- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

AXA Travel Insurance Review: Is it Worth The Cost?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

What is AXA?

Axa travel insurance plans, which axa travel insurance plan is best for me, can you buy axa travel insurance online, is axa legit, what isn't covered by axa travel insurance, is axa travel insurance worth it.

- Lowest-cost plan includes some medical coverage.

- Pre-existing conditions waiver add-on available for higher-cost plans.

- No add ons are available for Silver-level policyholders.

- CFAR upgrade is only available for highest-cost plan.

In the era of staff shortages and extreme weather, your trip may not go exactly to plan. When that happens, travel insurance can be a big help. Although an insurance policy can’t prevent a delay or cancellation from happening, it can help relieve the financial burden if something unpredictable does occur on your trip.

But how do you know which insurance provider to go with? Here's a look at AXA travel insurance to help you determine if one of its plans is right for you.

AXA is a French insurance company that does business in over 200 countries. It offers many different types of insurance, including policies for travelers. These include coverage for baggage loss , trip cancellation and interruption, emergency evacuation and emergency medical costs. Cancel for any reason coverage is also offered.

AXA Assistance USA is part of the AXA Group.

» Learn more: How much is travel insurance?

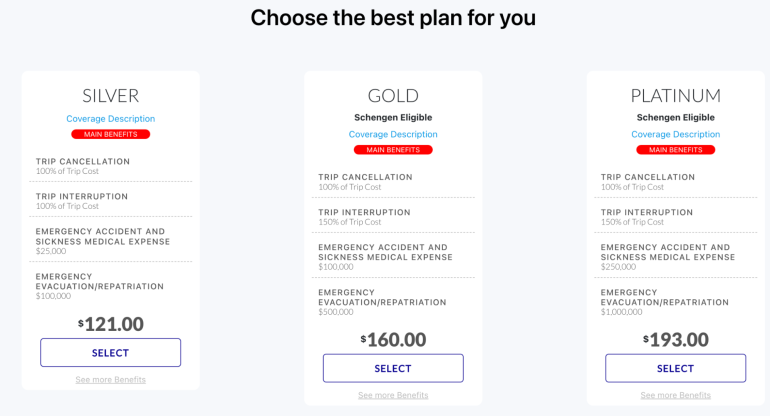

AXA Assistance USA offers travelers three insurance plans: Silver, Gold and Platinum. The plans are underwritten by Nationwide Mutual Insurance Company and their affiliates in Columbus, Ohio. Here's the coverage you can expect from each policy.

Silver: This is the least expensive plan that offers 100% trip cancellation and trip interruption coverage, $25,000 in emergency accident and sickness medical coverage and $100,000 in emergency evacuation and repatriation coverage.

Gold: The mid-range Gold policy comes with 100% trip cancellation and 150% trip interruption coverage, $100,000 in emergency accident and sickness medical coverage and $500,000 in emergency evacuation and repatriation coverage.

Platinum: The AXA Platinum travel insurance plan includes 100% trip cancellation and 150% trip interruption coverage, $250,000 in emergency accident and sickness medical coverage and $1,000,000 in emergency evacuation and repatriation coverage.

If you want to add Cancel For Any Reason coverage, you’ll need to select the Platinum plan and purchase a policy within 14 days of paying the initial trip deposit. It’ll cover 75% of the prepaid nonrefundable expenses for your travel.

If you’d like coverage for pre-existing medical conditions , a waiver is available on the Gold and Platinum plans as long as you buy coverage within 14 days of your first trip payment.

» Learn more: How does travel insurance work?

Let’s compare AXA’s plans, the costs and coverage for a 19-day trip to Indonesia that costs $1,500 for a 36-year-old traveler who lives in Utah.

Coverage and limits for the Silver-level plan include:

Trip delay: $100 per day, with a $500 maximum.

Trip cancellation: 100% of the trip cost.

Trip interruption: 100% of the trip cost.

Baggage delay: $200.

Lost baggage: $750, up to $150 per article.

Missed connection: $500.

Emergency evacuation: $100,000.

Accidental death and dismemberment: $10,000 ($25,000 if on a common carrier).

Emergency accident and medical expense: $25,000.

The plan cost for our sample trip is $55.

For $79, the Gold-level tier offers the following coverage and limits:

Trip delay: $200 per day, with a $1,000 maximum.

Trip interruption: 150% of the trip cost.

Baggage delay: $300.

Lost baggage: $1,500, up to $250 per article.

Missed connection: $1,000.

Emergency evacuation: $500,000.

Accidental death and dismemberment: $25,000 ($50,000 if on a common carrier).

Emergency accident and medical expense: $100,000.

Collision damage waiver: $35,000.

Platinum is AXA’s highest tier level. This plan includes:

Trip delay: $300 per day, with a $1,250 maximum.

Baggage delay: $600.

Lost baggage: $3,000, up to $500 per article.

Missed connection: $1,500.

Emergency evacuation: $1,000,000.

Accidental death and dismemberment: $50,000 ($100,000 if on a common carrier).

Emergency accident and medical expense: $250,000.

Collision damage waiver: $50,000.

Lost golf rounds: $500.

Lost skier days: $25 per day.

Pet boarding fees: $25 per day (up to five days).

This level of coverage costs $95.

» Learn more: The best credit cards for travel insurance benefits

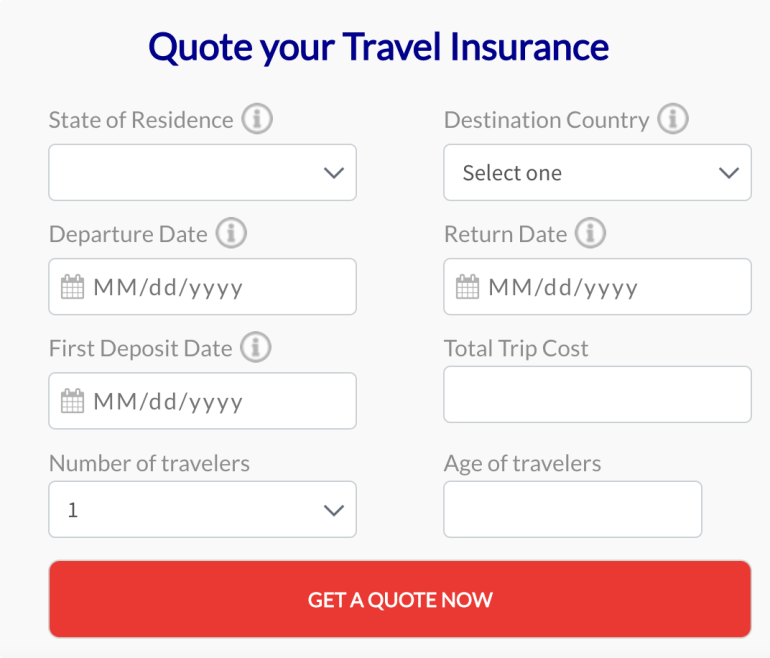

To get an AXA travel insurance quote, go to AXATravelInsurance.com and start by inputting your information in the quote box. Enter your state of residence, destination country, trip dates, date of first trip deposit, total trip cost, the number of travelers and their ages.

Once you’ve filled out the form, click on the “Get a quote now” button.

You’ll be presented with three quotes, one for each plan level. Make sure to click on the “See more benefits” link to get more information on each plan’s coverage limits. The plans with the highest coverage limits will be the most expensive.

If you need a pre-existing conditions waiver, select the Gold or Platinum plan. You’ll also have to purchase the plan within 14 days of making your initial trip deposit to be eligible.

The Gold and Platinum levels are also the two plans that offer Schengen zone coverage and a collision damage waiver . The Platinum plan is the only one that offers a Cancel For Any Reason add-on, so keep that in mind if you need more protection.

Overall, if you’re looking for emergency medical and emergency evacuation coverage specifically, the limits are good on all the plans, including the least expensive one.

To compare plans from multiple insurance providers at once, we recommend checking out Squaremouth, a travel insurance comparison site and a NerdWallet partner. The website helps you pick the right plan by displaying multiple quotes from many insurance providers, including AXA, in one spot.

AXA began in the early 19th century as a small insurance company specializing in property and casualty insurance.

Since then, the company has evolved, changing names and acquiring other insurance brands, until it became AXA in the 1980s. It is now one of the largest insurance companies in the world. In other words, yes, AXA is a legitimate travel insurance provider.

» Learn more: The best travel insurance companies

Every plan has different exclusions, so it's important to look at your coverage summary. Generally, pre-existing conditions without a previously purchased waiver are not covered.

Other limitations include:

Intentionally self-inflicted injuries.

Participation in bodily contact or extreme sports.

Traveling for the purpose of securing medial treatment.

Accidental injury or sickness when traveling against the advice of a physician.

Non-emergency treatment or surgery.

AXA handles more than 14 million cases each year, and every plan includes access to their 24/7 assistance hotline. The company is well established and has three plans for travelers to choose from.

AXA travel insurance covers several benefits including but not limited to 100% trip cancellation and trip interruption, medical emergencies, emergency evacuations, baggage delay or lost baggage, and accidental death and dismemberment. The Platinum plan also lets you add Cancel For Any Reason coverage.

AXA's least expensive plan, Silver, and its mid-range Gold policy do not have the option to add-on Cancel For Any Reason coverage. For travelers who opt to purchase the Platinum insurance plan, you can add Cancel For Any Reason coverage a la carte within 14 days of paying the initial trip deposit.

In the event that you need to make a claim, you can upload supporting documents online. If the claim is accepted, you will receive reimbursement within 30 days.

It's said that travel is the only thing you buy that makes you richer. But you don’t want to become poorer if something goes wrong before or during a trip. We don’t know what the universe has in store for us, so buying a travel insurance policy is one way we can protect our investment.

AXA offers budget, mid-range and premium policies that are easy to understand, provide adequate coverage and don’t cost a fortune.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

Need help? Check out our Travel Insurance most Frequently Asked Questions!

Ex : How to get an insurance quote?

Purchase of your Travel Insurance

What is travel protection.

Travel protection is the combination of travel insurance and travel assistance services available 24/7. Travel protection helps provide you peace of mind when away from home; whether traveling abroad or within the U.S. Plan your trip with the knowledge you will be protected – should you need it – through AXA USA.

Do I need to purchase Travel Insurance when I have other insurance coverage? What’s the difference?

The unexpected may happen at any given time and unfortunately, when least expected. AXA Assistance USA Travel Protection Plans provide world-class 24/7 travel assistance coupled with first-rate travel protection coverage. Our travel protection plans offer you a help-line to assist in navigating and managing through the unexpected as well as help provide financial protection for your travel costs, subject to plan limits and exclusions. Travel insurance may reimburse your non-refundable payments or deposits charged by travel suppliers such as tour operators and cruise lines, should you need to interrupt or cancel your trip for a reason covered by the plan.

Doesn’t my credit card, homeowner's insurance, or health insurance give me the coverage I need when I'm traveling?

Credit card, homeowner’s insurance or health insurance may not fully protect you while traveling. Double-check your existing policies to determine what benefits you have and what occurrences would be covered.

What’s a pre-existing medical condition?

“Pre-Existing Condition” means an illness, disease, or other condition during the 60 day period immediately prior to the date Your coverage is effective for which You or Your Traveling Companion, Business Partner or Family Member scheduled or booked to travel with You: 1)received or received a recommendation for a test, examination, or medical treatment for a condition which first manifested itself, worsened or became acute or had symptoms which would have prompted a reasonable person to seek diagnosis, care or treatment; or 2) took or received a prescription for drugs or medicine. Item (2) of this definition does not apply to a condition which is treated or controlled solely through the taking of prescription drugs or medicine and remains treated or controlled without any adjustment or change in the required prescription throughout the 60 day period before coverage is effective under this Policy.

Do I have to pay any deductibles?

No. AXA Assistance USA Travel Protection Plans do not have deductibles.

Who is the insurance provider for the plans?

The Silver, Gold and Platinum plans are underwritten by Nationwide Mutual Insurance Company and Affiliated Companies, Columbus, Ohio. Travel insurance coverages within the Adventure Travel Product are underwritten by United States Fire Insurance Company (NAIC #21113) under policy form series T210. Travel protection plans are administered by AXA Assistance USA, Inc. (in California, doing business as AXA Assistance Administrators, License Number 0H74893)

Do you have a glossary of travel insurance terms to help me understand my coverage?

General definitions of travel insurance terms can be found in the travel protection plan document. The plan document may be downloaded by clicking on the Coverage Description button after you obtain a quote.

Can I still purchase travel insurance if I have an existing medical condition?

Yes. Our travel protection plans may still cover you even if you have an existing medical condition. Coverage will vary depending on the protection plan you choose as well as your state of residency. We recommend that you review the plan documents, purchase your insurance policy within 14 days of first deposit, and Contact Us for additional information.

What services are available for me prior to my trip?

Global travel assistance services are available to you 24/7 before and during your trip, to assist with various travel needs such as: pre-trip advice, translation services, medical and legal referrals, cultural information, concierge services, identity theft resolution services and more.

What is Trip Cost?

The trip cost for AXA Travel Insurance is the total amount of non-refundable prepaid expenses that you have invested in your trip. This can include expenses such as airfare, hotel accommodations,tours, and other travel-related expenses that you have paid for prior to your departure. When you purchase a travel insurance plan from AXA, you will be asked to provide the trip cost as part of the application process. This information is used to determine the cost of your insurance premium and the level of coverage that you will receive. It's important to accurately calculate your trip cost to ensure that you have adequate coverage in the event of an unexpected situation or emergency that causes you to cancel or interrupt your trip. Additionally, you should keep all receipts and documentation of your prepaid expenses in case you need to file a claim with your travel insurance provider.

What does First Deposit Date mean for Travel Insurance?

The first deposit date for travel insurance refers to the date on which you made your initial payment or deposit for your trip. This is an important date when it comes to purchasing travel insurance because it determines the eligibility and coverage for Pre-existing medical conditons, cancel for any reason and other benefits. For AXA Travel Insurance, we insist that that you purchase your policy within 14 days of making your initial trip deposit in order to be eligible for trip cancellation/interruption coverage. This is because trip cancellation/interruption coverage is designed to protect you in the event that you need to cancel or interrupt your trip due to an unforeseen event, such as an illness or injury. If you purchase your travel insurance policy after the first deposit date, you may not be eligible for trip cancellation/interruption coverage or you may have limited coverage. It's important to review the policy terms and conditions carefully to understand the coverage provided and any exclusions orlimitations that may apply based on your first deposit date.

Can I cancel my Travel Insurance Policy?

You may cancel this Policy within 10 days of purchase by written notice delivered or mailed to the insurer, effective upon receipt of such notice or on such late date as may be specified in such notice. It is usually possible to cancel a travel insurance policy with AXA Travel Insurance, although the specific terms and conditions of cancellation may vary depending on the policy you purchased. To cancel your policy, you will need to contact AXA Travel Insurance USA directly. You can do this by calling their customer service number, which should be listed on your policy documents, or by visiting their website and filling out a cancellation request form. It is important to note that there may be certain restrictions and fees associated with cancelling your policy pending on the specific terms of your coverage. For example, some policies may have a minimum cancellation fee or may only allow cancellation for certain reasons, such as a medicalemergency or a change in travel plans. Be sure to carefully review your policy documents and consult with an AXA representative to understand the terms and conditions of cancellation before making any decisions.

Can I travel to multiple destinations?

Yes, AXA Travel Insurance offers policies that can cover travel to multiple destinations. When purchasing your policy, you will need to provide information about all of the destinations you plan to visit, as well as the length of time you will be spending in each location. It is important to note that the specific coverage and benefits provided by your policy may vary depending on the destinations you are visiting. For example, certain countries or regions may be subject to travel advisories or other restrictions that could affect your coverage. Before purchasing your policy, be sure to carefully review the terms and conditions of coverage to understand how your policy will apply to your specific travel plans. If you have any questions or concerns, you can contact AXA Travel Insurance directly to speak with a representative.

I need Medical Assistance in another country?

Contact: 855-327-1442 for 24/7 Emergency Assistance.

Our 24/7 Emergency Assistance Hotline team have multilingual specialists that can assist you in coordinating emergency medical treatment. Ensure that you have all the necessary documentation with you, including your travel insurance policy details and any relevant medical information. You may also need to provide proof of your identity, such as your passport or driver's license. Once you have contacted the emergency assistance number, they will be able to advise you on the best course of action. This may include directing you to a suitable medical facility or arranging for medical evacuation if necessary.

Do I need to Pay co-payments or Deductibles

Some AXA Travel Insurance plans may require you to pay a co-payment or deductible, while others may not. To know for sure whether you need to pay a co-payment or deductible, you should carefully review your policy documents or contact the insurer directly. The Silver Plan provides insurance coverage that comes into effect only after any other insurance policies you have are used up. However, it does not apply to private passenger auto no-fault benefits or third-party liability insurance which are already covered by other policies. In case of a loss or damage, if you have other valid insurance or indemnity in place, this policy will only pay for the amount that is not already covered by the other policies. This means that the insurance company will only pay for the amount of loss that exceeds what is already covered by your other insurance policies, and this policy also has an applicable deductible that you may need to pay.

Frequently Asked Questions about the Coronavirus (COVID-19) and Our Travel Protection Plans

AXA Assistance USA, Inc. (“AXA”) is monitoring COVID-19 and its potential impact on our customers and their travel. Travelers should consult the World Health Organization (WHO) (https://www.who.int) and the Centers for Disease Control and Prevention (CDC) (https://www.cdc.gov) for the most up to date information on COVID-19. This document is designed to provide general assistance regarding the terms our travel protection plans as they relate to certain COVID-19 situations. We urge any customer who has a medical issue while traveling or who has any other question regarding their specific travel protection plan to call us at 1-855-327-1442 or via collect call at 1-312-935-1719. Our website is also available at www.axatravelinsurance.com. We review every claim based on its unique facts and circumstances and are happy to answer any questions you may have. Please read your travel protection plan documents carefully if you are considering canceling your trip due to COVID-19. Fear of travel is generally not a covered reason for cancellation under our travel protection plans For other perils that are covered under our plans, each plan includes different coverages, limits and terms. For purposes of these FAQs and coverage under our plans, the term Quarantine means Your strict isolation imposed by a Government authority or Physician to prevent the spread of disease. An embargo preventing You from entering a country is not a Quarantine. “Stay at home” or “Shelter in Place” orders issued by federal, state or local governments are not considered Quarantines. Below are some general answers to questions we are receiving from customers regarding coverage under our travel protection plans:

If I want to cancel my trip because I’m afraid of exposure to COVID-19, does my travel protection plan cover that?

Cancellation of a trip for general concerns related to potential COVID-19 exposure is not generally covered under our travel protection plans.Please check with your travel provider to see if you can cancel or reschedule your trip without incurring fees or penalties and regarding potential refund, travel credit, or rescheduling options.

If I have booked a trip that leaves at some future date and my destination is affected by COVID-19, will I receive reimbursement for my claim if I cancel my trip?

As almost all destinations are currently impacted by COVID-19, coverage depends on a number of factors, including, but not limited to: the terms of your specific travel protection plan; your reason for cancelling; and the amount of your non-refundable payments and deposits.

What if my flight is delayed or cancelled by the airline?

If your flight is delayed or cancelled, Trip Interruption, Missed Connection and Travel Delay benefits may be available. Please check your specific travel protection plan for terms and conditions. Time restrictions may apply. Also, please check with your travel provider to determine your options.

If my travel protection plan includes Cancel for Any Reason (CFAR) benefits and I cancel my trip, am I covered?

You may be covered for a percentage of the unused, non-refundable trip cost that you elected to insure. Please refer to your plan documents for specific details as coverage may vary by state and plan.

Can I add CFAR coverage to my existing travel protection plan?

If you have an existing travel protection plan, you will not be able to add CFAR coverage to that plan at a later date. If available, CFAR coverage may generally only be included at the time of original purchase within the time sensitive period listed in your plan. Scope and availability of CFAR coverage may also vary by state and plan.

If I become ill with COVID-19, am I covered?

If you become ill with COVID-19 prior to your departure and after the effective date of your plan, you may be eligible for Trip Cancellation coverage. These claims will usually require a confirmed diagnosis from a physician with proof of illness that states you are medically unable to travel at the time of departure or evidence that you are subject to Quarantine. If you become ill with COVID-19 while on your trip you may be covered for Medical Expense, Emergency Evacuation, Trip Interruption, and/or Trip Delay benefits with a confirmed diagnosis, including proof of illness and inability to travel from a doctor, or evidence that you are subject to Quarantine. Please review your specific plan for the details and limits of such coverage.

If I am Quarantined before or during my trip, because of COVID-19 exposure or illness, am I covered?

If you are Quarantined while on a trip due to COVID-19 exposure or illness, your travel protection plan will usually continue in effect during such Quarantine. Medically imposed Quarantine may be a covered reason for Trip Cancellation, Trip Interruption or Medical Expense benefits depending on the terms of your specific plan. Please refer to your specific plan for the details and limits of such coverage and a description of covered expenses.

Can I cancel my travel protection plan and receive a refund for the costs of such plan?

You may be eligible for a refund under the terms of the plan review period. Check your travel protection plan documents for details.

Is there any coverage for the COVID-19 Test that is required by the CDC before I return to the USA?

What happens if i test positive for covid-19 as a result of the required testing prior to my return to the usa.

If you have tested positive for COVID-19 and are required to be Quarantined, you may be eligible for certain benefits as defined in your plan documents. Please refer to your specific plan for the details and limits of such coverage and a description of covered expenses.

What happens if my Traveling Companion tests positive during the COVID-19 test required for re-entry into the United States and I am required to Quarantine due to contact tracing and unable to travel home on my Scheduled Return Date?

If you are required to Quarantine, you may be eligible for Trip Interruption and/or Trip Delay benefits as outlined in your plan documents. Please refer to your specific plan for the details and limits of such coverage and a description of covered expenses.

If I am required to be Quarantined on my Scheduled Return Date, will my additional expenses be covered for hotel, food and transportation?

Please check your plan documents. You may be eligible for Reasonable Expenses as outlined under the Travel Delay benefit in your plan documents.

If my Traveling Companion or I am unable to re-enter the United States because their/my COVID-19 Test has not come back, will I have a payable claim?

No, there is no specific coverage for delayed test results.

If I am unable to get a mandatory COVID-19 test or my results are not back in time prior to my scheduled departure, do I have Trip Cancellation coverage?

No, this is not a covered peril under the Trip Cancellation benefit.

If I test positive for COVID-19 during my trip, does the plan provide reimbursement for my lodging expenses?

If you are allowed to Quarantine in your original prepaid accommodations, there are no eligible expenses for reimbursement. If you must leave your original prepaid accommodations and Quarantine elsewhere, the unused portion of your prepaid accommodations may be eligible for reimbursement. Please refer to your plan documents for specific details as coverage may vary by state and plan.

Can I claim the ticket expenses if the airlines denied my boarding due to failure to meet the entry requirements of the destination country related to travel restrictions associated with COVID-19?

No, unfortunately there are no benefits for this. Please make sure to verify information on the official page of the consulate or check the boarding requirements of the airlines.

Family member who was our host, contracts COVID-19 and I am now forced to incur hotel expenses, is this covered?

We are traveling for a work function and our conference was canceled. is this covered in my travel protection plan.

Event cancellations are not covered.

My work is requiring me to stay at home for some period of time upon returning from my trip. I cannot afford to take time off for vacation and then come back and take additional days.Will I be covered if I cancel my trip?

Work mandated stay at home orders are not covered.

What if the borders of the country of destination close while I am en route to my trip? 1) Will I have coverage under Trip Interruption? 2) If I am unable to leave my destination, will I have coverage under Travel Delay?

1) No, there is no Trip Interruption coverage for border closure. 2) No, there is no Travel Delay coverage due to border closure.

If the destination/resort to where I travelled mandates COVID-19 testing: 1) Is the cost of the mandatory test covered? 2) Will a positive test result administered by a non-qualified physician be satisfactory?

1) No, the cost of the test is not covered. 2) A positive test must be verified by a legally qualified Physician, as defined in your plan documents.

I tested positive for COVID-19 and my physician ordered me to Quarantine. My Quarantine is now over, and I am feeling well, however I have an upcoming trip next month, can I proceed to file a Trip Cancellation claim?

No, you must be certified as medically unable to travel or subject to Quarantine at the time of your trip. Eligible reason for cancellation can be found in the plan document language. Please refer to your plan documents for specific details as coverage may vary by state and plan.

Benefit Specific

Why are trip cancellation and trip interruption coverages important.

Most travel suppliers, such as travel agencies, cruise lines, tour operators, hotels, or airlines have cancellation penalties. A deposit or final payment may be paid toward a trip and suppliers may apply their published cancellation penalties to the trip. Published penalties may increase as the scheduled date of departure approaches. Travel suppliers may retain a large percentage or all of the money paid as down payment, deposit or final payment. Trip Cancellation and Trip Interruption coverages may reimburse you for eligible non-refundable, unused portions of the trip cost if you cancel or interrupt the trip for a covered reason.

Will I get all of my money back if I cancel my trip?

Trip cancellation coverage can reimburse your prepaid non-refundable payments if the trip has to be cancelled for any of the reasons covered by your plan, up to the maximum allowable limit as stated on your Confirmation of Coverage. Some covered reasons may include the following: bad weather, natural disaster at the destination, unannounced strikes or sudden medical emergencies.

What’s included under non-refundable costs?

The total sum of all of your trip payments that would not be refunded due to cancellation prior to the trip departure would be included in non-refundable costs. Examples may include tour, cruise and airline ticket costs. Cancellation policies vary, be sure to consult with your travel supplier or tour operator to verify what costs are non-refundable. It is important that all of your non-refundable trip costs are insured.

Am I covered if the tour operator, airline or cruise line I am booked with discontinues operations or becomes bankrupt?

Some of AXA Assistance USA’s Travel Protection Plans may provide coverage for Pre-Departure Trip Cancellation or Post-Departure Trip Interruption due to bankruptcy or default of an airline, cruise line, tour operator or travel supplier. Please review the plan document for all benefit requirements.

What if my flight is cancelled?

If your flight is canceled as a result of, for example, bad weather or an unannounced strike, you may take a later flight. AXA Assistance USA’s Travel Protection Plans may reimburse you for the non-refundable, unused portion of prepaid expenses for travel arrangements and/or the additional transportation cost paid to return home or resume your trip.

What happens if my bags don’t arrive at my destination when I do?

AXA Assistance USA’s Travel Protection Plans can provide baggage delay benefits if the delay is for more than 24 hours during your trip. The plans can provide reimbursement for certain personal items you may buy, such as toiletries or a change of clothing, up to the allowable benefit maximum. Please retain all receipts for anything you purchase. If requested, AXA Assistance USA may assist in tracking your delayed or lost baggage.

What if I no longer want to take my trip due to recent terrorist attacks?

If you cancel or interrupt your trip because of a terrorist attack, the trip cancellation and trip interruption benefit may provide coverage. Please review your plan document for all eligibility requirements.

If I need medical treatment while on my trip, will my medical bills be covered?

If you are injured or experience an illness while on your trip, AXA Assistance USA’s Travel Protection Plans can provide coverage for medical expenses up to the stated maximum allowable benefit, depending on the plan. If the treating physician deems it medically necessary to evacuate you to another facility or home, the AXA Assistance USA Travel Protection Plan can provide coverage up to the stated maximum allowable benefit amount. All arrangements for evacuation must be coordinated through AXA Assistance USA.

After Fulfillment

What happens if i need to make changes such as the trip cost or travel dates to a protection plan i have already purchased.

You may make changes to your travel protection plan provided you have not already departed on the covered trip or filed a claim. Please contact AXA via our Contact Us page to make any changes.

If I change my mind after purchasing the plan, can I get a refund?

Please notify AXA Assistance USA as soon as possible if you are dissatisfied and would like to cancel your travel protection plan and we will refund any unearned plan cost to you within 10 days of the request for cancellation or according to the terms of your plan.

Will I receive an insurance card to take with me after I purchase?

Yes, you will receive a travel insurance card, Confirmation of Coverage and any other applicable plan documents via e-mail. The travel insurance card and Confirmation of Coverage will include phone numbers to call in the event of an emergency. The plan documents explain the coverage benefits, conditions, limitations and exclusions.

What will the 24/7 global assistance service do for me?

Our 24/7 customer service team is staffed with multilingual specialists who can assist in a variety of situations while you are traveling on your trip, ranging from reporting lost baggage to coordinating emergency medical treatment.

NORTH AMERICA

Travel insurance for north america.

North America is the ultimate travel destination, offering an unmatched range of experiences and attractions that will exceed your wildest expectations. As the third biggest continent in the world, North America provides outstanding diversity. With its vast size and diverse landscapes, the continent is a paradise for outdoor enthusiasts, from skiing down the powdery slopes of Whistler in Canada to hiking the rugged terrain of the Grand Canyon in the United States and surfing the world-class waves in Mexico's Cabo San Lucas.

Why Choose AXA Travel Insurance for North America?

AXA is consistently ranked as the most reliable insurance company for a decade. There are several reasons why travelers trust us with their travel insurance plans. Here are some of the major ones: 1. Complete coverage: AXA covers a wide range of travel-related incidents, such as trip cancellation, trip interruption, medical emergencies, and lost or stolen luggage. 2. 24/7 emergency assistance: AXA offers 24/7 emergency assistance services to help travelers in the event of a medical or travel emergency. 3. Customizable plans: AXA allows customers to choose from a range of plans with different levels of coverage and benefits, allowing them to tailor their insurance to their specific travel needs. 4. Easy claims process: AXA has a straightforward and streamlined claims process, making it easy for customers to submit claims and receive reimbursement. 5. Worldwide coverage: AXA provides coverage for travel to countries worldwide, giving customers support no matter where their travels take them. 6. Additional benefits: Depending on the plan chosen, AXA may offer additional benefits, such as coverage for adventure activities, rental car damage, and identity theft protection.

North American FAQs

Which north american countries require travel insurance.

As of April 2023, no North American countries require travel insurance to enter. When planning to travel, it is essential to consider the potential expenses of medical care in your destination country. The U.S. Department of State - Bureau of Consular Affairs advises purchasing alternative medical insurance as a precautionary measure. Medical costs can quickly become overwhelming, especially if emergency services or transportation are required. It's worth noting that the quality and price of medical care can vary significantly among countries, with some being more remote than others. For instance, countries like Bermuda, Greenland, and Jamaica, where medical services are limited and more challenging to access, can lead to higher costs for medical care. In contrast, Costa Rica, Guadeloupe, and Guatemala offer well-established healthcare systems that provide affordable medical care to locals and visitors. Therefore, it's advisable to research the medical facilities and services available in your destination country and consider purchasing adequate medical insurance coverage before traveling.

What does AXA Travel Insurance cover in North America??

AXA Travel Insurance covers medical expenses, trip cancellation or interruption, lost or stolen luggage, and travel delay or interruption. Additional coverage may be available for activities such as adventure sports, rental car damage, or identity theft protection.

Can I purchase Travel Insurance after booking my trip to America?

Yes, travel insurance can typically be purchased after booking a trip to America. However, it is encouraged that you buy travel insurance as soon as possible after booking to ensure that you are fully covered for any unforeseen circumstances that may arise.

Does Travel Insurance cover COVID-19?

AXA Travel Insurance includes coverage for COVID-19 related expenses, such as medical treatment, quarantine, and trip cancellation or interruption due to the virus. However, it is essential to carefully review the policy's terms and conditions to understand the specific coverage and exclusions related to COVID-19.

AXA already looks after millions of people around the world

With our travel insurance we can take great care of you too

- Travel Insurance Plans

- AXA Assistance USA Cost

Compare AXA Travel Insurance

- Why You Should Trust Us

AXA Assistance USA Travel Insurance Review 2024

Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate insurance products to write unbiased product reviews.

Travel insurance is important because it can help cover the cost of unexpected medical expenses while you're traveling. It can also reimburse you for lost or stolen baggage, canceled flights, and other unforeseeable problems that may occur while you're away from home.

Simply put, there's a lot to consider.

But not all policies are created equal, and you must understand what you're covered for before you purchase a policy. This article will look in-depth at AXA Assistance USA travel insurance. We'll discuss the costs, coverage limits, exclusions, and more to help you make an informed decision about whether or not this particular travel insurance provider is right for you.

- Trip cancellation coverage of up to 100% of the trip cost

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Generous medical evacuation coverage

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Up to $1,500 per person coverage for missed connections on cruises and tours

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Covers loss of ski, sports and golf equipment

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Generous baggage delay, loss and trip delay coverage ceilings per person

- con icon Two crossed lines that form an 'X'. Cancel for any reason (CFAR) coverage only available for most expensive Platinum plan

- con icon Two crossed lines that form an 'X'. CFAR coverage ceiling only reaches $50,000 maximum despite going up to 75%

AXA Assistance USA keeps travel insurance simple with gold, silver, and platinum plans. Emergency medical and CFAR are a couple of the options you can expect. Read on to learn more about AXA.

- Silver, Gold, and Platinum plans available

- Trip interruption coverage of up to 150% of the trip cost

- Emergency medical coverage of up to $250,000

AXA Assistance USA Travel Insurance Review: Types of Policies Offered

AXA Assistance USA offers three levels of coverage: Gold, Silver, and Platinum. Each plan comes with different protections and varying coverage limits, with the Gold being the most basic option and Platinum offering the most premium coverage.

Some policies might even include added coverage free of charge, such as a waiver for pre-existing conditions, fee reimbursement for single occupancy rooms, or emergency medical assistance anywhere in the world. Compare each policy carefully to know what is included.

Additional Coverage Options

The plan you purchase will determine which add-ons are available. For example, those with a Platinum plan can add CFAR (cancel for any reason) coverage , allowing you to receive a full refund if you cancel your trip within 14 days of making the initial deposit.

Or, if you want extra protection for your rental car, depending on your AXA Assistance USA plan, you might be able to add a collision damage waiver (CDW). Policyholders with Gold plans can add $35,000 CDW, and those with Platinum plans can include $50,000 CDW.

AXA Assistance USA Travel Insurance Cost

The premium you pay will depend on various factors, including the age of the travelers, destination, and total trip costs. The average cost of travel insurance is 4-8% of total non-refundable travel costs.

For example, look at the premiums for a 50-year-old Florida resident spending $5,000 on a trip to Denmark.

In this case, the Silver plan costs nearly 3.5% of the total trip cost, while the Platinum plan costs just over 5% of the trip's price.

And here's another example. In this scenario, we looked at premium costs for a 45-year-old New York resident taking a trip to Mexico that cost $3,000. The lowest cost Silver plan costs just 3% of the total trip cost, while the Platinum plan runs 5%.

You can see that the higher the trip cost and the older the traveler, the greater the premium. But these rates still fall within industry standards, if not on the lower end.

How to File a Claim with AXA Travel Insurance

To file a claim with AXA Assistance USA, head to the claims forms online to find the appropriate form. Once you've filled out your form and gathered the required documentation, you can mail your claims to:

AXA Assistance USA

On Behalf of Nationwide Mutual Insurance Company and Affiliated Companies

P.O. Box 26222

Tampa, FL 33623

Or, submit your claim via email to [email protected].

AXA Assistance USA's customer service phone numbers are as follows:

Toll-Free (888) 957-5015

Collect (727) 450-8794

See how AXA Travel Insurance compares to top travel insurance providers.

AXA Assistance USA vs. AIG Travel Guard

When comparing AXA Assistance USA to Travel Guard , we'll look at the coverage levels from both of their mid-tier plans, the Silver plan and Travel Guard Preferred plan, respectively.

With AIG's Travel Guard Preferred plan, you'll get:

- Trip cancellation coverage up to $150,000

- Trip interruption coverage up to $225,000

- Emergency medical coverage of $50,000

- Coverage for baggage loss, theft, or damage up to $1,000

- Travel delay coverage of up to $800

Comparing those AIG Travel Guard coverages with AXA's Silver plan, you'll see that AXA's coverage limits are a bit higher. With AXA's Silver plan you'll get $100,000 in emergency medical coverage, for example. And the baggage loss coverage limit is up to $1,500.

If you're looking for greater coverage limits, AXA makes the most sense in this scenario. But premiums will also vary based on factors like the traveler's age, trip destination, and trip cost. So you'll have to run your own numbers to make a final decision.

AIG Travel Insurance Review

AXA Assistance USA vs. Allianz Travel Insurance

Allianz provides single-trip and multi-trip insurance for travelers who want to go abroad for an extended period of time. And, like with all insurance, the various plans have varying degrees of coverage.

Allianz's most popular single-trip option is the OneTrip Prime plan, which offers:

- Trip cancellation coverage up to $100,000

- Trip interruption coverage up to $150,000

- Emergency medical coverage for $50,000

- Coverage for baggage loss, theft or damage up to $1,000

- Travel delay coverage up to $800

Looking at AXA's mid-tier Silver plan, you'll see that, again, AXA offers more coverage for emergency medical and baggage loss, theft, or damage than Allianz. That said, if cost is an essential factor for you, you'll have to get quotes using your personal trip information to make an informed decision.

Allianz Travel Insurance Review

AXA Assistance USA vs. Credit Card Travel Insurance

Already have a great travel credit card, like the Chase Sapphire Reserve or American Express Platinum? Some of the standard coverages, such as rental car insurance, may be included in the card you already have. It's a good idea to research your travel rewards credit cards' insurance coverage before purchasing a separate travel insurance policy.

If you're driving to your destination and don't have any non-refundable trip expenses, the coverage from your credit card may be enough. Another time it might work is if you have health insurance covering you while abroad and you're in good health without worrying about possible medical costs.

It's essential to remember that credit card coverage is usually secondary. This means you'll have to file a claim with the other applicable insurance before filing a claim with your credit card company.

Best Credit Cards with Travel Insurance

Why You Should Trust Us: How We Reviewed AXA Assistance USA

We researched AXA Assistance USA by evaluating its travel insurance plans compared to other plans from the top travel insurance companies. The aspects we looked at included, but were not limited to, different coverage options, claims limits, what is covered, available add-ons, and extra services for policy holders.

What's important when choosing a policy isn't just the price — it's making sure you're getting adequate coverage that meets your needs without breaking the bank. Filing a claim should also be easy and stress-free if you ever have to use your policy.

AXA Assistance USA FAQs

AXA Assistance USA is owned by the AXA Group and provides various insurances, including travel, home, health, and automotive. With over 8,000 employees, it operates in over 200 countries and territories.

Yes, you can be covered anywhere in the world with an AXA Assistance USA travel insurance policy. Just remember, your policy will likely come with restrictions that'll exclude coverage under certain circumstances, like, for example, traveling to a war-torn country,

Review the specific terms of your plan concerning refunds. You can get a refund within 10 days of the cancellation request.

- Main content

- Best Extended Auto Warranty

- Best Used Car Warranty

- Best Car Warranty Companies

- CarShield Reviews

- Best Auto Loan Rates

- Average Auto Loan Interest Rates

- Best Auto Refinance Rates

- Bad Credit Auto Loans

- Best Auto Shipping Companies

- How To Ship a Car

- Car Shipping Cost Calculator

- Montway Auto Transport Reviews

- Best Car Buying Apps

- Best Websites To Sell Your Car Online

- CarMax Review

- Carvana Reviews

- Best LLC Service

- Best Registered Agent Service

- Best Trademark Service

- Best Online Legal Services

- Best CRMs for Small Business

- Best CRM Software

- Best CRM for Real Estate

- Best Marketing CRM

- Best CRM for Sales

- Best Free Time Tracking Apps

- Best HR Software

- Best Payroll Services

- Best HR Outsourcing Services

- Best HRIS Software

- Best Project Management Software

- Best Construction Project Management Software

- Best Personal Loans

- Best Fast Personal Loans

- Best Debt Consolidation Loans

- Best Loans for Bad Credit

- Best Personal Loans for Fair Credit

- HOME EQUITY

- Best Home Equity Loan Rates

- Best Home Equity Loans

- Best Checking Accounts

- Best Free Checking Accounts

- Best Online Checking Accounts

- Best Online Banks

- Bank Account Bonuses

- Best High-Yield Savings Accounts

- Best Savings Accounts

- Average Savings Account Interest Rate

- Money Market Accounts

- Best CD Rates

- Best 3-Month CD Rates

- Best 6-Month CD Rates

- Best 1-Year CD Rates

- Best 5-Year CD Rates

- Best Jumbo CD Rates of April 2024

- Best Hearing Aids

- Best OTC Hearing Aids

- Most Affordable Hearing Aids

- Eargo Hearing Aids Review

- Best Medical Alert Systems

- Best Medical Alert Watches

- Best Medical Alert Necklaces

- Are Medical Alert Systems Covered by Insurance?

- Best Online Therapy

- Best Online Therapy Platforms That Take Insurance

- Best Online Psychiatrist Platforms

- BetterHelp Review

- Best Mattress

- Best Mattress for Side Sleepers

- Best Mattress for Back Pain

- Best Adjustable Beds

- Best Home Warranty Companies

- American Home Shield Review

- First American Home Warranty Review

- Best Home Appliance Insurance

- Best Moving Companies

- Best Interstate Moving Companies

- Best Long-Distance Moving Companies

- Cheap Moving Companies

- Best Window Replacement Companies

- Best Gutter Guards

- Gutter Installation Costs

- Best Window Brands

- Best Solar Companies

- Best Solar Panels

- How Much Do Solar Panels Cost?

- Solar Calculator

- Best Car Insurance Companies

- Cheapest Car Insurance Companies

- Best Car Insurance for New Drivers

- Same-day Car Insurance

- Best Pet Insurance

- Pet Insurance Cost

- Cheapest Pet Insurance

- Pet Wellness Plans

- Best Life Insurance

- Best Term Life Insurance

- Best Whole Life Insurance

- Term vs. Whole Life Insurance

- Best Travel Insurance Companies

- Best Homeowners Insurance Companies

- Best Renters Insurance Companies

- Best Motorcycle Insurance

Partner content: This content was created by a business partner of Dow Jones, independent of the MarketWatch newsroom. Links in this article may result in us earning a commission. Learn More

AXA Assistance USA Travel Insurance Review (2024)

AXA Assistance USA offers affordable travel insurance plans that cover unexpected medical and cancellation expenses

Sarah Horvath is one of the home service industry’s most accomplished writers. Her specialties include writing about home warranties, insurance, home improvement and household finances. You can find her writing published through distributors like HouseMethod, Architectural Digest, Good Housekeeping and more. When not writing, she enjoys spending time in her home in Orlando with her fiance and parrot.

Tori Addison is an editor who has worked in the digital marketing industry for over five years. Her experience includes communications and marketing work in the nonprofit, governmental and academic sectors. A journalist by trade, she started her career covering politics and news in New York’s Hudson Valley. Her work included coverage of local and state budgets, federal financial regulations and health care legislation.

AXA Assistance USA, a global insurance provider, offers travel insurance and travel medical insurance with benefits that go above and beyond many other providers — but is it the best choice for your next trip? AXA.

We at the MarketWatch Guides team examined AXA’s coverage options, what you might pay for insurance and how it compares to the best travel insurance companies . Read on to find out whether it’s a good fit for you.

- Average Cost: $218

- BBB Rating: A-

- AM Best Score: A+

- Medical Expense Max: $250,000

- Emergency Evacuation Max: $1,000,000

Why Trust MarketWatch Guides

Our editorial team follows a comprehensive methodology for rating and reviewing travel insurance companies. Advertisers have no effect on our rankings.

Companies Reviewed

Quotes Collected

Rating Factors

Our Take on AXA Assistance USA Travel Insurance

After reviewing dozens of travel insurance providers, AXA ranks high on our list with 4.2 out of 5 stars. We also named the company as the best travel insurance choice for leisure.

AXA’s Platinum travel insurance plan — its top-tier offering — comes with unique perks, such as $500 for lost rounds of golf and $25 per lost ski day. Its Gold and Platinum plans also provide pre-existing medical coverage when you purchase the plan within 14 days of your initial trip deposit date.

While AXA offers unique benefits and competitive pricing, there are some limitations on its policies. Cancel-for-any-reason (CFAR) upgrades are only available on its most expensive plans, and add-on options are more limited than other insurers.

AXA is best for travelers with pre-planned activities and those looking for medical coverage on affordable plan options. If you’re looking for more customization, Trawick may be a better choice.

AXA Assistance USA Pros and Cons

AXA Assistance USA is part of AXA Group, which is a multinational conglomerate of companies that offer a wide variety of insurance products. We recommend AXA travel insurance as one of the top-rated providers of travel insurance in the U.S., particularly for leisure travelers looking for insurance.

AXA’s tiered policy plan system provides even basic policyholders with comprehensive coverage including medical costs, baggage loss and trip delays or interruptions. The range of insurance plans is limited, with fewer add-ons available compared to competitors, but we think the overall value of AXA’s insurance is very good.

AXA Assistance Travel Insurance Plans

AXA offers three plan options for international travel:

- Silver: AXA’s most affordable option, the Silver plan includes 100% trip cancellation and interruption coverage. It also includes $100 a day in trip delay coverage , $25,000 in medical expense coverage and $100,000 in emergency evacuation coverage.

- Gold: The Gold plan extends trip interruption coverage to include a 150% reimbursement and extends medical coverage to include $100,000 worth of protection. It also provides $500,000 in emergency evacuation coverage.

- Platinum: The Platinum plan extends coverage to include $250,000 worth of medical coverage and up to $1 million in evacuation coverage. The plan comes with a few leisure-related benefits, including coverage for lost ski days.

All plans include complimentary concierge coverage, 24/7 travel assistance and free identity theft protection.

AXA Add-On Options

Travel insurance add-ons, which are also referred to as riders, are optional extras that you can personalize your insurance policy with, depending on the kind of coverage you need. AXA travel insurance only has a couple of add-on options for their travel insurance plans, along with additional coverage in their Gold and Platinum Plans.

AXA’s coverage add-ons include:

- Cancel for any reason (CFAR)

- Collision damage waiver

Their Platinum Plan also includes:

- $25 for a lost skier day

- $500 for lost golf rounds

- $1,000 for sports equipment rental

Cost of AXA Travel Insurance Plans

How much you pay for an AXA travel insurance plan depends largely on which coverage tier you choose. Different plans provide reimbursements for varying situations, which means the risk the insurer takes on also varies.

Use the chart below to compare AXA Assistance's average cost to competitors:

AXA Assistance USA International Travel Cost

To help give an idea of the cost of AXA Assistance USA Insurance policies, below is an estimate we received for a travel insurance policy from AXA for an international trip to Croatia. Two citizens from the U.S., aged 25 and 27 years old, are traveling. Their trip is from September 1st, 2023 until September 9th, 2023 and costs $4,000. The initial deposit for the trip was made on May 5th, 2023.

Your trip cost will also play a role in coverage costs . For example, if you are traveling internationally and spend a high amount on airfare, the insurer will need to pay more to reimburse you if you file a claim.

AXA Assistance USA Domestic Travel Insurance

AXA Travel insurance works for trips both domestic and abroad. Take a look at how much you might pay for Gold-level domestic travel insurance based on where you are starting your trip, the trip’s cost and your age.

Read More: Travel Insurance For United States Tourists

AXA Assistance USA Travel Insurance Reviews

The majority of positive reviews about AXA travel insurance show that customers are pleased with the coverage options and the peace of mind that trip insurance provides. While many customers have positive claims experiences, others mentioned slow claims processing, slow response times from customer support staff and a generally low standard of customer service.

Below are company reviews that were found on Better Business Bureau (BBB) and Trustpilot .

“I found myself in a medical emergency whilst abroad and required surgery. Every single member of staff I spoke to [was] helpful, friendly and empathetic to my situation. They ensured additional seats for my journey home as well as airport assistance. I have made an additional claim on returning to the UK for expenses I incurred whilst in the hospital — this has been processed quickly and without issue. I feel very strongly that people only tend to complain on the back of a negative experience, but I felt compelled to make people aware of my experience which was completely positive.” —Abigail N. via Trustpilot “Every time I've made a claim with this company it's been dealt with superbly, no issues at all. Paid on two [COVID-19] claims this year, a cancelled holiday for illness a few ago and the sickness whilst away 7 years ago, comes as part of my bank package. Would have no hesitation in recommending them to anybody.” — Silver F. via Trustpilot “They paid very slowly, but they eventually did pay. I took a trip in June 2022. While there, I got COVID just before I was to return. My return home was delayed by 9 days, and I had to buy a new return ticket home. They do not respond to emails (other than the standard automatic "We received your correspondence, blah blah") but no personal communication until 8 to 10 weeks later. Don't bother calling because you will be put on hold for a very long time, then be disconnected. Can I recommend them? No. Will I be insured with them in the future? Certainly not. But to their credit, they did reimburse me, and for the full amount I asked for.” — William S. via BBB “Worst company to buy travel insurance . I had to cancel my return ticket due to being sick last year and I already provided all the asked documents and submitted the claim in December 2021 and am still awaiting a response. No updates, no progress on my claim, and it's been almost 6 months now. [...]” — Dilshadahemad K. via BBB

How To File a Claim with AXA Travel Insurance

Filing a travel insurance claim with AXA is straightforward. Follow these steps:

- Gather documentation: Once you are able to do so, gather documentation that proves your claim. If you are filing a claim for medical bills, gather a summary of the treatment you received and bills you owe or paid.

- Call or submit documentation online: Next, connect with a representative to submit your claim. You can reach AXA at 888-975-5015 or by logging into your online portal.

- Wait for reimbursement: Once you have filed your claim and any necessary documentation, the last step is to wait for reimbursement. You can contact AXA for updates as needed.

AXA Assistance USA vs. Competitors

Check out how AXA compares with some of the other top international travel insurance providers we have reviewed.

The destination you select plays a significant role in your pricing. Browse the table below to learn more.

Is AXA Assistance USA a Good Choice for Travel Insurance?

We found that AXA’s travel insurance coverage is best suited for adventure travelers and those looking for top-tier coverage. AXA’s Platinum plan can offer travelers more unique benefits, including payments for lost ski days and medical coverage for pre-existing conditions.

AXA might not be best for those looking for quick, cheap coverage . While its pricing is in line with other companies, it limits its CFAR coverage and most inclusive benefits to the highest pricing tier. Options like Faye Travel Insurance specialize in offering streamlined, quick coverage choices at lower prices, which can be beneficial for last-minute travelers.

Frequently Asked Questions About AXA Travel Insurance

What are the benefits of axa travel insurance.

One of the key benefits of AXA Travel Insurance is that they have a huge international network, which means you’ll receive travel assistance services along with insurance coverage. They also advertise a 24/7 concierge service that can be used before you travel for advice or recommendations on what to book and where to visit.

Who owns AXA Travel Insurance?

AXA Assistance USA is part of AXA Group, which is a multinational insurance company that was originally founded in France. The group is a collection of independently run businesses which includes travel insurance companies in countries across the world, primarily in North America, Western Europe and the Middle East.

Does AXA cover me abroad?

If you purchase a travel insurance policy from AXA, then you will be covered when you travel abroad. This includes coverage if you require medical treatment while in another country and emergency evacuation due to medical conditions or an unrelated incident.

What travel insurance is underwritten by AXA?

Many different travel insurance providers and policies are underwritten by AXA Insurance, which means that AXA determines the coverage that can be offered and how much this will cost. Travel insurance providers underwritten by AXA include TUI Travel Insurance, Coverwise travel insurance, Just Travel Cover and ABTA Travel Insurance.

Other Travel Insurance Providers to Consider

- Faye Travel Insurance Review

- TravelSafe Travel Insurance Review

- Nationwide Travel Insurance Review

- WorldTrips Travel Insurance Review

- World Nomads Travel Insurance Review

- Allianz Travel Insurance Review

- GeoBlue Travel Insurance Review

Methodology: Our System for Ranking the Best Travel Insurance Companies

- A 30-year-old couple taking a $5,000 vacation to Mexico.

- A family of four taking an $8,000 vacation to Mexico.

- A 65-year-old couple taking a $7,000 vacation to the United Kingdom.

- A 30-year-old couple taking a $7,000 trip to the United Kingdom.

- A 19-year-old taking a $2,000 trip to France.

- A 27-year-old couple taking a $1,200 trip to Greece.

- A 51-year-old couple taking a $2,000 trip to Spain.

- Plan availability (10%): We look for insurers with a variety of travel insurance plans and the ability to customize a policy with coverage upgrades.

- Coverage details (29%): We review the baseline coverage each company offers in its cheapest comprehensive plan. A provider with robust coverage earns full points, including baggage delay and loss, COVID-19 coverage, emergency evacuation and medical coverage, trip delay and cancellation coverage, and more. Companies also receive points for offering a variety of policy add-ons like accidental death and dismemberment, extreme sports, valuable items, cancel for any reason coverage and more.

- Coverage times and amounts (34%): We compare each company’s waiting periods and maximum reimbursement amounts for baggage, travel and weather delays. Companies that offer customers reimbursement after fewer than 12 hours of delays earn full points in this category. We also reward travel insurance providers that cover more than 100% of trip costs in the event of cancellations or interruptions.

- Company service and reviews (17%): We look for indicators that a company is well-prepared to respond to customer needs. Companies with an established global resource network, 24/7 emergency hotline, mobile app, multiple ways to file a claim and concierge services score higher in this category. We assess reputation by evaluating consumer reviews, third-party financial strength and customer experience ratings, specifically from AM Best and the Better Business Bureau (BBB).

For more information, read our full travel insurance methodology.

A.M. Best Disclaimer

If you have questions about this page, please reach out to our editors at [email protected] .

Passing Thru Travel

Travel Insurance 2024 – 10 Things You Need to Know – Choosing the Right Policy for International Trips

Posted: February 20, 2024 | Last updated: February 20, 2024

Traveling internationally is an exciting adventure, but it also comes with its share of uncertainties. Choosing the right travel insurance is one of the most important steps in planning your trip. Travel insurance can protect you from many unexpected circumstances, from medical emergencies and trip cancellations to lost luggage and flight delays. This guide will explore ten different travel insurance offerings, helping you make an informed decision for your next international journey.

World Nomads

World Nomads is widely acclaimed for its flexibility and comprehensive coverage, catering especially to adventurous travelers. Their policies often include activities that other insurers typically exclude, such as scuba diving, skiing, and hiking. Coverage extends to medical emergencies, trip cancellation, interruption, and baggage loss. They also provide tech gear coverage, a bonus for digital nomads. Their 24/7 emergency assistance is a key feature for those traveling to remote destinations.

Insider’s Tip: Check their activity list to ensure your adventure sport is covered.

Allianz Global Assistance

Allianz Global Assistance offers a variety of plans, allowing travelers to choose a policy that best suits the nature and budget of their trip. Their offerings range from basic emergency medical coverage to more comprehensive plans including trip cancellation, interruption, delay, baggage loss, and emergency medical transportation. Their annual plans are economical for frequent travelers. The 24/7 assistance service is invaluable for dealing with emergencies or unexpected changes in travel plans.

Insider’s Tip: Consider their multi-trip annual plans if you travel frequently.

Travelex Insurance Services

Travelex is renowned for its user-friendly policies, providing essential coverage like trip cancellation, interruption, medical expenses, and evacuation. They have a particular focus on family travel, with children under 17 covered at no extra cost under a parent’s policy. The Travel Select plan stands out for its upgrade options, allowing travelers to add coverage for adventure sports, additional medical coverage, and car rental protection.

Insider’s Tip: Their Travel Select plan is highly customizable with upgrades.

AXA Travel Insurance

AXA Travel Insurance offers a range of plans, including single-trip, multi-trip, and annual plans, each with varying levels of coverage. They cover medical emergencies, trip cancellation, and baggage loss, and offer additional options like “Cancel for Any Reason” coverage. Their plans are known for high coverage limits and the option to add adventure sports coverage, making them a versatile choice for different types of travelers.

Insider’s Tip: Look into their “Cancel for Any Reason” coverage for ultimate flexibility.

IMG (International Medical Group)

IMG specializes in medical travel insurance, ideal for travelers prioritizing health coverage. Their plans range from basic medical coverage to comprehensive policies that include evacuation, trip cancellation, and adventure sports. They also offer unique plans for travelers such as expats and missionaries. The inclusion of pre-existing conditions and their global network of hospitals make them a strong contender in medical travel insurance.

Insider’s Tip: Their global network of hospitals can be particularly useful.

Seven Corners

Seven Corners stands out for its flexibility and range of plan options. They offer medical coverage, trip cancellation, and interruption insurance, with unique features like the ability to choose your medical facility abroad. Their RoundTrip plans are particularly beneficial for trip cancellation, offering reimbursement for trip costs due to unforeseen cancellations.

Insider’s Tip: Their round-trip plans are great for trip cancellation coverage.

Travel Guard by AIG

Travel Guard by AIG offers a comprehensive range of travel insurance plans. Their offerings include medical expenses, evacuation, trip cancellation and interruption, baggage loss, and flight insurance. The Gold Plan is notable for its family-friendly coverage, offering coverage for children at no additional cost, making it an excellent option for family vacations.

Insider’s Tip: Their Gold Plan is ideal for families traveling with children.

HTH Worldwide

HTH Worldwide is known for its high medical coverage limits and extensive network of medical providers worldwide. They cover various medical services, including pre-existing conditions and medical evacuation. Their plans also cater to students and expatriates. The mobile app, which helps find local healthcare providers, is a notable feature for travelers in unfamiliar destinations.

Insider’s Tip: Use their mobile app to find qualified medical care internationally.

Cigna Global

Cigna Global is a leader in international health services, offering extensive medical insurance coverage. Their customizable plans allow travelers to add modules like vision and dental care. Their 24/7 customer support, providing assistance and guidance in medical emergencies, is a critical feature.

Insider’s Tip: They offer 24/7 customer support, which is useful for emergencies.

Generali Global Assistance

Generali Global Assistance provides traditional travel insurance coverage along with specialized services. Their plans cover trip cancellation, medical emergencies, and baggage loss, and offer concierge services. Their premium plans are ideal for sports enthusiasts, offering coverage for sporting equipment and adventure sports activities.

Insider’s Tip: Their premium plans offer coverage for sporting equipment.

The Bottom Line

Choosing the right travel insurance policy is crucial for peace of mind on your international travels. Whether you prioritize medical coverage, trip cancellation insurance, or specific needs like adventure sports coverage, there is a policy to suit your travel style. Always read the fine print, understand the extent of the coverage, and consider any pre-existing conditions you might have. With the right travel insurance, you can embark on your international adventures knowing you’re well-protected against the unexpected.

More Articles Like This…

Barcelona: Discover the Top 10 Beach Clubs

2024 Global City Travel Guide – Your Passport to the World’s Top Destination Cities

Exploring Khao Yai 2024 – A Hidden Gem of Thailand

The post Travel Insurance 2024 – 10 Things You Need to Know – Choosing the Right Policy for International Trips republished on Passing Thru with permission from The Green Voyage .

Featured Image Credit: Shutterstock / Song_about_summer.

For transparency, this content was partly developed with AI assistance and carefully curated by an experienced editor to be informative and ensure accuracy.

More for You

Hagar the Horrible by Chris Browne

7 Things Stroke Doctors Say You Should Never, Ever Do

28 celebrities you probably did not know are nonbinary

Crimean Air Defenses Hit by Ukraine ATACMS Strike: Reports

Barbara Corcoran predicted mortgage rates will hit 'a magic number' and send housing prices 'through the roof' — here's how to set yourself up today

Here’s What the US Minimum Wage Was the Year You Were Born

How Much Beer You'd Have To Drink To Equal A Single Shot Of Liquor

For Better Or For Worse by Lynn Johnston

Scientists claim people with this blood type more likely to have early stroke

Best Movies Now on Netflix

iPhone users in 92 countries received a recent stark warning

20 Loyal Dog Breeds That Will Never Leave Your Side

The Best Potluck Desserts No One Thinks to Bring

Red and Rover by Brian Basset

$20 Minimum Wage Backfires as Restaurant Orders Plummet

Mitch McConnell Confronted Over Voting to Acquit Donald Trump

Do I have to pay off my spouse's debts when they die? Here's what you're responsible for and what you aren't after a loved one's death

Smartest Dog Breeds, Ranked

LeBron James explodes on Darvin Ham during Lakers' Game 4 victory over Nuggets

11 Facts You Should Know About Hard-Boiled Eggs

IMAGES

VIDEO

COMMENTS

GET A QUOTE 855-327-1441. Embark on an international adventure with AXA's reliable and affordable travel plans. Ensure peace of mind against unexpected situations such as trip cancellations, medical emergencies, and lost or stolen luggage. Discover AXA's comprehensive coverage and travel with confidence worldwide. Learn more today.

Travel Assistance Wherever, Whenever. Speak with one of our licensed representatives or our 24/7 multilingual insurance advisors to find the coverage you need for your next trip. From Medical Coverage to Trip Cancellation Protection, our team of travel experts will help you choose the right coverage. 855- 327- 1441.

Compare AXA Travel Insurance Plans which includes benefits like trip cancellation, interruption, emergency medical expense, emergency evacuation and baggage delay to help give you peace of mind before and during your trip. ... International Travel Insurance Website Cookies Cookies Preference Center 855-327-1441 [email protected] AXA ...

This plan is ideal for international and domestic travel, cruises, and tours. Trip Cancellation Coverage - 100% of Trip Cost. Trip Interruption Coverage - 150% of Trip Cost. Trip Delay Coverage - $200/day; $1,000 maximum. Missed Connection Coverage - $1,000.

Learn about how travel insurance can help you on your next adventure based on your destination. Find out more ... AXA Travel Benefits. For your holidays in the USA and abroad ... International Travel Insurance Website Cookies Cookies Preference Center 855-327-1441 [email protected] ...

Platinum. Platinum is AXA's highest tier level. This plan includes: Trip delay: $300 per day, with a $1,250 maximum. Trip cancellation: 100% of the trip cost. Trip interruption: 150% of the trip ...