- US citizens overseas

Travel health insurance in Guam, Guam travel insurance

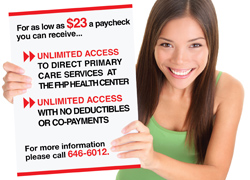

Travel insurance quote form, do you want to insure trip cost as well as the health of the traveler, please click here to buy travel insurance for quarantine coverage, travel insurance with trip protection coverage - highlights, trip cancellation.

Reimbursement for loss of pre-paid, non-refundable payments.

Medical evacuation

Transportation to or between hospitals as needed.

Reimbursement of food and lodging expenses due to delay in travel.

Lost baggage

Pays sum for lost or delayed luggage by airline.

Medical expenses

Covers cost of treatment for sickness or injury during your vacation.

Travel medical insurance with no trip protection - Highlights

Health care expenses.

Covers medical costs for sickness or accidents during travel.

Doctor visit

Covers cost of clinic or doctor visit.

Pharmacy drugs

Expenses from doctor prescribed eligible medications.

Repat of remains

Return of moral remains to home country or local burial.

Guam healthcare for tourists, Travel health insurance for Guam

Schengen Visa Insurance

US Expatriates Insurance

Guam Visitor Insurance

USA Visitors Insurance

Best insurance for travel to guam covid19.

International travel has been increasing again after the complete lockdown due to the covid19 pandemic. However given the health risks and increased healthcare costs involved in light of the pandemic, it is very important to have good travel insurance which covers covid19 illness. Travelers can Compare Guam visitor health insurance with Covid coverage by using our visitors insurance compare tool.

In the facility, we have a question clarifying if you need to compare visitors insurance for covid19. Even within our display comparing best Guam travel insurance for Covid19, we have a "filter" option where visitors can filter for covid19 travel insurance coverage plans only. Based on your unique visitors insurance requirements we display all the available Covid travel insurance plans from top rated US insurance providers.

US travel insurance for Guam

Guam in the US territory of Oceania has some of the most packed marine life with diverse diving spots to shipwrecks with simple reefs. It has over 200 species of coral with 60 diving sites. Guam is a country with night markets of Chamorro Village, World War monuments, attractive churches, and magnificent Pagat caves attract millions of travelers to the country. US citizens do not need a visa to travel to Guam and they can stay for up to 90 days .They just need a valid passport. The best time to visit Guam is between January to May. Guam receives several US travelers each year for a vacation.

Travelers with trips within the USA or the US territories need to buy a good US travel insurance . If, the visitor is traveling for more than 100 miles from their primary residence but are still within the US can buy domestic insurance for the trip. Travel insurance will protect travelers from any financial loss in the event of a health emergency, any accidents, flight delays, flight cancellation, baggage damage, lost baggage, death of traveler. Travelers can now travel without worrying of the cost invested in the trip as many US travel insurance providers offer coverage for trip delay or trip cancellation expenses, especially given the Covid19 pandemic and visiting a hospital without insurance may face huge financial loss.

Travel Insurance from Guam to Mainland USA

Traveling to the mainland US is very common among travelers from Guam. Several travelers from Guam visit the US for a vacation and to meet friends and family. All individuals born in Guam or any other US territories become an American citizen automatically. The summers are ideal for a vacation in the US.

Resourceful tourist insurance USA information

Find the best travel insurance, how does travel insurance work, how to buy travel insurance, travel insurance glossary, travel insurance for specific groups, compare travel insurance plans.

Annual travel insurance (Multi trip insurance)

Annual travel insurance (multi trip insurance) for travel within usa, travel insure - voyager annual insurance.

- Take an unlimited number of Covered Trips during the 364 day Policy period

- Covers domestic and international trips - up to 90 days each

- Offers two plan levels namely Silver and Gold offer options for different needs and budgets

- Provides coverage for Emergency Accident and Sickness, Emergency Medical Evacuation, Baggage & Personal Effects, Baggage Delay, and Accidental Death and Dismemberment.

- The Gold plan includes additional benefits like Trip Interruption and Political Natural Disaster Evacuation

Annual travel insurance for travel outside USA - Annual travel insurance for US Business travelers

Importance of american traveler insurance.

Traveling long distances has many unexpected and accidental incidents that need to be taken care in a professional manner in order to have an enjoyable experience. US travel Insurance very important while traveling which takes care of medical expenses due to sudden sickness or injury. In the US healthcare is closely linked to insurance coverage. US travel insurance providers have preferred provider networks and the hospital billing is much lower for insured patients when compared to uninsured patients. Having the best US traveler insurance reduces hospital bill along with paying for the outrageous cost of healthcare in the US.

US travel insurance plans can also insure trip expenses along with insuring the health of the traveler. Trip cancellation Insurance cover trip cancellation, trip interruption, travel delay, loss of luggage, baggage delay... Cancel for any reason travel insurance is an additional benefit available which will refund 75% of the trip cost in case of trip cancellation if the traveler cancels the trip for any reason. These benefits are very useful for traveler who are not sure of their travel schedules so that they should do not need to lose their travel investment if they do not travel.

Factors to consider

While buying Travel Insurance

While buying Travel Medical Insurance

American traveler insurance including trip cancellation coverage

US citizens should consider buying travel insurance especially if traveling outside their home state. The travel insurance plans are designed for US vacationers with coverage for insuring the health of the traveler as well the trip expenses cost. Some examples of coverage benefits are trip cancellation, trip delay, Covid quarantine travel insurance , medical evacuation, injury of family member, travel companion or pet, theft of passport, traffic accident, inclement weather resulting in delay or cancellation of common carrier.

- Non refundable cost of the trip.

- Unexpected medical expenses of the traveler.

- Loss or damage to the insured’s possessions.

IMG Trip insurance

The travel insurance offered by IMG is a three-tiered series of plans: Travel Lite , Travel SE and Travel LX . These plans offer coverage for unexpected medical expenses dues to accident or sickness as well as insure your trip expense investment in case of a trip cancellation or delay.

Travel LX insurance has 'Cancel for any reason' benefit included and provides coverage up to $100,000. The Travel SE and Travel LX plans offer Trip Delay benefit up a maximum of $2,000 per person and $2,500 per person respectively which satisfy many countries Covid travel insurance quarantine requirements.

Safe Travels Trip protection insurance

Safe Travels Trip protection insurance plans for trip cancellation expenses from Trawick International offer coverage for non refundable trip expenses incurred when a trip is cancelled. These are

- Safe Travels Voyager insurance

- Safe Travels Protect insurance

- Safe Travels First Class Trip Protection

Safe Travels Explorer Plus

- Safe Travels Journey insurance

- Safe travels Explorer insurance

- SafeTravels Armor insurance

- Safe Travels Defend insurance

- Safe Travels Single Trip Protection

The Safe Travels First Class Trip Protection , Safe Travels Voyager insurance and SafeTravels Armor have an optional benefit that is the ' Cancel for any Reason ' which is available as a rider at an additional cost.

The Safe Travels Voyager insurance and Safe travels Explorer insurance is quite popular as it offers Covid19 quarantine accommodation coverage.

Trip Protector Preferred insurance

- Available for US citizens and residents traveling outside the United States

- Includes $2000 in travel delay benefits for Covid quarantine/lodging.

- Trip cancellation up to $50,000/Trip interruption up to 200% of trip cost

- Offers $500,000 medical for sickness and injury/$1,000,000 medical transportation

Seven Corners Trip Protection Insurance Plans

The Trip Protection Series by Seven Corners offers plans with good, better, best plan with Trip Protection Basic and Trip Protection Choice . There is an additional cost for the number of days which exceed 30 days, but you can have a trip last up to 180 days.

Trip Protection Elite from Seven Corners offers cancel for any reason for residents of Missouri, New York, Pennsylvania and Washington travelling in the United States /internationally. you can have a trip last up to 90 days.

There is also the optional coverage for loss of ski days and equipment and lost golf rounds and rental. Note that insuring a trip for $0 to $500 gives the same, lowest rate available.

Travel Insurance Services Trip Protection Insurance Plans

Travel Insurance Select Insurance and Trip Care Complete Insurance from Travel Insurance Services,offers choice of three options to meet your needs and budget: Elite, Plus, and Basic. These plans includes coverage for trip cancellation, trip interruption, trip delay, medical expense, emergency evacuation, and baggage loss/delay coverage. Each option includes different features, benefits, and coverage limits.

Travel Insurance Select Plus and Elite plans offers "Optional cancel for any reason benefit" if purchased within 21 days of the date initial payment/deposit is received. (not available to residents of NY) and Trip Care Complete Insurance also offers "Optional cancel for any reason benefit" up to 75% of Trip Cost.

Trip cancellation insurance

Travel insurance for trip cancellation, baggage delay, trip interruption, unexpected medical expenses traveller and related emergencies.

Cancel for any reason(CFAR)

Optional benefit offered by travel insurance protects some insured trip costs for cancellation of trip due to any reason.

Rental car collision

Travel insurance for rental car if it is stolen or damaged due to collision, theft, vandalism, natural disaster, or a cause beyond your control.

US citizen annual travel insurance

US citizens and resident who are business people and working professionals travel overseas quite often and it is good to have international travel insurance.

Information about US mobile passport control and TSA pre check for US passport holders.

US expatriate insurance

Health insurance for U.S. expats is essential for providing access to quality healthcare while living abroad. Expatriates often need coverage that goes beyond what their domestic U.S. health insurance provides because most U.S.-based health insurance plans do not cover medical expenses incurred outside the United States.

Select the type of travel health insurance for visiting Guam...

travel insurance with quarantine coverage, travel insurance for quarantine coverage.

- Travel insurance for US Citizens and US Residents traveling outside USA

- Provides minimum coverage of $3,000 for potential or extended quarantine lodging expenses due to Covid19.

- Provides guaranteed travel insurance for Covid19 for medical expenses of at least USD $50,000.

- Covid-19 is covered as any other sickness

- Safe Travels Voyager plan's trip delay benefit can be upgraded.

- The base benefit is $3,000 (which is $250 per day). Traveler’s can choose $4000 ($300 per day) or $7000 ($500 per day).

- Travel insurance for American citizens and US Residents traveling outside USA

- Provides minimum coverage of $2,000 for potential or extended quarantine lodging expenses due to Covid19.

- Covid-19 is covered as any other sickness.

- Covid Quarantine Benefit: Coverage for accommodations due to a covered Trip Delay $2,000/$150 per person per day (6 hours or more) is included in the basic coverage.

- Optional Quarantine Benefit Upgrade at additional price Trip Delay Max Upgrade - including Accommodations (6 Hours or more) $4000 ($300/day) or $7000 ($500 per day)

- Travel insurance for Non US Citizens and Non US Residents traveling outside their home country

- Travel insurance for US Citizens and US Residents

- Provides minimum coverage of $1,000 for potential or extended quarantine lodging expenses due to Covid19.

- Covid19 medical expenses are covered and treated the same as any other sickness

- Offers coverage of $50,000 for emergency medical expenses

- Offers comprehensive trip cancellation coverage

- Travel medical insurance coverage outside USA

- Atlas insurance offers $50 per day for each day that travelers are quarantined abroad for a maximum of 10 days.

- Coverage must be bought for a minimum of 30 days. Proof of quarantine mandated by physician needed.

- Quarantine must be due to you testing positive for COVID-19/SARS-CoV2.

- Travel insurance for US Citizens and US Residents traveling outside US

- Trip cancellation up to $50,000

- Trip interruption up to 200% of trip cost

- $500,000 medical for sickness and injury/$1,000,000 medical transportation

- Include $2000 in travel delay benefits for quarantine/lodging.

Covid Quarantine insurance for US citizens

Despite the removal of the Covid-19 restrictions both in the US and around the globe, it is prudent for US citizens to purchase international travel insurance which will make the whole trip worry free and provide good protection for any medical or travel related expenses in case of unexpected situations.

US travelers can either buy US Covid quarantine coverage trip insurance (includes coverage for cost of the trip), or Covid quarantine travel health insurance (insures only the health of the traveler and is cheaper than trip insurance).

Travel medical insurance to emergency medical expenses

Best travel insurance, best international travel insurance for us citizens.

- Travel medical insurance for US Citizens and US Residents traveling outside USA

- Available up to 180 days

- Offers emergency sickness coverage up to $500,000

- Covid-19 covered as any other sickness

- Coverage for travelers traveling outside their home country whose destination excludes the U.S. and its territories.

- Deductible options from $0 to $2,500

- Policy Maximum from $50,000 to $2,000,000

- Renewable upto 24 continuous months

- Covers COVID-19/SARS-CoV-2 as any other Illness or Injury.

- Patriot Platinum Insurance is best suited for travelers expecting first-class medical coverage; vacationing families; individuals up to $8 million.

- Deductible options from $0 to $25,000

- Policy Maximum from $1,000,000 to $8,000,000

- USA travel medical insurance coverage outside USA for US citizens

- Available up to 365 days

- Offers maximum coverage up to $2,000,000

- Offers insurance coverage for Covid expenses

- US travel health insurance for US citizens outside USA

- Available from 5 days to 364 days

- Offers maximum coverage up to $5,000,000

- Travel Medical Choice insurance offers coverage for expenses related to COVID-19

- Short term fixed benefit cheap travel insurance USA for US citizens outside USA

- Plan maximum options available up to $130,000 for medical expenses

- Offers coverage outside the US

- Deductible options from $0 to $1,000

- Policy Maximum from $50,000 to $150,000

- Offers emergency medical evacuation coverage up to $500,000

- Offers coverage for travelling outside your home country

- It includes coverage for Covid-19 is covered as any other illness under the medical expense maximum.

- Testing for Covid-19 will only be covered if deemed medically necessary by a physician. The antibody test and prescreening test are not covered, as they are not medically necessary. Maximum age for plan eligibility is 64.

Expatriate heath insurance for living outside home country

Best expat insurance, best expatriate insurance, expat insurance plans.

- Ideal for US expatriates and for those global citizens living and working outside their home country.

- Xplorer Premier Insurance provides unlimited annual and lifetime medical maximum.

- It covers pre-existing conditions with creditable coverage

Trip cancellation insurance for trip investment expenses

Best trip cancellation insurance, best trip protection insurance, best trip cancellation insurance.

- Trip Cancellation: Up to 100% of insured trip cost

- US Residents on domestic and worldwide trips

- Travel SE Covid Quarantine Benefit : Travel SE plan offers Coverage for accommodations due to a covered Trip Delay $2,000/$125 per person per day is included in the basic coverage.

- Travel LX Covid Quarantine Benefit : Travel LX plan offers Coverage for accommodations due to a covered Trip Delay $2,500/$250 per person per day is included in the basic coverage.

- Inexpensive coverage for trip cancellation & interruption

- Travel Lite Covid Quarantine Benefit : Travel Lite plan offers Coverage for accommodations due to a covered Trip Delay $500/$125 per person per day is included in the basic coverage.

- Trip Cancellation: Up to 100% of Trip Cost Insured

- Up to 100% of Trip Cost Insured

- It covers Trip Cancellation coverage from $150 to $10,000.

- Trip Cancellation: Trip Cost: Up to a Maximum of $30,000.

- Maximum Trip Length 90 Days

- Offered by Trawick International and is highly rated.

- You can add a "Cancel for Any Reason" waiver onto the plan.

- It can cover trips up to 90 days long.

- Cancellation of policy must be purchased within 10 days of the initial trip deposit date.

- Trip Cancellation: Basic - $15,000 Max

- Trip Cancellation: Plus - $100,000 Max

- Trip Cancellation: Elite - $100,000 Max

- Trip Cancellation: 100% of trip cost up to $30,000

- Provides coverage for U.S. residents travelling outside their home country

- Trip Cancellation: 100% of trip cost up to $100,000

Trip cancellation insurance for Cancel for any reason

Cancel for any reason trip cancellation insurance, cancel for any reason plans.

- Cancel For Any Reason: 75% of non-refundable trip cost

- Trip Cancellation: Tour cost to a maximum of $100,000

- Cancel for Any Reason: Up to 75% of trip cost insured

- Trip Cancellation: Up to 100% of Trip Cost

- Cancel for Any Reason: 75% of non-refundable trip cost

- Trip Cancellation: Up to a Maximum of $50,000. ($30,000 for travellers above 80 years)

- Cancellation for Any Reason: 75% of the Insured Trip Cost within 21 days of trip deposit - some restrictions apply. Not available in NY or WA.

US seniors traveler insurance, Medicare supplement international travel insurance

Usa senior citizen travel insurance, us seniors travel insurance, travel insurance for older us travelers.

- The GlobeHopper Senior plan is available either as the GlobeHopper Single-Trip plan for single trips with coverage from 5 days to 365 days

- The GlobeHopper Multi-trip plan which covers a period of 12 months with a maximum of 30 days for each overseas trip

- It is an affordable international travel health insurance for US citizens.

- It offers coverage for medical and evacuation expenses for short trips.

- It is available up to 12 months

- It is an renewable long term international travel health insurance for US citizens.

- It offers coverage for medical and evacuation expenses.

- It is available up to 12 months.

Annual travel insurance, Yearly travel insurance

Best annual travel insurance, best yearly travel insurance, annual travel plans.

- Patriot Multi Trip is designed by IMG to cover travelers taking multiple trips in a year.

- Covers non US Citizens travelling multiple times annually outside their home country

- Trekker Essential Insurance offers maximum coverage of $50,000 for sickness and accidents.

- Available for both US and Non US citizens up to 75 years

- Maximum trip length is 30 or 45 days per trip

- Available for US residents only up to age 81 years

- Maximum trip length is 30 days per trip

- Voyager Annual (offered by USI Travel Insure) covers US citizens in and out of the US at least 100 miles away from home.

- It does not cover trip cancellation but can be used for 90 days at a time within a year and is great for frequent travelers.

- Provides coverage for Emergency Accident and Sickness, Emergency Medical Evacuation, Baggage & Personal Effects, Baggage Delay, and Accidental Death and Dismemberment.

Review and compare the best Annual insurance.

Types of US travel insurance

Single trip travel insurance.

Compare and Buy Best US Single trip travel Insurance for travel within the US and overseas

Single Trip vs MultiTrip Travel Insurance

Compare Single trip vs multi trip insurance plans offered by US insurers.

Guam health insurance for tourists - FAQ's

01. does guam travel insurance cover covid19 illness.

There are some USA Covid travel insurance plans available for travel to Guam that cover covid19 as a new illness. International travelers can Compare best Covid travel insurance plans and buy it online. These US covid travel insurance plans are available for visitors from Guam to the US, US citizens and US residents traveling abroad as well as non US travelers traveling outside their home country.

02. What is the best travel insurance for Guam?

This is a good question and American Visitor Insurance tries to answer for our customers. Given the different needs of different travelers there is not one policy that is always best for everyone.If you are a traveler with concerns about a pre-existing medical condition that cause an emergency, then you will be looking at different plans than someone without a life-threatening pre-existing condition. We endeavor to give our customer as much information as possible so they can find the Guam travel insurance plan that is best for their needs.If you want some more guidance, please feel free to contact us and our licensed agents will help you!

03. How much is travel insurance cost for Guam?

The cost for the Guam travel insurance varies depending on the age of the traveler and the duration of coverage required. The older the traveler the higher is the cost. The longer the duration of Guam travel insurance required, the greater will be the cost. Our Guam travel insurance quote comparison facility lists the travel insurance that satisfy your requirements comparing them based on price and benefit. Compare and buy buy Guam travel insurance and get free quotes online.

04. How does find the best travel insurance for USA? How to find the best international travel health insurance?

There are different factors for buying best health insurance for USA visitors. Visitors should compare fixed benefits and comprehensive visitor insurance plans. Foreign visitors to USA travel insurance customers should understand the concepts of deductibles and co-insurance and Pre-existing conditions travel health insurance. A prudent and well informed traveler will make the correct choice while buying tourist insurance in USA for his or her unique needs.

There are many international US travel health insurance plans for coverage both in the USA as well as around the world. Given the several international travel insurance options, it can be confusing to find the best health insurance for international travel. What is very useful in making this decision is to compare US visitor travel insurance available on American Visitor Insurance.

The compare US travel insurance tool allows travelers compare prices as well as coverage benefits in an objective manner. The traveler can change relevant factors like the medical maximum coverage and the deductible and coverage for pre-existing ailments or hazardous sports. After finding the best travel insurance for your needs, travelers can buy it by completing an online application and paying using a credit card. One completing the purchase the travel insurance plan is emailed to the customer.

05. Why is travel insurance for USA so expensive?

There is no denying that travel insurance to USA is unfortunately very expensive. The main reason for this is simply because the cost of healthcare in the USA is very expensive and the travel insurance USA costs are directly related to the healthcare costs. One more factor for some USA travel insurance plans to be very expensive is that there are specially designed travel insurance for USA plans available for older travelers, with higher medical coverage as well as some plans with coverage for pre-existing ailments.

06. What are the factors to consider for travel health insurance to USA?

The best travel insurance for USA depends these factors:

- The coverage for accident and sickness related medical expenses

- The coverage for medical and evacuation expenses

- The coverage for pre-existing conditions

- The deductible and co-payment options

- The network of hospitals and providers

- The customer service and claim process

Guam - General Information

Guam is an unincorporated territory of the United States located in the western Pacific Ocean. Guam is situated in the western Pacific Ocean and is the largest and southernmost of the Mariana Islands. It is located approximately 3,800 miles (6,100 kilometers) west of Hawaii and about 1,500 miles (2,400 kilometers) east of the Philippines. The capital city of Guam is Hagåtña, also known as Agana. It is located on the western shore of the island. The official languages of Guam are English and Chamorro. English is widely spoken, and it serves as the primary language for government, commerce, and education. The economy of Guam is heavily reliant on tourism, with visitors primarily coming from Japan, South Korea, and the United States. Other significant sectors include military bases and related activities, construction, and government services. Agriculture, particularly the cultivation of tropical fruits and vegetables, also contributes to the economy.

Western Pacific

United States dollar (USD)

English, Chamorro

Mid January

Around 162 thousand

agåtña, Tamuning, Talofofo, Umatac, Dededo, Inarajan, Merizo, Piti.

Popular tourist destinations in Guam

Talofofo Beach

This rock beach lies adjacent to the Talofofo River bridge. The contrast of the black exposed ancient coral against the white sand, lush green palms, and the sea green lit.

Ritidian Point

Located at the northernmost tip of Guam, Ritidian Point’s almost-white sand beaches and crystal clear waters are just the beginning of what there is to explore.

National Marine Sanctuary

Although the top deck of the Fish Eye Marine Park affords spectacular views of the ocean and Gaum’s mountain ranges in the distance, the real show is below sea level.

Pacific War Museum

Pacific War Museum is on the Marines, particularly in World War II, in which the United States battled Japan for control of the island.

Travel insurance Guam, Best travel health insurance Guam

Travel insurance Guam resources

International travel insurance resources for Guam visa holders.

Factors for travel insurance Guam online

Important factors while deciding on the best travel insurance to Guam.

Types of Guam travel insurance online

Different types of Guam visa travel insurance options.

Guam travel insurance claims procedure

Guam travel insurance claims process for medical care.

What is the best travel insurance from Guam to USA?

1. Atlas America offered by WorldTrips is considered one of the best travel insurance options offers coverage up to $2,000,000. This plan offers coverage for Hospitalization, Prescription drugs, Trip cancellation, Trip Interruption, covid19,Travel delay and Evacuation and much more!. This also offers coverage for acute onset of pre-existing conditions up to 79 years.

2. Patriot America Plus Insurance is another best travel insurance for visiting the USA offers coverage up to $1,000,000. It offers comprehensive medical insurance for non US citizens traveling individually or in groups to the USA. This also offers optional riders provide additional coverage for a minimal charge. This also offers coverage for acute onset of pre-existing conditions up to 70 years.

3. Visitor Secure insurance is fixed benefits plan and an affordable scheduled benefit plan for visitors to USA. It offers coverage up to chosen plan maximum for acute onset of pre-existing conditions up to 70 years. This plan covers Inpatient and Outpatient treatment facilities and price varies between the types of plans.

4. Safe Travels USA Comprehensive offers excellent medical coverage for Non-US Citizens and Non-US Residents while visiting the USA. This includes coverage for acute onset of pre-existing conditions, well doctor visit, emergency medical evacuation, repatriation and security evacuation benefits. This plan offers coverage up to $1,000,000.

5. Safe Travels USA is a cheap travel medical insurance plan that covers Non-US Citizens and Non-US Residents while visiting the USA. It offers comprehensive US Covid19 insurance coverage for illness and accident and offer a Well Doctor Visit which pays up to $125.Coevrs Unexpected Recurrence of a pre-existing conditions. This plan offers coverage up to $1,000,000.

6. Travel Medical Insurance from seven corners offers coverage for non-U.S. Residents and non-U.S. Citizens while traveling outside of your Home Country. This comprehensive insurance starts from $50,000 and provides up to $5,000,000. For people above age 80 years, they get a policy maximum of $10,000. This offers acute onset of pre-existing conditions up to 79 years and Adventure Activities up to medical maximum.

Guam - Where America's Day Begins

Thanks to its warm tropical climate, crystal clear waters, excellent hotels, great tax-free shopping and several leisure activities, Guam is a major tourist destination attracting over 1.5 million tourists annually. While the Japanese are the largest source of tourists, there has been also been a steady influx of Chinese, South Koreans and Russian tourists too. Holidaying in Guam is great fun, however healthcare like anywhere in the US is expensive. International tourists and even US travelers should make sure that they have good Guam travel medical insurance fortrip to Guam.

Japanese tourists in Guam and the need for US travel insurance

Thanks to its excellent weather, clear blue waters, high class hotels, excellent shopping facilities, Guam is a popular tourist destination for Japanese tourists. It also has the advantage of being only a Four hour flight from Japan. With the advantage of their location as well as their historic ties with Guam, the Japanese are the largest group of inbound tourists to Guam, significantly more than American tourists from mainland USA. However Japanese tourists should take care to buy good US travel health insurance in Guam.

Best travel insurance for cruises

Going on a cruise vacation is truly exciting, however one must take suitable action to ensure that the cruise vacation is not a disappointment. Vacationers are likely to book for the cruise well in advance of the actual travel dates, and it is possible that one is not able to make the cruise as planned.

Best Cruise trip insurance ensures that vacationers can vacation investment should there be a disruption and one cannot make the cruise. Most cruises offers Cruise protection, but that is not the same as trip insurance for cruises.

A cruise protection usually gives vouchers for the traveler if they miss the cruise, but getting money back is not the norm, which is what trip insurance for cruises offer. Vacationers can shield themselves best by purchasing the Cancel for any reason travel insurance benefit. This gives the flexibility of cancellation the cruise vacation for any reason, and the traveler can get reimbursed up to 75% of the non-refundable trip expenses. The cruise insurance protection offered by cruise lines provides very little benefits given their cost, this is particularly important for Seniors cruise vacationers who are most vulnerable and likely to need the benefits offered by the best cruise travel insurance plans. Get Quotes »

Cruise travel insurance for US citizen

Cruise travel insurance for pre-existing coverage.

Contact our customer service team, we are here to help you!

Travel insurance for international tourists visiting Guam

Trip cancellation insurance related emergencies while in Amsterdam.

Travel medical insurance

Travel medical insurance for Guam to cover accident and medical expenses.

Expatriate insurance

The plans offer comprehensive major medical coverage in all countries.

Group insurance

Group travel insurance for Guam for five or more travelers on same itinerary.

US citizens travelling to Guam

Traveling on a hard earned vacation can be expensive. Planning the details of a vacation, booking the airline, cruise and hotel tickets involve both time and money. Ensure that your well deserved vacation or even your business travel is not wrecked by unforeseen adverse circumstances by purchasing proper travel insurance.

Short term insurance

For short term travel vacations ranging from a few weeks to few months (less than a year). This covers all catastrophic health care expenses, but does not include coverage for preventive care and has limited cover for pre-existing conditions.

Long term insurance

Ideal for expats working overseas and for US pensioners living outside the US. These plans offers comprehensive coverage for preventive-care, pre-existing conditions, mental health, dental and vision benefits.

Confused whether to buy trip, travel or global health insurance? Understand the differences!

International travel Insurance for Guam residents

Select the best health insurance for visitors to usa..., covid travel health insurance for usa, coronavirus health insurance for foreigners in usa.

Most countries have opened their borders now for international tourism. Unfortunately, even years after the pandemic started in China, Covid is again making a comeback with new immune-evasive variants.

The Covid situation is made even more complicated with influenza and the respiratory syncytial virus (RSV) which is also spreading across the globe. Though there is a risk with the new variants, authorities have relaxed their strict controls thanks to improved vaccination coverage.

However, while Covid appears to be less virulent and no longer as dangerous thanks to a large percentage of the population having vaccinations and booster shots, Covid

Budget travel insurance with covid19 coverage for visiting USA

Trawick international travel insurance.

Trawick International offers visitor medical insurance for coronavirus with their Safe Travels USA Insurance . The Safe Travels USA Comprehensive plan is ideal for travelers with pre-existing medical conditions even for travelers older than 70 years. You can compare Safe Travels USA Covid19 travel insurance plans and buy it online to get coverage as early as the following day. After buying the Trawick travel insurance, travelers can download a visa letter which indicates that Safe travels USA visitors insurance covers covid19 illness.

- Safe Travels USA

- Compare and Buy Safe Travels USA insurance

- Safe Travels USA comprehensive

- Compare and Buy Safe Travels USA cost saver insurance

- Safe Travels Elite

- Compare and Buy Safe Travels Elite insurance

Seven Corners visitors medical insurance

International medical group (img) coronavirus insurance.

International Medical Group (IMG) travel insurance offers coronavirus insurance for USA. IMG's Patriot America Plus , Patriot Platinum insurance , Visitors Protect insurance and Visitors Care insurance plans cover COVID-19 like any other illness. The Patriot America Plus Insurance and Patriot America Platinum insurance include COVID coverage up to the policy maximum.

- Patriot America Plus insurance

- Compare and Buy Patriot America Plus insurance

- Visitors Protect insurance

- Compare and Buy Visitors Protect insurance

- Visitors Care insurance

- Compare and Buy Visitors Care insurance

- Patriot America Platinum insurance

- Compare and Buy Patriot America Platinum insurance

INF travel insurance

INF travel insurance offers coverage for coronavirus as any other new sickness. It is available for Non-US citizens or residents travelling to the US. INF Premier and INF Elite plans covers pre-existing complications from COVID-19.

- INF Premier insurance

- Compare and Buy INF Premier insurance

- INF Elite insurance

- Compare and Buy INF Elite insurance

- INF Elite 90 insurance

- Compare and Buy INF Elite 90 insurance

- INF Elite Plus insurance

- Compare and Buy INF Elite Plus insurance

- INF Traveler USA 90 insurance

- Compare and Buy INF Traveler USA 90 insurance

- INF Standard insurance

- Compare and Buy INF Standard insurance

- INF Traveler USA insurance

- Compare and Buy INF Traveler USA insurance

Global Underwriters US visitor insurance

Diplomat America visitors insurance by Global Underwriters offers coverage for covid-19 as a new sickness. It is available for Non-US citizens or residents travelling to the US. Diplomat Long term Covid19 medical insurance must be bought for a minimum of 3 months and has a plan maximum options of $500,000 and $1,000,000 for medical expenses. You can compare Diplomat insurance for visitors to USA.

- Diplomat America

- Compare and Buy Diplomat America insurance

- Diplomat LongTerm

- Compare and Buy Diplomat LongTerm insurance

WorldTrips insurance

Atlas travel insurance coverage will cover eligible medical expenses resulting from COVID-19/SARS-CoV-2.

- Atlas America

- Compare and Buy Atlas America insurance

- Atlas Premium

- Compare and Buy Atlas Premium insurance

- Atlas Essential

- Compare and Buy Atlas Essential insurance

- Atlas Multitrip

- Compare and Buy Atlas Multitrip insurance

Travel Insurance Services travel insurance

- If you are traveling to the US : Visit USA coronavirus insurance offers coverage for COVID-19 as a covered medical expense.

- Compare and Buy Visit USA insurance

Best health insurance for visitors to USA, Best travel insurance for USA

- Patriot America Plus Covid insurance offers coverage for coronavirus illness.

- Covers acute onset of pre-existing conditions till maximum limit (up to 70 years).

- Available for US citizens visiting USA

- Visitors Protect Covid insurance offers coverage for coronavirus illness.

- This plan covers pre existing conditions for age 69 and below up to $25,000 and for ages 70 and above it covers up to $20,000 with deductible up to $1,500.

- Atlas America Covid insurance offers coverage for coronavirus illness.

- Covers acute onset of pre-existing conditions till maximum limit (up to 79 years).

- Diplomat America Covid insurance offers coverage for coronavirus sickness

- Covers acute onset of pre-existing conditions up to policy maximum for age up to 69 years.

- It offers coverage for visitors up to 89 years.

- Covers Covid insurance offers coverage for coronavirus sickness

- Covers treatment of acute onset of pre-existing conditions (up to 79 years)

- INF Elite Covid19 insurance offers coverage for coronavirus.

- Treats Coronavirus/covid19 as a new sickness & covered by the plan

- Best comprehensive plan that covers all pre-existing conditions up to 99 years.

- Comprehensive plan with full pre existing condition coverage which is unique.

- Covers 90% of eligible medical expenses.

- There is a minimum purchase of 90 days required to buy this plan

- Covers Preventive & maintenance care and coverage for full body physicals.

- Coverage for TDAP, Flu, etc Vaccines

- INF Traveler USA 90 covers 90% of elgibile medical expenses

- Minimum purchase of 30 days is required for this plan.

- This is a comprehensive plan too but does not cover pre existing condition

- INF Traveler USA Covid insurance offers coverage for coronavirus illness.

- This plan is available for Non-US Citizens. Anyone visiting USA, Canada and Mexico can enroll in this plan.

- Optional pre-existing conditions rider offers coverage for Stroke or Myocardial Infarction (heart attack) for travelers of any age.

- Plan can be renewed up to 2 year.

- Offers coverage for acute onset of pre-existing conditions up to 79 years.

- Renewable up to 364 days

- It offers coverage for acute onset of pre-existing conditions up to 70 years.

- Plan can be renewed up to 364 days.

- Safe Travels Elite Covid insurance covers coronavirus illness.

- Covers acute onset of pre-existing conditions up to 89 years.

- This plan is not available to any individual who has been residing within the United States for more than 365 days prior to their Effective Date

- INF Premier Covid insurance covers coronavirus illness.

- Covers all pre-existing conditions, this means doctors, appointments, blood tests & labs, specialist care, urgent care visits, & hospital stays are all covered for pre-existing conditions.

- INF Standard Covid insurance covers Coronavirus illness.

- This is a fixed plan and is available for both US and Non US citizens visiting the US.

Best travel insurance for pre-existing conditions, Best Visitors insurance with pre-existing conditions coverage

- Covers acute onset of pre-existing conditions up to chosen maximum limit (aged up to 70 years).

- The plan is available for individuals traveling outside their country of residence and traveling to the US, Mexico, or Canada.

- Covers acute onset of pre-existing conditions up to chosen maximum limit (aged up to 79 years).

- Covers Acute Onset of a Pre-Existing Condition: Up to 69 years the limit is up to the Medical Maximum purchased per Period of Coverage. For any coverage related to cardiac disease, coverage is limited to $25,000 up to age 69 years, with a $25,000 Maximum Lifetime Limit for Emergency Medical Evacuation. Any repeat recurrence within the same policy period will no longer be considered Acute Onset of a Pre-Existing Condition and will not be eligible for additional coverage.

- Covers Up to $1,000 for sudden, unexpected recurrence of a Pre-existing Condition

- Safe travel USA Covid insurance offers coverage for coronavirus.

- Covers unexpected recurrence of a pre-existing medical conditions up to $1000

- Eligible for foreign residents visiting USA and worldwide

- Travel Medical Choice Covid insurance offers coverage for coronavirus sickness

- Covers expenses for treatment of acute onset of pre-existing conditions

- Acute onset of pre-exisitng conditions are available for Worldwide including US - $50,000 up to 65 years; $5,000 for 65 to 79 years and Worldwide excluding US - $50,000 up to 65 years; $10,000 for 65 to 79 years.

- The policy maximum for this comprehensive insurance starts from $50,000 and provides up to $5,000,000. For people above age 80 years, they get a policy maximum of $10,000

- Acute onset of pre-exisitng conditions are available for Worldwide including US - $5,000 up to 65 years; $2,500 for 65 to 79 years and Worldwide excluding US - $25,000 up to 65 years; $5,000 for 65 to 79 years.

- This is a comprehensive plan with excellent coverage.

- Elite plan with policy maximum $150,000 covers pre-existing condition coverage up to $25,000 maximum with deductible $1,500 for age 0 to 69 years.

- Policy maximum $75,000 covers pre-existing condition coverage up to $20,000 maximum with deductible $1,500 for age 70 to 99 years.

- This plan need to be purchased for a minimum of 3 months.

- This is a comprehensive plan with full pre existing condition coverage which is unique.

- Pre-existing complications from covid-19 covered

- Elite 90 plan with policy maximum $150,000 covers pre-existing condition coverage up to $25,000 maximum with deductible $1,500 for age 0 to 69 years $1,500 for age 0 to 69 years.

- Covers accident & sickness while traveling to USA, Canada, and Mexico and covers 90% of eligible medical expenses

- Elite Plus plan with policy maximum $150,000 covers pre-existing condition coverage up to $25,000 maximum with deductible $1,500 for age 0 to 69 years $1,500 for age 0 to 69 years.

- Policy maximum $75,000 covers pre-existing condition coverage up to $20,000 maximum with deductible $1,500 for age 70 to 99 years. Coverage for TDAP, Flu, etc Vaccines.

- Visit USA Insurance is an excellent medical insurance for tourists and holiday travelers, parents of students studying in the United States, new immigrants and visiting scholars in the USA.

- Visit USA offers 3 plans to satify your requirements and budget.

Senior Citizen travel insurance for above 60 years

- The best travel health insurance for 60 year old travelling to the US is Atlas America .

- With the best travel insurance plans for people under 70 years, you get covered up to policy maximum for acute onset of pre-existing conditions for people up to age 79.

- Atlas Premium is another version of this plan with higher coverage available for some of the benefits as compared to Atlas America.

- You can compare Atlas Travel insurance plans .

- Travel Medical Basic offers coverage up to $5,000 for acute onset of pre-existing condition in including USA and $25,000 for exclusing USA till 65 years.

- Travel Medical Choice Travelers must be at least 14 days old and under 75 years to be covered by this plan.

- You may buy coverage for yourself, your legal spouse, domestic partner, or civil partner, your unmarried children under the age of 19, and your traveling companions.

- The Inbound plans ( Travel Medical USA Visitor Basic , Travel Medical USA Visitor Choice ) cover acute onset of pre-existing conditions for people up to age 79 years.

- Patriot America Plus Plan offer coverage upto choosen plan maximum for travelers under 70 years. This is a comprehensive plan from IMG and is is similar to the Patriot America with the unique difference in the benefit that covers acute onset of pre existing conditions up to the age of 70

- Visitors Protect plan offer maximum limits from $50,000 to $250,000.

- Covers medical evacuation, emergency reunion, repatriation of remains, Accidental Death & Dismemberment, etc.

- Patriot Platinum Plan covers acute onset of pre existing condition up to the age of 70 for up to $1,000,000. $25,000 maximum limit for medical evacuation.

- This is a comprehensive plan and is the plan with excellent coverage.

- This plan covers all pre existing conditions including blood tess, doctor appointments, specialist care...for US and NON US citizens coming to the US, which is unheard of, when it comes to visitor insurance plans.

- This plan provides a maximum of $25,000 for pre existing conditions up to age 69 subjected to a deductible of $1,500.

- Pre-Existing complications from Covid-19 covered.

- This is a comprehensive plan with full pre existing condition coverage which is unique. This includes doctor appointments, blood tests and lab, specialist care, urgent care visits and hospital stays are covered for pre existing condition

- Covid-19 medically necessary testing & treatment covered 100% as any other new sickness with no cost sharing.

- Covers 90% of elgibile medical expenses

- This plan covers eligible accident & sickness (excluding pre-existing conditions) while traveling to USA, Canada, and Mexico

- Minimum purchase of 30 days is required for this plan

- This is a comprehensive plan too but does not cover pre existing condition.

- This is another comprehensive plan from INF.

- This plan differs from the other INF comprehensive plans where it does not cover pre existing conditions.

Older traveler medical insurance for above 70 years

- Safe Travels USA Comprehensive is a very popular option for coverage of acute onset of pre-existing condition for people above 70.

- Seniors travel insurance plan provides a coverage of $25,000 for acute onset of pre- existing condition and for heart related diseases a maximum of $15,000 upon attaining age 70.

- For the age of 65 and above this plan however provides a policy maximum of $50,000 only.

- Atlas America plans from WorldTrips have upgraded their benefits for acute onset of pre-existing conditions up to age 80.

- There is also a higher policy maximum option available for people above 70 up to the age of 79.

- Atlas Premium plans from WorldTrips have upgraded their benefits for acute onset of pre-existing conditions up to age 80.

- The highest maximum that can be purchased for a comprehensive plan is Patriot Platinum which offers pre-existing condition coverage up to $2,500 for any condition.

- In the $50,000 range there are many fixed benefit and comprehensive plan options available

- Travelers must be at least 14 days old and under 99 years to be covered by this plan.

- Offers coverage from 90 days to 12 months.

- This plan covers pre existing conditions for ages 70 and above it covers up to $20,000 with deductible up to $1,500.

- Visitors Care which offer limited coverage of $2,500. Visitors care insurance offers coverage for acute onset of pre-existing conditions with sublimits up to chosen plan maximum.

- INF Elite plan This plan provides a maximum of $20,000 for people over 70 up to the age of 99 for coverage of pre existing conditions.

- This plan is definitely the most suitable for people with pre existing condition as it is the full pre existing coverage plan.

- INF Elite 90 plan This plan provides a maximum of $20,000 for people over 70 up to the age of 99 for coverage of pre existing conditions.

- Pre-existing complications from covid-19 covered.

- Coverage for TDAP, Flu, etc Vaccines.

- INF Elite Plus plan This plan provides a maximum of $20,000 for people over 70 up to the age of 99 for coverage of pre existing conditions.

- INF Traveler USA 90 This plan provides a policy maximum of $75,000 for people over 70 up to the age of 99.

- This plan does not cover pre existing conditions including acute onset of pre existing conditions.

- Covers 90% of elgibile medical expenses and minimum purchase of 30 days is required for this plan.

- INF Traveler USA plan This plan provides a policy maximum of $75,000 for people over 70 up to the age of 99.

Senior Citizen travel insurance for above 80 years

- Travel Medical USA Visitor Basic insurance and Travel Medical USA Visitor Choice insurance with a higher deductible and up to $100,000 maximum.

- Inbound Choice Insurance is meant for immigrants to the US with or without green cards renewable up to 3 years, it is also available for any legal visitors to our lovely country.

- Senior Travelers above 90 years are also eligible to buy the Travel Medical USA Visitor Basic and Travel Medical USA Visitor Choice insurance.

- The Safe Travels USA Comprehensive is also very useful for this age group as it provides a policy maximum of $50,000 and provides coverage for acute onset of pre-existing conditions for $25,000 and $15,000 for heart related pre-existing condition.

- Non-US citizens and Non-US residents traveling outside their home country but not to the United States. This includes emergency medical evacuation, repatriation and security evacuation benefits.

- It is ideal for foreign residents visiting USA and then other countries worldwide. Travelers on transit visa in US can also purchase this plan.

- This Policy provides coverage to non-US citizens who reside outside the USA and are traveling outside of their Home Country to visit solely the United States, or to visit a combination of the United States and other countries worldwide.

- This Policy is not available to green card holders in the USA. This Policy is not available to anyone age 90 or above.

- Available for individuals traveling outside their country of residence and traveling to the US, Mexico, or Canada.

- It is available for travelers of ages 14 days to 99 years.

- This plan is available for people traveling to the USA and are not US Citizens, US Residents or Greencard Holders.

- It is available for travelers of ages 70 to 89 years

- INF Traveler USA plan plan provides a policy maximum of $75,000 for people over 70 up to the age of 99.

- This fixed plan from INF provides full pre existing condition coverage which includes doctor appointments, blood tests, specialty care, urgent care visits and hospital stays.

- For age 70 to 99 years for policy maximum $100,000 covers pre-existing condition maximum of $15,000/$25,000 with deductible $1,000/$5,000.

USA visa health insurance, Visitor visa health insurance USA

USA B1 visa health Insurance, B1 visa travel insurance for tourists.

B2 visa health insurance for tourists, B2 visa tourist insurance for USA.

F2 visa medical insurance for F1 visa dependents, F2 visa health insurance.

F1 visa student health insurance, International student insurance in USA.

J1 visa insurance for exchange scholars, J1 visa medical insurance.

Health insurance for green card holders, Green card health insurance.

Fiancée health insurance, K1 visa health insurance for fiancé on K1 visa.

H1B visa health insurance, Travel health insurance for H1B visa holders.

Travel insurance for tourists in USA, tourist insurance USA.

H4 visa health insurance, Health insurance H4 visa holders.

Travel tips for international travelers – safety, comfort and wellness.

Domestic travel insurance for your trip in the USA

Irrespective of whether you are traveling within the country or overseas, US citizens should have good travel insurance coverage. US citizens traveling within the USA can buy domestic travel insurance if they are traveling 100 miles from their primary residence. This travel insurance for domestic vacations is ideal whether within the state or as out of state travel health insurance.

Travel insurance has become extremely useful given the current pandemic and resultant disruptions in the travel industry. Delayed flights due to last minute cancellation of flights, hurricane or inclement weather causing delays in flights or missing flights due to crowded airports and delayed security checks, loss of baggage or baggage delays are common.

The financial loss due to these situations can be significant, especially if it involves an expensive planned vacation with airline tickets, hotel bookings or cruise booking. There are other situations beyond the control of traveler and the traveler is forced to change his or her travel plans. This can be due to the health of the traveler or that of an immediate family member or other work related conditions. These situations are also covered by Travel insurance with the cancel for any reason coverage benefit.

Along with disruption to travel plans, there is also the health of the traveler during the journey itself. An accident or an unanticipated health emergency while traveling will be covered by travel insurance even if one has regular health insurance. The best domestic travel insurance USA can be the secondary insurance and in some instances be the primary insurance and ensure that the travelers expenses is minimised.

How much does travel insurance for your trip in the USA cost?

Estimate cost table for the trip insurance within the usa, international medical group (img), travel lite, trawick international, safe travels voyager, safe travels explorer, safe travels journey, safe travels first class, safe travels single trip, hth worldwide, trip protector economy, trip protector preferred, trip protector classic, seven corners, trip protection basic, trip protection elite, trip protection economy, trip protection choice, factors that determine the cost of us travel insurance plans.

The cost of travel insurance is directly proportional to the age of the traveler. The older the traveler and greater will be the cost of the visitors health insurance.

Comprehensive travel insurance provides exhaustive coverage but is more expensive than fixed benefit insurance which has a specified limit for each treatment.

The price of visitors insurance is directly dependent on the maximum medical coverage and inversely proportional to the deductible of the plan chosen.

Travel insurance depends on the coverage region. The cost for visitor insurance for the United States is most expensive when compared to Europe or Asia.

The cost of travel insurance directly depends on the length of travel. The longer the duration of visitor medical insurance required, the higher will be the cost.

Additional add-on benefits to the basic travel insurance plan like adventure sports coverage, coverage for pre-existing conditions… will add to the overall cost.

Steps to buy US visitor travel insurance online

Step 1: finding all available us travel insurance plans.

Complete the travel insurance quote request form by providing details of the traveler & insurance requirements.

Step 2: Compare different travel health insurance options

Compare the price and the benefits of the different travel insurance options to identify what fits your needs best.

Step 3: Buy the travel insurance you like best and review documents

Buy the plan that fits your requirements and budget best by using a credit card and completing the online application.

Step 4: Review the visitors insurance documents & download visa letter is required

Review the visitors insurance documents & download visa letter is required.

Different types of US Visitors travel insurance

Fixed benefit travel insurance, comprehensive travel insurance.

Comprehensive travel insurance plans provide exhaustive coverage for health expenses up to the policy medical maximum amount. In contrast to fixed benefit plans there are no limits for each benefit. Comprehensive insurance is more expensive when compared to fixed benefit plans but provides significantly better coverage in case of a medical emergency or hospitalisation.

Insurance for travelers from Guam visiting USA

Senior citizens.

US Senior Citizens and pensioners above 65 years require comprehensive health insurance coverage while outside USA as Medicare doesn't offer full coverage outside US national borders.

Annual multi-trip insurance

These plans are ideal for regular international travelers who make many overseas trips annually. The annual multi-trip plans provide coverage for a whole year.

Why American visitor insurance?

- Best temporary usa visitors insurance options

- New US immigrant insurance plans available

- Best Schengen visa insurance plans

- Travel insurance vs trip cancellation insurance options

- International student health insurance plans

- Resourceful compare travel insurance usa tool

- Customer support and claims settled in the USA

- Wide range of international travel medical insurance plans

- 24/7 licensed visitors travel insurance agent support

- Guaranteed cheapest travel medical insurance price

- Provide travel health insurance support during any crisis

- Relevant travel insurance USA blogs, articles and FAQ's

- Detailed reviews of usa travel insurance plans

New US Immigrant health insurance

The Trump administration had introduced rules making it mandatory for prospective new US immigrants to show proof of adequate US health insurance while applying for the immigrant visa. The aim of this mandatory US health insurance for immigrants is to reduce the burden on the US hospitals, the overall US health care system and finally on US tax payers by uninsured new immigrants.

At American Visitor insurance we offer immigrant health insurance plans which work well for prospective new US immigrants. After buying this immigrant medical insurance, customers will immediately receive the health insurance policy document by email. Customers can use this immigrant insurance document as proof of US health insurance while applying for the Immigrant visa. Given this rule as well as the very high cost of healthcare in the US, it is strongly recommended to buy medical insurance for new US immigrants.

New US immigrant insurance blogs

Us immigrant health insurance plans.

Compare popular US immigrant plans suitable for immigrants regardless whether permanently in the US or traveling out or waiting for Green Cards

Difference between visitors and immigrant Insurance

Find out the difference between US visitors insurance and new immigrant insurance. Compare and buy the best immigrant insurance for USA!

US Health insurance mandatory for new US immigrants

The US government has made it compulsory for new immigrants coming to the US to have proper US immigrant health insurance coverage.

Covid travel insurance requirements for Guam residents traveling to the Philippines

The Philippines Inter-Agency Task Force for the Management of Emerging Infectious Diseases (IATF) has made these requirements compulsory for visitors from non-visa required countries for travel to the Philippines:

- Philippines travel insurance with coverage for Covid19 treatment with a minimum of $35,000 USD (approx P1.75 million) for the entire stay in the Philippines.

- A negative RT-PCR Covid test taken 48 hours before the departure from the country of origin.

- Valid return ticket to port of origin or next port of destination no longer than 30 days after arrival in the Philippines.

- A valid passport with validity of at least six months from the time of arrival in the Philippines.

Insurance for Guam residents visiting the USA

Senior citizens.

Senior citizens traveling overseas.

Pre-existing Coverage

Coverage for Pre-existing diseases or ailments.

Student Insurance

Guam students studying overseas.

Travel medical insurance Guam, Travel insurance to Guam from USA links

Travel insurance for guam faq.

FAQs about travel insurance for Guam.

Guam Travel Insurance Blog

Blog about travel health insurance Guam.

Travel Insurance to Guam Forum

Customer Queries for USA travelers to Guam.

Travel Insurance Claims in Guam

Claims about the travel insurance to Guam.

US medical insurance for visitors to global destinations

Us health insurance for travelers to usa.

- International travel insurance for USA

- US citizens residing outside US and visiting the US.

- USA Green Card holders travel insurance who travel overseas often

- New US immigrant insurance

- International USA travel health insurance for tourists visiting the USA

- Annual travel insurance for US business travelers

- Expatriate health insurance for expats working and living in the United States

- US non-immigrant work visa health insurance for H1B visa holders and H4 visa holders

- US international student health insurance for foreign students in USA (F1 visa / F2 visa holders)

- J visa insurance for US Exchange scholars and their dependents (J1 visa insurance and J2 visa insurance)

- Snowbird travel insurance for USA travelers from Canada and the UK (for warmer USA weather during winter)

US health insurance for tourists to Canada

- International travel insurance for Canada

- International travel insurance for tourists visiting Canada

- Annual travel insurance for US corporate travelers

- US international student health insurance

- Expatriate travel health insurance Expat insurance for US and other expatriates in Canada

US health insurance for travelers to Europe

- International travel insurance for Europe

- Schengen visa travel insurance as required by Schengen consulates

- Travel insurance coverage to insure trip expenses

- Long stay visa travel health insurance for Europe

- Expat insurance for US and other international expatriates in Europe

US health insurance for tourists to the Caribbean

- Travel insurance - Caribbean , Asia , Australia , Africa and South America

- International travel insurance for US tourists and vacationers

- US international student health insurance for US students abroad

- Annual travel insurance for business and corporate travelers

- US Expatriate insurance for expatriates living and working outside their home country

Find the best US visitor insurance coverage - Blogs and Articles

Affordable travel insurance online.

Fixed benefit or scheduled benefit plans are the most affordable international travel insurance plans.

Best international travel insurance

International travel insurance plans covering pre-existing conditions which many older travelers look for.

Compare US travel insurance online

Compare quotes online for best travel insurance online, Fixed vs comprehensive travel insurance USA.

Advantages of buying travel insurance online

Compare and buy the best travel medical insurance plans online.

Buy cheap travel insurance

There are many cheap international insurance plans also known as visitor insurance plans.

Coinsurance & Deductible - How visitor travel insurance works.

Best International travel insurance Cost

Travel insurance - pre-existing conditions coverage, international travel insurance resources, us visitors insurance providers.

You can find reliable US insurance providers like International Medical Group(IMG), Seven Corners, WorldTrips, Global Underwriters, Travel Insure, GeoBlue, HTH Worldwide and INF insurance.

More tourist medical insurance usa categories

Compare Visitors insurance USA

USA New immigrant Insurance

US visa health insurance

Senior Citizen travel insurance

Pre-existing visitors insurance

J1 Visa health insurance

International student Insurance

Green Card medical insurance

International Medical Insurance

Cruises Travel Insurance

- Call: (877)-340-7910

You are using an outdated browser. Upgrade your browser today or install Google Chrome Frame to better experience this site.

Guam (U.S.) Traveler View

Travel health notices, vaccines and medicines, non-vaccine-preventable diseases, stay healthy and safe.

- Packing List

After Your Trip

There are no notices currently in effect for Guam (U.S.).

⇧ Top

Check the vaccines and medicines list and visit your doctor at least a month before your trip to get vaccines or medicines you may need. If you or your doctor need help finding a location that provides certain vaccines or medicines, visit the Find a Clinic page.

Routine vaccines

Recommendations.

Make sure you are up-to-date on all routine vaccines before every trip. Some of these vaccines include

- Chickenpox (Varicella)

- Diphtheria-Tetanus-Pertussis

- Flu (influenza)

- Measles-Mumps-Rubella (MMR)

Immunization schedules

All eligible travelers should be up to date with their COVID-19 vaccines. Please see Your COVID-19 Vaccination for more information.

COVID-19 vaccine

Hepatitis A

Recommended for unvaccinated travelers one year old or older going to Guam.

Infants 6 to 11 months old should also be vaccinated against Hepatitis A. The dose does not count toward the routine 2-dose series.

Travelers allergic to a vaccine component or who are younger than 6 months should receive a single dose of immune globulin, which provides effective protection for up to 2 months depending on dosage given.

Unvaccinated travelers who are over 40 years old, immunocompromised, or have chronic medical conditions planning to depart to a risk area in less than 2 weeks should get the initial dose of vaccine and at the same appointment receive immune globulin.

Hepatitis A - CDC Yellow Book

Dosing info - Hep A

Hepatitis B

Recommended for unvaccinated travelers of all ages traveling to Guam.

Hepatitis B - CDC Yellow Book

Dosing info - Hep B

Cases of measles are on the rise worldwide. Travelers are at risk of measles if they have not been fully vaccinated at least two weeks prior to departure, or have not had measles in the past, and travel internationally to areas where measles is spreading.

All international travelers should be fully vaccinated against measles with the measles-mumps-rubella (MMR) vaccine, including an early dose for infants 6–11 months, according to CDC’s measles vaccination recommendations for international travel .

Measles (Rubeola) - CDC Yellow Book

Guam is free of dog rabies. However, rabies may still be present in wildlife species, particularly bats. CDC recommends rabies vaccination before travel only for people working directly with wildlife. These people may include veterinarians, animal handlers, field biologists, or laboratory workers working with specimens from mammalian species.

Rabies - CDC Yellow Book

Recommended for most travelers, especially those staying with friends or relatives or visiting smaller cities or rural areas.

Typhoid - CDC Yellow Book

Dosing info - Typhoid

Avoid contaminated water

Leptospirosis

How most people get sick (most common modes of transmission)

- Touching urine or other body fluids from an animal infected with leptospirosis

- Swimming or wading in urine-contaminated fresh water, or contact with urine-contaminated mud

- Drinking water or eating food contaminated with animal urine

- Avoid contaminated water and soil

Clinical Guidance

Avoid bug bites.

- Mosquito bite

- Avoid Bug Bites

Airborne & droplet

- Breathing in air or accidentally eating food contaminated with the urine, droppings, or saliva of infected rodents

- Bite from an infected rodent

- Less commonly, being around someone sick with hantavirus (only occurs with Andes virus)

- Avoid rodents and areas where they live

- Avoid sick people

Tuberculosis (TB)

- Breathe in TB bacteria that is in the air from an infected and contagious person coughing, speaking, or singing.

Learn actions you can take to stay healthy and safe on your trip. Vaccines cannot protect you from many diseases in Guam, so your behaviors are important.

Eat and drink safely

Food and water standards around the world vary based on the destination. Standards may also differ within a country and risk may change depending on activity type (e.g., hiking versus business trip). You can learn more about safe food and drink choices when traveling by accessing the resources below.

- Choose Safe Food and Drinks When Traveling

- Water Treatment Options When Hiking, Camping or Traveling

- Global Water, Sanitation and Hygiene | Healthy Water

- Avoid Contaminated Water During Travel

You can also visit the Department of State Country Information Pages for additional information about food and water safety.

Prevent bug bites

Bugs (like mosquitoes, ticks, and fleas) can spread a number of diseases in Guam. Many of these diseases cannot be prevented with a vaccine or medicine. You can reduce your risk by taking steps to prevent bug bites.

What can I do to prevent bug bites?

- Cover exposed skin by wearing long-sleeved shirts, long pants, and hats.

- Use an appropriate insect repellent (see below).

- Use permethrin-treated clothing and gear (such as boots, pants, socks, and tents). Do not use permethrin directly on skin.

- Stay and sleep in air-conditioned or screened rooms.

- Use a bed net if the area where you are sleeping is exposed to the outdoors.

What type of insect repellent should I use?

- FOR PROTECTION AGAINST TICKS AND MOSQUITOES: Use a repellent that contains 20% or more DEET for protection that lasts up to several hours.

- Picaridin (also known as KBR 3023, Bayrepel, and icaridin)

- Oil of lemon eucalyptus (OLE) or para-menthane-diol (PMD)

- 2-undecanone

- Always use insect repellent as directed.

What should I do if I am bitten by bugs?

- Avoid scratching bug bites, and apply hydrocortisone cream or calamine lotion to reduce the itching.

- Check your entire body for ticks after outdoor activity. Be sure to remove ticks properly.

What can I do to avoid bed bugs?

Although bed bugs do not carry disease, they are an annoyance. See our information page about avoiding bug bites for some easy tips to avoid them. For more information on bed bugs, see Bed Bugs .

For more detailed information on avoiding bug bites, see Avoid Bug Bites .

Stay safe outdoors

If your travel plans in Guam include outdoor activities, take these steps to stay safe and healthy during your trip.

- Stay alert to changing weather conditions and adjust your plans if conditions become unsafe.

- Prepare for activities by wearing the right clothes and packing protective items, such as bug spray, sunscreen, and a basic first aid kit.

- Consider learning basic first aid and CPR before travel. Bring a travel health kit with items appropriate for your activities.

- If you are outside for many hours in heat, eat salty snacks and drink water to stay hydrated and replace salt lost through sweating.

- Protect yourself from UV radiation : use sunscreen with an SPF of at least 15, wear protective clothing, and seek shade during the hottest time of day (10 a.m.–4 p.m.).

- Be especially careful during summer months and at high elevation. Because sunlight reflects off snow, sand, and water, sun exposure may be increased during activities like skiing, swimming, and sailing.

- Very cold temperatures can be dangerous. Dress in layers and cover heads, hands, and feet properly if you are visiting a cold location.

Stay safe around water

- Swim only in designated swimming areas. Obey lifeguards and warning flags on beaches.

- Practice safe boating—follow all boating safety laws, do not drink alcohol if driving a boat, and always wear a life jacket.

- Do not dive into shallow water.

- Do not swim in freshwater in developing areas or where sanitation is poor.

- Avoid swallowing water when swimming. Untreated water can carry germs that make you sick.

- To prevent infections, wear shoes on beaches where there may be animal waste.

Keep away from animals

Most animals avoid people, but they may attack if they feel threatened, are protecting their young or territory, or if they are injured or ill. Animal bites and scratches can lead to serious diseases such as rabies.

Follow these tips to protect yourself:

- Do not touch or feed any animals you do not know.

- Do not allow animals to lick open wounds, and do not get animal saliva in your eyes or mouth.

- Avoid rodents and their urine and feces.

- Traveling pets should be supervised closely and not allowed to come in contact with local animals.

- If you wake in a room with a bat, seek medical care immediately. Bat bites may be hard to see.

All animals can pose a threat, but be extra careful around dogs, bats, monkeys, sea animals such as jellyfish, and snakes. If you are bitten or scratched by an animal, immediately:

- Wash the wound with soap and clean water.

- Go to a doctor right away.

- Tell your doctor about your injury when you get back to the United States.

Consider buying medical evacuation insurance. Rabies is a deadly disease that must be treated quickly, and treatment may not be available in some countries.

Reduce your exposure to germs

Follow these tips to avoid getting sick or spreading illness to others while traveling:

- Wash your hands often, especially before eating.

- If soap and water aren’t available, clean hands with hand sanitizer (containing at least 60% alcohol).

- Don’t touch your eyes, nose, or mouth. If you need to touch your face, make sure your hands are clean.

- Cover your mouth and nose with a tissue or your sleeve (not your hands) when coughing or sneezing.

- Try to avoid contact with people who are sick.

- If you are sick, stay home or in your hotel room, unless you need medical care.

Avoid sharing body fluids

Diseases can be spread through body fluids, such as saliva, blood, vomit, and semen.

Protect yourself:

- Use latex condoms correctly.

- Do not inject drugs.

- Limit alcohol consumption. People take more risks when intoxicated.

- Do not share needles or any devices that can break the skin. That includes needles for tattoos, piercings, and acupuncture.

- If you receive medical or dental care, make sure the equipment is disinfected or sanitized.

Know how to get medical care while traveling

Plan for how you will get health care during your trip, should the need arise: