- Places to Visit

- Sightseeing

- Practical Tips

- Where to Stay

How to Use a Contactless Card on London Transport

Anyone with a contactless debit or credit card can use it to pay for travel in London. It’s ideal if you don’t have or want an Oyster card. Or if you run out of pay as you go credit on your Oyster card.

Your card is used the same way as an Oyster card – you tap in and out at the tube or train station ticket barriers or tap the yellow card reader when you get on a bus.

The main difference is that you don’t have to top-up your Oyster card with money, the fare is taken from your debit card or credit card the following day.

You need one contactless debit or credit card per person . You can’t pay for two or more people with one card.

Contactless single fares 2024

Underground.

For central London (zone 1) it costs £2.70 off peak and £2.80 peak per journey with a contactless debit or credit card.

Read more about London’s zones .

What are the contactless peak/off-peak hours?

Off-peak fares apply on Fridays from 8 March until 31 May 2024

Monday–Friday 6.30am–9.30am and from 4pm–7pm.

If you travel into central London (zone 1) from an outer zone, there is no afternoon peak rate . You are charged the off-peak fare.

Off-peak fares are charged at all other times, including Public Holidays.

Contactless Daily Cap 2024

If you want to use your contactless card to pay for travel for the whole day, there’s a ‘daily cap’. This is the maximum you pay for unlimited travel in one day. For central London, it’s £8.50 .

Contactless daily cap from 3 March 2024

It’s £1.75 for one bus journey or for unlimited bus journeys within one hour with a contactless card. If you use the buses all day, £5.25 is the maximum amount deducted from your card.

There are no zones for bus travel in London.

Contactless weekly fares

If you use a contactless card to pay for travel between Monday and Sunday there’s a weekly cap – the maximum amount deducted from your card.

As it runs from Monday to Sunday, the cap does not benefit everyone.

For anyone visiting London for 5-7 days, a weekly Travelcard or bus pass might be cheaper depending on the day you first use public transport.

For central London (zone 1) it’s £42.70 . Contactless weekly cap prices are the same as weekly Travelcard prices.

- You benefit from the contactless ‘weekly cap’ if you arrive in London on Monday or Tuesday and use it to pay for public transport every day until Sunday

- If you arrive in London on Wednesday to Sunday and use public transport every day for 6-7 days, buy a weekly Travelcard instead

The cost for bus travel between Monday and Sunday is £24.70.

- You benefit from the contactless weekly bus fare if you arrive in London on Monday, Tuesday or Wednesday and use the buses every day until Sunday

- If you arrive in London on Thursday to Sunday and use the buses for the next 5-7 days, buy an ordinary weekly bus pass instead

How do I use a contactless card?

Tap your contactless debit/credit card on the yellow card reader when you get on the bus. You don’t need to tap your card when you get off.

On the underground/overground

Tap your card on the yellow card reader to open the ticket barriers at the start of your journey. Do the same when you arrive at your destination. Even if the barriers are open, tap the reader otherwise you are charged the full fare.

The following working day, your journeys are added up and the money is deducted from your bank account or added to your credit card bill.

Non-UK issued contactless card

Visitors with non-UK issued cards should bear in mind that overseas transaction charges might apply when you use a contactless card. It’s probably best to check the fees with your card provider first.

If you have two or more contactless cards, make sure they’re not near each other when you tap your card on the reader. Decide which one you’re going to use and stick to it.

If you use different cards you will not benefit from the daily or weekly cap and you could be charged the ‘full fare’ (expensive!).

A record of usage is available, but you need register your contactless credit/debit card with TfL.

If you don’t want to do this, get an Oyster card instead. Receipts are available when you buy and/or top-up a card at an underground station ticket machine. You don’t get one automatically, you have to select ‘Receipt’ on the screen. Look out for the prompt – it’s easy to miss.

Related pages

- Guide to London transport tickets

- London transport zones

Last updated: 22 February 2024

Transport tickets & passes

- Guide to London's transport tickets

- One day & weekly Travelcards

- Zone 2–6 weekly Travelcards

- Bus tickets & passes

- Oyster card

- Oyster single tickets

- Oyster card refunds

- Contactless cards

- Child tickets & passes

- Local train tickets

Useful information

- Plan your journey

Popular pages

- Left luggage offices

- Congestion Charge

- 2 for 1 discounts at London attractions

- Oyster cards

- Top free museums & galleries

- Cheap eating tips

- Heathrow to London by underground

Copyright 2010-2024 toptiplondon.com. All rights reserved. Contact us | Disclaimer | Privacy

Finding the Universe

Travel tales, photography and a dash of humor

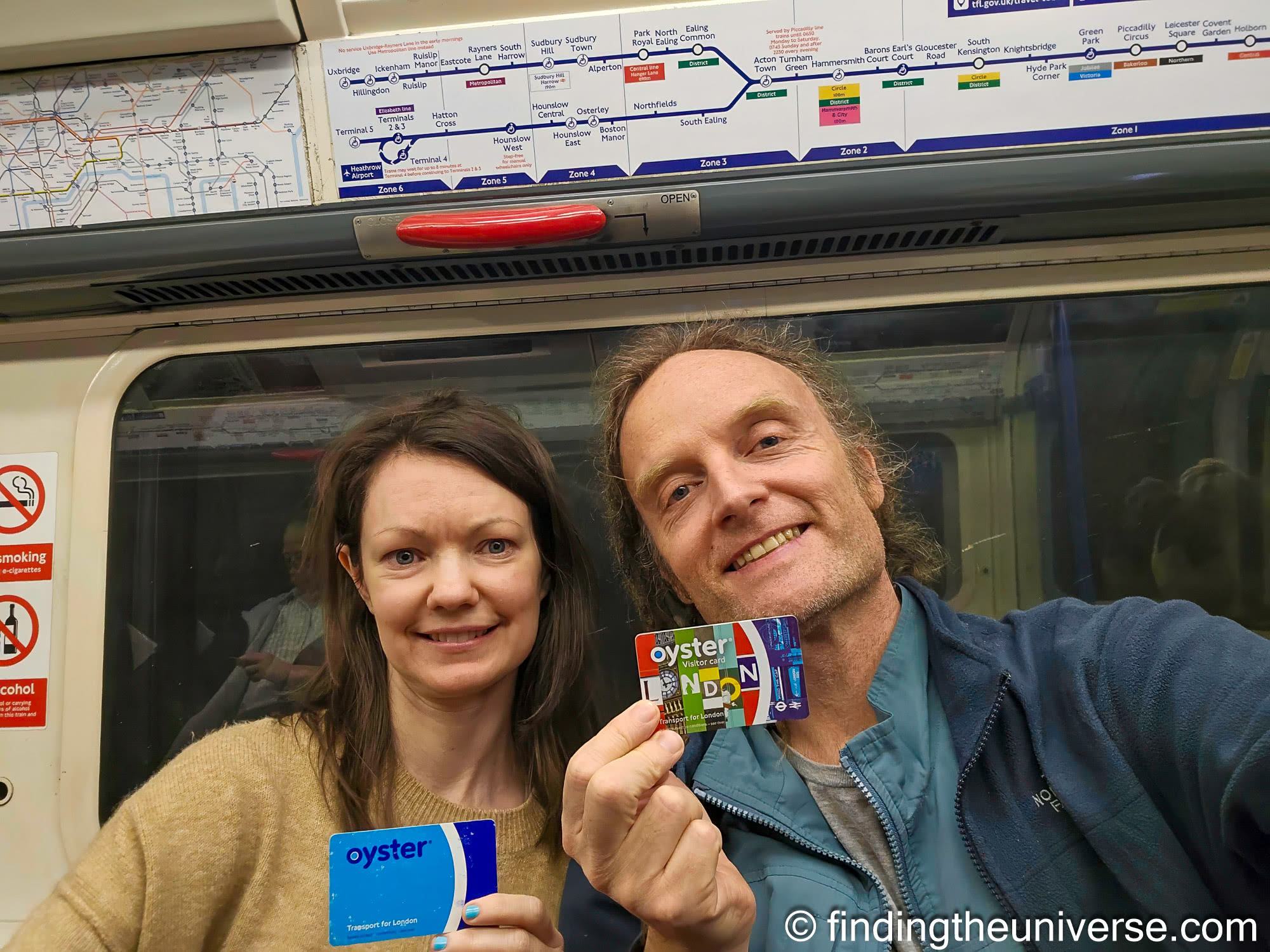

Oyster Card vs Contactless: How to Pay for Public Transport in London

Last updated: March 13, 2024 . Written by Laurence Norah - 62 Comments

I recently wrote a post about the best ways to get around London . That’s all well and good, but it’s missing a key component – the most cost-effective way to actually pay for transport in London.

You’d think this would be a fairly obvious answer, but unfortunately, it’s a little bit more complicated than you might imagine. Fear not though, this post will guide you through the options and help you decide which payment option is best for using London’s public transport system!

First, there are three ways that you can pay for the majority of public transport in London. These are cash, the London Oyster Card, and a contactless enabled credit / debit card. Let’s look quickly at these three options, and then figure out which is right for you.

Payment Options for Travel in London: Cash, Contactless and Oyster

Cash – Cash is by far the worst way to pay for transport in London, and should be avoided in pretty much all cases, with the exception of taxis (although these accept contactless and credit cards too).

Usually, cash fares are much higher than the other payment options, plus some services, like the bus, don’t even accept cash any more. Basically, don’t use cash to pay directly for your ticket in London if you can avoid it!

If you do want to use cash, the best option is to buy an Oyster Card. These can be purchased and topped up with cash at most stations. Just be sure to use a machine that accepts cash, or go to a ticket counter.

Oyster Card – The Oyster card is a London-wide rechargeable card, designed to be re-used, and accepted on pretty much every form of London transport. There are a number of versions of this card, however for the purposes of this post we’re going to focus on the standard blue Oyster card that you can purchase in London from most train and tube stations.

For more on the different kinds of Oyster card, including the benefits of buying a visitor Oyster card in advance, and detailed information on how to actually use an Oyster card for travel in London, read this detailed post on using the London Oyster card .

Contactless – The most recent payment option for travel in London is a bank issued credit or debit card which has been enabled for contactless transactions. This means that the card has a chip in it which can be read wirelessly when held near a contactless enabled reader.

As well as being able to use these cards for normal transactions, you can also use contactless cards to pay for travel in London. These can be used instead of buying tickets with cash or using an Oyster card. If you have an Apple Pay or Google pay enabled smartphone, you can also use this as a contactless payment option.

So those are the three options. In this post we’re going to focus on the Oyster Card and Contactless Cards, to see which one is best for you when paying for travel in London.

Given the high cost of buying tickets with cash, and the fact that cash isn’t even accepted on a few transport options, we’re going to ignore cash as a payment option in this post, and advise you to do so also.

Contactless vs Oyster Cards for London Travel

Contactless – which public transport supports it in london.

Currently contactless can be used to pay for travel on the following public transport options in London: bus, tube, tram, DLR, London Overground, IFS Cloud Cable Car, River Bus, and the majority of National Rail services inside London.

You can also use contactless for some airport services, including Gatwick Express and Heathrow Express. See our guide to getting to London from the airport for more information.

You can also pay for all black taxis using contactless, assuming the fare is less than the contactless threshold of £100. Note that black taxis are separate to other forms of public transport in London and are billed separately – they don’t fall inside travel cards, caps, or other payment schemes.

Basically, anywhere you can already use an Oyster card, you can use a contactless card – just look for the yellow Oyster card reader and don’t forget to touch in (and out, if necessary) to pay for your journey – see more here for details of how to use the different public transport options in London.

Advantages of Contactless

It’s already on a card you own: if you already have a supported contactless credit card or smartphone, using this for your travel is more convenient than getting a separate Oyster card, which you have to pay a deposit on and keep topped up.

Doesn’t need to be charged up: One of the main problems with Oyster is that it’s a preload system, so you need to have credit on the card in order to use it. You can set it up to automatically reload itself, but if you’re a visitor to London this extra hassle might not be worth it.

Instead, you’ll find yourself queuing at reload stations at tube stops, and if you’re at a bus stop with no credit you’re going to be out of luck as most of them don’t have reload points. Contactless cards are linked to your bank account, so as long as you have credit, you’ll always be good to go.

You can use a mobile payment system such as Google Pay or Apple Pay : If your smartphone supports a contactless payment system, then you don’t even need to carry a contactless card – you can just link your contactless card to your smartphone payment system, and pay with that. One less thing to carry!

Can be cheaper in certain situations: sometimes Contactless can be slightly cheaper for daily fares, especially if you are travelling from further out in London, due to a difference in the way daily capping works across zones. This isn’t usually a big difference, but can make contactless a little bit cheaper in some situations for daily journeys too.

Disadvantages of Contactless

Doesn’t support all foreign issued cards: You shouldn’t have a problem using UK issued contactless enabled cards on Visa, Mastercard, Maestro and American Express to pay for your travel on London transport.

Unfortunately, this isn’t true for foreign issued contactless cards, as standards appear to differ. Currently, all American Express contactless cards should work fine. Then, some foreign issued Mastercard, Maestro and Visa cards will work, and some won’t. There’s no definitive list – it’s a case of try it and see!

Foreign transaction fees: If you are using a foreign issued card, even if it is supported by the Oyster contactless system, you need to check to see if it incurs foreign transaction fees.

Contactless payments are in GBP, so if your card issuer charges you transaction fees for foreign currency transactions, then these costs could outweigh the savings of contactless. Check with your card provider before you travel to see if this is the case.

Concessions can’t be added: A big disadvantage of contactless is that the system currently doesn’t support concessions, such as those for seniors, students, and children of a certain age.

If, for example, you’re a visitor to London travelling with children aged 11-15, you will want to use Oyster cards or travelcards in order to get discounted travel, such as with the Young Visitors Discount which offers 50% off travel when loaded to an Oyster card.

Children under 11 qualify for free travel with a fare paying adult, and this does work with contactless. You will just have to use the wider ticket barriers (marked for accessible / luggage) in tube stations so you can pass through together.

See more about how this works when travelling with children here , and more on available concessions here .

Oyster – Which public transport supports it in London?

Oyster works on all the same public transport options in London as contactless, namely, bus, tube, tram, DLR, London Overground, IFS Cloud Cable Car, River Bus, and the majority of National Rail services inside London.

Note that you cannot use your Oyster card to pay for a black taxi in London.

The Oyster Card is also not supported on private services like Hop on Hop off buses, which you would need to purchase separately. You can see some Hop on Hop off options in London here for an idea of pricing.

Hop on Hop off transport options are also included on a card like the London Pass , which might be a good option if you plan on doing a lot of sightseeing when in the city.

Advantages of Oyster

It works and support is available. As noted not all contactless cards work with the system but the Oyster card should always work. If there are problems, you can get support or get your credit refunded if your card is registered on the TfL website .

Easier to keep track of spending: Because you have to load your Oyster card, it’s easier to keep an eye on how much you are spending on London transport and you can set a limit much easier.

That said, I don’t think this makes a great difference to your average person as you will likely have to travel anyway, but it’s something to keep in mind if you like to restrict your spend on public transport.

Supports travelcards: One of the main advantages of the Oyster card is that it supports travelcards. These are fixed payment pre-paid options, where you pay a certain amount for unlimited travel inside specific London zones for a weekly, monthly or annual price.

With weekly fare capping, this has become less of an advantage, because the price of a seven-day travelcard on Oyster is the same as the weekly cap on contactless. However, a seven-day Oyster travel card is valid for seven days from when you activate it, regardless of which day of the week it is, whereas contactless capping is fixed for Monday – Sunday.

If you are in London for seven days starting anytime outside of that Monday – Sunday period, and will be travelling enough to make the travel card worth it, then it will be better value than a contactless card.

Supports cash : If you want to pay for your transport in London using cash, you can buy and top up an Oyster card with cash. This is normally a lot more cost effective than paying for a cash ticket, with the rare exception of a one-off single journey as you have to consider the cost of the Oyster card.

Supports concessions: As discussed above, if you are travelling with children, or are a London resident who qualifies for one of the discounts and concessions available to adults (see here for full list), you will want to use the Oyster card that matches your concession in order to get the best deal on transport in London. As a visitor to London with children aged 11-15, you can also add a Young Visitor discount to an Oyster card for savings.

Visitor Oyster Card Discounts: If you buy a visitor Oyster card prior to your trip to the UK, such as the one included with the London Pass , it qualifies you for some discounts. I’d not say these are worth buying the card for specifically, but they are good to know about.

Disadvantages of Oyster

You have to pay a deposit: When you first get a regular Oyster card, you have to pay £7. This used to be refundable, but as of 2020 this £7 is added to the card as credit a year after your purchase.

This credit happens when you take a journey using the card between one year and eighteen months after first activating it. If you don’t use the card in that six-month window, the credit is lost. If you are only visiting London for a short time, this might not be credit you can use, meaning there’s a tangible £7 cost associated with using it.

Note the Visitor Oyster Card only costs £5 to buy, but this is a fee and does not become a credit. For most visitors though, the £7 of the regular Oyster card is lost anyway.

It has to be recharged: One of the main downsides of Oyster is that it’s a pay as you go card that needs to have credit on it use it. This is fine if much of your travel is by tube as the majority of tube stations have machines that you can top-up on.

However, if you travel by bus a lot (often the most cost-effective way to get around London), you’ll have to go out of your way to find a charge point, as most bus stops don’t have them. If you register your card online, you can mitigate this issue by setting up auto top up.

Can’t be used on taxis: This isn’t really a big deal, but it’s worth bearing in mind that you can’t use your Oyster card on taxis. To be honest, the higher fares associated with taxi rides mean we’d suggest avoiding using a taxi unless you really want a direct trip from point A to point B, however, we’ve added it for completion!

There will always be leftover funds: Because Oyster is a pay as you go system, you have to have funds on the card to use it. Because trips vary in fee, it’s almost impossible to get the card to zero. So if you stop using the card, there will be leftover money on it.

You can get this money back by returning the card, but we suspect most people don’t do this. TfL have shared that as of 2019 there’s over £400 million in unused balances and deposits!

Should You Use Oyster or Contactless to Pay for Public Transport in London?

First, if you are visiting London and don’t have a contactless payment card, I wouldn’t worry too much about trying to get one just for the trip to London – the Oyster system will suit you just fine.

If you would like to pick up a visitor Oyster card in advance, you can do so from this link .

Alternatively, if you are coming to London as a visitor, you can buy an Oyster card in a package with the London Pass here and save on attraction entry as well. See our review of the London Pass here .

The situation changes if you already have a contactless card which is compatible with the public transport system in London.

In the majority of cases, if you have a contactless enabled credit or debit card supported by the London transport network, then you should use it to pay for travel in London. It’s the easiest and most convenient way to pay, is supported on every form of transport, and in most cases is either cheaper or the same price as using an Oyster card.

The main times you should NOT use your contactless card are:

- If your card is not UK issued and your card issuer charges you fees for overseas transactions that make it more costly than Oyster

- If you are eligible for a concession , such as when you are travelling with children aged 11-15, or if you are a senior citizen resident in London

- If you are buying a weekly 7-day travelcard for travel exclusively outside Zone 1 (unlikely as a visitor to London)

- If you are buying a weekly 7-day travelcard, and you will travel enough to hit the daily cap on at least five out of those seven days and your trip is for a week-long period that isn’t from a Monday – Sunday.

- If you are buying a monthly travelcard for travel in London – this is not possible on contactless and there is no monthly capping

There are no doubt some more situations where an Oyster card or travelcard might be cheaper than contactless. Usually, figuring this out will require you to do a bit of math and have a detailed understanding of your exact travel plans, which might take more time than is worth the small saving!

As a visitor, we believe that in the majority of cases if you already have a contactless card you are going to find that it is both cheaper and easier to use contactless for your London travel, outside of the five points listed above. If one of those does apply, you can get an Oyster card here before you visit, or simply buy one on arrival.

Our advice therefore, is to use your contactless card for London travel if the five points above don’t apply to you. It’s easy and convenient, you don’t need to worry about recharging it, and you benefit from daily and weekly caps for travel, meaning it will likely be cheaper than the other options in nearly every case faced by most visitors to London.

Does Oyster Support Weekly Capping?

Until the end of September 2021, only contactless supported weekly capping on fares across the whole network. Both Oyster and Contactless have long supported daily capping (meaning you won’t ever pay more for your travel than if you had purchased a one day travel card), however until September 2021 only contactless supported the Monday – Sunday weekly cap.

As of 28th September 2021, both Oyster and contactless support both daily and weekly caps across the TfL network, which is great news for Oyster card users as it can be a significant saving.

For an example, if all your travel is within zones 1 and 2, the current weekly cap is £42.70 (as of March 2024). This weekly cap is calculated for travel from Monday through to Sunday, meaning it works best if your travel starts on a Monday. For comparison, the daily cap in zones 1 and 2 is £8.50. Over seven days, that works out to £59.50.

Tips for using your payment method

Once you have picked your payment method, be that contactless, Oyster or a smartphone payment system – make sure you stick to it, and only swipe that payment method on the reader! If you hold two payment methods near the terminal, it will randomly pick one of them, meaning you could be double charged if you don’t touch out with the same card.

If you are using a Google or Apple smartphone to pay, make sure you use that consistently. If you have a payment card registered on the device and decide to switch to the physical card instead of using the smartphone, or vice versa, this is technically registered as a different payment card.

This is actually a good workaround if there are two of you travelling together and you only have one contactless payment card. You can add the card to your Apple or Google device, and then one person can use the physical card and the other one can use the smartphone version.

We also highly recommend you register your payment method online with TfL . This has multiple benefits, including being able to keep track of your spending, and in the case of an Oyster card, you can reclaim and funds on it if you lose it!

Further Reading

We have plenty of further reading to help you plan your trip to London, both content we’ve created based on our experiences, and third-party content we think you’ll find useful.

- Looking for things to do in London? See this complete list on GetYourGuide of attractions, tickets and tours for some ideas!

- Our detailed guide to public transport in London

- The official TfL website , which will give you information on tickets, routes and any updates to services in the forms of delays or cancellations

- Jess’s detailed guide to the London pass , which will help you decide if this is a good way for you to save money on your London sight-seeing. The London Pass has a package option to include a Oyster Card and currently also includes Hop-on, Hop-off bus passes, which can be a great transport option.

- My guides for London must do’s in one day, as well as a detailed two day London itinerary . If you have longer in London, we also have a detailed six day London itinerary

- Harry Potter fans will want to check out our guide to the key Harry Potter filming locations in London

- Jess’s guide to a 1-day walking tour of the highlights of London .

- The Eyewitness Travel Guide to London , which has all sorts of information within, including more itineraries and ideas for your trip

- Rick Steve’s London guide, the #1 bestseller on Amazon for UK travel guides, and always an excellent source of relevant information

And that sums up our post on the best way to pay for public transport in London! As always, if you’ve got any comments or thoughts, let us know in the comments below!

Enjoyed this post? Why not share it!

There are 62 comments on this post

Please scroll to the end to leave a comment

Nilesh Sahni says

7th January 2024 at 4:27 pm

We are couple visiting London for 8 days and planning to go to Edinburgh by LNER rail. We are comfortable with contactless cards to commute in London, but I saw there are some railcard concessions on booking LNER tickets for Edinburgh.

I’m getting inclined to purchase twotogether railcard to make use of this concession. Please suggest is it worth buying this railcard just for LNER rail concession or is there any other better alternate to book this travel.

Laurence Norah says

9th January 2024 at 1:35 pm

A railcard can definitely save you money on train tickets. However, the best way to save is by booking as far in advance as you can. For example, a standard single from London to Edinburgh is around £193 at the moment. If you book in advance as far as you can, prices are as low as £44.10 currently for one person one way. I believe tickets can be booked up to 90 days in advance of travel.

In terms of a railcard, whether or not it will save you will depend on the ticket. With the previous example:

2 advanced singles without railcard would be £88.20 without the railcard, and £58.20 with the railcard. 2 anytime singles without railcard would be £387.8, and £255.90 with.

I believe the Two Together railcard costs £30. In the first case, the saving would be exactly the same, however I assume you are doing a return journey so yes you would end up saving. In the second case, you would definitely save.

Have a great trip!

Amanda Smith says

6th September 2023 at 4:16 pm

We will be traveling to London for the first time soon. We’re planning on staying in the city for a while then traveling to the Cotswolds for a few days before we head back to the airport. We are trying to decide on the best way to do this. We could rent a car in London but we’re a little intimidated about driving through the city (on the side of the road we are unaccustomed to driving on), or I’m thinking we could take a train to a less populated city (like Oxford, for example) and rent a car there to head to our final destination. My question is this: Can you use the contactless system and Oyster cards for the train? If so, is there some cost advantage to using one or the other? Do I need to book the train in advance? And finally, do any of these sound like a decent plan, or do you have a better option?

6th September 2023 at 4:23 pm

This is a great question. So I would highly recommend not renting your car in London. I’m actually doing something similar right now with a trip around Wales, so rather than rent in London I took the train to Cardiff and will be renting to and from Cardiff instead. London is challenging to drive in, plus there are the issues of the congestion charge zone AND the Ultra Low Emissions Zone to contend with. So best to skip all that if you can!

Oxford, Bath or Bristol would all be good options for getting to the Cotswolds. I’d probably err towards either Bath or Oxford as they are smaller so easier to drive from. I’d definitely suggest picking up and dropping the car at the same location as it avoids the one-way fee.

For trains, the Oyster card doesn’t work beyond London. However it’s easy enough to book train travel in the UK. There are direct trains from London Paddington train station to both Oxford (around an hour) and Bath (around 1.5 hours), and you can book trains online using a site like trainline . You can also just buy tickets on the day if you prefer with contactless payment from a ticket machine, but if you book in advance you normally get a better price and, depending on the train, a reserved seat. However you don’t have to book in advance.

Hopefully this answers your questions, but if not do let me know and I will do my best to help out! Have a great time in the UK. I’d also suggest reading my tips for driving in the UK which might give you some pointers 🙂

Jeremy says

15th October 2022 at 5:44 pm

Thank you for the detailed write up. A question: Instead if using one contactless and one physical card, can I use 2 contactless iPhones (Apple Pay) linked to the same card? As I do not intend to bring the physical card along. Thank you.

16th October 2022 at 3:45 pm

Yep, that would work! Every device creates it’s own “virtual card”, which the Oyster system sees as it’s own card.

Keith Pugsley says

19th September 2022 at 7:06 pm

Thanks for the Blog. With a son just starting study in London I have looked into this ‘minefield’ of confusion. If you have the knowledge (and inclination) I’d value your thoughts on the questions I still have. 18+ Oyster card talks of ‘discounted travel’ but all I can see from the Tfl website is that there is a discount for purchasing Travel cards. No mention of discount on fares. The only discount I can see for fares is if it is linked to a Railcard and then there is a 30% discount on off-peak travel on the tube. However you can link a Railcard to a standard Oyster card and also get this discount so what is the point of a student oyster card? Then it seems you have to pay a £20 ‘admin fee’ to get the student oyster card, whereas it seems you only pay £5 for a regular adult card. The Tfl site says for pay as you go using ‘contactless’ you don’t get cheaper fares! But this is not explained. just another ‘hanging statement’. If you are able to throw any light on this I’d be most grateful. Thanks.

20th September 2022 at 9:20 am

I hear you, the TfL website is a bit of a maze when it comes to finding things out. You are correct, the 18+ Oyster card does not offer discounted travel on pay as you go fares, only on Travelcards, for which there is a 30% discount. I think the theory is that this is aimed at someone who will be travelling multiple times a week, for whom a travel card would make sense, and so then there is the added benefit of a 30% discount.

The question really is to think about how often your son is likely to need to travel using public transport. If it is going to be at least 4 days a week, then a travel card with the discount is likely going to save money. If it’s less than that, then there might not be any savings, in which case just using a normal contactless bank card for payment, or an Oyster card, might be just as cost effective.

You are also correct that there is a railcard option, which might make sense if your son already has a railcard. I think the option exists to link it to a student Oyster card because you can still use a student oyster card as a normal Oyster card without adding the discounted travel card to it, so this would save someone having to carry two cards.

I hope this helps a bit. My main suggestion is to look at where your son will be living and his travel requirements, and then doing a bit of math to see which option is going to work out the most cost effective. I also wish him the best with this stage of his life 🙂

tawny own says

12th September 2022 at 3:58 pm

Thank you! Info which I think was not covered in the article – can you use cash to buy and top up an Oyster card – and which is difficult or impossible to find on the TfL site. Have spent about an hour trying to find out.

12th September 2022 at 3:59 pm

Thanks! I’ve updated the post to make this clearer, that you can definitely use cash to top up an Oyster card, as well as to buy one. The larger machines at tube stations accept cash, as do the ticket counters at stations with ticket counters.

5th September 2022 at 8:25 pm

My wife and I will be traveling from US to London soon. (4 days) We have a good no foreign fees contactless card, but the card is a joint account. Can we use the same card for two riders for underground/bus fare? I’m would like to use contactless for the reasons that you mentioned -(Initial charge for the Oyster card – how much to put on it – and we are sure to have unused money on it)

on another note – Quick question-transportation from Heathrow to city center can be cheaper and faster than a cab- but we will have luggage and need a transfer from station to the hotel (Westminster area). thoughts? Thanks Ken and I will also check out your other trips on visiting London

6th September 2022 at 10:43 am

So you can’t use the same physical card, but what you can do is use a virtual version of the card. So if you have a smartphone that supports contactless payments (Google Wallet or Apple Pay for example), or a smartwatch, then you can add the card to that device and use that as a second card. Because the smartphone assigns it a virtual card number, it works as a separate card for the purposes of the TfL system. This is fully supported and my wife and I do this, so I know it definitely works.

If you don’t have an app or supported phone, then you can also purchase an Oyster Card easily and load it up.

For transport to central London, for sure, the Underground, Elizabeth Line or Heathrow Express will be the lower cost option, although Heathrow Express won’t be much difference. The Underground would be around £10 for the two of you, and Elizabeth Line (to Paddington) will be around £24 for the two of you.

I actually have a whole guide to getting from London airports to central London .

So you have two options really, one is to book a transfer in advance from Heathrow using a service like minicabit . Prices will be in the region of £70 – £80 I expect.

Alternatively, you could take the Elizabeth Line to Paddington and then take a taxi or Uber from there. Honestly, the cost saving probably won’t be that great as you have to get across London. The cheapest option is definitely going to be the Underground but you will have to change lines and it will be less convenient of course.

Have a great trip to London and let me know if you have any more questions!

5th July 2022 at 7:22 am

I am slightly confused about the travelling with children situation. I am visiting in August with my 8 year old and can’t decide if I actually need a visitor oyster card or can just use contactless. A friend of mine travelled with her daughter last year and just used contactless but your article says that’s not possible? Any chance you could clarify this please? Thanks ☺️

5th July 2022 at 10:41 am

Your friend is correct, and I recently was able to get clarification from TfL on this point as well. Children under 11 can travel for free with a fare paying adult on contactless pay as you go, as long as they are with the adult. This works on contactless. I’ve updated the relevant section of this guide to be clearer on this point! When using the tube, just be sure to head to the wider barriers which are marked as accessible / for luggage, so you can pass through together.

Let me know if you have any more questions 🙂

5th July 2022 at 2:04 pm

Thank you so much, that’s really helpful information!

Olivia says

14th June 2022 at 2:40 pm

Thank you so much for the article Laurence, truly helpful!

I have a question… You mentioned about the possibility of sharing one bank card between 2 people by one using device and the other the physical card (contactless). How does that work? How does it show in the bank statement?

You recommended registering our payment method online and I saw on their website that you can actually know your trip history online if you use Apple Pay by adding your credit card number to your online account. But if me and my friend register the same credit card on our accounts (one of us using Apple Pay and the other the physical card), would that affect anything?

Many thanks!!

14th June 2022 at 4:18 pm

Hey Olivia!

My pleasure. Ok, this is a great question. So you can definitely use one card between two people by having one person use a physical card and one using a contactless payment method. This works (as I understand it), because Apple Pay / Google Pay create a virtual card number for transactions, so the TfL system sees it as a different card.

You can still register them “both” on the TfL system. I believe the way you do this is create an account normally, and then add the physical card details to your account. When you travel, it should show the different devices you are using (the card, Apple Pay, Google Pay etc). TfL even says that using different devices, like an Apple Watch or separate smartphones, also count as different payment methods, even on the same card.

However, I *think* you need to manage them from one account which would be registered to the person whose name the card is in.

Hopefully this makes sense, let me know if you have any more questions!

Jennifer Budd says

27th March 2023 at 6:53 pm

Hi Laurence- Quick piggy back question. What if there are three family members traveling together with the same card? We are traveling with our 16 year old son. Thanks! Jen

30th March 2023 at 2:10 pm

Hi Jennifer!

So you can’t use the same physical card for multiple people, but if you have multiple devices (an Apple Watch and an iPhone for example) then you can load the card onto a virtual payment method like Apple Pay or Google Wallet, and each person can then use the card. You just need a different device for each person, so that would be two devices and the physical card in your case.

I hope this makes sense, have a great time in London!

varados sucuri says

19th April 2022 at 9:14 pm

The system strikes me as relentlessly complicated and not at all user friendly. Cash appears to be considered poisonous. Is there any way to obtain an Oyster card with cash? I saw no mention of privacy. Are all these transactions automatically collected by the British government and used to track the movement of its citizens?

20th April 2022 at 11:04 am

Hi Varados,

You can indeed purchase an Oyster card with cash at various locations including at many newsagents and at tube stations across London. You can see a full list of where you can buy your Oyster card here: https://tfl.gov.uk/fares/how-to-pay-and-where-to-buy-tickets-and-oyster/buying-tickets-and-oyster?intcmp=54759

It can also be topped up with cash at ticket machines, just make sure you don’t use the “card only” ticket machines and you will be fine.

6th March 2022 at 11:10 pm

thank you.. it is really helpful

7th March 2022 at 11:56 am

My pleasure 🙂

28th August 2021 at 10:40 pm

Absolutely love that article. Thank you

29th August 2021 at 8:36 am

Thanks very much!

John Pressagh says

11th February 2020 at 7:57 pm

Please subscribe me to mailing list

11th February 2020 at 11:20 pm

I can confirm you are subscribed 🙂

Philip says

11th December 2019 at 1:00 pm

Thanks Laurence, most helpful. For occasional visitors to London, like me, contactless beats Oyster. I had an old style Oyster & applied for the newer type and received that by post. I went online and arranged to transfer my small balance over to the new card. As expected they cancelled the old card and said I would get the transfer on tapping in with my new card between dates in the very near future when I shall not be in London. I tried to arrange ithe transfer by phone but needless to say I have had to write. I set up auto top up on my new Oyster but the minimum transfer and retained credit is £20. Again a date I can’t make but that £20 will be transferred back to me automatically. Your warnings about unused balances now refers to a minimum of £20 if auto top up is set up. Frankly a single registered contactless credit card is much easier provided I use the card itself, Apple Pay on phone or on watch and never mix the card or devices on any given journey.

11th December 2019 at 3:32 pm

Hi Philip – we agree! There are only a few cases where an Oyster card makes more sense, we think that most visitors and travellers in London will benefit from contactless these days.

Thanks for stopping by and sharing your experience, much appreciated 🙂

24th October 2019 at 10:13 pm

Thank you so much for all the infos. Very comprehensive and useful … However it looks like the London public transports system is not only Byzantine but also quite expensive if not a scam. In comparison with Paris, the Navigo Card cost 22.80 € weekly (Monday to Sunday) or 75.20 € monthly, for all zones (plus 5 € for the card). With it you can use any Metro, RER (suburban express) train, buses, Transilien suburban trains, and trams … as much as you want. In a nutshell : It is unlimited for the period the card is valid (weekly or monthly) and can be top up for every new period. This has to be put in light that pollution in a real concern in Paris and the local authorities want to phase out dramatically the use of cars in the French capital to render it inconvenient and expensive : narrowing the streets to make wider pavements and or lanes for bus/taxi/bicycle as well as expensive car parks. On the other hand since the last 2/3 decades or so a lot of money has been invested to expand and modernize the infrastructures by offering an alternative/incentive to motorists/commuters while keeping affordable prices.

25th October 2019 at 4:41 pm

It certainly sounds like the Paris card is more cost effective, although I can’t comment as to why that is! Thanks for your input 🙂

1st August 2019 at 7:54 pm

Thank you very much for the information on the blog! I wanted to specifically ask you something.

I travel from Croydon/zone 5 to London bridge/zone 1 M-F also take busses. I was told to buy the weekly plan on the oyster card for £60. Because the contactless payment will most likely charge me a daily rate of £12. Is it just the same with a contactless payment and the oyster then? I understand from your blog, that no matter what, anyway there is a weekly limit?

2nd August 2019 at 9:10 am

Our pleasure. I will try to help 🙂

So the Oyster card has a daily cap for all journeys, and a weekly cap for bus and tram journeys only. Contactless has both a daily cap and a weekly cap for all journeys including the tube.

However, the weekly cap on contactless always runs from Monday to Sunday. So if someone is visiting London from say a Wednesday to a Tuesday, even though they may travel for a week, they end up falling into two weekly cap periods, so the overall cost might end up higher.

In this case, the 7 day travelcard would make more sense because it starts on the first day you use it and then runs for a week. However, if you are commuting regularly every week, then contactless would be best. After that, the Oyster travelcard would be better than just Oyster, as Oyster by itself has no weekly cap for tube journeys.

Let me know if this doesn’t make sense!

6th August 2019 at 1:44 pm

Hi Lawrence. One more question… if traveling with the oyster will set me up in a plan of a total of £60 per week. How much would be the max weekly cap m/f on the contactless payment. Using busses and trains from zone 5 to zone 1. I’m trying to understand what payment method will actually be cheaper… Many thanks! Juan!

7th August 2019 at 2:32 pm

The weekly cap prices are usually the same. Looking at the TFL site, the weekly contactless cap price for zones 1-5 is £60, with a daily cap of £12.

I hope this helps 😉 You can calculate it yourself here: https://tfl.gov.uk/fares/find-fares/tube-and-rail-fares/caps-and-travelcard-prices?intcmp=54720

Maggie says

27th July 2019 at 11:28 pm

Hello, great information, I was in London last year and used contactless card , it was so easy. I am now planning on returning to London next week, however I will be with my 2 children aged 7 and 9. I can’t seem to find anything clear on what to do with them. We will be taking national rail transport from surbiton into central London on a daily basis and I understand this is free for children their age, as all tube and bus transport in central London, if with an adult with travel card or oyster card. do i just use my contactless and have a guard always let them through the barriers? I presume this would be the case even if I did get a visitors oyster card. or I have read about a child zip oyster card? is this something they would have to get? I’d be grateful for any help you may be able to give, thanks

29th July 2019 at 7:47 pm

I’ve contacted TfL about this issue in the past as it’s quite a common question, and the response I am given every time basically mirrors what you say – the guard will let you through the barrier with your kids. As long as you have a valid card, they can travel with you. You don’t need the zip oyster card, I believe that’s just for kids travelling alone.

I hope this helps – let me know if you have any more questions!

Beckie says

12th June 2019 at 2:17 pm

Thanks for this useful article. I have lost the auto top up on my pay as you go Oyster recently due to not updating my card details in time. I don’t seem to be able to re-add it. I feel forced into using contactless, which I am OK about (and you advise for me, I travel 3 days a week Croydon to London and have no concessions) but I am going to miss being able to view my journey history. Occasionally I have picked up payment faults (like tap out not having worked properly) by looking at it. Am I right in thinking only the actual payment will show on my bank account, not where I tapped in/out of? I think this is a major downside and feel a bit vulnerable to over paying. Beckie

12th June 2019 at 2:29 pm

My pleasure. So certainly, TfL are moving towards contactless and away from Oyster in the mid term – it’s obviously easier for them if they don’t have to manage a whole card system.

The good news is that you can track your contactless journey history – just sign up at https://contactless.tfl.gov.uk/ and you can enter your card details and it will show you your journey history for that card, including all the payments, where the journey was to and from, when you hit a daily cap etc. It’s also accessible in the TfL app 🙂

I hope this helps – I’ll update the post to include this information 🙂

7th May 2019 at 5:23 pm

Hi, I will visit London for 10 days. I still don’t quite understand what a `contactless’ card is? Is it a regular credit card issued from a bank. I checked all my credit card and didn’t see any symbol or icon indicating the card is contactless. If I ask the local bank (in US), do they understand what contactless mean? Also, I have a travel card used for traveling and will not charge for transaction fee ( worked that way when I was in Asia). Do you know if that will work for this travel card at all the station machines and will not post transaction fee? (that may be a stupid question, the machines may only charge for what need to be charged, bank is the one will figure out the transaction fee, right?)

Thank you Joy

7th May 2019 at 5:40 pm

So a contactless card is a relatively new payment technology where the credit card has a wireless chip built into it, so instead of inserting it into a card machine, you just hold it near the card machine, and it takes the payment. As this is the same technology that the Oyster cards have used for a long time, when contactless cards became popular in the UK, the Oyster card readers were updated to support them. The contactless logo is on the card, and looks like four little single parentheses, all getting bigger.

I’m not sure how widespread contactless is in the USA however, it’s down to the individual banks to implement. Your bank should be able to tell you, it is certainly a well known technology by now.

For the bank card and transaction fees, your card should work the same as it did in Asia, so if you don’t get charged fees it should just work as a payment card. It’s important to always choose to pay in GBP rather than USD if given the choice, as your bank will usually give you a better rate than if you let the merchant do the conversion, as they usually give bad rates.

I hope this all helps, and it’s not a stupid question at all! If you still need clarification, I am happy to help!

7th May 2019 at 8:38 pm

Thank you so much for the information.

I checked my bank credit cards again, there is one with the logo you mentioned, I will check with the bank.

Wonder if you can give me suggestion about where should stay. Since I am a member of a brand hotel, and they are much cheaper than the ones in the London center. There is one not far away from Heathrow airport, (and the Hayes district ) I plan to stay there during my London visit and take Heathrow express daily to and back from London city. (I looked up the info, it takes may be 15min)

Should I purchase the oyster card for visitor and can the card be used for the Heathrow express, and while I am in the city?

Or purchase the one for the express for my daily travel, then another oyster card for the use in the city?

Thank you so so much for all your information. It is really reassuring, I am sure for all travelers who never been in a new city, to have a blog like yours. I hope you don’t mind later I have few more questions. ( I will try look up myself first …. that’s how to adventure travel)

Have a great day

8th May 2019 at 9:29 am

So you can use the Oyster Card for Heathrow Express, but I’d advise against it because it will charge you the full fare, which is up to £25 each way. This would quickly negate the cost saving of staying outside the city center! However, if you book online in advance you can get tickets for as low as £5.50. So if that is the option you choose, I would suggest doing that. A couple of posts worth reading are our guide to getting from London’s airports to the city centre:

https://www.findingtheuniverse.com/get-to-london-from-airport/

And one of our itinerary posts, which has a bunch of hotel recommendations 🙂

https://independenttravelcats.com/london-itinerary-6-days-in-london/#Where-to-Stay-for-6-Days-in-London

If you did decide to use the Oyster card, you would only need one, it covers the whole London area,

Happy to help with any more questions 🙂

francis croker says

22nd April 2019 at 9:55 am

am going down to Wembley in may for cup final,been told aneed a contactless card,please help me out,havnt a clue where to start.,

22nd April 2019 at 10:29 am

Hi Francis,

If you have a contactless debit or credit card from your bank (it will have a little symbol on it to indicate this), you can just use this to navigate – just touch the card on the yellow reader at the gates and the system will calculate the correct fare. If you don’t have a contactless card you can contact your bank and they should be able to send you one – most banks issue contactless cards by default these days.

If you don’t have a contactless card, you can just buy an Oyster card instead, most underground stations have Oyster card sales points. These are pay as you go cards, so you need to preload them in advance, which you can do at the station.

I hope this helps – enjoy the game!

Joseph Leiba says

31st March 2019 at 7:18 pm

Isn’t there a disadvantage of relying on a mobile payment option like Android Pay, because it requires cell service? I’m concerned that I would lose cell connection in an underground station and be out of luck.

For the auto top-up option with Oyster, is there still a danger of not having enough credit on the card for some trips with higher fares?

Thank you very much!

31st March 2019 at 7:48 pm

Android Pay doesn’t need cell service, it works offline 🙂 The card details are stored in your phone and passed directly to the reader. So it’s like using a normal credit card, which also works without cell service as you know 🙂

I just spoke with TfL about your second query as no-one has asked that before. They said that you are correct – if you try to take a journey that costs more than the balance on your card, it will likely reject the card. Heathrow Express for example is over £20, and the auto-topup only kicks in at £10. So if you have a balance of between £10 and £20, it won’t autotopup, but you also won’t be able to use it for that journey.

I would probably use contactless or Android Pay generally to avoid this situation,

Let me know if you have any more questions!

31st March 2019 at 9:06 pm

That is very helpful! Thank you so much!

Gavin Spencer says

12th March 2019 at 10:30 pm

Hi Laurence,

Two questions: An Oyster card doesnt merely extract payment. Before it does so, it needs to calculate how far you have travelled, and does this by recording where your journey begins (when you tap in) and later, where it ends (when you tap out). Contactless cards have this “journey calculation” capability? Wow, that’s an awful lot of extra “thinking” for a simple credit/debit card, isnt it? In any other transaction a contactless card merely has to make a predetermined payment. (I realise you didnt design the system, just wondering what you might know.)

Also, regarding the foreign transaction fees using overseas contactless cards: If you use an overseas credit/debit card to charge up an Oyster card, that will also incur foreign transaction fees, so isnt it kind of a wash? Or do you think that the fees will be more if you use the card to travel rather than just to charge up your Oyster card?

Thanks in advance. A very informative article.

13th March 2019 at 9:51 am

So as I understand it the processing doesn’t happen with the card, it happens with the Oyster system. When you tap in with your Oyster or contactless card, that information is registered with the Oyster system, which then tracks your journey. It’s also more clever than just tracking a single journey – it tracks your journeys on all the various Oyster enabled transport options, so if you fall under the daily or weekly caps, you won’t pay more than you have to.

For the foreign transaction fees – yes, you are correct, it would be the same if you used the same card for the top up. That said, some banks charge a minimum amount per foreign transaction. So if you top up an Oyster card once, you will only be charge that fee once. However, if you journey several times on the credit card, there’s a risk of being charged that minimum amount every time, which could add up quickly.

I hope this makes sense!

13th March 2019 at 6:00 pm

I see what you’re saying. But still, having the contactless card talk to the Oyster system is an extra layer of “intelligence”, over and above simply making payments.

On the other thing, gotta balance the possible fees with the inconvenience of obtaining an Oyster card and the £5 deposit, which as I recall can be a hassle to get back. Not every station and do it. Sigh….so many decisions 😉

Antony Macer says

5th March 2019 at 6:11 pm

Your web-page is a delight. As an ex-Londoner who now only occasionally visits the city, the need to find advice like this is essential. Many thanks for making access to it so simple.

5th March 2019 at 7:44 pm

Thanks so much Antony, that’s really kind. Let us know if you have any questions, and have a great time in London when you visit 😀

Susan Ireland says

16th October 2018 at 7:21 am

My husband and I are going to London for 10 days. We want to get Oyster cards. When we top up the card, can we use our US-issued mastercard and visa card? Or do we have to top up with cash? Thank you!

17th October 2018 at 7:33 pm

From what I have read, the majority of US issued credit cards will work in the machines. If they don’t, major travel centres like Heathrow, or the large train stations in London, will have ticket windows with a human where you will be able to use the card.

Hope this helps!

17th October 2018 at 9:43 pm

Thank you, Lawrence. That’s reassuring.

30th June 2018 at 6:06 am

contactless can be cheaper than oyster when you are mixing journeys in the centre of london with journeys further out. it’s because the daily price caps work in a slightly different way. There’s a clip of two people doing the same journeys with contactless and oyster here: https://www.youtube.com/watch?v=1w95ULafeSY contactless was a few pounds cheaper.

30th June 2018 at 9:24 am

Great video, thanks for sharing. I will update the post accordingly 🙂

Diovane Bonotto says

2nd December 2016 at 5:07 pm

Apple Pay from overseas can be use?

Laurence says

2nd December 2016 at 5:21 pm

Hello Diovanne,

You can use Apple Pay from overseas yes, but it’s up to your card issuer as to whether the card is supported, and you have to be sure you won’t be charged transaction fees. You can see more here: https://tfl.gov.uk/fares-and-payments/contactless/other-methods-of-contactless-payment/apple-pay?cid=applepay

Paul and Carole says

19th November 2016 at 11:09 am

Thanks for the information regarding the contactless option, we have always used cash previously and will definitely be using this option. We live in the UK and don’t get to London often so are looking forward to our trip next April. #TheWeeklyPostcard

19th November 2016 at 11:15 am

My pleasure! If you’ve got contactless, it’s definitely the way forward, so much easier (and miles cheaper!) than cash 🙂

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Let me know when there's a reply to my comment (just replies to your comment, no other e-mails, we promise!)

Subscribe to our monthly Newsletter where we share our latest travel news and tips. This also makes you eligible to enter our monthly giveaways!

We only ask for your e-mail so we can verify you are human and if requested notify you of a reply. To do this, we store your data as outlined in our privacy policy . Your e-mail will not be published or used for any other reason other than those outlined above.

London Tube Fares 2024

Transport fares vary depending on when and where you travel, and on the payment method you choose.

Time of the day:

If you travel during peak hours, costs will be more expensive than during off-peak hours. Peak hours are Monday to Friday, between 6:30 am to 9:30 am, and between 4:00 pm to 7:00 pm, except on public holidays.

Ticket type:

- Paper ticket or cash ticket: Single tickets cost between £6.70 and £9.80 .

- Pay-as-you-go (PAYG) or contactless payment methods: By using an Oyster card, which is a prepaid or contactless option, you can save significant money on each journey. For example, if you use it in Zone 1, your ticket will cost less than half the price of a paper ticket. It is worth learning more about this money-saving payment option; see below for more information.

Distance between stations:

When you are in front of the ticket machine, first you must choose the zones you will be travelling through in the next few days. If you are a tourist, you will usually travel within zones 1 and 2. Our suggestion is to select this option because it is where you will find the most famous attractions in London.

Another tip is to add enough credit for 3 days' travel, for example for a family of two adults and two kids: £20 per adult and £10 per child under 15.

Children under 15 are eligible for discounts and free travel. Children aged 5 to 15 pay half the adult fare, while those under 5 travel for free. To access these discounts, ask for assistance at the station; TfL staff will help you.

You must scan your card or ticket at the ticket barrier's reader upon both entering and exiting the Tube platforms.

Oyster Card and Travelcard

When travelling in London, using a prepaid card such as an Oyster Card or Travelcard is the savvy way to go. Not only do these cards offer cheaper fares compared to paying with cash, but they also come with daily spending limits to help you save even more.

The Oyster Card, costing just £5, can be ordered online and sent directly to your home before you arrive in London. Once you have it, you can top it up with as much credit as you need. This credit doesn't expire – it's yours to use whenever you're in London. Travel on the Tube, buses, and other TfL services becomes more cost-effective, thanks to the daily caps on spending. For example, if you hit the daily cap of £8.50 with an Oyster Card, you won't pay a penny more for any additional trips that day.

Remember, if you don't use all your credit, you can easily get a refund for up to £10 at any ticket machine – although the initial £5 cost for the card itself isn't refundable. The card is reusable for your next visit, though!

And if you prefer to travel light, you can tap in with a contactless bank card. Just keep an eye on any potential bank charges. Similar to the Oyster or Travelcard, contactless bank cards also benefit from a daily cap on charges, ensuring you don’t spend more than a set amount each day, regardless of how many trips you make.

Here are the tables that outline the fare caps and Travelcard prices:

Pay as you go (PAYG) caps: For trips on the Tube, DLR, London Overground, TfL Rail, and National Rail, there are daily and weekly spending caps that apply.

Travelcards: These cards give you unlimited travel within the chosen zones and are available for different lengths of time.

We highly recommend using a card when travelling around London – it's cheaper than cash and caps your daily spend. Grab an Oyster Card or a Travelcard for just £5. They're both prepaid, which means you can add money to them and only pay for the travel you use.

Before you come to London, you can buy an Oyster Card online and have it sent to your home. It's a durable card that never expires, ready for your next London adventure.

In addition to the Oyster Card, the Travelcard is an excellent option for those planning to make extensive use of public transport. You can purchase a Travelcard for periods of 7 days, a month, or even a year, making it ideal for regular visitors or residents of London. Unlike the Oyster Card, which charges per trip up to a daily cap, the Travelcard allows you unlimited travel within the zones you have selected, without concern for the number of trips you make.

For added convenience, both the Oyster Card and Travelcard can be topped up online, at ticket vending machines, or at any London train or Tube station. With these cards, you can fully enjoy all that London has to offer, moving around the city efficiently and cost-effectively.

Where to buy tourist tickets online?

Questions and answers.

Where can I buy tickets to travel on public transport in London?

- Tickets and prepaid card top-ups can be purchased at the ticket machines that can be found at the Tube stations. You can pay by credit/debit card or in cash (coins or notes). Ticket vending machines are available in different languages.

How much do young children pay on London transport?

- Children under 5 travel free with a fare paying adult.

- Children aged 5 to 10 travel free on buses and trams with an Oyster card, no ticket needed.

- Children aged 11 to 15 can receive the following benefit through an Oyster card: 50% off adult-rate pay-as-you-go fares and daily caps on a bus, Tube, tram, DLR, London Overground, Elizabeth line, National Rail services, and London Cable Car.

For more information on discounts, visit the official transport website . Tourists should note that the Oyster Card can be bought online before travelling to London and be delivered to their home address. The card costs £5. Then you decide how much credit you want to top it up with. This prepaid card has no expiry date.

Where can I find precise information for the rest of the fares and tickets?

- You can find detailed information on all fares and tickets in the official announcement regarding the March 2024 prices, available at this link: www.london.gov.uk/media/104143/download .

If you notice any errors on this website or have any suggestions, please use our contact form , and we will try to solve the problem as soon as possible.

Thank you for visiting our London Tube fares page, we hope you found it useful.

London tube map | Timetable | Fares | All subway lines

Which is better: Oyster, contactless or travelcard?

Which card should you choose?

One of the first decisions that a tourist has to make when travelling around London is whether to use an Oyster card , contactless card or travelcard .

The first thing to be aware of is that using cash to buy individual tickets is definitely the worst idea, as single tickets on the train are more than double the cost of Oyster and contactless, and you can’t even buy single tickets on the bus anyway. So which of the three cards do we recommend?

Oyster cards

An Oyster card is a credit card-sized piece of plastic. You load it up with money before you travel and then tap it down on the Oyster card readers on the buses and trains. The computer will then automatically deduct the correct fare from your credit. When you start running low on credit you can just top it up again at a ticket machine.

They come in two different types: normal blue Oyster cards are aimed primarily at the locals, whereas Visitor Oyster cards are aimed primarily at the tourists (although they are basically both the same, so it doesn’t really matter which one you get).

What are the benefits of using an Oyster card?

- The biggest benefit of using an Oyster card is its joint cheapest fares for single journeys (along with contactless)

- The Oyster daily cap is always cheaper than buying a 1-day travelcard

- Oyster pay-as-you-go credit can be used in zones 1-9, whereas travelcards are only valid in the zones you buy them for

- If you register your card online then you can turn on the ‘auto top-up’ feature which takes money out of your bank account whenever your credit gets low, so you don’t have to worry about running out

- Pay-as-you-go credit never expires, so you can carry on using any leftover credit on your next visit

- Visitor Oyster cards also come bundled with a book of discounts vouchers which can save you money at shops, restaurants and entertainment venues. These discounts are constantly changing all the time, but in the past they’ve included things like 10% off a boat ride, 10% off souvenirs in a particular gift shop, or 20% off a meal in a particular restaurant. The instructions for each venue will come with the vouchers, but most of the time all you have to do is show your Visitor Oyster card when you pay the bill, and the staff will apply the discount

What are the downsides of using an Oyster card?

- One of the downsides of using an Oyster card is that you can’t pay two fares with one card, so each traveller in your group will need their own

- The weekly cap only works from Monday to Sunday, whereas weekly travelcards can start on any day of the week you like

- You have to pay a £7 deposit whenever you buy a new Oyster card, or a £5 activation fee when you buy a Visitor Oyster card, which can’t be put towards fares

- You can’t buy a Visitor Oyster card in central London, only the normal blue Oyster cards. If you want a Visitor Oyster card then you have to buy it online in advance and have it posted to you

Contactless cards

A contactless payment card is just your normal everyday debit or credit card. It works in exactly the same way as a London Oyster card . You just tap it down on the Oyster card readers on the buses and trains and the computer will automatically deduct the correct fare from your bank account.

What are the benefits of using a contactless card?

- One of the main benefits of using a contactless card is that it’s just your normal everyday bank card or credit card, so you probably already have one

- Contactless also has the joint cheapest fares for single journeys (along with Oyster)

- The contactless daily cap is always cheaper than buying a 1-day travelcard

- Contactless can be used in zones 1-9, whereas travelcards are only valid in the zones you buy them for

- Unlike Oyster cards, you don’t have to pay a £7 deposit to set it up

- Unlike Oyster cards, there’s no need to keep topping it up with credit because the money comes straight from your bank account

- Contactless cards can be used in conjunction with Mobile Pay on your phone

What are the downsides of using a contactless card?

- One of the downsides of using a contactless card is that you can’t pay two fares with just one card, so each traveller in your group will need their own

- Unlike with Oyster, you can’t load a travelcard onto a contactless card

- Not all foreign-issued cards are accepted, and foreign cards might have a transaction fee added on by your bank every time you buy a ticket, bumping up the price of your journey

Travelcards

Travelcards are credit card-sized pieces of paper. They can also be loaded onto an Oyster card . You choose the duration you want it to cover (either 1-day, one week, one month or one year), whether you want it to cover just the bus/tram, or the train/bus/tram together, plus the zones you want to travel through, and then you’ll be entitled to unlimited travel in those zones until it expires.

What are the benefits of using a travelcard?

- The biggest benefit of using a travelcard is that you can make an unlimited number of journeys over one day, one week, one month or one year

- Depending on how many journeys you make in total, a weekly travelcard might work out cheaper than the Oyster and contactless weekly cap

- Unlike Oyster cards, you don’t have to pay a £7 deposit the first time you buy it

- You can take advantage of National Rail’s 2-for-1 offer to get cheap entry into 150+ tourist attractions. All you have to do is print out the relevant voucher from daysoutguide.co.uk/2for1-london and then hand it over at the attraction, alongside a valid National Rail travelcard for the same day of travel. But here’s the catch: the travelcard has to be printed on orange paper. That means that you have to buy it from a National Rail station (the big overground hubs like Euston , King’s Cross , Liverpool Street , Paddington , Victoria and Waterloo ). Travelcards bought at London Underground stations are no good, because they will be printed on TFL’s pink paper. And travelcards loaded onto an Oyster card are no good either

What are the downsides of using a travelcard?

- One of the downsides of using a travelcard is that you can’t share one between two people, so each person in your group will need their own

- One day travelcards are always more expensive than the daily cap on Oyster and contactless

- Unlike the pay-as-you-go-credit on Oyster and contactless cards, travelcards can only be used in the zones you bought it for. If you later decide that you want to travel outside of those zones then you’ll have to buy a completely separate ticket

- Travelcards are only valid for 1-day, one week, one month or one year – you can’t buy a travelcard that covers any other stretch of days

How do Oyster, contactless and travelcard fares compare?

Bear in mind that travelcards only allow you to travel between a set period (either one day, one week, one month or one year), whereas the Oyster daily cap and contactless daily cap apply all the time.

You can think of the daily cap as a price ceiling – it doesn’t matter how many buses or trains you ride each day, the maximum amount that the computer will take from your Oyster or contactless card will never rise above the cap.

Peak and off-peak fares – For Oyster and contactless peak fares apply to all journeys that start between 6:30 AM and 9.30 AM (Monday to Friday), or 4.30 PM and 7 PM (Monday to Friday). It doesn’t matter what time the journeys finish. Any other journey is classed as off-peak. Note: Between the 8th March and 31st May 2024 TFL are running a trial called ‘Off-Peak Friday Fares’, where Fridays will be classed as off-peak all day.

For travelcards, off-peak applies to any journey that starts after 9.30 AM (Monday to Friday).

Which is the cheapest: Oyster, contactless or travelcard?

The Oyster and contactless cap is always cheaper than buying a one day travelcard … but bear in mind that you also have to pay an £7 deposit on top the first time you buy an Oyster card , so a 1-day travelcard can still work out as better value.

The Oyster and contactless weekly cap is identical to buying a weekly travelcard, but you need to make enough journeys to make a weekly travelcard worthwhile. If you make at least three or more journeys on six days, or two or more journeys on seven days, then a 7 day travelcard will be worth it, otherwise you should go for an Oyster card or contactless instead.

Where can you use Oyster, contactless and travelcards?

Buses – Oyster cards, contactless cards and travelcards can be used on TFL buses all over London. And because buses don’t have zones you can use a train/bus/tram travelcard in whichever zone you like, regardless of which zones you actually bought it for.

London Underground, London Overground, DLR, TFL Rail, National Rail – The pay-as-you-go credit on Oyster cards and contactless can be used in all of the Oyster zones (1-9), but travelcards can only be used in the zones you bought it for.

You can also use Oyster and contactless on the Heathrow and Gatwick Express, but bear in mind that it won’t count towards the daily cap – it will just be deducted from your credit.

Taxis – Contactless cards can also be used to pay for black cabs (assuming that the fare is less than the current limit of £100). But Oyster cards and travelcards cannot.

IFS Cloud Cable Car & Thames Clipper – You can use Oyster cards and contactless to pay for a ticket on the cable car and Uber’s Thames Clipper service, but bear in mind that the cost will not count towards the daily cap – it will just deduct the relevant fare from your credit. Travelcards cannot be used to pay the fare.

How long do Oyster, contactless and travelcards last?

The pay-as-you-go credit on an Oyster card lasts forever. If you don’t use all the money up during your first holiday then you can simply carry on using it during your next visit.

Contactless cards don’t expire either, because they take the money straight out of your bank account.

A travelcard is the only one with an actual expiry date, because you have to choose a start date and duration when you buy it – either one day, one week, one month or one year. Once the duration has passed then the travelcard will stop working.

Which is best: Oyster, contactless or travelcard?

So which is better? If you’re a foreign visitor coming to London for just one day then we recommend choosing a one day travelcard . The Oyster and contactless daily cap might seem cheaper, but when you factor in the Oyster card’s £7 deposit, and the fact that your bank might add on a transaction fee every time you use a foreign bank card overseas, then a travelcard will likely work out cheaper.

If you’re a foreign visitor coming to London for more than one day then we recommend buying an Oyster card or Visitor Oyster card instead… unless you’re planning on making two or more journeys on seven consecutive days, or three or more journeys on six of those days, in which case a weekly travelcard will work out cheaper.

If you’re a UK visitor then we always recommend using your contactless card , regardless of how many days you’re staying, because the fares are the same as Oyster and you don’t have to pay a deposit to get one.

Your comments and questions

Jane Is a two traveling together card, work out cheaper than a pay as go Oyster card

Staff Hi Jane. No, if you're talking about the railcard then it doesn't apply to Oyster pay-as-you-go fares. It's only really any good if you're travelling on trains outside of London - twotogether-railcard.co.uk/using-your-railcard/travel-times-tickets/

JohnP My sister and I are coming to London for a week of museums and galleries. We've been there three times before, but each time I get confused between travelcards, Oyster cards, etc. We arrive and depart through Heathrow, and we're staying near Holland Park/Kensington, so I THINK the 7 Day travelcard is what we should use, but I'm not sure. Any suggestions or help in explaining it more clearly would be greatly appreciated

Staff Hi JohnP. Weekly travelcards always have a start date on them (which you choose when you buy it) and they're valid for for seven consecutive days. You also have to choose which zones you want it to cover. You'll probably want zones 1-2, but it depends where you're going. Oyster cards 'might' be better because they don't have a date on them, they can be used in all the zones, and they cap the maximum price you can spend each day (regardless of how many journeys you take). You can look up the daily caps on our Oyster card page - city-guide.london/transport/oyster-cards.php . This might work out cheaper, but if you're making at least three or more journeys on six days, or two or more journeys on seven days, then a weekly travelcard will be better