How Much Does a Doctor Visit Cost With and Without Insurance?

Without insurance, medical care can get pricy fast. Where you live, what doctor you’re going to, and what tests you need will all figure into your doctor’s visit bill. In this article, we’ll break down those costs and give you some tips for saving money.

What Goes into the Cost of a Doctor’s Visit?

Geography is one of the biggest factors in the price of a doctor’s visit. Most medical facilities pass some of their overhead expenses onto their patients. If you live somewhere with a higher cost of living, like California or New York City, you’ll likely pay more for doctors’ visits. The practice has to pay more for utilities and rent, and those costs show up in your bill. For example, Mayo Clinic’s Patient Estimates tool quotes $846 for a 60-minute office visit in Jacksonville, Florida, but $605 for the same visit in Wisconsin.

Like the cost of living, supplies and equipment will also end up on your tab. Say you need a strep test, blood draw, or Pap smear. The supplies needed for the test plus the cost of the lab fees will all figure into the price.

Bills for the same exams and procedures can also vary depending on what kind of facility you’re going to. Smaller practices and public health centers are often a lot cheaper than university or private hospital systems. This is due in part to their buildings being smaller and their overhead fees being lower.

Price of Out-of-Pocket Doctors’ Visits

The cost of a doctor’s office visit also depends on what kind of doctor and the procedure you need to have done. For example, an in-office general wellness checkup will be cheaper than a specialist procedure. If you have an emergency, an urgent care center will be much more affordable than the emergency room.

Primary Care Physician — Physical Exam

Physicals usually include blood pressure readings, cholesterol measurements, and vaccines. Prostate exams for men and Pap smears and breast exams for women are also often included. Pediatric physicals focus on the growth milestones for your child’s age. Doctors check height, weight, sleep patterns, diet, and the vaccines required by public schools.

The range for a yearly physical can be anywhere from $100 to $250 or more without insurance. A CVS Minutecare Clinic may charge just $59 for a sports physical, but not all organizations will accept this as proof of physical health.

Primary Care Physician — Procedures

On top of the base cost for physical exams, you may have extra charges for any specific tests or procedures you need. According to the Cardiometabolic Health blog, the most common procedures in primary care medicine include bloodwork, electrocardiograms, and vaccines/injections.

Bloodwork is one of the biggest cost wild cards. Certain tests can run you from as little as $10 to as much as $10,000 . Large national labs like Labcorp offer pricing on their website, so you know what to expect going in. For example, Labcorp’s General Health Blood Test , which includes a metabolic panel, complete blood count (CBC), and urinalysis, costs $78.

Electrocardiograms or EKGs check your heart health and can find cardi ac issues. This quick procedure involves monitoring your heartbeat through electrodes placed on your skin. While it’s a painless and accurate way to detect heart conditions, the costs can add up without insurance. Expect to pay as little as $410 or as much as $1700 for this procedure, depending on local prices.

Vaccines are often required before sending your kids to school. The CDC publishes a vaccination price list annually to give you an idea of what to expect. For example, they quote $19-$132 for DTaP, $21 for Hepatitis A, and $13-$65 for Hepatitis B. The COVID-19 vaccine, however, is free of cost, regardless of insurance status.

Urgent Care Visit

If you have an emergency but are stable, urgent care is much cheaper than the emergency room. According to Scripps , most urgent care centers and walk-in clinics can at least treat dehydration, cuts or simple fractures, fever, flu, strep, and UTIs. Note that if you have chest pain, a serious injury, seizures, a stroke, or pregnancy complications, you should go straight to the ER .

For a base exam at an urgent care facility, expect to pay between $100-$150 . That price will go up depending on what else you need. For example, Advanced Urgent Care in Denver quotes $80 for an X-Ray, $50 for an EKG, $135 for stitches, and $5 for a urinalysis. In comparison, expect to pay $1,000-$1,300 for the same procedures in the emergency room.

How to Lower Your Out-of-Pocket Medical Costs

Healthcare expenses may seem overwhelming without insurance. Luckily, there are many resources available to help you cover the costs.

Free & Low-Cost Immunization and Wellness Clinics

For standard vaccines and checkups, look for local free or low-cost clinics. Check out The National Association of Free and Charitable Clinics’ search tool to find a location near you. Your city’s public health department should also offer free or low-cost vaccines and basic medical care services.

Certain large vaccine manufacturers also offer vaccine programs. For example, Merck’s patient assistance program offers 37 vaccines and medicines free to eligible patients. The program includes albuterol inhalers and vaccines for Hepatitis A, Hepatitis B, MMR, and HPV.

Cash Negotiations

Most health systems offer lower rates for patients paying cash. Some even have free programs for low-income families. For example, Heritage UPC in North Carolina has a yearly membership for low-cost preventative care. In Northern California, the Sutter Health medical system offers full coverage for patients earning 400% or less of the Federal Poverty Income Guideline .

As of January 1, 2021, all hospitals in the United States now have to follow the Hospital Price Transparency Rule . That means they have to list procedure prices clearly on their website. You can also call medical billing before your appointment to discuss cash pay options.

Federal Medical Payment Support

If all else fails, there are federal programs to help you cover the cost of medical bills.

Organizations like The United Way and United for Alice offer grants for ALICE (asset-limited, income-constrained, employed) patients. These are people living above the poverty level, making them ineligible for other government programs but below the basic cost-of-living threshold.

Medicaid is available for children, pregnant women, and adults under a certain income threshold. If your income is too high to qualify for Medicaid but you can’t afford private insurance for your children, you may be eligible for the Children’s Health Insurance Program (CHIP) to cover your children’s medical care.

Use Compare.com for the Best Doctors’ Visit Prices

Navigating bills for a doctor’s visit can feel overwhelming, but Compare.com is here to help. With our price comparison tool, you can search all clinic and doctors’ office prices in your area. Compare makes sure you’re prepared for the cost of your checkup long before you schedule your appointment.

Nick Versaw leads Compare.com's editorial department, where he and his team specialize in crafting helpful, easy-to-understand content about car insurance and other related topics. With nearly a decade of experience writing and editing insurance and personal finance articles, his work has helped readers discover substantial savings on necessary expenses, including insurance, transportation, health care, and more.

As an award-winning writer, Nick has seen his work published in countless renowned publications, such as the Washington Post, Los Angeles Times, and U.S. News & World Report. He graduated with Latin honors from Virginia Commonwealth University, where he earned his Bachelor's Degree in Digital Journalism.

Compare Car Insurance Quotes

Get free car insurance quotes, recent articles.

Find Urgent Care today

Find and book appointments for:.

- Urgent Care

- Pediatric Urgent Care

- COVID Testing

- COVID Vaccine

Price Transparency

How much does a doctor’s visit cost without insurance.

According to the Agency for Healthcare Research and Quality, the average cost of a visit to the doctor’s office in 2016 was $265, with expenses ranging from $159 to $419 depending on the specialty.

- At an urgent care center you can expect to pay between $100-200 to see a provider, plus the cost of any treatments or testing you may need.

- Always ask for pricing information before you agree to any testing or treatment. You are entitled to this information.

Going to the doctor for any reason can be expensive. Without insurance, you can expect to pay approximately anywhere from $50–$350 just for a routine medical exam, which doesn’t include additional expenses such as x-rays , blood tests, or other lab work.

The cost of a doctor's visit

According to Solv’s Chief Medical Officer, Dr. Rob Rohatsch, the cost of a doctor’s visit can vary widely depending on factors such as:

- The type of doctor you are seeing

- The reason for your visit

- Where you see the doctor, for example, if you go to an urgent care facility or a doctor’s office

- Whether you are a new or established patient

- Any necessary tests or treatments

- Whether you need lab work

Visits to specialists such as primary care providers, pediatricians, and psychiatrists were lower than the average cost, while the most expensive doctor’s visits were for orthopedists and cardiologists.

Data from the Agency for Healthcare Research and Quality indicates that if you are visiting a doctor and don’t have insurance, you can expect to pay roughly the following amounts. The cost could vary depending on the factors listed above.

- Psychiatry: $159

- Pediatrics: $169

- Primary care: $186

- Dermatology: $268

- OB/GYN: $280

- Ophthalmology: $307

- Cardiology: $335

- All other: $365

- Orthopedics: $419

Additionally, if you are a new patient, there may be an additional charge associated with your new patient exam.

Where to see a doctor without insurance

If you don’t have insurance, the cost of your doctor’s visit can also be affected by where you go to see the doctor. There are many places you can seek medical care, some of which are more affordable than others, notes the Agency for Healthcare Research and Quality:

- Community health clinics often provide free medical care or low-cost care, including preventive care, health screenings, and vaccinations .

- Urgent care centers offer many health services. Many don’t require appointments, although your wait time may be less if you schedule an appointment in advance. You can expect to pay around $100 - $200 to see an urgent care provider, plus the cost of any treatments or testing you may need.

- Many health care facilities now offer telehealth services, which are often more convenient and more affordable. For some conditions, however, you may need to be seen in person for proper diagnosis and treatment.

- If your medical need is not urgent, and you know the type of doctor you need to see, you can schedule an appointment with a primary care physician or a specialist at their office. Be sure to ask about their payment policy in advance. If you don’t have insurance, you may be required to pay the entire bill at the time of service.

- If you have a medical emergency, you can visit the nearest emergency room. Even if you don’t have insurance, you will be able to receive treatment. However, this is typically the most expensive option. If you have a non-emergency medical condition that can wait until you can be seen at one of the other options, you will likely save money.

Paying self-pay prices for doctor’s visits

Even if you have insurance, you may be able to save money by paying cash for certain medical services. While preventive care may be covered at 100% by your insurance company, other tests and treatments may be applied to your deductible. If you have a high deductible and don’t expect to meet it – especially if it’s late in the calendar year – paying cash for your medical care may be a cheaper option.

Most doctor’s offices and health care providers charge a higher price when they bill the insurance company. For example, they may charge the insurance company $70 for a treatment or service, but if the patient is paying cash, they may only charge $60. This is known as the self-pay price . If you pay cash, the claim won’t be submitted to your insurance company, but you could end up saving money.

Always ask for pricing information before you agree to any testing or treatment. You are entitled to this information. As of 2021, hospitals are required to disclose self-pay prices, even when the patient has insurance. If the doctor’s office won’t provide you with this information, be persistent, or seek care somewhere else. If you plan on paying self-care prices, you aren’t limited to the providers in your insurance network. You’ll have a wider range of options to choose from, and you can choose a provider who is willing to provide fair, clear prices.

Let your doctor’s office know that you are paying out of pocket, and ask if they offer a discount for self-pay patients. Many doctor’s offices will offer special rates for patients who are paying cash or who do not have insurance; however, they may not advertise these rates, so it’s always a good idea to ask.

Know what you’ll pay ahead of time with Solv ClearPrice TM

According to Healthcare Finance News, more than half of Americans avoid going to the doctor when they’re sick due to high medical costs or unclear costs. Solv is committed to eliminating surprise medical bills with Solv ClearPrice™ . We partner with thousands of providers across the country who have agreed to display self-pay prices for their services. When you book an appointment on Solv, you will be able to see the self-pay price for many common services.

To schedule an appointment, search our directory for a provider in your area. Begin typing the service you are looking for, and choose from the list of options that appear. If you aren’t sure which type of doctor you need to see, you may want to try an urgent care clinic or a walk-in clinic . In many cases, you can schedule an appointment quickly and conveniently online, and many of our providers have same-day or next-day appointments available.

Frequently asked questions

What factors affect the cost of a doctor's visit, what is the average cost of a visit to the doctor’s office, are there any additional charges for new patients, where can i seek medical care if i don't have insurance, what is the self-pay price, are hospitals required to disclose self-pay prices, can i get a discount if i'm paying out of pocket, what is solv clearprice™.

Michael is an experienced healthcare marketer, husband and father of three. He has worked alongside healthcare leaders at Johns Hopkins, Cleveland Clinic, St. Luke's, Baylor Scott and White, HCA, and many more, and currently leads strategic growth at Solv.

Dr. Rob Rohatsch leverages his vast experience in ambulatory medicine, on-demand healthcare, and consumerism to spearhead strategic initiatives. With expertise in operations, revenue cycle management, and clinical practices, he also contributes his knowledge to the academic world, having served in the US Air Force and earned an MD from Jefferson Medical College. Presently, he is part of the faculty at the University of Tennessee's Haslam School of Business, teaching in the Executive MBA Program, and holds positions on various boards, including chairing The TJ Lobraico Foundation.

- Agency for Healthcare Research and Quality: Expenses for Office-Based Physician Visits by Specialty and Insurance Type, 2016 https://meps.ahrq.gov/data_files/publications/st517/stat517.shtml

- Hospital Price Transparency, Centers for Medicare and Medicaid (2022) https://www.cms.gov/hospital-price-transparency

- More than half of Americans have avoided medical care due to cost (2019) https://www.healthcarefinancenews.com/news/more-half-americans-have-avoided-medical-care-due-cost

- telemedicine

- primary care

- healthcare costs

- health insurance

- urgent care

Quality healthcare is just a click away with the Solv App

Book same-day care for you and your family

Find top providers near you

Choose in-person or video visits, manage visits on-the-go, related articles.

How Much Does Urgent Care Cost Without Insurance?

When you have a pressing medical issue, your first priority is getting to see a doctor, quickly. Getting an...

How Much Do Stitches Cost Without Insurance?

You fell and got a nasty gash that’s going to require stitches. You can easily get it stitched at an urgent care...

Why is My Copay Higher for Urgent Care Centers?

Urgent care centers can be a huge help when you or a family member needs immediate care for an illness or...

Cost of Blood Test Without Insurance in 2024

When you’re uninsured, you’re likely to keep a closer eye on all of your medical costs. However, staying...

How to Save Money on Healthcare Through Self-Pay

Americans hold a few core beliefs about how health insurance is supposed to work. They know that it’s meant to...

How Much Do Annual Physicals Cost Without Insurance?

If you are in need of an annual physical, you may be wondering how much annual physicals cost without...

Health Insurance 101: Key terms and plan types

The lack of transparency and easily accessible information can sometimes make it feel almost impossible to...

9 Things to Consider When Choosing Your 2020 Health Insurance

Open Enrollment began on the first of November–but what does this mean for you? Health insurance can be...

![gp visit fee Maintaining Healthy Cholesterol Levels [Infographic]](https://d1kve3ll6vvkpr.cloudfront.net/dir/media/W1siZiIsIjIwMTQvMDMvMDkvMTBfMjJfMzZfNThfY2hvbGVzdGVyb2wuanBnIl0sWyJwIiwidGh1bWIiLCI4MDB4NDE3IyJdLFsicCIsImVuY29kZSIsImpwZyIsIi1xdWFsaXR5IDk1Il1d/file.jpg?basename=Maintaining+Healthy+Cholesterol+Levels+%5BInfographic%5D&sha=7e0cef62b531a28b)

Maintaining Healthy Cholesterol Levels [Infographic]

Understanding how your heart works will give you greater insight so you can see just how dangerous cholesterol...

What You Need to Know About Surprise Bills

This year, more than 50% of Americans will struggle to pay for medical bills, according to data from Debt.com....

Related Health Concerns

Abdominal Pain

COVID-19 Vaccine

Cataract Surgery

Cold Medicine

Daycare Physical

Pinched Nerve

Sexually Transmitted Diseases

Urinary Tract Infection (UTI)

Urine Culture

This site uses cookies to provide you with a great user experience. By using Solv, you accept our use of cookies.

Cookies on citizensinformation.ie

We use cookies to collect information about how you use citizensinformation.ie. This helps us to improve your experience. You can find out more about the cookies we use in our Cookie notice . You can also read our Privacy policy . You can accept all cookies or you can chose which cookies to accept or reject. You can change your cookie preferences at any time by using the My cookie preferences link at the bottom of each page.

Cookie preferences

Cookies used by google analytics.

We use Google Analytics to measure how you use the website so we can improve it. We have configured Google Analytics to anonymise your IP address so that you are not personally identified. We gather information on:

- How you got to the site

- The pages you visit on citizensinformation.ie, and how long you spend on each page

- What you click while you are visiting the site

GP visit cards

What is a gp visit card, who can get a gp visit card, income limits for people aged under 70, how to apply for a gp visit card, more information on gp visit cards.

A GP visit card is a card that gives you free visits to a participating family doctor (GP). If you are not eligible for a medical card , you may be eligible for a GP visit card.

You can apply for a GP visit card online.

What does a GP visit card cover?

Your GP visit card covers the cost of visits to your GP and visits to GP out-of-hours services . You can read more about what services are available with the medical card and GP visit card.

What is not covered by the GP visit card?

The GP visit card does not cover hospital charges .

Prescribed drugs are not free but may be covered by the Drugs Payment Scheme .

You must be ordinarily resident in Ireland to apply for a GP visit card. This means that you are living in Ireland and intend to live here for at least one year.

You will qualify for a GP visit card with no means test if you are :

- Aged under 8 (see GP visit cards for children )

Aged over 70

- Getting Carer’s Benefit or Carer’s Allowance , at full or half-rate

If you are aged under 70, your income is assessed by the HSE to see whether you qualify for a GP visit card. See below for information about the HSE basic rates of income.

Your income is assessed by the HSE using the means test for people aged under 70 . However, the basic rates of income for the GP visit card are higher than the limits for the medical card.

Your weekly net income is compared to the HSE's weekly basic rate of income . This is your income after tax, PRSI and universal social charge (USC) have been deducted. There are extra allowances for children.

If your income is above the weekly basic rate you may still qualify for a GP visit card after you include allowable expenses such as childcare and rent (see ‘Allowable expenses’ below).

The weekly basic rates of income increased on 11 September 2023 and again on 13 November 2023. If you were not eligible in the past, you may be eligible now.

Allowable expenses

Some living expenses are allowable. This means they increase your weekly basic rate of income.

Allowable expenses include:

- Childcare costs

- Rent (not including any amounts paid by Housing Assistance Payment or Rent Supplement )

- Reasonable mortgage payments on your family home and other land or property.

- Mortgage protection insurance and associated life assurance.

- Home insurance.

- Maintenance payments you make.

- Nursing home, private nursing or home care costs for you or your spouse.

- The cost of public transport.

- Driving expenses if a car is required, at a rate of 30 cent per mile/18 cent per km. If a couple needs two cars to travel to work, a double allowance applies. The cost of parking can be taken into account.

- Reasonable contributions towards carpooling costs.

See examples of how you or your family’s income is calculated when you apply for a GP visit card.

Read the HSE National Assessment Guidelines for medical card and GP visit card (pdf) . You can also find a list of the documents you need to support your application.

Aged over 70 with dependants

If you are aged over 70, you are eligible for a GP visit card regardless of your income.

If you are over 70 and you have dependants who are aged under 70, for example, a spouse or partner your dependants may qualify for a GP visit card if your combined gross income is over €1050, but not greater than €1,400 a week.

If either of you are aged over 70, you will both qualify for a full medical card if your combined gross income is €1050 or less per week.

Finances over the qualifying financial threshold

When you apply for a GP visit card, the HSE will first assess your application for a medical card . If you don't qualify for a medical card, you will then be assessed for a GP visit card.

If your finances are over the qualifying financial threshold for a medical card or GP visit card, you may still qualify for a discretionary medical card if your medical expenses would cause you financial hardship without one.

If you want to apply for a discretionary medical card , you should also include information about your family’s medical expenses in your application.

Aged under 70

If you are under 70, you use the same application process to apply for a GP visit card as for a medical card . So, as part of the application process for the GP visit card, your entitlement to a medical card is automatically assessed.

You can apply for a medical card or GP visit card online on medicalcard.ie

You can also download an application form for the GP visit card and medical card (pdf) and email it to [email protected] or post it to:

National Medical Card Unit,

PO Box 11745,

If you are aged 70 or over, you can register for your GP visit card online .

You can also download the registration form for people aged 70 and over (pdf) and email it to [email protected] or post it to:

GP Visit Card Over 70s,

PO Box 12629,

You can also call 0818 22 44 78 to ask for a paper registration form.

Application for a spouse or partner

If you are over 70, with a dependant spouse or partner who is under 70, and you think your finances may be under the qualifying financial threshold, you can apply for GP visit cards for both of you. To do this, you use the standard medical card/GP visit card application form (pdf) and include details of your income and allowable expenses. (For the HSE weekly basic income rates, see ‘Dependants of people aged over 70’ above).

Applying if you are a carer

If you get Carer’s Benefit or Carer’s Allowance, at full or half-rate, you are eligible for a GP visit card. You can register for the GP visit card for carers by email or post .

Appealing your GP visit card application

If your application for a GP visit card is refused, you will receive a letter from the HSE to let you know. The letter will also set out the reasons why your application has been refused.

If you are not satisfied with the decision, you may have it reviewed. Your circumstances may have changed, or you may have left out some relevant information from the original application.

If you are not satisfied with the review, you can make an appeal to the Appeals Office of your HSE Area . You can also find the contact details for the Appeals Office in the letter of refusal from the HSE.

The Appeals Office will conduct a reassessment of your application. This will be conducted by HSE staff who were not involved in deciding on your original application.

Your entitlement to a GP visit card is reviewed periodically by the HSE. This is because your circumstances may change. If you don’t return your review form, your GP visit card may not be re-issued.

If you return your review form by the given date but the review process continues past the expiry date of your card, the HSE may extend your card’s validity so that you can continue to use it while the review is taking place. The extension is on a month-by-month basis, so it is advisable to contact the HSE Client Registration Unit (contact details below) to confirm that your card has been extended and continues to be valid.

Check the status of your application for a GP visit card on the HSE website . You will need the reference number from your application.

You can check if your GP visit card is still valid on the HSE website.

Contact Lo-call 0818 22 44 78 or your Local Health Office for more information on GP visit cards. You can also contact the Client Registration Unit.

Client Registration Unit

4th Floor HSE PCRS Finglas Dublin 11

Related documents

- Services for medical card and GP visit card holders Family doctors (GPs) provide certain services to medical card and GP visit card holders free of charge. 3262.3044

- GP visit cards for children under 8 Children under 8 are entitled to free visits to participating GPs. Find out how to register for the GP visit card for children. 3016.75

- Under 70s means test for medical card and GP visit card How your income is assessed for the medical card and GP visit card if you are under 70 years of age. 2785.8162

If you have a question about this topic you can contact the Citizens Information Phone Service on 0818 07 4000 (Monday to Friday, 9am to 8pm).

You can also contact your local Citizens Information Centre .

Manage cookie preferences

- For medical specialists

Medical Costs Finder

A tool to find and understand costs for gp and medical specialist services across australia.

This information is a guide only and should not be used as a quote or medical diagnosis.

See how the Medical Costs Finder can improve your healthcare experience.

Guide to costs

Get tips on how to discuss medical costs with your GP, specialist, and private health insurer.

About the Medical Costs Finder

Learn more about who the Medical Costs Finder is for. You can also read the terms of use and disclaimer .

How to use the Medical Costs Finder

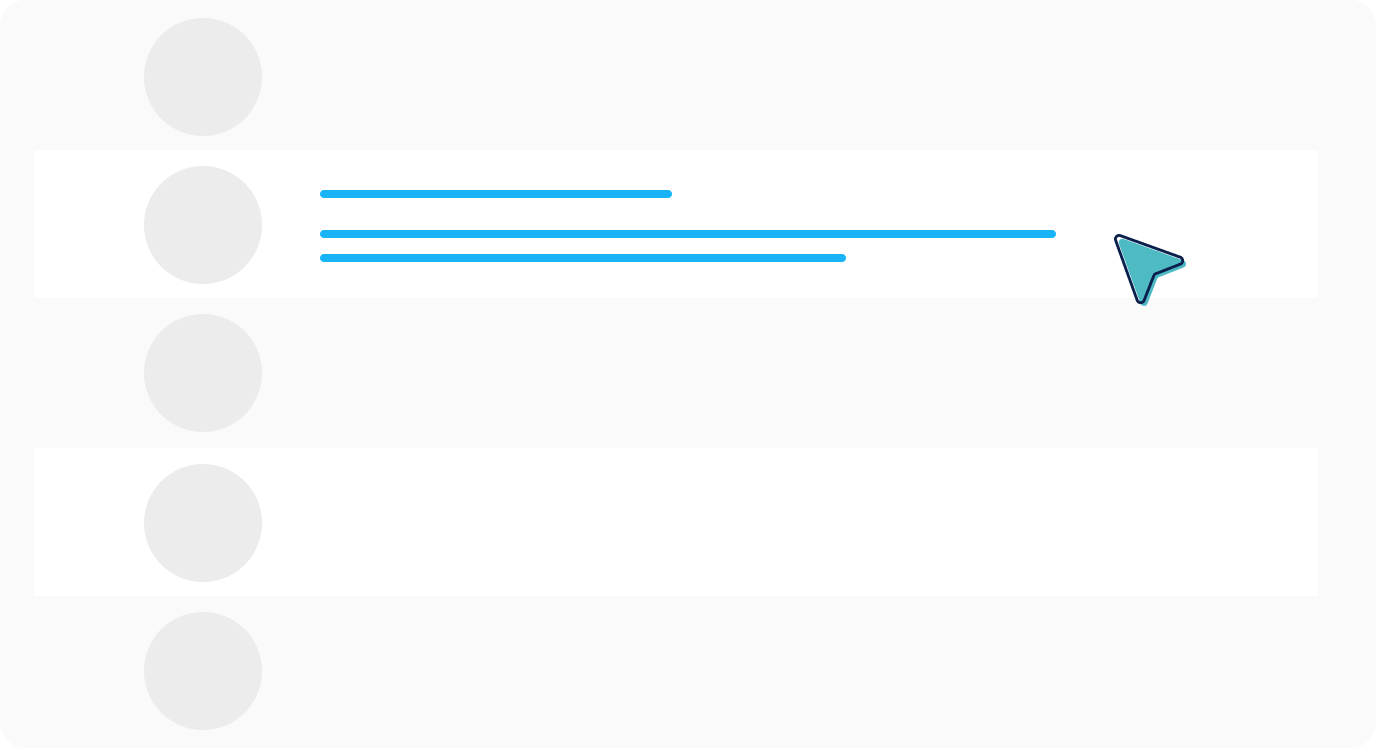

You can search for a procedure or service (including appointments), browse by category or enter an MBS item number. Explore typical costs across Australia. View indicative fees and costs of participating specialists.

Step 1. Search or select from list

Type in the procedure in the text box. Or choose a procedure, speciality or service.

Step 2. Select procedure or service

Choose a procedure or service from the results listed.

Step 3. Find typical costs near you

Explore the typical fees and costs for the selected service.

Step 4. View specialist fees and a typical patient journey

Click on patient journey and specialist fees to learn more about specialist fees. Understand what is involved for your procedure through the patient journey.

Step 5. Enter a postcode to find specialists near you

Enter a postcode to see participating specialists where available. Understand how different gap arrangements may change indicative fees.

Paying for doctor's visits

Doctors set their own fees. Children and some people who need to visit their doctor often can get free or subsidised visits.

Services for children

Many services for children under 14 are free.

Free health services for children

If you visit the doctor often

If you visit your doctor more than 12 times a year, your doctor can apply to the Ministry of Health for a High Use Health Card (HUHC) for you. This may reduce the cost of your future visits.

High Use Health Card

A Community Services Card can help you and your family with cheaper healthcare costs. You may pay less for some health services by simply showing your card.

Community Services Card

Doctor’s fees

Doctors’ practices and medical centres are privately owned and set their own fees so check with them to see what their costs are.

Who to contact for more help

If you need more help or have questions about the information or services on this page, contact one of the following agencies.

Ministry of Health

Senior Services

Utility links and page information

JavaScript is currently turned off in your browser — this means you cannot submit the feedback form. It’s easy to turn on JavaScript — Learn how to turn on JavaScript in your web browser. If you’re unable to turn on JavaScript — email your feedback to [email protected] .

Do not enter personal information. All fields are optional.

You must enable JavaScript to submit this form

Contact NZ government

- A-Z of government agencies

- Contact details by topic

About this website

- About Govt.nz

- Feedback about Govt.nz

- The scope of Govt.nz

Using this website

- Accessibility

- Terms of use

Date printed 23 August 2024

- Skip to primary navigation

- Skip to main content

- Skip to primary sidebar

- Skip to footer

- Best Global Medical Insurance Companies

- Student Insurance

- Overseas Health Insurance

- Insurance for American Expats Abroad

- Canadian Expats – Insurance and Overseas Health

- Health Insurance for UK Citizens Living Abroad

- Expat Insurance for Japanese Abroad

- Expat Insurance for Germans Living Abroad

- Travel Health Insurance

- Trip Cancellation Insurance

- Annual Travel Insurance

- Visitors Insurance

- Top 10 Travel Insurance Companies

- Best Travel Insurance for Seniors

- Evacuation Insurance Plans

- International Life Insurance for US Citizens Living Abroad

- The Importance of a Life Insurance Review for Expats

- Corporate and Employee Groups

- Group Global Medical Insurance

- Group Travel Insurance

- Group Life Insurance

- Foreign General Liability for Organizations

- Missionary Groups

- School & Student Groups

- Volunteer Programs and Non-Profits

- Bupa Global Health Insurance

- Cigna Close Care

- Cigna Global Health Insurance

- Cigna Healthguard

- Xplorer Health Insurance Plan

- Navigator Health Insurance Plan

- Voyager Travel Medical Plan

- Trekker Annual Multi-Trip Travel Insurance

- Global Medical Insurance Plan

- Patriot Travel Insurance

- Global Prima Medical Insurance

- Student Health Advantage

- Patriot Exchange – Insurance for Students

- SimpleCare Health Plan

- WorldCare Health Plan

- Seven Corners Travel Insurance

- Trawick Safe Travels USA

- SafeTreker Travel Insurance Plan

- Unisure International Insurance

- William Russell Life Insurance

- William Russell Health Insurance

- Atlas Travel Insurance

- StudentSecure Insurance

- Compare Global Health Insurance Plans

- Compare Travel Insurance Plans

- Health Insurance in the USA

- Health Insurance in Mexico

- Health Insurance in Canada

- Health Insurance in Argentina

- Health Insurance in Colombia for Foreigners

- Health Insurance in Chile

- UK Health Insurance Plans for Foreigners

- Health Insurance in Germany

- French Health Insurance

- Italian Health Insurance

- Health Insurance in Sweden for Foreigners

- Portuguese Health Insurance

- Health Insurance in Spain for Foreigners

- Health Insurance in China

- Health Insurance in Japan

- Health Insurance in Dubai

- Health Insurance in India

- Thailand Health Insurance

- Malaysian Health Insurance for Foreigners

- Health Insurance in Singapore for Foreigners

- Australian Health Insurance for Foreigners

- Health Insurance in New Zealand

- South Africa Health Insurance for Foreigners

- USA Travel Insurance

- Australia Travel Insurance

- Mexico Travel Insurance

- News, Global Health Advice, and Travel Tips

- Insurance Articles

- Travel Advice and Tips

- Best Hospitals in the United States

- Best International Hospitals in the UK

- Best Hospitals in Mexico

Or call for a quote: 877-758-4881 +44 (20) 35450909

International Citizens Insurance

Medical, Life and Travel Plans!

U.S. 877-758-4881 - Intl. +44 (20) 35450909

How Much Does Healthcare Cost in the U.S.?

The United States is notorious for having the highest healthcare costs in the world. You've likely heard stories of Americans going bankrupt due to medical bills, often because they don't have enough insurance or any at all. Unfortunately, these stories are not uncommon and highlight a serious issue with the affordability of healthcare across the country.

Whether you're considering visiting the United States, preparing for a possible move, or simply curious about the country's healthcare system, it's important to understand the potential financial burden you might face.

So, what is the actual cost of healthcare in the U.S. ? To give you a clearer picture, we've gathered the latest 2024 average prices for various common procedures and treatments without health coverage, so can make informed decisions before coming to the country and avoid any unpleasant surprises.

High-Quality Care Comes with a Price

Despite its mixed reputation, the U.S. healthcare system excels in many areas. It leads the world in medical research and innovation and drives the development of new treatments, technologies, and medicines. The country is also known for its excellent emergency care and high survival rates for serious conditions like heart attacks and strokes.

In addition, American doctors and healthcare professionals receive extensive training from some of the best medical schools and programs in the country. The U.S. healthcare system also offers patients many choices and access to the latest treatments, with a focus on personalized care.

However, high-quality care comes with a price, and healthcare costs in the U.S. are incredibly expensive. As a result, traveling to or living in the country can become extremely costly without sufficient coverage to manage the costs.

Find the Best International Medical Insurance

- Compare multiple quotes and coverage options

- Work with an insurance expert at no additional cost

- Find the best plan for your needs and budget

Why Is U.S. Healthcare So Expensive Compared to Other Countries?

Whether you are a resident, expat, or visitor to the U.S., you can't deny that the average cost of healthcare is much higher compared to other countries. This is not the result of one particular factor but rather a combination of issues that all contribute to increasing prices.

The lack of a universal healthcare system , high administrative costs, expensive medical technology, and higher prices for services all play a role. Other factors such as wasteful spending, high legal costs, and unregulated drug prices also drive up the cost of care.

Additionally, medical professionals in the United States earn higher salaries than their counterparts in other countries, which contributes to higher healthcare costs. Some hospitals operate as for-profit businesses, which further drives up costs as they aim to maximize profits by charging higher prices for services and treatments. Moreover, doctors often run a lot of tests out of fear of malpractice lawsuits.

All these factors combine to make healthcare unaffordable for many, especially those without health coverage to manage the costs.

Read More: US Health Insurance for Non-Citizens

How Much Does Healthcare Cost Without Insurance?

The infographics below show the average costs of common procedures in the United States, as well as unexpected medical treatments without coverage. While these are estimates and actual prices may vary depending on where you are and how complex the care is, they offer a good idea of what you might face as an expat or visitor without travel or international health insurance .

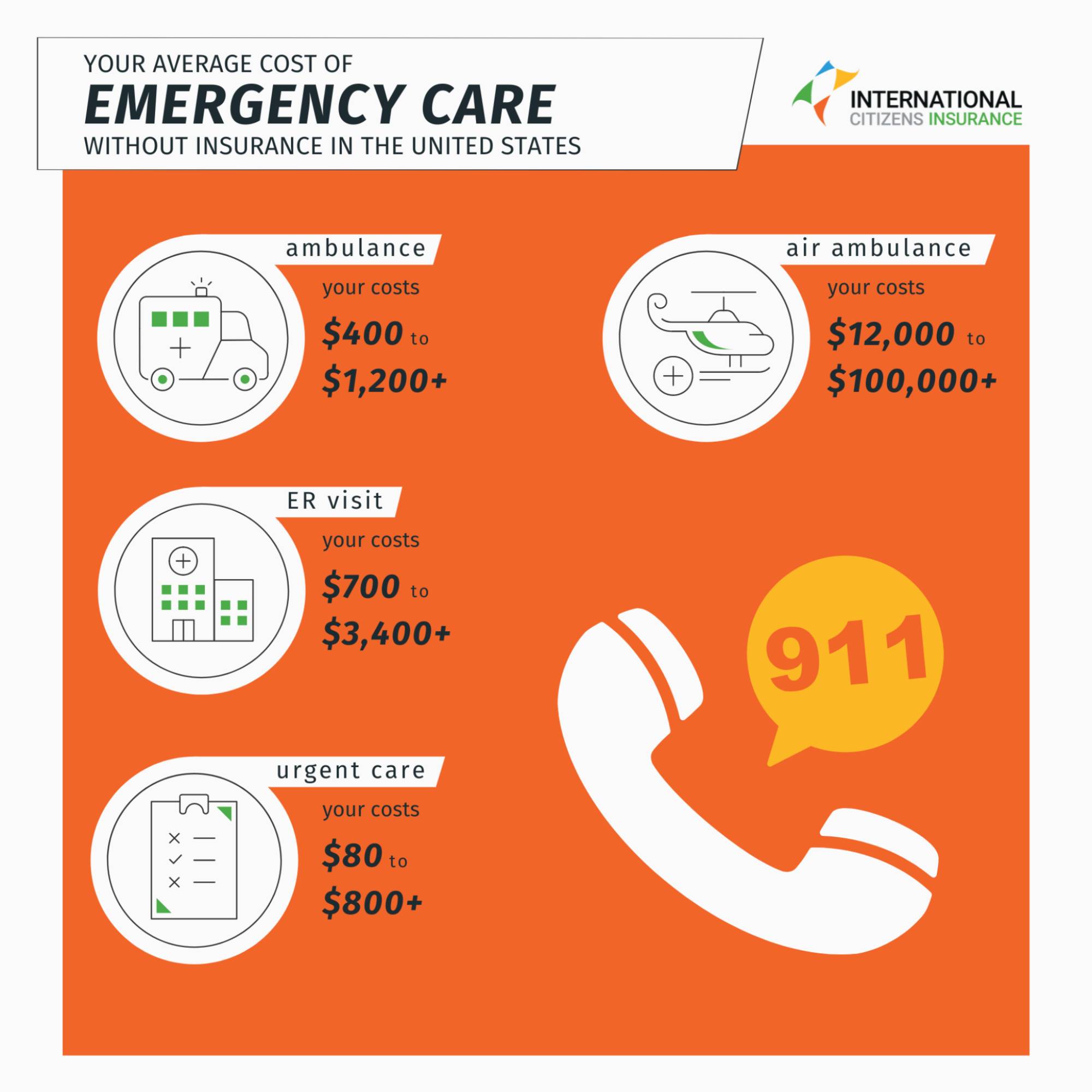

How Much Is Emergency Transport and Care?

If you become ill and need emergency care, your bills will begin adding up right away. An ambulance ride to the hospital starts at $400 and can reach up to $1,200 or more. And that’s just for the pickup – if you need any procedures in the ambulance, the costs can add up before you even reach the hospital. If you need air transport, the expenses are even higher, with emergency evacuation starting at around $12,000 and exceeding $100,000 in extreme cases.

An ER visit can cost between $700 and $3,400, depending on the type and complexity of care you need. If you have to stay overnight, an extra $5,000 might be added to your bill. These costs vary based on where in the U.S. you are treated and the nature of your emergency, but without coverage, it can be very expensive.

One way to save money if you need immediate attention is to go to an urgent care clinic instead of the ER. While you might still face additional costs for treatment, tests, and medications, the visit itself usually ranges from $80 to $800 or more.

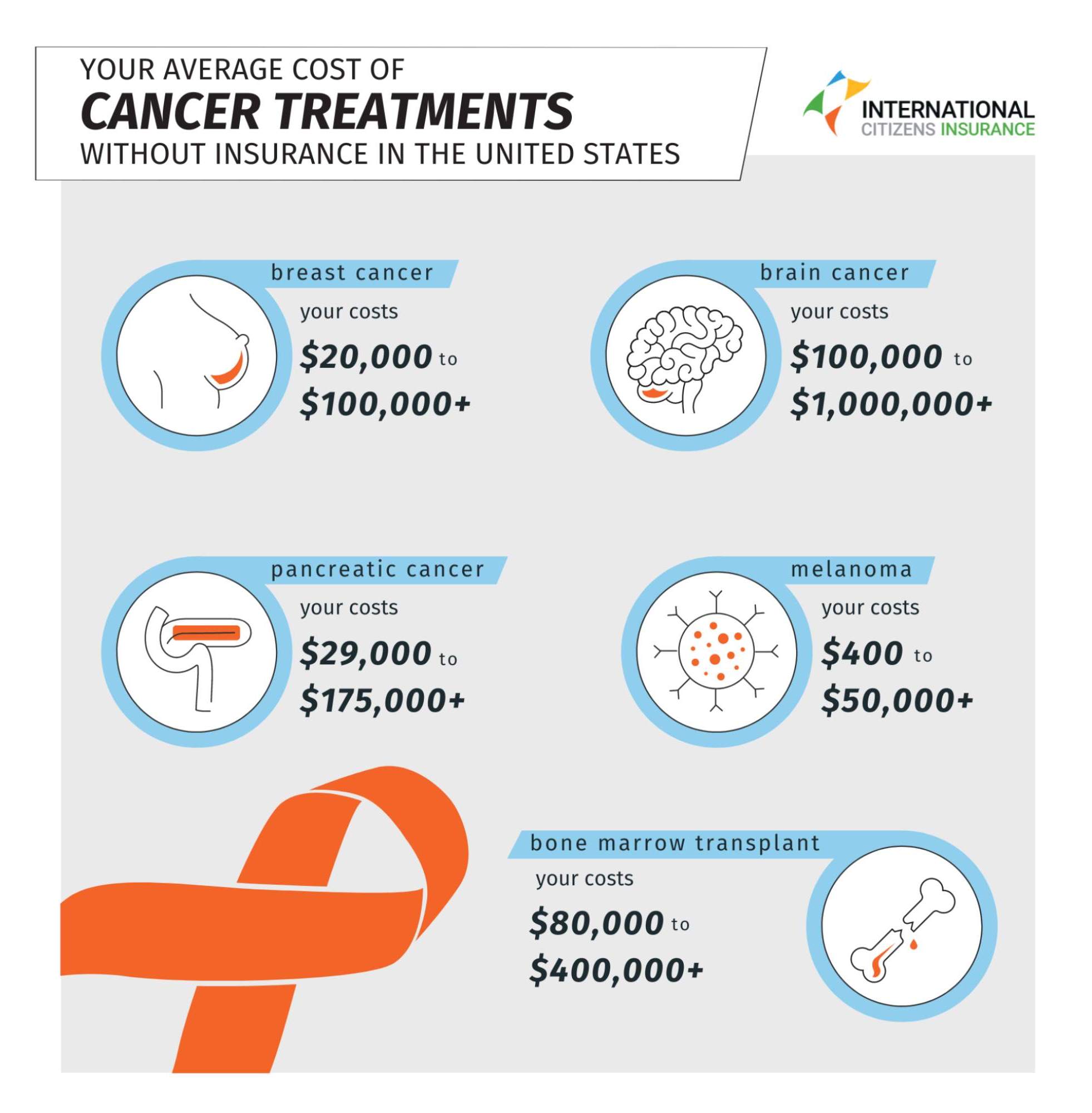

What Is the Average Cost of Cancer Treatment Without Health Insurance?

Cancer is something no one wants to think about, but it's important to understand the potential costs if it does become a reality.

Unfortunately, cancer care in the U.S. is very expensive. For example, early-stage melanoma might cost as little as $400, but without coverage, the cost can rise to $50,000 or more. Breast cancer costs can vary widely depending on the stage at which it is detected, but tend to start around $20,000 and can exceed $100,000.

Pancreatic cancer treatment can range from $29,000 to $175,000, while a bone marrow transplant can cost as much as $400,000 or more. Meanwhile, the price of treating brain cancer can exceed $1 million.

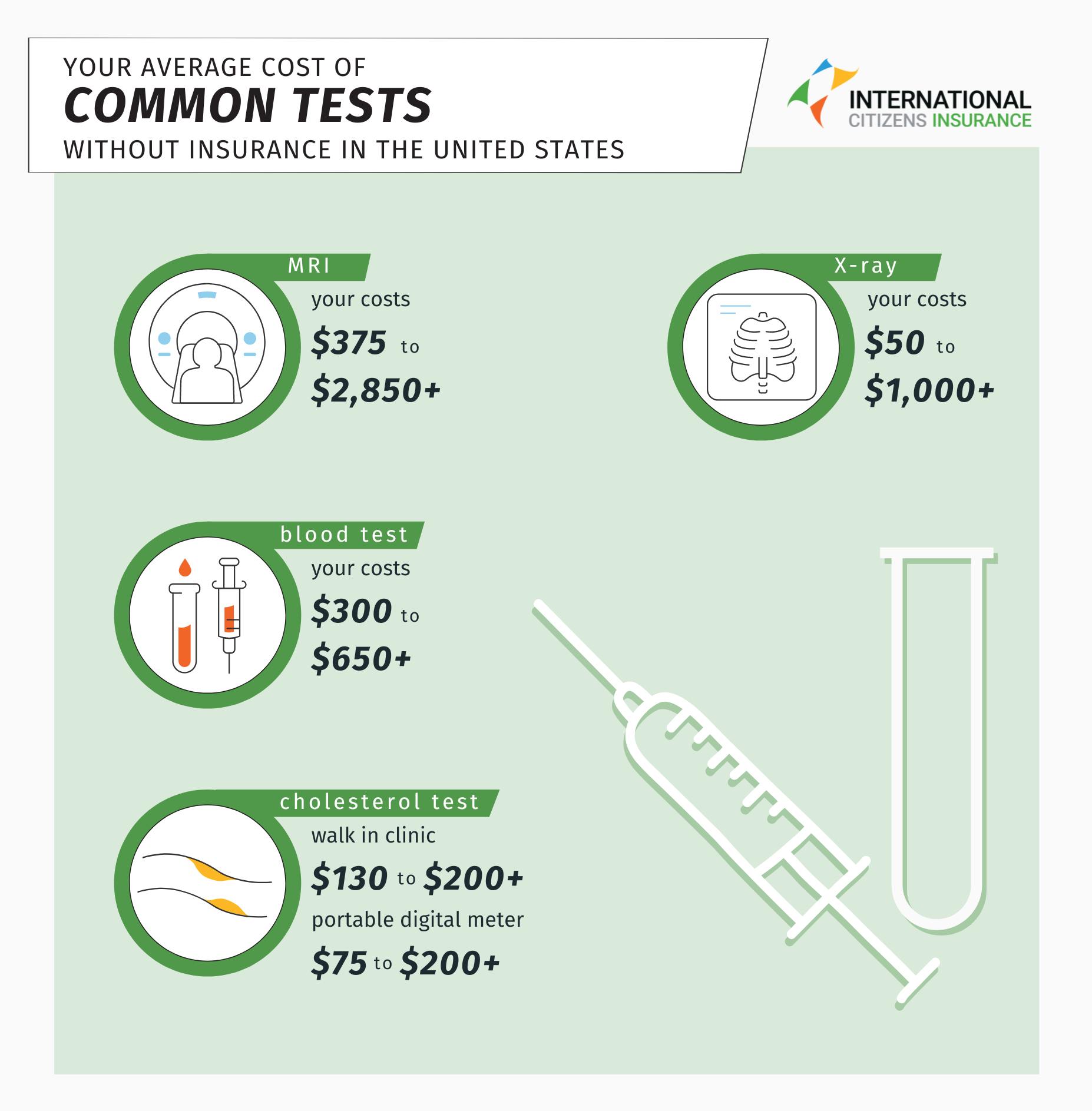

How Much Do Lab Tests Cost Without Insurance?

Lab tests are often essential when a doctor is trying to diagnose your medical issues. However, this is another area where the cost of U.S. healthcare can be high.

Without coverage, routine blood work can cost anywhere from $300 to $650 or more. If you just want to check your cholesterol levels, a lipid panel can range from $130 to $200 at the lab, or $75 to $200 for a portable digital meter to use at home.

An MRI scan can range from $375 for the simplest imaging, to $2,850 or more for a full body scan. While X-rays are generally more affordable, sometimes costing as little as $50, they can exceed $1,000 depending on the circumstances.

What Is the Cost of Prescription Drugs Without Insurance?

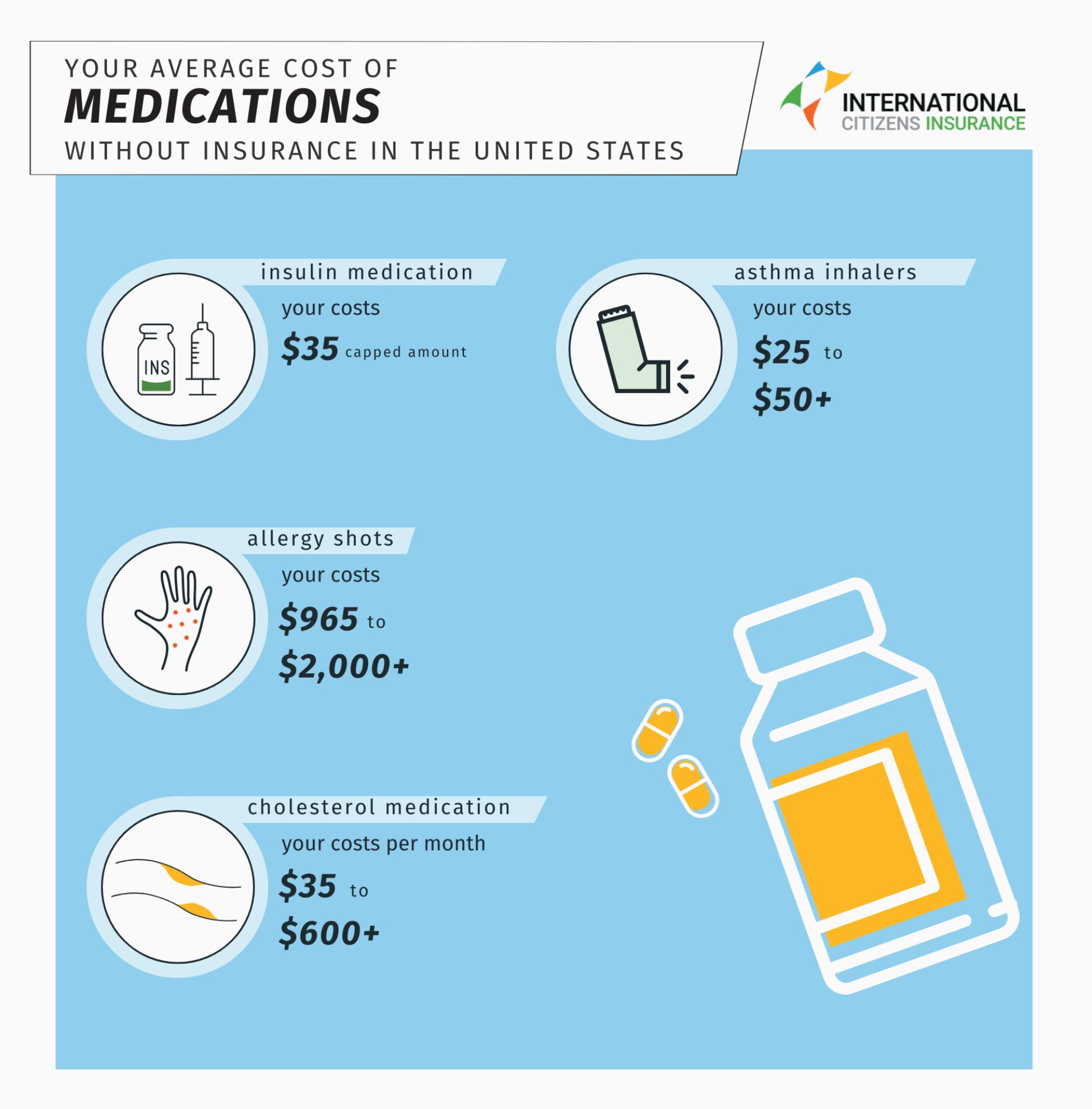

American healthcare prices are also high when it comes to prescription medication, though there have been some recent improvements. For example, insulin for diabetes is now capped at $35 per month, even without coverage. Following a price hike crisis, the cost of asthma inhalers is also more controlled, with prices ranging from $25 to $50.

However, prices for other medications can still vary widely depending on several factors. For instance, cholesterol medication may cost between $35 and $600 per month, while a year’s worth of allergy shots can range from $965 to over $2,000.

Prescription drugs can take up a large part of a patient's budget, which is why many insurance plans include coverage for these costs.

How Much Does It Cost to Have a Baby in America?

The United States is a notoriously expensive place to have a baby, and if you decide to start a family or add to it while living in the country, your healthcare costs will quickly add up.

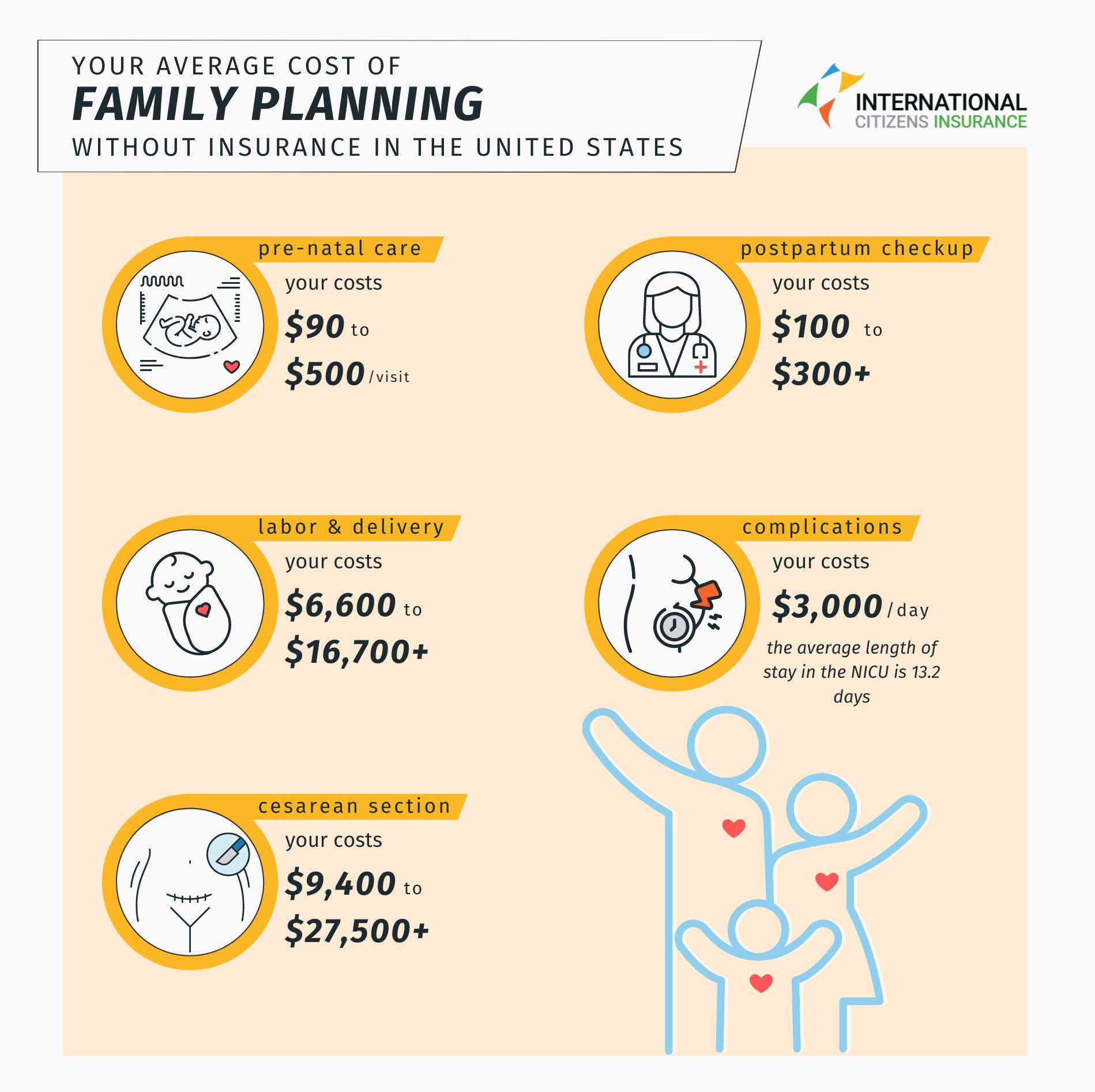

Prenatal doctor visits generally cost between $90 and $500 each time, and you will need several of them throughout your pregnancy. Labor and delivery alone can cost anywhere from $6,600 to $16,700 – and that’s for a vaginal delivery. A cesarean section, whether planned or emergency, is more expensive, ranging from $9,400 to $27,500 or more.

If there are complications and your baby needs a stay in the NICU, you can expect to pay around $3,000 per day without coverage. Given that the average NICU stay in the U.S. is 13.2 days, this could result in a staggering total bill of $39,600.

Postpartum checkups have similar costs to prenatal ones, ranging from around $100 to $300 per visit. Overall, pregnancy and childbirth in the U.S. are very costly, so having health coverage is crucial.

How Much Does Surgery Cost Without Insurance?

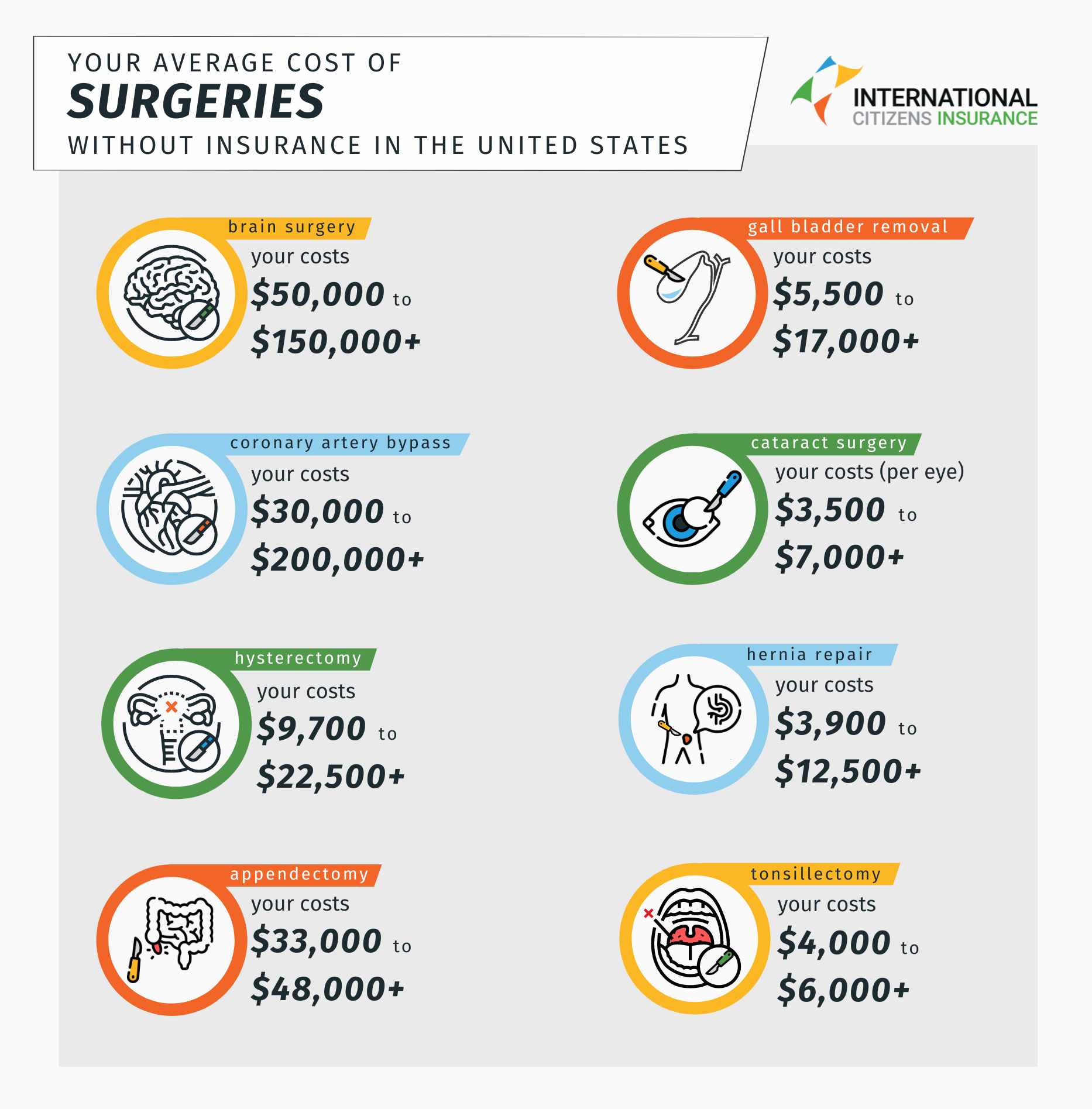

Whether you need emergency surgery like an appendectomy or elective surgery for cataracts, the costs in the U.S. are incredibly high. While it can be hard to pin down the exact figures, as they vary depending on a range of circumstances and fees, an appendectomy usually costs between $33,000 and $48,000 or more. Meanwhile, cataract surgery can cost between $3,500 and $7,000 or more per eye.

More common procedures, such as a tonsillectomy, are somewhat cheaper, costing between $4,000 and $6,000. If you need your gallbladder removed, you can expect to pay at least $5,500. However, factors such as your metro area and the complexity of the surgery can push that cost up to as much as $17,000.

A hysterectomy can be even more costly, ranging from $9,700 to $22,500 or more. As you might expect, a specialized and life-saving procedure like a coronary artery bypass can cost anywhere from $30,000 to over $200,000.

What Is the Cost of Treating Broken Bones and Sprains?

It could be anything from a simple fall on the sidewalk to a serious sports injury. Whatever the scenario, breaks and sprains can happen at any time and can be very expensive to treat in the U.S. if you don’t have adequate coverage.

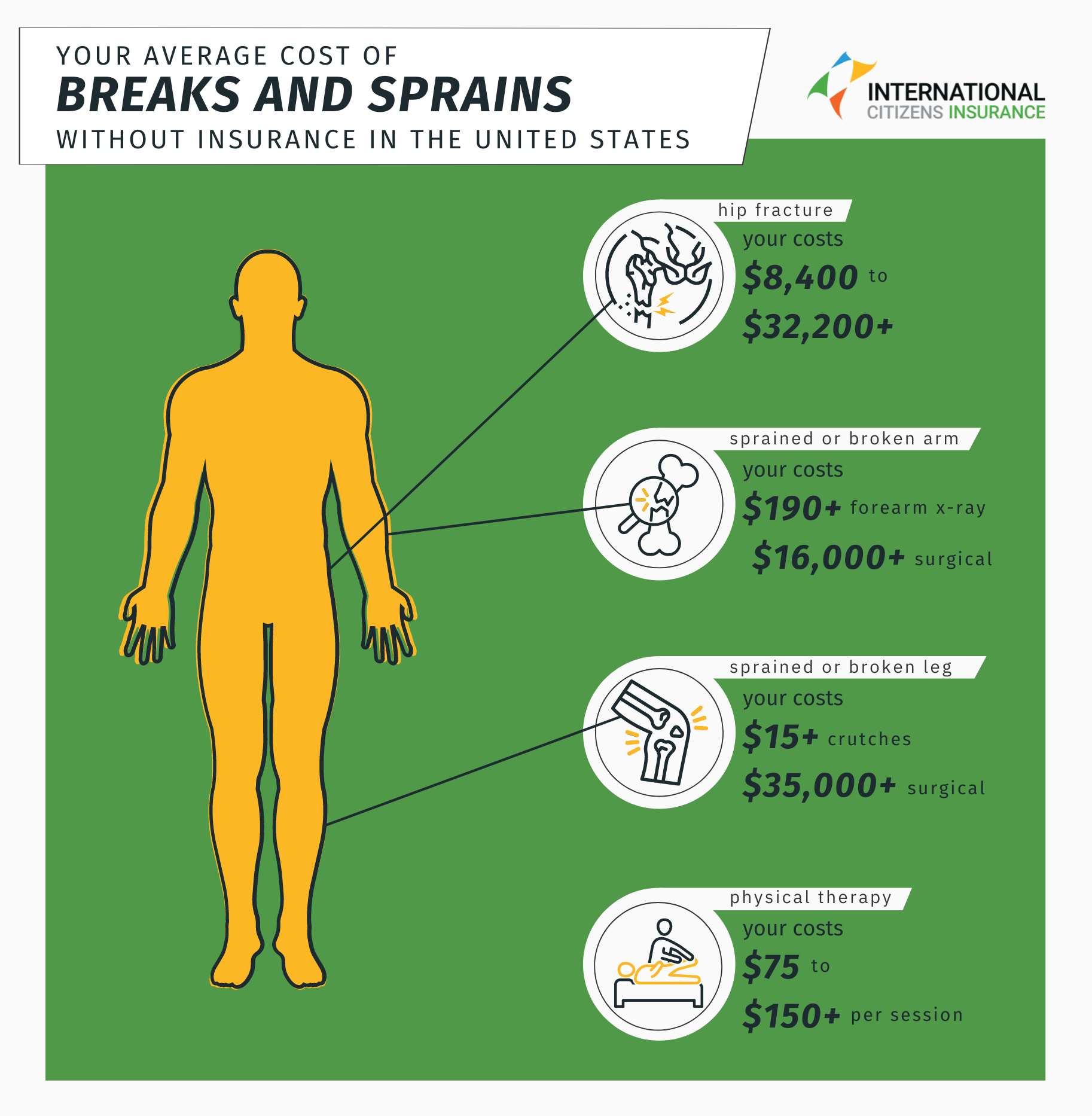

Like other types of medical care, costs can vary widely depending on where you are, how badly you’ve been hurt, and the type of treatment you need. If you sprain or break your arm, you could pay anywhere from $190 for a forearm X-ray to $16,000 or more for surgery.

A leg or ankle sprain may set you back as little as $15 for a set of crutches, but major surgery for a severe fracture can exceed $35,000. Breaking your hip can end up costing you between $8,400 and $32,200. And even after the bones heal, you’ll probably need some physical therapy to regain full function, with each session averaging $75 to $150 or more.

How Much Is a Doctor Visit Without Insurance?

A visit to a doctor's office is relatively affordable in the U.S. However, if you are ill, additional costs can quickly add up. This might include fees for diagnostic tests, procedures, and follow-up visits.

An initial consultation with a primary care doctor generally ranges from $100 to $200. Specialist visits are typically more expensive, with consultations averaging $250 or more, depending on the specialty and the nature of your visit.

Costs can vary significantly based on whether you have health coverage and the specifics of your plan. For urgent issues, urgent care centers can offer a more affordable option than emergency rooms, with visits generally costing between $150 and $300.

How Can You Cover Your Medical Costs in the U.S.?

As a frugal traveler or expat, you might be asking yourself what you can do to reduce your healthcare costs without sacrificing quality or convenience.

Firstly, remember that common over-the-counter medications and first aid supplies are widely available and very affordable in the United States. For example, you can find headache medication, mild heartburn medication, muscle cream, sinus decongestants, and skin ointments for under $25, with some items costing as little as $5. Consulting a pharmacist is also free, and they can offer valuable advice on treating minor, non-urgent, conditions.

Secondly, make sure that you have adequate travel insurance or health coverage while you are in the U.S. As you've seen above, if you fall ill while visiting the country, a relatively uncomplicated problem like an inflamed appendix can cost several times more than the trip itself. Similarly, as an expat, you may face significant medical expenses without proper coverage, which can lead to financial strain and unexpected burdens.

With the right plan, you can avoid worrying about facing a serious health problem and being hit with staggering medical bills afterward. Proper coverage will also prevent you from being overwhelmed by high costs in an emergency, which is stressful enough to deal with.

Find the Best International Travel Insurance

- Get multiple quotes and coverage options

- Travel Medical, Trip Cancellation & more options available

What Is the Cost of Medical Care in the U.S. With Insurance?

If you never go to the doctor, you won't face these high medical costs, and some people feel comfortable taking that risk. However, for most people, the risks are too significant. For expats in the US, buying international health insurance is the best way to offset that risk.

Although a plan requires you to pay a fixed monthly premium, even if you don’t visit the doctor, it is well worth it for the peace of mind it provides. It ensures that you are covered for medical services outlined in your policy, such as doctor visits and hospital stays, up to the specified limits and conditions.

How Does Health Insurance Work?

A high-quality health plan will cover all your costs, minus a deductible (the amount you pay before coverage kicks), an excess (the additional amount you may need to pay), and/or co-pay (a fixed amount you pay for a covered service such as a doctor's office visit after you've met your deductible).

Plans with higher deductibles and co-pays generally have lower monthly premiums. This means you'll pay less each month but more out-of-pocket when you use medical services. On the flip side, plans with lower deductibles and co-pays usually have higher monthly premiums, meaning you pay more each month but less when you use medical services.

Read More: Deductibles, Co-Pay and Out of Pocket Maximums

Depending on the plan you choose, it may cover all your medical costs without any limit. However, some plans put a cap on how much they will pay for your medical expenses, which is known as a medical maximum . Plans with a lower medical maximum generally have lower monthly premiums, but in exchange, you will take on more risk because if your medical bills exceed the cap, you'll be responsible for paying the extra costs yourself.

Due to all these factors, the cost of health coverage in America can vary significantly. An international health insurance plan will cost more than a travel medical insurance plan because it offers more extensive medical coverage. On average, our clients pay about $500 per month for a comprehensive global medical plan. While this may seem high, it's often more affordable than paying a $10,000 medical bill out of your own pocket.

Health and Travel Insurance Plans for Foreigners in the U.S.

There are a variety of coverage options available for foreigners in the United States, depending on their circumstances.

If you are planning to relocate to the country, you can opt for a global medical plan that provides basic coverage for common ailments or a more comprehensive plan that covers a wider range of services. You can also choose from several tiers to meet your needs and budget.

If you are visiting the U.S., there are a range of plans designed to cover emergency medical expenses if you get sick or injured and need hospital care. These options provide excellent value, offering peace of mind at a cost far lower than the potential risk of incurring large medical bills.

You can find more detailed information about these plans in our articles on US health insurance for non-citizens and safety and travel insurance for the U.S .

If you are moving to the United States, planning a trip to the country, or need coverage for any reason, our team of licensed brokers can help you research, compare, and purchase the right plans for your needs and budget. We offer some of the best international health insurance , travel medical insurance , group insurance , and travel insurance policies to people from all around the world.

So why not get in touch and get a quote now?

Looking for International Travel & Medical Insurance?

Request a free quote and we'll guide you through the process.

*Disclaimer: The information shown in these infographics was last updated in August 2024. The data is intended to aid decision-making. Medical costs and charges are subject to change at any time and can vary significantly by geographic location and insurance plan.

Expat Insurance: Health, Life, and Travel Insurance

Visitors Insurance Coverage

US Health Insurance for Non-Citizens

Safety and Travel Insurance for the USA

Author: Joe Cronin , Founder and President of International Citizens Insurance . Mr. Cronin, a former expat, is an authority in the areas of international travel, and global health, life, and travel insurance, with expertise in advising individuals and groups on benefits for today's global workforce. Follow him on LinkedIn or Twitter .

Get a fast, free, international insurance quote.

Global medical plans, specialty coverage, company info, customer service.

- Bladder, kidney and urinary system

- Bones and joints

- Brain and nerves

- Ear, nose and throat

- Emergencies and first aid

- Food and water borne diseases

- Immune system

- Infectious diseases

- Sexually transmitted infections (STIs)

- Stomach and bowel

- Treatments and surgeries

- Tests and procedures

- Women's health

- National Immunisation Schedule

- Vaccines given in Aotearoa

- When to immunise

- Book a vaccine

- Catching up on missed immunisations

- Preparing for a vaccination appointment

- Immunising your whānau

- Benefits of immunisation

- Vaccine side effects, reactions and safety

- How vaccines work

- Assault and abuse

- Cancer screening

- Environmental health

- Green Prescriptions

- Healthy habits

- Healthy weight BMI calculator

- Active older people

- Popular diets review

- Sexual health

- Teeth and gums

- Transgender and gender diversity

- Finding out you are pregnant

- Pregnancy and immunisations

- During pregnancy

- Labour and birth

- Breastfeeding

- The first 6 weeks

- The first year

- Caring for tamariki under 5

- Food and choking

- Well Child Tamariki Ora

- Childhood illnesses

- Mental health conditions

- Mental health services

- Alcohol and drug addiction

- Mental health medication

- Auckland (West and North Shore)

- Auckland (Central)

- Auckland (East and South)

- Bay of Plenty

- Rotorua and Taupō

- Hawke's Bay

- Manawatū-Whanganui

- Wellington and Hutt Valley

- Nelson Marlborough

- South Canterbury

- Otago and Southland

- Find the right healthcare for you and your whānau

- Services: Rights, privacy and complaints

- Alcohol and drug services

- Healthcare providers

- Health websites and apps

- Publicly funded health and disability services

- Pregnancy, birth and children services

- Support services

Ngā whare rata kaupapa whānui General practices

Everyone should sign up (enrol) with a general practice to get help with all their health needs. Unless it is an emergency, your general practice should be your first point of contact for health advice and care. Find out what they do and how to enrol.

On this page

What general practices do

Choose your general practice, māori health providers, your medical records, what you will pay, fees and subsidies, changing your general practice.

General practice teams can:

- provide treatment when you are unwell

- provide treatment and health advice for long-term conditions

- treat injuries

- help with wellbeing and mental health conditions

- prescribe medicines and give injections

- perform minor surgery

- refer you to other health professionals when necessary and work with them to look after you

- give lifestyle advice to help keep you well

- give immunisations.

Team members

General practices teams vary between general practices and can include:

- Qualified doctors trained in general practice.

- Practice nurses — registered nurses who provide nursing care, give treatment and advice.

- Clinical nurse specialists — expert nurses with special skills and knowledge in a specific clinical area, such as diabetes. They can prescribe some medicines

- Nurse practitioners — registered nurses with advanced education and clinical training. You may see a nurse practitioner instead of a GP. They can order tests, prescribe some medicines and treat you

- Counsellors and social workers

- Health improvement practitioners and health coaches.

They may also include allied health professionals such as:

- occupational therapists

- optometrists

- osteopaths.

In Aotearoa New Zealand, you can choose the doctor or general practice that you visit.

You can search Healthpoint for general practices. You can filter your search based on their hours, location, services and if they are enrolling new patients.

- GPs — Healthpoint (external link)

You can search the Medical Council's register to find out whether a doctor is currently registered and is able to practise in New Zealand, as well as other public information.

Register of doctors — Medical Council of New Zealand (external link)

Sometimes a general practice will not take on new patients. If this happens, they should refer you to their public health office (PHO) for help finding another practice. The PHO may put you on a waitlist, and arrange for you to get care in the meantime. You can also search Healthpoint PHOs.

- Primary health organisations — Te Whatu Ora (external link)

Māori health provider services are whānau-centred and sit within a kaupapa Māori framework. Providers support you to access and choose culturally relevant approaches to support your wellbeing. The services Māori health providers offer may include:

- Whanau Ora (family health)

- Well Child Tamariki Ora (child health)

- general practitioner services

- Māori community nursing

- rangatahi (youth health services)

- mental health

- disability support services

- health promotion and education.

Find a Māori health provider and the services they offer near you.

Kaupapa Māori — Healthpoint (external link)

It is free to enrol with a general practice. But they may charge a consultation fee each time you go to see them after that.

General practices normally charge a higher fee if you are not enrolled with their practice. This is often called a casual rate.

If you enrol with a general practice your care will be subsidised. This means you will pay a reduced consultation fee.

General practices can only enrol you if you are eligible for publicly funded health services. When you enrol you may be asked to show proof. This could include a passport or birth certificate. You will be asked to sign an enrolment form.

Eligibility for publicly funded healthcare — Health New Zealand (external link)

Your medical record is kept with the general practice you are enrolled with. But any health professional involved in your care can look at your record. You can ask to look at your record at any time.

Your rights and privacy (internal link)

General practices are private businesses. They set their own fees for visits and other health services they provide.

The cost of a visit will be lower if you are enrolled with the practice. This is because the Government subsidises the fee for enrolled patients.

For a list of practices and their fees, check the website of your local primary health organisation.

Primary health organisations — Health New Zealand (external link)

If you are seeing your general practice about an injury caused by an accident, you will be charged a lower fee if it is covered by ACC.

Treatment we can help pay for — ACC (external link)

General practices are usually open business hours, Monday to Friday. There is a requirement that arrangements are put in place for patients to get care outside of these hours

Check with your practice where you should go if you do need care outside working hours. You might have to visit an after hours accident and medical clinic or another practice.

Call Healthline for free health advice from registered nurses, 24 hours a day. Phone 0800 611 116

If you have a long-term health condition or a terminal illness, you may be eligible for Care Plus.

General practices get extra Government funding for Care Plus patients. This means the practice can provide additional care at no further cost to you.

Care Plus — Health New Zealand (external link)

If you are visiting a general practice where you are not enrolled, you will pay less if you have a Community Services Card.

If you have a card and are enrolled with a general practice you will also get cheaper visits. This also includes visits relating to injuries at most practices, which are covered by ACC.

More information is available on the Work and Income website. To check if you can get a card you can also call 0800 559 009

Community Services Card — Work and Income (external link)

You are entitled to free essential care during and after your pregnancy if your pēpi is born in Aotearoa New Zealand.

Services and support during pregnancy — Ministry of Health (external link)

General practices can charge a fee for services provided outside of a consultation. This includes repeat prescriptions or referral letters to a specialist.

Your doctor may refer you to a hospital or specialist doctor for further assessment or diagnosis.

- Specialist care is free through the public health system, but you may go on a waiting list.

- If you want to get specialist advice quickly, you may wish to use a private hospital or specialist. You will have to pay a fee for this, unless you have private health insurance.

Some general practices join a Very Low Cost Access programme run by their primary health organisation. This means they get extra Government funding to keep their fees at low levels for all enrolled patients.

All tamariki aged 13 and under are eligible for free general practice visits. This includes visits during the day and after hours. Not all general practices provide free visits, so check with your general practice first.

Zero fees for tamariki under 14 (internal link)

When you enrol with a new general practice, you will be asked to sign a form so your records can be transferred from your old practice.

A practice should not refuse to enrol you unless they already have too many patients.

A practice can end your enrolment if there is an ‘irreparable breakdown’ in the relationship.

If you want to make a complaint about the care you get from your general practice contact either the:

- Health and Disability Commissioner (external link)

- New Zealand Medical Council (external link)

MSP General Practice Fee Code Guide

- Consultations

- Complete Examination

- Other GPSC Fee Codes/Incentives

- Call Outs & Continuing Care

- Other Types of Various GP Visit Fee Codes

- General Practice Group Medical Visit (GMV Fee Codes)

- Community Based GP Hospital Visits

- Community Based GP with Active Hospital Privileges

- Long-Term Care Facility Visits

- Emergency Visits

- Miscellaneous Visits (MAiD GP Fee Codes)

- Mental Health Planning & Management

- GP Telehealth Fee Codes

- Gynecology

- Infant Care

- Surgical Assistance

- Minor Procedures Performed by GP

- Tests Performed in a Physician’s Office

- Operative Surcharges

- Final Takeaway:

If you’re an GP practising in British Columbia you may have noticed the vast amount of fee codes available to use.

Knowing which fee codes are available is an important aspect of billing correctly. Since there’s so many codes available, it’s not uncommon for GPs to undercode simply because they aren’t aware of what they can use.

Whether you’re a new physician just starting out, or you’re a seasoned physician used to billing, bookmark this page for a quick overview of all GP codes – along with tips on how to bill them properly. If you’re looking for a printable version to keep on your desktop scroll to the bottom!

When seeing a patient for the first time you’d bill a consultation or a complete examination.

You can only claim a consultation when it’s been specifically requested by the attending practitioner – basically this means that on every consultation claim you need to have a referring physician. Consultation fee codes are billed in age groups and whether the patient was seen in or out of the office.

In Office GP Consultation Fee Codes

12110 Consultation – in office: (age 0-1)

00110 Consultation – in office: (age 2 – 49)

15310 Consultation – in office (age 50 – 59)

16110 Consultation – in office: (age 60 – 69)

17110 Consultation – in office: (age 70 – 79)

18110 Consultation – in office: (age 80+)

Out of Office GP Consultation Fee Codes

12210 Consultation – out of office (age 0 – 1)

13210 Consultation – out of office (age 2 – 49)

15210 Consultation – out of office (age 50 – 59)

16210 Consultation – out of office (age 60 – 69)

17210 Consultation – out of office (age 70 – 79)

18210 Consultation – out of office (age 80+)

Special in hospital consultation

00116 : Special in hospital consultation

00116 applies to consultations done on in-hospital patients of an acute or extended care (or when the patient is in the ER with a complex problem as outlined below and a decision has been made to admit).

- It needs to be referred to you by a certified specialist (FRCP, FRCS or CCFP-EM) for advice about and/or the continuing care of complex problems for which the management is complicated and requires extra consideration. Examples of such problems include (but are not restricted to) the assessment of terminal illness, the planning of activation/rehabilitation programs and the management of patients with AIDS.

- Not applicable for transfer of care.

- Not applicable if the patient has been attended to by you or a physician in the same group in the last 6 months.

Complete Examination

When you do not have a referral from another physician or healthcare practitioner, you’d bill a complete examination.

A complete examination needs to include a complete detailed history and detailed physical examination of all parts and systems. In the history you should include complaints, history of present and past illness, family history, personal history, functional inquiry, physical examination, differential diagnosis, and provisional diagnosis.

The fee codes for complete examinations are billed by age group and whether they are seen in or out of the office.

In Office GP Complete Examination Fee Codes

12101 Complete examination – in office (age 0-1)

00101 Complete examination – in office (age 2-49)

15301 Complete examination – in office (age 50 – 59)

16101 Complete examination – in office (age 60-69)

17101 Complete examination – in office (age 70-79)

18101 Complete examination – in office (age 80+)

Out of Office GP Complete Examination Fee Codes

12201 Complete examination – out of office (age 0-1)

13201 Complete examination – out of office (age 2-49)

15201 Complete examination – out of office (age 50-59)

16201 Complete examination – out of office (age 60-69)

17201 Complete examination – out of office (age 70-79)

18201 Complete examination – out of office (age 80+)

Consults and Complete Examination Reminder

You can only bill for a consult or a complete examination once every 6 months. If you happen to see the patient again within the 6 months you need to add a note in the note field of the claim telling MSP what the medical necessity was and why you had to see them again. MSP will then review the claim and decide if it’s eligible or not.

Visits differ from a consultation or complete examination because consults/exams require a full history and complete exam while a visit requires a partial or regional exam. For example, when you see a new patient you’d give a full examination but when you’re seeing a regular patient for a complaint (like a cold, headache, etc.) you’d bill a visit. You can bill visit fee codes for any condition requiring partial or regional examination and history. This includes both initial and subsequent examination for the same/or related condition.

Visit fee codes are also billed by age groups and whether they are seen in the office or out of office:

GP In Office Visit Fee Codes

12100 Visit – in office (age 0-1)

00100 Visit – in office (age 2-49)

15300 Visit – in office (age 50-59)

16100 Visit – in office (age 60-69)

17100 Visit – in office (age 70-79)

18100 Visit – in office (age 80+)

GP Out of Office Visit Fee Codes

12200 Visit – out of office (age 0-1)

13200 Visit – out of office (age 2-49)

15200 Visit – out of office (age 50-59)

16200 Visit – out of office (age 60-69)

17200 Visit – out of office (age 70-79)

18200 Visit – out of office (age 80+)

Counselling Fee Codes

Counselling fee codes are billed in age groups as well as where the visit takes place. In order to be eligible to bill a counselling fee code you need to spend at least 20 minutes with the patient.

GP In Office Counselling fee codes

12120 Individual counselling – in office (age 0-1)

00120 Individual counselling – in office (age 2-49

15320 Individual counselling – in office (age 50-59)

16120 Individual counselling – in office (age 60-69

17120 Individual counselling – in office (age 70-79)

18120 Individual counselling – in office (age 80+)

GP Out of Office Counselling fee codes

12220 Individual counselling – out of office (age 0-1)

13220 Individual counselling – out of office (age 2-49)

15220 Individual counselling – out of office (age 50 – 59)

16220 Individual counselling – out of office (age 60-69)

17220 Individual counselling – out of office (age 70-79)

18220 Individual counselling – out of office (age 80+)

GP Group Counselling fee codes

00121 Group counselling first full hour 00122 Group counselling second hour

GPSC Annual Bonuses

Management fees provide funding for Family Physicians to identify, manage and improve care of patients. They help compensate for the additional work that goes beyond the office visit. 14033 Annual complex care management fee

14050 Gp annual chronic care bonus – diabetes mellitus

14051 Gp annual chronic care bonus – heart failure

14052 Gp annual chronic care bonus – hypertension

14053 Incentive for gp annual chronic care bonus copd

14250 Annual chronic care incentive(encounter)-diabet

14251 Annual chronic care incentive(encounter)-heart

14252 Annual chronic care incentive(encounter)-hypert

14253 Annual chronic care incentive(encounter)-copd

GPSC Attachment Fees

The GPSC Portal Codes (14070 and 14071) are zero value codes that you need to submit at the beginning of each year if you’re a full-service family physician (or a locum who will cover a full-service family physician). Billing the portal codes signifies that you’re providing full-service family practice service to your patients and you will do so for the entire year. Without billing the portal codes you won’t have access to the other GP incentive codes listed below.

Portal Codes

14070 attachment participation

14071 locum attachment participation

Incentive Codes

14074 unattached complex/high needs patient attachment 14075 attachment complex care management fee

14076 attachment telephone management fee

14077 attachment patient conference fee

If you’ve billed the portal codes through Dr.Bill before, our billing agents will automatically resubmit them for you. If you haven’t you need to follow these steps: How to submit the GPSC Portal code (14070)

Use diagnostic code 780 and the following program “Patient” demographic information:

PHN#: 975 303 5697

Patient Surname: Portal

First name: GPSC

Date of Birth: January 1, 2013

Once processed by MSP, this will then allow access to 14075 , 14076 , 14077 , 14078 and 14029 for the balance of that calendar year.

How to submit the GPSC Portal code for Locums (14071 )

The GPSC Locum Portal code (14071) may be submitted by the GP who provides locum coverage for Family Physicians who have submitted 14070. This code will still need to be submitted at the beginning of each calendar year or prior to providing the locum coverage. In order to submit 14071, you’ll need to follow the same exact steps as above.

Other GPSC Fee Codes/Incentives

14063 Palliative care planning fee

14066 Personal health risk assessment 14010 Maternity Network Incentive The Maternity Network incentive covers the costs of group/network activities for the shared care of obstetric patients (both assigned and unassigned obstetric patients): $2,100 per quarter ending March 31, June 30, September 30 and December 31. To bill the quarterly Maternity Network incentive you need to create a claim with the following information:

Billing amount: $2,100

PHN: 982487052

Patient last name: Maternity

Patient first name/initial: G

Date of birth: November 2, 1989

Diagnostic code: V26

For date of service use: Last day in a calendar quarter

Billing schedule: Last day of the month, per calendar quarter

14086 GP assigned inpatient care network The Assigned In-patient Network payment is an incentive for family physicians who provide in-patient care services for their own and colleagues’ patients (assigned).

This incentive is billed quarterly and you need to register for it in order to claim it. You can fill the registration form out electronically through Dr.Bill, otherwise you need to print it out and mail it to MSP: Assigned In-patient Care Network Registration form

14088 Unassigned inpatient care fee The GP inpatient care network incentive is if you’re actively participating in the GP Unassigned Inpatient Care or the GP Maternity Networks. It’s billable in addition to the visit fee code ( 00109 , 13109 , 13008 , 00127 , 14088 ) or the delivery fee and is a lump sum incentive based on the annual volume of unassigned inpatients.

Before you receive the incentive you need to be a member of the Assigned Inpatient Care Network, which means you need to register for it. You can fill this form out electronically through Dr.Bill, otherwise you need to print it out and mail it to MSP: Unassigned In-Patient Incentive

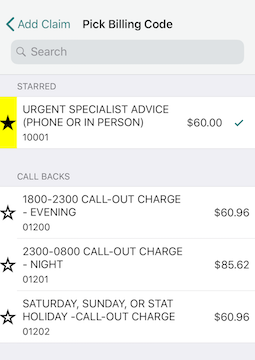

Call Outs & Continuing Care

A call out is a premium added when you are called from outside of the hospital to come and care for a patient.

During weekdays the call must be placed prior to 8:00am or after 6:00pm. On weekends the call must be placed after 8:00am.

REMINDER: If you’re called during regular weekday hours you’d bill an emergency visit instead , which covers both the visit and the surcharge.

To apply this premium to your time, fill out a claim logging your consult or visit with the patient. Then, at the bottom of the claims toggle the ‘Call Out’ button. Don’t forget to enter the Call Time, Start Time & End Time for your encounter. Our mobile app will automatically apply the correct Out of Office premiums to your claim.

Continuing Care

If you have logged a Call Out charge and then continue to see additional patients you would be entitled to bill continuing care surcharges for each 30 minutes after the initial 30 minutes you spent with the patient you were initially called to see.

If you see multiple patients in a 30 minute block you would only log the continuing care on the last patient in that block but for the entire 30 minute period. You must also note CCFPP in the MSP note field to tell MSP that these patients were seen following your initial call out to the hospital.

Continuing Care Rules

Timing begins after the first 30 minutes for consultations, visits or anesthetic evaluations. Payment is based on one half-hour of care or major portion thereof (at least 15 mins.). This means that your first continuing care surcharge is only eligible after 45 minutes of continuous care (30 mins. for the refractory period plus the major portion of 15 minutes).

Timing for the continuing care premium is based on the total time spent providing continuous care, not the number of patients you see. For example, if you see 3 patients within 30 minutes then you would only add the continuing care premium on the last patient, but for the entire 30-minute duration.

To apply these surcharges on Dr.Bill, log your consult or visit with the patient. On that claim toggle ‘Call Out & Continuing Care’. Don’t forget to enter the Call Time, Start Time & End Time for your encounter. Our app will automatically apply the correct Out of Office premiums to your claim.

Reminder: Only toggle Call-Out on the first patient, to show that it was the first. For the following claims just toggle Cont.Care. If you need to claim a call out on its own or aren’t using Dr.Bill then use the following fee codes:

Call Out Fee codes:

01200 : Evening (call placed between 6:00pm and 11:00pm and service rendered between 1800 hours and 0800 hours)

01201 : Night (call placed and service rendered between 11:00pm hours and 8:00am)

01202 : Saturday, Sunday or Statutory Holiday (call placed between 8:00am and 11:00pm)

Continuing Care Surcharge Fee Codes (n on-operative):

Billed in addition to visits and consultation fees.

01205 : Evening (service rendered between 6:00pm and 11:00pm) – per half hour or major part there of

01206 : Night (service rendered between 11:00pm hours and 8:00am) – per half hour or major part thereof

01207 : Saturday, Sunday or Statutory Holiday (Service rendered between 8:00am and 11:00pm) – per half hour or major part thereof

13070 : In office assessment of an unrelated condition(s) in association with a WorkSafe BC service

- Paid only when services are provided for an unrelated illness occurring in conjunction with a WorkSafe BC insured service.

- Unrelated service must be initiated by the patient.

- The unrelated condition(s) must justify a stand-alone visit.

- Only paid once per patient per day, and includes all other unrelated problems.

- Not paid if a procedure for the same or related condition is paid for the same patient on same day.

- The visit must be fully and adequately documented in chart.

13075 : In office assessment of an unrelated condition(s) in association with an ICBC service

- Paid only when services are provided for an unrelated illness occurring in conjunction with an ICBC insured service.

- Only paid once per patient per day, and includes all other unrelated problems.