- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How to Use an American Airlines Flight Credit

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

How to use a flight credit on American Airlines

How to use a trip credit on american airlines, 4 steps to book a flight with american airlines flight credit, 4 steps to book a flight with american airlines trip credit, final thoughts on american airlines flight credits and trip credits.

If you've previously canceled an American Airlines flight, you may be wondering how to use American Airlines flight credits or how to use American airlines trip credits. The good news is that redeeming flight credits and trip credits to book American Airlines flights is quick and easy.

Before learning more about each, including how to redeem these American Airlines credits, you’ll want to understand how flight credits and trip credits are earned and how these travel credits function.

Here's a look at how to use an American Airlines flight credit.

» Learn more: The best airline credit cards right now

American Airlines issues flight credit for unused or canceled tickets. This type of compensation is different from trip credits because flight credits can generally be used for the passenger whose name was on the original ticket only.

Here's what you need to know about flight credits:

You can use these credits for flights only.

Flight credits can't be redeemed for extras like seats or bags.

Flight credit is valid for one year from the issue date unless otherwise noted.

You can use one flight credit per passenger when booking at AA.com (contact American Airlines to book with more than one flight credit).

Only the same passenger named on the flight credit can book and travel.

American Airlines issues trip credit as compensation, refunds and for the remaining value of flight credit exchanges.

Here's what you need to know about trip credits:

Trip credit is valid for non-award bookings.

You can use trip credit for domestic or international flights originating in the U.S.

These credits can't be redeemed for extras like seats or bags.

Trip credit is valid for one year from the issue date.

You can use eight trip credits in a single passenger reservation when booking at AA.com (contact American Airlines to book more than one passenger).

The trip credit recipient can use their credit to book and pay for travel for themselves or others.

» Learn more: Complete guide to American Airlines elite status

Where can you see your flight credit or trip credit balance?

American Airlines will send an email with flight credit and trip credit information directly to travelers. You can go back to the email to review your credit details.

You can also review your credit details another way.

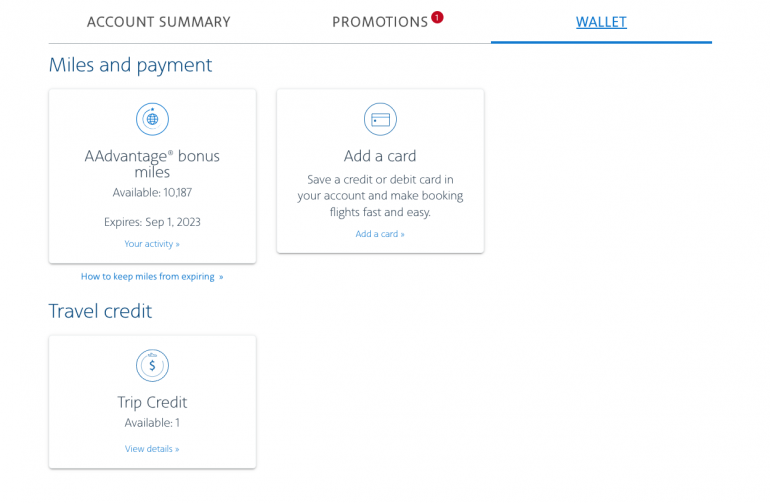

If you're an AAdvantage member, you can log in to your account and check any credits by clicking on your "Wallet." If you have active credits, they will be listed here.

How long are American Airlines flight credits and trip credits good for?

Most American Airlines travel credits are valid for one year from the issue date unless otherwise noted.

Special rules for eligible flight credits: If you're an AAdvantage member and have an original ticket issued from Jan. 1, 2020, to Dec. 31, 2021, the value of your unused ticket can be used by Sept. 30, 2022, for travel through Dec. 31, 2022.

What can I do if my flight credit or trip credit expired?

Make sure you check your flight credit and trip credit expiration dates. American Airlines won't make exceptions if your credit expires.

Here is a breakdown of what the airline's terms and conditions state about credit expirations:

American Airlines won't reissue trip credits past the expiration date and are not responsible for honoring invalid or expired trip credit.

American Airlines won't extend or reissue flight credits past the expiration date, and expired flight credits will not be honored.

» Learn more: Everything you need to know about the American Airlines AAdvantage program

Here is how to use American Airlines flight credit:

1. Have your flight credit details ready

You can find your flight credit ticket number in the email from American Airlines or by logging into your AAdvantage account and going to your wallet.

2. Browse and select flights

Search for and find your desired flights.

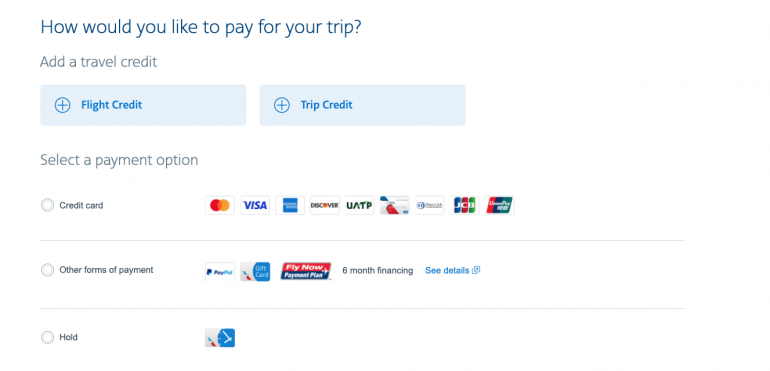

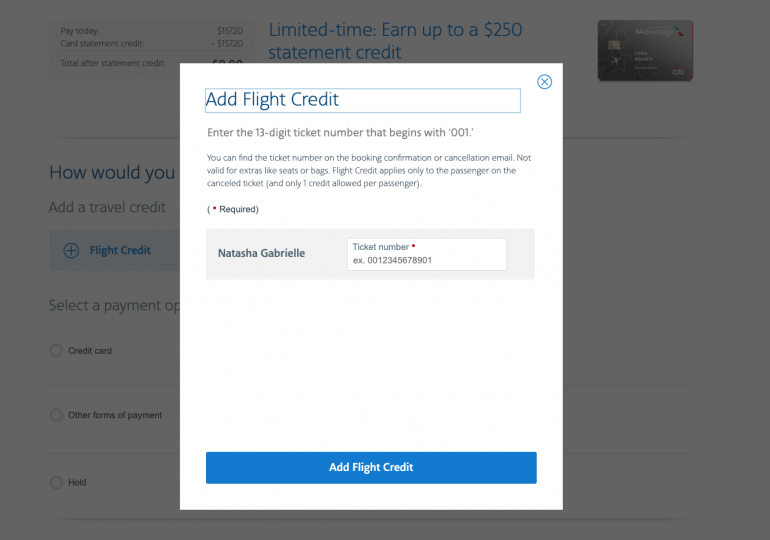

3. Click “+ Flight Credit” to apply your flight credit before checking out

After confirming your flight details, passenger details and selecting your seats, you'll see an option to add a flight credit before finalizing the payment and checkout process.

4. Finish the booking and checkout process

Once you apply your flight credit, you can complete the checkout process.

If you don't have enough credit to cover the cost of your flight, you'll choose a payment method to pay the difference.

If the ticket price is less than the value of your flight credit, you will receive the remaining credit balance issued as a credit to use for future travel.

The process of using an American Airlines trip credit is similar:

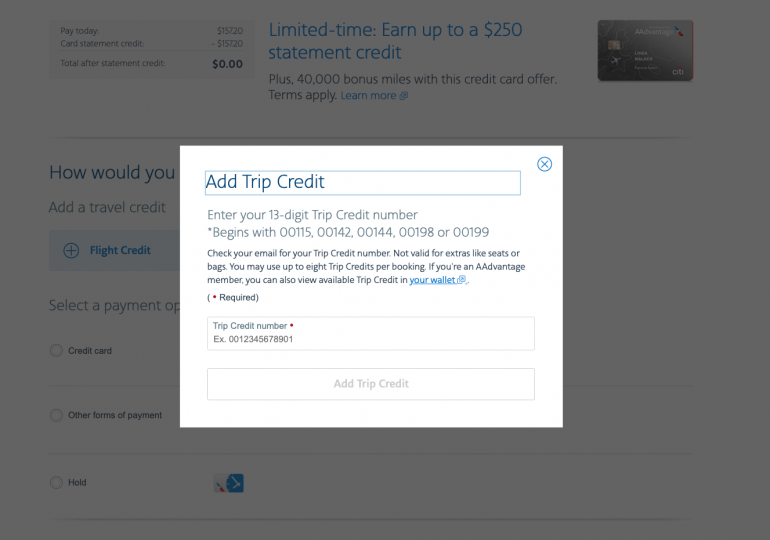

1. Have your trip credit details ready

You can locate your trip credit number in your email from American Airlines or in the wallet section of your AAdvantage member account.

2. Browse and select your flights

Search for and find the flights that you want to book.

3. Click “+ Trip Credit” to apply your trip credit before checking out

Once you confirm flight details, passenger details and select your seats, you'll be able to add a trip credit before finalizing the payment and checkout process.

Once you add your trip credit and see that it has been applied, you can continue through the checkout process.

If you don't have enough credit to cover the cost of your ticket, you'll choose a payment method to pay the difference.

If the ticket price is less than the value of your trip credit, you will receive the remaining value issued as a credit, which you can use for future trips.

American Airlines makes it easy to redeem travel credits when booking flights on their website. Now that you know how to use a flight credit and how to use a trip credit on American Airlines, you can put any remaining credits to use. Just make sure to keep on top of travel credit expiration dates so your credits don't go unused.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Capital One's website

2x-5x Earn unlimited 2X miles on every purchase, every day. Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options.

75,000 Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel.

on Citibank's application

1x Earn 1 Loyalty Point for every 1 eligible AAdvantage® mile earned from purchases.

70,000 Earn 70,000 American Airlines AAdvantage® bonus miles after spending $7,000 within the first 3 months of account opening.

on Chase's website

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

ALREADY A CARDHOLDER?

Start earning bonus airline miles for your next adventure

Select a category to find the best travel credit card for you:

Select a card category:

- Travel Needs

- Everyday Purchases

- Admirals Club® Membership

- Business Owners

Offer available if you apply here today. Offers may vary and this offer may not be available in other places where the card is offered.

All your travel needs.

Earn 50,000 American Airlines AAdvantage® bonus miles plus travel benefits

Bonus miles earned after $2,500 in purchases within the first 3 months of account opening, citi® / aadvantage® platinum select® world elite mastercard®, $0 intro annual fee for the first year , then $99 *, variable purchase apr: 21.24% – 29.99% *, *pricing details.

EVERYDAY PURCHASES AND NO ANNUAL FEE*

American Airlines AAdvantage® MileUp® Mastercard®

Earn 15,000 american airlines aadvantage® bonus miles with our no annual fee credit card*, bonus miles earned after $500 in purchases within the first 3 months of account opening, bonus miles earned after $500 in purchases within the first 3 months of account opening, no annual fee *.

BEST VALUE FOR ADMIRALS CLUB® MEMBERSHIP

Citi® / AAdvantage® Executive World Elite Mastercard®

Earn 70,000 american airlines aadvantage® bonus miles and enjoy the only credit card with admirals club® membership, bonus miles earned after $7,000 in purchases within the first 3 months of account opening, annual fee $595 *.

BUSINESS OWNERS

Citi® / AAdvantage Business™ World Elite Mastercard®

Limited-time: earn 75,000 american airlines aadvantage® bonus miles to redeem for business travel, bonus miles earned after you or your employees spend $5,000 in purchases within the first 5 months of account opening, make business travel more rewarding.

International credit cards

Find the country you live in and choose the card for you.

TERMS AND CONDITIONS

Offer availability.

American Airlines AAdvantage® bonus miles are not available if you have received a new account bonus for a Citi® / AAdvantage® Platinum Select® account in the past 48 months.

The card offer referenced in this communication is only available to individuals who reside in the United States and its territories, excluding Puerto Rico and U.S. Virgin Islands.

Bonus miles

Balance transfers, cash advances, checks that access your credit card account, items and services returned for credit, unauthorized charges, interest and account fees, traveler’s checks, purchases of foreign currency, money orders, wire transfers (and similar cash-like transactions), lottery tickets, and gaming chips (and similar betting transactions) are not purchases. American Airlines AAdvantage® bonus miles typically will appear as a bonus in your AAdvantage® account 8-10 weeks after you have met the purchase requirements. Miles may be earned on purchases made by primary credit cardmembers and authorized users. Purchases must post to your account during the promotional period. Many merchants will wait for a purchase to ship before they post the purchase to your account. Miles earned will be posted to the primary credit cardmember’s AAdvantage® account.

First checked bag free

For benefit to apply, the Citi® / AAdvantage® account must be open 7 days prior to air travel, and reservation must include the primary credit cardmember's American Airlines AAdvantage® number 7 days prior to air travel. If your credit card account is closed for any reason, these benefits will be cancelled.

Eligible Citi® / AAdvantage® primary credit cardmembers may check one bag free of charge when traveling on domestic itineraries marketed and operated by American Airlines, or on itineraries marketed by American Airlines and operated as American Eagle® flights by Envoy Air Inc., Republic Airways Inc., SkyWest Airlines, Inc., Mesa Airlines, Inc., PSA Airlines, Inc., or Piedmont Airlines, Inc. All flights on the itinerary must be domestic flights marketed by American Airlines and operated by American Airlines or American Eagle. This benefit will not be available for travel on codeshare flights booked with an American Airlines flight number but operated by another airline. For the Citi® / AAdvantage® credit card, up to four (4) companions traveling with the eligible primary credit cardmember will also get their first checked bag free of charge if they are listed in the same reservation. Waiver does not apply to overweight or oversized bags. This benefit cannot be combined with any existing AAdvantage® elite program benefits, or with First or Business class benefits, including any waiver of baggage charges. Please see aa.com/baggage » for baggage weight and size restrictions. Applicable terms and conditions are subject to change without notice.

Double miles on American Airlines purchases

Eligible American Airlines purchases are items billed by American Airlines as merchant of record booked through American Airlines channels (aa.com, American Airlines reservations, American Airlines Admirals Club®, American Airlines Vacations℠, Google Flights, and American Airlines airport and city ticket counters). Products or services that do not qualify are car rentals and hotel reservations, purchase of elite status boost or renewal, and AA Cargo℠ products and services. Miles earned will be posted to the primary credit cardmember’s AAdvantage® account in 8-10 weeks.

Double miles at restaurants and gas stations

Earn 2 AAdvantage miles for each $1 spent on purchases at restaurants (including cafes, bars, lounges, and fast food restaurants) and at gas stations. Food and beverage purchases made at the American Airlines Admirals Club® will be awarded 2 AAdvantage miles for each $1 spent as part of the Double Miles on American Airlines purchases benefit.

Certain non-qualifying purchases: Restaurant purchases not eligible to receive double miles include, but are not limited to, supercenters, warehouse clubs, discount stores, restaurants / cafes inside department stores, bowling alleys, public and private golf courses, country clubs, convenience stores, movie theaters, caterers and meal kit delivery services. Gas station purchases not eligible to receive double miles include, but are not limited to, purchases made at warehouse clubs that do not code gas station purchases under a gas station code, discount stores, department stores and convenience stores.

Merchant classification for rewards categories: Merchants are assigned a merchant category code ("MCC"), which is determined in accordance with Visa/Mastercard/American Express procedures based on the kinds of products and services the merchants primarily sell. Citi does not control the assignment of these codes and are not responsible for the codes used by merchants. When you use your card to make a purchase, Citi is provided an MCC for that purchase. Citi groups similar merchant codes into categories for purposes of making rewards offers. Sometimes you may expect a purchase to fit within a rewards category, but if the code assigned to the merchant wasn't grouped into that category as recognized by Citi, your purchase will not qualify for additional miles. [For example, you won't earn additional miles for purchases at a restaurant located within a retailer if the restaurant is assigned a "retailer" code instead of a "restaurant" code.] Please also note – purchases made through mobile/wireless technology may not earn additional miles depending on how the technology is set up to process the purchase.

Citi® reserves the right to determine which purchases qualify for this offer. Miles may be earned on purchases made by primary credit cardmembers and authorized users. Balance transfers, cash advances, checks that access your credit card account, items and services returned for credit, unauthorized charges, interest and account fees, traveler’s checks, purchases of foreign currency, money orders, wire transfers (and similar cash-like transactions), lottery tickets, and gaming chips (and similar betting transactions) do not earn miles. Miles earned will be posted to the primary credit cardmember’s AAdvantage® account in 8-10 weeks.

1 mile per $1

AAdvantage® miles are earned on purchases, except balance transfers, cash advances, checks that access your credit card account, items and services returned for credit, unauthorized charges, interest and account fees, traveler’s checks, purchases of foreign currency, money orders, wire transfers (and similar cash-like transactions), lottery tickets, and gaming chips (and similar betting transactions). Miles may be earned on purchases made by primary credit cardmembers and authorized users. Miles earned will be posted to the primary credit cardmember’s AAdvantage® account in 8-10 weeks.

Preferred boarding

For benefit to apply, the Citi® / AAdvantage® account must be open 7 days prior to air travel, and reservation must include the primary credit cardmember's American Airlines AAdvantage® number 7 days prior to air travel. If your credit card account is closed for any reason, this benefit will be cancelled. This benefit will not be available for travel on codeshare flights booked with an American Airlines flight number but operated by another airline. Up to four (4) companions traveling with and listed in the same reservation as the Citi® / AAdvantage® primary credit cardmember are eligible to board at the same time as the primary credit cardmember. Applicable terms and conditions are subject to change without notice.

Eligible credit cardmembers will board after Priority boarding is complete, but before the rest of economy boarding. The boarding benefit will display on your American Airlines boarding pass as Group 5. This benefit applies on flights marketed and operated by American Airlines, or on flights marketed by American Airlines and operated as American Eagle® flights by Envoy Air Inc., Republic Airways Inc., SkyWest Airlines, Inc., Mesa Airlines, Inc., PSA Airlines, Inc., or Piedmont Airlines, Inc.

$125 American Airlines Flight Discount

Earn a $125 American Airlines Flight Discount certificate (the "Flight Discount") after you spend $20,000 or more in purchases that post to your Citi® / AAdvantage® Platinum Select® credit card billing statement during your credit cardmembership year (every 12 months from the billing cycle after your anniversary month through the billing cycle of your next anniversary month). With the exception of special account status or circumstances (e.g. Military relief programs), the anniversary month will coincide with the month in which the annual fee is billed. To receive the Flight Discount, your account must be open for one full billing cycle after your anniversary month. For your first year of credit cardmembership, purchases qualify as of the date of your account opening. The Flight Discount expires one year from date of issue of the certificate. The Flight Discount is redeemable toward the initial ticket purchase of air travel wholly on flights marketed and operated by American Airlines, or on flights marketed by American Airlines and operated by Envoy Air Inc., Republic Airways Inc., SkyWest Airlines, Inc., Mesa Airlines, Inc., PSA Airlines, Inc., or Piedmont Airlines, Inc. for itineraries originating in the U.S., Puerto Rico, or U.S. Virgin Islands, and sold in US Dollars. The Flight Discount is also redeemable for air travel on any oneworld® carrier or American Airlines codeshare flight. The Flight Discount is redeemable online at aa.com, or by calling American Airlines Reservations. A reservations services fee may apply for travel booked through American Airlines Reservations. The Flight Discount is redeemable only toward the purchase of the base airfare and directly associated taxes, fees and charges that are collected as part of the fare calculation for travel. The Flight Discount cannot be used to pay the taxes and charges on mileage redemption tickets where only taxes and fees are being collected. The Flight Discount may not be used for flight products and/or services that are sold separately or non-flight products and/or services sold by American Airlines. If the ticket price is greater than the value of the Flight Discount, the difference must be paid only with a credit, debit or charge card, or with American Airlines Gift Cards. Any unused balance can be applied towards eligible future travel until the stated expiration date. If travel booked with the Flight Discount is cancelled or changed by the credit cardmember, the Flight Discount will be forfeited and the credit cardmember will be responsible for any applicable fare difference and the applicable change fee. The Flight Discount will not be replaced for any reason. The Flight Discount is non-refundable, may not be sold and has no cash redemption value. After qualification, please allow 8-12 weeks for delivery of the Flight Discount.

25% savings on eligible inflight purchases

Citi® / AAdvantage® credit cardmembers will receive a 25% savings on inflight purchases of food and beverages on flights operated by American Airlines when purchased with their Citi® / AAdvantage® card. Savings do not apply to any other inflight purchases, such as wireless internet access. This benefit applies to domestic flights marketed and operated by American Airlines or on domestic flights marketed by American Airlines and operated by Envoy Air Inc., Republic Airways Inc., SkyWest Airlines, Inc., Mesa Airlines, Inc., PSA Airlines, Inc., or Piedmont Airlines, Inc. This benefit is not available on codeshare flights booked with an American Airlines flight number but operated by another airline. Offer is available on eligible flights as long as supplies last. Savings will appear as a statement credit 8-10 weeks after the transaction is posted to the credit cardmember's card account. Applicable terms and conditions are subject to change without notice.

Authorized user

Before adding an authorized user to your credit card account you should know:

You're responsible for all charges made or allowed to the credit card account by the authorized user. Miles earned on an authorized user’s credit card will be allocated to the AAdvantage® account of the primary credit cardholder and not the authorized user. Authorized users have access to your credit card account information. Before adding an authorized user, you must let him/her know that we may report credit card account performance to the credit reporting agencies in the authorized user's name. If we ask for information about the authorized user, you must obtain their permission to share their information with us and for us to share it as allowed by applicable law. Authorized users do not receive the first checked bag free or boarding benefits.

Fraud Disclosure

If Citi sees evidence of fraud, misuse, abuse, or suspicious activity, as determined by Citi in its sole discretion, Citi reserves the right to take action against you and your credit card account. This may include, without limitation and without prior notice, declining your credit card account application, stopping you from earning American Airlines AAdvantage® miles for purchases made with your card, suspending or closing your Citi® / AAdvantage® card account, and advising American Airlines of such activity. Citi may also take legal action against you to recover monetary losses, including litigation costs and damages. Examples of activities that may trigger such actions include, but are not limited to, the following: (1) application for a card account in an attempt to take advantage of a bonus offer that was not intended for you or for which you are not eligible per the terms of the offer; (2) repeated cancellation or conversion of your Citi card accounts within one year after account opening or conversion; (3) returns of purchases you made to satisfy all or a substantial portion of the purchase requirements for a bonus offer or excessive returns of purchases for which you have earned AAdvantage® miles or (4) using your account other than for personal, family or household purposes.

Card Account Disclosure

The Card Account is only available if you have an open AAdvantage® program membership in your name. Citi reserves the right to cancel your Card Account if you or American Airlines terminates or deactivates your AAdvantage® program membership.

American Airlines reserves the right to change the AAdvantage® program and its terms and conditions at any time without notice, and to end the AAdvantage® program with six months’ notice. Any such changes may affect your ability to use the awards or mileage credits that you have accumulated. Unless specified, AAdvantage® miles earned through this promotion/offer do not count toward elite-status qualification or AAdvantage Million Miler℠ status. American Airlines is not responsible for products or services offered by other participating companies. For complete details about the AAdvantage® program, visit aa.com/aadvantage » .

Travel booked on American Airlines may be American Eagle® service, operated by Envoy Air Inc., Republic Airways Inc., SkyWest Airlines, Inc., Mesa Airlines, Inc., PSA Airlines, Inc., or Piedmont Airlines, Inc.

American Airlines, American Eagle, AAdvantage, AAdvantage Million Miler, MileSAAver, Business Extra, Flagship, Admirals Club, Platinum Pro, AAdvantage MileUp, AA Cargo, the Flight Symbol logo and the Tail Design are marks of American Airlines, Inc.

one world is a mark of the one world Alliance, LLC.

Citibank is not responsible for products or services offered by other companies. Cardmember program terms are subject to change.

Mastercard, World Elite and the circles design are registered trademarks of Mastercard International Incorporated.

© 2021 Citibank, N.A. Citi, Citi and Arc Design and other marks used herein are service marks of Citigroup Inc. or its affiliates, used and registered throughout the world.

American Airlines AAdvantage MileUp® Mastercard®

Statement credit and American Airlines AAdvantage® bonus miles are not available if you have received a statement credit or American Airlines AAdvantage® bonus miles for a new AAdvantage MileUp® account in the past 48 months.

Double miles on grocery store purchases

Earn 2 AAdvantage miles for each $1 spent on purchases at grocery stores. Grocery stores are classified as supermarkets, freezer/meat locker provisioners, dairy product stores, miscellaneous food/convenience stores, markets, specialty vendors, and bakeries.

Certain non-qualifying purchases: You won’t earn double miles for purchases at general merchandise/discount superstores, wholesale/warehouse clubs, candy/confectionery stores, cafes, bars, lounges, and fast food restaurants.

Merchant classification for rewards categories: Merchants are assigned a merchant category code (“MCC”), which is determined in accordance with Visa/Mastercard/American Express procedures based on the kinds of products and services the merchants primarily sell. Citi does not control the assignment of these codes and are not responsible for the codes used by merchants. When you use your card to make a purchase, Citi is provided an MCC for that purchase. Citi groups similar merchant codes into categories for purposes of making rewards offers. Sometimes you may expect a purchase to fit within a rewards category, but if the code assigned to the merchant wasn’t grouped into that category as recognized by Citi, your purchase will not qualify for additional miles. [For example, you won’t earn additional miles for purchases at a restaurant located within a retailer if the restaurant is assigned a “retailer” code instead of a “restaurant” code.] Please also note – purchases made through mobile/wireless technology may not earn additional miles depending on how the technology is set up to process the purchase.

AAdvantage MileUp® credit cardmembers will receive a 25% savings on inflight purchases of food and beverages on flights operated by American Airlines when purchased with their AAdvantage MileUp® credit card. Savings do not apply to any other inflight purchases, such as wireless internet access. This benefit applies to domestic flights marketed and operated by American Airlines or on domestic flights marketed by American Airlines and operated by Envoy Air Inc., Republic Airways Inc., SkyWest Airlines, Inc., Mesa Airlines, Inc., PSA Airlines, Inc., or Piedmont Airlines, Inc. This benefit is not available on codeshare flights booked with an American Airlines flight number but operated by another airline. Offer is available on eligible flights as long as supplies last. Savings will appear as a statement credit 8-10 weeks after the transaction is posted to the credit cardmember's card account. Applicable terms and conditions are subject to change without notice.

No mileage cap

There is no maximum number of American Airlines AAdvantage® miles that you can accumulate through your Citi® / AAdvantage® credit card account.

You're responsible for all charges made or allowed to the credit card account by the authorized user. Miles earned on an authorized user’s credit card will be allocated to the AAdvantage® account of the primary credit cardholder and not the authorized user. Authorized users have access to your credit card account information. Before adding an authorized user, you must let him/her know that we may report credit card account performance to the credit reporting agencies in the authorized user's name. If we ask for information about the authorized user, you must obtain their permission to share their information with us and for us to share it as allowed by applicable law.

American Airlines AAdvantage® bonus miles are not available if you have received a new account bonus for a Citi® / AAdvantage® Executive account in the past 48 months.

Eligible Citi® / AAdvantage® primary credit cardmembers may check one bag free of charge when traveling on domestic itineraries marketed and operated by American Airlines, or on domestic itineraries marketed by American Airlines and operated as American Eagle® flights by Envoy Air Inc., Republic Airways Inc., SkyWest Airlines, Inc., Mesa Airlines, Inc., PSA Airlines, Inc., or Piedmont Airlines, Inc. All flights on the itinerary must be domestic flights marketed by American Airlines and operated by American Airlines or American Eagle. This benefit will not be available for travel on codeshare flights booked with an American Airlines flight number but operated by another airline. For the Citi® / AAdvantage® card, up to eight (8) companions traveling with the eligible primary credit cardmember will also get their first checked bag free of charge if they are listed in the same reservation. Waiver does not apply to overweight or oversized bags. This benefit cannot be combined with any existing AAdvantage® elite program benefits, or with First or Business class benefits, including any waiver of baggage charges. Please see aa.com/baggage » for baggage weight and size restrictions. Applicable terms and conditions are subject to change without notice.

Enhanced airport experience

For benefits to apply, the Citi® / AAdvantage® Executive World Elite Mastercard® account must be open 7 days prior to air travel AND reservation must include the primary credit cardmember's American Airlines AAdvantage® number 7 days prior to air travel. If your credit card account is closed for any reason, these benefits will be cancelled. Citi® / AAdvantage® Executive credit cardmembers will have the following benefits: priority check-in (where available), priority airport screening (where available), and priority boarding privileges. The priority boarding benefit will display on your American Airlines boarding pass as Group 4.

These benefits apply when traveling on flights marketed and operated by American Airlines, or on flights marketed by American Airlines and operated as American Eagle® flights by Envoy Air Inc., Republic Airways Inc., SkyWest Airlines, Inc., Mesa Airlines, Inc., PSA Airlines, Inc., or Piedmont Airlines, Inc. Up to eight (8) companions traveling with the eligible primary credit cardmember will also get priority check-in (where available), priority airport screening (where available), and priority boarding privileges if they are listed in the same reservation. You may check in at any Business Class check-in position or First Class check-in when Business Class is not available, regardless of the class of service in which you are traveling on American Airlines.

These benefits will not be available for travel on codeshare flights booked with an American Airlines flight number but operated by another airline. Exclusive lanes at security checkpoints are available, subject to TSA approval. Applicable terms and conditions are subject to change without notice.

Citi® / AAdvantage® credit cardmembers will receive a 25% savings on inflight purchases of food and beverages on flights operated by American Airlines when purchased with their Citi® / AAdvantage® credit card. Savings do not apply to any other inflight purchases, such as wireless internet access. This benefit applies to domestic flights marketed and operated by American Airlines or on domestic flights marketed by American Airlines and operated by Envoy Air Inc., Republic Airways Inc., SkyWest Airlines, Inc., Mesa Airlines, Inc., PSA Airlines, Inc., or Piedmont Airlines, Inc. This benefit is not available on codeshare flights booked with an American Airlines flight number but operated by another airline. Offer is available on eligible flights as long as supplies last. Savings will appear as a statement credit 8-10 weeks after the transaction is posted to the credit cardmember's card account. Applicable terms and conditions are subject to change without notice.

Admirals Club® membership and credit card authorized user access

Only Citi® / AAdvantage® Executive World Elite Mastercard® primary credit cardmembers who are eighteen (18) years of age or older will receive full membership access privileges to Admirals Club® lounges. An authorized user of the Citi® / AAdvantage® Executive World Elite Mastercard® who is eighteen (18) years of age or older will receive access privileges to American Airlines Admirals Club® lounges. Full Admirals Club® membership privileges do not apply to a credit card authorized user. An Admirals Club® membership includes access to other airline lounges and clubs with which American Airlines may have reciprocal lounge or club access privileges. Membership also includes special pricing on conference rooms and other special offers that are available exclusively to Admirals Club® members. Neither membership nor the credit card authorized user access benefit provides access privileges to the Arrivals Lounge, International First Class Lounges, or Flagship® Lounge facilities, including Flagship® First Dining. Additionally, the credit card authorized user access benefit does not provide: (i) access privileges to other airline lounges or clubs with which American Airlines may have reciprocal lounge or club access privileges; or (ii) special pricing on conference rooms or other special offers. To locate a current list of Admirals Club® lounges please visit aa.com/admiralsclub » .

To access an Admirals Club® lounge, primary credit cardmembers and credit card authorized users must present: (i) their (a) active and valid Citi® / AAdvantage® Executive World Elite Mastercard® or (b) with respect to primary credit cardmembers only, AAdvantage® number; (ii) their current government-issued I.D.; and (iii) a boarding pass for same-day travel on an eligible flight, which includes any departing or arriving flight that is (1) marketed or operated by American Airlines, (2) marketed and operated by any oneworld® carrier, or (3) marketed and operated by Alaska Airlines; and (iv) any additional documentation required by American Airlines. Either immediate family members (spouse or domestic partner and children under eighteen (18) years of age) or up to two (2) guests traveling with the primary credit cardmember or authorized user may be admitted for free when accompanied by the primary credit cardmember or authorized user. Family members and guests must present a same-day boarding pass for an eligible flight as defined above. All persons must be of valid drinking age, based on applicable law, to consume alcohol.

If the primary credit cardmember is an Admirals Club® member on the date his or her Citi® / AAdvantage® Executive World Elite Mastercard® credit card account is approved by Citi® and has sixty (60) or more days remaining on such current Admirals Club® membership, he or she is eligible to receive a prorated refund from American Airlines for any unused portion of his or her current Admirals Club® membership fee. The refund will be a prorated amount of the annual membership fee calculated based on the number of days remaining on such primary credit cardmember’s current Admirals Club® membership as of the date his or her Citi® / AAdvantage® Executive World Elite Mastercard® credit card account is approved by Citi®. Refunds will be automatically made in the original form of payment within twelve (12) weeks of becoming a Citi® / AAdvantage® Executive World Elite Mastercard® credit cardmember. Memberships redeemed with Business Extra points, Lifetime Admirals Club® members and AirPass members with Admirals Club® privileges are not eligible for a refund.

Upon closure of the Citi® / AAdvantage® Executive World Elite Mastercard® account, all Admirals Club® benefits and access associated with the account will be immediately terminated, including, but not limited to, all benefits afforded to credit card authorized users. All Admirals Club® membership rules, terms and conditions apply. AMERICAN AIRLINES RESERVES THE RIGHT TO MODIFY ANY OR ALL RULES, TERMS AND CONDITIONS AT ANY TIME WITHOUT NOTICE. SUCH MODIFICATIONS SHALL BE EFFECTIVE IMMEDIATELY AND INCORPORATED INTO THIS AGREEMENT. BY ACCESSING ANY ADMIRALS CLUB® LOUNGE YOU SHALL BE DEEMED TO HAVE ACCEPTED THE ADMIRALS CLUB® TERMS AND CONDITIONS. To review the complete Admirals Club® membership terms and conditions, visit aa.com/admiralsclub » .

Global Entry or TSA PreCheck® application fee credit

Citi® / AAdvantage® Executive World Elite Mastercard® credit cardmembers are eligible to receive one statement credit up to $100 per account every five years for either the Global Entry or the TSA PreCheck® program application fee. Credit cardmembers must charge the application fee to their Citi®/ AAdvantage® Executive credit card to qualify for the statement credit. Credit cardmembers will receive a statement credit for the first program (either Global Entry or TSA PreCheck®) to which they apply and pay for with their eligible card, regardless of whether they are approved for Global Entry or TSA PreCheck®. Please allow 1-2 billing cycles after the qualifying Global Entry or TSA PreCheck® fee is charged to the eligible account for the statement credit to be posted to the account. Only fees associated with either the Global Entry or the TSA PreCheck® application fee will be eligible towards the statement credit.

For information on Global Entry, visit globalentry.gov. For information on TSA PreCheck®, visit tsa.gov. Applications are made directly with these organizations, and this information is not shared with Citi, nor does Citi have access to Global Entry or TSA records. Citi does not share account information with Global Entry or TSA. Decisions to approve/deny applications are made solely by these organizations, and Citi has no influence over these decisions. Citi is not notified of approvals or denials of applications.

TSA PreCheck® is a registered trademark of the Department of Homeland Security.

CitiBusiness® / AAdvantage® Platinum Select® World Elite Mastercard®

American Airlines AAdvantage® bonus miles are not available if you have received a new account bonus for a CitiBusiness® / AAdvantage® Platinum Select® account in the past 48 months.

Balance transfers, cash advances, checks that access your credit card account, items and services returned for credit, unauthorized charges, interest and account fees, traveler’s checks, purchases of foreign currency, money orders, wire transfers (and similar cash-like transactions), lottery tickets, and gaming chips (and similar betting transactions) are not purchases. American Airlines AAdvantage® bonus miles typically will appear as a bonus in your AAdvantage® account 8-10 weeks after you have met the purchase requirements. Miles may be earned on purchases made by primary credit cardmember and employee cardmembers. Purchases must post to your account during the promotional period. Many merchants will wait for a purchase to ship before they post the purchase to your account. Miles earned will be posted to the primary credit cardmember’s AAdvantage® account.

For benefit to apply, the CitiBusiness® / AAdvantage® account must be open 7 days prior to air travel, and reservation must include the primary credit cardmember's American Airlines AAdvantage® number 7 days prior to air travel. If your credit card account is closed for any reason, these benefits will be cancelled.

Eligible CitiBusiness® / AAdvantage® primary credit cardmembers may check one bag free of charge when traveling on domestic itineraries marketed and operated by American Airlines, or on itineraries marketed by American Airlines and operated as American Eagle® flights by Envoy Air Inc., Republic Airways Inc., SkyWest Airlines, Inc., Mesa Airlines, Inc., PSA Airlines, Inc., or Piedmont Airlines, Inc. All flights on the itinerary must be domestic flights marketed by American Airlines and operated by American Airlines or American Eagle. This benefit will not be available for travel on codeshare flights booked with an American Airlines flight number but operated by another airline. For the CitiBusiness® / AAdvantage® card, up to four (4) companions traveling with the eligible primary credit cardmember will also get their first checked bag free of charge if they are listed in the same reservation. Benefit does not apply to overweight or oversized bags. This benefit cannot be combined with any existing AAdvantage® elite program benefits, or with First or Business class benefits, including any waiver of baggage charges. Please see aa.com/baggage » for baggage weight and size restrictions. Applicable terms and conditions are subject to change without notice.

Double miles on purchases in select business categories

Earn 2 AAdvantage® miles per $1 spent on purchases at certain telecommunications merchants, car rental merchants, cable and satellite providers, and at gas stations. Telecommunications merchants are classified as merchants that sell telecommunications equipment such as telephones, fax machines, pagers, and cellular phones, along with providers of telecommunications services including local and long-distance telephone calls and fax services. Car rental merchants are classified as providers of short-term or long-term rentals of cars, trucks, or vans. Cable and satellite providers are classified as merchants that provide the connection and ongoing delivery of television, internet (computer network, information services, email website hosting services) telephone and radio programming via cable or satellite on a subscription or fee basis. Gas stations are classified as merchants that sell fuel primarily for consumer use and may or may not be attended.

Certain non-qualifying purchases: Car rental purchases not eligible to receive double miles include purchases at merchants that rent motor homes or other recreational vehicles and purchases made through travel agencies, tour operators and online third party travel sites, and charges paid on car rental redemptions through RocketMiles. Gas station purchases not eligible to receive double miles include, but are not limited to, purchases made at warehouse clubs that do not code gas station purchases under a gas station code, discount stores, department stores and convenience stores.

Merchant classification for rewards categories: Merchants are assigned a merchant category code (“MCC”), which is determined in accordance with Visa/Mastercard/American Express procedures based on the kinds of products and services the merchants primarily sell. Citi does not control the assignment of these codes and are not responsible for the codes used by merchants. When you use your card to make a purchase, Citi is provided an MCC for that purchase. Citi groups similar merchant codes into categories for purposes of making rewards offers. Sometimes you may expect a purchase to fit within a rewards category, but if the code assigned to the merchant wasn’t grouped into that category as recognized by Citi, your purchase will not qualify for additional miles. [For example, you won't earn additional miles for purchases at a restaurant located within a retailer if the restaurant is assigned a “retailer” code instead of a “restaurant” code.] Please also note – purchases made through mobile/wireless technology may not earn additional miles depending on how the technology is set up to process the purchase.

Citi® reserves the right to determine which purchases qualify for this offer. Miles may be earned on purchases made by primary credit cardmembers and authorized users. Balance transfers, cash advances, checks that access your credit card account, items and services returned for credit, unauthorized charges, interest and account fees, traveler’s checks, purchases of foreign currency, money orders, wire transfers (and similar cash-like transactions), lottery tickets, and gaming chips (and similar betting transactions) account do not earn miles. Miles earned will be posted to the primary credit cardmember’s AAdvantage® account in 8–10 weeks.

For benefit to apply, the CitiBusiness® / AAdvantage® account must be open 7 days prior to air travel, and reservation must include the primary credit cardmember's American Airlines AAdvantage® number 7 days prior to air travel. If your credit card account is closed for any reason, this benefit will be cancelled. This benefit will not be available for travel on codeshare flights booked with an American Airlines flight number but operated by another airline. Up to four (4) companions traveling with and listed in the same reservation as the CitiBusiness® / AAdvantage® primary credit cardmember are eligible to board at the same time as the primary credit cardmember. Applicable terms and conditions are subject to change without notice.

Eligible CitiBusiness® / AAdvantage® credit cardmembers board after Priority boarding is complete, but before the rest of economy boarding. The boarding benefit will display on your American Airlines boarding pass as Group 5. This benefit applies on flights marketed and operated by American Airlines, or on flights marketed by American Airlines and operated as American Eagle® flights by Envoy Air Inc., Republic Airways Inc., SkyWest Airlines, Inc., Mesa Airlines, Inc., PSA Airlines, Inc., or Piedmont Airlines, Inc.

25% savings on eligible inflight purchases of food and beverage

CitiBusiness® / AAdvantage® credit cardmembers will receive a 25% savings on inflight purchases of food and beverages on flights operated by American Airlines when purchased with their CitiBusiness® / AAdvantage® card. Savings do not apply to any other inflight purchases. This benefit applies to domestic flights marketed and operated by American Airlines or on domestic flights marketed by American Airlines and operated by Envoy Air Inc., Republic Airways Inc., SkyWest Airlines, Inc., Mesa Airlines, Inc., PSA Airlines, Inc., or Piedmont Airlines, Inc. This benefit is not available on codeshare flights booked with an American Airlines flight number but operated by another airline. Offer is available on eligible flights as long as supplies last. Savings will appear as a statement credit 8-10 weeks after the transaction is posted to the credit cardmember's card account. Applicable terms and conditions are subject to change without notice.

25% savings on inflight Wi-Fi purchases

Receive a 25% savings when you use your CitiBusiness® / AAdvantage® Platinum® Select credit card for the purchase of inflight Wi-Fi service from American Airline’s Wi-Fi merchants Gogo, Viasat, or Panasonic, and on American Airlines’ Wi-Fi Subscription Plan. This benefit applies to flights marketed and operated by American Airlines or on flights marketed by American Airlines and operated by Envoy Air Inc., Republic Airways Inc., SkyWest Airlines, Inc., Mesa Airlines, Inc., PSA Airlines, Inc., or Piedmont Airlines, Inc. This benefit is not available on codeshare flights booked with an American Airlines flight number but operated by another airline. Savings will appear as a statement credit 8-10 weeks after the transaction is posted to the credit cardmember's card account. Applicable terms and conditions are subject to change without notice.

American Airlines Companion Certificate

The primary credit cardmember will earn a $99 domestic economy fare American Airlines Companion Certificate after you spend $30,000 or more in purchases that post to your CitiBusiness® / AAdvantage® Platinum Select® credit card billing statement during your credit cardmembership year (every 12 months from the billing cycle after your anniversary month through the billing cycle of your next anniversary month). With the exception of special account status or circumstances (e.g. Military relief programs) the anniversary month will coincide with the month in which the annual fee is billed. To receive the Companion Certificate, your account must be open for one full billing cycle after your anniversary month. For your first year of credit cardmembership, purchases qualify as of the date of your account opening. After these conditions are met, please allow at least 8-10 weeks for availability of the Companion Certificate. You must have an open AAdvantage® account for the Companion Certificate to be awarded to your account and to redeem the certificate. When used according to its terms, the primary credit cardmember will pay a $99 companion ticket fee plus $21.60 to $43.20 in government taxes and fees, depending on itinerary, for one round trip qualifying domestic economy fare ticket for a companion when an individual round trip qualifying domestic Main Cabin fare ticket is purchased and redeemed through American Airlines Meeting Services. Travel must be booked and purchased in select Main Cabin inventory. The certificate must be redeemed and all travel completed by midnight of the Travel Expiration Date shown on the certificate. Valid for travel on flights within the 48 contiguous United States on flights marketed and operated by American Airlines, or on flights marketed by American Airlines and operated as American Eagle® flights by Envoy Air Inc., Republic Airways Inc., SkyWest Airlines, Inc., Mesa Airlines, Inc., PSA Airlines, Inc., or Piedmont Airlines, Inc. For residents of Alaska and Hawaii, the companion certificate is also valid for round-trip travel originating in either of those two states and continuing to the 48 contiguous United States. For residents of U.S. Virgin Islands and Puerto Rico, companion certificate eligible travel is also defined as round-trip travel originating in either of those two territories and continuing to the 48 contiguous United States. The Companion Certificate is not redeemable for air travel on any oneworld® carrier or on an American Airlines codeshare flight. Applicable terms and conditions are subject to change without notice. Details, terms and conditions, certain restrictions, and restricted dates apply and will be disclosed on the certificate.

Employees may be added to the account as authorized users. Miles earned on an authorized user’s credit card will be allocated to the AAdvantage® account of the primary credit cardholder and not to the authorized user. You must pay us for all charges made or allowed by authorized users. Authorized users are able to get account information. Authorized users must be employees or contractors of your business. You need the authorized user's permission to give us any information about them that we request and to allow us to share information about them as allowed by applicable law. This includes information we may get from you, any authorized user and others. It also includes information about their transactions on the account.

If Citi sees evidence of fraud, misuse, abuse, or suspicious activity, as determined by Citi in its sole discretion, Citi reserves the right to take action against you and your credit card account. This may include, without limitation and without prior notice, declining your credit card account application, stopping you from earning American Airlines AAdvantage® miles for purchases made with your card, suspending or closing your CitiBusiness® / AAdvantage® card account, and advising American Airlines of such activity. Citi may also take legal action against you to recover monetary losses, including litigation costs and damages. Examples of activities that may trigger such actions include, but are not limited to, the following: (1) application for a card account in an attempt to take advantage of a bonus offer that was not intended for you or for which you are not eligible per the terms of the offer; (2) repeated cancellation or conversion of your Citi card accounts within one year after account opening or conversion; (3) returns of purchases you made to satisfy all or a substantial portion of the purchase requirements for a bonus offer or excessive returns of purchases for which you have earned AAdvantage® miles or (4) using the account other than for business purposes.

ApplyURLsHome

How to change or cancel an American Airlines flight

Editor's Note

Planning a vacation can take a tremendous amount of time and energy. When things go wrong, and you need to change or cancel your plans, will it be easy to do so?

Thankfully, changing and canceling American Airlines flights is incredibly easy. Over the past few years, the airline has eliminated most of the fees associated with changing or canceling many types of tickets.

In this guide, we'll help you better understand American Airlines' cancellation policy, change policy and refund policy.

American Airlines' cancellation policy

If you purchased your ticket directly, American Airlines' cancellation policy is pretty straightforward. There are a few key points to consider:

- All tickets are fully refundable within the first 24 hours after booking as long as your departure date is more than two days in the future.

- Nonrefundable tickets can be changed or canceled without a fee, but you won't receive a refund. Instead, you'll receive a travel credit to use on another flight.

- Basic economy fares are the only fares that cannot be changed once booked. However, with recent policy changes , you can cancel the flight by paying a fee. Similar to other nonrefundable tickets purchased, you'll receive a refund in the form of a travel credit.

- You can refund fully refundable tickets at any time to the original payment method.

- You can cancel award tickets and redeposit the miles you used without a fee.

As you can see, the current American Airlines cancellation policy is extremely customer-friendly. Except for basic economy and some tickets that originate outside of North and South America, you won't have to worry about jumping through hoops or losing the entire value of your ticket. Also, when changing a nonrefundable ticket, you'll receive a travel credit for any reduction in fare. For example, if you change from a $500 ticket to a $300 ticket, you'll receive a travel voucher for $200 to use on a future ticket.

To dive into the basic economy flight cancellation policy, you can now cancel a basic economy fare. Previously, these fare types could not be changed. But, there are some caveats to be aware of. Firstly, you must be an AAdvantage member — and your number must be tied to your reservation. You also must have booked directly with American Airlines, be flying on an American Airlines-marketed and -operated flight, and be traveling within the 50 U.S. states. While you'll receive the the refund in the form of a travel credit, there's a cancellation fee of $99. This means if your flight costs $200, you'll end up with a credit of $101.

Additionally, there are a few different expiration dates when it comes to receiving a travel credit from canceling or changing an American Airlines flight. AAdvantage members will receive a credit that expires one year from the date the credit is issued, while nonmembers only have six months to use the credit (for credits issued on or after April 2, 2024). Enrolling in the AAdvantage membership program is free, so there's absolutely no reason not to be a member — and have your credit valid for a full year.

Related: American Airlines is making it much easier to redeem your existing travel credits

How to cancel an American Airlines flight

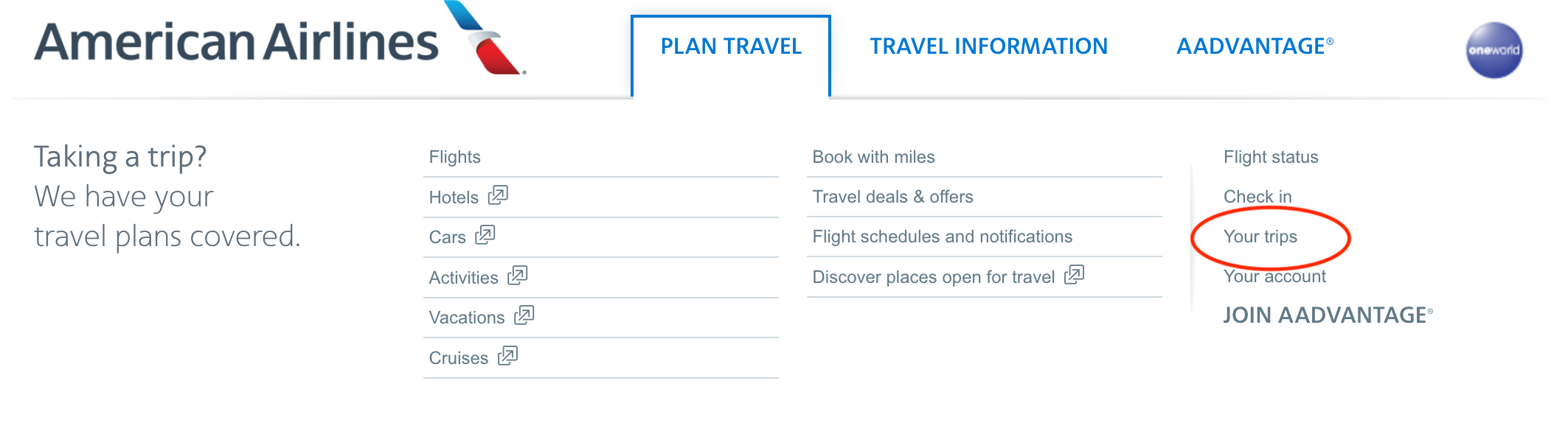

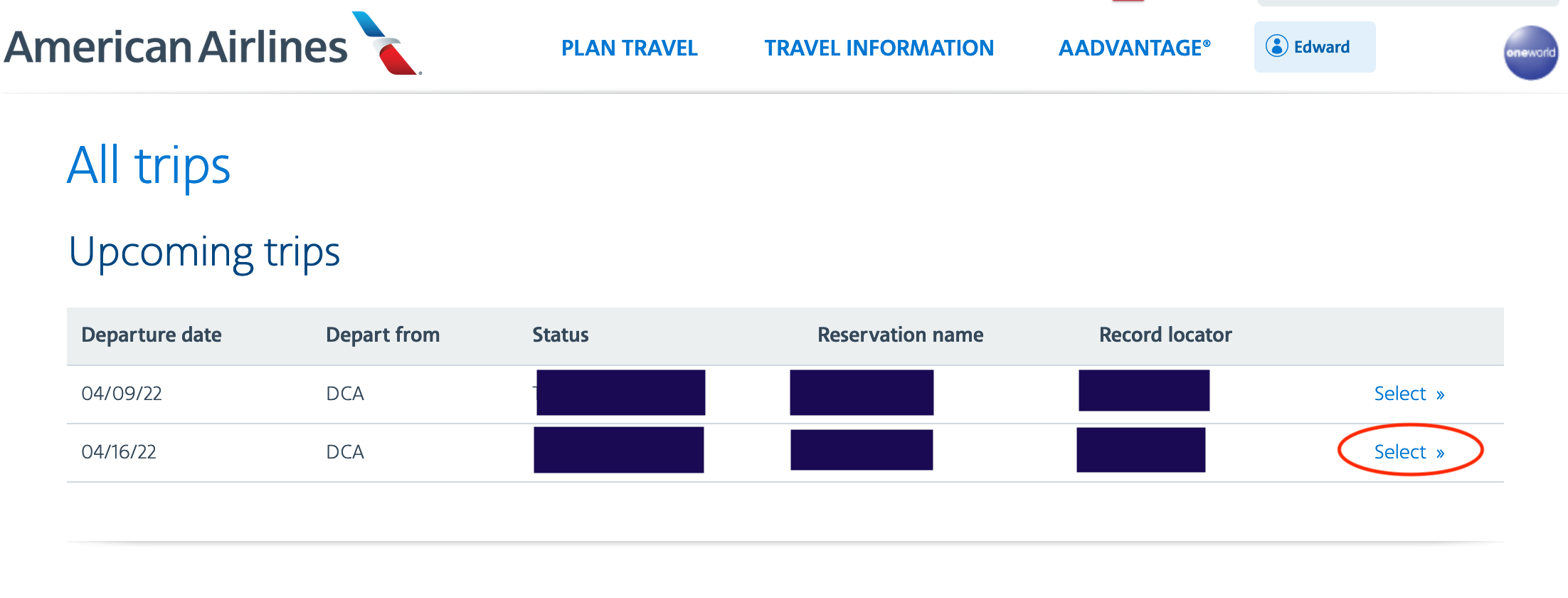

The steps to cancel an American Airlines flight on paid and award tickets are now virtually identical. Once you log in to your American Airlines account , click on the "Your trips" link in the menu:

From your list of upcoming trips, select the one you'd like to cancel:

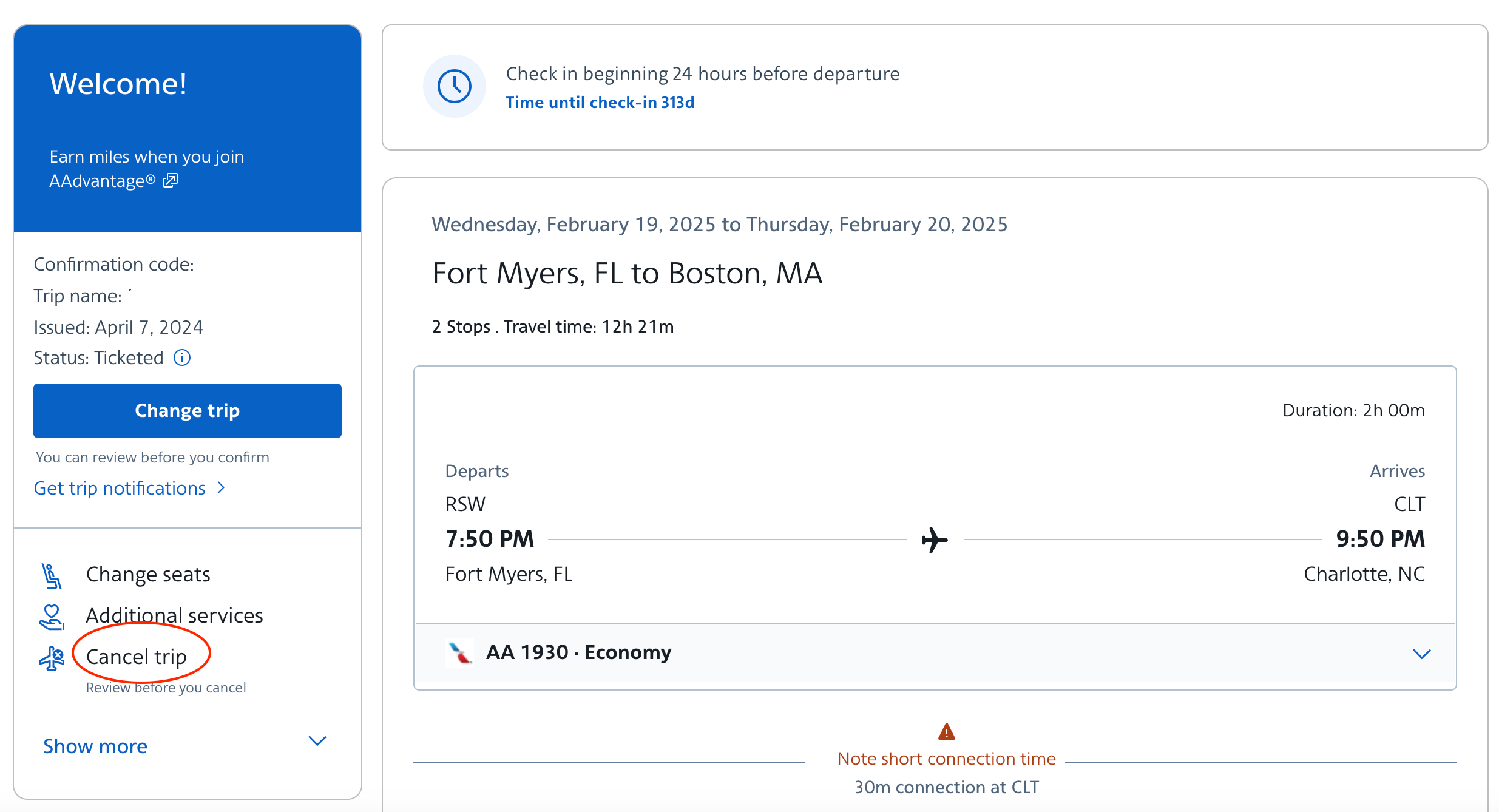

Select "Cancel trip":

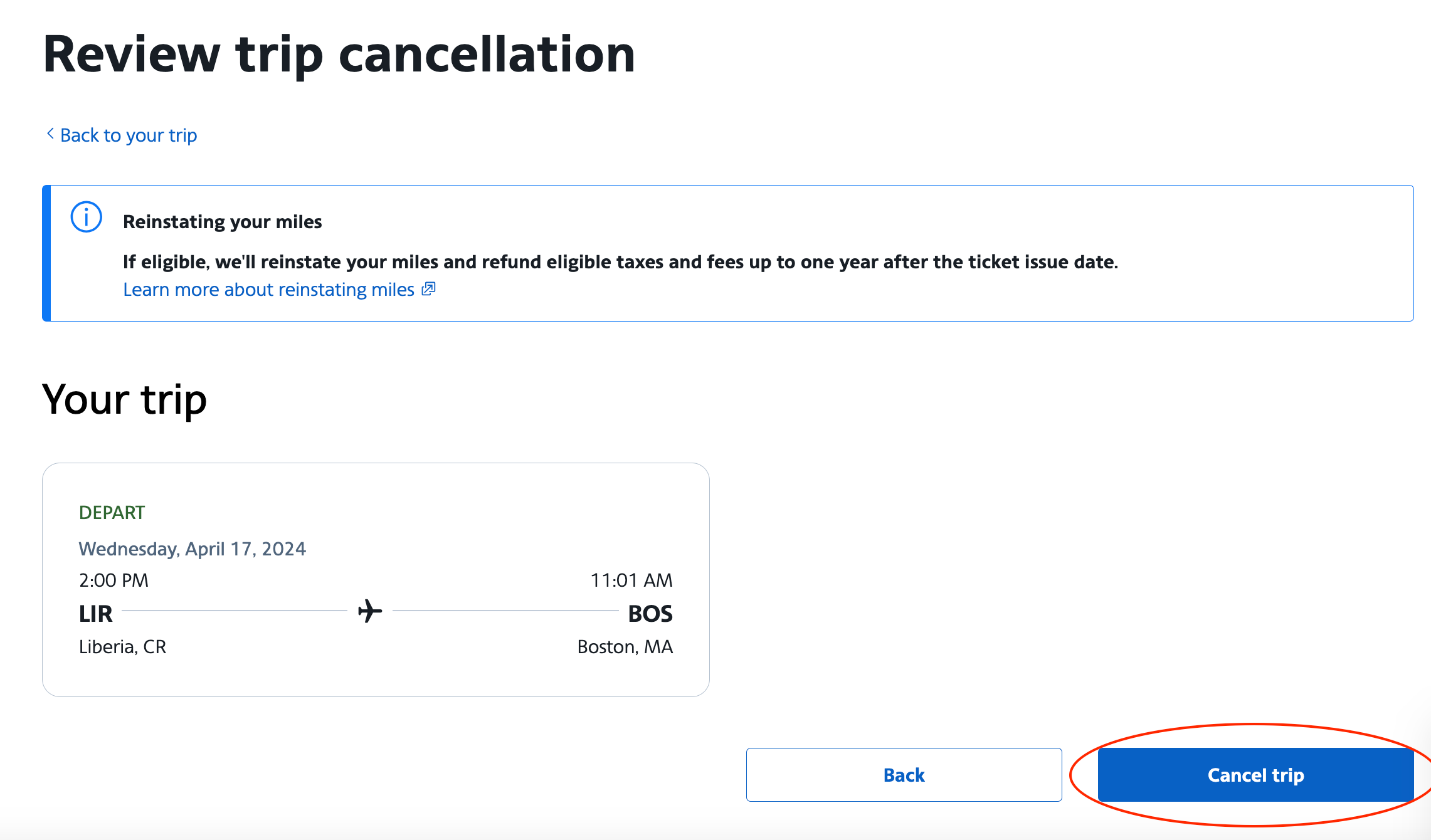

Then, confirm your cancellation:

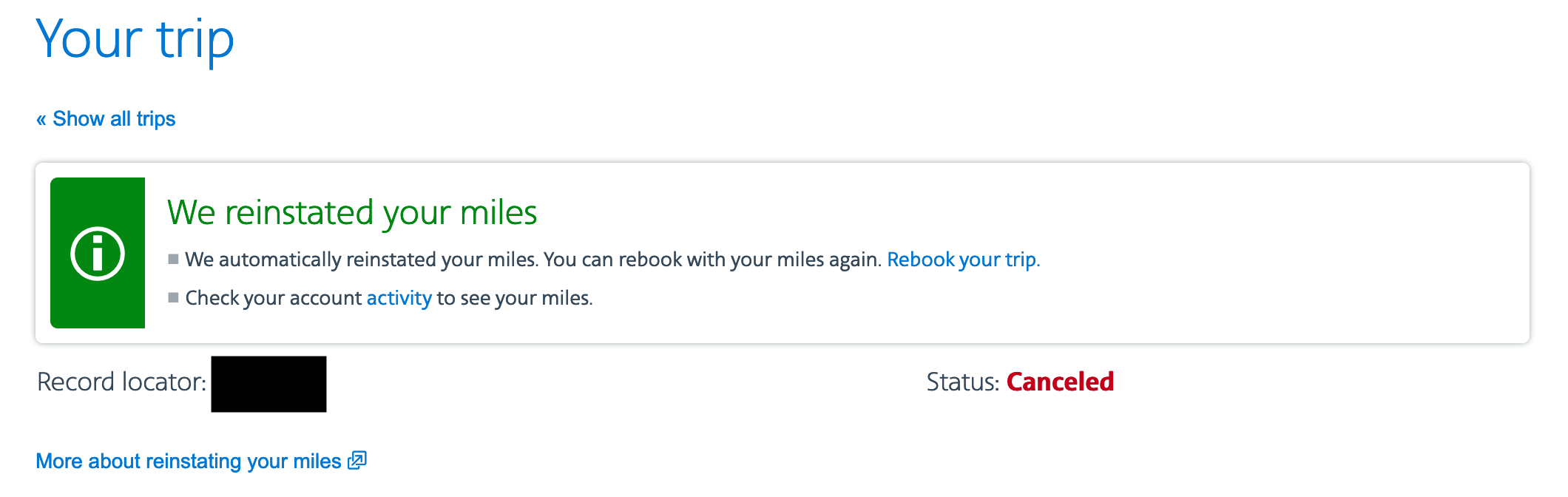

American Airlines should automatically reinstate your miles for award tickets, and the airline should automatically issue a travel voucher for paid tickets. The taxes and fees paid on award tickets should all be returned to the credit card used to pay. However, based on personal experience, double-check to ensure you receive the credit. If, by some chance, it gets refunded as a travel credit, you'll need to call American Airlines.

Related: Why you should wait to change or cancel your flight if you want your money back

How to change an American Airlines flight

Changing an American Airlines flight online is easy. You can also contact American Airlines via phone to change your flight. However, if you booked a web special fare with miles, those award flights can't usually be changed; you'll instead have to cancel and rebook. Here are the steps to change a flight:

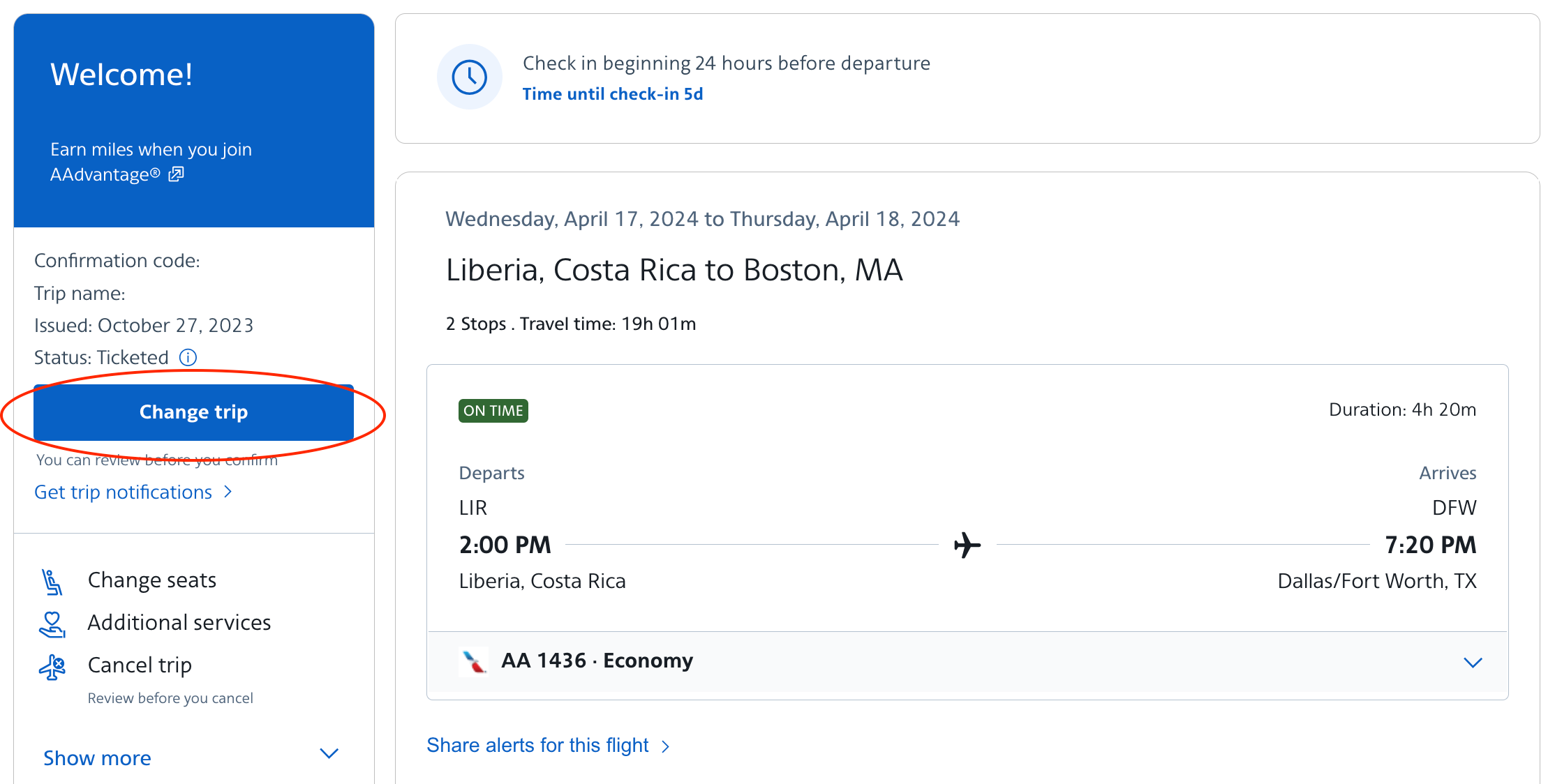

Once you've pulled up your trip in your account online, select the "Change trip" button:

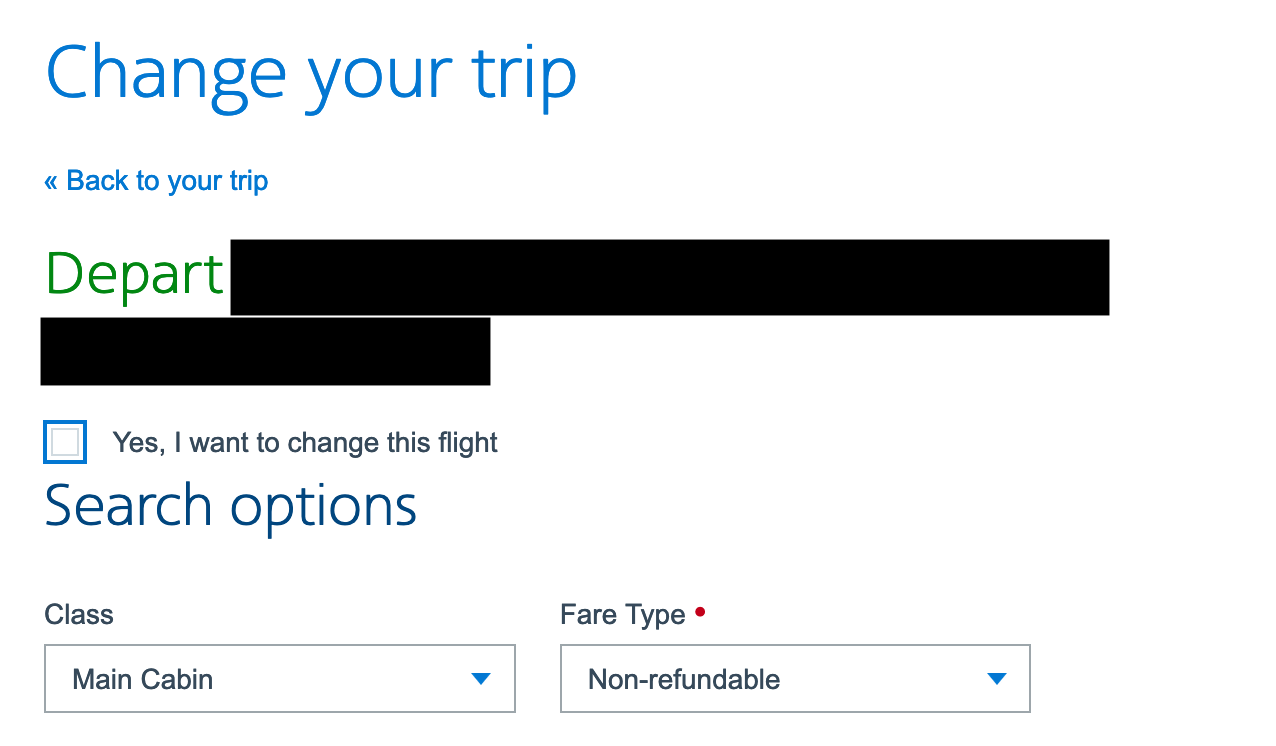

From there, click the box labeled "Yes, I want to change this flight," and search for new flights:

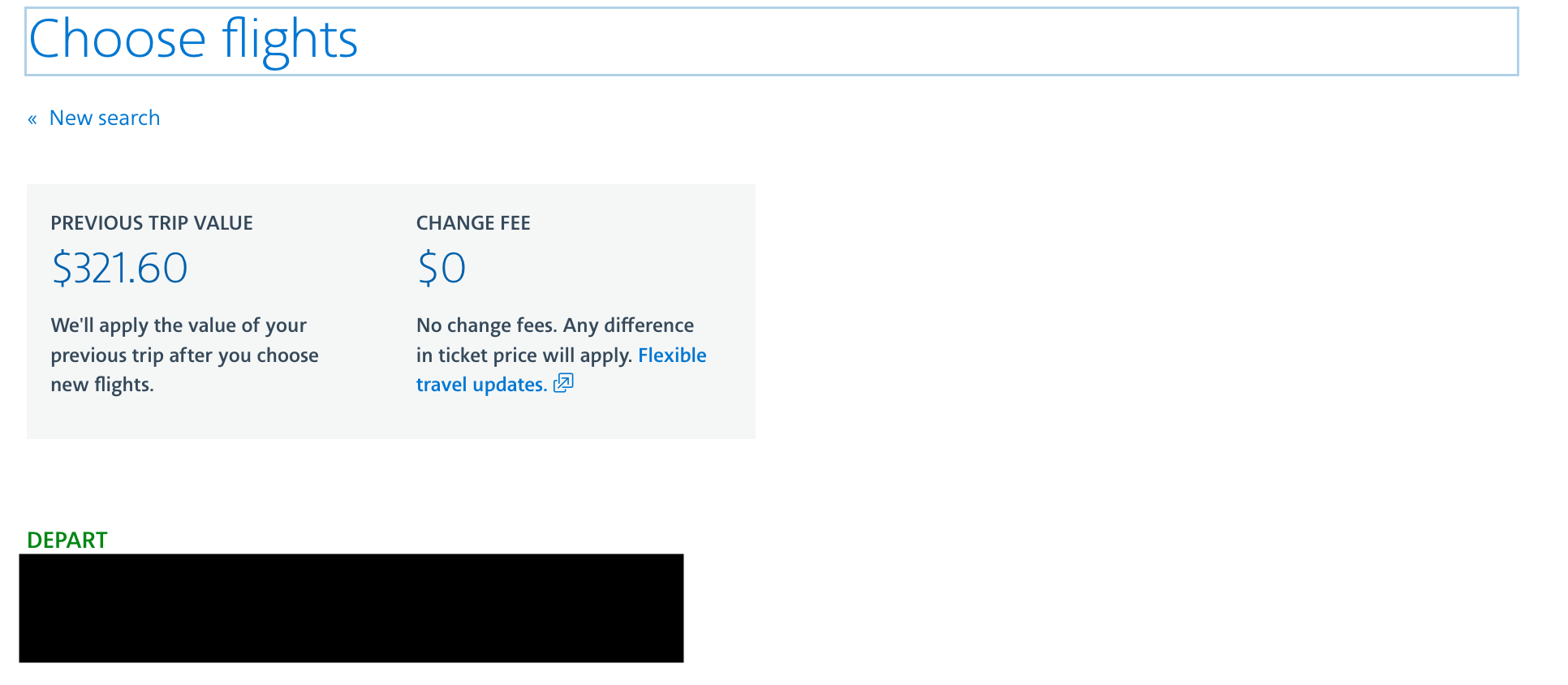

Select a new flight from the options given:

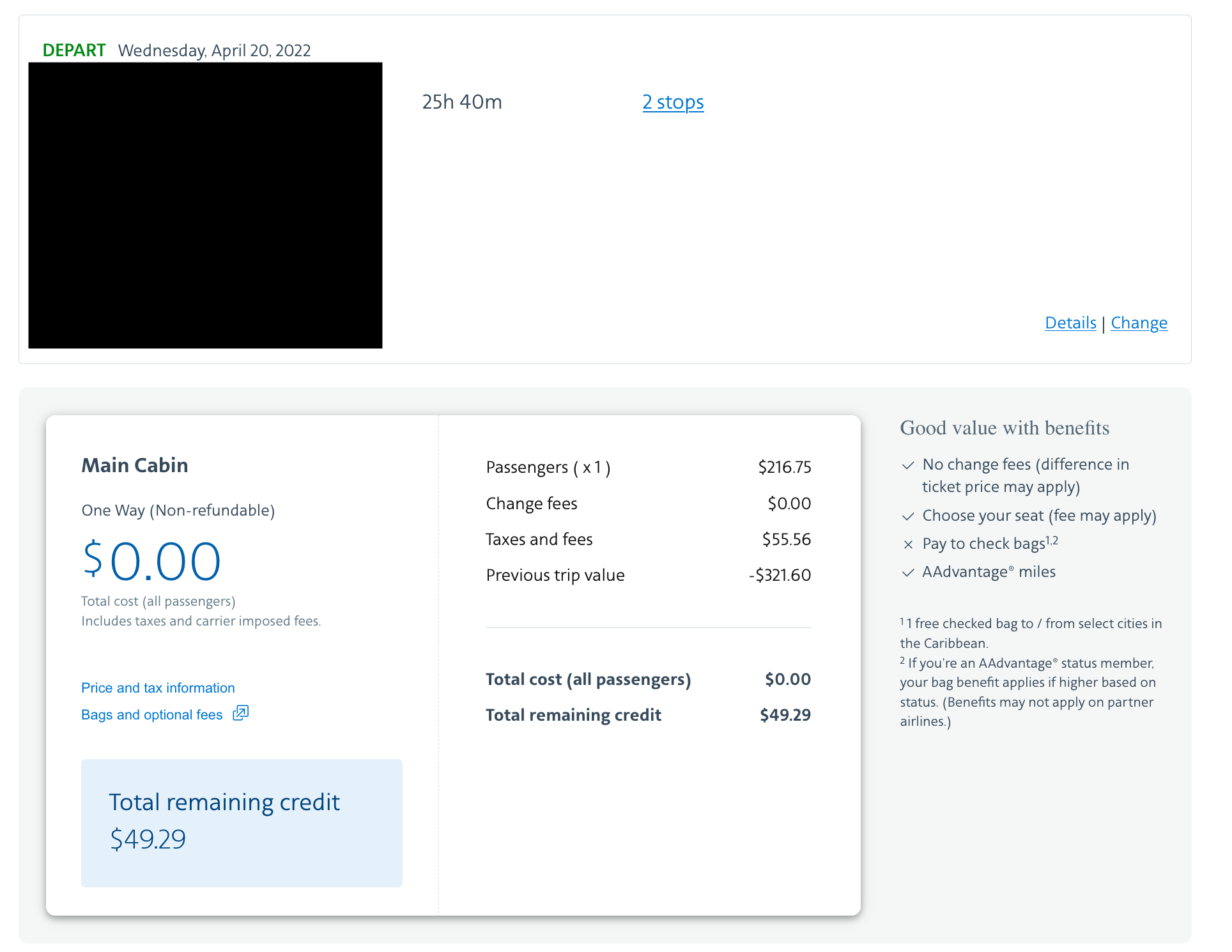

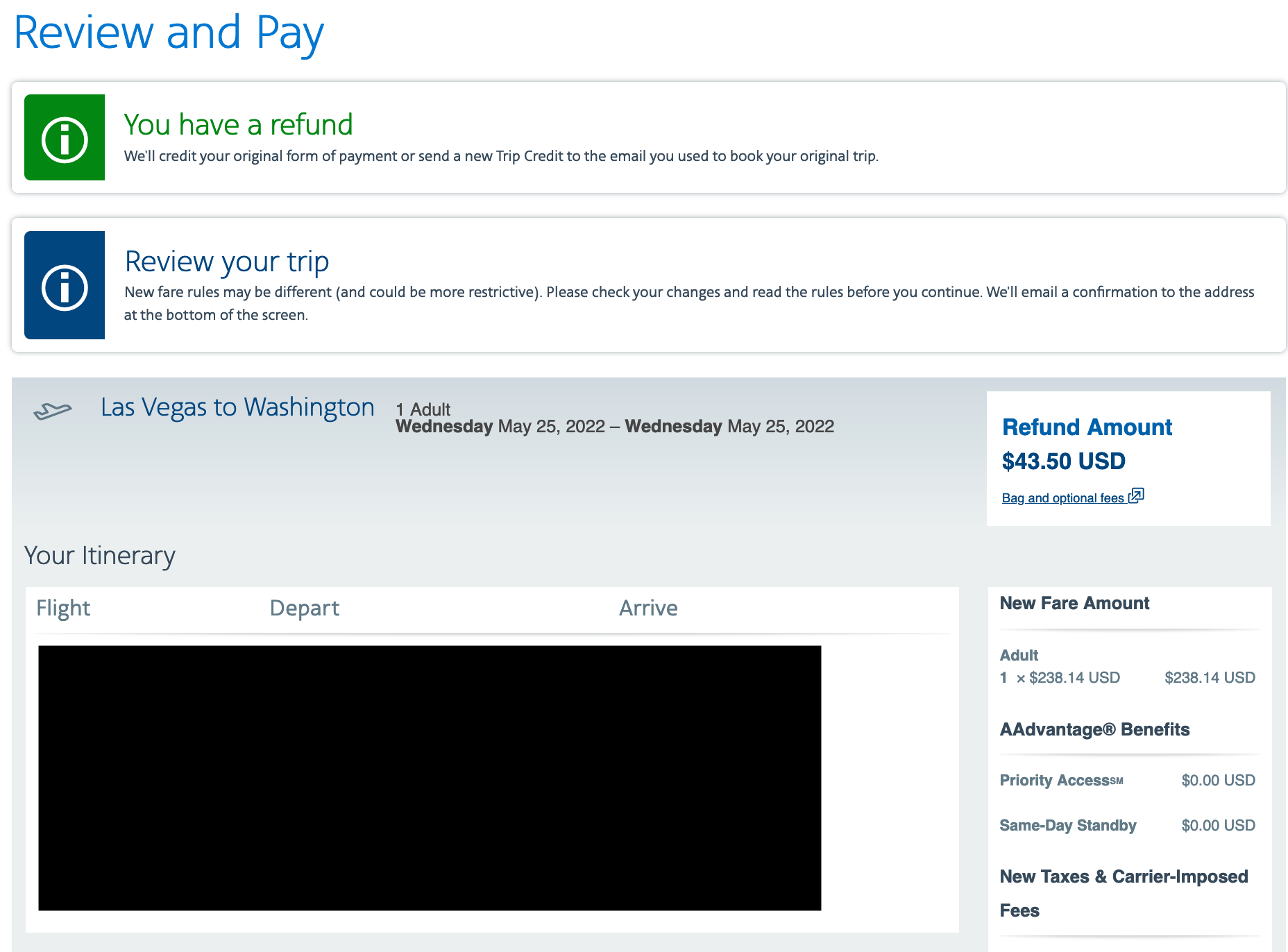

Then, American Airlines will display the new itinerary as well as whether you owe additional funds or are entitled to a credit:

If you're entitled to a travel credit, American Airlines will display this as a "Refund Amount." In almost all cases, that refund will be issued as a travel credit instead of a refund to your original payment method.

Once you've confirmed your new itinerary, you should receive an email from American Airlines with the travel credit to use on a future flight.

Related: The best credit cards that offer trip cancellation and interruption insurance

American Airlines' refund policy

American Airlines' refund policy is pretty straightforward but fairly restrictive.

Refundable tickets can be refunded to the original payment method at any time before departure. If you purchased the ticket directly from American Airlines, you can request a refund on the American Airlines website . But if you purchased your ticket from a travel agent, whether a traditional travel agent or an online travel agency such as Expedia, you'll need to contact them directly. For basic economy fares, you'll need to be an American Airlines AAdvantage member.

Nonrefundable tickets are only eligible for a refund more than 24 hours after purchase if one of the following applies:

- A schedule change of more than four hours

- Death of the passenger or a traveling companion

- Military orders for the passenger

Based on personal experience, if there's a schedule change (one less than four hours), American Airlines is very flexible with allowing you to change to a new flight — on the same day of travel or even the day before or after.

Related: The best credit cards for American Airlines flyers

Bottom line

Since American allows extra flexibility for changing or canceling a flight, you should be able to book without worrying about losing money or your miles.

And because American doesn't charge anything to redeposit miles, you should consider jumping on a great award booking as soon as you see it. You can always get those miles back without penalty if your plans change before departure.

Related reading:

- How to redeem miles with the American Airlines AAdvantage program

- Key travel tips you need to know — whether you're a beginner or expert traveler

- The best travel credit cards

- Where to go in 2024: The 16 best places to travel

- 6 real-life strategies you can use when your flight is canceled or delayed

- 8 of the best credit cards for general travel purchases

- 13 must-have items the TPG team can't travel without

How to use travel credits when booking a flight on all 11 major US airlines

- The upcoming holiday travel season is the perfect time to offload travel credit from flights canceled during the pandemic.

- Travel credit is often issued in lieu of a refund so an airline can keep the cash paid for the original flight.

- Each airline is different in how flyers can use credit and this step-by-step guide for all 11 major US airlines explains how to book flights using it.

- Visit Business Insider's homepage for more stories .

If you voluntarily canceled a flight during the pandemic, chances are that you received a travel or flight credit and not a cash refund.

Issuing a credit is the preferred method for airlines instead of cash refunds. It's almost like an interest-free loan for airlines as it lets them keep the money paid for a flight without having to provide the service until a later date.

With the holiday season fast approaching, travelers are contemplating returning to the skies, and now is the perfect time to use up that credit before it expires.

Each airline is different in what they'll allow the credit to be used for. Some airlines require that the same passengers use the credit while others are transferable. Credits may also be used to purchase extras like seat assignments or baggage allowance, depending on the airline.

Prospective flyers seeking to use a credit should call their airline to confirm what it can be used for and if their credit can be used multiple times if the full amount won't be used up in one trip. But once that's all done and it's time to book, the process is quite simple.

Here's a step-by-step guide on how to use travel credits when booking a flight on all 11 major US airlines.

American Airlines: Start by searching for a flight as you normally would from the airline's homepage.

Then, select the flight you'd like to take.

Once you're ready to book, move forward through the booking process as normal. Enter your passenger information, select your seats, and so on.

Once you arrive at the "review and pay" page, that's when you can enter your travel credit information.

Scroll down to "how do you want to pay for your trip" and select "add flight credit."

It will open this window and ask for your ticket number from the canceled flight for which you received a credit.

That can be found in the booking email.

Just scroll down to the payment information and the ticket number should be right there.

Once that's in, enter your credit card information (if there's a difference between the credit amount and the fare) and pay as normal.

Delta Air Lines: Start by searching for a flight as you normally would from the airline's homepage.

Once you arrive at the "review and pay" page, that's when you can enter your travel credit.

Scroll down to "payment" and select "use eCredits" in the top right corner.

It will open this window and ask for up to three eCredit numbers from the canceled flight or flights for which you received a credit. Delta will have sent an email with the eCredit number.

United Air Lines: If you have a future flight credit with United, you wouldn't start the booking process as normal.

Instead, go to "my trips" on the homepage. It will ask for the confirmation number for the flights in which you canceled to receive the credit, and your last name.

The website will then show you how much credit you have to use and by when you need to rebook. When you're ready to proceed, hit "book with credit."

Then, search for a flight as normal.

Prices will then reflect the difference you'll have to pay, not the actual cost of the flight.

Select the flight you wish to take.

Then, you can book as normal since the discount is already applied.

If United gave you an electronic travel credit, you'll have to start over and search for the flight as if it was a new booking altogether.

Once you've selected your flight and have reached the payment page, scroll down to "payment information" and select "travel certificates."

You can then enter the pin code and your last name to retrieve the credit. Once applied, you can book as normal.

Southwest Airlines: Start by searching for a flight as you normally would from the airline's homepage.

The "passenger & payment info" page is where you'll enter the travel credit information.

Once you've entered in all the required passenger information, hit "continue to payment."

Scroll down to and click "apply travel funds, LUV vouchers, and gift cards." You'll then enter in the confirmation number and passenger information from the canceled flight for which the credit was issued.

Frontier Airlines: Start by searching for a flight as you normally would from the airline's homepage.

Once a flight is selected, proceed normally through the booking process by entering passenger information, choosing any extras, and so on.

The "payment" page is where you'll enter the travel credit information.

Scroll down to "add additional payment" under the credit card section and select "Frontier voucher."

It'll then ask for the email address and confirmation number of the canceled flight for which the credit was issued.

You can use some of the credit or all of it. You should also check to see if any residual value will go back to the credit as some airlines choose to operate under a one-time use policy when it comes to travel credits.

The amount of the credit with then be taken off of the purchase price.

Spirit Airlines: Start by searching for a flight as you normally would from the airline's homepage.

Scroll down to "redeem a voucher or credit" just above the credit card section.

It'll then ask for the voucher number – if you have a voucher – or the confirmation number of the canceled flight for which the credit was issued.

JetBlue Airways: Start by searching for a flight as you normally would from the airline's homepage.

If you're a TrueBlue member, you should sign in as it makes it easier to access the credit on the next page.

The "review trips" page is where you'll enter the travel credit information.

Scroll down to "payment details" and find "apply JetBlue funds" just above the credit card section.

Click the box for "travel bank" and if you're logged into TrueBlue, the credit amount should come up. If you're not a TrueBlue member, a separate travel bank account with login information would've been emailed to you.

You can use any amount of the credit and any unused portion will remain until its expiration date.

The discounted price will then show under "payment amount."

Alaska Airlines: Start by searching for a flight as you normally would from the airline's homepage.

The "checkout: review and complete payment" page is where you'll enter the travel credit information.

Scroll down to "wallet and certificates" just above the credit card section. If you're logged in to Mileage Plan, the travel credit should appear until "wallet funds." If you're not logged in, you can check the "use certificates or gift cards (not deposited in a wallet account)" box.

You'll then be asked to enter the certificate code and pin, followed by a security verification check.

Allegiant Air: Start by searching for a flight as you normally would from the airline's homepage.

The "payment information" page is where you'll enter the travel credit information.

Scroll down to "do you have an Allegiant voucher or promo code" section, just under the travel insurance offer.

You'll then be asked to provide a voucher number from the canceled flight for which the credit was issued.

Sun Country Airlines: Start by searching for a flight as you normally would from the airline's homepage.

The "review & pay" page is where you'll enter the travel credit information.

Scroll down to the "payment" section, and select "use a Sun Country flight credit or voucher."

You'll then be asked to provide the confirmation code and last name or a voucher number from the canceled flight for which the credit was issued.

Hawaiian Airlines: The airline requires customers booking with a travel credit to call its reservations department at 1-800-367-5320 for US and Canada residents.

Flyers can also call the reservations department of any airline for assistance with booking using a credit.

- Main content

Financial Tips, Guides & Know-Hows

Home > Finance > How Do I Use Flight Credit On American Airlines

How Do I Use Flight Credit On American Airlines

Modified: February 21, 2024

Learn how to effectively use your flight credit on American Airlines and make the most of your finances. Discover step-by-step instructions and tips for maximizing your travel savings.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more )

Table of Contents

Introduction, understanding flight credit, checking flight credit balance, using flight credit for booking, redeeming flight credit for future travel, transferring flight credit to another passenger, making changes or cancellations with flight credit, terms and conditions of flight credit usage, frequently asked questions.

Welcome to the world of travel! As an avid traveler, you may have encountered various scenarios where you had to make changes to your flight plans or faced unexpected cancellations. This can be frustrating, especially when it comes to losing the money you invested in those tickets. However, there is a silver lining. Many airlines offer flight credits, which allow you to utilize the unspent amount from your original ticket towards future travel.

In this article, we will delve into how you can use flight credit specifically on American Airlines, one of the leading carriers in the aviation industry. Understanding how flight credit works, checking your credit balance, using it for booking, redeeming it for future travel, transferring it to another passenger, and making changes or cancellations using flight credit are all important aspects that we will explore.

Flight credit is a valuable resource that can save you money and provide you with flexibility in your travel plans. By the end of this article, you will have a comprehensive understanding of how to leverage your flight credit effectively on American Airlines.

Flight credit is a monetary value that you receive as a result of canceling or changing a flight on American Airlines. Instead of receiving a refund to your original form of payment, the airline provides you with credit that can be used towards future travel on their flights. This credit is typically valid for one year from the date of issuance, giving you ample time to plan your next adventure.

It’s important to note that flight credit is not the same as airline miles or rewards points. While airline miles and rewards points can be used for various purposes, including flight bookings, flight credit is specifically tied to the amount you paid for a ticket and can be applied towards the cost of a new ticket.

Flight credit can be an excellent solution when you are uncertain about your future travel plans. Instead of losing the value of your ticket entirely, you have the opportunity to use that money towards another trip, whether it’s for business or leisure.

Keep in mind that flight credit is typically non-transferable and can only be used by the original ticketed passenger. In some cases, airlines may have specific rules or restrictions regarding the use of flight credit, which we will explore in more detail later in this article.

Now that we have a basic understanding of flight credit, let’s move on to how you can check your flight credit balance on American Airlines.

Before you can start using your flight credit on American Airlines, it’s important to know how much credit you have available. Checking your flight credit balance is a straightforward process that can be done online or through the airline’s customer service channels. Here’s how you can check your flight credit balance:

- Online: Visit the American Airlines website and log in to your account. Locate the “My Trips” or “Manage Reservations” section and navigate to the specific reservation for which you received flight credit. The credit amount will be displayed alongside the reservation details.

- Customer Service: If you prefer to speak with a representative, you can contact the American Airlines customer service team. Provide them with your reservation details, and they will assist you in retrieving your flight credit balance.

It’s important to note that flight credit balance may not be immediately available after canceling or changing a flight. It can take a few days for the credit to be processed and reflected in your account. If you don’t see the updated credit balance, it’s advisable to wait a few more days or contact customer service for assistance.

Keeping track of your flight credit balance is crucial to ensure that you utilize it fully and avoid letting it expire. Now that you know how to check your flight credit balance, let’s dive into the process of using flight credit for booking on American Airlines.

Once you have checked your flight credit balance on American Airlines, it’s time to put that credit to use by booking your next flight. Using your flight credit is a simple and straightforward process that can be done online or through the airline’s reservation center. Follow these steps to use your flight credit for booking:

- Online: Start by visiting the American Airlines website and accessing your account. Enter your travel details, including departure and arrival airports, dates, and the number of passengers. On the payment page, you will have the option to apply your flight credit towards the total cost of the new reservation. Select the flight credit payment option and enter the amount you wish to apply. The system will adjust the remaining balance accordingly.

- Reservation Center: If you prefer to speak with a representative, you can contact the American Airlines reservation center. Provide them with your travel details and inform them that you would like to use your flight credit for booking. They will guide you through the process and assist you in applying the credit towards your new reservation.

It’s important to note that flight credit can only be used for the base fare of the new ticket. Taxes, fees, and additional services such as seat selection or baggage fees may not be covered by the flight credit and will need to be paid separately. Make sure to review and understand the terms and conditions associated with using flight credit before finalizing your booking.

Once you have successfully applied your flight credit towards the new reservation, you can proceed with the booking process as usual. Keep in mind that flight credit is tied to the original ticketed passenger and cannot be transferred or used by another individual. Additionally, any remaining credit after the booking transaction will be retained in your account and can be used for future travel within the specified time period.

Now that you know how to use flight credit for booking on American Airlines, let’s explore the process of redeeming flight credit for future travel.

Flight credit doesn’t have to go to waste! If you’re unable to utilize your flight credit immediately, you can redeem it for future travel on American Airlines. Redeeming flight credit is a simple and convenient process that allows you to maximize the value of your unused ticket. Here’s how you can redeem your flight credit for future travel:

- Online: To redeem your flight credit online, log in to your American Airlines account and navigate to the “My Trips” or “Manage Reservations” section. Select the reservation for which you have flight credit and proceed to the payment page. Look for the option to apply flight credit towards your new reservation. Enter the desired amount and complete the transaction.