Should you get travel insurance if you have credit card protection?

Editor's Note

Some credit cards offer built-in travel insurance as a cardholder benefit. And it may be tempting to rely on credit card travel protections instead of buying travel insurance. But, the entire point of travel insurance is to be covered if something goes wrong. So, you may be wondering whether you should buy travel insurance even if your credit card offers travel protection.

There isn't one answer that fits every traveler or situation. So in this guide, we'll explore some aspects you should consider, and I'll discuss my take on this topic. Let's dive in so you can make an informed decision for yourself.

Travel insurance you can buy

At a high level, you can pay a relatively small premium (compared to the total cost of your trip) to buy a travel insurance policy that may provide reimbursement or coverage for unexpected issues that affect your trip.

Many different types of protections fall under the term "travel insurance." Standard, comprehensive insurance policies typically include broad coverage across various potential issues.

But there are also policies that offer specific coverage. For example, it's possible to purchase travel insurance that only provides medical protection for international travel (such as GeoBlue ). Likewise, you can also purchase policies that allow you to select the protections you need (such as the build-your-own option with American Express Travel Insurance ).

We've previously compared the best travel insurance policies and providers . So, check out that guide to find the provider and policy that fits your needs best. You can also check a travel insurance aggregator to compare different policies quickly.

Most travel insurance policies exclude any loss incurred due to a preexisting medical condition. However, many policies include a process to obtain a waiver of the preexisting condition exclusion if you meet specific requirements. These requirements typically include purchasing the policy shortly after the first nonrefundable trip payment or deposit and being medically able to travel when you buy the policy. Some companies also require you to insure your trip's full, prepaid, nonrefundable cost to be eligible.

Likewise, all travel insurance policies have several exclusions. For example, most plans exclude medical benefits for injuries during adventure activities such as skydiving or skiing outside maintained trails.

Related: 7 things to look out for when buying travel insurance, according to an expert

Credit card travel protections

Some cards don't provide any special travel protections. But, many of the best travel rewards cards offer travel protections. Here's a look at our guides about some of the most common credit card travel protections:

- Trip delay reimbursement

- Baggage delay reimbursement

- Trip cancellation and interruption insurance

- Travel accident and emergency evacuation insurance

Check out our guide to the best cards that offer travel protections for more details on what card might be best for you. I also recommend reading the guide to benefits for your specific cards, as these documents will detail exactly what protections you can expect when you purchase travel with your card.

Note that some benefits require you to enroll — and virtually all require a formal claim process, with no reimbursement guarantee.

Related: Getting credit card travel insurance to cover the change fee on my Disney cruise

When to purchase travel insurance

Even if you have a credit card that offers travel protection, you may still want to purchase travel insurance for some trips. Here are some scenarios and trips for which it may make sense to purchase travel insurance.

Travel protections aren't offered

As discussed above, not all travel credit cards provide extensive travel protections when you book travel using the card. So, if you're using a card without travel protections or a card that only offers limited travel protections, you may want to purchase travel insurance .

Related: The best credit cards for booking flights

Some travelers aren't covered

Just because a card offers travel protections doesn't mean everyone traveling with you will be covered. In particular, travel protections usually only extend to select relatives of the cardholder. Your credit card's travel insurance may not cover friends, employees and all relatives.

Related: Who is covered by your credit card travel insurance?

Adventure activities

If you plan to partake in an activity that most insurance policies exclude, you may want to purchase a travel insurance policy that explicitly includes your activity of choice.

For example, many policies exclude adventure sports like base jumping, sky diving, free soloing, diving, mountaineering and paragliding. You may want to consider purchasing insurance from an association involved in your adventure activity, such as Divers Alert Network (DAN) if you're a diver or German Alpine Group (DAV) if you partake in alpine sports.

You're concerned about preexisting conditions

Most credit card trip interruption and cancellation insurance benefits exclude cancellations or interruptions caused by a sudden recurrence of a preexisting condition. So, you'll want to purchase travel insurance — and ensure you satisfy the provider's preexisting condition exclusion waiver conditions — if you want trip cancellation and interruption insurance that covers preexisting conditions.

Related: 7 times your credit card's travel insurance might not cover you

Nonmedical evacuation insurance

If you want evacuation insurance for nonmedical reasons, you should purchase travel insurance that offers this coverage even if you have a credit card with evacuation insurance .

Read the benefits guide closely, as evacuation benefits may not cover every evacuation you might need. For example, some policies don't cover evacuation from an area with a travel warning when you booked your trip or evacuation from a place suddenly inaccessible due to a landslide or other environmental incident.

Related: A Medjet medical transport membership is different from travel insurance

Cancel for any reason

Suppose you are uncertain whether you'll be able to take your trip, and you're worried that applicable credit card trip protections won't reimburse you if you decide to cancel or interrupt for a reason that isn't covered. In that case, you may want to purchase cancel for any reason trip insurance .

Related: 6 truths and myths about cancel for any reason travel insurance

You want peace of mind

Some travelers prefer to buy travel insurance — for each trip or via an annual travel insurance plan — for the peace of mind that having a travel insurance policy brings. Especially given the issues travelers have faced with a specific credit card insurance provider , it may be worth buying a travel insurance plan if you don't feel confident your credit card travel insurance and individual health insurance will combine to provide enough coverage during your trip.

Related: Here's why I buy an annual travel insurance policy, even though my credit cards offer travel protections

When credit card travel protections may be enough

Suppose you don't fall into any of the categories above and use one of the best credit cards with travel insurance when making travel purchases. In that case, you may determine that credit card protections are enough for some (or all) of your trips. However, I only recommend relying on credit card protections if you also have health insurance that will provide adequate coverage at your destination.

Below is a collection of reasons you can rely on credit card protections instead of purchasing independent travel insurance. If some (or most) of these reasons apply to your trip, it may be reasonable for you to rely on credit card protections instead of buying travel insurance:

- You have personal health insurance that will cover you on your trip, even if treatment is out of network at your destination

- You book your trip with a credit card that provides travel insurance

- You have a credit card that provides medical evacuation benefits during your trip

- You make refundable travel plans that you can cancel for little or no fee

- You tend to change your plans frequently or book travel at the last minute

- You have an emergency fund that can cover unexpected expenses if needed

- You have airline miles or transferable points you can use to leave the area or return home if needed.

- You avoid especially high-risk activities and destinations

The decision of whether to buy travel insurance is complex and personal. If you don't feel confident that your credit card protections and individual health insurance will provide adequate coverage, it's likely worth buying travel insurance.

Related: Why you might want to get a premium credit card instead of purchasing travel insurance

Why credit card travel insurance is usually enough for me

After researching the best travel insurance policies and providers , I purchased travel insurance for one specific trip because I wanted political evacuation coverage.

But for most of my trips, credit card protections and individual health insurance provide enough coverage for me. After all, my travel usually looks like the following:

- My flights are often award flights that I can cancel and redeposit free of charge — or ones that carry minimal change and cancellation fees

- My lodging can almost always be canceled without a penalty until shortly before my stay

- If I book a tour or activity, it's usually within a few days of said tour or activity (or offers free cancellation)

- My health insurance provides out-of-network coverage outside the U.S., so travel insurance would only pay for my deductible. In addition, my out-of-pocket maximum for out-of-network care is low enough to cover using my emergency fund

- I book flights and pay for the taxes and fees for award flights using the Ink Business Preferred® Credit Card , which provides excellent travel protections for a $95 annual fee card

- I have ample airline miles and transferable points that I can use to cover last-minute one-way flights if needed

As you can see, the benefits of purchasing travel insurance would be minimal for most of my trips. The travel protections I use most are trip delay protection and baggage delay protection , both of which the Ink Business Preferred Credit Card provides when I use it to pay for my flights.

Related: Why the Chase Sapphire Reserve and Ink Business Preferred combo is perfect for couples who travel

Bottom line

As you book trips, you may wonder whether you should purchase travel insurance. One way to decide is to consider whether you'd be adequately covered without purchasing travel insurance if the worst happens.

If you're willing and able to cover the costs in this situation — or you feel confident you'd be adequately covered by your credit card's travel protections and health insurance — then you may want to proceed without buying travel insurance. Otherwise, I recommend purchasing a travel insurance policy shortly after you make the initial payment for your trip.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

AAA Travel Insurance Review 2024: Is it Worth the Cost?

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

What does AAA travel insurance cover?

Aaa single-trip plans, aaa annual plans, which aaa travel insurance plan is best for me, can you buy aaa travel insurance online, what isn’t covered by aaa travel insurance, other aaa products, aaa travel insurance recapped.

- You don't need to be an AAA member.

- Annual or single-trip policies are available.

- Can add on a Rental Car Damage protector plan.

- Cheapest option doesn't include medical coverage.

- CFAR upgrade is only available for higher-cost plans.

Before going on a trip, it's important to give travel insurance some serious thought as it can protect you if anything goes wrong on your vacation. One provider to consider is AAA Travel Insurance.

The company’s policies are administered by Allianz Global Assistance, an insurer that serves 40 million customers in the U.S. and operates in 35 countries. You do not have to be a AAA member to purchase AAA travel insurance.

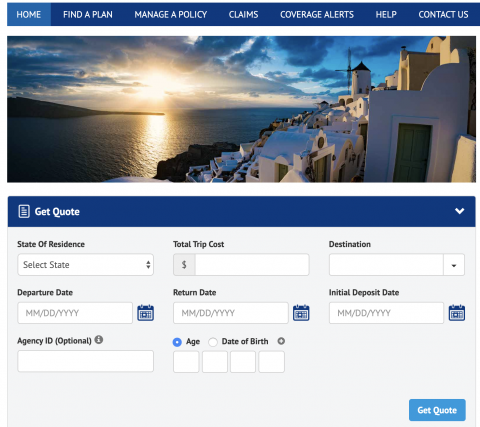

AAA offers annual or single-trip policies for domestic and international travel. The policies vary by state and travel destination, so the plans available in your home area may differ from the examples shown below. Use AAA's Get A Quote tool to see your specific pricing.

» Learn more: The majority of Americans plan to travel in 2022

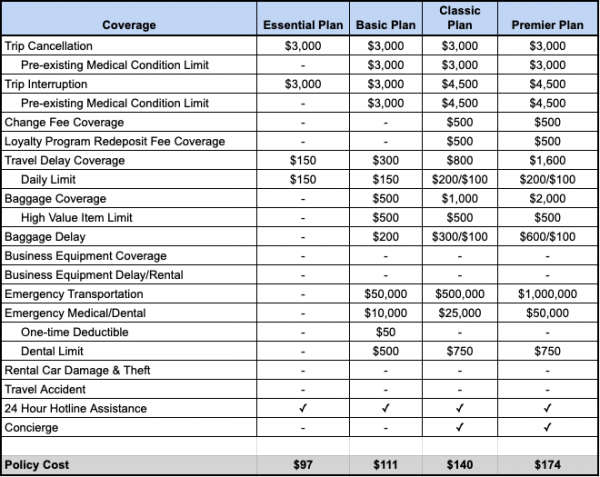

AAA’s single-trip plans are designed for travelers who are leaving their homes, visiting another destination, domestic or international, and returning. To get an idea of which plans are available, we input a sample itinerary of a $3,000, two-week trip to Spain by a 45-year-old from Indiana. For this itinerary, AAA offered four single-trip plans.

* Higher limit requires receipts to be submitted.

AAA single-trip plans cost

The Essential Plan ($97) is ideal for those who just want the basics of trip cancellation and trip interruption insurance and don't need the other protections. This is a good fit for domestic travelers who already have health coverage in the U.S. and don't plan on bringing business equipment.

The Basic Plan ($111) includes all the features of the Essential Plan, along with medical coverage and some increased protections for baggage and travel delays.

The Classic ($140) and Premier Plans ($174) are nearly identical, but the latter provides double emergency medical coverage, emergency transportation, trip delay and baggage delay limits.

The Classic Plan offers a "cancel for any reason" optional upgrade for $71, which would bring the total to $211.

There is also a Rental Car Damage protector plan for $135, which provides $1,000 of trip interruption and baggage loss coverage and $40,000 of rental car damage and theft benefits. This plan will cover your costs if the rental car is stolen or damaged. In addition, you’ll be reimbursed for the unused portion of your trip and if your bags are lost or damaged. This plan offers an alternative to purchasing coverage at the rental counter.

» Learn More: Cancel For Any Reason (CFAR) travel insurance explained

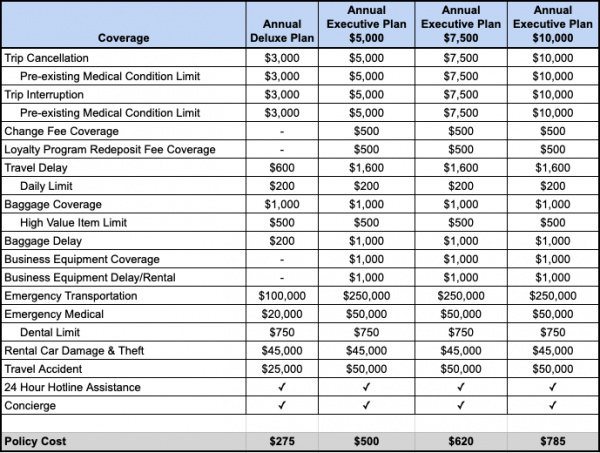

The annual policies provide 365 days of domestic and international coverage and are best suited for those who travel often. To see which plans are available, we input a $15,000 annual travel budget for coverage starting in July 2020 for a 30-year-old from New Hampshire. For this itinerary, AAA is offering four policies, with the three higher-end plans geared toward business travelers.

AAA annual plans cost

The Annual Deluxe Plan ($275) is designed for those who aren’t too concerned with pre-trip cancellation benefits or business equipment protections and are more interested in medical coverage while abroad. If you already have some travel insurance through a credit card, this plan may be sufficient.

The next three Annual Executive Plans ($500-$785) are tiered based on the amount of trip cancellation and interruption coverage provided ($5,000, $7,500 or $10,000). All the other protections under the Executive Plans are identical. All three plans include business equipment coverage as well as business equipment rental and delay protections. If you’re traveling for work, these plans may be your best bet.

Although all four of these are annual plans, no individual trip can exceed 45 days. For trips longer than 45 days, Allianz offers an AllTrips Premier plan , which provides coverage for up to 90 days per trip.

» Learn more: What to know before buying travel insurance

Choosing the right plan for your trip involves understanding what type of coverage you will want while you’re traveling.

If you have a premium travel card that already provides you with a sufficient level of trip cancellation coverage, you may only need to get a standalone emergency medical policy. For example, The Business Platinum Card® from American Express offers $10,000 per trip and $20,000 per year in trip cancellation benefits. Terms apply. Only the Annual Executive Plan ($10,000) has a comparable level of trip cancellation coverage.

If the coverage provided by your card isn’t adequate, you don’t have credit card coverage or you didn’t pay for your trip with that credit card, then you might be better off with a comprehensive plan like one of the single or annual trip plans, depending on your travel goals.

If you’re a long-term traveler and expect to take many trips, the annual plans will be the most suitable. However, with coverage for each trip capped at 45 days, you’ll want to look at other options if you will be away from home for longer.

Yes, you can buy AAA Travel Insurance onlince. Head over to Agentmaxonline.com , input your trip details and choose “Get Quote” to see a list of available plans.

Trip insurance plans have a lot of exclusions that you need to pay attention to so you know exactly what type of coverage you’re getting. Here are some general exclusions you can expect:

High-risk activities: Skydiving, bungee jumping, heli-skiing and other types of high-risk sporting activities that the insurer deems unsafe.

Intentional acts: Losses sustained from intoxication, drug use, self-harm and criminal activity.

Specifically designated events: Epidemics, natural disasters and war are specifically mentioned in the policy as exclusions.

It's important to note that exclusions may vary based on the policy and where you live, so it's always best to review the fine print to ensure you’re clear about what is and isn’t covered.

» Learn more: Will travel insurance cover winter weather woes?

In addition to travel insurance, AAA offers a wide range of coverage and insurance products, including:

AAA auto insurance .

AAA homeowners insurance .

AAA life insurance .

AAA renters insurance .

Boat insurance.

Flood insurance.

Motorcycle insurance.

RV insurance.

Yes. However, plan choices depend on your state of residence and trip duration. We performed various searches for sample trips and found policies for single trips and annual trips. Single-trip plans are great for travelers who are traveling from their home to a different destination (domestic or international) and then returning. Coverage ends when the traveler returns home. Annual trip plans are designed for those who want to take several trips during a specific period of time, regardless of how many times they return home during the covered period.

The cost of a travel insurance policy depends on many factors , including the trip length, your state of residence and how much coverage you’d like. Our sample search for a $3,000 two-week trip to Spain showed policies ranging from $97 to $211, representing 3% to 7% of the total trip cost.

Yes, AAA’s travel insurance policies offer coverage for international travel. To check the type of plans available for your intended destination, visit AAA’s travel insurance site and enter your trip details.

Travel insurance offers a safety net so that if something goes wrong while you’re on vacation, you’re not alone. Whether it's a cancelled flight, lost luggage or emergency medical care, travel insurance coverage will come in handy. Although it's never fun to think about unexpected emergencies that can derail your trip, consider how much risk you’re willing to take before deciding to not purchase a policy. That will help you decide if travel insurance is worth it .

The cost of a travel insurance policy

depends on many factors

, including the trip length, your state of residence and how much coverage you’d like. Our sample search for a $3,000 two-week trip to Spain showed policies ranging from $97 to $211, representing 3% to 7% of the total trip cost.

Yes, AAA’s travel insurance policies offer coverage for international travel. To check the type of plans available for your intended destination, visit

AAA’s travel insurance site

and enter your trip details.

Travel insurance offers a safety net so that if something goes wrong while you’re on vacation, you’re not alone. Whether it's a cancelled flight, lost luggage or emergency medical care, travel insurance coverage will come in handy. Although it's never fun to think about unexpected emergencies that can derail your trip, consider how much risk you’re willing to take before deciding to not purchase a policy. That will help you decide if

travel insurance is worth it

AAA was found to be one of the best travel insurance companies according to NerdWallet's most recent analysis.

Before shopping for a policy, check to see what coverage you may already have. Some premium credit cards provide travel insurance. If you hold one of these credit cards and the coverage limits are adequate, you may only need a standalone emergency medical insurance policy . However, if your credit card doesn’t cover you sufficiently, a comprehensive travel insurance plan might be the right choice. AAA offers a few plans to pick from, but the choices boil down to annual or single-trip insurance plans.

No matter what type of traveler you are, AAA offers various trip insurance options to choose from. Rates and options vary by state, so be sure to input your information into the online tool.

Insurance Benefit: Trip Cancellation and Interruption Insurance

The maximum benefit amount for Trip Cancellation and Interruption Insurance is $10,000 per Covered Trip and $20,000 per Eligible Card per 12 consecutive month period.

Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply.

Please visit americanexpress.com/benefitsguide for more details.

Underwritten by New Hampshire Insurance Company, an AIG Company.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Wells Fargo Autograph℠ Card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

Enable JavaScript

Please enable JavaScript to fully experience this site. How to enable JavaScript

- Contact American

Trip insurance

How to contact our trip insurance providers.

Have questions about purchasing trip insurance or filing a claim? Trip insurance is available to residents of the U.S., Canada and Mexico and insurance providers vary by country. Choose your country of residence to contact the provider regarding benefits, coverage and other services.

Request delay / cancellation verification for trip insurance

Trip insurance is provided by Allianz Global Assistance

Contact by mail or phone

Allianz Global Assistance 9950 Mayland Drive Richmond, VA 23233 800-628-5404 (Toll-free) 804-281-5700 (Collect)

From the U.S. 800-628-5404 Collect 804-281-5700

Contact by email

Visit the Allianz Global Assistance website for more information

- Purchase trip insurance Opens another site in a new window that may not meet accessibility guidelines

- Manage an existing plan Opens another site in a new window that may not meet accessibility guidelines

- File a claim Opens another site in a new window that may not meet accessibility guidelines

- Check claim status Opens another site in a new window that may not meet accessibility guidelines

Travel insurance provided by Allianz Global Assistance

Allianz Global Assistance 700 Jamieson Parkway Cambridge, ON N3C 4N6 Canada

From Canada or U.S. 866-520-8831 Collect 519-742-9013

Daily: 24 hours

Contact by email or file a claim

Send an email

Trip insurance provided by Allianz Travel Mexico

Allianz Travel Av. Insurgentes Sur 1602 - 302 Col. Crédito Constructor CP 03940 CDMX, México

From Mexico 01-800-999-9922 From the U.S. 866-328-4280 Collect (52) 55 53 77 3860

- Rankings Best Car Insurance AL AK AZ AR CA CO CT DE FL GA HI ID IL IN IA KS KY LA ME MD MA MI MN MS MO MT NE NV NH NJ NM NY NC ND OH OK OR PA RI SC SD TN TX UT VT VA WA WV WI WY Best Homeowners Insurance AL AK AZ AR CA CO CT DE FL GA HI ID IL IN IA KS KY LA ME MD MA MI MN MS MO MT NE NV NH NJ NM NY NC ND OH OK OR PA RI SC SD TN TX UT VT VA WA WV WI WY Best Renters Insurance AL AK AZ AR CA CO CT DE FL GA HI ID IL IN IA KS KY LA ME MD MA MI MN MS MO MT NE NV NH NJ NM NY NC ND OH OK OR PA RI SC SD TN TX UT VT VA WA WV WI WY Best SR-22 Car Insurance Best Motorcycle Insurance Best Life Insurance Best Online Insurance Marketplaces

- State Farm Reviews

- Progressive Insurance Reviews

- Allstate Reviews

- USAA Insurance Reviews

- Liberty Mutual Reviews

- Farmers Insurance Reviews

- Nationwide Insurance Reviews

- American Family Insurance Reviews

- Travelers Insurance Reviews

- Lemonade Insurance Reviews

- The Hartford Reviews

- Auto-Owners Insurance Reviews

- Assurant Reviews

- Erie Insurance Reviews

- Insurance Agent Ratings

- Car Insurance Guide

- Homeowners Insurance Guide

- Renters Insurance Guide

- Life Insurance Guide

- Motorcycle Insurance Guide

- Pet Insurance Guide

- Guide to Switching Insurance Companies

- Flood Insurance Guide

- Best Low-Mileage Car Insurance

- Best Car Insurance for Military Members

- Best Car Insurance Telematics Programs

- Best Life Insurance for Parents

- How to Get Cheap Car Insurance

- Progressive Snapshot Review

- State Farm Drive Safe and Save Review

- Allstate Drivewise Review

- Tips to Negotiate a Totaled Car Settlement

- Can I Register My Car in a Different State Than I Live in?

- Why Did My Car and Homeowners Insurance Rates Increase?

- Does Homeowners Insurance Cover a Flooded Basement?

- Write a Review

Save Money by Comparing Insurance Quotes

Almost there couple of quick questions, share this infographic, is american airlines’ travel insurance worth buying, it’s all about you. we want to help you make the right coverage choices..

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider. Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

- Allstate vs. GEICO

- Allstate vs. Liberty Mutual

- Geico vs. Progressive

- Progressive vs. State Farm

Despite the relaxation and excitement that a vacation can bring, traveling can be stressful. You have to get to the airport on time, deal with the crowds at security, and keep all of your belongings secure — all while preparing for the possibility of a trip interruption such as a canceled flight or trip delay.

Between the bustling environment of the airport and uncontrollable factors like weather, there are many places where you can run into obstacles along your journey.

That’s why providers like American Airlines provide the option to add travel insurance coverage to your purchase. And at first glance, travel insurance may seem like a sensible purchase to protect you from anything that goes wrong with your trip.

But do you need travel insurance? If so, is American Airlines’ travel insurance actually worth buying? The short answer is usually no. In fact, AA’s policy may specifically exclude the very event you’re concerned about. In this guide, we’ll cover the ins and out of travel insurance cover so that you can make an informed decision.

To ensure you're getting the best deal on travel insurance, compare multiple quptes. You can compare easily using our free search tool right now.

What Protection Does American Airlines’ Travel Insurance Cover?

Like other travel insurances, American Airlines’ travel insurance is sometimes advertised as if it is some necessity for every conscious consumer.

But before you click “purchase,” let’s look into what this policy really covers.

American Airlines’ travel insurance policy addresses a variety of scenarios that may alter your travel plans. These situations include:

- Circumstances impacting your travel – In the cases of illness, job loss, extreme weather, or other extenuating circumstances, travelers who purchase American Airlines travel insurance may receive financial coverage of changed plans or trip cancellation.

- Cancellations – If your flight is canceled, American Airlines travel insurance may reimburse some of your expenses.

- Lost luggage – A suitcase missing at baggage claim is a nightmare for any traveler. Travel insurance could potentially cover the cost of essential items you may need to purchase at your destination if your luggage is lost or delayed in transit.

- Injury or illness – If you sustain an injury or require medical attention during your trip, travel insurance can provide you with emergency medical and dental benefits in some cases.

- Damage to your rental car – Accidents can happen even when you’re on vacation, and it can be especially difficult to resolve legal and insurance matters when you get in an accident while driving a rented vehicle. American Airlines’ travel insurance could help you cover any damage to your rental car if your auto insurance policy only covers the vehicle you own. Keep in mind that, just as with regular auto insurance, exclusions apply.

- Theft – What happens if your rental car is stolen? American Airlines travel insurance can help you work through this stressful situation by providing theft coverage.

Airport employees are always doing their best to serve you, but long lines and complicated logistics can nonetheless make for a frustrating experience when problems arise.

American Airlines tries to encourage customers to purchase travel insurance by offering a streamlined customer service experience. In addition to these various areas of coverage, American Airlines also advertises the additional perk of “24/7 assistance hotline and concierge services” for customers who opt for travel insurance.

All of these offerings combine to depict a streamlined and protected travel experience.

But how accurate is this depiction, and is this travel protection worth the cost? Read on to dive deeper into the world of travel insurance writ large.

How Do I Know if a Travel Insurance Policy Is Worth It?

You’re not even legally allowed to drive without auto insurance, so does it follow that you should never be caught in the airport without travel insurance?

Not necessarily.

Sure, any number of scenarios could unfold and derail your travel plans. Insurance exists so you can stay protected in the event of these what-ifs—accidents, illnesses, and so on.

However, travel insurance policies aren’t always as beneficial to the customer as they may seem. Airlines take a large percentage of the profit from every insurance purchase, so it benefits them to market it to their customers as more essential than it is.

- With travel insurance, you may end up saving money in the case of flight cancellation or inclement weather.

- But consider your past travel history — most of the time, everything runs smoothly. You get where you’re going without spending money on insurance.

- Even if your journey does hit a roadblock or two, the policy may still not be your most economical option. When you dig deeper into the scenarios that travel insurance policies actually cover, you can expect to find many limitations and exclusions — so the coverage may not apply to your situation at all.

Exclusions, Explained

Are you worried about the possibility of extreme global circumstances throwing a wrench into your perfectly planned vacation?

While we live in an unpredictable world, it’s important to understand that travel insurance may specifically exclude the very situation you’ve been nervous about.

Exclusions in American Airlines’ travel insurance policy include:

- Natural disasters

- Pollution leading to grounded or delayed flights

- Nuclear and radioactive events

- Civil unrest

- Government bans on travel

While these circumstances may sound extreme, less extreme conditions such as standard rain or snow will usually not alter your travel plans to the point where travel insurance would prove beneficial.

Travel Insurance and Medical Care

Maybe you’re worried about your health delaying your plans or causing you trouble once you arrive at your destination.

American Airlines’ policy also names many exclusions on when they will provide health coverage, including:

- Pre-existing medical conditions

- Pregnancy, fertility treatments, and childbirth

- Mental health issues including self-harm

- Health issues accompanied by alcohol or drug use

- Issues stemming from training and competition in professional or amateur sports

Whether your condition is pre-existing or you start to feel sick after consuming a few too many airport martinis, there are many scenarios where your health needs will not be covered by travel insurance.

Additionally, even though many mental health disorders can lead to or cause physical ailments, travel insurance offers no coverage for them.

If you would like to account for potential health issues during travel, be sure to do your research to make sure your areas of concern are covered by the policy.

Travel Insurance in the COVID-19 Pandemic

We’ve already talked about one major exclusion — epidemics.

Of course, we’re continuing to live with the global results of a pandemic. The coronavirus outbreak has introduced a new level of precarity to the travel industry, with increased regulations and safety measures impacting flight schedules and airline ticket availability.

This uncertainty around travel may make travel insurance seem like a reasonable step to take. If your flight is canceled or rescheduled, you don’t want to be left in the dust.

However, American Airlines’ travel insurance does not offer protection against issues caused by the pandemic.

How do other policies stack up? Unfortunately, the Consumers Checkbook explains that “Most travel insurance policies specifically list epidemics and pandemics as general exclusions, which means if you buy one of these policies you aren't covered if you cancel or interrupt your trip due to an outbreak.”

You certainly want to handle travel with care and precision. However, travel insurance may not be the best way to do so.

Your best bet is to arrive at the airport early to give yourself ample time to sort out any issues. In addition, pay attention to safety protocols to protect your health and the health of your fellow travelers.

Broad Exclusions

American Airlines goes even further to shift the responsibility onto the individual and avoid covering losses.

They list the broad exclusion of “any loss, condition, or event that was known, foreseeable, intended, or expected when your certificate was purchased.”

Intent can be a hard thing to prove. Given the wording of these exclusions, it appears that American Airlines has broad discretion to avoid payouts on travel insurance.

A 2018 study on travel insurance by the office of Senator Edward Markey — aptly titled the Flyer Beware Report — reports, “The airlines and OTAs aggressively market these insurance policies as providing total trip protection, but travelers who purchase these insurance policies through airline or OTA websites may get much less coverage — and security — than they are led to believe.”

What Other Travel Insurance Options Do I Have?

Senator Markey’s study suggests that seeking out third-party travel insurance may be more advantageous than purchasing a policy directly from your air carrier.

Just because you want to stay protected while you travel doesn’t mean you need to buy the exact policy that is being pushed on you by your airline. Remember: you are in control of the insurance that you obtain. Despite what your airline tells you, there are other options out there.

How We Can Help You Stay Protected

The insurance market can be a tricky one to navigate. Different providers attempt to pull you in different directions and persuade you to buy their products. In many cases, they may be prioritizing their profits over your best interest.

Don’t fall victim to these business practices and end up with an expensive insurance policy you don’t need. We’re here to help you navigate the world of travel insurance — and all kinds of insurance! — bringing clarity to the chaos. We offer free comparative quotes , helping businesses and consumers make connections and find excellent matches for their needs and wants.

References:

- https://www.aa.com/i18n/plan-travel/extras/trip-insurance.jsp

- https://www.allianzworldwidepartners.com/api/certificates/disclosure?ProductID=001004474&State=CA

Related articles

- View all travel insurance articles

More insurance articles

- How do you choose the best insurance company

- 6 Tips we learned after filing an auto insurance claim

- A practical guide for understanding homeowners insurance

- Will your insurance policy cover your insurance claim?

- Should I buy rental car insurance?

- Survey: Do insurance reviews change buying behaviors?

- When is homeowners insurance not enough? Do I need umbrella insurance?

- A practical guide for understanding car insurance

- Top 5 things you should know about your renters insurance

About The Author: Alison Tobin

Feature Insurance Writer

Alison Tobin is a Feature Insurance Writer at Clearsurance. Her writing interests include “How to” guides across different insurance types as well as other educational pieces. Alison earned a BA in Communication and Media from Merrimack College in Massachusetts. She has been working in the insurance space for 4 years.

- Domestic Travel Insurance

- International Travel Insurance

- Make a Claim

- COVID-19 FAQs

Travel Insurance

Travel a little freer knowing we're on the journey with you

15% AA Member online exclusive discount

Financial Strength Rating

The Hollard Insurance Company Pty Ltd ABN 78 090 584 473 (Incorporated in Australia), ("Hollard"), has been given a financial strength rating of A (Strong) issued by Standard and Poor's. View the full details on the Financial Strength Rating .

An overseas policyholder preference applies. Under Australian law, if The Hollard Insurance Company Pty Ltd is wound up, its assets in Australia must be applied to its Australian liabilities before they can be applied to overseas liabilities. To this extent, New Zealand policyholders may not be able to rely on The Hollard Insurance Company Pty Ltd’s Australian assets to satisfy New Zealand liabilities.

Financial advice

The New Zealand Automobile Association provides general information about AA Travel Insurance products and services so that you can make a choice that best meets your needs. Information provided does not take into account your personal circumstances, needs or goals and is not intended to be financial advice. If you'd like to receive financial advice, you can get professional advice from a registered financial adviser.

More information

Contact us Policy Wording Make a claim Terms and conditions AA Traveller Member Benefits

* AA Members can receive an online exclusive 15% discount on AA Travel Insurance. 10% AA Member discount still available through AA Centres and over the phone. Simply provide each traveller’s valid AA Membership number on application. Discount applies to Base Price, including any additional pre-existing cover, but does not apply to additional cover for high value items. Discount does not apply in respect of policies purchased through quotes generated outside the relevant promotion period. View the full T&Cs .

- Car Insurance

- Travel Insurance

- Home Insurance

- AA Membership

- Van Insurance

- Car Service

- EU Breakdown

Backpacker Travel Insurance

Planning a gap year or just time to get away?

What is AA Backpacker Travel Insurance

Specialised insurance product designed for people who are planning longer-term travel, typically involving visits to multiple countries or regions, often with a focus on adventure and exploration. This type of insurance is aimed at meeting the unique needs of backpackers, who might find themselves off the beaten path and engaging in activities that regular travel insurance might not cover.

Get Covered Now!

Top Features And Benefits of AA Backpacker Travel Insurance* 🏝

Medical Expenses Cover

- So this plan covers you for any emergency medical expenses up to €5,000,000.

- It also includes 24/7 medical assistance so help is available anytime you need it. Read More.

Cancellation Cover

- This cover ensure that if you have to cancel your trip for some reason out of your control, this will cover up to €3,500 for any travel or accommodation costs you lose out on.

Baggage Cover

- It covers lost, delayed, or stolen luggage up to €2,000.

Flight Connections Cover

- Missed connection coverage that can cover up to €800.

Personal Accident

- Policy provides personal accident coverage of up to €25,000.

Add Winter Sports Cover

- Our coverage extends to a variety of exhilarating winter activities, including skiing and snowboarding, ensuring you can relish in the snowy thrills of the season with complete peace of mind. Read More.

COVID-19 cover

- Get coverage for cancellations, shortened trips, medical costs, and extra lodging expenses if COVID-19 affects your travel plans and you’re unable to return home on schedule. Click to read more about this protection.

Hitting the slopes? We’ve got you covered 👌

Before you carve your way through the fresh powder this season, ensure you’re equipped with AA Winter Sports Cover alongside your Essential or Extra Travel Insurance policy. Safeguard your winter wonderland escapades today!

Explore Other Holiday Insurance Cover That Could Suit Your Needs…

Annual travel insurance.

Single-Trip Travel Insurance

Winter Sports Travel Cover

Why Choose AA for Your Backpacking Journey?

Extensive Coverage :

- Dive into your travels knowing we’ve got you covered for up to a full year with options extending up to €5,000,000 for emergency medical expenses.

COVID-19 Peace of Mind :

- In these uncertain times, your health is our priority. Our policies are updated to include COVID-19 coverage, so you can travel with one less worry.

A Century of Trust :

- With over 100 years of service, AA is a name synonymous with reliability. Rated ‘Great’ by our customers, we’re dedicated to upholding that trust on every step of your journey.

Support When You Need It Most :

- Lost your bag? Missed a flight? No problem. Our support ensures that unexpected hiccups don’t derail your adventure.

Round-the-Clock GP Access with AA Backpacker Travel Insurance* 👌

All AA Travel Insurance policies now give you access to an English speaking GP 24/7 whilst you are abroad. If you need a doctor , they are just a call away or click away…

Backpacker Travel Insurance Frequently Asked Questions (FAQs)

What does backpacker travel insurance cover that regular travel insurance might not.

Regular insurance like Multi Trip Insurance have limits on the maximum trip duration (45 or 60 days depending on the policy). With Backpacker Travel Insurance you’re completely covered for from the start date & end date on your insurance policy.

Does Backpacker Travel Insurance cover multiple countries?

It does! With AA Backpacker Travel Insurance you’ve the choice of selecting between Europe, Worldwide & Australia, New Zealand. As an example, if you selected Europe, you’d be covered in France & Germany or even Spain!

What activities are not covered by Backpacker Travel Insurance?

Backpacker Travel Insurance doesn’t cover you for activities like Winter Spots, Golf, Business & Wedding. We recommend you read your AA Travel Insurance policy booklet to fully understand you coverage for specific activities.

What about my belongings?

- The accidental loss of, theft of or damage to baggage or valuables is covered under the AA Backpacker Travel Insurance policy.

How to make a claim on Backpacker Travel Insurance?

To make a claim on your policy you can call the claims centre on 01- 431 1204 from Ireland, or 00353 1431 1204 from outside Ireland.

Already Insured with us? 🤝

We hope your trip will go off without a hitch, but should something change. We’re here.

Uncover Our Travel Tips & Guides

Embark on Your Journey with Assurance, Guided by Our Top Travel Insights.

Emergencies Force 1 in 4 to Cancel Travel Plans

What does holiday insurance cover?

5 Unexpected Situations Where Travel Insurance Saves the Day

COMMENTS

Second the credit card. I buy my AA flights with my United Card, which is also a Chase card, and it has good flight insurance benefits (same as the Sapphire Preferred/Reserved--the Reserved are a bit better, due to the higher annual feed benefits). It can help cover emergency costs that the airlines might not.

American Express has a rider for primary auto insurance. It's $25-ish for the entire length of your rental and is automatically activated when you swipe your Amex at the rental agency. There's no need for the rental company's CDW insurance with this. You must call and get it added to your Amex account.

So one big option is "Cancel for any reason". Usually this adds a decent amount to travel insurance because you can cancel, well for any reason. Not just medical, weather, etc. So definitely think about whether that option is worth the extra money. Looking at what you mentioned, that Allianz option only offers $150 for delays.

American Airlines trip insurance would cover up to $10,000 in medical and dental expenses for an eligible occurrence. Travel delay. This is a valuable benefit, one covered by many credit cards. If ...

Years ago, booked two separate awards for a Euro vacation. Opted for the recommended Allianz policy on the outbound tickets, then called and filled them in on the rest of our trip (multi-country, multi-passenger, multi-ticket, etc.). I want to say the original "fee" was like $35-40 for the insurance on the outbound award ticket (x2 for 2 ...

American Airlines travel insurance protects you from unexpected events, including lost luggage and canceled flights. The cost of travel insurance from American Airlines varies, but plans typically start at $35. Adding AA trip insurance is easy - simply sign up when you purchase an American Airlines ticket.

Allianz Trip Insurance comes in a variety of plans to fit your specific needs. Single-trip plans can protect one trip, annual plans can protect all your trips for an entire year, and rental car protection plans can keep your budget safe from accidental collision and damage to a rental vehicle. All insurance is recommended / offered / sold by ...

Best travel insurance category. Company winner. Best overall. Berkshire Hathaway Travel Protection. Best for emergency medical coverage. Allianz Global Assistance. Best for travelers with pre ...

Enter your ZIP Code. Go. AAA is a federation of independent clubs throughout the United States and Canada. Whether you're traveling internationally or within the United States, AAA members have access to travel insurance which could help with non-refundable costs if you have to cancel your trip.

American Airlines, like the majority of airlines in the USA, uses Allianz Travel Insurance to provide flight trip insurance for their passengers. Clicking on the link at the bottom of the American Airlines home page takes us to the Allianz site for a quote. Inputting our trip details into the Allianz website for a quote, we have several options ...

There are many companies that offer policies, with Allianz and Travel Guard among the best-known. Here is a chart showing the benefits and coverage levels available on some Allianz policies ...

Some credit cards offer built-in travel insurance as a cardholder benefit. And it may be tempting to rely on credit card travel protections instead of buying travel insurance. But, the entire point of travel insurance is to be covered if something goes wrong. So, you may be wondering whether you should buy travel insurance even if your credit card offers travel protection.

Hi everyone - I'm building out our travel insurance guides and have this in draft: 1Cover vs Southern Cross vs AA Travel Insurance. ... The #1 Reddit source for news, information, and discussion about modern board games and board game culture. Join the community and come discuss games like Codenames, Wingspan, Brass, and all your other favorite ...

The cost of a travel insurance policy depends on many factors, including the trip length, your state of residence and how much coverage you'd like. Our sample search for a $3,000 two-week trip ...

Trip insurance provided by Allianz Travel Mexico. Contact by mail or phone. Allianz Travel Av. Insurgentes Sur 1602 - 302 Col. Crédito Constructor CP 03940 CDMX, México. From Mexico 01-800-999-9922 From the U.S. 866-328-4280 Collect (52) 55 53 77 3860. Contact by email. Send an email

The short answer is usually no. In fact, AA's policy may specifically exclude the very event you're concerned about. In this guide, we'll cover the ins and out of travel insurance cover so that you can make an informed decision. To ensure you're getting the best deal on travel insurance, compare multiple quptes.

Our insurance partner. AA Travel Insurance policies are brought to you by the New Zealand Automobile Association Incorporated (AA), are issued and managed by AWP Services New Zealand Limited trading as Allianz Partners and underwritten by The Hollard Insurance Company Pty Ltd ABN 78 090 584 473 (Incorporated in Australia) ("Hollard").

We would like to show you a description here but the site won't allow us.

AAA offers travel insurance policies in partnership with Allianz. The more robust policies include coverage for a missed port of call and free coverage for children under age 17.

Travel Insurance AA LOW EFFORT POST (SUBJECT TO DELETION) ... flight, the website asked me two questions. If I would like to make my flight fully refundable for an extra ($100) and travel insurance for an extra ($68) ... officially recognized American Express Community on Reddit! American Express, a premier financial institution, extends a ...

Specialised insurance product designed for people who are planning longer-term travel, typically involving visits to multiple countries or regions, often with a focus on adventure and exploration. This type of insurance is aimed at meeting the unique needs of backpackers, who might find themselves off the beaten path and engaging in activities ...

0330 058 2991. Lines are open Monday to Friday 9am to 5pm. Email [email protected]. Emergency Medical Assistance. +44 (0)147 335 6274. Lines are open 24/7 all year. AA Travel Insurance - a range of great value policies to suit your holiday or business trip, including medical expenses.