Bank of America Travel Rewards credit card benefits guide

Advertiser disclosure.

We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence.

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

- Share this article on Facebook Facebook

- Share this article on Twitter Twitter

- Share this article on LinkedIn Linkedin

- Share this article via email Email

- • Building credit

- • Credit card debt

The Bankrate promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money . The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. Terms apply to the offers listed on this page. Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any card issuer.

At Bankrate, we have a mission to demystify the credit cards industry — regardless or where you are in your journey — and make it one you can navigate with confidence. Our team is full of a diverse range of experts from credit card pros to data analysts and, most importantly, people who shop for credit cards just like you. With this combination of expertise and perspectives, we keep close tabs on the credit card industry year-round to:

- Meet you wherever you are in your credit card journey to guide your information search and help you understand your options.

- Consistently provide up-to-date, reliable market information so you're well-equipped to make confident decisions.

- Reduce industry jargon so you get the clearest form of information possible, so you can make the right decision for you.

At Bankrate, we focus on the points consumers care about most: rewards, welcome offers and bonuses, APR, and overall customer experience. Any issuers discussed on our site are vetted based on the value they provide to consumers at each of these levels. At each step of the way, we fact-check ourselves to prioritize accuracy so we can continue to be here for your every next.

Editorial integrity

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

Key Principles

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Editorial Independence

Bankrate’s editorial team writes on behalf of YOU — the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

Key takeaways

- The Bank of America Travel Rewards credit card is considered a starter travel rewards card, and for good reason. It doesn't have the robust benefits found with many other travel credit cards — but that doesn't mean it's not useful for some.

- Bank of America Preferred Rewards program members can get more out of this card with their boosted earnings rate.

- Because Bank of America's definition of "travel" is less strict than other issuers, cardholders can get travel credits for more than just airfare, hotels and related purchases.

If you like to adventure or have a few big trips coming up, you might be considering getting a travel credit card to supplement your budget by earning rewards. Most people don’t want to start off with a premium travel credit card, which comes with steep annual fees and rewards systems that can feel confusing to navigate. That’s where the Bank of America® Travel Rewards credit card might come in.

This Bank of America credit card has no annual fee but still offers enough benefits to get you started on your award travel journey. It also earns a flat rate of 1.5X points on all purchases. Although you’ll get the most out of this card as a Bank of America Preferred Rewards member — an invite-only program based on the sum of your deposits with the bank — it might still be a worthwhile card to consider.

To help potential cardholders understand what this card promises, we’ve made this benefits guide.

The Bank of America Travel Rewards credit card’s rewards benefits

While the Bank of America Travel Rewards credit card doesn’t offer much in terms of specific category rewards, it does still have its benefits when it comes to deals, redemption options and boosted rates.

Welcome bonus and intro APR offer

The Bank of America Travel Rewards credit card offers a solid welcome bonus that’s easily attainable for most cardholders. You can earn 25,000 points when you make $1,000 in purchases within 90 days of account opening. That’s about $250 worth of travel credits.

In addition to the welcome bonus, cardholders also get a 0 percent introductory annual percentage rate (APR) for 15 months on both purchase and balance transfers, but balance transfers do come with a 3 percent balance transfer fee and must be made within 60 days of account opening. After the introductory period ends, the ongoing variable APR of 18.24 percent to 28.24 percent takes over.

Varied redemption options

You can redeem your rewards points in a variety of ways, including as:

- Statement credits in an eligible Bank of America or Merrill account. This could add up if you decide to use the card as an everyday spending card.

- Cash deposits in an eligible Bank of America or Merrill account. The best part is that your cash redemptions don’t lose value, as with some rewards credit cards .

- Travel credits for purchases up to 12 months after the date of purchase. However, there’s a redemption minimum of 2,500 points, which is equal to about $25.

- Statement credits for dining and takeout purchases. Bank of America considers this to be a pretty broad category, meaning that in addition to restaurants, you can possibly get statement credits for purchases from bars, lounges and nightclubs.

- Gift cards. This redemption option only gives your points a value of 0.6 cents apiece and has a redemption minimum of 3,125 points.

Boosted rewards rates with the Bank of America Preferred Rewards Program

If you’re part of the Bank of America Preferred Rewards program , you’ll earn up to 75 percent more in rewards for each dollar you spend on your Travel Rewards card. The only requirement is to maintain a minimum balance in your eligible Bank of America or Merrill investing accounts. The minimum balance for each tier is as follows:

Though you need to maintain a significant amount of money on deposit with the bank to qualify for these tiers, you’ll find that it can really boost your earnings with the Travel Rewards card. At the highest tier, you could earn up to 2.62 points for every dollar spent on the card.

BankAmeriDeals

The BankAmeriDeals program gives you access to exclusive discounts by using your card at eligible retailers for a specific period of time. You can save anywhere from 5 percent to 15 percent on certain purchases by activating your offer and using your card according to the offer details. Some common retailers include:

- 1-800 Flowers

- The Home Depot

- Ulta Beauty

The Bank of America Travel Rewards credit card’s travel benefits

As a more entry-level travel card, the Bank of America Travel Rewards card lacks some of the more common travel benefits, like credits towards TSA PreCheck or Global Entry. There’s also no lounge access, travel insurance or annual credits. Instead, the card offers the following travel benefits:

No foreign transaction fees

Foreign transaction fees are typically 1 percent to 3 percent of a purchase, which can add up quickly depending on where you’re shopping. If you plan to travel abroad or shop internationally while online, you at least won’t bust your travel budget with these extra fees.

No annual fee

Most travel rewards credit cards charge an annual fee to pay for all of the perks they offer — especially if they’re branded as luxury travel credit cards. These cards can have fees as high as $695. However, while the Bank of America Travel Rewards credit card has no annual fee, it also doesn’t have nearly the same level of perks and benefits, so you’ll have to decide whether paying a fee is worth what you get with this card.

Visa Signature benefits

As a Visa Signature® card, the Bank of America Travel Rewards credit card also offers:

- Visa Signature® Concierge services

- Extended warranty coverage

- Access to roadside dispatch for emergency vehicle assistance

- Travel and emergency assistance

Broad travel categories

One benefit of the Bank of America Travel Rewards credit card that you don’t always see with other travel cards is how varied its definition of “travel” truly is. You can get travel statement credits for purchases with:

- Hotels and motels

- Trailer parks, motorhomes and recreational vehicle rentals

- Campgrounds

- Car, truck, trailer and boat rentals

- Cruise lines

- Travel agencies, tour operators and real estate agents

- Passenger trains

- Taxis, ferries and limousines

- Parking lots and garages

- Tolls and bridge fees

- Tourist attractions and amusement parks

- Art galleries and museums

- Carnivals and circuses

- Aquariums and zoos

Museums on Us

This unique benefit allows Bank of America cardholders to get free access to over 225 cultural institutions during the first weekend of each month. The program is perfect for those who love planning day trips or those who have a list of museums they’ve been excited about seeing. To take advantage of this perk, all you have to do is present your Bank of America debit or credit card and a valid photo ID.

How to maximize the Bank of America Travel Rewards credit card

This card’s flat rewards rate of 1.5X points for all purchases makes maximizing the Bank of America Travel Rewards credit card fairly easy — just use it on everyday purchases to see the points rack up.

Combine this card with another

However, you still might not get much out of just this card alone at the end of the day. To truly maximize your rewards, consider pairing this card with one that has a higher reward rate in specific spending categories. For example, you can get a rotating category credit card like the Discover it® Cash Back or a dining and entertainment card like the Capital One SavorOne Cash Rewards credit card . Then, you can use your Bank of America card to fill in the gaps for spending categories that won’t get boosted rewards with your other card.

Take advantage of the intro APR offer

If you’ve got a big purchase on the horizon or want to get rid of some credit card debt, the introductory APR can help you avoid interest. Just make sure you pay off your balance before the intro period ends and factor in the balance transfer fee as you pay off your debt.

Use this card for travel in niche categories

As we mentioned before, Bank of America has a much broader definition of what counts as “travel.” While you might get more rewards with another travel credit card when it comes to airfare or hotel stays, you likely won’t find many others that let you redeem travel credits for parking lot fees, tolls, campground rentals, museums or zoos. This card can come in handy for those kinds of expenses.

The bottom line

The Bank of America Travel Rewards isn’t the very best travel credit card out there. For most people, they’d be better off with a card that offers a higher travel rewards rate or even with a flat-rate cash back card like the Citi® Double Cash Card , which offers up to 2X rewards (1% when you buy 1% as you pay) on all spending.

But for those who meet Bank of America Preferred Rewards requirements, the card could provide substantially more value. Plus, it could be appealing to someone that wants their travel rewards to be useful for more than just airfare and hotels, or someone who is just getting started on their travel rewards journey . But even then, there are likely better cards available for you to take your travels to the next level.

Issuer-required disclosure statements

Information about the Bank of America® Travel Rewards credit card was last updated on February 5, 2024. Citi is an advertising partner.

Article sources

We use primary sources to support our work. Bankrate’s authors, reporters and editors are subject-matter experts who thoroughly fact-check editorial content to ensure the information you’re reading is accurate, timely and relevant.

“ Museums On Us ” Bank of America. Accessed on February 5, 2024.

Hidden benefits of the Bank of America Travel Rewards card

Why I love the Bank of America Travel Rewards card

Bank of America Premium Rewards vs. Bank of America Travel Rewards Credit Card

Is the Bank of America Travel Rewards card worth it?

Bank of America Travel Rewards Credit Card Review

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

Bank of America Travel Rewards Review: Easy Rewards for Easy Travel

What’s on This Page

The bottom line, pros and cons, detailed review, compare to other cards, benefits and perks, drawbacks and considerations, how to decide if it's right for you.

This solid no-fee travel credit card is especially rewarding for Bank of America® banking customers.

Rewards rate

Bonus offer

- 25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening - that can be a $250 statement credit toward travel purchases.

0% intro APR on Purchases for 15 billing cycles and 0% intro APR on Balance Transfers for 15 billing cycles for any balance transfers made in the first 60 days

Ongoing APR

APR: 18.24%-28.24% Variable APR

Cash Advance APR: See Terms

Penalty APR: 29.99%, Variable

Balance transfer fee

3% for 60 days from account opening, then 4%

Foreign transaction fee

- Earn unlimited 1.5 points per $1 spent on all purchases, with no annual fee and no foreign transaction fees and your points don't expire as long as your account remains open.

- Use your card to book your trip how and where you want - you're not limited to specific websites with blackout dates or restrictions.

- Redeem points for a statement credit to pay for travel or dining purchases, such as flights, hotel stays, car and vacation rentals, baggage fees, and also at restaurants including takeout.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more points on every purchase. That means instead of earning an unlimited 1.5 points for every $1, you could earn 1.87-2.62 points for every $1 you spend on purchases.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

No annual fee

New cardholder bonus offer

No foreign transaction fees

Flexible rewards redemption

Intro APR period

Requires good/excellent credit

No bonus categories

Best rewards limited to certain customers

The Bank of America® Travel Rewards credit card is an excellent option for frequent travelers who want flexible rewards but just can't bring themselves to pay an annual fee for a credit card.

Cardholders earn an unlimited 1.5 points per dollar spent on all purchases. Rewards never expire as long as the account is open, but some of the redemption options have a time limit attached (more on that later). Points can be redeemed for credit against any travel or restaurant purchase. With no foreign transaction fees and a $0 annual fee, this card definitely travels light.

Note that this card is different from the similarly named Bank of America® Travel Rewards credit card for Students . For more information about that version of the card, see our full review .

» MORE: NerdWallet’s best travel credit cards

Bank of America® Travel Rewards credit card : Basics

Card type: Travel .

Annual fee: $0 .

Sign-up bonus: 25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening - that can be a $250 statement credit toward travel purchases.

Rewards: 1.5 points per dollar spent.

Points are worth 1 cent apiece when redeemed for travel or restaurant purchases and a little over half a cent apiece for cash. Points can also be redeemed for gift cards at varying point values. Minimum redemption: 2,500 points for travel or cash.

Interest rate: 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply . (A 0% APR period is relatively rare on a travel card.)

Foreign transaction fees: None.

Flexible rewards

The Bank of America® Travel Rewards credit card isn't tied to any particular airline or hotel chain. Book travel any way you want, with no restrictions and no blackout dates, and then use points to wipe out the cost on your statement. Bank of America® also has one of the broadest definitions of "travel" of any major issuers. You can use points to get credit for airfare, hotel stays, cruises and car rentals, of course — but also for things like campgrounds, art galleries, amusement parks, carnivals, circuses, aquariums and zoos. Add to that, points are good for credit on restaurant purchases, too.

Points don't expire, but the travel and dining purchases you can redeem them for have a time limit. You can redeem points for a statement credit toward travel or dining purchases made within 12 months prior to the date of redemption. And, these redemptions are limited to the most recent 2,500 qualifying travel and dining purchases.

Travel-friendly features

As part of the Visa network, the Bank of America® Travel Rewards credit card travels well internationally. Visa is widely accepted worldwide, meaning you're less likely to run into trouble using it abroad. You also don’t have to worry about paying foreign transaction fees, which typically cost 1% to 3% of every transaction.

» MORE: Benefits of the Bank of America® Travel Rewards card

Bank of America Preferred Rewards® boosts earnings

The Bank of America Preferred Rewards ® program allows certain Bank of America® credit card holders to earn bonus rewards. If you have enough money in combined balances in Merrill accounts, you can earn bonuses of 25% or more. There are three tiers to the program, determined by your combined balances in those bank and investment accounts:

Say you spent $10,000 on your card in a year. That would usually earn you 15,000 points, worth $150 at a penny a point. If you were a Gold member in Bank of America Preferred Rewards®, your bonus would push your earnings to 18,750 points ($187.50). If you were Platinum, 22,500 points ($225). For Platinum Honors, 26,250 ($262.50).

» MORE: Bank of America® credit cards mobile app review

Other cards pay higher rewards rates

The Bank of America® Travel Rewards credit card is a great $0 -fee travel companion, but depending on how much you spend and how you prefer to redeem, a different card might better suit you.

Bigger spenders will likely get more value from the Capital One Venture Rewards Credit Card , which earns 2 miles per dollar spent on most purchases. Like the Bank of America® Travel Rewards credit card , it allows you to redeem rewards for credit against travel expenses at a rate of 1 cent per mile.

The annual fee on the Capital One Venture Rewards Credit Card is $95 . But, if you spend more than $4,750 annually, the rewards will offset the annual fee. Once you spend more than $19,000 a year, your rewards exceed those on the Bank of America® card even after taking into account the annual fee (assuming you aren't a Bank of America Preferred Rewards® member). Reducing the sting of the fee even further, the Capital One Venture Rewards Credit Card also reimburses you for the application cost for TSA Precheck or Global Entry, and it offers a substantially higher sign-up bonus: Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel.

You get a lower redemption value for cash

The Discover it® Miles has a lot in common with the Bank of America® Travel Rewards credit card : an unlimited 1.5 miles per dollar spent, a $0 annual fee and no foreign transaction fees. But a key difference is that the Discover it® Miles gives you the same value per point whether you redeem for travel or cash back. The Bank of America® Travel Rewards credit card has an edge over this card Visa's wider acceptance abroad, but the Discover it® Miles is worth considering if you want better cash-back value.

Premium perks can take your travel further

The PenFed Pathfinder Rewards American Express® Card offers premium perks without the premium cost. Cardholders get 3 points per $1 spent on travel purchases (4 points for those enrolled in the PenFed Honors Advantage program) and 1.5 points per $1 spent everywhere else. On top of rewards, the card offers a $100 annual air travel credit and up to $100 in the form of a statement credit for Global Entry and TSA PreCheck programs every five years.

This card comes with a $95 annual fee, but it's waived for PenFed Honors Advantage members. Even without qualifying for PenFed Honors Advantage, you can effectively cancel out the annual fee as long as you can take advantage of the full $100 air travel credit. You’ll need to be a credit union member to qualify for this card.

If you'd like to see how these cards compare with other potential travel card options, you can search NerdWallet's list of best rated credit cards .

The Bank of America® Travel Rewards credit card offers a solid travel rewards program for the fee-averse. If your deposits reside at Bank of America®, you can gain even more rewards.

If you're willing to pay an annual fee ( $95 ), this card gives you 2 miles per dollar on most spending. It has a big sign-up bonus, and miles are redeemable for statement credit against any travel expense.

Looking For Something Else?

Methodology.

NerdWallet reviews credit cards with an eye toward both the quantitative and qualitative features of a card. Quantitative features are those that boil down to dollars and cents, such as fees, interest rates, rewards (including earning rates and redemption values) and the cash value of benefits and perks. Qualitative factors are those that affect how easy or difficult it is for a typical cardholder to get good value from the card. They include such things as the ease of application, simplicity of the rewards structure, the likelihood of using certain features, and whether a card is well-suited to everyday use or is best reserved for specific purchases. Our star ratings serve as a general gauge of how each card compares with others in its class, but star ratings are intended to be just one consideration when a consumer is choosing a credit card. Learn how NerdWallet rates credit cards.

Frequently asked questions

The Bank of America® Travel Rewards credit card is a good choice for someone looking for simple rewards with a $0 annual fee. Cards with annual fees, however, typically offer more robust rewards and perks and may be a better fit for heavy travelers. With this card, you earn 1.5 points per $1 spent. (Bank of America Preferred Rewards ®customers earn 25%-75% more points.) Points can be redeemed for credit against any travel purchase.

Use your Bank of America® Travel Rewards credit card to book travel however you want, and then redeem points for credit on your statement against those travel purchases. You can use points to cover expenses like flights, hotels, vacation packages, cruises, rental cars, baggage fees and more.

Points are worth 1 cent each when redeemed for a travel statement credit.

Points don’t expire as long as your card account is open, but you will forfeit unused points if you close your account. While points don't expire, the travel and dining purchases you can redeem them for do have a time limit. You can redeem points for a statement credit toward travel or dining purchases made within 12 months prior to the date of redemption. And, redemptions are limited to the most recent 2,500 qualifying travel and dining purchases.

The more often you travel, especially if you travel internationally, the more value you can get out of a travel rewards credit card. However, if you don’t travel often, you may benefit from a cash-back card instead.

About the author

Melissa Lambarena

Travel Center Log In

Supported carriers include AT&T, Sprint, Boost, Verizon Wireless, U.S. Cellular©, T-Mobile©, MetroPCS©, Cincinnati Bell, Virgin Mobile USA, Cricket, Cellular South, Centennial and nTelos. The mobile carriers are not liable for delayed or undeliverable messages.

Link your Benefits OnLine Accounts

Link your bank of america accounts, anyone with access to your account will see the linked profiles., administrative site secure login, important notice.

For help with your User ID or Password, please go to www.bankofamerica.com or the Mobile Banking app.

Verify Your Identity

Challenge questions.

Add a Secured Transfer number

Request authorization code, enter authorization code, enter authorization code and card details, confirm your identity, don't close your browser window..

Verification Required

Are you sure, please verify your identity using safepass. select which device you'd like to use., press the button on your safepass card and enter the code here., you'll receive your safepass code momentarily at [[phonenumber]].

Plug your security key into your computer's USB port and press the gold disk or blinking light to complete your log in.

We couldn't complete your log in with your security key.

Your security key verification was not completed.

Security Preference

Enter your mobile token.

Check your mobile device

We sent a notification to your registered device. Verify your identity in the app now to Log In to Online Banking.

If you’re enrolled in this security feature, we sent a notification to your registered device. Verify your identity in the app now to Log In to Online Banking.

We can’t identify you at this time. Please use your User ID/Password to Log In.

Creating this link makes all of your eligible Personal profiles viewable in Bank of America’s Online and Mobile Banking. The original terms and conditions for your personal accounts and their related services will apply.

*You agree and understand that users and Administrators will be able to view and/or perform transactions with linked personal accounts, subject to the selected account or general service settings described in Section 7.A of the Online Banking and Transfers Outside Bank of America Service Agree.

Log in to take off on a new adventure.

Over 200,000 hotels and resorts

Over 200 airlines

24/7 phone support when you travel

Not an Online Banking customer? Enroll in Online Banking

Important notice

You are leaving bank of america.

You are continuing to another website that is not affiliated with Bank of America or Merrill. Bank of America is not responsible for and does not endorse, guarantee or monitor content, products, services and level of security that are offered or expressed on other websites. Please refer to the website’s posted privacy policy and terms of use. You can click the Cancel button now to return to the previous page.

Advertising Practices

We strive to provide you with information about products and services you might find interesting and useful. Relationship-based ads and online behavioral advertising help us do that.

Bank of America participates in the Digital Advertising Alliance ("DAA") self-regulatory Principles for Online Behavioral Advertising and uses the Advertising Options Icon on our behavioral ads on non-affiliated third-party sites (excluding ads appearing on platforms that do not accept the icon). Ads served on our behalf by these companies do not contain unencrypted personal information and we limit the use of personal information by companies that serve our ads. To learn more about ad choices, or to opt out of interest-based advertising with non-affiliated third-party sites, visit YourAdChoices powered by the Digital Advertising Alliance or through the Network Advertising Initiative's Opt-Out Tool . You may also visit the individual sites for additional information on their data and privacy practices and opt-out options.

To learn more about relationship-based ads, online behavioral advertising and our privacy practices, please review the Bank of America Online Privacy Notice and our Online Privacy FAQs .

New! Send wire transfers in our Mobile Banking app or Online Banking

Send domestic and international wire transfers in 140+ currencies to over 200 countries. Available in English and Spanish.

International Wire Transfer Features

$0 outbound wire transfer fee if sent in foreign currency.

Get a competitive foreign exchange rate in the app or Online Banking. 1

Know the exact amount your recipient will receive in their local currency. 2

Outbound wire transfer fees 1 , 3

As a Preferred Rewards Member, you could save on wire transfer fees.

Sending wire transfers

To send a wire transfer, log in to our Mobile app or Online Banking and tap Pay & Transfer. You will need your debit card number, PIN, and U.S. mobile number OR a USB security key .

- You need the recipient’s name, address, bank wire routing number (ABA) and account number.

- Cutoff time is 5 p.m. Eastern and typically arrives the same day (business days only).

International:

- You need the recipient’s name, address and bank information, including SWIFT code and account number.

- You can send in U.S. dollars or foreign currency; cutoff time is 5 p.m. Eastern and typically arrives in 1 to 2 business days.

- Some countries require specific bank identifiers (e.g. Canada's Transit Code or India's IFSC code), or account identifiers (e.g. IBAN, or CLABE for Mexico). See the Foreign Currency Payments Guide for details.

Fees and limits may apply .

Receiving wire transfers

To receive domestic and international wire transfers you will need to provide the sender your account information and the following information. To find your account number, log in to our Mobile App or Online Banking and select your receiving account.

Domestic (U.S):

- Bank of America’s wires routing number: 026009593

- Receive in U.S. dollars: SWIFT Code BOFAUS3N Bank of America N.A. 222 Broadway, New York, NY 10038

- Receive in foreign currency: SWIFT Code BOFAUS6S Bank of America N.A. 555 California St., San Francisco, CA 94104

Domestic transfers will typically be credited to your account the same business day, and international transfers will typically be credited to your account in 1 to 2 business days.

See how to do a wire transfer

Review digital demos to see how to set up domestic and international wire transfers with the Mobile Banking app or Online Banking.

You can also view our printable guide .

Get additional information

Want a secure, easy way to bank on the go.

Download the app today. It’s simple and convenient.

Enter your cell phone number

A message has been sent to

The iTunes App Store is open in a new browser tab. Please download the App in the iTunes App Store.

(XXX) XXX XXXX

form not submitted

We're sorry, something went wrong.

Message and data rates may apply. Terms and Conditions

The Travel Sisters

How to complete a bank of america travel notice online.

by The Travel Sisters | Mar 12, 2017 | Credit Cards | 1 comment

One of the things I do before I travel, is to let my banks that issued my credit or ATM cards know that I will be traveling abroad. While you can call your bank, some banks make it easy to quickly notify them of your travel plans online. Fortunately, Bank of America has an online travel notification form which makes it really easy to let them know of your travel plans.

When Should You Notify Bank of America of Your Travel Plans?

According to BofA, a travel notice can be set no more than 60 days prior to departure and can last for up to 90 days from the first day of your trip. Also, you can only have one travel notice set at a time.

While I usually complete travel notifications only when traveling internationally, the form also allows you to notify Bank of America when traveling to another state in the US. If you will be charging a lot of things on your credit card, it does not hurt to take a minute to complete the form.

How to Set Up a Bank of America Travel Notification Online

Log into your bankofamerica.com account and hover your mouse over “Help & Support” on the top right.

You will see a few options – click on “Set Travel Notice” and the Travel notification form will come up.

If you click on “Help & Support” you can reach the travel notification form either by clicking on “Set Travel Notice” under “Common Topics” or by clicking under “Travel Information”:

Complete, the Travel Notice form. You can complete the form for either domestic travel or international travel. The form even has a box where you can provide details of your trip.

While some people don’t notify their banks before travel and they don’t have any issues, I always make sure to complete an online travel notification form online. It only takes a minute and it is worth it to avoid getting your credit card declined in a foreign country.

Hello this Ysabel and Francisco Collado, we’re going to Europe and want to know we’re we can use atm in Rome to withdraws euro. Also let you guys know we’re goin away.

Submit a Comment Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Notify me of follow-up comments by email.

Notify me of new posts by email.

Subscribe to Blog via Email

Recent posts.

- Chase Freedom Flex 2024 2nd Quarter 5% Bonus Categories

- Discover 5% Cashback Calendar 2024: Categories That Earn 5% Cash Back

- Chase Freedom Calendar 2024 Categories That Earn 5% Cash Back

- All Southwest Airlines International Flight Destinations

- Chase Freedom Flex 2024 2nd Quarter 5% Bonus Categories – Activate Now!

Follow us on Facebook

Pin It on Pinterest

How to use Bank of America travel rewards points

Key takeaways.

- T he Bank of America travel rewards program can be lucrative and flexible, but the specifics of how you’ll earn points in this program depend on which credit card you sign up for.

- Bank of America travel rewards points can generally be redeemed for eligible travel purchases, cash back and gift cards.

- Bank of America Preferred Rewards members can earn an additional 25 percent to 75 percent more in rewards for each dollar spent.

Many credit card issuers boast a lineup of rewards credit cards that let you earn cash back, points or miles on travel, and Bank of America is no exception. Although not as popular as travel credit cards from Chase or American Express, Bank of America travel cards can be rather lucrative and flexible — but the specifics will depend on which credit card you sign up for.

If you’re ready to give the Bank of America travel rewards program a chance, you should find out which Bank of America credit cards let you earn rewards for travel, which travel rewards benefits are offered and how to use Bank of America travel rewards points to your advantage.

Which Bank of America cards earn travel rewards?

The main two Bank of America travel rewards cards are the Bank of America® Travel Rewards credit card and the Bank of America® Premium Rewards® credit card . However, Bank of America also offers the Bank of America® Premium Rewards® Elite Credit Card * and the Bank of America® Travel Rewards Credit Card for Students .

Bank of America Travel Rewards credit card: Best for no annual fee

- Welcome bonus: 25,000 online bonus points ($250 statement credit value toward travel purchases) if you make $1,000 in purchases within 90 days of opening the account

- Rewards rate: Unlimited 1.5X points per dollar on all purchases; 3X points on Bank of America Travel Center purchases

- Annual fee: $0

- Notable perks: No foreign transaction fees, flexible travel rewards

Bank of America Premium Rewards credit card: Best for occasional travelers

- Welcome bonus: 60,000 online bonus points after spending $4,000 on purchases in the first 90 days

- Rewards rate: Unlimited 2X points per dollar on travel and dining; 1.5X points per dollar on all other purchases

- Annual fee: $95

- Notable perks: Up to $100 in statement credits per year for incidental airline expenses to cover eligible costs; up to a $100 statement credit toward Global Entry or TSA PreCheck application fees every four years; no foreign transaction fees

Bank of America Premium Rewards Elite Credit Card: Best for frequent travelers

- Welcome bonus: 75,000 online bonus points (a $750 value) after you make at least $5,000 in purchases in the first 90 days of account opening

- Rewards rate: Unlimited 2X points on dining and travel purchases; unlimited 1.5X points on all other purchases

- Annual fee: $550

- Notable perks: Up to $300 annually in airline incidental statement credits for qualifying purchases (like seat upgrades and baggage fees); up to $150 annually for eligible lifestyle conveniences (including video streaming services, food delivery, fitness subscriptions and rideshare services); up to a $100 statement credit toward Global Entry or TSA PreCheck application fees every four years; complimentary Priority Pass membership; 20 percent off on domestic or international airfare for any class when paid with points

Bank of America Travel Rewards Credit Card for Students: Best for students

- Welcome bonus: 25,000 online bonus points after spending $1,000 in purchases within the first 90 days of account opening

- Rewards rate: 1.5X points on all purchases

- Annual fee: $0

- Notable perks: No foreign transactions fees, flexible travel rewards

Which Bank of America travel cards do not earn travel rewards points?

Bank of America also offers a surprising number of co-branded travel credit cards that are geared to loyalists with specific brands. However, these cards do not earn Bank of America travel rewards points. These include:

- Alaska Airlines Visa® credit card

- Free Spirit® Travel More World Elite Mastercard®*

- Allegiant World Mastercard®*

- Royal Caribbean Visa Signature® card*

- Norwegian Cruise Line® World Mastercard®*

- Celebrity Cruises Visa Signature® card*

- Virgin Atlantic World Elite Mastercard® *

- Air France KLM World Elite Mastercard®*

When it comes to redeeming your Bank of America travel rewards, your options may vary depending on the card you have.

Bank of America Travel Rewards credit card and Bank of America Travel Rewards Credit Card for Students

With the Bank of America Travel Rewards credit card and the Bank of America Travel Rewards Credit Card for Students, you can use your points for:

- Cash back in the form of a check or direct deposit to an eligible Bank of America or Merrill account

- A statement credit to cover eligible travel-related purchases

Unlike with other travel rewards programs, you can use your eligible card to book travel with any eligible providers, and Bank of America’s list of qualifying travel purchases is extensive. In addition to airlines, hotels, car rentals and eligible transit, travel-related purchases also include purchases made with eligible cruise lines, parking garages, travel agencies, tourist attractions, art galleries, amusement parks and more.

From there, you can redeem your points for a travel credit statement through your Bank of America account. However, note that you’ll need at least $25 worth of points to redeem for a travel credit.

Bank of America Premium Rewards credit card

The Bank of America Premium Rewards credit card lets you cash in your rewards for:

- Travel bookings through the Bank of America Travel Center

- Cash back in the form of a statement credit or a direct deposit to an eligible Bank of America or Merrill account

Bank of America Premium Rewards Elite Credit Card

With the Bank of America Premium Rewards Elite Credit Card, you can redeem your points for:

- Travel, experiences, event tickets and more through our Bank of America’s Concierge service

How to maximize Bank of America travel rewards points

To get the most of your travel rewards points with Bank of America, you should try to be as strategic as you can. When you go to redeem points, consider the ways you may be able to earn more points on your spending and any ways you can maximize your rewards .

Join the Bank of America Preferred Rewards program

One major way to earn more Bank of America travel rewards involves signing up for the Bank of America Preferred Rewards program . Doing so can net you an additional 25 percent to 75 percent more in rewards for each dollar you spend. However, note that you do need to meet certain qualifications to enroll in this program, including:

- An active, eligible Bank of America checking account

- A three-month average combined balance of $20,000 or more in eligible Bank of America accounts and/or Merrill investment accounts

Also, keep in mind that the Bank of America Preferred Rewards program offers additional perks like savings boosters and loan discounts for members with cash on deposit. The following chart shows how much more you could earn in rewards as a member, as well as how much you need to keep in eligible accounts to qualify for each tier.

While the minimum balance requirements are high, the Bank of America Preferred Rewards program can help you earn considerably more points on your spending if you qualify. For example, Bank of America Premium Rewards credit card members in the Platinum Honors tier have the potential to earn up to 3.5X points for every dollar spent on travel and dining purchases and up to 2.62X points on other purchases.

Also, it’s worth noting that there is one more Bank of America Preferred Rewards program tier, Diamond Honors.

Compare pricing in the travel portal

Keep in mind that the Bank of America Travel Center lets you make travel bookings with over 200,000 hotels and resorts and more than 200 airlines, among other options. Since some Bank of America travel rewards credit cards let you redeem your points for either travel-related statement credits or travel booked through the Bank of America Travel Center, you should compare the prices offered in the travel portal with other travel sites. By comparing prices, you can make sure you get the best deal.

Pick a card with an annual fee

Finally, make sure to think about your goals before you sign up for a travel credit card from this issuer. After all, a card with an annual fee comes with more benefits and perks. For example, when you pay the $95 annual fee for the Bank of America Premium Rewards card, you’ll get higher rewards rates on travel and dining spending, up to a $100 annual credit for incidental airline expenses to cover eligible costs and up to a $100 application fee credit toward Global Entry or TSA PreCheck membership every four years. All of this could easily leave you “ahead” in a financial sense.

The bottom line

Bank of America travel rewards can work differently depending on the card you sign up for, so make sure to compare all the rewards card options available before you decide on a card. In the meantime, spend some time comparing cards from this issuer to travel rewards credit cards from other major issuers. You may find that Bank of America has what you’re looking for in a travel rewards card, but you’ll never know for sure unless you check.

The Bank of America content in this post was last updated on June 23, 2023.

The information about the Alaska Airlines Visa® credit card was updated on June 23, 2023.

*The information about the Bank of America® Premium Rewards® Elite Credit Card, Free Spirit® Travel More World Elite Mastercard®, Allegiant World Mastercard®, Royal Caribbean Visa Signature® card, Norwegian Cruise Line® World Mastercard®, Celebrity Cruises Visa Signature® card, Virgin Atlantic World Elite Mastercard® and Air France KLM World Elite Mastercard® has been collected independently by Bankrate.com. The card details have not been reviewed or approved by the card issuer.

Foreign transaction fees: Everything you need to know

Editor's Note

There's very little that we dislike more here at TPG than unnecessary fees — including foreign transaction fees.

You may have noticed that when you use some credit cards abroad ( or on a website not hosted in the U.S. ), an additional fee gets tacked on to each purchase.

Today, let's walk through what those fees are and how you can avoid them in the future.

What Is a foreign transaction fee?

Foreign transaction fees are charged on certain cards when you make a purchase that goes through an overseas bank to process the transaction. When you make a transaction while traveling or through a foreign website, banks may have to convert the purchase into U.S. dollars. On some credit cards, issuers will then pass the conversion cost onto consumers.

The standard foreign transaction fee tends to be around 3%. However, Capital One and Discover are unique in having zero foreign transaction fees on all credit cards. And you can find no foreign transaction fees on personal and business cards from all issuers.

How much are foreign transaction fees?

Generally, foreign transaction fees hover around 3% for most issuers. Visa and Mastercard charge a 1% fee to banks for processing purchases made abroad, and many U.S. issuers tack on an additional 1-2% fee. Capital One and Discover do not charge foreign transaction fees on any of their credit cards.

Which cards have no foreign transaction fees?

Most of the top travel credit cards don't charge foreign transaction fees . In fact, it's rare for a card that offers travel rewards and perks to charge any foreign transaction fees. While most issuers charge foreign transaction fees of around 3% on at least some of their products, Capital One and Discover do not charge foreign transaction fees on any of their credit cards.

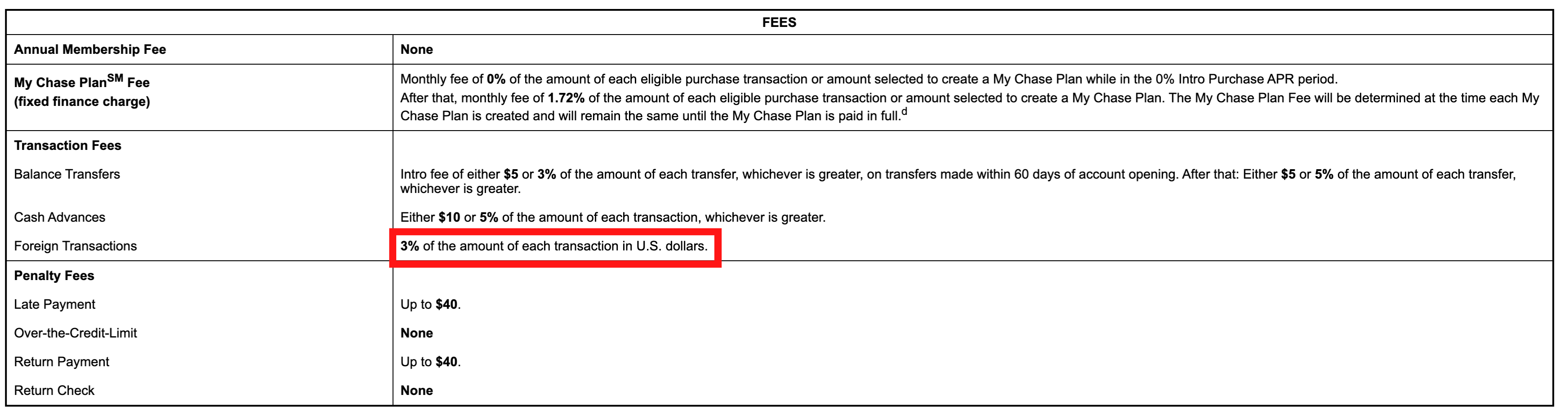

Card issuers are required to give potential and existing customers access to rates and fees associated with a credit card, including foreign transaction fees . Check the terms and conditions of your credit card to see whether or not your card (or the card you're considering applying for) charges foreign transaction fees.

When looking at the rates and fees table, you can typically find the foreign transaction fee listed explicitly under a fees section.

Foreign transaction fees vs. ATM fees

Another type of fee you may hear about when you travel is a foreign ATM fee. While the two fees can apply when traveling outside the U.S., they are not synonymous.

A foreign ATM fee is charged when you withdraw cash from an ATM in a foreign country. Some banks waive this fee, especially if you use an ATM that falls within a specific network of banks.

Additionally, you might be on the hook for additional fees when you use an ATM abroad, including a flat fee from your bank for using an ATM not affiliated with the bank (which is typically $5), a foreign currency conversion fee (which typically falls in line with foreign transaction fees at 3%) and additional fees charged by the owner of the specific ATM you use.

This is one reason we recommend paying with a credit card wherever possible. But in some places, cash is still king and you'll need to have a game plan for avoiding these types of fees — or factoring them into your budget.

Related: Ways to save on overseas ATM withdrawals

How to avoid foreign transaction fees

Use a card with no foreign transaction fees.

The easiest way to avoid foreign transaction fees is to use a card that doesn't charge them. TPG has a regularly updated guide on the top credit cards with no foreign transaction fees that can help you figure out the best cards to use for your trips.

Unfortunately, cash-back cards such as the Chase Freedom Unlimited and the Blue Cash Preferred® Card from American Express (see rates and fees ) tend to charge foreign transaction fees. But keep in mind that some issuers, including Capital One and Discover, don't charge foreign transaction fees at all across their credit cards.

Avoid 'dynamic currency conversion'

When using a card terminal abroad, you may be prompted to pay in the local currency or in U.S. dollars. You should always choose local currency.

Dynamic currency conversion is a sneaky way that banks encourage you to pay in your home currency (U.S. dollars) while abroad. However, they'll usually give you a poor conversion rate, so it's best to pay in euros, pesos or whichever is the local currency.

Related: I fell for dynamic currency conversion — reader mistake story

Pay with cash

Of course, you'll also avoid foreign transaction fees by paying with cash. But those purchases won't earn you any rewards, and withdrawing cash abroad may be subject to pesky fees.

Bottom line

The good news is that foreign transaction fees are much less common across top credit cards than they used to be. Hopefully, the industry as a whole is moving away from charging customers these types of fees. Until then, check your credit card's terms and conditions to know if you'll be on the hook for a fee when you're traveling and plan your card usage accordingly.

To avoid foreign transaction fees, choose a top travel rewards card or one from Capital One or Discover. And make sure to always pay in the local currency rather than U.S. dollars so that you can avoid poor conversion rates.

Additional reporting by Ryan Wilcox and Stella Shon.

For rates and fees of the Blue Cash Preferred card, click here .

You are using an outdated browser. Please upgrade your browser .

Moscow Travel Guide

- Guide to Russia

- Russian Destination Guide

Why travel to Moscow

Contrasts: 12th century monasteries and some of the tallest skyscrapers in Europe can be found side-by-side in this complex and captivating city. The diversity of this mega-city is astounding. Only a few steps away from the solemn red facade of the Kremlin and the sounds of righteous church bells, a buzzing night scene and alternative-fashion boutiques can be found.

Culture: In Moscow only the best goes. Be it a theatre, restaurant or gallery, the standards are certain to be world-class. The Bolshoi ballet company is reputed to be even better than the Mariinsky’s and “MMOMA” (Moscow’s museum of modern art) exhibits works of art as profound as any that could be found in the famed MOMA.

Convenience: Unlike the rest of Russia, it’s easy enough to get by with just English in Moscow and, driving excepted, it is surprisingly safe: the murder rate is lower than in some of America’s major cities.

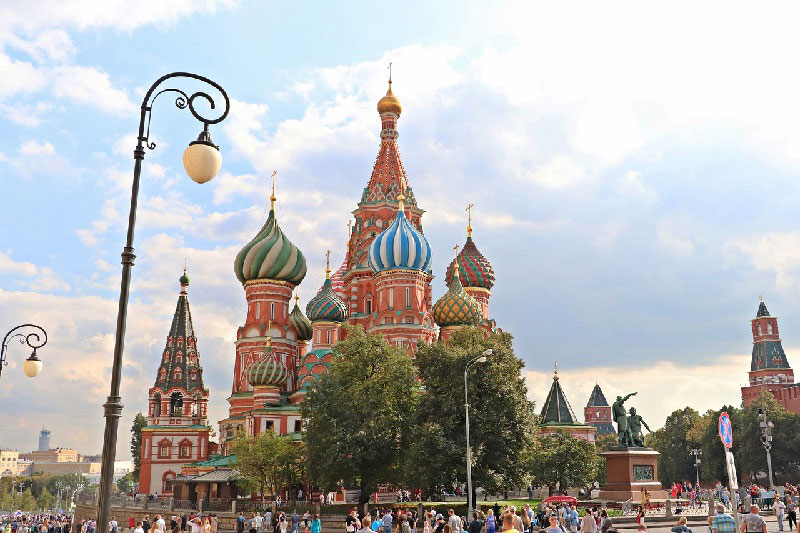

Top Sights in Moscow

St. Basil’s

Novodevichy Convent

MORE SIGHTS

- Moscow Fact File

- History of Moscow Russia

- Arriving in Moscow

- Getting Around

- Moscow Museums

- Nightlife in Moscow

- Moscow Restaurants

- Moscow Entertainment

- Activities in Moscow

- Outside Moscow

FEATURED MOSCOW TOURS

See tours which enjoy highest popularity with our customers

CLASSIC MOSCOW

A WEEK IN MOSCOW

WEEKEND IN MOSCOW

View all tours

Why visit Moscow

It would take more than two days to walk around the perimeter of the biggest city in Europe, Moscow. Many of its inhabitants barely know what’s beyond the few blocks around their flat and there are so many attractions that it’s almost impossible to know where to start. If there is such a thing as an antidote to boredom, Moscow City is it. The mind-boggling range and diversity of things to do, places to eat, parks, historical monuments and more means that a vacation in Moscow has a wealth of activities to offer for every type of traveler, from young families to retirees.

Reasons to Vacation in Moscow in 2022

The Bolshoi theatre is familiar to almost everyone as Russia’s grandest theatre, but what people don’t know is that there are many more bolshoi (big) sites in Moscow that are worth travelling all the way to Moscow to see. For more than 100 years, the world’s biggest bell has been hidden behind the Kremlin’s walls and inside Moscow’s main park (which is bigger than some countries!) there is the world’s largest outdoor ice-rink. Travelers that visit Moscow can stay at the Izmailovo, Europe’s biggest hotel, then eat at the largest and most historic McDonald’s in Europe and after that have fun at the largest European indoor theme park!

Ancient Past & Stunning Architecture:

As those who travel to Moscow will see, just because Moscow is a city of record-breaking, glitzy high-rises doesn’t mean that there is no history. On the famous Arbat street, time-worn, wooden storehouses and century-old churches are squashed up against grey, soviet blocks which are then towered over by 21st century office-blocks. Unlike its much younger sibling, St Petersburg, Moscow’s roots stretch way back to the 12th century. Within the walls of the Kremlin, the city’s oldest building the Cathedral of Assumption can be admired in all its 500+ years of age.

Culture & Convenience

For a foreigner who has never visited Russia, Moscow is the perfect stepping stone into this great land of mystery. From the country’s best classical ballet troupes to snow-white troikas trotting through the parks, all the highlights of Russian culture can be had in Moscow without any of the complications that would be expected in other, less developed regions of Russia.

Cheap as Caviar

In Moscow, everything is bargain when with the current foreign exchange rates being what they are. Even caviar doesn’t seem so dear when the exchange rate is at 60rub to the dollar, so go on indulge yourself! Take your 2022 vacation in Moscow and have the best of both worlds, with European luxury at very affordable prices.

Lena, our guide in Moscow was excellent. She was very knowledgable and could answer any question we had for her. We liked that she could pick up on our interests and take us places we might not have thought of to go. When we realized that one of the places we had chosen to see would probably not be that interesting to us, she was able to arrange entry to the Diamond Fund and the Armoury for us. Riding the Metro with Lena was a real adventure and a lot of fun. In Saint Petersburg we found Anna well versed in the history of the Tsars and in the Hermitage collection. Arkady in Veliky Novgorod was a very good guide and answered all of our questions with ease. Novgorod was perhaps a long way to go for a day trip, but we did enjoy it. Vasily was a great driver to have and kept us safe with good humour and skill. We enjoyed ourselves so much, my daughter says she is already planning to return. We would both have no hesistation to recommend ExpresstoRussia to anyone we know.

Just wanted to let you know that My grandson Bruno and I couldn´t have been more pleased with our week in Moscow (6/15 - 6/21). We were absolutely enchanted with the whole experience, including getting lost a couple of times in the Metro during our free time. Although both our guides (both Eleanas) were excellent, I would particularly commend the first one (she took us to the Tatiakov, the KGB tour, and to that beautiful cemetery where so many great Russian artists, authors, composers, musicians, militarists, and politicians are buried). Her knowledge is encyclopedic; and her understanding of today´s Russia as a product of its past was, for us, truly enlightening. I will be taking another tour in Russia, with my wife, within the next two or three years. I will be in touch with you when the time comes. Meanwhile, I will refer you to other potential visitors to Russia as I meet them.

We had a great time both in Moscow and St Petersburg. Your travel agency was excellent in coordinating the whole trip. Everything worked like clockwork. The guides assigned to us were very nice and friendly. They had a great knowledge of their subjects. The cars and the drivers were great. The hotels were good and the itinerary was good. All in all, it was a wonderful experience. It was nice dealing with you and your company. Thank you very much for a great Russian experience. Have a great future ahead

- 31 reviews of Express to Russia Moscow Tours in Moscow

Our travel brands include

Express to Russia

Join us on Facebook

We invite you to become a fan of our company on Facebook and read Russian news and travel stories. To become a fan, click here .

Join our own Russian Travel, Culture and Literature Club on Facebook. The club was created to be a place for everyone with an interest in Russia to get to know each other and share experiences, stories, pictures and advice. To join our club, please follow this link .

We use cookies to improve your experience on our Website, and to facilitate providing you with services available through our Website. To opt out of non-essential cookies, please click here . By continuing to use our Website, you accept our use of cookies, the terms of our Privacy Policy and Terms of Service . I agree

Opening your U.S. bank account

You may find that you need a U.S. bank account right away. banking or checking account is a type of account that enables you to deposit and withdraw available funds on demand, typically by using a debit card, using Bill Pay or transferring money to a friend." data-tooltip-title="bank of america foreign travel" data-tooltip-close-text="" data-tooltip-close-title="Close this window" aria-label="Help"> That's where we come in.

Application process and requirements

To apply for an account, you need to visit a Bank of America financial center.

You must be living in the U.S. in order to open an account and you'll need to provide both your foreign and your U.S. address.*

Home or permanent residence address

This must include building name or number and street name, city or town, state or province, country.

U.S. physical address

Only one of the following documents is needed:.

- Government-issued ID with photo

- Student ID with address and photo

- Current utility bill with your name and address

- Other (rental agreement, etc.)

*A post office box or locally known mail drop location (such as Mail Boxes) is not an acceptable U.S. physical address.

You will need two forms of identification.

- Foreign passport with or without passport visa (with photo)

- U.S. Non Immigrant visa and Border Crossing Card-DSP-150 (with photo)

- Mexican, Guatemalan, Dominican, Colombian Consular ID (with photo)

- Canadian Citizenship Certificate Card (with photo)

Secondary ID

- Foreign driver's license with photo or U.S. driver's license

- U.S. student ID validated for current term or school year (with photo)

- Debit or major credit card with Visa® or Mastercard® logo

- Major retail credit card from a nationally well-known company

- U.S. Department of State Diplomat ID

- Mexican Voter Registration Card (with photo)

Foreign Tax Identification Number (FTIN)

An FTIN issued by a country other than the U.S. A U.S. TIN/ITN is not required unless you’ve been issued one.

Pick a time and location that’s convenient for you.

Schedule an appointment

Once everything is in order, you’ll be able to start enjoying conveniences like the Mobile Banking app 1 , debit card and digital wallets – designed to help manage your finances.

If you're a non-resident alien, you must apply in person at one of our financial centers to open your account.

- You're looking to open a Bank of America Advantage SafeBalance Banking® account

- You are not a U.S. citizen

- You have a physical U.S. residential address

- You are not a permanent resident of the U.S. Non-resident alien: Any individual who is not a U.S. citizen or U.S. national Resident alien: Individuals who have met either the green card test or the substantial presence test for the calendar year Permanent resident: Green card (or permanent resident card) holders who are authorized to live and work in the United States on a permanent basis" data-tooltip-title="bank of america foreign travel" data-tooltip-close-text="" data-tooltip-close-title="Close this window" aria-label="Help">

You must be living in the U.S. to open your account. You'll need to provide both a foreign and U.S. address, as well as two forms of ID and a tax identification number.

See what you'll need

Once you have all your information collected and ready, find a time to see us.

Bank of America Advantage SafeBalance Banking® is a great choice for students

No monthly maintenance fee.

We'll waive the monthly maintenance fee for this account with an owner under 25 2 .

Just for you

Sole ownership can start as early as age 16 for students with a valid U.S. visa and physical U.S. address.

Where you need us

We have thousands of physical locations if you need assistance or just an ATM.

Make your financial journey here a little easier

Guidance, tools, calculators; it's all a part of banking with us.

International student? Why you should open a U.S. bank account

Learn how opening a U.S. bank account can help you save money and make it easier to manage your finances. Read more

International students: set yourself up for U.S. banking success

Having a domestic bank account up and running can make for a smoother adjustment to university. Read more

Today's exchange rate

Our foreign exchange calculator can help you find out how much your currency is worth in U.S. dollars. Try it

1 Mobile Banking requires that you download the Mobile Banking app and is only available for select mobile devices. Message and data rates may apply.

2 Fiduciary titled accounts, including UTMA/UGMA, do not qualify for the under the age of 25 requirement to waive the monthly maintenance fee. Please refer to your Personal Schedule of Fees for more information.

Better Money Habits, Bank of America and the Bank of America logo are registered trademarks of Bank of America Corporation

Advertising Practices

We strive to provide you with information about products and services you might find interesting and useful. Relationship-based ads and online behavioral advertising help us do that.

Bank of America participates in the Digital Advertising Alliance ("DAA") self-regulatory Principles for Online Behavioral Advertising and uses the Advertising Options Icon on our behavioral ads on non-affiliated third-party sites (excluding ads appearing on platforms that do not accept the icon). Ads served on our behalf by these companies do not contain unencrypted personal information and we limit the use of personal information by companies that serve our ads. To learn more about ad choices, or to opt out of interest-based advertising with non-affiliated third-party sites, visit YourAdChoices powered by the DAA or through the Network Advertising Initiative's Opt-Out Tool . You may also visit the individual sites for additional information on their data and privacy practices and opt-out options.

To learn more about relationship-based ads, online behavioral advertising and our privacy practices, please review the Bank of America Online Privacy Notice and our Online Privacy FAQs .

Qualifying direct deposit

A qualifying direct deposit is a recurring direct deposit of a paycheck, pension, Social Security or other eligible regular monthly income, electronically deposited by an employer or an outside agency into your new checking account. Please note, this does not include a transfer done via ATM, online, or teller, or a transfer from a bank or brokerage account, Merrill Edge® or Merrill Lynch® account.

Qualifying purchase

A qualifying debit card purchase is any purchase of goods or services made in store, by telephone or online using the debit card and/or debit card number associated with the new checking account that qualified for the $150 bonus. Purchases will be qualified based on the day the purchase posts to your new account. Purchases include any payments made using your debit card number but do not include ATM transactions (such as withdrawals).

This is the second paragraph

Bank of America Core Checking®

Have at least one Qualifying Direct Deposit of $250

Maintain a minimum daily balance of $1,500 or more

Students under age 24 are eligible to have this fee waived while enrolled in high school, college or a vocational program.

Preferred Rewards clients get this fee waived.

Or pay $12 /month

Bank of America Interest Checking®

Maintain a combined balance* of at least $10,000 or more

*Combined balances include: The average daily balance in eligible linked checking and savings accounts for the statement cycle

The current balances in linked personal CDs and IRAs at the end of the Interest Checking statement cycle

The current balance (2 business days before the end of the Interest Checking statement cycle) in your eligible linked Merrill Edge® and Merrill Lynch® investment accounts

Or pay $25 /month

Bank of America® Rewards Savings

Maintain a minimum daily balance of at least $500

Link your Bank of America Interest Checking® account to your Rewards Savings account (waiver applies to first 4 savings accounts)

When you are a Bank of America Preferred Rewards client (waiver applies to first 4 checking and savings accounts)

Or pay $8 /month

Important Notice

You're continuing to another website that Bank of America doesn't own or operate. Its owner is solely responsible for the website's content, offerings and level of security, so please refer to the website's posted privacy policy and terms of use. It's possible that the information provided in the website is available only in English.

Aviso Importante

Es posible que el contenido, las solicitudes y los documentos asociados con los productos y servicios específicos en esa página estén disponibles solo en inglés. Antes de escoger un producto o servicio, asegúrese de haber leído y entendido todos los términos y condiciones provistos.

Desea continuar?

Está a punto de entrar a un sitio web cuya propiedad o administración no pertenecen a Bank of America. El propietario del sitio es el único responsable del contenido, los productos y servicios ofrecidos, y el nivel de seguridad del sitio web, por lo que debe consultar la política de privacidad y los términos de uso publicados en el sitio. Es posible que la información proporcionada en el sitio web esté disponible solo en inglés.

- - K-town Now

Asia-Pacific

- - Storm Tracker

- Middle East

- Map of Memorials

- Entertainment

- - Video Games

- Europe Travel

- - Quick Trips

- - After Hours

- Pacific Travel

- The Meat and Potatoes of Life

- U.S. Travel

- Storm Tracker

- Rewards for readers

- Get Stripes

- Stripes Lite

- Archives/Library

- Special Publications

- Mobile Apps

- Email Newsletters

- Digital Access

- Home Delivery

- Marine Corps

- Coast Guard

- Space Force

- Archive photo of the day

- - Schedules Europe

- - Scoreboards Europe

- - Schedules Pacific

- - Scoreboards Pacific

- - Pacific Sports Blog

- - Military Matters

- - Force for Hire

- Out of Uniform

- Communities

- Stripes Europe

- Stripes Guam

- Stripes Japan

- Stripes Korea

- Stripes Okinawa

- Our Other Websites

- In Memoriam

- Month of the Military Child

- Best of Germany

- Best of the Pacific

- Letters to Santa

Navy Federal replaces Bank of America as operator of DOD’s Community Bank

A Bank of America logo is covered on a Community Bank ATM at the Navy-run New Sanno Hotel in Tokyo, Tuesday, April 9, 2024. (Aaron Kidd/Stars and Stripes)

Account holders should experience no change in service as the world’s largest credit union takes over all Department of Defense banks on overseas military bases.

Navy Federal Credit Union starting this month will operate those 60 facilities, known as Community Banks, and the 272 ATMs on installations in Europe and the Pacific, according to a Navy Federal press release April 2.

Bank of America held the contract for more than 40 years, Yahoo! Finance reported April 4.

“The Overseas Military Banking Program fits our core values at Navy Federal and is consistent with our primary mission of supporting Active Duty military members and their families,” Navy Federal’s chief operations officer, Kara Cardona, said in the release. “Serving these families through this important DoD program is directly aligned with our mission.”

Navy Federal claims 13 million members across all service branches and assets of more than $168 billion. It won the $9.4 million Overseas Military Banking Program contract, previously held by Bank of America, on Sept. 25, according to the DOD website.

Community Bank customers should expect business as usual, Navy Federal spokeswoman Amber Southard told Stars and Stripes by email Friday.

Navy Federal Credit Union claims 13 million members across all service branches and assets of more than $168 billion. (Jeremy Stillwagner/Stars and Stripes)

Navy Federal came under scrutiny after a CNN investigation published in December found the credit union approved mortgages for more than 75% of the white borrowers who applied for a new conventional home purchase in 2022 while approving less than 50% of Black borrowers who applied for the same type of loan. The cable news channel cited the most recent federal data available.

In January, 10 U.S. senators wrote Secretary Marcia Fudge of Department of Housing & Urban Development and director Rohit Chopra of the Consumer Financial Protection Bureau asking them to “thoroughly review Navy Federal’s mortgage lending practices and outcomes for compliance with all federal fair housing and fair lending laws and regulations.”

The same day, 42 members of the congressional Black Caucus wrote separately to Navy Federal president and CEO Mary McDuffie asking her to explain the reported disparity in lending and answer a series of questions.

An unnamed Navy Federal spokesperson in CNN’s Jan. 12 report said the credit union was already reviewing its mortgage practices and that it provided a higher percentage of its loans to Black borrowers than most other large lenders.

Community Bank provides unsecured, debt consolidation and auto loans, but not mortgage loans, according to its website. It also provides access to foreign currency, local ATMs, bill pay, savings, checking and other financial services to installation personnel and commands.

Navy Federal’s spokeswoman underscored Friday that the credit union and Community Bank are separate entities.

“Community Bank and Navy Federal Credit Union are independent of one another,” Southard wrote in her email. “While Navy Federal Credit Union has been selected to manage the Overseas Military Banking Program, these institutions will remain as separate entities.”

Customers cannot access Community Bank accounts at Navy Federal Credit Union locations, she said.

DOD established the Overseas Military Banking Program after World War II to provide active-duty service members and base commands with retail financial and cash services, according to a Navy Federal press release Sept. 25.

Community Bank operates through a contract between DOD, a commercial financial institution and the Defense Finance and Accounting Service. The contract began with a transition period, followed by a base year starting April 1 and one-year options for another eight years.

“There are no immediate improvements or features planned for Community Bank,” Southard said. “As we gain experience operating Community Bank for the DoD’s Overseas Military Banking Program we may identify opportunities for improvements in products and services. Those will be vetted through DFAS for approval prior to implementation.”

Sign Up for Daily Headlines

Sign up to receive a daily email of today's top military news stories from Stars and Stripes and top news outlets from around the world.

Sign Up Now

- Bahasa Indonesia

- Slovenščina

- Science & Tech

- Russian Kitchen

Moscow-City: 7 surprising facts about the Russian capital’s business center

1. Guinness World Record in highlining

The record was set in 2019 by a team of seven athletes from Russia, Germany, France and Canada. They did it on September 8, on which the ‘Moscow-City Day’ is celebrated. The cord was stretched at the height of 350 m between the ‘OKO’ (“Eye”) and ‘Neva Towers’ skyscrapers. The distance between them is 245 m. The first of the athletes to cross was Friede Kuhne from Germany. The athletes didn't just walk, but also performed some daredevil tricks. Their record is 103 meters higher than the previous one set in Mexico City in December 2016.

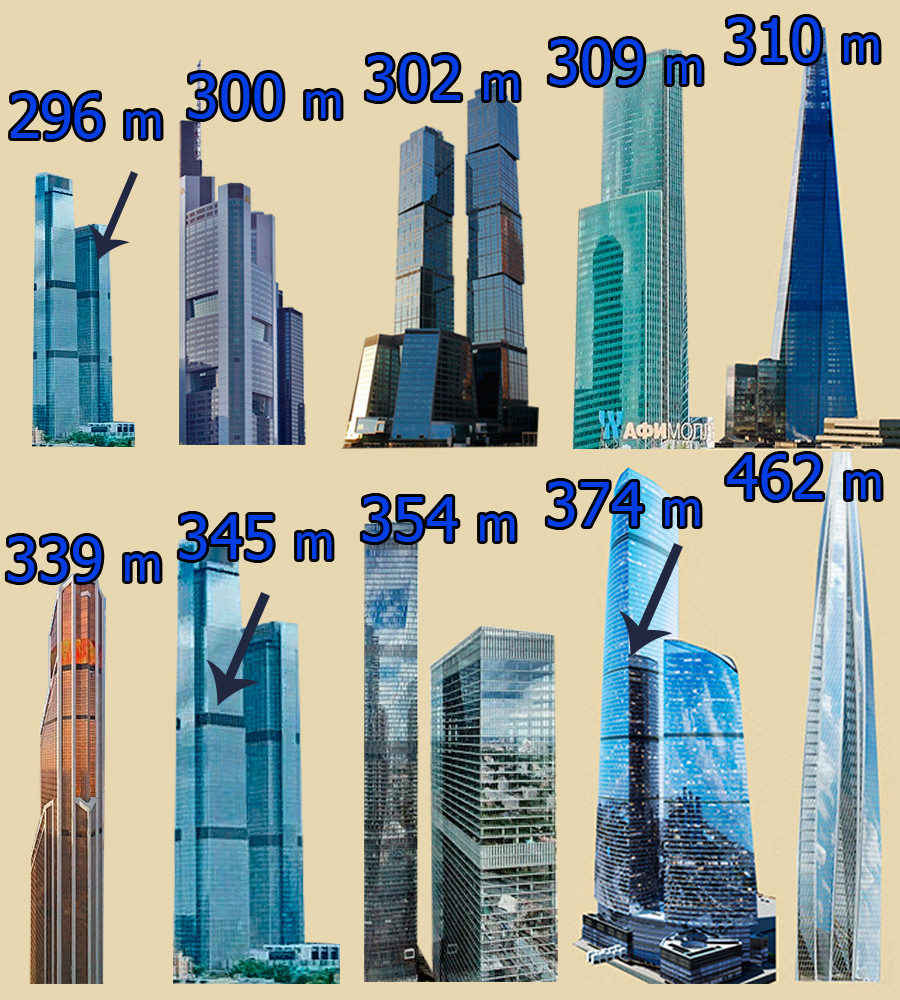

2. Domination of Europe's top-10 highest skyscrapers

7 out of 10 Europe’s highest skyscrapers are located in Moscow-City. Earlier, the ‘Federation Tower’ complex’s ‘Vostok’ (“East”) skyscraper was the considered the tallest in Europe.

Left to right: the lower of the ‘Neva Towers’ (296 m), Commerzbank Tower in Frankfurt (300 m), Gorod Stolits (“City of Capitals”) Moscow tower (302 m), Eurasia tower (309 m), The Shard’ skyscraper in London (310 m), Mercury City Tower (339 m), Neva Towers (345 m).

However, in 2018, the construction of the 462 meter tall ‘Lakhta Center’ in Saint-Petersburg was completed, pushing ‘Vostok’ (374 m) into 2nd place. The 3rd place is taken by OKO’s southern tower (354 m).

3. The unrealized ‘Rossiya’ tower