Travel, Tourism & Hospitality

Global tourism industry - statistics & facts

What are the leading global tourism destinations, digitalization of the global tourism industry, how important is sustainable tourism, key insights.

Detailed statistics

Total contribution of travel and tourism to GDP worldwide 2019-2033

Number of international tourist arrivals worldwide 1950-2023

Global leisure travel spend 2019-2022

Editor’s Picks Current statistics on this topic

Current statistics on this topic.

Leading global travel markets by travel and tourism contribution to GDP 2019-2022

Travel and tourism employment worldwide 2019-2033

Related topics

Recommended.

- Hotel industry worldwide

- Travel agency industry

- Sustainable tourism worldwide

- Travel and tourism in the U.S.

- Travel and tourism in Europe

Recommended statistics

- Basic Statistic Total contribution of travel and tourism to GDP worldwide 2019-2033

- Basic Statistic Travel and tourism: share of global GDP 2019-2033

- Basic Statistic Leading global travel markets by travel and tourism contribution to GDP 2019-2022

- Basic Statistic Global leisure travel spend 2019-2022

- Premium Statistic Global business travel spending 2001-2022

- Premium Statistic Number of international tourist arrivals worldwide 1950-2023

- Basic Statistic Number of international tourist arrivals worldwide 2005-2023, by region

- Basic Statistic Travel and tourism employment worldwide 2019-2033

Total contribution of travel and tourism to gross domestic product (GDP) worldwide in 2019 and 2022, with a forecast for 2023 and 2033 (in trillion U.S. dollars)

Travel and tourism: share of global GDP 2019-2033

Share of travel and tourism's total contribution to GDP worldwide in 2019 and 2022, with a forecast for 2023 and 2033

Total contribution of travel and tourism to GDP in leading travel markets worldwide in 2019 and 2022 (in billion U.S. dollars)

Leisure tourism spending worldwide from 2019 to 2022 (in billion U.S. dollars)

Global business travel spending 2001-2022

Expenditure of business tourists worldwide from 2001 to 2022 (in billion U.S. dollars)

Number of international tourist arrivals worldwide from 1950 to 2023 (in millions)

Number of international tourist arrivals worldwide 2005-2023, by region

Number of international tourist arrivals worldwide from 2005 to 2023, by region (in millions)

Number of travel and tourism jobs worldwide from 2019 to 2022, with a forecast for 2023 and 2033 (in millions)

- Premium Statistic Global hotel and resort industry market size worldwide 2013-2023

- Premium Statistic Most valuable hotel brands worldwide 2023, by brand value

- Basic Statistic Leading hotel companies worldwide 2023, by number of properties

- Premium Statistic Hotel openings worldwide 2021-2024

- Premium Statistic Hotel room openings worldwide 2021-2024

- Premium Statistic Countries with the most hotel construction projects in the pipeline worldwide 2022

Global hotel and resort industry market size worldwide 2013-2023

Market size of the hotel and resort industry worldwide from 2013 to 2022, with a forecast for 2023 (in trillion U.S. dollars)

Most valuable hotel brands worldwide 2023, by brand value

Leading hotel brands based on brand value worldwide in 2023 (in billion U.S. dollars)

Leading hotel companies worldwide 2023, by number of properties

Leading hotel companies worldwide as of June 2023, by number of properties

Hotel openings worldwide 2021-2024

Number of hotels opened worldwide from 2021 to 2022, with a forecast for 2023 and 2024

Hotel room openings worldwide 2021-2024

Number of hotel rooms opened worldwide from 2021 to 2022, with a forecast for 2023 and 2024

Countries with the most hotel construction projects in the pipeline worldwide 2022

Countries with the highest number of hotel construction projects in the pipeline worldwide as of Q4 2022

- Premium Statistic Airports with the most international air passenger traffic worldwide 2022

- Premium Statistic Market value of selected airlines worldwide 2023

- Premium Statistic Global passenger rail users forecast 2017-2027

- Premium Statistic Daily ridership of bus rapid transit systems worldwide by region 2023

- Premium Statistic Number of users of car rentals worldwide 2019-2028

- Premium Statistic Number of users in selected countries in the Car Rentals market in 2023

- Premium Statistic Carbon footprint of international tourism transport worldwide 2005-2030, by type

Airports with the most international air passenger traffic worldwide 2022

Leading airports for international air passenger traffic in 2022 (in million international passengers)

Market value of selected airlines worldwide 2023

Market value of selected airlines worldwide as of May 2023 (in billion U.S. dollars)

Global passenger rail users forecast 2017-2027

Worldwide number of passenger rail users from 2017 to 2022, with a forecast through 2027 (in billion users)

Daily ridership of bus rapid transit systems worldwide by region 2023

Number of daily passengers using bus rapid transit (BRT) systems as of April 2023, by region

Number of users of car rentals worldwide 2019-2028

Number of users of car rentals worldwide from 2019 to 2028 (in millions)

Number of users in selected countries in the Car Rentals market in 2023

Number of users in selected countries in the Car Rentals market in 2023 (in million)

Carbon footprint of international tourism transport worldwide 2005-2030, by type

Transport-related emissions from international tourist arrivals worldwide in 2005 and 2016, with a forecast for 2030, by mode of transport (in million metric tons of carbon dioxide)

Attractions

- Premium Statistic Market size of museums, historical sites, zoos, and parks worldwide 2022-2027

- Premium Statistic Leading museums by highest attendance worldwide 2019-2022

- Basic Statistic Most visited amusement and theme parks worldwide 2019-2022

- Basic Statistic Monuments on the UNESCO world heritage list 2023, by type

- Basic Statistic Selected countries with the most Michelin-starred restaurants worldwide 2023

Market size of museums, historical sites, zoos, and parks worldwide 2022-2027

Size of the museums, historical sites, zoos, and parks market worldwide in 2022, with a forecast for 2023 and 2027 (in billion U.S. dollars)

Leading museums by highest attendance worldwide 2019-2022

Most visited museums worldwide from 2019 to 2022 (in millions)

Most visited amusement and theme parks worldwide 2019-2022

Leading amusement and theme parks worldwide from 2019 to 2022, by attendance (in millions)

Monuments on the UNESCO world heritage list 2023, by type

Number of monuments on the UNESCO world heritage list as of September 2023, by type

Selected countries with the most Michelin-starred restaurants worldwide 2023

Number of Michelin-starred restaurants in selected countries and territories worldwide as of July 2023

Online travel market

- Premium Statistic Online travel market size worldwide 2017-2028

- Premium Statistic Estimated desktop vs. mobile revenue of leading OTAs worldwide 2023

- Premium Statistic Number of aggregated downloads of leading online travel agency apps worldwide 2023

- Basic Statistic Market cap of leading online travel companies worldwide 2023

- Premium Statistic Forecast EV/Revenue ratio in the online travel market 2024, by segment

- Premium Statistic Forecast EV/EBITDA ratio in the online travel market 2024, by segment

Online travel market size worldwide 2017-2028

Online travel market size worldwide from 2017 to 2023, with a forecast until 2028 (in billion U.S. dollars)

Estimated desktop vs. mobile revenue of leading OTAs worldwide 2023

Estimated desktop vs. mobile revenue of leading online travel agencies (OTAs) worldwide in 2023 (in billion U.S. dollars)

Number of aggregated downloads of leading online travel agency apps worldwide 2023

Number of aggregated downloads of selected leading online travel agency apps worldwide in 2023 (in millions)

Market cap of leading online travel companies worldwide 2023

Market cap of leading online travel companies worldwide as of September 2023 (in million U.S. dollars)

Forecast EV/Revenue ratio in the online travel market 2024, by segment

Forecast enterprise value to revenue (EV/Revenue) ratio in the online travel market worldwide in 2024, by segment

Forecast EV/EBITDA ratio in the online travel market 2024, by segment

Forecast enterprise value to EBITDA (EV/EBITDA) ratio in the online travel market worldwide in 2024, by segment

Selected trends

- Premium Statistic Global travelers who believe in the importance of green travel 2023

- Premium Statistic Sustainable initiatives travelers would adopt worldwide 2022, by region

- Premium Statistic Airbnb revenue worldwide 2017-2023

- Premium Statistic Airbnb nights and experiences booked worldwide 2017-2023

- Premium Statistic Technologies global hotels plan to implement in the next three years 2022

- Premium Statistic Hotel technologies global consumers think would improve their future stay 2022

Global travelers who believe in the importance of green travel 2023

Share of travelers that believe sustainable travel is important worldwide in 2023

Sustainable initiatives travelers would adopt worldwide 2022, by region

Main sustainable initiatives travelers are willing to adopt worldwide in 2022, by region

Airbnb revenue worldwide 2017-2023

Revenue of Airbnb worldwide from 2017 to 2023 (in billion U.S. dollars)

Airbnb nights and experiences booked worldwide 2017-2023

Nights and experiences booked with Airbnb from 2017 to 2023 (in millions)

Technologies global hotels plan to implement in the next three years 2022

Technologies hotels are most likely to implement in the next three years worldwide as of 2022

Hotel technologies global consumers think would improve their future stay 2022

Must-have hotel technologies to create a more amazing stay in the future among travelers worldwide as of 2022

- Premium Statistic Travel and tourism revenue worldwide 2019-2028, by segment

- Premium Statistic Distribution of sales channels in the travel and tourism market worldwide 2018-2028

- Premium Statistic Inbound tourism visitor growth worldwide 2020-2025, by region

- Premium Statistic Outbound tourism visitor growth worldwide 2020-2025, by region

Travel and tourism revenue worldwide 2019-2028, by segment

Revenue of the global travel and tourism market from 2019 to 2028, by segment (in billion U.S. dollars)

Distribution of sales channels in the travel and tourism market worldwide 2018-2028

Revenue share of sales channels of the travel and tourism market worldwide from 2018 to 2028

Inbound tourism visitor growth worldwide 2020-2025, by region

Inbound tourism visitor growth worldwide from 2020 to 2022, with a forecast until 2025, by region

Outbound tourism visitor growth worldwide 2020-2025, by region

Outbound tourism visitor growth worldwide from 2020 to 2022, with a forecast until 2025, by region

Further reports Get the best reports to understand your industry

Get the best reports to understand your industry.

Mon - Fri, 9am - 6pm (EST)

Mon - Fri, 9am - 5pm (SGT)

Mon - Fri, 10:00am - 6:00pm (JST)

Mon - Fri, 9:30am - 5pm (GMT)

An official website of the United States government

- Special Topics

Travel and Tourism

Travel and tourism satellite account for 2017-2021.

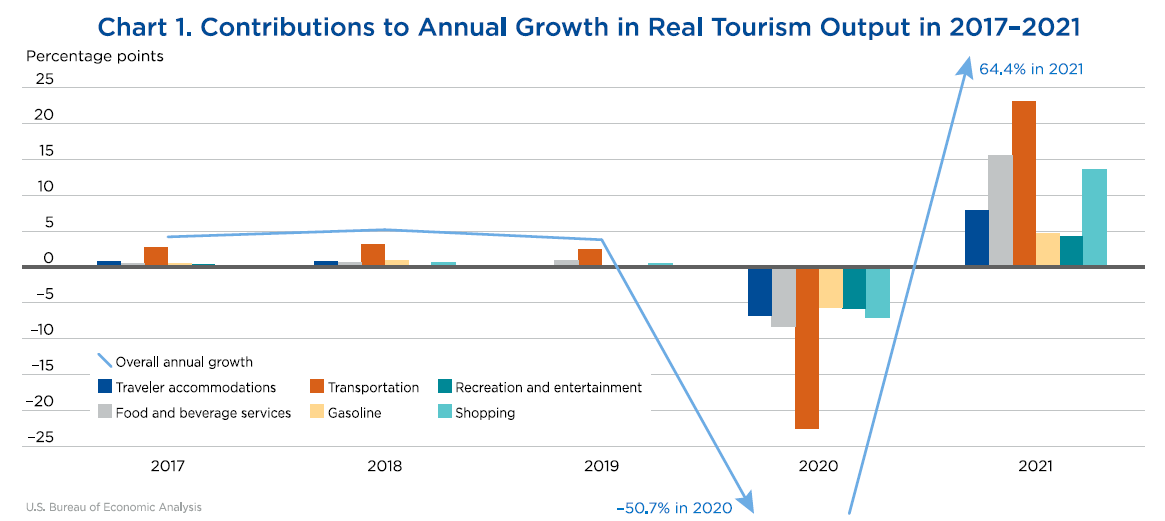

The travel and tourism industry—as measured by the real output of goods and services sold directly to visitors—increased 64.4 percent in 2021 after decreasing 50.7 percent in 2020, according to the most recent statistics from BEA’s Travel and Tourism Satellite Account.

Data & Articles

- U.S. Travel and Tourism Satellite Account for 2017–2021 By Sarah Osborne - Survey of Current Business February 2023

- "U.S. Travel and Tourism Satellite Account for 2015–2019" By Sarah Osborne - Survey of Current Business December 2020

- "U.S. Travel and Tourism Satellite Account for 2015-2017" By Sarah Osborne and Seth Markowitz - Survey of Current Business June 2018

- Tourism Satellite Accounts 1998-2019

- Tourism Satellite Accounts Data Sheets A complete set of detailed annual statistics for 2017-2021 is coming soon -->

- Article Collection

Documentation

- Product Guide

Previously Published Estimates

- Data Archive This page provides access to an archive of estimates previously published by the Bureau of Economic Analysis. Please note that this archive is provided for research only. The estimates contained in this archive include revisions to prior estimates and may not reflect the most recent revision for a particular period.

- News Release Archive

What is Travel and Tourism?

Measures how much tourists spend and the prices they pay for lodging, airfare, souvenirs, and other travel-related items. These statistics also provide a snapshot of employment in the travel and tourism industries.

What’s a Satellite Account?

- TTSA Sarah Osborne (301) 278-9459

- News Media Connie O'Connell (301) 278-9003 [email protected]

By Bastian Herre, Veronika Samborska and Max Roser

Tourism has massively increased in recent decades. Aviation has opened up travel from domestic to international. Before the COVID-19 pandemic, the number of international visits had more than doubled since 2000.

Tourism can be important for both the travelers and the people in the countries they visit.

For visitors, traveling can increase their understanding of and appreciation for people in other countries and their cultures.

And in many countries, many people rely on tourism for their income. In some, it is one of the largest industries.

But tourism also has externalities: it contributes to global carbon emissions and can encroach on local environments and cultures.

On this page, you can find data and visualizations on the history and current state of tourism across the world.

Interactive Charts on Tourism

Cite this work.

Our articles and data visualizations rely on work from many different people and organizations. When citing this topic page, please also cite the underlying data sources. This topic page can be cited as:

BibTeX citation

Reuse this work freely

All visualizations, data, and code produced by Our World in Data are completely open access under the Creative Commons BY license . You have the permission to use, distribute, and reproduce these in any medium, provided the source and authors are credited.

The data produced by third parties and made available by Our World in Data is subject to the license terms from the original third-party authors. We will always indicate the original source of the data in our documentation, so you should always check the license of any such third-party data before use and redistribution.

All of our charts can be embedded in any site.

Our World in Data is free and accessible for everyone.

Help us do this work by making a donation.

- Press Releases

- Press Enquiries

- Travel Hub / Blog

- Brand Resources

- Newsletter Sign Up

- Global Summit

- Hosting a Summit

- Upcoming Events

- Previous Events

- Event Photography

- Event Enquiries

- Our Members

- Our Associates Community

- Membership Benefits

- Enquire About Membership

- Sponsors & Partners

- Insights & Publications

- WTTC Research Hub

- Economic Impact

- Knowledge Partners

- Data Enquiries

- Hotel Sustainability Basics

- Community Conscious Travel

- SafeTravels Stamp Application

- SafeTravels: Global Protocols & Stamp

- Security & Travel Facilitation

- Sustainable Growth

- Women Empowerment

- Destination Spotlight - SLO CAL

- Vision For Nature Positive Travel and Tourism

- Governments

- Consumer Travel Blog

- ONEin330Million Campaign

- Reunite Campaign

Economic Impact Research

- In 2023, the Travel & Tourism sector contributed 9.1% to the global GDP; an increase of 23.2% from 2022 and only 4.1% below the 2019 level.

- In 2023, there were 27 million new jobs, representing a 9.1% increase compared to 2022, and only 1.4% below the 2019 level.

- Domestic visitor spending rose by 18.1% in 2023, surpassing the 2019 level.

- International visitor spending registered a 33.1% jump in 2023 but remained 14.4% below the 2019 total.

Click here for links to the different economy/country and regional reports

Why conduct research?

From the outset, our Members realised that hard economic facts were needed to help governments and policymakers truly understand the potential of Travel & Tourism. Measuring the size and growth of Travel & Tourism and its contribution to society, therefore, plays a vital part in underpinning WTTC’s work.

What research does WTTC carry out?

Each year, WTTC and Oxford Economics produce reports covering the economic contribution of our sector in 185 countries, for 26 economic and geographic regions, and for more than 70 cities. We also benchmark Travel & Tourism against other economic sectors and analyse the impact of government policies affecting the sector such as jobs and visa facilitation.

Visit our Research Hub via the button below to find all our Economic Impact Reports, as well as other reports on Travel and Tourism.

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( A locked padlock ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

- Search ITA Search

2020 Travel and Tourism Industry Impact on the U.S. Economy

Total economic output generated by travel and tourism in the united states decreased 50% in 2020 from 2019, decline in travel and tourism gdp accounted for more than half of the decline in u.s. gdp in 2020, decline in total tourism-related employment accounted for more than a third of the total employment decline in the united states in 2020 .

The National Travel and Tourism Office’s (NTTO) Travel & Tourism Satellite Account, produced annually by the Bureau of Economic Analysis, is the official U.S. Government estimate of the economic impact of the travel and tourism industry in the United States. The latest TTSA shows that in Calendar Year 2020:

Total economic output generated by travel and tourism fell $982.5 billion (-50.1%) from 2019 ($1.96 trillion) to 2020 ($978.4 billion).

- Among those sectors hardest hit, passenger air transportation services output declined by nearly $214.7 billion in 2020, followed by food services and drinking places/restaurants (down $131.1 billion), traveler accommodations (down $124.6 billion), and tourism-related shopping (down $123.5 billion).

- These four sectors accounted for 60.4% of the decline in total tourism-related output in 2020.

Total tourism-related employment declined from 9.5 million in 2019 to 6.3 million in 2020. This decline of 3.2 million in total tourism-related employment accounted for 34.2% of the overall 9.3 million employment decline in the United States from 2019 to 2020.

- Among those sectors hardest hit, employment supported by food services and drinking places declined by 972,000 in 2020, followed by traveler accommodations (down 685,000), air transportation services (down 338,000), and participant sports (down 262,000).

- These four sectors accounted for 70.8% of the decline in total tourism-related employment in 2020.

Travel and tourism value added, or GDP, (in nominal terms, not inflation adjusted) declined from $624.7 billion (2.9% of GDP) in 2019 to $356.8 billion (a historic low of 1.7% of GDP) in 2020 .This $267.9 billion decline in travel and tourism GDP accounted for more than half (56.0%) of the overall $478.8 billion decline in U.S. GDP from 2019 to 2020.

Domestic travel demand by resident households declined by 53.2% from 2019 to 2020. At the same time, domestic business travel demand declined by 40.9%; domestic government travel demand declined by 33.6%; and travel demand by nonresidents (international visitors in the United States) declined 82.4% — accounting for a fifth (20.7%) of the overall decline in total travel demand from 2019 to 2020.

Learn more on NTTO’s Travel and Tourism Satellite Account (TTSA) Program Page .

Travel and Tourism Satellite Accounts (TTSAs) allow the United States to measure the relative size and importance of the travel and tourism industry, along with its contribution to gross domestic product (GDP). Approved by the United Nations in March 2002 and endorsed by the U.N. Statistical Commission, TTSAs have become the international standard by which travel and tourism is measured. In fact, more than 50 countries around the world use travel and tourism satellite accounting.

View BEA’s Travel and Tourism Satellite Account .

An official website of the United States government

Here’s how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( Lock A locked padlock ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

U.S. Department of Commerce

- Fact Sheets

Was this page helpful?

Fact sheet: 2022 national travel and tourism strategy, office of public affairs.

The 2022 National Travel and Tourism Strategy was released on June 6, 2022, by U.S. Secretary of Commerce Gina M. Raimondo on behalf of the Tourism Policy Council (TPC). The new strategy focuses the full efforts of the federal government to promote the United States as a premier destination grounded in the breadth and diversity of our communities, and to foster a sector that drives economic growth, creates good jobs, and bolsters conservation and sustainability. Drawing on engagement and capabilities from across the federal government, the strategy aims to support broad-based economic growth in travel and tourism across the United States, its territories, and the District of Columbia.

The federal government will work to implement the strategy under the leadership of the TPC and in partnership with the private sector, aiming toward an ambitious five-year goal of increasing American jobs by attracting and welcoming 90 million international visitors, who we estimate will spend $279 billion, annually by 2027.

The new National Travel and Tourism Strategy supports growth and competitiveness for an industry that, prior to the COVID-19 pandemic, generated $1.9 trillion in economic output and supported 9.5 million American jobs. Also, in 2019, nearly 80 million international travelers visited the United States and contributed nearly $240 billion to the U.S. economy, making the United States the global leader in revenue from international travel and tourism. As the top services export for the United States that year, travel and tourism generated a $53.4 billion trade surplus and supported 1 million jobs in the United States.

The strategy follows a four-point approach:

- Promoting the United States as a Travel Destination Goal : Leverage existing programs and assets to promote the United States to international visitors and broaden marketing efforts to encourage visitation to underserved communities.

- Facilitating Travel to and Within the United States Goal : Reduce barriers to trade in travel services and make it safer and more efficient for visitors to enter and travel within the United States.

- Ensuring Diverse, Inclusive, and Accessible Tourism Experiences Goal : Extend the benefits of travel and tourism by supporting the development of diverse tourism products, focusing on under-served communities and populations. Address the financial and workplace needs of travel and tourism businesses, supporting destination communities as they grow their tourism economies. Deliver world-class experiences and customer service at federal lands and waters that showcase the nation’s assets while protecting them for future generations.

- Fostering Resilient and Sustainable Travel and Tourism Goal : Reduce travel and tourism’s contributions to climate change and build a travel and tourism sector that is resilient to natural disasters, public health threats, and the impacts of climate change. Build a sustainable sector that integrates protecting natural resources, supporting the tourism economy, and ensuring equitable development.

Travel and Tourism Fast Facts

- The travel and tourism industry supported 9.5 million American jobs through $1.9 trillion of economic activity in 2019. In fact, 1 in every 20 jobs in the United States was either directly or indirectly supported by travel and tourism. These jobs can be found in industries like lodging, food services, arts, entertainment, recreation, transportation, and education.

- Travel and tourism was the top services export for the United States in 2019, generating a $53.4 billion trade surplus.

- The travel and tourism industry was one of the U.S. business sectors hardest hit by the COVID-19 pandemic and subsequent health and travel restrictions, with travel exports decreasing nearly 65% from 2019 to 2020.

- The decline in travel and tourism contributed heavily to unemployment; leisure and hospitality lost 8.2 million jobs between February and April 2020 alone, accounting for 37% of the decline in overall nonfarm employment during that time.

- By 2021, the rollout of vaccines and lifting of international and domestic restrictions allowed travel and tourism to begin its recovery. International arrivals to the United States grew to 22.1 million in 2021, up from 19.2 million in 2020. Spending by international visitors also grew, reaching $81.0 billion, or 34 percent of 2019’s total.

More about the Tourism Policy Council and the 2022 National Travel and Tourism Strategy

Created by Congress and chaired by Secretary Raimondo, the Tourism Policy Council (TPC) is the interagency council charged with coordinating national policies and programs relating to travel and tourism. At the direction of Secretary Raimondo, the TPC created a new five-year strategy to focus U.S. government efforts in support of the travel and tourism sector which has been deeply and disproportionately affected by the COVID-19 pandemic.

Read the full strategy here

Share this page

The future of tourism: Bridging the labor gap, enhancing customer experience

As travel resumes and builds momentum, it’s becoming clear that tourism is resilient—there is an enduring desire to travel. Against all odds, international tourism rebounded in 2022: visitor numbers to Europe and the Middle East climbed to around 80 percent of 2019 levels, and the Americas recovered about 65 percent of prepandemic visitors 1 “Tourism set to return to pre-pandemic levels in some regions in 2023,” United Nations World Tourism Organization (UNWTO), January 17, 2023. —a number made more significant because it was reached without travelers from China, which had the world’s largest outbound travel market before the pandemic. 2 “ Outlook for China tourism 2023: Light at the end of the tunnel ,” McKinsey, May 9, 2023.

Recovery and growth are likely to continue. According to estimates from the World Tourism Organization (UNWTO) for 2023, international tourist arrivals could reach 80 to 95 percent of prepandemic levels depending on the extent of the economic slowdown, travel recovery in Asia–Pacific, and geopolitical tensions, among other factors. 3 “Tourism set to return to pre-pandemic levels in some regions in 2023,” United Nations World Tourism Organization (UNWTO), January 17, 2023. Similarly, the World Travel & Tourism Council (WTTC) forecasts that by the end of 2023, nearly half of the 185 countries in which the organization conducts research will have either recovered to prepandemic levels or be within 95 percent of full recovery. 4 “Global travel and tourism catapults into 2023 says WTTC,” World Travel & Tourism Council (WTTC), April 26, 2023.

Longer-term forecasts also point to optimism for the decade ahead. Travel and tourism GDP is predicted to grow, on average, at 5.8 percent a year between 2022 and 2032, outpacing the growth of the overall economy at an expected 2.7 percent a year. 5 Travel & Tourism economic impact 2022 , WTTC, August 2022.

So, is it all systems go for travel and tourism? Not really. The industry continues to face a prolonged and widespread labor shortage. After losing 62 million travel and tourism jobs in 2020, labor supply and demand remain out of balance. 6 “WTTC research reveals Travel & Tourism’s slow recovery is hitting jobs and growth worldwide,” World Travel & Tourism Council, October 6, 2021. Today, in the European Union, 11 percent of tourism jobs are likely to go unfilled; in the United States, that figure is 7 percent. 7 Travel & Tourism economic impact 2022 : Staff shortages, WTTC, August 2022.

There has been an exodus of tourism staff, particularly from customer-facing roles, to other sectors, and there is no sign that the industry will be able to bring all these people back. 8 Travel & Tourism economic impact 2022 : Staff shortages, WTTC, August 2022. Hotels, restaurants, cruises, airports, and airlines face staff shortages that can translate into operational, reputational, and financial difficulties. If unaddressed, these shortages may constrain the industry’s growth trajectory.

The current labor shortage may have its roots in factors related to the nature of work in the industry. Chronic workplace challenges, coupled with the effects of COVID-19, have culminated in an industry struggling to rebuild its workforce. Generally, tourism-related jobs are largely informal, partly due to high seasonality and weak regulation. And conditions such as excessively long working hours, low wages, a high turnover rate, and a lack of social protection tend to be most pronounced in an informal economy. Additionally, shift work, night work, and temporary or part-time employment are common in tourism.

The industry may need to revisit some fundamentals to build a far more sustainable future: either make the industry more attractive to talent (and put conditions in place to retain staff for longer periods) or improve products, services, and processes so that they complement existing staffing needs or solve existing pain points.

One solution could be to build a workforce with the mix of digital and interpersonal skills needed to keep up with travelers’ fast-changing requirements. The industry could make the most of available technology to provide customers with a digitally enhanced experience, resolve staff shortages, and improve working conditions.

Would you like to learn more about our Travel, Logistics & Infrastructure Practice ?

Complementing concierges with chatbots.

The pace of technological change has redefined customer expectations. Technology-driven services are often at customers’ fingertips, with no queues or waiting times. By contrast, the airport and airline disruption widely reported in the press over the summer of 2022 points to customers not receiving this same level of digital innovation when traveling.

Imagine the following travel experience: it’s 2035 and you start your long-awaited honeymoon to a tropical island. A virtual tour operator and a destination travel specialist booked your trip for you; you connected via videoconference to make your plans. Your itinerary was chosen with the support of generative AI , which analyzed your preferences, recommended personalized travel packages, and made real-time adjustments based on your feedback.

Before leaving home, you check in online and QR code your luggage. You travel to the airport by self-driving cab. After dropping off your luggage at the self-service counter, you pass through security and the biometric check. You access the premier lounge with the QR code on the airline’s loyalty card and help yourself to a glass of wine and a sandwich. After your flight, a prebooked, self-driving cab takes you to the resort. No need to check in—that was completed online ahead of time (including picking your room and making sure that the hotel’s virtual concierge arranged for red roses and a bottle of champagne to be delivered).

While your luggage is brought to the room by a baggage robot, your personal digital concierge presents the honeymoon itinerary with all the requested bookings. For the romantic dinner on the first night, you order your food via the restaurant app on the table and settle the bill likewise. So far, you’ve had very little human interaction. But at dinner, the sommelier chats with you in person about the wine. The next day, your sightseeing is made easier by the hotel app and digital guide—and you don’t get lost! With the aid of holographic technology, the virtual tour guide brings historical figures to life and takes your sightseeing experience to a whole new level. Then, as arranged, a local citizen meets you and takes you to their home to enjoy a local family dinner. The trip is seamless, there are no holdups or snags.

This scenario features less human interaction than a traditional trip—but it flows smoothly due to the underlying technology. The human interactions that do take place are authentic, meaningful, and add a special touch to the experience. This may be a far-fetched example, but the essence of the scenario is clear: use technology to ease typical travel pain points such as queues, misunderstandings, or misinformation, and elevate the quality of human interaction.

Travel with less human interaction may be considered a disruptive idea, as many travelers rely on and enjoy the human connection, the “service with a smile.” This will always be the case, but perhaps the time is right to think about bringing a digital experience into the mix. The industry may not need to depend exclusively on human beings to serve its customers. Perhaps the future of travel is physical, but digitally enhanced (and with a smile!).

Digital solutions are on the rise and can help bridge the labor gap

Digital innovation is improving customer experience across multiple industries. Car-sharing apps have overcome service-counter waiting times and endless paperwork that travelers traditionally had to cope with when renting a car. The same applies to time-consuming hotel check-in, check-out, and payment processes that can annoy weary customers. These pain points can be removed. For instance, in China, the Huazhu Hotels Group installed self-check-in kiosks that enable guests to check in or out in under 30 seconds. 9 “Huazhu Group targets lifestyle market opportunities,” ChinaTravelNews, May 27, 2021.

Technology meets hospitality

In 2019, Alibaba opened its FlyZoo Hotel in Huangzhou, described as a “290-room ultra-modern boutique, where technology meets hospitality.” 1 “Chinese e-commerce giant Alibaba has a hotel run almost entirely by robots that can serve food and fetch toiletries—take a look inside,” Business Insider, October 21, 2019; “FlyZoo Hotel: The hotel of the future or just more technology hype?,” Hotel Technology News, March 2019. The hotel was the first of its kind that instead of relying on traditional check-in and key card processes, allowed guests to manage reservations and make payments entirely from a mobile app, to check-in using self-service kiosks, and enter their rooms using facial-recognition technology.

The hotel is run almost entirely by robots that serve food and fetch toiletries and other sundries as needed. Each guest room has a voice-activated smart assistant to help guests with a variety of tasks, from adjusting the temperature, lights, curtains, and the TV to playing music and answering simple questions about the hotel and surroundings.

The hotel was developed by the company’s online travel platform, Fliggy, in tandem with Alibaba’s AI Labs and Alibaba Cloud technology with the goal of “leveraging cutting-edge tech to help transform the hospitality industry, one that keeps the sector current with the digital era we’re living in,” according to the company.

Adoption of some digitally enhanced services was accelerated during the pandemic in the quest for safer, contactless solutions. During the Winter Olympics in Beijing, a restaurant designed to keep physical contact to a minimum used a track system on the ceiling to deliver meals directly from the kitchen to the table. 10 “This Beijing Winter Games restaurant uses ceiling-based tracks,” Trendhunter, January 26, 2022. Customers around the world have become familiar with restaurants using apps to display menus, take orders, and accept payment, as well as hotels using robots to deliver luggage and room service (see sidebar “Technology meets hospitality”). Similarly, theme parks, cinemas, stadiums, and concert halls are deploying digital solutions such as facial recognition to optimize entrance control. Shanghai Disneyland, for example, offers annual pass holders the option to choose facial recognition to facilitate park entry. 11 “Facial recognition park entry,” Shanghai Disney Resort website.

Automation and digitization can also free up staff from attending to repetitive functions that could be handled more efficiently via an app and instead reserve the human touch for roles where staff can add the most value. For instance, technology can help customer-facing staff to provide a more personalized service. By accessing data analytics, frontline staff can have guests’ details and preferences at their fingertips. A trainee can become an experienced concierge in a short time, with the help of technology.

Apps and in-room tech: Unused market potential

According to Skift Research calculations, total revenue generated by guest apps and in-room technology in 2019 was approximately $293 million, including proprietary apps by hotel brands as well as third-party vendors. 1 “Hotel tech benchmark: Guest-facing technology 2022,” Skift Research, November 2022. The relatively low market penetration rate of this kind of tech points to around $2.4 billion in untapped revenue potential (exhibit).

Even though guest-facing technology is available—the kind that can facilitate contactless interactions and offer travelers convenience and personalized service—the industry is only beginning to explore its potential. A report by Skift Research shows that the hotel industry, in particular, has not tapped into tech’s potential. Only 11 percent of hotels and 25 percent of hotel rooms worldwide are supported by a hotel app or use in-room technology, and only 3 percent of hotels offer keyless entry. 12 “Hotel tech benchmark: Guest-facing technology 2022,” Skift Research, November 2022. Of the five types of technology examined (guest apps and in-room tech; virtual concierge; guest messaging and chatbots; digital check-in and kiosks; and keyless entry), all have relatively low market-penetration rates (see sidebar “Apps and in-room tech: Unused market potential”).

While apps, digitization, and new technology may be the answer to offering better customer experience, there is also the possibility that tourism may face competition from technological advances, particularly virtual experiences. Museums, attractions, and historical sites can be made interactive and, in some cases, more lifelike, through AR/VR technology that can enhance the physical travel experience by reconstructing historical places or events.

Up until now, tourism, arguably, was one of a few sectors that could not easily be replaced by tech. It was not possible to replicate the physical experience of traveling to another place. With the emerging metaverse , this might change. Travelers could potentially enjoy an event or experience from their sofa without any logistical snags, and without the commitment to traveling to another country for any length of time. For example, Google offers virtual tours of the Pyramids of Meroë in Sudan via an immersive online experience available in a range of languages. 13 Mariam Khaled Dabboussi, “Step into the Meroë pyramids with Google,” Google, May 17, 2022. And a crypto banking group, The BCB Group, has created a metaverse city that includes representations of some of the most visited destinations in the world, such as the Great Wall of China and the Statue of Liberty. According to BCB, the total cost of flights, transfers, and entry for all these landmarks would come to $7,600—while a virtual trip would cost just over $2. 14 “What impact can the Metaverse have on the travel industry?,” Middle East Economy, July 29, 2022.

The metaverse holds potential for business travel, too—the meeting, incentives, conferences, and exhibitions (MICE) sector in particular. Participants could take part in activities in the same immersive space while connecting from anywhere, dramatically reducing travel, venue, catering, and other costs. 15 “ Tourism in the metaverse: Can travel go virtual? ,” McKinsey, May 4, 2023.

The allure and convenience of such digital experiences make offering seamless, customer-centric travel and tourism in the real world all the more pressing.

Three innovations to solve hotel staffing shortages

Is the future contactless.

Given the advances in technology, and the many digital innovations and applications that already exist, there is potential for businesses across the travel and tourism spectrum to cope with labor shortages while improving customer experience. Process automation and digitization can also add to process efficiency. Taken together, a combination of outsourcing, remote work, and digital solutions can help to retain existing staff and reduce dependency on roles that employers are struggling to fill (exhibit).

Depending on the customer service approach and direct contact need, we estimate that the travel and tourism industry would be able to cope with a structural labor shortage of around 10 to 15 percent in the long run by operating more flexibly and increasing digital and automated efficiency—while offering the remaining staff an improved total work package.

Outsourcing and remote work could also help resolve the labor shortage

While COVID-19 pushed organizations in a wide variety of sectors to embrace remote work, there are many hospitality roles that rely on direct physical services that cannot be performed remotely, such as laundry, cleaning, maintenance, and facility management. If faced with staff shortages, these roles could be outsourced to third-party professional service providers, and existing staff could be reskilled to take up new positions.

In McKinsey’s experience, the total service cost of this type of work in a typical hotel can make up 10 percent of total operating costs. Most often, these roles are not guest facing. A professional and digital-based solution might become an integrated part of a third-party service for hotels looking to outsource this type of work.

One of the lessons learned in the aftermath of COVID-19 is that many tourism employees moved to similar positions in other sectors because they were disillusioned by working conditions in the industry . Specialist multisector companies have been able to shuffle their staff away from tourism to other sectors that offer steady employment or more regular working hours compared with the long hours and seasonal nature of work in tourism.

The remaining travel and tourism staff may be looking for more flexibility or the option to work from home. This can be an effective solution for retaining employees. For example, a travel agent with specific destination expertise could work from home or be consulted on an needs basis.

In instances where remote work or outsourcing is not viable, there are other solutions that the hospitality industry can explore to improve operational effectiveness as well as employee satisfaction. A more agile staffing model can better match available labor with peaks and troughs in daily, or even hourly, demand. This could involve combining similar roles or cross-training staff so that they can switch roles. Redesigned roles could potentially improve employee satisfaction by empowering staff to explore new career paths within the hotel’s operations. Combined roles build skills across disciplines—for example, supporting a housekeeper to train and become proficient in other maintenance areas, or a front-desk associate to build managerial skills.

Where management or ownership is shared across properties, roles could be staffed to cover a network of sites, rather than individual hotels. By applying a combination of these approaches, hotels could reduce the number of staff hours needed to keep operations running at the same standard. 16 “ Three innovations to solve hotel staffing shortages ,” McKinsey, April 3, 2023.

Taken together, operational adjustments combined with greater use of technology could provide the tourism industry with a way of overcoming staffing challenges and giving customers the seamless digitally enhanced experiences they expect in other aspects of daily life.

In an industry facing a labor shortage, there are opportunities for tech innovations that can help travel and tourism businesses do more with less, while ensuring that remaining staff are engaged and motivated to stay in the industry. For travelers, this could mean fewer friendly faces, but more meaningful experiences and interactions.

Urs Binggeli is a senior expert in McKinsey’s Zurich office, Zi Chen is a capabilities and insights specialist in the Shanghai office, Steffen Köpke is a capabilities and insights expert in the Düsseldorf office, and Jackey Yu is a partner in the Hong Kong office.

Explore a career with us

Travel and tourism to break records, bring over $11 trillion in 2024: report

Travel and tourism is expected to be a boon for the global economy this year.

Countries around the world will see travel and tourism produce $11.1 trillion in 2024, according to a report released Thursday by the World Travel & Tourism Council.

The group said the forecasted global economic contribution would mark an "all-time high" from the roughly $10 trillion the industry brought in pre-pandemic 2019.

The coronavirus hit many industries hard, with travel and tourism in particular seeing negative impacts from the lockdowns and restrictions instituted in the early days of the pandemic.

CLICK HERE TO READ MORE ON FOX BUSINESS

This year, both international and domestic tourists are expected to splash out during their travels.

READ ON THE FOX BUSINESS APP

The report, which involved a partnership with Oxford Economics, projected a record $5.4 trillion in spending would come from domestic travelers. That would set a record, according to the WTTC.

Meanwhile, international tourists will reportedly contribute $1.89 trillion.

And the WTTC had an even rosier outlook for a decade from now, when it predicted global tourism and travel will be responsible for nearly $16 trillion and 449 million jobs.

ECLIPSE TOURISM EXPECTED TO BRING BIG BUCKS TO AREAS IN PATH OF TOTALITY

The travel and tourism industry’s performance in 2023 provided momentum for this year, the group said.

In 2023, it produced $9.9 trillion around the world .

"This isn’t just about breaking records, we’re no longer talking about a recovery – this is a story of the sector back at its best after a difficult few years, providing a significant economic boost to countries around the world and supporting millions of jobs," WTTC CEO Julia Simpson said in a Thursday statement. "There’s a risk however, we need the U.S. and Chinese governments to support their national Travel & Tourism sectors."

The head of the WTTC warned the U.S . and China could "continue to suffer whilst other countries are seeing international visitors return much faster" if they don’t.

CRUISE LINES SAILING INTO 2024 SEEING STRONG DEMAND, AAA SAYS

The group pegged 2023’s U.S. international visitor spending at "more than a quarter below the peak of 2019" and China’s "almost 60% down."

In August, the WTTC issued a prediction that the U.S. travel and tourism industry would provide $2.2 trillion in 2023. It was responsible for $2 trillion the year prior to that.

Original article source: Travel and tourism to break records, bring over $11 trillion in 2024: report

- Thursday, April 18, 2024

© 2023 - Businessday NG. All Rights Reserved.

Billion-dollar industry: Erie County tourism growing as visitor spending is on the rise

Tourists are bringing and spending money when they visit Erie.

The Pennsylvania Tourism Office detailed in its 2022 visitor data report that people visiting Erie spent $1.03 billion in different categories from food and beverage to lodging and more.

For the Pennsylvania Great Lakes Region, which consists of Erie, Crawford, Mercer and Venango counties, visitor spending rose 13% at $1.75 billion which surpassed the pre-pandemic levels and exceeded numbers reported from 2016-2022.

Whether it's for festivals, sporting events, concerts or just curiosity in the region, people are finding reasons to visit northwestern Pennsylvania.

“These findings highlight the pivotal role tourism plays in strengthening Pennsylvania's economy," John Oliver, CEO of VisitErie stated in a news release. "With one in 10 jobs in Erie County connected to hospitality, tourism dollars support essential services, including transportation, infrastructure, education, and public safety programs. Without this contribution, every household in Pennsylvania would bear an additional tax burden of $880."

How are visitors spending their money?

Here is a breakdown of counties that makes up the Pa. Great Lakes Region and how visitors are spending money:

- Total: $1.0388 billion

- Lodging: $121.8 million

- Food and beverage: $229.4 million

- Retail: $187 million

- Recreation: $219.9 million

- Transportation: $280.8 million

More: It's totally happening April 8 in Erie, Pa. Check out these solar eclipse viewing events.

- Total: $257.4 million

- Lodging: $13 million

- Food and beverage: $61.7 million

- Retail: $41.9 million

- Recreation: $39.4 million

- Transportation: $101.4 million

- Total: $309.8 million

- Lodging: $33.8 million

- Food and beverage: $74.4 million

- Retail: $58.9 million

- Recreation: $57.9 million

- Transportation: $84.9 million

- Total: $147.8 million

- Lodging: $10.1 million

- Food and beverage: $26.3 million

- Retail: $21 million

- Recreation: $21.7 million

- Transportation: $68.7 million

An increase in spending from 2021

How do the numbers compare to the 2021 report? Here is the 2021 tourist spending report:

- Total: $927.7 million

- Lodging: $109.8 million

- Food and beverage: $209.3 million

- Retail: $179.3 million

- Recreation: $180 million

- Transportation: $24.93 million

- Total: $220.3 million

- Lodging: $11.7 million

- Food and beverage: $53.8 million

- Retail: $38.8 million

- Recreation: $32.2 million

- Transportation: $83.8 million

- Total: $270 million

- Lodging: $27.8 million

- Food and beverage: $64.8 million

- Retail: $57.2 million

- Recreation: $46.9 million

- Transportation: $73.1 million

- Total: $127.8 million

- Lodging: $8.6 million

- Food and beverage: $22.7 million

- Retail: $19.7 million

- Transportation: $59.6 million

More: Erie is expecting heavy traffic for the April 8 solar eclipse, and not just on our roads

Erie tourism numbers back in swing post-pandemic

The numbers are showing that Erie is back on track in the tourism industry following the COVID-19 pandemic.

The lowest total amount for spending in the Great Lakes Region was $1.228 billion in 2020 around the start of the pandemic.

"It continues to show that Erie has come out of the pandemic stronger than before it," Oliver said. "It shows that we're reaching and able to convince visitors that Erie is a place they should vacation at and it's evident that they are coming here to vacation and spending their dollars here benefiting our economy."

An increase in spending and job creations

The Great Lakes Region has seen spending flex from $1.665 billion in 2016 to $1.754 billion in 2022. The highest amount of visitor spending was reported in 2022.

"Certainly we would like to see spending across all categories," Oliver said. "That occurs when we are successful in attracting more visitors to the area."

For the visitor spending and employment unit of the report, the Great Lakes Region increased by 766 jobs at a 6% increase. Erie County has seen a 92.9% increase in this category since 2019. Erie County in 2022 reported 7,414 jobs supported by visitor spending in 2022.

"We're able to see the numbers on a month to month basis," Oliver said. "We're seeing on average over the course of a year over 13,000 people in Erie County that are employed in hospitality businesses."

Gov. Shapiro calls for increased funding for tourism

Gov. Josh Shapiro is calling for a $15 million increase in tourism funding in his 2024-25 budget proposal, as stated in the Pennsylvania Office of Tourism news release.

This increase would support nearly 500,000 Pennsylvanians who work in the travel and tourism industry creating a major investment to drive economic growth, leading to new businesses and jobs.

Oliver said he was encouraged by the call for increased funding.

"It wasn't that many years ago that Pennsylvania was being funded at a level of two million dollars," Oliver said. "To see the additional dollars be recommended I think shows that the governor understands and recognizes the important role that tourism plays in the overall economy for Pennsylvania."

Contact Nicholas Sorensen at [email protected] .

We have updated our terms and conditions and privacy policy Click "Continue" to accept and continue with ET TravelWorld

We use cookies to ensure best experience for you

We use cookies and other tracking technologies to improve your browsing experience on our site, show personalize content and targeted ads, analyze site traffic, and understand where our audience is coming from. You can also read our privacy policy , We use cookies to ensure the best experience for you on our website.

By choosing I accept, or by continuing being on the website, you consent to our use of Cookies and Terms & Conditions .

- Leaders Speak

- Brand Solutions

- India's travel and tourism sector poised for growth: Projected revenue to reach USD 23.72 bn by 2024

The total FDI inflows in India for the fiscal year 2023-2024 stand at a USD 17.96 billion, with USD 11.54 billion attributed to FDI equity. This announcement comes as the nation charts a course towards bolstering its tourism industry, positioning it as a major contributor to economic growth and job creation.

- Updated On Apr 16, 2024 at 01:37 PM IST

New York City expects 65 million visitors this year with over 3.8 lakh visitors from India

New York City is home to the world’s busiest airport system and the number one port of entry for US international travellers. New York City welcomed a total 61.8 million travellers in 2023, marking a recovery of 93 per cent of the City’s record 2019 visitation levels. New York City welcomed 336,000 India travellers – marking full recovery of the market’s pre-pandemic visitation levels.

- Published On Apr 16, 2024 at 01:36 PM IST

All Comments

By commenting, you agree to the Prohibited Content Policy

Find this Comment Offensive?

- Foul Language

- Inciting hatred against a certain community

- Out of Context / Spam

Join the community of 2M+ industry professionals

Subscribe to our newsletter to get latest insights & analysis., download ettravelworld app.

- Get Realtime updates

- Save your favourite articles

- tourism sector growth

- India travel market

- FDI in tourism

- Prime Minister Narendra Modi

- tourism industry projections

- package holidays market

- tourism infrastructure development

- global tourism destination

- tourism initiatives

- India Brand Equity Foundation (IBEF)

UN Tourism | Bringing the world closer

share this content

- Share this article on facebook

- Share this article on twitter

- Share this article on linkedin

International tourism growth continues to outpace the global economy

- All Regions

- 20 Jan 2020

1.5 billion international tourist arrivals were recorded in 2019, globally. A 4% increase on the previous year which is also forecast for 2020, confirming tourism as a leading and resilient economic sector, especially in view of current uncertainties. By the same token, this calls for such growth to be managed responsibly so as to best seize the opportunities tourism can generate for communities around the world.

According to the first comprehensive report on global tourism numbers and trends of the new decade, the latest UNWTO World Tourism Barometer, this represents the tenth consecutive year of growth.

All regions saw a rise in international arrivals in 2019. However, uncertainty surrounding Brexit, the collapse of Thomas Cook, geopolitical and social tensions and the global economic slowdown all contributed to a slower growth in 2019, when compared to the exceptional rates of 2017 and 2018. This slowdown affected mainly advanced economies and particularly Europe and Asia and the Pacific.

Looking ahead, growth of 3% to 4% is predicted for 2020, an outlook reflected in the latest UNWTO Confidence Index which shows a cautious optimism: 47% of participants believe tourism will perform better and 43% at the same level of 2019. Major sporting events, including the Tokyo Olympics, and cultural events such as Expo 2020 Dubai are expected to have a positive impact on the sector.

Responsible growth

Presenting the results, UNWTO Secretary-General Zurab Pololikashvili stressed that “in these times of uncertainty and volatility, tourism remains a reliable economic sector”. Against the backdrop of recently downgraded global economic perspectives, international trade tensions, social unrest and geopolitical uncertainty, “our sector keeps outpacing the world economy and calling upon us to not only grow but to grow better”, he added.

Given tourism’s position as a top export sector and creator of employment, UNWTO advocates the need for responsible growth. Tourism has, therefore, a place at the heart of global development policies, and the opportunity to gain further political recognition and make a real impact as the Decade of Action gets underway, leaving just ten years to fulfill the 2030 Agenda and its 17 Sustainable Development Goals.

The Middle East leads

The Middle East has emerged as the fastest-growing region for international tourism arrivals in 2019, growing at almost double the global average (+8%). Growth in Asia and the Pacific slowed down but still showed above-average growth, with international arrivals up 5%.

Europe where growth was also slower than in previous years (+4%) continues to lead in terms of international arrivals numbers, welcoming 743 million international tourists last year (51% of the global market). The Americas (+2%) showed a mixed picture as many island destinations in the Caribbean consolidated their recovery after the 2017 hurricanes while arrivals fell in South America due partly to ongoing social and political turmoil. Limited data available for Africa (+4%) points to continued strong results in North Africa (+9%) while arrivals in Sub-Saharan Africa grew slower in 2019 (+1.5%).

Tourism spending still strong

Against a backdrop of global economic slowdown, tourism spending continued to grow, most notably among the world’s top ten spenders. France reported the strongest increase in international tourism expenditure among the world’s top ten outbound markets (+11%), while the United States (+6%) led growth in absolute terms, aided by a strong dollar.

However, some large emerging markets such as Brazil and Saudi Arabia reported declines in tourism spending. China, the world’s top source market saw outbound trips increase by 14% in the first half of 2019, though expenditure fell 4%.

Tourism delivering ‘much-needed opportunities’

“The number of destinations earning US$1 billion or more from international tourism has almost doubled since 1998,” adds Mr Pololikashvili. “The challenge we face is to make sure the benefits are shared as widely as possible and that nobody is left behind. In 2020, UNWTO celebrates the Year of Tourism and Rural Development , and we hope to see our sector lead positive change in rural communities, creating jobs and opportunities, driving economic growth and preserving culture.”

This latest evidence of the strength and resilience of the tourism sector comes as the UN celebrates its 75th anniversary . During 2020, through the UN75 initiative the UN is carrying out the largest, most inclusive conversation on the role of global cooperation in building a better future for all, with tourism to be high on the agenda.

Related Links

- Download Excerpt of World Tourism Barometer, January 2020 (PDF)

- UNWTO World Tourism Barometer Nº18 January 2020

- Tourism in the 2030 Agenda

- Presentation (PDF)

- Infographics

Category tags

Related content.

International Tourism to Reach Pre-Pandemic Levels in 2024

International Tourism to End 2023 Close to 90% of Pre-P...

Tourism’s Importance for Growth Highlighted in World Ec...

International Tourism Swiftly Overcoming Pandemic Downturn

Stories You Don't Want to Miss for the week of April 8, 2024 KJZZ's Stories You Don't Want to Miss

The Arizona Supreme Court issued a ruling this week reinstating a near total ban on abortion in the state, a law that dates back to 1864. A new attraction is coming to Arizona’s billion-dollar Astro-tourism industry. The Phoenix Union High School District is stepping up efforts to educate its students in financial literacy. Plus the latest metro Phoenix and tribal natural resources news.

- Episode Website

- More Episodes

Top Podcasts In News

IMAGES

COMMENTS

Total contribution of travel and tourism to GDP worldwide 2019-2033. Total contribution of travel and tourism to gross domestic product (GDP) worldwide in 2019 and 2022, with a forecast for 2023 ...

Travel and Tourism Satellite Account for 2017-2021 The travel and tourism industry—as measured by the real output of goods and services sold directly to visitors—increased 64.4 percent in 2021 after decreasing 50.7 percent in 2020, according to the most recent statistics from BEA's Travel and Tourism Sate

Tourism has massively increased in recent decades. Aviation has opened up travel from domestic to international. Before the COVID-19 pandemic, the number of international visits had more than doubled since 2000. Tourism can be important for both the travelers and the people in the countries they visit. For visitors, traveling can increase their ...

International Tourism and COVID-19. Export revenues from international tourism dropped 62% in 2020 and 59% in 2021, versus 2019 (real terms) and then rebounded in 2022, remaining 34% below pre-pandemic levels. The total loss in export revenues from tourism amounts to USD 2.6 trillion for that three-year period. Go to Dashboard.

Tourism Statistics. Get the latest and most up-to-date tourism statistics for all the countries and regions around the world. Data on inbound, domestic and outbound tourism is available, as well as on tourism industries, employment and complementary indicators. All statistical tables available are displayed and can be accessed individually ...

Number employees by tourism industry. Total number of employees, disaggregated by tourism industry. Tourism industries include: Accommodation, Food and Beverage, Passenger transportation, Travel Agencies and reservation services, Other ... The Yearbook focuses on data related to inbound tourism (total arrivals and overnight stays), broken down ...

Increased tourism spending. The economic contribution of tourism in 2021 (measured in tourism direct gross domestic product) is estimated at US$1.9 trillion, above the US$1.6 trillion in 2020, but still well below the pre-pandemic value of US$ 3.5 trillion.Export revenues from international tourism could exceed US$700 billion in 2021, a small improvement over 2020 due to higher spending per ...

2020 was a watershed year for the travel and tourism industry. Total tourism-related output in the United States declinedfrom $1.9 trillion in 2019 to $978 billion in 2020, a 50.1% decline . Total tourism-related output consists of direct tou rism output and indirect tourism output. Direct Tourism Output: all domestically produced goods and ...

The top 10 tourism earners account for almost 50% of total tourism receipts Top 10 destinations by international tourism receipts, 2018 Source: World Tourism Organization (UNWTO). million Arrivals in top destinations % change 89 France 3 83 Spain 1 80 United States of America 4 63 China 4 62 Italy 7 46 Turkey 22

2021 was a year of recovery for the travel and tourism industry. Total tourism-related output in the United States increased to $1.7 trillion in 2021 from $951 billion in 2020 , a 79% increase from 2020 but still just 83% of 2019. Total tourism-related output consists of direct tourism output and indirect tourism output. Direct Tourism Output ...

WTTC's latest annual research shows: In 2023, the Travel & Tourism sector contributed 9.1% to the global GDP; an increase of 23.2% from 2022 and only 4.1% below the 2019 level. In 2023, there were 27 million new jobs, representing a 9.1% increase compared to 2022, and only 1.4% below the 2019 level.

These four sectors accounted for 70.8% of the decline in total tourism-related employment in 2020. Travel and tourism value added, or GDP, (in nominal terms, not inflation adjusted) declined from $624.7 billion (2.9% of GDP) in 2019 to $356.8 billion (a historic low of 1.7% of GDP) in 2020 .This $267.9 billion decline in travel and tourism GDP ...

Notes: Destinations with available Tourism Gross Domestic Product data for 2018, 2017 or 2016, where Tourism GDP is 5% or more of total GDP. When Tourism GDP was not available, "tourism gross value added (TGVA)" or "tourism internal consumption" was used. 1 Data for Spain corresponds to both direct and indirect contribution.

The travel and tourism industry was one of the U.S. business sectors hardest hit by the COVID-19 pandemic and subsequent health and travel restrictions, with travel exports decreasing nearly 65% from 2019 to 2020. ... or 34 percent of 2019's total. More about the Tourism Policy Council and the 2022 National Travel and Tourism Strategy ...

The tourism industry can make the most of available tech to draw customers, resolve existing pain points, and set the stage for a sustainable future. ... the total cost of flights, transfers, and entry for all these landmarks would come to $7,600—while a virtual trip would cost just over $2. 14 "What impact can the Metaverse have on the ...

The travel and tourism industry's performance in 2023 provided momentum for this year, the group said. In 2023, it produced $9.9 trillion around the world.

The UNWTO Tourism Data Dashboard - provides statistics and insights on key indicators for inbound and outbound tourism at the global, regional and national levels. Data covers tourist arrivals, tourism receipts, tourism share of exports and contribution to GDP, source markets, seasonality, domestic tourism and data on accommodation and employment.

Obinna Emelike. April 7, 2024. The World Travel & Tourism Council (WTTC) is projecting a record-breaking year for travel and tourism in 2024, with the sector's global economic contribution set to reach an all-time high of $11.1 trillion. According to the global tourism body's 2024 Economic Impact Research (EIR), Travel & Tourism will ...

The UNWTO Statistics Department is committed to developing tourism measurement for furthering knowledge of the sector, monitoring progress, evaluating impact, promoting results-focused management, and highlighting strategic issues for policy objectives.. The department works towards advancing the methodological frameworks for measuring tourism and expanding its analytical potential, designs ...

The Pa. Tourism Office released its 2022 visitor data report which shows that people visiting Erie spent a total of $1.0388 billion in hospitality, recreation, more. ... This increase would support nearly 500,000 Pennsylvanians who work in the travel and tourism industry creating a major investment to drive economic growth, leading to new ...

Tourism Sector Growth: The total FDI inflows in India for the fiscal year 2023-2024 stand at a USD 17.96 billion, with USD 11.54 billion attributed to FDI equity. This announcement comes as the nation charts a course towards bolstering its tourism industry, positioning it as a major contributor to economic growth and job creation.

International tourism growth continues to outpace the global economy. All Regions. 20 Jan 2020. 1.5 billion international tourist arrivals were recorded in 2019, globally. A 4% increase on the previous year which is also forecast for 2020, confirming tourism as a leading and resilient economic sector, especially in view of current uncertainties.

The Arizona Supreme Court issued a ruling this week reinstating a near total ban on abortion in the state, a law that dates back to 1864. A new attraction is coming to Arizona's billion-dollar Astro-tourism industry. The Phoenix Union High School District is stepping up efforts to educate its students in financial literacy.