We couldn’t find any results matching your search.

Please try using other words for your search or explore other sections of the website for relevant information.

We’re sorry, we are currently experiencing some issues, please try again later.

Our team is working diligently to resolve the issue. Thank you for your patience and understanding.

- Edit my quotes

Carnival Corporation Common Stock (CCL)

- Nasdaq Listed

- Nasdaq 100

- Summary Live

- Real-Time Live

- After-Hours Live

- Pre-Market Live

- Charts Live

NEWS & ANALYSIS

- Press Releases Live

- Analyst Research Live

- Dividend History

- Historical Quotes

- Historical NOCP

- P/E & PEG Ratios

- Option Chain

- Institutional Holdings

- Insider Activity

- SEC Filings

- Revenue EPS

CCL Dividend History

Dividend history information is presently unavailable for this company. This could indicate that the company has never provided a dividend or that a dividend is pending.

The Dividend History page provides a single page to review all of the aggregated Dividend payment information. Visit our Dividend Calendar : Our partner, Quotemedia, provides the upcoming ex-dividend dates for the next month (Other OTC & OTCBB stocks are not included in coverage for Dividend History). Please note that the dividend history might include the company’s preferred securities as well. Price/Earnings Ratio is a widely used stock evaluation measure. For a security, the Price/Earnings Ratio is given by dividing the Last Sale Price by the Actual EPS (Earnings Per Share).

- Type a symbol or company name. When the symbol you want to add appears, add it to My Quotes by selecting it and pressing Enter/Return.

These symbols will be available throughout the site during your session.

Your symbols have been updated

Edit watchlist.

- Type a symbol or company name. When the symbol you want to add appears, add it to Watchlist by selecting it and pressing Enter/Return.

Opt in to Smart Portfolio

Smart Portfolio is supported by our partner TipRanks. By connecting my portfolio to TipRanks Smart Portfolio I agree to their Terms of Use .

Carnival Corporation

Aum/Mkt Cap

YIELD Annualized forward dividend yield. Multiplies the most recent dividend payout amount by its frequency and divides by the previous close price.

& DIV

Exp Ratio Expense ratio is the fund’s total annual operating expenses, including management fees, distribution fees, and other expenses, expressed as a percentage of average net assets.

CCL | stock

- If the last five payouts show limited variability, we estimate future payouts equal to the most recent one.

- If the last five payouts show variability and are all growing, we estimate future payouts by applying the average growth rate to the most recent payout.

- If the last five payouts show variability and are not all growing, we estimate future payouts by applying the lowest growth rate (negative growth rates included) to the most recent payment.

Ratings - CCL

Dividend Safety

Years of consecutive dividend increase.

Yield Attractiveness

Forward dividend yield

Returns Risk

Returns Potential

Price target upside according to sell-side analysts.

Quant Recommendation - CCL

Ratings analysis incomplete due to data availability. Recommendations not provided.

Maximize Income Goal

See Best High Dividend Stocks Model Portfolio for our top maximize income ideas.

Retirement Income Goal

See Best Dividend Protection Stocks Model Portfolio for our top retirement income ideas.

Monthly Income Goal

See Best Monthly Dividend Stocks Model Portfolio for our top monthly income ideas.

Growth Goal

See Best Dividend Growth Stocks Model Portfolio for our top growth ideas.

Income & Growth Goal

See Best Dividend Stocks Model Portfolio for our top income & growth blend ideas.

Sector Income & Growth Goal

See Best Consumer Discretionary Dividend Stocks Model Portfolio for our top income & growth blend ideas in Consumer Discretionary.

CCL Payout History (Paid, Declared and Estimated)

Download Payouts Data in XLS

CCL Dividend Growth CAGR

Dividend capture strategy for ccl.

Dividend capture strategy is based on CCL’s historical data. Past performance is no guarantee of future results.

Step 1: Buy CCL shares 1 day before the ex-dividend date

Purchase Date (Estimate)

Upcoming Ex-Dividend Date

Step 2: SEll CCL shares when price recovers

Sell Date (Estimate)

Avg Price Recovery

Avg yield on cost

Maximize yield on cost.

Get the best dividend capture stocks for April.

Best Dividend Capture Stocks

News & Research

The market wrap for may 1: reopened economies & a potential covid-19 cure.

Aaron Levitt

Combination of both good and bad news throughout the week managed to place...

Carnival Corp. Suspends Dividend Amid COVID-19 Crisis

Shauvik Haldar

Carnival Corp. Suspends Dividend

Microsoft Corporation Leads 128 Securities Going Ex-Dividend This Week

Check out securities going ex-dividend this week.

Johnson & Johnson Leads 139 Securities Going Ex-Dividend This Week

Dividend Investing Ideas Center

Carnival Cruise Disasters: How the Stock Price Reacted

Shauna O'Brien

There have been many Carnival Cruise disasters over the years. Here's how the...

Dividend University

The Best Luxury Goods Stocks: An Investor's Cheatsheet

Stoyan Bojinov

This article offers a comprehensive look at dividend-paying luxury goods stocks.

Everything Investors Need to Know About Special Dividends

Jared Cummans

Special dividend stocks and how these payouts work.

Company Profile

Company overview.

Exchanges: NYSE

Sector: Consumer Discretionary

Industry: Gaming Lodging Restaurants

No company description available.

Related Companies

Company Name

© 2020  Market data provided is at least 15-minutes delayed and hosted by Barchart Solutions.

Information is provided ‘as is’ and solely for informational purposes, not for trading purposes or advice, and is delayed. To see all exchange delays and terms of use, please see disclaimer

Advertisement

Wait rates are rising, is your portfolio ready.

Critical Facts You Need to Know About Preferred Stocks

Have you ever wished for the safety of bonds, but the return potential...

Earn More With Dividend Stocks Than With Annuities for Your Retirement

If you are reaching retirement age, there is a good chance that you...

- Price history

- More Price history P/E ratio P/S ratio P/B ratio Operating Margin EPS Stock Splits Dividend yield Shares outstanding Fails to deliver Cost to borrow Total assets Total liabilities Total debt Cash on Hand Net Assets

Dividend history for Carnival Corporation (CCL)

Carnival Corporation (stock symbol: CCL) made a total of 127 dividend payments. The sum of all dividends (adjusted for stock splits) is : $22.62 Dividend yield (TTM) : 0.00% See Carnival Corporation dividend yield history

Dividend payments for Carnival Corporation (CCL) from 1988 to 2020

Annual dividend payments, list of all dividend payments, dividend payments for similar companies or competitors, what is the market capitalization of a company.

The market capitalization sometimes referred as Marketcap, is the value of a publicly listed company. In most cases it can be easily calculated by multiplying the share price with the amount of outstanding shares.

CompaniesMarketCap is receiving financial compensation for Delta App installs. CompaniesMarketCap is not associated in any way with CoinMarketCap.com Stock prices are delayed, the delay can range from a few minutes to several hours. Company logos are from the CompaniesLogo.com logo database and belong to their respective copyright holders. Companies Marketcap displays them for editorial purposes only.

- Privacy policy

- Terms and conditions

© 2024 CompaniesMarketcap.com

- Top Dividend Paying Stocks

- Reliable Dividend Stocks

- Dividend Stock Calendar

- Dividend Glossary

Carnival Corp. (Paired Stock) (CCL) Dividend History

Carnival Corporation & plc is a British-American cruise operator, currently the world's largest travel leisure company, with a combined fleet of over 100 vessels across 10 cruise line brands. A dual-listed company, Carnival is composed of two companies, Panama-incorporated US-headquartered Carnival Corporation and UK-based Carnival plc, which function as one entity. Carnival Corporation is listed on the New York Stock Exchange and Carnival plc is listed on the London Stock Exchange. Carnival is listed in both the S&P 500 and FTSE 250 indices. The Panama-incorporated entity Carnival Corporation has headquarters in the United States, with operational headquarters located in the city of Doral, Florida. The UK entity Carnival plc is based in Southampton.

Last update 04/05/2024

Dividend Yield Summary

Divinfo metrics ™, dividend history, dividend resources.

- Best Dividend Paying Stocks

- Dividend Broker Tips

- Dividend Investing vs. Buy Low, Sell High

- Dividend Reinvestment Plans (DRIP)

- What Affects Dividend Payouts?

- When You Should Buy Dividend Stocks

- DRIPS Offer Many Benefits to Investors

What cruise line stocks pay dividends? (2024)

- 1. Which Cruise Line has the best balance sheet?

- 2. Are cruise stocks good to buy now?

- 3. What are the benefits of owning 100 shares of Carnival stock?

- 4. How much dividends does Royal Caribbean pay?

- 5. Will carnival pay a dividend?

- 6. Which is a better stock to buy Carnival or Norwegian?

- 7. Is Norwegian Cruise Line a good stock to buy?

- 8. Is Carnival stock a good buy now?

- 9. Will cruise line stocks ever recover?

- 10. Is Carnival stock a buy or sell?

- 11. What is the highest Carnival cruise stock has been?

- 12. Why is Carnival stock dropping?

- 13. How much would it cost to buy 100 shares of Carnival stock?

- 14. What do Carnival shareholders get?

- 15. Does Royal Caribbean pay dividends in 2021?

- 16. Does Norwegian Cruise Line stock pay dividends?

- 17. Did Royal Caribbean suspend dividends?

- 18. Is Carnival cruise a good stock to buy?

Which Cruise Line has the best balance sheet?

First of all, Royal Caribbean is a top operator. One of its brands celebrity was named US News best cruise line for the money. Another brand Royal Caribbean International, they finished tied for second. Secondly, this is the best balance sheet in the industry.

If you hold a minimum of 100 shares of Carnival Corporation stock, you'll receive an onboard credit of $250 per cabin for cruises of 14 days or longer, $100 for cruises of seven to 13 days and $50 for cruises of six days or fewer . (Note that by “days,” Carnival means nights on board.)

The current TTM dividend payout for Royal Caribbean Cruises (RCL) as of August 25, 2022 is $0.00. The current dividend yield for Royal Caribbean Cruises as of August 25, 2022 is 0.00% .

A halt in dividend payments: Carnival has also stopped paying dividends to its shareholders in 2020 and 2021 and does not plan to pay dividends in 2022 , which may deter some investors from buying the stock.

The Bottom Line While both CCL and NCLH are expected to benefit, CCL looks more attractive at current levels because of its superior financials, lower valuation, and better growth prospects .

According to TipRanks' analyst rating consensus, NCLH stock comes in as a Moderate Buy . Out of 10 analyst ratings, there are five Buy recommendations and five Hold recommendations. The average Norwegian Cruise Lines price target is $22.00, implying an upside of 90.48%.

Analysts forecast its recovery to continue and anticipate 60% revenue growth in 2023 . They also believe Carnival will earn nearly $1 per share in 2023. That would amount to a 2023 forward price-to-earnings (P/E) ratio of just nine if it holds.

Revenue per share has recovered from the near-zero levels reached in the second half of 2020 and the first half of 2021, and while earnings per share is still negative, the bottom line is recovering .

17 Wall Street research analysts have issued "buy," "hold," and "sell" ratings for Carnival Co. & in the last year. There are currently 4 sell ratings, 8 hold ratings and 5 buy ratings for the stock. The consensus among Wall Street research analysts is that investors should "hold" CCL shares .

What is the highest Carnival cruise stock has been?

Historical daily share price chart and data for Carnival since 1989 adjusted for splits. The latest closing stock price for Carnival as of August 26, 2022 is 9.97. The all-time high Carnival stock closing price was 66.19 on January 29, 2018 .

Summary. Carnival's share price fell by -60% in 1H 2022, because of investors' worries about a weak economy, elevated fuel prices, and the high cost of refinancing or repaying existing debt .

If you buy in at a particularly low-cost time, you can get 100 stocks in Carnival Corp. for less than $2,000 . When prices are closer to the average, you may be investing $4,000 to $5,000, and when prices are particularly high, the price of 100 stocks could be over $6,000.

Carnival Corporation Shareholder Benefit Offer: $250 Onboard Credit per Stateroom on Sailings of 14 days or longer . $100 Onboard Credit per Stateroom on Sailings of 7-13 days. $50 Onboard Credit per Stateroom on Sailings of 6 days or less.

Does Royal Caribbean Cruises pay a dividend? No, RCL has not paid a dividend within the past 12 months . If you're new to stock investing, here's how to buy Royal Caribbean Cruises stock.

Norwegian Cruise Line (NCLH) does not pay a dividend .

Royal Caribbean (NYSE: RCL) suspended its dividend payments and all stock buybacks during the COVID-19 pandemic , and now says that after restructuring its debt with lenders, it is prohibited from restarting either program until after the third quarter of 2022.

Author : Cheryll Lueilwitz

Last Updated : 30/03/2024

Views : 6509

Rating : 4.3 / 5 (74 voted)

Reviews : 89% of readers found this page helpful

Name : Cheryll Lueilwitz

Birthday : 1997-12-23

Address : 4653 O'Kon Hill, Lake Juanstad, AR 65469

Phone : +494124489301

Job : Marketing Representative

Hobby : Reading, Ice skating, Foraging, BASE jumping, Hiking, Skateboarding, Kayaking

Introduction : My name is Cheryll Lueilwitz, I am a sparkling, clean, super, lucky, joyous, outstanding, lucky person who loves writing and wants to share my knowledge and understanding with you.

Without advertising income, we can't keep making this site awesome for you.

- Royal Caribbean Cruises-stock

- News for Royal Caribbean Cruises

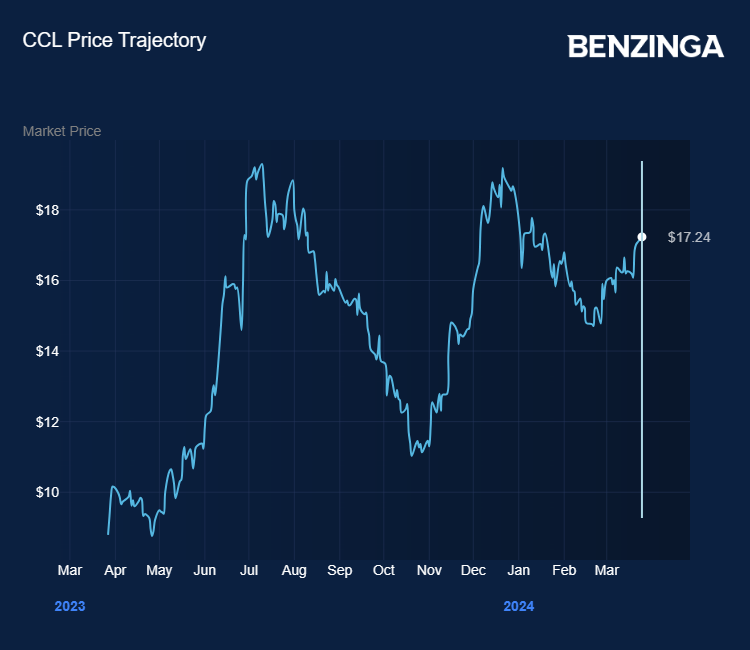

Can Carnival Stock Cruise Higher After Q1 Earnings?

Carnival Corp (NYSE:CCL) will report its first-quarter earnings on Wednesday, March 27, and while the company hasn’t yet fully recovered from the effects of the COVID-19 pandemic, like its sector rivals, Carnival is seeing strong growth in demand.

Carnival stock navigated extremely rough waters in the past four years, but revenues are rising and losses are easing.

The company said in its 2023 annual report that full-year revenues hit a record $21.6 billion and that it entered 2024 with its “best-booked position on record” for both price and occupancy.

Read Also: Norwegian Cruise Line Sets Sail For Stellar Outlook; Stock Jumps

However, the company is still struggling for profitability as its costs have risen and it repays the large debt pile accumulated during the pandemic. While operating profit rose significantly to $1.91 billion, it recorded a net loss of $74 million — although this was massively reduced from the net loss of $6 billion from the year before.

When Carnival reports its December-February quarter earnings on Wednesday, the company is expected to post $5.4 billion in revenues, up 22% from the same quarter last year, and a loss of $0.17 per share, an improvement of 69%.

Royal Caribbean, Norwegian Cruise Line Results Impress

Rival Royal Caribbean Group Ltd. (NYSE:RCL) recovered strongly since the pandemic. After reporting last month annual revenues of $13.9 billion and net income of $1.7 billion for its full year the company said “2023 was an exceptional year” and added it expected record earnings in 2024.

Just a couple of days later Norwegian Cruise Line Holdings Ltd (NYSE:NCLH) was also upbeat about its 2024 prospects after reporting forecast beat fourth-quarter revenues.

Shares in Carnival are down about 1% in 2024, but have risen 16% over the past four weeks. Royal Caribbean shares are up 5.5% on the year, and up nearly 19% in the past four weeks since it raised its 2024 outlook. Norwegian Cruise Line is up fractionally on the year, but has soared nearly 30% since its Q4 results and outlook.

Analyst Update

“With Royal Caribbean raising its full-year 2024 outlook in late February, the bar is set high for Carnival,” said Christopher Stathoulopoulos , analyst at Susquehanna Financial Group.

He added: “Ahead of Carnival’s first-quarter results this Wednesday, we are updating our estimates for FY24 & FY25, with our FY24 estimates for earnings reflecting the impact of the rerouting and cancellation of certain itineraries around the Red Sea,” estimated at $0.075 in adjusted earnings per share, or $95 million adjusted net income, “and what we believe will be outperformance in unit revenue.”

While cruise operators have enjoyed a resurgence in recent months, the exchange-traded fund that tracks them, as well as hotels and airlines, failed to fully take off as troubles with Boeing Co (NYSE:BA) jets have hampered the performance of airline stocks. Indeed, Southwest Airlines Company (NYSE:LUV) is the worst-performing stock on the S&P 500 over the past month, down 17%.

The Defiance Hotel, Airline, and Cruise ETF (NYSE:CRUZ) gained 3.7% during 2024.

Now Read: The Carnival Is Not Over: A Remarkable Bounceback For Cruise Industry After Punishing 2 Years

Photo: Viola from Pixabay

Carnival News MORE

Related stocks.

Technical Analysis of Carnival Corporation

The technical analysis of Carnival Corporation indicates that the stock is currently trending sideways. This means that the stock price has been moving within a relatively narrow range without a clear direction or trend. This sideways movement suggests a period of consolidation and indecision among market participants.

Furthermore, on a relative basis, the stock is rolling over. This indicates a relative underperformance compared to a benchmark index or its industry peers. This relative weakness suggests that the stock is facing challenges or lacks the same level of buying interest as its counterparts.

Investors should closely monitor the stock's performance and consider the implications of the sideways trend and relative underperformance. It is important to assess the potential risks associated with investing in a stock that is trending sideways and rolling over on a relative basis.

- Our Analysts

- Free Reports

- Newsletters

- My Services

- Portfolio Tracker

- Manage Account

The 3 Best Cruise Stocks to Buy in April 2024

Here are just a few of the top cruise stocks to buy and hold today

Advertisement

- These three cruise stocks should see smooth sailing ahead.

- Royal Caribbean ( RCL ): The company also increased its adjusted EPS guidance to $9.90 to $10.10 for the full year, as compared to earlier guidance of $9.50 to $9.70.

- Carnival ( CCL ): Stifel reiterated a buy rating on the CCL stock with a price target of $25.

- Defiance Hotel Airline and Cruise ETF ( CRUZ ): Diversify ahead of travel season with this ETF.

Source: Kokoulina / Shutterstock.com

It’s been smooth sailing again for some of the best cruise stocks to buy in April.

Most have enjoyed considerable upside over the last few months. All as consumers all over the world flock to cruise ships in record numbers again. It’s been so hot, that Viking Holdings recently announced it filed with the Security & Exchange Commission (SEC) to take its shares public. And

Even better, according to Reuters, travelers have been booking cruises for 2024 at “greater volumes” than even before the pandemic. About 35.7 million consumers are expected to cruise this year alone, up from 31.5 million in 2023.

Although many of the top cruise stocks have sailed higher, there’s even more upside ahead. Here are three of the best cruise stocks to buy in April.

Royal Caribbean (RCL)

Since bottoming out at around $35 in mid-2022, Royal Caribbean (NYSE: RCL ) is now up to $138.49. Stretched here, and overdue for a healthy pullback, I’d use any weakness as an opportunity to buy. After all, demand isn’t slowing. And unless something catastrophic happens to the overall economy, RCL should see even more smooth sailing ahead.

Royal Caribbean recently posted nearly $14 billion in total revenue in its most recent quarter — all thanks to very strong demand, and record-breaking bookings, which RCL expects to continue.

The company also increased its adjusted earnings per share ( EPS ) guidance to $9.90 to $10.10 for the full year, as compared to earlier guidance of $9.50 to $9.70. “For 2024, all four quarters and all key products are booked ahead of the same time last year in both rate and volume. Consumer spending for onboard purchases continues to exceed prior years driven by greater participation at higher prices, indicating quality and healthy future demand,” the company said .

Royal Caribbean also just launched a new ship, the Icon of the Seas .

Analysts over at Macquarie also just raised their price target to $160 from $145, with an outperform rating. The firm cited strength in demand.

Carnival (CCL)

Another one of the best cruise stocks to buy in April is Carnival (NYSE: CCL )(NYSE: CUK ), where I’d use weakness as an opportunity.

After rallying from a 2022 low of $6.15 to a recent high of $15.14, it’s pulling back after failing at double-top resistance. Plus, it did warn that the Baltimore bridge collapse would cut into its profits by about $10 million. Still, CCL is an attractive bet with the overall industry sailing higher.

Two, company earnings have been solid. Revenues of $5.4 billion were up 22% year over year . Operating profits of $276 million even marked the fourth consecutive quarter of being in the black. First-quarter customer deposits were above $7 billion, which is considerably higher than the $5.7 billion in bookings year over year.

CCL’s cash flow even improved to $1.8 billion, which was a sizable jump from the $400 million booked a year earlier.

Analysts at Stifel reiterated a buy rating on the CCL stock with a price target of $25. The firm says that if consumer demand holds up, CCL should beat its guidance for 2024.

Defiance Hotel Airline and Cruise ETF (CRUZ)

Or, if you’d rather diversify at a low cost of less than $23 a share, there’s the Defiance Hotel Airline and Cruise ETF (NYSEARCA: CRUZ ).

After bottoming out at around $17 in late 2023, the ETF rallied to a high of about $23. Now trading at $22.25 after a slight pullback, I’d use that weakness as an opportunity.

With an expense ratio of 0.45% , the ETF tracks 62 stocks in the — you guessed it — the hotel, airline, and cruise industries. Some of its top holdings include Hilton Worldwide (NYSE: HLT ), Marriott International (NASDAQ: MAR ), Royal Caribbean, Carnival, Delta Air Lines (NYSE: DAL ), and United Airlines (NASDAQ: UAL ) to name a few of the top ones.

In short, not only do you get solid exposure to top cruise stocks, but also some of the best hotel and airline stocks on the market. All for less than $23 a share. Better, with summer vacations nearing, all three industries could see further solid upside.

On the date of publication, Ian Cooper did not hold (either directly or indirectly) any positions in the securities mentioned. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.

Ian Cooper, a contributor to InvestorPlace.com, has been analyzing stocks and options for web-based advisories since 1999.

Consumer Discretionary , Cruise , Travel

Growth Stocks

Article printed from InvestorPlace Media, https://investorplace.com/2024/04/the-3-best-cruise-stocks-to-buy-in-april-2024/.

©2024 InvestorPlace Media, LLC

Subscriber Sign in

Not Yet a Premium Subscriber?

4 Reasons Carnival Stock Looks Like a Screaming Buy

Carnival (NYSE: CCL) stock is still recovering from the pandemic. At around $16 a share, the stock is still nowhere near the $50-plus price tag it was trading at in late 2019.

The company accumulated debt during the past few years as the business struggled with factors outside of its control, but things have been improving significantly for Carnival.

Although the stock rallied 60% in the past 12 months, here are four reasons it still looks like a screaming buy today.

1. A positive operating profit for four straight quarters

Last month, Carnival reported its first-quarter earnings, for the period that ended Feb. 29. Not only did revenue totaling $5.4 billion rise 22% year over year, but the cruise ship operator also posted an operating profit of $276 million. It marked the fourth consecutive quarter when its operating profit was in the black.

The company did incur a net loss last quarter, but that was largely due to interest expenses. In terms of actual operating activities, it was profitable, and that's an important factor since operating income can be a better reflection of how the business itself is actually doing on a day-to-day basis because it comes before other income and expense items.

2. Bookings are at all-time highs

The cruise business is looking incredible; demand isn't abating. Even though prices are higher, Carnival says its booking volumes for the first quarter were again at record levels and exceeded expectations.

In the first quarter, customer deposits topped $7 billion, which is higher than the previous record Carnival posted in the first quarter last year, when they totaled $5.7 billion.

The strong booking numbers and customer deposits suggest that unlike many other industries, the cruise business might be inflation resistant since it caters to a more affluent customer base.

3. Free cash flow shows significant improvement

Another number that is key for investors to watch is cash flow. Carnival's $28.5 billion long-term debt is a big reason many investors are wary about investing in the stock right now. But the company is in good shape to bring that balance down, as its business is posting operating profits and generating plenty of strong cash flow.

During the quarter, Carnival's operating cash flow was a positive $1.8 billion, which is a huge improvement from the $400 million it generated in the same period last year. And adjusted free cash flow of $1.4 billion also looked incredibly strong compared with the $144 million in adjusted free cash that it reported a year ago.

4. A modest forward P/E multiple makes this a fairly cheap buy

Despite the positive results, the stock isn't trading as high as it probably should be at just 15 times its estimated future earnings (based on analyst expectations). That's a dirt-cheap multiple for a growing business that's showing resiliency at a time when many companies are struggling. By comparison, the average stock on the S&P 500 trades at nearly 22 times its future profits.

While there is risk, particularly relating to Carnival's debt -- which might suggest a discount is warranted -- the company is proving to be on positive path. Not only is demand strong, but its financials are also in much better shape than they were even a year ago.

Carnival is an underrated stock to load up on right now

As interest rates are likely to come down, many investors might soon become more bullish on Carnival's stock, especially with its results looking a whole lot stronger of late. But buying the travel stock before that happens could set investors up for even better long-term returns.

Should you invest $1,000 in Carnival Corp. right now?

Before you buy stock in Carnival Corp., consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Carnival Corp. wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

See the 10 stocks

*Stock Advisor returns as of April 1, 2024

David Jagielski has no position in any of the stocks mentioned. The Motley Fool recommends Carnival Corp. The Motley Fool has a disclosure policy .

IMAGES

VIDEO

COMMENTS

Stay up-to-date on Carnival Corporation Common Stock (CCL) Dividends, Current Yield, Historical Dividend Performance, and Payment Schedule.

Dividend Summary for ticker CCL - Carnival Corporation & plc. *The ex-dividend date is November 20, 2007 for shares traded on the NYSE (because of the Thanksgiving holiday in the U.S.) and November 21, 2007 for shares traded on the LSE. The historical dividend information provided is for informational purposes only, and is not intended for ...

In the not-so-distant past, cruise ship operator Carnival Corporation (CCL-1.26%) (CUK-0.97%) was a predictable, high-yield dividend stock. The company's most recent dividend payout streak started ...

Norwegian Cruise Line Holdings Ltd. $18.83. ... 4 Reasons Carnival Stock Looks Like a Screaming Buy. ... The ratio of annual dividend to current share price that estimates the dividend return of a ...

Get the latest dividend data for Carnival Corporation & plc (CCL), including dividend history, yield, key dates, growth and other metrics. ... Carnival Cruise Line warns of possible $10M profit hit from Baltimore bridge collapse - New ... Carnival Stock Rises After Posting Smaller-Than-Expected Q1 Loss - Investopedia ; 6 days ago - Carnival ...

Dividend capture strategy is based on CCL's historical data. Past performance is no guarantee of future results. Step 1: Buy CCL shares 1 day before the ex-dividend date. Purchase Date (Estimate) N/A. Upcoming Ex-Dividend Date. N/A. Step 2: SEll CCL shares when price recovers.

In addition to debt maturities, CCL has 14 new ships on order, and the CapEx requirements for those will further suck up liquidity. According to CCL, their Cap-Ex costs will be as follows: $3.421 ...

Carnival CCL stock price quote (NYSE: CCL), stock rating, ... Dividend Yield (Trailing) ... Norwegian Cruise Line Holdings Ltd. NCLH

Historical dividend payout and yield for Carnival (CCL) since 1991. The current TTM dividend payout for Carnival (CCL) as of March 27, 2024 is $0.00. The current dividend yield for Carnival as of March 27, 2024 is 0.00%. Carnival Corporation operates as a cruise and vacation company.

Find the latest Carnival Corporation & plc (CCL) stock quote, history, news and other vital information to help you with your stock trading and investing.

Carnival annual total common and preferred stock dividends paid for 2021 were $0B, a 100% decline from 2020. Carnival Corporation operates as a cruise and vacation company. As a single economic entity, Carnival Corporation & Carnival plc forms the largest cruise operator in the world.

Carnival's Automatic Dividend Reinvestment Plans provide holders of the Corporation's Common Stock and Carnival plc's ordinary shares with a convenient and economical method of reinvesting cash dividends in additional shares without paying any brokerage commissions or service charges. ... Carnival Cruise Line, also known as America's Cruise ...

Carnival Cruise Line Inc., CCL for short, is a cruise line an American cruise line company. Market cap; Revenue; Earnings; Price history; P/E ratio; ... The sum of all dividends (adjusted for stock splits) is : $22.62 Dividend yield (TTM) : 0.00% See Carnival Corporation dividend yield history. Dividend payments for Carnival Corporation (CCL ...

Here's a step-by-step guide to adding the cruise stock to your portfolio. Step 1: Open a brokerage account. First, open and fund a brokerage account before buying shares of any stock. Here are ...

Carnival Corp. (Paired Stock) (CCL) Dividend History. Carnival Corporation & plc is a British-American cruise operator, currently the world's largest travel leisure company, with a combined fleet of over 100 vessels across 10 cruise line brands. A dual-listed company, Carnival is composed of two companies, Panama-incorporated US-headquartered ...

Carnival Corp. (CCL) Announces Extension of the Carnival Corporation Common Stock Share Sale and Carnival plc Share Purchase Program. Carnival Corp. (CCL) Declares $0.50 Quarterly Dividend; 3.9% ...

Is Carnival Cruise Lines a buy? Despite Carnival stock's run-up in 2023, it is still down roughly 80% from its all-time high, and management is unlikely to reinstate its dividend anytime soon.

Carnival Corporation Orders an Additional Excel-Class Ship for Carnival Cruise Line, the Line's 5th Excel-Class Ship and the 11th Across the Global Fleet PR Newswire Mar 26, 2024 2:00pm

The current TTM dividend payout for Royal Caribbean Cruises (RCL) as of August 25, 2022 is $0.00. The current dividend yield for Royal Caribbean Cruises as of August 25, 2022 is 0.00%. (Video) Buy These 3 High-Yield Stocks if You're in Your 60s | Cruise into Retirement. (Dividends And Income)

When Carnival reports its December-February quarter earnings on Wednesday, the company is expected to post $5.4 billion in revenues, up 22% from the same quarter last year, and a loss of $0.17 per ...

This benefit is available to shareholders holding a minimum of 100 shares of Carnival Corporation or Carnival plc. Employees, travel agents cruising at travel agent rates or interline rates, tour conductors or anyone else cruising at a reduced-rate or on complimentary basis are excluded from this offer. This benefit is non-transferable, cannot ...

Cruise line passengers are expected to increase 20% compared to 2019 levels. Carnival's leading market share in the industry will boost its topline this year. I expect Carnival to post a net ...

Carnival plans to expand capacity and increase onboard spending to enhance revenue. Holding a 39.5% market share, Carnival is ahead of Royal Caribbean and Norwegian Cruise Lines. Projected annual ...

Famous cruise line Carnival Corporation (CCL-4.80%) has been a hot stock over the past year. Shares have nearly doubled. Investors buying the stock as a play on recovering consumer spending ...

Carnival Corporation is a global cruise company that operates a fleet of cruise ships under various brands, including Carnival Cruise Line, Princess Cruises, and Holland America Line. ... The technical analysis of Carnival Corporation indicates that the stock is currently trending sideways. This means that the stock price has been moving within ...

The company also increased its adjusted earnings per share ( EPS) guidance to $9.90 to $10.10 for the full year, as compared to earlier guidance of $9.50 to $9.70. "For 2024, all four quarters ...

Tesla (TSLA) disappoints with Q1 deliveries, SoundHound AI (SOUN) faces fallout from short seller report, and Carnival Cruise Lines (CCL) struggles post-earnings. Technical analysis reveals ...

Although the stock rallied 60% in the past 12 months, here are four reasons it still looks like a screaming buy today. 1. A positive operating profit for four straight quarters. Last month ...

The past few years have been tough on Carnival Corp. (CCL-1.82%). The cruise line operator's revenue plunged in 2020 and 2021 as global travel ground to a halt during the pandemic, and it was ...

The company's boards of directors approved a record date for the quarterly dividend of February 21, 2020, and a payment date of March 13, 2020. Holders of Carnival Corporation common stock and Carnival plc ADSs will receive the dividend payable in U.S. dollars. The dividend for Carnival plc ordinary shares will be payable in U.S. dollars or ...