- Information for...

What are you looking for?

Travellers from China made 74.8 million outbound visits in 2019 (excluding Hong Kong and Macau), with a total international tourism expenditure of US$114.8 billion.

In 2022, the UK welcomed 46,986 visits from China. During the travellers’ visits, their total expenditure was £182.88 million, with an average spend of £3,892 per person.

Discover visitor behaviour, travel trade insights, detailed data visualisations for this market – and more. The statistics in this market report are collated from a range of sources such as the Office for National Statistics (ONS), as well as sponsored questions and our own research. For further details, see How we source this information .

Visitor characteristics

- Chinese visitors tend to be younger than the average visitor to the UK. 57% of visits from China were made by people aged 16-34 years old in 2022.

- Those visiting Britain from China are more likely than average to be making their first visit: only 29% of holidaymakers from China departing the UK in 2015 (excluding British expats) had already visited the UK within the past 10 years.

- The vast majority of holiday visitors from China are Chinese nationals.

- 78% of departing visitors from China (excluding British expats) were ‘extremely likely’ to recommend Britain for a visit in 2017.

Popular activities for this market

Dining in a restaurant.

Sightseeing of famous buildings and monuments.

Going shopping.

Explore the inbound data in full

Use our visualisations to see data from this market in greater depth and clarity. Compare annual statistics, and filter by age group, gender, trip duration and more. Includes seasonality, trip purpose and regional spread of visitors to UK destinations. This data is based on the International Passenger Survey, conducted by the Office for National Statistics (ONS).

Please click on the button below and select the country you are interested in.

Perceptions of Britain in the Chinese market

- Chinese perceptions of Britain increased in the 2022 Anholt Nation Brands Index, ranking it sixth overall compared to 60 nations, an increase of four ranks compared to 2021.

- Britain was ranked fifth for ‘contemporary culture’ and ‘vibrant cities’ as well as ‘would visit if money was no object’.

- Chinese respondents associate Britain highly with ‘museums’, and also ‘opera’ and ‘films’. Chinese respondents expect that a trip to Britain would be ‘romantic’ and ‘relaxing’.

Global context

Top-level statistics relating to the population, GDP, tourism expenditure and popular destinations for this market. For greater detail on inbound tourism flows from this market to the UK, see our data visualisations .

Key demographic and economic data

Caring for visitors.

- It is important to appreciate cultural differences.

- Visitors appreciate ‘support’ in the form of Chinese language facilities (signage, Mandarin-speaking staff and Chinese TV channels for example).

- Spicy food is a favourite, and if the younger and more affluent Chinese travellers are more exposed to European culture and food, there is still a preference for Chinese food among many.

- Mobile payments are becoming increasingly popular in China, and travellers appreciate being able to use those abroad as well.

The leisure and travel trade

- If the FIT (Free and Independent Travel) segment keeps growing, travel agents will still play a vital role in China, especially among first-time long-haul travellers. This is due to the convenience and assistance that they provide regarding language barriers and visa processes.

- There are 200+ recognised travel agents under the ‘Approved Destination Status’ agreement in China. These are the only agents who can process leisure ADS visa applications, and thus operate leisure tours.

- If visiting the trade in China it is important to take an interpreter/guide, to prepare business cards to exchange, and to be punctual and well-prepared.

Access to Britain from China

The key routes and transport modes that connect this market with the UK.

- The impact of the COVID-19 pandemic led to a 78% reduction in direct seat capacity from China to the UK in 2020. 2021 was 95% below pre-COVID levels and 2022 was 97% behind pre-pandemic levels.

- In 2023, capacity has shown signs of a quick recovery, now at 70% of pre-pandemic levels.

- The current reduced rate of Air Passenger Duty for visitors departing Britain for China is £87.

Further resources

China market profile.pdf, china market snapshot.pdf, china aviation profile.pdf, china covid-19 travel sentiment.pdf, where chinese visitors reside.xlsx, china visa study.pdf, leveraging britain’s culture in china, brazil & italy.pdf, how we source this information.

We work with a number of data sources to provide a rich and insightful picture of our key inbound source markets. This includes, but is not limited to, data provided by Oxford Economics, the UNWTO, Apex, Anholt-Ipsos Nation Brands Index and from our own surveys and ad-hoc research. The largest share of the data comes from the International Passenger Survey (IPS) by the ONS.

Visit our About the International Passenger Survey page for more information on how the data is collected and analysed.

Discover more

See the latest market data for Hong Kong – including traveller visits and spend, length of stay, behaviours and preferences.

See the latest market data for Japan – including traveller visits and spend, length of stay, behaviours and preferences.

South Korea

See the latest market data for South Korea – including traveller visits and spend, length of stay, behaviours and preferences.

Explore our curated information for...

Everything you need to inspire your clients. Discover new products, experiences and itinerary ideas – plus useful resources and the latest market insights.

Reach new customers and increase your profitability. Drive sales with our tools, events and training, find out about quality assessment and get expert guidance from the England Business Advice Hub.

Build sustainable and valuable growth. Learn about England’s new destination management structure, find expert advice, and boost your proposition with our training and toolkits.

Access resources for business events to support your business development and event strategy. Discover England, Scotland and Wales' business event offering for your next conference, incentive, exhibition or event.

Discover our media centres, image and video library and latest press releases, plus contacts for our corporate and consumer press teams.

Studying tourism at school, college or university? We’ve gathered essential resources and data for students of tourism, plus information about our internships.

[email protected]

+44 (0) 1273 262700

How many Chinese tourists will come to the UK in 2023?

Finally, Beijing has dropped its Covid restrictions and the Chinese are free to start travelling again and, in the UK and around the world, the travel industry is wondering what we can expect for this year. To help answer that question, here are Guanxi ’s top five predictions for Chinese visitor figures to the UK, timing, size of market, trends, opportunities and challenges for 2023.

In 2019, around 880,000 people came to the UK from China, staying an average of 16.33 nights and spending £1,937 per person . This made China the second most valuable inbound travel market for the UK. As an added benefit, the Chinese were more likely to travel around the country, overindexing vs other markets in travelling to Scotland. Many places, including the Lake District, Oxford, Cambridge, Manchester, York, Brighton and, of course, London, have really missed their Chinese visitors over the past three years.

So what do we think will happen now?

Prediction #1

VFR and student markets will be the first to recover, followed by FIT and small group travel

- There are around 150,000 Chinese students at UK universities. Some will be keen to go home for a holiday but, in many cases, their families will come to the UK to visit them.

- There are Chinese families living in the UK and numbers have been boosted by immigration from Hong Kong. It is hard to get accurate figures as the last published figures are from the 2011 census and state 393,000, but we can assume that friends and relatives will be keen to visit after three years apart.

- Once leisure travel restarts in earnest, expect to see small family groups and independent travellers. Large group travel will be last to come back. It presents a perceived risk to tour operators (who would be required to take responsibility of the entire group in the event of a Covid outbreak) and to the travellers themselves. The Chinese government policy on overseas group travel also remains unclear at the time of writing. It was banned in early 2020.

Prediction #2

The surge in Chinese leisure arrivals to the UK will be seen from May/June onwards (but it could be earlier)

- The market can’t recover without affordable flight seats. In 2019, there were 86 weekly air departures to China, 30% of which were Heathrow-Beijing. Flight capacity dropped by 95% in 2021, so we went from about 25,000 seats per week to fewer than 1,500. Flights are still very, very expensive and prices need to drop significantly. Airlift recovery is a big mountain and it won’t be climbed overnight.

- There are added complications for European carriers. Unlike Chinese carriers, they now have no over-flight rights for Russia. This means an additional two hours flight time and extra cost, making the route uncompetitive vs the Chinese carriers. In this environment, will British Airways and Virgin Atlantic consider the route to be viable?

- We can assume that the reinstatement of capacity for Chinese carriers, and a subsequent fall in prices, will happen in line with demand. There are also indirect routes to the UK via the Middle East, so the more determined (and affluent) will be able to get to Europe in the meantime.

- Passport offices have not been issuing new passports or extending current passports. They have now reopened. If you don’t have validity on your passport, you will have to wait.

- You need a visa to travel to the UK. UK visas cost around £100 and are valid for 2 years. There will doubtless be delays at visa offices as demand will overwhelm the system.

- You can not apply for a visa without a passport and a flight booking. So these issues have to be resolved first.

Prediction #3

The summer will be strong and long

- In 2019, 44% of visits from China took place July-Sept, with a further 19% between Oct – Dec. The summer is the best time to visit the UK for Chinese people due to the weather and the school holidays. Those who have been dreaming of a trip to the UK for the past three years will likely have big plans and big budgets. They will plan their dream holiday for the summer.

- Demand will be strong. People have been prevented from leaving China due to travel restrictions, but, unlike the rest of the world, many have also endured severe lockdowns within their own homes during the past 12 months. Covid has taught us all about the fragility of life and the benefits brought by the freedom to travel. It has also taught us about unpredictability. There will be a strong desire to travel far, have great experiences, and to do it now, because nobody knows what the future will bring.

- Slightly worse weather in Europe in October/November will not be as strong a deterrent for people this year. We therefore expect that the peak summer season will be longer than in previous years, and will extend to include Golden Week in early October in bigger numbers than pre-Covid.

Prediction #4

Experiences will trump shopping (but people will still shop)

- Spend on luxury goods in China rose to US$74.4 billion in 2021 , almost double the 2019 figure. Most of this was spent online or in duty free shopping meccas such as Hainan Island which exploded during the pandemic. We can expect that these channels will continue to flourish, and that Chinese people will continue to shop in this way.

- Consumer sentiment in China points towards a post-Covid desire for more meaningful activities. There is also more interest in sustainable travel options.

- Like the rest of the world, the Chinese have come to appreciate the natural world more than ever before. The big booms in China during Covid have been in rural tourism, cycling, hiking, camping and glamping, and, to a lesser extent, niche activities such as surfing, diving and wintersports.

- In the second decade of the 2000s, there was a movement away from ‘ticking off the sights’ when travelling , a rise in independent travel away from large group travel, and a growing trend to discover new and interesting places with a local flavour. Enjoying local food and wine, natural scenery and local cultural experiences became major motivations to travel, and these persist post Covid.

- There is no doubt that the Chinese love to shop when they travel, but the primary reason for travelling the UK has never been the shopping. Added to that, the UK government’s decision to cancel (then reinstate and then cancel again) the tax free shopping scheme for overseas visitors makes the UK less attractive as a shopping destination. Whilst shopping will continue to be a very popular activity for those who come to the UK, it is likely that more time will be allocated to building memories and experiences than ever before.

Prediction #5

VisitBritain and the UK travel trade are going to have to fight for this business

- Whilst most of VisitBritain’s promotional activity in China ceased during the pandemic, many other European countries maintained some level of spend. Germany, for example, continued to promote itself throughout the pandemic , with livestreaming, events, online training, PR and social media campaigns, understanding the importance of loyalty and commitment to China and capitalising on the fact that millions of future travellers were sitting at home with time to dream about their next trip and research and discuss ideas on social media. As soon as the talk turned to flight schedules increases and quarantine reductions, other tourist boards swung into action. For example, in November, Switzerland put on a major roadshow in 12 Chinese cities.

- Now the borders have opened, the predicted ‘bun fight’ has begun. Media outlets are overwhelmed, influencer schedules are filling up and every destination, attraction and tourism brand in the world will be vying for travel agents’ time for meetings and roadshows at a time when these same agents are suddenly busy with new customer enquiries.

- The strength of a country’s ‘China Welcome’ is going to be one of the most important factors for the leisure traveller choosing their destination. Safety continues to be a major consideration and this will move away from worries about contracting Covid towards worries about whether the tourist industry and local population will be friendly towards Chinese visitors. Hopefully, the British public will be open-minded, friendly, and reassured by the pre-arrival testing in place. Conversely, the policy may present Britain as less welcoming than other places.

- British tourism needs to restart its promotional plans in China and quickly. Messaging should be around Britain’s natural beauty, cultural heritage and, most importantly, its friendly welcome. We need to keep a close eye on trends to see if domestic travel trends convert into international ones. Hiking, glamping and cycling companies could be making hay while the sun shines this summer.

With grateful thanks to Midas Aviation for their insight into UK-China flight operations.

The future of Chinese tourism

With global travel on pause, the world’s richest outbound tourist market is turning to virtual travel, writes Charlotte Middlehurst

A young lady in a pink suit points at the Elgin Marbles. “The gods are much bigger than the other figures,” the tour guide says to the camera. A moment later her Chinese counterpart in a grey jacket and neat bob translates into Mandarin for the benefit of those watching live at home.

They are in the British Museum, alone with the exhibits, but with thousands of viewers in China who are watching their smartphones. A flurry of comments and emojis – coffee cups, hearts, thumbs-up – cascade across the screen at high speed. Occasionally, viewers break off to purchase the products that pop-up throughout the two-hour livestream.

This is the face of digital tourism in the post pandemic world, or at least one of them. Launched on July 1 by Alibaba, China’s biggest technology group, in partnership with the British Museum, this “experience” is an experiment in bringing historical tourism, and commerce, to modern immobile audiences.

Since its outbreak in January, the coronavirus has had a catastrophic impact on global travel. With national borders up and global air-fleets grounded, air travel is expected to fall by 55% this year, according to the International Air Transport Association. Many travel companies are struggling to survive, and even as people tentatively contemplate overseas holidays, it is not certain they will come back.

Leveraging existing e-commerce platforms, and the commercial opportunities they provide, will be key to weathering the storm.

At the centre of the global debate around tourism is China. Before the pandemic, Chinese travellers contributed more than a quarter of the world’s tourism expenditure (over £205 billion). In the past five years, the number of air routes connecting China with other countries has more than doubled to 784. As a sector, it has grown faster than the global economy as a whole.

As businesses buffer for the most severe global recession in generations, attention is turned to China for a clue of what the future might look like.

David Lloyd, general manager UK, Netherlands and Nordics at Alibaba, says the best way for companies to rebound from the shock of coronavirus is to connect with e-commerce platforms .

Even at the peak of the pandemic, e-commerce in China was growing by 5.9%, according to official figures. “China was already half of the world’s e-commerce. It has to be part of your strategy if you want to grow today,” he says.

The UK has long been one of the most popular destinations for Chinese tourists , with attractions like Buckingham Palace, the British Museum and Bicester Village drawing 850,000 Chinese visitors each year. Before the crisis, Bookings to the UK were expected to rise by a third every year on average.

Bicester Village draws 850,000 Chinese visitors each year

Britain has been one of the countries worst hit by the pandemic, with some of the highest death tolls, causing would-be visitors to stay away. Lloyd does not expect Chinese tourists to return in significant numbers before Golden Week, the autumn holiday in October, with numbers depending largely on the perception of safety. Leveraging existing e-commerce platforms, and the commercial opportunities they provide will be key to weathering the storm.

But when they do return, he expects two main trends to appear. One is that it will be younger tourists who return first; and two, there will be more independent travel, without tour operators and with more tailored individual experiences.

Digital hybrids, like the British Museum tour, will also increase. “Travel isn’t possible right now but there are these extraordinary locations around the world. The gardens of Marseille and other locations around Europe – we’ve done 30,000 of these livestreams now,” Lloyd says.

The use of online payments will accelerate too. Many international businesses already accept Alipay (Alibaba’s app-based e-wallet). QR codes – electronic barcodes that allow payments and link to other digital information – are already ubiquitous in Asia, but will become more widespread in the west to smooth the fintech transition.

It will be younger tourists who return first, and there will be more independent travel, without tour operators and with more tailored individual experiences

Finally, live-streaming will converge with virtual tourism. Fliggy, Alibaba’s travel site (a portmanteau of flying pig) is leading in these types of interactive experiences where armchair tourists can comment and shop as they go. “It satisfies that sweet spot for tourists between experience but also commerce,” says Lloyd.

In the serviced apartment sector, forecasts are more muted. “Due to some new cases of Covid-19 in China, the Chinese tourists are focusing on domestic travels at the moment,” says Rosemary Ni Sassi, senior corporate sales and relationship manager at Q Apartments , which caters to the leisure and business traveller market in the UK, Denmark and Brazil.

“Some Chinese clients….are coming to London for essential business trips and relocations. The numbers may increase in the coming months, it depends on the UK government’s policy. Chinese travellers are also watching closely to see if there is a second wave of Covid-19 in the UK or not.”

To adapt, Q has introduced virtual tours of the apartments, assists with online shopping, and advises those with pets to seek out local dog-walking services in advance of travel.

Despite the adjustments, most companies are just waiting for footfall to return. In part, this will depend on air travel. Global passenger traffic has dropped by as much as 90% in the past three months with only a slow rebound expected, according to Euromonitor International , a data consultancy. When it does return it will be domestic and short-haulers, rather than international airlines, that are best served.

Nadejda Popova, a senior analyst at Euromonitor International, is less sanguine about the return of tourism spending, as budgets tighten and high-levels of unemployment continue to affect demand and shake the industry. She expects the biggest declines in Germany, the United Kingdom and India.

“There will likely be a drop of over 23% in world arrivals in 2020; followed by a rebound of 17% the following year, leading to recovery to pre-crisis levels by 2022,” according to Popova. “This is one year longer than it took global travel and tourism to recover after 9/11, and one year longer than after the financial crisis.”

With global travel still in limbo, it seems inevitable that growing numbers of people will look online for a taste of travel. As the British Museum experiment shows, virtual tourism cannot replace the real thing, but it can provide something to do – or buy – in the meantime.

Charlotte Middlehurst

Charlotte is a journalist for the Financial Times and freelance writer with a focus on environment, energy and China. Tweets @charmiddle

Sara Hsu explains the benefits of China’s fintech explosion

Britain’s kew gardens is working to make tcm safer, related articles, huang xuelei discusses her new book,..., what is shein the chinese fast..., what trends emerged from lunar new..., top tips from scottish consumer brands..., “shop like a billionaire”: inside the..., how can scottish consumer brands thrive....

This website uses cookies to improve your experience. We'll assume you're ok with this, but you can opt-out if you wish. Accept Read More

- China Daily PDF

- China Daily E-paper

- Asia-Pacific

- Middle East

- China-Europe

- China-Japan

- China-Africa

Chinese tourists to accelerate recovery of UK's travel sector

The United Kingdom is keen to see Chinese tourists return in substantial numbers after a three-year hiatus due to COVID-19, the chief of the UK's national tourism agency said, anticipating that the visits will largely contribute to the recovery of the country's tourism industry.

"China is still one of our most valuable markets. We predict a strong rebound and hope there will be an appetite for travel.... We are trying to...grow value back as quickly as we can," said Patricia Yates, CEO of VisitBritain.

"We particularly like the Chinese market because they (Chinese tourists) spend a lot on their trips and stay longer. When we are rebuilding a sustainable and resilient industry, people who stay longer are obviously the people that we are trying to attract," she added.

In 2019, more than 880,000 people came to the UK from China, staying 16.33 nights on average and spending 1,937 pounds ($2,330) per person, making China the second-most valuable inbound travel market for the UK in terms of expenditure.

Yates said another reason the Chinese market is valuable to the UK's inbound tourism is that it fills the gap during the off-peak season. "We see seasonal inbound travel. The Chinese New Year holiday (in January-February) and Golden Week (beginning of October) work very well for us because they help extend the tourism season."

She said the growing number of Chinese students in the UK is an added benefit. "I think having Chinese students here is a win-win for us. These students will have that lifelong affinity with Britain, and they'll have their parents and family come over to visit."

Yates noted that social media helps boost the tourism sector as well. Chinese students use social media to tell "the story of Britain "to family and friends. This helps attract more visitors, she added.

According to the latest data from the Higher Education Statistics Agency, China sent a record number of 151,690 students to the UK in 2021-22, more than any other country or region, including the European Union.

While visitors from emerging markets are usually "very London-centric", one of the "peculiarities of the China market" is that the Chinese people are "adventurous" and like to explore, Yates said. "If they stay for, say, 16 days, they are absolutely going to travel around the country", she added.

Yates believes there is a huge pent-up demand for travel in China, and the UK is still on the wish list of Chinese travelers based on the agency's post-COVID research. She reckons Windsor will be on the top of the list for Chinese holidaymakers when they return to the UK, given their strong interest in royal heritage and since the coronation of King Charles III is scheduled for May.

VisitBritain recently launched its new multimillion pound international marketing campaign for 2023 to drive up tourism. Yates said the campaign title — "Which part of Britain is your cup of tea?" — will in particular resonate with the Chinese.

"Tea is something we have in common with China. ... What we have done is look at experiences in Britain and then teas have been made to reflect those experiences," she said. "It is very quirky, very British, and that sense of humor I think appeals to the Chinese market."

China was the world's largest outbound tourism market in 2019, with 166 million overseas trips made by the Chinese people and involving a total expenditure of $255 billion, according to the United Nations World Tourism Organization.

Many experts say new travel patterns will emerge among Chinese tourists in the post-pandemic era, with new habits developed and new tastes acquired during domestic travel in the past three years likely to have a spillover effect on their travels abroad.

Yates echoed the view, saying "there will be a growing desire for the countryside and more emphasis on personal well-being, something that Britain can cater for very well".

With visas needing renewal and direct flights yet to resume, the VisitBritain chief said it will take some time to see Chinese tourists returning to the UK in large numbers. The total number of visits is expected to reach its pre-COVID level by 2026, according to the agency.

"Once China comes back, it'll come back with a roar. The potential for growth is absolutely there," Yates said.

UK Faces the Slow Return of Chinese Tourists

Rashaad Jorden , Skift

November 16th, 2023 at 6:17 AM EST

Today's podcast discusses Chinese tourists in the UK, Etihad's growth plans, and Japan's efforts to meant tourism demands.

Rashaad Jorden

Skift Daily Briefing Podcast

Listen to the day’s top travel stories in under four minutes every weekday.

Good morning from Skift. It’s Thursday, November 16. Here’s what you need to know about the business of travel today.

🎧 Subscribe

Apple Podcasts | Spotify | Overcast | Google Podcasts | Amazon Podcasts

Episode Notes

The United Kingdom is seeing a gradual return of Chinese visitors , but a full recovery won’t take place until 2025, writes Global Tourism Reporter Dawit Habtemariam.

VisitBritain CEO Patricia Yates told Parliament on Tuesday that Chinese visitor numbers would slowly build back to pre-Covid levels. Flight bookings from China to the UK are down 50% from 2019. Yates attributed that massive drop to Beijing not approving the UK for outbound group travel until August.

Chinese visitors were the second-highest spenders in the UK behind American tourists prior to the pandemic.

Next, Etihad Airways has plans for significant growth . The company aims to double its fleet and triple its passenger number by 2030, writes Reporter Ajay Awtaney.

Etihad Aviation Group CEO Antonoaldo Neves said the company plans to increase its fleet size to 150 aircraft. That’s a part of its growth plan named Project 2030, a year Etihad wants to fly 33 million passengers. Awtaney reports the company expects to increase its number of partnerships over the next six months.

Finally, Japan has seen a major tourism boom recently . But tours and activities operators say they’re experiencing a capacity crunch in the country, writes Travel Experiences Reporter Selene Brophy.

The Japan National Tourism Organization said visitors to Japan topped pre-Covid levels for the first time in October. However, Wei-chun Liu, chief operating officer of experiences booking company KKday, said Japan has struggled to manage the surge in travel demand. Liu said KKday has seen constraints in areas such as bus and tour guide capacity.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: etihad , great britain , japan , skift podcast , united kingdom

Photo credit: The Palace of Westminster as seen from the river Thames. Skift

Chinese Tourists Agency

Chinese tourists want to go to UK in 2023 but …

Chinese tourists would love to travel back to the United Kingdom, visiting the country and shopping.

- More than 880,000 Chinese tourists spent more than half a billion pounds in the UK in 2018

- Chinese tourists spent more than £29m in shopping centres and on high streets across the UK

The UK tourism bureau hope that the trip of Chinese travelers will largely contribute to the recovery of the tourism industry.

“China is still one of our most valuable markets. We predict a strong rebound and hope there will be an appetite for travel…. We are trying to…grow value back as quickly as we can,”

said Patricia Yates, CEO of VisitBritain.

“We particularly like the Chinese market because they (Chinese tourists) spend a lot on their trips and stay longer. When we are rebuilding a sustainable and resilient industry, people who stay longer are obviously the people that we are trying to attract,”

UK plan to receive 250 000 Chinese travelers in 2023.

Chinese use to stay 16 nights on average and spending 1,937 pounds ($2,330) per person, biggest spender after rich UAE.

China the second-most valuable inbound travel market for the UK and is strategic.

She added that the growing number of Chinese students in the UK is an added benefit.

Having Chinese students here is a win situation for the education industry.

The best chance to attract Chinese visitors is through the creation of a digital marketing strategy.

Nowadays, China is the country which provides the largest number of tourists worldwide. But maybe, most important to companies is the fact that Chinese travelers are the ones who more spend during their trips. That is the reason why many businesses are trying to attract them.

The number of Chinese outbound travelers exceeded 100 million in the world in 2018.

Chinese travel abroad for different reasons such as sightseeing, go shopping. Therefore, British companies have adapted their services to the Chinese culture in order to attract tourists from the Asian giant.

The UK is on their way to the top European destination!

The United Kingdom has the objective to make the country as one of the most popular destinations to Chinese tourists wanting to travel to Europe. With the purpose to attract Chinese travelers, United Kingdom has developed different marketing strategies.

Over the past years the amount of Chinese tourists has rapidly boost due to the growth of the Chinese middle-class. The shopping amount become biggest since Chinese People are getting richer.

One of its most successful marketing strategies was a campaign launched by Visit Britain, the national tourism agency responsible for promoting Great Britain worldwide.

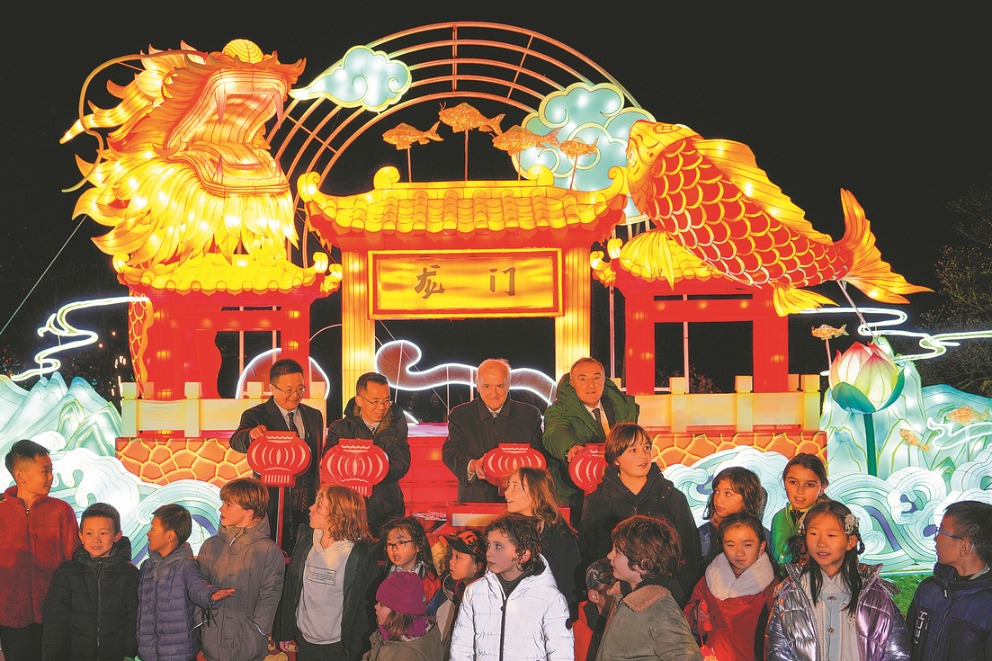

That online campaign encouraged Chinese population to give Mandarin names to tourist attractions, famous people, places and food from the United Kingdom. The campaign was developed via Chinese social media platforms such as WeChat and Weibo.

VisitBritain also created a campaign called Great China Welcome in order to attract 650,000 Chinese tourists to the UK a year by 2020, contributing about 1.1 billion pounds annually to the UK economy.

Through this campaign, hotels, restaurants, attractions and other hospitality businesses have become “China-ready”. Nearly 200 businesses are participating in this program which is free and open to any UK business which fulfils the necessary requirements.

Online video portal

Another digital marketing strategy of VisitBritain to attract Chinese visitors was the creation of an online video portal in China, LeTV.com with the aim to show the British’s culture and heritage to Chinese population. Through LeTV.com, VisitBritain launched the first British online film festival in China, called Great Britain on Screen where Chinese audience had the opportunity to discover the British lifestyle via UK’s film and TV programs.

Creating an online video portal is a very efficient way to attract more Chinese customers because they are used to watching a lot of videos to learn about a huge variety of topics, from how to use cosmetics to what the hottest destinations are.

Chinese tourists are the world most wanted tourists and they know it!

Majority of Chinese tourists are not able to speak and understand English. That is the reason why many hotels, attractions and tour agencies from UK are working to provide printed, online or audio information in Mandarin or Cantonese to Chinese travelers. With the aim to attract Chinese tourists, those businesses are also providing Chinese food and training their staff to meet cultural needs and expectations of Chinese visitors.

As example, many British stores have hired Mandarin-speaking staff to better deal with Chinese consumers while other stores have created Chinese-language apps, offering Chinese tourists store guides, restaurant menus and events details in order to be more China-friendly.

In addition, UK government has made easier the process to obtain the tourism visa to Chinese tourists. Last July, British authorities announced improvements to the visa system in China such as a 24-hour visa service or a new service allowing tourists to apply for the British and Schengen visa at the same time.

As we see, the best way to attract more Chinese visitors is through the creation of digital marketing strategies including Chinese social media platforms where businesses have the chance to reach a huge audience.

Interested in attracting Chinese tourists? Come and contact us to discuss your project!.

How to lure Chinese tourists to the UK?

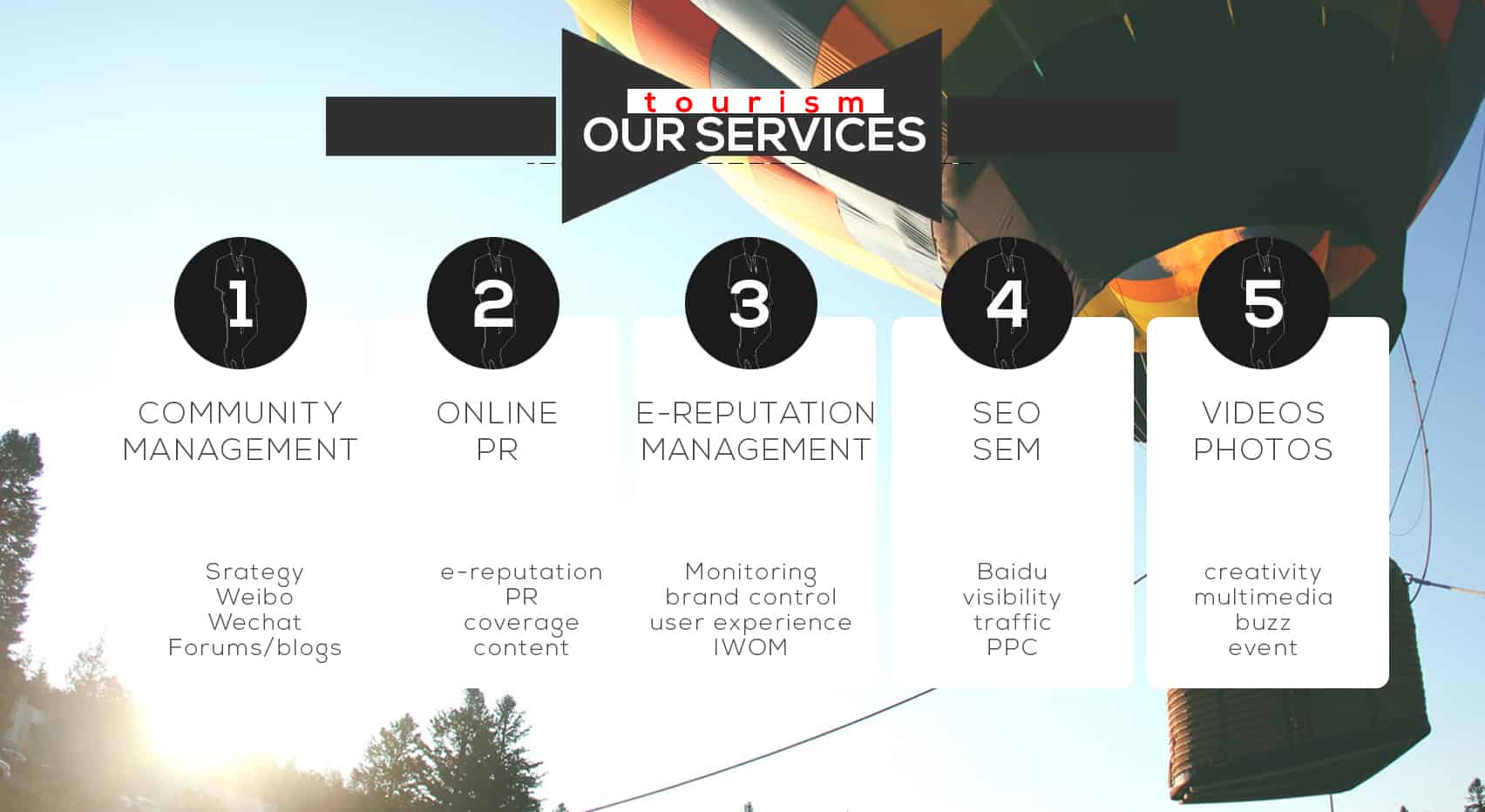

Lead generation.

Lead Generation is the process of attracting and capturing Chinese internet users and converting them into customers. This process is unique, fragmented and dynamic in China social media landscape. The Chinese’s consumers dont just want a simple Ads, but they want to see rich and authentic content, a storytelling before to trust you. Some travel agency willing to attract Chinese tourists should, first of all, understand their expectations and adapt their services to Chinese consumers. They are more and more sophisticated; they love luxury and high services.

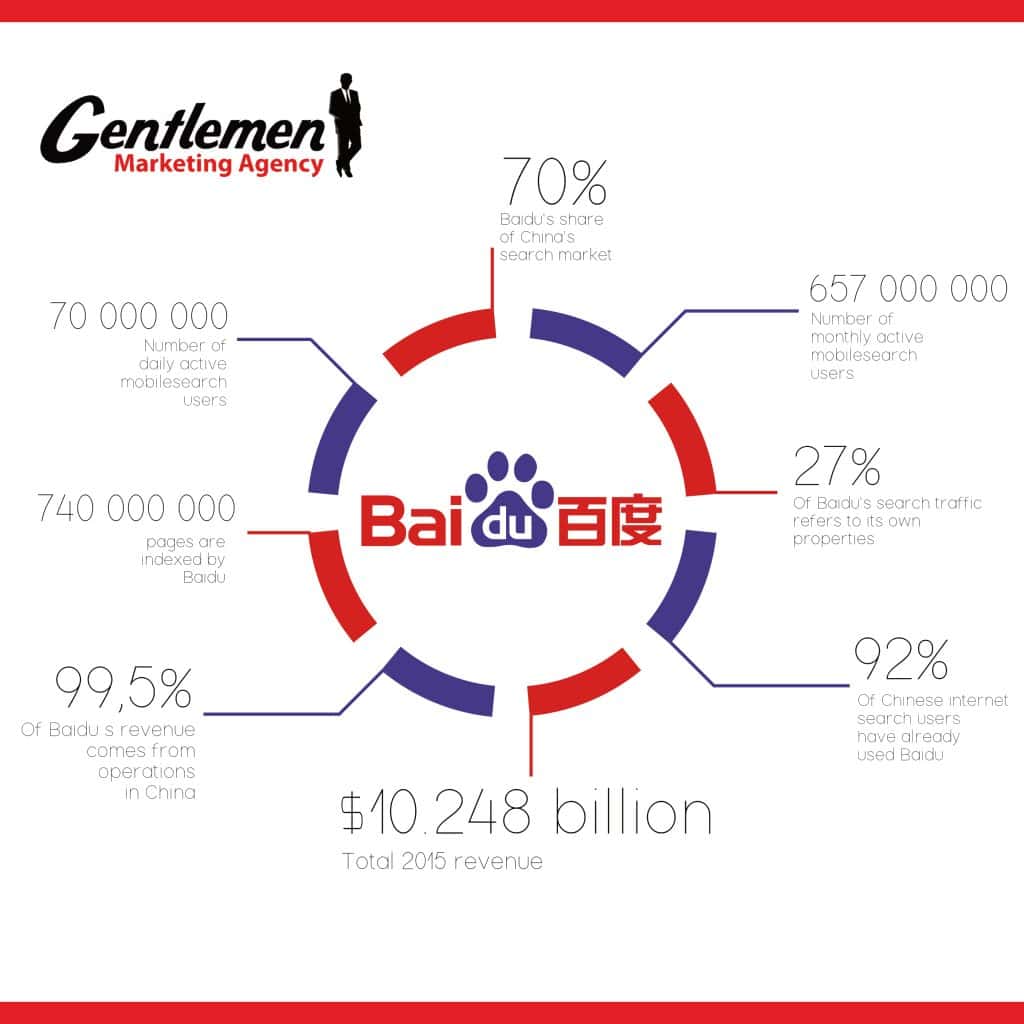

Search Engine in China

Chinese Search … and use different search Engine toool

SEO on Baidu leads to more exposure and traffic. Our team composed of experts optimize your website and the content to deliver SEO results on Baidu. In fact, Baidu is the largest Chinese search engine with 82% of the market. The SEO process is completely different in China, different skills and techniques are required when compared to western search engines like Google. Smart SEO strategy is focusing to create a good quality content for potential clients. Travel agency that understand this will have a competitive advantage because they will build up a better online image and reputation. This not only improves visibility, but also leads to the Chinese having a strong level of trust in your company, this leads to results.

E-Reputation is the conerstone

Chinese consumers don’t buy company but they buy trust. this is the reason why the reputation is very important in China. if you want reach more Chinese tourists in your travel agency, you have to work on your reputation. The Chinese’s tourists are looking for travel agency that have a good image and more visibility; they often create social buzz and forums to gauge the reputation of brands. A travel agency that wants to keep the Chinese as active clients has to promote its image on the right online portals to engage Chinese interest. Travel platforms like CTrip,Qunar, Qyer, Mafengwo,.. and some forums.

Social Media in China

Chinese social media is very different to western. The secret in Chinese social media is to generate “traffic”. In China, we are expert, and we know how to develop and engage more Chinese citizens. We combine Online Public Relations, Design and Viral Marketing with attractive communication methods on every Chinese platform:Wechat, Weibo,Tieba,Tianya,Douban, etc

Our Agency’s target:

– Generating traffic on Chinese social media channel to support our clients in this field,

– To educate and explain digital works in China and demonstrate how well we know our industry.

WE CAN HELP YOU

We know how to make it work for your travel agency in China.

We are developing social media projects in China every day.

- UK urged to attract Chinese tourists spending £650-a-day

Social Media influences Chinese travellers

- How to attract more Chinese tourists.

Similar Posts

5 things that Travel Agencies should know about Chinese Tourists

You are a travel Agency based outside of China and you want to attract Chinese travellers ? You have a lot of question , you are lost and you should read this article. Even though studies have shown China is experiencing a slow economic growth, the truth is the numbers of tourists for both outbound/…

What are the new trends on Chinese tourism market in 2020?

Chinese tourism market from 2012 to now Outbound tourism from China has grown significantly over the past 15 years. China continued to hold its position as the world’s highest spender on international travel from 2016 to 2017, a position the country has held since 2012. The World Travel & Tourism Council (WTTC) predicts that China…

Thinking about attracting Chinese wallets to your country in 2023?

Can you imagine the Chinese Population? 1,453,886,621 on February 17, 2023, based on the latest United Nations data. It’s the equivalent of 18.5% of the total world population! Can you figure out the Market Potential? Key figures about the Chinese tourism wave: China became the largest source of tourists in 2014 In 2019 more than 170 million…

Chinese tourist are in love with Serbia

Chinese visitors state ‘I do’ to Serbia. 1.2Million Chinese tourists to Serbia last year, that the crazy figure of the wedding and honeymoon plan of Serbia to attract all these young Chinese couples. source SCMP A “lady” in a pretty white dress and mentors goes through a field, her extended white cover rippling behind and…

Through social media sites, the Chinese population collects all kinds of information about products, services, and destinations before making their final traveling decisions. Social networks have become an essential and powerful source of information for Chinese tourists. Generally speaking, Chinese citizens spend a large amount of their time online, mainly on social networks and online…

What the Top 5 tourism CEO think about Chinese outbound tourism for 2016

The number of Chinese traveling abroad can be compared to the total population in Russia adding with the half of the population in Brazil. China has evolved rapidly in a very short time. The Chinese have a strong buying power regarding at Leisure and Trips. Sephen Kauer, Trip Advisor The Chinese market It’s definitely a…

11 Comments

- Pingback: Direct flight from Beijing to Shakespeare’s airport this summer. - Chinese Tourists Agency

Hello We have about 6 Three and Four star hotels in London and wish to attract Chinese guests. Can you please facilitate in getting contacts for us. Do you have an office in Europe or in the UK? Would appreciate a response from your end. Kind regards

Very good article. I am a Travel agency that think of China Tour Operators , kind of copoeration. What do you suggest to deal with these Big Companies ? What do they ask from European Small Inbound Travel Partner ?

We are a bespoke walking tour operation in the lake district uk and are looking to expand our business

How Many Chinese Tourists Went to UK in 2019.? Any recent datas?

I work for the marketing department of a small family owned bed and breakfast in Birmingham, this post has been very helpful to our strategy for attracting travelers specially from China and other Asian countries. thank you so much

I used to live in Hong Kong and we would travel back to the UK once a year , Im glad more chineese people are going to england every year.

the UK has become a great destination for tourism and business they are a leader of this things compared to most of the rest of the world , its great to see a piece like this one.

I want to go to the Uk in a couple of years , its a little bit pricey but its worth it I assume this article has been great to add to that future trip.

Ive been in the UK a couple of times and its been great so much history, I want to go back as soon as they get the pandemic under control, a great place to check off the bucket list if you’ve never been.

Hello I never knew the Chinese market was such a big influence in business across the UK but withe the pandemic we realized just how many tourists actually come here every year. thanks for the post!

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Notify me of follow-up comments by email.

Notify me of new posts by email.

Travel, Tourism & Hospitality

Industry-specific and extensively researched technical data (partially from exclusive partnerships). A paid subscription is required for full access.

- Number of tourist visits from China to the UK Q1 2014-Q1 2020

Number of visits from China to the United Kingdom (UK) from 1st quarter 2014 to 1st quarter 2020 (in 1,000s)

- Immediate access to 1m+ statistics

- Incl. source references

- Download as PNG, PDF, XLS, PPT

Additional Information

Show sources information Show publisher information Use Ask Statista Research Service

November 2021

United Kingdom

Q1 2014 to Q1 2020

*The source specifies to use the data for the first quarter of 2020 with caution as results are indicative. Figures do not include Hong Kong SAR. The release date is the date of access.

Other statistics on the topic

- Tourist visits from China to the UK 2009-2022

Leisure Travel

- Italy: number of Chinese tourist arrivals 2017, by region

Accommodation

- Number of Chinese tourist arrivals in accommodation in Italy 2008-2018

- Quarterly growth in tourist visits from China to the United Kingdom (UK) 2013-2020

To download this statistic in XLS format you need a Statista Account

To download this statistic in PNG format you need a Statista Account

To download this statistic in PDF format you need a Statista Account

To download this statistic in PPT format you need a Statista Account

As a Premium user you get access to the detailed source references and background information about this statistic.

As a Premium user you get access to background information and details about the release of this statistic.

As soon as this statistic is updated, you will immediately be notified via e-mail.

… to incorporate the statistic into your presentation at any time.

You need at least a Starter Account to use this feature.

- Immediate access to statistics, forecasts & reports

- Usage and publication rights

- Download in various formats

You only have access to basic statistics. This statistic is not included in your account.

- Instant access to 1m statistics

- Download in XLS, PDF & PNG format

- Detailed references

Business Solutions including all features.

Statistics on " Chinese tourism in Europe "

- International tourism spending of Chinese tourists 2008-2021

- Number of outbound visitor departures from China 2010-2024

- Share of outbound tourists in China 2018, by province of origin

- Major departure cities of outbound tourists in China 2018, based on tourist share

- Number of tourist arrivals from China to Europe 2019-2022, by destination

- Number of Chinese tourist arrivals in accommodation in the EU 2012-2018

- Nights spent by Chinese tourists in accommodation in the EU 2012-2018

- Share of nights spent by tourists from China in the EU 2016, by country

- Chinese tourist arrivals in selected European countries 2016-2022

- YoY change in Chinese tourist arrivals in selected European countries 2016-2022

- Growth in arrivals from China to Europe in Jan-Apr 2019, by country

- YoY change of travel destinations in Europe during Chinese Spring Festival 2017

- Nights spent by Chinese tourists in accommodation in Italy 2008-2019

- Italy: number of Chinese tourist overnight stays 2017, by region

- Growth in tourist visits from China to the United Kingdom (UK) 2004-2019

- Spending of tourists from China in the United Kingdom (UK) 2009-2019

- Average spend per visit of tourists from China in the United Kingdom (UK) 2004-2019

- Number of Chinese tourist visits to London 2009-2022

- Holiday spend of Chinese tourists in London 2006-2018

- Tourist visits from China to the United Kingdom (UK) 2018, by accommodation used

- Average tourist visits from China to United Kingdom (UK) 2018, by age

- Gender distribution of Chinese tourists visiting the UK 2018, by purpose

- Chinese tourists' shopping propensity in the United Kingdom (UK) 2016

- Chinese tourists' propensity to buy selected items on visits to the UK 2016

Other statistics that may interest you Chinese tourism in Europe

Overview: China outbound tourism

- Premium Statistic International tourism spending of Chinese tourists 2008-2021

- Premium Statistic Number of outbound visitor departures from China 2010-2024

- Premium Statistic Share of outbound tourists in China 2018, by province of origin

- Premium Statistic Major departure cities of outbound tourists in China 2018, based on tourist share

- Premium Statistic Number of tourist arrivals from China to Europe 2019-2022, by destination

- Basic Statistic Number of Chinese tourist arrivals in accommodation in the EU 2012-2018

- Basic Statistic Nights spent by Chinese tourists in accommodation in the EU 2012-2018

- Premium Statistic Share of nights spent by tourists from China in the EU 2016, by country

Destinations visited

- Premium Statistic Chinese tourist arrivals in selected European countries 2016-2022

- Premium Statistic YoY change in Chinese tourist arrivals in selected European countries 2016-2022

- Premium Statistic Growth in arrivals from China to Europe in Jan-Apr 2019, by country

- Premium Statistic YoY change of travel destinations in Europe during Chinese Spring Festival 2017

- Basic Statistic Number of Chinese tourist arrivals in accommodation in Italy 2008-2018

- Basic Statistic Nights spent by Chinese tourists in accommodation in Italy 2008-2019

- Premium Statistic Italy: number of Chinese tourist arrivals 2017, by region

- Premium Statistic Italy: number of Chinese tourist overnight stays 2017, by region

Destinations: United Kingdom

- Premium Statistic Tourist visits from China to the UK 2009-2022

- Premium Statistic Growth in tourist visits from China to the United Kingdom (UK) 2004-2019

- Premium Statistic Number of tourist visits from China to the UK Q1 2014-Q1 2020

- Premium Statistic Quarterly growth in tourist visits from China to the United Kingdom (UK) 2013-2020

- Premium Statistic Spending of tourists from China in the United Kingdom (UK) 2009-2019

- Premium Statistic Average spend per visit of tourists from China in the United Kingdom (UK) 2004-2019

- Premium Statistic Number of Chinese tourist visits to London 2009-2022

- Premium Statistic Holiday spend of Chinese tourists in London 2006-2018

Tourist profile and behavior

- Premium Statistic Tourist visits from China to the United Kingdom (UK) 2018, by accommodation used

- Premium Statistic Average tourist visits from China to United Kingdom (UK) 2018, by age

- Premium Statistic Gender distribution of Chinese tourists visiting the UK 2018, by purpose

- Premium Statistic Chinese tourists' shopping propensity in the United Kingdom (UK) 2016

- Premium Statistic Chinese tourists' propensity to buy selected items on visits to the UK 2016

Further related statistics

- Basic Statistic Share of visits by French tourists in Scotland, by travel reason

- Premium Statistic Quarterly inbound holiday visits to the United Kingdom (UK) 2015-2020

- Premium Statistic Number of inbound visits to the UK 2019-2022, by age group

- Basic Statistic International market contribution to tourism arrival growth in Europe 2019

- Premium Statistic Europe: growth in international tourist arrivals from Africa1980-2030

- Premium Statistic Inbound holiday visits from Europe to the United Kingdom (UK) 2011-2019

- Premium Statistic Monthly tourist visits from Europe to the UK 2018-2023

- Premium Statistic Inbound business visits to the United Kingdom (UK) 2011-2019

- Premium Statistic Market share of international tourist arrivals to Europe 2014

- Basic Statistic Contribution to growth in tourist arrivals in Europe 2016-2020, by market

- Premium Statistic Italy: number of overnight stays of French tourist in 2015, by region of destination

- Premium Statistic Change in number of visitors from Mexico to the U.S. 2018-2024

- Premium Statistic Municipalities most visited by international tourists in Slovenia 2022

- Premium Statistic Colombia: air passenger arrivals in Antioquia 2012-2018

Further Content: You might find this interesting as well

- Share of visits by French tourists in Scotland, by travel reason

- Quarterly inbound holiday visits to the United Kingdom (UK) 2015-2020

- Number of inbound visits to the UK 2019-2022, by age group

- International market contribution to tourism arrival growth in Europe 2019

- Europe: growth in international tourist arrivals from Africa1980-2030

- Inbound holiday visits from Europe to the United Kingdom (UK) 2011-2019

- Monthly tourist visits from Europe to the UK 2018-2023

- Inbound business visits to the United Kingdom (UK) 2011-2019

- Market share of international tourist arrivals to Europe 2014

- Contribution to growth in tourist arrivals in Europe 2016-2020, by market

- Italy: number of overnight stays of French tourist in 2015, by region of destination

- Change in number of visitors from Mexico to the U.S. 2018-2024

- Municipalities most visited by international tourists in Slovenia 2022

- Colombia: air passenger arrivals in Antioquia 2012-2018

Cookies on GOV.UK

We use some essential cookies to make this website work.

We’d like to set additional cookies to understand how you use GOV.UK, remember your settings and improve government services.

We also use cookies set by other sites to help us deliver content from their services.

You have accepted additional cookies. You can change your cookie settings at any time.

You have rejected additional cookies. You can change your cookie settings at any time.

- Passports, travel and living abroad

- Travel abroad

- Foreign travel advice

Entry requirements

This advice reflects the UK government’s understanding of current rules for people travelling on a full ‘British citizen’ passport from the UK, for the most common types of travel.

The authorities in China set and enforce entry rules. If you’re not sure how these requirements apply to you, contact the Chinese Embassy in the UK .

Immigration authorities may check and collect biometric data (for example, scanned fingerprints and photos) to register your entry into China.

COVID-19 rules

There are no COVID-19 testing or vaccination requirements for travellers entering China.

Passport validity requirements

To enter China, your passport must have an ‘expiry date’ at least 6 months after the date you arrive in China and 2 blank pages for visas and stamping.

Visa requirements

You need a visa to visit mainland China.

You can visit Hong Kong or Macao without a visa. See separate travel advice for Hong Kong and Macao .

You can also visit the island of Hainan for 30 days without a visa.

Visa-free transit through China is permitted, from 24 hours to 144 hours depending on location. See China Visa Application Centre for more information.

If you visit Hong Kong from mainland China and want to return to the mainland, you need a visa that allows you to make a second entry into China.

Check your visa details carefully and do not overstay your visa. The authorities carry out regular checks and may fine, detain and deport you.

If you want to stay in China longer than 6 months, you may need to get a residence permit.

Applying for a visa

If you’re 14 to 70 years old, you must apply for a visa in person at a visa application centre . If you’re aged 13 and under or aged 71 and over, you can only apply online. You must provide biometric data (scanned fingerprints) as part of your application. There are visa application centres in London, Manchester, Belfast and Edinburgh. The details of their opening hours are on their websites.

The Chinese Embassy has further information on visa categories and how to apply .

Dual Chinese-British nationality

China does not recognise dual nationality. If you enter China on a Chinese passport or identity card, the British Embassy may not be able to offer you help. If you were born in China to a Chinese national parent, you will be:

- considered by the Chinese authorities to have Chinese nationality

- treated as a Chinese citizen, even if you used a British passport to enter China

If you have formally renounced Chinese citizenship, you should carry clear evidence that you have done so. See guidance on nationality in China .

Working in China

You can only work in China if you have a work visa (Z visa). Tourist and business visas do not allow you to work. You must also hold a valid work permit. The local police regularly carry out checks on companies and schools. If you do not follow Chinese immigration laws, there can be serious penalties, including:

- imprisonment

- deportation

- an exit ban, which stops you from leaving China

- an exclusion order, which stops you from returning

Before you leave the UK, contact the Chinese Embassy in the UK to check Z visa requirements. When submitting your application, and when you receive your work permit, check the details are correct, including the location you’ll be working in. You can be fined or detained if details are incorrect, even if your employer or others have submitted the application on your behalf.

If you change employer once you’re in China, or change location in China with an existing employer, check with the Chinese authorities whether you need a new visa and work permit before doing so.

Vaccination requirements

At least 8 weeks before your trip, check the vaccinations and certificates you need in TravelHealthPro’s China guide .

Depending on your circumstances, this may include a yellow fever certificate.

Registering with the Chinese authorities

You must register your place of residence with the local Public Security Bureau within 24 hours of arrival. Chinese authorities enforce this rule with regular spot-checks of foreigners’ documentation. If you’re staying in a hotel, they will register you when you check in.

Customs rules

There are strict rules about goods you can take into or out of China . You must declare anything that may be prohibited or subject to tax or duty.

Related content

Is this page useful.

- Yes this page is useful

- No this page is not useful

Help us improve GOV.UK

Don’t include personal or financial information like your National Insurance number or credit card details.

To help us improve GOV.UK, we’d like to know more about your visit today. We’ll send you a link to a feedback form. It will take only 2 minutes to fill in. Don’t worry we won’t send you spam or share your email address with anyone.

- Inspiration

- Destinations

- Places To Stay

- Style & Culture

- Food & Drink

- Wellness & Spas

- News & Advice

- Partnerships

- Traveller's Directory

- Travel Tips

- Competitions

Can I travel to China? Travel rules from the UK explained

By Connor Sturges

In December 2019, a cluster of Chinese citizens in Wuhan reported mysterious flu-like symptoms in what became the start of a pandemic that would change the world as we knew it. Countries closed their borders and leading scientists embarked on a mission to create effective vaccines, leading many travellers to rediscover the wonders on their doorsteps and the concept of the great British staycation .

Fast forward to January 2023, and China is welcoming tourists once again. Hundreds of millions of Chinese citizens will be hoping to travel domestically to join family ahead of Chinese New Year and see in the Year of the Rabbit, while curious international travellers are adding the country to their bucket lists once again for the year ahead.

These are the entry requirements, and the UK government's advice, as of Monday 9 January 2023.

Can I travel to China from the UK, and back again?

Yes, with some restrictions. After almost three years of Covid stalling China’s tourism industry, Thursday 5 January 2023 marked the opening of China’s borders to the world once again. However, as of Monday 9 January 2023, China remains in the midst of a Covid surge, meaning strict rules are in place for travellers wishing to visit the country.

What are the entry requirements for China?

Since international flights to China resumed on Thursday 5 January 2023, all travellers are required to take a pre-departure PCR Covid test in the 48 hours prior to travel.

Once confirmed, a negative PCR test result can be submitted by filling in a health declaration form on the China customs website . Negative results can also be submitted on the China customs app or a registered WeChat account.

Travellers who display symptoms of fever on arrival in China may be asked to take a further antigen test. Self-quarantine will be imposed in the event of a positive test result and mild symptoms, while travellers can be sent to medical institutions for treatment if symptoms are more severe.

The UK government website recommends that all travellers pack a supply of medication to treat flu-like symptoms. It is also recommended that accommodation is stocked with additional food, water and medical supplies in case you are mandated to isolate.

What are the rules on returning to the UK from China?

All travellers aged 12 and over must obtain a negative pre-departure Covid test result no more than two days prior to travelling back from mainland China to the UK. Results are checked by airlines and Border Force officials in the UK. These rules currently apply to travellers on direct and indirect flights, and those arriving in England as a final destination plus anyone transiting through England.

Test results can be provided in the form of a printed document, an email, or text message, and must contain the following information:

- A full name that matches the name on travel documents

- Date of birth or age

- Result of the test

- Date the test sample was collected or received by the test provider

- Name of the test provider and their contact details

- Confirmation of the type of test taken, which can be a lateral flow or PCR

NHS-provided tests cannot be used as pre-departure tests. In addition to the required pre-departure tests when returning from mainland China, travellers arriving at London Heathrow Airport may be asked to undertake a voluntary test on arrival, as part of the UK government’s monitoring of potential new variants.

Are there any other entry requirements for travel to China?

According to the latest UK government website, travellers wishing to visit China on a British Citizen passport can do so by:

- Obtaining an “Invitation Letter” or “Verification Confirmation of Invitation” issued by a provincial foreign affairs office or department of commerce (M or F visa)

- Obtaining a “Notification Letter of Foreigners Work Permit” (Z visa)

- Visiting a family member with a Z, M, or F visa

- Intending to visit a family member who is a Chinese citizen or who holds a Chinese permanent residence permit

- Qualifying for a high-level talent (R) visa

- Qualifying for a transport crew (C) visa

Visa applications must be made, in person, at a Visa Application Centre. Note that biometric data (scanned fingerprints) has to be provided as part of the application process. Chinese Visa Application Centres in London , Manchester and Edinburgh are operating, but with limited opening hours. The Belfast centre remains closed.

More details, including the process for submitting forms for those still eligible, can be found on the Chinese Embassy website.

For more information and updated rules, visit the UK government website before travelling. We also recommend ensuring you have valid travel insurance with Covid cover before taking any trips.

Outlook for China tourism 2023: Light at the end of the tunnel

China is now removing travel restrictions rapidly, both domestically and internationally. While the sudden opening may lead to uncertainty and hesitancy to travel in the short term, Chinese tourists still express a strong desire to travel. And the recent removal of quarantine requirements in January 2023 could usher in a renewed demand for trips abroad.

Domestically, there are already signs of strong travel recovery. The recent Chinese New Year holidays saw 308 million domestic trips, generating almost RMB 376 billion in tourism revenue. 1 China’s Ministry of Culture and Tourism. This upswing indicates that domestic travel volume has recovered to 90 percent of 2019 figures, and spending has bounced back to around 70 percent of pre-pandemic levels. 2 McKinsey analysis based on China’s Ministry of Culture and Tourism data.

This article paints a picture of Chinese travelers and their evolving spending behaviors and preferences—and suggests measures that tourism service providers and destinations could take to prepare for their imminent return. The analyses draw on the findings of McKinsey’s latest Survey of Chinese Tourist Attitudes, and compare the results across six waves of surveys conducted between April 2020 and November 2022, along with consumer sentiment research and recent travel data.

From pandemic to endemic

By January 8, 2023, cross-city travel restrictions, border closures, and quarantine requirements on international arrivals to China had been lifted. 3 “Graphics: China’s 20 new measures for optimizing COVID-19 response,” CGTN, November 15, 2022; “COVID-19 response further optimized with 10 new measures,” China Services Info, December 8, 2022; “China reopens borders in final farewell to zero-COVID,” Reuters, January 8, 2023. This rapid removal of domestic travel restrictions, and an increase in COVID-19 infection rates, likely knocked travel confidence for cross-city and within-city trips. Right after the first easing of measures, in-city transport saw a marked drop as people stayed home—either because they were ill, or to avoid exposure. Subway traffic in ten major cities in mainland China fell and then spiked during Chinese New Year in February. Hotel room bookings also peaked at this time.

Domestic airline seat capacity experienced a minor rebound as each set of restrictions was lifted—suggesting a rise in demand as airlines scheduled more flights. Domestic capacity fluctuated, possibly due to the accelerated COVID-19 infection rate and a temporary labor shortage. International seat capacity, however, continued to climb (Exhibit 1).

By Chinese new year, China was past its infection peak—and domestic tourism recovered strongly. For instance, Hainan drew 6.4 million visitors over Chinese New Year (up from 5.8 million in 2019) and visits to Shanghai reached 10 million (roughly double 2019 holiday figures). 4 China’s Ministry of Culture and Tourism. Overall, revenue per available room (RevPAR) during this period recovered and surpassed pre-pandemic levels, at 120 percent of 2019 figures. 5 STR data. Outbound trips are still limited, but given the pent-up demand for international travel (and the upswing in domestic tourism) the tourism industry may need to prepare to welcome back Chinese tourists.

Tourism players should be ready for this; the time to act is now.

A demand boom is around the corner—Chinese tourists are returning soon

Before the pandemic, Chinese tourists were eager travelers. Mainland China had the largest outbound travel market in the world, both in number of trips and total spend. 6 World Tourism Organization (UNWTO) Tourism dashboard, Outbound tourism ranking. In 2019, Mainland Chinese tourists took 155 million outbound trips, totaling $255 billion in travel spending. 7 China’s Ministry of Culture and Tourism. These figures indicate total outbound trips, including to Hong Kong and Macau. China is also an important source market for some major destinations. For instance, Chinese travelers made up 28 percent of inbound tourism in Thailand, 30 percent in Japan, and 16 percent of non-EU visitors to Germany. 8 United Nations World Tourism Organization (UNWTO) database.

Leisure travel was the biggest driver of China’s outbound travel, representing 65 percent of travelers in 2019. In the same year, 29 percent of travelers ventured out for business, and 6 percent journeyed to visit friends and relatives. 9 Euromonitor International database.

Our most recent Survey of Chinese Tourist Attitudes, conducted in November 2022, shows that Chinese tourists have retained their keen desire to explore international destinations. About 40 percent of respondents reported that they expect to undertake outbound travel for their next leisure trip.

Where do these travelers want to go?

The results also indicate that the top three overseas travel destinations (beyond Hong Kong and Macau) are Australia/New Zealand, Southeast Asia, and Japan. Overall, respondents show less interest in travel to Europe than in previous years, down from 7 percent to 4 percent compared to wave 5 respondents. Desire to embark on long-haul international trips to Australia/New Zealand increased from 5 percent to 7 percent, and North American trips from 3 percent to 4 percent since the last survey. The wealthier segment (monthly household income over RMB 38,000) still shows a high interest in EU destinations (13 percent).

There are stumbling blocks on the road to recovery

While travel sentiment is strong, other factors may deter travelers from taking to the skies: fear of COVID-19; the need for COVID-19 testing which can be expensive; ticket prices; risk appetite of destination countries; and getting a passport or visa.

Chinese travelers may favor domestic trips, even if all outbound travel restrictions are removed, until they feel it is safe to travel internationally. A COVID-19-safe environment in destination countries will likely boost travelers’ confidence and encourage them to book trips again. 10 “Long-haul travel barometer,” European Travel Commission, February 1, 2023.

Travel recovery is also dependent on airline capacity. Some international airlines might be slow to restore capacity as fleets were retired during COVID-19 and airlines face a shortage of crew, particularly pilots. Considering that at the time of writing, in April 2023, international airline seat capacity has only recovered to around 37 percent of pre-pandemic levels, travelers are likely to face elevated ticket prices in the coming months. For instance, ticket prices for travel in the upcoming holidays to popular overseas destinations such as Japan and Thailand are double what they were in 2019. 11 Based on Ctrip prices. Price-sensitive travelers might wait for ticket prices to level out before booking their overseas trips.

Chinese airlines, however, appear more ready to resume full service than their international counterparts —fewer pilots left the industry and aircraft are available. Chinese carriers’ widebody fleets are mostly in service or ready to be redeployed (Exhibit 2).

Moving forward, safety measures in destination countries will affect travel recovery. Most countries have dropped testing requirements on arrivals from mainland China, and Chinese outbound group travel has resumed but is still limited to selected countries.

Many Chinese travelers—maybe 20 percent—have had passports expire during the COVID-19 period, and China has not been renewing these passports. Renewals are now possible, but the backlog will slow travel’s rebound by a few months. 12 Steve Saxon, “ What to expect from China’s travel rebound ,” McKinsey, January 25, 2023. Furthermore, travel visas for destination countries can take some time to be processed and issued.

Taken together, these factors suggest that the returning wave of Chinese travelers may only gather momentum by the Summer of 2023 and that China’s travel recovery will likely lag Hong Kong’s by a few months.

Overall, China is opening up to travel, both inbound and outbound—all types of visas are being issued to foreign visitors, and locals are getting ready to travel abroad. 13 “China to resume issuing all types of visas for foreigners,” China Briefing, March 14, 2023.

Would you like to learn more about our Travel, Logistics & Infrastructure Practice ?

The returning chinese traveler is evolving.

Although Chinese travelers did not have opportunities to travel internationally over the past three years, they continued to travel domestically and explore new offerings. Annual domestic trips remained at around 50 percent of pre-pandemic levels, amounting to 8.7 billion domestic trips over the past three years. 14 China’s Ministry of Culture and Tourism. During this time, the domestic market matured, and travelers became more sophisticated as they tried new leisure experiences such as beach resorts, skiing trips, and “staycations” in home cities. Chinese travelers became more experienced as thanks to periods of low COVID-19 infection rates domestically they explored China’s vast geography and diverse experiences on offer.

Consequently, the post-COVID-19 Chinese traveler is even more digitally savvy, has high expectations, and seeks novel experiences. These are some of the characteristics of a typical traveler:

- Experience-oriented: Wave 6 of the survey shows that the rebound tourist is planning their trip around experiences. Outdoor and scenic trips remain the most popular travel theme. In survey waves 1 to 3, sightseeing and “foodie” experiences were high on the list of preferences while traveling. From waves 4 to 6, culture and history, beaches and resorts, and health and wellness gained more attention—solidifying the trend for experience-driven travel. Additionally, possibly due to the hype of the Winter Olympics, skiing and snowboarding have become popular activities.

- Hyper-digitized: While digitization is a global trend, Chinese consumers are some of the most digitally savvy in the world; mobile technologies and social media are at the core of daily life. COVID-19 drove people to spend more time online—now short-form videos and livestreaming have become the top online entertainment options in China. In the first half of 2022, Chinese consumers spent 30 percent of their mobile internet time engaging with short videos. 15 “In the first half of the year, the number of mobile netizens increased, and short videos accounted for nearly 30% of the total time spent online,” Chinadaily.com, 27 July 2022.

- Exploration enthusiasts: Chinese travelers are also keen to explore the world and embark on novel experiences in unfamiliar destinations. Survey respondents were looking forward to visiting new attractions, even when travel policies limited their travel radius. Instead of revisiting destinations, 45 percent of respondents picked short trips to new sites as their number one choice, followed by long trips to new sites as their second choice.

Consumers are optimistic, and travel spending remains resilient

McKinsey’s 2022 research on Chinese consumer sentiment shows that although economic optimism is seeing a global decline, 49 percent of Chinese respondents reported that they are optimistic about their country’s economic recovery. Optimism had dropped by 6 percentage points since an earlier iteration of the survey, but Chinese consumers continue to be more optimistic than other surveyed countries, apart from India (80 percent optimistic) and Indonesia (73 percent optimistic) (Exhibit 3). 16 “ Survey: Chinese consumer sentiment during the coronavirus crisis ,” McKinsey, October 13, 2022.

Chinese consumers are still keen to spend on travel, and travel spending is expected to be resilient. Wave 6 of the tourist attitude survey saw 87 percent of respondents claiming that they will spend more or maintain their level of travel spending. Moreover, when consumers were asked “which categories do you intend to splurge/treat yourself to,” travel ranked second, with 29 percent of respondents preferring travel over other categories. 17 “ Survey: Chinese consumer sentiment during the coronavirus crisis ,” McKinsey, October 13, 2022.

Against this context of consumer optimism, the wave 6 tourist attitude survey results shed light on how travelers plan to spend, and which segments are likely to spend more than others:

- The wealthier segment and older age groups (age 45-65) show the most resilience in terms of travel spend. Around 45 to 50 percent of travelers in these two groups will spend more on their next leisure trip.

- The wealthier segment has shown the most interest in beach and resort trips (48 percent). Instead of celebrating Chinese New Year at home with family, 30 percent of Chinese travelers in the senior age group (age 55-65) expect to take their next leisure trip during this holiday—10 percent more than the total average. And the top three trip preferences for senior travelers are culture, sightseeing, and health-themed trips.

- When it comes to where travelers plan to spend their money on their next trip, entertainment activities, food, and shopping are the most popular categories. These are also the most flexible and variable spending categories, and there are opportunities to up-sell—attractions, food and beverage, and retail players are well positioned to create unique and unexpected offerings to stimulate spending in this area (Exhibit 4).

Independent accommodation is gaining popularity

Overall, Chinese consumers have high expectations for products and services. McKinsey’s 2023 consumer report found that local brands are on the rise and consumers are choosing local products for their quality, not just for their cheaper prices. Chinese consumers are becoming savvier, and tap into online resources and social media to educate themselves about the specific details and features of product offerings. 18 Daniel Zipser, Daniel Hui, Jia Zhou, and Cherie Zhang, 2023 McKinsey China Consumer Report , McKinsey, December 2022.

Furthermore, 49 percent of Chinese consumers believe that domestic brands are of “better quality” than foreign brands—only 23 percent believe the converse is true. Functionality extended its lead as the most important criterion influencing Chinese consumers, indicating that consumers are focusing more on the functional aspects of products, and less on emotional factors. Branding thus has less influence on purchasing decisions. 19 Daniel Zipser, Daniel Hui, Jia Zhou, and Cherie Zhang, 2023 McKinsey China Consumer Report , McKinsey, December 2022.