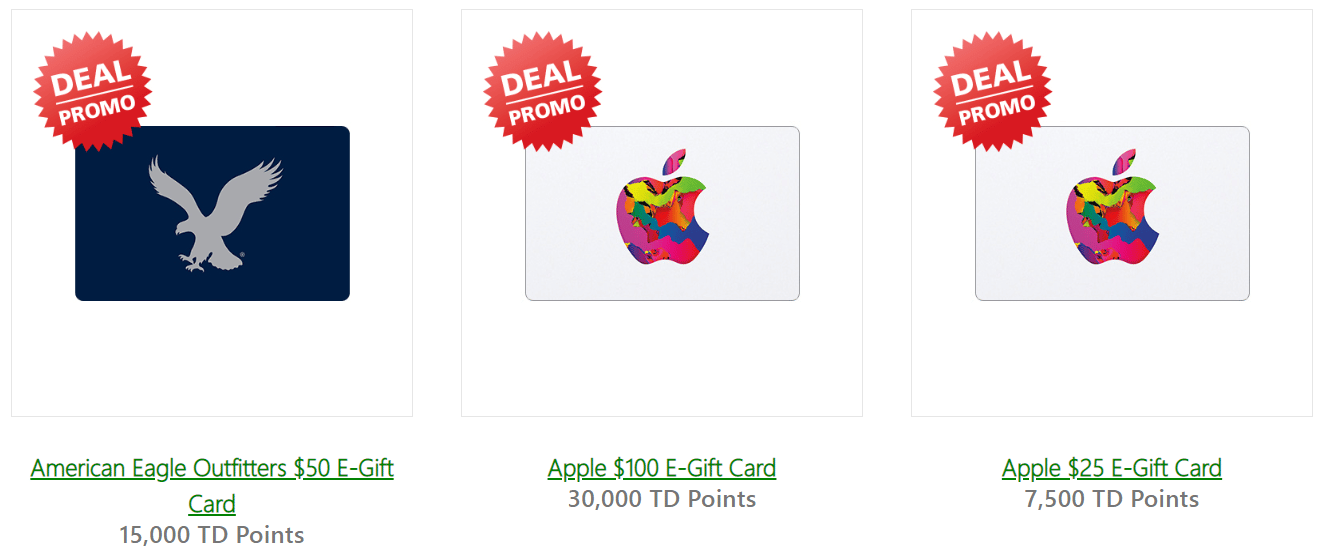

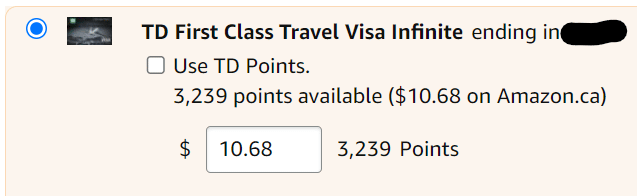

After travel you have several other redemption options via TD Rewards. You can choose to pay your credit card with points (Basically a cash back option) which requires 400 points for a $1 statement credit. Points can also be redeemed for education credits with HigherEdPoints at a rate of 62,500 points for $250 to pay tuition or student loans. You can also redeem points for merchandise via TD Rewards' merchandise catalog, Amazon Pay with Points or you can redeem them for dozens of different gift card options.

Features and Benefits

The card comes with some additional features and benefits but does lack in this department compared to some other Visa Infinite Cards. The primary benefit is an annual travel credit for select Expedia for TD bookings. On top of that benefit the card has a decent insurance package and your standard Visa Infinite card benefits. There are also partner benefits that are exclusive to TD which are outlined below.

Annual $100 Travel Credit

Each year you will receive a $100 travel credit that can be used on an eligible purchase made with Expedia For TD An Eligible Travel Credit Purchase means: • A Hotel, Motel, Lodging, or Vacation Rental Purchase of $500.00 CAD or more made with Expedia For TD; or • A Vacation Package Purchase of $500.00 CAD or more made with Expedia For TD, that includes a Hotel, Motel, Lodging or Vacation Rental booking packaged with a transportation booking.

Visa Infinite benefits

- Visa Infinite Luxury Hotel Collection provides benefits like room upgrades, complimentary Wi-Fi and breakfast, late checkout, and so much more at over 900 Visa Infinite Luxury Hotel Collection properties around the world.

- Visa Infinite Dining Series - Each event includes multi-course meals, drink pairings and an interactive experience. You'll get to taste dishes from some of the country's top chefs and restaurants as they guide you through each course.

- Wine country benefit from wineries across Ontario and British Columbia including complimentary tastings and tours. You can also get access to online offers like complimentary shipping and savings on wine purchases.

- Get golf perks with Troon Rewards® through your Visa Infinite card and automatically receive Silver Status. You’ll save 10% on golf fees, merchandise, and lessons at over 150 courses around the world.

- Access to private movie events and at-home offers as part of the Visa Infinite Screening Series. In the fall, get special perks at the Toronto International Film Festival®.

- Visa Infinite card includes a Complimentary Concierge service that can offer help with anything like the perfect travel itinerary, restaurant recommendations, finding the perfect birthday gift, and more

Partner Benefits

Starbucks rewards.

Earn 50% more TD Rewards Points and 50% more Stars at participating Starbucks stores when you link your TD First Class Travel Visa Card to your Starbucks Rewards account.

The TD First Class Visa Infinite Card comes with a very strong insurance package that includes the following:

- Out of Province/Country Emergency Medical Insurance (21 days under age 65, 4 days for 65+)

- Trip Cancellation Insurance

- Trip Interruption Insurance

- Flight Delay Insurance

- Baggage Delay Insurance

- Lost or Stolen Baggage Insurance

- Car Rental Theft and Damage Insurance

- Hotel Burglary Insurance

- $500,000 Travel Accident Insurance

- Purchase Security Insurance

- Extended Warranty Insurance

- Mobile Device Insurance

The accelerated earn rates when coupled with the birthday bonus are great. They provide up to a 4.4% return when you do use your points via Expedia for TD and that makes this card very competitive in that regard.

The range of flexible rewards options are good with this card. Your best value is to book via Expedia For TD but the fact you have the other options for any travel bookings, education payments, and more make the card's points quite versatile. And compared to this card's two biggest competitors, the CIBC Aventura Visa Infinite Cards and RBC Avion Visa Infinite Card, the any travel any time rewards options and value are great.

The welcome bonus is one of the better ones you'll find in the market for proprietary credit card reward programs. To be able to earn up to 135,000 points in the first year and pay no annual fee is a great deal.

If you take Expedia For TD redemptions out of the equation, the base earn rate is not good. We've stated in the past that no premium cards should have a base earn rate below 1% and this card kind of falls into that category. The Expedia option keeps the base earn rate at 1% but for those who love to book travel on their own you don't get that rate. For example, some people like to book directly with a hotel so they can earn points and receive status benefits, then that base earn rate of 0.8 to 0.88% isn't good if you redeem those points towards that hotel charge.

There is no lounge access benefit with this card. You would think with the name "First Class Travel" the card would at the very least have an annual lounge membership benefit where you still pay to enter the lounge. That isn't the case however with this card which is too bad as many of its competitors do offer lounge access programs.

No conversion options. I really wouldn't call this a 'not so good thing' about the card but it is more of wish on Rewards Canada's part. Before TD revamped this card in 2022 we called for it to be overhauled the year prior and one of the items we had suggested was a conversion option to Aeroplan. Seeing that TD is the primary issuer of Aeroplan co-brand cards it should be able to add a TD Rewards points to Aeroplan conversion. If they did this it would make this card even more appealing and definitely move it into the top 10 cards in Canada.

- Consumers who bank at TD and want to keep all financial products with one bank (especially if your account gives you a discount or rebate on your annual fee)

- Consumers who like having multiple redemption options with their points

- Consumers who can or do have significant spending with Expedia For TD, on groceries, restaurants and/or on recurring bills.

The TD First Class Travel Visa Infinite Card is a popular travel rewards credit card that is popular with TD and non-TD customers alike. Its overhaul in 2022 help the card regain some traction as a strong option in our very c ompetitive credit card market. By having accelerated earn rates coupled with a variety of redemption options, the card ranks in the top 15 of all travel cards in Canada. The biggest drawback to the card is the lack of additional benefits that are seen on other similar cards in Canada. If you don't need lounge access, travel enhancement credits or something like No Foreign Transaction Fees this card is definitely one to consider.

Apply for this card here

Latest card details:

TD First Class Travel ® Visa Infinite* Card

Earn up to $800 in value†, including up to 100,000 TD Rewards Points† and no Annual Fee for the first year† Conditions Apply. Account must be approved by June 3, 2024

Annual Fee: $139 | Additional Cards: $50 † | Annual interest rate 20.99% on purchases and 22.99% on funds advances | $60,000 personal or $100,000 household annual income

Terms & Conditions apply

Card details

- Earn a welcome Bonus of 20,000 TD Rewards Points when you make your first Purchase with your Card†.

- Earn 80,000 TD Rewards Points when you spend $5,000 within 180 days of Account opening†.

- Earn a Birthday Bonus of up to 10,000 TD Rewards Points†

- Get an annual TD Travel Credit† of $100 when you book at Expedia® For TD.

- Get an Annual Fee Rebate for the first year†.

- To receive the first-year annual fee rebate, you must activate your Card and make your first Purchase on the Account within the first 3 months after Account opening. To receive the first Additional Cardholder first-year annual fee rebate, you must add your first Additional Cardholder by June 4, 2024.

- Earn 8 TD Rewards Points† for every $1 you spend when you book travel through Expedia® For TD†

- Earn 6 TD Rewards Points† for every $1 you spend on Groceries and Restaurants†.

- Earn 4 TD Rewards Points† for every $1 you spend on regularly recurring bill payments set up on your Account†

- Earn 2 TD Rewards Points For every $1 you spend on other Purchases made using your Card† plus earn an annual Birthday Bonus† of up to 10,000 TD Rewards Points

- Your TD Points don’t expire as long as you are a TD First Class Travel Visa Infinite* Cardholder

- An annual TD Travel Credit† of $100 when you book at Expedia® For TD.

- TD Rewards Birthday bonus† that helps you celebrate in style.

- An extensive suite of travel insurance coverages which helps you travel prepared

- No travel blackouts†, no seat restrictions† and no expiry† for your TD Rewards Points as long as your account is open and in good standing.

- Redeem your TD Rewards Points towards making purchases at Amazon.ca with Amazon Shop with Points. Conditions apply. See more details.

- Click here to apply for TD First Class Visa Infinite Card

This offer is not available for residents of Quebec. For Quebec residents, please click here .

† Terms and Conditions apply . Sponsored advertising. The Toronto-Dominion Bank (TD) is not responsible for the contents of this site including any editorials or reviews that may appear on this site. For complete and current information on any TD product, please click the Apply Now button.

Other cards to consider if you are looking at this card:

- American Express Cobalt® Card

- CIBC Aventura Visa Infinite Card

- Desjardins Odyssey World Elite Mastercard

- HSBC World Elite® Mastercard®

- MBNA Rewards World Elite® Mastercard®

- National Bank of Canada World Elite Mastercard

- RBC Avion Visa Infinite Card

- Scotia Gold American Express Card

- Scotiabank Passport Visa Infinite card

Talk to us!

Tell us what you think of this card and/or review in the comments section below or join the conversation in our Facebook Group and on Twitter !

- How to Choose the Right Credit Card

- How to Apply for a Credit Card

- How to Cancel a Credit Card

- Ways To Pay Off Credit Card Debt

- Why Your Credit Card Was Declined

- How to Get Out of Credit Card Debt

- What to Know About Credit Card Minimum Payments

- What Is a Credit Card and Should You Get One?

- How Do Credit Cards Work in Canada?

- What Are the Different Types of Credit Cards?

- How an International Credit Card Works

- Common Credit Card Terms and Conditions

- Credit Card Fees and Charges

- Credit Card Interest Calculator

- First-Time Home Buyer Incentive

- Tax-Free First Home Savings Account

- Home Equity Loan

- How a Reverse Mortgage Works

- Home Equity Line of Credit

- Mortgage Renewal

- Getting a Second Mortgage

- How to Refinance a Mortgage

- How Does Mortgage Interest Work?

- Realtors vs Real Estate Agents vs Brokers

- Is Canada’s Housing Market Crashing?

- Types of Houses in Canada

- First-Time Home Buyer Grants and Assistance Programs

- Types of Mortgages in Canada: Which Is Right for You?

- How Does a Mortgage Work in Canada?

- What Is an Interest Rate?

- Guaranteed Investment Certificate (GIC)

- Savings Account Guide

- Common Canadian Bank Fees and Charges

- Types of Bank Accounts in Canada

- EQ Bank Review

- Simplii Financial Review

- Tangerine Bank Review

- National Bank of Canada Review

- CIBC Review

- Scotiabank Review

- TD Bank Review

- What Is Canadian Investor Protection Fund (CIPF) Coverage?

- How Capital Gains Tax Works

- Investing for Canadian Beginners

- Understanding Asset Classes in Investing

- Understanding Fixed-Income Investments

- How to Invest in Stocks

- What Are T-Bills

- What is a Bond

- What is Registered Disability Savings Plan (RDSP)

- What Are Mutual Funds

- What is an ETF (Exchange Traded Fund)

- What Is Forex Trading

- What Is Cryptocurrency and How Does It Work

- What Is a Stock

- What is Old Age Security and How Does It Work

- What is Registered Retirement Income Funds (RRIFs)

- How a Life Income Fund (LIF) Works for Retirement

- What Is An In-Trust Account

- What Is a Locked-in Retirement Account (LIRA)

- How Much Money You’ll Need To Retire

- Defined Benefit vs. Defined Contribution Pension Plans

- Can Annuities Fund Your Retirement?

- What Is a Personal Loan?

- Personal Loan Insurance: Do You Need It?

- What Is a Secured Personal Loan?

- What Is a Payday Loan?

- What Is a Pawn Loan?

- What Is a Car Title Loan?

- Small Business Loan vs Personal Loan

- Personal Loan vs. Line of Credit

- Personal Line of Credit vs Home Equity Loan:

- Personal Line of Credit vs Car Loan

- HELOC vs Personal Loan

- Debt Consolidation vs Personal Loan

- Cash Advance vs Personal Loan

- Business Loan vs Personal Loan

- Price Matching Tips to Help You Save Big

- How to save for Wedding

- How to Save Money on Groceries

- Ways to Save on Your Next Family Vacation

- Tips to Help You Save On Gas

- How to Save Money in 8 Easy Steps

- Passive Income: What It Is and How to Make It

- Budgeting 101: How to Budget Your Money

- Ways to Make Money Online and Offline in Canada

- How Do Credit Inquiries Work?

- What is the Ideal Credit Utilization Ratio?

- What Credit Score is Needed for a Credit Card?

- How to Get a Better Credit Score

- What is a Good Credit Score in Canada?

- Credit Cards

TD First Class Travel vs TD Aeroplan: How to Choose

The main difference between TD First Class Travel and TD Aeroplan is the rewards system. Aeroplan is Air Canada’s reward program, while the TD First Class Travel card is tied to TD Rewards Points. Thinking about where you shop and how you like to redeem your points can help you decide which of these cards is the better fit.

What is TD Aeroplan?

What is td first class travel.

- TD First Class Travel vs. TD Aeroplan: Which is better?

- TD First Class Travel cards

- TD Aeroplan cards

TD Aeroplan is the name given to a group of TD credit cards that earn Aeroplan points . You can use the points to buy things like flights, hotel rooms, car rentals, merchandise and more via Air Canada’s Aeroplan redemption platform.

TD offers four Aeroplan credit cards:

- TD Aeroplan Visa Infinite .

- TD Aeroplan Visa Platinum.

- TD Aeroplan Visa Infinite Privilege.

- TD Aeroplan Visa Business.

Did you know? TD isn’t the only issuer that works with Aeroplan. American Express and CIBC also offer Aeroplan credit cards with their own earn rates and perks.

Aeroplan rewards

Each of the four Aeroplan credit cards offered by TD have slightly different earn rates and reward categories. Learn more about each card’s earn rates and spending categories below:

TD Aeroplan Visa Infinite Card

- 1.5x Aeroplan points on eligible gas, groceries and Air Canada purchases.

- 1x Aeroplan points on everything else.

- Double the points earned when you shop with partner brands and through the Aeroplan eStore.

- 50% more Aeroplan points when you shop at Starbucks (card must be linked to your Starbucks Rewards account).

TD Aeroplan Visa Platinum Card

- 1 Aeroplan point per $1.00 spent on eligible gas, groceries and Air Canada purchases.

- 1 Aeroplan point per $1.50 spent on everything else.

TD Aeroplan Visa Infinite Privilege Card

- 2x Aeroplan points on Air Canada purchases.

- 1.5x Aeroplan points on eligible gas, groceries, travel and dining purchases.

- 1.25x Aeroplan points on everything else.

TD Aeroplan Visa Business Card

- 1.5x Aeroplan points on eligible travel, dining and business purchases.

- 1x Aeroplan points on everything else.

TD Aeroplan card earn rates and categories accurate as of June 22, 2023.

Pros of TD Aeroplan

- Range of cards to choose from.

- Business card available.

- Most cards include travel insurance, such as medical, baggage delay and flight cancellation.

Cons of TD Aeroplan

- The redemption program focuses mainly on Air Canada.

- Lower earn rates than similar cards, including the TD First Class Travel card.

TD First Class Travel is another name for one of TD’s rewards cards: the TD First Class Travel Visa Infinite card. It’s the only card from TD with the name First Class Travel, but not the only card that earns TD Rewards Points. The TD Platinum Travel Visa, TD Travel Rewards Visa and TD Business Travel Visa also earn TD Rewards Points.

TD First Class Travel rewards

The TD First Class Travel Visa Infinite card earns between two and eight TD Rewards Points per CAD spent, depending on the purchase category.

- 8x TD Rewards Points on travel bookings made via the Expedia for TD platform.

- 6x TD Rewards Points on groceries and restaurants.

- 4x TD Rewards Points on recurring bill payments.

- 2x TD Rewards Points on everything else.

Pros of TD First Class Travel

- High reward earn rates compared to TD Aeroplan cards.

- Travel TD Rewards Points can be redeemed with multiple booking platforms.

- Includes travel insurance, such as medical, baggage delay and flight cancellation.

Cons of TD First Class Travel

- Only one First Class Travel card to choose from.

- Highest earn rate is only for Expedia purchases.

TD First Class Travel vs TD Aeroplan: Which is better?

TD Aeroplan beats out First Class Travel when it comes to points value. Based on NerdWallet analysis, the average value of 1 Aeroplan point is worth 2.23 cents. To compare, you can expect to get around 0.25-0.5 cents per TD Rewards Point, according to NerdWallet analysis. These values depend on the redemption method you choose.

That’s not to say TD Aeroplan cards are better than the TD First Class Travel Visa Infinite card. If you don’t fly with Air Canada, for example, Aeroplan points may not be as practical. Look at features like annual fees , reward categories, redemption options, interest rates and insurance perks when making your decision.

TD First Class Travel and TD Aeroplan cards

Td first class travel® visa infinite* card.

- Annual Fee $139 To receive the first-year annual fee rebate, you must activate your Card and make your first Purchase on the Account within the first 3 months after Account opening. To receive the first Additional Cardholder first-year annual fee rebate, you must add your first Additional Cardholder by June 4, 2024. Waived first year

- Interest Rates 20.99% / 22.99% 20.99% on purchases, 22.99% on cash advances.

- Rewards Rate 2x-8x Points Earn 8 TD Rewards Points† for every $1 you spend when you book travel through Expedia® For TD†. Earn 6 TD Rewards Points† for every $1 you spend on Groceries and Restaurants†. Earn 4 TD Rewards Points† for every $1 you spend on regularly recurring bill payments set up on your Account†. Earn 2 TD Rewards Points For every $1 you spend on other Purchases made using your Card†.

- Intro Offer Up to 100,000 Points Earn up to 100,000 TD Rewards Points†: Earn a welcome Bonus of 20,000 TD Rewards Points when you make your first Purchase with your Card†. Earn 80,000 TD Rewards Points when you spend $5,000 within 180 days of Account opening†. Earn a Birthday Bonus of up to 10,000 TD Rewards Points†. Account must be approved by June 3, 2024.

- Earn up to $800 in value†, including up to 100,000 TD Rewards Points† and no Annual Fee for the first year†. Conditions Apply. Account must be approved by June 3, 2024.

- Earn a welcome Bonus of 20,000 TD Rewards Points when you make your first Purchase with your Card†.

- Earn 80,000 TD Rewards Points when you spend $5,000 within 180 days of Account opening†.

- Earn a Birthday Bonus of up to 10,000 TD Rewards Points†.

- To receive the first-year annual fee rebate, you must activate your Card and make your first Purchase on the Account within the first 3 months after Account opening.

- To receive the first Additional Cardholder first-year annual fee rebate, you must add your first Additional Cardholder by June 4, 2024.

- Earn 8 TD Rewards Points† for every $1 you spend when you book travel through Expedia® For TD†.

- Earn 6 TD Rewards Points† for every $1 you spend on Groceries and Restaurants†.

- Earn 4 TD Rewards Points† for every $1 you spend on regularly recurring bill payments set up on your Account†.

- Earn 2 TD Rewards Points For every $1 you spend on other Purchases made using your Card† plus earn an annual Birthday Bonus† of up to 10,000 TD Rewards Points.

- No travel blackouts†, no seat restrictions† and no expiry† for your TD Rewards Points as long as your account is open and in good standing.

- Each year, you will receive one $100.00 TD Travel Credit on your first Eligible Travel Credit Purchase of $500.00 or more made with Expedia For TD and posted to the Account in a calendar year.

- Interest Rates: 20.99% on purchases and 22.99% on cash advances.

- Go Places on Points: Your Points are worth more when you redeem through Expedia® For TD: Search over a million flights, hotels, packages and more! When you’re ready to book, you can redeem† your TD Rewards Points towards your travel purchase right away.

- Redeem your TD Rewards Points towards making purchases at Amazon.ca with Amazon Shop with Points. Conditions apply.

- Shop online through TDRewards.com Redeem your TD Rewards Points for great deals on a wide selection of merchandise and gift cards.

- Option to purchase TD Auto Club Membership†: and be covered 24 hours a day for emergency roadside assistance services in case something goes wrong when you are out on the road.

- Travel Medical Insurance†: Up to $2 million of coverage for the first 21 days. If you or your spouse is aged 65 or older, you are covered for the first 4 days of your trip. Additional top-up coverage is available.

- Trip Cancellation/Trip Interruption Insurance†: For Trip Cancellation, up to $1,500 of coverage per insured person, with a maximum of $5,000 for all insured persons, and for Trip Interruption, up to $5,000 of coverage per insured person, with a maximum of $25,000 for all insured persons on the same covered trip.

- To be eligible, $60,000 (individual) or $100,000 (household) annual income is required. Also, you must have a Canadian credit file and be a Canadian resident of the age of majority in the province or territory where you live.

- †Terms and conditions apply.

- This offer is not available for residents of Quebec.

- The Toronto-Dominion Bank (TD) is not responsible for the contents of this site including any editorials or reviews that may appear on this site. For complete and current information on any TD product, please click the Apply Now button.

TD® Aeroplan® Visa Infinite* Card

- Annual Fee $139

- Rewards Rate 1x-1.5x Points Earn 1.5 points† for every $1 spent on eligible gas, grocery and direct through Air Canada® purchases (including Air Canada Vacations®) made with your card. Earn 1 point† for every $1 spent on all other Purchases made with your Card.

- Intro Offer Up to 50,000 Points Earn up to 50,000 Aeroplan points†: Earn a welcome bonus of 10,000 Aeroplan points when you make your first purchase with your new card†. Earn 20,000 Aeroplan points when you spend $6,000 within 180 days of Account opening†. Plus, earn a one-time anniversary bonus of 20,000 Aeroplan points when you spend $10,000 within 12 months of Account opening†. Account must be approved by June 3, 2024.

- Earn up to $1,200 in value†, including up to 50,000 Aeroplan points† (enough for a round trip to New York City†), and additional travel benefits. Account must be approved by June 3, 2024.

- Earn a welcome bonus of 10,000 Aeroplan points when you make your first purchase with your new card†.

- Earn 20,000 Aeroplan points when you spend $6,000 within 180 days of Account opening†.

- Plus, earn a one-time anniversary bonus of 20,000 Aeroplan points when you spend $10,000 within 12 months of Account opening†.

- Earn 1.5 points† for every $1 spent on eligible gas, grocery and direct through Air Canada® purchases (including Air Canada Vacations®) made with your card.

- Earn 1 point† for every $1 spent on all other Purchases made with your Card.

- Earn points twice when you pay with your Card and provide your Aeroplan number at over 150 Aeroplan partner brands and at 170+ online retailers via the Aeroplan eStore (www.aeroplan.com/estore).

- Earn big rewards on the little things: Earn 50% more Aeroplan Points and 50% more Stars at participating Starbucks® stores. Simply link your TD Aeroplan Visa Infinite Card to your Starbucks® Rewards account. Conditions apply.

- Your Aeroplan Points do not expire as long as you are a TD® Aeroplan® Visa Infinite* Cardholder in good standing.

- Travel lightly through the airport and save on baggage fees†: Primary Cardholders, Additional Cardholders, and travel companions (up to eight) travelling on the same reservation will all enjoy their first checked bag free (up to 23kg/50lbs) when your travel originates on an Air Canada flight.

- Complimentary Visa Infinite Concierge†: On-call 24 hours a day, seven days a week, the Visa Infinite Concierge can help with any Cardholder request — big or small, to help you get the most out of life whenever you travel, shop and use your Card.

- Visa Infinite Luxury Hotel Collection†: Receive seven exclusive benefits when you book your stay through the Visa Infinite Luxury Hotel Collection featuring over 900 of the world’s most intriguing properties.

- Trip Cancellation/Trip Interruption Insurance†: For Trip Cancellation coverage of up to $1,500 per insured person, with a maximum of $5,000 for all insured persons, and for Trip Interruption coverage of up to $5,000 per insured person, with a maximum of $25,000 for all insured persons on the same covered trip.

- To be eligible, a $60,000 annual personal income or $100,000 household annual income is required. You must also be a Canadian resident and be the age of majority in the province or territory where you live.

TD® Aeroplan® Visa Platinum* Card

- Annual Fee $89 To receive the first-year annual fee rebate, you must activate your Card and make your first Purchase on the Account within the first 3 months after Account opening and you must add your Additional Cardholders by September 4, 2024. Waived first year

- Rewards Rate 0.67x-1x Points Earn 1 point† for every $1 spent on eligible gas, grocery and direct through Air Canada® purchases (including Air Canada Vacations®) made with your card. Earn 1 point† for every $1.50 spent on all other eligible purchases† made with your Card.

- Intro Offer Up to 20,000 Points Earn up to 20,000 Aeroplan points: Earn a welcome bonus of 10,000 Aeroplan points when you make your first purchase with your new card†. Earn an additional 10,000 Aeroplan points when you spend $1,000 within 90 days of Account opening†. Conditions Apply. Account must be approved by September 3, 2024.

- Earn up to $500 in value† including up to 20,000 Aeroplan points† and no annual fee for the first year. Conditions Apply. Account must be approved by September 3, 2024.

- To receive the first-year annual fee rebate, you must activate your Card and make your first Purchase on the Account within the first 3 months after Account opening and you must add your Additional Cardholders by September 4, 2024.

- Earn 1 point† for every $1 spent on eligible gas, grocery and direct through Air Canada® purchases (including Air Canada Vacations®) made with your card.

- Earn 1 point† for every $1.50 spent on all other eligible purchases† made with your Card.

- Your Aeroplan Points do not expire as long as you are a TD® Aeroplan® Visa Platinum* Cardholder.

- Flight/Trip Delay Insurance†: Up to $500 in coverage per insured person if your flight/trip is delayed for over 4 hours.

- Delayed and Lost Baggage Insurance†: Up to $1,000 overall coverage per insured person toward the purchase of essentials such as clothes and toiletries if your baggage is delayed more than 6 hours or lost.

- Common Carrier Travel Accident Insurance†: Up to $500,000 of coverage for covered losses while travelling on a common carrier (for example, a bus, ferry, plane, train or auto rental).

- Emergency Travel Assistance Services†: Help is just a call away. Toll-free access to help in the event of a personal emergency while travelling.

- To be eligible, you must be a Canadian resident and be of the age of majority in your province/territory of residence.

TD® Aeroplan® Visa Infinite Privilege* Credit Card

- Annual Fee $599

- Rewards Rate 1.25x-2x Points Earn 2 points† for every $1 spent on eligible purchases made direct through Air Canada® purchases (including Air Canada Vacations®). Earn 1.5 points† for every $1 spent on eligible gas, grocery, travel and dining purchases. Earn 1.25 points† for every $1 spent on all other purchases made with your Card.

- Intro Offer Up to 85,000 Points Earn up to 85,000 Aeroplan points: Earn a welcome bonus of 20,000 Aeroplan points when you make your first purchase with your new card†. Earn an additional 40,000 Aeroplan points when you spend $10,000 within 180 days of Account opening†. Plus, earn a one-time anniversary bonus of 25,000 Aeroplan points when you spend $15,000 within 12 months of Account opening†. Account must be approved by June 3, 2024.

- Earn up to $2,900 in value† including up to 85,000 Aeroplan points (enough for a round trip to Honolulu†) and additional travel benefits. Conditions Apply. Account must be approved by June 3, 2024.

- Earn a welcome bonus of 20,000 Aeroplan points when you make your first purchase with your new card†.

- Earn an additional 40,000 Aeroplan points when you spend $10,000 within 180 days of Account opening†.

- Plus, earn a one-time anniversary bonus of 25,000 Aeroplan points when you spend $15,000 within 12 months of Account opening†.

- Earn 2 points† for every $1 spent on eligible purchases made direct through Air Canada® purchases (including Air Canada Vacations®).

- Earn 1.5 points† for every $1 spent on eligible gas, grocery, travel and dining purchases.

- Earn 1.25 points† for every $1 spent on all other purchases made with your Card.

- Earn points twice when you pay with your Card and provide your Aeroplan number at over 150 Aeroplan partner brands and at 170+ online retailers via the Aeroplan eStore.

- Global Airport Lounge Access†: Receive a complimentary membership to the Visa Airport Companion† Program hosted by Dragonpass International Ltd. and take advantage of six lounge visits included for each Cardholder per membership year at over 1,200 airport lounges worldwide. Enroll through the Visa Airport Companion App or through visaairportcompanion.ca

- Complimentary Visa Infinite Concierge† : On-call 24 hours a day, seven days a week, the Visa Infinite Concierge can help with any Cardholder request — big or small, to help you get the most out of life whenever you travel, shop and use your Card.

- Visa Infinite Luxury Hotel Collection†: Receive seven exclusive benefits when you book your stay through the Visa Infinite Luxury Hotel Collection featuring over 900 of the world’s most intriguing properties. Enjoy an additional 8th benefit at over 200 properties, exclusively for Visa Infinite Privilege cardholders.

- Travel Medical Insurance†: Up to $5 million of coverage for the first 31 days. If you or your spouse is aged 65 or older, you are covered for the first 4 days of your trip. Additional top-up coverage is available.

- Trip Cancellation/Trip Interruption Insurance†: For Trip Cancellation coverage of up to $2,500 per insured person, with a maximum of $5,000 for all insured persons, and for Trip Interruption coverage of up to $5,000 per insured person, with a maximum of $25,000 for all insured persons on the same covered trip.

- Flight/Trip Delay Insurance†: Up to $1,000 in coverage per insured person if your flight/trip is delayed for over 4 hours.

- Delayed and Lost Baggage Insurance†: For delayed baggage over 4 hours, up to $1,000 of coverage per insured person for the purchase of essentials, such as clothing and toiletries. For lost baggage, up to $2,500 of coverage per insured person.

- Save time at the border with NEXUS: Enroll for a NEXUS and once every 48 months get an application fee rebate (up to $100 CAD)†. Additional Cardholders can also take advantage of this NEXUS rebate.

- To be eligible, $150,000 annual personal income or $200,000 household annual income is required. Also, you must have a Canadian credit file and be a Canadian resident of the age of majority in the province or territory where you live.

TD® Aeroplan® Visa* Business Card

- Annual Fee $149 Waived first year

- Interest Rates 14.99% / 22.99% 14.99% on purchases, 22.99% on cash advances.

- Rewards Rate 1x-2x Points 2x on Air Canada purchases, including Air Canada Vacations. 1.5x on travel, dining and select business categories, such as shipping, internet, cable and phone services. 1x on everything else.

- Intro Offer Up to 60,000 Points Earn up to 60,000 Points: Earn a welcome bonus of 10,000 Aeroplan points when you make your first purchase with your new card. Plus, earn up to 45,000 Aeroplan points when you spend $2,500 in purchases each month for the first 12 months of Account opening. Plus, earn up to 5,000 Aeroplan points when you spend $250 on eligible mobile wallet Purchases within 90 days of Account opening. Account must be opened by June 3, 2024.

- Earn up to 60,000 Aeroplan points¹, with no Annual Fee in the first year¹. Conditions Apply. Account must be opened by June 3, 2024.

- Earn 2 Aeroplan points for every dollar spent on eligible purchases made directly with Air Canada, including Air Canada Vacations.

- Earn 1.5 Aeroplan points for every dollar spent on eligible travel, dining and select business categories, such as shipping, internet, cable and phone services.

- Earn 1 Aeroplan point for every dollar spent on all other eligible purchases.

- Earn points twice when paying with a TD Aeroplan Visa Business Card and providing an Aeroplan number at over 150 Aeroplan partner brands and more than 170 online retailers via the Aeroplan eStore.

- Points can be redeemed for flights, hotels, merchandise, gift cards and more. They can also be used to pay down the card’s balance.

- Linked cards earn 50% more Aeroplan points and Stars at participating Starbucks stores.

- $149 annual fee — rebated in the first year.

- Free first checked bag for up to 9 people travelling on the same reservation on Air Canada flights.

- One free one-time guest pass to Maple Leaf Lounges for every $10,000 in net purchases. Maximum of 4 passes a year.

- Reach Aeroplan Elite Status more quickly by earning 1,000 Status Qualifying Miles and one Status Qualifying Segment for every $5,000 in net purchases.

- Access online reporting, review business expenses, managing existing credit limits and apply spend controls through the TD Card Management Tool.

- Visa SavingsEdge program: save up to 25% on eligible business purchases.

- Travel benefits: travel medical insurance (up to $2 million in coverage for the first 15 days for those under 65; coverage lasts for 4 days for those 65 and older); common carrier travel accident insurance (up to $500,000 for covered losses), trip cancellation insurance (up to $1,500 per insured person; maximum of $5,000), trip interruption insurance (up to $5,000 per insured person; maximum of $25,000), flight/trip delay insurance (up to $500 if a flight or trip is delayed for longer than 4 hours), delayed and lost baggage insurance (up to $1,000 of overall coverage per insured person), auto rental collision/loss damage insurance (covers the full cost of a car rental for up to 48 days), hotel/motel burglary insurance (up to $2,500), mobile device insurance (up to $1,000 in coverage).

- Toll-free emergency travel assistance services.

- Receive a rebate of up to $100 on NEXUS enrolment application/renewal fee costs once every 48 months.

- Save a minimum of 10% on the lowest available base rates in Canada and the U.S., and a minimum of 5% on the lowest base rates internationally on qualifying car rentals at participating Avis and Budget locations.

- Visa Zero Liability protection, Verified by Visa and instant alerts to prevent fraudulent card use.

- Purchase security and extended warranty protection.

- Minimum credit limit of $1,000.

- Interest rates: 14.99% on purchases, 22.99% on cash advances.

About the Author

Georgia Rose is a lead writer on the international team at NerdWallet. Her work has been featured in The Washington Post, The New York Times, The Independent and The Associated…

13 Best Aeroplan Credit Cards in Canada for 2024

The best Aeroplan credit cards in Canada earn points for Air Canada’s loyalty program on every purchase. Aeroplan points have an average value of 2.23 cents per point.

Aeroplan vs. Air Miles: Differences and Alternatives

Aeroplan is usually an ideal choice for those who want to use points for Air Canada flights, while Air Miles is a better choice for those who want flexible point redemption options.

19 Best Travel Credit Cards in Canada for March 2024

Explore the best travel credit cards in Canada for daily spending, flexible travel rewards, big welcome bonuses and more.

Best TD Bank Credit Cards in Canada

The best TD Bank credit cards in Canada include several Visa Infinite options as well as co-branded travel credit cards that earn Aeroplan points.

- Credit Cards

- TD Platinum Travel Visa Card Review: One of the Best Credit Cards for Expedia Loyalists

The Forbes Advisor editorial team is independent and objective. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive payment from the companies that advertise on the Forbes Advisor site. This comes from two main sources.

First , we provide paid placements to advertisers to present their offers. The payments we receive for those placements affects how and where advertisers’ offers appear on the site. This site does not include all companies or products available within the market.

Second , we also include links to advertisers’ offers in some of our articles. These “affiliate links” may generate income for our site when you click on them. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Forbes Advisor.

While we work hard to provide accurate and up to date information that we think you will find relevant, Forbes Advisor does not and cannot guarantee that any information provided is complete and makes no representations or warranties in connection thereto, nor to the accuracy or applicability thereof.

TD Platinum Travel Visa Card Review 2024

Updated: Mar 5, 2024, 12:47pm

The TD Platinum Travel Visa has plenty to offer, like no annual fee the first year, the ability to earn TD Rewards Points on purchases and a generous welcome bonus . However, when you look a little closer, there are some drawbacks, like conditions and caveats aplenty. Still, within the landscape of travel cards , the TD Platinum Travel Visa Card shines, but not nearly as bright as the competition. The main reason? Its affiliation with Expedia, both the card’s greatest strength and, paradoxically, its biggest limitation. That’s because the card’s offers are largely confined to Expedia getaways, demanding loyalty you may not want to give so readily.

- Generous welcome bonus.

- Better rewards program than most TD cards .

- Similarly-priced cards have better travel perks

Table of Contents

Introduction, quick facts, td platinum travel visa* card rewards, td platinum travel visa* card benefits, how the td platinum travel visa* card stacks up, methodology, is the td platinum travel visa* card right for you.

- Advertiser's Disclosure

Featured Partner Offers

TD Cash Back Visa Infinite* Card

On TD’s Secure Website

Welcome Bonus

Up to $500 in value†

$139 (rebated in the first year, account must approved by June 3, 2024)

Regular APR (Purchases) / Regular APR (Cash Advances)

20.99% / 22.99%

TD® Aeroplan® Visa Platinum* Card

$89 (first year of annual fee rebated)

TD® Aeroplan® Visa Infinite Privilege* Card

Up to 85,000 Aeroplan points†

Travel rewards for a low annual fee? Get the TD Platinum Travel Visa Card.

On TD’s Website

- Earn up to $370 in value†, including up to 50,000 TD Rewards Points†. Conditions apply. Account must be approved by September 3, 2024.

- Welcome Bonus of 15,000 TD Rewards Points when you make your first Purchase with your Card†.

- 35,000 TD Rewards Points when you spend $1,000 within 90 days of Account opening†.

- Pay no annual fee for the first year

- To receive the first-year annual fee rebate, you must activate your Card and make your first Purchase on the Account within the first 3 months after Account opening and you must add your Additional Cardholders by September 4, 2024.

- Earn up to 6 TD Rewards Points for every $1 spent on Expedia ® for TD †

- Earn 4.5 TD Rewards Points on every $1 you spend at your favourite eateries and grocery stores

- Earn 3 TD Rewards Points for every $1 of your recurring bill payments

- Earn 1.5 TD Rewards Points for every $1 you spend on everything else

- Includes travel insurance coverage

- Benefit from no travel blackouts, no seat restrictions and no expiry for your TD Rewards Points (as long as your account is open and in good standing)

- This offer is not available to residents of Quebec.

- † Terms and conditions apply.

When you think about a credit card that ties its perks to a popular online travel agency, TD Platinum Travel Visa Card immediately comes to mind. It’s almost as if TD had a tête-à-tête with Expedia and, together, they concocted an array of credit card benefits suited for the travel-savvy cardholder. If you’ve got a penchant for frequently booking through Expedia, TD Platinum Travel Visa Card isn’t just an option—it’s one of the best options. The world of travel rewards credit cards is vast, and in that sea TD Platinum Travel Visa stands out like a beacon for travellers anchored to Expedia.

Yet, while this card seems bespoke to a specific audience, what about the travellers who don’t necessarily pledge allegiance to Expedia? Here’s where things get a bit murky.

Do we love the fact that there’s no annual fee for the first year, a juicy introductory perk that could see you pocketing up to 50,000 TD Rewards Points? Absolutely. Is it phenomenal that you can bag 6 TD Rewards Points for every $1 on bookings through Expedia and up to 4.5 TD Rewards Points for every $1 you spend on everything else? Again, a resounding yes.

But, in the larger landscape of travel cards, where some offer travel perks like lounge access or extravagant concierge services, TD’s card feels a tad limited. Avid globe-trotters might find themselves yearning for a few more travel-related luxuries.

Would we recommend the TD Platinum Travel Visa Card? If Expedia is your go-to travel companion, yes, without any hesitation. But if you’re an indiscriminate traveller who casts a wider net to find the best deal, this might not be your catch of the day.

- Annual fee: Waived for the first year, then it’s $89 per year

- Reward rate: Ranging from 1.5 to 6 TD Rewards Points across diverse spend categories

- Flexibility: Points can be used for travel, merchandise or bill payments

- Introduction offer: Up to $370 in value and 50,000 TD Rewards Points, with certain conditions

- Insurance coverage: Comprehensive travel insurance included

Earning Rewards

Jumping into the rewards scene Collecting rewards with the TD Platinum Travel Visa Card can feel like striking gold. Each bite at a restaurant or grocery run puts 4.5 TD Rewards Points in your pocket. Your recurring bills? A nifty 3 points for each $1 you spend. And every other purchase earns you a steady 1.5 points. In the bustling world of reward credit cards, this one can hold its own. Plus, the TD Platinum Travel Visa Card offers a distinct Expedia advantage, turning everyday expenses into potential travel adventures.

Redeeming Rewards

With the TD Platinum Travel Visa Card’, you can convert your hard-earned points into exciting getaways on Expedia, choosing from a plethora of destinations. TD and Expedia have made redeeming points easy, so you can harness the full potential of your rewards on Expedia® For TD. You can also use your accumulated points to splurge on merchandise, even Amazon purchases. Plus, you can use TD Rewards Points to lower your credit card balance. While some cards make you jump through hoops for redemptions, TD’s portal makes redeeming your TD Rewards Points a breeze.

Rewards Potential

Savvy spenders who harness the card’s earning potential could pocket an impressive number of points towards travel, merchandise and more. Based on how Canadians typically spend, Forbes Advisor Canada estimates that cardholders can see an annual return of $312.42 worth of points, with the annual fee factored in, when you book travel with Expedia. When you book travel elsewhere, the annual return drops to $292.82 worth of points, with the annual fee factored in.

- First-year perks: No annual fee and up to 50,000 TD Rewards Points (Up to $370 in value)

- Dine and dash to points: Enjoy 4.5 TD Rewards Points on every $1 you spend at restaurants and grocery stores

- Expedia euphoria: Be the traveller that gets 6x TD Rewards Points for every $1 you spend on Expedia bookings, ensuring every trip, big or small, becomes a rewarding journey

- Security and peace of mind: Rest easy with comprehensive travel insurance that ensures that your voyages remain hiccup-free

Interest Rates

- Regular APR Min: 20.99%

- Cash Advance APR: 22.99%

- Balance Transfer APR: 22.99%

- Cash Advance fee: 1% ($3.50 minimum and $10 maximum)

- Balance Transfer fee: 3% maximum

- Foreign Transaction Fee: 2.5%

- Annual Fee: $89 (Get an annual fee rebate in the first year; account must be approved by September 3, 2024)

- Over Limit Fee: $29.00

- Late Payment Fee: $0

When evaluating the TD Platinum Travel Visa Card against some of its competitors, namely the TD Aeroplan Visa Platinum , American Express® Aeroplan®* Reserve Card and CIBC Aeroplan Visa Infinite Card, it’s clear that each has its unique strengths. While they may cater to different traveller preferences, from Expedia loyalists to Air Canada aficionados, picking the most suitable one for you depends on your travel habits, reward preferences and fee comfort levels.

TD Platinum Travel Visa Card vs. TD Aeroplan Visa Platinum Card

At face value, both cards come with an identical annual fee and APR, and both are generous with their first-year annual fee rebates. Yet, they’re tailored to different travellers. If Expedia is your go-to for travel bookings, the TD Platinum Travel Visa Card’s 6-point-per-$1 earn rate is unmatched. That said, TD Platinum Travel Visa Card offers a hearty welcome in the form of 50,000 TD Rewards Points, while TD Aeroplan Visa Platinum welcomes new cardholders with a 20,000 Aeroplan Point offer. But here’s the twist: TD Aeroplan Visa Platinum Card’s potential $500 value, along with the versatility of earning points in multiple ways, may out-woo the frequent traveller. However, for the everyday spender leaning into travel, TD Platinum Travel Visa Card’s reward structure, especially with groceries and dining , holds an edge.

TD Platinum Travel Visa Card vs. American Express® Aeroplan®* Reserve Card

When deciding between the TD Platinum Travel Visa Card and American Express Aeroplan Reserve Card, travellers have a lot to unpack. TD Platinum Travel Visa Card offers an attractive welcome bonus and a more affordable annual fee, especially with the first-year waiver. It’s also the perfect choice for dedicated Expedia customers looking to earn more rewards, faster than ever, on their getaways. On the flip side, the American Express Aeroplan Reserve Card offers a superior range of travel benefits, from lounge access to comprehensive insurance. But, with its higher annual fee, it’s geared towards frequent Air Canada travellers who’ll make the most of its perks. For the budget-conscious, TD Platinum Travel Visa Card takes the lead, but American Express Aeroplan Reserve Card is unrivalled when it comes to premium Air Canada perks.

TD Platinum Travel Visa* Card vs. CIBC Aeroplan Visa Infinite Card

Pitting the TD Platinum Travel Visa Card against the CIBC Aeroplan Visa Infinite Card is an exercise in balance. Both cards offer strong travel rewards, but they cater to slightly different demographics. TD Platinum Travel Visa Card, with its Expedia tie-in, is a dream for the site’s loyalists. Its annual fee is also modest, which is appealing for cardholders who balk at high yearly charges. Conversely, the CIBC Aeroplan Visa Infinite Card leans heavily into its Air Canada affiliation, granting perks like free checked bags and priority boarding. The card’s insurance coverage is also commendable. If you’re after broader travel flexibility and a cheaper fee, TD Platinum Travel Visa Card is your go-to. But, for frequent Air Canada flyers, CIBC Aeroplan Visa Infinite Card stands out.

When determining a rating for individual credit cards, the Forbes Advisor Canada editorial team factors in an exhaustive list of data points. With rewards, the scoring model used takes into account factors such as, but not limited to, rewards rates and categories, fees, welcome bonuses, and other benefits and features. Keep in mind, what may be best for some people might not be right for you. Conduct informed research before deciding which cards will best help you achieve your financial goals.

In short, the TD Platinum Travel Visa Card is a stellar choice for cardholders who frequently use Expedia. If you’re looking to cash in on a generous welcome bonus without a hefty annual fee, this is the card for you. It’s particularly suited to users who dine out or spend heavily on groceries , given the rewards rate. However, if you’re a travel enthusiast in search of comprehensive travel perks and insurance , you might find other similarly priced cards more appealing. While the TD Platinum offers decent protection features, there are more competitive options out there.

Related: Best Credit Cards To Use in Canada

Advertiser's Disclosure

Our partners are not responsible for anything reported by Forbes Advisor. To the best of our knowledge, everything is accurate at the time of publishing as of the date posted. For full information and details, please visit the advertiser’s website.

Frequently Asked Questions (FAQs)

Is the first-year annual fee really waived for the td platinum travel visa card.

Yes, as long as you activate your card and make your first purchase within the first three months of opening your account.

How do I earn the maximum welcome bonus for the TD Platinum Travel Visa Card?

To earn up to 50,000 TD Rewards Points, you must be approved by September 3, 2024. Once approved, activate your card and make your first purchase within the first three months. Also, remember to add any additional cardholders by September 4, 2024.

How does the TD Platinum Travel Visa Card's rewards program benefit frequent Expedia customers?

You earn 6 TD Rewards Points for every $1 you spend when you book your travel through Expedia For TD, making it a rewarding choice for cardholders who frequently use this platform.

What’s the earning rate for the TD Platinum Travel Visa Card on everyday purchases?

You earn 1.5 TD Rewards Points for every $1 you spend on everyday purchases. Plus, you can rack up 4.5 TD Rewards Points on every $1 you spend at restaurants and grocery stores.

Is the TD Platinum Travel Visa Card offer available to residents of Quebec?

Unfortunately, this offer isn’t available to Quebec residents.

Kevin Nishmas is an expert financial content writer with a long and successful history of working with Canada's largest financial institutions. His knack (and passion) for transforming complex personal finance information into clear, compelling content has landed him in leading business publications such as Report on Business, Advisor’s Edge, Benefits Canada and Investor's Digest of Canada.

- Best Credit Cards

- Best Travel Credit Cards

- Best Airport Lounge Access Credit Cards

- Best Cash Back Credit Cards

- Best Credit Cards for Bad Credit

- Best Aeroplan Credit Cards

- Best No Foreign Transaction Fee Credit Cards

- Best Balance Transfer Credit cards

- Best Rewards Credit Cards

- Best Mastercards

- Best Student Credit Cards

- Best Secured Credit Cards in Canada

- Best Business Credit Cards

- Best of Instant Approval Credit Cards

- Best Prepaid Credit Cards

- Best No-Annual-Fee Credit Cards

- Best Low-Interest Credit Cards

- Best Neo Financial Credit Cards

- Best Visa Cards

- Best Air Miles Credit Cards

- TD Aeroplan Visa Infinite Privilege Review

- EQ Bank Card Review

- TD Aeroplan Visa Platinum Card Review

- Scotiabank Platinum American Express Card

- TD® Aeroplan® Visa Infinite* Card

- KOHO Prepaid Mastercard Review

- MBNA Rewards World Elite Mastercard

- MBNA True Line Mastercard Review

- The American Express Business Edge Card Review

- TD First Class Travel Visa Infinite Card

- TD Rewards Visa Card Review

- RBC Avion Visa Infinite Review

- Scotiabank Gold American Express Card

- Neo Secured Credit Card Review

- Home Trust Secured Visa Review

- American Express Aeroplan Card Review

- Tangerine Money-Back Card Review

- TD Cash Back Visa Infinite

- Scotiabank Scene+ Visa Card

- Credit Card Interest Calculator

- Credit Card Minimum Payment Calculator

- Credit Card Expiration Dates: What You Need To Know

- What Is The Highest Limit Credit Card In Canada?

- What Is The Highest Credit Score Possible?

- Money transfer from Credit Card to the Bank

- How To Get Cash From A Credit Card At An ATM

- The Stack Mastercard Is No More

- How Is Your Credit Card Interest Calculated?

- How To Pay Your Mortgage With A Credit Card

- Does Applying For A Credit Card Hurt Your Credit?

- How To Check Your Credit Card Balance

- Cathay Pacific and Neo Financial Are Launching A Credit Card

- 4 Ways To Consolidate Credit Card Debt

- How To Get A Business Credit Card

- Canceling Credit Cards: Will I Get My Annual Fee Back?

- Can I Use A Personal Card For Business Expenses?

More from

Cibc costco mastercard review 2024: avid costco shoppers should not leave home without it, pc world elite mastercard review 2024, pc insiders world elite mastercard review 2024: earn the most pc optimum points in canada, cathay world elite mastercard review 2024: the only credit card in canada that earns asia miles, ja money card review 2024: earn cash back while learning about money management, bmo eclipse rise visa card review 2024: a starter credit card that rewards good financial habits.

- $799 annual fee

- Earn 70,000 Membership Rewards points when spending $10,000 in the first 3 months

- 30,000 additional points when making any purchase in months 14 – 17

- Earn 2 points per $1 spent on dining and travel, and 1 point on all other purchases

- $200 annual travel credit

- $200 annual dining credit (per calendar year)

- Unlimited airport lounge access

- MESSAGE ME FOR A REFERRAL LINK

Anyone who frequently travels or is looking for luxury travel perks should get the American Express Platinum Card . The primary cardholder and a guest get unlimited access to the American Express Global Lounge Collection, hotel status upgrades (Marriott Bonvoy and Hilton Honors), a NEXUS rebate (includes global entry and TSA precheck), and a comprehensive travel insurance package that covers travel medical and trip cancellation.

While some people will instantly pass when they see the $799 annual fee, you can get the card for just $199 for the first year. You get a $200 dining credit benefit each calendar year. That means you can use it twice before your second annual fee posts. You also get a $200 travel credit once every year of your cardmembership. All in, you can get up to $600 in credits in the first year. That effectively makes your annual fee for the first year just $199. This assumes you can use the dining credit.

Another reason this card is worth it for all types of travellers is the welcome bonus. When you sign up with a referral link, your welcome offer is typically worth 80,000 to 100,000 American Express Membership Rewards points. That has a minimum value of $800 to $1,000. However, if you transfer your points to Aeroplan at a 1:1 ratio, you could easily double the value of your points. In other words, the welcome offer could be worth $1,600 to $2,000.

If you’re a frequent traveller, this card is worth holding long term for the travel benefits. Even if you don’t travel often, signing up for the welcome bonus and benefits is worth it for the first year.

Eligibility : There’s no minimum income required. A credit score of 740 is recommended before applying. Welcome bonus : Typically worth 80,000 to 100,000 American Express Membership Rewards points when using a referral link. The minimum spending requirement is usually $5,000 to $10,000.

Best travel card for overall spending

American express cobalt card.

- $12.99 Monthly fee ($155.88 yearly)

- 1,250 monthly Membership Rewards points after charging $750 in purchases each month for a year (15,000 points total)

- Earn 5 points per $1 spent on eats and drinks

- Earn 3 points per $1 spent on streaming services

- Earn 2 points per $1 spent on travel

- Earn 1 point per $1 spent on all other purchases

When it comes to travel rewards, sometimes you need a card that earns you a lot of points on your daily spending. The American Express Cobalt Card ’s earning rate is 5 points per $1 spent on eats and drinks (including grocery stores), 3 points on select streaming services, 2 points on travel and transit, and 1 point on everything else. That’s a lot of bonus categories, but note that there is a monthly spending cap of $2,500 for each category. Once you reach it, you’ll earn 1 point per $1 spent.

Remember, you can transfer your American Express Membership Rewards points to Aeroplan at a 1:1 ratio. Since Aeroplan points can easily have a value of 2 cents per point, your earning rate on eats and drinks can be as high as 10%. There’s no other card that gives you that high of a return.

The downside of this card is that you don’t get many travel benefits. However, you do get mobile device insurance, and the welcome bonus has been consistent.

Eligibility : There’s no minimum income required. A credit score of 700 is recommended before applying. Welcome bonus : Typically, you’ll earn 2,500 American Express Membership Rewards points when you spend $500 monthly for the first 12 months. That’s 30,000 bonus American Express Membership Rewards points you can earn in the first year. The offer has also been as low as 1,250 monthly points for 12 months, with a minimum spend of $750 each month.

Best travel card for the welcome bonus

American express business gold rewards card.

- $199 annual fee

- Up to 115,000 Membership Rewards points welcome bonus when using a referral link

- Earn 75,000 Membership Rewards points when spending $5,000 in the first 3 months

- Earn 10,000 points when you charge $20,000 each quarter (yearly benefit)

- Earn 1 point per $1 spent on all purchases

- Mobile device insurance

Although the American Express Business Gold Rewards Card doesn’t have the highest welcome bonus, it gives you the best bang for your buck. You’ll get 75,000 American Express Membership Rewards points when you spend $5,000 in the first 3 months of cardmembership. This is an incredible offer since it’s a straight spend instead of spending a minimum each month for multiple months.

Since this is a business credit card, most of the benefits are focused on business owners. You get 55 interest free days, expense management reports, and employee abuse protection. You also get some travel insurance, but it doesn’t include travel medical.

Even though this is a business credit card, many consumers will apply for the card because of the welcome bonus. I’m not telling you to lie. I’m just reporting what I’ve heard.

Eligibility : There’s no minimum income required. A credit score of 700 is recommended before applying. Welcome bonus : Typically worth 75,000 American Express Membership Rewards points when spending $5,000 in the first three months.

Best travel card for all-in-one-travel

Scotiabank passport™ visa infinite* card.

- $150 annual fee

- 30,000 Scene+ points when spending $1,000 in the first 3 months

- 10,000 points when spending $40,000 in the first year

- Earn 3 Scene+ points per $1 spent at Empire owned supermarkets

- Earn 2 Scene+ points per $1 spent on eligible grocery stores, dining, entertainment, and daily transit purchases

- Earn 1 Scene+ point per $1 spent on all other eligible purchases

- Visa Airport Companion Program membership + 6 passes per year

- No foreign transaction fees

When looking at this list of the best travel credit cards in Canada, you’ll quickly realize that many cards excel in one area, but not all. With the Scotiabank Passport Visa Infinite Card , you get a travel credit card with a decent earning rate and good travel benefits. It’s ideal for people who don’t want to carry multiple credit cards, as you can use it at home or abroad.

The earning rate for this card is 3 Scene+ points at Empire-owned grocery stores (IGA, Safeway, Sobeys supermarkets), 2 points on all other eligible grocery stores, dining, entertainment, and transit purchases, and all other purchases get you 1 point. While this isn’t the best earning rate, it’s decent.

What really sets this card apart is the overall travel benefits. There are no foreign transaction fees, so you’ll save 2.5% on purchases made in foreign currencies. You also get a free Visa Airport Companion Program with six complimentary annual passes. Plus, a comprehensive travel insurance package is included.

Eligibility : A minimum personal income of $60,000 or a household income of $100,000 or at least $250,000 in assets under management. A credit score of 700 is also recommended. Welcome bonus : You’ll typically get 35,000 to 50,000 Scene+ points as the welcome offer. In most cases, you’ll need to spend a minimum amount in the first three months and another in the first 12 months for the full bonus.

Best travel card for Aeroplan rewards

Td aeroplan visa infinite card.

- $139 annual fee

- 10,000 Aeroplan points after your first purchase

- 20,000 additional Aeroplan points when you spend $6,000 in the first 180 days

- 20,000 Aeroplan points on your anniversary when you spend $10,000 in the first 12 months

- Earn 1.5 Aeroplan points per $1 spent on gas, groceries, and Air Canada purchases

- Earn 1 Aeroplan point per $1 spent on all other purchases

- First bag checked free on Air Canada flights

Since Air Canada is the country’s top airline, it’s natural that many people will want to earn Aeroplan points, Air Canada’s loyalty program. For most people in this situation, the best travel credit card would be the TD Aeroplan Visa Infinite Card . The earning rate is 1.5 Aeroplan points per $1 spent on gas, grocery, and Air Canada purchases. All other purchases earn you 1 Aeroplan point per dollar spent. In other words, you can earn Aeroplan points on every purchase.

Another reason this card is worth getting is the included free first checked bag for the primary cardholder and up to eight travelling companions. Since checked luggage normally costs $30 to $50 each way, this can be a valuable benefit. Other benefits you get include a NEXUS rebate and travel insurance.

It’s worth noting that Aeroplan has many retailer partners, so you can double dip on the points. All you need to do is shop via the Aeroplan eStore and then pay with your Aeroplan credit card. It’s that simple.

Eligibility : A minimum personal income of $60,000 or a household income of $100,000 is required. It’s also recommended that you have a credit score of at least 700. Welcome bonus : New cardholders typically get between 40,000 to 70,000 Aeroplan bonus points. This intro offer is usually divided into multiple parts with different minimum spending requirements.

Best travel card for premium Air Canada benefits

Td aeroplan visa infinite privilege card.

- $599 annual fee

- Earn 20,000 Aeroplan points after your first purchase

- Earn 40,000 Aeroplan points when you spend $10,000 in the first 180 days

- Earn 25,000 Aeroplan points when you spend $15,000 in the first year

- Earn 2 Aeroplan points per $1 spent on Air Canada purchases, 1.5 points on gas, and groceries, and 1 point on all other purchases

- First bag checked free, priority check-in & boarding on Air Canada flights

- Maple Leaf Lounge access in North America

- DragonPass airport lounge access + 6 free annual passes

Normally, I wouldn’t have two recommendations for Aeroplan, but the extra benefits of the TD Aeroplan Visa Infinite Privilege Card deserve its own category. Besides the free first checked bag, you also get unlimited access to Maple Leaf Lounges in North America for you and a guest, six free passes to airport lounges that are part of the Visa Airport Companion Program, priority boarding (zone 2), priority baggage handling, priority airport services, and priority airport standby and upgrades.

The annual fee for this card is $599, but as you can see, you get tons of benefits. Having Maple Leaf Lounge access and priority boarding can significantly impact your comfort when travelling. The earning rate is 2 points per $1 spent on Air Canada purchases, 1.5 points on gas, groceries, travel, and dining purchases, and 1 point on everything else.

Some travellers will apply for this card during a busy travel year to take advantage of all the benefits. When their anniversary is about to come up, they’ll downgrade to the TD Aeroplan Visa Infinite Card. This allows them to earn two welcome bonuses, which can easily be more than 150,000 total points.

Eligibility : A minimum personal income of $60,000 or a household income of $100,000 is required. It’s also recommended that you have a credit score of at least 700. Welcome bonus : Typically worth between 50,000 to 70,000 Aeroplan points. This bonus is usually divided into multiple parts with different minimum spending requirements.

Best travel card for WestJet flyers

Westjet rbc world elite mastercard.

- $119 annual fee

- 450 WestJet dollars when you spend $5,000 in the first 3 months

- Earn 2% back in WestJet dollars on WestJet flights or WestJet Vacations packages

- Earn 1.5% back on all other purchases

- Receive a round-trip companion voucher – every year – for any WestJet destination starting from $119 (plus taxes, fees, charges and other ATC)

- Get free first checked bags for the primary cardholder and up to 8 guests on the same reservation

In the last year or so, WestJet has changed its strategy and is now focused mainly on Alberta. As a result, the WestJet RBC World Elite Mastercard is now only good for people who fly WestJet regularly. Compare this to the past when WestJet had decent lift across Canada. Now they’re more of a niche airline.

With this card, you’ll earn 2% back in WestJet dollars on WestJet purchases and 1.5% on all other purchases. This is a decent earning rate since most cards only give you 1% back in rewards on all other purchases. That said, since WestJet Rewards is essentially a cash back rewards program. Although you’ll be able to use your points to offset the cost of your airfare, you won’t be able to get aspirational flights for cheap, like Aeroplan.

The real advantage of this card is the WestJet benefits. The primary cardholder and up to eight guests travelling on the same itinerary get their first checked bag free. In addition, you get a yearly companion voucher , which allows a guest to pay a lower base fare when they’re travelling with the primary cardholder. This benefit alone can save you hundreds of dollars each year.

Eligibility : Minimum personal income of $80,000 or a household income of $150,000. Welcome bonus : Usually up to 4450 WestJet dollars. You’re given 250 WestJet dollars after your first purchase and another 200 WestJet dollars when you spend $5,000 in the first three months. There have been occasional offers of up to 700 WestJet dollars.

Best travel card for hotel stays

Marriott bonvoy american express card.

- $120 annual fee

- 70,000 Marriott Bonvoy points when you charge $3,000 in the first 3 months with a referral link

- Earn 5 Marriott Bonvoy points per $1 spent at participating Marriott properties

- Earn 3 Marriott Bonvoy points per $1 spent at gas and travel purchases for the first 6 months (up to 15,000 points) – Offer ends May 6, 2024

- Earn 2 Marriott Bonvoy points for per $1 spent on all other purchases

- Annual free night certificate worth up to 35,000 points

So far, the list of the best travel credit cards in Canada has focused on airline rewards. However, many people just want to save on hotel stays or get free nights. That’s where the Marriott Bonvoy American Express Card excels. Marriott International has more than 8,500 properties in 130+ countries. That means you’ll be able to use your points in most parts of the world.

The earning rate is 5 Marriott Bonvoy points per $1 spent at Marriott properties and 2 points on all other purchases. Since one Marriott Bonvoy point has a value of about .9 cents each, you’re getting a decent return.

To be realistic, anyone who likes to travel should have this card. That’s because you get a free annual night certificate worth up to 35,000 Marriott Bonvoy points. That certificate can easily have a value of at least $300, which is clearly more than the $120 annual fee that this card charges. Another perk with this card is Marriott Bonvoy Silver Elite status, which gives you priority late checkout and 10% bonus points on stays. Some travel insurance is also included.

Eligibility : No listed income requirement. A credit score of at least 700 is recommended. Welcome bonus : Typically worth 50,000 – 70,000 Marriott Bonvoy points when you spend $3,000 in the first three months of card membership.

Best travel card with no annual fee

Cibc aeroplan visa card.

- No annual fee

- 10,000 Aeroplan points when you make your first purchase

- Earn 1 Aeorplan point per $1 spent on gas, groceries, and Air Canada

- Earn 1 Aeroplan point per $1.50 spent on all other purchases

Unfortunately, most of the best travel credit cards in Canada come with an annual fee, but not the CIBC Aeroplan Visa Card . The earning rate is 1 Aeroplan per $1 spent on gas, groceries, and Air Canada purchases. For every other eligible purchase, you’ll get 1 Aeroplan point per $1.50 spent.

Since this is a no fee card, the main benefits you get are purchase security and extended warranty. With purchase security, your purchases are protected from loss, theft, and damage for 90 days. The extended warranty doubles your manufacturer’s warranty for up to one additional year.