- Travel, Tourism & Hospitality ›

- Leisure Travel

Online travel market - statistics & facts

How big is the online travel market, what are the leading online travel agencies (otas), what travel products do consumers book online, key insights.

Winter is here! Check out the winter wonderlands at these 5 amazing winter destinations in Montana

- Travel Tips

How Online Travel Agencies Have Changed The World

Published: November 29, 2023

Modified: December 28, 2023

by Vonny Pedersen

- Hotel Reviews

- Plan Your Trip

- Sustainability

Introduction

Traveling has always been an exhilarating experience, allowing people to explore new destinations, immerse themselves in different cultures, and create memories that last a lifetime. In the past, planning a trip involved tedious tasks such as contacting travel agents, researching accommodations, and arranging transportation. However, with the advent of online travel agencies (OTAs), the way we plan and book our adventures has undergone a dramatic transformation. OTAs have revolutionized the travel industry, providing a convenient digital platform for travelers to browse, compare, and book various travel services all in one place. These platforms offer a wide range of options, from flights and hotels to car rentals and vacation packages, allowing travelers to customize their trips according to their preferences and budget. Gone are the days when travelers had to rely solely on traditional brick-and-mortar agencies. Online travel agencies have made the process of booking travel more accessible, streamlined, and efficient. With just a few clicks, travelers can access a vast array of options, read reviews from fellow travelers, and make informed decisions about their travel plans.

Evolution of Online Travel Agencies

The rise of online travel agencies can be traced back to the late 1990s when the internet became widely accessible to the general public. The first wave of OTAs, such as Expedia and Travelocity, emerged during this time, offering users the ability to search for and book flights, hotels, and other travel services online. These early platforms laid the foundation for the online travel industry we know today. As technology advanced, OTAs evolved to meet the changing needs of travelers. They began offering more comprehensive travel services, including vacation packages, car rentals, and activities. This shift allowed users to plan and book their entire trip from a single online platform, eliminating the need to visit multiple websites or contact various service providers. Furthermore, as mobile devices became increasingly prevalent, OTAs expanded their platforms to include mobile applications, making it even more convenient for travelers to access and book their trips on the go. Today, most leading OTAs have user-friendly mobile apps that offer the same functionalities as their desktop websites, providing a seamless user experience across different devices. In recent years, OTAs have also embraced emerging technologies such as artificial intelligence (AI) and virtual reality (VR) to enhance the user experience. AI-powered chatbots and virtual assistants are now common features on OTA platforms, providing personalized recommendations, answering queries, and assisting with booking processes. VR technology allows travelers to virtually explore destinations and accommodations before making a decision, further enhancing their confidence and satisfaction with their travel choices. Overall, the evolution of online travel agencies has revolutionized the way we plan and book our trips. The convenience, accessibility, and technological advancements offered by OTAs have made travel more accessible to a wider audience, empowering individuals to embark on new adventures and explore the world in ways that were once unimaginable.

Impact on Travel Industry

The emergence of online travel agencies (OTAs) has had a profound impact on the travel industry, transforming the way people plan, book, and experience their trips. The following are some key ways in which OTAs have influenced the travel industry:

- Increased Accessibility: OTAs have made travel more accessible to a wider audience, breaking down barriers and empowering individuals to explore new destinations. With just a few clicks, travelers can access a vast array of options, compare prices, and make informed decisions about their travel plans.

- Disintermediation: OTAs have disrupted the traditional distribution channels of the travel industry. In the past, travelers relied heavily on travel agents, who acted as intermediaries between travelers and airlines, hotels, and other service providers. With the advent of OTAs, travelers can now directly book their flights, accommodations, and other services, bypassing the need for intermediaries.

- Competitive Pricing: The rise of OTAs has fostered increased competition among service providers, leading to more competitive pricing in the travel industry. OTAs allow travelers to compare prices from various providers, ensuring that they get the best deal possible. This has forced service providers to offer more competitive prices and incentives to attract customers.

- Market Transparency: OTAs have brought transparency to the travel market by providing travelers with access to information and reviews from fellow travelers. This enables travelers to make informed decisions about their travel plans and ensures that service providers maintain high standards to attract positive reviews.

- Global Reach: OTAs have expanded travel options by offering a wide range of destinations and accommodations from around the world. Travelers are no longer limited to popular tourist destinations; they can now explore lesser-known locations and discover unique experiences.

Overall, the impact of online travel agencies on the travel industry has been transformative. They have democratized travel, making it more accessible, competitive, and transparent. Travelers now have the power to plan and customize their trips according to their preferences and budget, while service providers have to adapt and innovate to meet the evolving demands of the market.

Increased Convenience for Travelers

One of the significant advantages of online travel agencies (OTAs) is the increased convenience they offer to travelers. With the click of a button, travelers can access a myriad of options, compare prices, and book their travel arrangements. Here are several ways in which OTAs have enhanced convenience for travelers:

- 24/7 Access: OTAs are available 24/7, allowing travelers to plan and book their trips at any time that is convenient for them. There is no longer a need to adhere to traditional business hours or wait for travel agencies to open.

- One-Stop Shop: OTAs serve as a one-stop-shop for all travel needs. Travelers can search for flights, accommodations, car rentals, and even activities or tours, all on the same platform. This eliminates the need to visit multiple websites or make separate inquiries for each component of the trip.

- Flexible Booking: OTAs offer flexibility in terms of booking. Travelers can easily modify their travel plans, change flight dates, or upgrade hotel rooms online without the hassle of contacting various service providers individually. This convenience makes it easier for travelers to adapt to shifts in their schedules or preferences.

- Mobile Accessibility: Most OTAs provide mobile applications, allowing travelers to access their platforms from smartphones or tablets while on the go. This makes it incredibly convenient for travelers to search for and book travel arrangements, even while in transit.

- Real-Time Updates: OTAs provide real-time updates on flight schedules, hotel availability, and other travel-related information. This ensures that travelers have the most up-to-date information at their fingertips, allowing them to make informed decisions and respond to any changes or disruptions in their travel plans.

- Secure Online Transactions: OTAs prioritize the security of online transactions, providing encrypted payment gateways and secure booking processes. This gives travelers peace of mind, knowing that their personal and financial information is protected.

Overall, the increased convenience offered by online travel agencies has transformed the way travelers plan and book their trips. With the ability to access a wide range of options, make changes on the fly, and have real-time information at their disposal, travelers can now enjoy a smoother and more convenient travel experience.

Comparison Shopping and Competitive Pricing

One of the significant advantages of using online travel agencies (OTAs) is the ability to engage in comparison shopping and take advantage of competitive pricing. OTAs have revolutionized the way travelers search for and book travel arrangements by providing a platform that allows them to compare prices from multiple service providers. Here’s how comparison shopping and competitive pricing benefit travelers:

- Wide Range of Options: OTAs aggregate a vast array of travel options, including flights, hotels, car rentals, and vacation packages, from various providers. This gives travelers access to a wide range of options in terms of destinations, dates, and amenities.

- Transparent Pricing: OTAs provide transparent pricing, allowing travelers to see the costs associated with different travel services upfront. They display the total price, including taxes and fees, making it easier for travelers to compare and evaluate the value they will receive for their money.

- Instant Price Comparison: With just a few clicks, travelers can compare prices from different providers for the same travel service, such as a flight or hotel. This saves time and effort, as they can quickly identify the most competitive options and make informed decisions.

- Bargain Hunting: OTAs often offer exclusive discounts, promotional deals, and special packages that are not available elsewhere. This allows travelers to find the best bargains and secure cost-effective travel arrangements that suit their budget.

- Dynamic Pricing: Many OTAs leverage dynamic pricing algorithms that adjust prices based on supply and demand. This means that travelers can find varying prices for the same service depending on factors such as time of booking, availability, and popularity. Keeping an eye on price fluctuations can lead to significant savings.

- User Reviews and Ratings: OTAs also provide user-generated reviews and ratings for hotels, airlines, and other services. Travelers can read these reviews to gauge the quality and value of different options, helping them make more informed decisions based on the experiences of previous customers.

Overall, the ability to compare prices and take advantage of competitive pricing offered by online travel agencies gives travelers the power to find the best deals and maximize the value of their travel budget. Whether it’s scoring discounted flights, securing affordable accommodations, or finding budget-friendly vacation packages, comparison shopping through OTAs ensures that travelers can make cost-effective choices without compromising on quality or convenience.

Expansion of Travel Options

Online travel agencies (OTAs) have greatly expanded the travel options available to travelers, offering a vast array of destinations, accommodations, and experiences that were previously difficult to access. Here are several ways in which OTAs have expanded travel options:

- Global Reach: OTAs have opened up travel opportunities to destinations all around the world. Travelers can now explore and book flights, accommodations, and activities in lesser-known or remote areas, expanding their travel horizons beyond traditional tourist hotspots.

- Diverse Accommodation Options: OTAs offer a wide range of accommodations to suit various preferences and budgets. Travelers can choose from luxury hotels, boutique bed and breakfasts, vacation rentals, hostels, and more, ensuring that there is an option available for every type of traveler.

- Unique Experiences: OTAs provide access to unique travel experiences that go beyond simply booking flights and hotels. Travelers can now discover and book activities such as guided tours, cooking classes, adventure sports, cultural immersions, and wildlife expeditions, enhancing their travel experiences and creating lasting memories.

- Package Deals: OTAs often offer packaged travel deals that combine flights, accommodations, and activities into one convenient bundle. These packages provide travelers with an all-in-one solution and sometimes include added perks, such as discounted rates, complimentary meals, or guided tours.

- Flexible Travel Planning: OTAs allow travelers to customize their itineraries and create unique travel plans. Travelers can choose the duration of their stay, select specific dates, and even tailor their activities to suit their interests and preferences. This flexibility enables travelers to plan trips that suit their individual needs and desires.

- Specialized Travel: OTAs cater to various niche markets, offering specialized travel options such as eco-tourism, adventure travel, family-friendly vacations, solo travel, and more. This ensures that travelers with specific interests can find relevant options that align with their travel preferences.

Overall, the expansion of travel options provided by online travel agencies has made it easier for travelers to explore diverse destinations, find accommodations that suit their needs, and discover unique experiences that make their trips truly memorable. Whether it’s embarking on a safari in Africa, staying in a traditional ryokan in Japan, or indulging in a culinary tour of Europe, OTAs have made it possible for travelers to create their dream trips and embark on new adventures.

Rise of User Reviews and Ratings

The rise of online travel agencies (OTAs) has coincided with the proliferation of user reviews and ratings, which play a significant role in shaping the travel industry. Travelers now have access to a wealth of information and firsthand experiences shared by fellow travelers, allowing them to make more informed decisions. Here’s how user reviews and ratings have impacted the travel industry:

- Transparency and Trust: User reviews and ratings provide transparency in the travel industry. Travelers can read about the experiences of others, gain insights into the quality of accommodations, airlines, and other services, and make informed decisions based on real-life experiences. This transparency builds trust between travelers and service providers.

- Unbiased Feedback: User-generated reviews are seen as unbiased and trustworthy because they come from real travelers who have experienced the services firsthand. This enables travelers to get a more authentic and balanced perspective on the quality of the services they are considering.

- Quality Assurance: Positive reviews and high ratings act as endorsements for service providers. Accommodations, airlines, and other travel services that consistently receive positive feedback and high ratings are perceived as offering quality experiences, which can attract more customers.

- Improving Service Quality: User reviews and ratings provide valuable feedback for service providers, highlighting areas of improvement and commendation. Service providers can analyze the feedback and make necessary adjustments to enhance the quality of their offerings, ultimately benefiting future travelers.

- Enhanced Customer Satisfaction: User reviews give travelers a platform to express their opinions and share their experiences. Positive reviews can reinforce the satisfaction and happiness experienced by travelers, while negative reviews can help address any issues or concerns and improve the overall customer experience.

- Personalized Recommendations: OTAs can use user reviews and ratings to provide travelers with personalized recommendations based on their preferences. By analyzing past reviews and understanding a traveler’s preferences, OTAs can suggest accommodations, activities, or destinations that align with their interests.

As user reviews and ratings continue to grow in importance, the travel industry is incentivized to consistently deliver exceptional customer experiences, as a negative review can have a significant impact on a service provider’s reputation and business. Travelers, on the other hand, have become more discerning and empowered, relying on user feedback to make decisions that align with their expectations and preferences.

Challenges Faced by Online Travel Agencies

While online travel agencies (OTAs) have brought significant advancements to the travel industry, they also face several challenges. These challenges can impact their operations, customer satisfaction, and overall success. Here are some key challenges faced by OTAs:

- Competition: The online travel industry is highly competitive, with numerous OTAs vying for customers’ attention. Competing with other established players, as well as emerging startups, requires OTAs to constantly innovate, provide unique offerings, and differentiate themselves to attract and retain customers.

- Price Comparison: Price comparison is both a benefit and a challenge for OTAs. While it allows travelers to find the best deals, it also makes it easier for customers to find cheaper options on different platforms. This puts pressure on OTAs to continuously offer competitive pricing and value-added services to stay ahead.

- Dependency on Suppliers: OTAs heavily rely on collaborations with airlines, hotels, car rental companies, and other service providers to offer comprehensive travel options. Changes in terms, contract disputes, or disruptions in the supplier’s operations can impact the availability and reliability of services, and consequently, the OTA’s reputation.

- Technical Challenges: OTAs need to manage complex technical infrastructure to ensure seamless booking processes, real-time inventory updates, and secure payment transactions. Managing website uptime, handling high traffic volumes, and addressing potential cybersecurity threats requires continuous investment in technology and skilled IT resources.

- Customer Service: Providing efficient and prompt customer service can be challenging for OTAs due to the volume of customers and the potential for issues with bookings, cancellations, or refunds. Ensuring customer satisfaction and resolving complaints promptly is vital to maintain a positive brand image and retain customer loyalty.

- Dependency on Online Advertising: OTAs heavily rely on online advertising channels to drive traffic to their platforms. This not only requires significant financial investment but also means competing against other companies for ad space and managing advertising costs to ensure an adequate return on investment.

- Regulatory Compliance: The travel industry is subject to various regulations and licensing requirements, which can differ across different countries and regions. Compliance with local laws, taxes, and regulations can be complex and time-consuming for OTAs operating globally.

Despite the challenges, OTAs have demonstrated their resilience and adaptability in the face of evolving market dynamics. By staying updated with the latest trends, investing in technology, offering exceptional customer service, and fostering strong partnerships with service providers, OTAs can overcome these challenges and continue to shape the travel industry.

Online travel agencies (OTAs) have revolutionized the travel industry, providing unprecedented convenience, access to a wide range of options, and the ability to make informed decisions. The evolution of OTAs has transformed the way we plan, book, and experience our trips, making travel more accessible, transparent, and tailored to individual preferences. By harnessing the power of the internet and digital technology, OTAs have expanded travel options, allowing travelers to explore destinations and accommodations beyond traditional tourist hotspots. They have also facilitated comparison shopping and competitive pricing, empowering travelers to find the best deals and make cost-effective choices. Furthermore, the rise of user reviews and ratings has brought transparency and trust to the travel industry. Travelers can now rely on the unbiased feedback of fellow travelers to make informed decisions, while service providers are incentivized to maintain high standards and continuously improve their offerings to satisfy customers. However, OTAs are not without challenges. They face fierce competition, technical complexities, and the need to ensure reliable partnerships with service providers. Additionally, customer service and regulatory compliance are vital considerations for successful operations. Despite these challenges, OTAs continue to innovate and adapt, leveraging technologies such as artificial intelligence and virtual reality to enhance the customer experience. By staying ahead of market trends and investing in customer satisfaction, OTAs can continue to shape the travel industry and provide travelers with seamless, convenient, and personalized travel solutions. In conclusion, the emergence of online travel agencies has transformed travel planning and booking, offering travelers unprecedented convenience, access to a wide range of options, and the ability to make informed decisions. As the travel industry continues to evolve, OTAs will play a crucial role in shaping the future of travel, meeting the needs and expectations of travelers around the world.

- Privacy Overview

- Strictly Necessary Cookies

This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings.

If you disable this cookie, we will not be able to save your preferences. This means that every time you visit this website you will need to enable or disable cookies again.

Online Travel Agencies Market Share Across the World

The OTA market in North America

The ota market in south america, the ota market in europe, the ota market in apac.

- What are the Top online travel agencies in the world?

Would you prefer to listen rather than read?👇🏼🎧

The rise of online travel agencies (OTAs) is one of the most dramatic examples of the digital transformation of business and society over the last 25 years. The travel industry growth statistics are very favorable as well and OTAs are taking advantage.

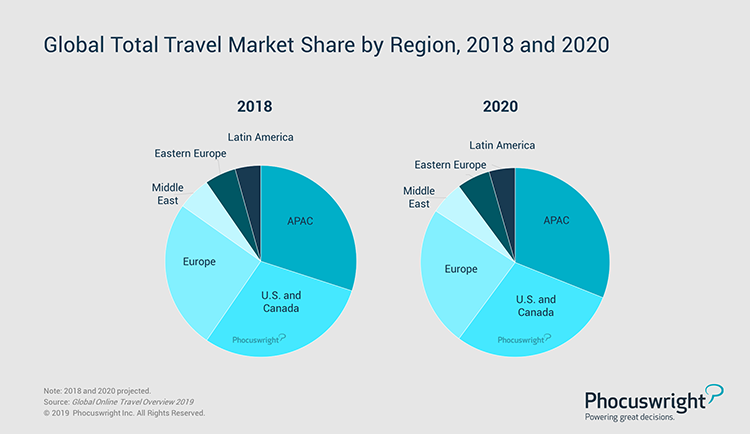

In a relatively short space of time, OTAs – from giants such as Booking.com, Expedia and Trip.com to the estimated 400 smaller players – have captured an average of 40% of the total global travel market (hotels, airlines, packaged tours, rail and cruises), according to research by PATA . It is essential to know how many people travel a year and who manages their travel arrangements.

OTAs have evolved into digital marketplaces that connect both B2B and B2C customers directly with a full range of travel products. In fact, OTAs can be viewed as a hybrid of an e-commerce platform and a travel agency.

Although OTAs have certainly taken market share from traditional travel agents, they have not replaced them. In many travel markets across the world, OTAs and traditional travel agencies co-exist because they perform different roles.

Many tourism businesses (hotel groups, tour operators, visitor attractions etc…) will use OTAs for a percentage of their distribution while using traditional travel agencies for specific segments – perhaps an older demographic or consumer groups who are less comfortable using travel tech .

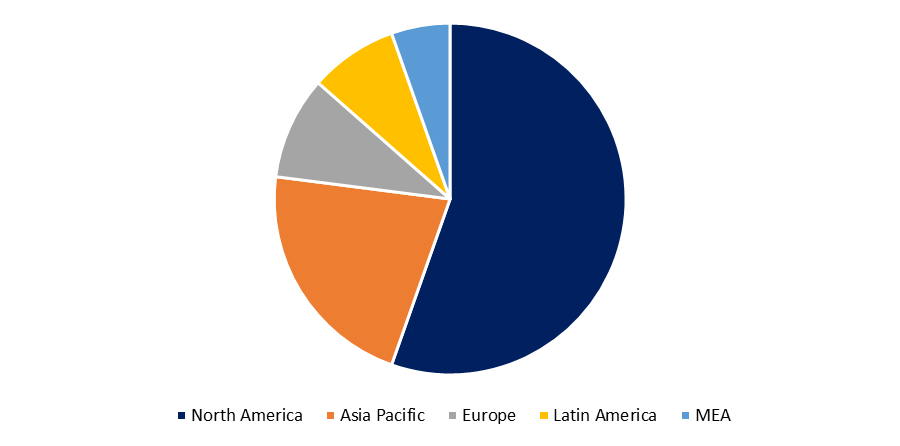

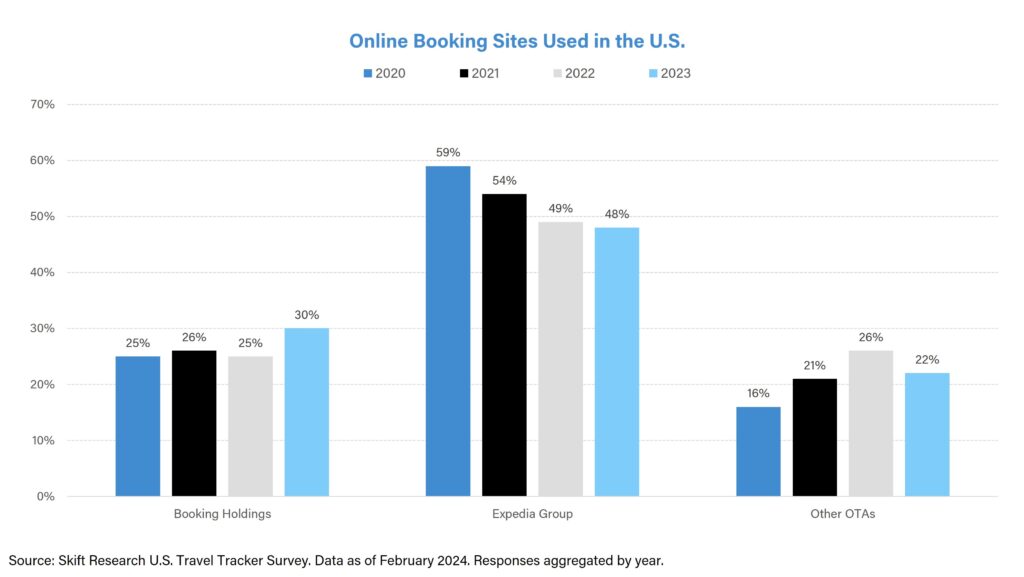

The United States is the largest travel market in the world, accounting for $2.1 trillion in 2019 . In the same year, the number of international tourist arrivals to the U.S. reached nearly 80 million after being on the increase for more than a decade. The two OTA giants, Expedia and Booking Holdings, continue to dominate in the US, representing 92% of the OTA market , says Phocuswright , although US online travel agency bookings fell sharply by 59% during 2020 as a result of the global pandemic.

Despegar , BestDay.com , and Price Travel are the main OTA players in South America . OTAs are top of the list for consumers looking for flights and accommodations in Argentina, and for accommodation in Mexico.

On the other hand, search engines are the number one channel to start searching for flights and accommodations in Brazil and for flights in Mexico, says a 2020 survey .

Although South America has been particularly hard hit by the global pandemic, one positive trend across the region’s travel market is the continued growth of online distribution.

Internet access is expanding significantly – Argentina boasts a 92% internet penetration rate , while Mexico’s mobile internet penetration jumped from 36% to 55% in 2019 , second only to Uruguay in South America. As a result, South American online travel revenue rose in 2019.

OTAs: Lead the Global Market!

Utilize our Fintech Suite for growth. Stay ahead in the competitive travel industry.

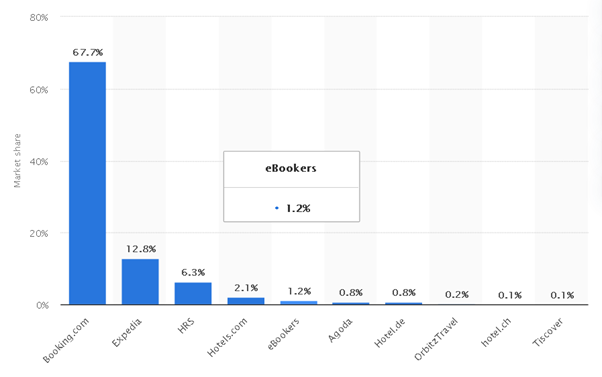

Chart 1: OTA market share in Europe in 2019

Booking.com is the biggest player in the European OTA market with a 67.7% share in 2019, according to Statista. Expedia and HRS had the second and third largest shares of the market, at 12.8% and 6.3% respectively.

Taking a look at individual countries, the UK’s online travel market is the largest in Europe , and the country’s online travel penetration is among the highest in the world, according to Phocuswright . Compared to Continental Europe, OTAs themselves play a smaller role in the UK market. In 2020, online supplier-direct booking share of the total market remained at 51% , while OTA share increased one percentage point to 18%.

In Spain, by comparison, OTAs accounted for 29.9% of the country’s travel market, making it one of the most popular booking distribution channels in Europe. Spain is home to a number of successful OTAs, including B2B bedbank Hotelbeds , which has its headquarters in Palma de Mallorca, and eDreams and Altrapálo , both based in Barcelona.

At $44.7 billion, China had the world’s second-biggest OTA market in 2018 , compared to the US at $77.1 billion, and its 27% growth compared to 2017 was more than four times that of the US, according to Phocuswright .

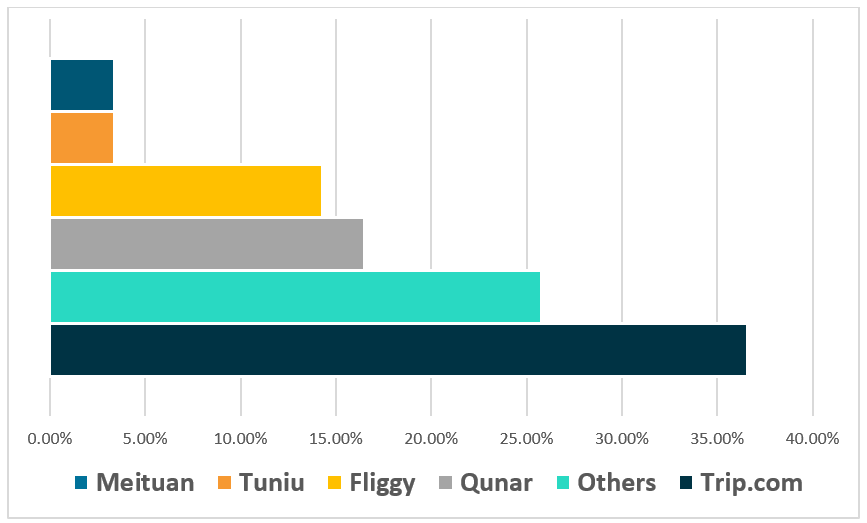

Trip.com ( formerly known as Ctrip) is the largest OTA in China with a 36.6% share of the online travel market. In next place comes Qunar (also owned by the Trip.com Group) with a 16.5% share. One of the key competitors to Trip.com’s dominance is Fliggy , which is owned by Alibaba , the Chinese e-commerce giant often compared to Amazon in the west. The Chinese OTA market displays a more competitive range of challenger players when compared to the duopoly of Booking.com and Expedia that exists elsewhere.

Chart 2: Popular OTAs in China

Looking outside China to other east and southeast Asian countries, MakeMyTrip, Rakuten and Recruit are the leading OTAs in Japan and Traveloka is the dominant player in Indonesia.

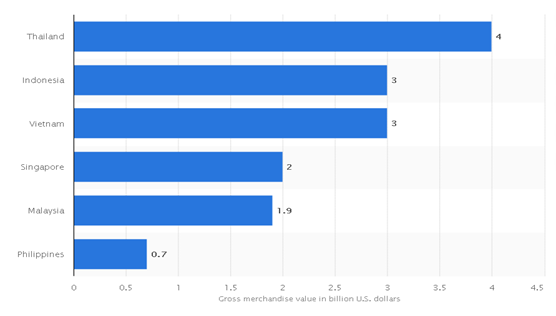

As measured by gross merchandise value, Thailand ($4b), Indonesia ($3b) and Vietnam ($3b) are the biggest online travel markets in the region outside China, according to data supplied by Statista.

Chart 3: APAC online travel market scale by country (2020)

In India, MakeMyTrip is the leading OTA. Excluding the four major international OTAs – Booking.com, Expedia, Airbnb and Agoda – that also operate successfully in the Indian online travel market, the sub-continent has a dynamic range of home-grown challenger OTAs, including Cleartrip, Yatra, and Via.com

What are the Top online travel agencies in the world ?

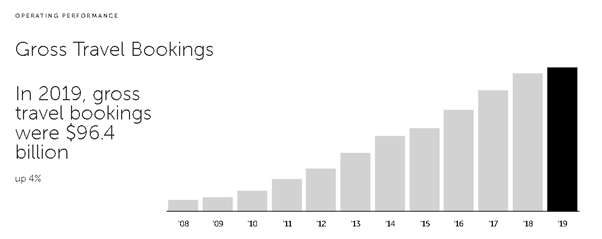

Booking Holdings (formally Priceline Group), the company that owns Booking.com , was the leading online travel agency worldwide in 2019. Its gross sales were $96.4 billion and EBITDA were at $5.9 billion, up 2% compared to the previous year.

Chart 4: Booking Holdings Gross Travel Bookings 2019

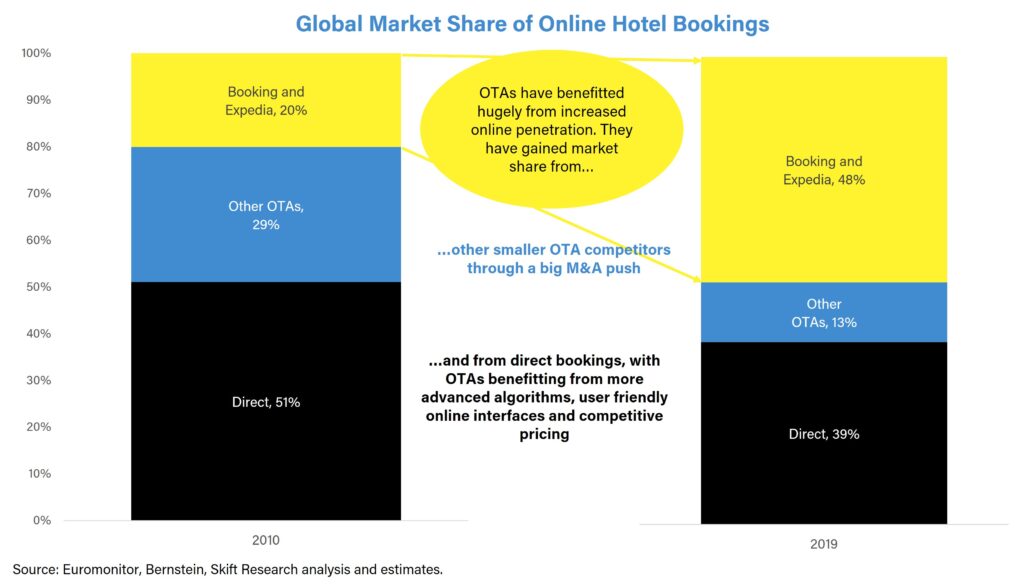

As previously mentioned, Booking Holdings and Expedia dominate the global OTA market, particularly in North America and Europe. They have succeeded in capturing maximum market share through a series of mergers and acquisitions making them essentially travel conglomerates. Here is a full list of the brands owned and operated by Expedia Group and Booking Holdings.

Chart 5: Brands owned by Expedia and Booking Holdings

As standalone online businesses, based on their 2019 results , the top five OTAs in the world are:

- Booking.com ($15.07b)

- Expedia ($12.07b)

- Trip.com ($5.10b)

- Tripadvisor ($1.56b)

- Trivago ($0.84b)

However, in terms of revenue growth , the picture was different in 2019, with On The Beach leading the list with the biggest increase in revenue that year:

- On The Beach (+41%)

- Lastminute (+20%)

- Trip.com (+12.3%)

- eDreams Odigeo (+8.2%)

- Expedia (+7.5%)

Obviously, 2019 marks our final year of the ‘old normal’ before the COVID-19 pandemic changed everything but some travel industry facts show that we’re going to witness a resurgence. You can also check out travel industry podcasts to get more insights. Still, with vaccine rollouts underway across the globe, it won’t be long before we are enjoying travel again , perhaps more than ever before!And OTAs will once again be playing their important roles in improving customer service and taking digital innovation forward.

Subscribe to our newsletter

Yay you are now subscribed to our newsletter.

Ben Walker has 18 years of experience in the hotel and travel sectors. He has worked as PR & communications manager for TRI Hospitality Consulting London, the creators of HotStats, the hotel market benchmarking, financial analysis, and performance reporting solution. He has also been the business editor of The Caterer, and communications manager and editor for the international professional body, the Institute of Hospitality.

Mize is the leading hotel booking optimization solution in the world. With over 170 partners using our fintech products, Mize creates new extra profit for the hotel booking industry using its fully automated proprietary technology and has generated hundreds of millions of dollars in revenue across its suite of products for its partners. Mize was founded in 2016 with its headquarters in Tel Aviv and offices worldwide.

Related Posts

All About Hotel Room Mapping: the Key to Booking Success

13 min. Do you want to listen instead of reading? 👇 Think about the last time you were looking for a hotel room while planning your vacation. So many hotels, so many rooms, and a million different options and possible combinations. Now try to imagine what it looks like behind the scenes of all this […]

The Battle of Booking: OTAs vs Traditional Travel Agents

13 min. Two and a half decades ago, the founders of Hotels.com came up with the idea to start using a toll-free phone number as a travel booking system. Little did they know that their idea would turn into a multibillion-dollar market. The proliferation of commercial internet helped morph their business into the world’s first […]

What Are OTAs & Why They Will Change the Travel Industry Forever

16 min. In 2023, 72% of travelers preferred to make their travel arrangements online. As much as 80% of them relied on OTAs rather than Google, social media, and meta-travel websites. Traveler habits and preferences indicate that OTAs are no passing trend. For those in the travel business, that means only one thing: OTAs are […]

Online Travel Agencies Market

Exploring the Online Travel Agencies Market: A Comprehensive Examination by Transportation, Vacation Packages, Accommodation

Transforming the Travel Landscape- Exploring the Expanding Online Travel Agencies Market and the Influence of Artificial Intelligence on Personalized Travel Experiences. Find more with FMI

- Report Preview

- Request Methodology

Online Travel Agencies Market Outlook (2023 to 2033)

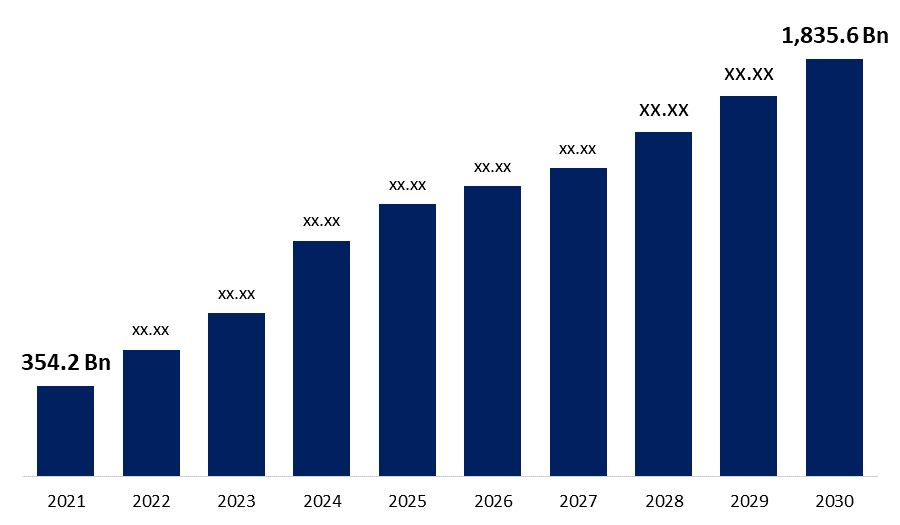

As per newly released data by Future Market Insights (FMI), the online travel agencies market is estimated at US$ 465.1 million in 2023 and is projected to reach US$ 1,694.2 million by 2033, at a CAGR of 13.8% from 2023 to 2033.

Don't pay for what you don't need

Customize your report by selecting specific countries or regions and save 30%!

Revenue of Online Travel Agencies from 2018 to 2022 Compared to Demand Outlook for 2023 to 2033

As per the FMI analysis, the market for online travel agencies secured a 6.70% CAGR from 2018 to 2022, touching US$ 355.4 million in 2022.

The technological development in the tourism industry has digitalized the entire process of travel bookings. Nowadays traveler makes more use of online services for travel booking as they feel it is a convenient and hassle-free process.

The online process has led to the growth of the tourism and hospitality industry. Therefore, online travel agencies play a significant role in the tourism industry.

Online travel agencies comprise various travel bookings, hotel bookings, transportation service bookings, and many more.

Online travel agencies serve the purpose of selling travel services on online platforms. In the last few years, there is a significant rise in the growth of online travel agencies. The growth has helped to revolutionize the tourism industry.

The above-mentioned factors augur well for the online travel agencies market future trends, where it is predicted that the market likely reaches US$ 1,694.2 million by 2033 at 13.8% CAGR through 2033.

What are the Features and Convenience of Use that Drive the Demand for the Online Travel Agencies?

- Online travel agencies offer a range of services either directly from their own companies or act as intermediaries between travel and booking agencies and end users.

- The main purpose of online travel agencies is to provide booking services online, covering everything from selecting a service to the point of sale on the Internet.

- Online portals offered by these agencies provide various services including price comparison, cost estimation, accommodation options, destination information, transportation modes, and even tour packages.

- The convenience, speed, and ease of booking provided by online travel services attract travelers, offering a convenient and efficient way to plan their trips.

- By utilizing online travel services, travelers can save both time and money, making it an appealing option for those seeking efficient and cost-effective travel arrangements.

Principal Consultant

Talk to Analyst

Find your sweet spots for generating winning opportunities in this market.

What is Fostering the Expansion of the Market Size: The Rise in Disposable Income and New Development Initiatives?

- Increasing disposable income among individuals has played a significant role in driving the demand for online travel agencies, as people now have more financial resources to explore and travel to various destinations worldwide.

- Online travel agencies have successfully established a global reach, expanding their services and operations across different regions and countries, catering to the diverse travel needs and preferences of customers.

- To meet the evolving demands of the market, online travel agencies continuously adopt new strategies and upgrade their technologies, ensuring enhanced service offerings and improved customer experiences.

- The inclusion of travel insurance and baggage insurance by online travel agencies provides an added layer of security and peace of mind for travelers, contributing to the overall convenience and reliability of their services.

- Transparency throughout the booking process is a key focus for online travel agencies, ensuring customers have access to comprehensive information and pricing details, fostering trust and confidence in their decision-making.

- The initiatives taken by online travel agencies, such as integrating advanced technologies and providing comprehensive travel solutions, have successfully attracted the new generation of tech-savvy travelers, generating a strong demand in the market.

- Despite the challenges faced during the pandemic, the online travel agencies market remains resilient and continues to evolve, adapting to changing customer expectations and emerging market trends.

What Impact Does the Increasing Number of Solo Travelers Have on the Growth of the Online Travel Agencies Industry?

- There has been a significant increase in the number of solo travelers in recent years, driven by specific reasons such as leisure, recreation, and engaging in activities like water sports, hiking, riding, skiing, and more.

- The influence of social media has played a major role in attracting a wide audience to explore different regions, leading to a rise in online travel agencies' booking transactions.

- Online travel agencies offer comprehensive tour plans, including vacation packages, and assist solo travelers in making travel, food, and accommodation arrangements through convenient platforms such as phones or other devices.

- This convenience and affordability make online travel agencies a preferred choice for solo travelers, who may lack extensive knowledge or prefer cost-effective options.

- In recent years, online travel agencies have surpassed offline tour operators and travel agents in terms of popularity and usage among solo travelers.

Get the data you need at a Fraction of the cost

Personalize your report by choosing insights you need and save 40%!

Country-wise Insights

What is the growth outlook for the europe online travel agencies industry.

The growth outlook for the Europe online travel agencies industry is positive, with a value share of 22.30% in 2022. The industry is expected to continue growing steadily, supported by various factors such as increasing online travel bookings, technological advancements, and evolving customer preferences.

The CAGR of the United Kingdom at 5.00% from 2023 to 2033 indicates a promising growth trajectory for the market. The rising adoption of online platforms for travel planning and booking, along with the convenience and extensive range of services offered by online travel agencies, are driving the industry's growth.

The industry is likely to witness further advancements in mobile applications, personalized travel experiences, and innovative marketing strategies, contributing to the expansion of the Europe online travel agencies market in the coming years.

How Online Travel Agencies Market is Progressing in India?

In India online leading companies like Yatra.com, Kesari Tours, Veena World, Make My Trip, others are dominating the tourism industry in India, contributing to the country’s anticipated CAGR of 6.0% from 2023 to 2033.

India attracts many foreigners to discover and explore its culture and diversity. Foreigners find Indian travel agencies more affordable than booking tours from abroad. Hence, they use Indian online travel agencies’ websites for booking accommodation and transportation.

Meanwhile, India being one of the leading countries in the count of internet users, it can be concluded that the vast majority of the population is tech-savvy. Thus, online travel agencies try various marketing tools to connect with travelers and encourage them to avail of their services.

The attractive advertisements, loyalty programs, and offers from leading online travel agencies have influenced the domestic market. Therefore, the known online agencies have gained the trust of domestic travelers of the country over the years.

What are the Factors Driving the Online Travel Agencies Industry in the United States of America?

As per the FMI analysis, the market for online travel agencies in the United States was predicted to garner a value share of 5.50% in 2022.

United States is one of the major markets of tourism with millions of travelers visiting every year. Domestic travelers in the United States of America use online travel agencies’ websites and applications extensively.

Apart from this, the airline service is availed by United States citizens majorly. Therefore, there is a high demand for travelers using online travel agencies’ websites for airline travel booking.

With the high standard of living and high disposable income due to the high value of currency travelers are ready to spend a high amount of money on traveling and exploring new adventures. Thus, there is a high demand from travelers for luxury tourism, adventure sports, and various type of outdoor activities.

Category-wise Insights

Which service type is more preferred by travelers in online travel agencies market.

According to the analysis, in terms of service type the transportation service is widely preferred by travelers with the sub-segment holding a 22.0% value share in 2022.

Transportation services generate a high demand for their services. Few the transport services such as car rentals or bus travel agencies are in heavy demand as they are the part of daily mode of transport for many travelers.

Apart from this the attractive offers and schemes from the transportation services attract travelers to use these online services more often. Lastly, the transportation services are having a wide coverage of travelers as compared to the tour/vacation packages or accommodations as they generate demand only when there is a need.

How is the Competitive Landscape in the Market for Online Travel Agencies?

Leading players operating globally in the market are focusing on the expansion of their business. Also working on their service and creating advanced technology to attract new customers.

The competitive landscape in the market for online travel agencies is intense and dynamic. Numerous players, ranging from established companies to emerging startups, compete for market share.

Key industry players strive to differentiate themselves by offering unique features, enhanced user experiences, and a wide range of travel services.

They invest in advanced technologies, such as artificial intelligence and machine learning, to provide personalized recommendations and streamline booking processes. Additionally, partnerships with airlines, hotels, and other travel service providers are crucial to expand their offerings and provide competitive pricing.

Continuous innovation, customer-centric strategies, and effective marketing campaigns are vital for online travel agencies to gain a competitive edge in this rapidly evolving market.

Key Players

- Expedia Group Inc.

- Booking Holding Inc.

- Trip Advisor Inc.

- MakeMyTrip Pvt. Limited

- Hostelworld Group PLC (HSW)

- Trivago N.V

- Thomas Cook India Ltd.

- Lastminute.com Group

- Orbitz Worldwide

- Walt Disney World

For instance:

- In the year 2018, Booking.com announced a new product version of the booking.com application and website at Vacation Rental Management Association (VRMA). The new product features allow users to select the product of a partner’s brand beyond booking.com own products. Also, they introduced group connect, guest management, and enhance connectivity features in their new application.

- Recently in 2022, Expedia Group announced an Open World Technology platform. The technology is developed for partner agencies. The platform has a complete e-commerce suit, with various blocks like payments, chatbot, services, and fraud detection, and is perfect for the agency planning to enter the newly in online travel business.

Segmentation Analysis

By service type:.

- Transportation

- Vacation Packages

- Accommodation

By Device Platform:

By payment modes:.

- Debit / Credit Card

- Others (Vouchers, Discount Codes)

By Booking Type:

- Online Travel Agents

- Direct Travel Agents

By Customer Segment:

- Corporate Traveller

- Individual Traveller

By Age Group:

- 15-25 Years

- 26-35 Years

- 36-45 Years

- 46-55 Years

- 66-75 Years

- North America

- Latin America

Frequently Asked Questions

How is the historical performance of the market.

During 2018 to 2022, the market grew at a 6.70% CAGR.

Who are the Key Market Players of this market?

Airbnb, Trip Advisor Inc., and Trivago N.V. are key market players.

What factors contribute to the attraction of this market in Europe?

Increasing online travel bookings raises the market.

How Big is this market?

This market is valued at US$ 465.1 million in 2023.

How Big will be this Market by 2033?

This market is estimated to reach US$ 1,694.2 million by 2033.

Table of Content

Recommendations.

Travel and Tourism

Travel Agency Services Market

REP-GB-3038

Managed Travel Distribution Market

REP-GB-3011

October 2022

Explore Travel and Tourism Insights

- Get Free Brochure -

Your personal details are safe with us. Privacy Policy*

- Get a Free Sample -

- Request Methodology -

- Customize Now -

I need Country Specific Scope ( -30% )

- Talk To Analyst -

I am searching for Specific Info.

- Download Report Brochure -

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

What are you looking for?

50 online travel booking statistics (latest 2024 figures).

Did you know that online travel booking had a $521 billion market size in 2023 ? And that this is estimated to hit $1 trillion in 2030 ?

As technology becomes a crucial part of our lives, the way that travellers plan and book their trips today have evolved.

There are now websites and mobile apps to buy flight tickets, reserve cheap hotel rooms , and book travel experiences.

With the constant changes in traveller’s behaviour and consumer trends, it can be important to understand how researching is done for travels.

This includes understanding more deeply about the online travel booking market, the global leaders in this industry, as well as the current trends and how mobile booking compares to websites.

Today we have some interesting statistics about online travel booking for you.

From the number of online travel companies there are currently to how the Coronavirus pandemic has impacted online booking.

Sources: With each stat, I have included the source for the data. Please go to the end of this post for a complete summary of all the sources and articles used here.

Travellerspoint

Online travel booking popular questions

What percentage of bookings are made online.

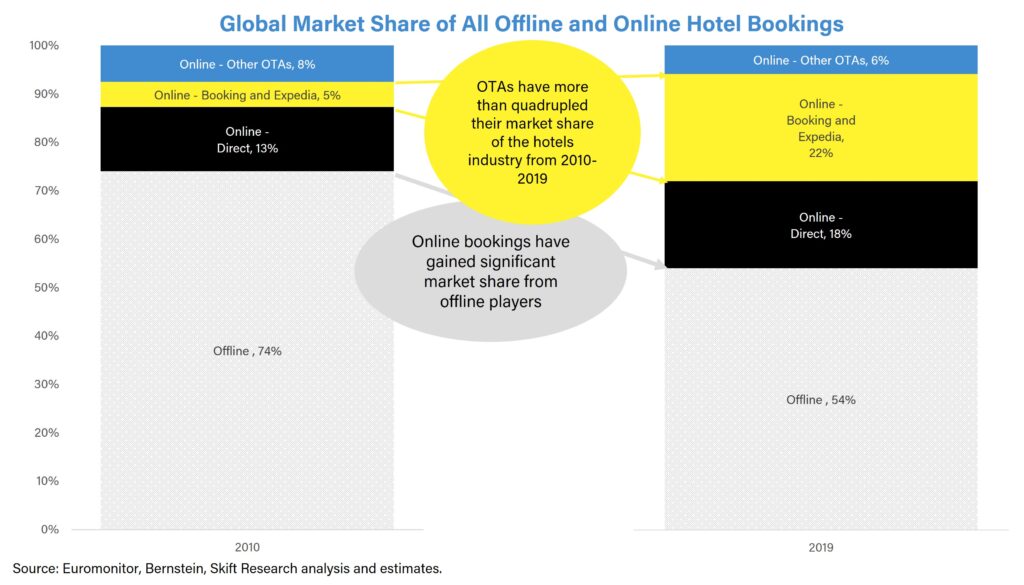

By 2019, 57% of all travel bookings were made online. Meanwhile, 68% of all sales in travel & tourism are made online in 2022.

What is the most popular travel booking site?

Booking.com was the most globally visited travel and tourism website in September 2023, when it received 554.5 million visits .

Which are the two largest online travel agencies worldwide?

In September 2023, Booking.com and Tripadvisor received around 554 million and 156 million visits, respectively.

How much is the global online travel sales?

In 2018, global online travel sales made $694 billion, a 10.4% increase compared to the previous year

Online travel booking main findings

- Online sales will generate 76% of revenue in the travel & tourism sector by 2028

- Among the many online travel agencies worldwide, Booking reported the highest revenue in 2021

- Marketplace bookings experienced a dramatic increase from 3.2% in 2017 to 9.1% in 2018, while direct online bookings fell from 79.2% to 66.7%

- 39% of users would download an app over using the mobile website because of the speed, while 30% enjoy the increased functionality of a mobile app

- 4 in 5 hotel customers who have been asked to leave a review do so

- Between 2016 and 2021, the portion of online travel sales via mobile has been steadily increasing compared to desktop or laptop, from only 36% to nearly 50% of all digital travel sales

- Around 50% of users in 2020 claimed that they made more last-minute travel bookings during the pandemic

Online travel booking market

What percentage of travel bookings are made online?

1. According to Statista, online sales will generate 76% of revenue in the travel & tourism sector by 2028.

Online travel booking is continuously taking up the travel booking market, and Statista estimates that by 2028, online sales will make up 76% of all revenue in travel and tourism.

2. In 2021, the online travel market size worldwide was $432 billion.

3. this figure rose slightly to $475 billion in 2022 and $521 billion in 2023..

The latest data on the global online travel agent industry stated that the market size in 2023 was $521 billion.

4. The online travel market size is predicted to reach over $1 trillion by 2030.

And with the rise of the digital nomad movement , the Internet will continue to play an increasingly large role in the travel industry.

5. The Singaporean online travel market size was the highest amongst selected Southeast Asian countries, with the gross merchandise value (GMV) recorded at $7 billion in 2023.

In comparison, in 2023, the Philippines saw an online travel market size of $3 billion.

6. In 2018, global online travel sales made $694 billion, a 10.4% increase compared to the previous year.

[JerseyIslandHolidays]

7. By 2019, 57% of all travel bookings were made online.

Travel bookings include accommodation, flight, tour, and other related activities.

8. Even back in 2012, 9 in 10 people researched their holiday online before making reservations, whereas 8 in 10 booked their holiday online.

[TravelWeekly]

Online travel booking has been a huge thing this past decade. In 2012, 90% of people conducted online research before booking their holidays. Meanwhile, 80% of people did their bookings online.

Online travel companies

What are the leading online travel agencies in the world?

9. Among the many online travel agencies worldwide, Booking reported the highest revenue in 2021.

In 2021, Booking.com was the online travel agency with the highest revenue.

10. Their revenue has consistently increased from $1.41 billion in 2007 to a record high of $15.07 billion in 2019.

11. as of december 2022, booking.com has a market cap of $78,171 million, making it the global market leader..

In terms of the online travel company market, Booking.com dominated with $78.17 billion in market capitalization in December 2022.

12. The second place goes to Airbnb with a market cap of $54,137 million.

Meanwhile, Airbnb has the second highest market capitalization with $54,137 million .

13. In the US in 2018, Tripadvisor used to be the leading travel website as it attracted 18% of all online users.

In 2018, the most popular travel website in the US was Tripadvisor, which was used by 18% of American online travel users .

14. Hotels.com ranked fourth at 11%, while Booking.com and Expedia placed sixth and seventh with 9% each.

15. booking.com was the most globally visited travel and tourism website in september 2023, when it received 554.5 million visits..

In terms of website visits, Booking.com is the most visited travel and tourism website in the world. It received 554.5 million visits in September 2023 alone.

16. With 156 million visits in September 2023, Tripadvisor is the second most visited travel and tourism website worldwide.

Online travel booking trend.

How many people make travel bookings online?

17. The majority of travellers in the US claim that they’d spend less than a week researching once they have decided to travel.

[Facebook IQ]

Most travellers from the US spend less than a week researching their travels.

18. The most popular day of the week for people to book trips on is Monday, while Saturday is the least popular.

[TrekkSoft]

TrekkSoft referred to 3 random data points between August and September 2019.

19. Meanwhile, the busiest time of day for booking is 10am CET. 6am CET is usually the least busy time.

20. marketplace bookings experienced a dramatic increase from 3.2% in 2017 to 9.1% in 2018, while direct online booking fell from 79.2% to 66.7%..

From 2017 to 2018, there was a significant increase in marketplace booking from 3.2% to 9.1%. On the other hand, less people booked directly on travel accommodation and company websites (from 79.2% to 66.7%).

21. By 2023, 700 million guests will book hotel rooms online.

It is estimated that 700 million guests will be booking their hotel rooms online by 2023.

22. A survey in the US in 2023 revealed that the most popular brand for flight search engine online bookings was Expedia.

This was a representative online survey with 2,405 consumers in the US.

23. Meanwhile, the most popular option for hotel and private accommodation online bookings in the United States was Booking.com, with Hotels.com and Expedia following.

Mobile and app travel booking.

How do mobile travel bookings compare with app bookings?

24. 39% of users would download an app over using the mobile website because of the speed, while 30% enjoy the increased functionality of a mobile app.

[SaleCycle]

Two of the most popular benefits of mobile apps compared to websites are the increased speed and functionality.

25. 1 in 5 users also report better user experience as a major reason for downloading a travel booking app.

20% of users also report that they download travel booking apps because of the better user experience.

26. Moreover, 11% download the app for the reward and discount the company offers.

Meanwhile, only 11% of users download a travel booking app for the reward and discounts they get.

27. Between 2016 and 2021, the portion of online travel sales via mobile has been steadily increasing compared to desktop or laptop, from only 36% to nearly 50% of all digital travel sales.

The last 5 years have been an important period for the growth of online travel sales via mobile as it increased from 36% to almost 50% of all digital travel sales.

28. In 2018, 82% of travel bookings were online either through websites or mobile applications.

29. nearly half (48%) of mobile phone users would be happy to book and plan a trip to a new place only using their mobile device..

37% of millennial parents actually rely on online reviews when picking where to visit.

30. The conversion rate for bookings made via mobile phone is only 0.7%, less than half of bookings made through desktop at a 2.4% conversion rate.

People are more likely to go through with their bookings when accessing websites through desktop (2.4% conversion rate) than mobile (0.7%).

31. 46% of all solo travellers make their hotel bookings by mobile.

[Phocus Wire]

Online travel booking is very important for solo travellers. In fact, 46% rely on mobile apps and access to book their hotels.

32. In 2022, the most downloaded OTA app worldwide was the Booking.com mobile app, which had 80 million total downloads on iOS and Google Play in that year.

The second place was secured by Airbnb, which had approximately 52 million mobile app downloads in 2022.

33. Between 2023 and 2027, the travel segment of the mobile app market is expected to increase by a total of 64%, or $0.8 billion, until it reaches $2 billion by 2027.

Reviews in online travel booking.

How many customers leave reviews when booking travels online?

34. 4 in 5 hotel customers who have been asked to leave a review do so.

35. meanwhile, 22% of customers would write a review without being requested..

22% of hotel customers always leave a review without being asked.

36. 95% of all reviews by travellers are positive.

An overwhelming majority (95%) of hotel reviews by customers are positive.

37. Tripadvisor’s report states that 96% of users think that reading reviews is important for their booking process.

[TripAdvisor]

83% of users usually refers to reviews before deciding on a hotel, while 76% depends on guest-uploaded travel photos for decisions.

38. According to SaleCycle, 54% of guests have written at least one review in the last 12 months.

More than half of all guests have written at least one review in the last year.

Coronavirus and online travel booking

How did the Covid-19 pandemic affect the online travel booking sector?

39. Booking.com’s revenue dropped from $15 billion in 2019 to only $6.8 billion in 2020.

The Covid-19 pandemic has caused Booking.com’s revenue to decrease by more than half in 2020, to just $6.8 billion.

40. Expedia, the online travel agency making the second highest revenue, experienced a similar decrease from $12 billion the previous year to around $5.2 billion in 2020.

41. tripadvisor’s revenue fell by almost 55% from $1.56 billion in 2019 to $604 million in 2020..

The popular travel destination and accommodation website, Tripadvisor, also saw a dramatic 55% decrease in revenue from $1.56 billion in 2019 to $604 million in 2020..

42. Around 50% of users in 2020 claimed that they made more last-minute travel bookings during the pandemic.

The future of online travel booking

What will online travel booking look like in the future?

43. According to SaleCycle, 30% of guests in a hotel who interact with a Chatbot would spend more than those who don’t.

Chatbots in hotel websites can play a crucial role in customer spending.

44. Almost 7 in 10 travellers use voice search technology when planning their trip.

70% of all travellers worldwide use voice search technology during the planning stage of their trip , and it’s reasonable to assume that this percentage would increase.

45. 67% of high-income tourists choose to spend money on experiences over expensive hotel rooms.

A majority of high-income tourists claim they would choose to spend more money on travel experiences than expensive hotel rooms.

46. 73% of tourists say that they plan to stay in an eco-friendly accommodation within the next year.

Region specific online travel booking statistics, 47. in canada, the top two products on a “travel product online bookings” survey in 2023 were hotels and flight tickets..

The travel survey was done online among 2,006 respondents in Canada , in which the top answers had been hotels and flight tickets.

48. The same top two answers came up in a similar survey in the US.

In the US, the travel survey was conducted among 10,011 respondents.

49. In 2023, the “travel product online bookings” survey in the UK also revealed hotels and flight tickets as the most common answers.

British respondents of a 2023 travel survey revealed that the most booked travel products online were hotels and flight tickets.

50. The same series of survey showed that in India, the top two most popular type of online booking for travel products were long distance train tickets and hotels.

Interestingly, when the survey was conducted among 4,034 participants in India , the top two answers changed.

In 2023, the most popular type of travel products that Indians tend to book online are hotels and long distance train tickets.

To conclude, it’s safe to say, based on data at least, that the online travel booking market will only grow and become more prevalent.

As we expect the market size to increase and take over traditional booking methods, travel-related businesses would benefit from developing their online booking system, especially where corporate and business travel is concerned.

Among the many online travel companies worldwide, Booking.com was the one to record the highest revenue back in 2020.

Meanwhile, Tripadvisor leads in terms of website visits as it became the most visited travel and tourism website.

While revenue for most companies had fallen due to the Coronavirus pandemic, this was to be expected as other businesses also experienced a decrease during this trying time.

At the same time, people have made more last-minute travel decisions in this pandemic era.

We can easily assume that online websites and mobile apps play a crucial role in their planning and booking.

We hope these statistics have been useful to help you understand more about online travel booking!

Did we miss any important information?

Drop your comments and thoughts down below.

Interested in our other statistic guides?

- Europe Travel & Tourism Statistics

- Female Travel Statistics

- Family Travel & Tourism Statistics

- RV Industry Statistics

- Travel Weekly

- Trip Advisor

- Phocus Wire

- Facebook IQ

Leave a comment

Let us know what you think.

5 million people can't be wrong

Contact the travel trade experts

020 8853 3700

The rapid rise of online travel agents

Following our recent interactive graph showing movement of the top 20 ATOL holders read our post on the rise of online travel agents.

Yesterday, we shared an interactive graph showing the movement of the top 20 ATOL holders from 2013-2020. We also gave some initial insights extracted from our deep dive into the data.

Over the next couple of weeks, we will be drilling down into these insights.

Firstly, we’re exploring the rise of online travel agents.

Over the past eight years, we have seen the rapid rise of online travel agents (OTAs).

They are built on slick, scaleable technology, selling primarily ‘fly and flop’ holidays and allowing customers to dynamically package a wide range of low-cost carrier flights and accommodation offers.

By October 2020, six of the top 20 ATOL holders could be classed as OTAs, where online distribution is their dominant channel as well as their key characteristic. Given the business model barely existed a decade ago, their growth rate has been phenomenal. For example, the largest UK OTA, On the Beach increased its ATOL from 639,000 passengers in 2013 to 1.65 million by 2019, a compound annual growth rate (“CAGR”) of 17%.

Loveholidays, a prominent PE-backed OTA grew from just 167,000 pax in 2015 to 1.37 million in 2019, a staggering CAGR of 69%!

Faced with the onset of the pandemic, both businesses reduced their licence projections by around a fifth as the UK went into the first lockdown in March 2020. However, this was far less than the market as a whole which is down 33 % .

Will online travel agents continue to grow? To answer this question, we have to look at how consumer spending habits have changed as a result of the pandemic.

How has Covid-19 changed consumer spending?

UK consumers continued to spend money in spite of the pandemic. However, the closure of shops and restrictions on mobility drove an unprecedented shift to online channels over the past eight months.

Data from the Office of National Statistics (ONS)* shows that over the past decade, consumers have been shifting online at a rate of around 1% per year. This leapt 9% in the 12 months to September 2020.

Sadly, travel spending was a negligible proportion in the last eight months, but it is clear that consumers are far more comfortable transacting online than they were pre-pandemic.

In addition, a recent study f rom McKinsey indicat ed that the shift online transcends demographics, with older and historically more-technophobic generations turning to online purchases to ease the boredom of lockdown.

So the prospects look great for OTAs post-pandemic?

Not so fast! COVID-19 has been indiscriminate in its devastation of the outbound travel sector and OTAs have had as tough a time as any. Their technology has been unable to cope with huge numbers of cancellations, forcing them into laborious manual refunding processes. On top of this, the OTAs have been disproportionately affected by the delayed refunds from the low-cost airlines, resulting in customers receiving only part of their money back.

Without a strong human relationship to fall back on, they have been roundly condemned in the consumer media. For example, On the Beach, loveholidays, lastminute.com and Travel Republic, all score poorly in this Money Saving Expert ‘ 70 best and worst firms for travel refunds ‘ list.

Incidentally, the report named Trailfinders and Travel Counsellors as the top two. Both are businesses where human interaction powers the vast majority of distribution.

It’s all to play for.

Going forward, we think travel will remain complicated for the foreseeable future. We expect travel restrictions to remain inconsistent, corridors to remain dynamic and testing and quarantine requirements to differ country by country.

In this environment, it’s easy to imagine customers returning to service-led, knowledgeable, human travel professionals. This Advantage Travel Partnership study in October 2020 appeared to support this theory. 44% of 25-34-year-old respondents said they are likely to consider using a travel agent in future.

At the same time, we know consumers have notoriously short memories. Customers at the value end of the market can always be enticed by bargain prices, leaving plenty of room for OTAs to recover when the great refund crisis fades from memory.

However, we think the biggest opportunity is change itself. That same Mckinsey study reported unprecedented levels of customer habit changes over the past eight months, with over 63% of UK respondents reporting switching to a new brand, new service or new retail outlet for the first time.

In that kind of environment, it’s all to play for.

If you enjoyed this post, why not sign-up to our newsletter? Get our latest travel blog posts, industry updates and exclusive content. Join the mailing list below.

* ONS data , the proportion of total non-food sales online increased 9ppts from 14.7% in September 2019 to 23.7% in September 2020. The change from September 2018 to September 2019 was 0.3ppts. The average annual increase over the last five years to September 2019 was 1.1ppts per year.

Related news & insights.

We share five ways we make hybrid working successful for our team.

Here is our latest round-up of interesting quotes from the recent travel company results.

Our monthly summary of consumer data, travel trends and not to be missed deadlines.

Join our newsletter

Join our newsletter for updates - single post.

- First name *

- Company name *

- Email address *

- Consent * I consent to my submitted data being collected and stored in accordance to our Privacy Policy *

- Email This field is for validation purposes and should be left unchanged.

Global Online Travel Market by Service type (Transportation, Travel Accommodation, and Vacation Packages), by Platform (Mobile and Desktop), Mode of Booking (Online Travel Agencies (OTAs) and Direct Travel Suppliers); By Region (U.S., Canada, Mexico, Rest of North America, The UK, France, Germany, Italy, Spain, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, the Netherlands, Luxembourg), Rest of Europe, China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa, Brazil, Argentina, Rest of Latin America) – Global Insights, Growth, Size, Comparative Analysis, Trends and Forecast, 2021-2030

The Global Online Travel Market size was valued at USD 354.2 Bn in 2021. The market is projected to grow USD 1,835.6 Bn in 2030, at a CAGR of 14.8 %. Review sites and travel e-commerce sites make up the majority of the internet travel sector. It provides the convenience of reserving from the comfort of one's own home and frequently entices customers with package deals and cost-cutting choices. As a result, many tourists are opting to book their trips online rather than through traditional brick-and-mortar travel firms. Furthermore, the primary global online travel market is being driven by greater consumer spending power, a government initiative to promote tourism, growing internet and credit card usage, and the creation of new online segments. The increasing penetration of international flight and hotel bookings supplied by online portals such as Booking.com, TripAdvisor.com, .

Get more details on this report -

The emergence of the travel and tourism business, as well as shifting patterns in standard of life, has resulted in a steady increase in the online travel market. The demand for online travels varies depending on the property type and is impacted by factors including location, size, and on-site amenities. The market is likely to be driven by rising disposable income, popularizing weekend culture, the introduction of low-cost airline services, and the developing service industry. The rise in spending power and the style of living are two of the most important factors driving people to luxury resorts. The demand for online travels is also fueled by a city's or country's hosting of sporting events. The development of the market has been hastened by the emergence of online lodging booking services. Marriott International, for example, published a new edition of its mobile app, Marriott Bonvoy, on February 10, 2021, with new features like better booking possibilities, greater personalized experiences, and customizations in earning and redeeming points. As a result, the industry is expected to consolidate due to growing demand for premium services with better booking options.

COVID-19 Analysis

The epidemic of COVID-19 has had a significant influence on the tourism and travel industries. The global implementation of social distancing, stay-at-home, and travel restrictions has stifled the expansion of the online travel industry. According to the American Hotel and Lodging Association 2021 study, hotel occupancy in the United States fell from 66 percent to around 40 percent in 2020, compared to the previous year. As a result of the pandemic, the hotel industry is likely to suffer a severe slowdown; nevertheless, the market is expected to return to its prior growth trajectory in the coming years.

Service Type Outlook

The travel accommodation segment accounted largest market share for the global online travel market in 2020. Market competitors are gradually providing travellers with a varied selection of hotel options at reasonable prices. Customers evaluate lodging options across multiple websites in order to get the most cost-effective option. Because they offer a diverse range of housing options, travelers prefer specialized online accommodation providers such as Airbnb, Inc. and OYO Rooms. As a result, the aforementioned reasons are responsible for the market's rise in the travel accommodation segment. These hotels usually have high-end designer interiors created with cutting-edge technology propels the demand for the growth of the global online travel market.

Global Online Travel Market Report Coverage

Platform Outlook

The mobile segment accounted largest market share for the global online travel market in 2020 owing to the expansion of the market through the mobile sector is mostly due to an increase in mobile usage and the development of novel mobile travel apps. The way people communicate and travel throughout the world has changed as a result of technological advancements. With the advancement of technology and the increased usage of mobile phones, simple and effective techniques are being developed to make travelling simple and comfortable, hence boosting the travel industry's growth. Travelers prefer to make their travel reservations using mobile travel apps, which are gradually gaining traction in the market. As a result, the expansion of the internet travel business is projected to be fueled by an increase in smart phone usage and a rise in digital literacy.

Mode of Booking Outlook

The online travel agencies (OTAs) segment accounted largest market share for the global online travel market in 2020. Online travel firms are becoming the most popular method of making reservations around the world. The rise of online travel agencies has been one of the most striking examples of industry and society's digital revolution in the last 25 years. OTAs have evolved into digital marketplaces that provide direct access to a wide range of online travel options for both B2B and B2C consumers. OTAs can be thought of as a cross between an e-commerce platform and a travel agency. Expedia, Booking.com, and Trip.com, among others, have dominated the global online travel business (hotels, airlines, packaged tours, rail and cruises).

Regional Outlook

Asia Pacific dominated largest market share for the global online travel market in 2020 owing to has the most potential for growth in the internet travel business, with India and China being the most profitable areas. The increase in discretionary income, rise in the middle-class section, and increasing penetration of internet facilities are all factors contributing to the expansion. In China, Ctrip is the most popular online travel agency (OTA), whereas in India, MakeMyTrip, Yatra, and Cleartrip are the most popular OTAs.

Europe is anticipated to emerge as the fastest-growing region over the forecast period. This is due to the presence of some of the world's most popular tourist spots. According to the UNWTO's Foreign Tourism Highlights 2019 Edition, Europe accounted for half of all international visitor arrivals in 2018. The survey also reveals that five major European countries are among the top ten destinations based on foreign tourist arrivals in 2018.

Key Companies & Recent Developments

Partnerships, strategic mergers, and acquisitions are expected to be the most successful strategies for industry participants to get speedy access to growing markets while also improving technological capabilities.

In addition, product differentiation and developments, as well as service expansion, are projected to help organizations thrive in the market.

Market Segmentation of Global Online travel Market

By Service Type

- Transportation

- Travel Accommodation

- Vacation Packages

By Platform

By Mode of booking

- Online Travel Agencies (OTAs)

- Direct Travel Suppliers

Key Players:

- Alibaba Group

- Elong, Inc.

- Tuniu Corporation

- AirGorilla, LLC

- Hays Travel limited

- Airbnb, Inc.

- Yatra Online Private Limited, India

- Trip Advisor Inc.

- MakeMyTrip Limited

- Hostelworld Group PLC (HSW)

- Trivago N.V

- Despegar.com, Corp

- Lastminute.com Group

- Single User: $3550 Access to only 1 person; cannot be shared; cannot be printed

- Multi User: $5550 Access for 2 to 5 users only within same department of one company

- Enterprise User: $7550 Access to a company wide audience; includes subsidiary companies or other companies within a group of companies

Premium Report Details

15% free customization.

Share your Requirements

We Covered in Market

- 24/7 Analyst Support

- Worldwide Clients

- Tailored Insights

- Technology Evolution

- Competitive Intelligence

- Custom Research

- Syndicated Market Research

- Market Snapshot

- Market Segmentation

- Growth Dynamics

- Market Opportunities

- Regulatory Overview

- Innovation & Sustainability

Connect with us

- smartphone USA- +1 303 800 4326

- smartphone APAC- +91 9561448932

- email [email protected]

- email [email protected]

Need help to buy this report?

- Skift Research

- Airline Weekly

- Skift Meetings

- Daily Lodging Report

The Past, Present, and Future of Online Travel

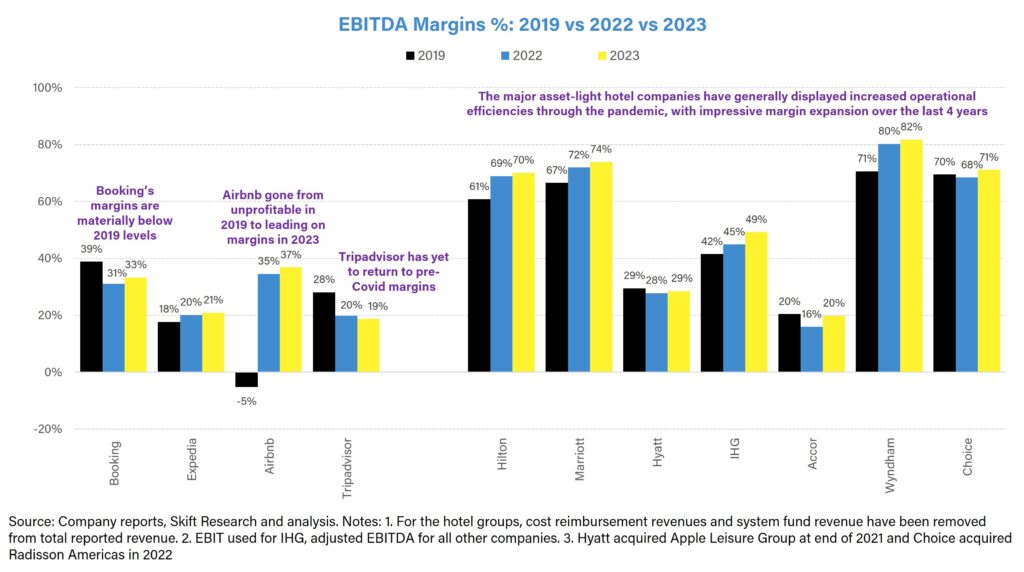

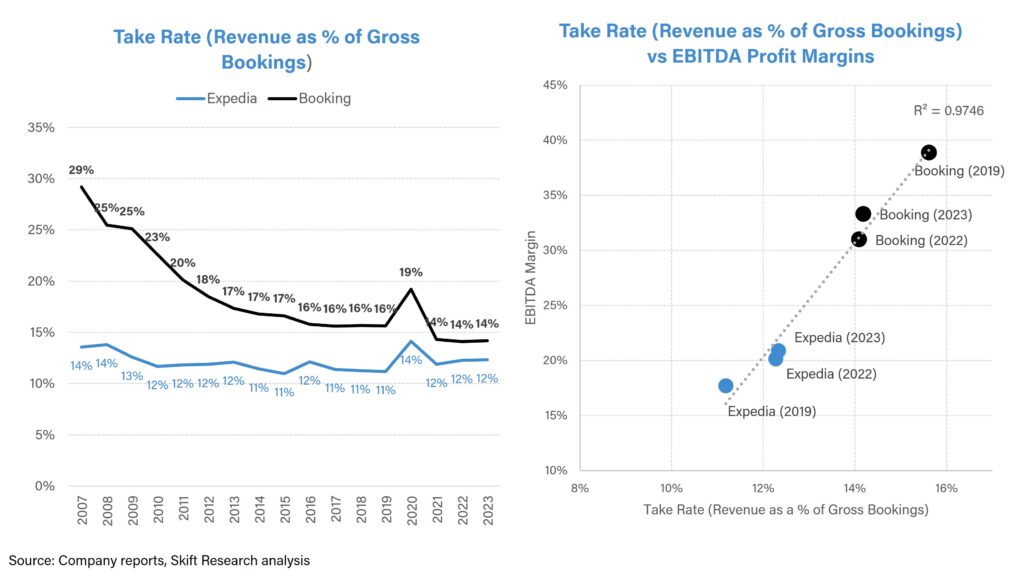

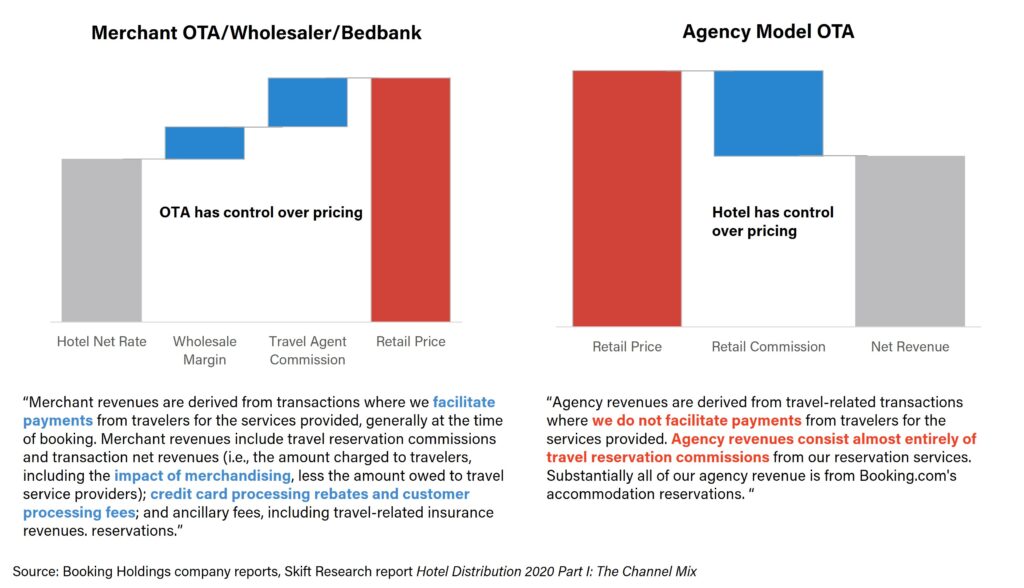

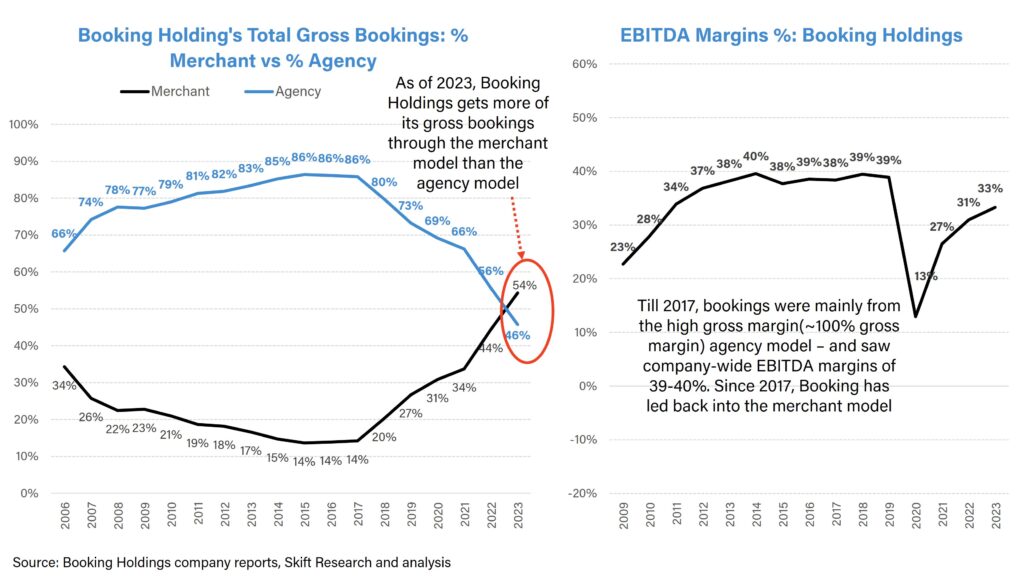

Executive summary, booking vs expedia, the online distribution landscape has re-fragmented and gotten more competitive , new competition from banks and credit cards powered by b2b partnerships now selling travel, direct hotel brands are gaining market share , hotels vs otas: company financials performance shows otas are investing to maintain market share in a more competitive environment , case study: a look into booking holdings’ growth and investment into lower margin businesses, related reports.

- State of Travel 2024: Travel in 350 Charts August 2024

- Booking Vs. Expedia: A 50 Chart Factbook August 2024

- A Deep Dive into Google Travel Part III: Hotel Distribution From East to West April 2024

- India’s Travel Booking Landscape March 2024

Report Overview

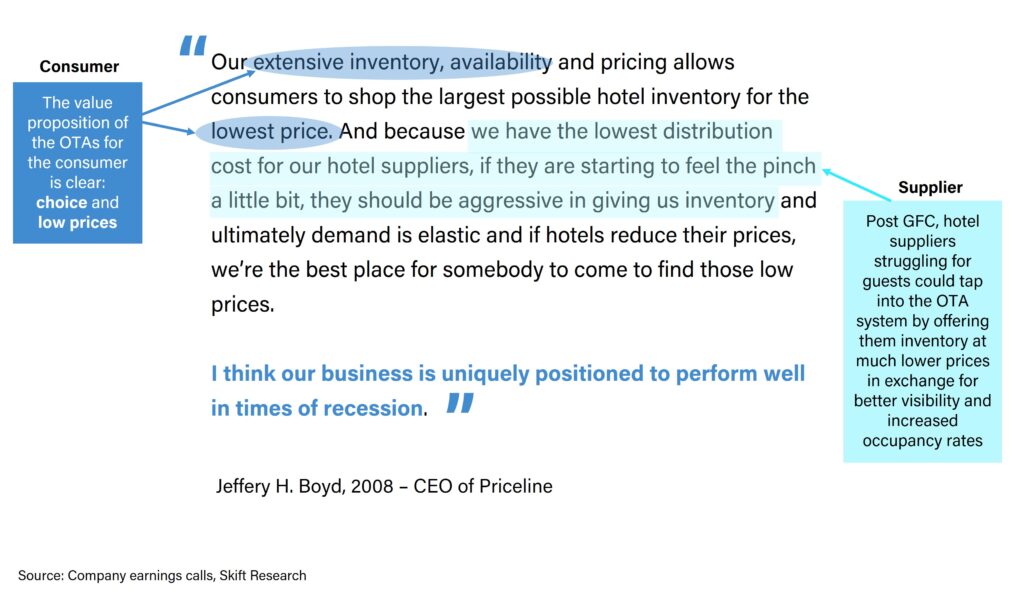

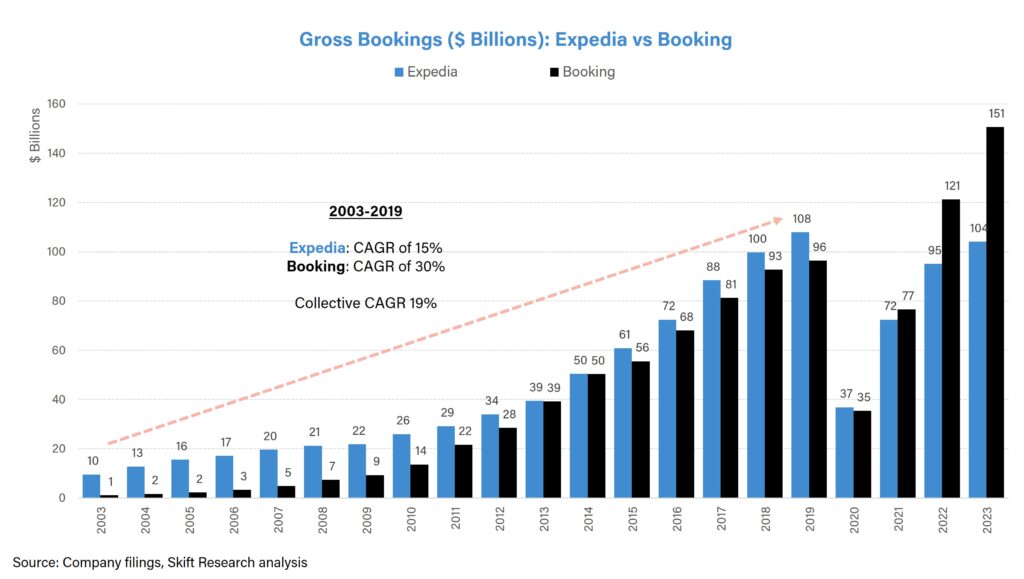

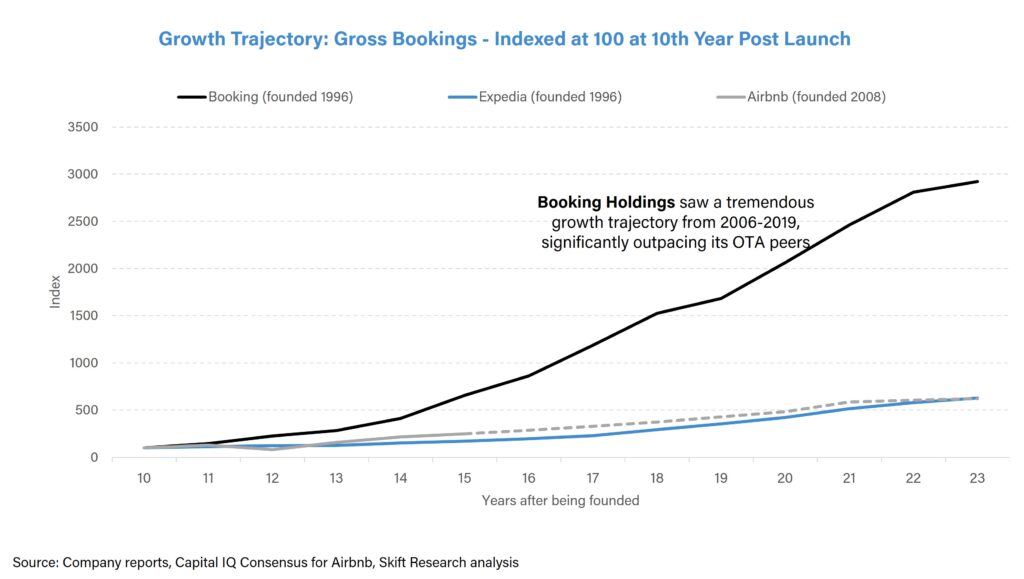

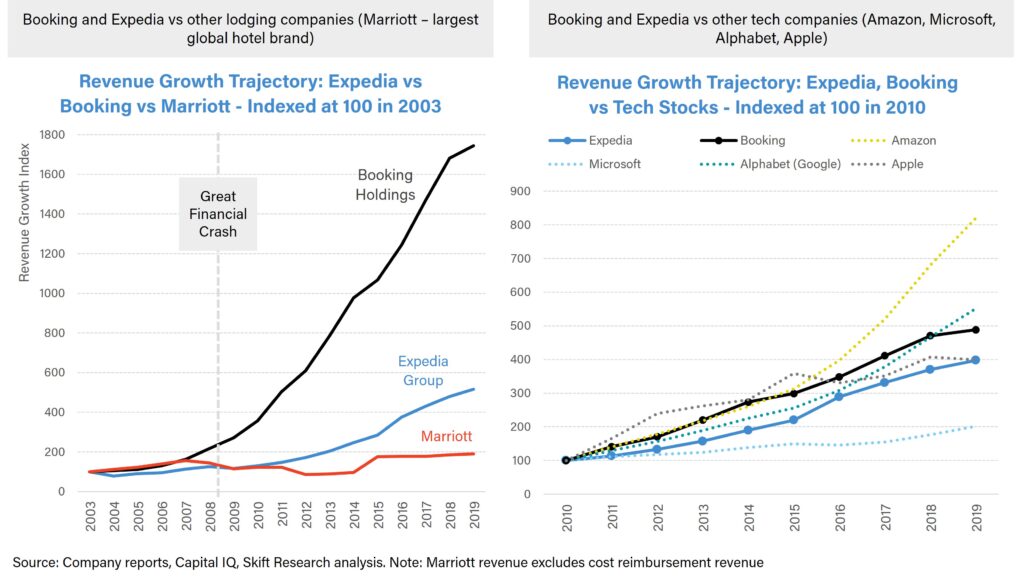

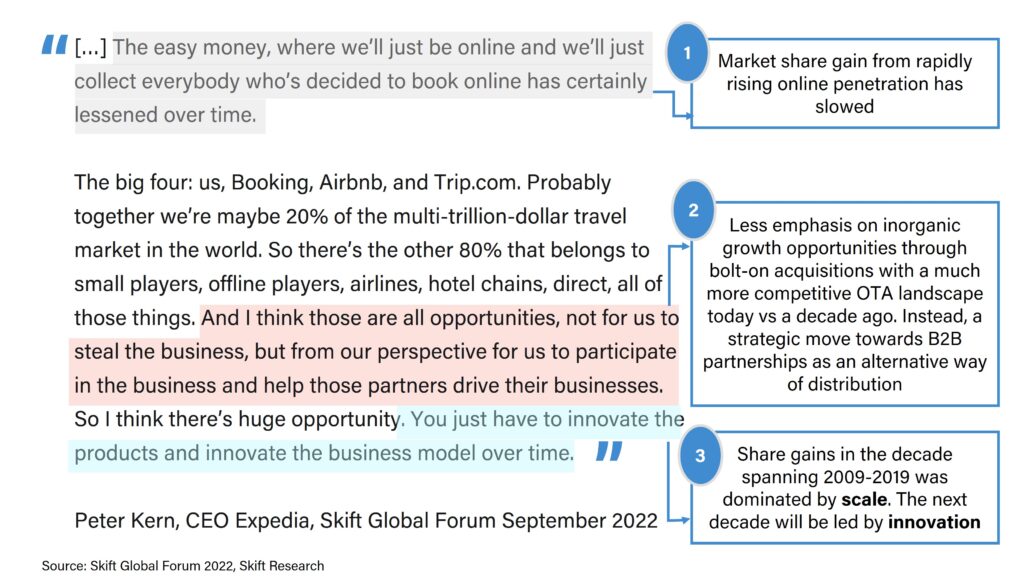

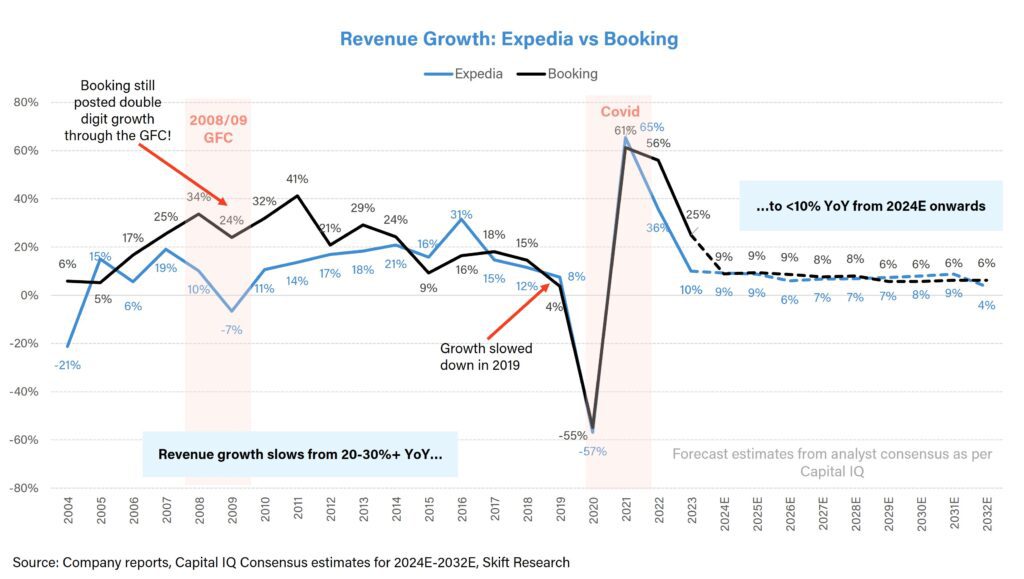

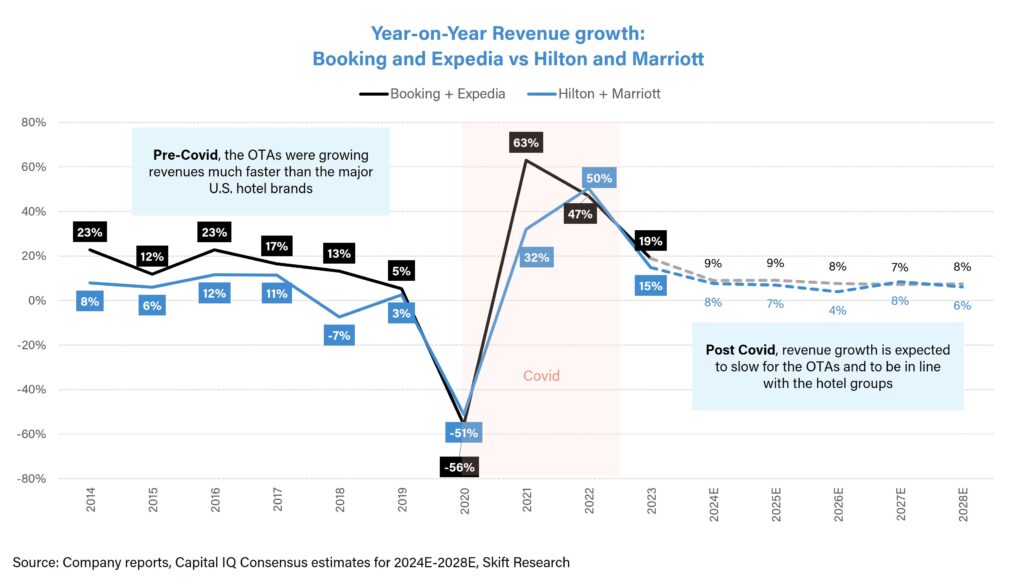

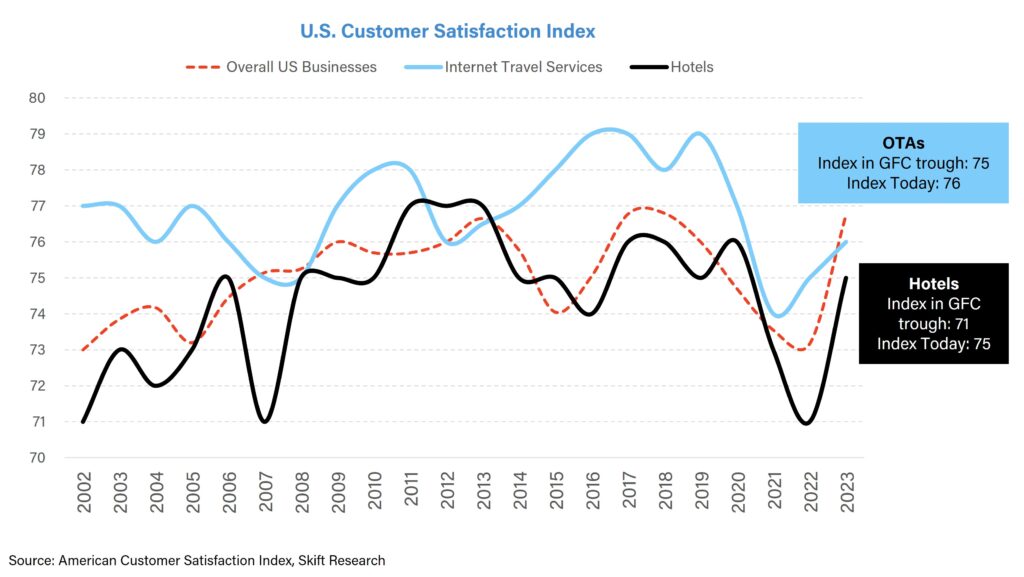

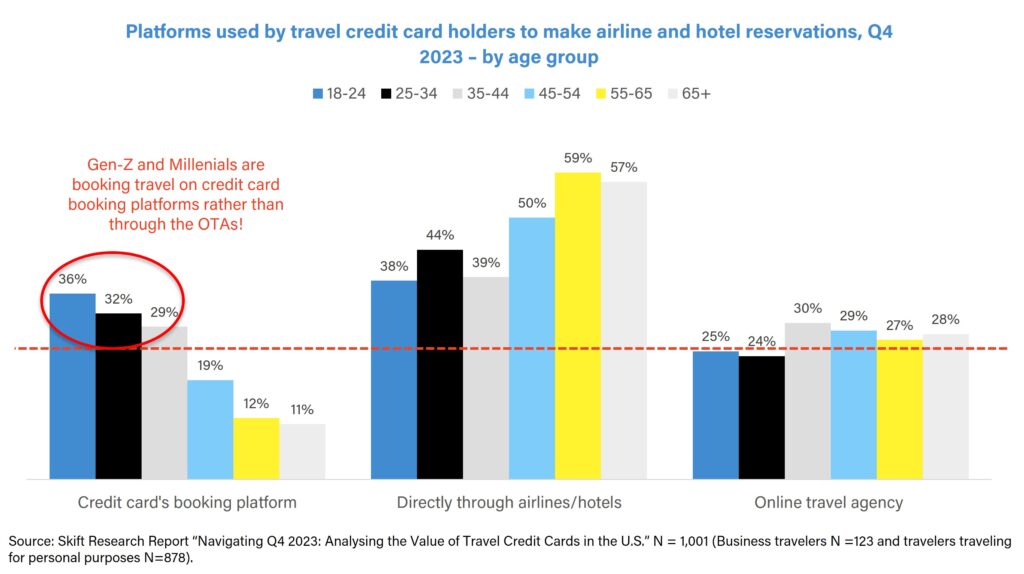

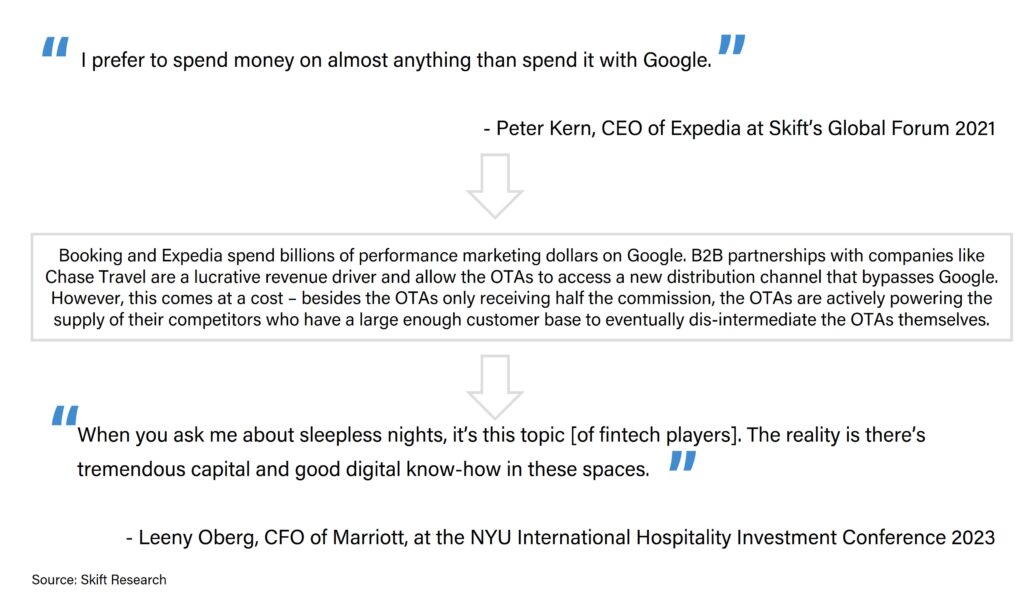

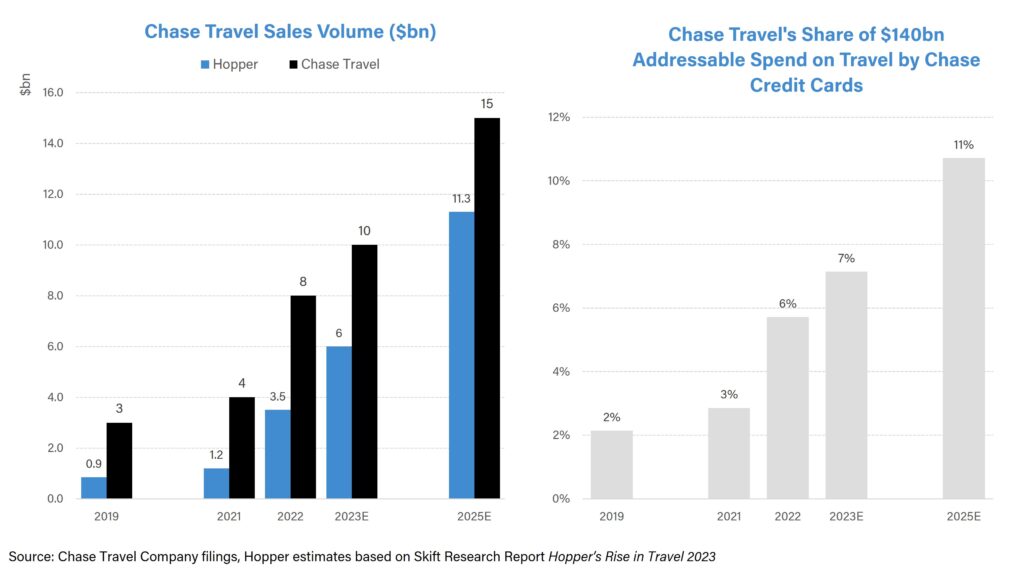

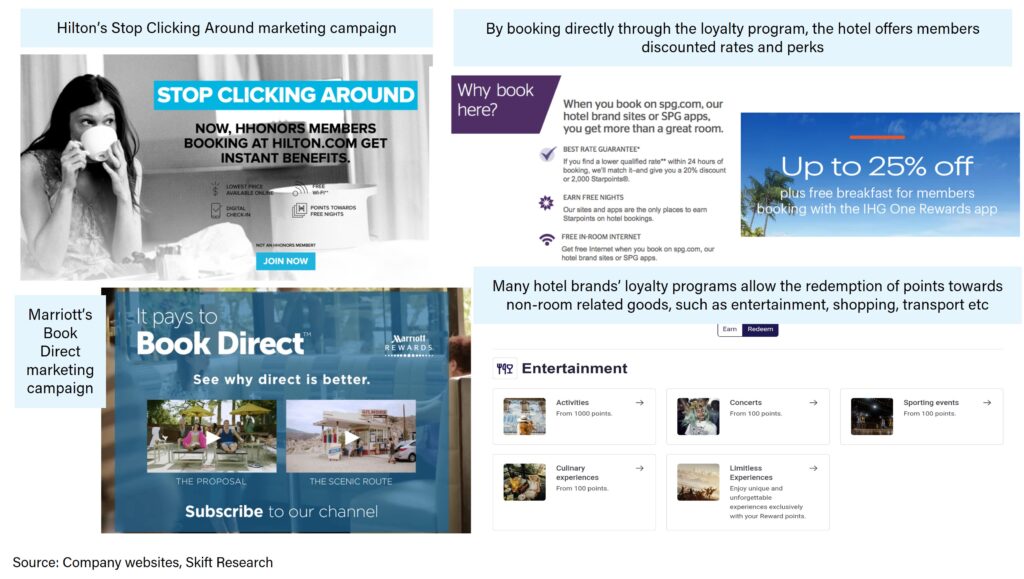

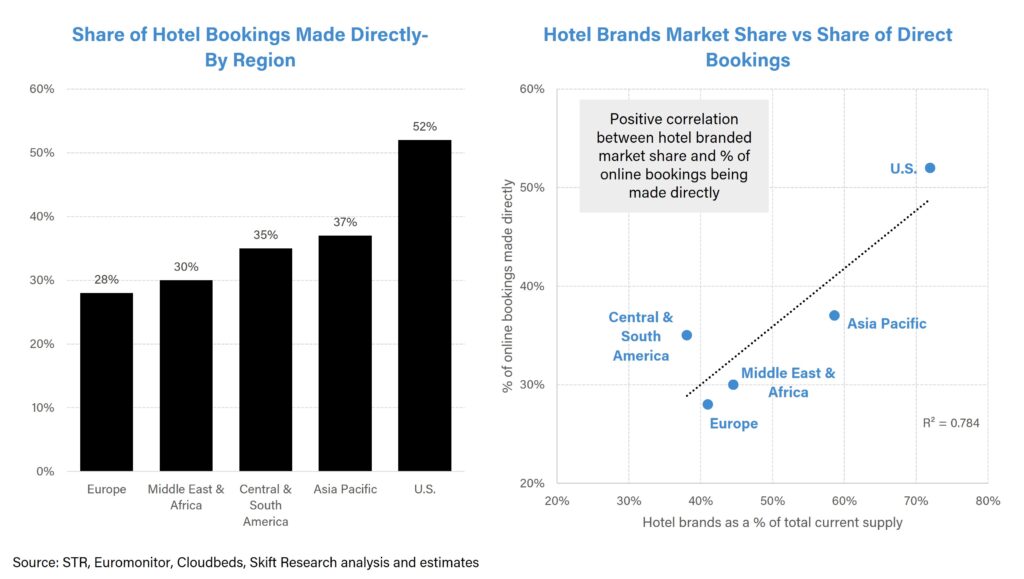

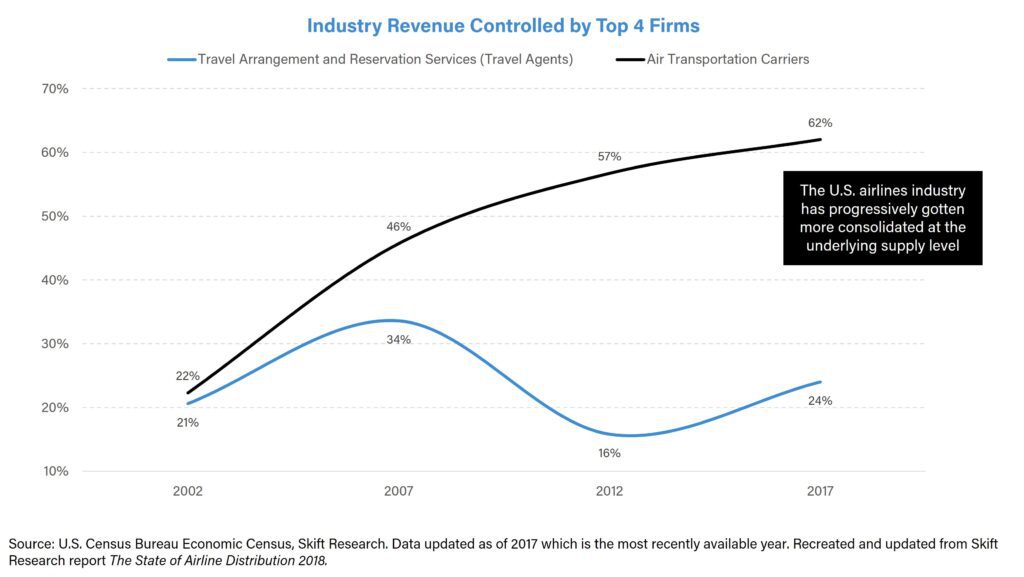

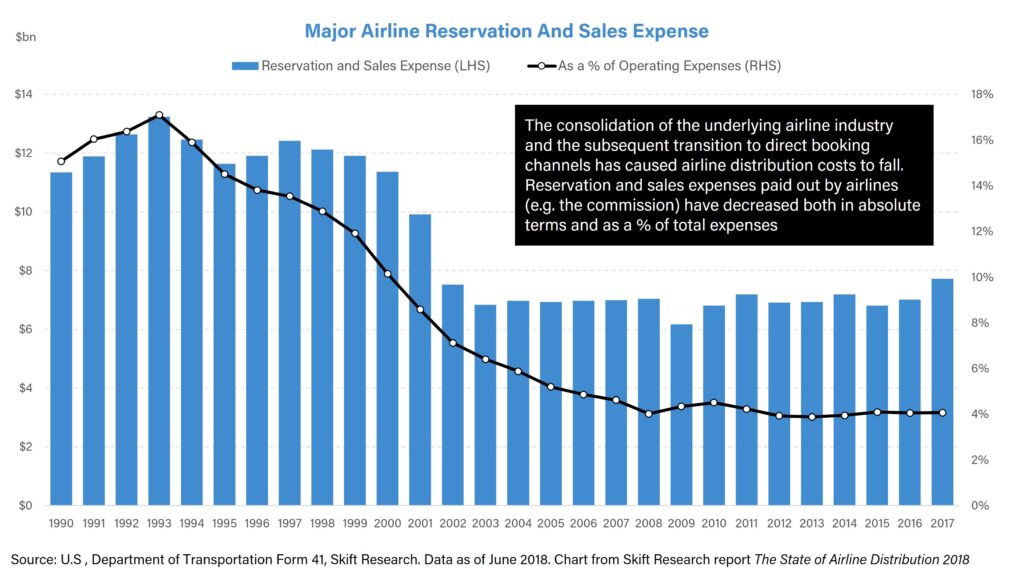

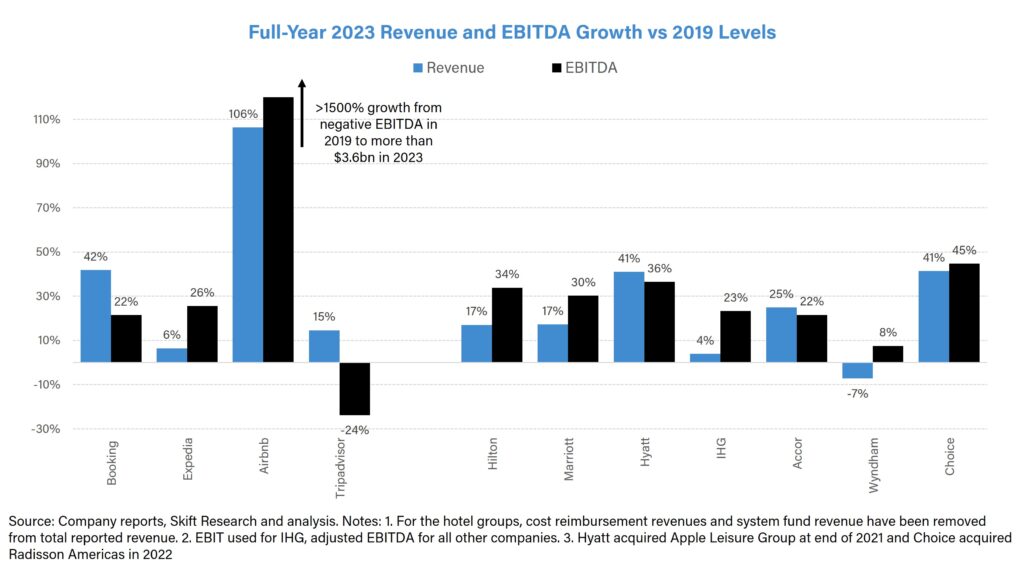

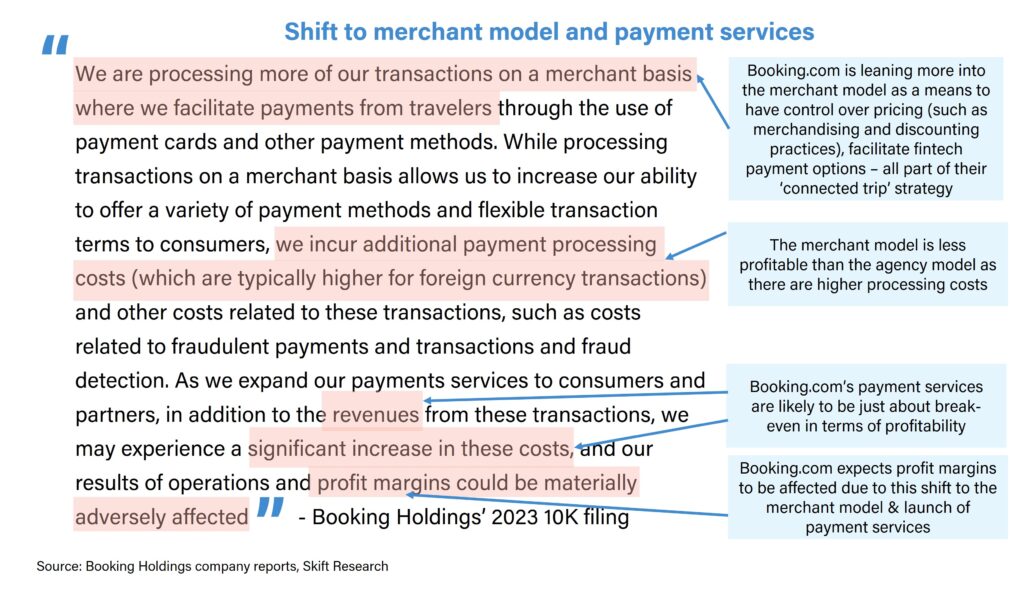

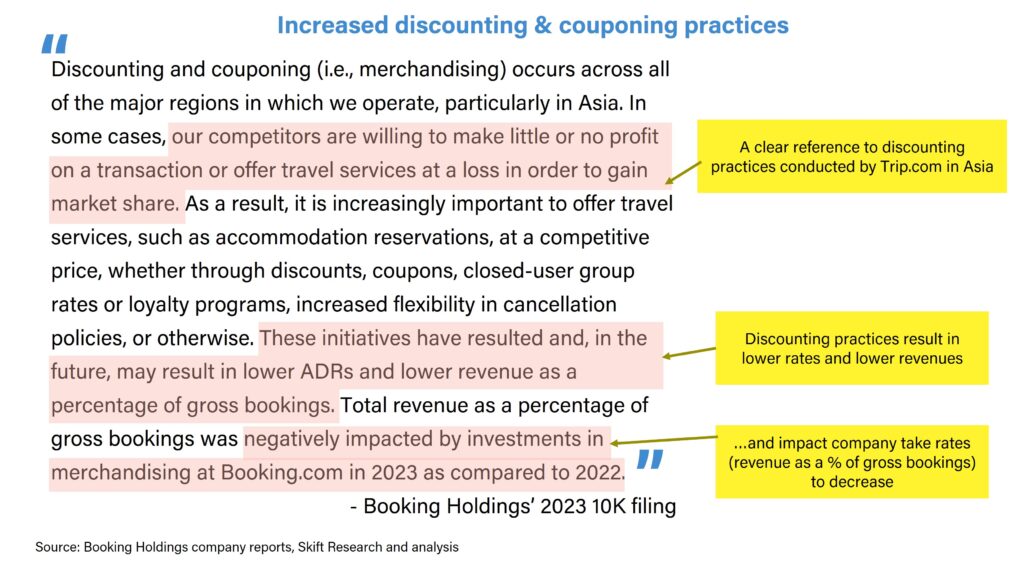

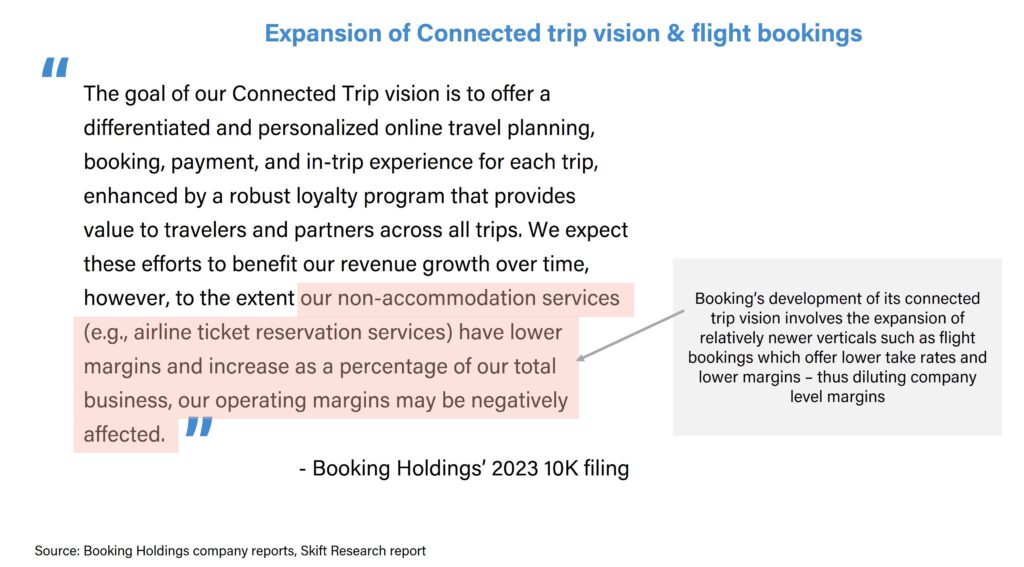

The rise of OTAs during the post-GFC era marked a golden decade of market share gains for Booking and Expedia, fueled by the shift to online bookings and a consolidated distribution landscape. However, today the legacy OTAs face slowing growth, heightened competition, and shrinking profit margins. With increased competition from tech-savvy direct hotel brands and new players entering the market, the future of OTA market share hangs in the balance. Yet, Booking and Expedia are not backing down, doubling down on innovation and expansion efforts to maintain their foothold in the industry – albeit at the cost of lower profit margins. Ultimately, the future of the online travel market will likely be shaped by who can best balance innovation with efficiency whilst establishing enduring customer loyalty.

What You'll Learn From This Report

- The Rise of the OTAs: Understand how Booking and Expedia leveraged industry trends following the Great Financial Crisis to become the dominant players in online travel.