Freephone our UK Team

0800 072 6778

Sales & Service

Monday to Friday: 8:30am to 8pm Saturday: 9am to 5:30pm Sunday: 10am to 5:00pm

Monday to Friday: 9am to 7pm Saturday: 9am to 5:30pm

Bank Holiday Opening Hours:

6th May: 9am-5pm 27th May: 9am-5pm

Travel Insurance

Medical travel insurance, seniors travel insurance, europe travel insurance, worldwide travel insurance, coronavirus travel insurance, cruise travel insurance.

- Unlimited medical emergency expenses¹

- Up to £10K cancellation cover

- 24/7 emergency medical helpline

Covered 27 million+ travellers

Trusted for 20+ years

24/7 emergency helpline

Whether you’re sailing on the seas or a river, we’ve designed our cruise travel insurance to keep you protected onboard and ashore. With no upper age limit and cover for pre-existing medical conditions, we cover potential issues that are specific to cruise travel.

What is cruise travel insurance and do you need it?

Just as cruises provide a unique style of holiday, they can also potentially come with their own unique issues. For example, bad weather could mean missed excursions or, if you get particularly unwell on a cruise, it could cost tens of thousands of pounds to airlift you for medical treatment. That’s why our cruise travel insurance covers you for any cruise-specific issues you could encounter.

For example, cruise insurance means you’re financially protected for costs from:

- Missed departures. Traffic jams always happen when you need them least, but this shouldn’t hinder your holiday. Cruise insurance means we’ll compensate you if you miss your cruise departure.

- Cabin confinement for any reason. It’s tough enough being cooped up, let alone having to worry about the money you’ve already spent. Cruise cover means you’ll get some money back for every day you’re confined to your cabin.

- Any money spent on unused excursions. If you miss an excursion for any reason, such as bad weather or illness, cruise cover means you’ll be compensated.

- Flights back to the mainland in case of illness. A 2010 study found that more than 12% of injuries aboard cruise ships are reported as serious . If you suffer a serious injury, you want to make sure you are covered for medical transport to a hospital if needed

- Repatriation back to the UK. In extreme cases, you may need to be flown back to the UK for treatment, which can be costly. Cruise insurance policies will cover you for this.

Some cruise providers require you to have comprehensive travel insurance arranged to travel – just one more reason to make sure you’re fully covered. To get cruise travel insurance, you’ll need to buy travel insurance and add the cruise cover option while you’re looking at the quote.

What does InsureandGo’s cruise travel insurance cover?

What’s covered.

- Cabin confinement : If you’re feeling a bit poorly and need to be confined to your cabin, make sure you confirm it with the ship’s medical officer so we can help with your compensation cover. We’ll pay £100 for each day you’re trapped inside, up to a limit of £1,000. If this confinement is due to a pre-existing illness you must have disclosed and discussed this with us before your cruise insurance purchase.

- Cruise interruption : If your cruise is interrupted because you need unexpected hospital treatment, we’ll cover up to £1,000 to help get you to the next port to rejoin the cruise and continue your holiday. Alternatively, our insurance for cruise holidays covers repatriation where necessary.

- Itinerary changes : If your cruise ship misses a port due to poor weather or timetable restrictions, our cruise insurance will cover you for up to £100 per port for up to 5 ports.

- Missed cruise ship on port : No one’s holiday deserves to be lost at sea! If you missed your cruise due to problems with public transport, experienced a vehicle breakdown or were affected by an accident-induced traffic jam en route to the port – we’ll cover up to £1,000 to get you to the next docking port point to meet your cruise.

- Unused excursions : If you missed out on some great activities or excursions that you’d booked and paid for before suddenly being taken ill and confined to your cabin, our cruise travel insurance will cover you up to £500.

(Note: The above is only available on our Silver, Gold and Black policies, and only when you pay the extra premium for cruise cover)

For more details on what you’re covered for, see our full cruise travel insurance policy breakdowns.

Anything else?

All our yearly holiday insurance policies include:

- Emergency medical expenses

- Cover for cancellation of your trip

- Personal belongings and baggage cover

- Personal money, passports and travel documents cover

The excess and amount of cover available varies depending on the level of travel insurance you buy. Make sure you have a look at our policy wording to see the full terms and conditions.

What’s not covered?

We aim to provide as much cover as we can on our policies. However, there are some situations no travel insurance will cover. For example:

- Events or reasons to claim which took place before you booked the trip or the insurance was purchased cannot be covered. Insurance exists to cover unexpected events outside of the insured’s control.

- Claims which are less than the excess for that section of cover. For example, you cannot claim a £40 lost item if your baggage excess is £60

- All of our cruise travel insurance policies include cover for cancellation of your trip, but there may be some exclusions. For example, you won’t be covered to cancel if you simply decide not to go.

Remember that to get cruise insurance, you need to book travel insurance and add cruise cover to that policy.

The best travel insurance for your cruise

Cruise insurance can be added to another type of travel insurance, and we have plenty of options to suit your holiday style. Wherever you’re travelling, and however long for, we’ll have a policy for you:

- First time cruising? Simply add cruise cover to a single-trip insurance policy. Easy peasy.

- Doing multiple holidays or cruises this year? It might work out better to get annual travel insurance and add cruise cover to that.

- Enjoying later life? Cruise travel insurance can be added to plans that suit your needs better, whether that’s travel insurance for over 50s , or even travel insurance for over 80s .

- Have a pre-existing health condition? Make sure your medical travel insurance covers your cruise

- Cruising along multiple stops? Depending on your cruise destinations, you might need worldwide travel insurance or travel insurance for Europe .

Choose a cover level to suit your travel needs

Which destinations are covered by our cruise travel insurance.

Our travel insurance policies are based on the following four groupings:

- Europe (plus countries bordering the Mediterranean Sea, plus Madeira and The Azores)*.

- Worldwide (except the USA , Canada, Mexico and the Caribbean).

*Europe includes: Albania, Andorra, Armenia, Austria, Azerbaijan, Azores, Balearics, Belarus, Belgium, Bosnia And Herzegovina, Bulgaria, Canary Islands, Croatia, Cyprus, Czech Republic, Denmark, Egypt, Estonia, Faroe Islands, Finland, France, Georgia, Germany, Gibraltar, Greece, Hungary, Iceland, Ireland, Israel, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Macedonia, Madeira, Malta, Moldova, Monaco, Montenegro, Morocco, Netherlands, Norway, Poland, Portugal, Romania, Russia, San Marino, Serbia, Slovakia, Slovenia, Spain, Sweden, Switzerland, Tunisia, Turkey, Ukraine.

If you’re already insured for a particular geographical group but want to make changes or add in new countries, we can always alter that for you. Just give us a ring, or send us an email .

How to buy travel insurance for cruises

We know your to-do list for your next trip can be a long one, so we make getting cruise insurance as simple as possible:

1. Let us know a little info

We need to know a bit about your cruise, who you want to cover and when you want the policy to start. We will also ask you for information regarding any pre-existing medical conditions so that we can ensure we provide you with the right level of cover.

It’s quick and easy to give us this information, either online or by calling our team:

2. Get your quote

Once we have all the details we need, we will send you your quote. At this stage, you can go ahead and buy your policy, or save the quote for the future.

“Cruise cover is an absolute must-have for anyone taking a cruise because it covers for issues you might face, like a missed departure or being confined to your cabin. Regular travel insurance doesn’t cover these, so specific cruise cover is super important. Without it you won’t have any cover while on a cruise.” Russell Wallace – Travel insurance expert

Cruise travel insurance with pre-existing medical condition cover

We cover a wide range of medical conditions on our policies, including those with insurance for a cruise, and we will never refuse to cover a diagnosed pre-existing medical condition without prior consideration.

We consider pre-existing medical conditions to be any illness or condition that has occurred before you take out an insurance policy, ranging from asthma to cancer . We can usually cover any medical conditions, often with no additional premium, and medical cover on your cruise holiday is no exception.

All you need to do is disclose your pre-existing condition during your quote, and we’ll sort the rest.

Frequently asked questions on cruise travel insurance

Why do i need special insurance for a cruise.

You need special insurance for cruises in case you run into any cruise-specific complications. These include things like cabin confinement if you are unwell, missed departures for any reason, and unused excursions, as well as typical holiday issues like delays or cancellations.

Some normal travel insurance plans might cover some of these problems, like delays or cancellations, they won’t cover cabin confinement and might not cover repatriation.

Do you need travel insurance for a domestic cruise?

Whatever the destination of your cruise, you will need to add cruise cover to your travel insurance – even if it’s a cruise around the UK. Cruise travel insurance makes sure you’re fully covered and includes elements of cover that are specific to cruises, such as being airlifted to the mainland.

While typical UK travel insurance usually covers land-based holiday issues, they won’t cover many of the issues you could face on a domestic river or sea cruise holiday.

Can I buy travel insurance after booking a cruise?

Some travel operators may require you to buy your insurance at the same time as booking your cruise holiday. Others are more flexible as long as you purchase your cruise travel insurance before you set sail.

It is a good idea to check with your cruise provider before booking insurance. Some cruise providers have specific requirements for travel insurance, such as having a certain amount of medical and COVID-19 cover.

How much is cruise insurance?

Insurance for a cruise doesn’t have to be expensive. The price you pay will depend on where you’re going, how long for, and whether you have any medical conditions. Choose either a single-trip or annual multi-trip policy and you’ll be given the chance to add cruise travel insurance to your policy.

Will my EHIC or GHIC cards cover my cruise?

The GHIC, or EHIC as it was previously known, does not cover specific costs that you might encounter when on a cruise, and it does not cover repatriation costs either.

Although the GHIC covers some of the medical costs when travelling in Europe, the UK Government website recommends that all UK travellers take out appropriate travel insurance when travelling abroad. It’s also important to note that the GHIC will not cover other cruise-specific issues, such as missing the departure or cabin confinement.

Does regular cruise insurance cover medical expenses?

Our cruise travel insurance covers emergency medical bills, as well as other complications, like delays, cancellations and missed departures.

Be sure to check the wording on your policy to find out exactly what is covered and what is not.

Who can buy an InsureandGo cruise insurance policy?

All our annual travel insurance policies are available to UK residents. This means:

- Someone who has been living in the UK or the Channel Islands for at least six of the last 12 months

- They must be in the UK at the time of buying

- All trips must start and end in the UK

Unfortunately, we can’t provide cover to anyone who doesn’t fit this description.

Get a quote online or browse our policy documents for more information. To choose the right cruise travel insurance policy for you, get a quote online or read our policy documents for more information.

Frequently asked questions

If you’ve got more questions about how our cruise travel insurance works, or more general travel insurance queries, have a read through our FAQs .

Travel advice

Our travel advice section offers handy tips and guides to specific countries, from what documents you need to what you might visit while you’re there.

Travel insurance reviews

If you want to know what our customers think of us, and why they rate us so highly, have a read through some of the reviews they’ve left us.

- Unlimited emergency medical expenses available on Black level policies.

- Based on 2,050 responses, correct as of 22/01/2024

June 1, 2020

Due to travel restrictions, plans are only available with travel dates on or after

Due to travel restrictions, plans are only available with effective start dates on or after

Ukraine; Belarus; Moldova; North Korea; Russia; Israel

This is a test environment. Please proceed to AllianzTravelInsurance.com and remove all bookmarks or references to this site.

Use this tool to calculate all purchases like ski-lift passes, show tickets, or even rental equipment.

OneTrip Emergency Medical Plan

Even free-spirited travelers need the reassurance of insurance. OneTrip Emergency Medical is flexible and affordable travel insurance that includes only post-departure benefits. This means you get emergency medical and emergency transportation benefits, as well as benefits for travel delays, missed connections and lost/stolen or damaged baggage. Designed for travelers with few prepaid expenses, this low-cost plan does not include trip cancellation or trip interruption benefits.

All benefits are per insured traveler unless otherwise noted. If you’re renting a car for your trip, you can upgrade your plan to include the affordable OneTrip Rental Car Protector.

Benefits/Coverage

Benefits/Coverage may vary by state, and sublimits may apply. Please see your plan for full details.

Epidemic Coverage

Adds certain epidemic-related covered reasons for Travel Delay; Emergency Medical Care; and Emergency Transportation benefits. For example, if you are diagnosed with an epidemic disease such as COVID-19 and require emergency medical care, you may be reimbursed for costs up to your plan’s maximum limit for the Emergency Medical Care benefit.

Emergency Medical

Up to $50,000

Provides benefits for losses due to covered medical and dental emergencies that occur during your trip. There is a $750 maximum for all covered dental expenses.

Benefit is per insured traveler.

Emergency Medical Transportation

Up to $250,000

Provides benefits for medically necessary transportation to the nearest hospital or appropriate facility following a covered illness or injury during your trip.

Baggage Loss/Damage

Up to $2,000

Covers loss, damage or theft of baggage and personal effects.

Baggage Delay

Reimburses the reasonable additional purchase of eligible essential items during your trip if your baggage is delayed or misdirected by a common carrier for 12 hours or more. Receipts for emergency purchases are required.

Travel Delay

Up to $1,000

Reimburses up to $200 per day per person for additional travel and lost prepaid expenses if your trip is delayed for six or more hours for a covered reason. Can also reimburse eligible additional transportation expenses if you miss your cruise or tour because of a covered delay.

Travel Accident Coverage

Up to $10,000

Pays benefits for losses when you, as a result of an accidental injury occurring during the covered trip, sustain a covered loss of life, sight, hands or feet.

24-Hr Hotline Assistance

With Allianz Global Assistance, you'll never travel alone. Our multilingual assistance team is available 24 hours a day to help you handle all kinds of travel emergencies. We can help you find local medical and legal professionals, arrange to send a message home, help with missed connections and lost/stolen travel documents, and much more.

Provides personalized information about your destination and assists you with obtaining restaurant reservations, tee times and tickets to events.

Pre-Existing Medical Condition

Your plan may provide pre-existing medical conditions coverage if you, a traveling companion, or family member has a pre-existing medical condition. We define a pre-existing medical condition as an injury, illness, or medical condition that, within the 120 days prior to and including the purchase date of this policy: 1. Caused a person to seek medical examination, diagnosis, care, or treatment by a doctor; 2. Presented symptoms; or 3. Required a person to take medication prescribed by a doctor (unless the conditions or symptoms are controlled by that prescription, and the prescription has not changed). The illness, injury, or medical condition does not need to be formally diagnosed in order to be considered a pre-existing medical condition.

Coverage for a pre-existing medical condition is excluded unless:

- You purchased your plan within 14 days of making your first trip payment or first trip deposit;

- On the policy purchase date, you insured the full non-refundable cost of your trip with us. This includes trip arrangements that will become non-refundable or subject to cancellation penalties between the policy purchase date and the departure date. (If you incur additional non-refundable trip expenses after you purchase this policy, you must insure them with us within 14 days of their purchase. If you do not, those expenses will still be subject to the pre-existing medical condition exclusion.);

- You are a U.S. resident;

- You were medically able to travel on the day you purchased the plan.

All other contract terms and conditions apply.

Get a Quote

{{travelBanText}} {{travelBanDateFormatted}}.

{{annualTravelBanText}} {{travelBanDateFormatted}}.

Type the country where you will be spending the most amount of time.

Age of Traveler

Ages: {{quote.travelers_ages}}

If you were referred by a travel agent, enter the ACCAM number provided by your agent.

Travel Dates

{{quote.travel_dates ? quote.travel_dates : "Departure - Return" | formatDates}}

Plan Start Date

{{quote.start_date ? quote.start_date : "Date"}}

RELATED PRODUCTS

Terms, conditions, and exclusions apply. Please see your plan for full details. Benefits/Coverage may vary by state, and sublimits may apply.

Insurance benefits underwritten by BCS Insurance Company (OH, Administrative Office: 2 Mid America Plaza, Suite 200, Oakbrook Terrace, IL 60181), rated “A” (Excellent) by A.M. Best Co., under BCS Form No. 52.201 series or 52.401 series, or Jefferson Insurance Company (NY, Administrative Office: 9950 Mayland Drive, Richmond, VA 23233), rated “A+” (Superior) by A.M. Best Co., under Jefferson Form No. 101-C series or 101-P series, depending on your state of residence and plan chosen. A+ (Superior) and A (Excellent) are the 2nd and 3rd highest, respectively, of A.M. Best's 13 Financial Strength Ratings. Plans only available to U.S. residents and may not be available in all jurisdictions. Allianz Global Assistance and Allianz Travel Insurance are marks of AGA Service Company dba Allianz Global Assistance or its affiliates. Allianz Travel Insurance products are distributed by Allianz Global Assistance, the licensed producer and administrator of these plans and an affiliate of Jefferson Insurance Company. The insured shall not receive any special benefit or advantage due to the affiliation between AGA Service Company and Jefferson Insurance Company. Plans include insurance benefits and assistance services. Any Non-Insurance Assistance services purchased are provided through AGA Service Company. Except as expressly provided under your plan, you are responsible for charges you incur from third parties. Contact AGA Service Company at 800-284-8300 or 9950 Mayland Drive, Richmond, VA 23233 or [email protected] .

Return To Log In

Your session has expired. We are redirecting you to our sign-in page.

- Favorites & Watchlist Find a Cruise Cruise Deals Cruise Ships Destinations Manage My Cruise FAQ Perfect Day at CocoCay Weekend Cruises Crown & Anchor Society Cruising Guides Gift Cards Contact Us Royal Caribbean Group

- Back to Main Menu

- Search Cruises " id="rciHeaderSideNavSubmenu-2-1" class="headerSidenav__link" href="/cruises" target="_self"> Search Cruises

- Cruise Deals

- Weekend Cruises

- Last Minute Cruises

- Family Cruises

- 2024-2025 Cruises

- All Cruise Ships " id="rciHeaderSideNavSubmenu-4-1" class="headerSidenav__link" href="/cruise-ships" target="_self"> All Cruise Ships

- Cruise Dining

- Onboard Activities

- Cruise Rooms

- The Cruise Experience

- All Cruise Destinations " id="rciHeaderSideNavSubmenu-5-1" class="headerSidenav__link" href="/cruise-destinations" target="_self"> All Cruise Destinations

- Cruise Ports

- Shore Excursions

- Perfect Day at CocoCay

- Caribbean Cruises

- Bahamas Cruises

- Alaska Cruises

- European Cruises

- Mediterranean Cruises

- Royal Destinations

- Cruise Planner

- Make a Payment

- Check-In for My Cruise

- Beverage Packages

- Shore Excursions

- Update Guest Information

- Book a Flight

- Dining Packages

- Royal Gifts

- Required Travel Documents

- Transportation

- Book a Hotel

- Redeem Cruise Credit

- All FAQs " id="rciHeaderSideNavSubmenu-7-1" class="headerSidenav__link" href="/faq" target="_self"> All FAQs

- Boarding Requirements

- Future Cruise Credit

- Travel Documents

- Check-in & Boarding Pass

- Transportation

- Perfect Day at CocoCay

- Post-Cruise Inquiries

- Royal Caribbean

- Celebrity Cruises

What Travel Protection Program does Royal Caribbean offer?

Make sure nothing gets in the way of your adventure with Royal Caribbean Travel Protection program benefits, including medical, baggage and Evacuation coverages to protect you during your trip. With the Royal Caribbean Travel Protection Program Cancellation Penalty Waiver (a non-insurance feature offered by Royal Caribbean), if your plans go awry and you cancel your cruise vacation (for specified reasons), Royal Caribbean will waive the non-refundable cancellation provision of your cruise ticket contract and pay you IN CASH the value of the unused portion of your prepaid cruise vacation. In addition, should you need to cancel for "any other reason" you may be eligible for credit toward a future cruise - up to 90% of the non-refundable, prepaid cruise vacation cost.

Because our liability for loss or damage is limited by the Cruise Ticket Contract, we recommend that all guests check their own insurance coverage or consider purchasing the Royal Caribbean Travel Protection Program.

RCC_10282020B

Still need help? Contact Us

Get support by phone or email.

Email Your Questions

Locate a Travel Agent

Previewing: Promo Dashboard Campaigns

My Personas

Code: ∅.

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

GeoBlue Travel Insurance Coverage Review — Is It Worth It?

Christine Krzyszton

Senior Finance Contributor

308 Published Articles

Countries Visited: 98 U.S. States Visited: 45

Director of Operations & Compliance

1 Published Article 1178 Edited Articles

Countries Visited: 10 U.S. States Visited: 20

Why Purchase Travel Insurance

Why choose geoblue, travel medical insurance and the covid-19 virus, short-term single-trip plan options — geoblue voyager, multi-trip plan options — geoblue trekker, long-term plan options, additional plans available, how to obtain a quote, the value of travel insurance comparison sites, geoblue vs. other travel insurance companies, geoblue vs. credit card travel insurance, everything else you need to know, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

We frequently discuss travel insurance and look closely at companies that offer the coverage , but today we’re narrowing our focus from comprehensive travel insurance to a specific type of travel coverage — travel medical insurance.

Chances are you’ve heard of BlueCross BlueShield (BCBS), one of the leading healthcare insurance providers in the U.S. The company was established in 1929 and currently insures over 107 million members. GeoBlue, an independent licensee of BCBS, picks up where BCBS leaves off, offering travel medical coverage worldwide .

You do not have to be a member of BCBS to purchase travel medical insurance from GeoBlue as the company makes its products widely available to U.S. citizens and permanent residents.

In an effort to determine the benefits of GeoBlue as a viable option for purchasing travel medical insurance, join us as we explore the following in today’s review:

- Why you should consider travel insurance and specifically GeoBlue

- An overview of the types of plans the company offers

- Comparing plans and obtaining a quote

- How the company measures up versus other companies and to credit card travel insurance

Insurance products, in general, serve the purpose of indemnifying you and making you whole (or nearly whole) should a covered event cause you to incur a financial loss. Travel insurance , and in this case travel medical insurance, is designed to accomplish the same objective.

Since our topic for this article is narrowed to travel medical insurance , let’s look at several reasons you’d want to consider this coverage.

- Your current health insurance policy does not provide coverage outside of the U.S. and/or its territories

- Your current health insurance policy covers you outside of the country but has a high deductible

- You are on Medicare and do not have a supplement plan

- You want a primary travel medical policy that gives you access to a network of medical providers in the country you’re visiting

- You have insurance from your credit card for trip cancellation, trip interruption , and other travel disruptions, but not travel medical coverage

- You are traveling to a remote area and want to have emergency evacuation insurance

This is just a sampling of some of the situations where you’d want to consider purchasing a travel medical insurance policy. Fortunately, the coverage is affordable and widely available.

Bottom Line: If your current health insurance policy does not cover you while traveling abroad or has a high deductible if it does provide coverage, you’ll want to consider purchasing travel medical insurance . Additionally, you should consider travel medical insurance if you’re concerned about emergency medical evacuation, or want to have 1 primary policy that covers you during your travels.

If you have the need to purchase travel medical insurance, there are certainly a lot of companies from which to select. GeoBlue stands tall among those competitors for several reasons.

First, the company has been providing global health insurance options since 1997, is a licensee of BCBS with a rating of excellent by financial insurance rating company, AM Best, and has an A+ rating by the Better Business Bureau.

Additionally, you can expect the following benefits when insuring with GeoBlue:

- GeoBlue has a vetted group of elite doctors in a network that spans 190 countries. Physicians must be certified by the American or Royal Board of Medical Specialties.

- Visits to network doctors/facilities are handled cashless, eliminating the need to file a claim for reimbursement.

- In addition to in-person care, GeoBlue utilizes alternative telemedicine options available 24/7 and provides access to a global network of physicians and facilities.

- Access is available to 24/7 assistance including translation services, physician referrals, prescription services, destination assistance, and more.

Bottom Line: GeoBlue is an established, highly-rated company that specializes in providing travel medical insurance with associated care via its global physician network, telemedicine services, and 24/7 medical assistance services.

Travel insurance, in general, does not cover voluntary trip cancellations due to the fear of getting ill for any reason, including the fear of contracting the COVID-19 virus. In addition, some travel insurance companies specifically exclude COVID-19 for most coverages. Other travel insurance companies provide limited coverage for COVID-19-related illnesses under trip interruption and medical care coverages only.

You’ll want to review any policy you’re considering to make sure your greatest concerns are covered.

In order to have any coverage that provides reimbursement for a voluntary trip cancellation, for example, you’ll need to consider Cancel for Any Reason (CFAR) insurance .

Travel medical insurance does not normally include extensive coverage for trip cancellations or disruptions but focuses more on providing medical care and reimbursement for the associated expenses that occur as a result of becoming ill or having an accident during your travels.

Fortunately, many of the medical insurance policies offered by GeoBlue do cover COVID-19-related illness . Let’s look closer at the available options.

Bottom Line: In order to have coverage for trip cancellation due to the fear of getting ill, you would need to purchase Cancel for Any Reason insurance. Some policies provide limited coverage for COVID-19 under trip cancellation and trip disruption coverages should you contract the virus prior to or during your travels. Many of the travel medical policies offered by GeoBlue cover COVID-19-related illness care .

GeoBlue Policy Comparisons

GeoBlue offers single trip, multi-trip, and long-term plans. The company also issues specialty travel medical plans for students, workers on assignment, missionaries, volunteers, and maritime workers while abroad.

First, let’s look at the policy options for individuals and group travelers.

GeoBlue Voyager plans are designed for individual single-trip travel or group single-trip events. Groups are defined as 5 or more persons traveling together and a 10% discount off of individual pricing is provided.

Voyager plans include coverage for COVID-19-related illness care.

Here’s how the 2 Voyager policy options compare.

If you’re a frequent traveler, it could make sense to purchase 1 annual policy that covers multiple trips. GeoBlue Trekker multi-trip plans cover all trips made within a 12-month period (up to 70 days in length) and offer 2 levels of coverage options.

Here is a comparison of the 2 GeoBlue Trekker plans.

Both plans cover pre-existing conditions and emergency and non-emergency medical care. Both plans require that you have a primary health plan in place to qualify for purchasing these plans.

If you’re a U.S. citizen or permanent resident living abroad and need medical insurance, GeoBlue offers 2 plans that may provide the coverage you need for you and your family.

These plans are different from short-term plans in that medical underwriting is needed in order to qualify. Here’s a brief summary of GeoBlue plans for U.S. expats.

All GeoBlue plans offer 24/7 global medical assistance, translation services, doctor searches, and destination health/security information.

GeoBlue Navigator, Xplorer, and Voyager plans include coverage for COVID-19-related illness .

GeoBlue provides additional medical plans for specific types of travelers working abroad, on assignment, or participating in study programs.

- Incoming international students studying in the U.S.

- Students studying abroad

- Employees of multi-national companies working abroad

- Expatriate Crew International Health Plan — for those working on ships

- Expatriate Missionary and Volunteer International Health Plan — covers missionaries, aid workers, and volunteers worldwide

Bottom Line: GeoBlue offers several comprehensive individual travel medical plan options, comprehensive student plans including coverage for international visiting students, and plans for U.S. students, faculty, and family when studying abroad. GeoBlue also offers employer plans that provide coverage to employees working abroad and their families. Missionaries, those who volunteer internationally, and maritime workers will also find policies designed specifically for those situations.

Obtaining a quote for any type of travel insurance can be quick, easy, and can even result in securing immediate coverage. The process is similar for travel medical insurance.

To obtain a quote from GeoBlue for a single trip plan, you’ll need to input your travel destination, your state of residence, the length of your trip, age, cost of the trip, and the date you made the first trip deposit.

For a multi-trip annual plan quote, the process is similar. You’ll need to input your zip code, age, and the desired effective date of the policy.

Obtaining a quote with GeoBlue for a single or multi-trip policy can be done in just a few minutes. To obtain a long-term policy quote, you’ll need to submit some of the same basic information and a quote will be emailed to you.

Bottom Line: Obtaining a quote for a single or multi-trip policy is a quick and simple process completed on the GeoBlue website. A long-term quote for qualifying applicants must be requested via email.

While purchasing a travel medical policy from GeoBlue ensures you’re dealing with a highly-rated established company, it’s always good to do some comparison shopping when looking for any type of insurance.

Viewing a selection of policies side-by-side makes it easy to compare coverages and costs. This task is easily accomplished by utilizing a travel insurance comparison website such as the ones listed here.

Additionally, comparison sites allow you to narrow the number of policies to those that contain the coverages most important to you. Here are a few we recommend:

- InsureMyTrip — great for stand-alone medical travel insurance policy comparisons but also offers comprehensive travel insurance policies from over 20 providers

- Squaremouth — easy to navigate site that allows you to compare dozens of travel insurance companies and filter by desired coverage, including travel medical insurance

- TravelInsurance.com — you’ll want to use this site for comparing travel insurance plans, including those with medical coverage, however, no stand-alone medical plan quotes are available

Bottom Line: Utilize a travel insurance comparison site to help you easily compare several plans, filter by desired coverage, and select those that best match your coverage priorities.

How GeoBlue Compares — Summary

We know that GeoBlue is a reputable choice for travel medical insurance but let’s look at how the company’s offerings compare to other travel medical providers and to the coverage that comes with your credit cards.

When we searched for a quote using the criteria of a traveler, age 40, for a trip to Mexico for 1 week that costs $3,000, the top 4 results above were shown. You’ll notice by the results that single-trip travel medical insurance can be an affordable option.

The next key element in selecting a policy will be to compare coverages. We know that GeoBlue Voyager policies include coverage for COVID-19 with the Voyager plans, for example, so this may be a key factor in our selection.

Digging deeper into our comparison we find that 1 policy does not include coverage for COVID-19. If we narrow our search to plans that only include this coverage, the next step will be to look at other coverages and limits that are important to us.

In this case, coverages for these policies are similar and costs do not vary widely. GeoBlue, however, remains competitive in both coverages offered and premiums charged.

Bottom Line: While GeoBlue holds its own and is competitive in both coverages and cost when compared to other travel medical insurance companies for single-trip plans, we know that coverage for multi-trip plans does not include coverage for COVID-19-related illness.

We frequently remind travelers that even the best credit cards for travel insurance are not a replacement for a comprehensive travel insurance policy. This is especially true for travel medical insurance coverage as you won’t find comprehensive medical coverage on any credit card .

There are very few cards that do offer emergency evacuation insurance and other ancillary medical/dental coverage. Here are 2 of the best options for travel-related coverages and benefits.

The Platinum Card ® from American Express

The Amex Platinum reigns supreme for luxury travel, offering the best airport lounge access plus generous statement credits, and complimentary elite status.

When it comes to cards that offer top-notch benefits, you’d be hard-pressed to find a better card out there than The Platinum Card ® from American Express.

Make no mistake — the Amex Platinum card is a premium card with a premium price tag. With amazing benefits like best-in-class airport lounge access , hotel elite status, and tremendous value in annual statement credits, it can easily prove to be one of the most lucrative cards in your wallet year after year.

- The best airport lounge access out of any card (by far) — enjoy access to over 1,400 worldwide lounges, including the luxurious Amex Centurion Lounges, Priority Pass lounges, Plaza Premium Lounges, and many more!

- 5x points per dollar spent on flights purchased directly with the airline or with AmexTravel.com (up to $500,000 per year)

- $695 annual fee ( rates and fees )

- Airline credit does not cover airfare (only incidentals like checked bags)

- Earn 80,000 Membership Rewards ® Points after you spend $8,000 on purchases on your new Card in your first 6 months of Card Membership. Apply and select your preferred metal Card design: classic Platinum Card ® , Platinum x Kehinde Wiley, or Platinum x Julie Mehretu.

- Earn 5X Membership Rewards ® Points for flights booked directly with airlines or with American Express Travel up to $500,000 on these purchases per calendar year and earn 5X Membership Rewards ® Points on prepaid hotels booked with American Express Travel.

- $200 Hotel Credit: Get up to $200 back in statement credits each year on prepaid Fine Hotels + Resorts ® or The Hotel Collection bookings with American Express Travel when you pay with your Platinum Card ® . The Hotel Collection requires a minimum two-night stay.

- $240 Digital Entertainment Credit: Get up to $20 back in statement credits each month on eligible purchases made with your Platinum Card ® on one or more of the following: Disney+, a Disney Bundle, ESPN+, Hulu, The New York Times, Peacock, and The Wall Street Journal. Enrollment required.

- $155 Walmart+ Credit: Cover the cost of a $12.95 monthly Walmart+ membership (subject to auto-renewal) with a statement credit after you pay for Walmart+ each month with your Platinum Card ® . Cost includes $12.95 plus applicable local sales tax. Plus Up Benefits are excluded.

- $200 Airline Fee Credit: Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees are charged by the airline to your Platinum Card ® .

- $200 Uber Cash: Enjoy Uber VIP status and up to $200 in Uber savings on rides or eats orders in the US annually. Uber Cash and Uber VIP status is available to Basic Card Member only. Terms Apply.

- $300 Equinox Credit: Get up to $300 back in statement credits per calendar year on an Equinox membership, or an Equinox club membership (subject to auto-renewal) when you pay with your Platinum Card ® . Enrollment required. Visit https://platinum.equinox.com/ to enroll.

- $189 CLEAR ® Plus Credit: Breeze through security with CLEAR Plus at 100+ airports, stadiums, and entertainment venues nationwide and get up to $189 back per calendar year on your Membership (subject to auto-renewal) when you use your Platinum Card ® . Learn more.

- $100 Global Entry Credit: Receive either a $100 statement credit every 4 years for a Global Entry application fee or a statement credit up to $85 every 4.5 years for a TSA PreCheck ® (through a TSA official enrollment provider) application fee, when charged to your Platinum Card ® . Card Members approved for Global Entry will also receive access to TSA PreCheck at no additional cost.

- Shop Saks with Platinum: Get up to $100 in statement credits annually for purchases in Saks Fifth Avenue stores or at saks.com on your Platinum Card ® . That's up to $50 in statement credits semi-annually. Enrollment required.

- $300 SoulCycle At-Home Bike Credit: Get a $300 statement credit for the purchase of a SoulCycle at-home bike with your Platinum Card ® . An Equinox+ subscription is required to purchase a SoulCycle at-home bike and access SoulCycle content. Must charge full price of bike in one transaction. Shipping available in the contiguous U.S. only. Enrollment Required.

- Unlock access to exclusive reservations and special dining experiences with Global Dining Access by Resy when you add your Platinum Card ® to your Resy profile.

- $695 annual fee.

- Terms Apply.

- APR: See Pay Over Time APR

- Foreign Transaction Fees: None

- Credit Card Reviews

- Credit Cards

- Travel Rewards Credit Cards

- Best Sign Up Bonuses

American Express Membership Rewards

To learn more about all the travel insurance coverages that come with the Amex Platinum card, you’ll want to review our in-depth article on the topic. Note that terms apply and enrollment may be required for some benefits, so make sure you enroll through your American Express account.

Chase Sapphire Reserve ®

A top player in the high-end premium travel credit card space that earns 3x points on travel and dining while offering top luxury perks.

If you’re looking for an all-around excellent travel rewards card, the Chase Sapphire Reserve ® is one of the best options out there.

The card combines elite travel benefits and perks like airport lounge access , with excellent point earning and redemption options. Plus it offers top-notch travel insurance protections to keep you covered whether you’re at home or on the road.

Don’t forget the $300 annual travel credit which really helps to reduce the annual fee!

- 10x total points on hotels and car rentals when you purchase travel through Chase TravelSM immediately after the first $300 is spent on travel purchases annually

- 10x points on Lyft purchases March 31, 2025

- $550 annual fee

- Does not offer any sort of hotel elite status

- Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That’s $1,125 toward travel when you redeem through Chase Travel SM .

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel SM immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel SM . For example, 75,000 points are worth $1125 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass TM Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck ®

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Member FDIC

- APR: 22.49%-29.49% Variable

- Foreign Transaction Fees: $0

Chase Ultimate Rewards

For more information on Chase Sapphire Reserve card travel insurance coverages , you’ll want to access our expanded overview.

Bottom Line: While credit cards may offer travel accident, trip delay , and other ancillary travel insurance coverages, these cards do not offer travel medical insurance.

Here’s some additional information we need to pass along applicable to the GeoBlue policies mentioned in our article:

- Eligibility includes U.S. citizens and permanent residents only

- Single and multi-trip medical insurance policies must be purchased in your home country before you travel

- Long-term policies, such as those for expats, may be purchased while abroad

- Travelers under 96 are generally eligible for coverage; other age limits may apply to specific policies

- Coverage is valid in all countries other than where the plan would violate U.S. economic trade sanctions

- Some GeoBlue policy options are secondary and require you to have an underlying medical insurance policy

- All policies issued by GeoBlue have a 10-day money-back guarantee

GeoBlue’s expertise at providing travel medical insurance makes it a good choice for purchasing coverage for a single or group trip, or if you’re an expat needing longer-term medical coverage while abroad. Students, faculty, and employers will also find comprehensive medical plans that fit their international medical insurance needs.

Finally, keep in mind that our article today is simply an overview and abbreviated summary of GeoBlue’s policy offerings — plenty of terms and conditions apply. The company’s website provides everything you need to select the appropriate policy, review coverages, obtain a quote, and purchase a plan.

All information and content provided by Upgraded Points is intended as general information and for educational purposes only, and should not be interpreted as medical advice or legal advice. For more information, see our Medical & Legal Disclaimers .

For rates and fees of The Platinum Card ® from American Express, click here .

Frequently Asked Questions

How does geoblue travel insurance work.

GeoBlue specializes in travel medical insurance. Care is provided internationally primarily via a comprehensive, vetted, and certified worldwide network of physicians and hospitals in 190 countries, but out-of-network international care is also covered. Additionally, the company provides worldwide care via telemedicine appointments.

The company offers international single trip, multi-trip, and group travel medical insurance plans.

It’s specialty travel medical insurance plans include policies for visiting international students, U.S. students studying abroad, and faculty members.

Additional plans include plans for those who work abroad for multi-national companies, maritime works, missionaries, and volunteers.

Is GeoBlue a good travel insurance company?

Yes. GeoBlue, a licensee of Blue Cross Blue Shield, is an established travel medical insurance company that has been offering international health insurance since 1997.

The company received a high financial rating from insurance rating company A.M. Best and an A+ rating from the Better Business Bureau.

Does GeoBlue meet Schengen visa insurance requirements?

Yes. GeoBlue travel medical insurance plans meet Schengen visa insurance requirements.

Does GeoBlue cover dental?

GeoBlue Voyager and Trekker plans offer ancillary dental coverage with limits between $100 and $500, depending on the plan, which includes emergency dental care for injury or relief of pain.

Voyager plans have additional dental and vision care riders which are optional add-ons.

Was this page helpful?

About Christine Krzyszton

Christine ran her own business developing and managing insurance and financial services. This stoked a passion for points and miles and she now has over 2 dozen credit cards and creates in-depth, detailed content for UP.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Related Posts

![cruise medical only insurance Citi Simplicity® Card — Review [2023]](https://upgradedpoints.com/wp-content/uploads/2019/11/Citi-Simplicity-Card.png?auto=webp&disable=upscale&width=1200)

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Travelex Travel Insurance: What You Need to Know

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

About Travelex coverage

Travelex insurance plans, what isn’t covered by travelex, how to choose a travelex plan online, which travelex plan is best for me.

Purchasing travel insurance can make a lot of sense when you’re planning a trip, especially since its coverage can reimburse you for unexpected — and sometimes costly — expenses.

Travelex is an insurance provider offering a variety of plans to travelers, including coverage for things like medical expenses, trip delays or issues with your flights. Let’s take a look at Travelex travel insurance, what its policies cover and whether purchasing a plan is the right move for you.

Travelex offers six different policies to travelers. Three of these are focused on comprehensive travel benefits, one is only for post-departure coverage and the other two provide coverage primarily for flight-related incidents.

» Learn more: How much is travel insurance?

Each of Travelex’s plans has different coverage levels, costs and benefits. Let’s take a look at what each plan includes.

Domestic and international trips: Travel Basic, Travel Select and Travel Med

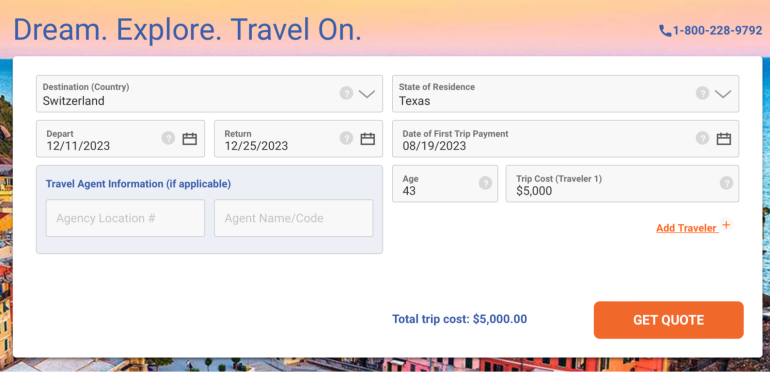

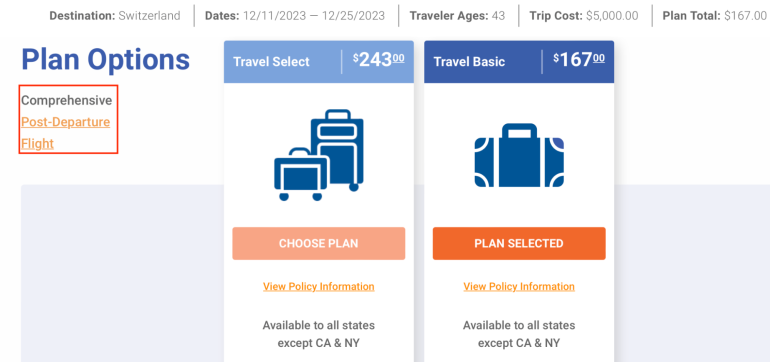

To compare the costs of Travel Basic, Travel Select and Travel Med plans, we generated a quote for a 43-year old traveler from Texas heading to Switzerland for two weeks with a total trip cost of $5,000.

The Travel Basic plan came in at $167 (3.34% of the total trip cost) while the Travel Select plan was $243 (4.86.% of the total trip cost). The Travel Med plan, which only covers expenses incurred after you’ve started your trip, costs $41 (0.82% of the total trip cost).

Let’s take a look at what each plan includes.

Note: Early purchase benefits are available if you purchase the policy within 15 days of making your initial trip payment.

Travel Basic

The Travel Basic plan is pretty comprehensive on its own, though its limits may be a little low depending on where you’re traveling. It’s possible to add on some upgrades:

Rental car insurance.

Accidental death and dismemberment (AD&D) coverage for flights.

Travel Select

Travelex’s most comprehensive plan includes coverage for your children as well as higher limits for most services. It also includes the ability to add on these options:

Cancel For Any Reason insurance .

Doubled medical insurance limits.

Adventure sports coverage.

Rental car insurance .

AD&D coverage for flights.

Doubled emergency evacuation and repatriation limits.

As of summer 2023, Travel Select also includes unique additional coverage options like:

Organ donating.

Attending childbirth.

School extension.

Cancel for business reasons.

Theft of travel documents.

This option is for travelers who make plans last-minute or who don't need benefits like trip cancellation because they have few prepaid expenses.

While it still provides coverage for unexpected travel situations, its limits are lower than the more robust Travel Basic and Travel Select plans. This plan’s coverage begins on the day you depart for your trip.

The Travel Med plan also allows you to add on rental car coverage if you need it.

» Learn more: Is Cancel For Any Reason travel insurance worth it?

Domestic trips: Travel America

Travelex has a United States-specific insurance plan, Travel America, which is valid for a maximum of 14 days. Here’s how coverage for this policy breaks down.

» Learn more: How travel insurance for domestic vacations works

Flight insurance plans: Flight Insure and Flight Insure Plus

If you’re looking for a policy that’ll reimburse you primarily for unexpected flight incidents, the Flight Insure or Flight Insure Plus options may be more your speed.

For these quotes, we used the same 43-year-old Texan heading to Switzerland. The Flight Insure policy came in at $19 (0.38% of the trip cost), while the Flight Insure Plus plan charged $25 (0.5% of the trip cost) for the vacation.

Here are the plan’s benefits and coverage limits.

» Learn more: How does travel insurance work?

While many situations are covered by Travelex’s insurance policies, there are some events that aren’t. These include:

Bad weather, including hurricanes if the policy was purchased after the storm was named.

Traveling for the purpose of receiving medical treatment.

Pre-existing medical conditions (unless you purchase a plan with a waiver).

Intentionally-inflicted injuries or suicide.

Psychological disorders.

High-risk or irresponsible behavior, including drug or alcohol use or committing illegal acts.

War, civil unrest and pandemics.

To find the full list of exclusions for your specific policy, be sure to review the plan’s benefits schedule.

» Learn more: What to know before buying travel insurance

Picking a Travelex plan online is simple. To do so, you’ll want to navigate directly to Travelex’s website . The homepage will include a search bar into which you can input your information.

Once done, clicking the Get Quote button will generate plan options from which to choose. Here you’ll be able to toggle through the different plans, whether you’re looking for comprehensive coverage, post-departure coverage only or just flight accident coverage.

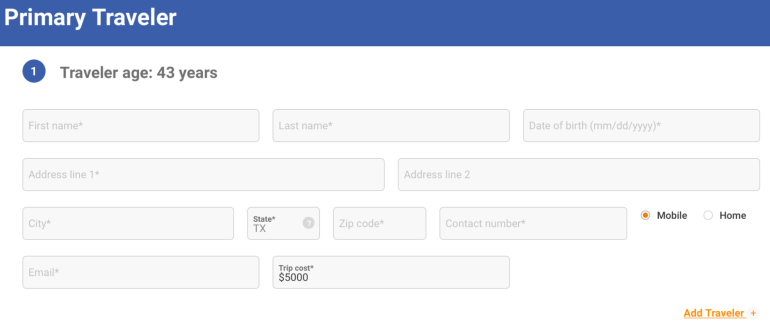

After you’ve chosen your plan, you’ll be given the option to select add-ons, including things like rental car insurance, Cancel For Any Reason coverage and adventure sports waivers. You’ll then go through the checkout process, which will include filling in your personal information and providing details about your travel plans.

From there, you’ll be taken to the payment page. Once you’ve paid, your policy becomes active.

» Learn more: 6 common travel insurance myths

With several plans from which to choose — and even more add-on options — it may be overwhelming trying to pick a policy that suits your needs. Here are some recommendations:

For family vacations . The Travel Select plan includes coverage for your children as well as you, which can save you a lot of money if your plans are interrupted.

For short-term domestic travel . The Travel America plan is low-cost and provides comprehensive benefits, including emergency medical coverage.

For moderate coverage and cheap costs . The Flight Insure Plus plan still offers emergency medical, baggage delay and missed connection coverage while charging a bare minimum.

For those without many prepaid expenses. The Travel Med plan is great for those who don’t need trip cancellation protection but still want coverage while traveling.

Travelex may offer a plan that makes sense, but many travel credit cards also offer complimentary travel insurance . Before buying travel insurance, do your due diligence to decide which option is the right move for you.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $1,125 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

- Business Partners

Buy Travel Insurance for Your Trip

Help protect your vacation investment

You dream. You plan. You save. Even the best laid travel plans can be affected by trouble at home, medical emergencies, lost luggage, flight delays or severe weather. Customers buy travel insurance and assistance plans from Generali Global Assistance to help protect vacation investments from certain unforeseen events that could upset travel plans and cost you.

To buy travel insurance for your trip, cruise or vacation visit the Generali Travel Insurance booking website .

Get A Quote

Why Buy Travel Insurance?

Problems happen more often than you think. One in six U.S. adults reported having to cut a trip short or change travel plans. And of those affected, only 22% had travel insurance, according to a recent U.S. Travel Insurance Association survey. 1

Travel protection plans include coverages and services that can help you before, during and after your trip:

- Trip Cancellation coverage

- Trip Interruption coverage

- Travel Delay

- Baggage Loss and Delay

- Medical and Dental coverage

- Emergency Assistance and Transportation

- 24-Hour Emergency Assistance Services Hotline

- Concierge Services

- Identity Theft Resolution Services

Buy Travel Insurance with a Free Look Period

We proudly stand behind our products and services. That’s why we offer a 10-day free look period . If you aren’t completely satisfied with your travel protection plan, you can cancel your purchase within 10 days and receive a full refund, as long as you haven’t left for your trip or filed a claim.

Still not convinced? See ratings and reviews from verified Generali Global Assistance customers.

After what we endured on this trip, it is nice to deal with a service-oriented company! - Richard M. from Rochester, MN

Travel Protection Plans are administered by Customized Services Administrators, Inc., CA Lic. No. 821931, located in San Diego, CA and doing business as CSA Travel Protection and Insurance Services and Generali Global Assistance & Insurance Services. Plans are available to residents of the U.S. but may not be available in all jurisdictions. Benefits and services are described on a general basis; certain conditions and exclusions apply. Travel Retailers may not be licensed to sell insurance in all states, and are not authorized to answer technical questions about the benefits, exclusions, and conditions of this insurance and cannot evaluate the adequacy of your existing insurance. This Plan provides insurance coverage for your trip that applies only during the covered trip. You may have coverage from other sources that provides you with similar benefits but may be subject to different restrictions depending upon your other coverages. You may wish to compare the terms of this Plan with your existing life, health, home and automobile policies. The purchase of this Plan is not required in order to purchase any other travel product or service offered to you by your travel retailers. Travel retailers receive payment from CSA related to the offer of travel insurance. If you have any questions about your current coverage, call your insurer, insurance agent or broker. This notice provides general information on CSA’s products and services only. The information contained herein is not part of an insurance policy and may not be used to modify any insurance policy that might be issued. In the event the actual policy forms are inconsistent with any information provided herein, the language of the policy forms shall govern.

JavaScript has been disabled on this browser. For a seamless experience, please enable the option to run JavaScript on this device

Log in to pay bills, manage policies, view documents, company news, materials & more.

Individuals

Private client group.

Policyholders in the U.S. can make online payments.

Workers’ Compensation (AIG Go WC)

Access workers’ compensation claims information, including FAQs, payments, prescription data, doctor information, and more.

Report a Claim

Report Aerospace, Commercial Auto, General Liability, Property, and Workers’ Compensation claims.

Dental, Group Life, and AD&D Claims

Employers and employees can access claim forms, claim reports, and information on claim status.

IntelliRisk Advanced

Clients and brokers can file claims, manage risks, and access claims data from 100+ countries.

myAIG Client Portal for Multinational

Track the status of controlled master programs, view policy details, download policy documents, access invoices, and more.

AIG Multinational Insurance Fundamentals

Receive free, accredited online training in multinational risk assessment and program design.

Brokers & Agents

Myaig portal for north america.

Generate loss runs, download policy documents, access applications and tools, and more.

myAIG Portal for Multinational

U.s. producer appointment and licensing.

Submit requests to become an AIG appointed brokerage/agent, expand or terminate your current AIG appointment.

Risk Managers

Log in to pay bills, manage policies, view documents, company news, materials & more.

- INDIVIDUALS

- BROKERS & AGENTS

- RISK MANAGERS

AIG Travel Guard

Get a quote in less than two minutes and travel with more peace of mind.

Travel Guard Plans

Compare coverage levels and pricing on our most popular plans with our product comparison tool—and find a Travel Guard plan that’s right for you.

Deluxe Plan

Our top-of-the-line, comprehensive travel coverage that sets the standard.

Preferred Plan

A comprehensive travel plan with superb coverage and service from start to finish.

Essential Plan

Savvy coverage for the budget-minded traveler.

Pack N' Go Plan

Immediate coverage for unplanned trips and adventures

Annual Travel Insurance Plan

Year-round coverage for your travel investments.

Millions of travelers each year trust AIG's Travel Guard to cover their vacations

Travel insurance plans provide coverage for certain costs and losses associated with traveling. Travel Guard ® helps you navigate canceled flights, lost bags, sudden health emergencies, and much more—almost anywhere in the world. Whether you’re planning a two-day getaway, a cruise, an adventure vacation, or a month-long international holiday, our plans help cover travelers and their trip inverstments.

Education Center

Sort through common questions about travel insurance

Traveler Resources

Safety information and travel tips for travelers

Preparing travelers wherever their journey takes them

AIG Travel CEO Jeff Rutledge shares how the underlying risks of travel have changed and what AIG is doing to help companies and individuals manage risks.

Coverage available to residents of U.S. states and the District of Columbia only. These plans provide insurance coverage that only applies during the covered trip. You may have coverage from other sources that provides you with similar benefits but may be subject to different restrictions depending upon your other coverages. You may wish to compare the terms of each policy with your existing life, health, home, and automobile insurance policies, as well as any other coverage which you may already have or is available to you, including through other insurers, as a member of an organization, or through your credit card program(s). If you have any questions about your current coverage, call your insurer or insurance agent or broker. Coverage is offered by Travel Guard Group, Inc .(Travel Guard). California lic. no. 0B93606, 3300 Business Park Drive, Stevens Point, WI 54482, www.travelguard.com. CA DOI toll free number: 800-927-HELP.

This is only a brief description of the coverage(s) available. The policy will contain reductions, limitations, exclusions and termination provisions. Insurance underwritten by National Union Fire Insurance Company of Pittsburgh, Pa., a Pennsylvania insurance company, with its principal place of business at 1271 Ave of the Americas, Floor 41, New York, NY, 10020-1304. It is currently authorized to transact business in all states and the District of Columbia. NAIC No. 19445. Coverage may not be available in all states.

Related Content

COVID-19 Updates

Corporate Accident & Health Insurance

Insurance for Individuals and Families

DO NOT SELL OR SHARE MY PERSONAL INFORMATION

The California Consumer privacy Act gives California residents the right to opt-out of the sale or sharing of their personal information. A "sale" is the exchange of personal information for payment or other valuable consideration and includes certain advertising and anatytics practices. "Sharing" means the disclosure of personal information for behavioral advertising purposes, where the informatirm used to serve ads is collected across different online services.

Opt-out from the sale or sharing of your personal information.

Your request to opt out will be specific to the browser from which you submit your request, and you will need to submit another request from any other browser you use to accessour website. Additionally, if you clear cookies from your browser after submitting an opt-out request, you will clear the cookie that we used to honor your request. For this reason, you will have to submit a new opt-out request.

For information about our privacy practices, please review our Privacy Notice .

Thank you. We have received your request to opt out of the sale/sharing of personal information.

More information about our privacy practices.

- Today's Deals

- Sign Up & Save!

- Top Cruise Destinations

- Alaska Cruises

- Bahamas Cruises

- Bermuda Cruises

- Caribbean Cruises

- Europe Cruises

- Mexico Cruises

- 1.800.764.7419

Never Miss a Cruise Deal

- Thank you for signing up!

- Click here to learn more about our specials.

Have Fun. Be Safe

- Health Protocols and Requirements for Sailing

Travel Documentation and Online Check-in

- Travel Documents

- Online Check-In

Getting There

- Cruise Terminal Information and Parking

- Airport and Pier Transportation

- Air Information

Before You Board

- Embarkation Day Check-In

Youth and Family

- Youth Programs (Under 2 and 2-11 years old)

- Teen Programs (12-17 years old)

- Carnival's Seuss at Sea

- Age Policies

Things to Know

Onboard experiences.

- Shore - Excursions

- Spa and Fitness

- Outdoor Fun

- Entertainment and Activities

- For Your Convenience

- Onboard Guidelines and Policies

- Past Guest Recognition Programs

Onboard Celebrations

- The Fun Shops

- Special Occasions

- Wedding Cruises and Vow Renewals

Dining and Beverages

- Dining and Snacking Options

- Dining Rooms

- CHEERS! Beverage Program

- Liquor and Beverage Policy

Onboard Communication

- WI FI Service and Carnivals HUB App

- Staying Connected

Money and Gratuities

- Gratuities (Tips)

- Sail & Sign Onboard Account

- Forms of Payment

- Cruise Cash/Bar/Photo

- Financial Access

Shipboard Health and Safety

- Passenger Bill of Rights

- Guest Screening Policy

- Safety and Security

- Safety Briefing - Muster Station Drill

- General Health Information

- Privacy Notice

- What to Pack

- Cruise Ticket Contract

- Carnival Vacation Protection

- Guests with Disabilities

- Choosing Your Cruise

- Tech Support

- Early Saver Promotion

- Minors / Infants / Pregnancy

- Making changes to your booking

- Carnival EasyPay

- Financing Powered by Uplift

- US Department of State Travel Tips

- And more things to know....

Debarkation - After Your Cruise

- Preparing to Go Home

- Post Cruise Inquiries

Medical Services

Should a guest require medical attention while aboard one of our vessels, the Medical Center staff is available to assist 24 hours a day. The on board medical centers are staffed and equipped to treat routine medical conditions as well as to initiate stabilization of more serious conditions. Physicians are available to render services at a customary fee. While at sea or in port, the availability of medical care may be limited.

Medical Center Hours The Medical Center has daily office hours which are listed in the HUB App. The medical staff is on call 24 hours a day for emergencies. Routine hours are subject to temporary change due to extenuating circumstances:

- Embarkation day: 8:00am-9:00am and 3:00pm-5:00pm

- Sea days: 9:00am-12:00pm and 3:00pm-6:00pm

- Port days: 8:00am-10:00am and 4:00pm-6:00pm

A charge for medical services will be billed to the guest's Sail & Sign® Account and a receipt will be provided for the guest to submit to their medical insurance provider upon return for possible reimbursement.

The physicians on board are independent contractors and are entitled to render services at a customary fee which may vary from ship to ship based on the time of day. The basic fee does NOT include medication, tests or treatment.

Note: Guests who purchased Carnival Vacation Protection™ may be eligible for reimbursement of up to $10,000 for covered medical-related expenses and up to $30,000 for necessary Emergency Medical Evacuation expenses should they become ill or injured or require medical evacuation while on their cruise vacation. The medical benefits are secondary to coverage the guest may have through their regular health insurance provider(s). Refer to https://www.carnival.com/about-carnival/vacation-protection.aspx for additional details.

Medication Over-the-Counter medications for cold, cough, upset stomach or other minor illnesses can be purchased at the Medical Center during business hours. In addition, the shops on board may carry some of these items. Prescription drugs and vitamins may not be readily available, either on board the ship or in the ports.

Meclizine, motion sickness pills can be purchased at the Medical Center, Guest Services or through Room Service. The cost is $3.29 USD for four pills. We do not carry motion sickness patches or wristbands. A motion sickness injection is available for a fee at the Medical Center but will only be administered to those who are actively vomiting and not as a preventative measure.

Diabetes/Medicine Storage

Staterooms on a number of ships are equipped with non-stocked mini bar units which are designed to maintain the temperature of beverages. Please do not use them to store medications that have specific temperature requirements. Should you need to store medicine that needs proper refrigeration, medi-coolers are available on board in limited quantities, and on a first come, first serve basis - please visit our Guest Services Desk once on board; a $75 refundable deposit is required. If a medi-cooler is not available, our ship’s Medical Center will arrange storage - please contact them once on board. Note: A small, personal-sized cooler no larger than 12” x 12” x 12” for the purpose of housing medications is permitted as carry-on luggage.

Medical Staffing and Equipment In order to maintain a safe and comfortable environment for our guests, our medical centers meet or exceed the standards established by the Cruise Lines International Association (CLIA) and the American College of Emergency Physicians (ACEP).

Our medical centers are staffed by qualified physicians and nurses who are committed to providing the highest quality of shipboard medical care. Medical staffing is correlated to the size of the ship and varies from one physician and three nurses to as many as two physicians and five nurses.

Ship’s physicians meet or exceed the credentialing guidelines established by the cruise ship medicine section of the American College of Emergency Physicians (ACEP). In addition, doctors must demonstrate competent skill levels and hold current certification in basic and advanced cardiac life support and cardiac care, have experience in general medicine or general practice including emergency or critical care, and have one to three years clinical experience and minor surgical skills, and board or similar international certification is preferred. The doctors on board are independent contractors.

Shipboard medical facilities are set up to provide reasonable emergency medical care for guests and crew. In cases of extreme emergency where more comprehensive facilities are required, patients are referred to shoreside facilities.

In addition to standard lifesaving equipment such as defibrillators and external pacemakers, our medical centers carry some of the latest in medical technology including thrombolytic therapy, electrocardiograph machines, lab equipment, pulse oximetry and x-ray machines on many of our ships.

Was this answer helpful?

Answers others found helpful.

- Health Concerns

- Shipboard Staffing and Equipment / Medical Emergencies

- Motion Sickness / Sea Sickness – What to Take

- Cellular Phone Service

PLAN A CRUISE

- Search Cruises

- Travel Agent Finder

- Weddings & Occasions

- Carnival Mastercard

- Away We Go Blog

Group Travel

- Group Shore Excursions

Already Booked

- Manage My Cruises

- Shore Excursions

- In-Room Gifts & Shopping