Don't risk your international trips Get your Travel Insurance Now We also cover Coronavirus hospitalisation -->

#1.5 crore+.

Happy Customers

Cashless Hospitals

24x7 In-house

Claim Assistance

Travel Insurance for Schengen VISA from India

The Schengen Visa, pivotal for seamless travel across 26 European countries, demands careful preparation, including the essential element of travel insurance. This visa encompasses nations like France, Germany, Italy, and Spain, allowing travellers to move freely within this territory. When applying from India, obtaining Schengen Visa insurance becomes imperative. Travel insurance for Schengen Visa from India must meet specific requirements. It should cover medical emergencies, repatriation, and other unforeseen circumstances up to €30,000 or more. The insurance also needs to be valid throughout the Schengen Area and for the entire duration of your stay.

Numerous insurance providers offer tailored packages meeting these criteria, facilitating a hassle-free application process. While purchasing, ensure the policy explicitly mentions "Schengen Visa insurance" to avoid complications during the visa application. It's prudent to compare different plans, considering coverage, premium, and additional benefits. Securing adequate travel insurance for Schengen Visa from India is not just a formality but a crucial aspect in ensuring a smooth and safe European excursion. Thus, selecting the right international travel insurance plan is pivotal for a stress-free travel experience.

Why Do You Need Schengen Travel Insurance?

Schengen travel insurance safeguards against unforeseen incidents, vital for hassle-free travel in Europe. Schengen Travel Insurance is indispensable for various reasons specific to the Schengen Visa, here are some:

• Travel Disruption Coverage: It safeguards against trip cancellations or interruptions due to unforeseen events like natural disasters or sudden illness before departure.

• Legal Protection: In the unfortunate event of accidents causing harm to others or property damage, Schengen travel insurance covers legal expenses and liabilities, averting financial strains.

• Peace of Mind: Having comprehensive Schengen Visa insurance ensures a worry-free exploration of the Schengen Area, allowing travellers to focus on their itinerary rather than potential financial burdens in emergencies.

• Emergency Assistance Abroad: It provides 24/7 support and assistance during unforeseen events such as loss of passport, flight cancellations, or emergency medical evacuations.

• Mandatory Requirement: Schengen Visa authorities necessitate adequate travel insurance for Schengen Visa from India or any other non-Schengen country. It's a prerequisite for visa approval.

• Visa Application Compliance: Without valid Schengen Visa insurance meeting specific criteria, your visa application might be rejected, causing delays and additional expenses in reapplication.

• Healthcare Coverage: Schengen travel insurance ensures coverage for medical emergencies up to €30,000 or more, including hospitalization, medicines, and repatriation in case of severe illness or accidents.

Benefits of Schengen Travel Insurance

Schengen travel insurance offers peace of mind and essential coverage for seamless exploration within Europe's Schengen Area. Here are some to look out for:

Comprehensive Medical Coverage

It provides extensive coverage for medical emergencies, ensuring peace of mind during your travels through the Schengen countries.

Financial Safeguard

Protects against unexpected expenses due to medical emergencies, flight cancellations, or lost baggage, reducing financial burdens while abroad.

24/7 Assistance

Offers 24/7 assistance for various crises, including medical evacuations, ensuring immediate support during unforeseen situations.

Requirement fulfilment

It is mandatory for Schengen Visa applications, ensuring compliance and increasing the chances of successful visa approval.

Repatriation Assistance

Offers support for emergency repatriation in case of severe illness, injury, or unfortunate incidents, ensuring a safe return to the home country.

Trip Cancellation Protection

Covers expenses in case of trip cancellations or interruptions due to unforeseen circumstances, allowing for rescheduled travel without added financial strain.

Family Coverage Options

Many policies include options to cover family members travelling together, providing comprehensive protection for the entire group.

Multi-Country Access

One policy covers travel across multiple Schengen countries, eliminating the need for separate insurance for each country visited within the Schengen Zone.

Value for money

Despite varying coverage levels, Schengen travel insurance offers excellent value for the coverage provided, making it a worthwhile investment for travellers.

Which are the Schengen Countries?

The Schengen Agreement, signed in 1985, created a borderless zone within Europe, comprising 26 countries to facilitate unrestricted movement. These Schengen countries include 22 European Union (EU) member states and four non-EU nations.

These countries collectively form the Schengen Area, offering travellers the opportunity to explore diverse cultures, landscapes, and histories without internal border checks, requiring a single travel insurance for Schengen Visa to access this enthralling zone.

Did you know?

It is mandatory to have a valid travel health insurance policy to enter any of the schengen area countries., who is eligible to travel across schengen visa permitted states.

All Indian citizens as well as citizens of other countries that are currently legally residing in India can apply for a Schengen VISA in India. Other Indian citizens currently residing elsewhere may only apply for a Schengen VISA in India if they are legally present there and provide a justification for doing so while in India rather than in their current country of residence.

Travel insurance for Schengen VISA requirements

Schengen Visa applications mandate specific travel insurance for Schengen Visa as a critical component. To meet these stringent requirements, the insurance must fulfil certain criteria:

Validity Period

The insurance coverage must be valid for the entire duration of the intended stay within the Schengen Area and should cover any potential extension periods.

Coverage Amount

The policy should provide coverage of at least €30,000 or its equivalent in Indian Rupees for medical emergencies, including repatriation for medical reasons and urgent medical attention.

Territorial Coverage

It's crucial that the insurance coverage extends to all the Schengen countries, ensuring comprehensive protection across the entire zone.

Insurance Provider Credibility

Opting for insurance from reputable and recognized providers ensures that the policy meets all necessary Schengen Visa insurance prerequisites, reducing the risk of rejection due to inadequate coverage or policy discrepancies.

Comprehensive Coverage

The insurance should encompass various potential risks, such as medical emergencies, accidents, repatriation, and liabilities, providing a comprehensive safety net during the travel period.

What is Travel Insurance for Schengen VISA?

Travel Insurance for Schengen Visa is a specialized insurance policy designed to meet the specific requirements set forth by the Schengen Zone for individuals applying for a Schengen Visa. This insurance serves as a crucial prerequisite for the visa application process. It offers comprehensive coverage, typically including medical emergencies, repatriation, and liabilities, ensuring travellers are protected throughout their stay within the Schengen Area.

Key components of this insurance encompass a minimum coverage amount of €30,000 or more, no deductibles, and validity spanning the entire duration of the intended stay. This coverage extends across all 26 Schengen countries, providing a safety net against unforeseen circumstances like accidents or sudden illnesses while travelling. Travellers from countries like India intending to explore the Schengen region must procure this insurance to fulfil visa requirements and ensure financial security and peace of mind during their European journey.

Searching for affordable travel insurance?

Get quick quotes on your favourite plan in just a few clicks, types of schengen visas.

The Schengen Area offers various types of visas catering to diverse travel purposes, each designed to meet specific needs:

Understanding these distinct Schengen Visa types is crucial, as each serves a specific purpose and duration of stay within the Schengen Area, offering flexibility for various travel needs and durations.

Documents Required for a Schengen Visa

Here are the required documents for a short-term Schengen visa application:

General Requirements:

• Visa Application Form: Completely filled and signed.

• Recent Photos: Two recent photos meet specific requirements.

Passport and Travel Information:

• Round Trip Itinerary: Details of entry and exit flights or reservations, indicating travel dates within Schengen.

• Valid Passport: Not older than 10 years, valid for at least 3 months beyond the intended departure from Schengen.

Financial and Insurance Documents:

• Proof of Accommodation: Booking details or invitation confirming where you'll stay in Schengen.

• Travel Health Insurance: Covering €30,000 for medical emergencies, available from providers like Europ Assistance.

• Paid Visa Fee: €80 for adults, €45 for children aged 6 to 12.

• Financial Means Proof: Options include bank statements, sponsorship letters, or a combination thereof.

Employment and Specific Situations:

• For Self-Employed: Business license, company bank statements, and income tax returns.

• For Employees: Employment contract, bank statements, leave permission, and income tax-related documents.

• For Students: Enrollment proof and a no-objection letter from the school/university.

• For Minors: Birth certificate, signed application by both parents, family court order (if applicable), ID/passport copies of both parents and parental authorization for minors travelling alone, duly notarized.

• For Unemployed Married to EU Citizens: Confirmation of employment from the spouse, marriage certificate, and spouse's passport.

• For Retirees: Pension statements for the last 6 months.

Ensuring all necessary documents are in order according to your specific situation greatly enhances the chances of a successful Schengen visa application.

What Is the Schengen Visa Procedure?

The Schengen Visa application process follows a structured procedure aimed at ensuring seamless travel within the Schengen Area:

• Identify the appropriate visa type based on the purpose and duration of the visit (tourism, business, family visit, etc.).

• Choose the Schengen country's embassy or consulate where the application will be lodged. This is usually the primary destination or the country of the longest stay.

• Compile all necessary documents such as completed application form, passport, photos, travel itinerary, health insurance, financial proofs, and specific documents based on employment, student status, or other situations.

• Schedule an appointment with the selected embassy/consulate for visa submission. Some locations might require prior appointment bookings.

• Attend the appointment or submit the application in person, providing biometric data (if required) and paying the visa fee.

• Allow the embassy/consulate time to process the application. Processing times vary but can take up to 15 calendar days.

• Receive the decision on the visa application. It can be approved, or denied, or additional documentation may be requested.

• Upon approval, collect the passport with the issued visa from the embassy/consulate or through a designated courier service.

• With the obtained visa, travel freely within the Schengen countries, ensuring to adhere to the visa's conditions regarding duration of stay, purpose, and other stipulations.

This systematic process ensures compliance with Schengen regulations and facilitates a hassle-free experience for travellers exploring the diverse and captivating Schengen Zone.

What Does The Schengen Travel Insurance Policy From Cover?

Here are the coverage offered by HDFC Ergo for their Schengen Travel Insurance Policy:

- Medical Coverage

- Journey-Related Coverage

- Baggage-Related Coverage

Trip Cancellation

Reimburses non-refundable expenses for accommodation, activities, and unexpected trip curtailment.

Flight-related Reimbursements

Covers missed connections, hijack distress, flight delays, cancellations, and trip curtailment.

Emergency Medical Expenses

Covers hospitalization, OPD treatment, ambulance costs, and medical evacuations.

Dental Expenses

Includes dental care during travel, subject to policy terms.

Personal Accident Coverage

Provides financial assistance to the insured's family in case of accidental death or permanent disability.

Emergency Cash Assistance

Facilitates fund transfers from India due to theft or robbery while travelling.

Baggage and Content Coverage

Reimburses for stolen or delayed baggage, ensuring your trip continues smoothly.

Personal Liability

Assists in compensating third-party damages while abroad.

Hospital Cash and Loss of Documents

Pays a daily allowance for hospital stays and covers expenses for lost documents like passports or driving licenses.

Common Carrier Accidents

Provides lump sum payouts for accidental death or disability while using common carriers.

Flight Delay & Cancellation

Flight delays or cancellations may be beyond our control, but worry not, our reimbursement feature allows you to meet any essential expenses arising from the setback.

Trip Delay & Cancellation

In case of a trip delay or cancellation, we will refund the non-refundable portion of your pre-booked accommodation and activities. Subject to policy terms and wordings.

Loss of Passport & International driving license

Losing important documents can leave you stranded in a foreign land. So, we will reimburse expenses related to obtaining a new or duplicate passport and/or international driving license.

Trip Curtailment

Don't worry if you have to cut your trip short due to unforeseen circumstances. We'll reimburse you for your non-refundable accommodation and pre-booked activities as per the policy schedule.

If you ever find yourself liable for third-party damage in a foreign land, our travel insurance helps you compensate for those damages effortlessly. Subject to policy terms and conditions.

Emergency Hotel Accommodation for Insured Person

Medical emergencies may mean you need to extend your hotel booking by a few days more. Worried about the added expense? Let us take care of it while you recover.subject to policy terms and conditions

Missed Flight Connection

Don't worry about unexpected expenses due to missed flight connections; we will reimburse you for the expenses incurred on accommodation and alternate flight booking to reach your destination.

Hijack Distress Allowance

Flight hijacks can be a distressing experience. And while the authorities help sort out the issue, we'll do our bit and compensate you for the distress it causes.

Emergency Cash Assistance Service

When traveling, theft or robbery can lead to a cash crunch. But don't worry; HDFC ERGO can facilitate fund transfers from the insured 's family in India. Subject to policy terms and conditions.

Loss Of Checked-In Baggage

Lost your checked-in baggage? Don't worry; we'll compensate you for the loss, so you don't have to go without your essentials and vacation basics. Subject to policy terms and conditions.

Delay of Checked-In Baggage

Waiting is never fun. If your luggage gets delayed, we'll reimburse you for essentials like clothing, toiletries and medication so you can start your vacation worry-free.

Theft of baggage and its contents

Theft of baggage can derail your trip. So, to ensure your trip stays on track, we'll reimburse you in case of baggage theft. Subject to policy terms and conditions.

What Does The Schengen Travel Insurance Policy Not Cover?

The following are the factors not covered under the Schengen Travel Insurance Policy:

Breach of Law or War

Health issues or sickness resulting from involvement in war activities or illegal actions leading to legal breaches are not covered by the insurance plan.

Intoxicant Substance Consumption

Any claims arising from the consumption of intoxicants or banned substances are not entertained under the policy.

Pre-Existing Diseases

Treatment costs related to illnesses existing before the insured travel period are not covered, including medical care for pre-existing conditions.

Cosmetic and Obesity Treatments

Any expenses incurred for cosmetic or obesity-related treatments during the insured travel are not covered by the policy.

Self-Inflicted Injuries

Hospitalization or medical costs resulting from self-inflicted injuries are not included in the insurance coverage.

Adventure Sports Incidents

Injuries or medical expenses resulting from participation in extreme or adventure sports are not covered.

Non-Medical Evacuation

Costs associated with non-medical evacuation from war zones or conflict areas are not part of the coverage.

High-Risk Activities

Incidents occurring during high-risk activities, such as skydiving or mountaineering, are excluded from the policy coverage.

Non-Compliant Medical Care

Expenses from seeking medical care not compliant with the policy terms and conditions are not reimbursed.

It's crucial to thoroughly review the policy documents to understand the exclusions to avoid any misunderstandings or unexpected expenses during travels within the Schengen Area under the Schengen travel insurance plan from India or any other non-Schengen country.

Why HDFC Ergo?

Here are a few reasons why you should choose HDFC Ergo for your Schengen Travel Insurance:

• 24/7 Support: We prioritize your peace of mind with round-the-clock customer care and dedicated claims approval, offering unwavering support during challenging times.

• Millions Secured: At HDFC ERGO, we've safeguarded over 1 Crore smiles, redefining relationships by consistently delivering reliable and affordable insurance solutions.

• No Health Check-ups: Enjoy hassle-free HDFC ERGO Travel Insurance without the need for any health examinations before obtaining your policy.

• Paperless Convenience: Embracing a digital world, we offer an online policy issuance process with minimal documentation, ensuring your policy lands directly in your inbox.

At HDFC ERGO, we strive to redefine the insurance experience, providing accessible, dependable, and flexible travel insurance solutions tailored for various travel needs, including those seeking Schengen visa insurance from India.

International Travel Insurance for Most Visited Countries

Take your pick from the options below, so you can be better prepared for your trip to a foreign country

Travel Insurance for

List Of Countries Where Travel Insurance Is Mandatory

Schengen countries.

- the Netherlands

- Switzerland

- Liechtenstein and Luxembourg

Other countries

Source : VisaGuide.World

Read Latest Travel Insurance Blogs

Valentine’s Day 2023: 9 Honeymoon Destinations That You Can Visit Visa-Free

Benefits of Sharing Your Medical History with Your Travel Insurance Provider

How to select a dependable travel health insurance?

A Comprehensive Travel Guide for Singapore

Frequently asked questions, 1. how long should the schengen travel insurance be valid for.

It should cover the entire duration of your intended stay within the Schengen Area, including any extensions if planned, as mentioned in your visa application.

2. Does Schengen Travel Insurance cover pre-existing medical conditions?

Typically, no. Most policies do not cover expenses related to pre-existing medical conditions unless explicitly mentioned otherwise in the policy terms.

3. Can I purchase Schengen Travel Insurance from India?

Absolutely, various insurance providers in India offer Schengen Travel Insurance policies that meet the requirements for obtaining a Schengen visa.

4. What is the minimum coverage required for Schengen Travel Insurance?

The policy must have a minimum coverage of €30,000 or its equivalent in Indian Rupees for medical emergencies, as mandated by Schengen visa requirements.

5. Do I need Schengen Travel Insurance if I have other travel insurance?

It's essential to have specific Schengen Travel Insurance that meets the visa requirements, even if you have other travel insurance. Ensure the policy explicitly mentions coverage for the Schengen Area.

6. Can I buy Schengen Travel Insurance after arriving in a Schengen country?

It's recommended to purchase the insurance before your trip begins. However, some providers might offer options to buy or extend coverage after arrival, but it's advisable to do it beforehand.

7. Does Schengen Travel Insurance cover adventure sports and high-risk activities?

Usually, standard policies might exclude coverage for high-risk activities. If planning such activities, it's wise to check and opt for additional coverage if needed.

Awards & Recognition

BFSI Leadership Awards 2022 - Product Innovator of the Year (Optima Secure)

ETBFSI Excellence Awards 2021

FICCI Insurance Industry Awards September 2021

ICAI Awards 2015-16

SKOCH Order-of-Merit

Best Customer Experience Award of the Year

Icai awards 2014-15.

CMS Outstanding Affiliate World-Class Service Award 2015

iAAA rating

ISO Certification

Best Insurance Company in Private Sector - General 2014

Motor Insurance

Motor Insurance : Car Insurance | Second Hand Car Insurance | Comprehensive Car Insurance | Third Party Car Insurance | Car Insurance Calculator | Compare Car Insurance | Zero Depreciation Car Insurance | Renew Expired Car Insurance | No Claim Bonus | Standalone OD Car Insurance | Return to Invoice | Insured Declared Value | Two Wheeler Insurance | Bike Insurance Calculator | Comprehensive Two Wheeler Insurance | Third Party Two Wheeler Insurance | Compare Two Wheeler Insurance | Standalone OD Bike Insurance | Vehicle Insurance | Commercial Vehicle Insurance | Multi Year Two Wheeler Insurance | Track Break-In Status | Pay as You Drive | Engine Protection Cover

- Health Insurance

Health Insurance : Individual Health Insurance | Family Health Insurance | Parents Health Insurance | Senior Citizen Health Insurance | Health Insurance Renewal | Cashless Health Insurance | Health Insurance Premium Calculator | Personal Accident | my:health Suraksha Silver Smart | my:health Suraksha Gold Smart | my:health Suraksha Platinum Smart | Health Suraksha pre policy checkup status | Medisure Classic/Medisure Super top up pre policy checkup status | my:health Suraksha Silver | my:health Suraksha Silver with ECB&Rebound | my:health Women Suraksha Critical Illness Comprehensive Plan | my:health Women Suraksha CI Essential Plan | my:health Women Suraksha Cancer Plan | my:health Women Suraksha Cancer Plus Plan | my:health Women Suraksha | Arogya Sanjeevani | Health insurance Portability | iCan Health Insurance | Energy Health Insurance | Health Wallet Insurance - Family | Health Wallet Insurance - Individual | Optima Restore - Family | Optima Restore - Individual | Koti Suraksha | Saral Suraksha Bima, HDFC ERGO | Optima Secure | Optima Secure Individual | Optima Secure Global Individual | Optima Secure Global Family | Optima Super Secure Plan | Optima Super Secure Plan Individual | my:health Medisure Super Top Up | BMI Calculator | EquiCover Health | Here.

Pet Insurance

Pet Insurance : Pet Insurance

- Travel Insurance

Travel Insurance : Travel Explorer | Individual Travel Insurance | Family Travel Insurance | Student Suraksha Insurance | Annual Multi-trip Insurance | Travel Insurance For Senior Citizens | Travel Insurance for Schengen VISA from India | Travel Insurance for Australia | Travel Insurance for Bali | Travel Insurance For Canada | Travel Insurance for Dubai | Travel Insurance for France | Travel Insurance for Germany | Travel Insurance for Ireland | Travel Insurance for Italy | Travel Insurance for Japan | Travel Insurance for Malaysia | Travel Insurance for Poland | Travel Insurance for Singapore | Travel Insurance for Spain | Travel Insurance for Switzerland | Travel Insurance for Thailand | Travel Insurance for USA | Travel Insurance for UAE | Travel Insurance for UK | International Travel Insurance

Home Insurance

Home Insurance : Home Insurance For Tenants | Home Insurance For Owners | Home Insurance for Television | Home Insurance for Washing Machine | Home Insurance for Air Conditioner | Home Insurance for Jewellery | Home Insurance for Refrigerator | Home Insurance for Lighting | Home Insurance for Electronic Equipment | Home Insurance for Landslide | Home Insurance for Earthquake | Building Insurance | Property Insurance | Flood Insurance | Monsoon Insurance | Home Content Insurance | Theft Insurance

- Other Insurance

Other Insurance: Cyber Sachet Insurance | Standard Fire&Special Perilis Insurance | Rural Insurance | Casualty Insurance | Group Insurance | Property&Misc Insurance | Risk Consulting Services | Specialty Insurance | Rural Insurance | Other commercial insurance

Expert Profiles

Expert Profiles: Deepika Mathur | Diwaker Asthana | Mukesh Kumar | S.Gopala Krishnan

Customer Reviews

Customer Reviews: Health Insurance | 2 Wheeler Insurance | Private Car Insurance | Critical Illness | Travel Insurance | Personal Accident | Home Insurance | Student Suraksha

Downloads: Brochure | Prospectus | Proposal Form | Policy Wording | Claim form | KYC Form | Other Documents

- Hospital Network

Healthcare Network : Hospital Empanelment form | Product wise cashless services

Procedure to make changes

Procedure to make changes: Health Insurance | Home Insurance | Motor Insurance | Travel Insurance | Personal Accident Insurance

Others: Account aggregator | Insurance FAQs | Glossary | Travel Medi Assist | IRDAI Website | Knowledge Centre | Omicron | Repositories

Read in Hindi

Read in Hindi: Health Insurance Hindi | Car Insurance Hindi | Two Wheeler Insurance in Hindi | Home Insurance in Hindi

Our Promoters

Our Promoters: HDFC Bank | ERGO

Other Important links

Other Important links: HDFC Bank | HDFC Life | HDFC Securities | HDFC Mutual Fund | HDFC Sales | HDB Financial Services | HDFC Pension

PET INSURANCE: UIN: HDFC ERGO Paws n Claws - IRDAN146RP0001V01202324 T&C Apply. @1.51 crores+ active customers as on July 2022

Terms and Conditions Applied. © HDFC ERGO General Insurance Company Limited. CIN: U66030MH2007PLC177117. Registered & Corporate Office: 1st Floor, HDFC House, 165-166 Backbay Reclamation, H. T. Parekh Marg, Churchgate, Mumbai – 400 020. Customer Happiness Center / Policy Issuing Address: D-301, 3rd Floor, Eastern Business District (Magnet Mall), LBS Marg, Bhandup (West), Mumbai - 400 078. For Claim/Policy related queries call us at or Visit Help Section on www.hdfcergo.com for policy copy/tax certificate/make changes/register & track claim. IRDAI Registration Number : 146 (Registration type: General Insurance Company). For more details on the risk factors, terms and conditions, please read the sales brochure/ prospectus before concluding the sale. Trade Logo displayed above belongs to HDFC Bank Ltd and ERGO International AG and used by the Company under license. HDFC Ltd. and HDFC Bank merger stands concluded, effective 1st July, 2023. HDFC ERGO General Insurance Company Limited is now a subsidiary of the Bank.

- Car Insurance

- Single Year Comprehensive Cover

- Third Party Cover

- Compulsory Personal Accident Insurance

- Standalone Car Insurance

Bike/Scooter Insurance

- Long Term Comprehensive Cover

- Standalone Two Wheeler Insurance

- For Individual

- For Parents

- For Senior Citizen

- Optima Secure

- Optima Secure Individual

- Optima Secure Global Individual

- Optima Secure Global Family

- Optima Super Secure plan

- Optima Super Secure plan Individual

- Optima Restore Family Floater

- Optima Restore Individual

- Critical illness Insurance

- Super Top up Insurance

- Corona Kavach Policy

- Arogya Sanjeevani Policy, HDFC ERGO

- Koti Suraksha

- Travel Explorer

- For Frequent Flyers

- For Student

- International Travel Insurance

- For Housing Society

Cyber Insurance

- Cyber Sachet Insurance

Commercial Vehicle Isurance

- Passenger Carrying Vehicle Insurance

- Goods Carrying Insurance

Corporate Insurance

- Casualty Insurance

- Group Insurance

- Property & Misc Insurance

- Risk Consulting Services

- Speciality Insurance

- Pradhan Mantri Fasal Bima Yojana

- Cattle Insurance Policy

- Rainfall Index Insurance

- Pradhan Mantri Suraksha Bima Yojana

Customer Claim Intimation

- Bike/Two Wheeler Insurance

Workshop Claim Intimation

Track claim status, claim process.

- Critical Illness Insurance

- Personal Accident Insurance

- Group Medical Insurance

- Group Personal Insurance

- Group Travel Insurance

- Marine Hull & Machinery Insurance

- Kidnap Ransom Insurance

- Cattle Insurance

Corporate Claims

- Track Health Claims

- Track Non Health Claims

Third Party Claim

- Habit of Life Survey NEW

- Download Here App NEW

- All Things EV

- Insurance Gyan

- Wellness Corner NEW

- Know Your Policy

- Garage Network

- Diagnostic Centers

- Branch Locator

- Workshop Portal

- HDFC ERGO community

- Grievance Redressal

How can we help you?

- Global Health Insurance

- Bharat Griha Raksha

Commercial Vehicle Insurance

- Become An Agent

Respect Senior Care Rider: 9152007550 (Missed call)

Help Control COVID-19 New

Get In Touch

Claim Assistance Numbers

Health toll free Number 1800-103-2529

24x7 Roadside Assistance 1800-103-5858

Motor Claim Registration 1800-209-5858

Motor On the Spot 1800-266-6416

Global Travel Helpline +91-124-6174720

Extended Warranty 1800-209-1021

Agri Claims 1800-209-5959

Sales : 1800-209-0144

Service : 1800-209-5858

All transactions, whether they are financial or of any other nature, must be conducted exclusively through our branch offices, our online portals www.bajajallianz.com , our insurance agents or POSPs, or via insurance intermediaries registered with IRDAI who are engaged in solicitation. If you require additional clarification, please write to us at [email protected]

Thank you for visiting our website.

For any assistance please call on 1800-209-0144

Most searched keywords

Two Wheeler Insurance

Health Insurance

Car Insurance

Pet Insurance

- Travel Insurance

Car Insurance Renewal

Family Health Insurance

Car Insurance Calculator

Third Party Car Insurance

Two Wheeler Insurance Third Party

Third Party Insurance for Bike

Two wheeler Insurance Renewal

- Travel Insurance For Schengen Countries

Select your Langauge

What Is Schengen Travel Insurance?

Share Details For Travel Insurance Quote

Thank You for Your Interest in Bajaj Allianz Insurance Policy, A Customer Support Executive will call you back shortly to assist you through the Process.

Do you intend to visit a Schengen nation this year? Before you leave on your trip, purchase Schengen visa insurance for Europe and travel insurance for a Schengen visa!

Travellers must get Schengen travel insurance, which safeguards them from unanticipated circumstances that could jeopardise their vacation by offering financial help in various situations.

Why Do You Need Travel Insurance from India to Schengen?

Schengen travel insurance and a Schengen visa are requirements for travel to any of the listed Schengen nations. Getting Schengen travel insurance is mandatory for most categories of Indian nationals travelling to the region.

You require Schengen travel insurance for the following reasons:

- To pay for emergency medical needs. Imagine that you are ecstatic about your upcoming trip to Europe. You anticipate discovering the cafes, strolling through the ancient streets, and sampling the diverse food. But all of a sudden, you fall sick and need to see a doctor.

- Your medical travel insurance for a Schengen visa will save the day. Hospitalisation, accidents, and even emergency dental pain relief are covered by it.

- To address potential issues that may arise while travelling. Nothing is worse than getting excited about a trip only to be completely derailed by an unforeseen event. Even though we have no control over what will happen, we want to be present to handle the fallout.

- Schengen visa travel insurance from India will protect you no matter what happens, including flight delays, trip cancellations, missed flights, passport loss, and even bounced reservations. It will reimburse you for the limitations specified in the insurance policy document.

- To protect what you value in your home country. Consider that you have already begun your travel when you suddenly learn that a family member has become ill. You couldn't take advantage of the upcoming vacation at that point. Additionally, you would undoubtedly require financial aid. Travel insurance for a Schengen visa from India reimburses your airfare and lodging expenses and even pays for any property damage.

Benefits of Having a Schengen Travel Insurance Policy from Bajaj Allianz General Insurance

Bajaj Allianz offers a Schengen travel insurance policy to individuals travelling to the Schengen area. The benefits of having a Schengen travel insurance policy are as follows:

Premium Amount

Bajaj Allianz General Insurance Company’s premiums make the policy an affordable option even for travellers on a budget..

Claim Procedure

Bajaj Allianz's Schengen travel insurance policy offers a paperless smartphone-enabled claim settlement process, making it a hassle-free and convenient way to file a claim.

Claim Settlement

Bajaj Allianz's Schengen travel insurance policy provides 24x7 claim settlement services, meaning that policyholders can file a claim any time of the day. The company also offers a missed call service at +91-124-6174720, allowing policyholders to request a call back to initiate the claim process.

Number of Covered Countries

Bajaj Allianz's Schengen travel insurance policy covers 27 countries providing comprehensive coverage to travellers.

Inclusion of Deductibles

Bajaj Allianz's Schengen travel insurance policy has certain deductibles that the policyholder must pay for any covered expenses specified in the policy terms.

Add-on Benefits

Bajaj Allianz's Schengen travel insurance policy offers several add-on benefits, including adventure sports coverage, hospitalisation, baggage delay, loss of passport, emergency cash advance, trip cancellation, and more. These benefits provide additional protection and peace of mind to travellers.

Types of Schengen Visas

It's crucial to understand which Schengen visa category best suits your trip before buying travel insurance for a Schengen visa in India:

Uniform Schengen visa

– It consists of two types of visas:

- Anyone flying through a Schengen nation and in transit requires a ‘Type A’ Schengen visa.

- ✓ Single-Entry Visa:The holder of a single-entry visa can enter the Schengen region only once as mentioned in the visa. Upon exit, the holder cannot re-enter the Schengen region even if they have not spent the permissible days as per the visa issued.

- ✓ Double-Entry Visa: Double-entry visa works in the same way as a single-entry visa, except you can return to a Schengen region once again after your exit.

- ✓ Multiple-Entry Visa: As the name suggests, a multiple-entry visa allows the holder to visit the Schengen region multiple times during the visa duration, till the time they do not violate the 90/180 rule. Depending on the frequency of your visit, you can opt for 1-year, 3-year, or 5-year multiple-entry visa.

National Schengen Visa or ‘Type D’ visa -

- Travelers who intend to stay in a Schengen nation for an academic programme, research, or educational purposes, professionals, international students, and individuals stranded in a Schengen nation due to a medical emergency and other relevant circumstances are all eligible for a National Schengen visa. It can be valid for more than 90 days and up to 1 year.

Ensure you get your travel insurance for a Schengen visa before your trip.

Schengen Visa Procedure - Explained

You can apply for a Schengen visa once you have purchased offline or online travel insurance. Even if the deadline is 15 days before the trip, it is best to apply for your Schengen visa at least 30 to 60 days before your trip begins. This is because processing times at the embassy or consulate where you apply for a Schengen visa could range from two weeks to two months.

Here's how to approach it:

Determine why you are travelling to a Schengen country and choose the appropriate Schengen visa type. These consist of:

- Transit Visa

- Tourist Visa

- Business visa

- Family and friends’ visitation visa

- Visa for official visits

- Visa for cultural and sports activities

- Medical visa

Submit an application to the embassy of the Schengen nation you plan to visit. Apply at the consulate or embassy of the primary destination nation if you travel to more than one Schengen country.

Choose an appropriate application window, with the earliest date being six months before the trip and the latest date being fifteen days before your trip.

Schedule an appointment with the Schengen nation's consulate, embassy, or visa centre. Most applications are submitted online, but if your preferred Schengen nation requires an in-person booking, you must adhere to that requirement.

You will receive the Schengen visa application form, which you must fill out with information about yourself, your background, your intended reason for travelling, and other pertinent information. Read the whole set of instructions before you begin filling out the form.

After completing the application form, gather the necessary paperwork (as specified above) and attach it to your submission. You will be notified of your appointment for a Schengen visa interview.

The cost of Schengen travel insurance visas varies between insurers.

What are the Travel Documents Required While Travelling from India to the Schengen?

All the paperwork needed for a Schengen visa is listed below:

- A printed copy of the visa application form duly filled out and signed

- Two recent passport-sized photos with a light background. .

- A valid Indian passport not more than ten years old with at least three months remaining on its validity after the date you want to leave the selected Schengen nation

- Evidence of lodging for your stay in the selected Schengen country and region.

- Travel insurance for the Schengen region with coverage of at least €30,000. Such travel insurance coverage must also have protection against accidents, unanticipated medical situations, and evacuation and repatriation.

- Flight schedules and travel tickets within and outside the Schengen region.

- A cover letter outlining why you're visiting the selected Schengen country.

- Your marriage certificate

- Filing tax return evidence for the last three years

- Recent six-month bank statement

- Child's birth certificate

- Ration Card Documentation demonstrating your ability to pay for your stay in the selected Schengen country

- Proof of admission if you are travelling as an overseas student; a letter of employment if you are travelling on business

- A guarantee form

- A copy of your host’s passport

- Proof of residence of your host

- Your detailed travel itinerary including hotel accommodations or a formal invitation letter.

- A copy of a medical certificateter.

- A copy of the confirmation of the treatment

- Proof of financial means

- An invitation letter from the host or the company that you plan to work with and other necessary details about the purpose of your business visit.

- A confirmation letter from the employer or client for the journalistic trip

- An invitation letter, if applicable

- Your identification proof as a journalist

If you are travelling to the Schengen region for a cultural exchange, there are additional documents required, based on the purpose of your visit. Please get in touch with your travel agent, the embassy of the country you are visiting, or consulate for additional information about it.

Note: If you are applying for a Schengen visa, insurance is mandatory and you must describe why you are travelling to the Schengen region on the application form and in the embassy interview.

Which are the Schengen Countries?

Before you get medical travel insurance for Europe, knowing about the Schengen countries is vital. The countries include:

Things to Do in Schengen Countries

The Schengen countries provide a wide variety of activities. Make sure you stay safe by buying travel insurance coverage to be safe at all times. You may travel to a well-known location like France and see the Eiffel Tower at dusk. You may travel to places like Greece and Vienna, awash with history on every side street.

You may travel to countries like the Czech Republic, Hungary, and Austria, which are rich in architectural history. While shopping in Germany and Belgium, you might indulge in the diverse cuisines of Italy and Spain. You can buy travel insurance online in a simple and hassle-free manner.

Best Time to Visit Schengen Countries

The highest temperature in Schengen countries never rises over 23 to 25 degrees Celsius so you may travel there any time of year. Even 24-degree weather can appear nice because most of India experiences hotter temperatures than those in Schengen nations. Make sure you get your travel insurance before travelling. There are four seasons in Schengen nations:

- During the summer, when temperatures range from 14 to 24 degrees Celsius (December – February

- Autumn, with temperatures ranging from 7 to 14 degrees Celsius (September – November).

- Spring, when the temperature ranges from 2 to 18 degrees Celsius (June – August). .

- Wintertime is when the temperature is around -10 degree Celsius temperature (March-May).

You can keep safe by getting your Schengen travel insurance online.

GOT A QUESTION? HERE ARE SOME ANSWERS

Why do i need travel insurance for the schengen area.

If you wish to go to any of the 26 nations that make up the Schengen region, you must have travel insurance for a Schengen visa. In addition, it is usually preferable to have financial security in an emergency that could deplete your resources

How long does it take to get a Schengen visa?

If everything in your application is complete, true and correct, processing a Schengen visa typically takes two weeks. In some unique circumstances, the embassy or consulate may require up to 30 days to process a Schengen visa. The visa processing can take up to 60 days due to some exceptional circumstances.

Are business travellers eligible to purchase Schengen travel insurance?

Yes, business travellers are required to purchase a Schengen travel insurance policy. Business visas are one of the most common Schengen visas.

And to avoid any hassles, anyone travelling for business or professional reasons must purchase a Schengen visa insurance policy.

TRAVEL INSURANCE FOR POPULAR COUNTRIES

Visa guide for popular countries, travel insurance articles.

Planning for a Business Trip? Here’s All That You Need To Know About Corporate Travel Insurance

Find Out How Does Trip Cancellation Insurance Work?

10 Surreal Places to Enjoy a Magical Winter Experience in the United Kingdom (UK)

Request call back

Chat with us

I hereby authorize Bajaj Allianz General Insurance Co. Ltd. to call me on the contact number made available by me on the website with a specific request to call back at a convenient time. I further declare that, irrespective of my contact number being registered on National Customer Preference Register (NCPR) under either Fully or Partially Blocked category, any call made or SMS sent in response to my request shall not be construed as an Unsolicited Commercial Communication even though the content of the call may be for the purposes of explaining various insurance products and services or solicitation and procurement of insurance business. Furthermore, I understand that these calls will be recorded & monitored for quality & training purposes, and may be made available to me if required.

Please enter valid quote reference ID

- Would you recommend Bajaj and its services to a friend who is looking to buy insurance? Select Select Definitely Not sure NO. Thank You Please select

- Any comments you have about our service/product/website? Please write your comment

Getting In Touch With Us Is Easy

Customer Login

Partner Login

Employee Login

Visa Traveler

Exploring the world one country at a time

Travel Insurance for Schengen Visa: A Comprehensive Guide

Updated: September 8, 2023

One of the key requirements of Schengen visa is the travel medical insurance. The travel insurance for Schengen visa must meet certain coverage and must be valid throughout the Schengen region for the entire duration of your stay.

With a myriad of travel insurance options in the market, picking out the right policy for your Schengen visa is difficult. In this article, you will everything about Schengen visa travel insurance and how to choose a policy for your visa.

Table of Contents

BONUS: FREE eBOOK

Enter your name and email to download the FREE eBOOK: The Secret to VISA-FREE Travel

Opt in to receive my monthly visa updates

You can unsubscribe anytime. For more details, review our Privacy Policy.

Your FREE eBook is on it’s way to your inbox! Check your email.

What is Schengen Travel Medical Insurance?

Schengen travel insurance is a type of insurance policy for travelers visiting the Schengen area. This type of travel insurance plan is designed specifically to comply with Schengen visa criteria of minimum coverage and validity requirements. Schengen travel insurance is also a mandatory requirement for obtaining a Schengen visa.

Who Requires Schengen Travel Health Insurance?

Visitors from visa-required countries planning to visit any Schengen country must require Schengen travel insurance.

If you are a traveler from a country that requires a visa to enter the Schengen zone, you must have a valid travel insurance policy. You must buy travel insurance not only for your Schengen visa application but also for any or all trips that you take to the Schengen area.

Is Travel Insurance Mandatory for Schengen Visa?

Yes, obtaining travel insurance is mandatory for Schengen visa . The European Commission’s 810/2009 Regulation mandates submitting valid travel medical insurance for Schengen visa applications.

Proof of travel medical insurance is not only mandatory for the first trip, but also for all subsequent trips for multiple-entry Schengen visas.

At the time of application, you would only need to provide proof of insurance for the first entry.

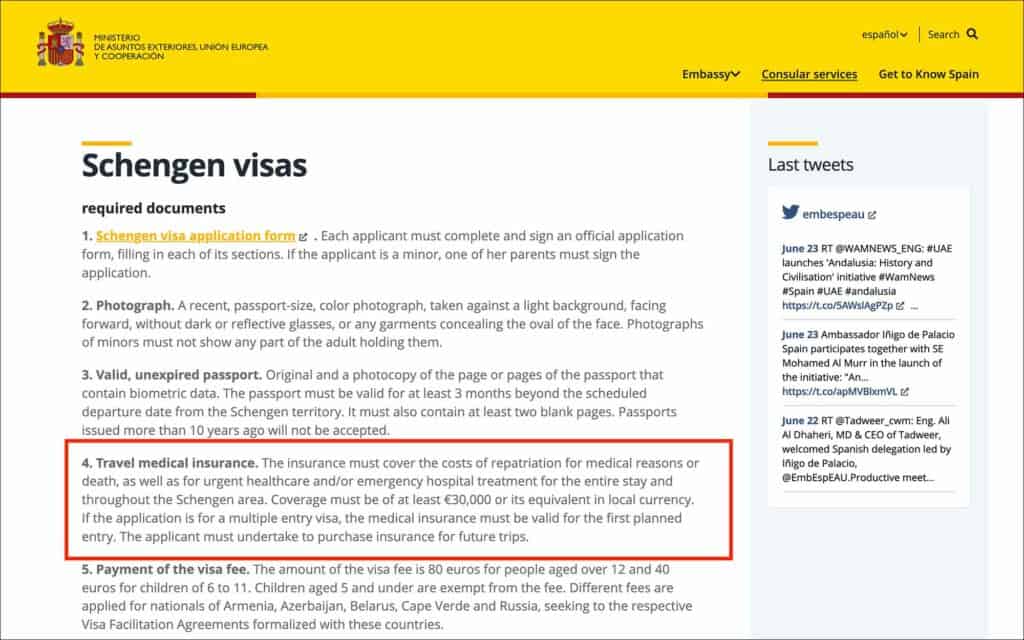

What are the Schengen Visa Insurance Requirements?

As per the Article 15 of REGULATION (EC) No 810/2009 , your Schengen visa travel insurance must meet the following three criteria:

- Must cover medical expenses up to a minimum of €30,000

- Must be valid for the entire duration of your stay

- Must be valid in all 27 Schengen countries

The policy must cover all medical expenses arising from emergency medical attention, treatment, hospitalization, emergency medical evacuation, repatriation due to medical reasons and death.

Let’s look at each of those requirements in detail.

1. Minimum Coverage

Your Schengen visa travel insurance must meet the minimum coverage requirement of €30,000. When purchasing Schengen visa travel insurance in USD, make sure the policy covers at least $50,000.

This minimum coverage is applicable for any medical expenses, emergency evacuation, and repatriation of remains.

This coverage is necessary to financially protect you in case of accidents, unforeseen illnesses, or other emergency situations that may arise during your travels in the Schengen area.

2. Validity Duration

Your travel insurance for the Schengen visa must remain valid for the entire duration of your stay in the Schengen area.

This travel insurance policy should cover you from the day you arrive in the Schengen area until the day you leave.

In terms of a multiple-entry visa, the Schengen visa insurance must be valid for the entire duration of your first entry only.

Here is an example:

You are applying for a multiple-entry visa and your trip is from Jan 01 to Jan 14. Your Schengen visa insurance must be valid from Jan 01 to Jan 14.

If you take another trip on the same visa, say from May 01 to May 14, then you must purchase another Schengen travel insurance at the time of your second trip.

For your visa application, you would only need to provide insurance for Jan 01 to Jan 14.

3. Validity in the Schengen Zone

Lastly, your Schengen visa travel insurance must be valid in all 27 Schengen countries. This is to make sure that you have coverage regardless of which Schengen country you visit during your trip.

Most Schengen travel insurance aggregators such as VisitorsCoverage provide insurances that are valid in the entire Schengen zone.

In fact, any insurance valid globally is acceptable for the Schengen visa. Provided, the the insurance covers at least €30,000 in all medical costs and emergencies.

What Does Schengen Visa Insurance Plan Cover?

In general, any Schengen visa insurance plan covers medical expenses, COVID-19 protection, and trip coverage.

These coverage options are designed not only to provide comprehensive protection but also to meet the Schengen visa insurance requirements.

1. Medical Coverage

Medical coverage is the most important aspect of Schengen travel insurance. It provides coverage for emergency medical expenses, accidents, and unexpected illnesses.

The coverage also includes hospitalization, emergency hospital treatment, doctor visits, prescription drugs, and other necessary medical treatments that are considered emergency and necessary.

The policy must cover at least €30,000 for the visa. But depending on your needs and activities in the Schengen area, you can opt for policies with higher coverage.

2. COVID-19 Protection

COVID protection is not mandatory for Schengen visa. But most Schengen visa travel insurance policies offer coverage for medical treatment and quarantine expenses related to COVID. COVID tests and quarantine must be prescribed by a doctor to be eligible for the coverage.

That being said, you must review the policy details to make sure that COVID protection is included. Even though it’s not mandatory, it can provide peace of mind during your trip.

3. Trip Coverage

Trip coverage is also not mandatory for Schengen visa. But most travel insurance plans provide protection against flight cancellations, delays, and lost luggage during your travels. Trip coverage will help lessen any expenses arising from trip interruptions and baggage delays.

Review the policy details to make sure comprehensive trip coverage is included. This way, you can ensure that your trip goes smoothly, even when faced with unexpected setbacks.

What Does Schengen Visa Insurance Plan Not Cover?

Though Schengen travel insurance plans provide coverage for a wide range of scenarios, there will usually be some exclusions. One common exclusion is the coverage for pre-existing medical conditions.

It’s crucial to understand the limitations and exclusions of your Schengen visa insurance policy. Let’s look into the exclusion of pre-existing medical conditions in detail.

Pre-existing Medical Conditions

Pre-existing medical conditions are generally not covered by Schengen visa insurance plans. If you have a medical condition that was present prior to the purchase of your Schengen insurance policy, any medical expenses related to that condition during the trip will not be covered.

Review the terms and conditions of your travel insurance policy to determine if any exclusions apply to pre-existing medical conditions.

Is COVID-19 Coverage Mandatory for Schengen Visa Travel Insurance?

No, COVID-19 coverage is not mandatory for Schengen visa travel insurance. But most Schengen travel insurance companies include COVID coverage in their policy.

Even though it’s not required, having COVID protection in your travel insurance can provide financial security during your Schengen trip.

It is always better to be prepared and have coverage than face challenges during the trip.

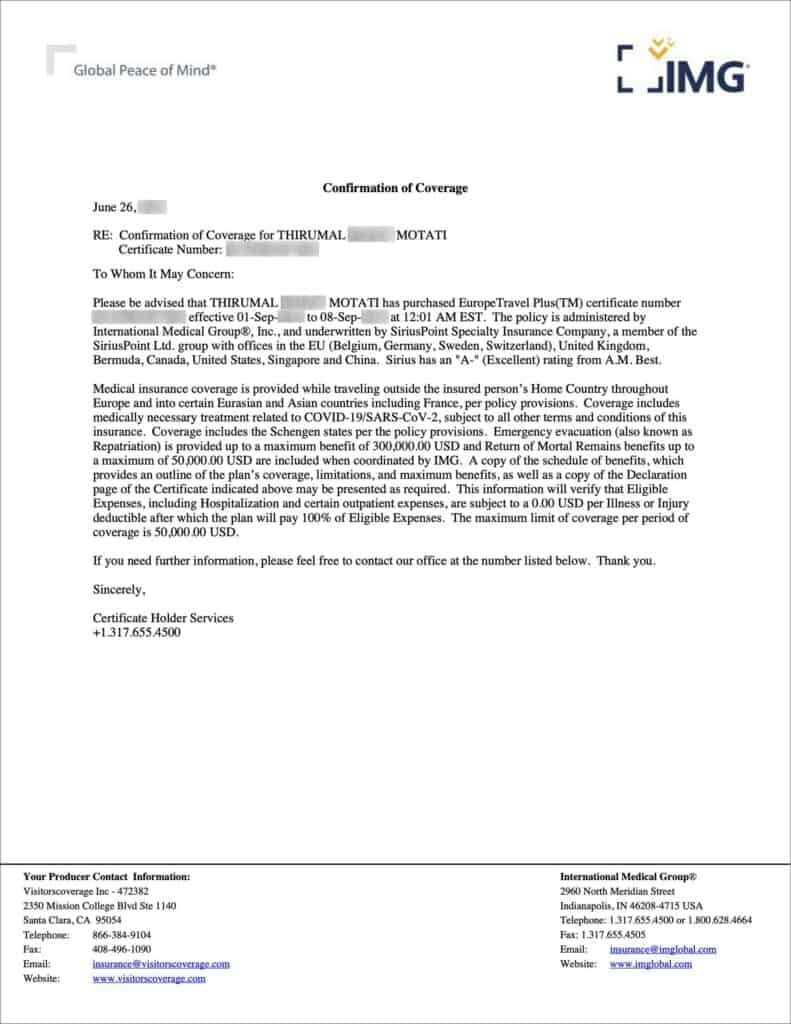

How Much Does Schengen Visa Medical Insurance Cost?

The cost of Schengen visa medical insurance varies depending on several factors, such as age, duration of your trip, total coverage amount, and the insurance company.

Schengen travel insurance from IMG Global, through VisitorsCoverage for up to 39 years of age will cost about a dollar a day. For a one-week trip, it would be about $7 USD. The cost goes up with age.

IMG Global is a US-based insurance company offering Schengen visa insurance. If you opt for a Europe-based insurance company such as Europ Assistance, the prices are even higher. A one-week insurance policy can cost about €18.

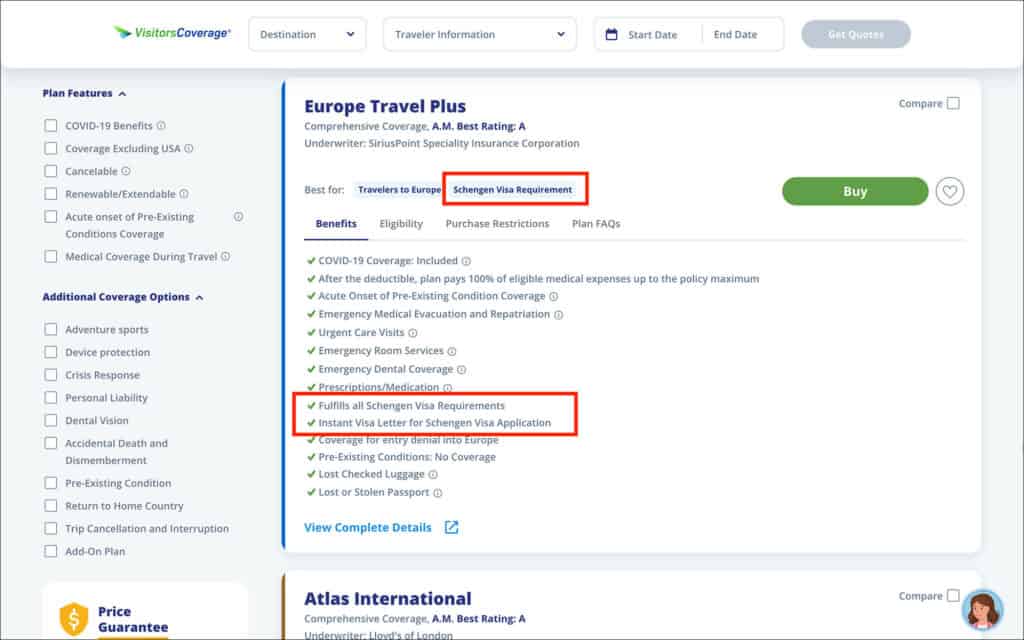

To find the most affordable insurance policy for the Schengen visa, compare different insurance providers and policies using an insurance aggregator such as VisitorsCoverage .

How to Choose the Right Travel Insurance for Schengen Visa?

With a myriad of options available in the market, choosing travel insurance for your Schengen visa can be a daunting task. To make this process easier, consider factors such as the reputation of the insurance company, coverage limits, and customer reviews.

Let’s look at each of these factors in detail.

1. Reputation of the Company

When selecting a travel insurance provider, it’s important to evaluate their reputation in the market. A reputable insurance company will have a track record of providing reliable and quality coverage, as well as excellent customer service.

You can assess the reputation of an insurance company by looking at its reviews and ratings on sites such as Trustpilot. VisitorsCoverage , for example, has a 4.7 rating on Trustpilot.

If you choose an insurance company with a strong reputation, you will have confidence in the coverage and support they provide throughout your trip.

2. Coverage Limits and Exclusions

Another important aspect to consider is the coverage limit. The policy must be Schengen visa compliant, meaning the policy must meet the minimum coverage requirement of €30,000.

Additionally, it’s important to review if there are any exclusions such as pre-existing medical conditions or other limitations.

By reviewing the coverage limits and exclusions, you can pick out a policy that is Schengen visa compliant and provide enough protection during your trip.

3. Customer Reviews and Ratings

Reviews and ratings can be invaluable resources when evaluating any product or service in the market. Travel insurance is no different. The reviews and ratings provide insight into the insurance provider’s customer service, claims process, and embassy acceptability.

By considering the experiences of other travelers you can assess the quality and reliability of the travel insurance.

4. Schengen Insurance Certificate

Lastly, the insurance company must be able to issue a Schengen insurance certificate, also called a visa letter. Submitting a visa letter along with the policy is a mandatory requirement for the Schengen visa.

This certificate confirms that your insurance policy meets the Schengen visa criteria. The certificate should include:

- Your name (as the policyholder)

- Policy number

- Total coverage amount, which should be no less than €30,000 (or $50,000)

- Dates of validity (must cover the entire duration of your stay in the Schengen area)

- Contact details for the insurance company, in case of emergencies

Where to Purchase Travel Insurance for Schengen Visa?

Travel insurance for Schengen visas can be purchased from online insurance providers, local insurance companies and travel agencies.

Local insurance companies and travel agencies can offer personalized advice. With online platforms, you can compare prices and coverage options from multiple insurers.

Regardless of where you purchase your insurance, it’s important to make sure the insurance policy meets Schengen visa insurance requirements and provides the necessary coverage for your trip.

My recommendation is to buy Schengen visa insurance from VisitorsCoverage. Their Europe Travel Plus policy is specifically designed for the Schengen visa, meeting the minimum coverage requirements and downloadable visa letter. Here is a comparison for a 33-year-old, 7 days trip to the Schengen area.

How to Purchase Travel Insurance for Schengen Visa

To purchase your travel insurance for Schengen visa, go to the VisitorsCoverage’s Europe Travel Plus plan. Enter the following details.

- Destination Country

- Citizenship

- Residence/Home country

- Coverage Start Date

- Coverage End Date

- Arrival Date

- Date of Birth

- Email Address

Click on Continue. In the deductible and policy maximum, select $0 for the deductible and $50K for the policy maximum. Then click on Continue.

In the next steps, enter your details as per your passport. Complete the payment and purchase the policy. Once your purchase is complete, you can download your visa letter.

How To Find Cheap Schengen Travel Insurance?

Finding cheap Schengen travel insurance requires research and comparison of policies and companies. I have done this already for you. VisitorsCoverage was the cheapest in my research. If you are older than 50, then you might want to check other insurance companies to see if you can find a cheaper option.

Frequently Asked Questions (FAQS)

Do us citizens need schengen insurance.

No. US citizens do not require Schengen insurance when traveling to the Schengen area. This is because Schengen insurance is mandatory for those that require a visa for the Schengen area. And, US citizens do not require a visa for the Schengen area.

Is Schengen travel insurance refundable?

Yes. Most Schengen visa insurance companies offer reimbursement or free cancellation in the event of visa refusal. That being said, review the terms and conditions of the insurance policy before purchasing to make sure the policy is cancellable in case of visa refusal.

Can I purchase travel insurance after obtaining a Schengen visa?

No. You must purchase travel insurance before obtaining the visa. This is because travel insurance is one of the mandatory requirements for obtaining the Schengen visa. Without purchasing travel insurance, you won’t even be able to apply for the Schengen visa.

Are pre-existing medical conditions covered by travel insurance?

Pre-existing medical conditions are usually not covered by Schengen visa insurance plans. This means that any medical expenses arising due to pre-existing conditions will not be covered during your trip. Before purchasing, review the terms and conditions of the policy to determine the exclusions.

Can I extend my travel insurance coverage if my stay in the Schengen area is prolonged?

It may be possible to extend travel insurance coverage if your stay in the Schengen area is prolonged. But it depends on the insurance company and the policy type. Review the terms and conditions and also contact the insurance provider to inquire about extensions.

Obtaining the right travel insurance is a crucial step in your Schengen visa application process. The travel insurance for Schengen visa must provide at least €30,000 coverage and must be valid throughout the Schengen region for the entire duration of your trip.

While purchasing your Schengen visa insurance, consider factors such as the provider’s reputation, coverage limits and customer reviews. Compare different travel insurance providers and policies to pick out the right insurance for your Schengen visa.

WRITTEN BY THIRUMAL MOTATI

Thirumal Motati is an expert in tourist visa matters. He has been traveling the world on tourist visas for more than a decade. With his expertise, he has obtained several tourist visas, including the most strenuous ones such as the US, UK, Canada, and Schengen, some of which were granted multiple times. He has also set foot inside US consulates on numerous occasions. Mr. Motati has uncovered the secrets to successful visa applications. His guidance has enabled countless individuals to obtain their visas and fulfill their travel dreams. His statements have been mentioned in publications like Yahoo, BBC, The Hindu, and Travel Zoo.

PLAN YOUR TRAVEL WITH VISA TRAVELER

I highly recommend using these websites to plan your trip. I use these websites myself to apply for my visas, book my flights and hotels and purchase my travel insurance.

01. Apply for your visa

Get a verifiable flight itinerary for your visa application from DummyTicket247 . DummyTicket247 is a flight search engine to search and book flight itineraries for visas instantly. These flight itineraries are guaranteed to be valid for 2 weeks and work for all visa applications.

02. Book your fight

Find the cheapest flight tickets using Skyscanner . Skyscanner includes all budget airlines and you are guaranteed to find the cheapest flight to your destination.

03. Book your hotel

Book your hotel from Booking.com . Booking.com has pretty much every hotel, hostel and guesthouse from every destination.

04. Get your onward ticket

If traveling on a one-way ticket, use BestOnwardTicket to get proof of onward ticket for just $12, valid for 48 hours.

05. Purchase your insurance

Purchase travel medical insurance for your trip from SafetyWing . Insurance from SafetyWing covers COVID-19 and also comes with a visa letter which you can use for your visas.

Need more? Check out my travel resources page for the best websites to plan your trip.

LEGAL DISCLAIMER We are not affiliated with immigration, embassies or governments of any country. The content in this article is for educational and general informational purposes only, and shall not be understood or construed as, visa, immigration or legal advice. Your use of information provided in this article is solely at your own risk and you expressly agree not to rely upon any information contained in this article as a substitute for professional visa or immigration advice. Under no circumstance shall be held liable or responsible for any errors or omissions in this article or for any damage you may suffer in respect to any actions taken or not taken based on any or all of the information in this article. Please refer to our full disclaimer for further information.

AFFILIATE DISCLOSURE This post may contain affiliate links, which means we may receive a commission, at no extra cost to you, if you make a purchase through a link. Please refer to our full disclosure for further information.

RELATED POSTS

- Cookie Policy

- Copyright Notice

- Privacy Policy

- Terms of Use

- Flight Itinerary

- Hotel Reservation

- Travel Insurance

- Onward Ticket

- Testimonials

Search this site

Currently the video chat timings are 9:30am to 6:30pm from Monday to Saturday.

Call us now to secure insurance coverage for health, motor, and more. Timing: 10:00 a.m. to 07:00 p.m. every day.

Find quick answers to all your insurance queries from our self-help section.

Call us for any help with renewals or claims. Timing: 09:00 a.m. to 07:00 p.m. every day.

Join India’s leading general insurance company. Timing 09:30 a.m. to 06:30 p.m. Monday-Saturday.

Your Quote Details

Key Benefits:

- € Medical Sum Insured - 30,000

- € Personal Accident - 10,000

- Compassionate visit

Tax Excluded

- Medical Sum Insured - $500,000

- Personal Accident - $30,000

- Personal Liability - $250,000

- Medical Sum Insured - $250,000

- Personal Accident - $25,000

- Personal Liability - $200,000

- Medical Sum Insured - $100,000

- Personal Accident - $20,000

- Personal Liability - $100,000

- Medical Sum Insured - $30,000

- Covers Loss of Passport & checked baggage

- Covers trip delay

- Medical Sum Insured - $25,000

- Covers loss of passport & checked baggage

- Covers Loss of passport & checked baggage

- Daily Hospitalisation Allowance

- Medical Sum Insured - $50,000

- Personal Accident - $15,000

- Medical Sum Insured - €30,000

- Personal Accident - €10,000

- Medical Sum Insured - €50,000

- Personal Accident - €15,000

- Personal Liability - $50,000

- Personal Liability - $150,000 & more ...

- Personal Liability - $100,000 & more ...

- 2 way Compassionate visit

Resend OTC in

Didn't receive OTC ? Resend OTC

We are unable to serve you at this moment. Please try again later.

Schengen Travel Insurance

Switch to Reliance General Insurance. Trusted by 3 Crore+ Indians

- No Paperwork

- No Medical Check-up

- 26 Countries 1 Policy

- Cashless Hospitalisation Worldwide

- Plan Details

- Manage Travel Claim

- Download Resources

What is a Schengen Travel Insurance Policy?

Schengen travel insurance policy is a compulsory travel medical insurance for visiting Schengen countries. This area-specific travel insurance protects you against a wide range of medical and other emergencies during your Schengen trip. A Schengen travel insurance plan offers coverage for emergency medical hospitalisations, accidental medical expenses, passport loss, baggage loss, luggage delay and other travel-related contingencies.

Just as you need an American Visa to visit the USA, you need to have a Schengen Visa to visit Schengen countries. You’re required to submit some documents to initiate the Schengen Visa application process. One of these documents includes Travel Insurance for Schengen Visa, which allows you to move freely in Schengen countries. It ensures that you have the compulsory minimum medical coverage of EUR 30,000 to secure you in case of medical emergencies.

Our Reliance Travel Care Policy: Schengen Plan provides coverage for medical emergencies, passport loss, baggage delays, baggage loss, personal accidents and liabilities, accidental death and compassionate visits. It is your trusted #TravelKaYaar for a worry-free and seamless trip in the Schengen Zone. Unlock the doors to hassle-free exploration in the Schengen countries with Reliance Travel Care Policy: Schengen Plan today!

Why Do You Need Schengen Travel Insurance?

It is mandatory to have travel insurance and Schengen Visa to move freely in any of the Schengen countries. Besides this compulsion, it is important to buy Schengen travel insurance to cover yourself from unforeseen circumstances during your trip. Here are some of the reasons why you need to get Schengen Travel Insurance from Reliance General Insurance:

Coverage for Personal Items

Lost luggage or stolen belongings shouldn't steal the joy from your Schengen trip. Reliance Schengen travel insurance plan provides a cover of up to EUR 300** to help you deal with situations like passport loss. In case of checked-in baggage delay or baggage loss, it helps you buy or reimburse the cost of purchasing necessary emergency personal items like toiletries, medication and clothing.

Protection During Medical Emergencies

Imagine you fall sick during your trip to Paris and need medical assistance. In such scenarios, Schengen travel medical insurance policy will cover medical expenses up to EUR 50,000**. This includes medical hospitalisation for any sudden illness or injury or COVID-like conditions, the cost of transportation to reach the nearest hospital or physician, accidental dental treatment and repatriation of mortal remains.

Coverage for Event Contingencies

If you accidentally injure or cause damage to a third party during your trip, Schengen travel insurance policy will help you to offer compensation of up to EUR 50,000** for third-party liabilities and damage. This will help you to travel worry-free and enjoy your trip to the fullest.

Benefits of Buying a Schengen Travel Insurance Plan

It is quite exciting to visit the Schengen countries – be it for personal business or leisure. More than just getting the mandatory travel insurance for Schengen Visa, you need to buy a Schengen travel insurance policy to protect you in case of unforeseen emergencies. Our Reliance Travel Care Policy: Schengen Plan offers a range of benefits to ensure you have a wonderful trip:

Coverage for Lost or Delayed Baggage

We won’t let anything ruin your Schengen trip – not even delayed or lost baggage. Our Schengen travel insurance policy provides compensation of up to EUR 500** in the unfortunate event of the total loss of your checked-in baggage by a common carrier. It also reimburses up to EUR 100 for purchasing necessary items like medications, clothing and toiletries in case of baggage delays.

Support for Passport Loss

Anything can happen when you’re not careful – you may misplace your passport or even lose it. Worry not. Reliance Travel Insurance for Schengen provides reimbursement of up to EUR 300** to help you get a duplicate or fresh passport if you lose your passport during your Schengen trip.

Medical Emergency Cover

Our Schengen travel medical insurance plan will take care of all your emergency medical expenses incurred during your Schengen vacation or stay. It will provide coverage of up to EUR 50,000** to help deal with emergency hospitalisation bills, transportation costs incurred for hospitalisation, and repatriation of mortal remains.

COVID-19 Coverage

Nothing is worse than contracting the COVID-19 virus on your international trip. Reliance Travel Insurance for Schengen will help you take care of your medical hospitalisation and medical bills (up to the limits specified in the policy schedule) in case you’re diagnosed with this virus during your trip.

Third-Party Liability Cover

Accidents happen and sometimes you might involuntarily hurt or injure someone. Our Schengen travel insurance policy offers compensation of up to EUR 50,000** to help you cover any third-party liability/damages caused by you during your Schengen stay. Specifically, it provides coverage if you accidentally injure a third-party or damage their properties.

Compassionate Visit

Our Schengen travel medical insurance policy also offers the compassionate visit cover** to help you during emergency hospitalisation abroad. Suppose you’re travelling solo and get hospitalised for more than seven consecutive days during your Schengen trip. Our travel insurance plan for Schengen will ensure that you’re not left alone and arrange for one of your family members to be with you during your hospital stay.

Features of Reliance Schengen Travel Insurance Policy

Reliance General Insurance offers two plans under its Schengen travel insurance policy. Our Basic Plan is created for travellers looking for a Schengen travel insurance policy that offers the mandatory minimum medical coverage of EUR 30,000. However, if you’re someone who is looking for comprehensive protection for your Schengen trip, then our Standard plan is perfect for you. Check the below table to understand the different types of covers offered under our Schengen travel insurance plans:

What’s Covered under Reliance Schengen Travel Insurance Plan?

Reliance Schengen Travel Insurance Policy covers the following:

Accidental bodily injury during the trip

Acute anaesthetic treatment of teeth due to an injury on your Schengen trip

Emergency expenses made for medical evacuation to India

Total loss of your checked-in baggage by a common carrier

Cost of obtaining a fresh or duplicate passport in case of a lost passport

Emergency medical expenses incurred by you for any sudden illness, injury or death during your Schengen stay or vacation

Compensation for death or permanent disability due to an accident, while riding as a passenger in a common carrier

Reimbursement of return ticket fare for a family member visiting you, the insured, if you’re hospitalised for more than 7 days

Expenses incurred while transporting the insured’s mortal remains back home or toward burial abroad in case of an untimely demise

Compensation for a third party in case your involuntary actions result in someone’s demise, cause someone injury or damage to health or property

What’s Not Covered under Reliance Schengen Travel Insurance Plan?

Here’s a list of exclusions for your Schengen Travel Insurance Policy:

Expenses incurred if you are traveling against the advice of a physician and have to be hospitalised; receiving or are on a waiting list for specified medical treatment; travelling to receive treatment abroad; have been given a terminal prognosis for a medical condition

Expenses incurred due to suicide; self-inflicted injuries or illnesses; mental disorder; anxiety, stress or depression; Venereal diseases; Alcohol/drug abuse; and HIV/AIDS

War or nuclear threat in the country where you are travelling

Delay or loss of checked-in baggage

Claims arising out of non-disclosed and non-declared pre-existing medical conditions

Any issues faced due to theft or loss of passport when left unattended or if you don’t report the loss to local police authorities

Life-threatening conditions covered only arising out of disclosed pre-existing diseases, which are mentioned in the policy schedule, for people up to 70 years of age. You need to declare all pre-existing diseases while taking the international travel insurance policy

Why Choose Us?

3 Crore+ Policyholders ^ Widely loved and trusted by our customers

98.6% Claim Settled # Hassle-free claims intimation and settlement

Personalised Plans Plans specially created to meet every need

Which are the Schengen Countries?

The Schengen Zone comprises 27 European countries, including Switzerland, Spain, Italy, France, Germany, Portugal and Denmark. These Schengen countries have abolished their internal borders, enabling tourists to freely explore these countries via road, train or airplane without any restrictions. Here is the latest list of Schengen countries:

Czech Republic

Liechtenstein

Netherlands

Switzerland

How to Buy Travel Insurance for a Schengen Visa?

Having a valid travel insurance plan is one of the prerequisites for your Schengen Visa application process. Thankfully, you can easily buy travel insurance online for Schengen countries through Reliance General Insurance. Just follow these steps and you are all set for your upcoming Schengen trip:

Step 1: Scroll up and give us your details including mobile number, email ID and travel destination.

Step 2: Select your plan and click on ‘Buy Now’.

Step 3: Check your premium details and enter your personal details, including passport number and nominee details.

Step 4: Complete payment using your preferred mode of payment and get insured for your upcoming Schengen trip.

How to Apply for a Schengen Visa from India?

You have to buy a travel insurance policy before you can apply for a Schengen Visa. You need to submit your duly filled Schengen Visa application form at least 15 days before the intended journey. However, it is advisable to submit your application at least a month before your journey as it may take up to 15 days to get your visa approved. Here are the steps to apply for a Schengen Visa from India:

Fill out the Schengen Visa application form.

Select the Schengen Visa type (Tourist Visa, Student Visa, Business Visa, etc.)

Collect all documents required for the Schengen Visa application process

Schedule a Visa interview and submit your Schengen Visa application form.

Pay the Visa fees and wait for your application to be accepted

Documents Needed for a Schengen Visa

Here’s a list of documents you need to apply for a Schengen Visa:

A Schengen Visa application form (you can download it from a consulate or Schengen embassy website)

Two recent passport-sized photographs

A valid passport and previous passports, if applicable

No objection letter from your employer or

A cover letter stating the purpose of your visit

Travel insurance with a medical cover of up to EUR 30,000

Proof of accommodation during your Schengen stay

Proof of booked flights and itinerary