- Credit Cards

- View All Credit Cards

- See If You're Pre-Selected

- Balance Transfer Credit Cards

- 0% Intro APR Credit Cards

- Rewards Credit Cards

- Cash Back Credit Cards

- Travel Credit Cards

- Retail Store Cards

- Small Business Credit Cards

Quick Links

- Banking Overview

- Certificates of Deposit

- Banking IRAs

- class="ssr-key" Small Business Banking

- Personal Loans

- Overdraft Line of Credit

- Home Lending

- Refinance Your Home

- Use Your Home Equity

- Small Business Lending

- Investing Overview

- Self-Directed Investing

- Guided Investing

- Working with an Advisor

- Wealth Management

- Citigold ® Private Client

- Citi Priority

- Open an Account

Notificación importante

Por favor, tenga en cuenta que las comunicaciones verbales y escritas de Citi podrían estar únicamente en inglés, ya que, tal vez, no podamos proporcionar comunicaciones relacionadas con los servicios en todos los idiomas. Estas comunicaciones podrían incluir, entre otras, contratos, divulgaciones y estados de cuenta, cambios en los términos o en los cargos, así como cualquier documento de mantenimiento de su cuenta.

Please be advised that verbal and written communications from Citi may be in English as we may not be able to provide servicing related communications in all languages. These communications may include, but are not limited to, account agreements, statements and disclosures, change in terms or fees; or any servicing of your account. If you need assistance in a language other than English, please contact us as we have language services that may be of assistance to you.

CITI TRAVEL with Booking.com

Introducing citi travel℠: your first stop to your next destination.

Earn ThankYou ® Points when you pay for part, or all, of your trip with your eligible Citi Card through the Citi Travel portal. Plus, you can redeem your points towards even more adventures through the Citi Travel portal. With customizable options and booking right from your Citi Mobile ® App for eligible cardholders, the way to go is now way easier.

Earn More ThankYou ® Points on Select Bookings Through the Citi Travel portal

10x the fun with citi strata premier℠.

Earn a total of 10x ThankYou ® Points on hotels and car rentals when you book on the Citi Travel portal. 1

5X the Fun with Rewards+ ®

Earn a total of 5x ThankYou ® Points on hotels and car rentals when you book on the Citi Travel portal. Offer expires December 31, 2025. 2

More Points, More Fun with Double Cash ®

Earn a total of 5 ThankYou ® Points per $1 spent on hotels and car rentals when you book on the Citi Travel portal. Offers expires December 31, 2024. 3

Offer provides 3 additional points on top of the 1 point per dollar on purchases and 1 point per dollar for payments on purchases

Earn More Points with Custom Cash ®

Earn an unlimited additional 4 ThankYou ® Points per $1 spent on hotels and car rentals when you book on the Citi Travel portal. Offers expires June 30, 2025. 4

Additional Citi Travel Portal Benefits

The citi travel portal offers perks to make your travel booking experience easier and more convenient., access to over 1.4 million hotel and resort options, competitive prices when booking flights, hotels, cars and attractions, 24/7 customer service support for your booking needs.

ThankYou ® Cards Make Every Day More Rewarding

It's easy to earn ThankYou ® Points with Citi credit cards. Find the one that helps you earn the most on your daily spending.

Citi Travel: Frequently Asked Questions

What is the citi travel portal.

Citi Travel is a travel booking portal that gives eligible Citi card members access to book flights, hotels, rental cars, and attractions at competitive prices, along with 24/7 customer support. Additionally, when you book through the Citi Travel portal using ThankYou ® rewards cards, you can earn ThankYou ® points on your travel spending which can then be redeemed to be used on your next journey.

How do I book through the Citi Travel portal?

To book through the Citi Travel portal:

- Login into your Citi Mobile App or directly into the Citi Travel portal using your Citi Online User ID and password.

- After that, search for the flights, hotels, car rentals or attractions you want to book and enter the necessary information (such as number of guests or passengers, travel dates, etc.)

- Confirm your booking and choose whether you want to pay with card, points, or a combination of these purchase options.ns.

Can I use any Citi ® card to book through Citi Travel?

All Citi ThankYou ® Rewards Credit Cards

Citi Travel℠ is powered by Rocket Travel Inc., part of the Booking Holdings Inc. group of companies together with Booking.com.

1 You will earn 10 ThankYou Points for each $1 spent on hotels, car rentals, and attractions when you use your Citi Strata Premier Card to book them through the Citi Travel site via CitiTravel.com or 1-833-737-1288 (TTY: 711). For bookings made with a combination of points and your Citi Strata Premier Card, only the portion paid with your card will earn points. Points are not earned on cancelled bookings. If your account is closed for any reason, including if you convert to another card product, you will no longer be eligible for this offer. Citi Travel is powered by Rocket Travel Inc., part of the Booking Holdings Inc. group of companies together with Booking.com.

2 Earn a total of 5 ThankYou ® Points per $1 spent on hotel, car rental and attractions excluding air travel when booked through the Citi Travel℠ portal on cititravel.com or by calling 1-833-737-1288 and saying "Travel". Offer is valid through 11:59 PM 12/31/2025. You earn 1 ThankYou ® Point per $1 spent on the Citi Travel portal bookings. You will earn an additional 4 bonus ThankYou ® Points per $1 spent on hotel, car rental and attractions excluding air travel when booked through the Citi Travel portal or by calling 1-833-737-1288 through 11:59 PM 12/31/2025. The booking must post to your account during the promotional period to qualify. This offer may overlap with other special offers in which you are currently enrolled. You must use your Citi Rewards+ ® Card registered at the Citi Travel portal to earn the bonus points . For bookings made with a combination of points and your Citi Rewards+ ® Card, only the portion paid with your card will earn points. Bonus points will take up to 3 billing cycles to post to your account. To qualify for this offer, this account must be open and current. Points will not be earned on canceled bookings. If your account is closed for any reason, including if you convert to another card product, you will no longer be eligible for this offer. Citi Travel is powered by Rocket Travel Inc., part of the Booking Holdings Inc. group of companies together with booking.com.

3 Earn a total of 5 ThankYou Points per $1 spent on hotel, car rental, and attractions excluding air travel when booked through the Citi Travel℠ portal on cititravel.com or by calling 1-833-737-1288 and saying "Travel". Offer is valid through 11:59 PM Eastern Time (ET) 12/31/2024. You earn 1 ThankYou Point per $1 spent on the Citi Travel portal bookings and an additional 1 ThankYou Point per $1 paid on Eligible Payments (as defined in the Citi ThankYou ® Rewards Terms and Conditions for Citi Double Cash ® Card Accounts) made to your Citi Double Cash card account. You will earn an additional 3 bonus ThankYou Points per $1 spent on hotel, car rental, and attractions excluding air travel when booked through the Citi Travel portal or by calling 1-833-737-1288 through 11:59 PM Eastern Time (ET) 12/31/2024. The booking must post to your account during the promotional period to qualify. This offer may overlap with other special offers in which you are currently enrolled. You must use your Citi Double Cash Card registered at the Citi Travel portal to earn the bonus points . For bookings made with a combination of points and your eligible Citi Double Cash card, only the portion paid with your card will earn the additional points. Bonus points may take one or two billing cycles to post to your account. To qualify for this offer, this account must be open and current. Points will not be earned on canceled bookings. If your account is closed for any reason, including if you convert to another card product, you will no longer be eligible for this offer. Citi Travel is powered by Rocket Travel Inc., part of the Booking Holdings Inc. group of companies together with booking.com.

4 Earn an additional 4 Thank You Points per $1 spent on hotel, car rental, and attractions excluding air travel through the Citi Travel℠ portal or by calling 1-833-737-1288 (TTY: 711). Offer is valid through 11:59 PM Eastern Time (ET) 6/30/2025. The booking must post to your account during the promotional period to qualify. This offer may overlap with other special offers in which you are currently enrolled. You must use your Citi Custom Cash ® Card registered at the Citi Travel portal to earn the bonus points . For bookings made with a combination of points and your eligible Citi card, only the portion paid with your card will earn the additional points. Bonus points may take one or two billing cycles to post to your account. To qualify for this offer, this account must be open and current. Points will not be earned on canceled bookings. If your account is closed for any reason, including if you convert to another card product, you will no longer be eligible for this offer. Citi Travel is powered by Rocket Travel Inc., part of the Booking Holdings Inc. group of companies together with booking.com.

To provide you with extra security, we may need to ask for more information before you can use the feature you selected.

Just a moment, please...

Get Citibank information on the countries & jurisdictions we serve

You are leaving a Citi Website and going to a third party site. That site may have a privacy policy different from Citi and may provide less security than this Citi site. Citi and its affiliates are not responsible for the products, services, and content on the third party website. Do you want to go to the third party site?

Citi is not responsible for the products, services or facilities provided and/or owned by other companies.

Por favor, tenga en cuenta que las comunicaciones verbales y escritas de Citi podrían estar únicamente en inglés, ya que, tal vez, no podamos proporcionar comunicaciones relacionadas con los servicios en todos los idiomas. Estas comunicaciones podrían incluir, entre otras, contratos, divulgaciones y estados de cuenta, cambios en los términos o en los cargos, así como cualquier documento de mantenimiento de su cuenta. Si necesita ayuda en un idioma distinto al inglés, por favor, comuníquese con nosotros, ya que tenemos servicios de idiomas que podrían serle útiles.

Share Your Screen With A Phone Representative

During your call, you may be asked to share your screen for a faster, more efficient experience. If you agree, the phone representative you're speaking with will give you a Service Code to enter below.

If you need assistance from a Citi representative, contact us via chat or phone

- Accounts & Deposits

- Local Currency Accounts

- Foreign Currency Accounts

- Time Deposits

- Open a Banking Account

- Citi Priority

- Citigold Private Client

- Global Banking

- Moving to Singapore

- Global Investment Opportunities

- Travelling Overseas

- Living Overseas

- Managing my Global Accounts

- Recommend a Friend

- Citibank Debit Mastercard

- CitiBusiness

- Cash Management

- CitiBusiness Online

- Citi Commercial Bank

- Citibank Branches & Other Touchpoints

- View all cards

- Supplementary Card

- Refer your friend & get S$150

- Commercial Cards

- View all privileges

Citi World Privileges

- Citi Thank YouSM Rewards

- Instant Rewards

- Petrol deals

- Additional services

- Pay your bills

- Manage your card

- Activate your card

- Increase your credit limit

- Mobile payments

- Visa checkout

- Electricity Bills

- New Property

- Refinancing

- Manage my Mortgage

- Mortgage Client Care

- Refer a friend

- Mortgage Calculator

- Your Personal Loan Solutions

- Debt Consolidation Plan

- Personal Loan

- Balance Transfer

- Ready Credit Products

- Ready Credit

- Ready Credit Card

- Apply for Citibank Ready Credit

- Activate your Ready Credit Card

- Manage your Ready Credit Account

- Increase your Credit Limit

- Repayment modes

- Credit Insure Insurance

- Ready Credit Tools & Calculators

- Insurance products

- Accident & Health Insurance

- Life Insurance Solutions

- Travel Insurance

- Services & Information

- Apply for Travel Insurance

- Insurance Gap Calculator

- Investment products

- Unit Trusts

- Fixed Income Securities

- Foreign Exchange

- Citibank Premium Account

- Citibank Brokerage

- Wealth Solutions

- Privileges and Offers

- Wealth Management Products

- Wealth Advisory

- Citibank International Personal Bank

- Credit Cards

- Debit Cards

- Investment/Online

- Apply for Credit Cards

- Apply for Ready Credit

- Find My Citi

- Citi ThankYou SM Rewards

- Citi PremierMiles Card

Miles Ahead with Citi PremierMiles Card

Miles ahead with citi premiermiles card -->, accelerate your holiday plans with up to 4 citi miles^^ per s$1 on qualifying foreign currency spend when you are overseas., start your travel adventure with welcome miles of up to 30,000 bonus citi miles * ..

Take flight to

Explore more of what you love with a welcome gift of up to 30,000 bonus Citi Miles*.

Earn 3 Citi Miles* on eligible travel bookings

Spend your way with 45,000 Citi Miles*

Welcome gift of up to 30,000 bonus Citi Miles

Receive up to 30,000 bonus Citi Miles when you spend S$800 in the first 2 months.

Earn bonus miles on your next overseas vacation

From now until 31 January 2024, earn up to 4 Citi Miles^^ per S$1 on qualifying foreign currency spend charged to your Citi PremierMiles Card while overseas.

Simply follow these steps:

Step 1: Enrol now by sending an SMS in the prescribed format CITIPMCFX<space>last 4 digits of your Citi PremierMiles Card number (e.g., CITIPMCFX 1234) to 72484.

Step 2: Make a min. of S$5,000 spend (can be in local and/or foreign currency) on your Citi PremierMiles Card per calendar month between 1 November 2023 and 31 January 2024.

Step 3: While overseas, charge your qualifying foreign currency spend at Point-of-Sale to your Citi PremierMiles Card.

Step 4: Earn up to 4 Citi Miles^^ per S$1 on qualifying foreign currency spend charged to your Citi PremierMiles Card, capped at the first S$5,000* of qualifying foreign currency spend per calendar month, from the month of enrolment between 1 November 2023 and 31 January 2024. *i.e. the maximum Bonus Miles that an Eligible Cardmember will receive under this Promotion is 10,000 Citi Miles each calendar month.

Promotion Terms and Conditions

PLEASE SELECT AN OFFER

Already have a Citi Credit Card?

Why citi premiermiles card.

1.2 Citi Miles # per S$1 local spend 2 Citi Miles # per S$1 foreign currency spend 2 Citi Miles ^^ per S$1 qualifying foreign currency spend while overseas between 1 November 2023 and 31 January 2024. Click here for T&Cs. --> Renewal bonus of 10,000 Citi Miles ^ on your card anniversary

Citi Miles never expire so you can use them whenever you want

Airport Lounge Access

2 complimentary visits** every year to airport lounges worldwide. For more information: Citi PremierMiles Mastercard - Register online for membership. Citi PremierMiles Visa Card - Register online for membership. .

Turn big payments into big rewards with Citi PayAll. Click here to find out more

Travel safely.

Up to S$1 million in insurance coverage when you charge your travel tickets to Citi PremierMiles + .

Use anywhere.

Enjoy the freedom of redeeming your miles with Citi Pay with Points or redeem for cash rebate through SMS

Enjoy maximum freedom on your rewards redemption through Citi ThankYou ™ Rewards. Choose to redeem for Pay with Miles to offset your purchases or redeem attractive vouchers from our Redemption Catalogue via Citi Mobile ® App.

PremierMiles promo

Earn miles faster

From now until 30 June 2023, earn up to 4 Citi Miles^^ per S$1 on qualifying foreign currency spend charged to your Citi PremierMiles Card while overseas.

Simply follow these steps: Step 1: Enrol now by sending an SMS in the prescribed format CITIPMFX<space>last 4 digits of your Citi PremierMiles Card number (e.g., CITIPMFX 1234) to 72484. Step 2: Make a min. of S$5,000 spend (can be in local and/or foreign currency) on your Citi PremierMiles Card per calendar month between 1 March and 30 June 2023. Step 3: While overseas, charge your qualifying foreign currency spend at Point-of-Sale to your Citi PremierMiles Card. Step 4: Earn up to 4 Citi Miles per S$1 on qualifying foreign currency spend charged to your Citi PremierMiles Card, capped at the first S$5,000 * of qualifying foreign currency spend per calendar month, from the month of enrolment between 1 March and 30 June 2023. * i.e. the maximum Bonus Miles that an Eligible Cardmember will receive under this Promotion is 10,000 Citi Miles each calendar month.

Great Giveaways

Download or log in to the Citi Mobile ® App now.

Citi PremierMiles Card Promotions

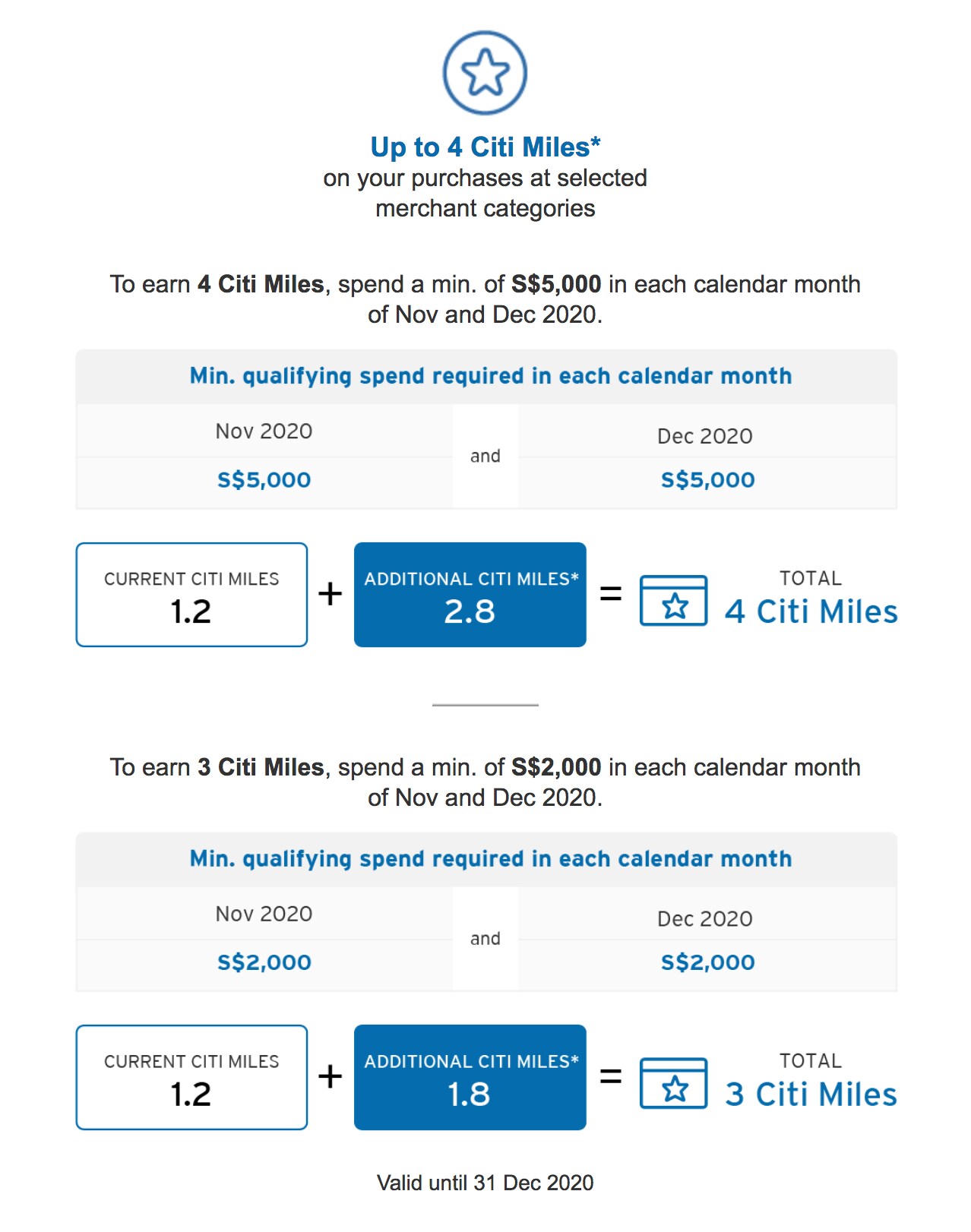

Spend & Get Promotion

Earn up to 4 Citi Miles^ per S$1 eligible spend ^Terms & Conditions Apply Valid till 31 December 2020 Show Details

Earn up to 4 Citi Miles* per S$1 of Eligible Spend Promotion from now until 31 December 2020. Terms and Conditions apply.

SMS to enroll now!

To enrol in this exclusive promotion, SMS PMSPEND <space><last 4 digits of your Citi PremierMiles Card> to 72484.

If you are overseas and wish to enrol, SMS PMSPEND <space><last 4 digits of your Citi PremierMiles Card> to +65 96572484.

*Promotion Terms and Conditions

Earn up to 4 Citi Miles^^ per S$1 on qualifying foreign currency spend when you are overseas Valid from 1 November 2023 to 31 January 2024. T&Cs apply Find out more

Citi ThankYou SM Rewards Promotion

From now until 29 Feb 2024, enjoy 25% off * when you use Pay with Points to offset your purchases or redeem attractive vouchers from our Redemption Catalogue this Lunar New Year. T&Cs apply * .

Earn 10 Citi Miles per S$1 spent on kaligo.com/bonus-miles Valid till 31 December 2024. T&Cs apply Book now Book Now -->

· Earn 10 Citi Miles per S$1 spent on Kaligo.com. Valid till 31 December 2023. Promotion Terms & Conditions

Book at www.kaligo.com/bonus-miles

Earn up to 7 Citi Miles per S$1 spent on hotel bookings worldwide on agoda.com/bonusmiles Valid for bookings made now till 31 December 2024 and for stays until 30 April 2025. T&Cs apply Book now Book Now -->

Travel Deals

Enjoy exclusive hotel, flight and other travel privileges when you plan the perfect unforgettable holiday with Citi PremierMiles Card.

UEFA Champions League 2024

Stand a chance to win a 4-day, 3-night all-inclusive trip to watch the UEFA Champions League Final 2024! T&Cs apply. Tickets courtesy of Mastercard, Official Sponsor of the UEFA Champions League. Learn More

Food Delivery & Home Entertainment

Earn 4 Citi Miles per S$1 spent on food delivery and home entertainment from now until 31 August 2021. Show Details

Enjoy additional rewards on your daily spend!

Be it online or in-store purchases, we’re making your daily spend even more rewarding with Citi Credit Cards. SMS to enrol and get up to 4 Citi Miles* at selected merchants from now until 30 June!

*Terms & Conditions Apply. Click here for promotion details .

3 Citi Miles on Travel Spend

Earn 3 Citi Miles* per S$1 local spend on airline, hotel, cruise and travel bookings Valid till 31 December 2021 Show Details

Earn 3 Citi Miles* per S$1 local spend on airline, hotel, cruise and travel bookings

Spend a min. of S$2,000 per calendar month of Nov and Dec 2021 and charge eligible travel-related bookings in the same calendar month to earn 3 Citi Miles* per S$1 local spend! To participate, SMS PM3MILES<space><last 4 digits of your Citi PremierMiles Card> to 72484 (e.g. PM3MILES 1234). Promotion Terms and Conditions

Get 10% off hotel bookings *Terms & Conditions Apply Show Details

Accelerated Rewards at Expedia on Flights and Hotels • 3 Citi Miles per S$1 spent on www.expedia.com.sg/bonusrewards • Valid till 31 May 2019 Click here for details

10% off hotel bookings on www.expedia.com.sg/citibank • Valid till 31 December 2019 Promo code: CITIEXPSG Click here for details

Top Citi PremierMiles Credit Card Features

Top 6 miles credit card features, citi pay with miles, use your citi miles to pay for any purchase, citi thankyou rewards, redeem and manage your citi miles as you wish, get deals and discounts locally, citi paylite, turn big purchases into small payments with citi premiermiles card, citi flexibill, turn statements into small payments, citi quickcash, instant cash to get things done right away, already a citi credit cardmember.

Get up to S$1,050 Bonus Cash for successful referrals!

Freedom to do more with the new Citi Mobile ® App

Everything at a glance

Activate a new card

Secure your transaction

Lock and unlock your card

Powerful features on demand

See your Citi Miles balance

Calculate your Citi Miles

Where are you going next.

Above destinations are for illustration purposes only. Actual Citi Miles required may differ at time of redemption and actual destinations can be varied depending on frequent flyer programmes of each airline.

Your world of Citi Miles in less than 10 minutes

Get a new Citi PremierMiles credit card from your mobile phone or computer in an easy, paperless signup process

Basic fee of S$196.20 inclusive of 9% GST

Min. income S$30,000 (Singaporean/PR) or S$42,000 (Foreigner) a year

Age 21 or older

Welcome gift of up to 30,000 bonus Citi Miles *

Documents required to apply for a Citi PremierMiles Card

- Documents for Singaporean/PR

- Documents for Foreigner

Salaried employee

- A copy of your NRIC/passport

- Latest original computerized payslip or Tax Notice of Assessment or last 12 months' CPF statements

- Click here to submit your CPF statement online

Self-employed

- Last 2 years’ Income Tax Notice of Assessment

- Last 3 months’ bank statements

- A copy of your passport and work permit (with minimum 6 months validity)

- A copy of utility/telephone bill or bank statement with your name and address

- Income Tax Notice of Assessment and latest original computerized payslip

*Terms & Conditions Apply. For new customer only.

Already a Citi Cardmember?

Refer a friend and get up to S$1,050 Bonus Cash for successful referrals!

Terms and Conditions

• ## Click here for the full terms and conditions of the Citi Great Giveaways contest.

• ^^ Click here to view Citi PremierMiles Card Foreign Currency Spend Promotion Terms & Conditions.

• * Welcome offer eligible for new Citi Cardmembers only with S$800 qualifying spend in the first 2 months. Promotion valid till 31 October 2024. Click here to view the Citi PremierMiles Card 8,000 bonus Citi Miles Welcome Gift Promotion Terms and Conditions.

• * Welcome offer eligible for new Citi Cardmembers only with S$800 qualifying spend in the first 2 months. Promotion valid till 31 October 2024. Click here to view the Citi PremierMiles Card 30,000 bonus Citi Miles Welcome Gift Promotion Terms and Conditions.

• ** Priority Pass membership is on application basis and is reserved for the Principal cardmember only, limited to 2 complimentary visits per calendar year. Every accompanying guest will be considered as 1 visit. Thereafter, US$35 per person per visit (or at the prevailing rate) will be charged to the Citi PremierMiles Card account.(Note: Priority Pass airport lounge charge of US$35 per person per visit may also be charged in a different currency equivalent to US$35 per person per visit.)

• + Up to S$1,000,000 coverage in the event of death or permanent disablement, arising from an accident in a common carrier. For full set of policy terms and exclusions please click here . (For claims, call HL Assurance Claims at (65) 6922 6003 or email [email protected]).

• ^ upon renewal of your annual membership and payment of the annual fee (S$196.20 inclusive of 9% GST)

• Click here to view the Cardmember's Agreement.

• Click here to view the Cardmember's Agreement. (effective 1 January 2024)

• Click here to view the Cardmember's Agreement (effective 24 July 2023).

• Click here to view the Information Sheet

• Click here to view the Cardmember's Agreement (effective from 12 September 2024)

• Click here to view the Information Sheet. (effective 1 January 2024)

• Click here to view the ABS Credit Card Guide

• Frequently Asked Questions on Credit Card Chargeback & Dispute Resolution

• # Click here for the list of merchants and/or Merchant Category Codes (“MCC”) which will not earn Citi Miles.

•Click here to view interest rates, fees and charges.

Welcome offer of up to 30,000 bonus Citi Miles *

- TERMS & CONDITIONS

- BANKING INFORMATION

Citigroup.com is the global source of information about and access to financial services provided by the Citigroup family of companies.

Copyright © 2024 Citigroup Inc.

No content.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

16 Best Travel Credit Cards of September 2024

The best travel credit card is one that brings your next trip a little closer every time you use it. Purchases earn points or miles you can use to pay for travel. If you're loyal to a specific airline or hotel chain, consider one of that company's branded travel credit cards. Otherwise, check out our picks for general-purpose travel cards that give you flexible travel rewards without the restrictions and blackout dates of branded cards.

400+ credit cards reviewed by our team of experts ( See our top picks )

80+ years of combined experience covering credit cards and personal finance

27,000+ hours spent researching and reviewing financial products in the last 12 months

Objective comprehensive ratings rubrics ( Methodology )

NerdWallet's credit cards content, including ratings and recommendations, is overseen by a team of writers and editors who specialize in credit cards. Their work has appeared in The Associated Press, USA Today, The New York Times, MarketWatch, MSN, NBC's "Today," ABC's "Good Morning America" and many other national, regional and local media outlets. Each writer and editor follows NerdWallet's strict guidelines for editorial integrity .

Show summary

NerdWallet's Best Travel Credit Cards of September 2024

Chase Sapphire Preferred® Card : Best for Max flexibility + big bonus

Capital One Venture Rewards Credit Card : Best for Flat-rate rewards

Capital One Venture X Rewards Credit Card : Best for Travel portal benefits

Chase Freedom Unlimited® : Best for Cash back for travel bookings

American Express® Gold Card : Best for Big rewards on everyday spending

Wells Fargo Autograph℠ Card : Best for Bonus rewards + no annual fee

The Platinum Card® from American Express : Best for Luxury travel perks

Ink Business Preferred® Credit Card : Best for Business travelers

Citi Strata Premier℠ Card : Best for Triple points on multiple categories

Capital One VentureOne Rewards Credit Card - Miles Boost : Best for Flat-rate rewards + no annual fee

Chase Sapphire Reserve® : Best for Bonus rewards + high-end perks

World of Hyatt Credit Card : Best for Best hotel card

Bilt World Elite Mastercard® Credit Card : Best for Travel rewards for rent payments

United℠ Explorer Card : Best for Best airline card

PenFed Pathfinder® Rewards Visa Signature® Card : Best for Credit union benefits

Wells Fargo Autograph Journey℠ Card : Best for Booking directly with airlines/hotels

Best Travel Credit Cards

Find the right credit card for you..

Whether you want to pay less interest or earn more rewards, the right card's out there. Just answer a few questions and we'll narrow the search for you.

Max flexibility + big bonus

Flat-rate rewards, travel portal benefits, cash back for travel bookings, big rewards on everyday spending, bonus rewards + no annual fee, luxury travel perks, business travelers, triple points on multiple categories, flat-rate rewards + no annual fee, bonus rewards + high-end perks, best hotel card, travel rewards for rent payments, best airline card, credit union benefits, booking directly with airlines/hotels, full list of editorial picks: best travel credit cards.

Before applying, confirm details on the issuer’s website.

Capital One Venture Rewards Credit Card

Our pick for: Flat-rate rewards

The Capital One Venture Rewards Credit Card is probably the best-known general-purpose travel credit card, thanks to its ubiquitous advertising. You earn 5 miles per dollar on hotels and car rentals booked through Capital One Travel and 2 miles per dollar on all other purchases. Miles can be redeemed at a value of 1 cent apiece for any travel purchase, without the blackout dates and other restrictions of branded hotel and airline cards. The card offers a great sign-up bonus and other worthwhile perks ( see rates and fees ). Read our review.

Capital One VentureOne Rewards Credit Card - Miles Boost

Our pick for: Flat-rate rewards + no annual fee

With the Capital One VentureOne Rewards Credit Card - Miles Boost , you don't pay an annual fee, but you also don't get rewards as rich as those on the regular Venture card ( see rates and fees ). Still, the bonus offer makes this a solid card for starting out with travel rewards. Read our review.

Chase Sapphire Reserve®

Our pick for: Bonus rewards + high-end perks

The high annual fee on the Chase Sapphire Reserve® gives many potential applicants pause, but frequent travelers should be able to wring enough value out of this card to more than make up for the cost. Cardholders get bonus rewards (up to 10X) on dining and travel, a fat bonus offer, annual travel credits, airport lounge access, and a 50% boost in point value when redeeming points for travel booked through Chase. Points can also be transferred to about a dozen airline and hotel partners. Read our review.

Chase Sapphire Preferred® Card

Our pick for: Max flexibility + big bonus

For a reasonable annual fee, the Chase Sapphire Preferred® Card earns bonus rewards (up to 5X) on travel, dining, select streaming services, and select online grocery purchases. Points are worth 25% more when you redeem them for travel booked through Chase, or you can transfer them to about a dozen airline and hotel partners. The sign-up bonus is stellar, too. Read our review.

Wells Fargo Autograph Journey℠ Card

Our pick for: Booking directly with airlines/hotels

The Wells Fargo Autograph Journey℠ Card stands out among general-purpose travel cards because it pays its highest rewards rates on travel bookings made directly with airlines and hotels, rather than requiring you to go through the issuer's travel agency, where prices might not be competitive. The points are flexible, you get a good bonus offer, and the card comes with a few other nice perks. Read our review.

Wells Fargo Autograph℠ Card

Our pick for: Bonus rewards + no annual fee

The Wells Fargo Autograph℠ Card offers so much value, it's hard to believe there's no annual fee. Start with a great bonus offer, then earn extra rewards in a host of common spending categories — restaurants, gas stations, transit, travel, streaming and more. Read our review.

Citi Strata Premier℠ Card

Our pick for: Triple points on everyday categories

The Citi Strata Premier℠ Card earns bonus points on select travel, supermarkets, dining, gas stations and EV stations. There's a solid sign-up bonus as well. Read our review.

U.S. Bank Altitude® Connect Visa Signature® Card

Our pick for: Road trips

The U.S. Bank Altitude® Connect Visa Signature® Card is one of the most generous cards on the market if you're taking to the skies or the road, thanks to the quadruple points it earns on travel and purchases at gas stations and EV charging stations. It's also a solid card for everyday expenses like groceries, dining and streaming, and it comes with ongoing credits that can offset its annual fee: $0 intro for the first year, then $95 . Read our review .

Capital One Venture X Rewards Credit Card

Our pick for: Travel portal benefits

Capital One's premium travel credit card can deliver terrific benefits — provided you're willing to do your travel spending through the issuer's online booking portal. That's where you'll earn the highest rewards rates plus credits that can make back the bulk of your annual fee ( see rates and fees ). Read our review.

Chase Freedom Unlimited®

Our pick for: Cash back for travel bookings

The Chase Freedom Unlimited® was already a fine card when it offered 1.5% cash back on all purchases. Now it's even better, with bonus rewards on travel booked through Chase, as well as at restaurants and drugstores. On top of all that, new cardholders get a 0% introductory APR period and the opportunity to earn a sweet bonus. Read our review.

The Platinum Card® from American Express

Our pick for: Luxury travel perks

The Platinum Card® from American Express comes with a hefty annual fee, but travelers who like to go in style (and aren't afraid to pay for comfort) can more than get their money's worth. Enjoy extensive airport lounge access, hundreds of dollars a year in travel and shopping credits, hotel benefits and more. That's not even getting into the high rewards rate on eligible travel purchases and the rich welcome offer for new cardholders. Read our review.

American Express® Gold Card

Our pick for: Big rewards on everyday spending

The American Express® Gold Card can earn you a pile of points from everyday spending, with generous rewards at U.S. supermarkets, at restaurants and on certain flights booked through amextravel.com. Other benefits include hundreds of dollars a year in available dining and travel credits and a solid welcome offer for new cardholders. There's an annual fee, though, and a pretty substantial one, so it's not for smaller spenders. Read our review.

Bilt World Elite Mastercard® Credit Card

Our pick for: Travel rewards on rent payments

The Bilt World Elite Mastercard® Credit Card stands out by offering credit card rewards on rent payments without incurring an additional transaction fee. The ability to earn rewards on what for many people is their single biggest monthly expense makes this card worth a look for any renter. You also get bonus points on dining and travel when you make at least five transactions on the card each statement period, and redemption options include point transfers to partner hotel and loyalty programs. Read our review.

PenFed Pathfinder® Rewards Visa Signature® Card

Our pick for: Credit union rewards

With premium perks for a $95 annual fee (which can be waived in some cases), jet-setters will get a lot of value from the PenFed Pathfinder® Rewards Visa Signature® Card . It also offers a generous rewards rate on travel purchases and a decent flat rate on everything else. Plus, you’ll get travel credits and a Priority Pass membership that offers airport lounge access for $32 per visit. Read our review.

United℠ Explorer Card

Our pick for: B est airline card

The United℠ Explorer Card earns bonus rewards not only on spending with United Airlines but also at restaurants and on eligible hotel stays. And the perks are outstanding for a basic airline card — a free checked bag, priority boarding, lounge passes and more. Read our review.

» Not a United frequent flyer? See our best airline cards for other options

World of Hyatt Credit Card

Our pick for: Best hotel card

Hyatt isn't as big as its competitors, but World of Hyatt Credit Card is worth a look for anyone who spends a lot of time on the road. You can earn a lot of points even on non-Hyatt spending, and those points have a high value compared with rival programs. There's a great sign-up bonus, free nights, automatic elite status and more. Read our review.

» Not a Hyatt customer? See our best hotel cards for other options.

Ink Business Preferred® Credit Card

Our pick for: Business travelers

The Ink Business Preferred® Credit Card starts you off with one of the biggest sign-up bonuses of any credit card anywhere: Earn 120k bonus points after you spend $8,000 on purchases in the first 3 months from account opening. That's $1,200 cash back or $1,500 toward travel when redeemed through Chase Travel℠. You also get bonus rewards on travel expenses and common business spending categories, like advertising, shipping and internet, cable and phone service. Points are worth 25% more when redeemed for travel booked through Chase, or you can transfer them to about a dozen airline and hotel partners. Learn more and apply .

OTHER RESOURCES

How travel rewards work.

Modern-day adventurers and once-a-year vacationers alike love the idea of earning rewards toward their next big trip. According to a NerdWallet study , 68% of American adults say they have a credit card that earns travel rewards.

With a travel rewards credit card, you earn points or miles every time you use the card, but you can often earn more points per dollar in select categories. Some top travel credit cards, such as the Chase Sapphire Reserve® , offer bonus points on any travel spending, while the Marriott Bonvoy Boundless® Credit Card grants bonus points when you use the card at Marriott hotels, grocery stores, restaurants or gas stations.

Not all points and miles earned on travel rewards credit cards are the same:

General-purpose travel credit cards — including the Chase Sapphire Preferred® Card , the American Express® Gold Card and the Capital One Venture Rewards Credit Card — give you rewards that can be used like cash to pay for travel or that can be exchanged for points in airline or hotel loyalty programs. With their flexible rewards, general-purpose options are usually the best travel credit cards for those who don't stick to a single airline or hotel chain.

Airline- and hotel-specific cards — such as the United℠ Explorer Card and the Hilton Honors American Express Card — give points and miles that can be used only with the brand on the card. (Although it's possible in some cases to transfer hotel points to airlines, we recommend against it because you get a poor value.) These so-called co-branded cards are usually the best travel credit cards for those who always fly one particular airline or stay with one hotel group.

How do we value points and miles? With the rewards earned on general travel cards, it's simple: They have a fixed value, usually between 1 and 1.5 cents per point, and you can spend them like cash. With airline miles and hotel points, finding the true value is more difficult. How much value you get depends on how you redeem them.

To better understand what miles are worth, NerdWallet researched the cash prices and reward-redemption values for hundreds of flights. Our results:

Keep in mind that the airline values are based on main cabin economy tickets and exclude premium cabin redemptions. See our valuations page for business class valuations and details about our methodology.

Our valuations are different from many others you may find. That’s because we looked at the average value of a point based on reasonable price searches that anyone can perform, not a maximized value that only travel rewards experts can expect to reach.

You should therefore use these values as a baseline for your own redemptions. If you can redeem your points for the values listed on our valuations page, you are doing well. Of course, if you are able to get higher value out of your miles, that’s even better.

HOW TO CHOOSE A TRAVEL CREDIT CARD

There are scores of travel rewards cards to choose from. The best travel credit card for you has as much to do with you as with the card. How often you travel, how much flexibility you want, how much you value airline or hotel perks — these are all things to take into account when deciding on a travel card. Our article on how to choose a travel credit card recommends that you prioritize:

Rewards you will actually use (points and miles are only as good as your ability to redeem them for travel).

A high earning rate (how much value you get in rewards for every dollar spent on the card).

A sign-up bonus (a windfall of points for meeting a spending requirement in your first few months).

Even with these goals in mind, there are all kinds of considerations that will influence your decision on a travel rewards credit card.

Travel cards are for travelers

Travel cards vs. cash-back cards.

The very first question to ask yourself when choosing a travel credit card is: Should I get a travel card at all? Travel credit cards are best for frequent travelers, who are more likely to get enough value from rewards and perks to make up for the annual fees that the best travel credit cards charge. (Some travel cards charge no annual fee, but they tend to offer lesser rewards than full-fee cards.) A NerdWallet study found that those who travel only occasionally — say, once a year — will probably get greater overall rewards from cash-back credit cards , most of which charge no annual fee, than from a travel card.

Flexibility and perks: A trade-off

Co-branded cards vs. general travel cards.

Travel credit cards fall into two basic categories: co-branded cards and general travel cards.

Co-branded cards carry the name of an airline or hotel group, such as the United℠ Explorer Card or the Marriott Bonvoy Boundless® Credit Card . The rewards you earn are redeemable only with that particular brand, which can limit your flexibility, sometimes sharply. For example, if your credit card's co-branded airline partner doesn't have any award seats available on the flight you want on the day you want, you're out of luck. On the other hand, co-branded cards commonly offer airline- or hotel-specific perks that general travel cards can't match.

General travel cards aren't tied to a specific airline or hotel, so they offer much greater flexibility. Well-known general travel cards include the Capital One Venture Rewards Credit Card and the Chase Sapphire Preferred® Card . Rewards on general travel cards come as points (sometimes called "miles" but they're really points) that you can redeem for any travel expense. You're not locked into using a single airline or hotel, but you also won't enjoy the perks of a co-branded card.

Evaluating general travel credit cards

What you get with a general travel card.

The credit cards featured at the top of this page are general travel cards. They're issued by a bank (such as Chase or Capital One), carry only that bank's name, and aren't tied to any single airline or hotel group. With these cards, you earn points on every purchase — usually 1 to 2 points per dollar spent, sometimes with additional points in certain categories.

Issuers of general travel cards typically entice new applicants with big sign-up bonuses (also known as "welcome offers") — tens of thousands of miles that you can earn by spending a certain amount of money on the card in your first few months.

» MORE: NerdWallet's best credit card sign-up offers

What do you do with those points? Depending on the card, you may have several ways to redeem them:

Booking travel. With this option, your points pay for travel booked through the issuer's website, using a utility similar to Orbitz or Expedia. For example, if points were worth 1 cent apiece when redeemed this way, you could book a $400 flight on the issuer's portal and pay for it with 40,000 points

Statement credit. This lets you essentially erase travel purchases by using your points for credit on your statement. You make travel arrangements however you want (directly with an airline or hotel, through a travel agency, etc.) and charge it to your card. Once the charge shows up on your account, you apply the necessary points and eliminate the cost.

Transferring to partners. The card issuer may allow you to transfer your points to loyalty programs for airlines or hotel chains, turning your general card into something like a co-branded card (although you don't get the perks of a co-brand).

Cash back, gift cards or merchandise. If you don't plan to travel, you can burn off your rewards with these options, although you'll often get a lower value per point.

Airline and hotel cards sharply limit your choice, but they make up for it with perks that only they can offer, like free checked bags or room upgrades. General travel cards, on the other hand, offer maximum flexibility but can't provide the same kinds of perks, because the banks that issue them don't operate the airlines or hotels. Still, there are some noteworthy perks on general travel cards, including:

Travel credit. This is automatic reimbursement for travel-related spending. Some top travel credit cards offer hundreds of dollars a year in travel credit.

Trusted traveler reimbursement. More and more travel credit cards are covering the application fee for TSA Precheck and Global Entry, programs that allow you to move through airport security and customs more quickly.

Airport lounge access. Hundreds of lounges worldwide operate separately from airlines under such networks as Priority Pass and Airspace, and several general travel cards offer access to these lounges.

Points programs

Every major card issuer has at least one travel card with a points program. American Express calls its program Membership Rewards, while Chase has Ultimate Rewards® and Citi pays in ThankYou points. Wells Fargo has Wells Fargo Rewards, and U.S. Bank has FlexPerks. Bank of America® travel cards offer points without a fancy name. Travel cards from Capital One, Barclays and Discover all call their points "miles."

These programs differ in how much their points are worth and how you can use them. Some offer the full range of redemption options, including transfers to loyalty programs. Others let you use them only to book travel or get statement credit.

» MORE: Travel loyalty program reviews

Evaluating airline credit cards

What you get with an airline credit card.

Airline credit cards earn "miles" with each purchase. You typically get 1 mile per dollar spent, with a higher rate (2 or more miles per dollar) on purchases with the airline itself. (Some airline cards have also begun offering extra miles for purchases in additional categories, such as restaurants or car rental agencies.) These miles go into the same frequent-flyer account as the ones you earn by flying the airline, and you can redeem them for free flights with the airline or its alliance partners.

Co-branded airline cards typically offer sign-up bonuses (or welcome offers). But what really sets them apart are the perks they give you. With some cards, for example, the checked-bag benefit alone can make up for the annual fee after a single roundtrip by a couple. Common perks of airline cards include:

Free checked bags. This commonly applies to the first checked bag for you and at least one companion on your reservation. Some cards extend this perk to more people, and higher-end cards (with higher annual fees) may even let you check two bags apiece for free.

Priority boarding. Holders of co-branded airline credit cards often get to board the plane early — after the airline's elite-status frequent flyers but before the general population. This gives you time to settle in and gives you a leg up on claiming that coveted overhead bin space.

In-flight discounts or freebies. You might get, say, 25% off the cost of food and beverages during the flight, or free Wi-Fi.

Airport lounge access. High-end cards often include a membership to the airline's airport lounges, where you can get away from the frenzy in the terminal and enjoy a complimentary snack. Some less-expensive airline cards give you only limited or discounted lounge access; others give you none at all.

Companion fares. This perk lets you bring someone with you for a lower cost when you buy a ticket at full price.

A boost toward elite status. Miles earned with a credit card, as opposed to those earned from actually flying on the airline, usually do not count toward earning elite status in an airline's frequent-flyer program. However, carrying an airline's high-end card might automatically qualify you for a higher tier within the program.

The biggest U.S. airlines — American, United and Delta — offer an array of credit cards. Each airline has a no-annual-fee card that earns miles on purchases but provides little in the way of perks (no free bags or priority boarding). Each has a high-end card with an annual fee in the neighborhood of $450 that offers lounge access and sumptuous perks. And each has a "middle-class" card with a fee of around $100 and solid ongoing perks. Southwest offers three credit cards with varying fees; smaller carriers may just have a single card.

» MORE: NerdWallet's best airline credit cards

Choosing an airline

Which airline card you get depends in large part on what airline you fly, and that's heavily influenced by where you live. Alaska Airlines, for example, has an outstanding credit card, but the airline's routes are concentrated primarily on the West Coast. So it's not a great option for those who live in, say, Buffalo, New York, or Montgomery, Alabama.

If your local airport is dominated by a single airline, then you're probably flying that carrier most (or all) of the time by default. Delta, for example, is the 800-pound gorilla at Minneapolis-St. Paul and Salt Lake City. United has the bulk of the traffic at Newark and Washington Dulles. American calls the shots at Charlotte and Dallas-Fort Worth. That airline's credit card may be your only realistic option. If you're in a large or midsize market with frequent service from multiple airlines, you have more choice.

» MORE: How to choose an airline credit card

Evaluating hotel credit cards

What you get with a hotel card.

Hotel credit cards earn points with each purchase. As with airline cards, you typically get more points per dollar for purchases from the co-brand partner, and some cards also give bonus points in additional categories. (Hotel cards tend to give you a greater number of points overall than airline cards, but each individual point is generally worth less than a typical airline mile.) Similar to the airline model, the points you earn with the card go into the same loyalty account as the points you earn from actually staying at a hotel. You redeem your points for free stays.

Hotel cards usually offer a sign-up bonus, but like airline cards, they really make their bones with the ongoing perks. Common perks on hotel cards include:

Free nights. Several cards offer this perk, which can make up for the card's annual fee. You may get a free night automatically every year, or you may unlock it by spending a certain amount within a year. In the latter case, it comes on top of the points you earn for your spending.

Upgrades and freebies. Cardholders may qualify for automatic room upgrades when available, or free or discounted amenities such as meals or spa packages.

Early check-in/late check-out. No one likes having to cool their heels in the hotel lobby waiting for 3 o'clock to check in. And no one likes have to vacate their room by 11 a.m. when their flight doesn't leave till evening.

Accelerated elite status. Some hotel cards automatically bump you up a level in their loyalty program just for being a cardholder.

» MORE: NerdWallet's best hotel credit cards

Choosing a hotel group

If you decide to go the hotel-card route, you'll need to decide which hotel group gets your business. Hotels aren't as market-concentrated as airlines, so if your travels take you mostly to metropolitan areas, you'll have a decent amount of choice. Keep in mind that even though there are dozens of nationally recognizable hotel brands, ranging from budget inns to luxury resorts, many of them are just units in a larger hotel company, and that company's card can unlock benefits across the group.

Marriott, for example, includes not only its namesake properties but nearly 30 other brands, including Courtyard, Fairfield, Renaissance, Residence Inn, Ritz-Carlton, Sheraton and Westin. The Hilton family includes DoubleTree, Embassy Suites, Hampton Inn and Waldorf-Astoria. InterContinental includes Holiday Inn, Candlewood, Staybridge and Crowne Plaza. Wyndham and Choice have more than 15 mid-tier and budget-oriented brands between them.

HOW TO COMPARE TRAVEL CREDIT CARDS

No travel rewards credit card is going to have everything you want. You're going to be disappointed if you expect to find a high rewards rate, a generous sign-up bonus, top-notch perks and no annual fee. Each card delivers value through a different combination of features; it's up to you to compare cards based on the following features and choose the best travel credit card for your needs and preferences.

Most of the best travel cards charge an annual fee. Fees in the range of $90 to $100 are standard for travel cards. Premium cards with extensive perks will have fees of $450 or more. Weigh the value of the rewards and perks you'll get to make sure they'll make up for the fee.

Can you find good cards without an annual fee? Absolutely! There are no-fee options on our list of the best travel credit cards, and we've rounded up more here . Just be aware that if you go with a no-fee travel card, you'll earn rewards at a lower rate, your sign-up bonus will be smaller, and you won't get as many (if any) perks.

Rewards rate

Rewards can be thought of in terms of "earn rate" and "burn rate".

The earn rate is how many points or miles you receive per dollar spent. Some general travel cards offer flat-rate rewards, meaning you get the same rate on all purchases, all the time — 2 miles per dollar, for example, or 1.5 points per dollar. Others, including most co-branded cards, offer a base rate of maybe 1 point per dollar and then pay a higher rate in certain categories, such as airline tickets, hotel stays, general travel expenses or restaurant meals.

The burn rate is the value you get for those points or miles when you redeem them. The industry average is about 1 cent per point or mile. Some cards, particularly hotel cards, have lower value per point on the "burn" side but give you more points per dollar on the earning side.

When comparing rewards rates, don't just look at the numbers. Look at the categories to which those numbers apply, and find a card that matches your spending patterns. Getting 5 points per dollar seems great — but if those 5X points come only on purchases at, say, office supply stores, and you don't spend money on office supplies, then you're getting lousy value.

Sign-up bonus

Travel cards tend to have the biggest sign-up bonuses — tens of thousands of points that you earn by hitting a certain amount of spending. But there's more to consider when comparing sign-up bonuses than just how many points or miles you earn. You must also take into account how much you have to spend to earn the bonus. While cash-back credit cards often require just $500 to $1,000 in spending over three months to unlock a bonus, travel cards commonly have thresholds of $3,000 to $5,000.

Never spend money you don't have just to earn a sign-up bonus. Carrying $3,000 in debt for a year in order to earn a $500 bonus doesn't make economic sense — the interest you'll pay could easily wipe out the value of the bonus.

Finally, keep in mind that the biggest bonuses will come on cards with annual fees.

Foreign transaction fees

A good travel card will not charge a foreign transaction fee. These fees are surcharges on purchases made outside the U.S. The industry standard is about 3%, which is enough to wipe out most if not all of the rewards you earn on a purchase. If you never leave the U.S., then this isn't much of a concern, but anyone who travels abroad should bring a no-foreign-transaction-fee card with them.

Some issuers don't charge foreign transaction fees on any of their cards. Others charge them on some cards but not all.

International acceptance

Not all travel credit cards are great companions for international travel. While Visa and Mastercard are good pretty much worldwide, you may encounter limited acceptance for American Express and, especially, Discover, depending on the destination. This doesn't mean world travelers should dismiss AmEx and Discover. Just know that if you take one of these cards with you overseas, you'd be smart to bring along a backup in case you run into acceptance problems. (Having a backup card is good advice within the U.S., too, really.)

Travel protections

Consider which travel protections — car rental insurance , trip cancellation coverage , lost baggage protection — are important to you.

"Rewards" are what you get for using a credit card — the points earned with each transaction and the bonuses you unlock with your spending. "Perks" are goodies that you get just for carrying the card. There's a very close correlation between the annual fee on a card and the perks you get for carrying it. Cards with no annual fee are all about rewards and go very light on perks. Premium cards with annual fees of $450 or more are laden with perks (although sometimes their rewards aren't too special). Midtier cards (in the $100 range) tend to have solid rewards and a handful of high-value perks.

Assuming you take advantage of them, the perks often make up for the annual fee on a card quite easily. This is especially true with co-branded cards. Free checked bags can pay for an airline card several times over, and a free night is usually worth more than the fee on a hotel card. When comparing the perks of various cards, be realistic about which ones you will and won't use. Sure, that card may entitle you to a free spa package the next time you're at a five-star hotel, but how often do you stay at five-star hotels?

SHOULD YOU GET A TRAVEL CARD? PROS AND CONS

Pros: why it's worth getting a travel card.

The sign-up bonus gives you a big head-start on travel. Bonuses on the best travel credit cards typically run $500 or more — enough for a roundtrip ticket in many instances.

Perks make travel less expensive and more relaxing. You won't have to worry about cramming a week's worth of clothes into a carry-on if your travel credit card gives you a free checked bag (or automatically reimburses you for the bag fee). Hate the crush of travelers in the terminal? Escape to the airport lounge. Renting a car? Use a travel card that provides primary rental car insurance.

Rewards get you closer to your next trip with every purchase. Spending money on the mundane activities of daily life has a silver lining when you know that every $1,000 you spend will knock $10 or $20 off the cost of that future beach vacation or trip home to see Mom and Dad.

No foreign transaction fee can mean big savings. Take just any old credit card with you on vacation outside the U.S., and $1,000 worth of purchases can cost you $30 off the top due to the foreign transaction surcharge. Good travel cards don't charge this fee.

"Double dipping" gives you more points on travel purchases. Buy a plane ticket or book a hotel room, and you'll earn loyalty points or miles regardless of how you pay. Use the right credit card, though, and you'll earn even more points and miles on top of those.

Strategic redemption can multiply your value. With cash-back credit cards, 1 cent is worth 1 cent, and that's just how it goes. The points and miles on many travel credit cards have variable value based on how you redeem them — booking travel with them vs. transferring them to a partner, booking domestic vs. international flights and economy vs. business class, staying at budget hotels vs. high-end resorts, and so on.

Cons: Why a travel card might not be for you

The best cards charge annual fees. In many cases, the value you get from a credit card more than makes up for the annual fee. But some people are dead set against paying a fee under any circumstances. If that's you, your options in travel cards will be sharply limited, and you won't get the perks that provide a big portion of the value on many cards.

Sign-up bonus spending requirements can be steep. A bonus worth $500, $600 or $700 is attractive, but only if you can afford to earn it with spending you were going to do anyway. If you have to amass thousands of dollars in debt and then pay interest on it, it's not worth it.

Travel cards aren't ideal for infrequent travelers. In the first year with a travel card, you're probably going to come out ahead: You can earn a big sign-up bonus, and several popular cards waive the first year's annual fee, too. In subsequent years, though, you'll break even on that fee only if you use the card enough to make up for it (with the rewards you earn and redeem and the perks you use). Infrequent travelers are more likely to get more total rewards from a cash-back card with no annual fee.

Cash back is simpler and more flexible. Some travel cards allow you to redeem your rewards only for travel. Others give you poor value unless you redeem for travel. Still others have complicated redemption options, making it hard to get the most out of your rewards. With cash-back credit cards, you can use your rewards on anything, you know exactly how much your rewards are worth, and redemption is usually simple.

Rewards cards tend to charge higher interest rates. If you regularly carry a balance from month to month, a travel credit card — or any rewards credit card — probably isn't your best choice. The interest you pay is eating up the value of your rewards. You're better off with a low-interest card that reduces the cost of carrying debt.

MAKING THE MOST OF YOUR TRAVEL CARD

Maximize your rewards with the following tips:

Plan your credit card application around a big purchase to earn the sign-up bonus.

Seize every opportunity to pick up the tab, especially if your travel credit card pays bonus rewards on dining; your friends can pay you back while you collect rewards.

Redeem rewards for travel instead of gift cards, merchandise or (in most cases) cash back to get the best value.

Join the loyalty program associated with a co-branded card — a frequent-flyer or frequent-guest program.

Shop for essentials in your card’s online bonus mall or through its exclusive offers, if available, to get extra rewards.

OTHER CARDS TO CONSIDER

It’s worth considering whether a travel credit card is even right for you in the first place. A NerdWallet study found that cash-back credit cards often earn more money — even for many travelers.

If you carry a balance from month to month, the higher interest rates typically charged by rewards cards can cancel out any rewards earned. If you have a good credit score, you're better off with a low-interest credit card that can save you money on interest.

A good travel credit card shouldn't charge foreign transaction fees, but there are good non-travel cards that also don't charge them. See our best cards with no foreign transaction fee .

If you value transparency and flexibility in your rewards, you can't go wrong with a cash-back card — and you can still use the rewards for travel, if you want.

Finally, if you're still not sure what's right for you, take a look at our best rewards credit cards for options beyond travel and cash back.

NerdWallet's Sam Kemmis contributed to this article.

To view rates and fees of the American Express® Gold Card , see this page . To view rates and fees of The Platinum Card® from American Express , see this page .

Last updated on August 23 , 2024

Methodology

NerdWallet's Credit Cards team selects the best travel rewards credit cards based on overall consumer value, as evidenced by star ratings, as well as their suitability for specific kinds of travelers. Factors in our evaluation include each card's annual fee, foreign transaction fees, rewards earnings rates, ease of use, redemption options, domestic and international acceptance, promotional APR period, bonus offers, and cardholder perks such as automatic statement credits and airport lounge access. Learn how NerdWallet rates credit cards.

Frequently asked questions

Travel credit cards earn points (sometimes called miles) each time you buy something. The standard earning rate is 1 to 2 points per dollar spent, and many cards give you extra points for certain purchases, particularly travel expenses. The value of a point depends on the card that earned it and how you redeem it, but a good rule of thumb is to assume each point is worth an average of about 1 cent.

Your points accumulate in a rewards account, where you can use them to pay for travel. Most cards let you book travel directly using a portal similar to those at online travel agencies or on airline and hotel websites, but instead of paying cash, you pay with your points. Depending on the card, you may also have the option of booking travel any way you want, paying for it with the card and then cashing in your points for a credit against those expenses.

Points and miles are just different names for the same thing: the currency used in a travel rewards program. Some travel credit cards call them points, some call them miles.

Airline frequent flyer programs have long used the term “miles” to refer to the rewards you earn for flying. That’s because at one time, you really did earn rewards according to how many miles you flew — the longer the flight, the more miles you earned. Nowadays, most domestic airlines give out “miles” based on how much you spend, not how far you fly, so they’re really just points. (There are a few exceptions, though, notably Alaska Airlines.)

Especially when it comes to redeeming your rewards, there’s no difference between points and miles. The number of points or miles you need is based mostly on the cost of what you’re redeeming them for. It takes more than 500 miles (value about: $5) to get a free 500-mile flight!

The value of a point or mile depends on the card you earned it with and how you redeem it. A common rule of thumb is to assume that each point or mile is worth an average of 1 cent, although you can certainly get a much higher (or lower) redemption value. See our travel loyalty roundup page for NerdWallet’s current valuations for airline miles and hotel points.

Travel credit cards fall into two main categories: co-branded and general-purpose.

• Co-branded travel cards carry the name of an airline or hotel chain. The rewards you earn on the card can typically be redeemed only with that brand (or maybe its partners). Co-branded cards limit your flexibility, but because they are issued in partnership with an airline or hotel, they can give you special perks, like free checked bags or room upgrades.

• General-purpose travel cards are issued by a credit card company and are not directly tied to any particular airline or hotel. They earn points in the issuer's own program, such as American Express Membership Rewards, Chase Ultimate Rewards® or Citi ThankYou. These points are a lot more flexible, as you can use them to pay for a range of travel expenses, including flights on any airline or stays at any hotel. However, they don’t offer the airline- or hotel-specific perks of co-branded cards.

Travel cards — like rewards cards in general — typically require good to excellent credit for approval. Good credit is generally defined as a credit score of 690 or better. However, credit scores alone do not guarantee approval. Every issuer has its own criteria for evaluating applications.

Business travel can earn credit card rewards just like leisure travel. Credit cards that earn rewards for travel purchases don't distinguish between one or the other — meaning, if a card pays 3X points on airfare, for example, it's going to pay it no matter why you're buying the ticket. There are also travel credit cards specifically designed for business operators, with benefits and perks better aligned with their needs.

Where things get complicated is when you're not arranging the travel yourself. With credit card points, the rewards go to the cardholder. So if you arrange travel through your employer and the cost goes on the "company card," then the company card gets the points. Put it on your own card and get reimbursed later, and you get the points. (And if you have a company card with your name on it? That may come down to company policy.)

When redeeming travel rewards, you want to get as much value as possible. If you can get more value by using your rewards than by using cash, then it's smart to do so. (And of course, the reverse also applies.) NerdWallet has calculated the baseline values of most major credit card points, airline miles and hotel points. When you get a value that exceeds these baselines, go ahead and use your rewards. If not, consider using cash.

For example, say you could book a trip by paying $400 cash for a ticket or by redeeming 50,000 points or miles. In that case, your points would be getting you a value of 0.8 cents apiece (50,000 x 0.8 cents = $400). If the baseline value of each point is 1 cent, then you're better off paying cash and saving the points for when you can redeem them for 1 cent or better.

That said, you don't want to be overthinking it and hoarding points indefinitely in search of the deal to end all deals. Like any other currency, travel rewards lose value over time. That flight that costs 50,000 points today might cost 55,000 next year. Do you have enough points to get you where you want to go, when you want to go, in the way you want to get there? If so, don't let fractions of a penny stop you from booking your trip. It's your money, and you get to decide how to spend it.

A number of travel credit cards come with "travel credits," which reimburse you for specific expenses. The Chase Sapphire Reserve® , for example, has a $300 annual travel credit; several cards offer credits toward things like airline fees or hotel bookings; and a bunch of cards have a credit for the application fee for TSA PreCheck or Global Entry .

The less restrictive a credit is, the easier it is to redeem. The easiest travel credit to redeem is one that:

Applies to a broad range of expenses. Some credits are very fickle. You may get $200 a year in "airline credit," but it applies only to incidental fees (not airfare) on a single airline that you have to choose ahead of time. A card may offer hundreds of dollars in credit toward travel, but you have to go through the issuer's booking portal, where rates may be more expensive and options more limited. Other credits, however, are broad and open-ended: $300 on any travel expense, $100 toward any airline booking, and so on.

Shows up automatically on your statement. Your issuer's system should be able to recognize qualifying expenses and then apply the credit to them without you having to do anything. If the only way to receive the credit is by calling a phone number or submitting receipts or other documentation, that makes it harder to redeem, which in turn makes it less likely that you'll redeem (and that may be the point).

About the author

Sara Rathner

- Reward types, points & expiry

- What card do I use for…

- Current Credit Card Sign Up Bonuses

- Credit Card Lounge Benefits

- Credit Card Airport Limo Benefits

- Credit Card Reviews

- Points Transfer Partners

- Singapore Airlines First & Business Class Seat Guide

- Singapore Airlines Book The Cook Wiki

- Singapore Airlines Wi-Fi guide

- The Milelion’s KrisFlyer Guide

- What is the value of a mile?

- Best Rate Guarantees (BRGs) for beginners

- Singapore Staycation Guide

- Trip Report Index

- Credit Cards

- For Great Justice

- General Travel

- Other Loyalty Programs

- Trip Reports

Review: Citi PremierMiles Card

The Citi PremierMiles Card's transfer partner variety, lounge access and travel insurance make it a solid option, though it's lost its Citi PayAll trump card.

Here’s The MileLion’s review of the Citi PremierMiles Card , launched all the way back in July 2007 and still going strong.

Initially positioned as a premium product with a minimum income requirement of S$80,000 (cardholders were even invited to join Citigold for a year, with a reduced AUM requirement!), this eventually gravitated towards the mass market, and today is available to anyone who meets the MAS-mandated minimum of S$30,000 per annum.

But unless you’re a snob, more accessible doesn’t mean less desirable. With a solid welcome offer, a wide variety of transfer partner and lounge access, the Citi PremierMiles Card can be a very compelling tool in your miles kit regardless of SES.

However, with the nerfing of Citi PayAll, I wouldn’t consider this card to be anywhere as essential as this time last year.

Overview: Citi PremierMiles Card

Let’s start this review by looking at the key features of the Citi PremierMiles Card.

The Citi PremierMiles Card was originally issued on the AMEX, Mastercard and Visa networks. However, the AMEX version was discontinued in 2019, and since April 2020 all new cards have been issued on the Mastercard network only.

Existing Citi PremierMiles Visa Cards remain valid, and will continue to be replaced/renewed unless you expressly consent to switch to the Mastercard version.

In any case, there’s very little difference between the Mastercard and Visa. We’ll be referring to the Mastercard version in this review, but everything said here applies to the Visa as well unless explicitly stated.

How much must I earn to qualify for a Citi PremierMiles Card?

The Citi PremierMiles Card has a minimum income requirement of S$30,000, the MAS-mandated minimum.

If you don’t meet the income requirement, it may be possible to place a S$10,000 fixed deposit with Citibank and get a secured version of the card, with a credit limit of roughly 80-90% of the fixed deposit amount. Visit a Citibank branch if you’d like to explore this option.

How much is the Citi PremierMiles Card’s annual fee?

The Citi PremierMiles Card has an annual fee of S$196.20 for the principal cardholder, and no fee for supplementary cards.

Cardholders can request a waiver of the first year’s annual fee, although this means they will only be eligible for a smaller sign-up bonus (see next section). Assuming you meet the definition of a new-to-bank customer, I’d strongly recommend paying the first year’s annual fee to enjoy the bigger sign-up bonus.

Annual fee waivers are at the discretion of Citi, and in my personal experience are fairly easy to obtain.

Should a waiver not be granted, paying the annual fee gets you 10,000 miles in return, which means buying miles at ~ 1.96 cents each. That’s certainly not the lowest price you can buy miles for, though it could still be worth it for some depending on how much you value a mile.

Sign-up bonus

New-to-bank.

From now till 31 July 2024, new-to-bank Citi PremierMiles Cardholders can choose between two sign-up offers:

- 8,000 bonus miles with a minimum spend of S$800, with a first year fee waiver

- 30,000 bonus miles with a minimum spend of S$800, with payment of the S$196.20 annual fee

The S$800 must be spent within the first 2 months after approval, otherwise known as the qualifying period. The qualifying period runs from the approval date and two full calendar months following that. For example, those approved on 15 August 2023 will have until 31 October 2023 to meet the minimum spend.

In other words, you actually have 2-3 months to hit the minimum spend, and should apply as early in the month as possible to maximise your time.

For the full details, refer to the following post.

Extended: Citi PremierMiles 30,000 miles sign-up bonus

If you already hold any principal Citi credit card, or cancelled one in the past 12 months, there is no sign-up bonus available to you. You will automatically be granted a first year fee waiver.

How many miles do I earn?

Sgd/fcy spending.

Citi PremierMiles Card members earn:

- 1.2 Citi Miles for every S$1 spent in Singapore Dollars (SGD)

- 2 Citi Miles for every S$1 spent in foreign currency (FCY)

1 Citi Mile is worth 1 airline mile, so that’s an equivalent earn rate of 1.2 mpd for local spending, and 2.0 mpd for FCY spending.

These were once respectable rates for its segment, but in recent times, the HSBC TravelOne Card, DBS Altitude Card and OCBC 90°N Card have leapfrogged the PremierMiles.

All FCY transactions are subject to a 3.25% fee, which is par the course for the market.

With a 3.25% fee, using your Citi PremierMiles Card overseas represents buying miles at 1.63 cents each.

Bonus miles on Kaligo & Agoda

Citi PremierMiles Cardholders who make hotel bookings through Kaligo by 31 December 2024 will earn an uncapped 10 mpd. The booking can be made for any future stay date.