- What is the Chase Travel Portal?

Benefits of Using the Chase Travel Portal

Chase ultimate rewards credit cards.

- Points Value

- How to Use the Portal to Book Travel

Chase Travel: Explore Destinations and Savings with Chase Ultimate Rewards

Affiliate links for the products on this page are from partners that compensate us and terms apply to offers listed (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate credit cards to write unbiased product reviews .

The information for the following product(s) has been collected independently by Business Insider: Chase Freedom Flex℠, Chase Freedom® Student credit card. The details for these products have not been reviewed or provided by the issuer.

- The Chase Travel℠ portal works just like an online travel agency.

- You can use points, cash, or a combination of both to book flights, hotels, rental cars, and more.

- Several Chase cards offer better redemption values or bonus points when you book through the portal.

The Chase Travel portal is an online booking platform for flights, hotels, rental cars, cruises, activities, and vacation rentals, similar to an Online Travel Agency (OTA). If you're a Chase Ultimate Rewards® cardholder, you can use points to book travel through the portal — or pay with your card or a combination of points and cash.

Chase Ultimate Rewards is one of the most flexible and lucrative credit card rewards programs, and its benefits can be even greater depending on the Chase cards you have. With a no-annual-fee card like the Chase Freedom Flex℠ or Chase Freedom Unlimited® , your points are worth 1 cent each toward travel booked through the portal.

But if you have a Chase travel credit card like the Chase Sapphire Reserve® , Chase Sapphire Preferred® Card , or Ink Business Preferred® Credit Card , you'll get 25% to 50% more value when you redeem your points for travel, plus the ability to transfer your points to Chase airline and hotel partners .

Some Chase cards also offer bonus points for paid bookings you make through the portal. Chase added lucrative new bonus categories to the Chase Sapphire Reserve® and Chase Sapphire Preferred® Card, including certain types of travel booked through the portal.

Here's everything you need to know about booking airfare, hotels, and more through the Chase travel portal — and how to make the most of your Chase Ultimate Rewards points.

What Is the Chase Travel Portal?

The Chase Travel portal works like any other Online Travel Agency (such as Travelocity or Priceline), and the searches you do for hotels, airfare, and more will produce similar results to what you see on that OTA.

You must be a Chase credit card customer to use Chase travel to book with cash or with points. In fact, you'll only access the Chase Travel portal when you log into your account management page with Chase.

Chase travel lets you book travel directly with Chase Ultimate Rewards points, use your credit card to pay, or combine the two. This is one of the main benefits of using Chase travel — you can spend the rewards points you earn directly on the travel you want without having to worry about dealing with specific hotel or airline loyalty programs.

There are a few other key benefits to know:

- You'll still earn airline miles and work toward elite airline status: You won't earn points or elite night credits when you book a hotel stay with Chase travel because it's considered a third-party booking. However, you can earn airline and elite-qualifying miles on flights you book as long as your frequent flyer number is attached to the reservation.

- Your points are worth more with certain Chase credit cards: Also be aware that some Chase credit cards give you more than the standard rate of 1 cent per point when you redeem your rewards for travel through Chase. We'll go into more detail on the cards that offer this perk below.

- The Chase Travel portal is easy to use: If you don't want to deal with a bunch of hotel and airline award charts, booking through Chase travel can help keep your rewards game simple. You'll always be able to use your points for any booking you want without having to worry about blackout dates or capacity controls you would normally encounter with loyalty programs.

To be eligible to use the Chase Travel portal, you'll need a Chase credit card that earns Chase Ultimate Rewards points .

No-annual-fee Chase cards open to new applicants (points are worth 1 cent each through the Chase Travel portal):

- Chase Freedom Unlimited® (read our Chase Freedom Unlimited review )

- Chase Freedom Flex℠ (read our Chase Freedom Flex review )

- Chase Freedom® Student credit card (read our Chase Freedom Student review )

- Ink Business Unlimited® Credit Card (read our Chase Ink Business Unlimited review )

- Ink Business Cash® Credit Card (read our Chase Ink Business Cash review )

Chase travel rewards cards open to new applicants (points are worth more with Chase travel, plus these cards allow you to transfer points to airline and hotel partners):

- Chase Sapphire Reserve® (read our Chase Sapphire Reserve review )

- Chase Sapphire Preferred® Card (read our Chase Sapphire Preferred review )

- Ink Business Preferred® Credit Card (read our Chase Ink Business Preferred review )

If you have more than one Chase card, you can transfer your Chase Ultimate Rewards points between accounts. It makes the most sense to pool your points in the account that gives you the best redemption value — for example, if you pair the Chase Freedom Unlimited® and Chase Sapphire Reserve®, moving all of your Chase Ultimate Rewards to your Sapphire Reserve account will increase the value of your points when you redeem through the Chase Travel portal.

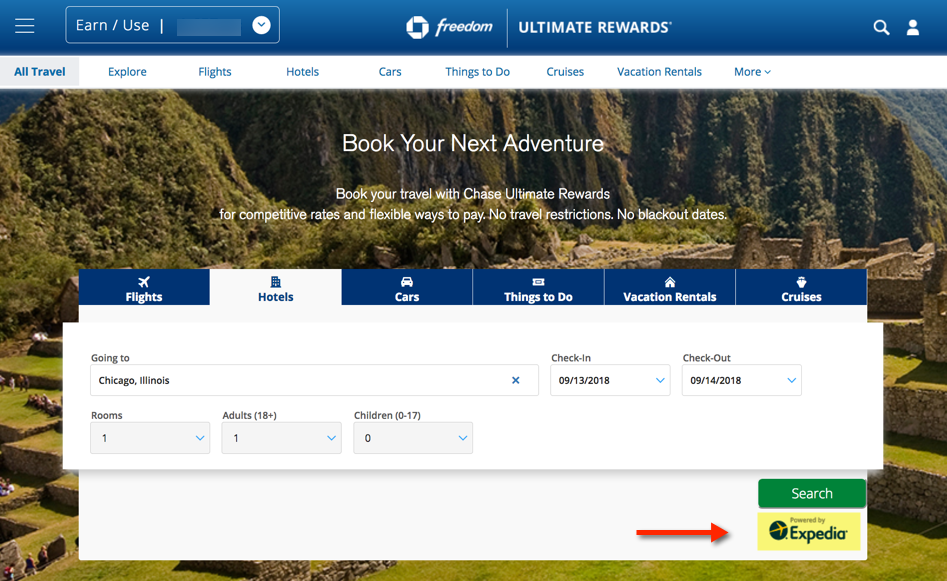

To pool your points onto one card, log into your Chase online account, navigate to the "Redeem" section for your Chase Ultimate Rewards card, then select the option to combine points in the "Earn/Use" tab:

From there, you can move your Chase points between accounts in any increments you want.

Points Value in the Chase Travel Portal

Some Chase credit cards give you a bonus when you redeem points through the Chase Travel portal. Here's a summary of how much your points are worth with each Chase card:

It's important to note that Chase Ultimate Rewards points are worth, on average, 1.8 cents apiece based on Personal Finance Insider's points and miles valuations . That's because it's possible to get outsized value when you transfer points to partners for award travel.

How to Use the Chase Travel Portal

Using the Chase Travel portal is a breeze, but it all starts with logging into your online account management page. From there, you'll click on the right side of your screen where it shows your Chase Ultimate Rewards account balance.

Once you click on the account balance, you'll have the option to select the card you want to access. And remember, this step can be important because some cards give you more value from your points when you redeem them for travel.

How to book a flight through Chase travel

Once you are logged into your Chase Ultimate Rewards account, you'll see different travel options to search for at the top of the page.

To search for a flight, make sure the prompt is on "Flights" and begin searching for the flight you want. Enter your departure airport, destination, travel dates, and the number of passengers.

Once your flight options pop up on the screen, you can filter your results by the number of stops, the airlines you want to fly, and arrival times.

Note that each of your flight options will include a payment amount in points as well as a cash price.

You can also click on "Details and baggage fees" in order to find out the cost of carry-on luggage or checked baggage, as well as whether your flight charges any change fees.

When you click to "Select" a flight option, you'll get a rundown of what is and isn't included in the fare you selected. You may also get a note that you can upgrade before you check out.

Once you settle on a flight you want, you'll be taken to the "Trip Details" page that shows the final cost of your flight in points or in cash, as well as a summary of the added costs you may be charged for baggage or change fees.

After you agree to the terms, you'll be taken to a final payment page where you can decide how you want to pay. You have the option to cover your flight entirely in points if you want, but you can also choose to pay with your Chase credit card or with a combination of points and your credit card.

During the booking process, make sure to add your frequent flyer number to your reservation. That way, you can earn miles on your booking and your flight will count toward elite status requirements. You'll also want to add your Known Traveler Number or Redress number if either applies to you.

If you forget to do it during your booking, however, you can add your frequent flyer information to your flight later on using the airline's website.

How to book a hotel through Chase travel

Booking a hotel through Chase is similarly easy, and you'll find a lot of different types of lodging options available. For example, you'll find properties from major hotel brands, but you'll also find rental condo options and boutique hotels.

To search for a hotel, enter the destination, dates, and the number of people you want to have in your room. Once you're presented with your options, you can filter hotels based on the hotel name you're looking for, the area or neighborhood, price point, guest rating, property type, and more.

Once again, you'll see a price listed in points as well as a cash price per night.

These prices do not include taxes and fees, however, so your price in points or cash will be higher by the time you get to the final booking page. Also be aware that the price listed is the lowest you can get for the property, but that better or upgraded rooms and suites will cost more in points.

The major downside to booking a hotel through the Chase portal is that you won't earn hotel points or elite night credits for your stay, because it's considered a third-party booking. There's also a risk that the property won't recognize your hotel elite status or give you the perks you'd normally be entitled to, like late checkout or free breakfast . This shouldn't be an issue if you're booking an independent or boutique hotel, but if you're looking for hotel points or status, it's something to be aware of.

You'll have the option to select a hotel you want as well as a room type at the property you're considering. You can also pay with your booking with points, your Chase credit card, or a combination of the two.

How to book a rental car through Chase travel

You can also book a rental car through Chase travel using the same set of steps. Once you log into your Chase Ultimate Rewards account, click on "Cars" and then select the destination and dates.

Once you are presented with your search results, you can select the types of cars you prefer, like an economy car or an SUV. You can also filter results based on a price range, the number of passengers you have, the rental car company, and the type of transmission you prefer (manual or automatic), as well as the total area you want to search in.

Note that, once again, taxes and fees are not included on the initial search page. Instead, they are added to your total cost when you select a rental car. You can also pay for a rental car through Chase with points, your credit card, or a combination of the two.

How to book activities with the Chase Travel portal

Chase also lets you book a variety of activities through the portal, which they refer to as "Things to Do." Chase activities can include excursions like snorkeling or scuba diving, as well as tours of museums and historic sites. But you can also book more practical options through their activities tab, including airport pickups and other types of transportation.

To search for activities, enter the destination and dates for your trip. You'll be shown a price in points and in cash that does include taxes and fees. You can also filter options based on the type of activity, your interests, and more. Once again, you have the option to pay for activities with your points, your credit card, or a combination of the two.

How to book a cruise through Chase travel

If you're a cruise enthusiast, you should know you can also book cruises through Chase travel. When you select "Cruises" at the top of the Chase Ultimate Rewards search page, you'll be presented with a list of featured cruises and cruise specials.

You can also search for cruises based on the destination or the name of the cruise line. Note, however, that only cash prices are listed for each cruise on the portal, and that you'll have to call Chase to make a booking.

Either way, you can absolutely use your Chase points to pay for all or part of your cruise. Just have your credit card number handy and call their customer service line at 855-234-2542.

How to book a vacation rental through Chase

Chase also offers a selection of vacation rentals, which can include vacation condos, luxury villas, and more. To search, click on "Vacation Rentals" at the top of the main page, then enter your destination, dates, and the number of people in your party.

Once you start your search, you'll have the option to filter results based on the local neighborhood you want, star ratings, price range, guest rating, property type, and more. Like hotels through Chase, the price you are shown excludes taxes and fees, but they will be added to your total once you make a selection.

Also be aware that the price shown in your search results is for the lowest-tier option for each property, and that a larger rental or upgraded rental may cost more in points.

When you book vacation rentals through Chase, you can pay with points, your Chase card, or a combination of the two.

Use the Chase Travel portal to book Luxury Hotel & Resort Collection properties

If you have the Chase Sapphire Reserve®, you can book properties within the Luxury Hotel & Resort Collection. This list of more than 1,000 properties can be reserved ahead of time, and you'll get extra benefits with each stay such as:

- Daily breakfast for two

- A special benefit worth up to $100

- Complimentary internet access

- Room upgrades when available

- Early check-in and late checkout

One detail to note with this program is the fact that you cannot pay with points. Instead, your online booking will reserve your room, and you'll be charged for the stay when you check out from the hotel.

Should you transfer Chase points instead?

While you can book travel through the Chase Travel portal directly, many people prefer to transfer points to Chase airline and hotel partners instead. Doing so could let you get more value for each point you redeem , but you'll have to run the numbers to find out for sure.

Here's a good example of how transferring points to a Chase airline or hotel partner can be a better deal, as well as the math you'll need to do to figure this out on your own. Take this one-way flight on Air France from Chicago to Paris, for example, and assume you have the Chase Sapphire Reserve® card, so you're getting 50% more value when you redeem points through the Chase Travel portal.

If you were to book this flight through Chase Travel, you would owe 39,607 points with the Chase Sapphire Reserve®, compared with the cash price of $594.10.

However, you could book an award ticket on the exact same flight through Flying Blue (Air France's loyalty program) directly if you transferred your Chase points there first. In this case, the identical flight would set you back 22,000 miles plus $109.44. This means you would transfer 22,000 miles from Chase to your Flying Blue account, and pay the taxes and fees in cash, or by redeeming points for a statement credit to your account.

When you compare, you'll find that booking with miles directly is a better deal. After you subtract the taxes and fees from the cost of booking through Flying Blue, you wind up with a value of around 2.2 cents per mile.

With the Chase Travel portal, on the other hand, you're forking over 39,607 points for the same flight, and you're getting a value of 1.5 cents for each point if you have the Chase Sapphire Reserve®.

Accessing Chase Travel is simple. If you're a Chase credit cardholder with Chase Ultimate Rewards points, you can log in to your Chase online account. Once logged in, navigate to the 'Travel" or "Rewards" section, where you'll find the Chase Travel portal. From there, you can search and book flights, hotels, and other travel services using your earned points or card benefits. It's a convenient way to plan and manage your travel adventures.

Chase Travel refers to the travel booking and rewards platform offered by Chase Bank. It's part of the Chase Ultimate Rewards program, allowing cardholders to use their earned points to book flights, hotels, car rentals, and other travel-related expenses. Chase Travel provides a convenient way to plan and book your trips while taking advantage of the rewards and benefits associated with Chase credit cards.

To earn 5% on Chase Travel, consider using a Chase credit card that offers bonus rewards on travel purchases. Cards like the Chase Sapphire Preferred or Chase Sapphire Reserve often offer 5 points per dollar spent on travel booked through the Chase Travel portal. Additionally, taking advantage of limited-time promotions and special offers can also help you maximize your rewards when booking travel with Chase.

Bottom Line

Keep in mind that, no matter which Chase credit card you have, there are other ways you can use your rewards points. You can redeem Chase points for statement credits or cash back, or cash them in for gift cards or merchandise. And if you have a premier Chase travel credit card, you can transfer your points to Chase airline and hotel partners at a 1:1 ratio.

However, booking travel through Chase can make your life considerably easier — especially if you don't like dealing with complicated hotel and airline programs. You may not get as much value from your points as you would if you booked a premium flight with airline miles, but the Chase Travel portal does offer the flexibility to book the flight you want without any blackout dates or hoops to jump through.

The Chase Travel portal offers yet another way to maximize rewards earned with a Chase credit card. Just make sure to consider all your options and the value you're getting for your points before you pull the trigger.

Editorial Note: Any opinions, analyses, reviews, or recommendations expressed in this article are the author’s alone, and have not been reviewed, approved, or otherwise endorsed by any card issuer. Read our editorial standards .

Please note: While the offers mentioned above are accurate at the time of publication, they're subject to change at any time and may have changed, or may no longer be available.

**Enrollment required.

- Main content

- Credit Cards

- All Credit Cards

- Find the Credit Card for You

- Best Credit Cards

- Best Rewards Credit Cards

- Best Travel Credit Cards

- Best 0% APR Credit Cards

- Best Balance Transfer Credit Cards

- Best Cash Back Credit Cards

- Best Credit Card Sign-Up Bonuses

- Best Credit Cards to Build Credit

- Best Credit Cards for Online Shopping

- Find the Best Personal Loan for You

- Best Personal Loans

- Best Debt Consolidation Loans

- Best Loans to Refinance Credit Card Debt

- Best Loans with Fast Funding

- Best Small Personal Loans

- Best Large Personal Loans

- Best Personal Loans to Apply Online

- Best Student Loan Refinance

- Best Car Loans

- All Banking

- Find the Savings Account for You

- Best High Yield Savings Accounts

- Best Big Bank Savings Accounts

- Best Big Bank Checking Accounts

- Best No Fee Checking Accounts

- No Overdraft Fee Checking Accounts

- Best Checking Account Bonuses

- Best Money Market Accounts

- Best Credit Unions

- All Mortgages

- Best Mortgages

- Best Mortgages for Small Down Payment

- Best Mortgages for No Down Payment

- Best Mortgages for Average Credit Score

- Best Mortgages No Origination Fee

- Adjustable Rate Mortgages

- Affording a Mortgage

- All Insurance

- Best Life Insurance

- Best Life Insurance for Seniors

- Best Homeowners Insurance

- Best Renters Insurance

- Best Car Insurance

- Best Pet Insurance

- Best Boat Insurance

- Best Motorcycle Insurance

- Travel Insurance

- Event Ticket Insurance

- Small Business

- All Small Business

- Best Small Business Savings Accounts

- Best Small Business Checking Accounts

- Best Credit Cards for Small Business

- Best Small Business Loans

- Best Tax Software for Small Business

- Personal Finance

- All Personal Finance

- Best Budgeting Apps

- Best Expense Tracker Apps

- Best Money Transfer Apps

- Best Resale Apps and Sites

- Buy Now Pay Later (BNPL) Apps

- Best Debt Relief

- Credit Monitoring

- All Credit Monitoring

- Best Credit Monitoring Services

- Best Identity Theft Protection

- How to Boost Your Credit Score

- Best Credit Repair Companies

- Filing For Free

- Best Tax Software

- Best Tax Software for Small Businesses

- Tax Refunds

- Tax Brackets

- Taxes By State

- Tax Payment Plans

- Help for Low Credit Scores

- All Help for Low Credit Scores

- Best Credit Cards for Bad Credit

- Best Personal Loans for Bad Credit

- Best Debt Consolidation Loans for Bad Credit

- Personal Loans if You Don't Have Credit

- Best Credit Cards for Building Credit

- Personal Loans for 580 Credit Score Lower

- Personal Loans for 670 Credit Score or Lower

- Best Mortgages for Bad Credit

- Best Hardship Loans

- All Investing

- Best IRA Accounts

- Best Roth IRA Accounts

- Best Investing Apps

- Best Free Stock Trading Platforms

- Best Robo-Advisors

- Index Funds

- Mutual Funds

- Home & Kitchen

- Gift Guides

- Deals & Sales

- Sign up for the CNBC Select Newsletter

- Subscribe to CNBC PRO

- Privacy Policy

- Your Privacy Choices

- Terms Of Service

- CNBC Sitemap

Follow Select

Our top picks of timely offers from our partners

Find the best credit card for you

How to use the chase travel portal, you can use chase points to book flights, hotels, car rentals and more through its travel portal..

With the right amount of planning, it's possible to book your entire vacation, including flights , hotels , cruises , car rentals , tours and other activities, entirely on points through the Chase travel portal.

But are you getting the best deal by doing this instead of transferring Chase Ultimate Rewards® points to travel partners and booking directly? It turns out there's a lot more to consider — everything from travel date flexibility and brand variety to the credit card you're using — if you want to get more value for your points by booking through Chase Travel SM .

Below, CNBC Select breaks down the best ways to book flights, hotels, cruises, tours and vacation activities through the Chase travel portal with Ultimate Rewards® points.

How to use the Chase travel portal

- How to earn and redeem Chase Ultimate Rewards points

How to get started with the Chase travel portal

How to book flights through the chase travel portal, how to book rental cars, cruises, and other travel activities, bottom line, how to earn and redeem chase ultimate rewards® points.

To access Chase Travel SM , you'll need to have a credit card that earns Chase Ultimate Rewards® points, like the Chase Sapphire Preferred® Card , Chase Sapphire Reserve® , Ink Business Preferred® Credit Card , Ink Business Unlimited® Credit Card , Ink Business Cash® Credit Card , Chase Freedom Unlimited® or Chase Freedom Flex℠ .

The easiest way to earn Chase Ultimate Rewards points quickly is by taking advantage of the lucrative welcome bonuses offered by certain rewards cards:

- You'll earn 60,000 points by signing up for the Chase Sapphire Preferred and spending $4,000 within the first three months of opening your account.

- With the Ink Business Preferred Credit Card 's welcome bonus, you'll earn 100k bonus points after you spend $8,000 on purchases in the first 3 months from account opening. That's $1,000 cash back or $1,250 toward travel when redeemed through Chase Travel SM.

- The Chase Sapphire Reserve 's welcome bonus gives you 60,000 bonus points after you spend $4,000 on purchases in the first three months from account opening.

The card you're using to redeem UR points will also affect your point redemption value . For instance, if you're using the Chase Sapphire Preferred to book through the Chase Travel SM portal, points are worth 25% more (1.25 cents per point). But if you're booking through Chase Travel℠ with the Chase Sapphire Reserve , points are worth 50% more (1.5 cents per point) — the other $0 annual fee Chase cards each carry a redemption rate of 1 cent per point.

That means the bonus points you'd earn from either the Chase Sapphire Preferred's welcome bonus is worth $750 towards travel and the Chase Sapphire Reserve's is worth $900 towards travel.

Chase Sapphire Preferred® Card

Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, and $50 annual Chase Travel Hotel Credit, plus more.

Welcome bonus

Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

Regular APR

21.49% - 28.49% variable on purchases and balance transfers

Balance transfer fee

Either $5 or 5% of the amount of each transfer, whichever is greater

Foreign transaction fee

Credit needed.

Excellent/Good

Terms apply.

Read our Chase Sapphire Preferred® Card review .

Ink Business Preferred® Credit Card

Earn 3X points per $1 on the first $150,000 spent in combined purchases in select categories each account anniversary year (travel; shipping purchases; internet, cable and phone services; and advertising purchases with social media sites and search engines), 1X point per $1 on all other purchases

Earn 100,000 bonus points after you spend $8,000 on purchases in the first 3 months from account opening.

21.24% - 26.24% variable

Good/Excellent

Read our Ink Business Preferred® Credit Card review.

Chase Sapphire Reserve®

Earn 5X total points on flights and 10X total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3X points on other travel and dining & 1 point per $1 spent on all other purchases plus, 10X points on Lyft rides through March 2025

Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

22.49% - 29.49% variable

5%, minimum $5

Read our Chase Sapphire Reserve® review.

To reach the Chase travel portal, log into your Chase account, then click the area near the right side of the screen where it says the amount of your Chase UR points. Depending on how many Chase credit cards you have, you may be asked to choose which one you want to proceed with.

The next screen is your credit card's main dashboard, showing how many UR points you currently have, as well as any deals or bonus opportunities. On the top of the page, you'll see several menus with redemption options.

While not the best redemption in terms of overall value, you could choose to use your Chase points for Apple and Amazon purchases, cash them in for gift cards and experiences, or reimburse yourself for certain recent charges through Chase's Pay Yourself Back tool . This is also where you can transfer points directly to one of Chase's 14 travel partners if you have a specific flight or hotel in mind. Otherwise, click "book travel" to enter the Chase travel portal.

From here, you'll be able to search for flights, hotels, rental cars, activities and cruises. Simply choose your category, plug in your desired dates and details, and book with points, cash or some combination of the two.

There are a few pros and cons to consider when booking flights through the Chase travel portal. You won't have to worry about blackout dates or limited award availability, which makes it great if you're not flexible with dates and flight times. Just make sure you compare the number of points needed through the Chase travel portal with how many points the airline would require if you were using its own miles, especially if you're hunting for a good deal on economy seats.

The catch with using the Chase travel portal is you won't be able to shop for tickets on low-cost carriers like Spirit Airlines, Frontier Airlines, or Allegiant Air — you can search for flights on Alaska, Southwest, Delta, JetBlue, American, and United. You'll also be able to book flights on most international carriers.

Remember that you can still earn miles and elite credits on flights, as tickets booked through the Chase travel portal are categorized as "paid" rather than as an award flight since you're "paying" for them with points instead of cash. Consider the taxes and fees you might have to pay if you were to transfer the points straight to one of Chase's travel partners versus booking directly through the portal, and to calculate and compare how many points and miles you'd earn by booking with either method.

You'll be able to search, filter, and sort by price, airline, booking class, departure time, arrival time, and departure airport. For this example, below, consider a round-trip flight from Seattle to Austin with sample dates of Feb. 1–7, 2024, booked through the travel portal with a Chase Sapphire Preferred card (redemptions are worth 1.25 cents per point):

Results included 107 results with an economy mix-and-match United and Delta fare for $370 or about 29,600 points being the most affordable option. For comparison's sake, the points price is about the same as what United and Delta are currently charging if you were to book the awards directly through the airlines, but Delta isn't a transfer partner of Chase. You also won't earn miles if you were to book these awards through the airlines, whereas you will earn miles when booking through Chase.

To finish booking your flight through the travel portal, select your route(s), review the details, choose how many points you'd like to use and complete your purchase.

How to book hotels through the Chase travel portal

While the best redemption rates are usually realized when you transfer Chase Ultimate Rewards points at a 1:1 ratio to hotel partner World of Hyatt, if you're not a huge fan of chain hotels or prefer boutiques or brands like Hilton, Choice Hotels, or Wyndham, it can be a good idea to book them through the travel portal.

As with flights, you won't have to worry about blackout dates or limited award night availability. However, keep in mind that hotels treat the Chase travel portal as a third-party booking agency, so you won't be able to earn hotel points on stays as you might by booking your stay directly with the hotel.

Hyatt hotels usually offer better deals when you book directly, and since it's one of Chase's hotel partners, you can transfer UR points instantly at a 1:1 ratio. Marriott and IHG are usually more varied, so you may score a better deal by booking via the Chase travel portal instead of transferring points over. For this reason, it's a good idea to ring up how much your hotel stay would cost in points through the portal as well as the hotel's website.

Start by searching by destination so you can see a list of all the available hotels. For this example, let's try looking for hotels in Downtown Austin from Feb. 1–7, 2024. Once the results appear, you'll be able to narrow down your search with filters based on price, star ratings, guest ratings, amenities and neighborhood.

Let's go over a couple of options within the Chase travel portal, each booked with a Chase Sapphire Preferred credit card. One option is the Four Seasons Hotel Austin, which is listed for $556 or about 44,500 points per night through Chase. If you book through Four Seasons, directly, you'll pay $561 per night. The hotel chain also doesn't have a rewards program but going through Chase provides a way to pay with points.

Another example is the Hyatt Place Austin Downtown for $288 or about 23,000 points per night through Chase. If you were to book this directly through Hyatt, you'd pay $279 per night as a member of its loyalty program or just 15,000 World of Hyatt points per night if you booked with points. Since you can transfer your Ultimate Rewards points to Hyatt at a 1:1 ratio, in this case, transferring would make more sense.

As you can see, it's worth comparing points required by the travel portal and each hotel's website, as the time of year, location, and other factors may play a part in pricing. To book your stay through the travel portal, select your room type, review the details, choose how many points you'd like to use and complete your purchase.

It's a pretty similar process if you want to book rental cars, tours and other travel activities through the Chase travel portal. Cruises can also be booked as well, but you'll need to call.

As far as car rentals, make sure you're booking through the travel portal with points that are connected to Chase Sapphire Preferred or Chase Sapphire Reserve to take advantage of extra perks like primary rental car insurance — you'll also need to decline the rental car company's auto collision damage waiver when you book to activate this. You'll want to charge at least a few dollars to the card and not use points to cover the entire booking which ensures that you're still "paying" for the car rental with your Sapphire card, which means you'll be entitled to the card's rental car insurance.

Beyond that, simply plug in your itinerary and search. Here's an example for a rental in Austin from February 1–7, 2024, booked with a Chase Sapphire Preferred credit card:

You'll be able to filter your search by capacity, car type, price per day, company, and car options (like air conditioning and automatic transmission). For a seven-day rental, it would cost around 24,800 points or $310 for the cheapest option. As with other travel portal purchases, you'll be able to enter how many Chase Ultimate Rewards points you wish to put toward the final price. It works the same way for booking tours and other travel activities, so you could potentially enjoy a free — or nearly free — vacation solely on Chase points if you were to plan it all out properly.

Booking through the Chase travel portal can be a great use of your Ultimate Rewards® points, but make sure to compare the rates against booking directly with an airline or hotel itself. Finally, consider transferring your points to one of Chase's travel partners, especially if you're looking to book a luxury hotel or flight in business class.

Money matters — so make the most of it. Get expert tips, strategies, news and everything else you need to maximize your money, right to your inbox. Sign up here .

Why trust CNBC Select?

At CNBC Select, our mission is to provide our readers with high-quality service journalism and comprehensive consumer advice so they can make informed decisions with their money. Every credit card guide is based on rigorous reporting by our team of expert writers and editors with extensive knowledge of credit card products . While CNBC Select earns a commission from affiliate partners on many offers and links, we create all our content without input from our commercial team or any outside third parties, and we pride ourselves on our journalistic standards and ethics.

Catch up on CNBC Select's in-depth coverage of credit cards , banking and money , and follow us on TikTok , Facebook , Instagram and Twitter to stay up to date.

Information about the Chase Freedom Flex℠ has been collected independently by Select and has not been reviewed or provided by the issuer of the card prior to publication.

- What are A.M. Best ratings for insurance? Liz Knueven

- Robinhood Gold Card announced — Earn 3% cash back everywhere Jason Stauffer

- Overhauled Amex Hilton Business card — Up to $240 in statement credits and more Jason Stauffer

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How to Change a Flight Booked Through Chase

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

I booked a flight through Chase Ultimate Rewards®

I transferred chase points to an airline or hotel, can travel insurance help, the bottom line.

Although some countries are slowly opening up for tourism as the coronavirus pandemic ebbs and flows around the world, constantly changing entry restrictions can create a risk for travelers booking nonrefundable trips. Luckily, many airlines and hotels are offering loosened change and cancellation policies to make it easier for travelers to modify their plans.

But what if you’ve booked your trip with Chase Ultimate RewardsⓇ points? Can you still get a full refund? If so, will you get your points back or a voucher? Here’s what you need to know about canceling trips booked through the Chase travel portal.

When you purchase a flight with cash, Chase Ultimate Rewards® points or a combination of both, your refund options will depend on your travel dates as well as Chase’s, and the carrier’s cancellation policy.

Cancel the flight by selecting it from the “My Trips” section within your chase account and either speak with a Chase representative through the live chat feature or complete Chase’s cancellation form. The form can only be accessed once you’re logged in to your account, and you will need your Chase itinerary number (11-15 characters included in your booking), along with the email address and phone number attached to your reservation.

Although calling customer service is an option, hold times can vary — so if your cancellation is straightforward, you’d be better off canceling your trip online.

» Learn more: AmEx vs. Chase points

Can I get a Chase Ultimate Rewards® points refund?

Generally, you should receive a refund in the original form of payment, but the evidence has been mixed. On Chase's website, the company says it will work with your travel provider on your behalf to manage any refunds or credits. This Reddit thread has differing reports from multiple people, ranging from receiving a refund in points or flight credits/vouchers. Some have reported initially receiving vouchers, but escalating the issue and then getting Chase Ultimate RewardsⓇ points back instead.

The situation is likely dependent on an airline’s policy. If the airline is offering flight vouchers, it may be difficult to receive a full refund in points from Chase (as opposed to a scenario in which the airline offers cash-back in the form of payment). If you’re not happy with the refund option you’ve received, try escalating the issue by contacting the Chase Ultimate Rewards® travel customer service phone number at 1-888-511-5326 or reaching out to Chase on Twitter.

» Learn more: The Chase Ultimate Rewards travel portal guide

If you’ve transferred your Chase Ultimate Rewards® points to a hotel or airline, and then made a reservation that you need to change or cancel, you’ll need to deal directly with the carrier rather than Chase. All point transfers from Chase to its airline and hotels partners are irreversible, so you will not get your Chase Ultimate Rewards® points back if you cancel your reservation. Any cancellations or changes made will be bound by the airline or hotel’s cancellation policy.

On the bright side, many airlines and hotels have loosened their cancellation policies , so there’s a higher likelihood that canceling a reservation will result in a refund of your airline or hotel points back to your loyalty account.

Travel insurance can help get your money back if you need to cancel a nonrefundable ticket for a covered reason, such as an illness, natural disaster or other extenuating circumstances.

Some travel insurance companies specifically exclude pandemics from coverage, which would nullify any claims made related to coronavirus since it was declared a pandemic by the World Health Organization on Mar. 11, 2020. Other providers do not have a pandemic exclusion at all. Furthermore, insurance options vary by state, so you’ll want to review the fine print of your policy before purchasing to ensure you get the coverage you’re looking for.

However, canceling your flight because you’re afraid of contracting coronavirus is not a covered reason. In instances like this, you’d want to look into a "Cancel For Any Reason" (CFAR) travel insurance optional add-on, which will allow you to cancel a trip for truly any reason and provide a 50%-75% refund as long as you cancel at least two days in advance. CFAR is offered by some insurers as a supplemental upgrade when purchasing a comprehensive travel insurance policy, and it cannot be purchased on its own.

» Learn more: Does my travel insurance cover the coronavirus?

Traveling now carries with it a higher degree of uncertainty than ever before. To save yourself heartache, get familiar with Chase’s and the carrier’s cancellation policies. If you’re planning a trip months away and want the option of canceling for any reason, consider purchasing the CFAR supplement when buying a travel insurance policy to ensure you receive a refund if you need to postpone your trip.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1.5%-6.5% Enjoy 6.5% cash back on travel purchased through Chase Travel; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year). After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

$300 Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1%-5% Earn 5% cash back on up to $1,500 in combined purchases in bonus categories each quarter you activate. Earn 5% on Chase travel purchased through Ultimate Rewards®, 3% on dining and drugstores, and 1% on all other purchases.

$200 Earn a $200 Bonus after you spend $500 on purchases in your first 3 months from account opening.

- Auto Insurance Best Car Insurance Cheapest Car Insurance Compare Car Insurance Quotes Best Car Insurance For Young Drivers Best Auto & Home Bundles Cheapest Cars To Insure

- Home Insurance Best Home Insurance Best Renters Insurance Cheapest Homeowners Insurance Types Of Homeowners Insurance

- Life Insurance Best Life Insurance Best Term Life Insurance Best Senior Life Insurance Best Whole Life Insurance Best No Exam Life Insurance

- Pet Insurance Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes

- Travel Insurance Best Travel Insurance Cancel For Any Reason Travel Insurance Best Cruise Travel Insurance Best Senior Travel Insurance

- Health Insurance Best Health Insurance Plans Best Affordable Health Insurance Best Dental Insurance Best Vision Insurance Best Disability Insurance

- Credit Cards Best Credit Cards 2024 Best Balance Transfer Credit Cards Best Rewards Credit Cards Best Cash Back Credit Cards Best Travel Rewards Credit Cards Best 0% APR Credit Cards Best Business Credit Cards Best Credit Cards for Startups Best Credit Cards For Bad Credit Best Cards for Students without Credit

- Credit Card Reviews Chase Sapphire Preferred Wells Fargo Active Cash® Chase Sapphire Reserve Citi Double Cash Citi Diamond Preferred Chase Ink Business Unlimited American Express Blue Business Plus

- Credit Card by Issuer Best Chase Credit Cards Best American Express Credit Cards Best Bank of America Credit Cards Best Visa Credit Cards

- Credit Score Best Credit Monitoring Services Best Identity Theft Protection

- CDs Best CD Rates Best No Penalty CDs Best Jumbo CD Rates Best 3 Month CD Rates Best 6 Month CD Rates Best 9 Month CD Rates Best 1 Year CD Rates Best 2 Year CD Rates Best 5 Year CD Rates

- Checking Best High-Yield Checking Accounts Best Checking Accounts Best No Fee Checking Accounts Best Teen Checking Accounts Best Student Checking Accounts Best Joint Checking Accounts Best Business Checking Accounts Best Free Checking Accounts

- Savings Best High-Yield Savings Accounts Best Free No-Fee Savings Accounts Simple Savings Calculator Monthly Budget Calculator: 50/30/20

- Mortgages Best Mortgage Lenders Best Online Mortgage Lenders Current Mortgage Rates Best HELOC Rates Best Mortgage Refinance Lenders Best Home Equity Loan Lenders Best VA Mortgage Lenders Mortgage Refinance Rates Mortgage Interest Rate Forecast

- Personal Loans Best Personal Loans Best Debt Consolidation Loans Best Emergency Loans Best Home Improvement Loans Best Bad Credit Loans Best Installment Loans For Bad Credit Best Personal Loans For Fair Credit Best Low Interest Personal Loans

- Student Loans Best Student Loans Best Student Loan Refinance Best Student Loans for Bad or No Credit Best Low-Interest Student Loans

- Business Loans Best Business Loans Best Business Lines of Credit Apply For A Business Loan Business Loan vs. Business Line Of Credit What Is An SBA Loan?

- Investing Best Online Brokers Top 10 Cryptocurrencies Best Low-Risk Investments Best Cheap Stocks To Buy Now Best S&P 500 Index Funds Best Stocks For Beginners How To Make Money From Investing In Stocks

- Retirement Best Gold IRAs Best Investments for a Roth IRA Best Bitcoin IRAs Protecting Your 401(k) In a Recession Types of IRAs Roth vs Traditional IRA How To Open A Roth IRA

- Business Formation Best LLC Services Best Registered Agent Services How To Start An LLC How To Start A Business

- Web Design & Hosting Best Website Builders Best E-commerce Platforms Best Domain Registrar

- HR & Payroll Best Payroll Software Best HR Software Best HRIS Systems Best Recruiting Software Best Applicant Tracking Systems

- Payment Processing Best Credit Card Processing Companies Best POS Systems Best Merchant Services Best Credit Card Readers How To Accept Credit Cards

- More Business Solutions Best VPNs Best VoIP Services Best Project Management Software Best CRM Software Best Accounting Software

- Manage Topics

- Investigations

- Visual Explainers

- Newsletters

- Abortion news

- Coronavirus

- Climate Change

- Vertical Storytelling

- Corrections Policy

- College Football

- High School Sports

- H.S. Sports Awards

- Sports Betting

- College Basketball (M)

- College Basketball (W)

- For The Win

- Sports Pulse

- Weekly Pulse

- Buy Tickets

- Sports Seriously

- Sports+ States

- Celebrities

- Entertainment This!

- Celebrity Deaths

- American Influencer Awards

- Women of the Century

- Problem Solved

- Personal Finance

- Small Business

- Consumer Recalls

- Video Games

- Product Reviews

- Destinations

- Airline News

- Experience America

- Today's Debate

- Suzette Hackney

- Policing the USA

- Meet the Editorial Board

- How to Submit Content

- Hidden Common Ground

- Race in America

Personal Loans

Best Personal Loans

Auto Insurance

Best Auto Insurance

Best High-Yields Savings Accounts

CREDIT CARDS

Best Credit Cards

Advertiser Disclosure

Blueprint is an independent, advertising-supported comparison service focused on helping readers make smarter decisions. We receive compensation from the companies that advertise on Blueprint which may impact how and where products appear on this site. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Blueprint. Blueprint does not include all companies, products or offers that may be available to you within the market. A list of selected affiliate partners is available here .

Credit Cards

Best ways to use Chase points

Julie Sherrier

“Verified by an expert” means that this article has been thoroughly reviewed and evaluated for accuracy.

Robin Saks Frankel

Updated 5:51 p.m. UTC March 28, 2024

- path]:fill-[#49619B]" alt="Facebook" width="18" height="18" viewBox="0 0 18 18" fill="none" xmlns="http://www.w3.org/2000/svg">

- path]:fill-[#202020]" alt="Email" width="19" height="14" viewBox="0 0 19 14" fill="none" xmlns="http://www.w3.org/2000/svg">

Editorial Note: Blueprint may earn a commission from affiliate partner links featured here on our site. This commission does not influence our editors' opinions or evaluations. Please view our full advertiser disclosure policy .

Oleh_Slobodeniuk, Getty Images

There’s a reason why Chase credit cards are recommended for a broad spectrum of travelers. Those new to the world of travel rewards as well as experienced veterans can find plenty of value and simplicity in the Chase Ultimate Rewards® program. Chase points, earned through welcome bonuses and everyday spending, provide access to some of the best hotel and airline transfer partners in the business — 14 of them in total. In addition, redeeming those rewards in the easy-to-use Chase Travel℠ portal can offset a variety of trip costs, from rental cars to activities and tours and more.

Our list of the best ways to use Chase points certainly isn’t exhaustive. Instead, our options supply travelers with a range of possibilities to inspire their next getaway, whether that’s a hotel stay, first-class flight, economy booking or a mix of it all. The “best” option comes down to your individual travel needs.

Book hotel stays by transferring Chase points to Hyatt

Among the major hotel chains, World of Hyatt generally has the most reasonable award pricing, with a nightly cost for a Hyatt property ranging from 3,500 points to 45,000 points. Chase Ultimate Rewards points transfer at a 1:1 ratio to World of Hyatt.

While the World of Hyatt hotel portfolio is smaller than many other international chains, the number of properties continues to expand globally. Currently, there are more than 1,300 hotels in 76 countries under the Hyatt umbrella, including luxury brands like Park Hyatt, Alila, Andaz and Miraval. Hyatt might not have the size of some other chains, but it makes up for it by delivering some of the most consistent (and generous) benefits to its program members.

Redeem for 1.25 to 1.5 cents per point on general travel

While transferring points can often provide outsized value, for simplicity’s sake (and for those newer to the world of rewards), redeeming points through Chase Travel℠ can be a worthwhile option. Those who hold the Chase Sapphire Reserve® can redeem points for a flat 1.5 cents each toward travel purchases, while cardholders with the Chase Sapphire Preferred® Card or Ink Business Preferred® Credit Card * The information for the Ink Business Preferred® Credit Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. can redeem points for 1.25 cents each toward travel.

This option means there is no need to search for capacity-constrained award availability; booking through the Chase Travel portal is similar to booking through any other online travel agency. However, Chase’s version allows cardholders to offset the cash cost of a booking with their points.

Transfer to Air France-KLM during Flying Blue “Promo Rewards”

Every month, Flying Blue, the joint loyalty program of Air France and KLM, offers exclusive discounts on flights to and from specific cities or regions for booking until the end of each month — along with a specified travel window. While these offers change from month to month, there are often exceptional deals that make transferring to Flying Blue a no-brainer. Chase Ultimate Rewards points transfer at a 1:1 ratio to Air France-KLM Flying Blue.

Sample Promo Rewards that we’ve seen include economy awards between Europe and John F. Kennedy International Airport (JFK), Los Angeles International Airport (LAX), Miami International Airport (MIA) and Seattle-Tacoma International Airport (SEA) for 15,000 miles each way. Even without a Promo Reward, you can generally expect that transatlantic business class awards will start around 55,000 miles each way, a decent value in and of itself.

Transfer to Virgin Atlantic Flying Club to fly ANA to Tokyo

A frequent flyer favorite redemption is the ability to book ANA first- and business-class flights via partner Virgin Atlantic Flying Club. For instance, Virgin requires just 60,000 points for a one-way, first-class ticket between New York (JFK) and Tokyo (TYO). Thanks to the ability to transfer Chase Ultimate Rewards points to Virgin at a 1:1 ratio, that means it’ll require as little as 60,000 Chase points for this specific flight. Keep in mind, as with all transferable award bookings, availability is often limited.

our partner

Blueprint receives compensation from our partners for featured offers, which impacts how and where the placement is displayed.

Chase Sapphire Preferred® Card

Welcome bonus.

Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That’s $750 when you redeem through Chase Travel℠.

Regular APR

Credit score.

Credit Score ranges are based on FICO® credit scoring. This is just one scoring method and a credit card issuer may use another method when considering your application. These are provided as guidelines only and approval is not guaranteed.

Editor’s Take

- Flexible points that can be transferred to 14 travel partners or redeemed through Chase Travel℠ at 1.25 cents each.

- $50 annual statement credit toward Chase Travel hotel bookings.

- Valuable travel protections.

- $95 annual fee.

- Category bonuses are limited and not competitive against other travel cards.

- Transfer partner list is limited compared to programs like Amex Membership ® Rewards and Citi ThankYou ® .

Card Details

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That’s $750 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 60,000 points are worth $750 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

Credit cards that earn Chase points

- Chase Sapphire Preferred Credit Card ($95 annual fee).

- Chase Sapphire Reserve Credit Card ($550 annual fee).

- Ink Business Preferred Credit Card ($95 annual fee).

Chase offers a variety of Ultimate Rewards points-earning credit cards, but it’s important to note the distinction that the no-annual-fee Chase Ultimate Rewards cards below must be combined with one of the cards above to transfer rewards.

- Chase Freedom Flex℠ * The information for the Chase Freedom Flex℠ has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. .

- Chase Freedom Unlimited® .

- Ink Business Cash® Credit Card .

- Ink Business Unlimited® Credit Card .

What other ways can you redeem Chase points?

Chase points can also be redeemed for a variety of non-travel options, from statement credits (1 cent per point), gift cards (1 to 1.3 cents per point), Apple purchases (1 cent per point) and more. Here’s a full list of the ways to redeem Chase points .

Tips for maximizing your Chase rewards

- Compare the cost of a booking through the Chase Travel portal with the cost of booking directly through a partner program. (For instance, look at United’s website to see how many miles a flight would cost and compare that to how many Chase points would be needed on the Chase Travel portal.)

- Be on the lookout for transfer bonuses that appear from time to time with specific programs; this will allow you to use fewer points for a redemption.

- Only transfer to a hotel or airline program when you have a specific use in mind; there is no way to reverse a transfer once it’s complete.

Frequently asked questions (FAQs)

50,000 Chase points are worth at least $500 when redeemed for cash back or travel through the Chase Travel portal and as much as $750 if you hold the Chase Sapphire Reserve® card. However, it’s possible to get even more value when transferring to Chase’s travel partners. For instance, perhaps two nights at a Hyatt property costs $2,000 in cash but only 50,000 Hyatt points to book (Chase transfers to Hyatt at a 1:1 ratio).

100,000 Chase points are worth at least $1,000 when redeemed through the Chase Travel portal, and as much as $1,500 for travel on the portal if you hold the Chase Sapphire Reserve Credit Card. However, it’s possible to get even more value when transferring to Chase’s travel partners for expensive premium cabin flights or luxury hotel stays.

Chase points never expire, but you do need to have an open credit card in good standing that earns Ultimate Rewards points.

Ultimate Rewards points are the rewards currency of select Chase credit cards, earned via welcome bonuses, spending, shopping portals and more. Those points can then be redeemed for a variety of travel and non-travel expenses.

Generally, cardholders can get the most value from Chase points (at more than 1 cent apiece) by booking travel, but redeeming points for cash back is also an option for those who prefer that over travel rewards redemptions.

*The information for the Chase Freedom Flex℠ and Ink Business Preferred® Credit Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

Blueprint is an independent publisher and comparison service, not an investment advisor. The information provided is for educational purposes only and we encourage you to seek personalized advice from qualified professionals regarding specific financial decisions. Past performance is not indicative of future results.

Blueprint has an advertiser disclosure policy . The opinions, analyses, reviews or recommendations expressed in this article are those of the Blueprint editorial staff alone. Blueprint adheres to strict editorial integrity standards. The information is accurate as of the publish date, but always check the provider’s website for the most current information.

Chris Dong is a travel, loyalty, and credit cards reporter. He has covered travel and personal finance content for national print and digital publications including The Washington Post, Business Insider, The Points Guy, Travel + Leisure, AFAR, Condé Nast Traveler, Lonely Planet, and more. When he’s not on the road, Chris calls Los Angeles home after nearly 10 years in New York City.

Julie Stephen Sherrier is a personal finance writer and editor based in Austin, TX. She is the former senior managing editor for LendingTree, responsible for all credit card and credit health content. Before joining LendingTree, Julie spent more than a decade as the managing editor and then editorial director at Bankrate and CreditCards.com. She also served as an adjunct journalism instructor at the University of Texas at Austin.

Robin Saks Frankel is a credit cards lead editor at USA TODAY Blueprint. Previously, she was a credit cards and personal finance deputy editor for Forbes Advisor. She has also covered credit cards and related content for other national web publications including NerdWallet, Bankrate and HerMoney. She's been featured as a personal finance expert in outlets including CNBC, Business Insider, CBS Marketplace, NASDAQ's Trade Talks and has appeared on or contributed to The New York Times, Fox News, CBS Radio, ABC Radio, NPR, International Business Times and NBC, ABC and CBS TV affiliates nationwide. She holds an M.S. in Business and Economics Journalism from Boston University. Follow her on Twitter at @robinsaks.

Hilton Honors American Express business card unveils new profile, plumps up annual fee

Credit Cards Carissa Rawson

Why my Citi Double Cash Card keeps getting better

Credit Cards Lee Huffman

Is the Citi Premier worth the annual fee?

Credit Cards Juan Ruiz

6 little known perks of the Citi Custom Cash Card

Credit Cards Harrison Pierce

Is the Chase Sapphire Preferred Worth it?

Credit Cards Tamara Aydinyan

Why I got the Citi Custom Cash Card this year instead of another travel rewards card

Credit Cards Kevin Payne

Breeze Airways releases new Breeze Easy credit card with lofty rewards, up to 10 points per $1

Credit Cards Stella Shon

6 little-known perks of the Citi Diamond Preferred Card

Guide to Wells Fargo Rewards: How to earn and redeem points for travel and other uses

Credit Cards Jason Steele

Best ways to use Citi ThankYou points

Credit Cards Michael Dempster

Why the Citi/AAdvantage Platinum Select is the best card for earning elite status

Top credit card combinations to maximize your rewards

Chase improves Ink Business Cash card’s welcome offer, adds first-year relationship bonus

How I used Citi ThankYou Points for an affordable Hawaiian vacation

My Citi Premier Card is underused — here’s why I’m pulling it out more in 2024

Chase Sapphire Preferred® Card: Details on 2x Points Per Dollar on Travel

Update: Some offers mentioned below are no longer available. View the current offers here .

I've had the Chase Sapphire Preferred® Card for several months now and the portion of my total spend on the card keeps increasing. I've extolled the benefits of this card many times and I firmly believe this is the best overall travel card on the market right now - at least for the savvy points collector - especially with the current 50,000 point sign-up bonus after spending $4,000 in 3 months (with an additional 5,000 points after you add an additional user and make a purchase in the first 3 months).

I also love the fact that you earn two points per dollar on travel and dining, since as I've said before - that's basically all I do. However, it hit me the other day that I didn't know exactly what was included in "Travel" since it's a pretty broad category. Honestly, I thought it would just include airfare, hotel and rental car - but it actually includes much more. I asked my contact at Chase to clarify and she confirmed the 2x points on travel actually includes:

Airlines Auto/truck/RV rental Limos and taxis - including Uber Lodging Travel agencies Railways Tolls and bridges Parking (lots, meters, garages) Bus Time shares

So honestly, this is much more than what we traditionally think of as travel. If you live in a city where you take taxis, the 2x points could add up quickly. The only things I don't put on my Chase Sapphire Preferred® Card is airfare, because I get 4 points per dollar when booking through using my Premier Rewards Gold Card from American Express and gas and groceries, which my Premier Rewards card gives 2x. Everything else will go on Sapphire, because I value Ultimate Rewards points and the instant 1:1 transfers to Continental, United, British Airways, Korean Air, Hyatt, Marriott, and Priority Club. Amex points are still valuable since they often run lucrative transfer bonuses, but if Chase ever matched them in that department, I'd shift even more spend away from Amex.

So yea, anytime you think something might qualify for travel, you might as well use your Chase Sapphire Preferred® Card card. And if a charge doesn't post as you expect, I know many people have had success calling Chase (live phone reps always answer) and making a case for the bonus points. Heck, I just purchased my Oneworld Mega Do tickets with my Chase Sapphire Preferred® Card - can't hurt to try and get 2x points on that!

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

- Credit Cards

19 Best Ways To Earn Lots of Chase Ultimate Rewards Points [2024]

Christine Krzyszton

Senior Finance Contributor

306 Published Articles

Countries Visited: 98 U.S. States Visited: 45

Keri Stooksbury

Editor-in-Chief

29 Published Articles 3054 Edited Articles

Countries Visited: 45 U.S. States Visited: 28

![chase travel only gave me 2x points 19 Best Ways To Earn Lots of Chase Ultimate Rewards Points [2024]](https://upgradedpoints.com/wp-content/uploads/2020/01/Chase-Sapphire-Reserve-Upgraded-Points-LLC-Large-6.jpg?auto=webp&disable=upscale&width=1200)

Flexibility of Ultimate Rewards

Ease of earning ultimate rewards, chase personal cards that earn ultimate rewards points, 1. earn a welcome bonus offer, 2. purchase travel, 3. use chase travel, 4. buy groceries, 5. dine out, 6. fill up your tank, 7. pay your household bills, 8. earn on quarterly bonus spending categories, chase business cards that earn ultimate rewards, 9. pay for travel expenses, 10. earning through chase travel, 11. pay other business expenses, 12. purchase gift cards, 13. dine out, 14. fill up your tank, 15. go shopping in the chase ultimate rewards shopping portal, 16. everyday purchases, 17. 90-day second chance welcome offer, 18. refer-a-friend for a chase credit card, 19. add an authorized user, everything else you need to know, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

Chase Ultimate Rewards points rival Amex Membership Rewards points as the “holy grail” of credit card rewards.

This is evidenced by the fact that Ultimate Rewards points offer everything you’d want from a rewards currency, including the ability to earn a lot of points without limits and the option to select from a wide variety of flexible redemption options .

Chase issues a powerful collection of credit cards that earn Ultimate Rewards points, so there’s a card (or combination of cards) for every spending profile, whether personal or business.

In fact, you may need a primer on how many ways you can earn Ultimate Rewards points. So, in this article, we’ll cover why you’d want to earn Ultimate Rewards points, which personal and business Chase credit cards earn Ultimate Rewards points, and all of the ways you can earn Ultimate Rewards points.

Let’s get started!

Why Ultimate Rewards Points?

Credit cards offer several reward currencies, but the most valuable are those with flexible redemption options that are relatively easy to earn .

Ultimate Rewards points are valuable because they have both of those key characteristics.

Flexible redemption options for your Ultimate Rewards points result in rewards that you can actually use!

- Redeem rewards at any time with no minimum or maximum redemption amount per transaction

- Transfer rewards to the loyalty programs of the Chase travel partners

- Transfer rewards between business and personal Ultimate Rewards accounts

- Use a combination of points and cash for travel purchases

- Have the option to redeem points for cash, gift cards, and more

Earning Ultimate Rewards points on your purchases is easy when your spending mix matches the reward-earning categories on your Chase credit card.

- Every purchase made earns Ultimate Rewards points

- Bonus category purchases allow you to earn up to 10x rewards

- Generous welcome offers jumpstart your earnings

- Earn up to 20x Ultimate Rewards or more through the Shop through Chase shopping portal

With all the ways available to earn Ultimate Rewards, you may need some assistance sorting through all of the options.

Let’s look at which Chase credit cards earn Ultimate Rewards points and the many ways to earn them.

Bottom Line: Earning a lot of valuable Ultimate Rewards points creates an asset that can be used to fund a family vacation, offset business expenses, or redeem for immediate cash in an emergency.

Earn Lots of Chase Ultimate Rewards With Chase Personal Cards

There are plenty of ways to earn Ultimate Rewards points with Chase personal credit cards. Whether your greatest spending is on travel, dining out, or shopping at wholesale clubs, you’re going to earn rewards on every purchase.

Let’s take a look at all the ways to earn Ultimate Rewards points with Chase personal cards.

There are a number of personal Chase credit cards that earn Ultimate Rewards points. Each has features, benefits, and earning structures that reward specific spending patterns.

Chase Sapphire Preferred ® Card

A fantastic travel card with a huge welcome offer, good benefits, and perks for a moderate annual fee.

The Chase Sapphire Preferred ® card is one of the best travel rewards cards on the market. Its bonus categories include travel, dining, online grocery purchases, and streaming services, which gives you the opportunity to earn lots of bonus points on these purchases.

Additionally, it offers flexible point redemption options, no foreign transaction fees, and excellent travel insurance coverage including primary car rental insurance . With benefits like these, it’s easy to see why this card is an excellent choice for any traveler.

- 5x points on all travel booked via the Chase Travel portal

- 5x points on select Peloton purchases over $150 (through March 31, 2025)

- 5x points on Lyft purchases (through March 31, 2025)

- 3x points on dining purchases, online grocery purchases, and select streaming services

- 2x points on all other travel worldwide

- $50 annual credit on hotel stays booked through the Chase Travel portal

- 6 months of complimentary Instacart+ (activate by July 31, 2024), plus up to $15 in statement credits each quarter through July 2024

- Excellent travel and car rental insurance

- 10% annual bonus points

- No foreign transaction fees

- 1:1 point transfer to leading airline and hotel loyalty programs like United MileagePlus and World of Hyatt

- $95 annual fee

- No elite benefits like airport lounge access or hotel elite status

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 60,000 points are worth $750 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

Financial Snapshot

- Foreign Transaction Fees: None

Card Categories

- Credit Card Reviews

- Travel Rewards Credit Cards

- Best Sign Up Bonuses

Rewards Center

- Chase Ultimate Rewards

- The Chase Sapphire Preferred 80k or 100k Bonus Offer

- Benefits of the Chase Sapphire Preferred

- Chase Sapphire Preferred Credit Score Requirements

- Military Benefits of the Chase Sapphire Preferred

- Chase Freedom Unlimited vs Sapphire Preferred

- Chase Sapphire Preferred vs Reserve

- Amex Gold vs Chase Sapphire Preferred

Chase Sapphire Reserve ®

A top player in the high-end premium travel credit card space that earns 3x points on travel and dining while offering top luxury perks.

If you’re looking for an all-around excellent travel rewards card, the Chase Sapphire Reserve ® is one of the best options out there.

The card combines elite travel benefits and perks like airport lounge access , with excellent point earning and redemption options. Plus it offers top-notch travel insurance protections to keep you covered whether you’re at home or on the road.

Don’t forget the $300 annual travel credit which really helps to reduce the annual fee!

- 10x total points on hotels and car rentals when you purchase travel through Chase TravelSM immediately after the first $300 is spent on travel purchases annually

- 10x points on Lyft purchases March 31, 2025

- 10x points on Peloton equipment and accessory purchases over $250 through March 31, 2025

- 5x points on airfare booked through Chase Travel SM

- 3x points on all other travel and dining purchases; 1x point on all other purchases

- $300 annual travel credit

- Priority Pass airport lounge access

- TSA PreCheck, Global Entry, or NEXUS credit

- Access to Chase Luxury Hotel and Resort Collection

- Rental car elite status with National and Avis

- $550 annual fee

- Does not offer any sort of hotel elite status

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 60,000 points are worth $900 toward travel.